?Mathematical formulae have been encoded as MathML and are displayed in this HTML version using MathJax in order to improve their display. Uncheck the box to turn MathJax off. This feature requires Javascript. Click on a formula to zoom.

?Mathematical formulae have been encoded as MathML and are displayed in this HTML version using MathJax in order to improve their display. Uncheck the box to turn MathJax off. This feature requires Javascript. Click on a formula to zoom.Abstract

The objective of this paper is to explore the relationship between business information, business networking, access to finance and financial performance of social enterprises. It broadens on theoretical threads from the perspective of resource-based view theory and signalling theory. Hypotheses are tested to assess the possible effect of business information, business networking, access to finance as well as financial performance of social enterprises. A cross-sectional survey was conducted by using the standardized questionnaire to collect primary data from a total of 384 owners/directors of social enterprises. Simple random sampling method was applied to select social enterprises functioning in the country. A Partial Least Square Structural Equation Modelling was applied to examine the data. This study found a positive and significant direct relationship between business information, access to finance, and business networking on financial performance of the social enterprises in Pakistan. The results supported the moderation effect of access to finance on business information and financial performance whereas, access to finance does not have a significant moderation impact between business networking and financial performance. Therefore, this study recommends that social enterprises in Pakistan should provide great emphasis on business networking and business information to introduce financially creative solutions for the societal problems, which are essential for overall wellbeing of different stakeholders of the social enterprises.

1. Introduction

The term social enterprise (SE) is relatively new, and over the course of the past two decades, people in several regions of the world have shown a rising interest in this sector (Kraus et al., Citation2014). The concept of SE was firstly used in Europe during the 1980s, but the term was not extensively applied until the 1990s. This type of business exists in the third sector, which is situated between markets, government policies, and public societies (Defourny & Nyssens, Citation2006). Scholars and business professionals are becoming more and more interested in social enterprise, which is shown by the increasing many research network systems and academic forums in this field (Kraus et al., Citation2017). Despite the fact that there is no widely accepted definition of social enterprise (Alegre et al., Citation2017). According to Yunus (Citation2020) SEs may combine social benefit and personal profit, and mostly, it is a combination of both personal profit and social benefit.

There are two primary schools of thought (Dees & Anderson, Citation2006). First one, the Social Enterprise School of Thought says that social enterprises are the companies that are focused on the market and use a strategy to make money to fulfil a social mission. The second one is, The Social Innovation School, says that social enterprises are businesses that solve social issues or meet social needs. The researchers used the definition of DiDomenico et al. (Citation2010), for this research, which not only gains a solid reputation among academics, but also appears to successfully combine the two above- mentioned points of view (i.e., Social Enterprise School of Thought). Based on these writers, SEs are businesses that try to reach a social goal or set of goals by selling products and/or services. By doing this, they hope to be able to support themselves financially without help from the government or other donors. This definition also fits with the European idea of SE, which is the businesses with a social mission and a clear financial incentive for doing it. Social enterprises (SEs) may combine social benefit and personal profit, and mostly, it is a combination of both personal profit and social benefit (Yunus, Citation2020). SEs are those types of organizations that possess the characteristics of the profit of the businesses and for organizations that are connected to the society and community. They normally deal with both financial and social resources to generate the activities for the enterprise and the benefit of the society in a broader perspective (Somerville & McElwee, Citation2011).

More and more people are starting to realize that social enterprises play a key role in solving problems in society by using new approaches, especially when resources and skills are limited (DiDomenico et al., Citation2010). The performance of these enterprises is low due to critical factors, lack of access to finance, lack of business networking (Asad et al., Citation2016). Business information, access to finance and business networking have been seen as valuable resources that increase the financial performance for a long time in the business. The ideas of business information, access to finance and business networking stand out in the existing literature. Business network is a group of businesses that work together to achieve their business goals (Ozcan & Eisenhardt, Citation2009). Most of the time, these objectives are both operational as well as strategic, and business networks utilise them in accordance with their position in the competitive environment of the market (Ford et al., Citation2014). Business network is a social business network that enables business people to join and interact with other entrepreneurs and executives in order to develop business interests through the formation of mutually profitable business connections (Soda et al., Citation2004). Business network is one of the strategically key resources that makes it possible for small businesses to expand in an environment that is both dynamic and competitive in the business world. Business networks connect small business owners and other owners of medium and small enterprises (SMEs) with other persons and companies in order to gain, share, as well as exchange information and resources (Machirori & Fatoki, Citation2013).

Business information is observed as one of the very important sources in any industry (Okello-Obura et al., Citation2008). Business information has been a very useful resource in every sector or sub-sectors of the economy of the country. It was listed as the fourth factor of output. No doubt, the organizations and the governments of the developed world are spending a great deal on this achievement. This is because the collection of the true information would lead to the quality choices that will have an impact on revenue and overall performance (Ojo et al., Citation2015).

Ability to gain advantage from both internal and external sources of financial support, with financial and non-financial barriers being kept to a minimum or removed completely. Access to finance plays a role as an external resource (Anwar et al., Citation2018). Access to important resources, like finance, is one of the most essential and important elements that encourage business activities in the economy (Xavier et al., Citation2013).

In Pakistan, social entrepreneurs face many problems, like lack of business networking, financial difficulties, an insufficient amount of information, bad infrastructure, and using old technology. All of these things make it hard for small businesses to grow and ultimately poor performance (Sherazi et al., Citation2013). In a country such as Pakistan, it is strongly recommended that SEs develop the awareness that will have a major effect on their performance (Ahmed et al., Citation2019). SEs’ performance is influenced by a wide range of factors, including business information, access to finance and business networking (Anwar et al., Citation2018; Bhattaraia et al., Citation2019; Caseiro & Coelho, Citation2019). But there is not any evidence on measuring the impact of business information, access to finance and business networking on the performance, particularly financial performance of SEs in Pakistan.

So, the aim of this article is to analyse the impact of business information, access to finance and business networking on the financial performance of SEs in Pakistan. According to best knowledge of the researchers, this research is the first academic effort to conduct a comprehensive analysis on the business information, access to finance, business networking, and financial performance of the SEs in Pakistan.

2. Literature review and hypotheses development

It is agreed that the performance is a multi-dimensional phenomenon (Gerba & Viswanadham, Citation2016). Previously, researchers have used growth and success as indicators that can be interchangeable for business performance (Wiklund & Shepherd, Citation2005).

Measuring the performance of SEs might be useful in the process of decision-making, as it would provide SEs with the information, they need to locate new opportunities and enhance the effectiveness and profitability of their operations (Arena & Azzone, Citation2010; Haider et al., Citation2017)). SEs are involved in a variety of business sectors, including education, service sectors, agriculture, health, as well as social services; thus, their organizational structures are different from one another (Alter, Citation2004), it may result in the use of different metrics for assessing their performance (Herman & Renz, Citation1997; Hussain et al., Citation2023). This research provides relevant measuring dimensions for a SE. It focuses specifically on financial performance as methods to measure performance of the SE.

Bae et al. (Citation2018) carried out a study in South Korea about the performance of the social enterprises. By using network centrality, researchers analysed the financial performance of social businesses. This study measured financial performance by using return on sales, growth rate of sale, and growth rate of net profit. According to the findings, a social enterprise that maintained a higher degree of centrality within the network of frequent meetings was able to produce better results on financial performance.

Another study by Cheah et al. (Citation2019) conducted in Malaysia and Singapore. According to a resource-based perspective, this empirical research developed a framework to evaluate the impact of the most important internal oriented resources, business planning, entrepreneurial orientation, as well as social salience on the financial performance of social enterprises. This study measured financial performance by using increase in revenue, increase in sales, and net profit. The findings of this study showed that internally oriented resources have a significant effect on financial performance.

2.1. Access to finance and performance

Access to finance is defined as the ability of individuals, households, entrepreneurs, and companies to access and utilize various financial services if they choose to do so (Adomako et al., Citation2016). Access to Finance increases financial inclusion and contributes to the deepening of the financial sector and overall economic growth. Access to finance also plays an essential role in the development of Small and Medium Enterprises (SMEs) (Kimani & Ntoiti, Citation2015). Moreover, the results of previous studies found that business information of the SMEs increase their access to financial resources through the timely dissemination of business information that can be used to related parties, such as bankers or lenders, thereby convincing funders. However, SMEs with business information, have good impact on access finance (Mashizha & Sibanda, Citation2017).

In addition, the result of previous studies found that resources like business information improves the access to finance, thereby improving business performance (Adomako et al., Citation2016; Hussain et al., Citation2018; Kimani & Ntoiti, Citation2015).

According to the above-mentioned discussion, the present study develops the following hypotheses.

H1:

Access to finance has a positive and significant effect on the financial performance of social enterprises in Pakistan.

H4:

Access to Finance moderates the relationship between business information and financial performance of social enterprises in Pakistan.

2.2. Business information and performance

Business information is observed as one of the very important sources in any industry (Okello-Obura et al., Citation2008). A common concept of the information is that it is the data that has been organized in such a way that it becomes meaningful. It includes a method that is used to create information that includes gathering the data and then exposing them to a process of transformation to create knowledge. The discrepancies between good and poor information can be recognized by evaluating whether the quality of the information has a few or all the attributes. The attributes can be relevant to the timing, content, and type of information (Hardcastle, Citation2008).

There is a fact that using the sources of business information supports the overall business performance. Haliso and Okunfulure (Citation2010) confirms that use of business information by companies adds to the competitive edge that is required to support their enterprise. Similarly, Okello-Obura et al. (Citation2008) mentioned that business information has become a leading source and relies on handling and usage. Keh et al. (Citation2007) revealed that there was a significant and a positive relation between information use and the performance of SMEs. Moorthy et al. (Citation2012) also supported were exposed that there is also a positive and a significant relation between usage of marketing information as well as the performance of the small medium enterprises in Malaysia.

A study conducted by Xiaoqing et al. (Citation2019) to see the relationship of information, traditional social activity, gender, and education on the performance of the small businesses in China. This research measured business information by categorized into five stakeholders, supplier information, government information, distributor customer, competitor information as well as society related information. The findings of the research showed that information about government as well as policies of the industry has a positive and substantial effect on the performance. Moreover, gender as well as education have moderating impacts on the relation between information and performance in a small firm.

According to the existing literature, this research attempts to develop the following hypotheses to recognize the impacts of business information on the financial performance (FP) of the SEs in Pakistan. Bunyasi et al. (Citation2014) described in their research on the effects of accessing business information on the financial performance of small medium enterprises that access to business information has a significant effect on performance of small medium enterprises. Nguyen et al. (Citation2022) described a positive relation between social activities and financial performance. Jamaludin et al. (Citation2022) and observed a positive impact on performance. Moreover, the research conducted by Okoro et al. (Citation2019) demonstrated that business information has a substantial and favourable impact on the performance of MSMEs. The authors eventually described based on the data that BI enhances the performance. Therefore, in the light of previous discussion, this research develops the following hypotheses.

H2:

Business information has a positive and significant effect on the financial performance of social enterprises in Pakistan.

2.3. Business networking and performance

The network of SEs and social entrepreneurs can play a vital role in communicating best practices. They tie social companies to other organizations, with similar features and goals to help to establish a platform for cooperation and assisting in the spread of people and ideas (DCMS & BEIS, Citation2017). When contractors begin to plan a new project and attaining information, learning new skills, tools, and business connections, they need to mobilize a broader social network and involve people, they may need in the future and most likely be part of the preparation process (Greve, Citation2003). A significant correlation between business networking and performance was found in some previous studies (Cisi et al., Citation2016; Kim & Lee, Citation2018; Zacca et al., Citation2015). Another study was done in Pakistan to see the relationship between business networking and performance of small enterprises and found a positive and significant relation between them (Asad et al., Citation2016).

Mlotshwa (Citation2019) performed research in South Africa. This study explained the relation between business networking, social networking, managerial networking, and performance. This study measured business networking by categorized into six stakeholders, relationships with government agencies, relations with your competitors, relations with suppliers, and relations with customers, member of association, and participation in trade fairs and seminars. According to the results of the research, business networking and managerial networking management have a positive effect on business performance. Networking activities help to gather environmental change information quicker and to respond to changes to external resources. Thus, the financial performance can be affected by interactions in the society and business networking have a positive and significant effect on the performance of SEs (Cho & Kim, Citation2017).

ALI and LI (Citation2021) conducted a study in China and described that networking positively effect on the financial performance of social enterprises. Another study was conducted in Brazil by (dos Santos et al. (Citation2021) and found a positive and significant impact on networking and financial performance. Bae et al. (Citation2018) carried out a study in South Korea about the networking and financial performance of the social enterprises. They found a positive and substantial relation between business networking and financial performance of the SEs. A study was conducted in Pakistan and described that business networking has a moderated effect on performance of small enterprises (Asad et al., Citation2016). According to Canning and Szmigin (Citation2016) described that improving network expertise enables entrepreneurs to gain access to the vital tools owned by others to achieve the better performance of the industry. So, this research develops the following hypothesis.

H3:

Business networking has a positive and significant effect on the financial performance of social enterprises in Pakistan.

Business networking play a positive role to strengthen and boost the relationship between access to finance and performance of MSEs (Wales et al., Citation2013). The role of access to finance helps the small enterprises to perform better than those MSEs that have certain issues accessing finance (Newman et al., Citation2014). Thus, these studies indicate a positive relationship between access to finance and performance of MSEs. But on the other hand, a few studies contradict the existence of positive relationship between access to finance and performance of MSEs (Mochona, Citation2006; Thio et al., Citation2006). Le and Nguyen (Citation2009) described a study in Vietnam and suggest that the relationship between business networking with suppliers and social ties and access to finance and SMEs growth have insignificant.

A study was conducted in the Buffalo City Municipality in the Eastern Cape Province of South Africa by Leroy (Citation2012). This study investigates the impact of networking on access to finance and performance of small and medium enterprises (SMEs). The objectives of this study are to examine whether networking is related to access to finance and performance. The results reveal that there is a positive relationship between networking and access to finance and performance of SMEs. The results of this study further reveal that access to finance partially mediates the relationship between networking and performance of SMEs. According to the above-mentioned discussion, this study develops the following hypothesis.

H5:

Access to Finance moderates the relationship between business networking and financial performance of social enterprises in Pakistan.

2.4. Supporting theories

The resource-based view (RBV) and the signalling theory supported as the foundation for the development of this research framework. It is presumable that the performance will be affected by the independent variables in this piece of writing, which is supported by the resource-based view theory. In addition, the connection between information about a company’s operations and the performance of those operations is frequently thought to be more consistent with the signalling theory.

The resource-based view, also known as the RBV theory, has emerged as one of the most prominent performance theories. In today’s business world, the resource-based view theory is widely regarded as one of the most impactful schools of thought concerning entrepreneurship (Barney & Barney, Citation1991). In the performance of the social enterprises industry, the resource-based view has been a frequently discussed (Dees, Citation1998). For example, the works of Lee (Citation2018); Liu et al. (Citation2015) and Liu et al. (Citation2014) are few empirical studies in the area of social enterprises that also applied the RBV theory. It is essential that the fact that not all resources have a significant effect on organizational performance be taken into account. Some of the resources that are utilized and controlled by the company, specifically those resources that are valuable, rare, inimitable, and non-substitutable (VRIN), have the ability and potential to develop the competitive advantage, which results in better performance (Barney & Barney, Citation1991).

Barney and Barney (Citation1991) gives a more detail description of a company’s resources, which includes physical, human, and organizational resources in addition to other types of resources. Intangible resources of the company include things like human capital and organizational structure, whereas tangible resources include things like inventory and machinery. Most of the research on RBV has focused on intangible assets like business information and business networking (Sampler, Citation1998). Information is one of the most valuable resources of any organization (Shafiee & Moqadam, Citation2017). Access to finance plays a role as an external resource (Anwar et al., Citation2018). Business networks are composed of intangible resources, and small businesses enhance their performance in a highly competitive market by leveraging these intangible resources (Machirori & Fatoki, Citation2013). A better and more extensive use of networking activities in SEs leads to excellent performance (Squazzoni, Citation2009).

Signaling theory is used to strengthen the link between information about a business and performance. Signaling theory is useful for figuring out the behaviour of two parties (individuals and organizations) which receive the information (Certo et al., Citation2011). Signaling theory examines the link between signals and their qualities, which explains why some signals are accurate and other signals are not (Donath, Citation2007). Business information has a positive and significant effect on businesses and helps them to increase the performance (Asif et al., Citation2021; Keh et al., Citation2007). Companies can increase the performance if they have access to the right information (Bendoly & Swink, Citation2007).

The proposed relationship among the variables in this study can be presented in a graphical format as below (Figure ).

3. Methodology

3.1. Survey design, sample size and sampling technique

In order to compile the primary data and ensure that the research was successful in achieving its goals, it was designed and carried out as a cross-sectional survey. The organization, and more specifically the social businesses that are registered in Pakistan, serves as the unit of analysis for this particular research. The survey was carried out completely online across the entire country of Pakistan.

The participants in this study are Pakistani organizations that are officially recognized as social enterprises. The majority of SEs in Pakistan are found in the informal sector. In Pakistan, there are approximately 3.2 million companies that have been officially registered; however, very close to 90 percent of these companies fit the definition of a small business (SMEDA, Citation2018). However, the number of SEs is not reported in any record that has been made public by the government. The number of registered SEs can only be found in the report that was put out by the British Council (Citation2016), which states that there are 448,203 organizations. This research estimates the sample size using the table developed by Krejcie and Morgan (Citation1970) based on the data presented here. This research decided to employ a sample size of 384.

The list of the data compiled from various sources, including (PPAF, SMEDA, SECP, NRSP, and the British Council in Pakistan), as well as from the WhatsApp community groups of SE owners and managers which was made by British Council during the programme of “The State of Social Enterprise in Pakistan”. In this research, a simple random sampling technique was applied. Each person in a population has an equal chance of being chosen for a sample that is drawn at random from that population. A population that is both small and homogenous is preferable if it can be achieved. The random numbers that were collected will serve as the basis for selecting the various components. When the sample size is low, it is simple to calculate, but it becomes impractical when the sample size is high. Moreover, Beh and Shafique (Citation2016) stated that There was a response rate of 46% from the Pakistani small businesses. The number of businesses that were included in this study’s sample was increased to 700 in order to achieve a high level of participation and reduce the influence of the non-response error (Salkind, Citation2012).

3.2. Data collection procedure

The data were obtained by selecting a subset of respondents to answer questions presented in an online survey. We obtained the respondents’ email IDs and other contact information from the State Bank of Pakistan as well as from the WhatsApp community groups that directors and managers of SEs belong to. The survey’s questionnaire was emailed to all 700 respondents, along with a request for their participation in the survey, and the total number of respondents was 700. After a week had gone, a gentle reminder in the form of an email asking respondents to fill out and return the questionnaire was delivered to their e—mails. There was a total of 384 people who participated in the study and provided feedback. Therefore, there were a total of 384 directors and managers of social enterprises included in this study’s sample. The participants were asked to provide their responses and opinions in an unbiased manner.

3.3. Measurement of the variable

Business information (BI), access to finance (AF), and business networking (BN) are included in this research to evaluate the financial performance of the SEs in Pakistan. The variables as well as their measurements are defined below.

The financial performance was assessed by adapting the financial performance indicators created by Lee (Citation2018).This research will measure financial performance by using return on investment (Bakar et al., Citation2014; Lee, Citation2018), sales growth (Abbas et al., Citation2019; Bhattaraia et al., Citation2019; Lee, Citation2018; Li & Zhang, Citation2007; Zhou et al., Citation2005), market share growth (Gali et al., Citation2020; Li & Zhang, Citation2007; Zhou et al., Citation2005), and profit growth (Bhattaraia et al., Citation2019; Gali et al., Citation2020). The financial performance (return on investment, market share growth, sales growth and profit growth) was measured by asking the respondents from one of the seven options: 0%, 1–10%, 11–20%, 21–30%, 31–40%, 41–50%, or over 50% (Lee, Citation2018).

Business information has the ability to contribute to success, and organizations must have accessibility to adequate information, sources of information and challenges of information to boost productivity and to assist market access. Business information was measured by adapting scale of Ojo et al. (Citation2015). This study used 7-point Likert- scale (1 is strongly disagree, and 7 is strongly agree). This study measured business information by using availability of information (Chiware, Citation2008; Ogunsola & Babalola, Citation2020; Ojo et al., Citation2015), accessibility of information (Ogunsola & Babalola, Citation2020; Ojo et al., Citation2015) and quality of information (Chavez et al., Citation2015; Gorla et al., Citation2010; Li & Lin, Citation2006).

Access to finance refers to the availability of various forms of financial resources, including internal resources, loans, and equity. Access to finance was measured by adapting scale of (Dzomonda, Citation2022). This study used 7-point Likert- scale (1 is strongly disagree, and 7 is strongly agree).

The basic objective of business networking is to inform others about your company and, ideally, convert them into your clients. Business networking adapted scale by using 7-point Likert- scale (1 is strongly disagree, to 7 is strongly agree) from (Mlotshwa, Citation2019). This research measured business networking by using networking with suppliers (Abbas et al., Citation2019; Huang et al., Citation2012; Mlotshwa, Citation2019), networking with customers (Abbas et al., Citation2019; Huang et al., Citation2012; Mlotshwa, Citation2019), networking with competitors (Abbas et al., Citation2019; Huang et al., Citation2012; Mlotshwa, Citation2019), networking with society (Bucktowar et al., Citation2015; Cho & Kim, Citation2017) and networking with complementary business which would be the contribution in business networking. All the questionnaires are attched in appendix one.

To summarize, a seven-point Likert scale was used to assess the business information, access to finance and business networking variables, and one of the seven options was chosen to evaluate financial performance. At each point on the scale, the participants indicate the degree to which they agree or disagree with the corresponding statement. On the scale, 1 = “strongly disagree”, 2 = disagree“, 3 = slightly disagree, 4 =neutral”, 5= slightly agree“, 6= agree” and 7= strongly agree”.

The first part of the analysis was carried out by concentrating on the demographic profile of the participants, which will include aspects such as age, gender, education, managerial position in the firm’s hierarchy, and the type of industry. The SPSS version 25 was used to perform the descriptive analysis, which consisted of calculating the mean, minimum, maximum, and standard deviation. In the second section of the investigation, a method called partial least squares structural equation modelling (PLS-SEM), which is also called as variance-based structural equation modelling (SEM), was applied with the help of the SmartPLS 3.3.2 software.

4. Analysis of the data and findings

4.1. Demographic profile of the respondents

As indicated in Table , this section provides an account of the individuals who contributed to the research. The information that pertains to those who participated in the survey is included in the demographic data. The demographic information for the people who took part in this research is presented in Table . In terms of demographics, the proportion of male respondents was 61.72%, while the proportion of female respondents was 38.28%. According to the table, 8.07% of respondents were between the ages of 21 and 29 years, 35.68% of respondents were in between the ages of 30 and 39, 37.24% of the participants were between 40 to 49 years old, 10.42% of participants were between 50 to 59 years old, and 8.59% of respondents were over the age of 60. As a result, the majority of the respondents consist of 37.24% from age between 30 and 39 years old.

Table 1. Demographic data

4.2. Assessment of the measurement model

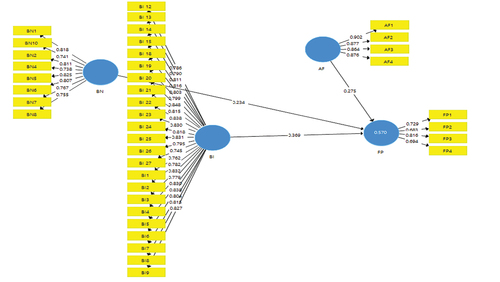

In this research, the researchers investigated both the validity and the reliability of the model that was employed in the process of analysing the outer model (also called measurement model), which served as the basis for the research. Figure presents an illustration of the outer factor loadings for the comprehensive measurement model used in this research. It is abundantly clear that all of the components had values that were substantially higher than the bare minimum requirement of 0.70. The findings indicate that the outer factor loadings are adequate to enable the model to be accommodated within the framework (Figure ). As a result, the model can be utilized in the subsequent stage of the analysis process, which is the reliability and validity test.

4.2.1. Internal consistency reliability and convergent validity

In order to determine the reliability of the model’s internal consistency, it was necessary to investigate the composite reliability (CR) of the model. Table showed that every value was higher than 0.60, which indicates that the criteria were satisfied and that the conditions were met (Sarstedt et al., Citation2019). Similarly, convergent validity is defined by (Hair & Ringle, Citation2017) as to what extent a latent construct is able to define the variance in its indicators. In addition, Table depicts that fifty percent of the total variance is identified by each of three variables (AVE is greater than 0.50), which is higher than the cut-off value provided by (Hair & Ringle, Citation2017).

Table 2. Indicator loadings, internal consistency reliability, and convergent validity

4.2.2. Discriminant validity

The square root of the AVE, which was supported by Fornell and Larcker (Citation1981) defines discriminating validity. In addition to this, the value of the square root of the AVE should be greater than the values of the latent variable, which will indicate discriminating value. Table reveals that the value of the whole diagonal is greater than the value of the other latent variables. In a similar vein, the second requirement is to determine whether or not the construct is valid (Gold et al., Citation2001; Kline, Citation2015). This finding suggests that the measurement model used in this research does not contain any errors. In other words, the discriminant validity was achieved by the factors that were taken into account in this study.

Table 3. Discriminant validity matrix

4.3. Assessment of the structural model

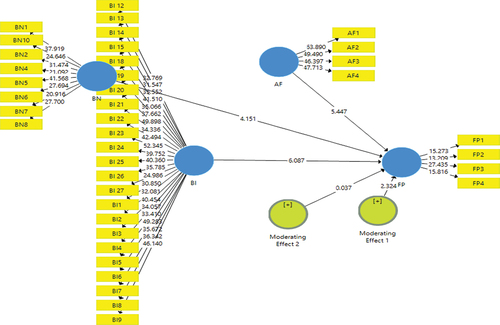

In this research, the structural model was analysed as a follow-up to the measurement model that was previously examined. According to the Sarstedt et al. (Citation2019), a structural model can assist in analysing the path coefficients as well as the t-values of the direct and indirect links in order to achieve a better understanding of how they interact with one another. Additionally, Henseler et al. (Citation2009) said that in order to determine whether or not the relation is significant, the t-value needs to be greater than 1.64. This value will then be used to guide decision-making regarding the hypotheses presented earlier. Figure illustrates the structure model for the study that was used. For the purpose of measuring the structural model of this research, PLS-SEM algorithm and the bootstrapping approach were utilized. The evaluation of the structural model includes to investigate the connections between the latent constructs. Figure illustrates the connections (also known as “paths”) that can be made between exogenous constructs and endogenous constructs. During the evaluation of the structural model, each and every one of the direct relationships (also known as direct hypotheses) was put to the test.

5. Hypotheses testing and discussion

Table shows that the hypotheses that were supported in this study have an at-value greater than 1.64. So, out of five (05) hypotheses that were tested in this study, four hypotheses were supported, and one hypothesis was rejected. The first hypothesis is verified, which indicates that the relationship between access to finance and financial performance is positive and significant (beta value = 0.257; t = 4.257; P = 0.000 and P < 0.05). This confirms that the first hypothesis is accepted. Likewise, the findings show that the second hypothesis, which says that business information has a positive and significant impact on financial performance, is also accepted (beta = 0.369; t = 5.596; P = 0.000, and P < 0.05), which demonstrates that the second hypothesis is supported by the data. Similarly, the results demonstrate third hypothesis, that business networking has a significantly positive impact on financial performance (beta = 0.234; t = 3.225; P = 0.001 and P < 0.05).

Table 4. Summary of the results of hypotheses testing

6. Moderation analysis

The aim of this study is to determine whether the moderator (access to finance) play a significant effect on the relationship or not. Furthermore, using SmartPLS software, the PLS algorithm calculated the standard beta coefficient value, and R2 value for access to finance and financial performance respectively. However, to calculate the T-value and p-value results, the study followed the bootstrapping procedure.

Table revealed that access to finance significantly moderates the relationship between business information and financial performance. Hypothesis (H4) results revealed that access to finance has positive and significant moderate the relation between business information and financial performance (beta = 0.127; t = 2.324; P = 0.010 and P < 0.05). According to the analysis results, this hypothesis is accepted. On the other hand, the findings of the fifth hypothesis show that access to finance has a positive but insignificant moderate relationship between business networking and financial performance, so this hypothesis is rejected (beta = 0.002; t = 0.037; P = 0.486, and P > 0.05), which demonstrates that the fifth hypothesis is not supported by the data.

As in moderation analysis, the change in R2 is an essential matter (Ramayah et al., Citation2018). For the current study, the previous R2 for financial performance (before interaction term) was 0.570, while the value of R2 for financial performance (after interaction term) became 0.586. this change of 0.016 indicates that with the addition of interaction term, the R2 had got additional variance of about 1.6%. The effect size (f2) of moderating relationship is calculated through the effect size (f2) equation below. The result of effect size (f2 = 0.039) is large as per guidelines of Aguinis et al. (Citation2005) and Kenny (Citation2018) regarding effect size (f2) of moderation analysis (i.e., 0.005, 0.01, 0.025 for small, medium, and large respectively).

7. Discussion

The research investigated whether or not there was a correlation between business networking and the financial performance of social enterprises. The goal of this research is to explore the effect of business networking, access to finance and access to relevant business information on financial performance of Pakistan’s SEs. Two different independent variables and one moderator were selected so that their influence on the dependent variable could be evaluated. Five (05) hypotheses were developed and formulated based on this research goal and the underlying issues that needed to be addressed. In order to carry out the statistical analysis, the software programs SPSS version 25 and PLS-SEM version 3.3.2 were utilized throughout the process. Four hypotheses have a positive and significant relationships on the social enterprises that are located in Pakistan, but one indirect hypothesis has insignificant relationship.

The findings and results of this research revealed that there is a correlation that could be deemed statistically substantial between the business information and the financial performance of the SEs. This finding lends support to the first hypothesis by showing that business information does, in fact, improve financial performance (H1). These findings demonstrated that there is a correlation between the two variables. According to the findings, there is a significant demand for information that could be of use to your company from the perspective of gaining a competitive advantage (Khan et al., Citation2021). By integrating its internal and external environments through the utilization of business information, a social enterprise is also able to broaden its scope of operation all the way up to the global level. A local social enterprise that makes use of business information can compete successfully with other social enterprises located all over the world. According to the findings of a number of studies, providing subjects with more and more accurate information makes it possible to more effectively improve their performance (Boone et al., Citation2005; Mani et al., Citation2010; Ogunsola & Babalola, Citation2020).

In addition, the present study found a positive and statistically substantial relation between business networking and financial performance in social enterprises. This finding lends support to hypothesis number two (H2). According to the research results, an appropriate level of business networking in social enterprises could lead to enhancements in the financial performance of the social enterprises. Previous research has found a positive and significant relationship between social enterprise business networking and financial performance (Ali & Li, Citation2021; Bae et al., Citation2018; dos Santos et al., Citation2021).

Moreover, this study has a positive and significant relation between access to finance and financial performance. This supports to the third hypothesis (H3). This implies that access to finance is important metric for social enterprises. The findings of this study are supported by other studies conducted in different contexts (Cecchetti & Kharroubi, Citation2015; Fowowe, Citation2017). However, finance is a major problem in developing and emerging economies due to the lack of enough internal resources for the start-up of the enterprise. So, they need to take finance from any external source such as banks or family members.

Additionally, a positive and statistically significant moderation impact of access to finance was found to have on the relationship between business information and financial performance of the social enterprises. It signifies the confirmation of hypothesis four (H4). The findings indicate that the moderation impact of access to finance can make a significant contribution to the social enterprises. The studies by Hussain et al. (Citation2018) and Adomako et al. (Citation2016) also reported similar findings. Lastly, the moderation effect of access to finance on the relationship between business networking and financial performance of social enterprises found insignificant indication which means hypothesis five (H5) is rejected. The study of Le and Nguyen (Citation2009) also reported similar findings.

8. Conclusion

In light of the results of this study, the researchers are in a position to give responses to research questions in the following order: According to the findings of our research, the financial performance of SEs in Pakistan is significantly influenced by the extent to which they engage in business networking. In addition to that, the importance of business information to the overall financial performance of social enterprises is brought to light in this article as well. According to the findings and results of the research, business networking is likely responsible for a sizeable portion of the financial performance achieved by social enterprises in Pakistan. This research also found that having a reasonable number of networking can perform a very vital role in improving the financial performance of SEs. In a similar vein, the findings of this paper indicated that business information has a substantial and positive impact on the financial performance of Pakistani SEs. Likewise, access to finance has a positive and significant effect on the financial performance of SEs in Pakistan. The findings of this study may provide a better knowledge and understanding regarding the business networking, access to finance and business information in social enterprises, all of which can influence the improvement of the financial performance of social enterprises in Pakistan. These findings broaden the application of the RBV to social enterprises and demonstrate how these resources like business networking, access to finance and business information can be utilized to improve the magnitude of the financial impact.

In addition, the empirical findings of this research can be helpful for the top management of social enterprises to make strong decisions and produce goods and services in order to give superior support for their customers. In conclusion, the findings of this research may be helpful to policymakers, government regulators, and other relevant parties in the design as well as implementation of more effective policies and regulations for increased business networking, access to finance and business information in order to confirm the long-term improvement of Pakistani social enterprises.

8.1. Limitations and future research recommendations

The participants in this research come from different social enterprises in Pakistan; however, they need to broaden their scope and look at other industries as well. This research is appropriate only for SEs operating in less developed countries. In order to widen the scope of this study, it should have been carried out by SEs from low-income countries all over the world. This research is only limited to SEs of developing countries like Pakistan. So, the results of this research cannot be generalized to the whole SEs and may vary in developed countries due to their different cultural backgrounds, different socio-economic conditions.

Disclosure statement

No potential conflict of interest was reported by the author(s).

References

- Abbas, J., Raza, S., Nurunnabi, M., Minai, M. S., & Bano, S. (2019). The impact of entrepreneurial business networks on firms’ performance through a mediating role of dynamic capabilities. Sustainability, 11(11), 3006. https://doi.org/10.3390/su11113006

- Adomako, S., Danso, A., & Ofori Damoah, J. (2016). The moderating influence of financial literacy on the relationship between access to finance and firm growth in Ghana. Venture Capital, 18(1), 43–21. https://doi.org/10.1080/13691066.2015.1079952

- Aguinis, H., Beaty, J. C., Boik, R. J., & Pierce, C. A. (2005). Effect size and power in assessing moderating effects of categorical variables using multiple regression: A 30-year review. Journal of Applied Psychology, 90(1), 94–107. https://doi.org/10.1037/0021-9010.90.1.94

- Ahmed, V., Nazir, A., Gregory, D., Faraz, Z., Ace, T., Nabil, Y., & Agyeben, M. (2019). Social enterprise development in Pakistan:Way forward. British Council, Development Inclusive and creative Economics.

- Alegre, I., Kislenko, S., & Berbegal-Mirabent, J. (2017). Organized chaos: Mapping the definitions of social entrepreneurship. Journal of Social Entrepreneurship, 8(2), 248–264. https://doi.org/10.1080/19420676.2017.1371631

- Ali, H., & Li, Y. (2021). Financial literacy, network competency, and smes financial performance: The moderating role of market orientation. The Journal of Asian Finance, Economics & Business, 8(10), 341–352.

- Alter, K. S. (2004). Social enterprise typology. Virtue Ventures, LLC. http://www.virtueventures.com

- Anwar, M., Shah, S. Z. A., & Khan, S. Z. (2018). The role of personality in SMEs internationalization: Empirical evidence. Review of International Business & Strategy, 28(2), 258–282. https://doi.org/10.1108/RIBS-12-2017-0113

- Arena, M., & Azzone, G. (2010). Process based approach to select key sustainability indicators for steel companies. Ironmaking and Steelmaking, 37(6), 437–444. https://doi.org/10.1179/030192310X12690127076433

- Asad, M., Sharif, M. N., & ALekam, J. M. (2016). Moderating role of entrepreneurial networking on the relationship between entrepreneurial orientation and performance of MSEs in Punjab Pakistan. Science International, 28(2), 1551–1556.

- Asad, M., Sharif, M. N. M., & Alekam, J. M. E. (2016). Moderating effect of entrepreneurial networking on the relationship between access to finance and performance of micro and small enterprises. Paradigms, 10(1), 01–13. https://doi.org/10.24312/paradigms100101

- Asad, M., Sharif, M. N., & Hafeez, M. (2016). Moderating effect of network ties on the relationship between entrepreneurial orientation, market orientation, and performance of MSEs. Paradigms: A Research Journal of Commerce, Economics, and Social Sciences, 10(2), 69–76. https://doi.org/10.24312/paradigms100207

- Asif, M. U., Asad, M., Kashif, M., & Haq, A. U. (2021). Knowledge exploitation and knowledge exploration for sustainable performance of SMEs. 2021 Third International Sustainability and Resilience Conference: Climate Change (pp. 29–34). Sakheer: IEEE. https://doi.org/10.1109/IEEECONF53624.2021.9668135

- Bae, J., Cho, H. S., & Caplan, M. A. (2018). Network centrality and performance of social enterprises: Government certified social enterprises in Seoul, South Korea. Asian Social Work & Policy Review, 12(2), 75–85. https://doi.org/10.1111/aswp.12140

- Bakar, S. A., Sulaiman, M., & Osman, I. (2014). Exploring the relationship between business factor and performance in the Malaysian halal biotechnology SMEs context. Procedia-Social and Behavioral Sciences, 121, 243–252. https://doi.org/10.1016/j.sbspro.2014.01.1125

- Barney, & Barney, J. (1991). Firm resources and sustained competitive advantage. Journal of Management, 17(1), 99–120. https://doi.org/10.1177/014920639101700108

- Beh, L. S, & Shafique. (2016). The nexus between transformational leadership and corporate entrepreneurship: The mediating role of absorptive capacity. Transylvanian Review, (3).

- Bendoly, E., & Swink, M. (2007). Moderating effects of information access on project management behaviour, performance and perceptions. Journal of Operations Management, 25(3), 604–622. https://doi.org/10.1016/j.jom.2006.02.009

- Bhattaraia, C. R., Kwong, C. C., & Tasavori, M. (2019). Market orientation, market disruptiveness capability and social enterprise performance: An empirical study from the United Kingdom. Journal of Business Research, 96, 47–60. https://doi.org/10.1016/j.jbusres.2018.10.042

- Boone, C., Olffen, W. V., & Witteloostuijn, A. V. (2005). Team locus-of-control composition, leadership structure, information acquisition, and financial performance: A business simulation study. Academy of Management Journal, 48(5), 889–909. https://doi.org/10.5465/amj.2005.18803929

- British Council. (2016). The state of social enterprise in Bangladesh,Ghana, India and Pakistan’The state of social enterprise in Pakistan. British Council Pakistan Office.

- Bucktowar, R., Kocak, A., & Padachi, K. (2015). Entrepreneurial orientation, market orientation and networking: Impact on innovation and firm performance. Journal of Developmental Entrepreneurship, 20(4), 1550024. https://doi.org/10.1142/S1084946715500247

- Bunyasi, W. G., Bwisa, H., & Namusonge, G. (2014). Effect of access to business information on the growth of small and medium enterprises in Kenya. International Journal of Business & Social Science, 5(1), 10.

- Canning, L., & Szmigin, I. (2016). Radical innovation, network competence and the business of body disposal. Journal of Business & Industrial Marketing, 31(6), 771–783. https://doi.org/10.1108/JBIM-05-2014-0110

- Caseiro, N., & Coelho, A. (2019). The influence of business intelligence capacity, network learning and innovativeness on startups performance. Journal of Innovation & Knowledge, 4(3), 139–145. https://doi.org/10.1016/j.jik.2018.03.009

- Cecchetti, S. G., & Kharroubi, E. (2015). Why does financial sector growth crowd out real economic growth? Available at SSRN 2615882. https://www.bis.org/publ/work490.pdf

- Certo, T. S., Connenly, B. L., Ireland, D. R., & Reutzel, C. R. (2011). Signaling theory: A review and sssessment. The Journal of Management, 37(1), 39–67. https://doi.org/10.1177/0149206310388419

- Chavez, R., Yu, W., Gimenez, C., Fynes, B., & Wiengarten, F. (2015). Customer integration and operational performance: The mediating role of information quality. Decision Support Systems, 80, 83–95. https://doi.org/10.1016/j.dss.2015.10.001

- Cheah, J., Amran, A., & Yahya, S. (2019). Internal oriented resources and social enterprises’ performance: How can social enterprises help themselves before helping others? Journal of Cleaner Production, 211, 607–619. https://doi.org/10.1016/j.jclepro.2018.11.203

- Chiware, T. E. (2008). Business information needs, seeking patterns and information services in the small, medium and micro enterprises sector (SMME) in Namibia [ Doctoral dissertation, University of Pretoria].

- Cho, S., & Kim, A. (2017). Relationships between entrepreneurship, community networking, and economic and social performance in social enterprises: Evidence from South Korea. Human Service Organizations, Management, Leadership & Governance, 41(4), 376–388. https://doi.org/10.1080/23303131.2017.1279094

- Cisi, M., Devicienti, F., Manello, A., & Vannoni, D. (2016). The impact of formal networking on the performance of SME’s. ISSN, 1–35.

- DCMS, & BEIS. (2017). Social enterprise: Market trends. Department for Digital, Culture, Media and Sport-Department for Business, Energy and Industrial Strategy.

- Dees, G. J. (1998). Enterprising nonprofit. Harvard Business Review, 6(1), 55–69.

- Dees, G. J., & Anderson, B. B. (2006). Framing a theory of social entrepreneurship: Building on two schools of practice and thought. Research on Social Entrepreneurship: Understanding and Contributing to an Emerging Field, 1(3), 39–66.

- Defourny, J., & Nyssens, M. (2006). Defining social enterprise. In M. Nyssens (Ed.), Social enterprise: At the crossroads of market, public policies and civil society (pp. 3–27). Routledge Taylor & Francis Group.

- DiDomenico, M., Haugh, H., & Tracey, P. (2010). Social bricolage: Theorizing social value creation in social enterprises. Entrepreneurship Theory and Practice, 34(4), 681–703. https://doi.org/10.1111/j.1540-6520.2010.00370.x

- Donath, J. (2007). Signals in social supernets. Journal of Computer-Mediated Communication, 13(1), 231–251. https://doi.org/10.1111/j.1083-6101.2007.00394.x

- dos Santos, J. A., Roldan, L. B., & Loo, M. K. L. (2021). Clarifying relationships between networking, absorptive capacity and financial performance among South Brazilian farmers. Journal of Rural Studies, 84, 90–99. https://doi.org/10.1016/j.jrurstud.2021.02.011

- Dzomonda, O. (2022). Environmental sustainability commitment and access to finance by small and medium enterprises: The role of financial performance and corporate governance. Sustainability, 14(14), 8863. https://doi.org/10.3390/su14148863

- Ford, D., Gadde, L. E., Håkansson, H., Lundgren, A., Snehota, I., Turnbull, P., & Wilson, D. (2014). Industrial Marketing and purchasing group. Managing business relationships. Wiley.

- Fornell, C., & Larcker, F. D. (1981). Structural equation models with unobservable variables and measurement error. Algebra and Statistics; Sage Publications.

- Fowowe, B. (2017). Access to finance and firm performance: Evidence from African countries. Review of Development Finance, 7(1), 6–17. https://doi.org/10.1016/j.rdf.2017.01.006

- Gali, N., Niemand, T., Shaw, E., Hughes, M., Kraus, S., & Brem, A. (2020). Social entrepreneurship orientation and company success: The mediating role of social performance. Technological Forecasting and Social Change, 160, 120230. https://doi.org/10.1016/j.techfore.2020.120230

- Gerba, Y., & Viswanadham, P. (2016). Performance measurement of small-scale enterprises: Review of theoretical and empirical literature. International Journal of Applied Research, 2(3), 531–535.

- Gold, A. H., Malhotra, A., & Segars, A. H. (2001). Knowledge management: An organizational capabilities perspective. Journal of Management Information Systems, 18(1), 185–214. https://doi.org/10.1080/07421222.2001.11045669

- Gorla, N., Somers, T. M., & Wong, B. (2010). Organizational impact of system quality, information quality, and service quality. Journal of Strategic Information Systems, 19(3), 207–228. https://doi.org/10.1016/j.jsis.2010.05.001

- Greve, A. (2003). Social network and Entrepreneurship. Entrepreneurship Theory and Practice, 28(1), 1–22. https://doi.org/10.1111/1540-8520.00029

- Haider, S. H., Asad, M., Fatima, M., & Atiq, H. (2017). Mediating role of opportunity recognition between credit, savings and performance of micro and small enterprises in Pakistan. Journal of Advanced Research in Business and Management Studies, 7(2), 91–99.

- Hair, S., & Ringle, G. (2017). Advanced issues in partial least squares structural equation modeling. sage publications.

- Haliso, Y., & Okunfulure, O. (2010). Information sources utilization and job performance of workers in MTN Ibadan, Nigeria. International Research Journal in Information Resources and Knowledge Management, 1(1), 42–53.

- Hardcastle, E. (2008). Business information Systems. Ventus Publishing.

- Henseler, J., Ringle, C. M., & Sinkovics, R. R. (2009). The use of partial least squares path modeling in International Marketing. New Challenges to International Marketing, 20, 277–319. https://doi.org/10.1108/S1474-7979(20)09000-0020014

- Herman, R. D., & Renz, D. O. (1997). Multiple constituencies and the social construction of nonprofit organization effectiveness. Nonprofit and Voluntary Sector Quarterly, 26(2), 185–206. https://doi.org/10.1177/0899764097262006

- Huang, H.-C., Lai, M.-C., & Lo, K.-W. (2012). Do founders’ own resources matter the influence of business networks on start-up innovation and performance. ELSEVIER Technovation.

- Hussain, A., Ahmad, S. A., & Mia, M. S. (2023). A systematic literature review on performance of social enterprises. Cogent Economics & Finance, 11(2), 2269738. https://doi.org/10.1080/23322039.2023.2269738

- Hussain, J., Salia, S., & Karim, A. (2018). Is knowledge that powerful? Financial literacy and access to finance: An analysis of enterprises in the UK. Journal of Small Business and Enterprise Development, 25(6), 985–1003. https://doi.org/10.1108/JSBED-01-2018-0021

- Jamaludin, M., Busthomi, H., Gantika, S., Rosid, A., Sunarya, E., & Nur, T. (2022). Market orientation and SCM strategy on SME organizational performances: The mediating effect of market performance. Cogent Economics & Finance, 10(1), 2157117. https://doi.org/10.1080/23322039.2022.2157117

- Keh, H. T., Nguyen, T. T. M., & Ng, H. P. (2007). The effects of entrepreneurial orientation and marketing information on the performance of SMEs. Journal of Business Venturing, 22(4), 592–611. https://doi.org/10.1016/j.jbusvent.2006.05.003

- Kenny, D. A. (2018). Moderation. https://davidakenny.net/cm/moderation.htm

- Khan, A. A., Asad, M., Khan, G. U., Asif, M. U., & Aftab, U. (2021). Sequential mediation of innovativeness and competitive advantage between resources for business model innovation and SMEs performance. 2021 International Conference on Decision Aid Sciences and Application (DASA) (pp. 724–728). Sakheer: IEEE. https://doi.org/10.1109/DASA53625.2021.9682269

- Kimani, P. M., & Ntoiti, J. (2015). Effects of financial literacy on performance of youth led entreprises: A case of equity group foundation training program in kiambu county. International Journal of Social Science Management and Entrepreneurship, 2(1), 2018–2231.

- Kim, C., & Lee, J. (2018). The effect of network structure on performance in South Korea SMEs: The moderating effects of absorptive capacity. Sustainability, 10(9), 3174. https://doi.org/10.3390/su10093174

- Kline, R. B. (2015). Principles and practice of structural equation modeling. Guilford publications.

- Kraus, S., Filser, M., O’Dwyer, M., & Shaw, E. (2014). Social entrepreneurship: An exploratory citation analysis. Review of Managerial Science, 8(2), 275‒292. https://doi.org/10.1007/s11846-013-0104-6

- Kraus, S., Niemand, T., Halberstadt, J., Shaw, E., & Syrjä, P. (2017). Social entrepreneurship orientation: Development of a measurement scale. International Journal of Entrepreneurial Behavior & Research, 23(6), 977‒997. https://doi.org/10.1108/IJEBR-07-2016-0206

- Krejcie, V. R., & Morgan, W. D. (1970). Determining sample size for research activities. Educational and Psychological Measurement, 30(3), 607–610. https://doi.org/10.1177/001316447003000308

- Lee, E. K. M. (2018). The impact of absorptive capacity and ordinary capabilities on both financial and social performance: The Case of social enterprises. A thesis submitted in partial fulfilment of the requirements for the degree of Doctor of Philosophy, Hong Kong Baptist University.

- Le, N. T., & Nguyen, T. V. (2009). The impact of networking on bank financing: The case of small and medium–sized enterprises in Vietnam. Entrepreneurship Theory and Practice, 33(4), 867–887. https://doi.org/10.1111/j.1540-6520.2009.00330.x

- Leroy, M. T. (2012). The impact of networking on access to finance and performance of SMEs in the Buffalo City Municipality, Eastern Cape, South Africa. An Unpublished Dissertation Submitted To the Faculty of Management and Commerce, University Of Fort Hare.

- Li, S., & Lin, B. (2006). Accessing information sharing and information quality in supply chain management. Decision Support Systems, 42(3), 1641–1656. https://doi.org/10.1016/j.dss.2006.02.011

- Liu, G., Eng, T.-Y., & Takeda, S. (2015). An investigation of marketing capabilities and social enterprise performance in the UK and Japan. Entrepreneurship Theory and Practice, 39(2), 267–298. https://doi.org/10.1111/etap.12041

- Liu, G., Takeda, S., & Ko, W. W. (2014). Strategic orientation and social enterprise performance. Nonprofit and Voluntary Sector Quarterly, 43(3), 480–501. https://doi.org/10.1177/0899764012468629

- Li, & Zhang, Y. (2007). “The role of managers’ political networking and functional experience in New venture performance: Evidence from China’s transition economy. Strategic Management Journal, 28(8), 791–804. https://doi.org/10.1002/smj.605

- Machirori, T., & Fatoki, O. (2013). The impact of firm and Entrepreneur’s characteristics on networking by SMEs in South Africa. Journal of Economics, 4(2), 113–120. https://doi.org/10.1080/09765239.2013.11884971

- Mani, D., Barua, A., & Whinston, A. (2010). An empirical analysis of the impact of information capabilities designs on business process outsourcing performance. Mis Quarterly, 34(1), 39–62. https://doi.org/10.2307/20721414

- Mashizha, M., & Sibanda, M. (2017). The link between financial knowledge, financial product awareness and utilization: A study among small and medium enterprises in Zimbabwe. International Journal of Economics and Financial Issues, 7(6), 97–103.

- Mlotshwa, S. H. (2019). The influence of networking on small medium enterprise performance in Gauteng, South Africa [ Doctoral dissertation].

- Mochona, S. (2006). Impact of microfinance in Addis Ababa: The case of gasha microfinance institution [Doctoral dissertation]. Addis Ababa University.

- Moorthy, K. M., Tan, A., Choo, C., Wei, S. C., Ping, Y. J., & Leong, K. T. (2012). A study on factors affecting the performance of SMEs in Malaysia. Academic Research in Business and Social Sciences, 2(4), 224–239.

- Newman, A., Schwarz, S., & Borgia, D. (2014). How does microfinance enhance entrepreneurial outcomes in emerging economies? The mediating mechanisms of psychological and social capital. International Small Business Journal, 32(2), 158–179. https://doi.org/10.1177/0266242613485611

- Nguyen, C. T., Nguyen, L. T., Nguyen, N. Q., & McMillan, D. (2022). Corporate social responsibility and financial performance: The case in Vietnam. Cogent Economics & Finance, 10(1), 2075600. https://doi.org/10.1080/23322039.2022.2075600

- Ogunsola, K., & Babalola, J. A. (2020). Dynamics of business information use and implications on customer satisfaction and performance of micro, small and medium - scale enterprises in Ibadan, Nigeria. Journal of African Interdisciplinary Studies, 4(6), 21–37.

- Ojo, A., Akinsunmi, S., & Olayonu, O. (2015). Influence of business information use on sales performance of SMEs in Lagos state. Library Philosophy & Practice (E-Journal), 1(1).

- Okello-Obura, Minishi-Majanja, M. K., Cloete, K. M., Ikoja-Odongo, J. R., & Okello‐Obura, R. J. (2008). Business activities and information needs of SMEs in northern Uganda: Prerequisites for an information system. Library Management, 29(4/5), 367–391. https://doi.org/10.1108/01435120810869138

- Okoro, J. O., Haliso, Y., & Otuza, C. E. (2019). Influence of business information use on performance of small and medium enterprises in Port-Harcourt Nigeria. Library Philosophy & Practice, 1(1), 1–10.

- Ozcan, P., & Eisenhardt, K. M. (2009). Origin of alliance portfolios: Entrepreneurs, network Strategies, and firm performance. Academy of Management Journal, 52(2), 246–279. https://doi.org/10.5465/amj.2009.37308021

- Ramayah, T., Cheah, J., Chuah, F., Ting, H., & Memon, M. A. (2018). Partial Least Squares Structural Equation Modeling (PLS-SEM) using SmartPLS 3.0 (2nd ed.). Pearson.

- Salkind. (2012). Exploring research (p. 407). Pearson Education. 9780205093816.

- Sampler, J. L. (1998). Redefining industry structure for the information age. Strategic Management Journal, 19(4), 343–355. https://doi.org/10.1002/(SICI)1097-0266(199804)19:4<343:AID-SMJ975>3.0.CO;2-G

- Sarstedt, M., Hair, J. F., Jr., Cheah, J. H., Becker, J. M., & Ringle, C. M. (2019). How to specify, estimate, and validate higher-order constructs in PLS-SEM. Australasian Marketing Journal, 27(3), 197–211. https://doi.org/10.1016/j.ausmj.2019.05.003

- Shafiee, H., & Moqadam, M. N. (2017). Information resources Management (IRM): The key of accountability. Information Resources Management, 30(2), 232–246.

- Sherazi, S. K., Iqbal, M. Z., Asif, M., Rehman, K., & Hussain Shah, S. S. (2013). Obstacles to small and medium enterprises in Pakistan Principal component analysis approach. Middle East Journal of Scientific Research, 13(10), 1325–1334.

- SMEDA. (2018). State of SMEs in Pakistan. https://smeda.org/index.php?option=com_content&view=article&id=7:state-of-smes-in-pakistan&catid=15.

- Soda, G., Usai, A., & Zaheer, A. (2004). Network memory: The influence of past and Current networks on performance. Academy of Management Journal, 47(6), 893–906. https://doi.org/10.2307/20159629

- Somerville, P., & McElwee, G. (2011). Situating community enterprise: A theoretical exploration. Entrepreneurship & Regional Development, 23(5–6), 317–330. https://doi.org/10.1080/08985626.2011.580161

- Squazzoni, F. (2009). Social entrepreneurship and economic development in Silicon Valley: A case study on the joint venture: Silicon Valley network. Non-Profit and Voluntary Sector Quarterly, 38(5), 869–883. https://doi.org/10.1177/0899764008326198

- Thio, R., Megananda, & Maulana, A. (2006). The impact of microfinance on micro and small enterprise’s performance and the improvement of their business opportunity (no. 200601). Department of Economics, Padjadjaran University.

- Wales, W. J., Patel, P. C., Parida, V., & Kreiser, P. M. (2013). Nonlinear effects of entrepreneurial orientation on small firm performance: The moderating role of resource orchestration capabilities. Strategic Entrepreneurship Journal, 7(2), 93–121. https://doi.org/10.1002/sej.1153

- Wiklund, J., & Shepherd, D. (2005). Entrepreneurial orientation and small business performance: a configurational approach. Journal of Business Venturing, 20(1), 71–91. https://doi.org/10.1016/j.jbusvent.2004.01.001

- Xavier, S. R., Kelley, D., Kew, J., Herrington, M., & Vorderwülbecke, A. (2013). Global Entrepreneurship monitor GEM 2012 global report.

- Xiaoqing, L., Xiaogang, H., & Zhang, Y. (2019). The impact of social media on the business performance of small firms in China. Information Technology for Development, 26(2), 346–368. https://doi.org/10.1080/02681102.2019.1594661

- Yunus, M. (2020). A note on social business and social Entrepreneurship. Social Business Pedia.

- Zacca, R., Dayan, M., & Ahrens, T. (2015). Impact of network capability on small business performance. Management Decision, 53(1), 2–23. https://doi.org/10.1108/MD-11-2013-0587

- Zhou, Z. K., Yim, K. C., & Tse, K. D. (2005). The effects of strategic orientations on technology-and market-based breakthrough innovations. Journal of Marketing, 69(2), 42–60. https://doi.org/10.1509/jmkg.69.2.42.60756

Appendix

Organizational performance

The following statements relate to the (Financial & Social performance). Please indicate the extent to which the following items describe your organization.

(1 represents “Strongly disagree”, 2 “Disagree”, 3 “Slightly Disagree”, 4 “Neutral”, 5 “Slightly agree”, 6 “Agree” and 7 “Strongly agree”.)

Section three

The following statements relate to the business networking. Please indicate the extent to which the following items describe your organization.

(1 represents “Strongly disagree”, 2 “Disagree”, 3 “Slightly Disagree”, 4 “Neutral”, 5 “Slightly agree”, 6 “Agree” and 7 “Strongly agree”.)

Section four

The following statements relate to the business information. Please indicate the extent to which the following items describe your organization.

(1 represents “Strongly disagree”, 2 “Disagree”, 3 “Slightly Disagree”, 4 “Neutral”, 5 “Slightly agree”, 6 “Agree” and 7 “Strongly agree”.)