?Mathematical formulae have been encoded as MathML and are displayed in this HTML version using MathJax in order to improve their display. Uncheck the box to turn MathJax off. This feature requires Javascript. Click on a formula to zoom.

?Mathematical formulae have been encoded as MathML and are displayed in this HTML version using MathJax in order to improve their display. Uncheck the box to turn MathJax off. This feature requires Javascript. Click on a formula to zoom.Abstract

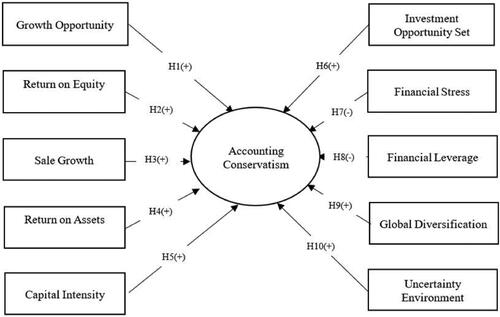

The research objectives is to analyze factors impacting on accounting conservatism such as growth opportunity, return on equity, sales growth, return on assets, capital intensity, investment opportunity, financial distress, financial leverage, global diversification and uncertainty environment. In this study, accounting conservatism is equal to non-operating accruals. The authors used balanced data collected from 379 listed companies in Vietnam stock market in a 5-year period from 2017 to 2021. The authors compared 3 models including Pooled OLS, FEM and REM to choose the most appropriate one. The test results show that FEM is the most appropriate, but this model has the phenomenon of heteroscedasticity, so the authors used FGLS to test the hypotheses. The research results show that among the independent variables included in the model, there are five variables impacting on the accounting conservatism with statistical significance of 5%. The independent variable which is investment opportunity set has a positive impact on the accounting conservatism. In contrast, the independent variables including growth opportunities, return on assets, financial leverage, and uncertainty environment have a negative impact on the accounting conservatism. Besides, the other five variables of return on equity, sales growth, capital intensity, financial distress, global diversification have no impact on the accounting conservatism in terms of statistical significance.

1. Introduction

Financial statements are a business manager’s explanation of the assets, capital, business situation, and cash flow of a business. Information on financial reports is the basis for interested parties to make rational decisions. Financial characteristics include financial indicators such as growth opportunities, return on equity, sales growth, and return on assets, capital intensity, investment opportunity set, global diversification, and uncertainty environment. These indicators will show the financial health of the business, its development prospects and its future going concern. Financial characteristics, if problematic, will cause managers to consider the possibility of applying appropriate accounting policies to mitigate risks, hence investors will monitor more effectively the company’s performance, to keep the investment safe from possible future risks (Saragih et al., Citation2022).

According to Ruch and Taylor (Citation2015), accounting conservatism is defined as ‘the tendency towards using policies and methods to understate the value of net assets with relation to their net economic value’. Besides, Sreenu et al. (Citation2022) argue that accounting conservatism is very important and essential. Additionally, Hajawiyah et al. (Citation2020) affirm that accounting conservatism is very important to be used to resolve uncertainties in the economic and business activities of enterprises.

Companies need to maintain sustainability with appropriate business strategies and policies to minimize the above difficulties and challenges. Applying accounting conservatism is a viable tool to overcome the above challenges and enhance the financial reporting quality. Because accounting conservatism plays an important role in minimizing asymmetric information, using accounting conservatism helps capital markets operate more efficiently. Accounting conservatism seems to be an important factor determining the financial reporting quality according to Watts (Citation2003a, Alves, Citation2023), accounting conservatism reduces managers’ opportunistic behavior and compensates for discrepancies in financial reporting. Hajawiyah et al. (Citation2020) asserted that accounting conservatism is important to be used to resolve uncertainties in the economic and business activities of enterprises. Accountants should carefully handle and quickly record situations that lead to losses. Cases that have the potential to generate profits will be delayed in recording until that situation occurs significantly.

According to Novari et al. (Citation2021), it has been observed that the disclosure of financial report information must be based on the principle of accounting conservatism. Managers should be cautious of errors and fraud and should highlight all significant factors for investors and other users in the company’s reports. Accounting conservatism is an accounting principle requiring a high degree of verification before a company can recognize any profits. Mrad, (Citation2022), companies complying with accounting conservatism will help investors trust the information disclosed, make the company reliable and have a good reputation in the financial markets, and enhance the possibility that companies will be listed in multiple stock markets such as the US stock market. According to Pujiono et al. (Citation2023), businesses can implement applying accounting conservatism into financial statement as a reaction to uncertain conditions which companies are facing.

According to Basu (Citation1997), from a theoretical perspective, positive accounting theory holds that companies can apply accounting skills, knowledge and understanding to apply appropriate accounting policies to address future events to minimize information asymmetry in recording ‘good news’ and ‘bad news’.

Conservatism does not define in an absolute manner but should be determined in a context through a certain factor. Studies emphasize the impact of accounting conservatism on the balance sheet (consistently valuing assets at lower values) or its influence on the income statement (using stock returns as a measure of news).

That the factors of financial characteristics affecting accounting conservatism is considered as an interesting researching topic. Accounting conservatism has received numerous researchers’ attention worldwide. Several typical studies include Basu (Citation1997), Givoly and Hayn (Citation2000), Beaver and Ryan (Citation2000), Qiang (Citation2007), Zhang (Citation2008), Beatty et al. (Citation2008), Xie (Citation2015), Ruch and Taylor (Citation2015), Banker et al. (Citation2016), Dutta and Patatoukas (Citation2017), Lin et al. (Citation2018), Ge et al. (Citation2019), Hajawiyah et al. (Citation2020), Dai and Ngo, (Citation2021), Khalifa et al. (Citation2023), etc. In Vietnam, there are also studies related to accounting conservatism such as Nguyen Thi Bich Thuy (Citation2019), Tang Tri Hung et al (Citation2021), Doan Thuy Duong (Citation2022), Le Tuan Bach et al. (Citation2022), Vo Thi Thuc (Citation2023), and so on. However, to the best of the authors’ knowledge so far, Vietnam has only a small number of research on accounting conservatism, particularly, no any research on the influence of financial characteristics on accounting conservatism. Therefore, this study objective is to analyze the impact of financial characteristics on accounting conservatism in the Vietnamese context. To achieve this research objective, the research questions are posed as follows: What is the impact of financial characteristics on the accounting conservatism of companies listed on the Vietnam stock market? Some functions need to be proposed.

First, adding a theoretical model on financial characteristics affecting accounting conservatism in the Vietnamese context. Second, the research results are a reference for future researchers related to this topic. Third, the research results are a useful scientific basis for relevant subjects to make appropriate decisions such as business managers, investors, shareholders, state management agencies, and so on.

2. Background

This research is driven with the Covid-19 pandemic which has truly become the biggest concern ever for the economy, as most countries around the world have shut down, and the goods trade has been enhanced, leading to a wave of business bankruptcies that seriously impact the economies worldwide. Moreover, a series of global events such as the conflict between Russia and Ukraine, climate change, fluctuating natural gas energy sources have caused price instability, and have heightened uncertainty about future events. Investors interested in accounting information have become more cautious, prudent, and risk-averse in investment matters. The aforementioned events further exacerbate the unpredictability of business trends and changing economic policies. They rely more on fundamental information where the accounting information quality and related accounting disclosures in financial reports become more crucial for users of accounting information during a time when the global economy is facing significant challenges. Financial statements serve as an explanatory dashboard for corporate management and governance regarding the state of assets, capital sources, business conditions, and the cash flow, but these figures must be prepared based on accepted standards and principles. In addition, Zahro (Citation2021) believes that managers presenting financial statements in an exaggerated way can cause confusion for users, affecting the decision making of relevant agencies. With such difficulties, companies must be careful and meticulous in preparing financial statements to attract investors and creditors as users of financial statements.

Accounting conservatism has been applied for more than a hundred years and there have been a series of fierce controversies over the application and elimination of accounting conservatism in preparing and presenting financial statements. The IASB (Citation2018) has brought accounting conservatism back into the conceptual framework after its removal in 2010, showing the importance of applying accounting conservatism in preparing and presenting financial statements.

Vietnam is a developing country receiving attention from partners and major investors worldwide. Therefore, businesses in Vietnam need to create a transparent business environment to attract investment from countries and corporations and promote their own potential strength. In addition, the Vietnamese economy needs to create an effective capital flow so that the stock market can support and promote the development of businesses. In addition, Vietnam is on the path to mandatory IFRS application by 2025. Therefore, information presented on financial reports needs to be more transparent and of higher quality to provide users with rational decision-making purposes, while accounting conservatism has an image of quality information on the financial statements. Financial characteristics are important indicators of a business to evaluate its ability to continuously operate and develop sustainably. Factors of good financial characteristics will increase expectations for the business about development opportunities and future cash flow. Therefore, research on the relationship between factors of financial characteristics and accounting conservatism in the context of businesses listed on the stock market in Vietnam is truly necessary.

3. Theoretical literature review

The relationship between financial characteristics and accounting conservatism is explained by a number of fundamental theories such as agency theory, positive accounting theory, signal theory, contractual theory.

3.1. Agency Theory

Agency theory is one of the fundamental theories in economic research. This theory is used to explain the issue of asymmetric information between managers and relevant parties. The groundwork for this theory was laid by Ross (Citation1973), and it was further developed by Jensen and Meckling in 1976. This theory evolves in the context of differing cooperative agreement relationships among managers, shareholders, and profits, and is viewed as a relationship between managers and shareholders. Here, there is a divergence of interests among company owners, investors, and managers. Owners or investors, who do not want to incur high taxes, would lose out on the profits they have earned. On the other hand, managers are concerned about highlighting profits to maintain their current positions. Due to these differing interests, the principle of conservatism needs to be applied to achieve the interests of all parties. Managers apply the principle of accounting conservatism in providing financial reporting information for the company. Therefore, administrators need to establish mechanisms to monitor managerial behavior in recording assets, capital sources, revenue, costs, and profits in order to enhance the quality of financial reporting. Additionally, when a company has numerous investment opportunities, it may face high agency costs. Thus, applying accounting conservatism can help mitigate information asymmetry and adjust the manipulation of managerial interests in line with shareholder interests.

Furthermore, in the event of financial crises such as the risk of bankruptcy, the agency costs also increase as the reliability of financial statements might be questioned. Accounting conservatism will help reduce agency costs by mitigating information asymmetry and enhancing the financial reporting quality.

3.2. Positive accounting theory

The empirical accounting theory was studied by Watts and Zimmerman (Citation1986). This theory aims to explain and predict various phenomena by applying accounting skills, knowledge, and understanding to use appropriate accounting policies to address future situations. This theory consists of three identified hypotheses: (1) the bonus plan hypothesis, (2) the debt covenant hypothesis, and (3) the political cost hypothesis. Zhang (Citation2008) pointed out that accounting conservatism benefits accounting information users by providing timely signals of default risk and uncertainty. This theory helps explain companies’ investment opportunities with accounting conservatism to reduce earnings volatility. Additionally, companies using more operating assets generate higher sales. According to Pujiono et al. (Citation2023), when uncertainty conditions exist in a business, managers need to apply suitable accounting policies to meet the assumption of continuous operations in the future. Saragih et al. (Citation2022) assert that higher capital intensity leads to more efficient utilization of all assets for revenue generation. This theory is also explained by the fact that higher capital usage results in higher political costs and a greater likelihood of reduced profits and more cautious financial reporting.

3.3. Signal theory

Signal theory explains about the assymetric information between buyers and sales. Wolk et al. (Citation2001) assumes that managers’ report positive signals to stakeholders through financial statement with a view to reducing asymmetric information circumstances. When applying accounting conservatism, high-quality profit is achieved. Companies with significant investment opportunities often have many opportunities to invest in high-profit projects but with elevated risks as well (Herma et al., Citation2023). Therefore, conservative accounting is applied in order to mitigate the potential risks, ensure financial stability, and provide timely information.

3.4. Contractual theory

Contracts have governed economic activities since ancient times, Jensen and Meckling (Citation1976) first introduced the theory of contracts. This theory studies how agreements and constraints within contracts are designed to minimize issues of asymmetric information between parties. A contract cannot predict all future situations. Accounting-related factors are indispensable in contracts. According to Dang and Tran (Citation2020), accounting figures in contracts are often adjusted to meet the conditions of the contract. According to this theory, as a company’s financial leverage increases, the application of accounting conservatism also increases.

4. Empirical literature review and hypotheses development

4.1. Growth opportunities and accounting conservatism

Growth opportunities are an opportunity that companies will invest in profit-making field. Based on Agency theory, proxy conflict between shareholders and managers will happen when the company has high growth rate. Businesses with hidden reserves using for investment will have a tendency to apply accounting conservatism. The trade advantage is when the market value is higher than the book value of equity. According to Holiawati and Julianty (Citation2017), when companies have growth opportunities, it tends to invest in possibly profit-making category in the future instead of distributing profits by receiving dividends. The relationship between growth opportunities and accounting conservatism has also been conducted by a number of studies, but the research results are also different. According to Sari (Citation2020), Holiawati and Julianty (Citation2017), development opportunities positively affect accounting conservatism, while Nuraeni and Tama (Citation2019), Penman and Zhang (Citation2002) has the opposite effect. Besides, the studies of Nafi’lnayati Zahro (Citation2021) were not influential.

It is such strong evidence that it is the basis for the author to propose the first hypothesis as follows:

H1: Growth opportunity has a positive effect on the accounting conservatism.

4.2. Return on equity and accounting conservatism

Return on equity is the company’s ability to generate profits from its capital. A higher profitability indicates a larger company value. The company must present profit information that is not excessively volatile as profitability increases. Accounting conservatism is a principle that needs to be applied as part of earnings management to present stable profit figures. The signaling theory explains that managers will provide a signal of high profitability in the form of the company’s future growth. High profits result in retained earnings, and this positively affects the return on equity, leading to an accounting conservatism approach according to Martani and Dini (Citation2010) and El-Habashy (Citation2019). This demonstrates that profitability has a positive impact on accounting conservatism. The relationship between return on equity and accounting conservatism has also been conducted by a number of studies, but the research results are also different. According to research by Mohammand Fawzi (Citation2021), return on equity positively affects accounting conservatism, while Abu Nassar and Mohammad Al Twerqi (Citation2021), Pandey (Citation2004), Artiach and Clarkson (Citation2013), and Lara et al. (Citation2011) found that return on equity negatively affects accounting conservatism. Mohammadi et al. (Citation2013) and Martani and Dini (Citation2010) stated return on equity was not influential. Based on the above results, and based on the signal theory explanation, the author proposes the next hypothesis as follows:

H2: Return on equity has a positive effect on the accounting conservatism.

4.3. Sales growth and accounting conservatism

Sales growth is the current change of revenue of one company in comparison to the previous period, which can be seen in the income statement. According to Barton et al. (Citation1989), sales growth reflects the success of investment in the past and can be used to estimate thriving factors in the future. If the annual sales growth is positive, the lucrative potential can be higher. If the revenue increases significantly, the future value of money (FV) of receivables from customers or immediately in cash will go up. Therefore, companies with positive sales growth get investors’ attention. According to Rahayu and Indra Gunawan, (Citation2018), based on positive accounting theory, the increased revenue results in the increased political cost. In order to reduce profits, accounting will apply conservatism when the revenue soars. Ahmed and Duellman (Citation2011) also found a positive relationship between sales growth and accounting conservatism. The relationship between sales growth and accounting conservatism has also been conducted by a number of studies, but the research results are also different. Rahayu and Indra Gunawan (Citation2018) found that sales growth positively affects accounting conservatism, while Goffar and Muhyarsyah, (Citation2022) stated that sales growth negatively affects accounting conservatism. Besides, Achyani and Lovita (Citation2021) concluded sales growth had no effect. The agency theory together with previous studies serves as the basis for the author to put forward the next hypothesis about the sales growth and accounting conservatism.

H3: Sales growth has a positive effect on the accounting conservatism.

4.4. Return on assets and accounting conservatism

Return on assets is the measure of how many profits that one unit of assets generates. Return on assets represents a company’s ability to earn profits from its assets (e.g. by selling assets to generate earnings). This ratio serves as a tool to analyze a company’s management efficiency, as the return on assets indicates the potential to generate profits. According to Ahmed et al. (Citation2002), a profitable company can be rewarded with lower debt costs. A higher return on assets reflects better financial efficiency and demonstrates the ability to manage existing assets to generate profits. Therefore, applying accounting conservatism is necessary to recognize the return on assets in order to reduce political costs. The relationship between return on assets and accounting conservatism has also been conducted by a number of studies, but the research results are also different. Mohammand Fawzi (Citation2021), Octavia (Citation2022) found that return on assets positively affects accounting conservatism, while Martani and Dini (Citation2010) claimed that return on assets negatively affects accounting conservatism. Besides, Goffar and Muhyarsyah (Citation2022), Nur Solichah and Fachrurrozie (Citation2019) claimed return on assets do not affect accounting conservatism. The next hypothesis is given as follows:

H4: Return on assets has a positive effect on the accounting conservatism.

4.5. Capital intensity and accounting conservatism

Capital intensity is the total amount of company’s capital known as assets and shows the effective level when using company’s assets for making profits. Companies with high-using capital intensity efficiently use their assets to increase profits. Zmijewski and Hagerman (Citation1981) said that enterprises with high-using capital intensity would have high profits, leading to suffer from a number of political costs (taxation) and cutting down the ability to earn an income by applying accounting principles. By contrast, Watts and Zimmerman (Citation1990) convinced that it was because of managers who urged to reduce profits so as to reduce the hidden political costs, financial statements were expected to be conservative. The relationship between capital intensity and accounting conservatism has also been conducted by a number of studies, but the research results are also different. According to research of Nafi’lnayati Zahro (Citation2021), Achyani and Lovita (Citation2021), Putri et al. (Citation2020), capital intensity positively affects accounting conservatism. Besides, Sholikhah and Baroroh (Citation2021) stated that capital intensity does not affect accounting conservatism. Thus, the H5 hypothesis in this study is:

H5: Capital intensity has a positive effect on the accounting conservatism.

4.6. Investment opportunity set and accounting conservatism

The investment opportunity set refers to decisions regarding investment in assets impacting asset growth and also represents options for future investments. According to agency theory, conflicts between managers and shareholders can be reduced through investment opportunities achieved by managerial decisions. On the other hand, signaling theory indicates that managers can attract investors through investment opportunity set; investors desire more investment opportunity set signals and have more specific evaluations about the company’s investment needs. Increasing investment opportunity set will attract investors willing to invest in the company. Managerial investment decisions directly affect the company’s value, thereby influencing stock prices. In fact, high stock prices impact the book value-to-market value ratio, which is a representation of accounting conservatism. Researchers such as Murwaningsari and Rachmawati (Citation2017), Herma et al. (Citation2023), have found a positive relationship between investment opportunity set and accounting conservatism. The relationship between investment opportunity set and accounting conservatism has also been conducted by a number of studies, but the research results are also different. According to research Sholikhah and Baroroh, (Citation2021), Murwaningsari and Rachmawati (Citation2017), investment opportunity set positively affects accounting conservatism. Besides, Goffar and Muhyarsyah (Citation2022) concluded that investment opportunity set does not affect accounting conservatism. Thus, the H6 hypothesis in this study is:

H6: Investment opportunity set has a positive effect on the accounting conservatism.

4.7. Financial distress and accounting conservatism

Financial distress of a company is a major concern in academia and practice, not only internally (for managers and shareholders) but also externally (for investors, creditors, etc.). Financial distress or financial crisis refers to a situation where a company faces financial difficulties leading to bankruptcy, evidenced by periods of reduced net income (Pujiono et al., Citation2023). Currently, there is not a universally agreed-upon definition of financial distress, resulting in various viewpoints. According to Dinh Khanh Nam (Citation2022), states of financial distress include failure, illiquidity, default, bankruptcy, and dissolution. However, Hashi (Citation1997) noted that these states could be challenging to observe in reality. According to Ohlson (Citation1980), strong corporate resources were more pronounced as a company’s scale increases. In empirical accounting theory, managers focus on reducing the level of accounting conservatism when addressing high levels of financial distress. Poor financial reporting could threaten managers as it might risk contract violations. Financial difficulties could lead to managerial dismissals due to ineffective management. Financial distress was a scenario where financial problems were evident, leading managers to reduce the level of accounting conservatism. When facing with uncertain conditions, companies need to exercise caution in reducing economic events, potentially benefiting stakeholders interested in financial statements. Altman (Citation1968) developed an early warning model for financial distress using the Z-score. Poor governance mechanisms could contribute to financial distress. Financial distress could erode investor confidence, decrease company value, and reduce the market-to-book ratio. Accounting conservatism enhanced income quality and decreased the likelihood of financial distress. Chen’s study (2009) found an inverse relationship between accounting conservatism and financial distress. The relationship between financial distress and accounting conservatism has also been conducted by a number of studies, but the research results are also different. According to research of Kao and Sie (Citation2016), Sari (Citation2020), Pujiono et al. (Citation2023), financial distress positively affects accounting conservatism, while Herma et al. (Citation2023), Chen et al. (Citation2009), Sholikhah and Suryani (Citation2020) found that financial distress negatively affects accounting conservatism. Besides, Meilinda et al. (Citation2022) stated that financial distress does not affect accounting conservatism. Along with the argument from the agency theory, the author proposes the next hypothesis as follows:

H7: Financial distress has a negative effect on the accounting conservatism.

4.8. Financial leverage and accounting conservatism

Financial leverage is a financing tool involving debt. When a company borrows debt, creditors always anticipate earnings returns from the borrowed funds. Agency theory explains the conflict between managers, shareholders, and investors, and managers are also monitored by creditors. For creditors and shareholders, a company with high financial risk tends to have high financial leverage. In positive accounting theory, a company with high leverage tends to shift future profits to the present, limiting the impact of debt covenants on the company’s value. If a company has high financial leverage, it can reduce its appeal to investors due to concerns about repayment risk, unless attractive and convincing business plans are presented to investors. Sajid et al. (Citation2016) noted that high-growth companies can utilize leverage for investment as they have sufficient cash flows to mitigate risks associated with leverage. A decrease in a company’s attractiveness would lead to reduced company and stock values, accordingly decreasing the market-to-book ratio. A lower ratio indicates less conservatism. According to Ahmed and Duellman (Citation2007), higher leverage leads to higher potential conflicts between shareholders and equity holders, impacting the need for conservatism. When funded through debt, managers concentrated to present ‘favorable’ financial reports when asset values and profits increased to reassure creditors. Researchers like Ahmed and Duellman (Citation2007), Gigler et al. (Citation2009), Geimechi and Khodabakhshi (Citation2015) found an inverse relationship between financial leverage and accounting conservatism. The relationship between financial leverage and accounting conservatism has also been conducted by a number of studies, but the research results are also different. According to the study Ge et al. (Citation2019), Dang and Tran (Citation2020), Octavia, (Citation2022), Pujiono et al. (Citation2023), financial leverage positively affects accounting conservatism, while Khalifa et al. (Citation2022) claimed that financial leverage negatively affects accounting conservatism. Besides, Meilinda et al. (Citation2022) and Nur Solichah and Fachrurrozie (Citation2019) stated that financial leverage does not affect accounting conservatism. Thus, the H8 hypothesis in this study is:

H8: Financial leverage has a negative effect on the accounting conservatism.

4.9. Global diversification and accounting conservatism

Currently, conglomerates are all seeking global expansion, making global diversification quite common. According to previous studies, global diversification can either enhance or diminish a company’s value. As noted by Denis et al. (Citation1997), diversified companies have a tendency to have lower managerial ownership compared to outside shareholders. Global diversification could pose a threat to corporate control. Similarly, Denis et al. (Citation2002) asserted that the increasing trend of global diversification over time stems from the rise in the proportion of companies operating in different countries through revenue generation. Global diversification could also cater to investor preferences. This was because the general sentiment was that when companies expanded globally, it boosted the confidence of stakeholders. Moreover, global diversification can offer benefits, power, reputation, treatment, and risk reduction for individual investment portfolios of managers (as per Jensen and Murphy (Citation1990), Amihud and Lev (Citation1981)).

According to Salama and Putnam (Citation2015), when there is a degree of global diversification, bondholders will see bondholders assign a higher value to accounting conservatism when there is more information asymmetry between stakeholders and managers caused by globalization diversification. According to Cahan et al. (Citation2005), companies had to face with different risks in different markets while it did not happen in domestic business; For example, the risk of costs, currencies, politics or the difference of culture, government policies, languages are some of the main factors triggering the drawbacks of businesses abroad activities. In terms of uncertainty factors, accounting conservatism was applied for alleviating the negative elements in international businesses. Accounting conservatism was also affected by international business activities when the quality of accounting information quality was increasing along with the uncertainty of companies’ value (Brown & Hillegeist, Citation2007). Along with the argument from the signal theory, the author proposes the next hypothesis as follows:

H9: Global diversification has a positive effect on the accounting conservatism.

4.10. Uncertainty environment and accounting conservatism

Uncertainty environment defined as the unpredictability of the actions of customers, suppliers, competitors and regulatory groups (Govindarajan, Citation1984). An uncertain environment refers to movements in a company’s business, specifically in terms of revenue. The uncertainty in the environment can lead to significant changes in reported income, motivating managers to mitigate such variability. Changes arise from external influences, company policies, and growth prospects, resulting in fluctuations in revenue and operational income. According to Ghosh and Olsen (Citation2009), the constraint in an uncertain environment lied in the unpredictability of actions taken by customers, suppliers, competitors. The research findings indicate that managers employ arbitrary accruals (representing a measure of accounting conservatism) and uncertainty environments to reduce variations in income reporting, especially when companies operate in uncertain environments. Govindarajan’s study in 1984 showed that managers were both adaptable and cautious in the face of environmental uncertainty. The relationship between environmental uncertainty and accounting conservatism has also been conducted by a number of studies, but the research results are also different. According to the study Cui et al. (Citation2023), Marziyeh Hejranijamil et al. (Citation2020), environmental uncertainty positively affects accounting prudence. From these arguments and previous research evidence, the author proposes the following final hypothesis

H10: Uncertainty environment has a positive effect on the accounting conservatism.

Based on the relevant literature reviews above, we have found that there are a number of factors concluded by most studies affecting on the conservatism accounting. However, the impact of these factors on the financial reporting quality has not been consistent. The factors and their impact results are summarized in below.

Table 1. Summary of results of some previous studies on factors affecting accounting conservatism.

5. Research design

5.1. Sample selection

The companies used in the study are companies listed on both Hose and HNX in Vietnam for a 5-year period from 2017 to 2021.

To be selected into the sample, companies must meet the following conditions:

+ Fiscal year from January 1 to December 31 of the calendar year

+ Not in the financial, banking, and insurance industries

Table 2. Sample selection.

5.2. Variables

Our research model includes a dependent variable and 10 independent variables. The dependent variable is accounting conservatism. Independent variables include those mentioned in most of the previous studies on the impact of factors about financial characteristics on the accounting conservatism.

5.2.1. Dependent variables

The dependent variable in this study is accounting conservatism. To measure accounting conservatism from the previous studies, there are the following methods: (a) based on the timeliness of asymmetric information by Basu (Citation1997) then developed by Khan and Watts (Citation2009) to get G-score and C-score, (b) based on market value divided by book value by Beatty et al. (Citation2008), (c) based on accrual by Givoly and Hayn (Citation2000), and (d) based on cash flow by Ball and Shivakumar (Citation2005).

In this study, the authors used the accounting conservatism measure according to Givoly and Hayn (Citation2000), based on non-operating accrual to find the relationship between financial characteristics and accounting conservatism. The accounting conservatism measure (ACC_NAC) model captures the difference between Total accruals (before depreciation) minus operating accruals divided total assets. The model is as follows:

In which:

ACC_NAC: Non-operating accruals; TAcc: Total accruals (before depreciation); NI: Net income; OAcc: operating accruals; Depr: Deprecition; CFO: Cash flow from operations;

TA: Total assets; ΔAR: Δ Accounts receivable; ΔIn: Δ Inventories; ΔPE: Δ Prepaid expenses; ΔAP: Δ Accounts payable; ΔTP: Δ Taxes payable.

The delta (Δ) is measured by the difference between the value t at the end of the year and the value t at the beginning of the year.

5.2.2. Independent variable

The independent variables of the research model include: (1) Growth opportunity, (2) Return on equity, (3) Sales growth, (4) Return on assets, (5) Capital intensity, (6) Investment opportunity set, (7) Financial distress, (8) Financial leverage, (9) Global diversification, and (10) Uncertainty environment. How these variables are measured is summarized in below.

Table 3. Measurement of independent variables.

5.3. Research model

Based on the fundamental theory and overview of the empirical studies conducted above, we propose the following research framework ():

Source: Author’s own construct.

To test the 10 hypotheses set out, we used a regression function to determine the relationship between 10 factors of financial and accounting characteristics. The regression model is as follows:

In which:

ACC_NAC: accounting conservatism; GRO: Growth opportunity; ROE: Return on equity; GRS: Sales growth; ROA: Return on assets; CIN: Capital intensity; IOS: Investment opportunity set; ZCO: Financial distress; LEV: Financial leverage; GDI: Global diversification; UOU: Uncertainty environment.

The study used Stata 16 software to evaluate and analyze the collected data to examine the relationship between ownership structure and accounting conservatism. The model analysis includes the following stages: descriptive statistics analysis, ordinary least squares model regression (Pooled OLS), fixed effects model regression (FEM) and random effects model (REM). However, Feasible Generalized Least Squares (FGLS) is selected to fix the defects of the model, testing the relationship between the dependent variable and 10 independent variables.

6. Empirical results and discussions

6.1. Descriptive analysis

shows descriptive statistics of the independent variables used in the whole model for the entire sample of 1895 observations over 5 years. The results have shown the mean, standard deviation, minimum and maximum values of the variables under study. The mean of the measures of accounting conservatism ACC_NAC is –0.053, standard deviation of 0.442 with a minimum value of –14.442 and a maximum value of 0.683. In general, the results show the existence of accounting conservatism in the listed companies under this study.

Table 4. Descriptive statistics for the variables examined in the study.

also shows that the mean of Growth opportunity is 1.552 (minimum value –17.787, maximum value 22.384). The mean of Return on equity is 0.122 (minimum value –6.313, maximum value 4.487). The average value of Sales growth is 0.339 (minimum value –0.994, maximum value 127.458). The mean of Return on assets is significant 0.072 (minimum –0.471, maximum value 1.18), The mean of Capital intensity is 17.445 (minimum 0.056, maximum value 12606.456). The mean of Investment opportunity set is 0.001 (minimum –0.584, maximum value 0.885). The mean of Financial distress is 1.248 (minimum 1, maximum value 3). The mean of Financial leverage is 0.437 (minimum 0.008, maximum value 1.237). The mean of Global diversification is 0.411 (minimum 0, maximum value 1), and more than half of the shares of the companies are in Environment uncertainty, which the mean of Environment uncertainty is 0.221 (minimum 0.008, maximum value 1.484).

6.2. Regression results

6.2.1. Choosing the appropriate model

This study uses ordinary least squares regression analysis to analyze the impact of financial characteristics and accounting conservatism on listed companies in Vietnam. Research data are balanced panel data, so the authors estimate regression model (1) by all 3 models including: Pooled OLS, FEM and REM to select the model that best fits the research data. Regression results of 3 models are shown in .

Table 5. Regression results of the Pooled OLS.

Table 6. Comparison results between Pooled OLS and FEM model.

Table 7. Comparison results between Pooled OLS and REM model.

6.2.2. Estimation with Pooled OLS

Pooled OLS estimation results are shown in below, adjusted coefficient R2 = 15.82%, and statistical value F = 36.581, Prob > F = 0.0000 (statistically significant at 1% level). It shows that the Pooled OLS estimate can be a suitable estimator.

6.2.3. Compare Pooled OLS with FEM

According to the results of below, the statistical results F (378,1506) = 1.42 and Prob > F = 0.0000 (statistically significant at 1%), showing that we can reject the null hypothesis H0 given that all coefficients ui = 0. This means that there is a difference between the subjects. In this case, the FEM model is more suitable than the Pooled OLS model.

6.2.4. Comparing Pooled OLS with REM

According to the results of Breusch and Pagan’s test (), Chibar2 value (01) = 0.99 and Prob > chibar2 = 0.1597 (Prob > P value (5%) show that we can accept the null hypothesis H0 given that all coefficients ui = 0. In this case, the estimate Pooled OLS volume is more suitable than REM.

Breusch and Pagan Lagrangian multiplier test for random effects

Estimated results:

Test: Var(u) = 0chibar2(01) = 0.99

Prob > chibar2 = 0.1597

Consequently, from the combined results of the tests comparing the three models Pooled OLS, FEM and REM, it is shown that the estimation of FEM is the most suitable. below summarizes the model selection tests: Pooled OLS, FEM and REM.

Table 8. Summary of Pooled OLS, FEM and REM model tests.

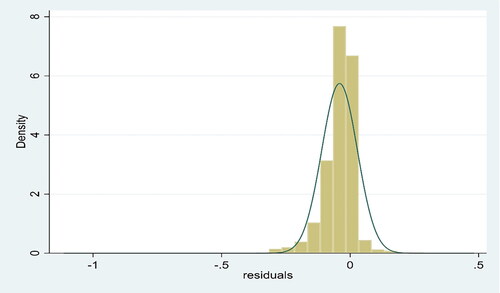

After determining that FEM model is the most appropriate among Pooled OLS, FEM and REM models, the authors test the model assumptions such as no multicollinearity phenomenon, distributed residuals, normal distribution, constant variance and no auto-correlation. The test results are shown in the appendix, specifically: All the VIF values of each independent variable of the model are less than 4, showing that there is no multicollinearity. The shape of the distribution chart of the residuals shows that the residuals have a normal distribution. Additionally, the result shows Prob > chi2 = 0.0000 (with statistical significance of 1%), so this model has heteroscedasticity phenomenon. At the same time, the results show that F(1, 373) = 0.523 and Prob > F = 0.4701 (no persistently significant at 5% level) showing that there is no the auto-correlation. Thus, one assumption has been violated: constant variance. To solve the violation of this assumption, the authors perform FGLS in order to test the proposed hypotheses.

6.2.5. Beta coefficient results and statistical significance

The results from below show among the independent variables included in the model, there are five variables impacting on the accounting conservatism with statistical significance of 5%. The independent variable which is investment opportunity set has a positive impact on the accounting conservatism. The independent variables have a negative impact on the accounting conservatism including growth opportunities, return on assets, financial leverage, uncertainty environment. The other five variables of return on equity, sales growth, capital intensity, financial distress, global diversification have no impact on the accounting conservatism in terms of statistical significance.

Table 9. Regression results FGLS estimate of model.

After conducting the FGLS model, the results show that 5 out of the 10 variables have an impact on accounting conservatism. Among these variables, growth opportunities, return on assets, financial leverage and uncertainty environment have a significant inverse effect at the 1% and 5% levels. The investment opportunity set variable has a positive impact with a significance level of 1%. However, the variables return on equity, sales growth, capital intensity, financial distress and global diversification do not have an impact on accounting conservatism.

Based on the above analysis results, the authors summarize the results of hypothesis testing as follows:

From the results of and , it can be seen that the influence of financial characteristics on accounting conservatism is as follows:

Table 10. Summary of hypothesis testing results.

6.2.6. Growth opportunities and accounting conservatism

The growth opportunity (GRO) has a significant inverse impact on accounting conservatism at a significance level of less than 5%, with a coefficient of -0.006. This implies that companies with greater growth opportunities tend to exhibit less conservative reporting. According to the explanation of proxy theory, the higher the growth opportunity, the higher the accounting conservatism. However, this result shows the opposite direction. This study aligns with the research conducted by Nuraeni and Tama (Citation2019), Penman and Zhang (Citation2002). However, it contradicts the findings of Sari (Citation2020), Holiawati and Julianty (Citation2017). Additionally, the study by Nafi’lnayati Zahro (Citation2021) found no significant impact on accounting conservatism.

6.2.7. Return on equity and accounting conservatism

The return on equity (ROE) does not have an influence on accounting conservatism. This implies that even companies with greater growth opportunities do not influence the application of accounting conservatism. The study by Mohammadi et al. (Citation2013), Martani and Dini (Citation2010) aligns with the results of this research, indicating no impact on accounting conservatism. This is not consistent with signaling theory, proxy theory and the results of some previous studies. Managers need to exercise prudence so as not to reduce profits and harm shareholders’ interests. Besides, the study by Mohammand Fawzi (Citation2021) found a positive impact, whereas the research by Abu Nassar & Mohammad Al Twerqi, Pandey (Citation2004), Artiach and Clarkson (Citation2013) reported a negative impact.

6.2.8. Sales growth and accounting conservatism

The revenue growth (GRS) does not have an impact on accounting conservatism, with coefficients of 0.002, respectively. This implies that revenue growth does not significantly influence the application of conservative reporting by businesses. Companies always promote sales to achieve the expected profits of shareholders and investors. However, there is no link between higher sales and managers must apply accounting conservatism, which proves that managers are only interested in achieving goals to satisfy shareholders and investors ignore caution. This study is consistent with the research by Achyani and Lovita (Citation2021), but contradicts the findings of Rahayu and Indra Gunawan (Citation2018) which found a positive impact, and the research by Goffar and Muhyarsyah (Citation2022) which reported a negative impact on accounting conservatism.

6.2.9. Return on assets and accounting conservatism

The return on assets (ROA) has a significant inverse impact on accounting conservatism at a significance level of less than 1%, with a coefficient of –0.738. This implies that as the return on assets increases, companies tend to report less conservatively. According to positive accounting theory, when businesses are in the process of profit growth, increased profits will encourage companies to apply accounting conservatism to reduce income to avoid rising costs. This study aligns with the research conducted by Mohammand Fawzi (Citation2021), Octavia (Citation2022). However, it contradicts the findings of Martani and Dini (Citation2010). Additionally, the research by Goffar and Muhyarsyah (Citation2022), Nur Solichah and Fachrurrozie (Citation2019) found no significant impact on accounting conservatism.

6.2.10. Capital intensity and accounting conservatism

The capital intensity (CIN) does not have an impact on accounting conservatism, with a coefficient of 0.000. This implies that the capital intensity does not significantly influence the application of conservative reporting by businesses. This result is not consistent with positive accounting theory because according to this theory, assets will generate revenue, and high capital intensity will cause large political costs. In fact, the more accounting conservatism companies apply, the study results were not influential. This study aligns with the research by Sholikhah and Baroroh (Citation2021). However, it contradicts the findings of Nafi’lnayati Zahro (Citation2021), Achyani and Lovita (Citation2021), Putri et al. (Citation2020) which found a positive impact on accounting conservatism.

6.2.11. Investment opportunity set and accounting conservatism

Investment opportunity set (IOS) has a positive impact on accounting conservatism at a significance level of less than 1%, with a coefficient of 0.047. This implies that companies with more investment opportunities can choose to report more conservatively. This study is consistent with signaling theory. Companies with high profitability prospects in the future will increase investment opportunities, making stock value go up, which will lead to the fact that the ratio of market value divided by book value will increase significantly. Accounting conservatism is also more applied, enabling managers to grasp the business situation, make predictions about the company’s performance and future investment decisions in the hope of bringing high profits. This result is corresponded to the research of Sholikhah and Baroroh (Citation2021), Murwaningsari and Rachmawati (Citation2017), but the research of Goffar and Muhyarsyah (Citation2022) does not there is an impact of investment opportunity set on accounting conservatism.

6.2.12. Financial distress and accounting conservatism

Financial distress (ZCO) does not have an impact on accounting conservatism, with a coefficient of 0.000. This implies that financial distress does not significantly influence the application of conservative reporting by businesses. This study is contrary to positive accounting theory and because according to positive accounting theory, companies will reduce their application of accounting conservatism when financial stress increases. Signaling theory suggests that companies will apply high caution when the company faces financial difficulties to reduce information asymmetry and generate quality profits to build trust with creditors and investors. This study aligns with the research by Meilinda et al. (Citation2022). However, it contradicts the findings of Kao and Sie (Citation2016), Sari (Citation2020), which found a positive impact, and the research by Herma et al. (Citation2023), Chen et al. (Citation2009), Sholikhah and Suryani (Citation2020), which reported a negative impact on accounting conservatism.

6.2.13. Financial leverage and accounting conservatism

Financial leverage (LEV) has a significant inverse impact on accounting conservatism at a significance level of less than 1%, with a coefficient of -0.046. Therefore hypothesis H8 is accepted. External capital financing in the form of debt will create a relationship between managers and creditors according to delegation theory. According to the research result, the higher the leverage value, the less cautious the manager is. The manager tries to increase information asymmetry to hide the ability to manipulate profits or over-presenting assets to demonstrate the ability to pay all debts. This implies that lower financial leverage corresponds to more conservative reporting by companies. This study aligns with the research by Ge et al. (Citation2019), Dang and Tran (Citation2020), Octavia (Citation2022), which found a positive impact. However, the research by Khalifa et al. (Citation2022) reported a negative impact. Besides, the research by Meilinda et al. (Citation2022), Nur Solichah and Fachrurrozie (Citation2019), Aburisheh et al. (Citation2022), Mrad (Citation2022) found no significant impact on accounting conservatism.

6.2.14. Global diversification and accounting conservatism

Global diversification (GDI) has no impact on accounting conservatism, with a coefficient of 0.01. This means that whether companies have revenue from international source or not does not affect the choice of applying accounting conservatism reporting. When doing business in different geographical environments, we will face risks that we do not face domestically, but these risks do not affect the application of accounting conservatism.

6.2.15. Uncertainty environment and accounting conservatism

The uncertainty operating environment (UOU) has an inverse impact on accounting conservatism at a significance level of less than 1%, with a coefficient of -0.103. This is contrary to expectations. This implies that as the level of uncertainty in the operating environment increases, companies tend to report less conservatively. When the environment is uncertain with high risk, conversely, information asymmetry and the need for careful accounting practices are reduced, and the benefits of debt transactions will become more apparent (Habib & Hossain, Citation2013). The findings of this study are linked to the research conducted by Cui et al. (Citation2023) and Marziyeh Hejranijamil et al. (Citation2020), which found a positive impact on accounting conservatism.

6.3. Additional test

The authors further test the above model with the measurement of the accounting conservatism variable according to another measurement method based on the ratio of market value to book value (ACC_MB) of Beaver and Ryan (Citation2000) and then extended by Beatty et al. (Citation2008), based on market value divided by book value. The accounting conservative measure (ACC_BM) model captures the difference between the book value and the market value of a firm’s total net assets.

The authors perform data analysis techniques to select the most appropriate estimation model, and then test the model assumptions such as no multicollinearity phenomenon, distributed residuals, normal distribution, constant variance, and no autocorrelation. The results show that the FEM model is the most suitable, and at the same time, has the phenomenon of heteroscedasticity and autocorrelation. Therefore, the authors use FGLS in order to test the proposed hypotheses.

The research results () show that out of 10 tested factors, 5 factors have results similar to those of testing the model with conservative accounting measurement based on non-operating accrual of Givoly and Hayn (Citation2000). Specifically, financial leverage and uncertainty environment have a negative impact on accounting conservatism. In contrast, sales growth, financial distress, and global diversification have no impact on accounting conservatism.The remaining factors have results dissimilar to those of testing the model with accounting conservatism measures based on non-operating accrual of Givoly and Hayn (Citation2000), which are growth opportunities, return on assets and capital intensity which have a positive impact. In the same direction, return on equity has a negative impact and Investment opportunity set has no impact on accounting conservatism.

Table 11. Regression results FGLS estimate of model (ACC_MB).

Thus, the additional test results show that 5 out of 10 factors included in the test have similar results for two methods of measuring accounting conservatism which are measurements based on the ratio of market value to book value by Beaver and Ryan (Citation2000) and measurement based on nonoperating accrual by Givoly and Hayn (Citation2000).

7. Summary and conclusions

The main objective of the study is to analyze the effect of financial characteristics on accounting conservatism. The research results show that out of the 10 factors tested, there are 5 factors affecting accounting conservatism, specifically, growth opportunities, return on assets, financial leverage, and environment. There is certainly a negative influence and investment opportunities have a positive influence on accounting conservatism. The remaining factors including return on equity, sales growth, capital intensity, financial distress and global diversification have no influence on accounting conservatism. Thus, based on these results, the authors propose some implications as follows: The careful application of accounting conservatism by businesses in preparing and presenting financial statements will increase the usefulness of their financial statements. However, the above empirical research results show that there are 5 influencing factors that affect accounting conservatism. Therefore, state management agencies need to strengthen the promulgation of relevant regulations so that businesses strictly comply and are not influenced by any motive. Independent auditors refer to these research results in performing financial statement audits, especially in risk assessment procedures. In addition, investors, suppliers, banks, etc. refer to these research results, specifically the factors affecting accounting conservatism, and the factors not affecting the accounting conservatism of companies to evaluate the usefulness of information in financial statements, and then make rational decisions. In addition, under uncertain conditions, business managers must be cautious in making decisions, ensuring the usefulness of information on financial statements provided by the business without being affected by a number of factors of financial characteristics, otherwise the business can create losses that must be borne by shareholders, creditors, investors, etc. This requires managers to have knowledge and understanding of accounting to apply appropriate policies to minimize risks in the business process.

This study collects a sample of 379 companies listed on the Vietnamese stock market in the 5-year period 2017–2021. Future studies can increase the sample size and extend the sample period. In addition, this study only focuses on factors that belong to the main characteristics of the company. Future studies can examine other groups of factors such as corporate governance characteristics and ownership structure and characteristics of the company, etc.

Author contributions

Both authors were involved in the conception and design, analysis and interpretation of the data; the drafting of the paper, revising it critically for intellectual content; and the final approval of the version to be published; and both authors agree to be accountable for all aspects of the work.

Informed consent

Informed consent was obtained from all individual participants included in the study. We have used the Stata 16 software to analyze the data of our research and we have obtained a copyright license of this Stata 16 software.

Disclosure statement

All authors declare that they have no conflict of interest.

Data availability statement

Data will be made available on reasonable request.

Additional information

Funding

Notes on contributors

Nguyen Thi Phuong Hong

Nguyen Thi Phuong Hong is a PhD and main lecturer of School of Accounting, University of Economics Ho Chi Minh City. Her main research areas include issues related to Accounting, Auditing, and Tax.

References

- Abu Nassar, M., & Mohammad Al Twerqi, H. (2021). Accounting conservatism and company’s profitability: the moderating effect of ownership concentration. Jordan Journal of Business Administration, 17(4), 1–24.

- Aburisheh, K. E., Dahiyat, A. A., Owais, W. O., Al Shanti, A. M., & AlQudah, L. A. (2022). The effect of ownership structure and board structure on accounting conservatism throughout financial reporting: Evidence from Jordanian industrial corporations. Cogent Business & Management, 9(1), 2112819. https://doi.org/10.1080/23311975.2022.2112819

- Achyani, F., & Lovita, E. P. (2021). The effect of good corporate governance, sales growth, and capital intensity on accounting conservatism (empirical study on manufacturing companies listed on the indonesia stock exchange). Jurnal Riset Akuntansi Dan Keuangan Indonesia, 6(3), 255–267. http://doi.org/10.23917/reaksi.v6i3.17578

- Ahmed, A., Billings, B., Morton, R., & Harris, M. (2002). The role of accounting conservatism in mitigating bondholder–shareholder conflict over dividend policy and in reducing debt cost. The Accounting Review, 77(4), 867–890. https://doi.org/10.2308/accr.2002.77.4.867

- Ahmed, A. S., & Duellman, S. (2007). Accounting conservatism and board of director characteristics: An empirical analysis. Journal of Accounting and Economics, 43(2-3), 411–437. https://doi.org/10.1016/j.jacceco.2007.01.005

- Ahmed, A., & Duellman, S. (2011). Evidence on the role of accounting conservatism in monitoring managers’ investment decisions. Accounting & Finance, 51(3), 609–633. https://doi.org/10.1111/j.1467-629X.2010.00369.x

- Altman, E. L. (1968). Financial ratios, discriminant analysis and the prediction of corporate bankruptcy. The Journal of Finance, 23(4), 589–609. https://doi.org/10.2307/2978933

- Alves, S. (2023). Do female directors affect accounting conservatism in European Union? Cogent Business & Management, 10(2), 2219088. https://doi.org/10.1080/23311975.2023.2219088

- Amihud, Y., & Lev, B. (1981). Risk reduction as a managerial motive for conglomerate mergers. The Bell Journal of Economics, 12(2), 605–617. https://doi.org/10.2307/3003575

- Artiach, T., & Clarkson, M. (2013). Conservatism, disclosure, and cost of capital. Australian Journal of Business, 4(9), 1–22. http://ssrn.com/abstract-1673516

- Bach, L. T., Ngan Ha, L. M., Thao, T. N. M., Anh, B. M., Phat, T. T., & Trang, H. N. (2022). Tác động của sở hữu nhà nước đến nguyên tắc thận trọng trong lập báo cáo tài chính: Bằng chứng thực nghiệm tại Việt Nam. Tạp Chí Công Thương, số, 20, 245–251.

- Baker, M., & Wurgler, J. (2002). Market timing and capital structure. The Journal of Finance, 57(1), 1–32. https://doi.org/10.1111/1540-6261.00414

- Ball, R., & Shivakumar, L. (2005). Earnings quality in UK private firms: Comparative loss recognition timeliness. Journal of Accounting and Economics, 39(1), 83–128. https://doi.org/10.1016/j.jacceco.2004.04.001

- Banker, R. D., Basu, S., Byzalov, D., & Chen, J. Y. (2016). The confounding effect of cost stickiness on conservatism estimates. Journal of Accounting and Economics, 61(1), 203–220. https://doi.org/10.1016/j.jacceco.2015.07.001

- Baroroh, N., Asrori, S., & A’yunin, Q. (2020). The implementation of accounting conservatism principle in Indonexia. Unicees 2018, 1072–1078.

- Barton, S. L., Hill, N. C., & Sundaram, S. (1989). An empirical test of stakeholder theory predictions of capital structure. Financial Management, 18(1), 36–44. https://doi.org/10.2307/3665696

- Basu, S. (1997). The conservatism principle and the asymmetric timeliness of earnings. Journal of Accounting and Economics, 24(1), 3–37. https://doi.org/10.1016/S0165-4101(97)00014-1

- Beatty, A., Weber, J., & Yu, J. J. (2008). Conservatism and debt. Journal of Accounting and Economics, 45(2-3), 154–174. https://doi.org/10.1016/j.jacceco.2008.04.005

- Beaver, W., & Ryan, S. (2000). Biases and lags in book value and their effects on the ability of the book-to-market ratio to predict book return on equity. Journal of Accounting Research, 38(1), 127–148. https://doi.org/10.2307/2672925

- Bodnar, G. M., Tang, C., & Weintrop, J. (1999). Both sides of corporate diversification: The value impacts of global and industrial diversification. Working paper Johns Hopkins University.

- Brown, S., & Hillegeist, S. (2007). How disclosure quality affects the level of information. Review of Accounting Studies, 12(2-3), 443–477. shttps://ssrn.com/abstract=956256 https://doi.org/10.1007/s11142-007-9032-5

- Bryan, T. G., McKnight, M. A., & Houmes, R. (2021). Accounting conservatism or earnings management: A study of the allowance for doubtful accounts. Corporate Ownership and Control, 18(3), 175–190. volume https://doi.org/10.22495/cocv18i3art14

- Cahan, S. F., Chua, F., & Nyamori, R. O. (2005). Board structure and executive compensation in the public sector: New Zealand evidence. Financial Accountability and Management, 21(4), 437–465. https://doi.org/10.1111/j.0267-4424.2005.00228.x

- Chen, S., Chen, X., Cheng, Q., & Hutton, A. (2009). Accouning conservatism and large shareholders: an empirical analysis Working paper, University of Texas at Austin, Austin, TX, December.

- Chen, M., Cheng, S., & Hwang, Y. (2005). An empirical investigation of the relationship between intellectual capital and firms’ market value and financial performance. Journal of Intellectual Capital, 6(2), 159–176. https://doi.org/10.1108/14691930510592771

- Cui, X., Ma, T., Xie, X., & Goodell, J. W. (2023). Uncertainty of uncertainty and accounting conservatism. Finance Research Letters, 52, 103525. https://doi.org/10.1016/j.frl.2022.103525

- Dai, L., & Ngo, P. (2021). Political uncertainty and accounting conservatism. European Accounting Review, 30(2), 277–307. https://doi.org/10.1080/09638180.2020.1760117

- Dang, N. H., & Tran, M. D. (2020). Impact of financial leverage on accounting conservatism application: the case of Vietnam. Custos E Agronegocio on Line, 16(3), 137–158.

- Denis, D. J., Denis, D. K., & Sarin, A. (1997). Agency problems, equity ownership, and corporate diversification. The Journal of Finance, 52(1), 135–160. https://doi.org/10.1111/j.1540-6261.1997.tb03811.x

- Denis, D., Denis, D., & Yost, K. (2002). Global diversification, industrial diversification, and firm value. The Journal of Finance, 57(5), 1951–1979. https://doi.org/10.1111/0022-1082.00485

- Duong, D. T. (2022). Mức độ thực hiện nguyên tắc thận trọng trong kế toán của các doanh nghiệp niêm yết trên thị trường chứng khoán Việt Nam Luận án Tiến sĩ, Đại Học Kinh Tế Quốc Dân.

- Dutta, S., & Patatoukas, P. N. (2017). Identifying conditional conservatism in financial accounting data: Theory and evidence. The Accounting Review, 92(4), 191–216. https://doi.org/10.2308/accr-51640

- El-Habashy, H. A. K. (2019). The effect of corporate governance attributes on accounting conservatism in Egypt. International Journal of Business and Management, 14(10), 1–18. https://doi.org/10.5539/ijbm.v14n10p1

- Ge, R., Seybert, N., & Zhang, F. (2019). Investor sentiment and accounting conservatism. Accounting Horizons, 33(1), 83–102. https://doi.org/10.2308/acch-52250

- Geimechi, G., & Khodabakhshi, N. (2015). Factors affecting the level of accounting conservatism in the financial statement of the listed companies in Tehran stock exchange. International Journal of Accounting Research, 2(4), 41–46.

- Ghosh, D., & Olsen, L. (2009). Environmental uncertainty and managers’ use of discretionary accruals. Accounting, Organizations and Society, 34(2), 188–205. https://doi.org/10.1016/j.aos.2008.07.001

- Gigler, F., Kanodia, C., Sapra, H., & Venugopalan, R. (2009). Accounting conservatism and the efficiency of debt contracts. Journal of Accounting Research, 47(3), 767–797. https://doi.org/10.1111/j.1475-679X.2009.00336.x

- Givoly, D., & Hayn, C. (2000). The changing time-series properties of earnings, cash flows and accruals: has financial reporting become more conservative? Journal of Accounting and Economics, 29(3), 287–320. https://doi.org/10.1016/S0165-4101(00)00024-0

- Goffar, A., & Muhyarsyah, M. (2022). The effect of managerial ownership, company growth, profitability, and investment opportunity set (IOS) on accounting conservatism. Budapest International Research and Critics Institute-Journal, 28474–28486. https://doi.org/10.33258/birci.v5i3.6934

- Govindarajan, V. J. (1984). Appropriateness of accounting data in performance evaluation: An empirical examination of environmental uncertainty as an intervening variable. Accounting, Organizations and Society, 9(2), 125–135. https://doi.org/10.1016/0361-3682(84)90002-3

- Habib, A., & Hossain, M. (2013). Accounting conservatism, environmental uncertainty and the capital structure. Corporate Ownership and Control, 11(1), 123–135. https://doi.org/10.22495/cocv11i1c1art1

- Hajawiyah, Ain, Wahyudin, Agus, Pahala, Indra, Kiswanto, Sakinah, (2020). The effect of good corporate governance mechanisms on accounting conservatism with leverage as a moderating variable. Cogent Business & Management, 7(1), 1779479. https://doi.org/10.1080/23311975.2020.1779479

- Hashi, I. (1997). The economics of bankruptcy, reorganisation and liquidation. Russian and East European Finance and Trade, 33(4), 6–34. https://www.jstor.org/stable/27749400

- Hejranijamil, M., Hejranijamil, A., & Shekarkhah, J. (2020). Accounting conservatism and uncertainty in business environments; using financial data of listed companies in the Tehran stock exchange. Asian Journal of Accounting Research, 5(2), 179–194. https://doi.org/10.1108/AJAR-04-2020-0027

- Herma, W., Amir, H., & Hibar, P. R. (2023). Determinants of accounting conservatism. Global Financial Accounting Journal, v 7n(1), 14–27. https://doi.org/10.18551/rjoas.2020-12.03

- Holiawati & Julianty, R. (2017). Tax incentives, growth opportunities and size of companies with conservatisme accounting applications. International Journal of Scientific Research in Science and Technology, 3(3), 586–591.

- Hung, T. T., Dung, T. Q., & Uyen, L. H. P. (2021). Tác động của nguyên tắc thận trọng đến giá trị hợp lý của các công ty niêm yết trên sàn giao dịch chứng khoán TP. Hồ Chí Minh. Tạp Chí Công Thương

- IASB. (2018). Conceptual framework for financial reporting. International Accounting Standards Board.

- Jensen, M., & Meckling, W. (1976). Theory of the firm: Managerial behavior, agency costs, and ownership structure. The Economic Nature of the Firm, 283–303. https://doi.org/10.1016/0304-405x(76)90026-x)

- Jensen, M. C., & Murphy, K. J. (1990). Performance pay and top management incentives. Journal of Political Economy, 98(2), 225–264. https://www.jstor.org/stable/2937665 https://doi.org/10.1086/261677

- Jia, W., Bi, S., & Du, Y. (2022). Director’s and officers’ liability insurance and accounting conservatism: empirical evidence from China. Managerial Auditing Journal, 37(8), 1091–1112. https://doi.org/10.1108/MAJ-10-2021-3353

- Kao, H. S., & Sie, P. J. (2016). Accounting conservatism trends and financial distress: Considering the endogeneity of the C-Score. International Journal of Financial Research, 7(4) https://doi.org/10.5430/ijfr.v7n4p149

- Khalifa, M., Trabelsi, S., & Matoussi, H. (2022). Leverage, R&D expenditures and accounting conservatism: Evidence from technology firms. The Quarterly Review of Economics and Finance, 84, 285–304. https://doi.org/10.1016/j.qref.2022.02.002

- Khalifa, M., Zouaoui, H., Ben Othman, H., & Hussainey, K. (2023). The impact of climate risk on accounting conservatism: evidence from developing countries. Journal of Applied Accounting Research, https://doi.org/10.1108/JAAR-01-2023-0028

- Khan, M., & Watts, R. L. (2009). Estimation and empirical properties of a firm-year measure of accounting conservatism. Journal of Accounting and Economics, 48(2-3), 132–150. https://doi.org/10.1016/j.jacceco.2009.08.002

- Lara, J. M. G., Osma, B. G., & Penalva, F. (2011). Conditional conservatism and cost of capital. Review of Accounting Studies, 16(2), 247–271. https://doi.org/10.1007/s11142-010-9133-4

- Lin, C. M., Chan, M. L., Chien, I. H., & Li, K. H. (2018). The relationship between cash value and accounting conservatism: The role of controlling shareholders. International Review of Economics & Finance, 55, 233–245. https://doi.org/10.1016/j.iref.2017.07.017

- Martani, D., & Dini, N. (2010). The influence of operating cash flow and investment cash flow to the accounting conservatism measurement. Chinese Business Review, 9(6), 1–6.

- Meilinda , Sri, Susanti, Santi, Zulaihati. (2022). Impact of leverage and financial distress on accounting conservatism. Marginal: Journal of Management, Accounting, General Finance and International Economic Issues, 1, 2, 126 – 139. https://doi.org/10.55047/marginal.v2i1.367

- Mohammadi, M. H. K., Heyrani, F., & Golestani, N. (2013). Impact of conservatism on the accounting information quality and decision making of the shareholders and the firms listed on the Tehran stock exchange. International Journal of Academic Research in Accounting, Finance and Management Sciences, 3(3), 186–197. https://doi.org/10.6007/IJARAFMS/v3-i3/129

- Mohammand Fawzi, S. (2021). Accounting conservatism and profitability of commercial banks: Evidence from Jordan. Journal of Asian Finance, Economics and Business, 8(6), 0145–0151. https://doi.org/10.13106/jafeb.2021.vol8.no6.0145

- Mrad, M. (2022). Accounting conservatism and corporate cross-listing: The mediating effect of the corporate governance. Cogent Economics & Finance, 10(1), 2090662. https://doi.org/10.1080/23322039.2022.2090662

- Murwaningsari, E., & Rachmawati, S. (2017). The influence of capital intensity and investment opportunity set toward conservatism with managerial ownership as moderating variable. Journal of Advanced Management Science, 5(6), 445–451. https://doi.org/10.18178/joams.5.6.445-451

- Nam, D. K. (2022). Nhân tố tác động đến khả năng xảy ra căng thẳng tài chính tại các công ty niêm yết trên thị trường chứng khoán Việt Nam. Tạp chí Tài Chính số 1 tháng 4.

- Nasr, M. A., & Ntim, C. G. (2018). Corporate governance mechanisms and accounting conservatism: evidence from Egypt. Corporate Governance: The International Journal of Business in Society, 18(3), 386–407. https://doi.org/10.1108/CG-05-2017-0108

- Novari, R., Yusnaini, Y., & Fuadah, L. L, Sriwijaya University, Palembang, Indonesia. (2021). The impact of tax incentives, political costs, litigation risk and equity valuation on accounting conservatism. Oblik i Finansi, 4(4(94), 39–45. I https://doi.org/10.33146/2307-9878-2021-4(94)-39-45

- Nur Solichah and Fachrurrozie. (2019). Effect of managerial ownership, levarage, firm size and profitability on accounting conservatism. Accounting Analysis Journal, 8(3), 151–157.

- Nuraeni, C., & Tama, A. I. (2019). Effect of managerial ownership, debt covenant, political costs and growth opportunities on accounting conservatism levels. International Journal of Economics, Business and Accounting Research (IJEBAR), 3(03), 263–269. https://doi.org/10.29040/ijebar.v3i03.591

- Octavia, D. M. (2022). The effect leverage, profitability, firm size and financial distress against accounting conservatism (Empirical study on Bank Sub-Sector Service companies Listed on the Indonesia Stock Exchange in 2017-2020). Global Accounting Jural Akuntansi, 1(2), 71–84.

- Ohlson, J. A. (1980). Financial ratios and the probabilistic prediction of bankruptcy. Journal of Accounting Research, 18(1), 109–131. https://doi.org/10.15294/aaj.v8i3.27847

- Pandey, I. (2004). Capital structure, profitability and market structure: Evidence from Malaysia. Asia Pacific Journal of Economics and Business, 2(8), 78–91.

- Penman, S., & Zhang, X. (2002). Accounting conservatism, the quality of earnings, and stock returns. The Accounting Review, 77(2), 237–264. https://doi.org/10.2308/accr.2002.77.2.237

- Pujiono, Radityo, Enggar, Kusumaningtias, Rohmawati, Putra, & Rediyanto. (2023). An overview fair play regulation in England premier league: Accounting information for leverage and financial distress to conservatism. Cogent Business & Management, 1, 10, 1–10. https://doi.org/10.1080/23311975.2023.2164996

- Putri, W. W. R., Tartilla, N., & Pamungkas, M. N. (2020). Analysis of the factors that affect the company’s accounting conservatism. The Accounting Journal of Binaniaga, 5(2), 101–112. https://doi.org/10.33062/ajb.v5i2.391

- Qiang, X. (2007). The effects of contracting, litigation, regulation, and tax costs on conditional and unconditional conservatism: Cross‐sectional evidence at the firm level. The Accounting Review, 82(3), 759–796. https://doi.org/10.2308/accr.2007.82.3.759

- Rahayu, SK., K., & Indra Gunawan, D. (2018). Factors influencing the application of accounting conservatism in the Company. KnE Social Sciences, 3(10), 180–197. https://doi.org/10.18502/kss.v3i10.3128

- Ross, S. (1973). The economic theory of agency: The principal’s problem. American Economic Review, 63, 134–139. https://www.jstor.org/stable/1817064

- Ruch, G. W., & Taylor, G. (2015). Accounting conservatism: A review of the literature. Journal of Accounting Literature, 34(1), 17–38. https://doi.org/10.1016/j.acclit.2015.02.001

- Sajid, M., Mahmood, A., & Sabir, H. M. (2016). Does financial leverage influence investment decisions? Empirical evidence from kse-30 index of Pakistan. Asian Journal of Economic Modelling, 4(2), 82–89. https://doi.org/10.18488/journal.8/2016.4.2/8.2.82.89

- Salama, F. M., & Putnam, K. (2015). Accounting conservatism, capital structure, and global diversification. Pacific Accounting Review, 27(1), 119–138. https://doi.org/10.1108/PAR-07-2013-0067

- Saragih, J. B. C., & Muda, I., & Rujiman. (2022). The Influence of capital intensity, company size, growth opportunity, tax on accounting conservatism with leverage as moderating variable on food and beverage company listed in bursa Efek Indonexia. Jurnal Mantik, 6(2), 1678–1684. https://doi.org/10.35335/mantik.v6i2.2610

- Sari, W. P. (2020). The effect of financial distress and growth opportunities on accounting conservatism with litigation risk as moderated variables in manufacturing companies Listed on BEI. Budapest International Research and Critics Institute (BIRCI-Journal) : Humanities and Social Sciences, 3(1), 588–597. https://doi.org/10.33258/birci.v3i1.812