Abstract

This paper examines the venture capital-driven process of making intangible assets in platform start-up firms. By examining the case study of the rise and fall of a venture capital-backed ‘unicorn’ firm developing a digital health platform, this paper argues that the process of real valorization of capital invested in platform start-up firms involves the making of algorithmic systems and data as intangible assets as well as the experimentation with strategies of exploitation and appropriation, which are inherently linked to the future-oriented financial valorization process of equity shares since unprofitable start-up firms continuously require outside capital to expand operations. While the fetish of ‘artificial intelligence’ posing the firm’s chatbot for self-diagnosis as an intelligent ‘doctor in your pocket’ plays an important role in financial valorization, it is the failed real valorization process in making profits that ultimately leads to the platform start-up’s financial collapse. The conceptual contribution of the paper centres on the contradictory nature of assetization processes which sheds light on how class domination operates in and through venture capital-driven accumulation.

Introduction

In 2022, what seemed like a never-ending rise of ‘unicorn’ start-up firms’ equity prices came to a sudden halt when inflation soared, and central banks raised interest rates to an extent not seen since the 2008 global financial crisis (GFC). For over a decade, it seemed as if the financial valorization of unicorns’ equity shares – in part fuelled by an inflow of capital from ‘non-traditional’ investors such as hedge funds, private equity firms, mutual funds, sovereign wealth funds (SWFs) and incumbent corporations seeking returns in private markets from start-up investing in a low-interest rate environment – would be ever increasing despite the fact that most unicorns remained unprofitable.

The hyperbole in private markets echoed Marx’ observation of speculative bubbles in stock markets when ‘fictitious capital’ in the form of publicly-traded shares accumulates so that ‘all connection with the actual process of capital's valorization is lost, right down to the last trace, confirming the notion that capital is automatically valorized by its own powers’ (Marx, Citation1981, p. 597). Last year’s downturn in venture capital – manifesting in an overall drop in venture capital investments, a freeze in the initial public offering (IPO) market, an increasing number of bankruptcies as well as ‘down rounds’ that start-ups had to accept to stay afloat – was a stark reminder that investors do not forever tolerate the often-hopeless unprofitability of unicorns – or in other words, the failure of start-up firms to valorize the real capital invested by outside investors.

That would not come as a surprise to Marx who held that the idea that equity prices are somehow detached from the production process is a capitalist myth: though the process of financial valorization can in certain periods operate relatively autonomously (as in the low-interest rate environment since the GFC in which quantitative easing propped up equity prices in public and private markets), it ultimately always remains anchored in the process of real valorization. Yet, scholarship accounting for both dimensions of venture capital – the processes of financial and real valorization – at the tech sector-finance nexus that have brought private tech firms and more broadly ‘platform capitalism’ (Langley & Leyshon, Citation2017; Srnicek, Citation2017) into being remain scarce. The phenomenon of ‘venture capital’ is largely absent from recent Marxist-inspired literature on finance capital (Chesnais, Citation2016), fictitious capital (Durand, Citation2017) or financialization (Lapavitsas, Citation2013), as well as from the broader sociological and political economy literature on ‘asset manager capitalism’ (Braun, Citation2021) and ‘financialization’ (van der Zwan, Citation2014).

More recently, a small but growing literature emerged that utilized the conceptual lens of ‘assets’ and ‘assetization’ processes (Birch & Muniesa, Citation2020) to examine the logics and dynamics of financial valorization processes in venture capital-driven accumulation to better understand how venture capital works. This body of literature includes STS inspired accounts (Birch, Citation2017, Citation2022; Hogarth, Citation2017) and accounts drawing on insights from the Bourdieusian tradition (Elder-Vass, Citation2021; see also Beckert, Citation2020) which examined social processes underpinning financial valorization within the formation of equity prices in venture capital. Scholarship in the comparative political economy (CPE) tradition focused on how equity stakes held in venture capital portfolios are made into financial assets, and how venture capital investment logics shape growth trajectories of start-up firms (Cooiman, Citation2022; see Langley & Leyshon, Citation2017). What is still missing is an account of the relations between financial and real valorization processes in venture capital.

Drawing on insights from the Marx-inspired literature on ‘fictitious capital’ (Durand, Citation2017; Palludeto & Rossi, Citation2022) as well as from the intellectual monopoly capitalism (IMC) tradition (Durand & Milberg, Citation2020; Pagano, Citation2014; Rikap, Citation2021), this paper argues that the process of real valorization of the venture capital invested in platform start-up firms involves the making of intangible assets (such as datasets and algorithmic systems) as well as the experimentation with strategies of exploitation and appropriation, which are inherently linked to financial valorization processes of start-up firms’ equity shares since unprofitable start-up firms continuously require outside capital to expand operations. The processes of real and financial valorization thus cannot be understood as being independent from each other but as bound up within a set of contradictory capitalist social relations – the crucial yet so far overlooked aspect of venture capital-driven accumulation.

This paper makes this argument by examining the empirical case of one once ‘high flying’ unicorn, the digital platform start-up firm Babylon Health, that within a decade went from raising US$380 million in the largest ever venture capital funding round in the United Kingdom in 2019 and a financial valorization of US$4.2 billion at its peak before the IPO in 2021 to a penny stock and then bankruptcy in 2023. The case study demonstrates that (1) equity prices of start-up firms never become fully detached from the underlying production process (which ultimately becomes apparent in the moment of the start-up firm’s financial collapse) and (2) the fetishization of technology (Harvey, Citation2003) plays a crucial role in the financial valorization of start-up firms’ equity shares. This is exemplified by the Babylon case study illustrating how fetish beliefs that pose ‘AI’ as an autonomously operating, intelligent ‘symptom checker’ chatbot for self-diagnosis temporarily validated investors’ anticipation of future profits while obscuring the social nature and actual workings of the underpinning algorithmic systems that Babylon set out but ultimately failed to make into intangible assets.

This paper contributes conceptually to the growing literature of ‘assetization studies’ (Birch & Muniesa, Citation2020) by focusing on the contradictory nature of assetization processes through examining venture capital-driven investing in platform start-up firms from a Marxist perspective. This now wide-ranging body of literature has highlighted how turning knowledge and data into intangible assets – typically understood as privatized resource or ‘capitalized property’ (Birch, Citation2017, p. 468) – enables asset owners to limit and control the access to and thus exclude others from using this knowledge and data, for example, by establishing legal monopoly rights (e.g. via patents, trademarks, or trade secrets) over the asset to extract value from society in the form of durable economic rents (Birch, Citation2020). While scholars from various traditions examined the social practices involved in assetization processes in great empirical detail (e.g. see Birch et al., Citation2021, on personal data and Bourgeron & Geiger, Citation2022, on patents), questions about the role that ideologies play in the making of intangible assets or how assetization processes depend on labour exploitation and reproduce class relations have largely been neglected.

This paper aims to broaden the current debate about the political dimensions and social consequences of assetization processes by highlighting how the making of intangible assets takes place within capital, which ‘is not a thing, but a social relation’ (Marx, Citation1976, p. 932). It builds on the IMC tradition’s argument that the dynamics of capital accumulation in the tech sector are underpinned by a new set of relations of production enabling (1) appropriation of value through labour exploitation as well as (2) ‘accumulation by dispossession’ (Harvey, Citation2004) in the form of systematic appropriation of knowledge and data (and thus value) from society at large (see Rikap, Citation2021). Consequently, class conflicts unfold alongside the capital-labour dimension as well as over the privatization of public services such as healthcare or of personal data.

The empirical section of this paper focuses on the case study of Babylon Health and draws on qualitative data from 81 semi-structured interviews with investors, entrepreneurs, doctors, healthcare executive, academics and civil servants, participant observation at Health Tech and company-specific public events in London, and primary documents (including company statements, regulatory filings and financial disclosures) as part of multi-sited ethnographic fieldwork between 2018 and 2022. The paper utilizes the case study of Babylon to empirically unpack and examine the ‘microfoundations’ (Braun, Citation2016) of venture capital-driven accumulation as an increasingly powerful capitalist macro process. In the following sections, the paper introduces the conceptual framework, presents the case study-based analysis and offers some broader implications for future research.

Venture capital and the relation between financial and real valorization processes

The problem at the heart of venture capital is the difference in monetary value between (1) the capital that is paid in exchange for equity shares in privately held start-up firms (i.e. the real capital invested in the firm) and (2) the monetary amount ascribed to equity shares (i.e. their price) derived on the basis of potential future profits yet to be made.

Though the institutional manifestations of venture capital and private equity type investments do not feature in Marx’s analysis of the circulations of capital through the credit system in Capital: Volume 3 (which is unsurprising given that these would only start to emerge after WWII), two observations that Marx made in his explorations into ‘interest-bearing’ and ‘fictitious capital’ – despite the fact that his analysis largely focuses on credit, government bonds and publicly-traded shares – are still helpful to unpack the problem of venture capital. For Marx, the fictitious character of interest-bearing capital stems from two processes: (1) its monetary value becomes detached from the value of real capital invested; and (2) this form of capital reifies capitalist relations of production by (a) appearing as a ‘mere thing … money that creates more money’ (Marx, Citation1981, p. 515), while (b) invisibilizing its relation to production processes and the capital-labour contradiction at the core of capitalism: ‘In interest-bearing capital, the capital relationship reaches its most superficial and fetishized form … .[which] appears unmediated by the production and circulation processes’ (Marx, Citation1981, pp. 515–516).

These two elements also characterize the fictitious character of venture capital. Venture capital also concerns investments in property titles the monetary value of which is derived from anticipated income streams (Marx, Citation1981, p. 597). However, venture capital lacks what is typically seen as key characteristic of fictitious capital: a high degree of liquidity resulting from the tradability of equity shares in secondary markets (Chesnais, Citation2016; Durand, Citation2017; Palludeto & Rossi, Citation2022). The reason is that venture capital concerns investments in equity stakes of privately held start-up firms. There is only a limited secondary market for highly valued start-up equity shares in late-stage funding rounds making them an illiquid type of investment. It is through exit transactions by either creating liquidity through an IPO of shares which trade as a form of fictious capital in stock markets through which investors can realize capital gains (Hilferding, Citation1981; see also Durand, Citation2017), or through selling equity shares in acquisitions by incumbent corporations. Venture capital investing concerns the capitalist investment process prior to the issuance of stocks as fictitious capital.

In contrast to CPE accounts that understand venture capital as a specific asset management firm with a high risk/return investment strategy (Cooiman, Citation2022) or ‘patient capital’ (Klingler-Vidra, Citation2016), this paper offers a preliminary Marx-inspired definition of venture capital as a form of interest-bearing capital that is primarily invested in equity shares of privately held start-up firms over several funding stages to reduce investment risks until the ‘exit’ transaction through which investors seek to sell equity shares to other investors at higher prices to make financial profits in the form of capital gains to generate investment returns at the portfolio-level. This broader definition of venture capital accounts for the fact that the low-interest rate environment instituted by central banks after the GFC drove interest-bearing capital – manifesting in an increasing variety of financial firms, investment funds and incumbent corporations – to seek financial profits from participating indirectly and directly in equity investments in start-up firms. The rise of institutional investors such as pension funds, endowments, insurance corporations, SWFs, mutual funds and ‘alternative’ investment managers since the 1980s (Braun, Citation2021; Fichtner, Citation2020) paved the way for increasing inflows of capital allocated to venture capital fundsFootnote1 in the last decade. Mutual funds, SWFs, hedge funds and private equity firms also increasingly started to invest directly in start-up firms typically in late-stage funding rounds as ‘nontraditional’ investors (Fan, Citation2022) while individual capitalists acted as ‘angel’ investors in early rounds.

All these investors came to seek capital gains as part of venture capital because the venture capital fund-specific investment imperative of ‘blitzscaling’ (Hoffman & Yeh, Citation2018) or ‘hypergrowth’ (Cooiman, Citation2022) became a general feature of equity investing in start-up firms after the GFC enabled by platform-mediated business models which could absorb more venture capital over longer periods of time to propel the rise of platform capitalism (Langley & Leyshon, Citation2017). To maximize portfolio returns over the 10-year time horizon of a typical venture capital fund, general partners of venture capital firms came to seek ‘fund returners’ with enormous growth trajectories when investing in start-up firms in sectors such as IT (primarily software) where technologies are often proven and businesses can be built at lower cost on intangible assets and/or scaled rapidly to reach high equity prices in anticipated exit transactions (Cooiman, Citation2022).

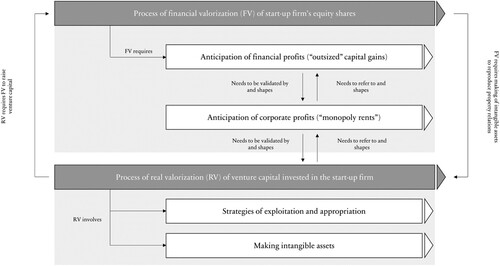

The dynamics and contradictions of the venture capital investment process across the funding stages stem from ‘the tension between the process of real valorisation and the process of financial valorisation’ (Durand, Citation2017, p. 42). The term ‘financial valorization’ refers in this paper to the process of how monetary value is ascribed to equity shares (i.e. their price) based on anticipated profits from future real valorization processes. Real valorization’ denotes here the process of how venture capital invested in start-up firms is deployed to hire and exploit labour, appropriate data, develop technologies and expand operations to make profits. illustrates how we can make sense of the contradictory relationship between financial and real valorization in venture capital in which the making of intangible assets takes place:

The financial valorization of equity shares requires investors to anticipate ‘outsized’ capital gains realized through high prices of equity shares at potential exit transactions. Importantly, the anticipation of financial profits needs to be validated by an anticipation of how the start-up firm is going to make profits (i.e. the anticipation of ‘corporate profits’).

The anticipation of ‘outsized’ capital gains shapes how investors anticipate start-up firms to make profits. ‘Blitzscaling’ platforms to reach dominant market positions that would result in monopoly rents translating into high equity prices at the exit transaction (regardless if corporate profits are actually realized or not) became the dominant logic to anticipate corporate profits which was ex-post validated by the success of previous platforms in social media and internet sectors (Langley & Leyshon, Citation2017).

The process of financial valorization based on the anticipation of outsized capital gains shapes the unfolding of the real valorization process in start-up firms through the anticipation of corporate profits. But as the outcome of the new capitalist venture and technological development are unknowable in advance, start-up firms need to experiment with strategies of exploitation and appropriation (see Rikap, Citation2022) while seeking to make intangible assets and scale up operations. The process of real valorization shapes and needs to continuously validate investors’ anticipation of future corporate profits to validate the anticipation of future capital gains to raise more venture capital to continuously finance corporate expansion.

If this validation process fails, the anticipation of future corporate and financial profits breaks down and the financial valorization of equity shares collapses. This is how real valorization ultimately ‘over-determines the process of financial valorisation’ (Durand, Citation2017, p. 41) despite the fact that the former can operate relatively autonomous under certain conditions.

While equity prices are formed under competitive conditions in private markets, venture capital’s financial valorization requires a broader ideological process through which capitalists coordinate their actions and anticipate corporate (and financial) profits. ‘Business model narratives’ are crucial for capitalist entrepreneurs and investors to rationalize and anticipate corporate profits, and also function as a discursive reference point for calculations of future corporate revenues or financial returns (Elder-Vass, Citation2021). Capitalist entrepreneurs also strategically utilize symbols and ascribed status of reputable early investors to enrol more investors by lending credibility to the future prospects of their start-up firms and validate anticipated corporate profits (see Ferrary & Granovetter, Citation2009). These symbols become ideologically powerful because of the fictitious character of venture capital which reifies equity prices through ‘unicorn’ fetishism (see Hogarth, Citation2017) which obscures the mediating processes between real and financial valorization processes.

Further, venture capital produces a specific form of technology fetishism to validate anticipated corporate profits by ‘endow[ing] technologies – mere things – with powers they do not have’ … ‘even magical powers to move and shape the world in distinctive ways’ (Harvey, Citation2003, p. 3). The fetishism of ‘AI’ portrays algorithmic systems as autonomously operating, intelligent ‘machines’ while obscuring the manifold labour processes, digital infrastructures and forms of appropriating vast sways of personal data on which the algorithmic operations always depend (Burrell & Fourcade, Citation2021). The general tendency of venture capital to fetishize ‘AI’ does not come as a surprise since developing an ‘intelligent robot’ to increase the efficiency of production and reduce labour costs to make profits with the aim to automate and displace living labour altogether has been a long-standing capitalist desire (Marx, Citation1976; Noble, Citation1984). What gave this desire a new impetus were real technological changes since dot-com in the form of ever larger datasets in combination with machine learning algorithms and growing computing power which were largely driven – not, as capitalists like to portray it, by some magical force of ‘technological progress’ taking place outside of capitalist social relations – by the profit-imperative of Big Tech and other intellectual monopolies (Rikap, Citation2021). Capitalist entrepreneurs reproduce such fetishisms through a mix of articulated hyperbole and ‘fake it till you make it’ mentality with the intention to raise capital (Liu, Citation2020). The fetishism of AI also proved powerful in capturing the imagination of the ruling classes and the broader public (Elish & Boyd, Citation2018; Katz, Citation2020, Chapter 2), serving capitalist entrepreneurs in enrolling powerful allies to sell their products. It also serves venture capital to legitimate the experimentation with new strategies of exploitation and appropriation in the name of ‘technological disruption’ supposedly bringing about societal change for the benefit of all.

Making intangible assets through venture capital: The (failed) capitalist experiment of Babylon Health and its contradictions

Historical background: NHS privatization and foreign venture capital inflow into UK tech

Babylon Holdings was founded by former Goldman Sachs investment banker Dr Ali Parsadoust (Parsa) in London (United Kingdom) in 2013. The historical context in which Babylon emerged was characterized by two decades of increasing privatization in the National Health Service (NHS) – set up in 1948 as a tax-funded public institution with the mission to offer universal access to healthcare for free at the point of use – enabled through marketization by consecutive Tory and Labour governments since the Thatcher government in the 1980s (Pollock, Citation2004; Pollock & Price, Citation2011). Government-induced funding cuts to healthcare spending in the name of austerity following the GFC while costs of healthcare provision continuously increased pushed the NHS in 2015 to the brink of financial collapse (The King’s Fund, Citation2021). The consequences were deteriorating working conditions for frontline clinical staff who faced increasing workloads and suffered pay cuts of up to 32 per cent in real terms between 2010 and 2020 (London Economics, Citation2021), an immense shortage of clinical and support staff, a severe lack of equipment (e.g. the lack of PPE becoming visible after the outbreak of the COVID-19 pandemic in early 2020), decreasing quality of care and increasing waiting times for patients to get consultations with specialists and general practitioners (GPs) or receive treatments.

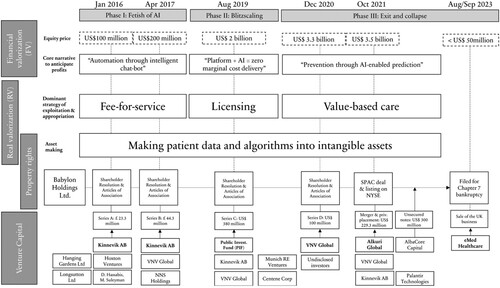

Over the last decade, a new wave of NHS privatization through digital tech firms was driven by venture capital and enabled by the UK government pushing for the ‘platformization’ of the NHS (Faulkner-Gurstein & Wyatt, Citation2021). The rise of Babylon represented and coincided with an increase in venture capital investments in British tech start-up firms, making the United Kingdom the third largest destination in terms of total amount of venture capital invested (after the United States and China) in 2020 – totalling US$15 billion – with 63 per cent of capital coming from foreign investors (Tech Nation, Citation2021). Record amounts of venture capital have been flowing into the UK’s ‘digital health’ sector, an umbrella term used by investors to describe start-up firms that repurpose data-driven technologies, platform business models and social media logics as part of ‘consumer-centric healthcare services’ (e.g. via smartphone apps) in healthcare. In this context, Babylon’s capitalist entrepreneurs, domestic and foreign investors, insurance corporations, and their ruling class allies in the Tory government under Theresa May proposed, financed and politically backed the idea that bringing Uber’s platform model to healthcare in combination with an ‘AI’ powered chatbot for self-diagnosing could address some of the structural issues the NHS was facing under the guise of ‘democratiz[ing] healthcare for everyone on Earth’ (Babylon Health, Citation2022) and despite antagonisms and opposition from NHS workers and patients to further privatizing healthcare services. But before exploring the consequences of Babylon’s expansion, let’s first look at the contradictory nature of the venture capital-driven process of making intangible assets underpinning Babylon’s digital health platform which is illustrated in .

What venture capital requires: Anticipation of profits, strategies of exploitation and appropriation, and making of intangible assets

Phase I: Fetish of AI

In 2016 and 2017, Babylon’s capitalist entrepreneurs attracted venture capital by constructing a simple yet effective narrative of how a symptom checker chatbot could automate clinical labour of triaging and diagnosing in primary care at scale in combination with a platform-mediated telemedicine service that patients would access via smartphones to reduce consultation costs by keeping patients tied to their phones and out of physical clinics. With this narrative of how a chatbot could reduce labour costs, Parsa enrolled an influential group of early investors that combined foreign capital with technological expertise in AI and domestic political influence. This group included the founder capitalist entrepreneurs of UK-based AI company DeepMind, Demis Hassabis and Mustafa Suleyman – who had just sold their company for £400 million to Google in 2014 – Hoxton Ventures, a London-based venture capital firm, and the two Swedish listed investment groups Kinnevik and VNV Global, mainstream tech investors that had invested in ‘consumer internet’ start-up firms such as Zalando and Groupon (Kinnevik) and the rise of food delivery platform firms such Deliveroo (Hoxton), Foodpanda (Kinnevik) and Delivery Hero (VNV). Longsutton Ltd and NNS Holdings, the two investment vehicles of Ian Osborne – an informal advisor to former Tory prime minister David Cameron – and Egyptian billionaire Nassef Sawiries – who donated ∼£200,000 to the Tory party between 2017 and 2018 (Lawrence, Citation2021) – also invested in Babylon's Series A and B rounds that priced the firm’s equity shares at US$200 million and injected close to £70 million in venture capital.

To further stimulate investors’ anticipation of the start-up firm’s potential to eventually turn a profit, Babylon’s capitalist entrepreneurs strategically engaged in a carefully orchestrated mix of hyperbole (that sometimes became outright lies), public performances to position Parsa as a ‘visionary’ founder, and the continuous fetishization of the ‘AI chatbot’ as a supposedly intelligent ‘doctor in your pocket’ that could at least in part replace certain medical diagnosing tasks that ‘human’ doctors typically conduct.Footnote2 Babylon held a promotional event at the prestigious Royal College of Physicians in London in June 2018 to announce that ‘Babylon AI achieves equivalent accuracy with human doctors in global healthcare first’ (Babylon Health, Citation2018). Babylon’s chatbot supposedly would score 80 per cent on selected sample questions of the final exam for primary care doctors in the United Kingdom and thus would ‘provide health advice which is on-par with practicing clinicians’ (Babylon Health, Citation2018). Despite significant public backlash from medical experts, academics and primary care doctors questioning patient safety and general functioning of the chatbot by highlighting its various malfunctions and inherent limitations to expose the company’s ongoing and – in the eyes of critics – fraudulent marketing ploys (Das, Citation2019; Fraser et al., Citation2018; Watkins, Citation2018; see also Lomas, Citation2021), Matt Hancock – who became Secretary of State for Health and Social Care in July 2018 in the government of Theresa May – became Babylon’s cheerleader-in-chief publicly praising the chatbot in newspaper articles, parliamentary sessions and at a promotional event at Babylon’s HQ in September 2018 (Parsa, Citation2018), and played a decisive part in pushing ‘AI’ to the top of the government’s healthcare and industrial policy agenda.

The fetishism of the ‘AI chatbot’ functioned ideologically by conjuring up the image of an autonomous machine that would inevitably become better at diagnosing illnesses. Though it is hard to believe that anyone could take the hyperbole about a ‘robot doctor’ seriously, what captured the hearts and minds of many was the idea that algorithmic systems such as Babylon’s AI chatbot would – as more patient data was fed into them – continuously improve its automatically generated medical advice, which potentially could make the algorithmically generated outputs not only ‘plausible’, but perhaps at some point even ‘reasonable’ enough to represent medical diagnosing information that patients could take ‘serious’. This story of how the ‘mystical force’ of progress in AI would ‘inevitably’ improve the chatbot proved particularly influential among regulatory agencies such as the Medicines and Healthcare products Regulatory Agency (MHRA) which refrained from banning the roll-out of Babylon’s chatbot despite its publicly known severe technical limitations.Footnote3 The AI fetish was also crucial to how investors started to anticipate the potential corporate profits from reducing clinical labour costs because it was entirely unclear at the time how Babylon as a firm could profit from potential cost savings directly.

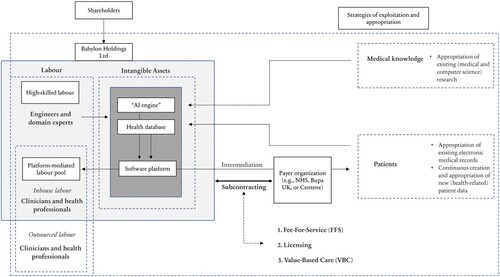

This becomes clear by looking at how Babylon's process of real valorization took shape (see ). Since initial attempts to sell its digital health service directly to patients in the United Kingdom failed, Babylon shifted to a business-to-business model seeking subcontracting arrangements with payer organizations to get access to patents (and revenue streams). The UK government marketized primary care through passing the GP Choice Policy in 2015 which enabled Babylon to become a subcontractor to a GP practice in London in 2017 (‘GPatHand’) and get access to patients beyond the traditional, geographical limits for primary care practices (‘catchment area’) for its digital services. From 2017 onwards, Babylon generated revenues under a fee-for-service model that guaranteed a fixed, regulated fee per patient per year (∼£155 in 2019/2020 across England) for providing primary care services paid by the tax-funded NHS budget. The rationale behind this strategy was to enrol as many patients as possible to maximize revenues while the AI chatbot would reduce patients’ needs for (and costs associated with) seeing clinicians virtually or in person. Babylon expanded rapidly to become the largest primary care provider in England in December 2020 with over 96,000 registered patients in London and Birmingham with only a handful of physical GP practices.

Figure 3 Babylon’s intangible assets in-the-making and strategies of exploitation and appropriation.

Source: Author’s analysis

To make this expansion possible, Babylon hired and exploited engineers to develop a software platform through which the firm hired and exploited a growing number of clinicians (see ). The design of Babylon’s digital health platform was fundamentally shaped by two logics to reduce consultation costs: the logic of intermediation and the logic of ‘self-care’ (Dowling, Citation2021). It is through those logics that venture capital’s imperative to scale shaped the platform design in a fundamental way to enable the integration of as many patients as possible and clinical labour as needed. To provide patients with quick access to clinical staff via video chat, Babylon commanded and exploited a growing pool of clinical (and later non-clinical) labour in the United Kingdom on full and part-time contracts working remotely to conduct digital consultations on demand (Ipsos Mori, Citation2019). The most notorious part of Babylon’s platform was shaped by the logic of self-care. To minimize the number of physical and virtual appointment with clinical labour, the platform increasingly urged patients to use the ‘symptom checker’ to diagnose themselves by entering symptoms in and receiving automated responses from the chatbot ranging from ‘“call an ambulance”, “go to A&E/ER”, “urgent GP” (i.e. within 6 h) [to] “non-urgent GP” (i.e. within a week), “pharmacy” and “selfcare”’ (Baker et al., Citation2020, p. 3). The algorithmic thresholds between those categories reflect the contradiction between cost cutting and patient safety imperatives as participant 29, a senior clinician working in the NHS, highlighted: ‘with these chatbots, it’s either that the threshold to guide people to A&E is very low, or they are dangerous!’ (Interview 29, conducted over Zoom, May 2020).

Table 1 Babylon Health’s disclosed financials

Another necessary (though not sufficient) condition to attract venture capital was that Babylon could privatize its core technologies through legal and/or organizational safeguards. The firm’s intangible assets-in-the-making included: (1) the health databases, (2) the algorithmic systems to make predictions underpinning the chatbot (‘AI engine’) and (3) the software systems of the digital health platform. Despite the efforts to privatize knowledge via legally registering patents, Babylon warned investors later in its pre-IPO filing that ‘[m]uch of our technology and software is maintained as trade secrets and not protected by patents’ (Babylon Holdings Ltd, Citation2021, p. 83). Securing knowledge as privately-owned intangibles was an ongoing challenge that Babylon’s capitalist entrepreneurs sought to address through organizational capture, trade secrecy law protection, and forcing its workers to sign non-disclosure agreements (NDAs) – which would also be deployed as a legal means of worker control (see below).

Phase II: Blitzscaling

In 2019, Babylon had become one of the ‘hottest’ tech ventures in the United Kingdom. The AI symptom checker was the future of healthcare. To live up to early investor’s anticipation of potentially ‘outsized’ capital gains from eventually selling a stake in the ‘Google of Healthcare’ as well as to appropriate more patient data to fuel its health databases and AI engine, Babylon needed to raise more capital to expand its still loss-making healthcare services from the United Kingdom across the globe. The sales pitch through which corporate profits could be anticipated became more sophisticated in projecting ‘unit economics’ of revenues and consultation costs per patient as part of a narrative of a full-blown digital health platform that had been ‘tried and tested’ in the United Kingdom, trial-run in Rwanda and a number of Asian countries, and thus could now be expanded globally by drawing on the ‘AI symptom checker’ to provide healthcare delivery at ‘almost zero marginal costs’ for patients via smartphones in all parts of the world simply by ‘renting more servers’ (Interview 14, conducted in person in Babylon’s office in London, December 2019). Through blitzscaling its platform services, Babylon would be able to appropriate more and more patient data, which would improve the AI symptom checker, beat its competitors in capturing healthcare systems and reinforce its monopoly trajectory: ‘The player with the most data will produce the best diagnoses, which will in turn attract more customers, which will in turn generate more data, in turn further distancing the quality of the product from competition and so on’ (Vostok New Ventures Ltd, Citation2020, p. 4).

Through successfully invoking the anticipation of monopoly rents, Babylon’s capitalist entrepreneurs enrolled two new investors as part of its Series C funding round in August 2019. The Public Investment Fund (PIF) – the SWF through which Saudi’s rulers invest capital generated by producing its vast oil reserves – channelled over US$190 million into Babylon (Babylon Holdings Ltd, Citation2020).Footnote4 PIF – which also invested directly in Uber – represented what established venture capitalists sometimes call ‘dumb money’: inexperienced investors that jump onto a trend without a clear grasp of the underlying technologies. The US insurance giant Centene Corp completed Babylon’s Series C funding round which became one of the largest venture capital founding rounds in the United Kingdom and Europe at the time totalling US$380 million and pricing Babylon’s total equity at US$2 billion (at revenues of US$16 million, see ).

The process of financial valorization came to determine how Babylon deployed investors’ capital as the firm’s real valorization followed a blitzscaling trajectory that would ultimately prove disastrous: Babylon hired more high skilled labour, further invested in platform infrastructure that offered an increasing number of different services, expanded to the United States, Canada and 13 other countries (at the end of 2019) through buying into or otherwise securing access to healthcare systems – a herculean task given the organizational and regulatory specificities of each national healthcare system – while onboarding and exploiting more clinical platform labour. To improve its ‘AI engine’, platform software, and patient databases and make them into intangible assets, the firm hired hundreds of engineers as well as health or ‘domain’ experts between 2018 and 2019 to address the fundamental technical challenge at the very heart of the AI chatbot system (which Babylon would ultimately not be able to resolve): the quality and reliability of the output of the AI engine could not simply be improved by ingesting more health and patient data.Footnote5

PIF’s capital fuelled an ever more aggressive expansion and led Babylon to experiment with a new strategy of exploitation and appropriation: licensing its platform technology to payer organizations as its digital platform matured. As expanding its ‘fee for service’ model in the United Kingdom required an ever growing pool of clinical and non-clinical labour and the anticipated cost reductions in primary care consultations did not materialize for Babylon’s own operations, Babylon’s entrepreneurs promised cost reductions through keeping patients out of physical healthcare facilities (including A&E departments) to NHS Trusts as well as large corporates in Asia (Prudential), and Canada (Telus Health) if they would license Babylon’s platform and symptom checker (Parsa, Citation2020). In the United Kingdom, Babylon signed a deal with the University Hospitals Birmingham NHS Foundation Trust – the largest NHS Trust in the country – in 2019 and a 10-year licensing deal with Royal Wolverhampton NHS Trust in early 2020 to ‘create the world’s first integrated digital healthcare system’ (The Royal Wolverhampton NHS Trust, Citation2020). What led NHS Trusts to procure Babylon’s platform technology was material necessity dictated by the disastrous state of the NHS, especially the increasing shortage of clinical labour. As participant 30 – an executive of one NHS Trust who was part of the procurement process of Babylon’s services – put it:

The NHS has been relatively underfunded for 10 years … You cannot build real, long-term capacity very quickly, however hard you try. So, you're looking at the best way in the world, that is a 3–5-year project to really build up capacity in the NHS. Anything that you can bring on quicker than that is AI! (Interview 32, conducted over Zoom, May 2020)

Phase III: Exit and collapse

Venture capital’s requirement of ‘blitzscaling’ Babylon’s platform resulted in an increasingly expensive cost structure of high-skilled labour and infrastructure-related costs of Babylon’s digital platform. But Babylon’s AI chatbot and telemedicine services could not deliver the anticipated cost reductions in medical consultations (which validated its financial valorization) – neither at home nor abroad. The ‘AI symptom checker’ had been severely discredited by critics in the United Kingdom and only used by around half of Babylon’s NHS patients who sought a doctor consultation anyway (Ipsos Mori, Citation2019). Experimenting with both strategies of exploitation and appropriation – fee-for-service and licensing – in different geographies failed to balance the books with no clear path to profitability in sight in 2020. Given the high cost structure, the ‘fee-for-service’ model never became profitable in the United Kingdom despite Babylon intentionally targeting the most lucrative strata of young and relatively healthy patients, living in urban areas such as London, who tended to be cheaper to treat (Ipsos Mori, Citation2019). But patients used Babylon’s virtual and in person consultations with doctors more often than anticipated (Ipsos Mori, Citation2019) which was, given the dire state of general practice and resulting long average waiting times in the NHS, perhaps not surprising. Licensing deals required significant commitments of in-house skilled labour to overcome technical integration challenges with clients’ existing IT infrastructure,Footnote6 while total contract revenues were not high enough to balance the platform’s costs.

To stimulate venture capital’s anticipation of capital gains and keep the process of asset-making going despite mounting financial losses, Babylon’s entrepreneurs and investors adopted a new, grotesque narrative out of the Silicon Valley playbook of how Babylon could make profits based on social media logics designed to maximize screentime and self-care while minimizing in-person consultations: the platform would utilize data-driven ‘predictive analytics’ to generate ‘health advice’ to continuously nudge patients through the smartphone app towards taking ‘preventative’ measures to avoid illness and optimize their health and wellbeing.Footnote7 The COVID-19 outbreak in early 2020 enabled Babylon to experiment with the ‘value-based care’ (VBC) strategy as part of which this narrative manifested in risk-sharing contracts with insurance corporations paying Babylon upfront in monthly rates the annual patient budget (mostly on public insurance schemes Medicare and Medicaid) while Babylon ‘assume[d] the financial responsibility’ (Babylon Holdings Ltd, Citation2021) to either deliver or pay for patients’ primary and secondary care while pocketing any cost savings from service provision. Through this contractual structure, investors anticipated much higher revenues per patient (in the thousands of US dollars), but also the risk of Babylon being responsible to cover potentially high consultation costs if the AI chatbot and health advice could not make patients opting for more self-care instead of seeing a doctor in person.

In 2020, Babylon set up a second headquarters in Austin and shifted its strategy entirely towards ramping up VBC in the United States. To integrate patients and access revenue streams, the firm acquired Meritage and Fresno healthcare networks in California for US$57 million while further extending subcontracting agreements with Centene to other US states. Centene kept Babylon afloat, and the making of intangible assets going, by becoming one of its largest VBC clients in January 2021, leading to a 400 per cent increase of revenues annually (Babylon Health, Citation2021). To adjust its platform model to growing labour demand of VBC, Babylon increased the number of clinicians almost eightfold between 2019 and 2021, and increasingly outsourced platform labour to lower paid, non-clinical workers engaging in ‘preventative’ healthcare such as ‘personal care assistants’ and ‘behavioural coaches’ (Babylon Holdings Ltd, Citation2022a). At the same time, Babylon sought to rein in costs by cancelling long-term licensing contracts with UK NHS Trusts and firing highly paid engineers.

At the height of the IPO market in autumn 2021, Parsa sought to raise additional capital and enable investors to exit by pursuing an IPO through a reverse merger with Alkuri Global – a blank check special purpose acquisition company (SPAC) – that listed Babylon on the NYSE in October 2021. However, the planned fundraising largely failed as Babylon raised only US$229 million in a private ‘PIPE’ transaction to further fund the US expansion (Babylon Holdings Ltd, Citation2022b) falling short of its US$575 million target as many SPAC investors ultimately pulled their money (Criddle, Citation2022). While the PIPE investment remained undisclosed, it presumably enabled some investors to recoup investments, while existing shareholders VNV, Kinnevik and Peter Thiel-founded surveillance firm Palantir invested in Babylon. While the company listed at a US$4.2 billion market capitalization, the share price tanked to reach US$0.37 on 14 October 2022, a year after its listing. Ultimately, Babylon’s real valorization process never materialized. Its efforts to make its AI technology and patient databases into intangible assets failed. Investors’ anticipation of profits that could be realized through an all-encompassing platform with services for the entire ‘care pathway’ from back-end office automation to diagnosing and prevention never worked (and the chatbot never turned intelligent) while pushing the firm onto a blitzscaling trajectory that was doomed to fail. The firm’s experiment with strategies of exploitation and appropriation also failed. While VBC drove substantial revenue growth, the claims/expenses from VBC grew at a similar rate while Babylon became dependent on a handful of VBC clients (see ). When that became clear to investors, Babylon’s financial valorization collapsed, and the share price dropped. The financial engineering of a share split (in December 2022) and debt raised after the IPO from new investors – including AlbaCore Capital which took Babylon private again in May 2023 in the hope to recover its investments – only prolonged the inevitable collapse of Babylon into bankruptcy in August 2023. One of Babylon’s UK-based subsidiaries was sold to US-based eMed Healthcare at a price of £500,000, or around 0.001 per cent of the US$4.2 billion total financial valorization of Babylon’s equity shares at its peak in October 2021 (Alvarez & Marsal Europe LLP, Citation2023).

What venture capital inevitably brings with it: Opening new terrains of class struggle

Looking at Babylon’s trajectory in the United Kingdom through the lens of venture capital-driven making of intangible assets sheds light on new dimensions of class struggle in contemporary capitalism which originate in the ownership of and control over the firm (and its intangible assets). Those were defined through the wage-labour relation within Babylon Holdings Ltd but also unfolded outside of it as part of the struggles over dispossession of healthcare and patient data.

Within Babylon Holdings Ltd: Struggles over control and exploitation

Babylon’s public promise to ‘democratize healthcare’ for the benefit of patients and society served venture capital to obscure how Babylon’s capitalist entrepreneurs and investors established new property relations through which (1) Babylon effectively owned and controlled patients’ health data (as well as the AI algorithms) and (2) Parsa as Babylon’s founder and CEO sought to retain full control over the firm even after the IPO through the corporate governance regime of dual-class shares.

The precondition for venture capital investments are legal contracts (e.g. share purchase agreements) signed in every funding deal to amend the share structure defining the regime of ownership and control over Babylon Holdings Ltd, the parent company incorporated in Jersey (United Kingdom) (see ). Babylon’s founder managed to stay in control of the holding company through establishing a dual-class share structure with ‘super-voting’ shares granting him the majority of voting rights – and thus the power to determine the course of the firm – even after selling a substantial number over four funding rounds to outside investors to raise venture capital. Class A shares retained 50 per cent of the voting rights and remained in Parsa’s control, while Class B and C shares together split the remaining 50 per cent (of which Parsa directly and indirectly held ∼14.25 per cent). Parsa instituted this structure in August 2019 before Saudi’s PIF invested US$190 million – representing close to 50 per cent of total venture capital raised at that time – to buy 51 per cent of Class C shares associated with only ∼7 per cent of voting rights (ALP Partners Limited, Citation2020; Babylon Holdings Ltd, Citation2019, Citation2020). PIF effectively traded corporate influence in exchange for equity stakes as legal claims on anticipated ‘outsized’ capital gains. The NYSE allowed Parsa to temporarily stay in control by retaining 83.1 per cent of voting rights after the SPAC-facilitated IPO in October 2021 (Babylon Holdings Ltd, Citation2022b, p. 129). However, in December 2022 Parsa removed the unequal voting structure in a last (and ultimately unsuccessful) attempt to attract outside capital and boost the share price despite mounting losses.

Having total control over Babylon enabled Parsa to fire, under the pressure of outside investors afraid that anticipated returns might not materialize, hundreds of workers during the pandemic in 2020 and later in 2022 to reduce costs. This was facilitated by the absence of a workers’ union and a regime of labour control that aimed at preventing workers from speaking out against the firm in public. A growing number of Babylon’s workers grew frustrated with how capitalist entrepreneurs managed the company and irresponsibly fetishized the ‘AI engine’ behind Babylon’s symptom checker, but Babylon’s management utilized NDAs to effectively silence workers even after leaving the company through the threat of lawsuits (see Lomas, Citation2021).

One of the reasons why Babylon was able to hire primary care doctors in the United Kingdom when setting out its exploitative platform scheme in the NHS from 2017 onwards was because of the disastrous labour conditions in NHS general practice. Some primary care doctors thankfully accepted the offer of higher pay and more flexible working hours Babylon offered at the expense of workplace surveillance (as every consultation was recorded). Primary care doctors who joined Babylon’s ‘GP at Hand’ service ‘expressed frustrations about working in traditional general practice, particularly linked to long hours and increasing workloads’, while Babylon offered a ‘better work-life balance than traditional practice’ (Ipsos Mori, Citation2019, p. iii). Most of Babylon’s doctors worked remotely for two days a week on average, while simultaneously working elsewhere (e.g. in another NHS general practice) (Ipsos Mori, Citation2019, p. iii). This trend at Babylon did not only mirror the ‘gig’ work of ride-hailing services such as Uber (where teachers who turn drivers at night became a common phenomenon in the United States), but also demonstrates again how venture capital financed experimentation with platform-mediated strategies of exploitation in UK healthcare through Babylon is facilitated by a decade of underfunding the NHS.

Outside of Babylon Holdings: Struggles over dispossession of patient data

Outside of Babylon’s Holdings, the concerted effort by Babylon’s capitalist entrepreneurs, investors as well as the UK government enabling the platform company’s reckless expansion in the NHS fed on the detrimental effects of decades-long neoliberal policies and fuelled already ongoing conflicts over the ruling classes’ deliberate project of cost-cutting in and privatization of healthcare services and patient data within the NHS that would later culminate in the largest strikes in the history of the NHS as part of the industry-wide strike actions in February 2023 which some commentators saw as a new incarnation of the ‘winter of discontent’ of 1978–1979.

In 2019, this conflict manifested in protests by clinical staff across the United Kingdom not only against Babylon’s expansion but also against the private nature of its healthcare service designed for and relying on the appropriation of public NHS funds. While proclaiming to ‘provide healthcare to everyone’, Babylon’s fee-for-service strategy was based on cherry picking the most lucrative-to-treat patients which destabilized the region-based NHS funding structure because increasing rents extracted by Babylon led to lower amounts of public funding being available for other primary care providers (Cundy & Ram, Citation2019). This led to resistance among primary care doctors across the country. Unite the Union – the largest trade union in the United Kingdom with 1.4 million members – called on primary care doctors to protest in East London in November 2019. At the protest, the Chair of Doctors in Unite, Jackie Applebee stated that Babylon ‘GP at Hand’ service is ‘draining resources from the NHS to the private sector and reducing the resources that [other] GPs have for their more chronically ill and elderly patients’ (Unite the Union, Citation2019). Tower Hamlets, the primary care practice of which Applebee is a partner, is located in one of England’s 10 most deprived local authorities that suffered the hardest from the government’s funding cuts in the public health budget (IPPR, Citation2019). It is here where the severe consequences of Babylon’s parasitic expansion materialize: Tower Hamlets registered the largest outflow of patients who registered with Babylon (Ipsos Mori, Citation2019), representing a direct loss in funding to cover the treatment of other, more vulnerable patients in need.

The other dimension through which the struggles over dispossession unfolded was the increasingly widespread appropriation of patient’s health data by capital, a process that was crucial for Babylon’s asset-making process and part of a broader move of Babylon’s investors (and other tech corporations) to enclose patient data through the NHS. By investing in Babylon in 2021, Palantir sought to learn from experimenting with ways of how to effectively integrate and analyse NHS health data. Babylon thus became part of Palantir’s broader strategy of, as its UK director puts it, ‘buying our way in’ (Solon, Citation2022) through investments into start-up firms such as Babylon that operated already within the NHS while seeking to secure a £480 million five-year contract from the UK government to build a new NHS-wide data infrastructure. Palantir’s move sparked protests of patients, clinicians and activists in London in September 2022 under the banner of the Hackney Keep our NHS Public campaign voicing their demand to ‘end Palantir’s involvement in the NHS as soon as possible and not award them any more contracts’ (Foxglove, Citation2023).

Concluding discussion

The case of Babylon Health illustrated that once capitalist entrepreneurs raise venture capital based on investors’ anticipation of monopoly rents, start-up firms have to deploy capital by following a blitzscaling trajectory to continuously validate the anticipation of potential corporate profits which underpin the financial valorization of equity shares. This financial valorization in part rested on the potential of the symptom checker to reduce labour costs in clinical consultations which was temporarily verified by the fetishization of the ‘AI’ chatbot as a supposedly intelligent ‘doctor in your pocket’. Seeking to make algorithmic systems as well as health and patient datasets into intangible assets formed a key part of Babylon’s real valorization process because it underpinned not only the chatbot but the digital infrastructure of the platform through which the firm sought to exploit clinical and non-clinical labour. Yet, Babylon’s asset-making failed not only because the ‘AI’ technology never lived up to the hype, but also because the firm’s experiments with strategies to appropriate patient data and exploit clinical labour to seek corporate profits never worked. The case study thus demonstrated that despite the seemingly self-valorizing equity prices of ‘unicorn’ start-up firms, financial valorization in venture capital only operates autonomously in relative terms over a certain period of time, while remaining always anchored in and ultimately being determined by processes of real valorization. In other words, financial valorization determines the parameters in which the process of real valorization in venture capital comes to unfold but not the success of the latter. The broader implication of the case study is that the making of intangible assets can only be fully understood in relation to mental conceptions of technologies, the forms of capitalist finance in which the asset making process takes place, and the antagonisms resulting from data appropriation and labour exploitation, which are not outside of but integral to asset making. This provides an important addition to previous accounts of venture capital which focused on the making of start-up equity stakes as financial assets while neglecting how the underlying processes of production ultimately overdetermines the (success of) the making of financial assets (Cooiman, Citation2022).Footnote8

At least two issues highlighted by the case study warrant further investigation and should be highlighted here at least in brief. The first issue concerns the relative autonomy of financial valorization from processes of real valorization in venture capital-driven accumulation, and illustrates how the making of intangible assets poses a challenge for our understanding of macro dynamics in contemporary capitalism. The paper cautions against adopting a conjunctural lens of financial cycles that interprets the rise of ‘unicorns’ merely as another dot-com bubble because it risks missing important structural changes and continuities within the ‘finance’ side of start-up investing. That the capital inflows in dot-com companies helped to finance the IT infrastructure development underpinning platforms and paved the way for unicorns is well known (Srnicek, Citation2017). But what happened on the finance side in venture capital over the last decades is less well known. Here a plethora of different investment firms got involved in equity investments over longer periods of time and channelled unparalleled amounts of capital into start-up firms. This required an extremely sophisticated process of financial valorization that cannot be explained by the pre-validation of equity prices through quantitative easing policies of central banks alone. As Marx already observed, financial ‘fictions’ are required for the continuous reproduction of capitalism through finance and thus a fundamental aspect of the dynamism of capitalist accumulation (Durand, Citation2017). It would be fruitful to further investigate the hyper-rational process of making new capitalist ventures investable that continuously seeks to conjure up and validate anticipations of corporate profits for interest-bearing capital from all over the globe by examining the institutional arrangements of power at the intersection of finance and tech that enable the coordination of actions among the investor class under highly competitive conditions to channel capital into start-up firms to seek profits.

The second issue concerns the nature of technological innovations such as AI developed by start-up firms formerly financed by venture capital (e.g. Microsoft and Google) and by those still privately held (e.g. OpenAI). Here the analytical lens of making intangible assets opens up new avenues to investigate if and how AI technologies could (and should) be ‘reconfigured’ towards emancipatory and democratically determined ends (Bernes, Citation2013; see also Steinhoff, Citation2021) because it lends itself well to examine the economic, legal, ideological and political dimensions of technological development informed by a commitment to radical political change. If appropriation and exploitation are integral to the making of intangible assets, then private ownership must be abolished to socialize ‘assets’ by bringing them under truly democratic control. But the case study of Babylon suggests that this would not be enough to make assets usable for emancipatory ends as (venture) capitalist rationalities shape the very design of start-up’s digital technologies – in Babylon’s case even down to the algorithmic level – an argument that STS scholarship building on Marx-inspired critical theories of technology have made since the 1980s (MacKenzie & Wajcman, Citation1985; Noble, Citation1984). Open questions thus are: is it ‘feasible’ to truly reconfigure intangible assets (Steinhoff, Citation2021), to what extent can (or should) what remains of ‘seized’ intangible assets be used for emancipatory ends, or under which conditions could AI be built from scratch in a socialist democratic manner? Key to answering the latter probably would also be exploring how a process of democratic planning could look like that – in contrast to today’s chaotic, destructive and exploitative process of venture capital – could help to scale up the use of publicly funded novel technologies but in ways that would ensure its social benefits from design to deployment. Future research into both issues could thus further shed light on how class domination operates in and through venture capital-driven accumulation (and through the technologies that the latter brings about), and how it might be countered.

Acknowledgements

The author would like to thank Cecilia Rikap, David Pinzur, Carrie Friese, Judy Wajcman, Tim White, Afshin Mehrpouya, Babak Amini, Eva Spiekermann, Sandy Hager, and the participants of the London Political Economy Network PhD workshop at City, University of London in May 2022, as well as the editors of this special section, the editors of Economy and Society, and three anonymous reviewers for their insightful suggestions and encouraging feedback.

Disclosure statement

No potential conflict of interest was reported by the author(s).

Additional information

Notes on contributors

David Kampmann

David Kampmann is a Career Development Fellow in the School of Geography and the Environment (SoGE) at the University of Oxford and Affiliated Research Associate at the Alan Turing Institute, the UK’s national institute for data science and artificial intelligence. He received his PhD in Sociology from the London School of Economics and Political Science with a doctoral thesis on the political economy of venture capital titled ‘Venture capital as power bloc: A critique of artificial intelligence and platform corporations’.

Notes

1 A venture capital fund is an investment fund type in which a subset of institutional investors act as limited partners (LPs) transferring capital to venture capital firms’ partners acting as general partners to manage LPs’ money by investing in start-up firms to generate investment returns for LPs typically within 10 years (and charge management fees of typically 2–3 per cent and the ‘carried interest’ of around 20 per cent).

2 Participant 25, an academic working on machine learning in healthcare who published a review of Babylon’s symptom checker in an academic journal, told the author that the firm’s claims ‘were just a lie, basically!’. Interview 26, conducted over Skype, March 2019.

3 This issue was highlighted in several interviews with doctors, civil servants working at NHSX at the time, and academics.

4 Interview 14, conducted in person in Babylon’s office in London, December 2019. PIF declined the interview request.

5 Interview 22, conducted in person at Babylon’s London office, February 2020, and Interview 26, conducted over Skype, March 2019.

6 Interview 64, conducted over Zoom, January 2022.

7 Interview 14, conducted in person in Babylon’s office in London, December 2019.

8 This does of course not imply that investors cannot make significant capital gains by selling equity stakes in still unprofitable start-up firms through exit transactions as the recent exit wave in 2021–2022 demonstrated.

References

- ALP Partners Limited. (2020). Annual return of ALP Partners Limited. Retrieved from https://www.jerseyfsc.org/registry/documentsearch/NameDetail.aspx?Id = 295623.

- Alvarez & Marsal Europe LLP. (2023). Notice of administrator's proposal. Retrieved from https://find-and-update.company-information.service.gov.uk/company/14707874/filing-history.

- Babylon Health. (2018, June 27). Babylon AI achieves equivalent accuracy with human doctors in global healthcare first. Retrieved from https://www.babylonhealth.com/press/assets/ai-event.

- Babylon Health. (2021). Home State Health and Babylon Partner to bring app-based, 24/7 healthcare to southeast Missouri. Retrieved from https://www.babylonhealth.com/us/press/home-state-health-partners-with-babylon.

- Babylon Health. (2022). Partnerships: Babylon for social impact. Retrieved from https://www.babylonhealth.com/en-us/partnerships/social-impact.

- Babylon Healthcare Services Ltd. (2019). Annual Report and Financial Statements: Year ended 31 December 2018. Retrieved from https://find-and-update.company-information.service.gov.uk/company/09229684/filing-history?page=2.

- Babylon Holdings Ltd. (2019). Special resolution: Registration of a special resolution with the Jersey Financial Services Commission on 14 August 2019. Retrieved from https://www.jerseyfsc.org/registry/registry-entities/entity/299779.

- Babylon Holdings Ltd. (2020). Annual return 2020. Retrieved from https://www.jerseyfsc.org/registry/registry-entities/entity/299779.

- Babylon Holdings Ltd. (2021, August 6). Form F-4/A - Registration statement for securities issued by foreign private issuers in certain business combination transactions (Amendment). Retrieved from https://sec.report/Document/0001193125-21-239477/.

- Babylon Holdings Ltd. (2022a). Capital markets presentation May 2022. Retrieved from https://d1io3yog0oux5.cloudfront.net/_c1ed76ec5b5a75ea2aeb3fad5f199af4/babylonhealth/db/2137/20118/pdf/Capital+Markets+Day+Presentation+May+22.pdf.

- Babylon Holdings Ltd. (2022b). Form 20-F: Annual Report 2021. Retrieved from https://ir.babylonhealth.com/sec-filings/all-sec-filings/content/0001866390-22-000013/0001866390-22-000013.pdf.

- Babylon Holdings Ltd. (2023). Form 10-K: Annual Report 2022. Retrieved from https://ir.babylonhealth.com/financials/all-sec-filings/content/0001866390-23-000055/0001866390-23-000055.pdf.

- Babylon Partners Ltd. (2019). Annual Report and Financial Statements: Year ended 31 December 2018. Retrieved from https://find-and-update.company-information.service.gov.uk/company/08493276/filing-history?page=2.

- Baker, A., Perov, Y., Middleton, K., Baxter, J., Mullarkey, D., Sangar, D., … Johri, S. (2020). A comparison of artificial intelligence and human doctors for the purpose of triage and diagnosis. Frontiers in Artificial Intelligence, 3(November), 1–9.

- Beckert, J. (2020). Markets from meaning: Quality uncertainty and the intersubjective construction of value. Cambridge Journal of Economics, 44(2), 285–301.

- Bernes, J. (2013). Logistics, counterlogistics and the communist prospect. Endnotes. Retrieved from https://endnotes.org.uk/issues/3/en%0A/jasper-bernes-logistics-counterlogistics-and-the-communist-prospect.

- Birch, K. (2017). Rethinking value in the bio-economy: Finance, assetization, and the management of value. Science, Technology, & Human Values, 42(3), 460–490. doi: 10.1177/0162243916661633

- Birch, K. (2020). Technoscience rent: Toward a theory of rentiership for technoscientific capitalism. Science Technology, & Human Values, 45(1), 3–33. doi: 10.1177/0162243919829567

- Birch, K. (2022). Reflexive expectations in innovation financing: An analysis of venture capital as a mode of valuation. Social Studies of Science, 53(1), 29–48. doi: 10.1177/03063127221118372

- Birch, K., Cochrane, D. T. & Ward, C. (2021). Data as asset? The measurement, governance, and valuation of digital personal data by Big Tech. Big Data and Society, 8(1), 1–15. Retrieved from https://doi.org/10.1177/20539517211017308

- Birch, K. & Muniesa, F. (2020). Assetization: Turning things into assets in technoscientific capitalism. MIT Press.

- Bourgeron, T. & Geiger, S. (2022). (De-)assetizing pharmaceutical patents: Patent contestations behind a blockbuster drug. Economy and Society, 51(1), 23–45. doi: 10.1080/03085147.2022.1987752

- Braun, B. (2016). From performativity to political economy: Index investing, ETFs and asset manager capitalism. New Political Economy, 21(3), 257–273. doi: 10.1080/13563467.2016.1094045

- Braun, B. (2021). Asset manager capitalism as a corporate governance regime. In J. Hacker, A. Hertel-Fernandez, P. Pierson & K. Thelen (Eds.), The American political economy: Politics, markets, and power (pp. 270–294). Cambridge University Press.

- Burrell, J. & Fourcade, M. (2021). The society of algorithms. Annual Review of Sociology, 47(1), 213–237. doi: 10.1146/annurev-soc-090820-020800

- Chesnais, F. (2016). Finance capital today: Corporations and banks in the lasting global slump. Brill.

- Cooiman, F. (2022). Imprinting the economy: The structural power of venture capital. Environment and Planning A: Economy and Space, 1–17. Retrieved from https://doi.org/10.1177/0308518X221136559

- Criddle, C. (2022, November 22). Babylon performance after float a ‘disaster’, chief says. Financial Times. Retrieved from https://www.ft.com/content/950b8f74-ca74-4298-96bd-4617ca6eed7a

- Cundy, A. & Ram, A. (2019, May 23). Babylon’s GP at hand service runs up £21.6 m deficit. Financial Times. Retrieved from https://www.ft.com/content/93843cfc-788c-11e9-bbad-7c18c0ea0201

- Das, S. (2019, October 13). It’s hysteria, not a heart attack, GP app Babylon tells women. The Sunday Times. Retrieved from https://www.thetimes.co.uk/article/e8023558-ed0e-11e9-9861-f093f6623161

- Dowling, E. (2021). The care crisis: What caused it and how can we end it? Verso.

- Durand, C. (2017). Fictitious capital: How finance is appropriating our future. Verso.

- Durand, C. & Milberg, W. (2020). Intellectual monopoly in global value chains. Review of International Political Economy, 27(2), 404–429. doi: 10.1080/09692290.2019.1660703

- Elder-Vass, D. (2021). Assets need audiences: How venture capitalists boost valuations by recruiting investors to asset circles. Finance and Society, 7(1), 1–19. doi: 10.2218/finsoc.v7i1.5588

- Elish, M. C. & Boyd, D. (2018). Situating methods in the magic of big data and artificial intelligence. Communication Monographs, 85(1), 57–80. doi: 10.1080/03637751.2017.1375130

- Fan, J. S. (2022). Nontraditional investors. BYU Law Review, 48(2), 463–534.

- Faulkner-Gurstein, R. & Wyatt, D. (2021). Platform NHS: Reconfiguring a public service in the age of digital capitalism. Science Technology & Human Values, 48(4), 888–908. doi: 10.1177/01622439211055697

- Ferrary, M. & Granovetter, M. (2009). The role of venture capital firms in Silicon Valley’s complex innovation network. Economy and Society, 38(2), 326–359. doi: 10.1080/03085140902786827

- Fichtner, J. (2020). The rise of institutional investors. In P. Mader, D. Mertens & N. van der Zwan (Eds.), The Routledge international handbook of financialization (1st ed., pp. 265–275). Routledge.

- Foxglove. (2023). No Palantir in our NHS. Retrieved from https://nopalantir.org.uk/

- Fraser, H., Coiera, E. & Wong, D. (2018). Safety of patient-facing digital symptom checkers. The Lancet, 392(10161), 2263–2264. doi: 10.1016/S0140-6736(18)32819-8

- Harvey, D. (2003). The fetish of technology: Causes and consequences. Macalester International, 13(7). Retrieved from http://digitalcommons.macalester.edu/macintl/vol13/iss1/7.

- Harvey, D. (2004). The ‘new’ imperialism: Accumulation by dispossession. Socialist Register, 40, 63–87.

- Hilferding, R. (1981). Finance capital: A study of the latest phase of capitalist development. Routledge & Kegan Paul.

- Hoffman, R. & Yeh, C. (2018). Blitzscaling: The lightning-fast path to building massively successful companies. Currency.

- Hogarth, S. (2017). Valley of the unicorns: Consumer genomics, venture capital and digital disruption. New Genetics and Society, 36(3), 250–272. doi: 10.1080/14636778.2017.1352469

- IPPR. (2019).Hitting the poorest worst? How public health cuts have been experienced in England's most deprived communities. Retrieved from https://www.ippr.org/blog/public-health-cuts.

- Ipsos Mori. (2019). Evaluation of Babylon GP at hand: Final evaluation report. Retrieved from https://www.hammersmithfulhamccg.nhs.uk/media/156123/Evaluation-of-Babylon-GP-at-Hand-Final-Report.pdf.

- Katz, Y. (2020). Artificial whiteness: Politics and ideology in artificial intelligence. Columbia University Press.

- Klingler-Vidra, R. (2016). When venture capital is patient capital: Seed funding as a source of patient capital for high-growth companies. Socio-Economic Review, 14(4), 691–708. doi: 10.1093/ser/mww022

- Langley, P. & Leyshon, A. (2017). Platform capitalism: The intermediation and capitalization of digital economic circulation. Finance and Society, 3(1), 11–31. doi: 10.2218/finsoc.v3i1.1936

- Lapavitsas, C. (2013). Profiting without producing: How finance exploits us all. Verso.

- Lawrence, F. (2021, June 22). Shareholders of firm backed by Matt Hancock have donated to the Tories. Guardian. Retrieved from https://www.theguardian.com/politics/2021/jun/22/shareholders-of-firm-backed-by-matt-hancock-have-donated-to-the-tories.

- Liu, W. (2020). Abolish Silicon Valley: How to liberate technology from capitalism. Repeater Books.

- Lomas, N. (2021, March 5). UK’s MHRA says it has ‘concerns’ about Babylon Health – and flags legal gap around triage chatbots. TechCrunch. Retrieved from https://techcrunch.com/2021/03/05/uks-mhra-says-it-has-concerns-about-babylon-health-and-flags-legal-gap-around-triage-chatbots/.

- London Economics. (2021, March 24). London Economics' analysis of agenda for change pay erosion. Retrieved from https://londoneconomics.co.uk/blog/press-event/test/.

- MacKenzie, D. & Wajcman, J. (eds.). (1985). Introductory essay: The social shaping of technology. In The social shaping of technology: How the refrigerator got its hum (pp. 2–25). Open University Press.

- Marx, K. (1976). Capital: Volume 1. Penguin/New Left Review.

- Marx, K. (1981). Capital: Volume 3. Penguin/New Left Review.

- NHS Digital. (2021, March). Patients registered at a GP practice. Retrieved 16 March 2021 from https://digital.nhs.uk/data-and-information/publications/statistical/patients-registered-at-a-gp-practice/march-2021.

- Noble, D. F. (1984). Forces of production: A social history of industrial automation. Alfred A. Knopf.

- Pagano, U. (2014). The crisis of intellectual monopoly capitalism. Cambridge Journal of Economics, 38(6), 1409–1429. doi: 10.1093/cje/beu025

- Palludeto, A. W. A. & Rossi, P. (2022). Marx’s fictitious capital: A misrepresented category revisited. Cambridge Journal of Economics, 46(3), 545–560. doi: 10.1093/cje/beac017

- Parsa, A. (2018). A US$100 million investment in your health. Babylon Health blog. Retrieved from https://www.babylonhealth.com/blog/business/babylon-is-investing-us-100-million-to-build-the-next-generation-of-ai-powered-healthcare-technologies.

- Parsa, A. (2020, October 12). VNV Global Capital Markets Week: Babylon Health presentation. Retrieved from https://www.youtube.com/watch?v = ENRSPJ1ASBQ.

- Pollock, A. M. (2004). NHS Plc: The privatisation of our health care. Verso.

- Pollock, A. M. & Price, D. (2011). The final frontier: The UK’s new coalition government turns the English National Health Service over to the global health care market. Health Sociology Review, 20(3), 294–305. doi: 10.5172/hesr.2011.20.3.294

- Rikap, C. (2021). Capitalism, power and innovation: Intellectual monopoly capitalism uncovered. Routledge.

- Rikap, C. (2022). The expansionary strategies of intellectual monopolies: Google and the digitalization of healthcare. Economy and Society, 52(1), 110–136. doi: 10.1080/03085147.2022.2131271

- Solon, O. (2022, September 30). Palantir had plan to crack UK health system: ‘Buying our way in’. Bloomberg.com

- Srnicek, N. (2017). Platform capitalism. Polity Press.

- Steinhoff, J. (2021). The social reconfiguration of artificial intelligence: Utility and feasibility. In P. Verdegem (Ed.), AI for everyone? Critical perspectives (pp. 123–144). University of Westminster Press.

- Tech Nation. (2021). The future UK tech built. Retrieved from https://technation.io/wp-content/uploads/2021/03/Tech_Nation_Report_2021_deck_v3.pdf.

- The King’s Fund. (2021, December 1). NHS trusts in deficit. Retrieved from https://www.kingsfund.org.uk/projects/nhs-in-a-nutshell/trusts-deficit.

- The Royal Wolverhampton NHS Trust. (2020). The Royal Wolverhampton NHS Trust and Babylon to create the world’s first integrated digital health system to serve the city’s population. Retrieved 25 March 2020 from https://www.royalwolverhampton.nhs.uk/media/latest-news/january-2020/the-royal-wolverhampton-nhs-trust-and-babylon-to-create-the-worlds-first-integrated-digital-health-system/.

- UK Office for National Statistics. (2023). Average Sterling exchange rate: US Dollar XUMAUSS. Retrieved from https://www.ons.gov.uk/economy/nationalaccounts/balanceofpayments/timeseries/auss/mret.

- Unite the Union. (2019, November 19). Privatisation of GP services prompts east London protest on 21 November. Retrieved from https://www.unitetheunion.org/news-events/news/2019/november/privatisation-of-gp-services-prompts-east-london-protest-on-21-november/.

- Van der Zwan, N. (2014). Making sense of financialization. Socio-Economic Review, 12(1), 99–129. doi: 10.1093/ser/mwt020

- Vostok New Ventures Ltd. (2020). Annual Report 2019. Retrieved from https://www.vostoknewventures.com/netcat_files/12/13/vnv_ar19_eng.pdf.

- Watkins, D. (2018). ‘Bad bot’ (part II). Retrieved from https://us02web.zoom.us/j/87975038498?pwd = T1VaTHB5aytpUExqenZXYjZYQ0tWdz09.