The chances of limiting global warming to 2.0°C by 2050 are close to zero

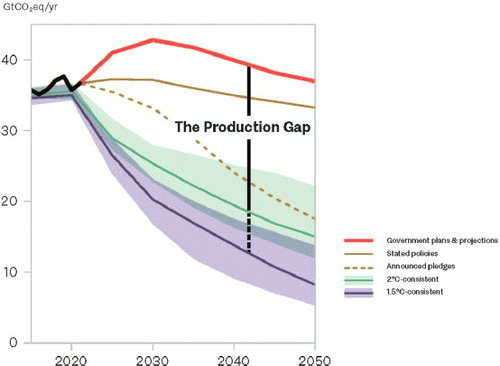

The United Nations Environment Programme (UNEP) has produced an annual “Production Gap” report since 2019. These track the discrepancies between governments’ planned fossil fuel production and global production levels consistent with limiting warming to 2050. The Production Gap Report 2023 was released in November 2023 (https://www.unep.org/resources/production-gap-report-2023). It makes grim reading and shows that the top fossil fuel producers plan even more extraction despite climate promises.

This conflicts with government commitments under the Paris Agreement, and clashes with expectations that global demand for coal, oil, and gas will peak within this decade even without new policies.

shows the global production gap and shows the details for coal, oil and gas production.

Figure 1. Global fossil fuel production. Source: https://www.unep.org/resources/production-gap-report-2023

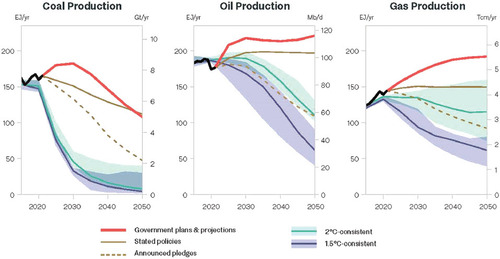

Figure 2. Government plans and projections for global fossil fuel production https://www.unep.org/resources/production-gap-report-2023. Current plans would lead to an increase in global coal production until 2030, and in global oil and gas production until at least 2050. See the report for details. The legend is the same as for .

Globally, Australia is a small contributor

The production, import, export, and net supply for domestic consumption of primary fossil fuels in exajoules (EJ) by country in 2021 is summarised in . An exa-joule is one joule x 10 to 18th. Values are rounded to one decimal place. Exports are shown as negative values. The contribution by China dominates.

Table 1. Production, import, export, and net supply for domestic consumption of primary fossil fuels in exajoules (EJ) by country in 2021. Source: https://www.unep.org/resources/production-gap-report-2023

Meanwhile, Australia’s greenhouse gas emissions remain almost unchanged

The results of the December 2022 quarterly update (https://www.dcceew.gov.au/about/news/australias-greenhouse-gas-emissions-dec-2022-quarterly-update) show that emissions were 463.9 million tonnes of CO2 equivalent in the year to December 2022. This was 0.4% or 2.0 million tonnes lower than the same period in 2021.

The trend over the year indicated:

Reductions in emissions from electricity as renewable energy uptake continues

Decreased fugitive emissions, reflecting reduced production in coal mining due to the impacts of heavy rainfall events in New South Wales and Queensland

Decreased emissions from stationary energy (excluding electricity) driven primarily by decreased activity in the manufacturing sector and decreased gas consumption in the residential sector

Increased transport emissions reflecting the ongoing recovery from COVID related travel restrictions, particularly in domestic aviation

Increased emissions from agriculture, returning to pre-drought levels because of increases in livestock numbers and crop production.

There’s a lot of work to do to make a substantial reduction.

Santos and Beach to develop Moomba carbon capture and storage project

Santos and joint venture partner Beach Energy recently announced a final investment decision to proceed with the A$220 million Moomba carbon capture and storage (CCS) project in South Australia, with startup expected in 2024. Santos has successfully registered the Moomba CCS project with the Clean Energy Regulator. The Regulator’s CCS method provides a crediting period of 25 years, over which period the project will qualify for Australian Carbon Credit Units for emissions reduction from Moomba CCS. The plan is to permanently to store 1.7 million tonnes of CO2 per year in the same reservoirs that used to hold oil and gas. They are hoping for a first injection during 2024 at a cost of US$6-8 per tonne of CO2.

Whether CCS will make a significant impact to drive down carbon emissions is yet to be determined. The International Energy Agency’s (IEA’s) Sustainable Development Scenario requires a hundredfold increase in CCS between now and 2050 to achieve the world’s climate goals– going from 40 million tonnes of CO2 stored each year today to 5.6 billion tonnes in just 30 years’ time. We are not told how much CO2 they expect to store over the life of the project, but we look forward to the first results in 2024.

The Resources and Energy Quarterly provides a good summary of the health of our resources industries

The September 2023 Resources and Energy Quarterly is worth a read, even if there are 178 pages (https://www.industry.gov.au/publications/resources-and-energy-quarterly).

The current issue underlines the importance of the sector, which contributes about 14% to Australia’s GDP and makes up more than two-thirds of Australia’s total merchandise exports. In 2022-23 the commodity export earnings set a record of $467 billion.

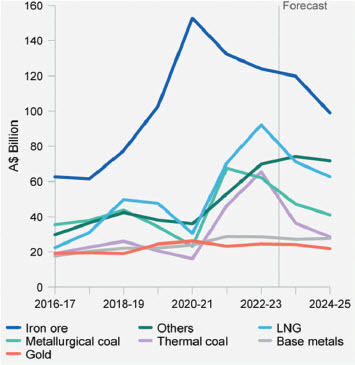

When you add on the $1 billion invested each quarter on mineral exploration, it is surprising that the economists are forecasting a significant downturn in future years. summarises the current situation and shows what the economists are forecasting.

Figure 3. Australia’s resource and energy exports. Source: https://www.industry.gov.au/publications/resources-and-energy-quarterly-september-2023

It is surprising that that the forecast is for a decline in export values for most of our commodities. It does not appear to consider the value of the battery-building minerals, such as copper and lithium, and you might have expected a larger contribution from the petroleum sector. The levels of exploration expenditure have been so small over the last few years, they can only go up.

In all the volatility of the price of commodities, gold has averaged between USD 1800- USD1900, over the past four years. So, gold continues to shine brightly and provide stability. With good values, gold exporters should be able to make a living!