?Mathematical formulae have been encoded as MathML and are displayed in this HTML version using MathJax in order to improve their display. Uncheck the box to turn MathJax off. This feature requires Javascript. Click on a formula to zoom.

?Mathematical formulae have been encoded as MathML and are displayed in this HTML version using MathJax in order to improve their display. Uncheck the box to turn MathJax off. This feature requires Javascript. Click on a formula to zoom.Abstract

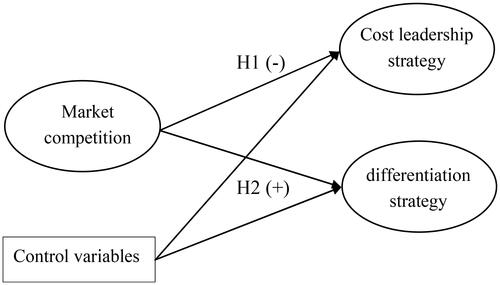

This study investigates the relationship between market competition (MC) and business strategy by analyzing data from 562 non-financial companies listed on the Vietnamese stock market between 2010 and 2019. Utilizing the Generalized Method of Moments (GMM), we assess the impact of MC on specific business strategies, namely cost-leadership and differentiation strategies. The research reveals that MC negatively affects the cost-leadership strategy while positively influencing the differentiation strategy. Grounded in the Theory of Contingency and the Theory of Asymmetric Information, these findings deepen our understanding of MC’s implications on business strategy. Additionally, the study provides empirical evidence for future research and proposes implications for both enterprises and government regulatory agencies.

IMPACT STATEMENT

This study explores the impact of market competition on business strategy within the Vietnamese context. Our findings reveal a significant correlation between market competition and the adoption of differentiation and cost leadership strategies. The results underscore the pivotal role of strategic choices in navigating highly competitive environments.

Reviewing Editor:

1. Introduction

Market competition and business strategy share a pivotal relationship, guiding managers in making informed decisions. The dynamic nature of market competition compels businesses to take calculated risks, enabling them to formulate effective strategies for success in challenging environments. Globally recognized for its substantial impact on both theoretical frameworks and practical applications, research on the intricate connection between market competition and business strategy has garnered widespread attention from scholars (Galbreath et al., Citation2022; Liu et al., Citation2022; Muhmad et al., Citation2021; Sanusi et al., Citation2023; Xuan Ha & Thi Tran, Citation2022; Yang et al., Citation2021; Yeh & Liao, Citation2020).

Distinct from prior studies, our evaluation of market competition’s impact on business strategy, employing Balsam et al. (Citation2011) measurement, focuses on cost-leadership and differentiation strategies for listed enterprises, excluding non-financial companies. Despite numerous studies on business strategy and market competition, research specifically on the impact of market competition on business strategy is limited, with notable exceptions like Van Witteloostuijn (Citation1993), Ghemawat (Citation2002), and Ghofar and Islam (Citation2015). While Van Witteloostuijn (Citation1993) explores Porter’s five competitive forces, Ghemawat (Citation2002) highlights how competition alters strategy, and Ghofar and Islam (Citation2015) use Miles and Snow’s (Citation1978, Citation2003) business strategy to examine the business environment-strategy link, the latter study acknowledges limited evidence of this connection.

Distinct from previous studies, our examination of the impact of market competition on business strategy focuses on cost-leadership and differentiation strategies for listed enterprises, excluding non-financial companies. Using Balsam et al. (Citation2011) measurement, this approach offers a unique perspective. While there are numerous studies on business strategy and market competition, research specifically delving into the impact of market competition on business strategy is scarce. Notable exceptions include studies by Van Witteloostuijn (Citation1993), Ghemawat (Citation2002), and Ghofar and Islam (Citation2015). Van Witteloostuijn (Citation1993) explores Porter’s five competitive forces, Ghemawat (Citation2002) emphasizes how competition alters strategy, and Ghofar and Islam (Citation2015) use Miles and Snow’s (Citation1978, Citation2003) business strategy to examine the link between the business environment and strategy. However, it is important to note that the latter study acknowledges limited evidence of this connection.

The current research landscape in Vietnam is marred by significant challenges, primarily stemming from the enduring impact of the COVID-19 pandemic over the past two years. The Vietnam Business White Book (2022) reports a stark reality, indicating that by 31 December 2021, 54,960 enterprises had temporarily ceased operations. This represents an 18.0% increase from 2020 and a staggering 90.8% surge from the 2016–2020 average. The 2022 Provincial Competitiveness Index survey further highlights persistent challenges, showcasing consistently low company size, growth rates, and business efficiency since the onset of the pandemic. In response to these adversities, Vietnam enacted Decree 71/2017/ND-CP and revised the Enterprise Law (No. 59/2020/QH14) to fortify the corporate governance framework. Recognizing the pivotal role of this framework, Vietnam has dedicated substantial efforts, particularly in the post-COVID era characterized by intense market competition. Against this backdrop, understanding the impact of market competition on business strategy becomes imperative.

This study, through a comprehensive literature review and an examination of Vietnam’s research context, seeks to investigate this impact. The findings aim to contribute valuable insights to the existing body of research on this topic, serving as a crucial reference for businesses striving to enhance their efficiency, integration, and overall development.

The paper’s organization is as follows: Section 2 encompasses the literature review and hypothesis development; Section 3 details data methods and research models; Section 4 presents results; and Section 5 concludes the findings and outlines policy implications.

2. Literature review and hypothesis development

2.1. Literature review

2.1.1. Asymmetric information theory

In this study, we employ Akerlof (Citation1970)’s Asymmetric Information Theory, introduced in the 1970s. Asymmetrical information occurs when one party possesses a more comprehensive set of information than the other. This information imbalance is a prevalent characteristic in almost all economic interactions, particularly evident in situations involving adverse selection or moral hazard (Eisenhardt, Citation1989). The presence of information asymmetry significantly shapes the informational landscape within business strategy and managerial control (Bentley-Goode et al., Citation2017). Asymmetric information plays a crucial role in influencing the firm’s business strategy, with the differentiation strategy exhibiting a lower degree of information asymmetry compared to the cost-leadership strategy (Bentley-Goode et al., Citation2017). Businesses may choose a motivated differentiation strategy to alleviate information asymmetry by striving to disclose more information. One potential approach to achieving this is by enhancing the marketability of their products, thereby gaining access to external information sources (Bushee et al., Citation2010). In this study, we apply the Asymmetric Information Theory to examine the impact of information asymmetry within the business environment.

2.1.2. Contingency theory

The contingency theory approach originated in organizational science in the 1960s and became influential in business administration. According to the contingency approach, organizational systems need to be in alignment with the specific context of an organization to function effectively. The core idea behind the theory of contingency is that uncertainties arise unpredictably, thus impacting a firm’s performance either through correlation or inherent modifications (Donaldson, Citation2001). Contingent situations encompass various aspects, including both the external and internal characteristics of the business environment, as well as competitive strategy (Geiger et al., Citation2006; Hambrick, Citation1983; Langfield-Smith, Citation1997). The contingency theory employed in this study is rooted in exploring the connection between random elements within the business environment and competitive strategy.

2.1.3. Market competition

Market competition constitutes a crucial dimension of the business environment (Allen & Gale, Citation2000; Chou et al., Citation2011). Economists contend that competition plays a vital role in contributing to the economy, emphasizing that the absence of competition negatively affects the overall welfare of market participants (Vickers, Citation1995). Additionally, competition serves to mitigate inertia and sluggishness within organizations, leading to enhanced operational efficiency (Hart, Citation1983; Hermalin, Citation1992). Highly competitive markets typically exhibit increased dynamism, while less competitive markets tend to be more stable (Gani & Jermias, Citation2009). The influence of market competition on business performance operates through various intermediary factors, including the corporate governance index (Xuan Ha & Thi Tran, Citation2022), the cost of debt (Valta, Citation2012), and organizational structure (Bloom et al., Citation2010). Existing research highlights the substantial impact of contextual factors such as market competition and organizational structure on business performance (Donaldson, Citation2001; Fauzi & Idris, Citation2009).

2.1.4. Business strategy

Business strategy, as conceptualized by Ansoff (Citation1965), serves as a comprehensive framework guiding a company in selecting optimal opportunities. Hambrick (Citation1983) underscores the pivotal role of a company’s competitive strategy, asserting its influence on goals across dimensions like marketing, production, finance, and human resources, thereby shaping the overall enterprise operation. This study adopts Porter’s business strategy model for its universal applicability, clarity, simplicity, and generality (Ormanidhi & Stringa, Citation2008). Porter (Citation1980, Citation1998) delineates two primary and effective business strategies: cost leadership and differentiation. Companies employing a cost-leadership strategy prioritize optimizing production processes, supply chains, and operational costs while extracting added value from resources. In contrast, those adopting differentiation strategies concentrate on unique product development, robust branding, high quality, meeting specific needs, and fostering close customer relationships.

2.2. Hypothesis development

2.2.1. Market competition impact on cost-leadership strategy

Existing studies emphasize the context-dependent nature of factors such as market competition, business strategy, and organizational structure (Donaldson, Citation2001; Fauzi & Idris, Citation2009). The level of market competition and an enterprise’s adaptability significantly influence its survival and long-term growth. However, in the current era of globalization and dynamic customer demands, adapting to the business environment presents considerable challenges for enterprises (Thompson et al., Citation2010). Enterprise flexibility is manifested through the adoption of appropriate business strategies and the efficient utilization of existing resources. This adaptability enables companies to achieve their desired market share and foster sustainable growth, even amidst the unpredictability of today’s business landscape.

In highly competitive markets, companies employing a cost-leadership strategy must prioritize controlling operational processes to minimize manufacturing costs. However, Geiger et al. (Citation2006) demonstrated that as market rivalry intensifies, companies are more likely to adopt differentiation strategies. Valta (Citation2012) also argued that in fiercely competitive markets, firms may face higher interest rates when borrowing money from banks. This suggests that banks perceive companies operating in intensely competitive markets as riskier propositions, leading to higher risk premiums. Consequently, when market competition is substantial, companies are more inclined to choose a differentiation strategy over a cost-leadership strategy. Building on this rationale, the authors formulate the following hypothesis:

H1: Market competition negatively impacts the adoption of cost-leadership strategy.

2.2.2. Market competition impact on differentiation strategy

The argument from hypothesis H1 suggests that market competition and adaptability critically impact performance and competitive advantages. Firms aligning strategy with market dynamics gain an edge for sustainable development. Enterprises adopting a differentiation strategy can better adapt to increasing competition. Competitive strategy effectiveness hinges on industry competition levels (Hambrick, Citation1983). Geiger et al. (Citation2006) illustrate that as managerial control intensifies, firms are more inclined toward a differentiation strategy. Research by Handoyo et al. (Citation2023) indicates companies embracing a prospector strategy, akin to differentiation, achieve superior performance compared to those pursuing a defensive one. Previous studies (Mansfield, Citation1968; Scherer, Citation1967) identify a positive correlation between market competition and research and development expenditures. Firms pursuing differentiation invest in R&D to create distinct products. As market competition rises, more businesses tend to adopt differentiation. From this, we propose:

H2: Market competition positively influences differentiation strategy adoption.

3. Data and methodology

3.1. Data collection

For data acquisition, we gathered the requisite information from annual reports, financial statements, listed company websites, and Refinitiv Eikon’s provided data. The sample includes data from 562 non-financial companies listed on the Ho Chi Minh City (HoSE) and Hanoi (HNX) stock exchanges, spanning a 10-year period from 2010 to 2019. Companies in the finance, banking, and insurance sectors were excluded due to their distinctive business and accounting systems. As a result, the final sample comprises a total of 4938 observations.

3.2. Variable measurement

3.2.1. Market competition measurement

Babar and Habib (Citation2021) delineate four methods for measuring market competition: (1) Barriers to entry (Clarkson et al., Citation1994); (2) Lerner index (Lerner, Citation1934); (3) Herfindahl-Hirschman index (HHI) (Giroud & Mueller, Citation2010; Jaroenjitrkam et al., Citation2020); (4) Text-based competitive measures (Li et al., Citation2013). Following the approaches of Giroud and Mueller (Citation2010) and Babar and Habib (Citation2021), we opt for the HHI index as our market competition measurement.

3.2.2. Business strategy measurement

Balsam et al. (Citation2011) note that various studies have attempted to formulate strategic frameworks based on cognitive measurements, such as Dess and Davis (Citation1984), or by focusing on a restricted number of data points (Kotha & Nair, Citation1995; Nair & Filer, Citation2003). Balsam et al.’s (Citation2011) analysis, grounded in financial statements and the framework proposed by Tripathy (Citation2006), asserts that a company implementing a differentiation strategy charges a premium price due to perceived uniqueness (Berman et al., Citation1999). Hence, a differentiation strategy allocates costs primarily to research, product development, and marketing. Hambrick (Citation1983) contends that the core aspect of cost-leadership is efficiency, achieved through cost efficiency and resource parsimony (Hambrick & Macmillan, Citation1984). A cost-leadership approach emphasizes asset utilization, staff productivity, and discretionary expenses.

3.2.3. Control variable measurement

3.2.3.1. Firm size (SIZE)

A pivotal determinant of a company’s value is its size (Surajit & Saxena, Citation2009), gauged by total investment capital, total assets, total employees, and net revenues. Larger companies possess greater organizational resources (Capon et al., Citation1990), often dealing with intricate expenditures (Linck et al., Citation2008). The measurement method adopted in this study, derived from previous research (Khuong et al., Citation2020; Mubeen et al., Citation2021; Yameen et al., Citation2019), is expressed as follows:

3.2.3.2. Tangible assets (TANG)

Fixed assets are company-owned assets designated for use in production and commercial operations, representing a crucial variable in assessing a firm’s value. Our measurement methodology in this study aligns with previous research (Khuong et al., Citation2020; Nguyen et al., Citation2021). The fixed asset ratio is computed as follows:

3.2.3.3. Firm age (AGE)

Firm age is a key indicator of growth potential and complexity (Adams & Mehran, Citation2012; Germain et al., Citation2014). Longer-established firms leverage their expertise to manage operations effectively, enhance production, and improve financial performance. However, these firms may be less dynamic and adaptable to the changing corporate environment (Boone et al., Citation2007; Loderer et al., Citation2011). The study adopts the following scale from previous research (Boone et al., Citation2007; Yameen et al., Citation2019; Yeh & Liao, Citation2020), as follows:

3.2.3.4. Financial leverage (DEBT)

Financial leverage, the amalgamation of liabilities and equity, aids corporations in comprehending their business risk. It significantly shapes risk and investment policies (Vengesai & Kwenda, Citation2018). Moreover, an escalation in debt levels can heighten the risk of fraud, necessitating robust internal controls. Consequently, companies burdened with substantial debt incur higher costs for supervision (Jensen & Meckling, Citation1976). The formula for calculating leverage in this study is derived from established methodologies in prior research (Khuong et al., Citation2020; Nguyen et al., Citation2021; Tran, Citation2020; Yeh & Liao, Citation2020):

3.2.3.5. State ownership (SOE)

State ownership is a distinctive institutional feature observed in publicly listed companies. Shareholders under government management leverage extensive government networks, allowing them to access equity and debt-related incentives (Cull & Xu, Citation2005). Additionally, these enterprises may enjoy tax or fee reductions, fostering operational expansion (Lu, Citation2011). These advantages contribute to long-term efficiency gains for the companies (You & Du, Citation2012). The measurement scale for state ownership in this study is adopted from earlier research, utilizing the ratio of state-owned shares to total business shares (Al Amosh & Khatib, Citation2021; Cull & Xu, Citation2005; Liu et al., Citation2018; Tran, Citation2020). The calculation formula is as follows:

The variable descriptions are presented in .

Table 1. The measurements of all variables used in this study.

3.3. Research models

Building upon insights from prior research on the relationship between market competition and business strategy (Ghemawat, Citation2002; Ghofar & Islam, Citation2015; Van Witteloostuijn, Citation1993), we present the following research model ().

Market competition impacts on cost-leadership strategy:

Market competition impacts on differentiation strategy:

where i = 1,2,…,562 (562 listed companies); t = 1,2,3,.,10 (10 years, from 2010 to 2019).

α is the intercept, and β_1 through β_6 are regression coefficients applied to measure the per-unit change in the dependent variable associated with a one-unit change in the respective independent variable, holding other independent variables constant. ε_it is the random error term.

3.4. Data analysis

We utilize STATA 14.2 and the Generalized Method of Moments (GMM) to evaluate the impact of market competition on business strategy. Traditional estimation methods, such as pooled ordinary least squares (OLS), fixed effects models (FEM), and random effects models (REM), are difficult to control for endogeneity problems (Wooldridge, Citation2015). The Hansen test is used to evaluate for over-identification of limitations and to test the instrument’s reliability. Due to its consistency in the presence of autocorrelation and heteroscedasticity, the Hansen test is preferred to the Sargan test for overdetermined constraints (Ullah et al., Citation2021).

4. Empirical results

4.1. Descriptive statistics

The data presented in provides an insight into the evolution of listed companies within eight competitive industries over the specified period 2010–2019.

Table 2. Statistical overview of eight competitive industries.

In 2010, the total count amounted to 417 listed companies, distributed among various sectors. Notably, technology and mining comprised 75 companies, retail and automobile repair had 74, accommodation and food service had 45, mining and energy had 35, medical activities had 15, transportation, warehousing, and construction had 140, and electronic technology had another 140.

From 2010 to 2019, there was a consistent overall increase in the number of businesses across all industries. Particularly noteworthy was the substantial growth in the transportation, warehousing, and construction sector, followed by technology and mining. In contrast, the sectors of technology and electronics exhibited the least pronounced growth during this timeframe.

provides the descriptive statistics for the variables in this study. The mean value for HHI is 0.091, with a minimum of 0.023 and a maximum of 0.293. For DIFF, the mean is −0.00000003, the minimum is −33.216, and the maximum is 29.886. The COST variable has a mean of −0.00000001, with a minimum of −0.161 and a maximum of 39.806.

Table 3. Descriptive statistics of the variables.

Notably, both DIFF and COST exhibit substantial variations between their maximum and minimum values, indicating significant differences within the samples. Moreover, the control variables, including fixed assets (TANG), years of operation (AGE), company size (SIZE), and state ownership (SOE), display wide distributions, showcasing diverse and representative market characteristics. The results suggest variations in competition levels among enterprises, and the range of years of operation spans from 0.693 to 4.779, implying that a majority of selected enterprises have relatively limited listing durations on the stock exchange.

4.2. Correlation matrix

Following the guidance provided by Gujarati (Citation2022), if the pair correlation coefficient surpasses 0.8, it could result in multicollinearity problems in regression equations. The correlation matrices presented in and showcase the relationships between variables in our research. The Pearson correlation coefficients between the independent variables are all below 0.5, indicating the absence of multicollinearity among the variables. Therefore, the correlation matrix demonstrates that the correlation coefficients within the study fall within acceptable limits.

Table 4. Correlation matrix for the market competition model with cost-leadership strategy.

Table 5. Correlation matrix for the market competition model with differentiation strategy.

4.3. Regression results

4.3.1 Panel – data unit root and cointegration tests

For the panel-unit root test, Fisher-type tests (xtunitroot Fisher) were employed in this study, as detailed in . The results reveal that the modified t-statistic for all variables is significantly different from zero at the 99% confidence level. This leads us to reject the null hypothesis, indicating that the series is stationary. In essence, the evidence strongly suggests the absence of a unit root, and we can infer that all variables in the study are stationary.

Table 6. Panel-data unit-root tests.

Moving on to the cointegration tests presented in , the results demonstrate that all test statistics reject the null hypothesis of no cointegration. Instead, they support the alternative hypothesis that there exists a cointegrating relation among all variables in the panel. In simpler terms, the variables are cointegrated across all panels.

Table 7. Results of the Kao Cointegration Test.

4.3.2. Regression results

The following is a table of regression results on the impact of market competition on cost leadership and differentiation strategies:

The regression results in support hypothesis H1, indicating a positive relationship between the market competition index and the adoption of the cost-leadership strategy. Notably, the market competition index consistently moves inversely to the market competition level, signifying that a higher index corresponds to a lower level of market competition. This implies that elevated market competition negatively impacts firms’ likelihood of choosing a cost-leadership strategy. In situations of intense competition, companies are more inclined to opt for a differentiation strategy, aligning with the findings of Geiger et al. (Citation2006). Thus, the results endorse hypothesis H1, suggesting that firms are more likely to adopt the cost-leadership strategy when faced with lower market competition.

Table 8. Regression results of the market competition model’s impact on cost-leadership and differentiation strategies.

Hypothesis H2 indicates a negative impact of the market competition index on the differentiation strategy, aligning with the consistent inverse correlation observed in hypothesis H1 between the market competition index and the level of competition. This alignment suggests a positive influence of heightened market competition on the adoption of the differentiation strategy. These findings resonate with previous research by Scherer (Citation1967) and Mansfield (Citation1968). Furthermore, Echegoyen et al. (Citation2020) have substantiated that companies can enhance profitability by adopting a differentiation strategy, emphasizing unique products and services. In conclusion, the evidence suggests that an increased level of market competition positively contributes to the adoption of the differentiation strategy.

5. Conclusions and implications

This study investigates the influence of market competition on business strategy within the Vietnamese context, considering the country’s status as a developing nation with an evolving legal framework for investor protection. Analyzing a sample of 562 non-financial companies listed on the Vietnamese stock exchange from 2010 to 2019, the study reveals that market competition negatively impacts the cost-leadership strategy while positively affecting the differentiation strategy.

The rationale lies in the necessity for companies to innovate and carve out unique market niches to thrive in highly competitive environments, making a differentiation strategy more suitable. These findings align with prior research, indicating a correlation between market competition and R&D expenses (Mansfield, Citation1968; Scherer, Citation1967), and affirming that a differentiation strategy yields more positive company relationships than a low-cost strategy (Echegoyen et al., Citation2020).

For policymakers, the study highlights the inadequacy of disclosed information in financial statements, particularly regarding marketing expenses and R&D spending. This points to the need for more effective and transparent oversight, urging state management agencies to enhance supervision processes comprehensively.

Governance implications for listed firms underscore the superiority of differentiation strategies in highly competitive environments. However, caution is advised in monitoring and avoiding resource wastage, especially when making high-risk investment decisions.

Limitations include the exclusion of finance-related sectors and the absence of data from the COVID-19 pandemic years. Future research should broaden the scope to include financial institutions and assess post-pandemic scenarios, with a particular focus on the 3–5 years following the COVID-19 epidemic. Comparative studies within the ASEAN region would also contribute valuable insights.

Disclosure statement

No potential conflict of interest was reported by the author.

Additional information

Funding

Notes on contributors

Le Thi Thoan

Le Thi Thoan, a Ph.D. student at the University of Economics and Law, Vietnam National University Ho Chi Minh, and a lecturer in the Faculty of Business Administration at Hutech University. She is a co-author of several articles and particularly interested in corporate governance, business strategy, and market competition. She looks forward to contributing to the overall development of the academic and business communities through research and teaching.

Vo Thi Ngoc Thuy

Vo Thi Ngoc Thuy is an Associate Professor. She has done PhD at Aix-Marseille University, Aix-Marseille Business School, IAE Aix, France. She is currently a President at Hoa Sen University, 08 Nguyen Van Trang, Ben Thanh Ward, District 1, Ho Chi Minh City, Vietnam. Her research interests are in service marketing, brand management, and tourism development. She has published her research in the International Journal of Hospitality Management, Tourism and Hospitality, International Review on Public and Nonprofit Marketing, International Journal of Business and Society. She is also a reviewer for Environmental Science and Pollution Research for the AMA conference.

Tran Thanh Long

Tran Thanh Long, with a research focus on international business, he is dedicated to contributing to the overall development of the academic community and businesses through research, teaching, and management.

References

- Abernethy, M. A., Kuang, Y. F., & Qin, B. (2019). The relation between strategy, CEO selection, and firm performance. Contemporary Accounting Research, 36(3), 1–13. https://doi.org/10.1111/1911-3846.12463

- Adams, R. B., & Mehran, H. (2012). Bank board structure and performance: Evidence for large bank holding companies. Journal of Financial Intermediation, 21(2), 243–267. https://doi.org/10.1016/j.jfi.2011.09.002

- Akerlof, G. A. (1970). The market for “lemons”: Quality uncertainty and the market mechanism. The Quarterly Journal of Economics, 84(3), 488–500. https://doi.org/10.2307/1879431

- Al Amosh, H., & Khatib, S. F. (2021). Ownership structure and environmental, social and governance performance disclosure: The moderating role of the board independence. Journal of Business and Socio-Economic Development, 2(1), 49–66. https://doi.org/10.1108/JBSED-07-2021-0094

- Allen, F., & Gale, D. (2000). Corporate governance and competition. Corporate Governance: Theoretical and Empirical Perspectives, 23, 1–42.

- Ansoff, H. I. (1965). Corporate strategy: An analytic approach to business policy for growth and expansion. McGraw-Hill Companies.

- Babar, M., & Habib, A. (2021). Product market competition in accounting, finance, and corporate governance: A review of the literature. International Review of Financial Analysis, 73, 101607. https://doi.org/10.1016/j.irfa.2020.101607

- Balsam, S., Fernando, G. D., & Tripathy, A. (2011). The impact of firm strategy on performance measures used in executivecompensation. Journal of Business Research, 64(2), 187–193. https://doi.org/10.1016/j.jbusres.2010.01.006

- Bentley-Goode, K. A., Omer, T. C., & Twedt, B. J. (2017). Does business strategy impact a firm’s information environment? Journal of Accounting, Auditing & Finance, 34(4), 563–587. https://doi.org/10.1177/0148558X17726893

- Berman, S. L., Wicks, A. C., Kotha, S., & Jones, T. M. (1999). Does stakeholder orientation matter? The relationship between stakeholder management models and firm financial performance. Academy of Management Journal, 42(5), 488–506. https://doi.org/10.2307/256972

- Bloom, N., Sadun, R., & Van Reenen, J. (2010). Does product market competition lead firms to decentralize? American Economic Review, 100(2), 434–438. https://doi.org/10.1257/aer.100.2.434

- Boone, A. L., Field, L. C., Karpoff, J. M., & Raheja, C. G. (2007). The determinants of corporate board size and composition: An empirical analysis. Journal of Financial Economics, 85(1), 66–101. https://doi.org/10.1016/j.jfineco.2006.05.004

- Bushee, B. J., Core, J. E., Guay, W., & Hamm, S. J. (2010). The role of the business press as an information intermediary. Journal of Accounting Research, 48(1), 1–19. https://doi.org/10.1111/j.1475-679X.2009.00357.x

- Capon, N., Farley, J. U., & Hoenig, S. (1990). Determinants of financial performance: A meta-analysis. Management Science, 36(10), 1143–1159. https://doi.org/10.1287/mnsc.36.10.1143

- Cho, E., & Tsang, A. (2020). Corporate social responsibility, product strategy, and firm value. Asia-Pacific Journal of Financial Studies, 49(2), 272–298. https://doi.org/10.1111/ajfs.12291

- Chou, J., Ng, L., Sibilkov, V., & Wang, Q. (2011). Product market competition and corporate governance. Review of Development Finance, 1(2), 114–130. https://doi.org/10.1016/j.rdf.2011.03.005

- Clarkson, P. M., Kao, J. L., & Richardson, G. D. (1994). The voluntary inclusion of forecasts in the MD&A section of annual reports. Contemporary Accounting Research, 11(1), 423–450. https://doi.org/10.1111/j.1911-3846.1994.tb00450.x

- Cull, R., & Xu, L. C. (2005). Institutions, ownership, and finance: the determinants of profit reinvestment among Chinese firms. Journal of Financial Economics, 77(1), 117–146. https://doi.org/10.1016/j.jfineco.2004.05.010

- Dess, G. G., & Davis, P. S. (1984). Porter’s (1980) generic strategies as determinants of strategic group membership and organizational performance. Academy of Management Journal, 27(3), 467–488. https://doi.org/10.2307/256040

- Donaldson, L. (2001). The contingency theory of organizations. Sage.

- Echegoyen, H. G., Ramírez, S. L. C., & López, A. T. (2020). Market forces, competitive strategies and small business performance: Evidence from Mexicos low-income market. Contaduría y Administración, 65(1), 11.

- Eisenhardt, K. M. (1989). Agency theory: An assessment and review. The Academy of Management Review, 14(1), 57–74. https://doi.org/10.2307/258191

- Fauzi, H., & Idris, K. M. (2009). The performance implications of fit among environment, strategy, structure, control system and social performance. Issues in Social and Environmental Accounting, 3(2), 117–142. https://doi.org/10.22164/isea.v3i2.40

- Fernando, G. D., Schneible, R. A., Jr,., & Tripathy, A. (2016). Firm strategy and market reaction to earnings. Advances in Accounting, 33, 20–34. https://doi.org/10.1016/j.adiac.2016.04.006

- Galbreath, J., Lucianetti, L., Tisch, D., & Thomas, B. (2022). Firm strategy and CSR: The moderating role of performance management systems. Journal of Management & Organization, 28(1), 202–220. https://doi.org/10.1017/jmo.2020.27

- Gani, L., & Jermias, J. (2009). Performance implications of environment-strategy-governance misfit. Gadjah Mada International Journal of Business, 11(1), 1–20. https://doi.org/10.22146/gamaijb.5541.

- Geiger, S. W., Ritchie, W. J., & Marlin, D. (2006). Strategy/structure fit and firm performance. Organization Development Journal, 24(2), 10–22.

- Germain, L., Galy, N., & Lee, W. (2014). Corporate governance reform in Malaysia: Board size, independence and monitoring. Journal of Economics and Business, 75, 126–162. https://doi.org/10.1016/j.jeconbus.2014.06.003

- Ghemawat, P. (2002). Competition and business strategy in historical perspective. Business History Review, 76(1), 37–74. https://doi.org/10.2307/4127751

- Ghofar, A., & Islam, S. (2015). Corporate governance and contingency theory. Springer.

- Giroud, X., & Mueller, H. M. (2010). Does corporate governance matter in competitive industries? Journal of Financial Economics, 95(3), 312–331. https://doi.org/10.1016/j.jfineco.2009.10.008

- Gujarati, D. N. (2022). Basic econometrics. Prentice Hall.

- Hambrick, D. C. (1983). High profit strategies in mature capital goods industries: A contingency approach. Academy of Management Journal, 26(4), 687–707. https://doi.org/10.5465/255916

- Hambrick, D. C., & MacMillan, I. C. (1984). Asset parsimony-managing assets to manage profits. Sloan Management Review (Pre-1986), 25(2), 67.

- Handoyo, S., Suharman, H., Ghani, E. K., & Soedarsono, S. (2023). A business strategy, operational efficiency, ownership structure, and manufacturing performance: The moderating role of market uncertainty and competition intensity and its implication on open innovation. Journal of Open Innovation: Technology, Market, and Complexity, 9(2), 100039. https://doi.org/10.1016/j.joitmc.2023.100039

- Hart, O. D. (1983). The market mechanism as an incentive scheme. The Bell Journal of Economics, 14(2), 366–382. https://doi.org/10.2307/3003639

- Hermalin, B. E. (1992). The effects of competition on executive behavior. The RAND Journal of Economics, 23(3), 350–365. https://doi.org/10.2307/2555867

- Ittner, C. D., Larcker, D. F., & Rajan, M. V. (1997). The choice of performance measures in annual bonus contracts. Accounting Review, 72(2), 231–255.

- Jaroenjitrkam, A., Yu, C. F., & Zurbruegg, R. (2020). Does market power discipline CEO power? An agency perspective. European Financial Management, 26(3), 724–752. https://doi.org/10.1111/eufm.12240

- Jensen, M. C., & Meckling, W. H. (1976). Theory of the firm: Managerial behavior, agency costs and ownership structure. Journal of Financial Economics, 3(4), 305–360. https://doi.org/10.1016/0304-405X(76)90026-X

- Khuong, N. V., Liem, N. T., Thu, P. A., & Khanh, T. H. T. (2020). Does corporate tax avoidance explain firm performance? Evidence from an emerging economy. Cogent Business & Management, 7(1), 1780101. https://doi.org/10.1080/23311975.2020.1780101

- Kotha, S., & Nair, A. (1995). Strategy and environment as determinants of performance: Evidence from the Japanese machine tool industry. Strategic Management Journal, 16(7), 497–518. https://doi.org/10.1002/smj.4250160702

- Langfield-Smith, K. (1997). Management control systems and strategy: A critical review. Accounting, Organizations, and Society, 22(2), 207–232. https://doi.org/10.1016/S0361-3682(95)00040-2

- Lerner, A. P. (1934). Economic theory and socialist economy. The Review of Economic Studies, 2(1), 51–61. https://doi.org/10.2307/2967550

- Li, F., Lundholm, R., & Minnis, M. (2013). A measure of competition based on 10‐K filings. Journal of Accounting Research, 51(2), 399–436. https://doi.org/10.1111/j.1475-679X.2012.00472.x

- Linck, J. S., Netter, J. M., & Yang, T. (2008). The determinants of board structure. Journal of Financial Economics, 87(2), 308–328. https://doi.org/10.1016/j.jfineco.2007.03.004

- Liu, C., Li, Q., & Lin, Y. E. (2022). Corporate transparency and firm value: Does market competition play an external governance role? Journal of Contemporary Accounting & Economics, 19(1), 100334. https://doi.org/10.1016/j.jcae.2022.100334

- Liu, L., Qu, W., & Haman, J. (2018). Product market competition, state-ownership, corporate governance, and firm performance. Asian Review of Accounting, 26(1), 62–83. https://doi.org/10.1108/ARA-05-2017-0080

- Loderer, C. F., Neusser, K., & Waelchli, U. (2011). Firm age and survival. Available at SSRN 1430408.

- Lu, Y. (2011). Political connections and trade expansion: Evidence from Chinese private firms. Economics of Transition, 19(2), 231–254. https://doi.org/10.1111/j.1468-0351.2010.00402.x

- Mansfield, E. (1968). Industrial research and technological innovation; an econometric analysis.

- Miles, R. E., & Snow, C. C. (1978). Organizational strategy, structure, and process. McGraw-Hill.

- Miles, R. E., & Snow, C. C. (2003). Organizational strategy, structure, and process. Stanford University Press.

- Mubeen, R., Han, D., Abbas, J., Álvarez-Otero, S., & Sial, M. S. (2021). The relationship between CEO duality and business firms’ performance: The moderating role of firm size and corporate social responsibility. Frontiers in Psychology, 12, 669715. https://doi.org/10.3389/fpsyg.2021.669715

- Muhmad, S. N., Ariff, A. M., Majid, N. A., & Kamarudin, K. A. (2021). Product market competition, corporate governance and ESG. Asian Academy of Management Journal of Accounting & Finance, 17(1), 63–91.

- Nair, A., & Filer, L. (2003). Cointegration of firm strategies within groups: A long‐run analysis of firm behavior in the Japanese steel industry. Strategic Management Journal, 24(2), 145–159. https://doi.org/10.1002/smj.286

- Nguyen, T., Bai, M., Hou, Y., & Vu, M. C. (2021). Corporate governance and dynamics capital structure: Evidence from Vietnam. Global Finance Journal, 48, 100554. https://doi.org/10.1016/j.gfj.2020.100554.

- Ormanidhi, O., & Stringa, O. (2008). Porter’s model of generic competitive strategies. Business Economics, 43(3), 55–64.

- Porter, M. E. (1980). Industry structure and competitive strategy: Keys to profitability. Financial Analysts Journal, 36(4), 30–41. https://doi.org/10.2469/faj.v36.n4.30

- Porter, M. E. (1998). Competitive advantage: Creating and sustaining superior performance. Free Press.

- Sanusi, F., Januarsi, Y., Purbasari, I., & Akhmadi . (2023). The discipline vs complement role of product market competition and market power: Evidence from real earnings management in an emerging market. Cogent Business & Management, 10(1), 2170072. https://doi.org/10.1080/23311975.2023.2170072

- Scherer, F. M. (1967). Market structure and the employment of scientists and engineers. The American Economic Review, 57(3), 524–531.

- Surajit, B., & Saxena, A. (2009). Does the firm size matter. An Empirical Enquiry into the Performance of Indian Manufacturing Firms.

- Thompson, A. A., Arthur, A., Strickland, A. J., & Gamble, J. E. (2010). Crafting and executing strategy 17th edition.

- Tran, T. M. T. (2020). Corporate governance of banks in Vietnam and their roles on banks’ risk-taking and efficiency: a thesis presented in partial fulfilment of the requirements for the degree of Doctor of Philosophy in Banking Studies at Massey University, Manawatu Campus, New Zealand (Doctoral dissertation, Massey University).

- Tripathy, A. (2006). Strategic positioning and firm performance. PhD Dissertation, University of Texas at Dallas.

- Ullah, S., Zaefarian, G., & Ullah, F. (2021). How to use instrumental variables in addressing endogeneity? A step-by-step procedure for non-specialists. Industrial Marketing Management, 96, A1–A6. https://doi.org/10.1016/j.indmarman.2020.03.006

- Valta, P. (2012). Competition and the cost of debt. Journal of Financial Economics, 105(3), 661–682. https://doi.org/10.1016/j.jfineco.2012.04.004

- Van Witteloostuijn, A. (1993). Multimarket competition and business strategy. Review of Industrial Organization, 8(1), 83–99. https://doi.org/10.1007/BF01029771

- Vengesai, E., & Kwenda, F. (2018). The impact of leverage on discretionary investment: African evidence. African Journal of Economic and Management Studies, 9(1), 108–125. https://doi.org/10.1108/AJEMS-06-2017-0145

- Vickers, J. (1995). Concepts of competition. Oxford Economic Papers, 47(1), 1–23. https://doi.org/10.1093/oxfordjournals.oep.a042155

- Wooldridge, J. M. (2015). Introductory econometrics: A modern approach. Cengage Learning.

- Xuan Ha, T., & Thi Tran, T. (2022). The impact of product market competition on firm performance through the mediating of corporate governance index: empirical of listed companies in Vietnam. Cogent Business & Management, 9(1), 2129356. https://doi.org/10.1080/23311975.2022.2129356

- Yameen, M., Farhan, N. H., & Tabash, M. I. (2019). The impact of corporate governance practices on firm’s performance: An empirical evidence from Indian tourism sector. Journal of International Studies, 12(1), 208–228. https://doi.org/10.14254/2071-8330.2019/12-1/14

- Yang, M. J., Li, N., & Lorenz, K. (2021). The impact of emerging market competition on innovation and business strategy: Evidence from Canada. Journal of Economic Behavior & Organization, 181, 117–134. https://doi.org/10.1016/j.jebo.2020.10.026

- Yeh, Y. H., & Liao, C. C. (2020). The impact of product market competition and internal corporate governance on family succession. Pacific-Basin Finance Journal, 62, 101346. https://doi.org/10.1016/j.pacfin.2020.101346

- You, J., & Du, G. (2012). Are political connections a blessing or a curse? Evidence from CEO turnover in China. Corporate Governance: An International Review, 20(2), 179–194. https://doi.org/10.1111/j.1467-8683.2011.00902.x

- Zhang, H. (2018, October 6). Product market competition and corporate governance: Substitutes or complements? Evidence from CEO duality. Evidence from CEO duality. https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3088768.