?Mathematical formulae have been encoded as MathML and are displayed in this HTML version using MathJax in order to improve their display. Uncheck the box to turn MathJax off. This feature requires Javascript. Click on a formula to zoom.

?Mathematical formulae have been encoded as MathML and are displayed in this HTML version using MathJax in order to improve their display. Uncheck the box to turn MathJax off. This feature requires Javascript. Click on a formula to zoom.ABSTRACT

The introduction or adoption of innovations at the firm level has consequences for job creation that may differ across low-middle and high-income countries. Also, the type of innovation that firms introduce, such as process or product innovations, can affect employment through different channels. This paper aims to study the effects of innovation on employment growth at the firm level using a framework that considers the nature of innovation and the relative efficiency of the firms. The study uses a rich panel dataset that combines information from two different surveys in Colombia: the Annual Manufacturing Survey and the Survey on Development and Technological Innovation in the Manufacturing Sector. The article provides empirical evidence supporting the idea that the nature of innovation in the country involves complementarities between process and product innovations. The paper discusses how this result is related to the patterns of innovation in middle income countries, which need not only new technologies but also imitation of processes and products. Another novelty of this analysis is the study of displacement effects of process innovation through improvements in the relative efficiency of the firms. Findings show that some firms reduce employment from process innovations, reflecting high heterogeneity in efficiency among firms.

1. Introduction

Innovation often leads to economic growth, which in turn boosts employment levels in a country. However, it may take time to fully reap the benefits of innovation. In the meantime, the introduction of new products and technologies in firms can impact and modify production systems, which can affect future job creation.

Potential effects of innovation on firm-level employment depend on the nature of the innovation introduced that is ‘product innovation’ and ‘process innovation’. Furthermore, how firms introduce and adopt innovations in low- and middle-income countries may differ from those in high income countries. In low- and middle-income countries, firms may passively adopt foreign technologies, but to catch up technologically, they need specific production capabilities that may not currently exist in the country or the firm. These capabilities may include education and business infrastructure. To efficiently utilise the new technology, the firm may need to adapt it to different inputs and take into consideration country-specific tastes, customs, and cultures (Fagerberg, Srholec, and Verspagen Citation2010).

As a result, in the process of adopting a technology to introduce a new or significantly improved good or service in the country or region, the firm may have to create production capabilities, and in the process of doing so, further innovation may also occur. Moreover, firms in low-middle income countries often improve imported technology which requires a complementary process and product innovation. This pattern is more prevalent in low-middle income countries, while high income economies concentrate more on product innovation. Both ways of developing innovations and introducing them into firms may lead to growth in the economy, yet the effect of innovation on employment in low-middle income countries will have different channels and characteristics. By comprehending these transmission effects, one can design more effective industrial policies.

This article focuses on assessing the effect of innovation on jobs at the firm level. It offers an integrated explanation and detailed empirical analysis of how innovation drives employment creation in Colombia, with a focus on the manufacturing sector. The main novelty is that the analysis can account for both the nature of innovations and the relative efficiency of the firms. The paper provides empirical evidence at the firm level on the role of complementary process and product innovation on job creation in Colombia. Additionally, I introduce an extended empirical framework that allows for differences in relative efficiency among firms.

A shortcoming in previous studies is that panel data on innovation is not often available for low-middle income countries. To address this issue, I have created a unique panel database that covers the years 2008 to 2016 (only even years). This database combines data from two surveys conducted in Colombia: the Annual Manufacturing Survey and the Survey on Development and Technological Innovation in the Manufacturing Sector. Panel data allows for consideration of heterogeneity that cannot be controlled for with cross-sectional data.

The paper obtains empirical evidence on the separate role of process and product innovation after allowing for the potential endogeneity of the innovation decision. To account for endogeneity issues the paper makes use of instrumental variables, particularly, it introduces the role of institutional variables on employment creation through an instrumental variable of a firm’s cooperative agreements on innovation. Also, the empirical investigation accounts for the relative efficiency of firms by introducing an estimated variable using stochastic frontier analysis for panel data.

The results show that product innovation increases employment growth. Complementary process and product innovation also have a significant impact on employment growth. Process innovation alone does not have a direct displacement effect. However, more efficient firms compared to less efficient ones are correlated with less new employment at a firm level.

The discussion in this paper is organised as follows. Section 1 presents a literature review of the effects of innovation on employment at the firm level and the hypothesis development. Section 2 explains the panel dataset that was built based on two surveys of manufacturing firms in Colombia. It also presents descriptive statistics on employment and innovation in the country. Section.1 discusses the empirical strategy. Section 1.4.1 presents the econometric estimates and discusses the results. The last section provides concluding remarks and sets out future areas of research.

The supplementary material presents the theoretical model and the stochastic frontier analysis used to estimate the efficiency variable included in the econometric model.

1.1. Literature review and hypothesis development

Penrose’s (1959:100) seminal work, The Theory of the Growth of the Firm encapsulated the idea that the survival and growth of firms depend in large part on their ability, ‘to anticipate, or at least to match threatening innovations in products, processes and marketing techniques’. Firm growth depends on external and internal causes. Penrose gave particular importance to resources within the firm (internal causes), mainly, managerial resources. The firm’s available productive resources need internal coordination and direction to produce goods and services. Firm expansion requires managerial resources (which are not found in the market) to plan, coordinate and make effective use of resources and innovation (Penrose Citation2009).

Neoclassical analysis is concerned with examining the equilibrium of industries through market-based analysis. It considers the supply and demand functions and factors in the theory of price and output to determine a firm’s equilibrium. However, Penrose’s ideas are not easily assimilated in neoclassical thinking as they do not assume optimising agents and static equilibria. In this paper, the integration of a Penrosian analysis in a conventional neoclassical analysis can help understand innovation within a firm’s growth process (analysing the production function). This way, one can combine the neoclassical perspective of efficient allocation of resources with the Penrosian knowledge creation process in a firm. Instead of assuming that a firm already possesses the required know-how, internally generated knowledge can be utilised to coordinate resource allocation and innovation growth. Here, the internally generated knowledge is useful to coordinate the allocation of resources inside a firm and innovation growth (Pitelis Citation2009). Furthermore, employment relations in a firm can be explained through productivity gains generated by knowledge growth.

Innovation can create new jobs or displace employment depending on the existing production technology and the type of innovation. Innovation includes both process or product innovations, which can be labour/capital saving, skill-biased, etc (see for instance Acemoglu and Autor (Citation2011) for a study on skill-biased and technical change). Therefore, the overall effect depends on different variables and may differ in the short and long run. Moreover, the link between innovation and employment can be analysed at the firm, sector, or aggregate level.

The effects of innovation on employment at the firm level can be studied through different channels, depending on the type of innovation (product and process innovation). summarises displacement and compensation effects on employment by type of innovation. The introduction of new or improved goods and services (product innovation) is widely viewed to have a positive effect on employment growth at the firm level due to increased demand (compensation effect) and therefore in output growth. Product innovations can be new to the world, incremental improvements on previous innovations or imitations of goods and services produced in other firms or regions. Usually, new or improved products or services open new markets leading to an increase in production and employment (Pianta Citation2003). However, there might be productivity differences in the production of new compared to old products since new products that generate new employment may nevertheless come with lower demand for employment (if they are labour-saving innovations) compared to the production of old products. Moreover, it could also be the case of new products replacing old ones.

Table 1. Effects of innovation and efficiency on firm-level employment.

Concerning process innovation, improvements in the production process affect productivity and unit costs which have a negative and positive effect on employment respectively (see Katsoulacos (Citation1984), Pianta (Citation2003), Vivarelli (Citation2014) and Calvino and Virgillito(Citation2018)) for a discussion on displacement and compensation effects). Process innovation that enhances productivity allows the firm to reduce costs and lower prices. Depending on the elasticity of demand for the good or service, a lower price may increase demand (if demand is sufficiently price responsive) and market share. An increase in demand, if the elasticity is high, will have a positive effect on employment. Similarly, process innovations that increase quality may increase jobs when the demand for the good or service increases (when the elasticity is high).

Alternatively, process innovation may also affect employment through firm efficiency. Specifically, firms that operate beneath the production frontier may move towards the technological frontier by exploiting available knowledge in the innovation process or improvements in organisational methods. To do so, they may increase their output without requiring more inputs or produce the same level of output using fewer inputs (Coelli et al. Citation2005, ch 1). Therefore, the overall effect of innovation on the demand for labour depends on the complex balance between labour-creating and saving effects.

Empirically, it is difficult to identify the displacement and compensation effects due to data availability and because firms are often involved in product and process innovation simultaneously (Hall, Lotti, and Mairesse Citation2008). Measuring the effect of innovation on employment poses the following challenges, including: i) the difficulty of measuring innovation, in particular, investment in innovation and product and process innovation, ii) the identification and measurement of institutional mechanisms such as enforcement of intellectual property rights, and iii) disentangling the final effect of innovation on employment due to other factors such as labour dynamics and macroeconomic cycles (Vivarelli Citation2014).

Yet, micro econometric studies can look at firm-level variables on product and process innovation and employment growth (Vivarelli Citation2014). Evidence on the relationship between employment and innovation at the firm level generally indicates that innovation tends to be positively related to employment (Blanchower and Burgess Citation1998; Pianta Citation2003; Van Reenen Citation1997; Vivarelli Citation2014). However, Greenan and Guellec (Citation2000) using a panel of French manufacturing firms find that innovative firms create more jobs than non-innovative ones but the reverse is true at the sectoral level so the overall effect is negative and only product innovation is job-creating.

Few studies highlight the difference between low-middle income and high income countries, for instance, Raffo et al. (Citation2008) study the relationships between innovation inputs (usually R&D), output (for instance, product innovation), and economic performance (expressed by labour productivity) for three European countries (France, Spain and Switzerland) and three Latin American countries (Argentina, Brazil and Mexico) using firm-level data and the CIS survey and Latin American innovation surveys. The study presents empirical evidence using the Crepon, Duguet and Mairesse’s (Citation1998) structural model (CDM modelFootnote1) where R&D intensity affects product innovation. Results indicate innovation has a positive effect on labour productivity in countries studied for Latin America (Brazil and Mexico) except Argentina (however, the result is not robust). The difference in results might reflect the heterogeneity of the countries, for instance, the authors found that in Latin American countries there is a lack of cooperative agreements with Universities and other interactions between academic research and industry.

Empirical literature at the firm level that focuses on the distinction between the effect of process and product innovation on employment presents evidence of the positive impact of product innovation on employment. However, results regarding process innovation are not conclusive since some authors find a negative and significant relation and others find no significant link between process innovation and employment. Hall et al. (Citation2008), Peters (Citation2004) and Harrison et al (Citation2005, Citation2014), derive an employment growth equation, using the labour demand equations in (4) and a logarithm rate of growth of the old product to derive a linear equation. The equation is derived from an identical separable production function with different Hicks-neutral technological productivity indexed by θ (see Annex 1). In Harrison et al. (Citation2014) the model assumes that the productivity index θ represents the efficiency of the investments in R&D in generating process and product innovation. Hall, Lotti, and Mairesse (Citation2008) interpret productivity as labour productivity rather than total factor productivity in the estimation of the model; since this study did not have data on capital and other materials. Garcia et al., (Citation2004) argue that the productivity index θ, used by Harrison et al. (Citation2005), also gives the degree of efficiency attainable for any firm (independently of its R&D activities) as a result of knowledge spillovers and learning, among others.

Harrison et al. (Citation2014, Citation2005) use the third wave of the Community Innovation Survey (CIS) from Germany, France, the UK and Spain, finding that process innovation tends to displace employment but the growth of demand for the old products compensates for the effect, while product innovation is basically labour friendly. Overall innovation stimulates employment. Hall, Lotti, and Mairesse (Citation2008) extended this model using combinations of process and product innovation, their results show positive employment effects and no displacement due to process innovation when using a panel of Italian manufacturing firms over the period 1995–2003. Lachenmaier and Rottmann(Citation2011) estimate a dynamic panel GMM system estimation and they find a higher positive result of process innovation on employment as compared to product innovation, with an overall positive effect of innovation on employment. Moreover, Criscuolo (Citation2009) reports estimates on labour productivity in 15 European countries and Brazil, finding a positive relation with product innovation (except for Switzerland). However, the coefficient for process innovation shows a negative or non-significant relation.

Some studies for Latin America have followed previous work by Harrison et al. (Citation2014) with mixed findings. In Chile, Benavente and Lauterbach (Citation2008) used firm-level data from the third survey on innovation in the manufacturing sector (514 manufacturing firms). The authors found a positive and significant effect of product innovation on employment and no effect on process innovation. Alvarez et al (Citation2011) extend the analysis for Chile including additional waves of the innovation survey. The authors find that process innovation does not seem to affect employment growth, but the simultaneous process and product innovation are positively related to employment growth.

Crespi et al. (Citation2019) studied the impact of process and product innovation in Argentina, Chile, Costa Rica, and Uruguay. Their findings indicate product innovation is significantly and positively related in all cases, but process innovation has mixed results. Process innovation was found to have no effect in Argentina and Chile, while it had a significant and negative effect in Uruguay and a positive effect in Costa Rica. Differences in the results might be related to a lack of uniformity in the design of surveys among countries, for instance, the instruments used for the instrumental variables were different for each country since the questionnaire was not the same. Also, the estimates for each country vary in the number of waves and observations.

In most of these studies from Latin America, process innovation is not significantly correlated with employment. Some of the shortcomings are probably due to the assumptions in the model, differences across surveys – including differences in sampling method and coverage – and differences in measurement (innovation such as process only or a combination of process and product innovation). For instance, previous research such as Benavente and Lauterbach (Citation2008) assumes that all technological changes are exogenous, not related to process innovation and identical for all the firms, so the constant term of the production function would represent the average efficiency growth for all firms. Introducing a more flexible assumption can enhance the analysis of the results since process innovation also improves firm efficiency, which, in turn, affects employment. Yet, these studies do not measure efficiency directly, therefore I included in this paper a measure for relative efficiency in the model proposed.

Management fosters teamwork and cooperation that enables members of the firm to learn and accumulate knowledge on how to use the productive resources of the firm in the best way possible (Fagerberg et al. Citation2005, ch.2; Penrose Citation2009, 42–43). For companies to collaborate effectively in innovation, they must have the ability to absorb the latest information and skills. This is refer to as absorptive capacity, which can be defined as firms’ ability to assimilate knowledge and ideas from other organisations and apply this external knowledge. Managerial decisions play a crucial part in this process of learning, sharing knowledge and expertise, and applying and adapting relevant information (Michie and Oughton Citation2016). Management is instrumental in implementing practices that encourage and facilitate knowledge use and sharing through interaction with others. As Penrose suggests, having access to managerial resources is essential for gaining the knowledge required to enter a new field and for a firm’s growth. For example, if a company plans to expand by producing multiple products, it will need an appropriate amount of managerial support to achieve this goal.

To introduce an innovation, a firm typically combines various knowledge, skills, capabilities, and resources. Furthermore, as innovation is an ongoing process, the company must engage with its surroundings and other organisations to gain knowledge and learn. According to Freeman (Citation1987), the success of research and development (R&D) in increasing productivity growth relies on how firms interact within an innovation system that includes universities and government. Studies indicate that collaborating on innovation impacts a company’s chances of being an innovator and its sales expectations (Becker and Peters Citation2000; Grazzi et al. Citation2016). Michie and Oughton (Citation2016) demonstrate that companies that partner with universities have a higher likelihood of innovating.

Moreover, diffusion of innovation, the process of adopting new technologies or replacing an older one with a new one, is a fundamental part of the innovation process and it may involve both process and product innovation. Miravete and Pernias (Citation2006) study the complementarity of process and product innovation in the Spanish ceramic tile industry, finding that innovative process-innovative firms obtain a competitive advantage by reducing costs or applying more efficient processes or technology. Findings show that the complementarities among innovation strategies depend on unobserved heterogeneity, where the characteristics of the firm in terms of managers and organisational forms become crucial elements to coordinate and take advantage of innovation possibilities.

For low-middle income countries, diffusion can be an important part of the process of innovation (Fagerberg, Srholec, and Verspagen Citation2010; Hall Citation2004). Hence, process innovation is closely related to product innovation in low-middle income countries since the firm needs to introduce new processes to adopt a new technology. Therefore, one of the approaches I use in this paper is to investigate the simultaneous effects of process and product innovation.

Regarding differences in measurement, innovation surveys in Latin America are not harmonised and this leads to different results. One example concerns the measurement of the percentage of sales of new products as a proportion of total sales, as mentioned by Alvarez et al (Citation2011), while the Chilean survey on innovation reports this variable in intervals (that is, 0, 0–10%, 11–30%, and 71–100%, the Colombian innovation survey reports the value declared by the firm without intervals. Moreover, compared to survey data from other Latin American countries (such as Argentina, Chile, Uruguay, Costa Rica, and Panamá), the Colombian survey is the only one that is a Census and therefore better goodness of fitness in models could be explained by the nature of the survey (Crespi and Zuniga Citation2012).

To provide a more comprehensive model, the estimations of this paper are done using a five-wave panel database that combines information from the survey of innovation (EDIT survey) with performance indicators from the main survey of manufacturing firms (EAM). Furthermore, this research aims to contribute to the gap in the literature by allowing for differences in efficiency across the firms and investigating the effect of process and product innovation on job creation at the firm level when they happen simultaneously.

The main hypotheses behind the analysis proposed in this research are that:

H1:

Product innovation positively affects employment at the firm level.

H2:

In Colombia, one of the transmission mechanisms of innovation affecting employment at the firm level is through complementary product and process innovation.

H3:

Firms that innovate only in the process (and not in the product) affect employment negatively through efficiency improvements, which are very heterogeneous in middle income countries.

Previous studies have found difficulties in identifying empirically the displacement and compensation effects of innovation on employment due to data availability and measurement issues. Moreover, differences in the introduction of product and process innovations between middle and high income countries may influence the results. This research goes further than the previous literature on innovation and employment by:

Providing empirical evidence at the firm level on the role of complementary process and product innovation on job creation in Colombia.

Proposing an extended empirical framework that allows for differences in relative efficiency among firms.

By accounting for endogeneity issues related to product innovation, the analysis uses instrumental variables I consider the role of institutional variables on employment creation through an instrumental variable of a firm’s cooperative agreement on innovation.

Building a unique panel database, covering the period between 2008 and 2016 (only even years), that combines information from two different surveys in Colombia: the Annual Manufacturing Survey and the Survey on Development and Technological Innovation in the Manufacturing Sector. A shortcoming in previous studies is that panel data on innovation is not often available for low- and middle-income countries. A key advantage of using a panel database is that it allows me to consider heterogeneity that I would not be able to control for using cross-sectional data.

1.2. Data sources and descriptive statistics

A shortcoming in the literature review is the lack of available panel data on innovation in Latin American countries. To address this, I built a comprehensive panel database, which includes details on manufacturing firms and their innovation. This database will help gain insights into the impact of innovation on employment, as well as the role of cooperative agreements and other firm characteristics in promoting innovation. This section provides an overview of the data sources used in the study and the process of constructing the panel dataset, along with relevant summary statistics.

To build the panel dataset I combined two firm-level surveys in the manufacturing sector in Colombia: the Annual Manufacturing Survey (EAM by its acronym in Spanish) and the Survey on Development and Technological Innovation (EDIT by its acronym in Spanish). The Colombian National Administrative Department of Statistics (DANE) conducts the EAM every year and the EDIT every two years (DANE Citation2017). On one hand, the innovation survey reports data on process and product innovation, innovation expenditures or activities such as R&D expenditures, product design, personnel training, and managerial (Mairesse and Mohnen Citation2010). On the other hand, the EAM collects specific information on the characteristics of manufacturing firms and their establishments such as age, use of capital, intermediate goods, and region, among others, to study the impact of innovation on employment.

Both the EAM and the EDIT surveys are stratified according to economic sectors and geographical location. The obtained results provide national coverage divided by metropolitan areas and departments of Colombia. Both databases cover the years between 2008 and 2016. The combination of these two databases provides a unique panel dataset that can be used to improve the analysis of manufacturing firms, innovation, and employment issues.

1.2.1. Summary statistics

The complete dataset used for the model estimation is an unbalanced 5-wave panel from 2008 to 2016 (every two years). The database consists of 42,464 observations on manufacturing firms in total, which I classified into innovators and firms that do not innovate. shows the number of manufacturing firms for each year between 2008 and 2016, the last column presents the statistics for all five waves together. It shows a summary of descriptive statistics of the percentage of firms, employment growth and average employment by type of firms innovator (non-innovator, process innovator, product innovator and simultaneous process and product innovators).

Table 2. Employment growth and innovation.

On average, between 2008 and 2016, 26.7% of manufacturing firms reported innovations while 73% were non-innovators. More manufacturing firms innovated during the years 2008 and 2010, compared to the years 2012, 2014, and 2016. This decreasing trend reflects the lower economic growth after the global financial crisis.

Moreover, information from the EDIT survey allows me to classify firms that innovate into product innovators, process innovators or simultaneous process and product innovators. Most of the firms that innovate reported they do process innovation (11.4% of all manufacturing firms) followed by firms that do both process and product innovation simultaneously (9.4% of all manufacturing firms), while 6% of all firms do product innovation only.

Analysis of the Colombian data shows that firms that innovate have on average more than three times the number of workers compared to firms that are not innovators. Employment growth decreased drastically after 2008 in line with the fall in GDP growth from 6.8% in 2007 to 1.2% per cent in 2009, related to the decrease in economic growth with the global financial crisis. In 2010 GDP growth started to recover, and the manufacturing sector started to grow again however it did not grow at the same path rate as other sectors such as construction, mining, or services. Interestingly, firms that innovate simultaneously in product and process are the ones that show, on average, higher employment growth for all years.

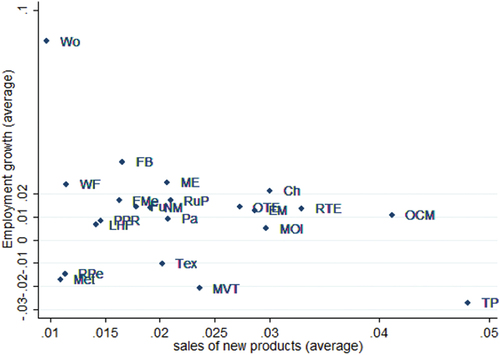

One way of measuring innovation is to use the percentage of sales derived from new or improved goods and services (Oslo Manual, 2005; Oecd/Eurostat Citation2018). shows the firm yearly average of the share of turnover from new products.

Table 3. Share of turnover from new products (average).

depicts the share of sales of new products and the average employment growth of 22 manufacturing industries in Colombia. Important variability across industries is observed in the graph. These differences are also observed across European industries (see Pianta Citation2003). Industries such as office and computing machinery (OCM in the graph), Radio, television, and communication equipment (RTE), chemicals (CH), other transport equipment (OTE), electrical machinery (EM) and medical and optical instruments (MOI) have a combination of a higher share of turnover due to new products and better employment performance than other industries (see right-top quadrant). By contrast, basic metals (Met) and refined petroleum (RPe) average negative growth of employment and low innovation as measured by sales from new products. For the case of refined petroleum, one explanation can be a combination of the 2009 financial crisis-induced recession with the low (and volatile) price of oil in the years after the recession. Traditional industries such as textiles (Tex) have an intermediate increase in sales associated with new products and positive job effects. Other industries like wood and products of wood (Wo), food and beverages (FB), wearing apparel and dyeing fur (WF), and fabricated metal products (FMe) have low innovation as measured by sales from new products, with gains in employment.

Regarding the size of the firms survey data indicate that, on average, 39% of enterprises are small (with less or 10 employees) while 61% reported having more than 10 employees.

Human capital is important and firms may have different demands for skills. On average, firms hire 70% of workers with ‘up to secondary level’, 15% with technical and vocational and 14% with university level education or more. These percentages vary between firms that innovate and do not innovate, with innovators showing a higher proportion of workers from higher education levels compared to non-innovators.

The next section presents the empirical strategy.

1.3. Empirical strategy

In this paper, I propose an analytical framework that allows me to provide empirical evidence on three key areas of firm innovation affecting employment:

The role of complementary process and product innovation on job creation.

Differences in relative efficiency among manufacturing firms as a result of knowledge spillovers, learning, etc. This is important since process innovation can be captured through efficiency improvements. Yet previous studies did not have the data to make a more flexible assumption to investigate this transmission mechanism.

The role of institutional variables on employment creation through an instrumental variable of the firm’s cooperative agreement on innovation. This analysis builds on Edith Penrose’s (Penrose Citation2009) work on the importance of the availability of managerial and planning resources at the firm level, which allows the expansion of the firm and the development of knowledge.

First, I use the empirical framework applied by Hall et al. (Citation2008) and Harrison, Jaumandreu, Mairesse and Peters (Citation2014) to study the effect of displacement and compensation forces of innovation on employment growth at the firm level. The model assumes that: i) a firm is observed in two periods of time, ii) a firm can produce various products (old and new or significantly improved products), and ii) there is an identical separable production function. Using the firm’s cost function and assuming cost minimisation the authors estimate the labour demand (Annex 1 Equation 4). Annex 1 discusses the theoretical model in detail. Then, using the labour demand equations and the employment equation one can write the employment growth equation.

Second, I augment the model specification with an efficiency variable to account for the relative efficiency of firms. The model is useful for the analysis since it permits disentangling the effect of innovation on employment at the firm level in product innovation, process innovation and efficiency. This is important to investigate the adoption of innovations in Latin American countries, for instance, these countries might show more complementarities of process and product innovation compared to high-income countries where product innovation alone can be more frequent.

The extended model specification for the employment growth equation augmented by a variable to account for the relative efficiency of firms (f) is the following:

i = 1,…,N_{firms}

where:

is the rate of employment growth between the year t = 1 and t = 2

is the deflated growth of sales for old products

(

) is the employment growth rate less the rate of growth of deflated sales from old products.

Increase in sales of new products.

Β0 is the relative efficiency of the production of old and new products.

is the negative of the average efficiency growth in the production of the old products. This indicates that non-process innovators can achieve efficiency gains through learning, and improvements in human capital, among others.

is the average efficiency growth for process innovators

is a dummy variable that takes the value of 1 if the firm implements simultaneously a process and product innovation

Β1 is the coefficient measuring the effect of the process and product innovation attributed to the production of new products.

is a variable interacting sales growth for new products with simultaneous process & product innovation

f is the relative efficiency in production of the firms. I normalised this variable between 0 and 1.

trend is a variable accounting for the trend in sales growth, innovation, and efficiency gains.

Equation 1 can also be interpreted as a measure of labour productivity growth by rewriting equation 5 in the annex 1 as: . In this case, the dependent variable is the growth of real output per worker and the analysis could provide an interpretation in terms of productivity growth.

I use stochastic frontier analysis (Aigner, Lovell, and Schmidt Citation1977; Meeusen and van Den Broeck Citation1977) to generate the efficiency measure f that accounts for the relative efficiency among firms. Annex 2 presents the econometric model to estimate the stochastic frontier analysis to predict an efficiency measure. Here I assume that not all firms are equally technically efficient (f variable), meaning that there are firms in the manufacturing sector that operate on the frontier, but other firms operate beneath the frontier.

I include a time trend variable (trend) to account for trends in sales growth, innovation, and efficiency gains. Productivity improvements in the production of existing products due to past industry innovations or learning can be captured by time trends.Footnote2

1.4. Extended model: results

The results of estimating Equation 1 are reported in .

Table 4. Employment, efficiency, and innovation.

1.4.1. Product innovation

Starting the production of a new or significantly improved good or service is viewed to have a positive effect on employment. Here product innovation is studied through the coefficient on real sales growth of production of new goods (

) which is positive and significant; implying that innovation that leads to growth of output due to new or significantly improved products (product innovation) increases labour growth, this is the gross effect of product innovation on employment. Moreover, the coefficient

isFootnote3 not significantly different from 1 suggesting that the increase of labour due to the demand of new products is not different compared to the one of old products. In other words, there is no difference in the relative efficiency of production of new products compared to old products. This suggests no displacement of workers from productivity differences between the new and old products.

I instrumentedFootnote4 the sales growth due to new productsFootnote5 using a variable for cooperative agreements on innovation,Footnote6 increased rangeFootnote7 of products and investment in research and development.

1.4.2. Process and product innovation

Preliminary empirical exercise for considering process innovation only suggest no evidence of significant employment displacement effects from process innovation only, the coefficient for the dummy variable was not significantFootnote8 and therefore was not included in the final specification. However, process innovation has a potential impact on employment when firms innovate both in process and product innovation at the same time. Firms that introduce both new process and product innovations have a growth of employment of 0.11% higher compared to other firms, so there are no signs of displacement effects. In this case, as suggested by (Peters Citation2004) process innovations may not necessarily lead to a reduction in labour since firms may want to improve the quality of their products or introduce processes to meet legal requirements. Unfortunately, the survey does not differentiate what share of process innovation goes to new versus old products. Therefore, this effect necessarily captures process innovation related to old products.

To separate the effect of process innovation related to product innovation, I assume that this process innovation is related to new products by including a variable interacting with a process and product indicator with the sales growth due to new products (). Firms may also introduce new processes to be able to produce a new product and to rationalise in terms of reducing average production costs. The coefficient is negative but is not significant indicating that the effect of improvements in processes related to new products might be reflected in a decrease in prices or quality improvement (compared to similar products in the market), which increases demand and therefore employment. So, in this case, there is no sign of displacement effects on workers (since the coefficient is not significant) due to productivity increases.

This article provides empirical evidence supporting the idea that complementary processes and product innovation do affect employment growth. As suggested by Bogliacino et al. (Citation2009) low- and middle-income countries differ from high income countries in their patterns of innovation. Innovation in low- and middle-income countries requires the acquisition of new technologies and imitation of processes and products developed in advanced economies, this is, firms need to introduce both process and product innovations. Previous studies focusing on Latin American countries have not found clear results on the role of simultaneous process and product innovation. For instance, Alvarez et al. (Citation2011) found in the case of Chile, that simultaneous process and product innovation is significant and positively related to employment growth, in contrast, Benavente and Lauterbach (Citation2008) found a negative relationship with employment and a small coefficient (the study used one wave of the innovation survey and 514 observations).

1.4.3. Efficiency

Different production efficiencies explain differences in employment growth at the firm level. Least squares econometric production models assume all firms are technically efficient. However, the combination of new technology and process improvements (for instance, organisational improvements and eliminating inefficiencies in the supply chain) increases efficiency and reduces costs. As pointed out by Brynjolfsson and Hitt (Citation2000) some of these savings may improve productivity, increase output quality or introduce variety without increasing the cost. Firms that operate beneath the production frontier may increase their output without requiring more input or produce the same level of output using less input (Chapter 1 Coelli et al. Citation2005).

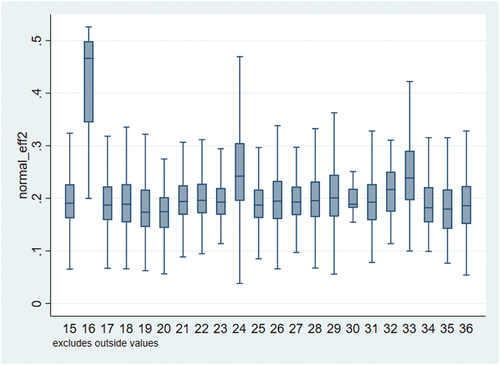

One novelty of this article is the study of the displacement effect through the increase in the relative efficiency of the firms using stochastic frontier analysis. Here the intuition is that more efficient firms compared to less efficient ones may be correlated with less new employment at the firm level. The overall efficiency (variable f in ) of the firm does influence employment growth. I normalised the variable between 0 and 1 for interpretation purposes (this allows me to have the same scale for all subjects) and it indicates that more efficient firms, compared to less efficient ones, are correlated with less new employment generation. In particular, the coefficient (-(2.109) related to the variable of efficiency (f) shows that for a 1% increase in efficiency of a firm, compared to other firms, employment decreases by about 2%. Moreover, the coefficient of efficiency is significantly different to oneFootnote9 suggesting that innovative firms closer to the technological frontier will increase employment less than proportionally. If the coefficient of efficiency were not significantly different to one, then increases in efficiency would affect employment equally for all firms.

The descriptive results (Annex 2, ) show that most firms have efficiency values far from 1 (even below or close to 0.5). From a policy perspective one can look at it as an opportunity to innovate while creating jobs at the same time. According to a report by Cornell University (Citation2019), Colombia scores above the regional average in all pillars of innovation inputs, indicating the potential for takeoff in the future. However, the report mentions that the country is lacking in effectively translating innovation investments into innovation outputs.

Figure 2. Efficiency by sub-sector of the manufacturing sector.

This could be related to the heterogeneity in efficiency among firms. One interpretation of this heterogeneity is that firms introduce process innovations when they are adopting new technologies, but new frontier technologies do not diffuse immediately. Instead, innovative technologies are first adapted to country-specific circumstances and adopted by frontier firms. Then, after technologies are tested, they start to diffuse (Andrews, Criscuolo, and Gal Citation2015). Another likely explanation is related to knowledge spillovers and the possibility of learning from others since a firm needs to acquire information about the compatibility of new processes or production techniques with the firm’s existing capital stock and workers (Davis et al. Citation1998).

Major differences in efficiency among firms could also reflect the case where firms introduce only process innovations. Firms in middle income countries may introduce new processes to decrease prices and this could be enough to survive in local markets. Studies have observed that in Colombia low productivity firms can stay in business for a long time.Footnote10

The effects of increasing efficiency are usually perceived over time. looks at the dynamics of efficiency by showing the estimates for three cases of my efficiency variable: column 1 refers to the lag of efficiency (Eff_1), column 2 presents the efficiency in the current period (f) and column 3 shows the results for the case where the efficiency variable is estimated for t + 1 (Fwd_eff). The results show that past improvements in efficiency have a positive effect on future employment (Eff_1). However, in the period where firms implement these improvements, employment growth is negatively affected by these changes (f). The forward efficiency (Fwd_eff) can be interpreted as anticipated expectations of the firm’s efficiency, and it may be used as a sort of measure for the rationality of the investors.

Table 5. Dynamics of efficiency: lag, present and forward.

Finally, the trend variable indicates that efficiency gains across the years are significant and positively related to employment creation. This could be associated with the introduction of new products, and/or if complementarities of new and old products exist, then the positive sign of the trend could also refer to the increase of demand for the old product due to these complementarities.

2. Concluding remarks

This paper finds that in Colombia, innovation often entails a combination of process and product innovation simultaneously. This reflects the dynamics behind the introduction of new technologies into the firm: in the process of putting a new technology into efficient use the firm adapts it and as a consequence not only introduces new or significantly improved products but also new or significantly improved processes.

Results indicate that the sources of employment growth are split between the contribution of growth of sales of new and old products and a simultaneous process and product innovation. Even though there is no evidence of significant employment displacement effects from process innovation only, estimates show robust evidence of displacement effects from differences in the relative efficiency of the manufacturing firms. This reflects process improvements and process innovations. One of the novelties of this analysis is that it allows a more flexible assumption about technological change by assuming that process innovation also improves firm efficiency – which is no longer identical for all firms – and therefore I estimated a variable of relative efficiency, which affects employment. A firm’s heterogeneity in middle income countries can be reflected in differences in efficiency or in decisions to introduce innovations into the firm. For example, uncertainty about the development, adoption and regulation of new products, new processes and production techniques affects a firm’s decisions to experiment with innovative technologies, which in turn, generates differences in outcomes among firms (Davis et al. Citation1998). Another likely reason for heterogeneity is differences in managerial ability, including the ability to identify and develop products, adapt to changing circumstances and organise production activity. Edith Penrose (Penrose Citation2009) conceptualised the importance of the availability of managerial and planning resources at the firm level, which allows the expansion of the firm and the development of knowledge.

Firm heterogeneity is important for explaining the effects of innovation on employment. Firms that have efficiency values close to 1 have higher labour productivity, which is similar to results from high income countries. However, most of the firms show efficiency values far below 1 and, in this case, increases in efficiency do not have such a negative effect on employment creation. This means that Colombia has an opportunity to innovate and create jobs at the same time since a substantial number of firms still need to catch up in terms of efficiency and while doing so, they are not necessarily displacing employment.

In addition, the empirical results show the importance of knowledge for innovation associated with cooperative agreements. This reflects the role of institutional variables, such as cooperative agreements on innovation, in impacting the probability of success of implementing innovations and the expectation in terms of sales growth. That is, cooperative agreements contribute to firm access to extra-industrial technology knowledge. Also, and in line with the literature, this study consistently found evidence of the importance of R&D in shaping innovation outcomes when using the variable as an instrument for product innovation.

The results of this paper do not differentiate by granular type of innovation, for instance, some firms may introduce a new process that is automated, and others introduce a non-automated process but it was not possible to study this difference since the information is not reported in the survey.

Further research should also include whether innovation activities induce a change in the skill structure of employees.

Disclosure statement

I wish to acknowledge the Colombian Statistical Agency DANE for allowing me access to the EAM and EDIT surveys and the use of their data, and to their staff for technical support. I am grateful for the beneficial comments provided by the reviewer and the editor. My deepest gratitude to Professor Pasquale Scaramozzino, for his valuable guidance, constructive comments, advice and support through each stage of my research. A special mention goes to Professor Giovanni Trovato, from Tor Vergata University of Rome, who guided me through stochastic frontier analysis and econometric methods. I thank the International J.A. Schumpeter Society” for the Honorary Mention for the paper. Juana Paola Bustamante’s affiliation to WHO, where she is a labour economist, is provided for identification purposes only and does not constitute institutional endorsement. Any views and opinions expressed are hers alone and do not represent WHO.

Additional information

Notes on contributors

Juana Paola Bustamante Izquierdo

Juana Paola Bustamante Izquierdo is an economist with a PhD in Economics, a master in Development Economics and a master in Environmental Economics. This paper is part of her PhD research. She has a strong background in economic analysis, research and policy advising in development economics, innovation, firm analysis and labour markets. She has worked at the international level with WHO, ILO and World Bank (IFC), and at the country level in Colombia at the Ministry of Labour and Social Security, Ministry of Finance and National Department of Planning.

Notes

1. Crepon, Duguet and Mairesse developed a three-step structural model on the relationship between innovation, output and productivity. The first step models the decision of firms to invest in R&D. The second step models the relationship between investment in R&D and the probability to be innovative, using a knowledge production function. The third step is the production function where productivity depends on innovation.

2. As discussed in Coelli et al. (Citation2005, ch 8), if there are observations over time then one should include a time trend to explicitly account for changes in economic relationships, such as production functions, due to technological advances.

3. can be interpreted as the relative efficiency of the production of old and new products, see Supplementary Material Annex 1 on the Theoretical Model.

4. I test for different specifications and in all cases the Sargan- Hansen test p-value confirms the validity of the instruments, there is no rejection of the null hypothesis.

5. Output growth of new products is not observed but nominal sales. The variable of nominal sales might be correlated with unanticipated shocks because data do not include price changes of sales at the firm level, and both output and prices are affected by movements in demand. This leads to endogeneity of g which could be correlated with the error term since prices changes are in the error term. Due to endogeneity issues applying Ordinary Least Squares (OLS) would result in biased estimates and would underestimate the true effect of product innovation.

6. The variable for cooperative agreements on innovation is a dummy variable indicating if the firm has established these agreements with one of the institutions in the National System of innovation.

7. Takes the value of 0 if the firm reports that the effect of the new or improved products or process (effect of innovation) has been irrelevant for broadening the range of goods and services, and 1 if it has had medium or high importance in the impact on broadening the range of products.

8. One of the reasons for this outcome could be that firms introducing only process innovations may have observed increased sales for old products due to price decreases. So the growth in sales of existing products compensates for possible improvements in labour productivity of old products due to process innovation.

9.

10. For instance, Eslava et al. (Citation2019) present evidence suggesting that there is a higher probability that less productive young firms in Colombia survive and continue in business, more commonly as compared to the USA.

1 in which case process innovation can affect the efficiency of old and new products Hall et al. (Citation2008)

2 the estimates suggested no evidence of significant employment displacement effects from firms that only introduce process innovation since the coefficient for the dummy variable of process innovation was not statistically significant and therefore I did not include it in the final specification on equation 7

References

- Acemoglu, D., and D. Autor. 2011. “Skills, Tasks and Technologies: Implications for Employment and Earnings.” In Handbook of Labor Economics, edited by David Card and Orley Ashenfelter, Vol. 4, 1043–1171. New York: Handbook of Labor Economics, Elsevier (printed in Great Britain). https://doi.org/10.1016/S0169-7218(11)02410-5

- Aigner, D., C. K. Lovell, and P. Schmidt. 1977. “Formulation and Estimation of Stochastic Frontier Production Function Models.” Journal of Econometrics 6 (1): 21–37. https://doi.org/10.1016/0304-4076(77)90052-5.

- Alvarez, R., J. M. Benavente, R. Campusano, and C. Cuevas. 2011. Employment Generation, Firm Size, and Innovation in Chile. Technical report, Inter-American Development Bank.

- Andrews, D., C. Criscuolo, and P. N. Gal. 2015. “Frontier Firms, Technology Diffusion and Public Policy: Micro Evidence from OECD Countries.” Technical report, OECD Productivity Working Papers.

- Baltagi, B. H. 2015. The Oxford Handbook of Panel Data. New York, USA: Oxford University press.

- Battese, G. E., and T. J. Coelli. 1992. “Frontier Production Functions, Technical Efficiency and Panel Data: With Application to Paddy Farmers in India.” Journal of Productivity Analysis 3 (1–2): 153–169. https://doi.org/10.1007/BF00158774.

- Becker, W., and J. Peters. 2000. Technological Opportunities, Absorptive Capacities, and Innovation. Augsburg: Institut fur Volkswirtschaftslehre der Universitat Augsburg.

- Benavente, J. M., and R. Lauterbach. 2008. “Technological Innovation and Employment: Complements or Substitutes?” The European Journal of Development Research 20 (2): 318–329. https://doi.org/10.1080/09578810802060744.

- Blanchower, D. G., and S. M. Burgess. 1998. “New Technology and Jobs: Comparative Evidence from a Two-Country Study.” Economics of Innovation & New Technology 5 (2–4): 109–138. https://doi.org/10.1080/10438599800000002.

- Bogliacino, F., G. Perani, M. Pianta, and S. Supino. 2009. “Innovation in Developing Countries: The Evidence from Innovation Surveys.” In FIRB conference Research and Entrepreneurship in the Knowledge-based Economy Milano: Universita L. Bocconi.

- Brynjolfsson, E., and L. M. Hitt. 2000. “Beyond Computation: Information Technology, Organizational Transformation and Business Performance.” Journal of Economic Perspectives 14 (4): 23–48. https://doi.org/10.1257/jep.14.4.23.

- Calvino, F., and M. E. Virgillito. 2018. “The Innovation-Employment Nexus: A Critical Survey of Theory and Empirics.” Journal of Economic Surveys 32 (1): 83–117. https://doi.org/10.1111/joes.12190.

- Coelli, T. J., D. S. P. Rao, C. J. O’Donnell, and G. E. Battese. 2005. An Introduction to Efficiency and Productivity Analysis. New York, NY: Springer Science & Business Media.

- Cornell University, I. N. S. E. A. D. W. 2019. “The Global Innovation Index 2019: Creating Healthy Lives-The Future of Medical Innovation.”

- Crépon, B., E. Duguet, and J. Mairesse. 1998. “Research, Innovation and Productivity: An Econometric Analysis at the Firm Level.” Economics of Innovation & New Technology 7 (2): 115–158.

- Crespi, G., E. Tacsir, and M. Pereira. 2019. “Effects of Innovation on Employment in Latin America.” Industrial and Corporate Change 28 (1): 139–159. https://doi.org/10.1093/icc/dty062.

- Crespi, G., and P. Zuniga. 2012. “Innovation and Productivity: Evidence from Six Latin American Countries.” World Development 40 (2): 273–290. https://doi.org/10.1016/j.worlddev.2011.07.010.

- Criscuolo, C. 2009. “Innovation and Productivity: Estimating the Core Model Across 18 Countries.” Innovation in Firms: A Microeconomic Perspective, 111–138. Paris: OECD Publishing. https://doi.org/10.1787/9789264056213-5-en.

- DANE. 2017. Methodology for the Survey on Development and Technological Innovation in the Manufacturing Sector Edit. Bogotá, Colombia: Departamento Administrativo Nacional de Estad[istica-DANE].

- Davis, S. J., J. C. Haltiwanger, S. Schuh. 1998. Job Creation and Destruction, 1. USA: MIT Press Books.

- Eslava, M., J. C. Haltiwanger, and A. Pinzon. 2019. Job Creation in Colombia Vs. the US: “Up or Out dynamics” Meets “The Life Cycle of Plants”. Massachusetts, USA: National Bureau of Economic Research.

- Fagerberg, J., D. C. Mowery, and R. R. Nelson, ed. 2005. The Oxford Handbook of Innovation. Oxford university press.

- Fagerberg, J., M. Srholec, and B. Verspagen. 2010. “Innovation and economic development.” In Handbook of the Economics of Innovation, edited by Bronwyn H. Hall and Nathan Rosenberg, Vol. 2, 833–872. North Holland.

- Freeman, C. 1987. Technology Policy and Economic Performance. London and New York: Pinter Publishers Great Britain.

- Garcia, A., J. Jaumandreu, and C. Rodriguez. 2004. Innovation and Jobs: Evidence from Manufacturing Firms. MRPA Paper, (1204).

- Grazzi, M., C. Pietrobelli. 2016. Firm Innovation and Productivity in Latin America and the Caribbean. Washington DC: Inter-American Development Bank.

- Greenan, N., and D. Guellec. 2000. “Technological Innovation and Employment Reallocation.” Labour 14 (4): 547–590. https://doi.org/10.1111/1467-9914.00146.

- Hall, B. H. 2004. Innovation and diffusion. National Bureau of Economic Research, (No. w10212).

- Hall, B. H., F. Lotti, and J. Mairesse. 2008. “Employment, Innovation, and Productivity: Evidence from Italian Microdata.” Industrial and Corporate Change 17 (4): 813–839. https://doi.org/10.1093/icc/dtn022.

- Harrison, R., J. Jaumandreu, J. Mairesse, and B. Peters. 2014. Does Innovation Stimulate Employment? A Firm-Level Analysis Using Comparable Micro-Data from Four European Countries. International Journal of Industrial Organization Elsevier.

- Harrison, Rupert, Jordi Jaumandreu, Jacques Mairesse, and Bettina Peters. 2005. Does Innovation Stimulate Employment? A Firm-Level Analysis Using Comparable Micro Data from Four European Countries. Madrid: Mimeo, Department of Economics, University Carlos III.

- Katsoulacos, Y. 1984. “Product Innovation and Employment.” European Economic Review 26 (1–2): 83–108. Journal of Industrial Organization, 35:29-43. https://doi.org/10.1016/0014-2921(84)90023-0.

- Lachenmaier, S., and H. Rottmann. 2011. “Effects of Innovation on Employment: A Dynamic Panel Analysis.” International Journal of Industrial Organization 29 (2): 210–220. https://doi.org/10.1016/j.ijindorg.2010.05.004.

- Mairesse, J., and P. Mohnen. 2010. “Using Innovation Surveys for Econometric Analysis.” In Handbook of the Economics of Innovation, edited by Bronwyn Hall and Nathan Rosenberg, Vol. 2, 1129–1155. North Holland (Printed and bound in the UK).

- Meeusen, W., and J. van Den Broeck. 1977. “Efficiency Estimation from Cobb-Douglas Production Functions with Composed Error.” International Economic Review 18 (2): 435–444. https://doi.org/10.2307/2525757.

- Michie, J., and C. Oughton. 2016. “Creating Local Economic Resilience: Co-Operation, Innovation and firms’ Absorptive Capacity.” In Global Economic Crisis and Local Economic Development, edited by J Begley, D Coffey, T Donnelly, and C Thornley, 12–29. Abingdon and New York: Routledge.

- Miravete, E. J., and J. C. Pernias. 2006. “Innovation Complementarity and Scale of Production.” The Journal of Industrial Economics 54 (1): 1–29. https://doi.org/10.1111/j.1467-6451.2006.00273.x.

- Oecd/Eurostat, E. C. 2018. Oslo Manual 2018: Guidelines for Collecting, Reporting and Using Data on Innovation. OECD publishing.

- Penrose, E. T. 2009. The Theory of the Growth of the Firm. United Kingdom: Oxford University Press.

- Peters, B. 2004. Employment Effects of Different Innovation Activities: Microeconometric Evidence. ZEW-Centre for European Economic Research Discussion Paper, (04-073).

- Pianta, M. 2003. “Innovation and Employment.” The Oxford Handbook of Innovation.

- Pitelis, Christos. 2009. Edith Penrose’s ‘The Theory of the Growth of the Firm’ Fifty Years Later. Cambridge, UK: Cambridge University.

- Raffo, J., S. Lhuillery, and L. Miotti. 2008. “Northern and Southern Innovativity: A Comparison Across European and Latin American Countries.” The European Journal of Development Research 20 (2): 219–239. https://doi.org/10.1080/09578810802060777.

- Van Reenen, J. 1997. “Employment and Technological Innovation: Evidence from UK Manufacturing Firms.” Journal of Labor Economics 15 (2): 255–284. https://doi.org/10.1086/209833.

- Vivarelli, M. 2014. “Innovation, Employment and Skills in Advanced and Developing Countries: A Survey of Economic Literature.” Journal of Economic Issues 48 (1): 123–154. https://doi.org/10.2753/JEI0021-3624480106.

Annex 1

Theoretical Model for innovation and employment at the firm level

The assumptions of the theoretical model are the following (Hall et al. (Citation2008), Harrison et al (Citation2014)):

A firm i is observed at two points in time: t1 and t2.

Firms can produce various products. The firm can produce two types of goods and services: old products (j = 1) in the first period (t1) and, if they innovate, they can also produce new or significantly improved ones (j = 2) in the second period(t2). In this way, I denote outputs at time t as Yjt.

Each type of product is produced with constant returns to scale in capital (K), labour (L) and intermediate goods (M) (i.e., it is assumed that the model is linear-homogeneous in these inputs).

There is an identical separable production function with different Hicks-neutral technological productivity indexed by θjt. Here, Harrison et al. (Citation2014) assume that θ represents the efficiency of the investments in research and development (R&D) to generate process and product innovations.

In this paper, I assume a broader definition of efficiency to propose an extended model. That is, θ also gives the degree of efficiency attainable for any firm (independently of its R&D activities) because of knowledge spillovers and learning, among others (Garcia et al., Citation2004). If I assume that knowledge raises the marginal productivity of inputs then the efficiency in the productive process, both for new and old products, can increase due to learning effects and process innovations (Peters, 2004). Therefore, this research introduces assumptions regarding θ:

i) Not all firms are technically efficient (θjti), and

ii) Process innovation can increase a firm’s relative efficiency.

The production function (Yjti) for a product of type j in period t and firm i is represented as follows:

In the first period (t1) the firm produces only the old type of product (j = 1)

In the second period (t2) the firm produces the old type of product (j = 1) and some firms decide to produce and sell new products (j = 2), hence

Old products:

New products:

where μi and νi are unanticipated productivity shocks.

Using the firm’s cost function (see Hall et al. (Citation2008) and Peters (Citation2004)for detailed equations) and assuming cost minimization and applying Shephard’s Lemma, labour demand is given by:

where cwL represents the derivative of the marginal cost to the wage.

The employment equation decomposes the growth of employment into growth due to the production of old and new goods between the two years t=1 and t=2. The assumption is that the prices of inputs are constant in time and equal for both old and new goods.

If efficiency gains related to old products are different between process innovators and non-process innovators, and that firms may implement bothFootnote1 process and product innovations- the econometric model can be written as:

where:

is the rate of employment growth between the year t = 1 and t = 2

and

are the corresponding rates of output growth for old and new products respectively.

Β0 is the relative efficiency of the production of old and new products.

is the negative of the average efficiency growth in the production of the old products. This indicates that non-process innovators can achieve efficiency gains through learning, and improvements in human capital, among others.

is the average efficiency growth for process innovators

is a dummy which takes the value of 1 if the firm implements an innovation in a process and it is not associated with product innovation.

d2 taking the value of 1 if the firm implements simultaneously a process and product innovation.

I proposed an extended model specification augmented by an efficiency variable, to account for the relative efficiency of firms.

where:

f is the relative efficiency in the production of the firms

trend is a variable accounting for the trend in the product growth, innovation and efficiency gains.

From the data it is not possible to observe the real growth of sales () but the nominal increase of total sales). Therefore, instead of using sales of products

this article uses the deflated growth of sales

(see Hall et al. Citation2008; Harrison et al. Citation2014).

Since is not directly observed then the model uses the increase of sales of new products

. Therefore, sales in period 2 can be divided into sales growth due to old products) and sales growth due to new products (

). Note that from the EDIT survey, it is possible to observe the share of turnover of new products (

) for firms that innovate. So it is possible to estimate the growth of sales of new products as

where gSales is the deflated growth of sales of the production of old products.

I include a binary indicator for process innovators only and another one for simultaneous process and product innovators (). However, it is not possible to quantify how much of the process innovation applies to old or new products in the case where the firm innovates both on process and product. Therefore, I performed a preliminary empirical exercise on equation 5 with alternative specifications to consider processFootnote2

innovation and the final preferred equation is the following:

where the capture the interaction of simultaneous process and product innovation with the growth of new products. This assumes that the process innovation is related to the introduction of new products and

Annex 2

measures the effect.

Annex 2 Stochastic frontier analysis

I estimated the relative efficiency of the firms using Stochastic Frontier Analysis. To study efficiency requires introducing a frontier production process relative to which efficiency can be measured (Baltagi, Citation2015). Technical efficiency refers to the ability of a firm to obtain the maximum output from given inputs (Coelli et al., Citation2005). The technical efficiency of a given firm may have different definitions, this paper follows Battese and Coelli (1992) and considers technical efficiency as the ratio of “its mean production (conditional on its levels of factor inputs and firm effects) to the corresponding mean production if the firm utilizes its levels of inputs more efficiently”.

In this paper, I use the stochastic frontier analysis to predict efficiency effects by measuring technical efficiency as the ratio of observed output compared to the corresponding stochastic frontier output (Coelli et al., Citation2005).

This measure of efficiency takes a value between zero and one depending on the distance of the output of the i-th firm relative to the output produced by a fully efficient firm with the same inputs. This estimated variable corresponds to f.

The production function used to estimate the stochastic frontier production for the manufacturing sector in Colombia is a translog production function in which the inefficiency effect is a time-varying decay model. The translog functional form is a second-order log-linear form with all cross terms included, and it is flexible since it allows the data to indicate the curvature of the function. The specification of the stochastic frontier production function for the panel estimated in with a time-varying decay model is:

where represents the total value of sales of production ;

includes consumption of intermediate goods, energy and raw materials;

is the number of workers and

is investment. It also includes the interaction of the variables, the square of the variables and the lag of

All the estimated coefficients are statistically significant (). The parameters in the translog production function do not represent output elasticities, hence I must use a linear combination of frontier parameters to compute elasticities.

The estimate of in the model shows a negative sign which means that inefficiency increases over time (see Battese and Coelli, Citation1992).

Table A1 Time decay frontier model