Abstract

Retail banking has always been considered as a core activity of banks because it has the effect of accelerating the cash flow process and creating a mainstream medium and long-term capital source for the bank. Vietnamese commercial banks now are facing great risks. This reality requires banks to improve competitive capability to compete with domestic banks and foreign banks. This study examines the determinants affecting the competitiveness of retail bank service in VietinBank. By using Structural Equation Modelling (SEM) technique, the results show five determinants affecting positively to the competitiveness of the retail banking services including service quality, financial capacity, risk management, organizational culture, and social responsibility. The findings indicate that financial capacity has biggest effect and service quality has smallest effect on competitive capacity of retail banking service in VietinBank. The research also proposes specific solutions to enhance the competitiveness and sustainable development of retail banking services in Vietnam.

1. Introduction

Banks play an important role in the development of economies and act as a financial regulator and intermediary between the sender and the borrower. The banking system in Vietnam contributes positively into mobilizing capital sources in society to serve the needs of economic development, create jobs and improve people’s lives. As a result, the proportion of the population accessing banking services in Vietnam has gradually increased over time, from 31% in 2014 to 70% in 2020 (British Business Group Vietnam, Citation2019). The banks serve a wide range of customers and provide a wide range of services in different forms including retail banking with the main activity of providing products and services to individual customers, small and medium enterprises. Retail banking has always been considered as a core activity of banks because it has the effect of accelerating the cash flow process, taking advantage of the great potential of capital of all economic sectors, limiting cash payments, helping to save costs and time for both banks and customers. In addition, retail banking service also plays an important role in expanding the market, enhancing competitiveness, creating a mainstream medium and long-term capital source for the bank, contributing to diversify banking operations and non-banking products and services, and bringing revenue with less risk. Thereby, retail banking service develops the existing and potential customer network of commercial banks.

Nowadays, retail service activities are playing an increasingly large role in the development of banks. In the US, retail banking has become a strategic spearhead with retail debt and deposits increasingly contributing to the balance sheets of commercial banks, and the rapid rise of bank branches (Clark et al., Citation2007). The development of retail banking services also enhances the competitiveness of banks in emerging and developing countries. In Vietnam, the retail banking model in Vietnam currently has a lot of potential for growth, which means that competition in the retail segment among banks is becoming increasingly fierce. Domestic banks compete with foreign ones because of the process of integration and globalization. Furthermore, it is undeniable that the development of the 4.0 revolution has created a series of fintech companies, also becoming direct competitors of banks. Therefore, banks need to improve their competitiveness to survive and develop sustainably, especially in the retail banking segment.

To maintain competitive advantage in the service sector such as banking, the service provider needs to promote ten factors respectively, which are reputation, good staff, high brand recognition, supporting service/products, financial resources, customer orientation, business knowledge, diverse product lines, customer satisfaction and highly concentrated market (Aaker, Citation2001). Service managers should focus on improving the functional factors such as timeliness of service delivery, attentiveness of staff, communication with client about service delivery time, accurate invoice information, promptness of service and willingness to help staff (Meesala & Paul, Citation2018). In other words, staff attitude towards service users, proper communication and correct service delivery are essential. Customers are not only looking for tangible benefits, but also value the experience they received (Prentice et al., Citation2019; Roy et al., Citation2018). From the customer’s point of view, the service provider needs to offer quality service to be competitive as customers have a lot of alternatives to achieve their goals. Inversely, a failure in service delivery can decrease customer satisfaction.

The focus of many previous research papers was generally to look at the factors affecting the competitiveness of banks in developed countries. However, banking system in developing economies such as Vietnam may experience more adverse conditions than in developed economies, which causes differentiation in retail banking service between developing and developed economies. The intrinsic of the retail banking in Vietnam remains many limitations such as low equity; basic products and services not meeting the needs of customers; ineffective distribution channel; unclear marketing strategy; undeveloped technology; poor service quality and high fees (British Business Group Vietnam, Citation2019).

Starting from the importance of the retail banking segment at commercial banks, this paper clarifies the status of competitiveness and examines the external and internal factors of the bank affecting the competitiveness of retail banking services in one of four largest state-owned banks in Vietnam. VietNam Joint Stock Commercial Bank for Industry and Trade (VietinBank) was established in 1998 and has always played a key role in the banking system in Vietnam. VietinBank has a nationwide network and is also the first and only Vietnamese bank present in Europe. However, VietinBank is currently slower than its competitors in promoting the retail banking segment. While at other banks, personal loans account for a large proportion. However, at Vietinbank, personal loan has only accounted for about 3% of total loan balance in 2019 (British Business Group Vietnam, Citation2019). This study also provides solutions to enhance the competitiveness of retail banking service in the context of financial institutions in Vietnam is suffering from both positive and negative shocks from the outside.

2. Theoretical framework and literature review

2.1. Theoretical framework

Retail banking is a banking service provided to individual individuals, small and medium enterprises (SMEs) through a network of branches or customers who can directly access banking products through electronic means of telecommunications (Mishkin, Citation2019). The competitiveness of commercial banks is also understood as the ability of banks to control favorable business conditions compared to other banks (Casu & Molyneux, Citation2003; S. Uddin & Gupta, Citation2012). In other words, the competitiveness of commercial banks is the ability to create and effectively use comparative advantages to compete with other commercial banks, which is reflected in the higher number of services provided, wider network of activities, increasing utilities of products and customer satisfaction level and more people knowing and using retail banking service.

According to the Value Disciplines Model, the three main pillars that create the competitive strength of enterprises include product leadership, operational excellence, and customer intimacy (Treacy & Viersema, Citation1993). Product leadership is the constant effort to deliver leading edge products or useful new applications. This requires companies to be creative and responsive to the market. Operational excellence is about providing reliable products or services to customers at competitive prices and the timeliest service. Customer intimacy is about constantly tailoring its products and services to customers in a way that can provide the best total solution. Loyal customers are the cornerstone of competition.

The competitiveness of retail banking depends on the economic environment (such as economic growth, inflation, exchange rate, entry conditions), the industry environment (market forces such as customers, suppliers, and competitors), and the internal environment (Barth et al., Citation2002). The theory of resources and sustainable competitive advantage shows that there are three types of internal resources of enterprises to maintain competitive advantage, including: (i) physical capital; (ii) human resources and (iii) organizational capital (Barney, Citation1991). Specifically, Holdford (Citation2018) suggests that these internal resources can be financial (cash, access to credit); material (factory, equipment); legal (patents, trademarks); people (management and communication skills); organization (corporate culture, governance); information (knowledge of the market); relationships (relationships with suppliers and customers).

2.2. Literature review

To maintain a competitive advantage in the long term, enterprise in general must continuously add value to customers. Product advantages at low costs can effectively improve the competitiveness of enterprises. According to Piha and Avlonitis (Citation2015), bank managers can retain customers by creating barriers that prevent users from leaving using a portfolio of premium and diversified services that users can hardly give up any of them. The results of switching costs for customer as well as their subjective perception of a bank product can have a positive effect on a deteriorating relationship between customers and banks. Cost leadership does not only mean charging significantly lower prices than competitors, but also improving service delivery to better meet customer needs. When a bank creates a superior difference in products/services, high price is a signal that shows the attractiveness of this bank ‘s products/services compared to other banks (Matzler et al., Citation2006). Therefore, the research hypothesis is:

H1: Good product has a positive relationship with the competitiveness of retail banking services.

The research of Hamzah et al. (Citation2017) evaluated the service quality of retail banking in Malaysia from the customer perspective and put it in relation to the overall service quality when considering the relationship between service quality with the bank’s reputation, customer satisfaction and trust. This study pointed out service quality affects the bank’s image in the evaluation of customers. Recently, banks in Vietnam are paying more attention to the quality of their products and services as well as maintaining relationships with customers to improve competitiveness. Banks should put customer-related criteria such as customer perception of service quality and satisfaction as the core of their development strategy. This will help improve customer loyalty and stabilize profit (Ngo & Nguyen, Citation2016). Therefore, the research hypothesis is:

H2: Service quality has a positive relationship with the competitiveness of retail banking services.

Distribution network is one of the two activities that commercial banks could master and gain competitiveness (Lammarque, Citation2005). Different distribution channels allow for value-added optimization of banking service. The choice of modern distribution channels such as counter, telephone, internet, mobile creates differentiation about the competitiveness of banks. The wide system of branches and transaction offices that are convenient for transactions contributes to the real competitiveness of the bank. In recent years, e-banking services (internet banking, mobile banking, SMS banking …) are developing strongly, and at the same time affect the competitive advantage of traditional banking services. However, modern distribution channels still cannot completely replace traditional distribution channels (Akinci et al., Citation2004). The right combination and development of distribution channels will help banks increase their accessibility and satisfy customers in providing retail banking services. Given the significance of digitalization, Bäckström and Johansson (Citation2017) specifically considered the importance of retail distribution channels. Therefore, the research hypothesis is:

H3: Distribution channel has a positive relationship with the competitiveness of retail banking services.

Salome et al. (Citation2018) provided an empirical analysis of the trade-off between financial inclusion and credit risk of commercial banks in Kenya. The paper analyzed the effect of financial inclusion on credit risk and banking competitiveness of commercial banks in Kenya. Givi et al. (Citation2010) identified factors affecting the competitiveness of the banking system in Iran, thereby ranking the banks. The main independent factors are financial capacity, market share, human resources, international cooperation, and information technology application. The results of the study showed that financial strength is the main factor affecting the competitiveness of commercial banks. Therefore, the research hypothesis is:

H4: Financial capacity has a positive relationship with the competitiveness of retail banking services.

To create the competitive strength of retail banking, the application of science and technology into the operation process is very important. High technology will help people to access information quickly and accurately, from which to make timely and correct decisions. When banks apply modern technology, it will help save cost, speed up payment and cash flow and use capital effectively (Kemunto & Kagiri, Citation2018; Lin, Citation2007). According to Grewal et al. (Citation2016), retailers have always been inundated with data collected from enterprise system, websites, social data, location-based details from phones and applications. In recent years, they increasingly start to take advantage of option for organizing these data better. The power of data and analytical system enables retailers to understand customer behaviors, permitting them to manage issues such as product, location, time, channel. They can use this data strategically to optimize price and maximize sales. From a retailer’s perspective, technology significantly reduces personnel costs by reducing face-to-face customer interactions and reducing order processing times. In addition, the efficiency of technology also helps retailers and service providers reach the right customers at a lower cost, offering ads or recommendations that are tailored to the needs of the customer. This result is in line with our expectation regarding technology’s contribution to the competitiveness of service retailer such as banks. Therefore, the research hypothesis is:

H5: Technology has a positive relationship with the competitiveness of retail banking services.

To properly control the performance of an organization, it is necessary to recognize potential threats and risks, thereby strengthening management according to financial goals and accountability (Dellana et al., Citation2021). Risks in retail banking are unexpected events that, when occurring, will lead to a loss of the bank’s assets, a decrease in the actual profit compared to expected or banks must spend a certain amount of money to complete a certain financial task. Banking is one of the sectors facing the most risks because all activities are related to money. In the context that all types of risks are closely related and interact with each other, they can cause great losses to the commercial banking system. Therefore, risk management plays a very important role in helping the bank to defend against outside attacks and to thrive in the long term. Risk management capacity is one of the most important factors promoting competitive competence in banking services in Vietnam, besides financial and marketing capacity (Thuy & Dai, Citation2014). Therefore, the research hypothesis is:

H6: Risk management has a positive relationship with the competitiveness of retail banking services.

A commercial bank can enhance the competitiveness of retail banking services through trade promotion activities such as advertising, sales promotion, personal selling, public relations, and direct marketing. Each bank has different sales promotion methods such as direct advertising, advertising through mass media such as television, radio, internet. Promotions improve sales significantly (Das & Kumar, Citation2009) but tend to attract consumers towards bank switching rather than loyalty in the long run. Therefore, the research hypothesis is:

H7: Promotion program has a positive relationship with the competitiveness of retail banking services.

Organizational culture includes ‘values’, ‘beliefs’ and ‘standards’ that influence the thinking and behavior of everyone in the organization. Organizational culture is an important source of competitive advantage. Carmeli and Tishler (Citation2004) studied the relationship between intangible factors (organizational culture, communication, and knowledge) on the performance of the organization. Organizational culture drives the organization’s efforts to improve the overall performance and quality of its products and services. The research by Chen and Lin (Citation2020) showed that organizational culture affects both competitiveness and productivity. Therefore, the research hypothesis is:

H8: Organizational culture has a positive relationship with the competitiveness of retail banking services.

The study of Zhao et al. (Citation2019) extended the examination of the relationship between social responsibility and competitive advantage. The results showed that social responsibility could positively affect competitive advantage directly and indirectly through mediating variables on the structure and relational aspects of competitive advantage. In a dynamic environment, social responsibility indirectly creates competitive advantages by enhancing dynamic capabilities, such as the ability to integrate resources and the ability to organize learning, but not by the ability to innovate and transform. Ruiz and García (Citation2021) indicated the impact of corporate social responsibility on bank reputation of leading banks in the United Kingdom and Spain. The results showed ability of corporate social responsibility to improve a banking reputation in an unstable financial system. Therefore, the research hypothesis is:

H9: Social responsibility has a positive relationship with the competitiveness of retail banking services.

The competitiveness of commercial banks also depends on external factors such as socio-economic environment, scientific and technological environment, and infrastructure (M. B. Uddin & Akhter, Citation2011). According to Barth et al. (Citation2002), the bank’s competitiveness depends on the business environment (market forces as customers and suppliers), the economic environment (economic growth, accession conditions) and internal environment (scale, accessibility of customers, banking risk management). In this study, Provincial competitiveness index is presented for external environment factor affecting the competitiveness of retail banking services. Therefore, the research hypothesis is:

H10: Provincial competitiveness index has a positive relationship with the competitiveness of retail banking services.

In the context of developing countries, this paper extends relevant literature by examining the effect of external factor such as provincial competitiveness index and internal factors such as organizational culture and social responsibility on the competitiveness of retail banking services.

3. Research methodology and research design

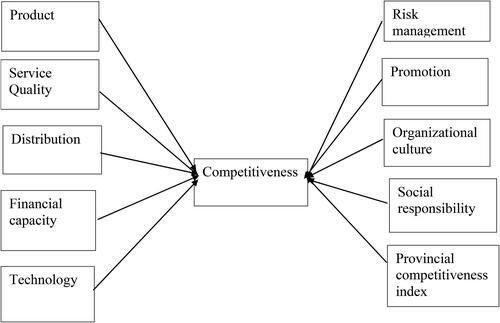

This study applies quantitative method. The quantitative method examines numerical data and often requires the use of statistical tools to analyze data collected. This allows for the measurement of variables and relationships between them can then be established. From literature review, the research proposes factors affecting the competitive capability of retail banking service in VietinBank including product, service quality, distribution, financial capacity, technology, risk management, promotion, organizational culture, social responsibility, and provincial competitiveness index ().

The research is conducted through three phases as follows:

Phase 1: Respondents are customers who have been using one or more retail banking services of VietinBank. There are 1659 customers surveyed at branches of 6 provinces/cities in regions of North, Central and South Vietnam. Sampling method is simple random. To use this sampling technique, we asked for help from branch directors in 6 provinces/cities. Branch directors would ask tellers to distribute surveys to customers when they came to the bank to make transactions. The survey includes two parts. The first part is general information about customer. The second one is evaluation of customers about retail banking service of VietinBank. There are a total of 17 questions and 44 items for 10 factors. The items scale for factors is built based on foreign studies and by in-depth interview with banking experts (see Appendix A). Customer’s response is measured through questionnaire on a 5-point Likert scale ranging from ‘strongly disagree’ to ‘strongly agree’. After the survey results are available, the collected data will be analyzed.Phase 2: The variables are tested by Cronbach’s Alpha coefficient to analyse reliability of the scale and Exploratory Factor Analysis to reduce many observed variables into a set of factors but still contain most of the information of the original set of variables. All data collected from the questionnaire are coded and processed by SPSS 20.0 and AMOS software. Total correlation coefficient is ≥ 0.3 and Cronbach’s Alpha coefficient is ≥ 0.7 which ensures reliability of the scale. The observed variables are correlated when Average Variance Extracted is > 50%, the KMO coefficient is within 0.5 to 1, Sig ≤ 5%. Exploratory factor analysis (EFA) with factor loading of all observed variables higher than 0.5 is performed.Phase 3: The model is tested with Confirmatory Factor analysis (CFA) and Structural Equation Modelling (SEM). SEM technique is a combination of multiple regression and factor analysis to examine the structural relationships among the constructs, well-applied in relevant studies (Ashraf & Ali, Citation2022; Hair et al., Citation2017). The advantages of SEM are grouped in four categories such as modelling of measurement errors and unexplained variances, simultaneous testing of relationships, ability to link micro- and macro-perspectives, and best-fitting model and theory development. A research model is considered with econometric issues if probability level ≤ 5%; CMIN/df ≤ 5; GFI, TLI, CFI ≥ 0.9; RMSEA ≤ 0.08; PCLOSE ≥0.01. Apart from the above criteria, the test results must also ensure composite reliability (CR) > 0.6; Average Variance Extracted (AVE) > 0.5 and Maximum Shared Variance (MSV) is lower than Average Variance Extracted (AVE) (Hair et al., Citation2010).

4. Findings

4.1. Data description

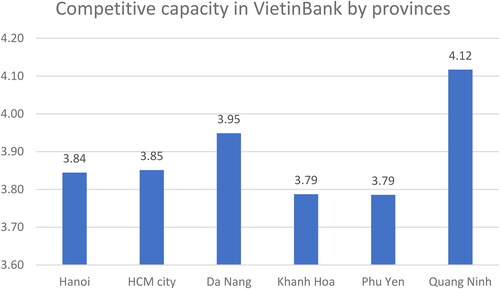

There are 6 cities/provinces surveyed located in 3 regions of North, Central and South of Vietnam including Hanoi, Quang Ninh, Da Nang, Khanh Hoa, Phu Yen and Ho Chi Minh city. In general, the percentage of customers participating in the survey is quite similar in the three regions of North, Central and South of Vietnam with 32%; 37% and 31%, respectively. Customers participated in the survey are mainly from 3 big cities: Hanoi (27%), Ho Chi Minh City (33%) and Da Nang (15%). These are 3 cities with dense population with developed socio-economic activities ().

Figure 2. Competitive capacity in VietinBank by provinces. Source: The researchers’ collecting data.

The bank’s retail banking competitiveness of VietinBank is measured on a 5-point Likert scale that increases from 1 to 5 with 1-strongly disagree and 5-strongly agree. This figure reveals that customers rate competitiveness of retail banking service highest in Quang Ninh (4.12), followed by Da Nang (3.95), Ho Chi Minh City (3.85) and Hanoi (3.84). The lowest competitiveness level of retail banking service is in Khanh Hoa and Phu Yen provinces (3.79). Therefore, Vietinbank’s branches in these provinces need to improve the quality of retail service to improve their competitiveness compared to other provinces across the country ().

Table 1. Information about customers surveyed in VietinBank.

With a number of observations of 1659 customers, the proportion of men is 47% and the proportion of women is 53%. It can be seen that the number of women and men participating in the survey is quite balanced.

In the total number of customers participating in the survey, the age group from 30 to under 40 years old has accounted for the highest percentage (35%), which is followed by age group from 20 to under 30 years old (28%) and age group 40 to under 50 years old (19%). The rest percentage are age groups under 20 years old (6%), 50 to under 60 years old (8%), and from 60 years old and above with the proportion (3%). It can be said that the age of customers using retail banking services at VietinBank is quite diverse, mainly young people from 20 to under 50 years old.

Out of a total of 1659 people surveyed, 946 people have university degrees, accounting for the highest proportion (57%). In addition, the number of people with intermediate/college degree is 320 people, equivalent to 19%. The remaining percentage of customers who completed high school or postgraduate school has not much difference, accounting for 13% and 11%, respectively.

In terms of income, about 70% of the customers who participated in the survey have an income of less than 20 million. Specifically, income level below 10 million is 31% and income level from 10 to under 20 million is 39%. The rate of people with income level from 20 to under 30 million is 19%. The remaining percentage of customers with income level from 30 and above is 11%.

In terms of time using banking services at VietinBank, the majority of survey respondents have long-term attachment to services at VietinBank. The percentage for customers who have used the service for more than 5 years is 35%, which is followed by customers using the service from 1 to less than 3 years (26.4%) and from 3 to 5 years (25.9%). Customers using the service for less than 1-year account for only 13% ().

Table 2. Period of using retail service of customers by different ages.

Among those who have used the service for more than 5 years, customers are mainly between the age of 30 and under 50 (68.9%). Specifically, customers aged 30 to under 40 accounts for 45.2%, and customers aged 40 to under 50 accounts for 23.7%. For a period from 3 to 5 years, customers are aged 20–40 years old (66.7%) with customers aged 20 to under 30 (32.9%) and customers aged 40 to under 50 (33.8%). For a period from 1 to 3 years, customers are mainly aged 20–40 years old (73.3%) with customers aged 20 to under 30 (41.6%) and customers aged 30 to under 40 (31.7%). For a period under 1 year, customers are mainly aged under 30 years old (67.6%) with customers aged 20 to under 30 (39%) and customers aged under 20 (28.6%). This reveals that most of VietinBank’s long-term customers are adults between 30 and 50 years old. The time for using the service of young people is not long so VietinBank should focus on the potential customers in the future ().

Table 3. Period of using retail service of customers by different income.

In terms of income, with two groups of customers with average income (10 to less than 20 million and 20 to less than 30 million) and high income (from 30 million or more), most of them use the service for 3–5 years or more than 5 years. The group of customers with low-income under 10 million have short time using retail service mainly under 3 years.

The services most used by customers are money transfer (78.9%), followed by saving (62.1%), bill payment (53.4%) and checking account information (53.4%). These services have high customer demand and are traditional banking services. Therefore, the bank can improve the competitive quality of these services to gain new customers, thereby expanding its market share and cross-selling other products and services. In fact, some banks in Vietnam such as Techcombank, MBBank are using the method of free money transfer to attract new customers because money transfer service is the basic service that new customers can access. Some services that are rarely used by customers are remittance payment, financial consulting, securities investment consulting, insurance services, asset management and investment trust and discounting valuable papers. These are financial service with greater complexity than traditional service and therefore fewer customers to use.

4.2. Estimation results

The research is tested by a reliability scale with Cronbach’s Alpha coefficient. The factors have total correlation coefficient greater than 0.3 and Cronbach’s Alpha coefficient is greater than 0.7 which ensures reliability of the scale (Hair et al., Citation2010). By using exploratory factor analyses (EFA) with factor loading of observed variables higher than 0.5 and items of factor having high convergence, there are 7 factors performed in . The factors with factor loading less than 0.5 are removed from model such as Product, Distribution and Technology. Therefore, hypotheses H1, H3 and H5 are not examined in this study.

Table 4. Reliability and validity of constructs.

shows that Cronbach’s Alpha for service quality is 0.865; Risk management is 0.899; Organizational culture is 0.900; Financial capacity is 0.924; Promotion is 0.855; Social Responsibility is 0.871; Efficiency is 0.923. This showed that the scales used for factors are appropriate. Such observations make it eligible for the survey variables after testing scale. This data is suitable and reliability for researching. The result of the EFA scales with Promax rotation shows the total explained variance (66.789%) of the variation of the sample, and the Eigenvalues stop is 1.019. Barlett’s test has statistical significance with Sig = 0.000 and KMO = 0.953. Besides, factor loading is satisfactory and has very high convergence. Thus, the scales are satisfactory, then will be used to analyze Confirmatory Factor analysis (CFA) and run structural equation model (SEM)

CFA test in critical measurement model to evaluate the distinction between concepts in research model. The critical model has 339 degrees of freedom. CFA results show that the model has a Chi-square of 1012.8 (P-value = 0.000); CMIN/df = 2.988 < 5; CFI = 0.980, TLI = 0.976, GFI = 0.958, PCLOSE = 1.000. Indexes are all greater than 0.90 and RMSEA = 0.035 < 0.05. Therefore, it is confirmed that the model has a high degree of suitability with data on assessing the bank’s competitiveness. shows that the factors ensure composite reliability (CR) must be greater than 0.6; Average Variance Extracted (AVE) must be greater than 0.5, Maximum Shared Variance (MSV) is lower than Average Variance Extracted (AVE) (Hair et al., Citation2010).

Table 5. Discriminant validity.

indicates Discriminant validity is satisfield. These factors are not correlated with each other.

shows five hypotheses are supported, and one hypothesis is rejected. The estimation results show that there are 5 factors affecting the competitive capability of VietinBank at 5% significance level including service quality, financial capacity, risk management, organizational culture, and social responsibility. The finding indicates that financial capacity is the factor that strongly affects competitive capacity of retail banking service in VietinBank (standardized coefficient is 0.338), which is followed by organizational culture (standardized coefficient is 0.284). Meanwhile, the standardized coefficients for social responsibility and risk management are 0.225 and 0.155, respectively. Service quality has the smallest effect on competitive capacity (standardized coefficient is 0.082). The standardized coefficient of Provincial Competitiveness Index is positive, which reveals that branches of VietinBank in provinces with high competitiveness index representing a healthy business environment, will have higher competitive capacity in retail banking service.

Table 6. Coefficients from the structural equation modelling (SEM).

The service quality factor positively affects the competitiveness of retail banking services. This result is similar to the study of Hamzah et al. (Citation2017); Prentice et al. (Citation2019); Roy et al. (Citation2018) and Ngo and Nguyen (Citation2016). The financial capacity factor positively affects the competitiveness of retail banking services. This result is similar to the study of Givi et al. (Citation2010). The risk management factor positively affects the competitiveness of retail banking services. This result is similar to the study of Dellana et al. (Citation2021) and Thuy and Dai (Citation2014).

This research extends relevant literature by examining the effect of internal factors such as organizational culture and social responsibility and external factor such as provincial competitiveness index on the competitiveness of retail banking services. The result shows organizational culture factor has positive effect on the competitiveness of retail banking services. This result is similar to the study of Carmeli and Tishler (Citation2004) and Chen and Lin (Citation2020) about the relationship between intangible factors (organizational culture, communication, and knowledge) and competitiveness of the organization. The social responsibility factor has positive effect on the competitiveness of retail banking services. This result is similar to the study of Zhao et al. (Citation2019) and Ruiz and García (Citation2021) about the positive impact of corporate social responsibility on competitive advantage of reputation of the organization. The external factor represented by the Provincial Competitiveness Index promotes higher competitive capacity in retail banking service, This result is similar to the study of M. B. Uddin and Akhter (Citation2011) about the bank’s competitiveness depending on the business environment.

Another contribution in this study is standardized coefficient of income is positive at the significance level 10% and standardized coefficient of time using service is negative at the significance level 5%. It implies that customers having higher income and shorter time using service evaluate the competitiveness of retail banking banking service better. This is suitable because young customers who spend a short time using banking service are more easy-going than customers who have been using it for a long time.

To test the fit of model, we analyzed some indices such as goodness of fit index (GFI = 0.952), adjusted goodness of fit index (AGFI = 0.940), comparative fit index (CFI = 0.975), normal chi-square to degree-of- freedom (CMIN/DF = 3.170), root mean square error of approximation (RMSEA = 0.045), root mean squared residual (RMR = 0.048), and normal-fit index (NFI = 0.964). According to Hair et al. (Citation2010), these indices are within the recommended level.

5. Conclusion

The main purpose of this study is to analyze competitive capacity of retail banking service in VietinBank and identify determinants affecting competitive capacity. By applying SEM for a sample data of 1659 customers, the research finds five factors have a positive impact on competitiveness of retail banking service in VietinBank including service quality, financial capacity, risk management, organizational culture, and social responsibility. The finding reveals that financial capacity is the factor that strongly affects competitive capacity of retail banking service, which is followed by organizational culture, social responsibility, and risk management. Service quality has the smallest effect on competitive capacity. The external factor represented by the Provincial Competitiveness Index is positive, which reveals that a highly competitive business environment promotes higher competitive capacity in retail banking service. Higher income and shorter time using service of customers also contribute to determine competitiveness of retail banking banking service better.

VietinBank needs to focus on factors having a positive impact on competitiveness including service quality, financial capacity, risk management, organizational culture, and social responsibility. The bank should continue to improve service quality by diversifying retail services with competitive price along with professional employees to serve customers better. Service providers should focus on bringing convenient services to customers because the products usually do not have much difference among competitors. Bank staffs need to pay more attention to interpersonal skills for understanding and providing personalized services for customers. Better service quality helps the bank strengthen relationships with old customers, attract new customers, thereby maintaining long-term relationships with customers and increasing customer satisfaction as well as expanding market share. Financial capacity is to ensure the minimum capital adequacy ratio as regulated by the State Bank and to ensure the safety of the bank’s own operations during the credit operation process. Increasing capital will allow banks to invest in technology development, human resource training and expand distribution channels. These are also indispensable factors if the bank wants to improve its competitiveness. Retail banking has many potential risks. Risk management activities ensure safety in transaction. Having a risk control system through a technology platform helps the bank deal with risk incidents and improve its competitiveness compared to other banks. Good risk management also helps the bank increase its financial ratios and financial capacity. Organizational culture is improved by increasing the high involvement of bank staff in processes and decisions so that employees are committed and have a high sense of responsibility to the bank. VietinBank needs to have a common set of values, beliefs, and symbols, and have a high degree of coordination and consistency among employees and management levels in the bank. The strengthening of social responsibility does not stop at the implementation of the full tax obligations to the state and ensuring customer benefits. Social responsibility through the bank’s participation in community programs helps to improve its public image, thereby gaining more new customers.

In the context of international economic integration, Vietnam Government is implementing international commitments about opening banking services and aiming at building a competitive banking system on an international level according to the legal framework. To improve the competitiveness of the Vietnamese commercial banking system and promote sustainable development of the banking industry in the coming period, VietinBank needs to expand the most effective customer network based on the relationships with existing customers of the bank. When existing customers are satisfied with banking services, they will introduce potential customers to the bank. In addition, cross-sales are also very effective as the bank exploits the needs of existing customers and sells other products and services that customers have not used. Improving competitiveness will help the bank sustain in the short term and develop sustainably in the long term against negative shocks that the economy may cause.

The limitation of the new research is that it focuses on customer data, so the results may lack generalizability. Therefore, future studies can design more questionnaires to investigate more data from employees and managers about the competitiveness of retail banking services so that the research results can be compared to find similarities and differences about independent factors. In addition, the research only investigated VietinBank branches in some provinces/cities across the country. So, the scale of future studies can be extended to more branches of VietinBank in many provinces and cities across Vietnam to make the data more representative. In addition, the study points out several internal and external factors that affect the competitiveness of retail banking services in VietinBank. Future studies can add other internal and external factors to increase the rationality of the research model, thereby proposing more appropriate solutions for banks for retail banking services.

Disclosure statement

No potential conflict of interest was reported by the author(s).

Additional information

Notes on contributors

Phuong Thi Nguyen

Phuong Thi Nguyen’s research area focuses on Economics and Management. She has published many papers in reputable journals such as Journal of Small Business and Enterprise Development; International Journal of Productivity and Performance Management; Journal of Economics Studies; Transforming Government: People, Process and Policy, etc.

Loan Thi Phuong Nguyen

Loan Thi Phuong Nguyen’s research area focuses on Business Administration.

Trang Thi Huyen Vu

Trang Thi Huyen Vu’s research area focuses on Applied Mathematics and Economics.

Quyen Thi Tu Nguyen

Quyen Thi Tu Nguyen’s research area focuses on Human Resource Management.

References

- Aaker, D. A. (2001). Developing business strategy (6th ed.). John Wiley and Sons Inc.

- Akinci, S., Aksoy, Ş., & Atilgan, E. (2004). Adoption of Internet banking among sophisticated consumer segments in an advanced developing country. International Journal of Bank Marketing, 22(3), 1–14. https://doi.org/10.1108/02652320410530322

- Ashraf, Y., & Ali, F. (2022). How innovative organization culture affects firm performance in the wake of enterprise resource planning? Evidence from energy- and non-energy-sector firms in Pakistan. Frontiers in Environmental Science, 10, 991319. https://doi.org/10.3389/fenvs.2022.991319

- Bäckström, K., & Johansson, U. (2017). An exploration of consumers’ experiences in physical stores: Comparing consumers’ and retailers’ perspectives in past and present time. The International Review of Retail, Distribution and Consumer Research, 27(3), 241–259. https://doi.org/10.1080/09593969.2017.1314865

- Barney, J. (1991). Firm resources and sustained competitive advantage. Journal of Management, 17(1), 99–120. https://doi.org/10.1177/014920639101700108

- Barth, J., Dopico, L., Nolle, D., & Wilcox, J. (2002). An international comparison and assessment of the structure of bank supervision [Online].https://doi.org/10.2139/ssrn.306764

- British Business Group Vietnam. (2019). VIETNAM 2019 – FINTECH [Online]. https://bbgv.org/business-center/knowledge/sector-reports-knowledge/vietnam-2019-fintech/.

- Carmeli, A., & Tishler, A. (2004). The Relationships between intagible organizaitonal elements and organizational performance. Strategic Management Journal, 25(13), 1257–1278. https://doi.org/10.1002/smj.428

- Casu, B., & Molyneux, P. (2003). A comparative study of efficiency in European banking. Applied Economics, 35(17), 1865–1876. https://doi.org/10.1080/0003684032000158109

- Chen, S., & Lin, N. (2020). Culture, productivity and competitiveness: disentangling the concepts. Cross Cultural & Strategic Management, 28(1), 52–75. https://doi.org/10.1108/CCSM-02-2020-0030

- Clark, T., Dick, A., Hirtle, B., Stiroh, K., & Williams, R. (2007). The role of retail banking in the U.S. banking industry: Risk, return, and industry structure. Economic Policy Review, 13(3), 1–18.

- Das, G., & Kumar, R. V. (2009). Impact of sales promotion on buyers behaviour: An empirical study of Indian retail customers. Global Marketing Journal, 3(1), 11–24.

- Dellana, S., Rowe, W., & Liao, Y. (2021). A scale for measuring organizational risk management maturity in the supply chain. Benchmarking: An International Journal, 29(3), 905–930. https://doi.org/10.1108/BIJ-11-2020-0578

- Elif, A. (2016). Factors affecting firm competitiveness: Evidence from an emerging market. International Journal of Financial Studies, 4(9), 1–10.

- Givi, H. E., Ebrahimi, A., Nasrabadi, M. B., & Safari, H. (2010). Providing competitiveness assessment model for state and private banks of Iran. The International Journal of Applied Economics and Finance, 4(4), 202–219. https://doi.org/10.3923/ijaef.2010.202.219

- Grewal, D., Roggeveen, A. L., & Nordfält, J. (2016). The future of retailing. Journal of Retailing, 93Issue(1), 1–6. https://doi.org/10.1016/j.jretai.2016.12.008

- Hair, F., Black, C., Babin, J., & Anderson, E. (2010). Multivariate data analysis (7th ed.). Pearson.

- Hair, J. F., Matthews, L. M., Matthews, R. L., & Sarstedt, M. (2017). PLS-SEM or CB-SEM: Updated guidelines on which method to use. International Journal of Multivariate Data Analysis, 1(2), 107–123. https://doi.org/10.1504/IJMDA.2017.10008574

- Hamzah, Z., Lee, S., & Moghavvemi, S. (2017). Elucidating perceived overall service quality in retail banking. International Journal of Bank Marketing, 35(5), 781–804. https://doi.org/10.1108/IJBM-12-2015-0204

- Holdford, D. (2018). Resource-based theory of competitive advantage – A framework for pharmacy practice innovation research. Pharmacy Practice, 16(3), 1351. https://doi.org/10.18549/PharmPract.2018.03.1351

- Kemunto, E., & Kagiri, A. (2018). Effect of implementation of fintech strategies on competitiveness in the banking sector in Kenya: A case of KCB Bank Kenya. European Journal of Business and Strategic Management, 3(3), 29–40.

- Lammarque, E. (2005). Identifying key activities in banking firms: A competence-based analysis. Advances in Applied Business Strategy, 7, 29–47.

- Lin, B. (2007). Information technology capability and value creation: Evidence from the US banking industry. Technology in Society, 29(1), 93–106. https://doi.org/10.1016/j.techsoc.2006.10.003

- Matzler, K., Würtele, A., & Renzl, B. (2006). Dimensions of price satisfaction: A study in the retail banking industry. International Journal of Bank Marketing, 24(4), 216–231. https://doi.org/10.1108/02652320610671324

- Meesala, A., & Paul, J. (2018). Service quality, consumer satisfaction and loyalty in hospitals: Thinking for the future. Journal of Retailing and Consumer Services, 40, 261–269. https://doi.org/10.1016/j.jretconser.2016.10.011

- Mishkin, F. (2019). The economics of money, banking, and financial markets (12th ed.). Pearson.

- Ngo, M. V., & Nguyen, H. H. (2016). The relationship between service quality, customer satisfaction and customer loyalty: An investigation in Vietnamese retail banking sector. Journal of Competitiveness, 8(2), 103–116. https://doi.org/10.7441/joc.2016.02.08

- Piha, L. P., & Avlonitis, G. J. (2015). Customer defection in retail banking: Attitudinal and behavioural consequences of failed service quality. Journal of Service Theory and Practice, 25(3), 304–326. https://doi.org/10.1108/JSTP-04-2014-0080

- Prentice, C., Wang, X., & Loureiro, S. M. C. (2019). The influence of brand experience and service quality on customer engagement. Journal of Retailing and Consumer Services, 50, 50–59. https://doi.org/10.1016/j.jretconser.2019.04.020

- Roy, S. K., Shekhar, V., Lassar, W. M., & Chen, T. (2018). Customer engagement behaviors: The role of service convenience, fairness and quality. Journal of Retailing and Consumer Services, 44, 293–304. https://doi.org/10.1016/j.jretconser.2018.07.018

- Ruiz, B., & García, J. (2021). Analyzing the relationship between CSR and reputation in the banking sector. Journal of Retailing and Consumer Services, 61, 102552.https://doi.org/10.1016/j.jretconser.2021.102552

- Salome, M., Stephen, M., & Lucy, M. (2018). Financial inclusion, bank competitiveness and credit risk of commercial banks in Kenya. International Journal of Financial Research, 9(1), 203–218.

- Thuy, N. V., & Dai, D. N. (2014). Impact of competitiveness on business performance of Joint Stock Commercial Banks in Ho Chi Minh City. Journal of Economics and Development, 203, 99–110.

- Treacy, M., & Viersema, F. (1993). Customer intimacy and other value disciplines. Harvard Business Review. https://hbr.org/1993/01/customer-intimacy-and-other-value-disciplines

- Uddin, M. B., & Akhter, B. (2011). Strategic alliance and competitiveness: Theoretical framework. International Refereed Research Journal, 2(1), 43–54.

- Uddin, S., & Gupta, A. (2012). Concentration and competition in the non-banking sector: Evidence from Bangladesh. Global Journal of Management and Business Research, 12(8), 81–88.

- Zhao, H., Teng, H., & Wu, Q. (2019). The effect of organizational culture on firm performance: Evidence from China. China Journal of Accounting Research, 11(1), 1–19. https://doi.org/10.1016/j.cjar.2018.01.003