ABSTRACT

Organizations today are shifting toward collaborative forms of value creation and rely on digital technologies to operate interorganizational processes. This has led blockchain technology to gain considerable momentum, given its ability to foster collaboration among multiple actors. Nevertheless, despite its benefits, building a blockchain-based platform requires integrating heterogeneous needs and adapting to decentralized governance structures. This research investigates the successful deployment of a blockchain-based solution for interbank collaboration. Our empirical analysis focuses on the Spunta Banca DLT Project, initiated in 2017 to automate the interbank reconciliation processes in Italy, through the deployment of a permissioned blockchain-based solution. A qualitative analysis of interview data collected from project participants was conducted to gain insights on the process to build a blockchain-based platform for interbank collaboration. The findings of our exploratory case study reveal that successful deployment hinges on a sequential legitimacy-building process, encompassing pragmatic, normative, and cognitive legitimacy.

Introduction

Digital platforms have been transformative and impactful in many industries and have provided a novel landscape for interorganizational collaboration. Their relevance has been associated with their ability to offer new ways of collaboration [Citation18, Citation60], value capture, and value creation [Citation33]. As collaborative technologies continuously advance, new ways of organizing and gaining competitive advantage have also emerged [Citation22]. As a result, the combination of new technological developments with organizational innovation has contributed to the development of innovative collaborative platforms [Citation64]. Recently in this regard, the dynamic and all-purpose nature of digital platforms has been explored in terms of emerging technologies such as blockchain, for which the properties have offered the opportunity to reconceptualize decision-making functions, and interorganizational interactions are orchestrated in blockchain-based platforms [Citation47, Citation66].

As a distributed ledger, a blockchain allows the verification and shared recording of transactions among authorized actors [Citation24, Citation27]. It adopts a mix of cryptographic and computer protocols to store and exchange data following a predetermined set of rules without the need for intermediaries [Citation6, Citation38]. Therefore, through the deployment of trust-building mechanisms and standardized components, blockchain offers unique opportunities to achieve transactional privacy, transparency, risk reduction, and fraud minimization [Citation13, Citation27, Citation52]. Considering the importance of trust in interorganizational systems, blockchain-based digital platforms have the potential to change traditional paradigms of platform governance and enable new forms of collaboration [Citation66]. Nevertheless, despite the general agreement on the potential benefits of blockchain, less attention has been paid to the conditions that determine the successful deployment of interorganizational collaborative platforms based on blockchain [Citation66]. Factors contributing to our limited understanding stem from the novelty accompanying blockchain technology, the small number of blockchain implementations in interorganizational systems, and the difficulties in conceptualizing collaboration in blockchain-based platforms [Citation66].

The objective of this study is to address the identified gap by investigating a case of successful deployment of a blockchain-based platform in the context of interbank collaboration. We answer the following research question: How can multiple banks successfully deploy a blockchain-based platform for interbank collaboration? Considering that an essential obstacle when deploying systems for interorganizational collaboration regards the diversity of interests [Citation15, Citation44], we argue that the deployment of a blockchain-based platform is underpinned by the different needs and wants of actors. We adopt the concept of legitimacy as a sensitizing tool for our empirical analysis. Legitimacy refers to the “generalized perception or assumption that the actions of an entity are desirable, proper, or appropriate within some socially constructed system” [Citation58]. Subsequently, since a blockchain-based platform is an entity performing interbank collaboration actions, its successful deployment is conditioned by the outcomes of a legitimacy-building process undertaken to reconcile the diverse interests at stake. This article aims to showcase this process by analyzing the deployment practices of a blockchain-based platform for interbank collaboration.

We focus on interbank collaboration as it is considered a crucial aspect in fostering a stable financial system by facilitating risk sharing, ensuring a more effective liquidity management, enhanced services, and fraud prevention. In this regard, we conducted an exploratory case study on the deployment of a permissioned blockchain system within the Italian banking sector, known as the Spunta Banca DLT Project, which was initiated in 2017 by the innovation division of the Italian Banking Association (ABI Lab) and was implemented as an interorganizational platform to restructure interbank reconciliation processes. Interbank reconciliation consists of a series of tasks often prone to human error, aimed at checking transaction flows, detecting nonmatching transactions, and resolving pending transactions between banks based on bilateral registers [Citation19, Citation57]. Research shows that digital platforms can play an important role in automating interbank collaboration through the deployment of a standardized system to manage data [Citation20, Citation25]. Nevertheless, despite multiple pressures to embrace digital technologies, various bank operations are still based on intense manual labor, and information technology (IT) systems in banking consist of siloed applications that are poorly interoperable and constrain the execution of interorganizational processes among various actors [Citation20, Citation21]. Therefore, the Spunta Banca project serves as an illustrative example of a successful deployment of a blockchain-based platform, representing a legitimacy-building process for a novel form of interbank collaboration.

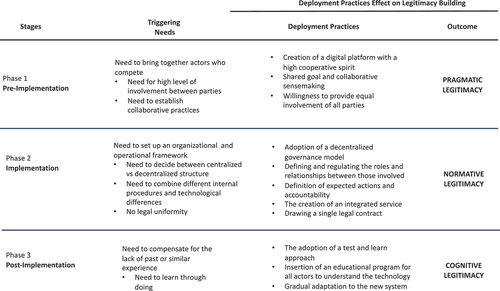

Our findings suggest that for successful deployment of blockchain-based platforms, a sequential approach to legitimacy building should be pursued, beginning with pragmatic legitimacy, followed by normative legitimacy, and concluding with cognitive legitimacy. We articulate these findings through a stage process model comprising of preimplementation, implementation, and postimplementation phases. This model facilitates a deeper comprehension of how the actions of various actors contribute to establishing legitimacy and ultimately ensuring the success of a blockchain-based platform. From a managerial point of view, the contribution concerns the provision of an inspirational example to guide the implementation of blockchain-based solutions at industry level within the banking sector or similar highly regulated sectors.

This article is structured as follows: We commence by providing a review of previous works relevant to the main themes underpinning this research. We continue by delineating the key aspects forming the foundation of our conceptual model. The following sections respectively delve into the case study and the methodology employed. Next there is a summary of the main findings, followed by a discussion, before a concluding section addressing the primary implications and limitations of our study.

Literature Review

Blockchain-Based Platforms

The concept of the digital platform has become a hot topic in the literature, as it represents an interorganizational system that enables more efficient means of collaboration and value creation between actors [Citation33]. In doing so, it challenges incumbents to co-create value by means of software-based technologies [Citation33]. The emergence of digital platforms reflects the general shift toward new collaborative forms of value creation observed in many sectors, including banking, driven by the need to improve efficiency, reduce risk, and strengthen competitive position [Citation4, Citation50] . These approaches combine cooperation and competition [Citation50] with the main goal of enhancing collaborative value creation through the exploitation of supplementary and complementary resources such as digital technologies [Citation45, Citation50]. Nevertheless, despite the innovative outlook offered by digital platforms, two major obstacles constrain the establishment of sustainable interactions mediated by digital platforms: the level of trust between participants, and the capacity of actors to perform their tasks, to pursue a common goal, and to accept the role assigned within the platform [Citation35]. In view of such challenges and given the recent rise to prominence of decentralized technologies, blockchain-based platforms have been contemplated as potential prospects in addressing online forms of interorganizational collaboration [Citation47, Citation66].

Blockchain is considered today to be one of the most promising technologies for the development of interorganizational systems since it enables collaborative forms of value creation across industries, reduces the complexity and cost in the value chain, and increases efficiency and transparency of transactions [Citation6, Citation14, Citation38, Citation47]. Blockchain has the potential to greatly impact interorganizational processes, providing a reliable and transparent way to coordinate different actors without the need to assign control power through means of decentralization and disintermediation [Citation6, Citation13]. Such characteristics have led to a proliferation of blockchain-based platforms aimed at creating collaborative spaces for which the rules are embedded in and enforced by software systems [Citation36]. The distributed ledger technology behind blockchain-based platforms allows for transactions to be transparent, secure, and tamperproof while also accessible and potentially shared with all the participants in a network [Citation47, Citation53]. The unique features of blockchain-based platforms offer a new outlook at how value can be collaboratively created in light of distributed technologies [Citation36]. In addition, blockchain being the underlying technology of such digital platforms offers novel mechanisms to align the interests of multiple parties through predefined rules embedded in the system and enforced thereafter through the software [Citation14].

Blockchain offers a novel perspective on digital platforms. This decentralized technology offers new means for standardization and automation, potentially leading to increased adoption and success rates [Citation1]. Furthermore, the unique characteristics of blockchain-based platforms create new opportunities for interorganizational collaboration [Citation36]. Nevertheless, our understanding of the blockchain potential is limited by the lack of maturity of blockchain projects [Citation6]. While many studies on blockchain-based platforms primarily emphasize the anticipated benefits in terms of service innovation and added value [Citation47, Citation66], it is essential to acknowledge that deploying such platforms comes with challenges. Therefore, understanding the contextual practices and activities crucial for successful deployment is deemed critical [Citation36, Citation65]. Our work represents a significant advancement in this area, offering valuable insights into the necessary actions for deploying a successful blockchain-based platform for interorganizational collaboration.

The Deployment of a Blockchain-Based Platform

Since the goal of digital platforms in core consists of supporting interorganizational relationships and stipulating predefined ways of interactions, the deployment of such platforms is closely connected to value co-creation. In a typical digital platform, value co-creation is generally influenced by platform governance and the autonomy assigned to complementors [Citation33]. Complementors consist of autonomous actors that engage with the platform based on the degree of control and openness, and the distribution of decision rights defined by the platform owner [Citation33]. In blockchain-based platforms, such properties are typically embedded into software code for organizing collaborations both within and across organizations [Citation40]. For instance, smart contracts can be stored on a blockchain to define a specific set of rules for designating interorganizational arrangements [Citation16]. Ultimately, as blockchain has advanced significantly, so have its abilities to provide different access rights, various degrees of openness, and several levels of control that can accommodate the heterogeneous needs of different participating actors [Citation9].

A main element of distinction between platform deployment processes concerns the configurational arrangements, which set out the roles, responsibilities, and processes in the system [Citation8]. In particular, a distinction can be made between centralized and decentralized platforms: Centralized platforms are characterized by a platform owner—also called platform provider or platform leader—which manages and coordinates the system by defining rules, structure, goals, and distribution of value between participants [Citation14, Citation47]. However, the literature highlights several drawbacks of this structure, such as the risk that the platform owner assumes an opportunistic behavior prioritizing its interest to the detriment of the interests of other platform participants [Citation8, Citation14, Citation61], the establishment of trust [Citation51], data ownership and security concerns [Citation47, Citation61], leadership and actors’ roles [Citation4, Citation8], and an equal distribution of value [Citation8, Citation14]. Decentralized structures overcome these barriers, creating a shared infrastructure between participants without assigning market power to a third party [Citation13, Citation61]. In these systems, there is no platform owner that has complete control over the platform, as the control power is distributed among participants. Usually, there is still an entity—called the “platform orchestrator” [Citation61] —that sets up the platform and coordinates the different participants, but it gives up the decisional power to them [Citation14, Citation45]. In decentralized platforms, great importance is given to collaboration as a mean to aid transformation [Citation48]. However, also this type of structure has some drawbacks, such as slow decision-making processes [Citation14, Citation47], the risk of not reaching an agreement between parties, and the need for a high level of involvement and collaboration of participants [Citation14, Citation47, Citation61].

Previous studies on platforms have argued that the platform architecture is contingent on the nature of interactions supported by the platform itself and identify three types of interactions: information sharing, collaboration, and collective action [Citation55]. Other studies have focused on the challenge of combining heterogeneous interests and resources in the development of interorganizational structures and argue that the involvement of stakeholders in the deployment phases of the platform is fundamental, ensuring that everyone’s interests are represented [Citation17]. In this regard, blockchain has the potential to build a new way of deploying interorganizational platforms, by distributing authority and control power among actors dynamically, without any third-party control [Citation13, Citation61]. The literature acknowledges that blockchain deployment in interorganizational settings facilitates the governance of digital platforms, overcomes the low level of trust between actors [Citation13, Citation23, Citation38], reduces the costs of intermediation (transaction costs) [Citation6, Citation47], and mitigates the risks related to data privacy and security [Citation6, Citation13, Citation47].

The use of blockchain, however, also raises new challenges, such as higher coordination costs [Citation47], the need of strong involvement by participants [Citation14, Citation32], scalability and interoperability problems [Citation28, Citation52, Citation63], and strategic and structural inflexibility [Citation42, Citation47]. So far, despite the great attention in the literature toward the possible role of blockchain as an enabler of interorganizational collaboration, this field of research is not mature enough, and a general theoretical orientation is missing [Citation6, Citation27]. This showcases the need to address the limitations of current studies through tangible examples of efficient deployment of blockchain-based solutions, in which decentralized tools lead to new forms of interorganizational collaboration.

Theoretical Framework

While blockchain-based platforms present numerous opportunities, their deployment entails a complex process due to the diversity of users and interests involved, necessitating significant standardization efforts [Citation12, Citation15, Citation44]. Given the dynamic complexity resulting from the involvement of a network of different actors, research underscores the importance of focusing not only on technical aspects but also on social elements to comprehend the development process of such interorganizational structures [Citation31]. Building on these perspectives, we propose that the successful deployment of blockchain-based platforms depends on effectively coordinating the diverse users and their inherent needs.

To guide our analysis of deployment actions and practices, we adopt the concept of legitimacy and argue that the successful deployment of a blockchain-based platform is contingent upon legitimacy building. Legitimacy is defined as the compatibility or appropriateness of certain patterns of behavior exhibited by an entity with specific socially constructed frameworks of definitions, values, or norms [Citation58]. Legitimacy is dependent on the evaluative and cognitive perspective of a history of events [Citation29]. Therefore, the establishment of legitimacy ought to be considered based on specific time-spanning endeavors that depend on the set of objectives against which such endeavors are evaluated. Consequently, as platforms represent interorganizational systems rooted not only in technology but also in social configurations, their legitimacy can be derived from the actions and practices performed to integrate diverse interests toward achieving some common goals.

Legitimacy is considered an important element in strategically aligning divergent interests of actors in digital platforms [Citation62]. While some studies, such as Constantinides and Barret [Citation17] and Kway et al. [Citation39], have begun exploring how the combination of heterogeneous interests in developing interorganizational structures relates to different types of legitimacy, these investigations have primarily focused on healthcare and e-commerce systems. These studies have adopted legitimacy to analyze the development of interorganizational establishments such as digital infrastructures and platforms. However, they do not provide insights into decentralized structures like blockchain-based platforms, which rely on significantly different configurations.

In this article, we draw on Suchman’s three types of legitimacy, namely, pragmatic, normative, and cognitive legitimacy [Citation58], to describe the actions leading to the successful deployment of a blockchain-based platform. The first, pragmatic legitimacy, is grounded on the self-interest, especially toward the entity’s closest audience, such as stakeholders. This legitimacy constitutes of direct interactions between the entity and its audience and how such interaction affects the audience’s contentment [Citation58]. A key aspect of pragmatic legitimacy relates to the willingness to share some level of authority with the affected audience, and as such the entity is perceived to be responsive to a broader interest [Citation26, Citation58]. The second, normative or moral legitimacy, relates to normative evaluation and approval of an entity’s activities [Citation5]. In contrast to pragmatic legitimacy, normative legitimacy departs from narrow self-interest toward a broader societal welfare evaluated based on the particular entity’s constructed value system [Citation49, Citation58]. Thus, normative legitimacy does not rely on the assessment of whether particular actions benefit an evaluator,but on whether such actions are the “right thing to do” on a broader level [Citation58]. Normative legitimacy can be divided into three types upon which its attainment can be based: consequential legitimacy, which refers to the measures of an entity’s effectiveness based on their achievements and accomplishments; procedural legitimacy, referring to the “sound practices” or proper means and procedures toward achieving a certain goal [Citation11, Citation58]; and structural legitimacy, referring to an entity’s socially constructed capacity to perform specific types of work [Citation54]. While consequential legitimacy can be empirically discovered, structural and procedural legitimacy are often evaluated on the basis of strategies, approaches, and outcomes [Citation43]. The third, cognitive legitimacy, is based on how well activities are executed from the point of view of stakeholders [Citation58]. This is an important legitimacy since it defines the level of durability and sustainability of an entity after having been experienced in the daily life of an audience [Citation49]. Cognitive legitimacy would become unattainable in the presence of challenges or unmanageable disorders.

Background of the Project

An Overview

This study centers on the Spunta Banca DLT Project, which serves as a compelling example of how a blockchain-based platform can effectively tackle standardization and automation challenges in the banking sector, thereby streamlining labor-intensive and time-consuming interorganizational processes [Citation19]. This initiative offers valuable insights into the processes and activities involved in establishing a new form of interorganizational collaboration through the deployment of a blockchain-based platform. Given the potential challenges posed by diverging needs of actors during the blockchain platform deployment, the Spunta Banca DLT Project stands out as a successful case, demonstrating how legitimacy can be established through the implementation of a decentralized system. Furthermore, the study examines interorganizational relations from the perspective of interbank collaboration, recognized for its pivotal role in promoting a more stable, efficient, and risk-free financial system.

The project was promoted by the Italian Banking Association (ABI) under the supervision of the ABI Lab—the innovation division of ABI. The objective of the project was to create a shared infrastructure within the Italian banking sector—the so-called ABILabChain—that could host different initiatives [Citation57]. The working group for the development of the project was composed of 14 banking groups, representing 78% of the Italian banking sector in terms of employees. The first issue to be addressed by this initiative concerned the creation of a blockchain-based platform for the management of the “Spunta” process, which refers to the process of interbank reconciliation of the flows and operations that generate entries on bilateral accounts to clear every mismatch in double-entry bookkeeping. This process was chosen as the first application of the platform due to four main reasons: It presented low standardization and slow operating procedures, it was relatively simple, it related to an internal process that does not impact end customers, and ABI is the entity that manages the regulation of this in Italy [Citation57].

Within the Italian banking sector, the process of interbank reconciliation of bilateral accounts was governed by an interbank agreement signed in 1978 and updated with amendments in 1994, so both the process and the rules governing it were well established but outdated [Citation2]. The reconciliation process was carried out monthly, according to bilateral agreements between banks, where usually the “Spunta owner” was defined, that is, the bank in charge of the reconciliation process for a given period. The process owner was in charge for a three-year period and then the roles were reversed. Only the owner had full view of the transactions. Each bank had a customized system to manage movements and identify suspended transactions, and different bilateral agreements had different rules for recognizing and suspending transactions. In addition, there was no structured communication process between the banks to analyze suspended transactions, hence bank employees were forced to coordinate with their counterparties via e-mails and phone calls, which were difficult to record for future review. Given the aforementioned shortcomings, the Spunta Banca DLT Project aimed at standardizing the process, automating tasks, reducing operational risk, increasing transparency and quality, and simplifying audit activities [Citation7, Citation57, Citation61].

Timeline of Events

Although the Spunta Banca DLT Project started in 2017, the preproduction phase began in 2018, when a general simulation was carried out loading 2 months of data in the platform. Before running the simulation, a new interbank agreement was defined to structure the process, the governance model, and the integration plan. In October 2019, a performance test was carried out by simulating the use of the platform over 12 months with more than 200 million transactions between 200 banks—representative of the entire Italian banking system [Citation2]. The blockchain system chosen was the private, permissioned DLT Corda Enterprise by R3. The engagement of participating banks was done gradually, splitting the entry of banks into 3 waves starting on 1 March 2020. The platform became fully operational in October 2020. By March 2021, the platform had reached 100 nodes—thus 100 participating banks—and it had processed 332 million transactions, 98.2 per cent of which were automatically matched [Citation7]. The platform governance is based on 6 layers within which the participating parties play different functions. See Appendix A for the different roles pertaining to each actor involved. The most innovative characteristic of this governance model is its decentralized nature: The platform is not controlled by a single entity, but decision rights are shared among all the participants. ABI Lab, even though it was the initiator of the project by setting up the platform under the role of business network governor, essentially acts as a coordinator, without exclusive decision-making power [Citation61].

Since the interbank reconciliation process is regulated by the same subject promoting the project, the Italian banking association (ABI), compliance was straightforward. The content of the new agreement was approved by the ABI executive committee on 15 May 2019 and communicated to all banks on 13 June 2019. Concerning the roles and responsibilities of different actors, a single contract was drafted and signed to define rules within the platform. represents a summary of the comparison between the before and after the new system implementation.

Table 1. “Before” and “After” the Spunta System Implementation.

The Spunta Banca DLT has been considered a successful case as the new system, which now comprises more than 100 banks, has transformed the interbank reconciliation process by having an automatic match rate of 98%. The new system was able to process 332 million transactions in the two first terms of application alone, and has been associated with faster processing times, lower operating risks, and elevated transparency compared to previous processes [Citation7, Citation19]. Each bank in the network has installed its data center, which represents a node in the system, with all nodes being interconnected. The nodes communicate with each other automatically through blockchain protocol according to preestablished rules and automatically check that the entries on the bilateral accounts match. Currently, the application allows 98% of transactions to be matched automatically and the process of investigating suspended transactions to be carried out within the application. Moreover, the new system allows both parties involved to have a total view of transactions, although the role of the “Spunta owner” remains. Given the positive outcome of the Spunta Banca DLT, the project now aims to extend the perimeter of the Spunta system in the future by applying the same principles to foreign reconciliation processes and to potentially host additional applications pertaining to other areas of banking [Citation3].

Methodology

The selected design for this study is based on a case study focusing on the in-depth analysis of the Spunta Banca DLT Project. The emphasis of this design is the provision of a detailed and intensive examination of the case, and the selection of the case of interest should be based on the expected opportunity to learn from it [Citation10]. The rationale behind the choice of the Spunta Banca DLT Project is that it represents a successful case of blockchain-based platform in the banking sector. Such thorough analysis aims at providing insights that can be useful for future projects in this domain and at contributing an important addition to the existing literature on the use of blockchain forming the basis for future theoretical analysis [Citation10]. Thus, this study can be categorized as an instrumental case study that aims to provide a deeper understanding of the application of blockchain technology within the banking industry [Citation10]. The main criticism of the use of a single-case-study methodology is having a limited sample to be representative and generalizable. However, even if from a single case study it is difficult to obtain a theoretical generalization, it is possible to produce “moderatum generalization” or “case-to-case transfer,” which means “to make generalization from one case to another one” [Citation10].

Data Collection

Primary data were collected through semistructured interviews, which allow for an effective engagement, but also guarantee a certain degree of flexibility to both the interviewer and the interviewee to deepen relevant concepts that might arise [Citation10]. Since the aim of the research was to investigate the building and deployment of the blockchain-based platform created, a generic purposive sampling was applied, which establishes as the main selection criterion the relevance to the research purpose, to identify knowledgeable respondents who can provide an important contribution to the field of interest [Citation10]. The selected sample aimed at comprehending representatives from all levels of governance of the project and collecting the perspectives of different actors. Among the 10 organizations whose representatives were interviewed, all the levels of governance were represented. Both managerial and operational figures were interviewed, as detailed in . The focus of the interviews concerned the practices and actions regarding the deployment of the new platform, expressed in terms of key events and behaviors. The closing of the sampling process and interviews was made once theoretical saturation was reached, resulting in the collection of data from a total of 18 respondents. More information on the interview guide and covered themes is provided in Appendix B.

Table 2. Dataset Overview.

To guarantee reliability and validity of the data collection, interviews were recorded and fully transcribed. The full transcripts of the interviews and all the documents gathered and produced during the work were collected and stored to enable any possible revision of the material. In addition, to ensure the credibility of the findings, the technique of respondent/member validation was applied [Citation10]. At the beginning of each interview, a summary of the research’s objectives was provided, and at the end of the interview a summary of what was discussed was also distributed to each participant. In addition, the interviews were accompanied by secondary data collection, which included reports, journal publications, project presentations, and press releases related to the development of the Spunta Banca DLT Project.

Data Analysis

The data analysis followed the thematic analysis framework, which is based on the development of a coding system that emerges inductively from the analysis of the interviews’ transcripts and is regarded as the most suitable method for qualitative analysis because it entails the certain degree of flexibility necessary to study different types of unstructured data while also providing a general structure to carry out a comprehensive and coherent analysis through the coding process [Citation10]. The first level of coding concerned the in-depth analysis of the individual interviews and the identification of concepts of interest—the empirical themes—that adhere to the respondents’ terms and views, with little attempt to categorize them. The concepts identified in the different interviews were then compared with each other to pinpoint patterns and common themes according to two main criteria: the repetition across interviews, and the relevance to the focus of the research question “what are the drivers and conditions leading to the sustainable deployment of a blockchain-based platform for interbank collaboration?,” prioritizing concepts that can help describe and explain the phenomena of interest. The last step involved the aggregation of the conceptual categories into dimensions related to the three legitimacies, based on their respective characteristics as evidenced in our theoretical framework [Citation30]. The coding process was carried out using NVivo software. From the interviews’ transcripts, 243 references were highlighted, which were combined into 18 empirical themes (first level), then 7 conceptual categories (second level), and finally 3 aggregate dimensions (third level) as depicted in . In the analysis of our data, we gave particular consideration to the understanding of the events, activities, choices, and actions in terms of sequential patterns, allowing thus the development of a process model.

Findings

From the analysis of the interview data, a specific set of actions and practices emerged in the deployment of the blockchain-based platform, which we assign to each of the three main stages in the development process: preimplementation, implementation, and postimplementation phases. The preimplementation phase consisted mostly of establishing collaborative behavioral patterns and specific roles and responsibilities for facilitating coordination and cooperation [Citation41]. The implementation phase consisted of the establishment of the decentralized control as foreseen by the implementation of the blockchain technology and the standardization required in terms of operations, technology, and legal aspects to support the deployment [Citation34, Citation52]. Lastly, the postimplementation phase consisted of the adjustments to the new platform through the training of the actors [Citation56] and a trial-and-error implementation [Citation59]. A summary of the following findings and their respective representative quotations has been illustrated in Appendix C.

Phase 1: Preimplementation

The first deployment practice related to the ability to foster joint collaboration between all parties, who appeared to be very involved and cohesive in the attempt to reach an industry solution, showing flexibility, negotiation skills, and empathy. The interviewees were aware that a major challenge of the project was to bring together actors who usually compete. The creation of a joint blockchain-based platform, where all actors cooperate to achieve a common goal, appeared central to successful deployment. The shared feeling that led to this strong cohesion between the participants was the belief that they were trying to achieve an important system-wide solution from which all the banks could benefit as a sector. In this regard, the words of Respondent F1 are emblematic:

The success factor is always to be found in those people who have a vision of how the world is going and also the ability to negotiate, to relate and to empathize […] Taking a cue from the concept of “co-opetition,” there is indeed competition between banks, but if certain things are done together, we can save on investment, we can reduce time, and we can better mitigate risks.

A second deployment practice in this phase regarded the engagement of all stakeholders within the system. In this regard, respondents pointed out that the establishment of a clear governing model, and defining the roles and relationships between the different parties involved, played an important role in the preimplementation phase. Six governance levels were defined within the platform, each of which foresees a precise role and functions. According to the interviewees, these levels were necessary for the correct governance and functioning of the system. The importance of a clear governance model lies in the ability to precisely identify the boundaries of accountability. In this regard, Respondent C stated:

With a governance system designed in this way, it is very clear where the boundaries are, what I have to do, what the software developer has to do, what ABI Lab, which governs the system, has to do, and so on.

Lastly, interviewees pointed out that at the beginning of the project, two barriers to development were mistrust among participants and the need for coordination between banks with different needs and capabilities. In this regard, it is important to highlight how ABI Lab, as Business Network Governor, was able to take on a facilitating role within the project, in order to build stakeholder coordination among all the actors involved in the project but without actually ruling—instead, letting all decisions be taken jointly by all network actors. In this way, ABI Lab fostered a collaborative climate by ensuring the equal involvement of all. For instance, an employee of one of the banks identified as Responded F2 stated:

I can say that perhaps the most unique element for me was working together, all as equals, getting together with so many colleagues and deciding together what to do. […] ABI Lab considered all banks as being equal. This may not even be the case because there are bigger banks and smaller banks.

Phase 2: Implementation

The interviewees pointed out that the idea of decentralized governance is essential in the development of platforms that use blockchain technology, which is why in the implementation phase decentralizing control ought to be the first and most important deployment practice. According to our information, a major flaw in projects that implement the blockchain technology is that of creating a distributed infrastructure but adopting centralized governance, causing the main benefits offered by the distributed ledger to be lost. In addition, the adoption of a decentralized governance model facilitated the deployment of the platform because it removed the need to find an entity on which to centralize decision-making powers. All participants felt involved in the decision-making process and were able to advocate their interests. For instance, Respondent B stated:

There must be a desire to manage things in a decentralized way. For instance, if you make a blockchain but then there is only one company that manages everything, this could have been done with a centralized infrastructure.

Furthermore, concerning the infrastructural aspect, from the interviews it emerged that integrating IT systems and operations was a major challenge for the project, since within the Italian banking system there was a lack of standardization of internal procedures and substantial differences in terms of technologies, also due to the different sizes of the banks involved. To overcome this challenge and enable the integration of the systems, the technological partners developed an integrated service solution for all banks. Despite the system being centrally managed in order to guarantee a suitable level of interoperability between banks, it also allowed each actor to manage its node and run its own application. The key strength of this solution was centralizing the development of the solution and the management of the technological issues because it made it possible to define a solution that considered the needs of all parties involved. According with Respondent C:

By doing this type of integration we have brought a completely turnkey solution, so no bank had to worry about the shared infrastructure. The integration of the banks’ legacy systems was all in all very simplified […]. Concentrating the technological issue on one subject instead of distributing it and making it a problem for all banks is the key to the success of applications of this type that involve communities of subjects because when we solve it, we solve it for everyone.

From a legal point of view, the interviewees emphasized that the success factor in formalizing legal requirements regarding the platform deployment was the involvement and collaboration of all stakeholders. A significant in-depth legal study was carried out through the establishment of a working table between the lawyers of each bank, coordinated by ABI Lab’s legal department, which made it possible to discuss and define all the legal aspects and to draw up a single contract signed by all the parties regulating the system. For instance, a manager in one of the banks identified as Responded I stated:

The other important thing is the legal in-depth analysis conducted. We had many meetings with the lawyers involved by ABI Lab and with the lawyers of each bank, so when it came to signing the contract, all the legal aspects had already been dealt with and defined, and no doubts were left open about legal and compliance issues.

Lastly, as the banking sector is highly regulated, the legal aspect related to the use of technology is also accompanied by the issue concerning the need for regulatory adaptation. In the specific case of the interbank reconciliation (Spunta), the process of regulatory adaptation was straightforward since ABI Lab, the promoter of the project, is also the regulator. However, it emerged from the interviews that for the development of projects of this kind, it is important to have an alignment from a regulatory point of view, as stated by Respondent D:

The coordination of different actors, both private and public, banks, technological partners, and the supervisory authority itself, to redefine the regulatory profiles is fundamental. I must say that from this point of view ABI Lab did an extraordinary job of coordination, but it was a nontrivial hurdle at the outset.

Phase 3: Postimplementation

In the postimplementation phase, an important point highlighted by interviewees concerned the training of the actors to the new system and technology through a testing and learning approach. The technology partners were aware of the lack of knowledge of the banks and pointed out that projects often do not go into production because participants did not ultimately understand the technology or the benefits of it. To overcome this issue, a “Test and Learn” approach was adopted, so that banks could ease into the process gradually. In this regard, Respondent E2, said:

Let’s say that we had trained during the test phase where we tried to do the various operations, so the adaptation was easy because by the time it went into production, we already knew the system.

In addition, a similar approach was also implemented to assess the technical performance of the platform through a series of trials and standard tests. Since the new system would be implemented gradually, enough time was allocated to evaluate the stability and responsiveness of the blockchain-based platform through trial-and-error mode of adjustment. These would allow for any underlying issues or necessary adaptations to be made promptly. In this regard, Respondent F1 said:

So, thanks to the performance testing and stress testing that we did on Spunta, R3 engineers were able to take action and improve the performance considerably at the platform level.

Discussion

This section presents an in-depth discussion of the findings. Based on the findings emerging from the data analysis, we argue that the three identified phases can be aligned with the following sequence of legitimacy-building activities that guarantee the successful deployment of a blockchain-based platform: pragmatic, normative, and cognitive legitimacy. A depiction of the findings in the form of a stage process model depicting the stages, actions, and practices and associated legitimacies can be seen in .

The preimplementation phase consisted of the need to primarily set the ground for the adoption of the blockchain-based platform, which would subsequently drive toward decentralization of control. In the preimplementation phase, what became imminent was the important role of stakeholders and their involvement with the Spunta project. This was addressed through the establishment of a joint collaborative spirit and willingness to offer equal involvement in the project to all the stakeholders. When it comes to the collaboration between the actors, a potential problem often highlighted in literature with decentralized technologies such as blockchain is the need for a high level of involvement between parties [Citation14, Citation32]. For Spunta, our analysis reveals that the main driver of the cohesion was the belief that they could create a system solution that would bring important benefits to the banking sector. This is consistent with the literature analyzed, which highlights how companies are shifting toward a more collaborative approach with their competitors within their value chain to improve efficiency, reduce risk, and strengthen their competitive position [Citation4, Citation50]. This new approach—which combines both collaboration and competition to enhance value creation—is referred to as “co-opetition” [Citation50] and relies on the exploitation of digital technologies such as blockchain.

In addition, the clear definition of the governance model, roles, and responsibilities within the system guarantees the ability to identify precisely and easily the boundaries of accountability. This issue of role clarity seems to address the main barriers to the success of interorganizational platform development, namely, the cost and the complexity of collaboration between participants, as it drastically reduces uncertainty regarding roles and responsibilities [Citation4]. Moreover, the clear definition of roles and responsibilities can lead to a stronger alignment of participants’ goals, which is considered in the literature as a key element for the proper development of digital platforms [Citation4, Citation8]. This is an important point, as failure to have clear roles and responsibilities could have resulted into various tensions stemming from different structural expectations, inconsistent goals, and contestable collaborative arrangements [Citation4]. Furthermore, the findings unfolding in the preimplementation phase show that crucial to the successful deployment has been the role of ABI Lab, which managed the development of the platform and the coordination of the different actors assuming the role of business network governor, but never ruling. This interpretation of the governor role assumed by ABI Lab matches the figure of the “platform orchestrator” found in the literature, who sets up the platform and coordinates the different participants, but it gives up the decisional power to them [Citation61].

According to the interviewees providing coordination mechanisms for negotiating goals, integrating deliberation and establishing clear roles and responsibilities to all stakeholders are critical in ensuring transparency of the collective decision-making process. These specific characteristics could be inferred to have played an important role in minimizing two of the key tensions in digital platform as underlined by literature, namely, lack of trust and complexity of collaboration stemming from heterogeneous actors [Citation35, Citation45]. Furthermore, the role assumed by ABI Lab of coordinating the involvement of all stakeholders and the joint decision-making processes adopted are consistent with the best practices highlighted in literature for the proper development and functioning of an interorganizational structure, such as involving all stakeholders in the development phases and ensuring that everyone’s interests are represented [Citation17]. These practices are aimed at establishing pragmatic legitimacy among actors. In fact, pragmatic legitimacy is dependent on the level of self-interest perceived by an entity’s closest audience, such as stakeholders, and stakeholders will perceive an entity as legitimate as long as they derive benefits from the actions undertaken on their behalf [Citation58]. Based on the aforementioned findings, we argue that if equal involvement had been denied and some of the stakeholders had been neglected, there would have been less willingness to collaborate and coordinate between them. A key aspect of pragmatic legitimacy relates to the willingness to share some level of authority with the affected audience, and in the case of the Spunta project it was reflected by being equally responsive to all the broader set of interests [Citation26, Citation58].

While the preimplementation phase addressed the need to pragmatically legitimate the deployment of a blockchain-based platform among actors with competing goals, the implementation phase consisted of the operational practices needed to deploy the blockchain-based platform. This corresponds to attaining normative legitimacy that relies on the ability to “do the right thing” [Citation58] and is evaluated on the basis of strategies, approaches, and outcomes [Citation43]. Particularly, our findings indicate the achievement of the procedural type of normative legitimacy, which makes reference to the “sound practices” or proper means and procedures implemented towards achieving a certain goal [Citation11, Citation58].

More specifically, in the implementation phase, the analysis highlighted the establishment of decentralized control, where power is shared by multiple actors. Although such a deployment practice can be inferred from the previous studies that refer to the inherent features of blockchain technology that allow one to overcome barriers related to traditional centralized governance systems [Citation6, Citation13, Citation23, Citation47], our study shows that this is a crucial step in the implementation of a blockchain-based platform. Another important point that was uncovered by the findings as crucial in the implementation phase was the need to harmonize any technical, organizational, or legal disparities that could hinder the governance of a blockchain based platform. Our findings showcase how the innovative nature of a technology such as blockchain requires the ability to adopt common interfaces and to create a shared infrastructure [Citation52, Citation61]. Fundamental to the proper functioning of this type of system is the standardization of data flows among participants and ensuring that they all have the same operational capacity. The key strength of the solution adopted by the Spunta project was to centralize the development and the technical management of the shared infrastructure in a single technology provider.

Additionally, from a legal point of view the success factor in overcoming the several challenges highlighted in the literature—such as governance and accountability, contract enforcement, data privacy and security [Citation34, Citation42, Citation57]—was the involvement and collaboration of all stakeholders around the legal issues from the early stages of the project through the establishment of a working group made by lawyers appointed by each participant, who discussed and defined all the legal aspects and drew up a contract signed by all the parties regulating the system. Such practices support previous studies underlining that for the development of projects of this kind, it is necessary to have an alignment from a regulatory point of view by the supervisory authority and therefore collaboration between public and private actors [Citation34, Citation42].

Finally, the postimplementation phase refers to the testing-and-learning practices adopted by the Spunta project where all the actors had the opportunity to understand and adapt to the technology in a gradual and guided way. That process allowed for the blockchain-based digital platform to be used more easily and consciously, once implemented fully. This made it possible to overcome the challenge highlighted in the literature regarding the lack of knowledge and understanding of the technology [Citation52, Citation56], which is also closely linked to one of the barriers to the success of interorganizational platforms, namely, the capacity of all actors to fulfill their tasks [Citation4]. The adoption of blockchain technology, the training of actors in using the new technology, the shared technological infrastructure, and the strategic alignment represent the key elements highlighted by research for organizations to achieve business intelligence agility, which is considered fundamental to compete in today’s turbulent digital business environments [Citation46].

In addition, different tests and technical examinations were performed to assess the performance of the platform. This would allow for any issues to be addressed in a timely manner and allow for the necessary adaptations to be made to the platform. As banking is a highly regulated sector and regulatory requirements are stringent but also constantly updated [Citation37], adaptations in this regard should be considered as a recursive process that can follow any alternation in terms of collaboration or standardization, that is, change in legal requirements that would need adjusting, and vice versa. Consequently, we argue that all the deployment practices taking place in the postimplementation phase led to building cognitive legitimacy, which evaluates how well activities are executed [Citation58] and the sustainability level of an entity after having been experienced in reality through a real user audience [Citation49]. As cognitive legitimacy can be attained when issues and challenges are properly addressed, the testing and learning practices allowed for the appropriate measures to be taken to tackle any difficulties and thus to successfully build a cognitive legitimacy as well.

In conclusion, it can be inferred that our findings concur with how the successful deployment of blockchain-based digital platform for interbank collaboration is dependent on the standardization of technological and procedural components and the level of collaboration established [Citation35]. In doing so, this underlines again how blockchain as an enabler of digital platform should be associated with decentralized control, emergence of new forms of collaboration, and a continuous adaptation process [Citation66]. Moreover, the findings presented in this study also extend current research on the role of legitimacy in developing similar interorganizational structures [Citation17] [Citation39]. Constantinides and Barret [Citation17] focused on information infrastructures in the health care and argued that pragmatic legitimacy should be the first to be pursued, followed by cognitive legitimacy, and lastly normative legitimacy. The divergence in findings showcases how the nature of entities under review, or the domain, can play an important role in the sequence of legitimacy building stages.

Theoretical Implications

Considering the multisided nature of digital platforms, this research adopts a legitimacy building framework for looking at the successful deployment of a blockchain-based platform given the importance of legitimacy in aligning divergent interests in interorganizational structures [Citation62]. Based on the findings, we contribute to the building of a process model showcasing how the successful deployment is conditioned by the different actions and practices that lead to a sequential legitimacy building pattern undertaken to reconcile the diverse interests at stake. The emerging actions and practices as depicted in the process model summarized by this study offer new insights on interorganizational interoperability and its close relations to different types of legitimacy [Citation58].

This research supports the existing literature on the use of blockchain for the creation of interorganizational structures. The case of Spunta confirms the centrality highlighted in the literature of a proper governance model for the proper development and functioning of a successful interorganizational platform. In particular, the adoption of a decentralized technology allows overcoming the barriers associated with the traditional centralized structures, such as the need to assign control power to a party and the low level of trust between participants [Citation13, Citation23, Citation38], and the costs of intermediation [Citation6, Citation47]. Furthermore, the analysis underpins previous research on platform development [Citation17, Citation55, Citation61] by highlighting that the successful functioning of a decentralized governance model requires the provision of collaboration mechanisms for defining roles and responsibilities, negotiating goals, and ensuring that everyone’s interests are represented.

From an operational point of view, the analysis confirms that the adoption of a blockchain system requires a process of standardization of the operational capabilities of different actors and the ability to parallel management of multiple separate infrastructures through the adoption of common interfaces and the creation of shared infrastructure [Citation52, Citation61]. Furthermore, another central theme in the literature confirmed by the analysis concerns the need to train actors in using the new system to overcome the barriers of lack of knowledge and understanding of the technology [Citation52, Citation56] and the capacity of all actors to fulfill their tasks [Citation4].

Even though the study was based on the practices and activities leading the successful deployment of a blockchain-based digital platform, the reverse can also hold true. From a theoretical perspective, it should be considered that actions different from what has been documented throughout this study, as also highlighted throughout the literature, can create obstacles to the implementation of blockchain for interorganizational collaboration. Overall, the aforementioned findings and implications contribute to the emerging literature on the role of legitimacy in the development of interorganizational structures [Citation17, Citation39].

Practical Implications

From the analysis of the success of the Spunta Banca DLT Project, it is possible to derive six main takeaways useful for the deployment of similar projects. First, blockchain technology shows greatest potential in light of collaboration and successful exchange of information between different actors through the creation of a secure and trusted environment. Second, it is important to adopt a decentralized control to make the most of the potential of the technology, while clearly defining roles and responsibilities and adopting coordination mechanisms to ensure alignment between parties and the functioning of the system. In this regard, a facilitating element is the presence of an entity that acts as a facilitator between the parties—the platform orchestrator—who sets up the platform and coordinates the different participants, but gives up the decisional power to them. Third, due to the distributed nature of the technology, a blockchain-based platform requires the integration of the different systems of the participants and the creation of shared infrastructure, ensuring that all the actors have the same operational capacity. Fourth, it is important to provide training for all actors involved in the project, so that everyone can use the technology easily and consciously to fulfill their tasks. Involving all actors from the initial testing phases can help them to know and understand the technology in a gradual and guided way. From a legal point of view, the use of blockchain can raise the need to assess various issues. For this reason, the discussion and definition of the legal aspects among the participants in the project are important. In addition, if the platform operates in a regulated sector such as banking, an adaptation from a regulatory point of view and thus the involvement and alignment of the supervisory authority is also crucial. Lastly, an important element that emerged from this study related to the importance of the managerial dynamics within this interorganizational initiative. The involvement of managers in the decision-making process and their cooperative spirit should be highlighted as an important success factor for the implementation of the system.

Limitations and Future Research

There are two main limitations pertaining to this study that can be addressed through future research. First, it should be noted that the results of this article are based only on the analysis of the selected case study; therefore, drawing generalizations from the conclusion may be limited, but can be addressed through future research within a similar domain. The second limitation concerns the specific geographical and regulatory context in which the use case is developed. In fact, since the banking sector is a highly regulated sector with potential differences from one country to another, this study and its conclusions are mainly useful for contexts that present similar regulatory and cultural conditions. Regarding such limitations, a future comparative study with other similar initiatives in other countries could provide more generalizable results by examining several similar projects developed in different contexts and comparing their characteristics and results to identify points of convergence and divergence. Concerning the development of new use cases on the common infrastructure created, future research could evaluate the new benefits and challenges faced when applying the technology to the management of processes that deal with the banks’ business and the relationships with customers.

Supplemental Material

Download MS Word (20.3 KB)Acknowledgments

The authors thank ABI Lab, NTT Data, and SIA for the practical support received in relation to the work carried out for this article. Furthermore, they would like to thank all the interviewees from the banks who participated in the research. Their knowledge and helpfulness made the realization of this work possible.

Disclosure statement

The authors are solely responsible for the analysis and interpretation of the data collected in this study. Any inaccuracies or misrepresentations in the findings are not attributable to the organizations or individuals who participated in the research.

Supplementary Material

Supplemental data for this article can be accessed online at https://doi.org/10.1080/10864415.2024.2332051.

Additional information

Notes on contributors

Esli Spahiu

Esli Spahiu ([email protected]) received her Ph.D in Management from Luiss University in Rome, Italy, where she currently holds a postdoctoral position. Since joining Luiss, she has also served as an adjunct professor for the digital course in qualitative methods for management and as a research assistant at CLIO, Center for Leadership, Innovation and Organization. Dr. Spahiu’s research interests include digital transformation, innovation, digital infrastructures, and distributed systems

Paolo Spagnoletti

Paolo Spagnoletti ([email protected]; Corresponding author) is a professor at Luiss University, where he holds the Vodafone Chair in Cybersecurity and Digital Transformation. He is also an adjunct professor at the University of Agder, Norway. He holds a Ph.D. in Information Systems from Luiss University. Dr. Spagnoletti’s research interests include digital innovation, information infrastructures, and cybersecurity. He has published in such journals as Journal of Information Technology, Journal of Strategic Information Systems, and Information and Management.

Augusto Sposito

Augusto Sposito ([email protected]) is an associate consultant and Mastercard Data & Services employee in Lisbon, Portugal, where he specializes in providing analytics and strategy consulting for clients across Europe. Prior to joining Mastercard, he completed a double degree program, earning an M.Sc. in Management with a major in Entrepreneurship and Innovation from Luiss University, and an M.Sc. in Innovation and Industrial Management from the University of Gothenburg.

References

- ABI Lab. Spunta Banca DLT. AbiLab, 2020. https://www.abilab.it/documents/20124/0/Descrizione+iniziativa+Spunta+Banca+DLT.pdf/1a458e5c-29d7-cdbc-2bda-554ea70bd3e8?t=1590615492283 (accessed February 4, 2023).

- ABI Lab. Verso l’Euro digitale: fare tesoro dell’esperienza delle banche italiane. AbiLab, 2021. https://www.abi.it/mercati/innovazione (accessed on February 4, 2023).

- ABI Lab. Spunta Conti Ordinari e Esteri DLT. AbiLab, 2022. https://www.abilab.it/documents/20124/1610406/ABI+Lab_Spunta+Conti+Ordinari+e+Esteri+DLT.pdf/4753a77a-8b65-2233-1535-902d7a48cf02?t=1673455338152 (accessed February 5, 2023).

- Adner, R. Ecosystem as structure: An actionable construct for strategy. Journal of Management, 43, 1 (2017), 39–58.

- Aldrich, H.E., and Fiol, C.M. Fools rush in? The institutional context of industry creation. Academy of Management Review, 19, 4 (1994), 645–670.

- Ali, O.; Ally, M.; Clutterbuck; and Dwivedi, Y. The state of play of blockchain technology in the financial services sector: A systematic literature review. International Journal of Information Management, 54 (2020), 102199.

- Attanasio, S. The Spunta Project—Blockchain for Italian Interbank Reconciliation. European Payments Council, 2021. https://www.europeanpaymentscouncil.eu/news-insights/insight/spunta-project-blockchain-italian-interbank-reconciliation (accessed on February 4, 2023).

- Aulkemeier, F.; Iacob, M. E.; and van Hillegersberg, J. Platform-based collaboration in digital ecosystems. Electronic Markets, 29, 4 (2019), 597–608.

- Beck, R.; Müller-Bloch, C.; and King, J. L. Governance in the blockchain economy: A framework and research agenda. Journal of the Association for Information Systems, 19, 10 (2018), 1020–1034.

- Bell, E.; Bryman, A.; and Harley, B. Business Research Methods. Oxford: Oxford University Press, 2018.

- Berger, P.L.; Berger, B.; and Kellner, H. The Homeless Mind: Modernization and Consciousness. New York: Random House, 1973.

- Bowker, G. C., and Star, S. L. Sorting Things Out: Classification and its Consequences. Cambridge, MA: MIT Press, 2020.

- Catalini, C.; and Gans, J.S. Some simple economics of the blockchain. Communications of the ACM, 63, 7 (2020), 80–90.

- Chen, Y.; Pereira, I.; and Patel, P. C. Decentralized governance of digital platforms. Journal of Management, 47, 5 (2020), 1305–1337.

- Ciborra, C. From Control to Drift: The Dynamics of Corporate Information Infrastructures. New York: Oxford University Press, 2000.

- Cole, R.; Stevenson, M.; and Aitken, J. Blockchain technology: Implications for operations and supply chain management. Supply Chain Management: An International Journal, 24, 4 (2019), 469–483.

- Constantinides, P.; and Barrett, M. (2014). Information infrastructure development and governance as collective action. Information Systems Research, 26, 1 ( 2015), 40–56.

- Cozzolino, A.; Corbo, L.; and Aversa, P. Digital platform-based ecosystems: The evolution of collaboration and competition between incumbent producers and entrant platforms. Journal of Business Research, 126 (2021), 385–400.

- Cucari, N.; Lagasio, V.; Lia, G.; and Torriero, C. The impact of blockchain in banking processes: The Interbank Spunta case study. Technology Analysis & Strategic Management, 34, 2 (2021), 138–150.

- Cuesta, C.; Ruesta, M.; Tuesta, D.; and Urbiola, P. The digital transformation of the banking industry. BBVA Research, 1 (2015), 1–10.

- Currie, W.L.; Gozman, D.P.; and Seddon, J.J. Dialectic tensions in the financial markets: A longitudinal study of pre- and post-crisis regulatory technology. Journal of Information Technology, 33, 4 (2018), 304–325.

- Cusumano, M.A.; Gawer, A.; and Yoffie, D.B. The Business of Platforms: Strategy in the Age of Digital Competition, Innovation, and Power. New York: Harper Business, 2019.

- Davidson, S.; de Filippi, P.; and Potts, J. Blockchains and the economic institutions of capitalism. Journal of Institutional Economics, 14, 4 (2018), 639–658.

- De Angelis, S.; Aniello, L.; Baldoni, R.; Lombardi, F.; Margheri, A.; and Sassone, V. PBFT vs proof-of-authority: Applying the CAP theorem to permissioned blockchain. Italian Conference on Cybersecurity, 2018, 11––20.

- De Reuver, M.; Verschuur, E.; Nikayin, F.; Cerpa, N.; and Bouwman, H. Collective action for mobile payment platforms: A case study on collaboration issues between banks and telecom operators. Electronic Commerce Research and Applications, 14, 5 (2015), 331–344.

- Elms, H.; and Phillips, R.A. Private security companies and institutional legitimacy: Corporate and stakeholder responsibility. Business Ethics Quarterly, 19, 3 (2009), 403–432.

- Frizzo-Barker, J.; Chow-White, P.A.; Adams, P.R.; Mentanko, J.; Ha, D.; and Green, S. Blockchain as a disruptive technology for business: A systematic review. International Journal of Information Management, 51 (2020), 102029.

- Garg, P.; Gupta, B.; Chauhan, A.K.; Sivarajah, U.; Gupta, S.; and Modgil, S. Measuring the perceived benefits of implementing blockchain technology in the banking sector. Technological Forecasting and Social Change, 163 (2021), 120407.

- Ginzel, L.E.; Kramer, R.M.; and Sutton, R.I. Organizational impression management as a reciprocal influence process: The neglected role of the organizational audience. Organizational Identity (2000), 223–261.

- Gioia, D.A.; Corley, K.G.; and Hamilton, A.L. Seeking qualitative rigor in inductive research: Notes on the Gioia methodology. Organizational Research Methods, 16, 1, (2012), 15–31.

- Hanseth, O.; and Lyytinen, K. Design theory for dynamic complexity in information infrastructures: The case of building Internet. Journal of Information Technology, 25, 1 (2010), 1–19.

- Harris, W.L.; and Wonglimpiyarat, J. Blockchain platform and future bank competition. Foresight, 21, 6 (2019), 625–639.

- Hein, A.; Schreieck, M.; Riasanow, T.; Setzke, D. S.; Wiesche, M.; Böhm, M.; and Krcmar, H. Digital platform ecosystems. Electronic Markets, 30, 1 (2020), 87–98.

- Herian, R. Regulating disruption: Blockchain, GDPR, and question of data sovereignty. Journal of Internet Law, 22, 2 (2018), 1–16.

- Jacobides, M.; Cennamo, C.; and Gawer, A. Towards a theory of ecosystems. Strategic Management Journal, 39, 8 (2018), 2255–2276.

- Jovanovic, M.; Kostić, N.; Sebastian, I.M.; and Sedej, T. Managing a blockchain-based platform ecosystem for industry-wide adoption: The case of TradeLens. Technological Forecasting and Social Change, 184 (2022), 121981.

- Kaniadakis, A.; and Constantinides, P. Innovating financial information infrastructures: The transition of legacy assets to the securitization market. Journal of the Association for Information Systems, 15, 5 (2014), 244–262.

- Kołodziej, M. Classification of blockchain technology implementations in finance industry. Finanse, 1 (2019), 43–55.

- Kwak, J.; Zhang, Y.; and Yu, J. Legitimacy building and e-commerce platform development in China: The experience of Alibaba. Technological Forecasting and Social Change, 139, (2019), 115–124.

- Lumineau, F.; Wang, W.; and Schilke, O. Blockchain governance—A new way of organizing collaborations? Organization Science, 32, 2 (2021), 500–521.

- Lusch, R.F.; and Nambisan, S. Service innovation. MIS Quarterly, 39, 1 (2015), 155–176.

- Malhotra, A., O’Neill, H., and Stowell, P. Thinking strategically about blockchain adoption and risk mitigation. Business Horizons, 65, 2 (2022), 159–171.

- Meyer, J.W.; and Rowan, B. Institutionalized organizations: Formal structure as myth and ceremony. American Journal of Sociology, 83, 2 (1977), 340–363.

- Monteiro, E. Scaling information infrastructure: The case of next-generation IP in the Internet. The Information Society, 14, 3 (1998), 229–245.

- Mukhopadhyay, S.; and Bouwman, H. Orchestration and governance in digital platform ecosystems: A literature review and trends. Digital Policy, Regulation and Governance, 21, 4 (2019), 329–351.

- Pappas, I.O.; Mikalef, P.; Giannakos, M.N.; Krogstie, J.; and Lekakos, G. Big data and business analytics ecosystems: Paving the way towards digital transformation and sustainable societies. Information Systems and e-Business Management, 16, 3 (2018), 479–491.

- Pereira, J.; Tavalaei, M.M.; and Ozalp, H. Blockchain-based platforms: Decentralized infrastructures and its boundary conditions. Technological Forecasting and Social Change, 146 (2019), 94–102.

- Pollari, I. The rise of Fintech opportunities and challenges. Jassa, 3 (2016), 15–21.

- Powell, W.W.; and DiMaggio, P.J. The New Institutionalism in Organizational Analysis. Chicago: University of Chicago Press, 2012.

- Ritala, P.; Golnam, A.; and Wegmann, A. Coopetition-based business models: The case of Amazon.com. Industrial Marketing Management, 43, 2 (2014), 236–249.

- Ross, W.; and LaCroix, J. Multiple meanings of trust in negotiation theory and research: A literature review and integrative model. International Journal of Conflict Management, 7, 4 (1996), 314–360.

- Saheb, T.; and Mamaghani, F.H. Exploring the barriers and organizational values of blockchain adoption in the banking industry. Journal of High Technology Management Research, 32, 2 (2021), 100417.

- Schmeiss, J.; Hoelzle, K.; and Tech, R.P. Designing governance mechanisms in platform ecosystems: Addressing the paradox of openness through blockchain technology. California Management Review, 62, 1 (2019), 121–143.

- Scott, W.R. Effectiveness of organizational effectiveness studies. In P.S. Goodman and J.M. Pennings (Eds.), New Perspectives on Organizational Effectiveness. San Francisco: Jossey-Bass, 1977, pp. 63–96.

- Spagnoletti, P.; Resca, A.; and Lee, G. A design theory for digital platforms supporting online communities: A multiple case study. Journal of Information Technology, 30, 4 (2015), 364–380.

- Spahiu, E.; Spagnoletti, P.; and Federici, T. Beyond scattered applications. In P. De Giovanni (ed.), Blockchain Technology Applications in Businesses and Organizations, IGI Global, 2022, p. 264.

- Stasi, R.; and Attanasio, S. Moving an entire banking sector onto DLT: The Italian banking sector use case. Journal of Digital Banking, 5 (2021), 313–320.

- Suchman, M.C. Managing legitimacy: Strategic and institutional approaches. Academy of Management Review, 20, 3 (1995), 571–610.

- Treiblmaier, H. Toward more rigorous blockchain research: Recommendations for writing blockchain case studies. Frontiers in Blockchain, 2 (2019), 1–31.

- Valkokari, K.; Seppänen, M.; Mäntylä, M.; and Jylhä-Ollila, S. Orchestrating innovation ecosystems: A qualitative analysis of ecosystem positioning strategies. Technology Innovation Management Review, 7, 3 (2017), 12–24.

- Vella, G., and Gastaldi, L. Blockchain Platform Ecosystem: An Empirical Analysis on the Italian Banking Sector. 3rd Symplatform, 2021, 1–13.

- Wen, Y. Rightful resistance: How do digital platforms achieve policy change?. Technology in Society, 74, (2023), 102266.

- Wimmer, M. A.; Boneva, R.; and Di Giacomo, D. Interoperability Governance: A Definition and Insights from Case Studies in Europe. Proceedings of the 19th Annual International Conference on Digital Government Research: Governance in the Data Age, (2018), 1–11.

- Yablonsky, S. A multidimensional platform ecosystem framework. Kybernetes, 49, 7 (2020), 2003–2035.

- Yoffie, D. B.; Gawer, A.; and Cusumano, M. A. A study of more than 250 platforms a reveal why most fail. Harvard Business Review (2019). https://hbr.org/2019/05/a-study-of-more-than-250-platforms-reveals-why-most-fail (accessed February 14, 2023).

- Zutshi, A.; Grilo, A.; and Nodehi, T. The value proposition of blockchain technologies and its impact on digital platforms. Computers & Industrial Engineering, 155, (2021), 107187.