Abstract

Exploring the financial behavior traits amidst the unexpected financial challenges and the unparalleled rise in fintech, this study provides insight into the interplay of entrepreneur digital financial literacy (EDFL), entrepreneur financial competency (EFC), and entrepreneur financial skill (EFS) impacting entrepreneur financial decision-making (EFDM). Toward this goal, data were gathered from 223 active women entrepreneurs from India who have accounts in the social media platform. The three-step hierarchical regression analysis disclosed that an entrepreneur with sound EDFL, EFS, and EFC can significantly enhance strategic decision-making (EFDM). The research outcome reveals that EFDM is a consistent predictor of the financial performance of women-owned enterprises. In addition, the entrepreneur’s financial decision-making does not mediate the relationship between financial experience, financial competency, financial skill budgeting, and financial skill_acumen with financial performance. In contrast, partial mediation is observed between digital financial awareness, digital financial knowledge, and financial skill_analytics. The novel insight accounted for a significantly low level of experience in entrepreneurs’ utilization of digital platforms for payment, financing loans, and asset management. The outcome carries academic, regulatory, and managerial significance, recognizing the unique interaction; the cumulative efforts strengthen the capacity to address socio-economic challenges and translate them into gender-specific policy interventions and practices.

IMPACT STATEMENT

The research presents a timely exploration into the evolving financial landscape, particularly focusing on the digital literacy and competency of women entrepreneurs amidst unprecedented challenges and the rapid expansion of fintech solutions. By delving into the intricate dynamics of digital financial behavior traits, the study underscores the pivotal role of entrepreneur digital financial literacy, competency, and skill in shaping strategic decision-making processes. The findings not only highlight the indispensable link between entrepreneur financial decision-making and enterprise performance but also shed light on the nuanced relationships within the digital financial realm. This research contributes significant insights into how women entrepreneurs leverage digital platforms for financial transactions, loan management, and asset optimization, despite facing notable challenges in experience levels. Such insights hold profound implications for academia, regulatory frameworks, and managerial practices, advocating for tailored interventions and policies that empower women entrepreneurs and foster inclusive economic growth amidst the evolving financial landscape.

Reviewing Editor:

SUBJECTS:

1. Introduction

The global business landscape has witnessed a significant economic, technological, and social shift, conforming to a new normal business environment (Ahlstrom et al., Citation2020; Srhoj et al., Citation2022). Scholarly narration views this new normal as a transitional phase implementing changes at varying levels depending on the attributes of the organization, industry, and nation to which they belong (Ahlstrom et al., Citation2020; Raghavan et al., Citation2021). Thereupon, the new normal has prompted the organization to adapt by fostering innovation, embracing technology, and crafting new business models. Globalization in the new normal environment drives entrepreneurs to navigate by formulating effective strategies to respond to the challenges in emerging economies (Gao et al., Citation2023; Lingappa et al., Citation2023; Na & Erogul, Citation2021). This is because of the economic liberalization in several of the world’s emerging countries, like Brazil, Russia, and India, who have similarly experienced a period of economic transition (Abad-Segura et al., Citation2020). The demographic ‘tail’ wind driving economic growth is shifting to ‘head’ wind in developed economies, which is likely even observable in older developing countries (China and Russia). Furthermore, this advantage will persist in younger emerging economies such as Brazil and India within the next 20–30 years (Ahlstrom et al., Citation2020).

The pandemic has accelerated business digitalization, and the adoption of digital technologies by entrepreneurs as an essential requirement in the current context (Chen et al., Citation2023; Jiménez-Zarco et al., Citation2021; Kukreja et al., Citation2021). Among the emerging economies, more than one in two expects to increase the use of digital technologies, compared to just half of other economies. The world digital rate penetration is 64%, who expect their business to use more digital technologies in their entrepreneurial venture. Furthermore, the proportion of those entrepreneurs who expect to use digital technologies in their business ranged from 52% (South Africa) to 84% (Brazil), where India maintained 69% (Global Entrepreneurship Monitor [GEM], 2022). This indicates the preparedness of entrepreneurs for the evolving business world; but also reveals the inclination toward embracing digital transformation among Indian entrepreneurs, nearly 7 out of 10 entrepreneurs except to incorporated digital technologies.

Over the recent years, India has witnessed an explosive surge in mobile phone penetration (Hendershott et al., Citation2021; Melubo & Musau, Citation2020; Mossie, Citation2023) coupled with increase in internet access and internet based services, which entrepreneurs can leverage (LEAD, Citation2020). IndianStack serve as the underlying platform of the digital India, offering a collaborative technical and innovative backbone upon which digital ecosystem grow, enabling novel form of presence less, paperless and cashless transaction (IBM, Citation2018). India ranks among the world’s top five fintech markets (Asif et al., Citation2023; Hasan et al., Citation2023; Kukreja et al., Citation2021), this rapidly growing sector is expected to expand from $50 billion in 2021 to $150 billion by 2025, driven by the influence of the internet and emerging technologies. Fintech is shaping the way financial products and services are designed and delivered making it accessible for the public (Asif et al., Citation2023; Hasan et al., Citation2023; Yue et al., Citation2022). Hence, India offers a compelling backdrop for the examination of how financial behavior trait impact women owned enterprise. As one of the world’s fastest-growing major economies (Jha & Alam, Citation2022; Ravikumar et al., Citation2022; Sellappan & Shanmugam, Citation2023), with a thriving startup ecosystem (Aernoudt & De San José, Citation2020). This growth presents opportunities and challenges for women entrepreneurs who have long struggled with gender disparities (Adikaram & Razik, Citation2022; Islam & Muzi, Citation2022). They must navigate the unique challenges due to cultural, social, and economic factors (Cardella et al., Citation2020; Gao et al., Citation2023; Ogbo et al., Citation2019), as well as harness the various government initiatives and schemes to reduce the digital divide (Adikaram & Razik, Citation2022; Hattiambire & Harkal, Citation2021; Newman et al., Citation2023).

Furthermore, the pandemic has significantly influenced the shift that should be studied and analyzed (Carroll & Conboy, Citation2020; Gao et al., Citation2023; GEM, 2022; Jiménez-Zarco et al., Citation2021; Ravikumar et al., Citation2022). The risk, volatility, and uncertainty due to the COVID-19 pandemic have affected global financial markets and afflicted the financial, economic, and psychological well-being of every stratum of society (Srhoj et al., Citation2022). In the aftermath, economic deterioration led to enterprise closures or reduced financial performance, especially in developing countries like India (Krammer, Citation2022). Consequently, the decline in profits and revenue results in the financial weakness of the enterprise. Women-led businesses experienced challenges in accessing financial support and resources, exacerbating the financial strain they experienced (Mucha, Citation2020). The pandemic highlighted pre-existing gender disparities in access to finances and resources, making it even more challenging for women entrepreneurs to sustain their businesses (Jiménez-Zarco et al., Citation2021; Srhoj et al., Citation2022). This paper centers on the perspective of women entrepreneurs, where the emotions stirred by such disruption affect their ability to make financial decisions. Such dynamic and uncertain scenarios disproportionately affect those least equipped to handle them (Aernoudt & De San José, Citation2020; Organisation for Economic Co-operation and Development [OECD], Citation2022). Women entrepreneurs possess limited financial knowledge, thus resulting in a lack of skills necessary to avoid financial mismanagement (Kumar et al., Citation2023; Rachel Kuruvilla & N Harikumar, Citation2020; Yoopetch, Citation2021; Yue et al., Citation2022).

Conversely, there is a growing recognition of the crucial role played by women entrepreneurs in driving economic growth and fostering sustainable development (Gang et al., Citation2022; International Finance Corporation, 2018). As more women actively participate in the entrepreneurial landscape, exploring the factors that can influence their financial performance becomes imperative. As emergence of digital financial services has transformed the financial landscape, offering new opportunities and challenges for entrepreneurs worldwide (Jiménez-Zarco et al., Citation2021; Panos & Wilson, Citation2020; Qiao et al., Citation2023; Ughetto et al., Citation2020).

Behavioral finance examines such emotional turbulence and its detrimental effect on Entrepreneurial financial decision-making (Asif et al., Citation2023; Morgan et al., Citation2019; Qiao et al., Citation2023; Sara et al., Citation2023), and its impact on financial performance (Lingappa et al., Citation2023; Sellappan & Shanmugam, Citation2023; Yazdanfar & Öhman, Citation2015). It could be attributed to entrepreneurs evaluating their competencies (Fazal et al., Citation2022; Lavi & Yaniv, Citation2023) to uphold financial stability and manage their financial circumstances, which are intricately connected with their financial performance (Fazal et al., Citation2022; Kisubi et al., Citation2022). Therefore, behavioral heterogeneity paves the way for coping strategies (Asif et al., Citation2023; Liñán & Chen, Citation2009), as entrepreneurs possessing moderate financial literacy tend to react sensibly to economic uncertainty (Iram et al., Citation2021; Yue et al., Citation2022). Simultaneously, the rapid advancement of digitization and the exceptional growth in financial technologies amid the pandemic emphasized the significance of financial decision-making in enhancing financial performance (Lavi & Yaniv, Citation2023; Ruiz-Dotras & Lladós-Masllorens, Citation2022).

This study views entrepreneurship through the digital technology lens, how the integration of digital structures and elements (apps, website) has disrupted the entrepreneurial process by expanding the borders of entrepreneurial endeavors and partnerships (Jiménez-Zarco et al., Citation2021; Kelly & McAdam, Citation2023). As well as the technological acceptance regarding accessibility, entrepreneur engagement, and interactivity (Panos & Wilson, Citation2020; Puschmann, Citation2017). It holds significance for marginalized groups like women, as digital technology is considered a great lever (Kelly & McAdam, Citation2023; Mossie, Citation2023), leading to the democratization of entrepreneurship. Prior studies indicate that financially literate and knowledgeable entrepreneurs make informed financial decisions (Khurana & Lee, Citation2023; Zainol & Al Mamun, Citation2018) leading to their economic stability and financial performance. Economic crisis results in funding shortages and the inability to handle finance (De Simone et al., Citation2021; Srhoj et al., Citation2022), which leads to diminishing financial performance (Sharma, Citation2021). To tackle such situations, researchers recommend enhancing prudent financial behavior through regular assessment of expenses, maintenance of contingency funds (Mokhtar et al., Citation2020), budgeting, which encompasses financial skills (Oggero et al., Citation2020; Rink et al., Citation2021), gaining financial competencies (Fazal et al., Citation2022; Kisubi et al., Citation2022; Man et al., Citation2002), and improving financial literacy (Sara et al., Citation2023; Valdes et al., Citation2022).

The study aims to uncover, investigate, and understand how specific financial behavioral traits influence women entrepreneurs in India, particularly in the context of financial decision-making, and how these decisions impact the overall financial performance within the backdrop of the changing economic and business landscape referred to as the ‘New normal’. The paper has a specific research agenda aimed at understanding the role of specific traits, including digital financial literacy, financial competency, and financial skill, in shaping financial decision-making and performance. It is justified due to the rapidly changing financial landscape brought by the penetration of mobile phones and the reduced digital divide (GEM, 2022; Islam & Muzi, Citation2022; Mossie, Citation2023). It explores how adapting to digital financial tools and developing financial competencies and skills impact women entrepreneurs in this new economic context, particularly beyond the post-pandemic. These factors are interrelated (Burchi et al., Citation2021; Cole et al., Citation2009; Ruiz-Dotras & Lladós-Masllorens, Citation2022) and collectively contribute to improving financial decision-making (Raghuvanshi et al., Citation2017; Rapp et al., Citation2018; Ravikumar et al., Citation2022) and ultimately impact the financial performance of women -owned enterprises (Anwar et al., Citation2020; Shkodra et al., Citation2021; Sui et al., Citation2022) in the evolving financial landscape.

In today’s digital age, the penetration of mobile phones, digital technologies, and online platforms has resulted in a reduction in the digital divide that transformed the business landscape in India (LEAD, Citation2020). Entrepreneurial digital financial literacy is crucial as it equips women entrepreneurs with the knowledge and skills needed to navigate the digital financial landscape (Asif et al., Citation2023; Chen et al., Citation2023; Islam & Muzi, Citation2022). Mobile payment and internet connectivity became essential tools for financial transaction that enables digital payment and online transactions (Gao et al., Citation2023; Islam & Muzi, Citation2022; Kedir & Kouame, Citation2022; Mossie, Citation2023). Focusing on digital financial literacy enables women entrepreneurs to leverage the potential of digital tools to their advantage, allowing them to make informed financial decisions.

Financial competency is a fundamental element of any entrepreneur’s success (Ferreras-Garcia et al., Citation2021; Lavi & Yaniv, Citation2023). In the realm of women-led business in India, ensuring that entrepreneurs possess the required financial competency is vital for sustainable business operations (Agarwal et al., Citation2022; Krishna, Citation2003; Mokbel Al Koliby et al., Citation2022). The new normal perspective, with the increased reliance on digital financial tools, necessitates that women entrepreneurs are not only aware of these tools but are competent enough to use them effectively (Draksler & Širec, Citation2018). This competency directly impacts their financial decision-making, enabling them to confidently evaluate financial information and make informed financial decisions.

Building on financial competency, financial skill encompasses the proficiency to implement financial strategies and decisions effectively. In an economy driven by digital and mobile technologies, the ability to apply financial skills is crucial (Ravikumar et al., Citation2022; Struckell et al., Citation2022). Women entrepreneurs should possess the essential skills required for managing finance, making payments, accessing credit, analyzing market trends, and making prudent investments (Oggero et al., Citation2020; Ruiz-Dotras & Lladós-Masllorens, Citation2022). The new normal perspective underscores the importance of adaptability and agility in managing financial matters, and having financial skills will empower entrepreneurs to navigate the evolving financial landscape.

It examines financial skills like financial acumen, analytical skills, and budgeting to investigate the interplay in making a better financial decision. Prior studies have overlooked the explicit role of financial skills (Atkinson, Citation2017; Struckell et al., Citation2022) and digital financial literacy (Ji et al., Citation2021; Jiménez-Zarco et al., Citation2021) as determinants of financial decision-making. Numerous research studies have delved into financial decision-making (Baker et al., Citation2019) and financial performance (Oo et al., Citation2022); their results were inconclusive regarding the geographical scope and variables employed, displaying ambiguity (Esubalew & Raghurama, Citation2020). It motivates the empirical research to reveal the interplay of the entrepreneurs’ financial skills, digital financial knowledge, and financial competency, which consequently impact decision-making. Therefore, the study has three objectives; the first involves determining factors influencing financial decision-making. Secondly, understand how behavioral traits like digital financial knowledge, financial skill, and financial competency collectively affect the financial decision-making abilities of women entrepreneurs in India. Third, to explore to what extent financial decision-making mediates the associations between digital financial knowledge, financial competency, and financial skill with financial performance.

Drawing from the research analysis, the finding underscore the consistent role of entrepreneur financial decision-making (EFDM) as a predictor of the financial performance of women-owned enterprises. Furthermore, the mediation analysis revealed that an entrepreneur’s financial decision-making does not act as a mediating factor in the relationship between digital financial experience, financial competency, financial skill budgeting, and financial skill acumen with financial performance. However, the examination could witness a partial mediation of EFDM between entrepreneurial digital financial awareness, entrepreneur digital financial knowledge and financial skill analytical. It’s worth noting that all the financial behavior traits examined in the study were predictors of EFDM except entrepreneurial financial experience. The novel insight accounted from this research highlights that entrepreneurs have significantly low level of experience in utilize the digital platforms for payment, financing loans, and asset management.

The paper is structured as follows, with subsection: Section 2 gives the literature review discussing the behavioral traits that determine the financial decision-making of women-owned enterprises. It examines the literature, outlines the research framework, and presents hypotheses. Section 3 methodology outlines the study’s approaches, followed by the presentation and analysis of the results. The implications for theory and practice and recommendations are then provided. The paper concludes with a summary of the key findings in the final section.

2. Literature review

2.1. Entrepreneurs’ financial decision making

Over the past decade, there has been considerable focus on Entrepreneur Financial Decision Making (EFDM) and Enterprise Financial Performance (EFP) due to the inconsistency unveiled in the extended financial planning (De Simone et al., Citation2021; Panos & Wilson, Citation2020) and the financial sustainability of organizations (Anwar et al., Citation2020; Butticè et al., Citation2023). EFDM operates on the premise that entrepreneurs’ decisions depend upon the available alternatives and prefer those that lead to better financial performance (Lavi & Yaniv, Citation2023). It is believed to involve evaluating alternative costs and benefits, which include financial implications and associated elements (Kumar et al., Citation2023). Financial performance results from consistent financial behavior (Aljarodi et al., Citation2022), including financial literacy (Yue et al., Citation2022), financial competency (Lingappa et al., Citation2023), and financial skills (Miller & Le Breton-Miller, Citation2017) encompassing the domain knowledge to achieve sustainable entrepreneurial financial growth and objectives.

Evaluating business performance, particularly for small businesses, is complex and contentious due to the various performance elements involved (Lingappa et al., Citation2023; Sellappan & Shanmugam, Citation2023; Sui et al., Citation2022). Researchers advocate the exclusive reliance on financial metrics, while recent research underscores the importance of non-financial factors. Financial metrics are essential yet inadequately capture the overall organizational performance of small businesses. Financial performance metrics of small businesses fall short of providing an authentic and impartial representation of business outcomes (Sefiani & Bown, Citation2013). Hence, a self-reporting performance indicator essentially meets the requirement for measuring the performance of small businesses (Esubalew & Raghurama, Citation2020).

Moreover, small businesses often neglect to maintain their books of account, which complicates the task of collecting historical and unbiased data showcasing performance (Esubalew & Raghurama, Citation2020). Furthermore, obtaining accurately documented financial information is unlikely and preferable from the owner’s reporting perspective (Sefiani & Bown, Citation2013). Hence, this study gauges the performance by assessing their perceived financial performance on profits, turnover, and debt asset proportion. Evaluating financial performance, particularly small business, poses challenges and is controversial due to diverse performance characteristics. The concept of financial performance itself is still in its nascent stage. Notably, the achievement of women entrepreneurs triggers a social shift as they exhibit a significant drive toward addressing social concerns (Iram et al., Citation2021; Rosca et al., Citation2020).

Prior studies on financial performance are confined to predictors that can be categorized into financial behavior, situational, and psychosocial factors. Although existing studies reflect on the objective dimension of financial performance, they fail to evaluate the depth of entrepreneurial emotions and responses to financial situations. Studies on financial performance should encompass subjective attributes incorporating the perception of wealth maximization for achieving the future financial goal (Baker & Martin, Citation2011). More recently, emerged the concept of Perceived Financial Performance, a concept that lacks a widely agreed definition, encompasses the financial performance interplay by considering several factors, such as the potential for financial management, the stress associated with cash management, and anticipation of forthcoming financial stability (Netemeyer et al., Citation2018). On the other hand, the novelty lies in its consideration of the non-financial dimension, which is subjective, namely Enterprise Perceived Financial Performance (EPFP), as it ‘reflects the perceived assessment of the experience and quality of entrepreneurial finance without reference to the objective facts’ (OECD, 2020).

Moreover, entrepreneurs undergoing similar circumstances perceive financial performance differently, especially in assessing their capacity to effectively manage the accessible funds to meet their present and future requirements (Sui et al., Citation2022). ‘They also mention that Perceived Financial Performance reflects entrepreneurs’ comprehensive and subjective emotions about their financial position’ (Khan et al., Citation2022), stemming from their financial skills (Lingappa et al., Citation2023), financial acumen, financial literacy, and similar other characteristics (Burchi et al., Citation2021; Ruiz-Dotras & Lladós-Masllorens, Citation2022; Sara et al., Citation2023). This study centers on developing nations like India, making the EPFP a better fit due to the prevalence of micro and small sectors.

2.2. Entrepreneurs’ digital financial literacy

Digital Financial literacy encompasses a multi-dimensional perspective (Hasan et al., Citation2023), it is defined as ‘knowledge of digital financial products and services, awareness of digital financial risks and control, and awareness of rights and redress procedures’. It stems from the ‘Gain Goal Framework’ within the goal-framing theory. The theory emphasizes that attaining the goals (informed decisions and sustainable financial performance) requires enhancing resources (intangible resources like entrepreneur digital financial literacy [EDFL]) (Lindenberg & Steg, Citation2007; Serido et al., Citation2020). It suggests that entrepreneurs can strengthen their goals (financial performance) by employing diverse self-regulating behaviors. Moreover, the theory posits that entrepreneurs seek contradictory objectives, propelling them to engage in higher-order cognitive functioning (Lauto et al., Citation2022).

Furthermore, ‘the goals are grouped into goal frames, which subsequently govern decision-making action based on various frames such as hedonic, gain, and normative’. The ‘hedonic goal frame centers on experiencing immediate well-being, and the gain goal frame relates to making wise decisions that preserve resources and increase income’ (Lindenberg & Steg, Citation2007). ‘The normative goal frame pertains to heuristic behavior emerging from external factors’. Goal frames, however, are not necessarily exclusive, and this is the critical aspect of the theory that suggests that a goal frame’s potency is determined by how it interacts with an individual’s immediate objective resulting from unforeseen circumstances. For instance, a financially literate individual with a saving mentality (gain goal frame) might be involved in impulsive overspending or imprudent investment, influenced by impulsivity (hedonic goal frame). Thus, it’s essential to recognize the role of goal frames in decision-making resulting from a cumulative influence of external factors and an individual’s ability to regulate behavior (Serido et al., Citation2020).

The rise of fintech offerings has heightened the relevance of Digital Financial Literacy, as it revolutionized and streamlined the financial process (Chen et al., Citation2023; Luo et al., Citation2021; Yue et al., Citation2022). It offers efficient solutions for tasks like payments, lending, transactions, and risk management, which enhances operational efficiency, reduces cost, and provides access to innovative tools. Embracing fintech improves customer experiences, better financial decision-making, and increased competitiveness in the emerging business landscape (OECD, Citation2020). Three dimensions of digital literacy significantly influence online privacy-related action: ‘knowledge about internet technicalities, awareness of common institutional practices, and understanding of current privacy policy’ (Chen et al., Citation2023; Islam & Muzi, Citation2022; Sultan & Sultan, Citation2020). One stream of scholarly narration views the digital environment as a liberating setting for developing an entrepreneurial identity (Ji et al., Citation2021; Panos & Wilson, Citation2020; Sultan & Sultan, Citation2020). These digital spaces are ‘envisaged to be inclusive and neutral, which lessens the social hierarchies and promotes open communication in the form of synchronous and real-time interactions’ (Kelly & McAdam, Citation2023). Scholarly narratives rooted in post-feminism examine the alleged liberty and the potential for women’s success in digital entrepreneurship (Islam & Muzi, Citation2022).

However, Digital Financial Literacy is a nascent concept (Rahayu et al., Citation2022) that has delved into the determinants and their significance (Qiao et al., Citation2023), and less research explicitly investigated the interconnection between Digital Financial Literacy, Financial Decision Making, and Financial Performance. We propose that having Financial Skills, Financial Competency, and Digital financial literacy encourage entrepreneurs to improve their Financial Decision Making, which is economical, goal-oriented, and timely (Rapp et al., Citation2018), resulting in sustainable financial performance. Financial literacy encompasses knowledge of financial products and services, experience with these digital platforms, and a keen awareness of the associated risk (Oggero et al., Citation2020; Qiao et al., Citation2023; Ughetto et al., Citation2020). Hence, we argue that Digital Financial Literacy enables entrepreneurs with appropriate digital skills to maneuver through the digital financial domain, enabling them to make prudent financial choices and foster sustainable financial growth. Therefore, we suggest the following hypothesis:

Hypothesis (H1a):

Entrepreneur Digital financial awareness has a significant positive impact on Entrepreneur Financial Decision making.

Hypothesis (H1b):

Entrepreneur Digital financial experience has a significant positive impact on Entrepreneur Financial Decision making.

Hypothesis (H1c):

Entrepreneur Digital financial knowledge has a significant positive impact on Entrepreneur Financial Decision making.

2.3. Entrepreneurs’ financial competency

Financial competency encompasses a multifaceted, dynamic concept that enables one to comprehend financial knowledge, money management, forecasting, product and service selection, and remain informed (Kyndt & Baert, Citation2015). It is further defined ‘in terms of two dimensions: the ability to act (based on acquired knowledge) and the opportunity to act (Product accessibility, affordability, user-friendliness, reliability, and safety)’ (Fazal et al., Citation2022; Lavi & Yaniv, Citation2023). It encompasses ‘attitude and psychological attributes within the socioeconomic-cultural context, leading to the optimal management of financial resources and facilitating rational financial decisions, like planning and budgeting’ (Khurana & Lee, Citation2023; Man et al., Citation2002). Due to these choices, there is an enhancement in financial competency, subsequently leading to improved financial stability and financial performance (Silveyra et al., Citation2021). The notion finds its most robust foundation in the capability approach introduced in 1980s. Amartya Sen and Martha Nussbaum argued that the concept should not be seen as an individual trait isolated from the surrounding social and cultural context (Allmark & Machaczek, Citation2015; Kumar et al., Citation2023). Instead, ‘it should be perceived as a conversion element that transforms accessible resources (money) into valuable resources’ (Financial return) (Zayadin et al., Citation2023).

In the context of the Gain Goal frame within the framework of goal framing theory, it is proposed that individual perceive and process information (competency) related to a desired state (financial performance). According to this theory the desired goal (financial performance) direct people (entrepreneur) in terms of what they should focus on, how to evaluate situation and which behavior to cultivate (Lindenberg & Steg Citation2007). This influence is particularly strong on cognitive and motivational processes. The extent of engagement in this behavior determines the perceived material benefit and the outcome associated with such behavior. Numerous cognitive biases (Oo et al., Citation2022), including information overload, status quo bias, and loss aversion, hinder the transformation from adequate information into goal-oriented behavior.

Earlier studies extensively examined Financial Competency in relation to its influencing fact and its impact on entrepreneurial performance (Bagheri & Abbariki, Citation2017; Fazal et al., Citation2022; Hazlina Ahmad et al., Citation2010; Kyndt & Baert, Citation2015; Luo et al., Citation2021). Until now, studies have explicitly explored how entrepreneur financial competency (EFC) influences the relationship between EFDM and EFP. Hence, we frame our hypothesis as follows:

Hypothesis (H2):

Entrepreneur Financial Competency has a significant positive impact on Entrepreneur Financial Decision making.

2.4. Entrepreneurs financial skill

The shift toward digitalization assisted with technological advancement demands the necessity of acquiring specific abilities to make informed financial decisions (Ravikumar et al., Citation2022). According to the report by the OECD, ‘skills are essential for harnessing the advantage of the digital revolution, protecting against the potential skill in digital financial services, comprehending complex information, and making informed financial choices’ (OECD, Citation2017). It is argued that possessing financial skills and fundamental knowledge are requisites for appropriate financial management (Amatucci & Crawley, Citation2011; Valaskova et al., Citation2019). Precisely it refers to, ‘elevated levels of cognitive skills that are outcomes of rational financial decision-making, such as learning rate and reasoning ability, are directly linked to reduced financial errors, low payment default, and portfolio diversification’ (Cole & Shastry, Citation2009). This concept stems from the Self-efficacy the, wherein entrepreneurial cognitive capabilities and achievement significantly affect their confidence in their ability for sustainable financial growth (Bandura, Citation1977). The current study considers budgeting, financial acumen, and analytics as Financial Skills that impact effective decision-making. Regarding the assessed financial skill component, ‘financial analytical thinking involves recognizing patterns and inconsistencies’, and ‘the aptitude to effectively manage and allocate funds over a specified timeframe is called budgeting skill’ (Ahsan et al., Citation2022). Meanwhile, financial acumen ‘is the availability of financial skills to judge the financial implications of various financial decisions adopted’ (Pabelona, Citation2023). Having a stronger financial acumen is a vital precursor for achieving sustainable financial growth as it promotes financial stability through prudent decision-making (Fernandes et al., Citation2014). It is argued that possessing skills in analytical, budgeting, and financial acumen forms a foundation that enhances reasoning and the assurance to utilize digital financial tools (Amatucci & Crawley, Citation2011; Lingappa et al., Citation2023; Warmath & Zimmerman, Citation2019). Entrepreneurs are equipped with the necessary mathematical, critical, and analytical capabilities along with financial acumen to ‘comprehend, assess, apply, and compare online financial products and services in the complex financial landscape’ (Amatucci & Crawley, Citation2011).

Furthermore, ‘the cumulative impact of these skills subconsciously leads to entrepreneurial empowerment and optimism in financial decision-making’ (Daher et al., Citation2022; Polas et al., Citation2022). Nevertheless, extant research emphasizes financial literacy (Burchi et al., Citation2021; Lusardi, Citation2019) and underscores the interplay of budgeting, analytics, and financial acumen as a practical approach that establishes a platform for financial behavior. In response to this gap, we formulate the following hypothesis:

Hypothesis (H3a):

Entrepreneur Financial Analytical skill has a significant positive influence on financial decision-making.

Hypothesis (H3b):

Entrepreneur Financial budgeting skill has a significant positive influence on financial decision-making.

Hypothesis (H3c):

Entrepreneur Financial Acumen skill has a significant positive influence on financial decision-making.

Examining the impact of financial competency and other influencing financial behavioral factors related to financing entrepreneurial endeavors necessitates an investigation into its effect on the overall financial performance of the enterprise. Therefore, we hypothesize that:

Hypothesis (H4):

Entrepreneur Financial decision-making has a significant positive impact on financial performance.

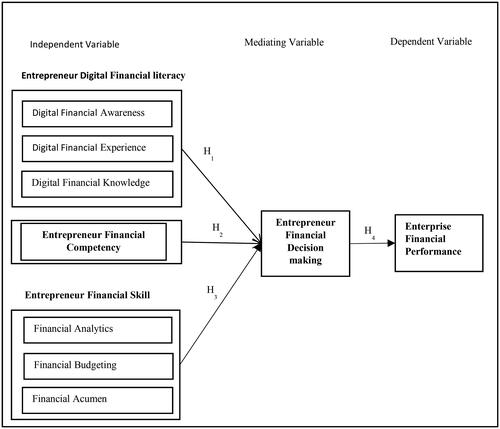

Based on the discussion, the Conceptual framework is proposed in .

3. Methodology

3.1. Questionnaire design and measure

This study adopts a pragmatic research philosophy by employing quantitative methods to gather primary data. The survey form has three sessions-; first part consists of the entrepreneurial profile and enterprise profile of the participants. The second part gathered information on the behavioral traits, the level of financial decision-making (FDM) ability, and financial performance. shows the measurement scale and items utilized in the study to assess the underlined components. The research incorporated and adapted elements from previous relevant studies, where all items centered on the perception of women entrepreneurs in India. The items of EDFL were adapted from (Morgan et al., Citation2019), and those for EFP were derived from (OECD, Citation2020). The items for EFDM were modified and adapted from (Sanz de Acedo Lizarraga et al., 2019). Finally, the items of entrepreneur financial skill (EFS) were referred from Warmath and Zimmerman (Citation2019). The responses toward the item of the second part of the instrument were captured using a five-point Likert scale, ranging from 1–5 (strongly disagree–strongly agree). illustrates the five-point scale with mean range and verbal interpretation for each point utilized in this study. The demographic profiles were gathered using the categorical scale recommended in the OECD framework. The criterion variable EFP was initially assessed on a categorical scale (Increase, stable, and decrease), and subsequently, it was condensed into a single factor through factor reduction in SPSS (OECD, Citation2020). We have used the SPSS 23.0 statistical package software to analyze the data of our research and we have obtained a copyright license of this SPSS 23statistical software. The five-point scale, its verbal interpretation, and the mean range utilized in this study are shown in . Since the scale in the model was modified, we conducted a pilot test with a sample of 50 respondents to evaluate the face validity and content validity. The Cronbach’s alpha values surpass the 0.75 threshold limit, signifying that the questionnaire exhibits strong construct reliability. Appendix A provides the list of the items.

Table 1. Five-point scale, mean range, and its verbal interpretation .

Table 2. Level of financial decision-making of women entrepreneur.

Table 3. Validity and reliability of the item.

3.2. Sampling and data collection

The data were collected by adopting a cross-sectional survey of 223 Indian women entrepreneurs from various sectors and regions who have accounts on the LinkedIn professional social platform (Särndal et al., Citation2003). Data were collected between November 2022 and April 2023. The LinkedIn contacts were identified through the keywords ‘entrepreneur’, ‘owner’, and ‘she/her’. They were mailed 100 weekly requests with a message for participating in the survey and the structured questionnaire link. Participation in the study was voluntary, and their privacy and data confidentiality were rigorously maintained for academic purposes. We obtained the consent of the participants and were informed about their right to withdraw at any time. provides an overview of the demographic characteristics of women entrepreneurs. Leveraging LinkedIn was justified as it offers direct access to entrepreneurs with rich demographic profiles and with ethical consideration for their voluntary participation.

Table 4. Demographic characteristics.

In addition, the study ensured the heterogeneity of the population consciously. The sample size was ascertained using the Slovin statistics calculator; a minimum sample size of 210 was computed with 5% significance. The Solving formula is considered when the population is known, significant, or nearly estimated. Finally, regarding the contingency associated with the primary study, the researcher collected 223 questionnaires and used them in the analysis.

shows the EFDM ability of women entrepreneurs and its influential behavioral traits: EDFL, EFC, and EFS. It was demonstrated that entrepreneurial financial skill_Aumen (EFS_ac) (M = 3.90) has the highest mean rating, while entrepreneurial digital financial awareness (EDFe) (M = 3.47) has the lowest mean rating among all the behavioral traits considered. The surveyed women entrepreneurs also agreed on the items of EFC (M = 3.57), entrepreneurial financial skill_analytical (EFS_a) (M = 3.83), and entrepreneurial financial skill_ budgeting (EFS_b) (M = 3.78). They also reported that they slightly agree on their entrepreneurial digital financial awareness (M = 3.47) and agree (M = 3.57) on their entrepreneurial digital financial knowledge that determines entrepreneurial digital financial literacy that influences decision-making.

The theoretical model with a higher-order construct was assessed to test the validity of the scale used in the study. To determine the validity of the item, PCA (principal component analysis), with a minimum threshold of .50, was used. Item reliability was evaluated using Cronbach alpha value (α). demonstrated both validity and reliability with the standard threshold ≥ 0.70. The study demonstrated effective discriminant validity. Furthermore, the Average Variance Extracted value (AVE) exceeded the squared inter-construct correlations criteria (Fornell & Larcker, Citation1981). Moreover, the values of all constructs exceeded 0.5. The result demonstrated that the study successfully attained convergent validity, as all standardized factor loading fell within the range of .50 and .95 (Hair et al., Citation2016).

4. Analysis and results

4.1. Descriptive statistics

Descriptive statistics for the three behavioral traits examined in the study and the mediator variable entrepreneurs’ financial decision-making that underpin the research are displayed in . The statistical tools employed include frequency counts, percentages, and means to provide demographic characteristics. Three steps of Hierarchical regression analysis were used to understand the individual and the combined effect of behavioral traits on decision-making. The study considers the EFDL, EFC, and EFS impact on Enterprise Financial Performance (EFP) when influenced by EFDM ability in the new normal using Hayes Process v4.2 macro (SPSS) by Andrew F Hayes for mediation.

4.2. Entrepreneur profile

The Results presented in show the demographic characteristics of the respondents associated with both their enterprise profile and entrepreneur profile. The composition of entrepreneurs is as follows: 58% are sole proprietors, 20% are firm partners, 12% operate the business under the co-operative model, and 11% own limited liability partnerships. Of these enterprises, 31% have no employees; they are either sole proprietors or limited liability companies; 57% have 2–9 employees, 4.9% have 10–20 employees, and 6.7% have more than 20 employees. Regarding registration, 67% have undergone statutory registration under a statute and are liable to tax, thus contributing to the nation’s overall income, while the remaining 33% remain unregistered. According to the sectoral breakdown provided in the OECD (2020) report, out of 10 sectors, less than 0.4% belong to agriculture, forestry, and fishing, while 5.8% belong to the manufacturing sector. Additionally, 1.3% of the construction and real estate sectors and 5.4% are associated with accommodation, food, and beverage services. The majority, constituting 67%, fall within the personal services category (Education, Health, Beauty, Repairs, laundry). Furthermore, 3.1% of the sectors are related to information and communication, and 7.6% are connected to business services such as legal, accounting, advertising, and cleaning. As per the MSME classification, all women entrepreneurs reported falling within the micro sector category, with investments less than one crore and turnover below five crores. Among the respondents, 4.48% were engaged in exporting their products, predominantly handicrafts, while 95.5% did not engage in exporting.

The entrepreneur’s demographic profile is as follows: 46% of the respondents fall between the 18–35 age bracket, 38% were in the 35–50 range, and 16% were aged 50 and above. Concerning their educational background, 40% hold graduation degrees, while 60% have completed postgraduate studies. Out of the total, 41% received commerce education, while the remaining 59% did not. In terms of entrepreneurial experience, 19% had less than 1 year of experience, 27% had between 1 and 2 years of experience, 32% had between 2 and 5 years of experience,13% had between 5 and 10 years of experience, and 9.4% had more than 10 years of experience.

4.3. The impact of behavioral traits on financial decision-making

The significant behavioral traits that determine financial decision-making in the new normal were identified as EFDL, EFC, and EFS. The latent variable EFDL was measured using the observed variable Entrepreneurs Digital Financial Awareness (EDFa), Entrepreneurs’ Digital financial experience (EDFe), and Entrepreneurs Digital financial knowledge (EDFk). The result depicted in shows that Entrepreneurs Digital Financial Awareness (EDFa) (β = 0.34; p < .05) and Entrepreneurs Digital financial knowledge (EDFk) (β = 0.50; p < .05) positively impacted EFDM. Contrary to our expectations, Entrepreneurs Digital’s financial experience (EDFe) did not impact FDM; hence, we rejected H1b.

Table 5. Hypothesis testing.

However, EFC significantly predicted FDM (β = 0.92; p < .05), thus supporting H2. Finally, the variable EFS was measured using the observed variable Entrepreneurs’ Financial Skill_analytics (EFS_a), Entrepreneurs’ financial Skill_budgeting (EFS_b), and Entrepreneurs’ financial Skill_Acumen (EFS_ac). EFS_a (β = 0.36; p < .05), EFS_b (β = 0.38; p < .05) and EFS_ac (β = 0.27; p < .05) positively impacted EFDM thus supporting H3a, H3b, H3c. In addition, EFDM (β = 0.62; p < .05) positively predicted financial performance.

4.4. Combined impact of the behavioral trait in financial decision-making

The results of the three-step Hierarchical Multiple Regression analysis are shown in . The first step of hierarchical regression analysis disclosed that the behavioral traits that determine EFDM, EFDL in terms of EDFa (beta =.298) and EDFk (beta =.463) were found to be significant predictors of financial decision making, except EDFe (beta =.131). In model 1, the determinants explained 73% (R2 =0.73) of the variance in the EFDM outcome variable.

Table 6. Hierarchical regression of the level of financial decision-making of women entrepreneurs depending upon the influential factors EDFL, EFC, EFS .

The second step of the analysis revealed that EFC (beta=.640) is a significant predictor of financial decision-making along with EFDL. EFC and EFDL explained EFDM by 90% (R2 = .90). The additional 16.2% (R Square Change) change in the variance is due to the presence of financial competency in the model and is a significant contribution (F (1,218) = 335.96). The last step of the analysis showed that Entrepreneur Financial Skill_analytics (EFS_A) (beta = .241) and Entrepreneur Financial Skill_budgeting (EFS_b) (beta =.257) were significant enough to predict the entrepreneurial ability for financial decision-making along with EFC and EDFL. It is essential to know that Entrepreneur Financial Skill-acumen (EFS_ac) (beta = −.025) is not a significant predictor of EFDM. EFDL, EFC, and EFS explained EFDM by 95% (R2 = .95). The additional 6.1% (R Square Change) change in the variance is due to the presence of EFS in the model and is a significant contribution.

4.5. The associations between behavioral traits and financial performance with the mediating effect

The mediation analysis consists of a DE (direct effect, (c’)), representing a direct relationship between an independent and dependent variable when a mediator is present. The IE (indirect effect, (a*b)) signifies the relationship that flows from an independent variable to a mediator and subsequently to a dependent variable (a*b)). Finally, the TE (total effect (c = c’ + a*b)) encompasses the cumulative impact of the direct effect between two constructs and the indirect effect that passes through the mediator.

The study uses the IBM SPSS-Process v4.2 by Andrew F. Hayes for mediation analysis. Mediation analysis is significant if its indirect effect is significant. The results shown in indicate that the indirect effect of EFDM impact on the relationship between Entrepreneur Digital Financial Awareness (EDFa) (β = 0.07, t = 1.977) and Enterprise Financial Performance (EFP) is significant. The DE (β = 0.28) and the TE (β = 0.35) are also significant at t = 1.977, p < .05. Hence, EFDM partially mediates the relationship between EDFa and EFP and is a complimentary mediation. The indirect effect of EFDM on EDFe and EFP is insignificant; therefore, H3d is rejected. In contrast, the EFDM partially mediates the impact of EDFk on EFP, with an indirect effect (β = 0.93, t = 2.643, p < .05). Given the TE (β = 0.44) and DE (β = 0.44,) and are significant.

Table 7. Hypothesis test result for mediation analysis.

It is revealed that the indirect effect of EFDM on EFC and EFP is insignificant; hence, H2a is rejected. The study assessed the mediating role of EFDM on the relationship between Entrepreneur Financial Skill_analytics (EFS_a) and EFP. The result revealed a partial mediation at indirect effect (β = 0.05, t = 2.867, p < .05) and with TE (β = 0.52), DE (β = 0.44). In addition, there is no mediation effect of EFDM on EFS_b and EFS_ac on EFP, respectively.

5. Discussion and implication

Scholarly narration over the past decade has gained attention over the key drivers of EFDM (Iram et al., Citation2021; Lavi & Yaniv, Citation2023; Rapp et al., Citation2018) and EFP (Anwar et al., Citation2020; Harpriya et al., Citation2022; Niu et al., Citation2020; Tuffour et al., Citation2022). However, the scholarly findings are ambiguous (Cullen, Citation2019; Tajeddini et al., Citation2021). The study explores the impact of financial behavioral traits that impact entrepreneurial financial decision-making considering factors like EDFL, EFS, and EFC.

The test result from exhibits that the hypothesis test (H1a–H1c) investigated the direct effect of EDFL on EFDM and were consistent except for H1b. Hypothesis H1aindicate that women entrepreneur digital financial awareness positively impacts enterprise financial decision making (EDFM), and it partially mediates its relationship with financial performance. Despite the low mean of digital awareness, the positive relationship indicate that limited digital awareness are still able to leverage their existing digital financial knowledge and experience to make informed financial decisions and engage with digital financial tools, albeit to a lesser extent. There may be pockets of effective utilization of digital financial resources among certain entrepreneurs, potentially due to factors such as proactive learning (Goyal & Kumar, Citation2021), peer influence (van Rooij et al., Citation2011) or specific needs that drive engagement with these. The findings align with the prior research which has considered the financial literacy of entrepreneurs that tends to make informed financial decisions (Iram et al., Citation2021; Munyuki & Jonah, Citation2022). However our study uniquely explores the influence of digital financial literacy which was not extensively examined in previous studies. Due to the potency of digital platforms and the awareness initiated by government bodies, the benefits and challenges have been disseminated adequately at the entrepreneurial level, surpassing the typical level of awareness in the entrepreneurial context (Abdelwahed et al., Citation2022; Rajan Chauhan & Kaur Dhami, Citation2021; Tuffour et al., Citation2022). The women entrepreneurs were asked about their awareness regarding the legality of the fintech provider, interest rate, and transaction fee.

Even though the considered women entrepreneur have an average digital awareness, they possess the necessary digital financial knowledge and are aware of comprehending digital financial products and services that enable them to make informed Entrepreneurial decisions (Gajendra Naidu, Citation2017; Hussain et al., Citation2018; Rai et al., Citation2019). Still, the study found that they lack digital financial experience. Hypothesis H1b is postulated as women entrepreneur digital financial experience positively impact enterprise financial decision making, although this assertion cannot be substantiated. Digital financial experience challenges the financial experience exploration in prior studies. Past studies have evidence of financial experience with significant impact on informed financial decision and its impact on financial performance (Kyrgidou et al., Citation2021; Taylan et al., Citation2022; Vershinina et al., Citation2020). Increased financial experience results in development of financial skills and knowledge (Burchi et al., Citation2021). Overtime experienced entrepreneurs attain the proficiency in assessing and managing financial risk (Razen et al., Citation2021; Ruiz-Dotras & Lladós-Masllorens, Citation2022; Sulistianingsih & Santi, Citation2023), identifying opportunity (Abdelwahed et al., Citation2022; Mishra & Zachary, Citation2014), long term planning, resource allocation building credit and trust (Caracota et al., Citation2010; Chundakkadan & Sasidharan, Citation2021; Xiu et al., Citation2023) which enables in making prudent decision and achieving sustainable financial growth. Astonishingly, women entrepreneurs have less experience using various digital financial platforms, like using digital payments for their business transactions, and less experience in digitally financing loans and asset management.

The negative effect on financial performance among women entrepreneurs may not solely stem from limited digital financial experience but could also arise due to a lack of diversity in their overall financial experience. This findings depicts the Digital financial gap in India despite the surge of fintech worldwide, where India occupies a prominent lead and are in consistent with past literature (Asif et al., Citation2023; Ji et al., Citation2021; Morgan et al., Citation2019; Yue et al., Citation2022).

The hypothesis H1c, suggest that women entrepreneur’s digital financial knowledge has a positive influence on enterprise financial decision-making, has been validated. This is in consistence with past studies that suggest financial knowledge is a vital element of financial literacy and holds significance at all levels in influencing financial decision-making (Asaad, Citation2015; Hussain et al., Citation2018; Rink et al., Citation2021). Prior studies have reported an equivalent, but average level of digital financial knowledge is possessed by women entrepreneurs, supporting the above finding (Agusti & Rahman, Citation2023; Chen et al., Citation2023; Jha & Alam, Citation2022; Munyuki & Jonah, Citation2022). They are aware of the digital payment products, digital asset management products, digital alternatives, digital insurance, and customer rights and protection. Digital financial literacy additionally guarantees financial robustness and financial decision making by facilitating mainstream financial services for underserved minorities, creating opportunities for credit and savings combined with proficiency in financial skill and financial competency (Anwar et al., Citation2020; Jha & Alam, Citation2022; Munyuki & Jonah, Citation2022).

The comparison shows that digital financial knowledge is high compared to digital financial experience and digital financial awareness, it necessarily means that knowledge has not translated into awareness or experience. The relationship between the factors can be more complex. The goal framing theory suggests that entrepreneurs may have different frames or perspectives through which they view or act on financial information (Lindenberg & Steg, Citation2007; Serido et al., Citation2020). Delving deeper into the complex components and how they relate to each other, digital financial knowledge is the foundation in financial decision making (Chen et al., Citation2023; Jha & Alam, Citation2022; Resmi et al., Citation2019). While digital financial awareness that is the realization and recognition of digital financial options and their potential benefits and risk often depend on knowledge (Abdelwahed et al., Citation2022; Rajan Chauhan & Kaur Dhami, Citation2021; Tuffour et al., Citation2022). However, it’s possible for someone to be less aware of its potential despite having in-depth knowledge (Ismail, Citation2014; Jha et al., Citation2018). For example, they may know that mobile banking exists but have no understanding of all its features. Reflecting on the digital financial experience, the practical use of digital financial tools and services are result of both knowledge and awareness but not solely determined by knowledge and awareness, but rather it is a product of both (Choudhary & Kamboj, Citation2017; Morgan et al., Citation2019; OECD, 2022). People may adopt digital financial tools for a range of reasons, but based upon their convenience or necessity, even if they have knowledge (Islam & Muzi, Citation2022; Panos & Wilson, Citation2020; Ughetto et al., Citation2020). Knowledge might restrict the effectiveness of awareness and experience, but they are not necessarily interdependent (Hussain et al., Citation2018; Rink et al., Citation2021). It is crucial to consider other factors like access to resources, socio-economic status, and individual motivations, as these variables can influence complex interactions (Cullen, Citation2019; Jha & Alam, Citation2022; Khawar & Sarwar, Citation2021).

In the context of goal framing theory, entrepreneurs often approach financial decisions with different cognitive frames. The goal framework typically focuses on achieving favorable results and optimizing benefit. Given the positive correlation between digital financial awareness and financial decision making, it implies that women owned enterprise in India who are more aware of digital financial tools and resources are more inclined to formulate their financial goal (objective) in the terms of gain (Profit). They are motivated to learn about and leverage digital financial options in pursuit of enhancing their financial wellbeing, potentially aiming to increase profits, cost savings or improved financial stability (Alshebami & Alzain, Citation2022; Mishra & Zachary, Citation2014; Romano et al., Citation2001). While using this framework to examine the negative relationship between digital financial experience and financial decision making is interesting. It implies that women entrepreneurs may not be strongly motivated to prioritize gain-oriented financial goal (profit) solely based on the practical experience with digital financial tools (Danes & Haberman, Citation2007; Khan et al., Citation2022; Romano et al., Citation2001). This might result from a range of factors including limited awareness of the potential benefit of such experiences or a lack of trust in digital financial tool (Asif et al., Citation2023). This explicitly demonstrate the digital gender divide (Adikaram & Razik, Citation2022; Cowling et al., Citation2020), and the failure to translate knowledge into practical experience, primarily rooting on the socio-cultural factors.

Reflecting on the gain goal framework within the scope of the study, it is evident that factors like digital financial awareness and knowledge have a substantial impact on the financial decision-making process as well as shaping women-owned entrepreneur’s financial behavior. Entrepreneurs with a deeper understanding and knowledge of digital financial tools are more inclined to make financial decisions with the goal of attaining positive outcome and maximizing gain (Serido et al., Citation2020). To fully embrace gain goal frame, women entrepreneurs may need not only experience but also expand their awareness and knowledge to recognize the potential gains through the digital financial literacy (Angeles, Citation2022).

Competency It highlights the exemplary influence of competency, which underscores the financial competency building and skills, which act as a prerequisite for effective financial resource management, enabling optimal financial decisions. Stemming on the gain goal frame it directs entrepreneurs to evaluate what competency to be developed. Furthermore, the findings imply that digital financial literacy strengthens financial competencies, enabling entrepreneurs to be aware of the various reliable digital financial platforms that are both accessible and affordable, thereby enhancing sustainable financial performance. Regarding the positive relationship between the components of financial skills and entrepreneurial financial decision-making, the outcome is consistent with the self-efficacy theory (Adebusuyi et al., Citation2022; Bandura, Citation1977; Uddin et al., Citation2022). The finding implies that entrepreneurs make informed financial decisions by employing financial management and analytical techniques. The rationale provided by Cole and Shastry (Citation2009) justifies the results, suggesting that entrepreneurs with domain knowledge of financial skills reduce financial errors and mitigate loan defaults, reflected in informed decision-making and sustainable financial performance.

5.1. Hierarchical regression

The study finds an insignificant mediation between EFDM on EFC and EFP, but the direct association of EFC on EFDM is positively significant. The findings indicate that an entrepreneur’s knowledge and attitude toward Entrepreneurial financial decision-making reduces behavioral bias and financial risk, ultimately guiding them toward rational, profitable, and informed decision-making. These findings align with the goal-framing theory that financial competency is significant in making better financial decisions. Although the study explores the insignificant mediating pathway, the outcome aligns with a hypothesized positive relationship of the prior observations (Esubalew & Raghurama, Citation2020; Yang et al., Citation2022).

In summary, prompt, and logical financial decision leads to sustainable financial performance, which is not a possibility but a reality that can be facilitated by improving their financial cognition. In today’s digital era, with the myriad of financial opportunities, entrepreneurs must be competent enough to harness the opportunity. The critical solution is timely access to financial advice from experts, investigating roadblocks to financial access, comprehensive financial planning that outlines short-term and long-term goals, cash flow management, risk assessment of financial choices, regulatory changes, and technological advancement in relation to the business financial landscape. Networking and collaboration with experts in exchange for insight and experience related to financial decision–making. Considering the long-term implications of financial decisions, is essential, especially concerning technological adoption. Despite the promising interventions and approaches, the comprehensive understanding of the situation remains incomplete due to the interplay of the complex nature of socio-cultural norms, political and economic instability, risk perception, personal financial beliefs, and cognitive biases.

6. Conclusion

In an era marked by unprecedented challenges and transformations, unraveling the interplay of financial behavioral traits and the financial performance of women-owned enterprises in India is paramount. The study aims to shed light on the direct and mediating influence of diverse financial behavior traits on financial decision-making and financial performance within women-owned enterprises, recognizing the rationale that they collectively contribute to the effective acquisition, management, and investment of financial resources. Responses from 223 women entrepreneurs surveyed are analyzed using IBM -SPSS. Our result reveals that entrepreneurial financial decision-making ability is significantly influenced by entrepreneurs ‘digital financial awareness, digital financial knowledge, financial competency, and financial skills. Financial skills include analytical skills, budgeting skills, and acumen. When examined as a direct or mediating factor, an entrepreneur’s digital financial experience does not significantly affect financial decision-making ability. However, when digital financial awareness, digital financial knowledge, and financial analytic skills are associated with financial performance, financial decision-making as a mediator partially mediates.

The research significantly contributes to advancing behavioral finance research in multiple dimensions. Prospective scholars will find this distinct endeavor offering the nexus among digital financial literacy, financial competency and financial skill, financial decision-making, and financial performance. The investigation substantiates the study underpinned by relevant theories (goal framing theory and self-efficacy theory) and contemporary literature, reflecting the current discourse on the concept. For educators, policymakers, and professionals, this interplay enhances insights into entrepreneurial and critical thinking, enabling them to confront environmental challenges and navigate socio-economic pressure effectively. It also underscores the significance of translating these benefits into gender-specific policies. For countries undergoing swift automation and digitalization, the capacity of digital financial literacy to explain the financial decision-making process undeniably contributes to fostering digital financial inclusion. Policymakers can foster private-public partnerships, ensuring widespread access to affordable programs that help them navigate unfamiliar digital platforms and fintech products, considering the associated benefits and risks.

Policymakers should monitor and evaluate these programs to determine the impact, degree of penetration, acceptance, and inclusivity these initiatives achieve. The study’s findings highlight the necessity for entrepreneurs to strengthen their financial competency to seamlessly acquire digital financial literacy to enhance their financial skill that facilitates financial decision-making. The study offers a promising avenue for the entrepreneur to comprehend the nexus between financial behavioral traits and financial decision-making in the new normal perspective.

6.1. Limitation and future research scope

Although the paper is distinctive with theoretical underpinning and the examination of the unique mediator and construct, financial decision-making, it is essential to acknowledge that it is not free of limitation. Based on the analysis and the findings, it is evident that there is no favorable correlation between digital financial experience and entrepreneurial financial decision-making. However, it does hint at the potential for a lower level of digital financial experience among female entrepreneurs in India. Several factors may contribute to this situation, including limited access to digital financial services, insufficient training or exposure to digital financial tools, and other unique barriers faced by women-owned enterprises in India. To delve deeper into this issue and uncovering the underlying causes of the limited digital financial experience, extend the scope for future research. A low level of knowledge could limit the effectiveness of awareness and experience, but they are not necessarily interdependent. It’s crucial to consider other factors like access to resources, socio-economic status, and individual motivations, which can affect how these elements interact. The paper should delve deeper into these relationships and provide a nuanced analysis to draw meaningful conclusions.

Conducting qualitative research methods, such as interviews and focus groups, to gain insight into the unique challenges and barriers that women entrepreneurs face in gaining digital financial literacy can be further explored. This endeavor reveals the fundamental factors contributing to the deficiency in digital financial literacy within the socio-cultural context. Exploring the impact of digital financial training programs tailored for female entrepreneurs by evaluating their potential to improve digital financial proficiency and subsequently influence their financial decision-making is a promising avenue for further research. Investigating the direct impact of financial literacy on the financial performance of women-owned enterprises and how it compares to the impact of other financial behavior traits can be further explored. The data acquisition from the LinkedIn platform posed challenges, resulting in a low response rate despite the direct access to potential respondents, thus containing our sampling efforts.

To maintain focus and clarity, the study limits the scope to a few factors that allow for a more in-depth analysis of those traits. Including a wide range of demographic profiles in the analysis increases the study’s complexity and potentially dilutes the findings. Exclusion of other potential factors, including entrepreneurial experience, age, education, access to capital, market condition, sociocultural factors, network and support systems, business type and industry, economic policy and regulation, family, and market dynamics, etc., don’t necessarily imply their lack of relevance or significance. These factors interact and influence financial behavior traits, benefiting a broader analysis. The study considers a few of the variables as exogenous variables. Future research endeavors may undertake cross-country studies and extend their investigation into emerging markets to reveal the variation influenced by regional dimensions. This research opens the realm of opportunities for further Cross-Cultural Comparative Analysis, Longitudinal Studies, Financial Inclusion Initiatives, and Policy and Regulatory Factors. Future studies may incorporate the multidimensional factors that unravel financial decision-making, contributing to the ever-expanding field of behavioral finance.

Ethical approval

The research received approval for ethical clearance, granted by the KMC &KH Institutional Ethics Committee (IEC: 882/2021). Participants were informed regarding the research purpose and voluntary participation. The data confidentiality and anonymity are maintained throughout.

Author contributions

Conception and design of the work: Serin Peter and Dr. Geetha E

Collected the data: Serin Peter and Anju Gupta

Contributed analysis tool: Dr. Geetha E, Anju Gupta, and Serin Peter

Performed the analysis: Serin Peter and Anju Gupta

Drafted the paper: Serin Peter and Anju Gupta

Reviewing the article for final approval: Dr. Geetha E, Anju Gupta, and Serin Peter

Disclosure statement

No potential conflict of interest was reported by the author(s).

Data availability statement

Available upon request through an email to the corresponding author.

Additional information

Funding

Notes on contributors

Serin Peter

Serin Peter, a research scholar at the Department of Commerce, Manipal Academy of Higher Education in Manipal, specializes in Business Finance with a current research emphasis on Women Entrepreneurship, Digital Finance, and Sustainability.

Geetha E

Dr. Geetha E, an Associate Professor at the Department of Commerce, Manipal Academy of Higher Education (MAHE) in Karnataka, India, conducts research in developmental economics, E-commerce, Innovative Business strategies, Entrepreneurship, Business Finance, Corporate governance, and Banking, with publications in Scopus and ABDC-listed journals.

Anju Gupta

Anju Gupta, also a research scholar at the Department of Commerce, Manipal Academy of Higher Education in Manipal, focuses on Behavioral Finance and Economics, with her current research directed towards Entrepreneurship, Behavioral Finance, financial literacy, and financial well-being.

References

- Abad-Segura, E., de la Fuente, A. B., González-Zamar, M. D., & Belmonte-Ureña, L. J. (2020). Effects of circular economy policies on the environment and sustainable growth: Worldwide research. Sustainability, 12(14), 1. https://doi.org/10.3390/su12145792

- Abdelwahed, N. A. A., Bastian, B. L., & Wood, B. P. (2022). Women, entrepreneurship, and sustainability: The case of Saudi Arabia. Sustainability, 14(18), 11314. https://doi.org/10.3390/su141811314

- Adebusuyi, A. S., Adebusuyi, O. F., & Kolade, O. (2022). Development and validation of sources of entrepreneurial self-efficacy and outcome expectations: A social cognitive career theory perspective. The International Journal of Management Education, 20(2), 100572. https://doi.org/10.1016/j.ijme.2021.100572

- Adikaram, A. S., & Razik, R. (2022). Femininity penalty: Challenges and barriers faced by STEM woman entrepreneurs in an emerging economy. Journal of Entrepreneurship in Emerging Economies, 15(5), 1113–25. https://doi.org/10.1108/JEEE-07-2021-0278

- Aernoudt, R., & de San José, A. (2020). A gender financing gap: Fake news or evidence? Venture Capital, 22(2), 127–134. https://doi.org/10.1080/13691066.2020.1747692

- Agarwal, S., Ramadani, V., Dana, L. P., Agrawal, V., & Dixit, J. K. (2022). Assessment of the significance of factors affecting the growth of women entrepreneurs: Study based on experience categorization. Journal of Entrepreneurship in Emerging Economies, 14(1), 111–136. https://doi.org/10.1108/JEEE-08-2020-0313

- Agusti, R. R., & Rahman, A. F. (2023). Determinants of tax attitude in small and medium enterprises: Evidence from Indonesia. Cogent Business & Management, 10(1), 1–15. https://doi.org/10.1080/23311975.2022.2160585

- Ahlstrom, D., Arregle, J. L., Hitt, M. A., Qian, G., Ma, X., & Faems, D. (2020). Managing technological, sociopolitical, and institutional change in the new normal. Journal of Management Studies, 57(3), 411–437. https://doi.org/10.1111/joms.12569

- Ahsan, T., Al-Gamrh, B., & Mirza, S. S. (2022). Economic policy uncertainty and sustainable financial growth: Does business strategy matter? Finance Research Letters, 46(August), 102381. https://doi.org/10.1016/j.frl.2021.102381

- Aljarodi, A., Thatchenkery, T., & Urbano, D. (2022). The influence of institutions on early-stage entrepreneurial activity: A comparison between men and women in Saudi Arabia. Journal of Entrepreneurship in Emerging Economies, 15(5), 1028–1049. https://doi.org/10.1108/JEEE-02-2021-0076

- Allmark, P., & Machaczek, K. (2015). Financial capability, health, and disability. BMC Public Health, 15(1), 243. https://doi.org/10.1186/s12889-015-1589-5

- Alshebami, A. S., & Alzain, E. (2022). Toward an ecosystem framework for advancing women’s entrepreneurship in Yemen. Frontiers in Education, 7(April), 887726. Frontiers Media. https://doi.org/10.3389/feduc.2022.887726

- Amatucci, F. M., & Crawley, D. C. (2011). Financial self-efficacy among women entrepreneurs. International Journal of Gender and Entrepreneurship, 3(1), 23–37. https://doi.org/10.1108/17566261111114962

- Angeles*, I. (2022). The moderating effect of digital and financial literacy on the digital financial services and financial behavior of MSMEs. Review of Economics and Finance, 20, 505–515. https://doi.org/10.55365/1923.x2022.20.57

- Anwar, M., Tajeddini, K., & Ullah, R. (2020). Entrepreneurial finance and new venture success-The moderating role of government support. Business Strategy & Development, 3(4), 408–421. https://doi.org/10.1002/bsd2.105

- Asif, M., Khan, M. N., Tiwari, S., Wani, S. K., & Alam, F. (2023). The impact of FinTech and digital financial services on financial inclusion in India. Journal of Risk and Financial Management, 16(2), 122. MDPI. https://doi.org/10.3390/jrfm16020122

- Asaad, C. T. (2015). Financial literacy and financial behavior: Assessing knowledge and confidence. Financial Services Review, 24, 101–117.

- Atkinson, A. (2017). Financial education for MSMEs and potential entrepreneurs. OECD, 43, 75. https://doi.org/10.1787/bb2cd70c-en

- Bagheri, A., & Abbariki, M. (2017). Competencies of disabled entrepreneurs in Iran: Implications for learning and development. Disability & Society, 32(1), 69–92. https://doi.org/10.1080/09687599.2016.1268524

- Baker, H. K., Kumar, S., Goyal, N., & Gaur, V. (2019). How financial literacy and demographic variables relate to behavioral biases. Managerial Finance, 45(1), 124–146. https://doi.org/10.1108/MF-01-2018-0003

- Baker, H. K., & Martin, G. S. (2011). Capital structure and corporate financing decisions: Theory, evidence, and practice. Wiley.

- Bandura, A. (1977). Self-efficacy: Toward a unifying theory of behavioral change. Psychological Review, 84(2), 191–215. https://doi.org/10.1037/0033-295X.84.2.191

- Burchi, A., Włodarczyk, B., Szturo, M., & Martelli, D. (2021). The effects of financial literacy on sustainable entrepreneurship. Sustainability, 13(9), 5070. https://doi.org/10.3390/su13095070

- Butticè, V., Croce, A., & Ughetto, E. (2023). Gender diversity, role congruity and the success of VC investments. Entrepreneurship Theory and Practice, 47(5), 1660–1698. https://doi.org/10.1177/10422587221096906

- Caracota, R. C., Dimitriu, M., & Dinu, M.-R. (2010). Building a scoring model for small and medium enterprises. Theoretical & Applied Economics, 17(9), 117–128. http://eserv.uum.edu.my/login?urlhttp://search.ebscohost.com/login.aspx?direct=true&db=bth&AN=54995927&site=ehost-live&scope=site

- Cardella, G. M., Hernández-Sánchez, B. R., & Sánchez-García, J. C. (2020). Women entrepreneurship: A systematic review to outline the boundaries of scientific literature. Frontiers in Psychology, 11, 1557. https://doi.org/10.3389/FPSYG.2020.01557

- Carroll, N., & Conboy, K. (2020). Normalising the “new normal”: Changing tech-driven work practices under pandemic time pressure. International Journal of Information Management, 55, 102186. https://doi.org/10.1016/j.ijinfomgt.2020.102186

- Chen, P., Yan, Z., & Wang, P. (2023). How can the digital economy boost the performance of entrepreneurs? A large sample of evidence from China’s business incubators. Sustainability, 15(7), 5789. https://doi.org/10.3390/su15075789