?Mathematical formulae have been encoded as MathML and are displayed in this HTML version using MathJax in order to improve their display. Uncheck the box to turn MathJax off. This feature requires Javascript. Click on a formula to zoom.

?Mathematical formulae have been encoded as MathML and are displayed in this HTML version using MathJax in order to improve their display. Uncheck the box to turn MathJax off. This feature requires Javascript. Click on a formula to zoom.Abstract

Previous research has examined the relationship between ESG disclosure and firm value, but it has yet to fully explain how the former can increase the latter. Thus, the current study aims to fill the research gap by analyzing the relationship between ESG disclosure and firm value with competitive advantage as a mediating variable. This research was conducted in Indonesia on the ground that Indonesia is a developing country with a great potential for an increased economy even though its ESG implementation is still less optimal. This study employed the purposive sampling method with the criteria that the companies to be included as the sample were non-financial companies listed on the IDX and were consistent in disclosing ESG and publishing their financial reports. The sample of this study comprised 42 non-financial companies in Indonesia within the 2015–2021 period, with a total of 252 observations were conducted. The data were analysed using PLS-SEM with WarpPLS 7.0 to test hypotheses and draw conclusions. The findings showed that ESG disclosure did not affect firm value. However, when competitive advantage was included as a mediating variable in the relationship between the two variables, the results showed a significant positive direction toward firm value. This research contributes to the practical implications and development of signal theory and resource theory, especially in accounting and sustainability disciplines in the context of non-financial companies.

IMPACT STATEMENT

In creating corporate sustainability, information about corporate responsibility in managing business is required. This information consists of environmental, social, and governance (ESG) aspects. Indonesia is a country that is committed to ESG criteria as evidenced by the Indonesia Stock Exchange (IDX) joining the Sustainable Stock Exchange Initiative. This research shows that ESG disclosure is able to make a positive contribution to competitive advantage, leading to an increase in firm value. Thus, it is recommended for companies to optimize ESG disclosure. Not only does it help companies meet the regulatory standards set by a country, it also enables them to meet stakeholders’ demand for social balance and environmental sustainability.

1. Introduction

In recent years, ESG disclosures have attracted the attention of business people around the world due to the increasing demand for ESG information by stakeholders (Rabaya & Saleh, Citation2021). Furthermore, a survey conducted by KPMG (Citation2017) regarding sustainability reports (ESG) shows that there has been a significant increase in 49 countries in terms of disclosure of corporate responsibility. Reflecting on this fact, the demand for ESG in Indonesia will continue to grow. This can be seen by the decision of the Indonesian Stock Exchange (IDX) to become member of the Sustainable Stock Exchange (SSE) Initiative in 2019. SSE states that in 2030, large companies are required to disclose ESG in their annual reports. This development shows that companies around the world, including Indonesia, have a high commitment to ESG disclosure.

Extant literature shows that companies carry out ESG disclosure, given the various contributions that it makes. It allows for interactions between companies and stakeholders (Diez-Cañamero et al., Citation2020), improves ethical behavior (Rezaee & Tuo, 2019), increases the level of corporate accountability and transparency (Jizi, Citation2017; Rezaee and Tuo, Citation2019), generates a positive image to the public (Allegrini & Greco, 2013), assesses organizational performance simultaneously (Lahouel et al., 2020), provides a positive signal to firm value, and reduces information asymmetry (Bardos et al., Citation2020; Iatridis, Citation2013; Thahira & Mita, Citation2021; Yordudom & Suttipun, Citation2020).

Despite the huge amount of attention paid to ESG disclosure, there remains a debate as to how ESG disclosure positively impacts on company value, given the inconsistent results of previous studies. Some of the studies reported that ESG disclosure can increase company value (Abdi et al., Citation2021; Aboud & Diab, Citation2019; Bardos et al., Citation2020; Chauhan & Kumar, Citation2018; Cho, Citation2022; Feng & Wu, Citation2021; Melinda & Wardhani, Citation2020; Suttipun & Thanyaorn, Citation2021; Thahira & Mita, Citation2021; Yiwei et al., Citation2018; Zumente & Bistrova, Citation2021). On the other hand, several studies found contrasting empirical evidence (Behl et al., Citation2021; Duque et al., 2019; Sadiq et al., Citation2020). Those studies revealed that ESG disclosure has a negative impact on firm value. Investors consider that ESG disclosure is an investment that leads to waste as it is used by management to increase value for their own interest rather than for (Moller et al., Citation2015) shareholders. In addition, some studies reported that there is no significant relationship between ESG and firm value (Atan, Citation2017; Haryono & Iskandar, Citation2015; Servaes & Tamayo, Citation2013). It is believed that firm value is built with other alternatives rather than ESG disclosure. Companies disclosing ESG aspects, minimally or optimally, cannot show a reaction to their market value.

The understanding of how ESG disclosure can have an impact on company value is still limited. Not only are they less clear, inconsistent findings may also be misleading (J. Wang, Citation2016). There is a possibility that the relationship between ESG and firm value is not direct. Maaloul et al. (Citation2023) revealed that this relationship can be influenced by company characteristics or attributes that tend to be overlooked in previous studies. One of these company attributes is competitive advantage (Gjerde et al., Citation2009; Masliza et al., Citation2021).

Competitive advantage is a company’s ability to obtain a rate of return on its resources that exceeds the cost of capital (Gjerde et al., Citation2009). When a company desires to have a competitive advantage, it must have valuable, rare, inimitable, non-substitutable resources (Barney, Citation1991). One of these resources is ESG disclosure.

A competitive advantage can be achieved by a company if the company makes an ESG discloure (Nyuur et al., Citation2019; Rabaya & Saleh, Citation2021; Taliento et al., Citation2019; Zhao et al., Citation2019). A company that is actively involved in environmental, social, and governance activities tends to get a positive response from stakeholders, giving it a competitive advantage over its competitors. In fact, as empirical evidence from previous studies has shown, stakeholders tend to make decisions after they have examined the competitive advantage of a company (Andes et al., Citation2020; Wijayanto et al., Citation2019).

This study focused on non-financial companies in Indonesia as these companies tend to have greater negative environmental and social impacts than their financial counterparts. In addition, Indonesia is one of developing countries with great potential for incrased company value, but the implementation of ESG disclosure is still low. The results of the national ESG survey organized by the Center for Risk Management and Sustainability in 2019 showed that the practical condition of ESG implementation in Indonesia still yields sub-optimal results. Forty-point-nine percent of the companies have integrated ESG disclosure, but not fully, and it is still under consideration and done intuitively in 24.6% others. ESG disclosure has been integrated into business processes and decision-making in 18.7% others, and it has already been explained in specific guidelines in 15.8% others.

These results are supported by Loh and Thomas’ (2018) findings in their study on sustainability reporting in ASEAN countries. They found that, in terms of environmental disclosure, Indonesia scored lower (40.6%) than Malaysia (54.4%), Singapore (50.8%), Thailand (48.9%), and the Philippines (48.1%). Likewise, in terms of social disclosure, Indonesia scored lower (52.1%) than Malaysia (60.6%), Singapore (55.7%), and Thailand (56.3%). Meanwhile, the disclosure of governance in Indonesia from 2012 to 2019, which refers to the ASEAN Capital Markets Forum 2019, has increased in its average score.

In light of the description above, it is important necessary to conduct further research on ESG disclosure and firm value. The novelty of this study lies upon the aim to explore the role of competitive advantage in mediating the relationship between ESG disclosure and firm value. This study uses signal theory as a grand theory, while to explain the inconsistencies of previous research, it uses resource-based theory.

The analysis in this study used the Structural Equation Model (SEM) with the Partial Least Square (PLS) alternative method and the WarpPLS 7.0 tool to answer the research. Furthermore, a purposive sampling method was employed for non-financial companies in Indonesia listed on the IDX within the period of 2015–2021.

The results of this study show that ESG disclosure has no impact on firm value. However, the results are different when competitive advantage is employed as a mediating variable between ESG disclosure and firm value. ESG disclosure has a positive and significant impact on firm value through competitive advantage. This research extends the previous research (Atan, Citation2017; Haryono & Iskandar, Citation2015; Servaes & Tamayo, Citation2013), demonstrating that ESG disclosure has no effect on firm value.

This study is essential as it has four significant contributions. First, it contributes to the new literature on the relationship between ESG disclosure and firm value, which is influenced by the firm’s attribute of competitive advantage. Second, it contributes to the literature on the importance of ESG disclosure that impacts on the creation of competitive advantage. Third, it also contributes to the understanding of the role of company management in increasing firm value. Fourth, it enhances stakeholders’ insights in making economic decisions.

The remainder of this paper is structured as follows. Section 2 presents a literature review and hypothesis development regarding the relationship among ESG disclosure, competitive advantage, and firm value. Section 3 discusses the research methodology. Section 4 presents the analysis and discussion of the results of the study. Section 5 provides the research conclusion and suggestions based on the findings of the study.

2. Literature review and hypothesis development

The existing literature has provided several theories that can explain the relationship among ESG disclosure, firm value, and competitive advantage.

2.1. Literature review

2.1.1. ESG disclosure

The scope of ESG disclosure includes issues related to a company’s activities in terms of the environment, social relations, and corporate governance (Bloomberg database, 2021). ESG disclosure is important because (1) investors will pay attention to ESG aspects if something is considered problematic within the company and is usually under pressure and (2) ESG disclosure can partially protect against a decline in shareholder value if something goes wrong (Möller et al., Citation2015). Previous literature examining ESG disclosure used several theories such as stakeholder theory, signaling theory, agency theory, institutional theory, and governance theory. However, this study employs on two theories: signaling theory and resource theory.

Signaling theory

Signaling theory is a theory related to information asymmetry in terms of business reporting activities (Yekini & Jallow, Citation2012). This information asymmetry is a state in which a company knows more of its condition and quality compared to investors and other stakeholders. It can be minimized by the company providing this information repeatedly because companies also operate in an environment that tends to be dynamic (Janney & Folta, Citation2006).

Resource-based view theory

The resource-based view (RBV) states that a company should have resources that are valuable, rare, and difficult to replace. These resources can be in the forms of expertise, organizational processes, attributes, information, and knowledge (Barney, Citation1991). As explained by Fahy (Citation2000), there are three sub-groups related to resources, namely, tangible assets, intangible assets, and capabilities. The last of the three refers to the skills of the company in terms of, among other things, organizational culture, teamwork, and interaction skills. RBV theory views that ESG disclosure can be a corporate resource that can create a competitive advantage (Armstrong & Shimizu, Citation2007).

2.2. Hypotheses development

2.2.1. ESG disclosure and firm value

Corporate disclosure is an important aspect to investors because disclosure has a significant role in decision making related to the allocation of economic resources. It is paramount in assessing investment opportunities and ensuring that the assessment has a high level of accuracy (Chauhan & Kumar, Citation2018). One of a company’s disclosures that has relevant value in decision-making is concerned with non-financial information, e.g. ESG disclosure.

ESG disclosure has attracted the attention of investors in the decision-making process as to whether to invest in a particular company or not (Bianchi et al., Citation2010). In fact, the majority of business leaders and investment professionals today mention that individual ESG programs create value over the short and long terms. Jizi (Citation2017) stated that continuous disclosure of ESG aspects is highly recommended because it gives the impression of a higher level of corporate accountability in the eyes of stakeholders. In addition, information transparency has become better (Zhang & Yang, Citation2023). Yiwei et al. (Citation2018) even stated that ESG disclosure can increase stakeholder loyalty and long-term corporate value.

Thus, companies should pay attention to ESG disclosure because, if the disclosure is carried out optimally, there will be great opportunities to raise investor confidence, in which those investors will react by being willing to trade their shares (Zumente & Bistrova, Citation2021). Besides, it can support investor choices because it can help in obtaining broader information and reflect that the company is more ready for analysis (Feng & Wu, Citation2021). Lee et al. (Citation2022) stated that enterprise-driven ESG signaling can improve direct judgment. In addition, the participation of companies in social and environmental activities will be offset by much better financial efficiency, while governance can increase the market value of the company (Abdi et al., Citation2021; Albitar et al., Citation2020; Masliza et al., Citation2021). Prior studies that used signaling theory in explaining the relationship between ESG disclosure and firm value include those conducted by Bardos et al. (Citation2020), Cho (Citation2022), Iatridis (Citation2013), Melinda and Wardhani (Citation2020), Suttipun and Thanyaorn (Citation2021), and Yiwei et al. (Citation2018). Thus, the hypothesis below is proposed:

H1: ESG disclosure has a positive effect on firm value.

2.2.2. ESG disclosure and competitive advantage

Competitive advantage is a condition of a company where its competitors cannot imitate or gain from its business strategy (Barney, Citation1991). To establish a competitive advantage, a company must have certain resources. An explanation of efforts to gain a sustainable competitive advantage is provided by the resource-based view (RBV) theory (Armstrong & Shimizu, Citation2007; Fahy, Citation2000). It states that a company can gain a competitive advantage if it has valuable, rare, inimitable, and irreplaceable resources. These resources can be in the forms of expertise, organizational processes, attributes, information, and knowledge (Barney, Citation1991). A company can also attain a competitive advantage by implementing a good business strategy in carrying out its business activities (Aouadi & Marsat, Citation2018). one of the strategies is to perform ESG disclosure (H. Wang et al., Citation2021).

ESG disclosure can provide various benefits, such as increasing stakeholder trust and involvement (Albitar et al., Citation2020; Khuong et al., Citation2023; Masliza et al., Citation2023; Qureshi et al., Citation2020), giving a positive impression to creditors that may affect their financing decision-making (Feng & Wu, Citation2021), improving performance (Masliza et al., Citation2021), leaving consequences for returns that are non-monetary in nature, such as increased corporate reputation and customer satisfaction (Zhao et al., Citation2019), and minimizing risk through company compliance (Isada & Isada, Citation2019). Some previous studies that proved that ESG disclosure has a positive impact on competitive advantage include those conducted by Chen and Chang (Citation2013), Isada and Isada (Citation2019), Masliza et al. (Citation2021), Nyuur et al. (Citation2019), Rabaya and Saleh (Citation2021), Taliento et al. (Citation2019), Yu et al. (Citation2017), and Zhao et al. (Citation2019).

However, discussions about using ESG disclosure as a resource to gain a competitive advantage are still limited. Therefore, this study seeks to fill the existing gap. It will contribute to the expansion of resource theory by elaborating that ESG disclosure can be an alternative in increasing competitive advantage. Thus, we hypothesize that:

H2: ESG disclosure has a positive effect on competitive advantage.

2.2.3. Competitive advantage and firm value

Sigalas and Pekka (Citation2013) defined competitive advantage by looking at performance and resource perspectives. From the performance perspective, competitive advantage refers to something that can provide profitability, returns, cost-benefit gaps, and other economic benefits. This is supported by Sadiq et al. (Citation2020), who stated that a company is said to have a competitive advantage if it has a rate of return on its resources that exceeds its capital costs. Competitive advantage in the aspect of the gap between the rate of return/benefit and these costs can be used as a signal to stakeholders.

Competitive advantage can show a company’s current condition and future prospects. This condition can be a signal for investors and stakeholders, not all of whom know the situation experienced by the company. A competitive advantage as a signal to stakeholders can increase the company’s market value, stock prices, and revenues (Stanfield, Citation2005). Previous research has found that competitive advantage contributes positively to firm value (Andes et al., Citation2020; Boasson et al., Citation2005; Wijayanto et al., Citation2019). However, research on the role that competitive advantage plays in firm value from the perspective of signal theory is still limited. Thus, the current research aims to bridge the gap. This research provides a new perspective that a competitive advantage can be a communication tool for a company in giving a positive signal to investors and stakeholders. This positive signal will a contribute in increasing the value of the company. Based on the description above, it can be hypothesized that:

H3: Competitive advantage has a positive effect on firm value.

2.2.4. The relationship among competitive advantage, ESG disclosure, and firm value

Competitive advantage is a company’s ability to generate returns from resources that exceed its cost of capital (Gjerde et al., Citation2009). As posited by Fahy (Citation2000), resource theory is the main contributing theory to competitive advantage. One of the strategies that can be implemented to achieve competitive advantage in a business is to engage in ESG disclosure (Nyuur et al., Citation2019; Porter et al., Citation2019; Rabaya & Saleh, Citation2021). ESG disclosure is an indicator that the company has paid attention to environmental and social conditions in its business activities by implementing good corporate governance.

By engaging in ESG disclosure activities, the company can have a better social image, which will create a competitive advantage (Kotler & Lee, Citation2008). As Masliza et al. (Citation2021) assert, companies with good ESG scores always have a direction that is in line with a competitive advantage. ESG disclosure makes a company more open, triggers investor interest, strengthens customer loyalty, increases the company’s accountability, improves the company’s reputation, and helps the company maintain its stakeholders’ trust (Rabaya & Saleh, Citation2021). After gaining a competitive advantage, the company will have a better ability to maximize shareholder wealth (Masliza et al., Citation2021). This is because competitive advantage can provide signals to stakeholders, which will have a positive impact on firm value. Therefore, the hypothesis developed is as follows:

H4: Competitive advantage positively mediates the impact of ESGD on firm value.

3. Methodology

This study was conducted on non-financial companies in Indonesia within the period of 2015 to 2021. The population size in this study was 79. The year 2015 was selected as a starting point because 2015 was the year when companies in Indonesia were required to comply with several environmental social responsibility policies, i.e. Ministrial Regulation on State-owned Companies No. PER-09/MBU/2015, Law No. 40 of 2007 article 74, and Government Regulation No. 47 of 2012. Meanwhile, 2021 was used as the final point because complete data on ESG disclosure were obtained by then.

3.1. Sample

Research sample was obtained using the purposive sampling method. The companies included in the study were non-financial companies in Indonesia that were listed on the IDX for the period of 2015 to 2021 and were always consistent in publishing their financial statements and ESG disclosure scores in their annual reports. Data for ESG disclosure, competitive advantage, and firm value were obtained from the Bloomberg ESG database. presents the sample selection criteria used in this study.

Table 1. Criteria for sample selection.

3.2. Variable measurement

Firm value (FV) in this study was projected by Tobin’s Q. The Tobin’s Q value was determined by referring to the Bloomberg database (i.e. (market capitalization + total liabilities + preferred equity + minority interest)/total assets), adopted from Abdi et al. (Citation2021), Aboud and Diab (Citation2019), Behl et al. (Citation2021), Chauhan and Kumar (Citation2018), Feng and Wu (Citation2021), Sadiq et al. (Citation2020), and Thahira and Mita (Citation2021). The measurement of ESG disclosure referred to the Bloomberg ESG database. There were 14 indicators of environmental disclosure, 21 indicators of social disclosure, and 27 indicators of governance disclosure, adopted from Almeyda and Darmansya (Citation2019), Azhar (Citation2020), Behl et al. (Citation2021), Buallay (Citation2018), Huang et al. (Citation2022), and Qiu et al. (Citation2016). The measurement of competitive advantage (CA) in this study took into account the rate of return on resources, i.e. return on invested capital (ROIC) with weighted average cost of capital (WACC), while the formula for WACC was available on the Bloomberg database (i.e. (KD × (TD/V)) + (KP × (P/V)) + (KE × (E/V)), adopted from Gjerde et al. (Citation2009) and Masliza et al. (Citation2021). Size is defined as a measure determining a company’s size as indicated by the logarithm of the assets owned by the company, adopted from Abdi et al. (Citation2021), Aboud and Diab (Citation2018), Dahlberg and Wiklund (Citation2018), and Feng and Wu (Citation2021). Leverage is defined as the ratio of total debt to total assets, adopted by Abdi et al. (Citation2021), Aboud and Diab (Citation2018), and Chauhan and Kumar (Citation2018). The size of the audit committee (SOAC) refers to the Bloomberg database formula (i.e. the number of permanent directors on the company’s audit committee).

3.3. Model specification

The model specifications developed in this research are shown in the following equation:

(1)

(1)

(2)

(2)

(3)

(3)

3.4. Data analysis

The data analysis conducted in this study used the Structural Equation Model (SEM) approach, with Partial Least Square (PLS) being an alternative method. This approach was selected because in this study, there were second-order formative-formative construct variables that could only use SEM-PLS and could not use CB-SEM (Hair et al., Citation2017). Additionally, the SEM-PLS approach does not require that the data be normally distributed (Ghozali & Latan, Citation2016; Sholihin & Ratmono, Citation2021). Therefore, data analysis using SEM-PLS was considered suitable for this study.

4. Results and discussion

4.1. Descriptive statistics

shows the descriptive statistics of all the estimated variables.

Table 2. The descriptive statistics of variables.

shows that the mean ESGD was 0.5724, with a standard deviation of 0.1815, which means that ESG disclosure in Indonesia was still sub-optimal. However, the mean score of ESG disclosure tended to increase from one year to the next. This reflects that ESG disclosure was increasingly important to companies as a form of accountability to stakeholders. Furthermore, from the point of view of each ESG disclosure element, it can be seen that the element most disclosed by non-financial companies was governance, with a score of 0.7182, followed by the social element, with a score of 0.5530. This indicates that non-financial companies in Indonesia had a strong initiative in disclosing governance, which consisted of audit risk and oversight (AR&O), board composition (BC), compensation, diversity, nomination and governance over (N&G), sustainability governance (SG), and tenure. On the other hand, environmental disclosure was still not optimal, with an average value of 0.4245. This shows that non-financial companies in Indonesia had yet to be able to integrate their company policies with their environmental management system.

The mean for CA was 0.786, with a standard deviation of 17.953, which means that non-financial companies in Indonesia tended to build competitive advantage, especially by paying attention to the gap between benefits and costs, in this case, ROI and WACC. The mean firm value proxied by Tobins-Q of 1.582 reflects that non-financial companies in Indonesia tended to be able to manage their resources effectively and efficiently. According to Kaijser (Citation2014), when the firm value projected by Tobin’s Q exceeds one, it implies that the company is good because its market value is higher than its replacement cost; therefore, the company can benefit from the investment it has made.

Company size had an average value of 31.0136, with a standard deviation of 1.1819 and a maximum value of 34.0384. This illustrates that non-financial companies in Indonesia were large companies, which gave them the opportunity to disclose ESG, have a competitive advantage, and have the potential to improve their company reputation. Corporate leverage had an average value of 0.4909, with a standard deviation of 0.1970. This illustrates that non-financial companies in Indonesia used near to 50% debt capital structure. In other words, non-financial companies in Indonesia tended to be stable in the use of debt and capital in financing their assets. Finally, SOAC had a mean of 3.369, which indicates that non-financial companies in Indonesia had complied with POJK 55/2015, which requires requires companies to have at least one independent commissioner and at least two external people as permanent directors on the audit committee.

4.2. Model testing

4.2.1. Construct measurement

The purpose of this measurement model was to evaluate the validity of each construct. The ESG disclosure variable in this study was a formative construct because it was formed of three disclosure elements, namely, environmental disclosure, social disclosure, and governance disclosure. Furthermore, each of these disclosures was composed of several elements: environmental disclosure which consisted of climate change (CH), ecological and biodiversity impact (E&B), energy, material and waste (M&W), supply chain, and water; social disclosure which consisted of community and customers (C&C), diversity, ethics and compliance (E&C), health and safety (H&S), human capital (HC), and supply chain; and governance disclosure which consisted of audit risk and oversight (AR&O), board composition (BC), compensation, diversity, nomination and governance over (N&G), sustainability governance (SG), and tenure. Therefore, the measurement was carried out through two stages: first-order formative and second-order formative. presents the outputs of the first-order formative construct indicators:

Table 3. Output first-order formative construct indicator weights.

shows that the p-values for all indicators of environmental, social, and governance disclosure were less than 0.05. This indicates that all the formative constructs for ESG disclosure had met the requirements. After measuring the first-order formative, the next step was to measure the second-order formative construct indicators. presents the second-order formative construct indicator outputs:

Table 4. Output second-order formative construct indicator weights.

shows that the p-values of the ESGD formative constructs were < 0.05, and the VIF values were less than 3.3, which indicates that there was no multicollinearity. Therefore, the three elements of ESG disclosure (i.e. environmental disclosure, social disclosure, and governance disclosure) and the other six variables had met the validity requirements for formative constructs.

4.2.2. Evaluation of goodness of fit

To determine the feasibility of the model, this study used 10 indicators. The outputs of the feasibility evaluation of the model built along with several indicators are presented in .

Table 5. The goodness of fit evaluation results of the empirical research model.

shows the indicators of the fit of the model developed. It indicates that the model has fulfilled the model fit criteria. The APC value was 0.218, with a p-value 0.001 ≤ 0.05, which means that the APC indicator was fit. The ARS value was 0.293, with a p-value 0.001 ≤ 0.05. This means that the ARS indicator was fit. The AARS value was 0.287, with a p-value 0.001 ≤ 0.05, which means that the AARS indicator was also fit. Besides, the AVIF and AFVIF values were 1.178 and 1.377, respectively, below 3.3, indicating no multicollinearity problem in the model built. Then, the GoF value was 0.530 ≥ 0.36, which means that the model fit was categorized as strong (large). The SPR value was 0.833 (above 0.7), and the RSCR value was 0.998 (above 0.9000), which means that the model was free from any causality problems. Finally, the SSR and NLBCDR values were 1 and 0.833, respectively, which were above 0.7, meaning that there were no causality problems in the model.

4.2.3. Evaluation of structural models

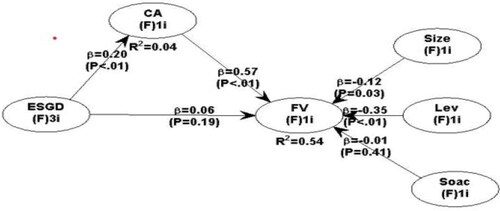

A structural model evaluation was carried out to provide an overview of the causality relationship between variables developed based on theories. It was carried out by assessing the collinearity problem and the R-squared value. The results are presented in .

Table 6. Latent variable coefficients.

Based on the VIF value, which was less than 3.3, as presented in , the model developed was free from any collinearity problems. Then, the R2 value was 54.5, indicating that ESG disclosure and competitive advantage contributed to firm value at 54.5%, while the remaining 45.5% influence came from other factors.

4.3. Hypotheses testing

4.3.1. Testing for direct effects

This study used PLS-SEM with WarpPLS 7.0 to validate the relationship between ESG disclosure and firm value. The results are presented in as well as , each concerned with path coefficients, p-values, and standard errors.

Table 7. Path coefficients.

Table 8. p-Values.

Table 9. Standar errors for path coefficients.

As indicates, ESG disclosure had no effect on firm value. This can be seen in the coefficient of 0.056, with a p-value 0.186 > 0.05. This figure shows that the first hypothesis, that ‘ESG disclosure has an effect on firm value’, was rejected. In other words, non-financial companies in Indonesia had attempted to disclose ESG information, but it did not result in any increase in company value. Therefore, it was assumed that stakeholders did not give any sufficient response or positive feedback from the signals sent by the company if they reviewed ESG disclosures. They would see other attributes attached to the company, such as the competitive advantage of the company.

Furthermore, the coefficient for the effect of ESG disclosure on competitive advantage was 0.205, with a p-value < 0.001. This shows that ESG disclosure had a positive and significant influence on competitive advantage, with a significant level of 0.001. Therefore, the second hypothesis, which states that ‘ESG disclosure has a positive effect on competitive advantage’, could be accepted. Finally, the coefficient of the effect of competitive advantage on firm value was 0.566. This coefficient shows that the third hypothesis was supported. Meanwhile, the p-value was < 0.001. This means that there was a positive influence with a significance level of 0.001. Thus, the third hypothesis, which states that ‘Competitive advantage has a positive and significant effect on firm value’, could be accepted.

4.3.2. Testing for indirect effects

The results of the testing for the indirect effect of ESG disclosure on firm value through competitive advantage are presented in :

Table 10. Indirect effect.

Based on , competitive advantage acted as a mediating variable in the relationship between ESG disclosure and firm value. The coefficient of the indirect effect of the ESG disclosure variable on firm value through competitive advantage was 0.116, with a p-value of 0.004. This shows that the indirect effect of this variable was stronger than the direct effect, as the direct effect had a smaller coefficient of 0.056, with a p-value of 0.186. Thus, because the direct effect was not significant while the indirect effect was significant, it can be concluded that competitive advantage was a full mediating variable between ESG disclosure and firm value (Hair et al., Citation2017). Competitive advantage being a full mediating variable means that competitive advantage was a variable connecting two variables, namely, ESG disclosure and company value. This means that a company’s ESG disclosure would create a competitive advantage and in the end increase the company value.

4.4. Discussion

4.4.1. The effect of ESG disclosure on firm value

The first coefficient yielded in this research was 0.06, and the p-value was 0.19, which exceeded the significance value of 5%. The research results do not support to the first hypothesis proposed, which means that ESG disclosure had no influence on firm value. This finding shows that companies that disclose ESG have not been able to increase firm value. The absence of an influence from ESG disclosure on firm value is explained by the possibility that stakeholders and investors did not immediately give a positive response or signal. Rather, stakeholders would assess in advance whether ESG disclosure could make a company superior to its competitor.

This research is in line with previous research showing that ESG disclosure had no significant effect on firm value. The research conducted by Atan (Citation2017) showed that ESG disclosure has no significant relationship with firm value. This means that both companies that disclose ESG and companies that do not disclose ESG have the same value in the market. Another study consistent with this study is the one conducted by Haryono and Iskandar (Citation2015) which demonstrated that firm value is built by other alternatives, not by ESG disclosure. Companies that disclose minimal or optimal ESG cannot show a reaction to the company’s market value. Likewise, Servaes and Tamayo (Citation2013) revealed that social environmental disclosure does not directly affect the value of the company. To create firm value, it is insufficient to solely focus on social and environmental aspects; it is also essential to cultivate the company’s reputation. However, the results of this research are not in line with signal theory, which proposes that that when a company discloses ESG, the value of the company increases. In addition, the results of this research are different from those produced by Dkhili (Citation2023), indicating that ESG disclosure has a positive impact on firm value. Especially when companies involve women in the board of directors in the relationship between ESG and firm value (Qureshi et al., Citation2020).

4.4.2. The effect of ESG disclosure on competitive advantage

The results of hypothesis testing in show that the coefficient for the effect of ESG disclosure on competitive advantage was 0.20, with a p-value 0.01 < 0.05. This suggests that ESG disclosure had a positive effect on competitive advantage. Therefore, the second hypothesis, which states that ESG disclosure has a positive effect on competitive advantage, was accepted.

This result confirms resource theory. Armstrong and Shimizu (Citation2007) and Fahy (Citation2000) explained that to gain a competitive advantage, a company must have certain resources. The company’s resources can serve as a source of competitive advantage if they have value. These resources are considered valuable when the company can implement its strategy by paying attention to effectiveness and efficiency (Barney, Citation1991). One of the business strategies that can be implemented by the company in carrying out its activities effectively and efficiently is to disclose ESG aspects.

ESG disclosure is expected to make a company superior to other companies. ESG disclosure makes the company more open and more accountable, attracts investor interest, triggers customers to become more loyal, increases the company’s reputation, and maintains the trust of stakeholders (Rabaya & Saleh, Citation2021). The company is said superior when it can generate a rate of return on the investment made above the industry average and in excess of its costs.

The result of this research is in line with previous research, such as the research conducted by Masliza et al. (Citation2021), which states that ESG disclosure scores will be offset by competitive advantage. The same result was obtained by Nyuur et al. (Citation2019) who provided empirical evidence that ESG can increase support from stakeholders and give a company legitimacy. These stakeholders become more appreciative of the company because they recognize that there are efforts to increase productivity, provide satisfaction, involve employees, and increase loyalty to customers. In addition, ESG disclosure makes a positive contribution to social image and has an impact on creating competitive advantage (Kotler & Lee, Citation2008). In fact, by involving companies in ESG activities, market reputation can be achieved (Masliza et al., Citation2023), while a firm reputation can be a trigger for creating competitive advantage (Adomako & Tran, Citation2022; Cantele & Zardini, Citation2018; Saeidi et al., Citation2015). These activities can improve image and competitiveness. Similar results were shown by Zhao et al. (Citation2019) who stated that competitive advantage is positively influenced by ESG, both directly and indirectly with the mediating role of social capital and dynamic capabilities.

4.4.3. The effect of competitive advantage on firm value

Test results provided evidence to the hypothesis proposed, which states that ‘Competitive advantage has a positive effect on firm value’. The coefficient obtained was 0.57, and the p-value was 0.01. This shows a positive and significant coefficient direction. Therefore, it was concluded that a company’s value can be better if the company has a competitive advantage to its competitors.

The results of this research imply that every company wants to be superior to its competitors. One aspect of competitive advantage is the ability to gain a rate of return that exceeds the cost of capital (Gjerde et al., Citation2009; Masliza et al., Citation2021). A competitive advantage gives the company better value since the company has given positive signals to its stakeholders. This finding is in line with signaling theory, which states that a competitive advantage can show a company’s current condition and prospects. This condition can provide a positive signal to investors and other stakeholders. Subsequently, this positive signal is expected to have an impact on the stock price and contribute to better firm value.

The results of this study confirm the previous research. Andes et al. (Citation2020) successfully showed that firm value will be affected by competitive advantage because global competition and company business continuity can be maintained. In addition, Wijayanto et al. (Citation2019) stated that current conditions and prospects will be reflected by competitive advantages, which can be a positive signal for stakeholders. Thus, in the end, these competitive advantages will affect high stock prices and firm value. Furthermore, Ferreira and Fernandes (Citation2017) provide empirical evidence that company value is formed not only because the company has abundant resources but also because the company has special competencies that lead to the development of competitive advantages.

4.4.4. The effect of ESG disclosure on firm value through competitive advantage

Research results provided empirical evidence that competitive advantage could mediate the relationship between ESG disclosure and firm value. Data processing results showed that the indirect effect of this relationship was stronger than the direct effect. The coefficient for the indirect effect was 0.116, with a p-value of 0.004, while the coefficient for the direct effect was 0.06, with a p-value of 0.19. Thus, it can be stated that to obtain better firm value when associated with ESG disclosure, a mediating role of competitive advantage is needed.

The mediating role of competitive advantage in the relationship between ESG disclosure and firm value is that it indicates that the environmental, social, and governance components have been implemented by the company. ESG disclosure shows that not only does the company care about environmental and social conditions, it also carries out management well. In addition, it also shows that the company has paid attention to the rights of its stakeholders. ESG disclosure gives the company a competitive characteristic when compared to its competitors. In other words, ESG disclosure can be a source of competitive advantage. This is because the company has valuable resources which can be implemented in its business strategy with attention paid to effectiveness and efficiency (Barney, Citation1991).

This finding is in line with the internally sourced RBV theory, which is based on company resources and the characteristics of its managers (Fahad & Busru, Citation2020; Sabatini & Sudana, Citation2019; Vira & Wirakusuma, Citation2019). Masliza et al. (Citation2021) confirmed that companies that have a good ESG score always have a direction that is in line with their competitive advantage. Thus, it can be said that stakeholders who entrust their environmental social responsibility to the company reflect that ESG disclosure has a positive correlation with resources that lead to achieving competitive advantage. Upon considering that the company has elements of competitive advantage, stakeholders will respond positively. This positive response, which has a positive impact on the company value, arises because the company has given a signal to stakeholders. This research is in line with previous research such as Andes et al. (Citation2020), Ferreira and Fernandes (Citation2017) and Newbert (Citation2008) which provides empirical evidence that competitive advantage can make a positive contribution to firm value. Therefore, the current research can be said to have novelty based on previous research on the relationship between ESG disclosure and company value, namely that it is necessary to have a mediating variable first to achieve better firm value.

5. Conclusion

This study proposed four hypotheses, three of which were accepted and one was rejected. The first hypothesis regarding the effect of ESG disclosure on firm value was rejected. This means that whether a company did a minimum or optimum ESG disclosure did not give any positive signal on its company value. Stakeholder did not react significantly. So, the company value did not experience any changes. In other words, ESG disclosure alone was not enough to increase company value; other alternatives such as creating a competitive advantage first were necessary.

Furthermore, the results of testing the second hypothesis showed that competitive advantage could be created by disclosing ESG elements. This indicates that by disclosing ESG, the company is indirectly building resources in the form of company characteristics or attributes. This attribute can make the company unique compared to companies that do not disclose ESG, so that it can make the company superior to its competitors. Meanwhile, excellence here is in the context of the company’s ability to manage its company effectively and efficiently so that it is able to produce an ROIC that is greater than WACC. The third hypothesis testing results provided empirical evidence that a competitive advantage to other companies increased the value of a company. This explains that if a company has a competitive advantage over its competitors, the firm value will increase.

Finally, when competitive advantage was included as a mediating variable in the relationship between ESG disclosure and value, the results showed a positive and significant direction. This research provides empirical evidence that competitive advantage can be a mediating variable in the relationship between ESG disclosure and firm value. Meanwhile, the type of mediation in this relationship is full mediation. These results show that competitive advantage can be achieved by companies that disclose ESG.When a company makes ESG disclosures, this indicates an indication that the company has implemented the existing components in each dimension of environmental, social and governance disclosures. Furthermore, when a company has a competitive advantagen, this can ultimately have an impact on increasing firm value.

5.1. Theoretical implications

This research has contributed to development of literature on the relationship relationship between ESG disclosure and company value. It suggests that competitive advantage is able to fully mediate the two relationships. Besides that, this study supports RBV theory, which states that ESG disclosure can be part of resources capable of creating a competitive advantage, especially in accounting and sustainability disciplines. By disclosing ESG elements, a company is actually building valuable resources, thus making it superior to companies that do not disclose ESG elements. In addition, this study also supports signal theory, which states that ESG disclosure can have a positive impact on competitive advantage and in turn give a positive signal to firm value.

5.2. Practical implications

This study has several practical implications for management, regulatory bodies, and stakeholders. Company management is expected to increase its understanding of the importance of ESG disclosure, which can encourage optimal ESG disclosure by the company. In addition, it is important for company management to understand that ESG disclosure can increase competitive advantage, especially in the case of non-financial companies. Finally, it is also essential for company management to understand that an increase in competitive advantage can increase the value of the company.

This research Has practical implications for regulators, such as the government and the financial services authority, in the formulation of regulations related to efforts to increase disclosure of ESG elements by companies, especially non-financial companies.Companies should disclose their environmental, social and governance (ESG) components.

Finally, stakeholders such as investors, creditors, and the general public are expected to be able to provide insights and increase their understanding in analyzing economic decisions that will be taken, especially those related to ESG disclosure, competitive advantage, and company value. Thus, the decisions and actions taken by these practitioners become more appropriate.

5.3. Research limitations

This research has several limitations. First, the sample used in this study was still limited to non-financial companies. Therefore it did not represent all companies or financial companies and the observations were limited. Second, the sample was only from a single country, Indonesia, which did not reflect the wider scale, such as the Asian region. Finally, this research only focuses on one attribute in the relationship between ESG disclosure and firm value, namely competitive advantage.

5.4. Future research agenda

First, future research can examine the impact of ESG disclosure on firm value in all types of companies, both financial and non-financial, so that the differences between the two can be obseved. Second, future research can be carried out on non-financial companies on a wider scale, such as the Asian region or in other developing countries, because they may have different characteristics. Finally, future research could consider other attributes in the relationship between ESG disclosure and firm value such as customer satisfaction or firm reputation.

Acknowledgments

The authors gratefully acknowledge the Indonesia Endowment Fund For Education (LPDP) for the scholarship grant.

Disclosure statement

No potential conflict of interest was reported by the author(s).

Additional information

Funding

Notes on contributors

Hendi Rohendi

Hendi Rohendi is a lecturer in the accounting study program at the Bandung State Polytechnic, Indonesia. His expertise is in financial accounting and sustainability. His research interests span financial accounting, and sustainability. ESG disclosure is an important aspect in corporate sustainability, and it also holds true in non-financial companies. This study seeks to show that ESG disclosure can create competitive advantage and ultimately increase corporate value. Future research can examine financial companies or a combination of financial and non-financial companies.

Imam Ghozali

Imam Ghozali is a professor at the Faculty of Economics and Business, Diponegoro University, Indonesia. His expertise is in management accounting, and research methods. His recent research is entitled ‘Hexagon Fraud: Detection of Fraudulent Financial Reporting in Indonesian State-owned Enterprises’.

Dwi Ratmono

Dwi Ratmono is a lecturer at the Faculty of Economics and Business, Diponegoro University, Indonesia. His expertise is in public sector accounting, CSR and research methods.

References

- Abdi, Y., Li, X., & Càmara-Turull, X. (2021). Exploring the impact of sustainability (ESG) disclosure on firm value and financial performance (FP) in airline industry: The moderating role of size and age. Environment, Development and Sustainability, 24, 1–17. https://doi.org/10.1007/s10668-021-01649-w

- Aboud, A., & Diab, A. (2018). The impact of social, environmental and corporate governance disclosures on firm value: Evidence from Egypt. Journal of Accounting in Emerging Economies, 8(4), 442–458. https://doi.org/10.1108/JAEE-08-2017-0079

- Aboud, A., & Diab, A. (2019). The financial and market consequences of environmental, social and governance ratings in Egypt. https://doi.org/10.1108/SAMPJ-06-2018-0167

- Adomako, S., & Tran, M. D. (2022). Sustainable environmental strategy, firm competitiveness, and financial performance: Evidence from the mining industry. Resources Policy, 75(December 2021), 102515. https://doi.org/10.1016/j.resourpol.2021.102515

- Albitar, K., Hussainey, K., Kolade, N., & Gerged, A. M. (2020). ESG disclosure and firm performance before and after IR The moderating role. International Journal of Accounting & Information Management, 28(3), 429–444. https://doi.org/10.1108/IJAIM-09-2019-0108

- Allegrini, M., &Greco, G. (2013). Corporate boards, audit committees and voluntary disclosure: Evidence from Italian Listed Companies. Journal of Management & Governance, 17(1), 187–216. https://doi.org/10.1007/s10997-011-9168-3

- Almeyda, R., & Darmansya, A. (2019). The influence of environmental, social, and governance (ESG) disclosure on firm financial performance. IPTEK Journal of Proceedings Series, 0(5), 278. https://doi.org/10.12962/j23546026.y2019i5.6340

- Andes, S. L., Nuzula, N. F., & Worokinasih, S. (2020). Competitive advantage as mediating factor for creating firm value: A literature review. BISNIS & BIROKRASI: Jurnal Ilmu Administrasi Dan Organisasi, 27(1), 5. https://doi.org/10.20476/jbb.v27i1.11760

- Aouadi, A., & Marsat, S. (2018). Do ESG controversies matter for firm value? Evidence from international data. Journal of Business Ethics, 151(4), 1027–1047. https://doi.org/10.1007/s10551-016-3213-8

- Armstrong, C. E., & Shimizu, K. (2007). A review of approaches to empirical research on the resource-based view of the firm. Journal of Management, 33(6), 959–986. https://doi.org/10.1177/0149206307307645

- Atan, R. (2017). The impacts of environmental, social, and governance factors on firm performance. Management of Environmental Quality, 29(2), 182–194. https://doi.org/10.1108/MEQ-03-2017-0033

- Azhar, E. N. (2020). Do environmental, social, and governance practices (ESG) signify firm value? Evidence from FTSE4Good Bursa Malaysia (F4GBM). Global Business and Management Research: An International Journal, 12(4), 365–376.

- Bardos, S. K., Ertugrul, M., & Gao, S. L. (2020). Corporate social responsibility, product market perception, and firm value. Journal of Corporate Finance, 62, 101588. https://doi.org/10.1016/j.jcorpfin

- Barney, J. (1991). Firm resources and sustained competitive advantage. Journal of Management, 17(1), 99–120. https://doi.org/10.1177/014920639101700108

- Behl, A., Kumari, P. S. R., Makhija, H., & Sharma, D. (2021). Exploring the relationship of ESG score and firm value using cross-lagged panel analyses: Case of the Indian energy sector. Annals of Operations Research, 313, 231–256. https://doi.org/10.1007/s10479-021-04189-8

- Bianchi, R. J., Drew, M. E., & Walk, A. N. (2010). On the responsible investment disclosure practices of the world’s largest pension funds. Accounting Research Journal, 23(3), 302–318. https://doi.org/10.1108/10309611011092619

- Boasson, V.,Boasson, E.,MacPherson, A., &Shin, H. (2005). Firm value and geographic competitive advantage: Evidence from the U.S. pharmaceutical industry*. The Journal of Business, 78(6), 2465–2495. https://doi.org/10.1086/497038

- Buallay, A. (2018). Is sustainability reporting (ESG) associated with performance? Evidence from the European banking sector. Management of Environmental Quality, 30(1), 98–115. https://doi.org/10.1108/MEQ-12-2017-0149

- Cantele, S., & Zardini, A. (2018). Is sustainability a competitive advantage for small businesses? An empirical analysis of possible mediators in the sustainability–financial performance relationship. Journal of Cleaner Production, 182, 166–176. https://doi.org/10.1016/j.jclepro.2018.02.016

- Chauhan, Y., & Kumar, S. B. (2018). Do investors value the nonfinancial disclosure in emerging markets? Emerging Markets Review, 37(April), 32–46. https://doi.org/10.1016/j.ememar.2018.05.001

- Chen, Y. S., & Chang, C. H. (2013). Enhance environmental commitments and green intangible assets toward green competitive advantages: An analysis of structural equation modeling (SEM). Quality & Quantity, 47(1), 529–543. https://doi.org/10.1007/s11135-011-9535-9

- Cho, Y. (2022). ESG and firm performance: Focusing on the environmental strategy. Sustainability, 14(13), 7857. https://doi.org/10.3390/su14137857

- Dahlberg, L., & Wiklund, F. (2018). ESG investing in Nordic countries: An analysis of the shareholder view of creating value. https://www.diva-portal.org/smash/record.jsf?pid=diva2%3A1229424&dswid=6576

- Diez-Cañamero, B., Bishara, T., Otegi-Olaso, J. R., Minguez, R., & Fernández, J. M. (2020). Measurement of corporate social responsibility: A review of corporate sustainability indexes, rankings and ratings. Sustainability, 12(5), 2153. https://doi.org/10.3390/su12052153

- Dkhili, H. (2023). Does environmental, social and governance (ESG) affect market performance ? The moderating role of competitive advantage. https://doi.org/10.1108/CR-10-2022-0149

- Duque, E., &Javier, A. (2019). Environmental, social and governance (ESG) scores and financial performance of multilatinas: Moderating effects of geographic international diversification and financial slack. Journal of Business Ethics, 168, 315–344.

- Fahad, P., & Busru, S. A. (2020). CSR disclosure and firm performance: Evidence from an emerging market. Corporate Governance: The International Journal of Business in Society, 21(4), 553–568. https://doi.org/10.1108/CG-05-2020-0201

- Fahy, J. (2000). The resource-based view of the firm: Some stumbling-blocks on the road to understanding sustainable competitive advantage. Journal of European Industrial Training, 24(2/3/4), 94–104. https://doi.org/10.1108/03090590010321061

- Feng, Z., & Wu, Z. (2021). ESG disclosure, REIT debt financing and firm value. The Journal of Real Estate Finance and Economics. 67, 388–422. https://doi.org/10.1007/s11146-021-09857-x

- Ferreira, J., & Fernandes, C. (2017). Resources and capabilities’ effects on firm performance: What are they? Journal of Knowledge Management, 21(5), 1202–1217. https://doi.org/10.1108/JKM-03-2017-0099

- Ghozali, I., & Latan, H. (2016). Partial least squares, Konsep, Metode dan Aplikasi Menggunakan Program WarpPLS 5.0 (3rd ed.). Badan Penerbit Universitas Diponegoro.

- Gjerde, O., Knivsfla, K., & Saettem, F. (2009). Evidence on competitive advantage and superior stock market performance. https://core.ac.uk/download/pdf/30836331.pdf

- Hair, J., Hult, T., Ringle, C., & Sartstedt, M. (2017). A primer on partial least squares structural equation modeling (PLS-SEM) (2nd ed.). Sage.

- Haryono, U., & Iskandar, R. (2015). Corporate social performance and firm value. International Journal of Business and Management Invention, 4(11), 69–75.

- Huang, Q., Li, Y., Lin, M., & McBrayer, G. A. (2022). Natural disasters, risk salience, and corporate ESG disclosure. Journal of Corporate Finance, 72(2021), 102152. https://doi.org/10.1016/j.jcorpfin.2021.102152

- Iatridis, G. E. (2013). Environmental disclosure quality: Evidence on environmental performance, corporate governance and value relevance. Emerging Markets Review, 14(1), 55–75. https://doi.org/10.1016/j.ememar.2012.11.003

- Isada, F., & Isada, Y. (2019). An empirical study of strategic corporate governance and competitive advantage. Journal of Economics, Business and Management, 7(1), 10–16. https://doi.org/10.18178/joebm.2019.7.1.573

- Janney, J. J., & Folta, T. B. (2006). Moderating effects of investor experience on the signaling value of private equity placements. Journal of Business Venturing, 21(1), 27–44. https://doi.org/10.1016/j.jbusvent.2005.02.008

- Jizi, M. I. (2017). The influence of board composition on sustainable development disclosure. Business Strategy and the Environment, 26(5), 640–655. https://doi.org/10.1002/bse.1943

- Kaijser, P. S. (2014). Tobin’s Q theory and regional housing investment Empirical analysis on Swedish data. http://uu.diva-portal.org/smash/get/diva2:726815/FULLTEXT01.pdf

- Khuong, N. V., Huu, L., & Anh, T. (2023). The nexus between corporate social responsibility and fi rm value: The moderating role of life-cycle stages. Social Responsibility Journal, 19(5), 949–969. https://doi.org/10.1108/SRJ-09-2021-0370

- Kotler, P., & Lee, N. (2008). Corporate social responsibility: Doing the most good for your company and your cause. Wiley.

- KPMG. (2017). The road ahead. The KPMG Survey of Corporate Responsibility Reporting, 2017.

- Lee, M. T., Raschke, R. L., & Krishen, A. S. (2022). Signaling green! Firm ESG signals in an interconnected environment that promote brand valuation. Journal of Business Research, 138(September 2021), 1–11. https://doi.org/10.1016/j.jbusres.2021.08.061

- Maaloul, A.,Zéghal, D.,Ben Amar, W., &Mansour, S. (2023). The effect of environmental, social, and governance (ESG) performance and disclosure on cost of debt: the mediating effect of corporate reputation. Corporate Reputation Review, 26(1), 1–18. https://doi.org/10.1057/s41299-021-00130-8

- Masliza, W., Mohammad, W., & Wasiuzzaman, S. (2021). Environmental, social and governance (ESG) disclosure, competitive advantage and performance of fi RMS in Malaysia. Cleaner Environmental Systems, 2(September 2020), 100015. https://doi.org/10.1016/j.cesys.2021.100015

- Masliza, W., Mohammad, W., Zaini, R., & Kassim, A. A. (2023). Women on boards, firms’ competitive advantage and its effect on ESG disclosure in Malaysia. Social Responsibility Journal, 19(5), 930–948. https://doi.org/10.1108/SRJ-04-2021-0151

- Melinda, A., & Wardhani, R. (2020). The effect of environmental, social, governance, and controversies on firms. Value: Evidence from Asia, 27, 147–173. https://doi.org/10.1108/s1571-038620200000027011

- Moller, V., Koehler, D., Stubenrauch, I. 2015. New perspectives on corporate social responsibility. In O Riordan, linda, Zmuda, piotr (Eds.), Finding the value in environmental, social and governance performance. Wiesbaden: Springer Gabler.

- Newbert, S. L. (2008). Value, rareness, competitive advantage, and performance: A conceptual-level resource-based view of the firm. Strategic Management Journal, 768(May), 745–768. https://doi.org/10.1002/smj

- Nyuur, R. B., Ofori, D. F., & Amponsah, M. M. (2019). Corporate social responsibility and competitive advantage: A developing country perspective. Thunderbird International Business Review, 61(4), 551–564. https://doi.org/10.1002/tie.22065

- Porter, M., Serafeim, G., & Kramer, M. (2019). Where ESG fails _ institutional investor. Institutional Investor, 1–17. https://www.institutionalinvestor.com/article/b1hm5ghqtxj9s7/Where-ESG-Fails

- Qiu, Y., Shaukat, A., & Tharyan, R. (2016). Environmental and social disclosures: Link with corporate financial performance. The British Accounting Review, 48(1), 102–116. https://doi.org/10.1016/j.bar.2014.10.007

- Qureshi, M. A., Kirkerud, S., Theresa, K., & Ahsan, T. (2020). The impact of sustainability (environmental, social, and governance) disclosure and board diversity on firm value: The moderating role of industry sensitivity. Business Strategy and the Environment, 29(3), 1199–1214. https://doi.org/10.1002/bse.2427

- Rabaya, A. J., & Saleh, N. M. (2021). The moderating effect of IR framework adoption on the relationship between environmental, social, and governance (ESG) disclosure and a firm’s competitive advantage. Environment, Development and Sustainability, 24, 2037–2055. https://doi.org/10.1007/s10668-021-01519-5

- Rezaee, Z., &Tuo, L. (2019). Are the quantity and quality of sustainability disclosures associated with the innate and discretionary earnings quality? Journal of Business Ethics, 155(3), 763–786. https://doi.org/10.1007/s10551-017-3546-y

- Sabatini, K., & Sudana, I. P. (2019). Pengaruh Pengungkapan Corporate Social Responsibility Pada Nilai Perusahaan Dengan Manajemen Laba Sebagai Variabel Moderasi. Jurnal Ilmiah Akuntansi Dan Bisnis, 14(1), 56–69. https://doi.org/10.24843/JIAB.2019.v14.i01.p06

- Sadiq, M., Singh, J., Raza, M., & Mohamad, S. (2020). The impact of environmental, social and governance index on firm value: Evidence from Malaysia. International Journal of Energy Economics and Policy, 10(5), 555–562. https://doi.org/10.32479/ijeep.10217

- Saeidi, S. P., Sofian, S., Saeidi, P., Saeidi, S. P., & Saaeidi, S. A. (2015). How does corporate social responsibility contribute to firm financial performance? The mediating role of competitive advantage, reputation, and customer satisfaction. Journal of Business Research, 68(2), 341–350. https://doi.org/10.1016/j.jbusres.2014.06.024

- Servaes, H., & Tamayo, A. (2013). The impact of corporate social responsibility on firm value: The role of customer awareness. Management Science, 59(5), 1045–1061. https://doi.org/10.1287/mnsc.1120.1630

- Sholihin, M., & Ratmono, D. (2021). Analisis SEM-PLS dengan WarpPLS 7.0. CV. Andi Offset.

- Sigalas, C., &Pekka Economou, V. (2013). Revisiting the concept of competitive advantage. Journal of Strategy and Management, 6(1), 61–80. https://doi.org/10.1108/17554251311296567

- Stanfield, Ken. (2005). Intangible finance standards: advances in fundamental analysis and technical. San Diego, CA: Elsevier Academic Press.

- Suttipun, M., & Thanyaorn, Y. (2021). Impact of environmental, social and governance disclosures on market reaction: An evidence of Top50 companies listed from Thailand. https://doi.org/10.1108/JFRA-12-2020-0377

- Taliento, M., Favino, C., & Netti, A. (2019). Impact of environmental, social, and governance information on economic performance: Evidence of a corporate “sustainability advantage” from Europe. Sustainability, 11(6), 1738. https://doi.org/10.3390/su11061738

- Thahira, A. M., & Mita, A. F. (2021 ESG disclosure and firm value: Family versus nonfamily firms [Paper presentation]. Proceedings of the Asia-Pacific Research in Social Sciences and Humanities Universitas Indonesia Conference (APRISH 2019), 558(Aprish 2019) (pp. 653–657). https://doi.org/10.2991/assehr.k.210531.081

- Vira, A. N., & Wirakusuma, M. G. (2019). Pengaruh Pengungkapan Corporate Social Responsibility Pada Nilai Perusahaan Dengan Good Corporate Governance Sebagai Pemoderasi. E-Jurnal Akuntansi, 26(2), 1299–1326. https://doi.org/10.24843/EJA.2019.v26.i02.p17

- Wang, H., Wang, S., Wang, J., & Yang, F. (2021). Does business strategy drive corporate environmental information disclosure? Journal of Environmental Planning and Management, 66(4), 733–758. https://doi.org/10.1080/09640568.2021.2002278

- Wang, J. (2016). Literature review on the impression management in corporate information disclosure. Modern Economy, 07(06), 725–731. https://doi.org/10.4236/me.2016.76076

- Wijayanto, A., Dzulkirom, M., Nuzula, N.F., Suhadak , (2019). The effect of competitive advantage on financial performance and firm value: Evidence from Indonesian manufacturing companies. Russian Journal of Agricultural and Socio-Economic Sciences, 85(1), 35–44. https://doi.org/10.18551/rjoas.2019-01.04

- Yekini, K., & Jallow, K. (2012). Corporate community involvement disclosures in annual report: A measure of corporate community development or a signal of CSR observance? Sustainability Accounting, Management and Policy Journal, 3(1), 7–32. https://doi.org/10.1108/20408021211223534

- Yiwei, L., Gong, M., Zhang, X.-Y., & Koh, L. (2018). The impact of environmental, social, and governace disclosure on firm value: The role of CEO power. The British Accounting Review, 50(1), 60–75. https://doi.org/10.1016/j.bar.2017.09.007

- Yordudom, T., & Suttipun, M. (2020). The influence of ESG disclosures on firm value in Thailand. GATR Journal of Finance and Banking Review, 5(3), 108–114. https://doi.org/10.35609/jfbr.2020.5.3(5)

- Yu, H. C., Kuo, L., & Kao, M. F. (2017). The relationship between CSR disclosure and competitive advantage. Sustainability Accounting, Management and Policy Journal, 8(5), 547–570. https://doi.org/10.1108/SAMPJ-11-2016-0086

- Zhang, J., & Yang, Y. (2023). Can environmental disclosure improve price efficiency? The perspective of price delay. Finance Research Letters, 52(2022), 103556. https://doi.org/10.1016/j.frl.2022.103556

- Zhao, Z., Meng, F., He, Y., & Gu, Z. (2019). The influence of corporate social responsibility on competitive advantage with multiple mediations from social capital and dynamic capabilities. Sustainability, 11(1), 218. https://doi.org/10.3390/su11010218

- Zumente, I., & Bistrova, J. (2021). ESG importance for long-term shareholder value creation: Literature vs. practice. Journal of Open Innovation: Technology, Market, and Complexity, 7(2), 127. https://doi.org/10.3390/joitmc7020127