Abstract

Unlike large firms, the relationship between research and development (R&D) intensity and the firm performance of small- and medium-enterprise firms (SME firms) was found that in the past many studies However, the results of the study of this relationship still differ according to the context, especially in Thailand. Therefore, this study aims to test whether there is a possible relationship between R&D intensity and firm performance, moderated by the size of SME in Thailand. A total of 151 Thai SME firms from The Office of National Higher Education Science Research and Innovation Policy Council were used as samples. The data were analyzed using questionnaires sent via mail, descriptive analysis, a correlation matrix and multiple regression. The results reveal that R&D intensity has a negative effect on firm performance, whereas firm size has a positive effect on firm performance. Additionally, the interaction effect between R&D intensity and firm size has a significant negative effect on firm performance. The study’s findings might provide general investors and Thai SME enterprises with helpful guidelines for comparing business performance to R&D expenses. The Thai government can also benefit from this information when developing policies that support R&D in Thailand

REVIEWING EDITOR:

1. Introduction

Research and development (R&D) are one of the most important activities that any business or corporation may utilize to create and enhance new goods, services and processes to increase firm value (Gharbi et al., Citation2014). R&D expenses can be classified according to the following types of business: (1) Support ongoing R&D t in business by taking measures to retain or grow market share, one can boost profitability and societal approval. (2) Survey analysis describes a study that is done to learn more about an idea that interests a firm or to find new commercial ventures. (3) Examining potential new high-risk business ventures, it is a procedure with the aim of creating a new product, method or market. This study on innovative, high-risk business ventures may be the outcome of fruitful survey research or it may be a brand-new endeavor involving technology. (Brown, Citation1972). Additionally, R&D can be utilized to expand businesses, obtain a competitive advantage and increase predicted profits for the company, and attain the sustainable development needed for corporations to compete with the same market share as the competitors (Jiang et al., 2019). However, R&D can deliver both advantages and disadvantages to firms. On one hand, R&D intensity can develop and enhance alternative products and services as well as corporate processes, which can make it difficult for competitors to imitate (Callimaci & Landry, Citation2004). In addition, R&D intensity can enable corporations to launch products, services and processes as a direct response to client requests. On the other hand, corporations must spend a large amount of financial assets to invest in R&D activities, which will affect short-term shareholders, who would like to have both dividends and gain profits from trading prices due to high performance (Franzen & Radhakrishnan, Citation2009). One of the engines that drive the economy today are small- and medium-sized enterprises (SMEs), and they are also an important factor in the process of creating new products and services, technology R&D, job creation, employment and increased tax collection (Williams et al., Citation2018). Based on data from The Organization for Economic Co-Operation and Development (OECD, Citation2017), SMEs make up more than 45% of the workforce globally and over 33% of the gross domestic product (GDP) in emerging economies, but since 2002, the SME sector has experienced a high bankruptcy rate of nearly 69% (Veskaisri et al., Citation2007), mostly because SMEs don’t have clearly defined strategies and suitable management tools, don’t do enough R&D and don’t have enough cash (Kulkalyuenyong, Citation2018). In Thailand, even though SMEs account for over 40% of the country’s GDP, 80% of all jobs and 99% of all Thai businesses (Office of SMEs Promotion (OSMEP), Citation2018), compared to large-scale businesses, they nevertheless have constraints and have a greater failure rate (Kulkalyuenyong, Citation2018). In terms of R&D intensity, according to the Thailand Financial Reporting Standards Section No. 38 on intangible assets (2017), R&D intensity is included as a part of corporate intangible assets where Thai firms can identify all R&D intensity as a form of intangible assets and reduce annual amortization.

Past studies examining the relationship between R&D expenditures and performance have mostly been conducted in large economies, such as education in the Netherlands by Belderbos et al. (Citation2004) study of R&D cooperation that affects the operating efficiency of companies in the Netherlands, R&D cooperation are divided into four types: (1) cooperation with trading partners (2) cooperation with suppliers (3) cooperation with research institutes (4) cooperation with universities. Study in Norway by Lome et al. (Citation2016) study of the relationship between R&D and firm performance during the financial crisis of SMEs in Norway. It has also been studied in the United States, China and India. These countries are considered to have large economies and has one of the highest GPDs in the world (Chen & Ibhagui, Citation2019; Guo et al., Citation2018; Sharma, Citation2012). Thailand continues to have a relatively small economy. There are very few studies on the intensity of R&D, such as those by Ekpol (Citation2007) Study the relationship between R&D expenditures and stock returns. The data was collected from companies listed on the stock exchange between 1997 and 2006. And Siripong et al. (Citation2019) study the relationship between the level of disclosure of R&D information. By collecting data from companies listed on the Stock Exchange of Thailand in the SET 100 group between 2016 and 2017. It is seen that the small number of R&D studies in Thailand may be because few Thai companies provide information on the R&D intensity of their businesses. (Sangnapawan, Citation2007). And most past research has been concentrated in companies listed on the stock exchange, most of which are large companies, however, Thailand differs from other countries in several of ways, including corporate R&D intensity, shareholder and investor protection and civil and common law (Sangnapawan, Citation2007). In addition, the study of factors that determine the investment in R&D of companies in Thailand also found that firm size has a positive effect on R&D investment, meanings that the larger the company, the more likely it is to increase R&D investment (Insee & Suttipun, Citation2023). However, to study the factors of R&D investment in Thailand, the findings are quite limited and the results of previous studies in Thailand are still unclear. To fill the gaps left by other studies, this study aims highlight the relationship between R&D intensity and firm performance in Thailand. Another reason is the need to study the impact of R&D in Thailand. Because, at present, it is found that government agencies in Thailand are committed to promoting and developing increased investment in R&D, and when considering the ratio of R&D expenditure to GDP in 2019, it was 1.14%. There are also policies and plans to increase the ratio of R&D expenditures to 1.5% and 2% by 2027 (NXPO, 2019). Therefore, studying the influence of R&D expenditure on performance in Thailand is of great importance to Thai companies.

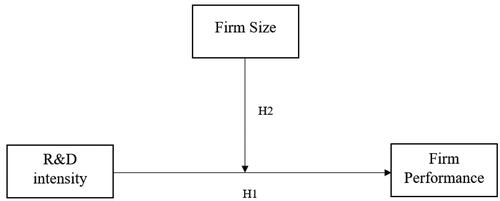

Regarding the findings of earlier investigations, it was discovered that there may be correlations in many different directions. Although the majority of research discover a connection between R&D intensity and performance (Belderbos et al., Citation2004; Diéguez-Soto et al., Citation2019; Ghaffar & Khan, Citation2014; Guo et al., Citation2018; Sharma, Citation2012). However, some studies show conflicting findings, concluding that the relationship between R&D expenditures and corporate performance is not linear. It indicates that the relationship is negative at the beginning of an investment project, turns positive later on, and then, goes back to being negative (Chen & Ibhagui, Citation2019; Kim et al., Citation2018). Additionally, R&D expenditures are not detrimental to business outcomes (Ahmed & Jinan, Citation2011; Gharbi et al., Citation2014; Shin et al., Citation2009). R&D might not immediately benefit the company, which is another reason (Ravšelj & Aristovnik, Citation2020). Some studies also indicate that R&D expenses have a negative impact on business performance (Artz et al., Citation2010; Chen et al., Citation2019). The value created by R&D intensity is unclear because the R&D project might not be successful, which is the cause of the negative association. Shareholders may, therefore, consider R&D intensity to be a wise investment, taking on more risk to perform better (Chamber et al., Citation2002), while the reason for corporations use R&D investment, which has a positive association with both variables to respond to their stakeholders demands which include both their shareholders and investors, therefore, if they are able to meet their demands, the corporations will be able to achieve better outcomes such as performance, image and reputation, firm value and share price (Han & Manry, Citation2004). However, a recent study conducted in Thailand, the results of the study did not find a relationship between the disclosure of R&D expenses or R&D spending and firm performance (Ekpol, Citation2007; Siripong et al., Citation2019). According to the above study issues, the research objective was to test for a possible relationship between R&D intensity and firm performance moderated by firm size, specifically, the SME firms in Thailand (see framework of study in ). There is one main research question: Is there any possible relationship between R&D intensity and the performance of SME firms in Thailand? This study used the method adopted in previous related studies. By using simple random sampling of 151 SME firms, which (1) invest in R&D activities and (2) are under The Office of National Higher Education Science Research and Innovation Policy Council. The mail questionnaire collected data from three sections: SME information, R&D intensity and firm performance. The data were initially analyzed using descriptive analysis, a correlation matrix and multiple regression.

This study provided some expected outcomes. This study demonstrates whether the theory of stock investment and speculation can be used to describe the negative relationship between R&D intensity and the performance of SME firms in Thailand. The purpose of this study is to contribute to and update the current literature applies the relationship to the test between R&D intensity and SME firm performance in Thailand, where the most recent related study was conducted in 2007. With the following study findings, the perspective of value creation based on R&D intensity will be better understood by Thai SME enterprises. Finally, the study’s findings can be used to help regulators and policymakers create more effective policies that support R&D in Thailand. When assessing performance and contrasting it with R&D investments, it is also helpful for investors. The study starts with a theoretical perspective to describe what happened for the relationship between R&D intensity and firm performance, which is represented by the theory of stock investment and speculation. In the following part, previous relevant literature is used to review the literature and generate a hypothesis. The following methods were implemented in this study: population and sample, data collection, variable measurement and data analysis. The findings and discussions were inferred using statistical software. We explain our findings, contributions, limits and recommendations for further research in the last part.

2. Theoretical perspective

Stakeholders are considered important for R&D activities (Gao et al., Citation2017). Following earlier studies (Callimaci & Landry, Citation2004; Nord, Citation2011) used stakeholder theory to discuss the positive relationship between R&D intensity and firm performance, wherein corporations use R&D investment to respond to stakeholder and investors demands and earn better outcomes if the demand is met (Han & Manry, Citation2004). In this study, the negative correlation between R&D intensity and SME success was explained using the theories of stock investment and speculation. Many studies have used the theory of stock investment and speculation (Cazavan-Jeny & Jeanjean, Citation2006; Mozafari, Citation2017; Wu & Wei, Citation1998). Based on an investment theory perspective, most of these expenditures are allocated to intangible assets that are difficult to estimate, assisting to explain the distinction between investment in R&D and investment in general (Bremser & Barsky, Citation2004). This is because R&D intensity can be successful or failure. Therefore, shareholders may avoid investing in a common share of risk and unknown companies, especially those concerned about high R&D intensity. Moreover, shareholders will assess the difference between actual and predicted returns; thus, if there is a wide gap between actual and expected returns, shareholders could become concerned and view the company as a high-risk investment (Saad & Zantout, Citation2008). Many types of corporate risk can be associated with R&D intensity, including the risk of product or service failures, earnings variability, systematic risk, corporate bond risk, poor performance and pricing volatility (Gharbi et al., Citation2014).

The negative relationship between corporate R&D intensity and business performance is that value creation from R&D intensity is uncertain; therefore, shareholders may view R&D intensity as a high-risk investment in exchange for poor corporate performance (Chamber et al., Citation2002). Another negative relation is that shareholders may not succeed or may choose to overlook the long-term benefits of business R&D intensity in their assessment (Duqi et al., Citation2011). For example, Chen et al. (Citation2019) and Lev et al. (Citation2005) found that as corporate R&D spending rises, business performance is discounted. Therefore, if corporate risk is represented by R&D intensity, corporate performance suffering greater risk because of increases in R&D intensity is properly discounted, as opposed to firm performance not seeing such types of increases (Berk et al., Citation2004). This is explained by the concepts of stock investment and speculation, in which shareholders and investors avoid investing in common stock in risky and uncertain enterprises, as in the case of R&D intensity (Chamber et al., Citation2002). Additionally, investors typically assess the difference between projected and actual income to hedge their investments. Therefore, they are concerned and identify these businesses as high-risk investments if there is a significant discrepancy between actual and predicted income (Saad & Zantout, Citation2008). This is because R&D intensity can be either advantageous or detrimental. Agency issues between owners and bondholders may also arise because of R&D, due to the risk and uncertainty of future returns from investments in R&D, bondholders are worried about default (Shi, Citation2003).

Regarding the moderating effect of firm size determinants on the relationship between R&D intensity and firm performance, previous research supports Schumpeter’s theory, according to which large businesses can afford to take on riskier R&D projects because they have a high level of financial security. Furthermore, big businesses are thought to have greater resources, which allows them to spend in R&D facilities and pay more for the hire of developers and researchers (Mishra, Citation2007). Despite R&D intensity being able to launch different products and services to compete with competitors to provide a competitive advantage against other corporations, it can also make corporate shareholders feel insecure, as corporations risk large amounts of money, which can affect corporate performance (Duqi et al., Citation2011; Nord, Citation2011). Therefore, from the shareholders’ perspective, there is a negative correlation between R&D intensity and firm performance (Callimaci & Landry, Citation2004). If larger companies tend to invest more in R&D, Therefore, the larger the company, the more likely it is to have a negative impact on its firm performance.

3. Literature review and hypothesis development

According to the Thailand Financial Reporting Standards (TFRS, Citation2017) Section 38 on intangible assets (2017). The intensity of R&D is considered as a component of the company’s intangible assets. R&D intensity is divided into two groups: R&D intensity. In terms of research intensity, corporations must recognize intensity as a corporate annual expense, which will be disclosed in their income statement. In terms of development intensity, corporations may deem them intangible assets, which are reported in the financial position statement. However, if corporations have a high value of R&D intensity, they can classify them as R&D intensity and intangible assets and reduce amortization every year. Furthermore, wages for highly qualified researchers account for over half of R&D investment costs, and it is challenging to estimate how these expenses affect capital costs, because R&D responds slowly to changes in cost (Bremser & Barsky, Citation2004). For SMEs enterprises, there may be resource limitations and difficulty in accessing R&D and innovation activities, in order SME enterprises to utilize knowledge within the organization, they may need to rely on knowledge and strong partnerships with external partners (Aliasghar et al., Citation2023). In addition, SMEs do not have clear R&D management strategies and tools, are insufficient and face liquidity problems (Kulkalyuenyong, Citation2018).

One of the most essential corporate activities that firms may utilize to create and improve their products and services, as well as their research processes, is R&D intensity (Chamber et al., Citation2002). R&D intensity can be used to provide firms with a competitive advantage when competing in the same market share (Jiang et al., 2019). However, R&D intensity can provide both advantages and disadvantages to corporations. On the one hand, increased R&D intensity can improve various products and services as well as business procedures, making it difficult for competitors to replicate (Cazavan-Jeny & Jeanjean, Citation2006). R&D intensity can facilitate the corporations’ launch of new products, services and processes that directly respond to their customer demands. Corporations, on the other hand, must spend substantial sums of money to invest in R&D operations, which might have an impact on short-term investors who are still determining whether to buy the company’s common stock (Franzen & Radhakrishnan, Citation2009). Findings from a study on the impact of investment behavior in R&D on the performance of Taiwanese semiconductor companies, it was discovered that business performance will decline during the same period when R&D investments are made. Greater resources will be allocated to R&D by larger businesses (Chen et al., Citation2019). However, some study discusses that patents obtained by R&D have a negative effect on revenue expansion (Artz et al., Citation2010). In addition, a study of the global electronics industry from 2000 to 2005 found that companies with high R&D expenditures did not generate returns on equity (ROE) and returns on assets (ROA) (Shin et al., Citation2009).

In the same way that prior pertinent studies in Thailand, there are related studies conducted in Thailand, there are relatively few reports on R&D intensity. Study by Sangnapawan (Citation2007) examined the R&D intensity of Thai listed companies and found that only 11% of all the samples used in the study conducted R&D intensity in their activities and actions. Manomansatham (Citation2015) found a positive relationship between R&D intensity and firm size, but a negative correlation between firm risk and R&D intensity. Siripong et al. (Citation2019) collect data from the top 100 companies listed on the Stock Exchange of Thailand (SET100) during the year 2018, found that R&D reporting negatively influences corporate performance. In prior literature related to this study, Ekpol (Citation2007) tested for the correlation between R&D intensity and fluctuation in the performance of companies listed on the Stock Exchange of Thailand and found that there was no possible relationship between the two variables.

During the development of the hypotheses, the findings regarding the association between R&D intensity and firm performance were inconsistent. Studies have found that R&D expenses have a negative impact on performance during the initial stages of investment projects (Kim et al., Citation2018). And many studies have also been found that indicate that relationship between R&D intensity and firm performance are negative (Artz et al., Citation2010; Cazavan-Jeny & Jeanjean, Citation2006; Chen et al., Citation2019; Franzen & Radhakrishnan, Citation2009; Lev et al., Citation2005; Mozafari, Citation2017; Penman & Zhang, Citation2002; Saad & Zantout, Citation2008; Shin et al., Citation2009). The reason for this is because investing in R&D is an intangible asset that is difficult to value in the future. And because R&D intensity in corporations can be successful or unsuccessful. Therefore, shareholders and investors may resist investing in common stock due to risk aversion, particularly in new companies, in which case we address the concerns associated with R&D intensity. On the one hand, shareholders will compare the gap between actual and expected returns; thus, if there is a wide gap between actual and expected returns, shareholders can become concerned and view companies as high-risk investments. In contrast, some related literature by Gharbi et al. (Citation2014), Duqi et al. and Nord (Citation2011) find a positive relationship between R&D investment and firm performance. This is because corporations use R&D expenditure to respond to the expectations of their stakeholders, who include both shareholders and investors, and when there is a response to the demand, corporations can earn better outcomes, such as performance, image and reputation, firm value and share price. Although past studies have shown both positive and negative relationships between R&D and firm performance, a positive relationship is often found for studies in large economies. Considering the economic environment comparable to Thailand, the findings of the Taiwanese study (Chen et al., Citation2019), which discovered that R&D intensity had a negative relationship with firm performance. Therefore, education in Thailand may provide education in the same direction. Moreover, most previous studies in Thailand have not found a positive relationship between R&D intensity and firm performance. However, in Thailand, there are few studies on the relationship between R&D intensity and firm performance. This may be since just 11% of Thai listed companies are engaged in significant R&D (Ekpol, Citation2007). In addition, previous studies have shown that larger businesses have more resources and are therefore able to invest more in R&D (Hall et al., Citation2009). Larger ones have more resources to set up research laboratories and hire highly skilled professionals. Therefore, there is a greater opportunity to make informed investment decisions (Mishra, Citation2007). Therefore, firm size may play an important role in determining R&D investment. and may affect firm performance as well. Thus, the hypotheses of this study are as follows.

H1: There is a negative relationship between R&D intensity and the firm performance of SMEs in Thailand.

H2: Firm Size moderates the relationship between R&D intensity and SME performance in Thailand.

4. Research data and methodology

4.1. Data collection and sample

The sample was selected from SME firms in Thailand: (1) invest in R&D activities and (2) operate under The Office of National Higher Education Science Research and Innovation Policy Council (NXPO). This is because SME invest in R&D activities and are not limited to large firms in Thailand. Moreover, this sample group is more suitable for testing the influence of R&D intensity on SME performance. According to the Thai Ministry of Industry (The Ministry of Industry, Citation2019), Businesses classified as SMEs have fewer than 200 employees or assets worth no more than 200 million Thai Baht. Thailand’s SMEs are divided into two types: small and medium-sized. Small-sized businesses are businesses have less than 50 employees or assets totaling less than 50 million Thai baht, whereas medium-sized businesses are those with between 50 and 200 employees or total assets of between 50 million and 200 million Thai baht.

Steps in data collection (1) Collect company names and emails. Companies from the report on companies with R&D activities in Thailand registered by The Office of National Higher Education Science Research and Innovation Policy Council (NXPO). (2) Send questionnaires for data collection via email in Google form. In this study, 735 completed surveys were distributed by email to 151 SME firms, yielding a response rate of 20.54%. Data was collected between January and March 2022.

4.2. Variables’ measurement

The research instrument used in this study was a questionnaire adapted from previous studies, concepts, theories and other documents (Leonard, Citation1971; Liao & Greenfield, Citation2000; Mulugeta, Citation2021). Details of the variable measurement and proxies are represented as follows:

4.2.1. Independent variables

R&D intensity variable, which is measured from the ratio of R&D intensity to operating income (Guo et al., Citation2018; Hall & Bagchi-Sen, Citation2002).

4.2.2. Dependent variables

Firm performance, which was measured from the total revenue of SMEs (Ferdaous & Mizanur Rahman, Citation2017; Hall & Bagchi-Sen, Citation2002)

4.2.3. Mediating variables

Firm size, which were measured by utilizing the natural logarithm number of employees (Belderbos et al., Citation2004; Mulugeta, Citation2021).

4.3. Data analysis

This study analyzes the relationship between R&D intensity and firm performance. And test the firm size variable that plays a role as a moderating variable. A review of past literature, especially in Thailand, found unclear relationships between R&D intensity and firm performance. Analysis of firm size as a moderating variable reveals the size and direction of the relationship more clearly.

The SPSS Statistics Software Program (Version 23) was used to examine the data. Data were first examined utilizing the descriptive statistical results of all variables shown in . All the variables included in this study were tested for multicollinearity using the correlation matrix, as shown in . Finally, after using the output Process v3.5, Andrew F. Hayes in SPSS () was constructed. Three equation models were implemented in this study:

Table 1. The participant’s demographics and descriptive statistics (N = 151).

Table 2. Means, standard deviations and bivariate correlations.

Table 3. Model summary.

PERFORMANCE = β0 + β1R&D + ε (Model A)

PERFORMANCE = β0 + β2SIZE + ε (Model B)

PERFORMANCE = β0 + β3R&D * SIZE + ε (Model C)where:

PERFORMANCE as Firm performance

R&D as R&D intensity

SIZE as Firm size

5. Results and discussion

One hundred fifty-one samples total from the study’s sample collection, there were 76.2% in the manufacturing sector, the others were allocated to the service sector and wholesale and retail sector, which were 10.6% and 13.2%, respectively. A large number of businesses, or 75% of all businesses, were between the ages of 10 and 49. It was also found that more than half of businesses had between 50 and 200 employees. The total number of medium-sized enterprises in this study was 61.6% and only 38.4% were small-sized enterprises.

To check for multicollinearity among the mentioned variables, a correlation matrix was also used in . There were three variables: a dependent variable, an independent variable and a moderating variable. The correlation of two variables should not be greater than 0.700 according to a fixed effects model for panel testing, and the variables utilized in this study did not have a multicollinearity problem because the highest Pearson correlation (between PERFORMANCE and SIZE) was 0.699 (Hair et al., Citation2010). Multicollinearity in the multiple regression did not seem to be an issue because of the low coefficients in the correlation matrix between the study’s variables. Thus, multicollinearity was not identified in our study.

As shown in , the results reveal that, R&D intensity has a significant negative effect on firm performance (b = –4.313, p < .01). Firm size has a significant positive effect on firm performance (b = 1.017, p < .01) consistent by (Chen et al., Citation2019; Hall et al., Citation2009; Mishra, Citation2007) The interaction between R&D intensity and firm size had a significant negative effect on firm performance (b = –2.267, p < .01). This result is consistent with those of prior studies by Chen et al. (Citation2019), Penman and Zhang (Citation2002), Lev et al. (Citation2005), Wu and Wei (Citation1998), Franzen and Radhakrishnan (Citation2009), Titi (Citation2014) and Mozafari (Citation2017). explanations for the inverse link between operating performance and expenditure on R&D This could be because investors don’t believe the expenditure on R&D leads to innovation. They have concerns about assessing the company’s financial condition considering all its R&D expenditures. Furthermore, it could be the case that because shareholders and investors tend to avoid investing in common shares of high-risk, unproven enterprises, there is a negative correlation between R&D intensity and firm performance. In this study, the authors concentrated on corporations and their investments in R&D. Shareholders and investors will compare the gap between actual and expected returns, and if there is a wide gap between actual and expected returns, they may be concerned that the companies are high-risk investments. In Thailand, Companies may spend excessive amounts of money on R&D for no reason, which widens the gap between their actual and expected returns, which can leave shareholders and investors feeling uneasy. Theories of stock investment and speculation support the study’s findings.

6. Discussion

The objectives of this study are (1) to examine the causal effect of R&D intensity and firm performance and (2) to investigate how firm size moderate effects on the relationship between R&D intensity and firm performance. The results show that R&D intensity negatively affects firm performance. The results of this study are based on Investment theory. R&D expenditures differ from typical investments in many respects. The first point is that more than 50% of R&D expenditure is paid into the wages and salaries of skilled researchers. Second, R&D expenditure is the price that one must pay to invest in intangible assets and is the basis of knowledge development. When a company develops innovative technology and productivity, it can also expect a return from generated profits in the future (Hall & Lerner, Citation2010). It was also found that investments in R&D are only part of an entity’s resources and are characterized by long-term investments and the potential for project failure (Bremser & Barsky, Citation2004). Consistent with the study conducted by Xu and Jin (Citation2016), it was found that investment in R&D has a negative effect on operating results, it shows that cumulative R&D expenditure has a negative impact on business performance, and that for every 1% increase in R&D expenditure, the profit margin will drop by approximate 0.3%. Lu and Wang (Citation2011) conducted another study on the effect of R&D investment on business performance, and the findings showed a negative correlation between R&D investment and business performance. In addition to the above, there was also a study by Mulugeta (Citation2021) who also explained how R&D expenditure had a negative impact on firm performance in the year 2021.

In response to the second research objective, we examined the moderating roles of firm size between R&D intensity and firm performance. The results reveal that R&D intensity has a substantial negative effect on firm performance, especially for large firms. Based on the results of this study, it is possible that large companies may invest in R&D with relatively small capital expenditures that may not contribute to positive innovation outcomes. The study of factors that determine investment in R&D are clarified by Limanlı (Citation2015) who explains that the probability of investing in R&D depends on the increased size of the company. The larger the company, the greater are the opportunities to invest in R&D. Moreover, according to Mulugeta (Citation2021), firm size has a negative impact on innovation performance (the likelihood of introducing both product and marketing innovation). The larger the company, the lower the impact on innovation performance, which may cause R&D intensity in large companies to have a more negative effect on performance than in smaller companies. However, the results of this study contradict a resource-based theory that states that a businesses with important, scarce resources that cannot be replicated or substituted would improve firm performance (Barney, Citation1991). However, SME entrepreneurs may need to rely on external knowledge and maintain good relationships with partners (Aliasghar et al., Citation2023). Furthermore, research on the connection between R&D and operational effectiveness during COVID-19 was discovered. According to the study’s findings, there is a mediating role played by digital technology in the relationship between R&D spending and performance. As a result, focusing digital technology could aid in reducing the negative impact that R&D has on performance (Guan et al., Citation2022). Further research on this topic in the context of Thailand is still necessary.

The study contributes several new ideas to the field. In terms of theoretical contributions, this study shows that the theory of stock investment and speculation can be used to explain the negative correlation between R&D intensity and performance in Thai SME firms. Moreover, the study results can contribute to the expansion of the literature on the relationship between R&D intensity and firm performance in emerging economic countries, as well as in developed countries. In terms of practical contributions and implications, SME in Thailand are concerned about whether their R&D intensity and spending provide positive or negative outcomes. The study’s findings contribute to a better understanding of the relationship between R&D and firm performance. The findings of this study will be included in the body of knowledge on the relationship between R&D and firm performance because earlier research has produced results that have been understood in a variety of ways. It increases the results of the research conducted in Thailand by examining the role of mediating variables in the investigation of the relationship between R&D and firm performance. This allows for an improved evaluation of the relationship’s direction. This study highlights the significance of firm size in influencing the relationship between R&D intensity and firm performance. It was discovered that large firms’ R&D intensity is more likely to have a negative effect on the performance of the company. The study’s findings indicate that businesses, particularly large ones, should exercise caution when making R&D investments due to the possibility that they may have a detrimental effect on the performance of their business. It also serves as a warning to investors to exercise caution when funding businesses that make R&D investments. This is because although R&D intensity can produce innovative products, services or processes that cause corporations to generate greater profitability, greater image and high sustainability, R&D intensity can create risks that make shareholders and investors feel insecure about their decision - making. Finally, regulators and policy - makers such as the Office of National Higher Education Science Research and Innovation Policy Council (NXPO) and the Federation of Accounting Professions will be better equipped to understand the implications of the impact of R&D intensity and spending on firm performance in Thailand, especially in SMEs. However, Thai businesses do not perform better when they invest in R&D, which might be caused by a context that is different from that of developed countries. However, in the Thai context, it may be suitable for applying the sufficiency economy philosophy to an organization’s operations. The implementation of the Sufficiency Economy Philosophy has a positive effect on Thai SMEs (Suttipun & Arwae, Citation2020).

However, this study has some limitations that must be mentioned. First, there were only 151 SME samples used in this study, but according to The Office of National Higher Education Science Research and Innovation Policy Council (Citation2019) there are over 700 Thai SME firms. This is partly because it is difficult to ask for numbers and secondary data via mail. The key problem is that there is no way to find the numbers and secondary data of SMEs in Thailand, because such data are not accessible from listed or large companies on the Stock Exchange of Thailand. This study examines the role of the mediating variable, only the firm size. Future studies should include additional moderating variables that may affect this relationship, such as government support, organizational structure or family company. Finally, this study focused on only one single emerging economic market, Thailand, despite several other emerging economic countries. Therefore, the authors suggest that in future studies, researchers should attempt to further investigate the R&D intensity of large companies, especially those in capital markets, and to test for the influence of R&D intensity and firm performance between other ASEAN regions, such as Malaysia, Indonesia, the Philippines and Vietnam.

Declaration

Ethics approval and consent to participate.

Authors’ contributions

Muttanachai Suttipun, Conception and design, writing - original draft, final approval; Krittiga Insee, Conception and design, analysis and interpretation of the data, writing - original draft, revising content, final approval. All authors agree to be accountable for all aspects of the work.

Acknowledgement

This research has no conflicts of interest to declare. Any errors are our own.

Disclosure statement

No potential conflict of interest was reported by the authors.

Data availability

The data that support the findings of this study are available from the corresponding author upon reasonable request.

Additional information

Funding

Notes on contributors

Muttanachai Suttipun

Muttanachai Suttipun is an Assistant Professor, lecturer at the Accountancy Department, Faculty of Management Sciences, Prince of Songkla University, Thailand.

Krittiga Insee

Krittiga Insee is a PhD candidate in the Management Program of Faculty of Management Sciences, Prince of Songkla University, Thailand. Currently I work at Kiatnakin Phatra Bank.

References

- Ahmed, K., & Jinan, M. (2011). The association between research and development expenditure and firm performance: Testing a life cycle hypothesis. International Journal of Accounting, Auditing and Performance Evaluation, 7(4), 1–12. https://doi.org/10.1504/IJAAPE.2011.042771

- Aliasghar, O., Sadeghi, A., & Rose, E. L. (2023). Process innovation in small- and medium-sized enterprises: The critical roles of external knowledge sourcing and absorptive capacity. Journal of Small Business Management, 61(4), 1583–1610. https://doi.org/10.1080/00472778.2020.1844491

- Artz, K. W., Norman, P. M., Hatfield, D. E., & Cardinal, L. B. (2010). A longitudinal study of the impact of R&D, patents, and product innovation on firm performance. Journal of Product Innovation Management, 27(5), 725–740. https://doi.org/10.1111/j.1540-5885.2010.00747.x

- Barney, J. (1991). Firm Reources ad Sustained Competitive Advantege. Journal of Management, 17(1), 99–120. https://doi.org/10.1177/014920639101700108

- Belderbos, R., Carree, M., & Lokshin, B. (2004). Cooperative R&D and firm performance. Research Policy, 33(10), 1477–1492. https://doi.org/10.1016/j.respol.2004.07.003

- Berk, J. B., Green, R. C., & Naik, V. (2004). Valuation and return dynamics of new ventures. Review of Financial Studies, 17(1), 1–35. https://doi.org/10.1093/rfs/hhg021

- Bremser, W. G., & Barsky, N. P. (2004). Utilizing the balanced scorecard for R&D performance measurement. R&D Management, 34(3), 229–238. https://doi.org/10.1111/j.1467-9310.2004.00335.x

- Brown, A. E. (1972). New definitions for industrial R&D. Research Management, 15(5), 55–57. https://doi.org/10.1080/00345334.1972.11756146

- Callimaci, A., & Landry, S. (2004). Market valuation of research and development spending under Canadian GAAP. Canadian Accounting Perspective, 3(1), 33–54. https://doi.org/10.1506/V5LY-4CNE-3J0Q-00HN

- Cazavan-Jeny, A., & Jeanjean, T. (2006). The negative impact of R&D capitalization: A value relevance approach. European Accounting Review, 15(1), 37–61. https://doi.org/10.1080/09638180500510384

- Chamber, D., Jennings, R., & Thompson, R. B. (2002). Excess returns to R&D intensive firm. Review of Accounting Studies, 7(2/3), 133–158. https://doi.org/10.1023/A:1020217817156

- Chen, T. C., Guo, D. Q., Chen, H. M., & Wei, T. T. (2019). Effects of R&D intensity on firm performance in Taiwan’s semiconductor industry. Economic Research-Ekonomska Istraživanja, 32(1), 2377–2392. https://doi.org/10.1080/1331677X.2019.1642776

- Chen, Y., & Ibhagui, O. W. (2019). R&D-firm performance nexus: New evidence from NASDAQ listed firms. The North American Journal of Economics and Finance, 50(January), 101009. https://doi.org/10.1016/j.najef.2019.101009

- Diéguez-Soto, J., Manzaneque, M., González-García, V., & Galache-Laza, T. (2019). A study of the moderating influence of R&D intensity on the family management-firm performance relationship: Evidence from Spanish private manufacturing firms. BRQ Business Research Quarterly, 22(2), 105–118. https://doi.org/10.1016/j.brq.2018.08.007

- Duqi, A., Mirti, R., & Torluccio, G. (2011). An analysis of the R&D effect on stock returns for European listed firms. European Journal of Scientific Research, 58(4), 482–496.

- Ekpol, S. (2007). Relationship between firm life cycle, firm size, research and development expenditure and stock returns [Master thesis of accounting program]. Chulalongkorn University.

- Ferdaous, J., & Mizanur Rahman, M. (2017). The effects of research and development expenditure on firm performance: An examination of pharmaceuticals industry in Bangladesh. Business & Entrepreneurship Journal, 6(2), 1–20. https://doi.org/10.20522/apjbr.2017.1.2.37

- Franzen, L., & Radhakrishnan, S. (2009). The value relevance of R&D across profit and loss firms. Journal of Accounting and Public Policy, 28(1), 16–32. https://doi.org/10.1016/j.jaccpubpol.2008.11.006

- Gao, Y., Wu, J., & Hafsi, T. (2017). The inverted U-shaped relationship between corporate philanthropy and spending on research and development: A case of complementarity and competition moderated by firm size and visibility. Corporate Social Responsibility and Environmental Management, 24(6), 465–477. https://doi.org/10.1002/csr.1420

- Ghaffar, A., & Khan, W. A. (2014). Impact of research and development on firm performance. International Journal of Accounting and Financial Reporting, 4(1), 357. https://doi.org/10.5296/ijafr.v4i1.6087

- Gharbi, S., Sahut, J. M., & Teulon, F. (2014). R&D investment and high-tech forms’ stock return volatility. Technology Forecasting & Social Change, 88(2), 306–312. https://doi.org/10.1016/j.techfore.2013.10.006

- Guan, F., Tienan, W., & Tang, L. (2022). Organizational resilience under COVID-19: The role of digital technology in R&D investment and performance. Industrial Management & Data Systems, 123(1), 41–63. https://doi.org/10.1108/IMDS-04-2022-0220

- Guo, B., Wang, J., & Wei, S. X. (2018). R&D spending, strategic position and firm performance. Frontiers of Business Research in China, 12(1), 1–19. https://doi.org/10.1186/s11782-018-0037-7

- Hair, J. F., Black, W. C., & Babin, B. J. (2010). Multivariate data analysis. Pearson Prentice Hall.

- Hall, B. H., & Lerner, J. (2010). The financing of R&D and innovation. In Handbook of the Economics of Innovation (1st ed., Vol. 1, Issue 1C). Elsevier BV. https://doi.org/10.1016/S0169-7218(10)01014-2

- Hall, B. H., Lotti, Æ F., & Mairesse, Æ J, O, O. Á. (2009). Innovation and productivity in SMEs : Empirical evidence for Italy. Small Business Economics, 33(1), 13–33. https://doi.org/10.1007/s11187-009-9184-8

- Hall, L. A., & Bagchi-Sen, S. (2002). A study of R&D, innovation, and business performance in the Canadian biotechnology industry. Technovation, 22(4), 231–244. https://doi.org/10.1016/S0166-4972(01)00016-5

- Han, B. H., & Manry, D. (2004). The value-relevance of R&D and advertising expenditures: Evidence from Korea. The International Journal of Accounting, 39(2), 155–173. https://doi.org/10.1016/j.intacc.2004.02.002

- Insee, K., & Suttipun, M. (2023). Determinants of R&D Investment of Private companies in Thailand. The 61st Kasetsart University Annual Conference (pp. 71–79). Bangkok: Kasetsart University. https://annualconference.ku.ac.th/61/eproc/E-ProceedingKUConf61-3.pdf

- Jiang, C., John, K., & Larsen, D. (2019, October 23–26). R&D Investment Intensity and Jump Volatility of Stock Price. The FMA Annual Meeting at 2019. New Orleans, USA.

- Kim, W. S., Park, K., Lee, S. H., & Kim, H. (2018). R & D investments and firm value: Evidence from China. Sustainability (Switzerland), 10(11), 1–17. https://doi.org/10.3390/su10114133

- Kulkalyuenyong, P. (2018). Strategies in building corporate entrepreneurship. Journal of Humanities and Social Sciences Rajapruk University, 4(1), 1–11.

- Leonard, W. N. (1971). Research and development in industrial growth. Journal of Political Economy, 79(2), 232–256. https://doi.org/10.1086/259741

- Lev, B., Sougiannis, T., & Sarath, B. (2005). R&D reporting biases and their consequences. Contemporary Accounting Research, 22(4), 977–1026. https://doi.org/10.1506/7XMH-QQ74-L6GG-CJRX

- Liao, Z., & Greenfield, P. F. (2000). The synergy of corporate r & d and competitive strategies: An exploratory study in Australian high-technology companies Journal of High Technology Management Research, 11(1), 93–107. https://doi.org/10.1016/S1047-8310(00)00025-0

- Limanlı, Ö. (2015). Determinants of R & D investment decision in Turkey. Procedia - Social and Behavioral Sciences, 195, 759–767. https://doi.org/10.1016/j.sbspro.2015.06.471

- Lome, O., Heggeseth, A. G., & Moen, Ø. (2016). The effect of R&D on performance: Do R&D-intensive firms handle a financial crisis better? The Journal of High Technology Management Research, 27(1), 65–77. https://doi.org/10.1016/j.hitech.2016.04.006

- Lu, Y. M., & Wang, C. M. (2011). Effect of R&D investment on performance of Chinese listed companies-take manufacturing and IT industry as an example. Science and Technology Management Research, 5(5), 122–127.

- Manomansatham, W. (2015). The relationship between company characteristics and R&D disclosure: A case of listed companies in the Stock Exchange of Thailand. Master Independent Study of Accountancy Program, Thammasat University.

- Mishra, V. (2007). The determinants of R&D expenditure of firms: Evidence from a cross-section of Indian firms. Economic Papers, 26(3), 237–248. https://doi.org/10.1111/j.1759-3441.2007.tb00433.x

- Mozafari, S. (2017). The impact of R&D expenditure volatility on stock return of the listed companies in Tehran Stock Exchange. Specialty Journal of Accounting and Economics, 3(2), 7–11.

- Mulugeta, T. (2021). Impacts of R & D expenditures on firms’ innovation and financial performance : A panel data evidence from Ethiopian firms. Res. Sq. 2021, 1–31. https://doi.org/10.21203/rs.3.rs-1106769/v1

- Nord, L. (2011). R&D investment link to profitability: A pharmaceutical industry evaluation. Undergraduate Economic Review, 8(1), 25–57.

- Office of SMEs Promotion (OSMEP). (2018). SMEs Promotion Scheme Number 4 (2560-2564 B.C.) www.sme.go.th/th/download.php?modulekey=12

- Organization for Economic Co-Operation and Development (OECD). (2017). Enhancing the contributions of SMEs in a global and digitalized economy. www.oecd.org/mcm/documentsC-MIN-2018-EN-pdf.

- Penman, S., & Zhang, H. X. (2002). Accounting conservatism, the quality of earnings and stock returns. The Accounting Review, 77(2), 237–264. https://doi.org/10.2308/accr.2002.77.2.237

- Ravšelj, D., & Aristovnik, A. (2020). The impact of R and D expenditures on corporate performance: Evidence from Slovenian and world R&D companies. Sustainability, 12(5), 1943. https://doi.org/10.3390/su12051943

- Saad, M., & Zantout, Z. (2008). Stock price and systematic risk effect of discontinuation of corporate R&D programs. Journal of Empirical Finance, 16(4), 568–581. https://doi.org/10.1016/j.jempfin.2009.03.001

- Sangnapawan, P. (2007). Research and development disclosures of listed companies in Agriculture and food industry in the Stock Exchange of Thailand. Master Independent Study of Accountancy Program, Chiang Mai University.

- Sharma, C. (2012). R&D and firm performance: Evidence from the Indian pharmaceutical industry. Journal of the Asia Pacific Economy, 17(2), 332–342. https://doi.org/10.1080/13547860.2012.668094

- Shi, C. (2003). On the trade-off between the future benefits and riskiness of R&D: A bondholders’ perspective. Journal of Accounting and Economics, 35(2), 227–254. https://doi.org/10.1016/S0165-4101(03)00020-X

- Shin, N., Kraemer, K. L., & Dedrick, J. (2009). R&D, value chain location and firm performance in the global electronics industry. Industry & Innovation, 16(3), 315–330. https://doi.org/10.1080/13662710902923867

- Siripong, W., Phramhan, N., Pimpakarn, P., Panyaying, R., Saengsri, S., Malawaichan, I., & Suttipun, M. (2019). The relationship between research and development disclosure and financial performance of listed companies in the Stock Exchange of Thailand (SET). MUT Journal of Business Administration, 16(2), 173–190.

- Suttipun, M., & Arwae, A. (2020). The influence of sufficiency economy philosophy practice on SMEs’ performance in Thailand. Entrepreneurial Business and Economics Review, 8(2), 179–198. https://doi.org/10.15678/EBER.2020.080210

- Thailand Financial Reporting Standards (TFRS). (2017). Intangible asset. Federation of accounting professions under the royal patronage of his majesty the king.

- The Ministry of Industry. (2019). Definition of SMEs in Thailand. www.industry.go.th

- The Office of National Higher Education Science Research and Innovation Policy Council. (2019). Annual Report 2019. https://anti-corruption.nxpo.or.th/wp-content/uploads/2020/06/AR-สอวช-Final-Final.pdf

- Titi, A. (2014). The effect of R&D expenditures on stock returns, price, and volatility. Master Degree Project in Finance. University of Gothenburg.

- Veskaisri, K., Chan, P., & Pollard, D. (2007). Relationship Between Strategic Planning and SME Success: Empirical Evidence from Thailand California State University-Fullerton, California, USA. Asia and Pacific DSI, September. 1–13.

- Williams, R. I., Manley, S. C., Aaron, J. R., & Daniel, F. (2018). The relationship between a comprehensive strategic approach and small business performance. Journal of Small Business Strategy, 21(2), 193–215.

- Wu, C., & Wei, K. C. J. (1998). Cooperative R&D and the value of the firm. Review of Industrial Organization, 13(4), 425–446. https://doi.org/10.1023/A:1007761717501

- Xu, J., & Jin, Z. (2016). Research on the Impact of R&D Investment on Firm Performance in China’s Internet of Things Industry. Journal of Advanced Management Science, 4(March), 112–116. https://doi.org/10.12720/joams.4.2.112-116