?Mathematical formulae have been encoded as MathML and are displayed in this HTML version using MathJax in order to improve their display. Uncheck the box to turn MathJax off. This feature requires Javascript. Click on a formula to zoom.

?Mathematical formulae have been encoded as MathML and are displayed in this HTML version using MathJax in order to improve their display. Uncheck the box to turn MathJax off. This feature requires Javascript. Click on a formula to zoom.Abstract

The study aims to investigate the relationship between board characteristics, earnings management, insolvency risk, and corporate social responsibility (CSR). The first objective examines the relationship between the board of directors’ characteristics (i.e. board financial expertise, ownership concentration, and board size) and earnings management during the ISIS (Islamic State of Iraq and Syria) crisis, and the second discusses earnings management and insolvency risk of local banks. Third, this research aims to consider earnings management as a mediator between board characteristics and insolvency risk, while the fourth purpose is to consider CSR involvement as a moderator in the relationship between earnings management and insolvency risk. To achieve these objectives, a quantitative method and secondary data were used on 35 banks from 2010 to 2020. Data from Iraqi-listed firms’ annual reports and Smart PLS were employed for analysis. The analysis results demonstrated that the relationship between board characteristics (board financial expertise, concentration of ownership, and board size) had negative impacts on earnings management and a significant negative impact on insolvency risk. Correspondingly, earnings management mediated between board characteristics (board financial expertise, the concentration of ownership, and board size) and insolvency risk. Furthermore, CSR was an impactful moderator in the relationship between earnings management and insolvency risk.

IMPACT STATEMENT

This research has investigated the relationship between board characteristics, earnings management, insolvency risk, and corporate social responsibility (CSR). The first objective examines the relationship between the board of directors’ characteristics (i.e. board financial expertise, ownership concentration, and board size) and earnings management during the ISIS (Islamic State of Iraq and Syria) crisis, and the second discusses earnings management and the insolvency risk of local banks. Third, this research aims to consider earnings management as a mediator between board characteristics and insolvency risk, while the fourth purpose is to consider CSR involvement as a moderator in the relationship between earnings management and insolvency risk. To achieve these objectives, a quantitative method and secondary data were used on 35 banks from 2010 to 2020. Data from Iraqi-listed firms’ annual reports and Smart PLS were employed for analysis. The analysis results demonstrated that the relationship between board characteristics (board financial expertise, concentration of ownership, and board size) had negative impacts on earnings management and a significant negative impact on insolvency risk. Correspondingly, earnings management mediated between board characteristics (board financial expertise, the concentration of ownership, and board size) and insolvency risk. Furthermore, CSR was an impactful moderator in the relationship between earnings management and insolvency risk.

1. Introduction

In brief, opportunistic behavior and financial statement manipulation have played a key role in many multinational accounting scandals. The same phenomenon exists in Iraqi firms with a high level of earnings management practice. In this regard, and according to previous research, most Iraqi enterprises engage in opportunistic practices of earnings management (Mohammed et al., Citation2017; Talab et al., Citation2017). Therefore, to achieve completeness, accuracy, and dependability in financial reporting, board characteristics help reduce earnings management practices (Aleqab & Ighnaim, Citation2021). The board’s primary goal is to resolve agency issues while harmonizing the interests of agents and principals (Moussa, Citation2019). Excessive surveillance may cause a loss of corporate value (Ali et al., Citation2021). Anecdotal data suggest that shareholder-oriented board structures may compel managers to take excessive risks, resulting in an increased chance of insolvency. Thus, the characteristics of governance are critical to the long-term survival of the corporation’s performance and the preservation of investor trust (Sailendra & Mayangsari, Citation2020; Zalata et al., Citation2021). Despite the implementation of new norms, regulations, and public monitoring organizations, it is still feasible to engage in earnings management behaviors and insolvency risk. However, there is a research shortage on these specific phenomena affecting financial institutions, particularly during times of crisis. As such, this current study addresses the first gap by studying the association between board characteristics and earnings management in Iraqi banks. Therefore, this study examines the first relationship between board characteristics and earnings management throughout the ISIS crisis.

In terms of insolvency risk, financial distress occurs when a company’s debt or cash flow reserves do not meet payment obligations (Gadzo et al., Citation2019). In such a case, a company must undergo financial or organizational reorganization, which will affect its operations. In the absence of adjustments in operating and financial practices, the situation could deteriorate into a structural default. As a result, financial management is critical to lowering the likelihood of insolvency and increasing a company’s attractiveness and growth potential. The term ‘insolvency’ refers to a condition where there is a lack of cash from current operations and outside sources (such as credit lines). Hence, the second objective of this study is to address local banks’ earnings management and insolvency risk.

Nevertheless, although a significant number of studies have examined the outcome of corporate governance on different company outcomes, corporate governance is deemed one of the new requirements for improving the country’s economy with the positive application of its disclosure principles and transparency in the Iraqi listed companies on the financial markets (Abdulsamad et al., Citation2018). Besides, there are multiple impacts of corporate governance principles and the regulating role of the relationship among all stakeholders and users of the financial statements. Hence, most developing countries take measures to ensure that companies do not fail by enacting corporate laws to comply with corporate governance principles (Amin et al., Citation2023; Sarpong-Danquah et al., Citation2018).

According to past research (Espahbodi et al., Citation2018; Tang & Chang, Citation2015), earnings management affects business performance and has explained how managers choose customized accounting procedures and how they affect firm performance. As a result, the link between earnings management and firm performance varies depending on the quality of a company’s management (Dakhlallh, Citation2020). According to Pernamasari et al. (Citation2020), if managers transfer useful and superior knowledge of a firm to shareholders, earnings management may not harm shareholders or the public. On the other hand, many managers are inclined to magnify the firm’s performance in the competitive environment for investors, which leads to creating inspiration for managers to create a perfect performance image by using earnings management to attract investors. In this case, earnings management may harm shareholders and the public.

Related to that, Lu et al. (Citation2016) observed that adopting the genuine meaning of corporate social responsibility (CSR) practices may overcome problems between agents and owners. Also, the detection of reliable and timely financial reports is considered an essential part of CSR since CSR improves financial reporting by reducing creative accounting (Abed et al., Citation2022). Thus, it bases stakeholder relationships on the firm’s claims, operations, and future safety. Huynh (Citation2020) found a significant correlation between CSR and earnings management. In their study, Ghaleb et al. (Citation2021) also uncovered that firms with CSR status tend not to manipulate earnings in the beginning, indicating excellent performance resulting from the long-term viewpoint of a business’s sustainable operations. CSR also means an organization’s focus on stakeholder responsibilities in various contexts (Hong & Kim, Citation2017). Therefore, concepts of CSR activities become essential to all businesses at both global and national levels. This is because investment in CSR activities could increase company credibility and help cultivate customer relationships (Swaen et al., Citation2021).

For those reasons, the third objective of this study is to consider earnings management as mediating between board characteristics and insolvency risk, while the fourth one is to consider CSR engagements as a moderator in the relationship between earnings management and insolvency risk. Although previous studies have claimed CSR’s moderating effect (Hong & Kim, Citation2017; Li et al., Citation2023; Lu et al., Citation2016), no studies have examined CSR’s moderating effect on the relationship between earnings management and insolvency risk. Therefore, the current paper seeks to make the following contributions to the existing literature examining the impact of CSR’s moderating factors, including social items, product responsibility, sustainability, stakeholders, and environmental items, on the relationship between earnings management and insolvency risk. Second, this study used empirical research and existing studies to develop a comprehensive and holistic theoretical model that identifies CSR’s antecedents, outcomes, and moderating role between board characteristics and earnings management.

In contrast, many empirical and theoretical investigations have studied different framework characteristics. In this case, applying the corporate governance concept to Iraqi-listed companies will help reduce opportunistic practices and address financial and accounting corruption, particularly in relation to financial reporting. Moreover, corporate governance concepts will lead Iraqi companies to understand better the definition of stakeholders’ and investors’ rights and the separation between the board of directors’ responsibility and executive responsibility. Thus, the research questions that this study is grappling with are: Do board characteristics (i.e. board financial expertise, concentration of ownership, and board size) have an impact on earnings management? Does local banks’ earnings management have an impact on insolvency risk? Third, does earnings management mediate between board characteristics and insolvency risk? Fourth, does CSR engagement function as a moderator in the relationship between earnings management and insolvency risk?

The structure of this paper is as follows: First, the introduction discusses the primary objectives and motivation. Second, the background explains the policy issues and the main developments within the research setting. Third is a theoretical literature review elucidating the basic theory. Fourth are the empirical literature review and hypotheses development. The fifth is research design. Sixth, empirical results and discussion are presented. Finally, the conclusion is drawn.

2. Background

Iraq struggled to maintain stability after the first and second Gulf wars and the 2003 political transition. After invading Kuwait in 1991, Iraq faced over a decade of harsh economic sanctions. Due to hostilities and economic sanctions, Iraq’s economy never recovered, and it has no stock market. ISIS also controlled one-third of Iraq in 2014. ISIS believes terrorism and terrorist organizations continue to plague companies worldwide. Only 37 of the 162 nations assessed by the Institute for Economics and Peace are terrorism-free (IEP, Citation2015). In 2017, ISIS expelled the Iraqi military from Mosul and other key cities, earning global terrorist renown. ISIS started in 1999 as Jama’at al-Tawhid wal-Jihad. After the 2003 US-led invasion of Iraq, it pledged allegiance to eliminate Al-Qaeda and collaborated with Iraq (Zelin, Citation2014). ISIS wanted to overthrow the Iraqi and Syrian governments. After taking large amounts of land in Iraq and Syria, ISIS wanted to expand the caliphate and create a global radicalization operation that could last decades. The group planned a long-term caliphate for regional power centers.

In Iraq’s economy and politics, a new era began following freedom. Despite problems in state administration, combating terrorism, reducing corruption, and public sector mismanagement, the nation has some positive traits that may help strengthen its essential institutions. With those, the Iraq Stock Exchange Market slowly reopened by encouraging firms to relist and begin trading. These initiatives increased the number of Iraq Stock Exchange-listed businesses, share volume, and market value.

Despite growth in the stock exchange market, many obstacles remain to be overcome to reach a true and progressive working level. However, it is insufficient to continue market activities, win shareholder and investor confidence, and attract local and foreign investors under rapid environmental changes. In addition, the supervisory authority and general commission of the Iraq Stock Exchange (ISEX) ought to enhance their understanding of the directives and protocols of international financial markets and the regulations governing capital markets. These instructions must be disseminated to shareholders, potential investors, and other market participants. They facilitate informed economic decision-making by divulging pertinent information regarding the operations of corporations or the trading of their shares.

Thus, this study concentrates on earnings management practices in Iraqi companies, as they widely use and practice earnings management. According to prior evaluations of Iraqi-listed companies, they suffer from opportunistic practices and poor management (Mohammed et al., Citation2017; Rahman et al., Citation2021; Talab et al., Citation2017). As a result, the firm performance was negatively impacted, as was the confidence of investors and stakeholders in the financial statements provided by the managers. It is thus imperative to establish and maintain a successful method that reassures stakeholders and investors, as inaccurate financial information hinders the ability of users of financial statements to make informed decisions.

Additionally, corporate governance mechanisms are considered beneficial characteristics to limit earnings management (El Diri et al., Citation2020). In the US, Europe, and most Asian countries, legislation was passed to ensure financial report quality, transparency, and reliability and protect shareholders by monitoring management (Al-Rahahleh, Citation2017). Alaraji (Citation2017) stated that compliance with corporate governance standards leads to the issuance of reports and lists with credibility and transparency (Al-Shaer & Zaman, Citation2018) due to the influence of corporate governance on preparing reports (which reflects on the credibility of the financial statements). Accordingly, company governance systems should be developed and executed to limit opportunistic managerial behavior and improve financial statement credibility (Huynh, Citation2020). Moreover, corporate governance is central to firm operations, sustainability, and investor trust, and expanding the analysis framework beyond traditional standards to include norms and values will strengthen it (Omware et al., Citation2020; PeiZhi & Ramzan, Citation2020; Sailendra & Mayangsari, Citation2020).

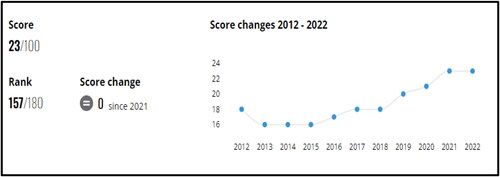

Earnings management practices remain, especially in Iraq, despite laws, regulations, and public monitoring bodies, which ranked 157 out of 180 in the transparency international index (); it is because current laws, regulations, and monitoring bodies do not meet changing market expectations (L. B. Abdullahi & Ibrahim, Citation2017). In Iraq, corporate governance issues still generate intense interest, especially after the last Iraqi war with ISIS. Also, Iraqi companies are suffering from a lack of a framework for corporate governance (OECD, Citation2019), which is based on a set of principles and standards to define the relationship between listed company boards and shareholders in a way that improves company performance and efficiency, as well as the Iraqi economy (Hussein, Citation2018). Although many features of nations are shared in other areas, there are considerable disparities in corporate governance laws and listing requirements. Because of these differences, the results of empirical studies undertaken in these nations will likely be inapplicable to the realities of Iraqi society.

3. Theoretical literature review

The prior studies depended on various theories to explain the relationships between corporate governance mechanisms, earnings management practices, insolvency risk, and CSR as agency and stakeholder (Boshnak, Citation2022; Lu et al., Citation2016; Omware et al., Citation2020; Sameer, Citation2021). Although corporate and academic interest in corporate governance, earnings management, and CSR has increased in the recent century, no comprehensive theoretical framework can explain this relationship among them. Therefore, this study will get insights from agency theory and stakeholder theory to explain the relationships. This study extends the line of research by using agency theory as a basis for earnings management practice, investigating the relationship between corporate governance mechanisms and earnings management, using stakeholder theory as a basis for CSR, and examining the relationship between earnings management and insolvency risk through the moderating role of CSR in Iraq. In this section, each of the two theories is described.

3.1. Agency theory

According to the agency theory, management and shareholders are linked by a conflict of interests. Therefore, management strives to maximize its interests at the expense of the company’s stockholders. The agency hypothesis suggests that managers are motivated to act opportunistically by self-interest and external rewards. Agency difficulties may arise because of the separation of ownership and control (Fama & Jensen, Citation1983). Arnold and de Lange (Citation2004) mention that information asymmetry gives a big opportunity to practice opportunities. Thus, the owners may not accurately monitor and evaluate managers’ behavior due to information asymmetry (Jiraporn et al., Citation2008). According to agency theory, the mechanisms of governance can lower the opportunistic behavior of managers. The agency theory shows that governance mechanisms are considered one of the classic treatments for fixed agent-principal conflicts (Brennan & Solomon, Citation2008). Strong internal governance includes a board that can help lower the costs of the agency (Ronen & Yaari, Citation2008).

Researchers have used various theoretical frameworks to study CSR in business, but a general paradigm is yet to be established. For that reason, this current review identified four major theoretical frameworks for describing and evaluating board characteristics: corporate governance mechanisms, earnings management, insolvency risk, and CSR as a moderator. Aspects of agency and stakeholder engagement are also explored. The selected hypotheses from this study will also be provided.

Consequently, the management (agent) is charged with carrying out certain activities in favor of the first party (shareholders) and delegating the powers of decision-making on his behalf (Al-Fadhel, Citation2014). On the other hand, agency theory assumes that some of the board characteristics can impact the onboard ability to monitor and provide advice (Azeez, Citation2015). Besides, Elston (Citation2019) indicated that agency theory focuses on the difference between shareholders’ behaviors and managers’ behavior.

Agency theory emphasizes the separation between ownership and management, which results in heightened agency conflicts and expenses, such as information asymmetry, which in turn encourages managers to act in their self-interest. As a result, monitoring mechanisms are implemented to restrict such conflicts. According to numerous studies, effective governance mechanisms (Shiri et al., Citation2012) reduce agency costs and conflicts in the firms, thus enhancing the firm’s performance. Accordingly, agency theory posits that members have different human expertises and experiences that improve the quality of board decisions and ultimately enhance firm value. It has a better capacity for monitoring, which is deemed an effective governance tool in monitoring management, thereby obtaining an independent monitoring mechanism for the boarding process, which leads to a decrease in agency conflicts and improves performance (Kutum, Citation2015).

Additionally, insider ownership can affect the discretionary financial reporting practices of managers. According to agency theory, insider ownership facilitates a stronger correlation between the interests of shareholders and managers. Correspondingly, the managers who own insider ownership are less likely to be involved in aggressive accounting, which will damage their inherent ownership benefits. Furthermore, the board size of the agency theory suggests that large financial institutions may need a large number of directors to increase expertise, resources, and customer and depositor contacts. According to Abed et al. (Citation2022), Alaraji (Citation2017), Bajra and Cadez (Citation2018), Daghsn et al. (Citation2016), Ghaleb et al. (Citation2021), Sarpong-Danquah et al. (Citation2018), and Temile et al. (Citation2018), many directors strengthened the board. They provided essential resources like professional networks, domain knowledge, skills, and experience.

3.2. Stakeholder theory

Under stakeholder theory, CSR improves the transparency of revealed accounting information and decreases earnings management possibilities (Dhaliwal et al., Citation2014). In a study conducted by Buertey et al. (Citation2020), stakeholder theory takes into consideration the effect on corporate disclosure practices of various stakeholder groups. It follows from this idea that company information policy is a tool for managing information for different stakeholders. Therefore, it can be discussed that there is an implied social contract between the company and the people affected by its operations. In addition, a company may not react equally to all parties concerned but only to the most influential stakeholders. The power of a stakeholder to influence management may be interpreted as the level of control by a stakeholder over the resources needed by the company (Olanrewaju & Johnson-Rokosu, Citation2016). The more important the resources of the stakeholders are for a company’s long-lasting survival and development, the higher the expected response to the demands of these stakeholders. A successful company is thought to meet the expectations of the different influential groups of stakeholders (sometimes competing). To get support from the most influential stakeholders, managers utilize information and, in particular, information connected to company activities (Coffie et al., Citation2018).

In general, the above theory considers companies as part of a wider social system. In addition, a company is impacted and impacts society with diverse actors in which it operates. CSR disclosures might, therefore, be seen as a method for guaranteeing social contract engagement, according to the stakeholder perspective. The stakeholder theory supporter believed that the different stakeholder groups, whether inside or outside organizations dominate the pressures that push them to corporate responsibility. Thus, this study utilizes CSR as a moderator in the relationship between earnings management and insolvency risk. Additionally, it employs stakeholder theory as the underlying framework to explain this relationship. Previous research has extensively used and implemented stakeholder theory to empirically validate the relationship between CSR and earnings management (Akben Selcuk & Kiymaz, Citation2017; Franco et al., Citation2020; Sial et al., Citation2018).

4. Literature review and hypotheses development

4.1. Characteristics of the board and earnings management

4.1.1. Board finance experience and earnings management

As a controversial topic in the corporate governance literature, the board answers important questions about the board of directors’ works for shareholders. After the 1990s and 2007s financial crises, accounting scandals at Enron, HealthSouth, Tyco, and WorldCom shook investors’ confidence and led policymakers to require every company to have at least one financial expert on the board. The laws and guidelines mentioned in Minton et al. (Citation2014) have made it easier to obtain information and monitor management with more financial experts on the board. Booth and Deli (Citation1999) and Naheed et al. (Citation2022) cite market-savvy financial experts who help firms borrow and acquire financing, monitor TMTs, and provide timely operational guidance to managers to solve agency problems. The board of directors has three main roles: control, service, and resource-based roles (Bolton & Park, Citation2022). The board of directors controls managers by providing benefits and firing them if necessary to align their interests with shareholders. In addition, financial experts on the board are more important in financial reporting, financial announcement statements, and reassuring potential creditors and investors to invest more in the firms.

However, financial expertise is another board feature that may affect earnings management. Accounting expertise is essential to monitor the financial reporting process and control manipulation. Financial expertise, according to studies, affects the quality of financial statements. Companies with a corporate and financial background are less likely to participate in earnings management (Munro & Buckby, Citation2008). Directors with more board experience are also less likely to relate to earnings management (Triki Damak, Citation2018). Researchers have found that board expertise increases monitoring incentives. Similar to Jeanjean and Stolowy (Citation2009), they revealed a negative association between board financial expertise and earnings management based on data from roughly 48 empirical investigations.

In summary, all the studies noted the value of boards of directors with specific knowledge and experience. Accounting and financial expertise help boards grasp financial statements and reporting challenges. There may be a relationship between the board’s financial expertise and earnings management. Thus, here is the first hypothesis:

H1: Financial expertise has a negative impact on earnings management.

4.1.2. Ownership concentration and earnings management

Drawing from the literature, this study assumes that governance mechanisms can effectively constrain earnings management by appropriately monitoring executives’ activities (e.g. Abdullahi and Ibrahim (Citation2017) and Eisenhardt (Citation1989). Agency theory suggests aligning managers’ interests with those of shareholders by including managers in the firm’s ownership structure (Eisenhardt, Citation1989). If offered an ownership stake in the company, managers are more likely to work in the firm’s interest rather than engage in earnings management practice. Also, institutional investors are considered to be more capable of preventing earnings management activities because of their more professional ability to control company accounts. According to agency theory, managers’ stockholdings help align their interests with shareholders’. Thus, agency theory encourages delegation and board control concentration (Eisenhardt, Citation1989). The convergence-of-interest concept predicts that insider ownership is inversely associated with earnings management since it constrains managers’ opportunistic conduct (L. B. Abdullahi & Ibrahim, Citation2017; Nedal & Abuzayed Bana, Citation2010). Previous researchers have shown the negative links between earnings management and insider ownership (Esa & Zahari, Citation2016; Suyono & Farooque, Citation2018). Therefore, the second hypothesis is:

H2: Insider ownership has a negative impact on earnings management.

4.1.3. Board size and earnings management

Fama and Jensen (Citation1983) point out that the board of directors is the most important governance mechanism. Directors with less expertise can monitor and evaluate management activities, which implies that bigger boards are more likely to be on the lookout for agency problems (Aleqab & Ighnaim, Citation2021). According to agency theory, bigger boards facilitate effective oversight by limiting the CEO’s influence and advocating for shareholders’ interests (Coles et al., Citation2008). Gerged et al. (Citation2023) showed that only the size of the board had a significant effect on earnings management. In addition, Chekili (Citation2012) revealed significant links between earnings management and the size of the board. Elnahass et al. (Citation2022) found a negative effect between board size and earnings management. Also, Al-Absy et al. (Citation2019) discovered a negative effect of board size on earnings management. As such, the third hypothesis is formulated as follows:

H3: Board size has a negative impact on earnings management.

4.1.4. Board characteristics and insolvency risk

Companies’ directors can pursue their interests rather than those of shareholders, and managers of organizations may be more risk-averse than shareholders to protect their investment in the organization. Governance can change managers’ behavior and readiness to take more risks (Ramírez-Orellana et al., Citation2017). According to Al Haddad and Juhmani (Citation2020), shareholder corporate governance structures boost risk-taking and financial firm growth. After the financial crisis, many studies examined how corporate governance affects risk-taking and financial performance. The current global financial crisis has prompted various studies on financial institutions’ risk-taking (Al Haddad & Juhmani, Citation2020; Ali et al., Citation2021; Enguix, Citation2021). According to these analyses, financial institutions took excessive and unsuitable risks during the crisis. This increased risk-taking in the financial sector may lead to financial institution defaults, especially during times of financial turmoil in the industry (Aleqab & Ighnaim, Citation2021).

In line with Widhiadnyana and Ratnadi (Citation2019), institutional ownership reduces agency conflicts. Most institutional shareholders own a large proportion of a company’s shares, allowing them to control and supervise its performance to fight for its rights. Institutional shareholders also have a focus on the company’s performance in the long term (Donker et al., Citation2009). Ibrahim (Citation2019) uncovered that institutional ownership significantly impacts financial distress. The greater the value of ownership, the greater the possibility of the company experiencing financial distress. Large ownership allows control over company management, performance, and agency issues and conflicts of interest (Mariano et al., Citation2021). Institutional ownership improves company performance, as they can withdraw their funds if the management team is not fighting for performance, especially during financial crises, which will hurt the company’s sustainability (Van Essen et al., Citation2013). Furthermore, Jebran and Chen (Citation2021) stated that institutional ownership during the COVID-19 crisis can monitor and improve disciplinary mechanisms. Correspondingly, institutional ownership reduces financial distress risk.

Moreover, the board size can reduce agency conflicts and information asymmetry. The board of directors’ responsibilities include drawing the company’s goals and implementing the necessary actions (Block & Gerstner, Citation2016). The large board plays a direct role in the company’s performance and can make better financial decisions, provide multiple opinions and perspectives on financial issues, and help prevent financial distress. According to Prasetyo et al. (Citation2023), a small board of directors is more likely to experience financial distress. Meanwhile, Khatib and Nour (Citation2021) asserted that financial expertise is a monitoring mechanism that improves or maintains company performance in times of crisis because a larger board can accommodate more expertise. Insider ownership plays a crucial role in reducing the risk of uncertainty crisis (Foss, Citation2021; Shen et al., Citation2020). Furthermore, given COVID-19’s widespread impact on firm operations, the board of directors must take several steps to address it, including restructuring capital, policies, and organizational design and preparing for short- and long-term conditions, especially emergencies. Insider ownership increases these vital duties because they monitor, provide policy input, and oversee independently (Croci et al., Citation2020). Based on that, the next hypotheses, 4, 5, and 6, are proposed:

H4: Board finance experience has a negative impact on insolvency risk.

H5: Ownership concentration has a negative impact on insolvency risk.

H6: Board size has a negative impact on insolvency risk.

4.1.5. Characteristics of the board, Insolvency risk and earnings management

According to earlier researchers (Mostafa & Ibrahim, Citation2019; Sarkar et al., Citation2008), the idea of earnings management relates to the actions of opportunists. Handayani and Ibrani (Citation2020) stated that several definitions of earnings management define it as income smoothing. In other words, managers can use earnings management in line with Generally Accepted Accounting Principles (GAAP) without breaking the law since it is a legal practice (Obigbemi et al., Citation2016). Consequently, earnings management falls under the accounting creative classification. According to Wu et al. (Citation2012), creative accounting and earnings management practices hurt the integrity of the market. Obigbemi et al. (Citation2016) also demonstrated that presenting predicted revenues as current-year turnover allows skilled accountants to employ earnings management to decrease R&D expenses while simultaneously generating favorable cash flow. Several studies have found insolvent firms managing upward earnings.

According to research, insolvent firms’ profitability declined for three years before improving significantly in the final two years. The most likely explanation was that the insolvent firms changed their accounting practices to maximize profits. The study revealed that delisted firms used discretionary accruals to manage earnings upward in the years before delisting. The amounts owed in the year before the write-off increased compared to the previous two years. However, financial expertise, insider ownership, and board size usually improve business governance. Insolvency risk and earnings management may be affected. Insolvency risk is the probability of a firm going insolvent, while earnings management manipulates financial records to meet goals. In this case, the researchers look at whether board qualities such as financial knowledge, insider ownership, and board size affect insolvency risk and earnings management. For instance, a board with more financial competence, insider ownership, and board size may supervise management better and reduce insolvency risk.

However, Al Haddad and Juhmani (Citation2020) studied the use of positive earnings management by bankrupt companies in danger of being forced to engage auditors to avert this result. Their study uncovered that insolvent firms had better positive earnings management practices than non-insolvent companies. The authors also discovered that companies that met all three insolvency criteria outperformed those that met only one or two. Between 1995 and 2013, Lee and Kim (Citation2017) investigated the earnings management practices of companies under administration or delisted, and they found flaws in prior research methodologies and the possibility of prior analysis errors. They confirmed the need for further research to draw more consistent conclusions. Hence, the hypotheses 7, 8, 9, and 10 are formulated as follows:

H7: Earnings management has a positive impact on insolvency risk.

H8: Financial expertise has a negative impact on insolvency risk mediated by earnings management.

H9: Insider ownership has a negative impact on insolvency risk mediated by earnings management.

H10: Board size has a negative impact on insolvency risk mediated by earnings management.

4.1.6. Moderator role of CSR

Throughout the last century and into this one, there have been many intriguing studies examining the effect of CSR on company performance (Duman et al., Citation2016; Xia et al., Citation2018). There is also an increasing demand for businesses to enhance or adapt their CSR practices (Boulouta & Pitelis, Citation2014). Rather than maximizing short-term profits, its socially responsible executive focuses on long-term relationships with the stakeholders. Shareholders want to know both financial, social, and environmental parameters when deciding whether to invest in a company, both of which are components of CSR (Dyck et al., Citation2019; Gras-Gil et al., Citation2016). For many firms, attracting as many stakeholders’ attention as possible is an important aspect of their commitment to corporate social responsibility (Cooper & Uzun, Citation2019). To better understand CSR investments, most scholars have looked at the behaviors of the company’s executives (Cronqvist & Yu, Citation2017).

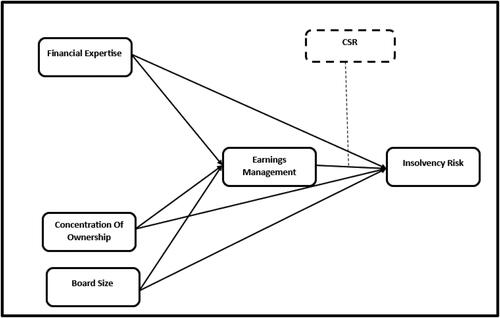

Furthermore, stakeholder theory, as mentioned, is generally acknowledged to explain socially responsible long-term investment maximization by understanding the relevance of stakeholder groups and applying that information to the firm’s strategy; the stakeholder theory believes that CSR is a successful strategy for managing stakeholder interactions (Cho & Chun, Citation2016). Therefore, this research employed CSR as a moderator in the relationship between earnings management and insolvency risk as showed in . This is because executives utilize CSR to hide poor financial outcomes. The attention of investors has diverted away from the company’s poor profitability, which helps management legitimize it (Moratis & van Egmond, Citation2018). Thus, hypothesis 11 is derived as follows:

H11: Corporate social responsibility moderates the relationship between earnings management and insolvency risk.

5. Research design

The primary objective of this study is to examine the proposed hypotheses, and for this purpose, a quantitative research method was adopted. The paper sample consisted of Iraqi banks based on data from 35 Iraqi listed banks. A sample period was from 2010 to 2020. The researchers collected data from the Iraqi stock market website and the annual reports of banks to empirically study the relationship between board characteristics, insolvency risk, earnings management, and the moderating influence of CSR. The research data obtained for ten years, from 2010 up to 2020, in the Data Stream database has current data for Iraqi banks. One more reason for selecting Iraqi banks for ten years is the small number of banks listed on the Iraqi stock exchange, which ensures that the sample is enough to conduct statistical analysis. The sampled banks were drawn from the total number of banks listed on the Iraqi stock exchange. Thirty-five (35) banks were selected for this study from a total of one hundred and twenty-nine (129) financial and non-financial companies listed on the Iraqi stock exchange between 2010 and 2020.

Several reasons underlie bank selection. First, the market values of some banks differ from those of other companies in that they include other factors, such as the value of any real operational options. Second, money transfer services and banks have accounting policies that differ from those of other companies. Third, the study was limited to ten years of data because bank performance and earnings management practices often change over time. Additionally, banks have a significant portion of the economic output, which in turn ensures that the reflect the study objectives.

5.1. Measurement of variables

5.1.1. Earnings management (EM)

Earnings management was calculated using five variables as part of the Beneish approach (Beneish, Citation1999); Beneish’s model was used to identify earnings management practices in businesses and research earnings management’s actual presence. This model differs significantly from the earlier model by Dechow et al. (Citation2010), which focused only on average accrual procedures. It also helps identify the motivations involved in GAAP violations. The researchers also incorporated several variables to account for the financial data distortions produced by GAAP violations. As a result, it aids companies in detecting abnormal accruals. The following is a description of Beneish’s model in :

Table 1. M-score method measurement.

5.1.2. Insolvency risk

This study employed the Z-score to measure insolvency risk. In this case, Iraq is a country that is still developing. Therefore, using an appropriate model for such a market is appropriate. Altman (Citation2005) suggested a model for predicting emerging-market turmoil using the Z-score for developing countries, revising the original model. It is a frequently used model in emerging countries and has high stated accuracy. Because emerging countries have a scarcity of relative trade liquidity, in this strategy, the asset book value is used instead of the market value (Alfaro et al., Citation2019). This paradigm utilizes ratios 1, 2, 3, and 4. The amount of working capital is divided by total assets, amount of retained earnings (RE)/total assets, and amount of operating income (OI)/total liabilities. A Z-score lower than 1.8 means that the company is in financial distress and has a high probability of going bankrupt. On the other hand, a score of 3 or above indicates that the company is in a safe zone and is unlikely to file for bankruptcy. A score of between 1.8 and 3 denotes that the company is in a gray area and has a moderate chance of filing for bankruptcy (Hussain et al., Citation2022).

5.1.3. Characteristics of board

shows the studied factors, showing how well the board characteristics worked.

Table 2. Board characteristics measurement.

5.1.4. CSR measurement

Past research mentions that analysis of content is an excellent way to determine how companies report social responsibility. As a result, the researchers can figure out how many things have been revealed (Fodio et al., Citation2013). The initial step involved the selection of CSR dimensions. To construct the CSR dimensions, a complete list of elements related to social responsibility that firms may include in their annual reports has been established. The CSR index list covers the important events in the reporting year, including financial and non-financial elements, which recommend disclosing social and environmental information. The disclosure dimensions’ score components of social responsibility information were chosen from the research of Boshnak (Citation2022), Jackson et al. (Citation2020), and Shahab et al. (Citation2019).

In the second step, based on previous research, CSR dimensions were adapted to sort information into five groups: social items, product responsibility, stakeholders, sustainability, and environmental items. Each dimension included several items of CSR disclosures, as shown in . In the third step, the list of the CSR dimensions used in this study was achieved after reviewing all the published CSR disclosure literature. This study selected several dimensions and then found which dimensions were more commonly used by the literature to determine the quality of the information to use. The CSR measurement aims to provide a list of CSR dimensions that include a wide range of items, as shown in CSR Index Classification.

Table 3. CSR measurement.

The last step was calculating the CSR index. However, the study used sentences as an analytical technique because the coder does not need to make subjective judgments, and the dimensions of analysis considered are crucial to content analysis (Riyadh et al., Citation2019). Correspondingly, searching for specific dimensions in sentences is deemed a reliable method. Therefore, this study utilized the CSR index by dividing the number of CSR-related sentences by the total number of annual report sentences (Akben Selcuk & Kiymaz, Citation2017). The following is the sum of the CSR measurements,

In addition, the Inter-Rater Reliability Test Using Krippendorff’s Alpha presented in 3.5 from the test reported an acceptable agreement and confirmed the reliability of the instrument for the CSR index reporting. Inter-Rater Reliability Test Using Krippendorff’s Alpha (α) is a reliability coefficient that has been improved and developed to measure agreement between measurement tools. Krippendorff α is used for content analysis tools; however, it is widely used to determine the reliability of the resulting data to represent something real. The numbers range from 0 to 1, where 0 indicates total disagreement, and 1 represents perfect agreement. Krippendorff’s alpha suggests: ‘It is customary to need α ≥.800. It is where preliminary findings are still acceptable, and α >.40 is the lowest possible limit. In this study, the value of Krippendorff’s alpha ranged between 0.577 and 0.777, indicating that the reliability values for the content analysis for CSR measurement were acceptable.

6. Empirical results and discussion

The following sections elucidate the empirical findings, including hypotheses testing statistically, mediation analysis, moderating analysis, and a relevant discussion of the data.

6.1. The goodness of fit model

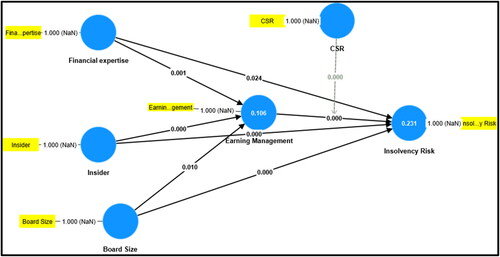

In , the R2 value for earning management was 0.106. It signifies that the variability of data research could be explained by the model structure of 10.6%, whereas another 89.4% would be influenced by another variable undescribed in this study. Meanwhile, the R2 for insolvency risk was 0.231, meaning that 23.1% of the results variable would be influenced by another independent variable as showed in .

Table 4. The goodness of fit model.

6.2. Hypotheses testing

Based on the data processing, the form of direct impact is shown in . In the T-test, direct impacts in hypothesis testing, if the coefficient path shown by the t-statistic is more than 1.96 or p-value < 5% (0.05), the alternative hypothesis can be stated as supported. Nevertheless, if the statistical value of the T-statistic is less than 1.96 or the p-value is >5% (0.05), the alternative hypothesis is not supported.

Table 5. Direct impact.

The study results provide evidence supporting the hypothesis that earnings management acts as a mediator in the relationships between financial expertise, insider ownership, board size, and insolvency risk. This implies that a portion of the effect of board size, financial expertise, or insider ownership on insolvency risk is transmitted through their influence on earnings management. Therefore, understanding earning management as a medium highlights its role in the causal pathway between certain antecedent variables (board size, financial expertise, insider ownership) and the outcome of insolvency risk. As such, organizations should be aware that interventions targeting financial expertise, insiders, or board size influence insolvency risk through their impact on earnings management ().

Table 6. Specific indirect effects.

Based on the moderating effect in , the findings support the hypothesis that the relationship between earnings management and insolvency risk is contingent on the level of CSR. In other words, the effect of earning management on insolvency risk is not constant but varies depending on the level of CSR. A significant interaction term suggests that the presence of CSR activities can mitigate the impact of earnings management on the likelihood of financial distress.

Table 7. Moderating effect.

7. Discussion

This study examines the relationship between board characteristics, earnings management, insolvency risk, and corporate social responsibility (CSR). The characteristics of the board of directors are board financial expertise, ownership concentration, and board size. It is breakdown into four objectives: the first is the relationship between board characteristics and earnings management throughout the ISIS crisis; the second addresses local banks’ earnings management and insolvency risk; the third is to consider earnings management as a mediator between board characteristics and insolvency risk; the fourth is to consider CSR engagements as a moderator in the relationship between earnings management and insolvency risk.

These relationships were examined and tested under two theoretical premises: agency and stakeholder theories. The agency theory was adopted to explain the relationship between board characteristics and earnings management and the relationship between earnings management and insolvency risk. According to Fama and Jensen (Citation1983), agency relationships are defined as one or more people’s shareholders (principals) engaging another person (agents) to deliver a service and having the decision-making authority. In addition, the agency theory explains the relationship between stakeholders and board directors. Agency theory is based on the separation of the functions between the ownership of investors and management (Mamun et al., Citation2013). However, the separation of authority between the owner of the company (principal) and the manager by the management (agent) tends to lead to agency conflicts between principals and agents (Paradisea, Citation2017). Such conflicts occur because the principal, which is the administration, works for personal interests and neglects organizational interests.

Meanwhile, stakeholder theory was used to examine corporate social responsibility as a moderating variable. In this regard, stakeholder theory shows that stakeholder has various interests; therefore, they have various effects on a firm, either negative or positive, and the firm is seen to be responsible for achieving their interests despite being outside of the firm (de Graaf, Citation2019). Furthermore, there is a social contract between a firm and a society formed by stakeholders. In accordance with the social contract, the firms agree to carry out different socially desired actions in return for societal approval of their targets and other rewards, which ultimately guarantees the firm’s continued existence.

In this study, the direct relationship between board characteristics (board financial expertise, the concentration of ownership, and board size) and earnings management represented in H1, H2, and H3 had a significant negative impact. In other words, in these roles, financial experts on the board play a more critical role in financial reporting, financial announcement statements, and reassurance of potential creditors and investors to engage more financial resources for the firms. Expertise is essential to monitoring the financial reporting process and controlling manipulation. In addition, insider ownership managers with a stake in the company are more likely to work in the firm’s interest rather than engage in earnings management practice. Furthermore, larger boards facilitate effective oversight by limiting the CEO’s influence and advocating for shareholders’ interests. These findings are in accordance with previous research (M. S. Abdullahi et al., Citation2018; Esa & Zahari, Citation2016; Minton et al., Citation2014; Munro & Buckby, Citation2008; Nedal & Abuzayed Bana, Citation2010; Suyono & Farooque, Citation2018; Triki Damak, Citation2018).

Moreover, the direct relationship between board characteristics (board financial expertise, the concentration of ownership, and board size) and insolvency risk represented H4, H5, and H6 had a significant negative impact. It denotes that the insolvency risk can be reduced if the financial expertise member exists on the board due to the expertise of a monitoring mechanism with a significant role in improving or maintaining the company’s performance during the crisis. The larger the content expertise of the members, the more they will accommodate different knowledge. Further, insider ownership of directors and the board has a very significant role in mitigation the risk of uncertainty. Besides that, the board contributes significantly to the prevention of financial distress. The larger the board, the lower the probability of company failure because the board’s accountability is more secure. These findings are consistent with previous studies (Block & Gerstner, Citation2016; Foss, Citation2021; Khatib & Nour, Citation2021; Shen et al., Citation2020).

Another direct relationship in H7 is that earnings management had a positive impact on insolvency risk, which means the managers, once they practice earnings management, will increase the possibility of insolvency. The effect of earnings management on insolvency risk is essential for external stakeholders, such as creditors and investors, to assess the insolvency risk, financial capability, and creditworthiness of a company. When managers use earnings management, it indicates that they care more about short-term goals (such as getting investors’ trust getting good reviews from employees, and others) than long-term goals (like accountability and openness). This can lead to a steady flow of liability or equity investment, which hurts the company’s ability to stay in business.

Additionally, earnings management conceals poor operational or financial performance, preventing early diagnosis and treatment, leaving the problems lurking within daily operations, thus making the firm unable to withstand a competitive environment and leading the entity to insolvency. The outcome is similar to agency cost in agency theory. This lowers the chance of management not looking out for the interests of principals (the agency problem) since too much earnings management can be used to hide a bad financial situation. Empirical proof that the businesses that suffered losses do exhibit a high level of earnings management supports this. Furthermore, this result corresponds to previous studies (Lee & Kim, Citation2017; Mostafa & Ibrahim, Citation2019; Obigbemi et al., Citation2016; Sarkar et al., Citation2008).

Furthermore, the indirect relationship between board characteristics, earnings management, and insolvency risk was investigated. The hypotheses of earnings management mediating between board characteristics and insolvency risk were represented in H8, H9, and H10. However, financial expertise, insider ownership, and board size usually improve business governance. Insolvency risk and earnings management may be affected. Insolvency risk is the probability of a firm going insolvent, while earnings management manipulates financial records to meet goals. Board characteristics like financial knowledge, insider ownership, and board size were seen to affect insolvency risk and earnings management. Therefore, based on these findings, a board with more financial expertise, insider ownership, and board size may supervise management better and reduce insolvency risk, which is confirmed by Al Haddad and Juhmani (Citation2020) and Lee and Kim (Citation2017).

Also, CSR was examined to moderate the relationship between earnings management and insolvency risk as formulated in hypothesis 11 of the present study. The finding revealed that CSR as the moderator significantly and positively moderated the direct relationship between earnings management and insolvency risk. Thus, hypothesis 11 was supported. A probable reason behind CSR’s impact is that managers may not be much concerned about improving the firm’s performance due to personal interests, but with a concern for CSR, firm performance can be enhanced. Hence, with the presence and recognition of high CSR, the managers are obligated to produce and participate in improving firm performance, which indicates that CSR is crucial for companies because they are in the spotlight of public attention, pressure, and scrutiny, leading to a reduction in insolvency risk (Sial et al., Citation2018). Besides, the significant correlation between CSR and firm performance lessens the impact of the relationship between earnings management and firm performance, which indicates that CSR could be a variable that strongly reduces engagement in earnings management and, in turn, reduces the insolvency risk. Consecutively, a review of the literature exposes a research gap on the moderating role of CSR in the relationship between earnings management and insolvency risk. The idea of using CSR as the moderating variable is that companies should increase their practices and reporting in CSR to protect and sustain their performance from declining due to the practice of earnings management. CSR would play a significant role as the moderator by reducing the negative effect of earnings management practices on insolvency risk.

Thus, the prevalent theory explaining the relationships between corporate governance, earnings management, and insolvency risk is agency theory (Ghaleb et al., Citation2021). In this regard, Azeez (Citation2015) indicated that a number of the underlying theories contribute to the development of corporate governance agency theory. Furthermore, agency theory also indicates that CSR initiatives can be used as a way through which managers can ‘legitimate’ expend valuable firm resources at the expense of the firm’s shareholders’ wealth maximization objective (Ansong, Citation2017). This study discussed the role of corporate governance in reducing earnings management practice through agency theory, using board characteristics such as insider ownership and board size as governance mechanisms.

8. Conclusion

The findings back up the study’s eleven assumptions, broken down into three objectives. The first is the relationship between board characteristics and earnings management throughout the ISIS crisis, and the second is local banks’ earnings management and insolvency risk. The third objective is to consider earnings management as a mediator between board characteristics and insolvency risk, and the fourth objective is to consider CSR engagements as a moderator in the relationship between earnings management and insolvency risk. In brief, the analysis uncovered significant evidence that board financial expertise, ownership concentration, board size, and earnings management practice are relevant. As such, the composition of new boards must be shaped and guided by regulators working to enable multiple banking systems (i.e. financial expertise, ownership concentration, and board size). Therefore, regulators must consider financial competence, ownership concentration, and board size when designing financial reporting methods in banking.

Furthermore, internal board processes like these are also successful in reducing management opportunism in banks. The study findings provide a valuable overview for regulators, auditors, investors, and other decision-makers. This finding underscores the importance of considering CSR practices in understanding the relationship between earnings management and insolvency risk. Companies engaging in CSR activities may experience a different risk profile associated with earnings management compared to those that do not. This has practical implications for firms seeking to manage financial risk and highlights the potential protective role of CSR in the context of earnings management and financial stability. Also, it is crucial to acknowledge potential limitations in the study and recognize that moderation effects do not necessarily imply causation. In summary, the results suggest that CSR plays a moderating role in the relationship between earnings management and insolvency risk, providing valuable insights for organizations aiming to understand and manage their financial risks in the context of corporate social responsibility.

The main contributions of this research are, first, to shed light on the possibility of improving banks by academics and practitioners adopting CSR activities. Therefore, policymakers must realize the critical and vital role of quality CSR disclosure. Second, this paper encourages policymakers to recognize the necessary role of corporate governance (CG) mechanisms in mitigating the manager’s opportunistic behaviors and reducing the earning management practices in Iraq. Further, companies must also be encouraged to improve the quality of CSR reporting. Finally, these findings may help guide and prevent Iraq’s earnings management practices from becoming more extreme in the business atmosphere. Following that, looking at the role of CSR from the entrenchment perspective gives a different view and awareness of the negative use of CSR. In addition, the theoretical contributions of this study are given the escalating trend worldwide towards earnings management and CSR. This empirical exploration of the extent of the characteristics of the board of directors (board financial expertise, ownership concentration, and board size) in relation to insolvency risk centers on the often-overlooked category of Iraqi banks.

However, owing to certain limits, the current study has several limitations. The nature of the data is one of the limitations, as the data employed in the present study covered the period from 2010 to 2020, which might have an endogenous effect. Data for 2014 and 2017 were affected by the ISIS war period in Iraq. Therefore, it is also possible that some companies’ data were severely affected by the economic conditions at that time, which did not reflect the real economics of some banks. Furthermore, for the sample size, this study applied to Iraqi-listed banks, which were the only ones included in the study. As a result, it may not reflect the whole community of Iraqi publicly traded firms. The findings can be extra cautiously extrapolated to other firms’ sectors. Hence, further research could explore the specific mechanisms through which CSR moderates the relationship between earnings management and insolvency risk and investigate whether these findings hold across different industries or regions. Particularly, CSR is a relatively new concept for the Iraqi business environment, and there is still much-mixed understanding. This research could be a starting point for CSR research at Iraqi banks. It is hoped that a broader study with a larger sample size and cross-cultural studies will soon be done.

Authors’ contributions

Study conception and design: Hosam Alden Riyadh; data collection: Dr.Maher A. Al-Shmam; analysis, draft manuscript preparation, and interpretation of results: Mohammed Ghanim Ahmed.

Acknowledgments

The authors would like to thank the anonymous reviewers and the editor, Professor Collins Ntim, for their very helpful suggestions and comments, which led to huge improvements in the first original draft.

Disclosure statement

The authors declare that they do not have any competing interests.

Data availability statement

The data are in the hands of the principal researcher, and we can provide it to editors when needed. The data that support the findings of this study are available in Iraq Stock Exchange at http://www.isx-iq.net/. These data were derived from the following resources available in the public domain: http://www.isx-iq.net/

Additional information

Funding

Notes on contributors

Hosam Alden Riyadh

Dr. Hosam Alden Riyadh is an assistant professor, lecturer, and researcher at Telkom University, Indonesia. His main research interests are financial accounting, corporate governance, and CSR. Dr.Hosam is a Certified Sustainability Reporting Specialist (CSRS) and a Certified Sustainability Reporting Assurer (CSRA).

Maher A. Al-Shmam

Dr. Maher A. Al-Shmam is an associate professor, lecturer, and researcher at the Department of Accounting, College of Administration and Economics, University of Mosul, Iraq. Dr. Maher has supervised many Ph.D. students and master students, and his main research interests are accounting theory and financial accounting.

Mohammed Ghanim Ahmed

Dr. Mohammed Ghanim Ahmed is a lecturer and researcher who obtained his Ph.D. degree from Universiti Sains Malaysia, Malaysia. His main research interests are financial accounting, corporate governance, and sustainability.

References

- Abdullahi, M. S., Ali, A. I., & Abdulrazaq, Z. (2018). Determinants of corporate social responsibility in listed companies. Asian People Journal, 2(1), 1–22.

- Abdullahi, L. B., & Ibrahim, S. O. (2017). An evaluation of factors determining earnings management in Nigeria. Amity Global Business Review, 12, 33–45.

- Abdulsamad, A. O., Wan Fauziah, W. Y., & Lasyoud, A. A. (2018). The influence of the board of directors’ characteristics on firm performance: Evidence from Malaysian public listed companies. Corporate Governance and Sustainability Review, 2(1), 6–13. https://doi.org/10.22495/cgsrv2i1p1

- Abed, I. A., Hussin, N., Haddad, H., Al-Ramahi, N. M., & Ali, M. A. (2022). The moderating effects of corporate social responsibility on the relationship between creative accounting determinants and financial reporting quality. Sustainability, 14(3), 1195. https://doi.org/10.3390/su14031195

- Akben Selcuk, E., & Kiymaz, H. (2017). Corporate social responsibility and firm performance: evidence from an emerging market. Accounting and Finance Research, 6(4), 42. https://doi.org/10.5430/afr.v6n4p42

- Al Haddad, O., & Juhmani, O. I. (2020 Corporate Governance and the Insolvency Risk: Evidence from Bahrain [Paper presentation].2020 International Conference on Decision Aid Sciences and Application (DASA), 454–458. https://doi.org/10.1109/DASA51403.2020.9317279

- Al-Absy, M. S. M., Ku Ismail, K. N. I., & Chandren, S. (2019). Audit committee chairman characteristics and earnings management. Asia-Pacific Journal of Business Administration, 11(4), 339–370. https://doi.org/10.1108/APJBA-10-2018-0188

- Alaraji, F. A. A. S. (2017). The role and impact of corporate governance on narrowing the expectations gap between the external auditor and the financial community (A practical study of a sample of external audit offices and companies invested in Iraq) (case study in Iraq). American Scientific Research Journal for Engineering, Technology, and Sciences (ASRJETS), 33(1), 305–327.

- Aleqab, M. M., & Ighnaim, M. M. (2021). The impact of board characteristics on earnings management. Journal of Governance and Regulation, 10(3), 8–17. https://doi.org/10.22495/jgrv10i3art1

- Al-Fadhel, M. A. (2014). The relationship between corporate governance and accounting disclosure quality in light of agency theory: Study for the case of Iraq. Economic Horizons, 34(126), 71–127.

- Alfaro, L., Asis, G., Chari, A., & Panizza, U. (2019). Corporate debt, firm size and financial fragility in emerging markets. Journal of International Economics, 118, 1–19. https://doi.org/10.1016/j.jinteco.2019.01.002

- Ali, S., Hussain, N., & Iqbal, J. (2021). Corporate governance and the insolvency risk of financial institutions. The North American Journal of Economics and Finance, 55, 101311. https://doi.org/10.1016/j.najef.2020.101311

- Al-Rahahleh, A. (2017). Corporate governance quality, board gender diversity and corporate dividend policy: Evidence from Jordan. Australasian Accounting, Business and Finance Journal, 11(2) https://doi.org/10.14453/aabfj.v11i2.6

- Al-Shaer, H., & Zaman, M. (2018). Credibility of sustainability reports: The contribution of audit committees. Business Strategy and the Environment, 27(7), 973–986. https://doi.org/10.1002/bse.2046

- Altman, E. I. (2005). An emerging market credit scoring system for corporate bonds. Emerging Markets Review, 6(4), 311–323. https://doi.org/10.1016/j.ememar.2005.09.007

- Amin, A., Ali, R., Ur Rehman, R., & Ntim, C. G. (2023). CEO personal characteristics and firms’ risk-taking behaviour: the moderating role of family ownership. Gender in Management: An International Journal, https://doi.org/10.1108/GM-02-2022-0034

- Ansong, A. (2017). Corporate social responsibility and firm performance of Ghanaian SMEs: The role of stakeholder engagement. Cogent Business & Management, 4(1), 1333704. https://doi.org/10.1080/23311975.2017.1333704

- Arnold, B., & de Lange, P. (2004). Enron: An examination of agency problems. Critical Perspectives on Accounting, 15(6-7), 751–765. https://doi.org/10.1016/j.cpa.2003.08.005

- Azeez, D. A. A. (2015). Corporate governance and firm performance: Evidence from Sri Lanka. Journal of Finance and Bank Management, 3(1) https://doi.org/10.15640/jfbm.v3n1a16

- Bajra, U., & Cadez, S. (2018). The impact of corporate governance quality on earnings management: Evidence from European companies Cross-listed in the US. Australian Accounting Review, 28(2), 152–166. https://doi.org/10.1111/auar.12176

- Beneish, M. D. (1999). The detection of earnings manipulation. Financial Analysts Journal, 55(5), 24–36. https://doi.org/10.2469/faj.v55.n5.2296

- Block, D., & Gerstner, A. (2016). One-tier vs. two-tier board structure: A comparison between the United States and Germany. Comparative Corporate Governance and Financial Regulation. University of Pennsylvania Law School, Spring 2016. https://scholarship.law.upenn.edu/fisch_2016/1

- Bolton, B., & Park, J. (2022). Social impact as corporate strategy: Responsibility and opportunity. Cogent Business & Management, 9(1) https://doi.org/10.1080/23311975.2022.2111035

- Booth, J. R., & Deli, D. N. (1999). On executives of financial institutions as outside directors. Journal of Corporate Finance, 5(3), 227–250. https://doi.org/10.1016/S0929-1199(99)00004-8

- Boshnak, H. A. (2022). Determinants of corporate social and environmental voluntary disclosure in Saudi listed firms. Journal of Financial Reporting and Accounting, 20(3/4), 667–692. https://doi.org/10.1108/JFRA-05-2020-0129

- Boulouta, I., & Pitelis, C. N. (2014). Who needs CSR? The impact of corporate social responsibility on national competitiveness. Journal of Business Ethics, 119(3), 349–364. https://doi.org/10.1007/s10551-013-1633-2

- Brennan, N. M., & Solomon, J. (2008). Corporate governance, accountability and mechanisms of accountability: An overview. Accounting, Auditing & Accountability Journal, 21(7), 885–906. https://doi.org/10.1108/09513570810907401

- Buertey, S., Sun, E., Lee, J. S., & Hwang, J. (2020). Corporate social responsibility and earnings management: The moderating effect of corporate governance mechanisms. Corporate Social Responsibility and Environmental Management, 27(1), 256–271. https://doi.org/10.1002/csr.1803

- Chekili, S. (2012). Impact of some governance mechanisms on earnings management: An empirical validation within the Tunisian market. Journal of Business Studies Quarterly, 3(3), 95–104.

- Cho, E., & Chun, S. (2016). Corporate social responsibility, real activities earnings management, and corporate governance: evidence from Korea. Asia-Pacific Journal of Accounting & Economics, 23(4), 400–431. https://doi.org/10.1080/16081625.2015.1047005

- Coffie, W., Aboagye-Otchere, F., & Musah, A. (2018). Corporate social responsibility disclosures (CSRD), corporate governance and the degree of multinational activities. Journal of Accounting in Emerging Economies, 8(1), 106–123. https://doi.org/10.1108/JAEE-01-2017-0004

- Coles, J. L., Daniel, N. D., & Naveen, L. (2008). Boards: Does one size fit all? Journal of Financial Economics, 87(2), 329–356. https://doi.org/10.1016/j.jfineco.2006.08.008

- Cooper, E., & Uzun, H. (2019). Corporate social responsibility and bankruptcy. Studies in Economics and Finance, 36(2), 130–153. https://doi.org/10.1108/SEF-01-2018-0013

- Croci, E., Hertig, G., Khoja, L., & Lan, L. L. (2020). The advisory and monitoring roles of the board - evidence from disruptive events. SSRN Electronic Journal, https://doi.org/10.2139/ssrn.3581712

- Cronqvist, H., & Yu, F. (2017). Shaped by their daughters: Executives, female socialization, and corporate social responsibility. Journal of Financial Economics, 126(3), 543–562. https://doi.org/10.1016/j.jfineco.2017.09.003

- Daghsn, O., Zouhayer, M., & Mbarek, K. B. H. (2016). Earnings management and board characteristics: Evidence from French listed. Arabian Journal of Business and Management Review, 6(5), 1–9.

- Dakhlallh, M. M. (2020). Accrual-based earnings management, real earnings management and firm performance: Evidence from public shareholders listed firms on Jordanian’s stock market. Journal of Advanced Research in Dynamical and Control Systems, 12(1), 16–27. https://doi.org/10.5373/JARDCS/V12I1/20201004

- de Graaf, F. J. (2019). CSR processes in governance systems and structures: The development of mental modes of CSR. Business and Society Review, 124(4), 431–448. https://doi.org/10.1111/basr.12183

- Dechow, P., Weili, G., & Catherine, S. (2010). Understanding earnings quality: A review of the proxies, their determinants and their consequences. Journal of Accounting and Economics, 50(2-3), 344–401. https://doi.org/10.1016/j.jacceco.2010.09.001

- Dhaliwal, D., Li, O. Z., Tsang, A., & Yang, Y. G. (2014). Corporate social responsibility disclosure and the cost of equity capital: The roles of stakeholder orientation and financial transparency. Journal of Accounting and Public Policy, 33(4), 328–355. https://doi.org/10.1016/j.jaccpubpol.2014.04.006

- Donker, H., Santen, B., & Zahir, S. (2009). Ownership structure and the likelihood of financial distress in the Netherlands. Applied Financial Economics, 19(21), 1687–1696. https://doi.org/10.1080/09603100802599647

- Duman, D. U., Giritli, H., & McDermott, P. (2016). Corporate social responsibility in construction industry: A comparative study between UK and Turkey. Built Environment Project and Asset Management, 6(2) https://doi.org/10.1108/BEPAM-08-2014-0039

- Dyck, A., Lins, K. V., Roth, L., & Wagner, H. F. (2019). Do institutional investors drive corporate social responsibility? International evidence. Journal of Financial Economics, 131(3), 693–714. https://doi.org/10.1016/j.jfineco.2018.08.013

- Eisenhardt, K. M. (1989). Agency theory: An assessment and review. The Academy of Management Review, 14(1), 57–74. https://doi.org/10.2307/258191

- El Diri, M., Lambrinoudakis, C., & Alhadab, M. (2020). Corporate governance and earnings management in concentrated markets. Journal of Business Research, 108, 291–306. https://doi.org/10.1016/j.jbusres.2019.11.013

- Elnahass, M., Salama, A., & Yusuf, N. (2022). Earnings management and internal governance mechanisms: The role of religiosity. Research in International Business and Finance, 59, 101565. https://doi.org/10.1016/j.ribaf.2021.101565

- Elston, J. (2019). Corporate governance: What we know and what we don’t know. Journal of Industrial and Business Economics, 46(2), 147–156. https://doi.org/10.1007/s40812-019-00115-z

- Enguix, L. P. (2021). The new EU remuneration policy as good but not desired corporate governance mechanism and the role of CSR disclosing. Sustainability, 13(10), 5476. https://doi.org/10.3390/su13105476

- Esa, E., & Zahari, A. R. (2016). Corporate social responsibility: Ownership structures, board characteristics & the mediating role of board compensation. Procedia Economics and Finance, 35, 35–43. https://doi.org/10.1016/S2212-5671(16)00007-1

- Espahbodi, R., Liu, N., & Weigand, R. A. (2018). Firm performance and earnings management around dividend change announcements. SSRN Electronic Journal, https://doi.org/10.2139/ssrn.3157874

- Fama, E. F., & Jensen, M. C. (1983). Separation of ownership and control. The Journal of Law and Economics, 26(2), 301–325. https://doi.org/10.1086/467037

- Fodio, M. I., Abu-Abdissamad, A. M., & Oba, V. C. (2013). Corporate social responsibility and firm value in quoted Nigerian financial services. International Journal of Finance and Accounting, 2(7), 331–340. https://doi.org/10.5923/j.ijfa.20130207.01

- Foss, N. J. (2021). The impact of the COVID-19 pandemic on firms’ organizational designs. Journal of Management Studies, 58(1), 270–274. https://doi.org/10.1111/joms.12643

- Franco, S., Caroli, M. G., Cappa, F., & Del Chiappa, G. (2020). Are you good enough? CSR, quality management and corporate financial performance in the hospitality industry. International Journal of Hospitality Management, 88, 102395. https://doi.org/10.1016/j.ijhm.2019.102395

- Gadzo, S. G., Kportorgbi, H. K., & Gatsi, J. G. (2019). Credit risk and operational risk on financial performance of universal banks in Ghana: A partial least squared structural equation model (PLS SEM) approach. Cogent Economics & Finance, 7(1), 1589406. https://doi.org/10.1080/23322039.2019.1589406

- Gerged, A. M., Albitar, K., & Al-Haddad, L. (2023). Corporate environmental disclosure and earnings management: The moderating role of corporate governance structures. International Journal of Finance & Economics, 28(3), 2789–2810. https://doi.org/10.1002/ijfe.2564

- Ghaleb, B. A. A., Qaderi, S. A., Almashaqbeh, A., & Qasem, A. (2021). Corporate social responsibility, board gender diversity and real earnings management: The case of Jordan. Cogent Business & Management, 8(1) https://doi.org/10.1080/23311975.2021.1883222

- Gras-Gil, E., Palacios Manzano, M., & Hernández Fernández, J. (2016). Investigating the relationship between corporate social responsibility and earnings management: Evidence from Spain. BRQ Business Research Quarterly, 19(4), 289–299. https://doi.org/10.1016/j.brq.2016.02.002

- Handayani, Y. D., & Ibrani, E. Y. (2020). The effect of audit committee characteristics on earnings management and its impact on firm value. International Journal of Commerc and Finance, 6(2), 104–116.

- Hołda, A. (2020). Using the Beneish M-score model: Evidence from non-financial companies listed on the Warsaw stock exchange. Investment Management and Financial Innovations, 17(4), 389–401. https://doi.org/10.21511/imfi.17(4).2020.33