Abstract

The sustainable competitive advantage of incumbent firms has been widely discussed, but its relation to the integral processes incorporated into product design and production remains poorly understood. This study investigates how differences in product architecture, that is, the presence of an integral process with new and old technology in new product design and production, are related to the intensity of market competition and the protection of incumbent firms from imitation. By comparing incumbent firms’ and new entrants’ levels of integral knowledge of old and new technologies, this study verifies that integral processes in new product development and production lead to incumbent firms’ sustainable competitive advantage. From a product architecture perspective in the context of the Japanese imaging industry, this study discusses why Japanese incumbent firms had been able to maintain a sustainable competitive advantage in an industry facing rapid digitalization. Findings indicate that the encapsulation of integral processes in incumbent firms’ product design and manufacturing, combining old and new technologies, can prevent the imitation of a product or technological development. This study also provides key insights into how product architecture affects the size of market entry barriers, the speed of manufacturing information leakage, and the intensity of market competition.

Reviewing Editor:

Introduction

When new technology emerges, incumbent firms that provide products to customers with established technology generally resist investing in the research and development (R&D) of the new technology and entering the new market. Consequently, these firms face the risk of losing their market positions. Previous studies have explored why incumbent firms face difficulties in adopting to discontinuous technological innovation (e.g. Ansari & Krop, Citation2012; Birkinshaw, Citation2023; Christensen, Citation1997; Christensen & Bower, Citation1996; Henderson & Clark, Citation1990; Rothaermel & Hill, Citation2005; Tripsas & Gavetti, Citation2000; Utterback, Citation1994). Most incumbent firms lose customers to new entrants, which provide new products based on new technology, and ultimately lose customer support.

Meanwhile, some incumbent firms have been observed to shift their production toward new products that adopt new technology and introduce drastic changes in a mature industry (e.g. Argyres et al., Citation2015; Bergek et al., Citation2013; Birkinshaw, Citation2023; Magnusson et al., Citation2003; Magnusson & Werner, Citation2022). From the perspective of product architecture, arranging an integral process (Clark & Fujimoto, Citation1990) in the design and manufacture of a product is one approach to retrieve and protect incumbents’ monopoly benefits (Fixson & Park, Citation2008). An advantage of incumbents is that they develop existing technologies rapidly and can integrate new technologies and existing knowledge in developing new products (Bergek et al., Citation2013; Magnusson & Werner, Citation2022). Therefore, to achieve re-integration and decreased modularization (Fixson & Park, Citation2008) and to maintain a sustainable competitive advantage in the industry, incumbents could theoretically integrate old and new components to which old and new technology is applied, and they could design new products in a way that upgrades the existing product architecture.

The existing literature explains that product modularization leads to not only innovation benefits but also imitation by rivals and that modular architecture leads to a trade-off between incremental innovation benefits and imitation deterrence (Ethiraj et al., Citation2008; Pil & Cohen, Citation2006). However, in the imaging industry, which is the focus of our study, and probably in other industries, some incumbent firms apply technological integration in the design and production of new products with modular innovation and maintain their benefits in the industry.

A review of previous studies shows that the difficulty of imitation for new entrants and the sustainable competitive advantage of incumbent firms depend more on whether new products exhibit modular or architectural innovation than on the process of designing or producing a new product (Birkinshaw, Citation2023; Henderson & Clark, Citation1990). However, very few studies have closely analyzed whether the integral processes incorporated into product design and production are truly related to the sustainable competitive advantage of incumbent firms. Thus, based on a product architecture perspective and a case study, the current work addresses the following two research questions: First, how are the differences in product architecture, that is, the presence or absence of an integral process in new product development and production, related to the intensity of market competition and the deterrence of imitation by new entrants? Specifically, this study attempts to assess the links between the characteristics of each product’s architecture, technical areas applied to each product component, technological knowledge (and integral technological knowledge) of incumbents and new entrants, speed of market maturity, and competition intensity within the market.

Second, does the existence of integral processes in new product development and production lead to a sustainable competitive advantage for incumbent firms? To address this research question, this study compares the levels of integral knowledge of old and new technologies between incumbent firms and new entrants. It also suggests that modular innovation can support a re-integration strategy (Fixson & Park, Citation2008) by arranging the integrality process with new and old technologies (Magnusson & Werner, Citation2022) in product design and manufacture.

Literature review

Product architecture and modularity

The integral architecture of products requires intensive managerial coordination within manufacturing firms to adjust the relationships among components in the design process (Clark & Fujimoto, Citation1990; Orton & Weick, Citation1990; Sanchez & Mahoney, Citation1996; Ulrich, Citation1995). Integral knowledge and skills are also needed to understand the technical interdependencies between components in product architecture (Chesbrough & Kusunoki, Citation2001) to achieve high product performance and quality. Owing to the complexities of interconnected component-specific interfaces, an integration process is required to link and coordinate firms’ complex product design and manufacturing architecture, thereby increasing the difficulty of product imitation by rivals (Pil & Cohen, Citation2006).

Conversely, modular architecture uses independently designed components without detailed adjustments or specific interfaces (Ulrich, Citation1995). It does not require organizational information processing associated with performance improvements, integral knowledge, and skills in the process of improving or redesigning products; hence, it could be easily imitated, and firms lose product performance advantages (Pil & Cohen, Citation2006).

Product architecture generally shifts from integral to modular as old product technology matures, a process known as ‘modularity’ (Baldwin & Clark, Citation2000; Brusoni et al., Citation2001; Chesbrough & Kusunoki, Citation2001; Fixson & Park, Citation2008; Pil & Cohen, Citation2006). Following the progress of modularity, the focus of industry competition has shifted to economies of scale, incremental innovation, and multiple new entrants in the market (Fixson & Park, Citation2008; Tushman & Anderson, Citation1986). In addition, modularity leads to ‘commoditization’ (Christensen & Raynor, Citation2003) and results in product imitation and price competition (Brusoni et al., Citation2001; Chesbrough & Kusunoki, Citation2001; Pil & Cohen, Citation2006) because components can be assembled without firm-specific technological knowledge or expertise (Ethiraj et al., Citation2008; Pil & Cohen, Citation2006). Therefore, incumbent firms in mature industries can fall into the integrality trap (Chesbrough & Kusunoki, Citation2001). Despite possessing state-of-the-art technological knowledge and offering high-quality products, incumbents often cannot survive harsh price competition owing to commoditized and modularized products; ultimately, incumbents are replaced by new entrants and often withdraw from the market.

Innovation and incumbents’ behavior

In response to innovation, incumbent firms sometimes face difficulty in shifting to designing and manufacturing products that apply new technological developments and thus find their market share eroded by new entrants (Christensen & Bower, Citation1996). They tend to hesitate to invest in new technology, which generally performs worse than established technology in the emerging phase (Arthur, Citation2009; Christensen & Bower, Citation1996; Zajac & Bazerman, Citation1991) and may contradict established organizational operations, identities, and traditions (Oliver, Citation1997). Many previous studies have discussed incumbent firms’ behavior when faced with radical innovation based on the resource-based view (RBV). RBV theory (e.g. Barney, Citation1991; Barney et al., Citation2021; Priem & Butler, Citation2001) argues that for a company to establish long-term competitive advantage, it should compete based on resources with favorable value, rarity, inimitability, and organizational appropriability (VRIO) conditions (Barney and Wright, Citation1998; Cardeal & Antonio, Citation2012). Under conditions of high uncertainty, the value of a firm’s advantageous resources may become indeterminate (Furr & Eisenhardt, Citation2021), and incumbent firms sometimes fail to change their resource investment patterns in response to discontinuous changes (Gilbert, Citation2005). Consequently, incumbents experience organizational inertia (Gilbert, Citation2005; Hannan & Freeman, Citation1984), and their core capabilities can become core rigidities (Leonard-Barton, Citation1992). Thus, resources and capabilities should be conceived as capacities that enable firm actions (Kraaijenbrink et al., Citation2010), which, in turn, affect the interfirm rivalry and competitive interaction of the industry (Chen et al., Citation2021).

From the perspective of product design and production, several previous studies have discussed why incumbent firms’ core capabilities transform into core rigidities when faced with innovation (e.g. Birkinshaw, Citation2023). Innovation that reconfigures an established system represents ‘architectural innovation’, whereas that which changes only the core design concepts of one or more components, with other existing linkages remaining unchanged, represents ‘modular innovation’ (Henderson & Clark, Citation1990). Architectural innovation is competence-destroying for incumbent firms, leads to technological uncertainty for all product architecture components and associated linkages (Magnusson et al., Citation2003), and is driven by exploratory knowledge and experimentation to acquire new concepts or technologies (Popadiuk & Choo, Citation2006). It is typically introduced by new entrants with fewer limitations on organizational communication channels and information filters (Henderson & Clark Citation1990) to break through stagnant markets. Meanwhile, modular innovation is competence-enhancing for incumbent firms, requires component-specific knowledge, leads to technological uncertainty for specific parts of a product, and involves the use and development of existing ideas and products.

Some incumbents achieve innovation with substantial societal impact (Bergek et al., Citation2013; Christensen & Bower, Citation1996; Fixson & Park, Citation2008). For incumbents, exploiting existing knowledge enhances new technological innovations in the industry (Birkinshaw, Citation2023). Relative to new entrants, incumbents have an advantage in accumulating technological competence (Kang & Song, Citation2017), knowledge, and expertise through past R&D and the design and manufacture of existing products; thus, in product development, they can rapidly exploit established technology and integrate it with new ones (Bergek et al., Citation2013; Lavie, Citation2006). In a mature industry, incumbents that enjoy competitive advantage through integral knowledge can introduce products with new integral architecture, decrease modularity, and maintain their competitive advantage (Fixson & Park, Citation2008). In this context, arranging an integral process (Clark & Fujimoto, Citation1990) in the design and manufacture of a product can retrieve and protect incumbent firms’ monopoly benefits (Fixson & Park, Citation2008). Therefore, combining and creating interdependence among old and new components and technologies and designing new products to upgrade the existing product architecture are theoretically possible.

Previous studies have demonstrated incumbents’ advantages in integrating old and new technologies to develop products that prevent imitation by new entrants. Nevertheless, few studies have empirically detailed firms’ product architecture design and technology/product development to prevent imitation and preserve incumbent firms’ monopoly benefits. Although incumbent firms can develop new and innovative products by combining old and new technologies, they face competition from new entrants and rivals if these technological combinations exhibit high imitability. Technological knowledge is a company resource (Mahmood & Mubarik, Citation2020). In particular, expertise in product design and production processes in the manufacturing industry can be a source of sustainable competitive advantage if it meets the VRIO conditions. If incumbent firms combine the technnological knowledge and expertise they have cultivated through past business with new technology and if the integral process meets VRIO conditions, they will be able to establish an advantage over new entrants. From a product architecture perspective, this study attempts to identify an effective product architecture design to prevent imitation by new entrants and rivals by focusing on technological areas and combinations thereof in new product development by incumbents.

Data and methods

Case selection

To address the first research question, this study centers on product architecture and investigates how the presence of an integral process in new product development and production is related to the intensity of market competition and protection against imitation by new entrants. The digital imaging industry was chosen as a case study, with a particular focus on Japanese manufacturers’ technological capabilities and market performance. The imaging industry is a suitable study subject because three major products, each with a different product architecture, emerged during a major shift from old technology (analog) to new technology (digital). In the imaging industry, incumbent Japanese firms have established sustainable competitive advantages by integrating new and existing technologies into product design and production processes. Several prior studies have focused on this industry and have derived theoretical implications from camera manufacturing firms’ behavior in shifting from analog to digital technologies. Benner and Tripsas (Citation2012) examined the conceptualization of products for firms and showed that prior industry experience shapes firms’ product feature choices and concurrent behavior. The authors also showed that firms are likely to imitate the behavior of other firms in the same industry. Wu et al. (Citation2014) showed that firms’ technology investment behavior depends on their complementary assets that are affected by their technological trajectory choices, which are in turn affected by path dependency. Using a long study period in the digital imaging industry, Kang and Song (Citation2017) found that incumbent leaders generally have superior resources and capabilities to latecomers and that historically accumulated capabilities and knowledge are required to catch-up with industrial leaders. Although several academic and practical implications have been derived from the literature, they explain firms’ technological strategies and behaviors without considering the detailed product architecture of some digital cameras and the specific technologies applied to each product component even though sophisticated technological skills are needed in the camera manufacturing process.

In this industry, three new types of digital cameras with different product architectures were developed based on the digitalization of recording media around the same time: digital single-lens reflex (DSLR) cameras, digital single-lens mirrorless (DSLM) cameras, and compact digital still cameras (DSC). The characteristic product architectures of and the technologies applied to each product are quite different, and these differences are reflected in the market performance of the firms that produce each product and the intensity of market competition. Incumbent firms have experience manufacturing film-type single-lens reflex (SLR) cameras, which are the precursors of digital cameras. New entrants are firms that entered the camera market after digital cameras became commonplace; most of them originally manufactured home electronics and entered this industry after cameras were digitized. In other words, incumbent firms have been able to draw on the optical technology knowledge they gained from past experience in manufacturing SLR cameras, whereas new entrants have entered the industry without that knowledge. Although this case study focuses on one industry and the analysis period is limited, it partially answers the first research question, and the selected industry is suitable as a case study subject for this research.

In the global digital imaging market in previous years, most high-ranking firms were Japanese, leading to fierce competition in domestic products and technological development, especially in the DSLR camera market. These Japanese companies included incumbent firms and new entrants and competed against one another. To achieve the research objectives, this study focuses on the technological trends and product development strategies of Japanese companies in the camera industry at the time. Japanese business magazines, newspaper articles, and research publications provide the most detailed qualitative information on the development trends of Japanese companies, strategic policies of their management teams, backgrounds of product development, and so on. Hence, they are an excellent source of information about cooperative research and competitive opposition between firms, comments or dialogues of product developers, and details about product architecture and applied technologies. Accordingly, they are suitable references for our case study.

Data collection and analysis

The first purpose of this research is to examine how differences in product architecture–that is, the presence or absence of an integral process in new product development and production–are related to the intensity of market competition and protection against imitation by new companies. The first part of the analysis surveyed the differences in product architecture, manufacturing processes, and applied technologies in the components and architectural interfaces. The differences in the product architecture of DSLR cameras, DSLM cameras, and compact DSC are generally difficult to understand, but they are strongly linked to the differences in the sustainable competitive advantages of incumbent firms. Therefore, we explain in detail the structure and production process of DSLR cameras. The mirroring hypothesis (Burton & Galvin, Citation2018) predicts that when a product architecture is integrated, components remain interdependent, and the associated task, knowledge, and firm boundary will correspondingly favor vertical integration within the firm and mirror the technical architecture of the product (Meissner et al., Citation2021).

Information on firms’ market performance for the period 1990–2014 was obtained from Fuji Chimera Research Institute, Inc. Information on new entrants and withdrawing firms was extracted from the same source and from business magazines. Information on the firms’ product development strategies was sourced from their annual reports and business magazines, such as Nikkei Business, Nikkei Technology, and Toyo Keizai.

The second research purpose is to compare the level of integral knowledge of old and new technologies between incumbent firms and new entrants and to ensure that the existence of an integral process in new product development and production leads to sustainable competitive advantages for incumbent firms. To clarify the differences in technical capabilities between incumbent firms and new entrants, the second half of the study employed patent landscape analysis based on corporate patent data. The patent search database service provided by Patent Integration Inc. was used in the patent data analysis for the period of 1991–2013, during which Japanese firms that currently manufacture and sell digital cameras applied for patents. Keyword searches for ‘camera’ in the patent dataset of each of the 11 firms elicited 251,166 patents. To exclude patents for unrelated products with cameras for capturing photographs, such as microscopes, telescopes, and communication devices, we used the F-term assigned to each patent. In total, 201,800 patents were extracted. Using these patent data, this study investigated the differences in firms’ technological capabilities, distinguishing between new entrants and incumbent firms. In addition to the total patents applied for by firms, this study considered the first three digits of the International Patent Classification (IPC) code, which classifies each patent according to the technological area. The analysis used three IPC codes: ‘G02’ for ‘optics’; ‘G03’ for ‘pictures, movies, similar technology using waves, excluding light waves, electrophotography, and holography’; and ‘H04’ for ‘electronic communication’. IPC sections G and H represent physics and electronics, respectively.

To detect the technological areas of the firms’ patent applications, we calculated the odds by using the ratio of the number of patents attached to a particular IPC code to the total number of patents sampled. This variable indicated the probability of observing a patent in a particular technological area relative to the probability that such a patent is not observed among all camera-related patents that a firm applied for. It is a proxy variable for the volume of R&D resources that a firm allocates to a particular technological area or combination of technologies. In other words, it refers to the technological area specified by a firm’s core competency.

To deepen the comparison between incumbents and new entrants, we calculated the odds ratio of having a particular IPC code for both groups and then compared the time-series variations. The odds ratio was calculated by dividing the odds of incumbents by those of new entrants. This variable indicated the probability of a patent in a particular technological area being observed in the incumbent group relative to the new entrant group. It proxies for the relative magnitude of incumbent firms’ R&D allocation in a particular technological area and/or a combination of technological areas in comparison with that of new entrants. Using this variable thus enabled us to analyze the differences in firms’ resource allocation and capabilities.

Finally, this study examined the relationship between individuals or combinations of technological areas applied in product development/manufacturing and product imitability. Using time-series patent data, we established the transition of patent applications within specific technological areas or combinations thereof for new entrants and incumbent firms. This transition demonstrates the catch-up speed of new entrants in technological development and fosters an understanding of the technological strategies of incumbent firms that strengthen the imitation barriers for new entrants in product/technological development.

Of the 11 firms sampled in this study, 7 are new entrants: Olympus Corporation (Olympus), Canon Inc. (Canon), Sigma Corporation (Sigma), Tamron Co., Ltd. (Tamron), Nikon Corporation (Nikon), Ricoh Imaging Company, Ltd. (Ricoh), and Fujifilm Corporation (Fujifilm). The remaining four firms are incumbents: JVC Kenwood Corporation (JVC), Casio Computer Co., Ltd. (Casio), Sony Corporation (Sony), and Panasonic Corporation (Panasonic).

Product architecture, technological integral process, and intensity of market competition

DSLR camera

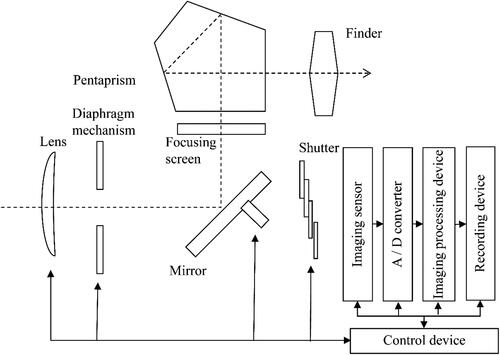

The DSLR camera, which converts an exposed image into a digital format for recording media, was developed in 1975. shows the analog and digital components of the DSLR camera architecture. The DSLR camera has some distinctive optical components, such as a mirror box, which includes the lens, mirror, and pentaprism, to reflect the incident light in the camera body to the optical viewfinder. This arrangement of components is the same as that of the film-type SLR camera (analog camera) and is unlike that of the DSLM camera and compact DSC. The advantage of the mirror box is that users can view an object directly through the optical finder without a time lag from the lens to photograph a moving subject with sensitive focal adjustment. In a DSLR camera, optical and electronic components, such as a sensor-based electronic adjusting lens, interlocking shutter modules, and mirror position, are interconnected through an electronic circuit. Each of the optical and electronic components is also linked to control system modules through an electronic circuit.

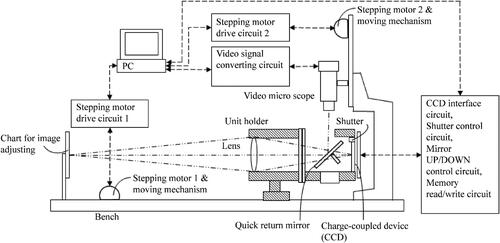

depicts the focus screen position adjustment apparatus based on Olympus patent application for the mechanism to adjust the optical position of the focus screen and solid imaging element unit surfaces while assembling them into the main body. During this process, the optical position must be detected by adjusting the light focus reflected by the optical components inside the mirror box. To adjust the position of the solid imaging element unit, mirror box, and finder screen, which are assembled on the camera body for focus, engineers check the screen displayed by the video microscope to confirm whether an object image is displayed clearly. Thus, an interaction adjustment between each component in the product assembly process is required to interrelate the optical and electronic components within the same product architecture.

Figure 2. Adjustment apparatus for the positioning of the focusing screen. Source: Compiled by the author based on Japanese patent number 4334949 applied for by Olympus Corporation.

If the focus is displaced from the optimal position by even a micrometer, the image quality of the camera declines significantly. To maintain high image quality in DSLR cameras, engineers must assemble the optical and electronic components of the camera body and fine-tune the focal adjustment, a process that is relatively expensive and time consuming.

More than two decades after the launch of the first DSLR camera, manufacturing had not yet been outsourced from design firms to original equipment manufacturers (OEMs). Thus, information and technological skills were not shared or leaked among firms, and only a few firms had reaped the benefits of the DSLR industry.

shows the quantity-based global market size and shares of DSLR, compact DSC, and DSLM cameras. The global DSLR camera market reached 5.3 million units in 2006, peaked at 15.82 million units in 2012, but slowly declined to 9.4 million units in 2015. Currently, Canon and Nikon control 90 percent of this market, and the Herfindahl–Hirschman index (HHI) of the DSLR camera market in 2010 was 0.39, increasing to 0.48 in 2015, thus implying more oligopolistic competition among manufacturers. Nine camera manufacturers entered this market between 1995 and 2015 (although four firms later withdrew), and they included Samsung Electronics Co., Ltd. (Samsung), Eastman Kodak Company (Kodak), Panasonic, Konica Minolta Inc. (Konica Minolta), Sony, Olympus, and Pentax, which remained in the market but could not expand their market share.

Table 1. Global market size and market share of DSLR cameras, DSLM cameras, and compact DSCs in 2010 and 2015 (quantity-based).

DSLM camera

The DSLM camera was developed by Panasonic in 2008. It is a digital camera with an interchangeable lens that does not contain a mirror box mechanism and an optics finder; instead, it uses a liquid crystal monitor and digital finder. Currently, the image quality of the DSLM camera is almost identical to that of the DSLR camera. The lack of a mirror and pentaprism resulted in a lightweight camera, thus enabling miniaturization and enhancing portability.

As the camera architecture does not include a mirror box, the incident light from the lens forms images using a solid imaging element unit. Therefore, an adjustment process for focusing and detecting the optimal position of the screen is not required when assembling the components. In other words, the integral mechanism of the optical and electronic components is removed from the manufacturing process, thus allowing firms to design and manufacture without possessing technological knowledge and skills in optics and integral component processes.

Although the DSLM camera followed the DSLR camera, manufacturing outsourcing progressed faster, thereby reducing costs. Some design firms outsourced production to other countries, with DSLM camera manufacturing services entailing lower labor costs. As of 2015, Nikon outsourced to Xacti Corporation (Xacti) and Ability Enterprise Company Ltd. while Olympus outsourced to Foxconn Technology Group (Foxconn).

The global DSLM camera market reached 10,000 units in its launch year in 2008 and peaked at 4.75 million units in 2012 before decreasing to 3.95 million units in 2015. As shows, competition among DSLM camera producers became fiercer over time, with new entrants steadily expanding their market share. The HHI for the DSLM camera market in 2015 was 0.33, which was lower than that for the DSLR camera market, indicating that DSLM camera manufacturers faced greater competition than DSLR camera manufacturers in balancing product quality, differentiation, and costs.

Eight firms entered and survived the DSLM camera market between 1995 and 2015. Olympus, Panasonic, Samsung, and Fujifilm withdrew from the DSLR camera market before entering the DSLM market. With the removal of some optical components and with a simplified DSLR camera product architecture, the DSLM camera assembly process was made straightforward for all manufacturers, lowering the market entry barriers for both incumbents and new entrants. Consequently, competition in terms of both price and quality was expected to intensify.

Compact DSC

As DSLR and DSLM cameras were more expensive and less portable, compact DSCs—lens-integrated digital cameras—became the most popular among individual users in the imaging industry, despite being launched after the two. The compact DSC has a product architecture similar to that of the DSLM camera, except for the unchangeable lens. The degree of modularization of the compact DSC is progressing, and this product can be assembled without firm-specific knowledge and expertise.

In 2010, the global market for compact DSCs peaked at approximately 136 million units. In 2015, its market size decreased to 23 million units, approximately one-sixth of the 2010 value. While the markets for all three cameras shrank, the ratio of the market size for compact DSCs decreased the most. shows that each of the major camera manufacturers possess only 10–20 percent of the DSC market. In 2015, the HHI for the compact DSC market was 0.18, implying that competition in this market was the harshest among the three camera markets.

The compact DSC market withs mature, which implies that firms must aggressively outsource manufacturing to OEMs to lower their costs. The relationships between design firms and OEMs have become complicated because of the progressive outsourcing of compact DSC manufacturing. As compact DSCs do not have a mirror box and are comparatively easy to assemble, new entrants such as OEMs and original design manufacturers (ODMs) do not face significant technological entry barriers. All major compact DSC design manufacturers, such as Canon, Nikon, Sony, Samsung, Fujifilm, Panasonic, Olympus, Casio, Ricoh, and GE, outsource their manufacturing to OEMs to reduce manufacturing costs and survive the intense price competition in the compact DSC market.

With the improved high-quality imaging of camera-equipped smartphones, these devices are progressing toward replacing compact DSC. Meanwhile, the DSLR camera market peaked later, and the rate of decrease was smaller than that of the compact DSC market. Owing to intense price competition, many camera manufacturers, such as Kyocera Corporation, Kodak, Konica Minolta, Hewlett-Packard Company, Fujifilm, Canon, Panasonic, and Olympus, have withdrawn from the compact DSC market or ceased R&D activities.

Level of integral knowledge: incumbent firms vs. new entrants

shows the time-series transition in the number of patents applied for by each firm. In the 1990s, Canon, Nikon, and Sony were the top firms in terms of patent applications. After 2003, when Panasonic began allocating resources to R&D for the DSLM camera, its patent applications increased rapidly. Currently, Canon, Nikon, Sony, and Olympus (in that order) have the most patent applications, reflecting their high camera R&D capabilities.

Table 2. Time-series transition of the number of patents applied for by 11 camera manufacturing firms.

shows the numbers, percentages, and odds ratios of the camera-related patents for each IPC code and the combination of more than two IPC codes applied for by the 11 firms between 1980 and 2015. JVC, Casio, Sony, Canon, Olympus, and Panasonic (in that order) had a relatively high percentage of patents with the H04 code among all applied patents; all these companies, except Casio, were new entrants. This result indicates that new entrants allocate more resources to electronics R&D than physics. The odds ratio value of Casio to Sigma implies that the probability of Casio applying for such a patent was 8.5 times that of Sigma. Conversely, Tamron, Olympus, Nikon, Ricoh, Canon, and Fujifilm (in that order), all of which were incumbent firms, had the highest percentages and odds with G02 patents, implying that incumbent firms allocate more resources to this technological area than new entrants.

Table 3. Number, percentages, and odds of camera-related patents applied for by 11 Japanese camera manufacturers for each IPC code and combinations thereof.

Canon, Ricoh, Olympus, Nikon, Sony, Fujifilm, and Panasonic (in that order) had the highest number of patents for both the H04 and G02 codes; the first four firms were incumbents while Sony and Panasonic were new entrants. Furthermore, Olympus, Tamron, Canon, Nikon, Ricoh, Casio, Sigma, and Fujifilm (in that order) have the highest percentages and odds of patents with both codes; all of them are incumbent firms, except Casio. These results show that new entrants have technological advantages only in electronics and that incumbent firms have advantages in both electronics and optics. Furthermore, incumbent firms overtake new entrants in terms of the percentages and odds of patents with both physics section codes.

Additionally, JVC, Casio, Nikon, Olympus, Tamron, Fujifilm, Sony, Panasonic, and Sigma (in that order) have higher percentages and odds of patents with the H04 and G03 codes. New entrants invest at almost the same level as incumbent firms in this technological area.

Nikon, Olympus, Canon, Ricoh, Casio, Tamron, Sigma, Fujifilm, JVC, Sony, and Panasonic (in that order) have higher percentages and odds of patents with the H04, G02, and G03 codes. Except for Casio, all are incumbent firms that conduct more R&D in cross-technological areas than new entrants and have corresponding technological competencies.

shows the numbers, odds, and odds ratios of the patents applied for by each group calculated for each IPC code and their combinations over a five-year period from 1980 to 2014. To confirm statistically significant differences, we conduct a chi-square test between the incumbent and new entrant groups. The results are significant for all IPC codes and their combinations at the 1 percent level of significance or better.

Table 4. Odds ratios (incumbents:new entrants) of the probability of each IPC code appearance (1980–1999).

The odds ratio for the H04 code generally continued to increase until 2014, was less than 1 until 2000–2004, and then exceeded 1 after 2005–2009 (). This trend implies that the percentage of resources that incumbent firms invested in electronics was less than that invested by new entrants until 2000–2004 and that this percentage increased after 2005–2009.

Table 5. Odds ratios (incumbents:new entrants) of the probability of each IPC code appearance (2000–2014).

For the G02 and G03 codes, the odds of incumbent firms were greater than those of new entrants in all periods. This result means that incumbent firms allocate more resources to physics development than new entrants. In addition, the odds ratio for G03 was higher than that for G02, thus indicating more differences in research efforts between the two groups for G03 than for G02. The odds ratio for G02 remained unchanged while that for G03 decreased until 2000–2004; these two values then continued to increase after 2005–2009. Incumbents demonstrate considerable advantage in physics over new entrants.

Before the development of digital cameras, incumbent firms (camera manufacturers) had their own technological capabilities in optics, and new entrants (general consumer electronics manufacturers and not camera manufacturers) had their own technological capabilities in electronics. After digital cameras were developed and became mainstream, incumbent firms began allocating their resources to electronics and a combination of electronics and optics to cultivate an advantage over new entrants. In addition, the odds ratios for the two physics section codes were higher than those for the electronics section code in all periods. These results show that incumbent firms’ technological capabilities in physics provide greater competitive advantage than new entrants’ technological capabilities in electronics.

Regarding the combination of all three IPC codes, incumbent firms exceeded new entrants between 1995 and 1999. For the combination of the two physics codes, incumbents had an advantage, whereas for the combination of the electronics code with another code, incumbents had an advantage after 1995–1999.

Discussion

Type of innovation, technological integration process in product architecture, and market of three digital cameras

This study shows that the size of the entry barrier to a market, degree of technological maturity, speed of manufacturing information leakage, and intensity of market competition differ in each of the three digital camera markets with different product architectures. Additionally, incumbents and new entrants differ in the technological areas to which they allocate their R&D resources. The analysis reveals that the characteristics of product architecture, namely, whether an integral process is required in design and manufacturing, influence incumbent firms’ ability to obtain a sustainable competitive advantage. In this section, the results are discussed in relation to the research purpose, and modular innovation is put forward as a strategic choice of product architecture for incumbents that could lead to a sustainable competitive advantage in their market.

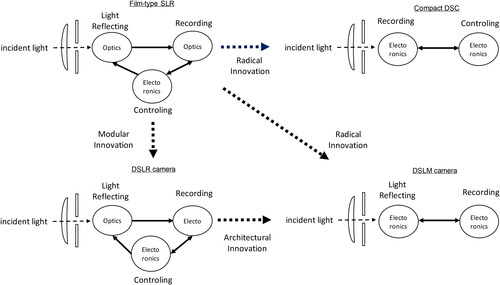

The differences in the product architecture of the three types of digital cameras are interpreted according to three product components: memory, control device, and light reflection. The interrelationships among these components and the main technologies applied to them are shown in . The DSLR camera was developed by replacing the memory from film in the film-type SLR camera with electronics; thus, the DSLR camera is a modular innovation. The compact DSC was developed by replacing film with electronic memory and removing the mirror box that reflects light; thus, the compact DSC is a radical innovation of the film-type SLR camera. The DSLM camera was developed by removing the mirror box from the DSLR camera and is thus an architectural innovation of the DSLR camera and a radical innovation of the film-type SLR.

Most analog components of the film-type SLR camera remain in the architecture of the DSLR camera, whereas some have been replaced by digital components. Unlike the DSLM camera and compact DSC, which mostly do not have optical components, the DSLR camera is most similar to the film-type SLR camera in terms of its architecture. In addition, DSLR and DSLM cameras have interchangeable lenses, whereas compact DSCs do not. Therefore, in terms of their similarity to the film-type SLR camera, the order of the architecture of these cameras is DSLR camera, DSLM camera, and compact DSC.

The prices of these products vary, and their markets are clearly segmented. The DSLR camera targets users in high- and semi-high-end markets, such as professional photographers, journalists, and individuals who love photography. The compact DSC targets users in the low-end market, and the DSLM camera is ranked midway between these markets.

Incumbent firms’ product/technology imitation deterrence for new entrants in the digital imaging industry depends on product architecture, especially the integration of new and old technologies in the development and production processes to help maintain high product market performance. Generally, shifts in knowledge generation involve the integration of external knowledge into the industry’s knowledge base (Huenteler et al., Citation2016). The patent analysis shows that incumbent firms have an advantage in exploiting the technological knowledge acquired from past production activities. If incumbent firms can exploit this knowledge, in combination with new knowledge, for product development in ways that entrants cannot imitate, they are likely to enjoy advantages in the new product market. Integrating old and new knowledge contributes to the development of high-quality products and can sow the seeds of innovation (Chesbrough, Citation2006).

In the digital imaging industry, Canon and Nikon maintain a large share of the DSLR camera market. As incumbent firms, they accumulated technological knowledge of and capabilities for integral optics and electronics processes through their past R&D activities in designing and manufacturing film-type SLR cameras. Thus, they were able to surpass the high entry barriers in the DSLR camera market with high image quality requirements. As the patent data analysis shows, the technological capability of new entrants lies in electronics, and they do not possess the requisite knowledge of the integrality between optics and electronics. Most new entrants cannot enter or perform well in the DSLR camera market and subsequently withdraw because they cannot satisfy the user demand for high image quality. For example, Panasonic could not achieve the same high image quality as Canon and Nikon, particularly with respect to mirror adjustment, and was criticized by users for its low image quality. In sum, entry into the DSLR camera market was competence-enhancing for incumbent firms but competence-destroying for new entrants. When the firms launched new products, the product architecture, including the components, modules, and interfaces, was restricted by the firms’ past R&D experience. In other words, the markets that they could enter were also restricted.

Firms’ market performance data show that the technological area of firm investment in R&D activities in the past affected not only the firms’ product features (Benner & Tripsas, Citation2012) but also their market performance. If firms can exploit the technological knowledge that they acquired through past R&D activities, they can still perform well in the new product market. However, if firms do not possess the required technological knowledge, they cannot enter the new product market, or if they could, they will perform poorly. Most firms with large market shares in the DSLR camera market have experience manufacturing film-type SLR cameras, whereas new entrants without such experience withdrew from the market because they did not possess incumbents’ level of knowledge about optics and the integrality between optics and electronics. Except for Sony, Japanese new entrants could not achieve a high level of image quality in the DSLR camera market and thus withdrew eventually.

The presence of an integral technological process in new product development and production is also related to the intensity of price competition, progress in manufacturing outsourcing, and speed of modularization. Generally, when entry barriers are low and the market is attractive to new entrants, competition intensifies among firms, resulting in harsher product and price competition. In the digital imaging industry, the price competition in the DSLR camera market is moderate, with a few firms enjoying monopolistic benefits. Consequently, the competition in the other two product markets, which are easier to enter, is fiercer.

Furthermore, as price competition increases, design firms outsource manufacturing to OEMs to reduce manufacturing costs. In a mature industry, design firms opt for lower costs to survive price competition at the expense of product differentiation from rival design firms. However, design firms’ manufacturing outsourcing to OEMs has not significantly progressed in the DSLR camera market, relative to the other two markets, for two reasons. First, only engineers with high expertise in optics and electronics can design and manufacture DSLR cameras. Second, design firms tend to protect their technological knowledge and skills, which benefit them in the assembly process, from being leaked to rival firms. Hence, the information and technological skills for manufacturing DSLR cameras have not been shared or leaked among firms, and only a few firms have monopolized the DSLR camera industry. Generally, when the technological knowledge utilized in product development is tacit, complex, and firm-specific, it lends the firm a competitive advantage (McEvily & Chakravarthy, Citation2002). Therefore, by guarding their technological knowledge and skills, incumbents in the DSLR camera market prevent product and process imitation and maintain a long-term competitive advantage.

Additionally, under fierce price competition, firms’ cost reduction requirements demand product modularity. Price competition and manufacturing outsourcing enhance product modularity, and many firms participate in product development competition. Modularity encourages firms to focus on economies of scale and incremental innovation, resulting in harsh price competition, imitation, and commoditization (Brusoni et al., Citation2001; Chesbrough & Kusunoki, Citation2001; Christensen & Raynor, Citation2003; Fixson & Park, Citation2008; Pil & Cohen, Citation2006). Incumbents have an advantage in exploiting the technological knowledge of old products acquired from past activities. For new product development, if incumbents could exploit such knowledge in combination with new knowledge, they would enjoy more advantages in the new product market than new entrants would. In addition, products with integral architecture are easier to differentiate in the development, design, and manufacturing processes than those with modular architecture to avoid imitation by rivals. Therefore, if incumbents develop a product with integral process by utilizing existing and new technological knowledge, they could achieve sustainable competitive advantage in the market (Magnusson & Werner, Citation2022). In the digital imaging industry, incumbents such as Canon and Nikon have won and maintained a large share of the DSLR camera market. They have advantages in the integral process of optics with electronic components for manufacturing a DSLR camera, a process that is difficult for most new entrants.

In summary, modular innovation in a mature industry could lead to decreased modularity and a sustainable competitive advantage for incumbents. Products with modular architecture comprise interchangeable components and interfaces. To replace old components with new components that apply new technologies, incumbents can engage in modular innovation, utilize old technological knowledge accumulated from their past design and manufacturing experience, and integrate new and existing knowledge into manufacturing products (Bergek et al., Citation2013). Furthermore, if the integration process requires specific technological knowledge from firms, only incumbents that possess integral knowledge and skills related to old and new technologies can design and manufacture products; meanwhile, new entrants cannot imitate the design and manufacture of such high-quality products. Therefore, such innovation leads to re-integration (Fixson & Park, Citation2008), prevents imitation from new entrants, and offers a sustainable competitive advantage to incumbents.

New entrants’ strategy

Sony is the only new entrant to have survived in the DSLR market. Ranked third in terms of market share, it applied for more optics patents than other new entrants. To expand the DSLR camera business, Sony acquired an imaging unit from Konica Minolta to compensate for its lack of optics knowledge and obtained licenses from the latter’s patents and engineers who possessed the technological knowledge required for designing and manufacturing DSLR cameras. Acquisition from other firms is one way to change a firm’s resource structure and overcome its lack of knowledge (Karim & Mitchell, Citation2000).

In addition, Sony selected and focused on resource allocation and reformed its organizational structure. A digital imaging department was established by separating the unit from the home electronics network company. In its subsequent restructuring in 2013, Sony consolidated its digital imaging and video camera departments for R&D synergies between DSLR cameras, compact DSCs, and video camera technologies. Thus, Sony overcame difficulties in DSLR camera manufacturing and optics R&D through acquisition and organizational restructuring.

Conceptual implications

The case study highlights the lack of discussion in previous research. First, a common perception in innovation studies is that the more the product architecture of an innovation differs from that of an existing product, the more competence-destroying it is for incumbents. However, this approach is not always feasible. In the digital imaging industry, the product architecture of the compact DSC and DSLM camera is significantly different from that of the film-type SLR camera, the architecture of which is similar to that of the DSLR camera. Nevertheless, these products were not competence-destroying innovations for the incumbent firms Canon and Nikon. By contrast, manufacturing DSLR cameras was competence-destroying for new entrants.

Furthermore, even if a newly developed product is an architectural innovation, rival firms immediately enter the market, thus intensifying market competition, especially if the innovator does not exploit its firm-specific technological knowledge in product development. Despite Panasonic’s innovation of the DSLM camera, many incumbent firms and new entrants entered this market. Consequently, Panasonic could not sustain its competitive advantage in the DSLM market. Therefore, a firm’s market performance is defined not by the degree of change in product architecture but by whether the firm possesses and encapsulates the firm-specific technological knowledge required to manufacture the new product.

Second, innovations in the digital imaging industry partly contradict the existing definitions of innovation. Previous research has noted that firms must possess knowledge of at least one architectural component to achieve modular innovation (Henderson & Clark, Citation1990; Popadiuk & Choo, Citation2006). However, in the digital imaging industry, although the DSLR camera is a modular innovation developed by replacing the film in the film-type SLR camera with digital memory, the interface between the existing optical and new electronic components had to be newly designed owing to the interchangeable memory in development. By changing the core concept, the manner of interaction between the new components, core concepts, and existing components may change. Thus, redesigning the development interface can provide firms with a sustainable competitive advantage. This case pattern is consistent with the opinion that new digital technologies in existing products are inherently modular (Baldwin, Citation2023). Modular innovation occasionally requires a firm to integrate new and existing components into the assembly process, and the interfaces between the components must change according to the replaced components.

However, if innovation is not based on firm-specific integral technological knowledge in design and manufacturing, new products have high imitability and low market entry barriers, thus shifting the market conclusively toward price competition and modularity. In the digital imaging industry, numerous followers have entered the DSLM camera market, making it more competitive than the DSLR camera market. Therefore, the imitability by rivals in new product development/manufacturing depends not on the degree of change but on firm-specific technological capabilities and components combining new and old technologies in product architecture.

Practical implications

In many mature industries, the modularization of product architecture has recently progressed to varying degrees, even for products with complex architectures, such as automobiles and precision electronic devices. In accordance with the modularization of an industry, many incumbents move into the integrality trap.

One strategy to avoid the integrality trap is the ‘encapsulation’ (Baldwin & Clark, Citation2006) of each component. In this strategy, the firm exploits the optimal balance between quality, function, and price for a component and encloses this knowledge in a black box to maintain its sustainable competitive advantage. Previous literature has shown that this strategy is effective for parts makers but is not always effective for assembly makers that retain their competitive advantage in product differentiation.

The DSLR camera was developed by incumbents and offers sustainable competitive advantages to innovators. This product requires the interaction of components that are based on new and existing technologies in product architecture and their integration into the manufacturing process.

In summary, developing a new integral product through modular innovation is an effective strategy for incumbents suffering from harsh price competition in a commoditizing market. By replacing existing components with new ones and linking them in new ways in products with modular architecture, incumbents can achieve modular innovation by exploiting their existing knowledge. In addition, if an integral process exists in the combination of old and new technologies in product design and manufacturing and if the manner of interaction between these components is encapsulated, then incumbents can achieve a sustainable competitive advantage in the market because they can utilize their creative accumulation (Fixson & Park, Citation2008) and prevent imitation from rivals, including new entrants. Modular innovation is a strategic choice of product architecture that could lead to the dematurity of the industry and to a sustainable competitive advantage for incumbents. In addition, this strategy is certainly effective for final assembly manufacturers with architectural knowledge of existing products.

Conclusion

This study shows that product architectural design defines incumbent firms’ imitation deterrence strategies for new entrants, the size of market entry barriers, and the intensity of market competition. If incumbent firms can arrange and encapsulate a new product with integral processes of new and old technologies acquired from past manufacturing experience, they can prevent imitation by new entrants and enjoy monopolistic benefits. Modular innovation is a product architecture strategy that leads to reintegration in an industry.

This study has a few limitations. First, the data analyzed are old and do not provide complete guidance on the sources of sustainable competitive advantage for companies and the product design needed for the current and future imaging industry. This study aimed to analyze the relationship between the differences in product architecture and the intensity of market competition and industry structure, targeting three types of cameras, each with a different product architecture. Therefore, the selection of cases was restricted to a previous time period. Additionally, more patent data are required for a more sophisticated analysis of firms’ technological knowledge and behaviors. Future efforts should consider other countries’ patent applications to test foreign firms, especially for long time-series analyses. Using a more detailed technological categorization in the analysis would help observe technological trends in the industry.

Second, as an analytical limitation, the results of the case study should be demonstrated using samples from multiple firms. Next, we should identify industries other than the digital imaging industry to verify the effects and impacts of modular innovation on the performance of industries and incumbents.

Third, the case study should be developed further from the perspectives of customers and markets. This study focuses on the technological aspect of innovation, and this issue must thus be analyzed from the viewpoint of the effects of innovation on customer needs. According to Benner and Tripsas (Citation2012), focusing on product features and consumer demand for each product is the next step in combining a firm’s technology and market information.

Finally, for practical applications, a discussion on management is necessary, especially regarding how firms acquire the technological knowledge they need. This study does not cover how firms restructure their organizations or redesign communication among departments when they enter a new product market and need to innovate.

Disclosure statement

No potential conflict of interest was reported by the author(s).

Data availability statement

The data that support the findings of this study are openly available in J-PlatPat, at https://www.j-platpat.inpit.go.jp/.

Additional information

Funding

Notes on contributors

Tomomi Hamada

Tomomi Hamada (PhD in Economics) is an Associate Professor at the Faculty of Graduate School of Management, Chukyo University, Japan. Her research interests include technology management, business strategy, and human resource management for inventors.

References

- Ansari, S. S., & Krop, P. (2012). Incumbent performance in the face of a radical innovation: Towards a framework for incumbent challenger dynamics. Research Policy, 41(8), 1–19. https://doi.org/10.1016/j.respol.2012.03.024

- Arthur, B. W. (2009). The nature of technology: What it is and how it evolves. Free Press.

- Argyres, N., Bigelow, L., & Nickerson, J. A. (2015). Dominant designs, innovation shocks, and the follower’s dilemma. Strategic Management Journal, 36(2), 216–234. https://doi.org/10.1002/smj.2207

- Baldwin, C. Y., Clark , K. B. (2006). Complex Engineered Systems: Science Meets Technology. In Braha, D., Minai, A.A., Bar-Yam, Y., (Eds.), Modularity in the Design of Complex Engineering Systems (pp. 175, 205). New York Springer.

- Baldwin, C. Y., & Clark, K. B. (2000). Design rules: The power of modularity. MIT Press.

- Baldwin, C. Y. (2023). Design Rules: Past and Future. Industrial and Corporate Change, 32(1), 11–27. https://doi.org/10.1093/icc/dtac055

- Barney, J. (1991). Firm Resources and Sustained Competitive Advantage. Journal of Management, 17(1), 99–120. https://doi.org/10.1177/014920639101700108

- Barney, J., Ketchen, D. J., & Wright, M. (2021). Resource-based theory and the value creation framework. Journal of Management, 47(7), 1936–1955. https://doi.org/10.1177/01492063211021655

- Barney, J., & Wright, P. (1998). On becoming a strategic partner; examining the role of human resources in gaining competitive advantage. Human Resource Management, 37(1), 31–46. https://doi.org/10.1002/(SICI)1099-050X(199821)37:1<31::AID-HRM4>3.0.CO;2-W

- Benner, M. J., & Tripsas, M. (2012). The influence of prior industry affiliation on framing in nascent industries: The evolution of digital cameras. Strategic Management Journal, 33(3), 277–302. https://doi.org/10.1002/smj.950

- Bergek, A., Berggren, C., Magnusson, T., & Hobday, M. (2013). Technological discontinuities and the challenge for incumbent firms: Destruction, disruption or creative accumulation? Research Policy, 42(6-7), 1210–1224. https://doi.org/10.1016/j.respol.2013.02.009

- Birkinshaw, J. (2023). How incumbent firms respond to emerging technologies: Comparing supplyside and demand-side effects. California Management Review, 66(1), 48–71. https://doi.org/10.1177/00081256231199263

- Brusoni, S., Prencipe, A., & Pavitt, K. (2001). Knowledge specialization, organizational coupling, and the boundaries of the firm: Why do firms know more than they make? Administrative Science Quarterly, 46(4), 597–621. https://doi.org/10.2307/3094825

- Burton, N., & Galvin, P. (2018). When do product architectures mirror organisational architectures? The combined role of product complexity and the rate of technological change. Technology Analysis & Strategic Management, 30(9), 1057–1069. https://doi.org/10.1080/09537325.2018.1437259

- Cardeal, N., & Antonio, N. (2012). Valuable, rare, inimitable resources and organization (VRIO) resources or valuable, rare, inimitable resources (VRI) capabilities: What leads to competitive advantage? African Journal of Business Management, 6(37), 10159–10170. https://doi.org/10.5897/AJBM12.295

- Chen, M. J., Michel, J. G., & Lin, W. (2021). Worlds apart? Connecting competitive dynamics and the resource-based view of the firm. Journal of Management, 47(7), 1820–1840. https://doi.org/10.1177/01492063211000422

- Chesbrough, H. W. (2006). Open innovation: A new paradigm for understanding industrial innovation. In H. W. Chesbrough, W. Vanhaverbeke, & J. West (Eds.), Open innovation: Researching a new paradigm. Oxford University Press.

- Chesbrough, H. W., & Kusunoki, K. (2001). The modularity trap: Innovation, technology phase shifts, and the resulting limits of virtual organizations. In I. Nonaka & D. Teece (Eds.), Managing industrial knowledge: Creation, transfer and utilization (pp. 202–230). Sage Press.

- Christensen, C. M. (1997). The Innovator’s Dilemma: When New Technologies Cause Great Firms to Fail. Boston: Harvard Business School Press.

- Christensen, C. M., & Bower, J. L. (1996). Customer power, strategic investment, and the failure of leading firms. Strategic Management Journal, 17(3), 197–218. https://doi.org/10.1002/(SICI)1097-0266(199603)17:3<197::AID-SMJ804>3.0.CO;2-U

- Christensen, C. M., & Raynor, M. E. (2003). The innovator’s solution: Creating and sustaining successful growth. Harvard Business School Press.

- Clark, K. B., & Fujimoto, T. (1990). The power of product integrity. Harvard Business Review, 68(6), 107–118.

- Ethiraj, S. K., Levinthal, D., & Roy, R. R. (2008). The dual role of modularity: Innovation and imitation. Management Science, 54(5), 939–955. https://doi.org/10.1287/mnsc.1070.0775

- Fixson, S. K., & Park, J. (2008). The power of integrality: Linkages between product architecture, innovation, and industry structure. Research Policy, 37(8), 1296–1316. https://doi.org/10.1016/j.respol.2008.04.026

- Furr, N., & Eisenhardt, K. (2021). Strategy and uncertainty: Resource-based view, strategy creation view, and the hybrid between them. Journal of Management, 47(7), 1915–1935. https://doi.org/10.1177/01492063211011760

- Gilbert, C. G. (2005). Unbundling the structure of inertia: Resource versus routine rigidity. Academy of Management Journal, 48(5), 741–763. https://doi.org/10.5465/amj.2005.18803920

- Hannan, M. T., & Freeman, J. (1984). Structural inertia and organizational change. American Sociological Review, 49(2), 149–164. https://doi.org/10.2307/2095567

- Henderson, R. M., & Clark, K. B. (1990). Architectural innovation: The reconfiguration of existing product technologies and the failure of established firms. Administrative Science Quarterly, 35(1), 9–30. https://doi.org/10.2307/2393549

- Huenteler, J., Ossenbrink, J., Schmidt, T. S., & Hoffmann, V. H. (2016). How a product’s design hierarchy shapes the evolution of technological knowledge—Evidence from patent-citation networks in wind power. Research Policy, 45(6), 1195–1217. https://doi.org/10.1016/j.respol.2016.03.014

- Kang, H., & Song, J. (2017). Innovation and recurring shifts in industrial leadership: Three phases of change and persistence in the camera industry. Research Policy, 46(2), 376–387. https://doi.org/10.1016/j.respol.2016.09.004

- Karim, S., & Mitchell, W. (2000). Path-dependent and path-breaking change: Reconfiguring business resources following acquisitions in the U.S. medical sector, 1978–1995. Strategic Management Journal, 21(10-11), 1061–1081. https://doi.org/10.1002/1097-0266(200010/11)21:10/11<1061::AID-SMJ116>3.0.CO;2-G

- Kraaijenbrink, J., Spender, C., & Groen, J. (2010). The resource-based view: A review and assessment of its critiques. Journal of Management, 36(1), 349–372. https://doi.org/10.1177/0149206309350775

- Lavie, D. (2006). Capability reconfiguration: An analysis of incumbent responses to technological change. Academy of Management Review, 31(1), 153–174. https://doi.org/10.5465/amr.2006.19379629

- Leonard-Barton, D. (1992). Core capabilities and core rigidities: A paradox in managing new product development. Strategic Management Journal, 13(S1), 111–125. https://doi.org/10.1002/smj.4250131009

- Magnusson, T., Lindström, G., & Berggren, C. (2003). Architectural or modular innovation? Managing discontinuous product development in response to challenging environmental performance targets. International Journal of Innovation Management, 07(01), 1–26. https://doi.org/10.1142/S1363919603000714

- Magnusson, T., & Werner, V. (2022). Conceptualisations of incumbent firms in sustainability transitions: Insights from organisation theory and a systematic literature review. Business Strategy and the Environment, 32(2), 903–919. https://doi.org/10.1002/bse.3081

- Mahmood, T., & Mubarik, M. S. (2020). Balancing innovation and exploitation in the fourth industrial revolution: Role of intellectual capital and technology absorptive capacity. Technological Forecasting and Social Change, 160, 120248. https://doi.org/10.1016/j.techfore.2020.120248

- Meissner, D., Burton, N., Galvin, P., Sarpong, D., & Bach, N. (2021). Understanding cross border innovation activities: The linkages between innovation modes, product architecture and firm boundaries. Journal of Business Research, 128, 762–769. https://doi.org/10.1016/j.jbusres.2019.05.025

- McEvily, S. K., & Chakravarthy, B. (2002). The persistence of knowledge-based advantage: An empirical test for product performance and technological knowledge. Strategic Management Journal, 23(4), 285–305. https://doi.org/10.1002/smj.223

- Oliver, C. (1997). Sustainable competitive advantage: Combining institutional and resource-based views. Strategic Management Journal, 18(9), 697–713. https://doi.org/10.1002/(SICI)1097-0266(199710)18:9<697::AID-SMJ909>3.0.CO;2-C

- Orton, J. D., & Weick, K. E. (1990). Loosely coupled systems: A reconceptualization. The Academy of Management Review, 15(2), 203–223. https://doi.org/10.2307/258154

- Pil, F. K., & Cohen, S. K. (2006). Modularity: Implications for imitation, innovation, and sustained advantage. Academy of Management Review, 31(4), 995–1011. https://doi.org/10.5465/amr.2006.22528166

- Popadiuk, S., & Choo, C. W. (2006). Innovation and knowledge creation: How are these concepts related? International Journal of Information Management, 26(4), 302–312. https://doi.org/10.1016/j.ijinfomgt.2006.03.011

- Rothaermel, F. T., & Hill, C. W. (2005). Technological discontinuities and complementary assets: A longitudinal study of industry and firm performance. Organization Science, 16(1), 52–70. https://doi.org/10.1287/orsc.1040.0100

- Priem, R. L., & Butler, J. E. (2001). Is the resource-based “view” a useful perspective for strategic management research? The Academy of Management Review, 26(1), 22–40. https://doi.org/10.2307/259392

- Sanchez, R., & Mahoney, J. (1996). Modularity, flexibility, and knowledge management in product and organizational design. Strategic Management Journal, 17(S2), 63–76. https://doi.org/10.1002/smj.4250171107

- Tripsas, M., & Gavetti, G. (2000). Capabilities, cognition, and inertia: Evidence from digital imaging. Strategic Management Journal, 21(10-11), 1147–1161. https://doi.org/10.1002/1097-0266(200010/11)21:10/11<1147::AID-SMJ128>3.0.CO;2-R

- Tushman, M. L., & Anderson, P. (1986). Technological discontinuities and organizational environments. Administrative Science Quarterly, 31(3), 439–465. https://doi.org/10.2307/2392832

- Ulrich, K. (1995). The role of product architecture in the manufacturing firm. Research Policy, 24(3), 419–440. https://doi.org/10.1016/0048-7333(94)00775-3

- Utterback, J. (1994). Mastering the Dynamics of Innovation: How Companies Can Seize Opportunities in the Face of Technological Change. Harvard Business School Press.

- Wu, B., Wan, Z., & Levinthal, D. A. (2014). Complementary assets as pipes and prisms: Innovation incentives and trajectory choices. Strategic Management Journal, 35(9), 1257–1278. https://doi.org/10.1002/smj.2159

- Zajac, E. J., & Bazerman, M. H. (1991). Blind spots in industry and competitor analysis: Implications of interfirm (mis)perceptions for strategic decisions. The Academy of Management Review, 16(1), 37–56. https://doi.org/10.2307/258606