?Mathematical formulae have been encoded as MathML and are displayed in this HTML version using MathJax in order to improve their display. Uncheck the box to turn MathJax off. This feature requires Javascript. Click on a formula to zoom.

?Mathematical formulae have been encoded as MathML and are displayed in this HTML version using MathJax in order to improve their display. Uncheck the box to turn MathJax off. This feature requires Javascript. Click on a formula to zoom.Abstract

This research aims to understand the nonlinear relationship between financial inclusion and Islamic banking stability, as well as the moderating effect of corporate social responsibility on this relationship. To do so, we use a sample of 27 Islamic banks operating in the GCC countries (Kuwait, Oman, Qatar, Saudi Arabia, and the United Arab Emirates) over the period 2012–2020. We used the two-step system generalized method of moments (SGMM). This method accounts for the dynamic nature of the dependent variable and potential endogeneity. The results indicate that there is an inverted U-shaped relationship between financial inclusion and Islamic banking stability. Moreover, they show that CSR moderates the relationship between financial inclusion and Islamic banking stability. It is imperative that policymakers and the leaders of Islamic banking institutions adopt a thoughtful financial inclusion strategy that carefully balances its advantages, such as promoting equity and financial justice, reducing funding costs and improving financial stability, with its potential disadvantages, such as the risks associated with excessive leverage. Moreover, the trade-off between financial inclusion and CSR is drastic to avoid default risks and optimize the effect of financial inclusion on Islamic banking stability.

1. Introduction

In the modern era, financial inclusion occupies a central place as a key enabler for achieving the UN Sustainable Development Goals by 2030 (UNSGSA, 2021). It is recognized that the promotion of financial inclusion is of critical importance to the growth of the economy as a whole (Kim et al., Citation2018; Murshed et al., Citation2023). One of its main benefits lies in its ability to eradicate global economic crises and foster economic resilience and financial stability (Ozili, Citation2018; Wang & Luo, Citation2022).

Historically, lessons learnt from the Subprime crisis have urged policymakers to move from a conventional banking model detrimental to financial stability and economic growth to an Islamic banking model essential to alleviate these problems. Due to their religious specificity, Islamic banks are based on profit and loss sharing, unlike the interest-based deposit and lending system of conventional banks. The strength of the governance structure, combining the Shariah-compliant supervisory board and the board of directors, is a hallmark of Islamic banks. This enables them to avoid systemic risks and financial turbulence (Mollah & Zaman, Citation2015; Nomran et al., Citation2018).

Extending access to formal financial services to the entire population, known as financial inclusion, is at the forefront of current economic policy debates. This concept implies that every adult should have the opportunity to access affordable financial services tailored to their needs (Bruhn and Love, Citation2014; Le et al., Citation2019). Beyond its direct implications for economic growth and individual well-being, financial inclusion is a central element in discussions about the stability of banking institutions (Wang & Luo, Citation2022).

In the era of sustainable development, financial inclusion brings significant benefits at both the macroeconomic and microeconomic levels. At the macroeconomic level, it is emerging as an essential lever in the fight against poverty and income inequality, helping to build a more equitable and sustainable foundation for society (Bruhn & Love, Citation2014). It has an impact on the social sphere by focusing on the inclusion of low-income individuals on the one hand, and by targeting specific cohorts such as women and young people on the other. It also focuses on the accessibility and inclusion of small, medium, and micro enterprises (Eid et al., Citation2023). Moreover, financial inclusion stimulates economic growth by facilitating access to financial resources for a greater number of people, thereby promoting a virtuous circle of development and sustainable growth (Emara & El Said, Citation2021). At the same time, it plays a crucial role in job creation, thereby increasing economic opportunities for the population (Ayyagari et al., Citation2008).

At the microeconomic level, financial inclusion is crucial for firms. It acts as a catalyst by facilitating access to bank credit, thereby reducing the barriers associated with imperfect information, such as anti-selection and moral hazard. By minimising these problems, it creates a more stable financial environment conducive to firm growth, thereby promoting the expansion and long-term viability of economic activities (Lee et al., Citation2020; Khémiri et al., Citation2023). In addition, financial inclusion stimulates competition among financial institutions by encouraging them to diversify their products and focus on their quality to attract a greater number of customers and transactions. This process also legitimises informal channels, further strengthening the financial landscape (Banna et al., Citation2022; Wang & Luo, Citation2022).

Financial inclusion is crucial for bank stability as it contributes to a more secure and robust financial system. Research has shown that a higher level of financial inclusion is associated with greater bank stability, especially for banks with higher customer deposit funding share, lower marginal costs of providing banking services, and those operating in countries with stronger institutional quality (Ahamed & Mallick, Citation2019). Additionally, evidence suggests that an amplified share of lending to small firms can improve financial stability, highlighting the benefits of greater financial inclusion (Morgan & Pontines, Citation2018). In an inclusive financial sector, banks can attract more stable customer deposits and provide safe loans, thereby enhancing their stability (Nguyen & Du, Citation2022). Overall, the link between financial inclusion and bank stability is characterized by more synergies than conflicts, with both being essential for a well-functioning financial system (Mu & Lin, Citation2016).

In theory, following (Banna et al., Citation2021), the association between financial inclusion and banking stability could be apprehended via three distinct hypotheses: (i) diversification, cost reduction and market power, (ii) reduction of procyclicality, (iii) absorption of inclusion-induced monetary shock. The first hypothesis focus on how financial inclusion can enhance banking stability by reducing information asymmetry and agency costs. It explains that information asymmetry occurs when lenders have incomplete information about borrowers’ project quality, leading to credit rationing and market inefficiencies (Jensen & Meckling, Citation1976). To overcome this problem, banks can diversify their services and reach new customer segments, thereby reducing the risk of default and the impact of market volatility (Danisman & Tarazi, Citation2020; Mishkin, Citation1992; Tang et al., Citation2024; Widarjono et al., Citation2023). In addition, this hypothesis is based on three lines of discussion. First, the role of agency costs in creating operational risks and conflicts of interest between shareholders, managers, and employees (Ghosh, Citation2022; Jensen & Meckling, Citation1976). It argues that shareholders may encourage managers to take risky decisions that are not aligned with the long-term interests of the bank, and that managers and employees may engage in opportunistic behaviour or neglect internal controls. To reduce these costs and ensure stability, banks can implement behavioural control and incentive mechanisms (Fama & Jensen, Citation1983). Second, it explores how operating costs affect the relationship between financial inclusion and banking stability. It argues that using innovative technologies to serve more customers reduces the costs of providing financial services and mitigates the information asymmetry problem (Banna et al., Citation2021). It also claims that Islamic banks can lower their intermediation costs through factors such as operating costs and diversification, and that Islamic banking assets are linked to lower bank margins (Ibrahim & Law, Citation2020; Miah et al., Citation2020). Third, it focuses on the role of market power in enhancing banking stability. It suggests that financial inclusion increases the bank market power, enabling them to negotiate better with other market players and improve their financial stability (Ahamed & Mallick, Citation2019; Banna et al., Citation2021; Ghosh, Citation2022). It further states that financial inclusion is advantageous for banking stability, and that Islamic banks may have more market power than conventional banks (Risfandy et al., Citation2019).

The second hypothesis proposes that financial inclusion can enhance banking stability by reducing procyclicality, which is the tendency of banks to lend more or less depending on the economic cycle. It argues that financial inclusion can act as a shock absorber, allowing individuals and firms to access credit even in downturns, and preventing the development of a parallel banking system that could undermine regulation and amplify risks (Beck et al., Citation2012; Ghosh, Citation2022). It also asserts that financial inclusion can help banks diversify their portfolios and reduce their exposure to economic volatility, thereby promoting stability. It suggests that financial inclusion can serve as a countercyclical adjustment mechanism in the financial system. Moreover, it claims that Islamic banks may have lower procyclicality than conventional banks, as their financing activities may be less affected by economic cycles (Soedarmono & Yusgiantoro, Citation2023).

The third hypothesis discusses how financial inclusion can enhance banking stability by absorbing monetary shocks, which are unexpected changes in economic conditions. It argues that financial inclusion allows individuals and firms to access financial services, reduce external debt, and diversify their funding sources, thereby increasing their resilience to shocks (Marcelin et al., Citation2022). It also claims that financial inclusion encourages banks to take more risks, lend to SMEs, and compete with new players, leading to greater financial stability in the long run (Ahamed & Mallick, Citation2019; Danisman & Tarazi, Citation2020; Ghosh, Citation2022; Ozdemir et al., Citation2023). In addition, it examines the role of Islamic banking in managing and absorbing monetary shocks. It suggests that Islamic banks can cope with shocks better than conventional banks, as they follow the principles of risk sharing, limited risk-taking, and real activities (Zaheer & Farooq, Citation2014). It further states that Islamic banks are more resilient to shocks and less procyclical, and that they can promote financial stability during crises by maintaining lending activities.

In practice, the banking literature is mixed on the impact of financial inclusion on financial stability (Čihák et al., Citation2021). A few empirical studies have examined the relationship between financial inclusion and banking stability (e.g., Ahamed & Mallick, Citation2019; Morgan & Pontines, Citation2018; Wang & Luo, Citation2022). According to a number of studies, financial inclusion could lead banks to engage in lending to borrowers with a higher level of risk. This can lead to higher transaction costs and information asymmetries. This leads to increased default risk, which translates into additional costs in terms of provisioning and funding that negatively affect lending and profitability, and vice versa (Ghosh, Citation2022).

However, the most research focus on analysing the influence of financial inclusion on conventional banking stability. There are limited studies investigating the relationship between financial inclusion and Islamic banking stability (Damrah et al., Citation2023). The purpose of this study is to fill a gap in the literature. We examine the possible association between financial inclusion on Islamic banking stability in GCC countries.

Furthermore, the linear relationship between financial inclusion and banking stability has been the focus of empirical studies (e.g., Ahamed & Mallick, Citation2019; Danisman & Tarazi, Citation2020). However, there is another gap in the literature. Thus, this study focuses on the non-linear relationship between financial inclusion and banking stability. More precisely, we hypothesize that the relationship between financial inclusion and Islamic banking stability may follow an inverted U-shaped. This scenario reveals two categories of banks: those whose stability increases due to the need for greater financial inclusion, but only up to an inflection point where bank fragility begins to worsen due to levels of financial inclusion. The study suggests that financial inclusion may not automatically improve banking stability (Oanh et al., Citation2023), and that it is crucial for Islamic banks to be involved in the process of optimizing their stability. Consequently, Islamic banks must reach a certain threshold of financial inclusion to optimize their stability in the GCC countries.

In this case, it is important to assess the impact of financial inclusion on Islamic bank stability, considering the effects of other factors that may influence this relationship. Particularly, corporate social responsibility (CSR) - an approach to stakeholder satisfaction that has many similarities with financial inclusion - can make a major contribution to managing the impact of financial inclusion on the stability of Islamic banks. More precisely, it should be noted that improving CSR can help enhance the banking stability. Indeed, because of the complexity of their financial products, Islamic banks may face agency issues that reduce their credibility (Ahmed & Chapra, Citation2002; Mollah et al., Citation2017). To alleviate this problem, Islamic banks have adopted a different ethical and religious approach to that adopted by conventional banks with a view to generating social benefits for their stakeholders, while fulfilling their CSR (Belal et al., Citation2015). In this framework, the Accounting and Auditing Organization for Islamic Financial Institutions (AAOIFI) has mandated Islamic banks to disclose CSR to enhance their stability by issuing Standard No. 7. Although this regulatory body has acted, it is possible that Islamic banks may not be publicly disclosing their CSR practices, even if they are implementing them, and this issue needs to be addressed (Mallin et al., Citation2014).

Some studies have analysed the impact of CSR on Islamic bank stability and found opposite results (e.g., Neitzert & Petras, Citation2022; Salim et al., Citation2023). Other studies have looked at CSR effects on financial inclusion (e.g., Singh et al., Citation2021; Vo et al., Citation2022). CSR is crucial in reducing systemic and systematic risks (Farah et al., Citation2021; Dorfleitner & Grebler, Citation2022). Incorporating CSR practices into corporate policies can enhance the reputation of firms, foster the confidence of investors and creditors, and thereby contribute to the creation of a more stable financial environment (Elgattani & Hussainey, Citation2020; Khémiri & Alsulami, Citation2023; Salim et al., Citation2023). In this context, agency theory suggests that CSR activities can benefit shareholders and reduce bank risk, but only if they are well designed and well managed. Otherwise, CSR programmes may focus on pleasing stakeholders instead of increasing firm value, potentially to the detriment of bank stability (Fama & Jensen, Citation1983; Jensen & Meckling, Citation1976).

While there is some research indicating the importance of financial inclusion and CSR for the Islamic bank’s stability, there is another gap in the existing research regarding the potential tensions between financial inclusion and CSR. In fact, these two approaches may be at odds with each other, even though they pursue similar objectives: minimising interest conflicts, financial constraints and enhancing banking stability. Therefore, the moderating effect of CSR on the relationship between financial inclusion and Islamic bank stability needs to be studied.

For this purpose, this research has the main objectives as outlined below. Firstly, to explore the impact of financial inclusion on Islamic banking stability in GCC countries. Secondly, to investigate the nonlinear relationship between financial inclusion and Islamic banking stability. Finally, to study the moderating effect of CSR on the relationship between financial inclusion and Islamic banking stability.

In order to achieve these objectives, this study addresses the following research questions. First, how does financial inclusion affect the stability of Islamic banks in the GCC countries? Second, what is the nature and magnitude of the nonlinear relationship between financial inclusion and Islamic bank stability? Third, how does CSR moderate the relationship between financial inclusion and Islamic bank stability?

Consequently, the present paper attempts to provide the main contributions to the extant literature. First, the paper is the first attempt to investigate the effect of financial inclusion on Islamic banking stability in GCC countries. Second, the paper is the first attempt to test the nonlinear relationship between financial inclusion and Islamic banking stability. Third, the study contributes to the literature by providing further evidence on the moderating effect of CSR on financial inclusion and Islamic banking stability in GCC countries. Fourth, although various studies have been conducted on the influence of financial inclusion on financial stability in various countries and regions, the paper is the first attempt to examine the relationship between financial inclusion and Islamic bank stability in the GCC region.

There are several reasons for choosing the GCC countries. These countries are world leaders in Islamic banking, with a large share of regional banking assets. Islamic banks in the GCC have similar economic environments, which makes the analysis more consistent. This study is important because Islamic governance is distinguished from conventional governance by its adherence to Sharia principles, which prioritise justice, social responsibility and the refusal of personal interest. These principles shape the decisions and operations of IFIs, making them different from conventional ones (Raouf & Ahmed, Citation2022). While the benefits of financial inclusion have been widely highlighted in the literature, little attention has been paid to its impact on banking stability. Assessing this impact is essential for understanding the difficulties banks have faced in expanding their services, especially in the aftermath of the global economic crisis of 2008-2009. The researchers stress the importance of this concern, as banking stability plays a positive and significant role in economic development.

In addition, these countries have made significant progress in advancing financial inclusion, CSR, and Islamic banking in recent years, but they also face some challenges and opportunities. The GCC countries are among the leading markets for Islamic banking in the world, accounting for about 40% of the global Islamic banking assets (Akkaş, Citation2017). Islamic banking has grown rapidly in the region, driven by the demand for Sharia-compliant products and services, the support of the governments and regulators, the development of the Islamic financial infrastructure and ecosystem, and the diversification of the economies away from oil dependence. However, some of the issues and prospects that arise include the need for more standardization and harmonization of the Islamic banking regulations and practices, the enhancement of the risk management and governance frameworks, the expansion of the product offerings and customer segments, the adoption of fintech and digital solutions, and the alignment of Islamic banking with the sustainable development goals (SDGs).

The GCC countries have adopted various policies and initiatives to enhance financial inclusion, such as developing national financial inclusion strategies, establishing financial inclusion committees, promoting digital financial services, supporting micro, small, and medium enterprises (MSMEs), and strengthening financial literacy and consumer protection. However, some of the challenges and gaps that remain include low levels of financial inclusion among women, youth, rural populations, and refugees; limited availability and diversity of financial products and services; inadequate financial infrastructure and interoperability; and regulatory barriers and risks related to financial technology (fintech) and anti-money laundering and combating the financing of terrorism (Ltaifa et al., Citation2018).

The GCC countries have demonstrated a strong commitment to CSR, particularly in the areas of environmental sustainability, social responsibility, and governance. Some examples of CSR initiatives in the region include the adoption of green and social bonds, the implementation of Environmental, Social, and Governance (ESG) standards and reporting, the establishment of CSR awards and indices, the integration of CSR into national visions and strategies, and the involvement of various stakeholders (e.g., governments, regulators, banking etc.).

However, there are challenges and opportunities in the GCC region related to CSR. The first challenge is the lack of a common definition and framework for CSR: This can make it difficult for organizations and stakeholders to align their CSR efforts and measure their impact effectively (Ghardallou & Alessa, Citation2022). The second challenge is need for more awareness and capacity building: Increased awareness and capacity building are essential for organizations and stakeholders to effectively implement and manage CSR initiatives (AlDhaen, Citation2022). The third challenge is the potential for enhancing CSR innovation and impact measurement: The region can benefit from further innovation in CSR practices and improved measurement techniques to assess the impact of CSR initiatives (Ghardallou & Alessa, Citation2022). The fourth challenge is the role of CSR in addressing the COVID-19 pandemic and its aftermath. CSR can help organisations and stakeholders respond to the challenges of the pandemic and rebuild their operations and strategies.

Using the two-step system generalized method of moments (SGMM), we examine the non-linear relationship between financial inclusion and Islamic bank stability, given that stakeholders are expected to interact positively with high levels of financial inclusion and vice versa. The main findings of this study are that financial inclusion improves the Islamic bank stability and that Islamic banks do not need to reach a certain threshold of financial inclusion to improve their stability. This study contrasts with other recent research that suggests that increasing (decreasing) levels of financial inclusion always leads to bank stability. This may be due to the specificity of Islamic banks.

The paper is structured as follows. The literature review and hypothesis development are outlined in Section 2. Section 3 describes the research methodology used and provides a detailed description of the specifications of the empirical model, the data used, and the econometric methods applied in this study. The various findings are discussed in Section 4. Finally, section 5 is a summary of the conclusions.

2. Background

The GCC countries have played a significant role in the growth and development of Islamic finance, with Islamic banks and financial institutions holding a substantial portion of the total banking assets in the region. The first Islamic bank, Dubai Islamic Bank, was established in 1975, marking the beginning of Islamic banking in the GCC region (Chazi et al., Citation2018). Islamic banks in the GCC countries have experienced significant growth. According to a report by Fitch Ratings (Citation2020), the GCC Islamic banks had a combined total asset of $1.1 trillion at the end of 2019, representing 42.3% of the global Islamic banking assets. The GCC countries have been instrumental in the growth of Islamic finance, with their Islamic banks and financial institutions now holding a significant portion of the total banking assets in the region. These countries have developed various Islamic financial instruments, which have contributed to the growth of Islamic finance in the region.

Overall, Islamic banks in the GCC countries have experienced substantial growth and development, with a significant portion of total banking assets now held by Islamic banks and financial institutions. The GCC countries have played a crucial role in this growth, with their regulatory frameworks and economic initiatives supporting the expansion of Islamic finance in the region. The regulatory, reform, and policy issues related to financial inclusion, CSR, and Islamic bank stability in the GCC countries have been the subject of several studies. These countries have been actively pursuing reforms to enhance financial stability (Magazzino, Citation2022; Qanas & Sawyer, Citation2022), focusing on promoting digital financial inclusion to enhance access to financial services for all segments of the population (IMF, Citation2018). This is in line with the sustainable economic growth goals of the region and pursuing reforms to enhance CSR (Garas & ElMassah, Citation2018).

Specifically, financial inclusion is an important factor in the economic and social development of GCC countries. According to the World Bank, financial inclusion refers to the ability of individuals and businesses to access a range of financial products and services that are affordable, useful, tailored to their needs and offered by reliable and responsible providers. Financial inclusion can help reduce poverty, promote shared prosperity, build resilience to shocks, stimulate entrepreneurship, and support the transition to low carbon economies. GCC countries have made significant progress in financial inclusion in recent years, thanks to the implementation of national strategies and policies, technological innovation, diversification of products and distribution channels, improved regulation and supervision, and the promotion of financial awareness and education (Mekouar & Robert, Citation2019).

These countries have made significant progress in financial inclusion in recent years, thanks to the implementation of national strategies and policies, technological innovation, diversification of products and distribution channels, improved regulation and supervision, and the promotion of financial awareness and education. Kuwait has adopted several reforms to improve its financial inclusion, such as issuing regulations for electronic payments and Fintech products, introducing, and regulating new types of bonds and sukuk (Sattout & Azmy, Citation2022), and enhancing its macroprudential framework and financial safety net (IMF, Citation2019). However, Kuwait still faces challenges from its limited economic diversification, high concentrations in its banking sector, and external risks from oil price shocks and geopolitical tensions.

In recent years, Oman also has adopted several key financial inclusion reforms to enhance its financial sector and promote inclusive growth. First, the Oman adopted different measures such as provisions in the country’s labour law obliging employers to pay salaries into bank accounts have contributed to high levels of financial inclusion (Oxford Business Group, Citation2018). Second, Oman’s structural reform agenda under Vision 2040 aims to foster inclusive growth, enhance job creation, and bolster resilience (IMF, Citation2023). The reforms under implementation include the improvement of fiscal and external positions, prudent fiscal management, and high oil prices to strengthen the social safety net. Third, the Central Bank of Oman (CBO) is working on improving the monetary policy framework and strengthening the banking sector’s resilience by expediting the implementation of its Monetary Policy Enhancement Project (IMF, Citation2023). These reforms demonstrate Oman’s commitment to promoting financial inclusion and fostering sustainable economic progress for all its citizens.

As for Qatar, several key financial inclusion reforms have been adopted to enhance its financial sector. First, the Qatar Central Bank (QCB) collaborated with MicroSave consulting (MSC) to develop a national financial inclusion and literacy strategy, which includes a comprehensive national survey of Qatar’s population. Second, Qatar’s regulators, including the Qatar Financial Markets Authority (QFMA), have taken proactive measures to strengthen the financial system and promote initiatives focused on sustainable finance, green finance and digital transformation. Qatar also occupies a strategic position as a FinTech hub leader in the Middle East, distinguished by its pioneering role in digital transformation and the promotion of sustainability in the financial services sector.

Saudi Arabia has implemented several financial inclusion reforms in recent years. The Council for Economic Affairs and Development launched a project entitled Financial Sector Development Program 2020. This program is considered the largest and most exclusive aimed at promoting financial planning, known as financial inclusion policies (Nurunnabi, Citation2017).

As for the United Arab Emirates (UAE) has undertaken significant financial inclusion reforms in recent years to modernize its financial services sector. First, the UAE replaced the 1980 Union Law with Federal Law No 14 of 2018 regarding the Central Bank and Organization of Financial Institutions and Activities, strengthening the Central Bank’s regulatory control over the financial sector in line with international best practices and standard (CBUAE, Citation2018). Second, the Central Bank of UAE (CBUAE) launched the FIT programme to accelerate digital transformation in the financial services sector. This initiative seeks to enable the UAE to become a financial and digital payments hub by supporting financial services and promoting digital transactions. The programme includes initiatives such as the launch of a domestic card scheme, an instant payments platform, and the issuance of a central bank digital currency for cross-border and domestic use (CBUAE, Citation2023). Third, the UAE has introduced a regulatory sandbox framework to provide an alternative pathway for the licensing of innovative fintech products and services, such as buy now pay later (BNPL) and open banking (CBUAE, Citation2018).

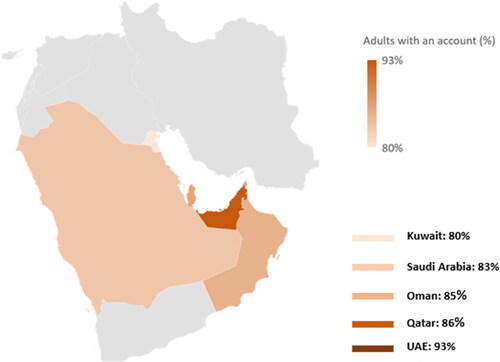

These reforms aim to improve financial inclusion in GCC countries, which has seen an increase by international standards. According to the World Bank’s Global Findex database, bank account possession among adults in GCC countries rose from 62% in 2014 to 73% in 2017, above the global average of 69%. illustrates a map of the Adults with an account (%) in GCC countries in 2021 (Kuwait (80%), Saudi Arabia (83%), Oman (85%), Qatar (86%) and UAE (93%).

Figure 1. Map of the adults with an account (%) in GCC countries in 2021. Source: World Bank (Global Findex) and authors’ creation.

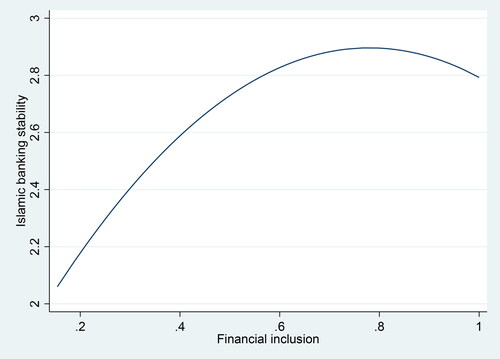

Figure 2. The inverted U-shaped association between financial inclusion and Islamic banking stability.

In recent decades, the promotion of CSR has been of interest to both developed and developing countries (Wirba, Citation2023). Like other countries, the GCC countries have also tried to promote CSR. For example, the CSR is an important aspect of Kuwait’s business culture, and the country has taken steps to promote CSR within businesses. In addition, the Kuwait government’s promotion of CSR stems primarily from the importance of cultural, political, and economic structures (White & Alkandari, Citation2019).

As for Oman, it has undertaken significant CSR reforms to promote corporate governance and sustainability. In 2015, Oman established the Oman Center for Governance and Sustainability (OCGS) through Royal Decree 30/2015 to spread awareness among the corporate sector on good practices in corporate governance and sustainability issues. The OCGS aims to encourage and optimize CSR practices in Oman and facilitate the sharing of good practices. Additionally, there have been efforts to reshape the social protection landscape of the Sultanate of Oman, which has the potential to further improve CSR initiatives in the country. Furthermore, a study has shown that CSR budgeting and spending have increased considerably during the COVID-19 pandemic, indicating a humanitarian response to the crisis (Baatwah et al., Citation2022). These reforms and initiatives reflect Oman’s commitment to advancing CSR and sustainability practices within the country.

In addition, Qatar. has made significant efforts to address CSR. Qatari banks have embraced ESG practices and are adopting sustainability measures. The Central Bank of Qatar (QCB) has created a dedicated department to define ESG policies, standard reporting framework, and management of ESG risk and compliance. The QCB has been actively involved in promoting sustainable investment and green finance, as highlighted in the Second Strategic Plan for Financial Regulation (SSP-2) published collaboratively by the three domestic regulators in 2018. The Qatari banking sector has also been actively engaged in ESG initiatives, with banks incorporating ESG principles into their strategies, distributing green bonds, offering green loans and mortgages, and implementing ESG disclosures. For example, Qatar Islamic Bank (QIB) has made a major step towards sustainability by being the first Qatar-based bank to join the Equator Principles Association (EP Association). This global regulatory regime provides guidelines for identifying, assessing and managing the environmental and social risks associated with bank-financed projects (QIB, Citation2023).

CSR reforms in Saudi Arabia have been evolving, with companies increasingly focusing on social and environmental issues in addition to their core business activities. The country has embarked on social-economic reforms known as the Saudi Vision 2030, which aims to improve the country’s competitiveness and reduce its reliance on oil. CSR plays a crucial role in achieving these goals by promoting sustainable development and addressing social issues. CSR in Saudi Arabia faces several challenges, including the lack of a regulatory framework, limited awareness, and the influence of religious and cultural factors (Abo Shareb, Citation2023). However, there is a growing interest in CSR among Saudi businesses, and the government has been taking steps to address these challenges. The Saudi banking sector has been actively involved in CSR initiatives, demonstrating a commitment to sustainability and community engagement. Banks have been implementing CSR initiatives in various areas, such as education, healthcare, and environmental conservation.

CSR reforms in the United Arab Emirates (UAE) are initiatives that aim to promote and regulate CSR practices among companies operating in the country. The CSR UAE Fund, established by the federal government in 2018, which is a platform that encourages, manages, and directs the contributions of the business sector towards national priority initiatives and sustainable development goals. The Dubai Chamber CSR Label, launched by the Dubai Chamber of Commerce and Industry in 2010, which is a certification scheme that recognizes and rewards the best CSR practices among companies in Dubai (Zamoum & Serra Gorpe, Citation2020). The CSR Law, proposed by the Ministry of Commerce and Investment in 2019, which would make CSR mandatory for all companies in the UAE, and would create a CSR fund, a CSR council, and a CSR rating system. These CSR reforms reflect the growing awareness and demand for responsible business practices in the UAE, as well as the alignment of CSR with the Islamic principles of social justice, environmental stewardship, and ethical conduct. CSR reforms in the UAE also offer opportunities for businesses to enhance their reputation, competitiveness, and sustainability in the local and global markets.

3. Theoretical literature review

In the banking literature, there is a growing awareness of the crucial role that financial inclusion help to diminish information asymmetry in financial markets, thereby contributing significantly to improving the banking stability (Allen et al., Citation2014; Beck et al., Citation2012). This complex relationship between financial inclusion, the reduction of information asymmetry and financial stability is increasingly attracting interest in academic and policy circles (Wang & Luo, Citation2022). To better understand this relationship, it is important to review the literature on the link between access to finance and banking stability.

The relationship between financial inclusion and banking stability could be explained by three basic hypotheses (Banna et al., Citation2021). The first hypothesis involves diversification, cost reduction and market power. This hypothesis is supported by an extensive analysis of the intrinsic mechanisms for reducing information asymmetry in the banking sector. In an environment dominated by the existence of imperfect information, lenders cannot fully observe the project quality for which a borrower is seeking a loan, which creates a breeding ground for information asymmetry problem. This problem can lead to credit rationing and market inefficiencies, with borrowers potentially excluded even if they are able to repay their loans. In the banking context, information asymmetry problem can lead to opportunistic behaviour, moral hazard, and adverse selection problems, thereby threatening the financial (Jensen & Meckling, Citation1976).

Therefore, controlling the information asymmetry problem becomes crucial to build trust, minimise the risk of default, promote allocation of resources and ensure financial stability (Allen et al., Citation2014; Mishkin, Citation1992). Asymmetric information theory (Akerlof, Citation1970) underlines the challenges present in the marketing of financial services, not least the difficulty of distinguishing solid from less reliable borrowers. This problem occurs when one of the parties involved in a loan transaction possesses more information than the other, making it more difficult to assess the reliability of borrowers. This issue restricts access to credit, impacting efficiency and stability. The advent of financial inclusion, considered by the massive arrival of new customers with no prior experience of the formal financial sector, exacerbates this problem. Lenders struggle to determine the quality of borrowers, threatening financial performance and the financial system stability. In this context, banks face major difficulties in operating effectively when dealing with financial inclusion, due to this persistent information asymmetry.

Furthermore, under financial intermediation theory (Diamond, Citation1984), the role of banks as intermediaries between borrowers and savers, facilitating the collection and disbursement of funds to bridge the financial gap between market players. The availability Banks strive to reduce market-trading costs by promoting greater financial inclusion. This approach aims to reduce information asymmetries, thereby reducing market imperfections among its participants.

By broadening access to financial services, banks can reach new customer segments and reduce the opacity that often exists in the relationship between lender and borrower. The resulting diversification of banking services enables financial institutions to offer a wide range of products and services, thereby limiting their dependence on any one source of income. This diversification helps mitigate the risks associated with asset concentration and reduces the potential impact of financial market volatility on bank stability (Danisman & Tarazi, Citation2020; Tang et al., Citation2024). In addition, in Islamic banking, income diversification and risk reduction can lead to the reduction of the price of Islamic bank financing products as well as their intermediation costs (Saifurrahman & Kassim, Citation2022; Widarjono et al., Citation2023). This is emphasizing the role of diversification in reducing risk and potentially lowering costs in Islamic banking operations.

Following on from the first hypothesis, in terms of costs, the relationship between financial inclusion and banking stability could be better understood through the question of agency and operating costs. First, agency costs can create operational risks by introducing conflicts of interest between different stakeholders, thereby increasing transaction cost (Ghosh, Citation2022). In addition, agency theory suggests that shareholders, seeking to maximise their personal wealth, may induce managers to take risky decisions that are not in the long-term interests of the bank. These incentives may lead to opportunistic behaviour and the pursuit of risky projects, thereby increasing the probability of default (Jensen & Meckling, Citation1976). Managers may be incentivised to take excessive risks in portfolio management, ignore internal control procedures or neglect regulatory compliance to generate higher risks. In addition, agency costs can manifest themselves in the relationship between managers and employees, creating internal operational risks. To reduce costs and vertical alliances between different stakeholders and to ensure long-term stability, behavioural control and incentive mechanisms are implemented. Second, operating costs play a key role in the financial inclusion-banking stability nexus. More specifically, the use of innovative financial technologies to serve a wider customer base improves banks’ operational efficiency, thereby reducing the costs associated with the provision of financial services. This cost reduction is particularly important in the context of reducing information asymmetry, as it allows banks to allocate their resources more effectively to assessing and managing the risks associated with lending. By lowering barriers to entry and making financial services more accessible, operational costs could be reduced, helping to broaden access to credit while minimizing the risks associated with decision-making under imperfect information (Banna et al., Citation2021). In addition, in Islamic banking, Islamic banks can indirectly reduce financial intermediation costs through various factors such as operating costs and diversification (Ibrahim & Law, Citation2020; Miah et al., Citation2020). The presence of Islamic banking assets is associated with lower bank margins, on average, which implies a potential for cost reduction in the banking sector.

Finally, another idea linked to the first hypothesis is also worth exploring: the market power. Indeed, the expansion of the customer base resulting from financial inclusion strengthens the bank market power. Increased market power can enable banks to bargain more effectively with other market participants, thereby reducing transaction costs and improving financial stability. By strengthening their position, banks can better absorb potential shocks, thereby strengthening the resilience of the financial system as a whole (Ahamed & Mallick, Citation2019; Banna et al., Citation2021; Ghosh, Citation2022). The first hypothesis then suggests that financial inclusion has a substantial and positive influence on the banking stability. Furthermore, in Islamic banking, banks may express a higher degree of market power than conventional banks (Risfandy et al., Citation2019).

The second hypothesis concerns the reduction of procyclicality. This hypothesis suggests that financial inclusion can act as an economic shock absorber, mitigating the hostile effects of economic cycles on financial stability. In period of economic downturn, banks play a crucial role in facilitating access to financial services, especially credit, for individuals and firms. By broadening financial inclusion, a larger number of actors have access to financing mechanisms, which can counterbalance the tendency of banks to tighten their credit policies in times of crisis.

In difficult economic period, banks often tend to restrict lending, fearing an upsurge in defaults and a deterioration in asset quality. However, robust financial inclusion could mitigate this response by allowing individuals and firms to continue to access financial services, thereby limiting the influence of the credit crunch on the real economy. Moreover, restricting access to credit can have a significant impact, in particular by encouraging the development of a parallel banking system. This emergence poses a major challenge to financial stability; as such, an extensive parallel network has the potential to significantly weaken the effectiveness of existing banking regulations. Moreover, the use of unregulated funding channels exacerbates procyclicality and creates a dynamic in which financial risks are amplified. This situation highlights the importance of balancing access to credit to support growth while maintaining the financial stability. By facilitating access to credit even during downturns, financial inclusion can help sustain aggregate demand, support investment, and mitigate deflationary pressures (Beck et al., Citation2012; Ghosh, Citation2022).

This ability to reduce the procyclicality of the financial system is essential for overall stability, as it helps to limit the exacerbated fluctuations of the economic cycle. Indeed, more flexible credit management in difficult times can help to mitigate the adverse effects of economic volatility, thereby promoting greater financial stability. Greater financial inclusion offers banks the opportunity to contribute in deposit and lending operations for moderately disadvantaged segments of the population. This helps to mitigate pro-cyclical risk for banks by exposing them to a more diverse customer base. By integrating these socially disadvantaged groups, banks can stabilise and diversify their financial portfolios by reducing the sensitivity of their activities to economic fluctuations. Thus, this hypothesis highlights the central role of financial inclusion in supporting stability by acting as a countercyclical adjustment mechanism in the financial system.

In Islamic banking, the reduction of procyclicality suggests that Islamic banks may exhibit lower procyclicality compared to conventional banks. Procyclicality refers to the tendency of banks to increase or decrease lending activities during economic booms or downturns. The hypothesis implies that Islamic banks’ financing activities may be less influenced by economic cycles, potentially reducing the overall procyclicality in the financial system (Soedarmono & Yusgiantoro, Citation2023).

The third hypothesis relates to absorption of inclusion-induced monetary shock. It highlights the crucial role of financial inclusion in producing a financial system that is resilient to economic shocks. Financial inclusion allows not only individuals but also firms to be better prepared for unforeseen economic events by facilitating access to financial services for a wider section of the population. When financial inclusion stimulates the growth of stable deposits, it offers countries the opportunity to reduce their reliance on external debt, thereby helping to mitigate potential shocks. This transformation encourages banks to seek an optimal mix of funding, which has a significant impact on their strategic risk-taking. As a result, banks may be more inclined to take risks, benefit from increased liquidity and strengthen their market power.

Although traditionally criticized, the perspective on risk-taking is changing, allowing banks to lend to SMEs with greater confidence in the recovery of their investments (Marcelin et al., Citation2022). This is because well-managed financial inclusion provides banks with opportunities for diversification and growth, mitigating the traditional perception of reduced risk tolerance in an era of falling funding costs (e.g., Ahamed & Mallick, Citation2019; Danisman & Tarazi, Citation2020). In the long run, well-managed financial inclusion can strengthen financial stability (Vo et al., Citation2019). By expanding access to financial services, financial inclusion has the potential to increase competition in the market (Owen & Pereira, Citation2018).

The introduction of new players, such as microfinance institutions and digital banks, puts upward pressure on competition, prompting traditional banks to offer more competitive interest rates to attract and retain customers (Ozdemir et al., Citation2023). At the same time, this expansion promotes transparency and reduces information asymmetries, contributing to a more efficient financial market. Better informed and educated borrowers can negotiate more favourable interest rates, thereby limiting the potential for financial repression through artificially low interest rates (Ghosh, Citation2022). In sum, the positive influence of financial inclusion on banks’ funding dynamics, founded on the monetary shock absorption hypothesis, is manifested in an increased propensity of banks to take risks, thereby promoting financial stability in the long run.

This hypothesis in Islamic banking refers to the ability of Islamic banks to manage and absorb monetary shocks, which may arise owing to factors such as changes in interest rates, inflation, and economic conditions. This hypothesis suggests that Islamic banks can effectively manage these shocks, reducing their impact on the overall financial system and promoting financial stability (Zaheer & Farooq, Citation2014). In addition, Islamic finance emphasizes risk sharing, limits on excessive risk-taking, and strong links to real activities, which can help Islamic banks manage monetary shocks more effectively than conventional banks. Furthermore, Islamic banks, due to their emphasis on risk management and real activities, are believed to be more resilient to shocks and less prone to procyclical behaviour. Finally, Islamic banks are believed to play a role in promoting financial stability, especially during crises. For example, they may be less likely to cut lending during liquidity crises, reducing financial fragility and the transmission of financial shocks to the real economy.

4. Empirical literature review and hypotheses development

4.1. Financial inclusion and bank stability

As mentioned earlier, the theoretical framework focuses primarily on the asymmetric information theory invented by Akerlof (Citation1970) to explain the link between financial inclusion and banking stability. This theory suggests that borrowers in the commercialization of financial services make it difficult to distinguish between good and bad borrowers. This leads to a credit crunch and affects financial efficiency and stability. They also suggest that financial inclusion, which brings more uninformed customers into the formal sector, exacerbates the problem of asymmetric information, and poses a challenge to banks (Bofondi & Gobbi, Citation2004).

There have been empirical studies have focused on the asymmetric information theory to explain the impact of financial inclusion and financial stability. For example, using a large sample of 2635 banks in 86 countries over the period 2004-2012, Ahamed and Mallick (Citation2019) suggested that financial inclusion contributes to improving financial stability, especially in economies with better institutional quality. In addition, Danisman and Tarazi (Citation2020) examined the relationship between financial inclusion and European banking stability. The study provides evidence that financial inclusion not only benefits society but also contributes to the European banking stability. Furthermore, Banna et al. (Citation2021) investigated the impact of fintech-based financial inclusion on banks’ risk-taking behaviour in OIC countries. The study analyses data from 534 banks. The objective is to determine whether a higher degree of fintech-based financial inclusion increases banks’ risk-taking behaviour. The results suggest that, with the relationship becoming stronger in the post-Industrial Revolution 4.0 (IR4.0) era, a higher degree of fintech-based financial inclusion regulates banks’ risk-taking behaviour. In addition, by comparing countries with high and low levels of financial development, Oanh et al. (Citation2023) show that financial inclusion improves financial stability in countries with high levels of financial development. However, in low financial development countries, financial inclusion has a diminishing influence on financial stability. This suggests that in countries with a high level of financial development, the relationship between financial inclusion and financial stability may be more complex and that financial inclusion does not necessarily contribuate to an improvement in financial stability.

In the same vein, Morgan and Pontines (Citation2018) found that maintaining financial stability could be achieved by increasing the share of SME lending in total bank lending in Singapore. They concluded that financial stability is achieved by decreasing the probability of default and non-performing loans through increasing the share of lending to SMEs. In addition, Ghosh (Citation2022) found the same result across countries, notwithstanding interest rate repression. Perrin and Weill (Citation2022) found that improving women’s access to credit supports financial stability. Using 36 emerging market countries, Wang and Luo (Citation2022) showed that improving financial inclusion could enhance financial stability.

If we compare studies on conventional and Islamic banks, the results are still mixed. As for conventional banks, for example, Feghali et al. (Citation2021) provided insights into the relationship between financial inclusion and macroeconomic stability using international evidence. The main finding suggested that financial inclusion can weaken financial stability if not properly managed, while payments and savings inclusion have neutral or positive effects. They also highlighted the importance of considering bank market structure in understanding the impact of financial inclusion on financial stability. Neaime and Gaysset (Citation2018) examined the impact of financial inclusion on income inequality, poverty, and financial stability in the MENA (Middle East and North Africa) countries. They found that financial inclusion decreases income inequality, but it has no significant effect on poverty. Additionally, the empirical links both population size and inflation to rising income inequality. The study provides valuable insights into the relationship between financial inclusion, income inequality, and poverty in the MENA region, which can have implications for policy and practice in the context of financial stability. In addition, Vo et al. (Citation2019) explored how financial inclusion, which involves providing individuals and small businesses with access to affordable financial services, affects macroeconomic stability in 22 emerging and frontier markets. They suggested that financial inclusion has a positive impact on financial stability, inflation, and output growth up to a certain point. The paper also discusses the policy implications of its findings. Furthermore, Malik et al. (Citation2022) aimed to assess how social sustainability may increase financial inclusion and maintain financial stability in Asia. The study argues that social sustainability can encourage the population in an economy to initiate and maintain good terms with the institutions, thereby supporting financial inclusion and stability. The research emphasizes the need for governments to reconsider their policies by creating a balance between economic growth, environmental sustainability, and social sustainability to foster financial inclusion and stability in Asian countries. The study provides valuable insights into the role of social sustainability in promoting financial inclusion and stability, particularly in the context of Asian economies.

Several studies have focused on Islamic finance and revealed some important conclusions. For instance, Elghuweel et al. (Citation2017) investigated the influence of corporate and Islamic governance mechanisms on corporate earnings management behaviour in Oman. The findings revealed that better-governed corporations in Oman tend to engage significantly less in earnings management than their poorly governed counterparts. Additionally, the study suggests that companies that are more committed to integrating Islamic religious beliefs and values into their operations through the implementation of Islamic governance structures are also less likely to engage in earnings management practices. Albassam and Ntim (Citation2017) investigated the impact of Islamic values on the extent of voluntary corporate governance disclosure in Saudi listed firms. The findings indicated that firms demonstrating a greater commitment to incorporating Islamic values into their operations tend to have higher levels of voluntary CG disclosure. This suggested that Islamic values may influence the transparency and disclosure practices of firms in Saudi Arabia. In addition, Elamer et al. (Citation2020a) explored the impact of Sharia supervisory board and governance structures on the extent of operational risk disclosures in Islamic banks in MENA countries. The outcomes suggested that Sharia supervisory board, block ownership, board independence, and country-level governance quality are positively associated with operational risk disclosures.

As for Islamic banking, empirical studies are based on the analysis of financial stability determinants. Lassoued (Citation2018) found that the stability of Malaysian Islamic banking is positively influenced by independent board members. However, it seems that Shariah board size and board size do not affect the stability of Islamic banking. In addition, Raouf and Ahmed (Citation2022) showed that risk governance negatively affects the stability of Islamic banking in CCG. The authors concluded that the level of risk governance is lower compared to their conventional counterparts. This consequently reduces their financial stability. Furthermore, Elamer et al. (Citation2020b) analyzed the relationship between Islamic governance quality, national governance quality, and bank risk management and disclosure in MENA countries. The results showed that Islamic governance quality and national governance quality are positively associated with bank risk management and disclosure. Banna et al. (Citation2022) suggested that greater application of digital financial inclusion enhances Islamic banking stability, which reduces the risk of default. Ozdemir et al. (Citation2023) showed that the integration of microfinance helps to promote the activities of participatory banks in Turkey.

In the light of these empirical studies, we observed that the most studies focused on the investigating of the effect of financial inclusion on conventional bank stability. However, few studies examined this relationship in the case of Islamic banking (Damrah et al., Citation2023). This study aims to fill this gap by exploring the relationship between financial inclusion and Islamic bank stability in GCC countries. In addition, the previous studies have analysed the linear relationship between financial inclusion and bank stability (e.g., Ahamed & Mallick, Citation2019; Danisman & Tarazi, Citation2020). In this case, we are interested in the possibility of a nonlinear relationship (inverted U-shaped) between financial inclusion and Islamic bank stability. According to this idea, there would be an inflection point at which financial inclusion would have a negative effect on the stability of Islamic banks, by increasing their fragility. We argue that financial inclusion is not always beneficial for banking stability (Oanh et al., Citation2023), and that Islamic banks need to find the optimal level of financial inclusion to enhance their stability.

Based on the asymmetric information theory-our theorical background- and the arguments provided by empirical studies on the correlation between financial inclusion and banking stability, the first hypothesis of the study is stated below:

Hypothesis 1. Financial inclusion and Islamic banking stability have an inverted U-shaped relationship.

4.2 Moderating effect of corporate social responsibility

As mentioned earlier, this is the first study to address the moderating role of CSR on financial inclusion-banking stability nexus. In this case, it is important to highlight the theoretical framework for understanding the moderating influence of CSR on the nonlinear link between financial inclusion and banking stability. To do so, it is essential to focus on theories inspired by asymmetric information theory addressing the link between CSR and banking stability. These are agency and stakeholder theories. Based on agency theory, CSR can have a negative impact on financial stability (Jensen & Meckling, Citation1976). Indeed, a conflict of interest may arise between shareholders and management when managers try to satisfy the needs of all stakeholders. This may increase agency costs and reduce payouts to shareholders due to excessive investment in CSR. Financial stability may be affected by excessive investment in CSR initiatives (Barnea & Rubin, Citation2010; Friedman, Citation1970). Therefore, agency theory is based on maximizing shareholder returns.

However, under stakeholder theory, CSR can have a positive impact on financial stability. By addressing the concerns of specific stakeholders (society, employees, suppliers and customers), firms have the opportunity to create sustainable value and enhance their reputation, thereby promoting greater long-term stability (Brooks & Oikonomou, Citation2018; Freeman, Citation1984). The same reasoning can be applied to banks, where CSR can improve financial stability by creating a more sustainable business model. Indeed, socially responsible banks can enhance their reputation, build a loyal customer base, and attract motivated employees. This, in turn, can help to maintain their long-term profitability and strengthen their financial stability (Salim et al., Citation2023).

In practice, several empirical studies have analysed the direct impact of CSR on the conventional bank stability (e.g., Gambetta et al., Citation2017; Neitzert & Petras, Citation2022; Ramzan et al., Citation2021; Salim et al., Citation2023). Conversely, few studies have examined the relationship between CSR and risk disclosure (e.g., Elamer et al., Citation2020b; Mukhibad & Nurkhin, Citation2020) in Islamic banking. The results of these studies are mixed. Furthermore, the link between CSR and Islamic banks stability in the GCC is non-linear, as shown by Khémiri and Alsulami (Citation2023).

Nevertheless, other recent studies have explored the moderating effect of certain factors on the link between CSR and financial stability (or corporate performance) in different industries (e.g., Khémiri & Alsulami, Citation2023; Bokhari et al., Citation2023 (institutional quality); Zahid et al., Citation2022; Khémiri & Alsulami, Citation2023; Salim et al., Citation2023 (governance structure) and Feghali et al., Citation2021 (market structure). For instance, Khémiri & Alsulami, Citation2023 showed that governance moderates the nonlinear link between CSR and GCC Islamic bank stability. Considering previous studies, it would be reasonable to examine the potential role of CSR as a moderator in the link between financial inclusion and Islamic banking stability. Recently, few studies have explored the moderating influence of various factors on the correlation between financial inclusion and bank stability (Gosh, 2022, interest rate repression). However, this study attempts to fill this gap by examining the moderating role of corporate social responsibility (CSR) in the relationship between financial inclusion and Islamic banking stability.

Based on these theoretical foundations and empirical studies, the second hypothesis is stated as follows:

Hypothesis 2. CSR moderates the inverted U-shaped link between financial inclusion and Islamic bank stability.

Hypothesis 2 (a). Under agency theory, CSR negatively moderates the nonlinear relationship between financial inclusion and Islamic bank stability.

Hypothesis 2 (b). Under stakeholder theory, CSR positively moderates the nonlinear relationship between financial inclusion and Islamic bank stability.

5. Research design

5.1. Data

This study employs a balanced panel data set of 27 commercial Islamic banks in five GCC countries (Kuwait, Oman, Qatar, Saudi Arabia, and United Arab Emirates) for the period from 2012 to 2020. We have excluded banks in Bahrain as there is no information on financial inclusion in Bahrain. In addition, investment banks, savings banks and cooperative banks are excluded from the sample as they have different operational objectives. Finally, all banks without at least two years of continuous data were excluded. The final dataset contains 243 bank-year observations over the period 2012-2020. This study uses information from several sources. The Bankscope database provides the bank-level data. For In addition, macroeconomic data are obtained from the World Bank’s World Development Indicators (WDI). To obtain information on CSR and governance mechanisms, we manually collect data from the annual reports available on each bank’s website. and show the breakdown of banks and distribution of Islamic banks, respectively.

Table 1. Breakdown of companies.

Table 2. Distribution of Islamic banks.

5.2. Measurement of variables

5.2.1. Dependent variable

Following Ahamed and Mallick (Citation2019) and Wang and Luo (Citation2022), the Z-score was selected in this study to measure the Islamic banking stability. It is designed to measure the probability of bank-level insolvency. This probability is highest when the value of the Z-score is lowest, and conversely. The Z-score formulation in this study is as follows:

(1)

(1)

Where represents return on assets for bank i at time t,

is defined as the ratio of total equity to total assets of bank i at time t, and

is the standard deviation of ROA of bank i at time t. the standard deviation is calculated using a three-year rolling window approach (Guidi, Citation2021).

5.2.2. Main independent variable

In line with Khémiri et al. (Citation2023), To assess financial inclusion, we adopt the dimensions of access and usage. The first dimension (ACCI) consists of three indicators: number of commercial bank deposit accounts per 1,000 adults, number of ATM machines per 100,000 adults (demographic penetration) and number of ATM machines per 1,000 km2 (geographic penetration). The second dimension (USAI) comprises two indicators: outstanding commercial bank deposits (as a percentage of GDP) and outstanding commercial bank loans (as a percentage of GDP).

According to Khémiri et al. (Citation2023), principal component analyses (PCA) are used to construct the composite index. Before performing PCA, the indicators used for each dimension need to be normalized using the min-max normalization technique. In addition, by constructing the two dimensions using PCA, we capture the common variation between the indicators for each dimension. Therefore, we used PCA to identify the common principal component. We performed two specific tests to assess the applicability of the data to factorial analysis: Bartlett’s sphericity test and Kayser-Meyer-Olkin (KMO) test (). A multidimensional index of financial inclusion was constructed as follows, following Khémiri et al. (Citation2023):

(2)

(2)

Where are the component weights; and

are the original variables. We take the same weights (i.e., 0.7071) for both dimensions. To facilitate the analysis, following Khémiri et al. (Citation2023), we additionally normalize this index on a scale from 0 to 1 using the min-max normalization technique. Note that zero represents financial exclusion and one represents financial inclusion.

shows the indicators of financial inclusion in the GCC countries. The results show that the five countries have quite different levels of financial inclusion. It appears that the levels of financial inclusion in Qatar and the UAE are too high, reaching 0.920 and 0.935 respectively. This is because the governments of these two countries have adopted adequate policies to improve access to formal financial services compared to Kuwait, Oman, and Saudi Arabia.

Table 3. FIMI, ACCI, and USAI indicators across GCC countries.

5.2.4. Moderator variable

In order to investigate the moderator effect of CSR, we follow Mallin et al. (Citation2014) and Khémiri and Alsulami (Citation2023) using the CSR Disclosure Index. This index consists of 10 dimensions with 84 itemsFootnote1. These items are based on the studies of Maali et al. (Citation2006) and Haniffa and Hudaib (Citation2007), and the AAOFI Standard No. 7. In addition, we assigned every item a value of one or zero (dummy variable) depending on whether it was included in the annual reports/websites or not. In this way, the index has equal weights and avoids possible biases due to scoring and scaling methods, as shown in EquationEquation (3)(3)

(3) .

(3)

(3)

where

is corporate social responsibility index,

is the number of items anticipated in the bank i, and

is a binary variable that equals 1 if the item is divulged and 0 if it is not.

5.2.4. Control variables

According to previous studies (e.g., Ahamed & Mallick, Citation2019; Salim et al., Citation2023; Wang & Luo, Citation2022), our model includes various control variables to explore the link between FIMI and IsBS. We utilize the ratio of loan loss provisions to gross loans to control for asset quality (AQ). Furthermore, to control for bank efficiency (BE), we use the cost-to-income ratio. In addition, to control for bank age, we employ the log of the number of years since the bank was founded. Also, we use the log of total assets to control for bank size. To control for liquidity (LIQ), we use the ratio of liquid assets to deposits and short-term funding.

In addition, we use two other variables to control the governance practices. To do so, we follow Khémiri and Alsulami (Citation2023), using two governance indices. First, we construct the Sharia Supervisory Board (SSB) score, which comprises five dimensionsFootnote2. We then combined these indicators using principal component analysis (PCA). PCA avoids multicollinearity and reduces measurement error by aggregating the variables associated with each factor into a separate composite score (Elamer et al., Citation2020b).

The second is the Governance Structure (GS) index. The GS is composed of four dimensions. Depending on the availability of data, the GS is constructed using four internal governance indicators, namely the size of the board, the independence of the board, the duality of the CEO and the gender diversity (Koseoglu et al., Citation2021). PCA is used to combine these indicators. Furthermore, as far as macroeconomic variables are concerned, only one variable has been included to control for macroeconomic fluctuations. This variable is Gross Domestic Product growth (GDPG). Then, we use these various control variables to reduce the problems of variables that may have been omitted.

5.3. Econometric model

We examine the nonlinear relationship FIMI and IsBS, as well as the moderating effect of CSR on the FIMI-IsBS nexus. The baseline model seeks to investigate the inverted U-shaped link between FIMI and IsBS (first hypothesis). To this end, we have implemented the SGMM technique advanced by Blundell and Bond (Citation1998). The equation of the Islamic banking stability model can be expressed as follows:

(4)

(4)

Where, is the Islamic banking stability for country c, firm i at time t,

is one year lag of Islamic banking stability,

is the financial inclusion for country c, firm i at time t,

is the square term of financial inclusion studying the inverted U-shaped relationship,

is the vector of control variables, and

is the error term.

Some studies have used the SGMM to investigate bank stability (e.g. Boussaada et al., Citation2023; Salim et al., Citation2023; Wang & Luo, Citation2022). SGMM has multiple benefits. First, it can address omitted variable problems, measurement error, dynamic panel differences and possible endogeneity due to independent variables related to the error term. Second, it works well when a panel has a shorter time dimension (like ours, where T is 9) than its cross-sectional dimension (where N is 27). However, the test for second-order autocorrelation (Arellano & Bond, Citation1991) shows no significant results for the AR (2) model, implying that there is no autocorrelation. This implies that the model has an appropriate lag structure and that only one lag for the IsBS variable is sufficient. To ensure the accuracy of the SGMM method, appropriate tools were used, e.g. the values of t-1 and t-2 for the difference formula and a single lag for the level formula. The instruments we used are shown to be reliable for the models by the Hansen J statistic of over-identifying restrictionsFootnote3.

In order to draw further implications, this research seeks to analyse the moderating effect of CSR on the financial inclusion-Islamic banking stability nexus. To test our second hypothesis, the baseline model is reformulated. More specifically, in EquationEquation (5)(5)

(5) , we will add the interaction terms as follows:

(5)

(5)

6. Empirical results and discussion

6.1. Statistical analyses

shows the descriptive statistics for all the variables included in this study. The mean value of the IsBS variable is 2.665, with a standard deviation of 1.183, a minimum value of -1.305 and a maximum value of 5.141. This result shows that Islamic banks in the GCC countries are stable over the period 2012-2020. In addition, the FIMI has an average value of 0.560. The standard deviation is 0.318. However, the average score on access to credit, estimated to be 0,538, is slightly lower than the average score on access to financial facilities, estimated to be 0,649. Likewise, CSRI variable with mean of 0.271 and standard deviation of 0.224 indicates low level of CSR disclosure despite Islamic banks’ focus on Islamic ethics. Over the period 2012–2020, the control variables show a positive trend.

Table 4. Descriptive statistics.

It seems unlikely that the empirical models studied suffer from a multicollinearity problem, according to the results presented in . In fact, the correlation coefficients between the exogenous variables do not cross the limit of 0.80. This indicates a weak correlation between these variables (Gujarati, Citation2004). Furthermore, the result of the variance inflation factor (VIF) is lower than 10. This implies that there is no multicollinearity between the variables ().

Table 5. Pairwise and VIF correlations.

6.2. Baseline results

This section aims to analyse the inverted U-shaped (curvilinear) relationship between financial inclusion and Islamic banking stability in the GCC. To this end, we employed a two-stage GMM estimator. The different results are compiled in . According to the results of the J-Hansen test, the null hypothesis of the instrumental variables is accepted. The null hypothesis of first and second order correlation is also confirmed by the results obtained using AR (1) and AR (2). These results suggest that the GMM estimator is likely to be applicable to the research at hand.

Table 6. Financial inclusion and Islamic banking stability: main results.

According to the results in , all coefficients of the variable are positive and significant at the 1% level. This can be explained by the fact that the value of

is higher than that of the previous year. The existence of adjustment costs associated with the stability of Islamic banking is reflected in this result. In this case, Islamic banks have maintained their financial health over time (Čihák & Hesse, Citation2010). They have adopted sound and sustainable financial practices. In fact, these banks have been able to implement appropriate financial policies (maintenance of profitability, reduction of loan levels, effective risk management, etc.).

Regarding our variable of interest (financial inclusion), the result shows that FIMI has a significantly positive effect on IsBS (column 1). In this case, a 10.0% increase in FIMI is associated with a 5.4% increase in IsBS. This is in line with asymmetric information theory, according to which Islamic banks can contribute to better resource allocation and risk reduction by offering Sharia-compliant financial products, thereby promoting financial stability. In practice, this outcome is similar to those of Ahamed and Mallick (Citation2019) and Banna et al. (Citation2021), showing that financial inclusion reduces bank risk.

Nevertheless, this result can be interpreted more clearly by looking at the inverted U-shaped link between the FIMI and the IsBS.The quadratic term of FIMI has a negative effect on IsBS, specifying the presence of an inverted U-shaped link (column 2). However, this is not enough to prove the existence of the nature of this link. Thus, it is necessary to check the lower and upper limits (bounds) of the link and the extreme points. For an inverted U-shaped curve to be valid (Lind & Mehlum, Citation2010), the slope of the lower limit should be positive and significant and the slope of the upper limit should be negative and significant. The extreme point should be located between the minimum value and the maximum value of the curveFootnote4. shows that the relationship between FIMI and IsBS is inverted U-shaped. Then, the results offer empirical support for hypothesis 1. According to this hypothesis, FIMI has a curvilinear effect on IsBS.

Table 7. U-shaped curve test.

Specifically, the objective of this study was to address the mixed results in the literature (Wang & Luo, Citation2022) by providing theoretical clarification and empirical assessment of how FIMI affects IsBS. The literature suggests that FIMI is strongly related bank stability (Ghosh, Citation2022). However, previous outcomes have also indicated that high levels of FIMI may be detrimental to bank stability because of the risk-taking costs they entail (Ghosh, Citation2022; Wang & Luo, Citation2022).