Abstract

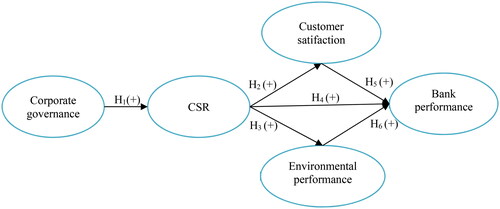

This study aims to estimate the effect of corporate governance on the performance of commercial banks in Vietnam. By using the qualitative method (interview and survey of experts) and the quantitative method (PLS-SEM data analysis using SmartPLS4), the findings confirm the direct effect of corporate governance on corporate social responsibility (CSR). In addition, this study highlights the indirect correlation between CSR and bank performance via two mediators: customer satisfaction and environmental performance. Based on these findings, commercial bank managers must recognize the significance of corporate governance and CSR and implement effective corporate governance mechanisms to enhance practical performance.

Reviewing Editor:

1. Introduction

Joseph and Tranos (Citation2018) asserted that corporate governance pertains to the processes, systems, controls, accountabilities, and decision-making of an organization, thereby holding significant importance. Investors utilize corporate governance mechanisms to exert control over insider management (Indraneel, Citation2010). Corporate governance best practices are useful in controlling and directing a firm in the best interests of its owners and stakeholders, as corporate governance represents decision-making and its application (Bhagat & Bolton, Citation2008).

The core principles of corporate governance revolve around internal and external issues. Internal governance primarily involves management, which serves as a shareholder. Conversely, external governance stems from a firm’s need to raise its capital. The intricacy of the corporate governance concept centers on values that include responsibility (Joseph & Tranos, Citation2018).

Performance and responsibility encompass various facets within theories such as agency theory, ethical theory, stakeholder theory, and CSR. Corporate Governance and CSR underscore the importance of ethics and morals in the firms (Sharma, Citation2022). According to Hunjra et al. (Citation2024), corporate governance plays a crucial role as it represents the relationship between the board of directors, management, owners, and stakeholders (Bhasin & Shaikh, Citation2013). Moreover, it signifies the organization’s responsiveness to all stakeholders’ concerns (Farooq et al., Citation2021).

Adhering to good corporate governance practices ensures that firms are shielded from anticipated financial distress in the future (Bauwhede, Citation2009) and helps them achieve their financial objectives (Vu et al., Citation2018). Furthermore, effective corporate governance is essential for the stability of the financial system and for preventing financial crises, particularly in the banking sector (Komath et al., Citation2023).

Farooq et al. (Citation2021) find that listed firms’ disclosure practices improve with better corporate governance, particularly materiality assessment disclosures. Consequently, efficient corporate governance encourages financial institutions to become more responsible for shareholders (Gennaioli et al., Citation2013). CSR has been noted as the development of good governance (Jo & Harjoto, Citation2012), where companies with better governance are often found to be more socially responsible (Ntim & Soobaroyen, Citation2013).

The relationship between corporate governance, CSR, and firm performance has been extensively researched, yielding inconsistent findings (Ledi & Ameza-Xemalordzo, Citation2023; E. G. Xu et al., Citation2022). The relationships between CSR, CG, and FP are still largely inconclusive (Siddiqui et al., Citation2023; E. G. Xu et al., Citation2022; Ye et al., Citation2021).

The author also discovered the intercorrelation between these factors and filled this gap by investigating these indirect relationships in the research model. Specifically, the effect of corporate governance on bank performance is mediated by CSR, customer satisfaction, and environmental performance. Therefore, existing studies examine the effect of corporate governance on bank performance by considering mediating factors, including CSR, customer satisfaction, and environmental performance. Hence, to achieve this objective, this study aims to answer the research question ‘Do CSR, customer satisfaction, environmental performance intervene the relationship of corporate governance and bank performance in Vietnamese commercial banks?’.

The remainder of this article is structured as follows: The subsequent section reviews the development of relevant theories and hypotheses. The following sections present our methodology. Subsequently, the analysis and findings derived from the empirical studies are outlined. Finally, the article concludes with a summary of the findings and an exploration of their limitations.

2. Literature review and hypothesis development

2.1. Literature review

According to Fama and Jensen (Citation1983), a company’s division of control and ownership generates agency costs because of divergent and conflicting interests between shareholders and management. These agency costs tend to be high, particularly in organizations with widely dispersed share ownership, such as commercial banks. Consequently, shareholders seek increased information disclosure in order to facilitate monitoring. This scenario underscores the importance of robust corporate governance mechanisms (Joseph & Tranos, Citation2018). In this theory, besides corporate governance, CSR is another way to reduce agency conflicts, agency costs, and information asymmetry (Tops, Citation2017). It is expected that better and more transparent CSR disclosures can reduce companies’ agency problems the company faces (Eriqat et al., Citation2023; Ratmono et al., Citation2021).

As elucidated by Jansson (Citation2005), stakeholder theory underscores the interconnectedness of a firm’s diverse stakeholders, including investors, customers, employees, and suppliers. This theory asserts that an organization should generate value for its shareholders and all stakeholders affected by its decisions, as noted by Bonnafous-Boucher and Rendtorff (Citation2016). It emphasizes the responsibility of managers to uphold accountability toward these parties to safeguard their interests.

Given the pivotal role of stakeholders in the success of CSR practices, enterprises should adopt strategies that effectively engage key stakeholders to enhance operational efficiency. Stakeholder theory posits that an organization’s core purpose is to cultivate relationships and augment value for all stakeholders, irrespective of variations in their numbers, depending on the industry and business model of the company. According to Freeman and Dmytriyev (Citation2017), these stakeholders hold equal significance and there should be no compromise between them. Instead, executives must devise strategies to reconcile divergent interests.

According to Nikolova and Arsić (Citation2017), CSR aligns with stakeholder theory to maximize benefits in terms of societal development, and contributes to fostering a motivated workforce, enhancing company branding, increasing sales and profitability, and ensuring customer satisfaction. Consequently, CSR has emerged as a fundamental aspect of corporate responsibility that facilitates the success of various stakeholders. Harrison et al. (Citation2019) further utilize stakeholder theory to underscore the benefits of CSR, emphasizing the repercussions when a company neglects its CSR obligations. Both stakeholder theory and CSR underscore the significance of a company’s responsibility to its community and society. While stakeholder theory emphasizes the importance of nurturing relationships and fostering value between the firms and their diverse stakeholders, CSR underscores positive impacts on society (Freeman & Dmytriyev, Citation2017).

Gulema and Roba (Citation2021) confirm that CSR can facilitate firms in various ways if handled appropriately. According to Hart (Citation1995), a deeper level of social and environmental strategy may facilitate the development of rare organizational capabilities and explore new markets that contribute to companies’ sustained competitive advantage. CSR includes environmental CSR (ECSR), which mostly focuses on corporate governance (Mazurkiewicz, Citation2005; Williamson et al., Citation2006), environmental performance (Moon & deLeon, Citation2007). Certain types of CSR practices reflect companies’ efforts to establish trust-based and cooperative firm-stakeholder relationships, which could add value to their financial and social performance (Barnett, Citation2007; Maqbool & Zameer, Citation2018; Yoon & Chung, Citation2018). Moreover, CSR can be regarded as a public relations effort. It adds value to firms by stabilizing and maintaining good corporate performance, reducing environmental impact, and strengthening company and regulatory body relationships to reduce the regulatory burden on firms.

The extant study emphasized the significant growth in concern about CSR in recent decades, and many theoretical and empirical studies have focused on the consequences of CSR, linking CSR with corporate financial performance, consumer loyalty, and corporate reputation (Brammer & Pavelin, Citation2006; Orlitzky et al., Citation2003). In contrast, strikingly inadequate attention has been paid to the antecedents of socially responsible or irresponsible corporate behavior.

2.2. Empirical studies

The research conducted by J. Xu and Jin (Citation2022) examined how CSR acts as a mediator between corporate governance and firm performance. Their results underscore the importance of CSR in moderating the link between corporate governance and firm performance, a role that varies between family- and non-family owned firms.

Siddiqui et al. (Citation2023) investigated the influence of corporate governance and corporate reputation on the disclosure of CSR and its impact on firm performance. They found a noteworthy effect of CSR disclosure on corporate reputation, particularly enhancing firm performance.

Ledi and Ameza-Xemalordzo (Citation2023) explored the correlation between corporate governance and CSR and their impact on the performance of manufacturing companies through corporate image.

Ali et al. (Citation2020) and Cherian et al. (Citation2019) determine the impact of CSR on financial performance. However, the study by Ali et al. (Citation2020) have considered the mediators of corporate image and customer satisfaction in the relationship between CSR and firm performance.

Anh and Phuong Thao (Citation2021) investigate the relationship between CSR and customer loyalty in Vietnam. By constructing a structural model, the authors demonstrated that correlations between the relationships in the model were statistically significant. The study identified several factors that impact customer loyalty, with customer engagement, trust, and satisfaction being the most influential in descending order. These findings suggest that CSR strongly influences customer trust. Furthermore, this study revealed that CSR, customer engagement, trust, and satisfaction collectively exert interdependent and positive effects on customer loyalty.

In brief, most empirical studies focus on the relationship between corporate governance, CSR, and firm performance. Some have explored the role of mediators or moderators in the CSR-performance relationship. However, few studies focus on the impact of CSR on the banking sector. Remarkably, there has been less focus on examining the relationship between corporate governance and CSR, as well as their effect on commercial bank performance via customer satisfaction and environmental performance.

2.3. Hypothesis development

2.3.1. Corporate governance affects CSR

Bolourian et al. (Citation2021) acknowledged the relationship between corporate governance and CSR. CSR has been noted as the development of good governance (Jo & Harjoto, Citation2012), where companies with better governance are often found to be more socially responsible (Ntim & Soobaroyen, Citation2013).

While corporate governance is the force behind CSR aims and objectives in organizations (Jamali et al., Citation2008), the board of directors, as a core element of corporate governance (Eccles et al., Citation2014) are responsible for achieving and monitoring set aims and objectives (Bolourian et al., Citation2021).

Friedland and Jain (Citation2022) attempt to explain how the concepts of corporate governance and CSR are interlinked. In particular, studies such as Aboud and Yang (Citation2022), Bolourian et al. (Citation2021), and Zaman et al. (Citation2022) demonstrate that CSR is a function of corporate governance. Thus, corporate governance positively affects CSR.

Based on these arguments, the following hypothesis is proposed:

H1: Corporate governance has a positive effect on CSR at Vietnamese commercial banks.

2.3.2. CSR and customer satisfaction

According to Luo and Bhattacharya (Citation2006), CSR is the driving force behind satisfaction in large companies with a rising market value (Rhou et al., Citation2016). Customer satisfaction can be influenced by CSR (Martínez & Del Bosque, Citation2013).

Rashid et al. (Citation2013) state that CSR encompasses initiatives aimed at benefiting customers in various ways. These include ensuring product and service quality, offering affordable prices, maintaining an efficient distribution system, addressing customer complaints, respecting customer privacy rights, and engaging in charity and environmental protection activities. In essence, CSR strategies encompass all efforts geared toward enhancing customer satisfaction. Based on this discussion, we propose the following hypothesis:

H2: CSR has a positive impact on customer satisfaction at Vietnamese commercial banks.

2.3.3. The relationship between CSR and environmental performance

As mentioned above, CSR includes ECSR, which is considered the duty to cover the environmental implications of the company’s operations, products, and facilities, eliminating waste and emissions, maximizing the efficiency and productivity of its resources, and minimizing practices that might adversely affect the enjoyment of the country’s resources by future generations (Chuang & Huang, Citation2018; Rahman & Post, Citation2012).

With the rise of environmental awareness in the past, especially in Vietnam, enterprises have been increasingly required to comply with international treaties and regulations on environmental issues, which aim to increase firm value. Environmental performance encompasses internal and external efforts, environmental ethics, and values surrounding developmental concerns (Chuang & Huang, Citation2018; Wu et al., Citation2020). They showed that ecological performance measures address environmental concerns, including internal systems, diverse stakeholder interactions, limiting external consequences, and compliance with environmental rules.

Kao et al. (Citation2010) defined environmental performance as a company’s contentment with its current efforts to diminish pollution and cut production expenses, its satisfaction with ongoing endeavors to lessen environmental penalties, its satisfaction with initiatives enhancing community relations, and its satisfaction with measures aimed at bolstering its environmental protection image (Chuang & Huang, Citation2018),

Chuang and Huang (Citation2018) explore the relationship between environmental CSR and environmental performance, mediated by green information technology structural capital and green information technology relational capital. Kraus et al. (Citation2020) demonstrated that CSR has no significant direct influence on environmental performance.

Based on the above arguments, the author proposes the hypothesis is:

H3: CSR has a positive effect on environmental performance at Vietnamese commercial banks.

2.3.4. CSR and bank performance

As proposed by Freeman (Citation1984), stakeholder theory suggests a favorable relationship between CSR and firm performance, asserting that CSR efforts lead to stakeholder satisfaction, thereby bolstering external trust in firms. Moreover, the implementation of CSR practices is deemed advantageous for banks because it can enhance customer relations and overall performance (Fornell et al., Citation2006). Carroll and Shabana (Citation2010), building upon the insights of Kurucz et al. (Citation2008), elaborate on how CSR activities can positively impact performance. These activities mitigate the costs and risks associated with CSR adoption by reducing exposure to environmental regulations, averting negative societal reactions, and providing tax benefits.

Birindelli et al. (Citation2013) confirm that CSR in banks also attempts to manage activities, including credit granting and asset management, to limit and mitigate default risks that significantly affect society and the environment; hence, performance improves. Furthermore, Esteban-Sanchez et al. (Citation2017) and Nizam et al. (Citation2019) confirm that bank CSR is positively associated with financial performance.

From the points of view mentioned above, the following hypothesis is proposed:

H4: CSR has a positive impact on bank performance at Vietnamese commercial banks.

2.3.5. Customer satisfaction and bank performance

In various research models that focus on customer satisfaction, a common finding emerges: satisfaction positively influences customer loyalty, enhances overall customer satisfaction, and improves bank performance. Additionally, studies such as Eklof et al. (Citation2020) have demonstrated that customer satisfaction significantly impacts bank performance. Furthermore, it has been observed that customer satisfaction can serve as a reliable predictor of future performance, as the satisfaction index from previous year’s influences financial performance in subsequent years.

The following hypothesis is proposed:

H5: Customer satisfaction has a positive impact on the bank performance at Vietnamese commercial banks.

2.3.6. Environmental performance and bank performance

The conventional perspective suggests that, while adhering to environmental regulations, allocating resources to nonproductive anti-pollution measures alongside reduced investment in productive equipment can diminish productivity (Conrad & Morrison, Citation1985). Some studies indicate that environmental performance does not notably impact firm performance (Darnall et al., Citation2008). However, the contemporary viewpoint contends that robust corporate environmental performance can effectively curb energy consumption and waste generation, thereby facilitating cost savings for firms and enhancing their financial performance (Sánchez-Medina et al., Citation2015).

The following hypothesis is proposed:

H6: environmental performance has a positive impact on the bank performance at Vietnamese commercial banks.

3. Methodology and proposed model

3.1. Sample

According to Hair et al. (Citation2017), the minimum sample size should be between 100 and 150. Information collection was conducted from March 2022 to September 2022. A questionnaire was distributed to 320 respondents working in commercial banks in Vietnam, including top managers, finance managers, chief accountants, and employees. A total of 320 questionnaires were distributed among the responders via simple random sampling, resulting in 305 questionnaires being returned. However, 15 were excluded because of incomplete records. Thus, 300 questionnaires were deemed suitable for the analysis, achieving a response rate of 93.75% ().

3.2. Research model

3.3. Research methods

The study comprises three stages employing both qualitative and quantitative methodologies.

In the first stage, qualitative methods, such as expert interviews and customer surveys, are utilized to refine and supplement the observation variables in preliminary scales. The outcomes of the group discussions form the primary scale. Subsequently, the author formulated an interview questionnaire and conducted surveys to develop the formal questionnaire. Qualitative methods are employed to identify relevant factors in the current sector through interviews with ten experts from commercial banks. A group discussion involving 50 surveyed staff members was convened to fine-tune appropriate factor scales, aiming to enhance the reliability of the survey questions (Dawadi et al., Citation2021).

In the second stage, convenience sampling was employed to randomly survey participants. Finally, quantitative research methods were employed, utilizing SmartPLS 4 to assess the proposed hypotheses through measurement and structural models. Quantitative analyses were conducted to evaluate the impact of corporate governance on CSR and its influence on bank performance, with customer satisfaction and environmental performance as mediators. Data were collected, coded, and screened for analysis using SmartPLS 4, with Partial Least Squares Structural Equation Modeling (PLS-SEM) utilized to predict the research findings.

4. Research results and discussions

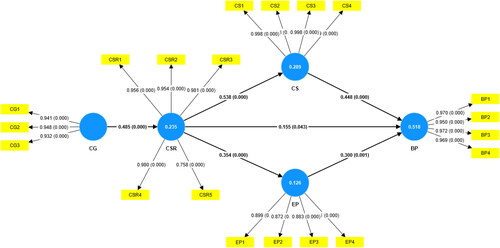

First, the measurement model was evaluated based on the indicator reliability, construct reliability, convergent validity, and discriminant validity. The reliability and validity of the constructs are presented in .

Table 1. Composite reliability.

Based on , construct reliability was tested by calculating Cronbach’s alpha and composite reliability for each construct. All constructs have Cronbach’s alpha values above 0.8, which suggests that the constructs are acceptable (Henseler et al., Citation2015). Moreover, according to Hair et al. (Citation2017), the composite reliability (CR) and AVE should be greater than 0.7 and 0.5, respectively, to establish reliability and convergent validity, respectively. All the constructs satisfy the conditions of CR and AVE, so they have reliability and convergent validity.

shows the discriminant validity assessment using the Fornell-Larcker criterion, as suggested by Fornell and Larcker (Citation1981). The Fornell-Larcker criterion is commonly used to evaluate the degree of shared variance between the latent variables of the model. The Fornell-Lacker criterion can be achieved when the square root of AVE values is higher than the assessment of (partial) cross-loadings in the same column and row, indicating that the scales have good discriminant validity.

Table 2. Fornell-Larcker criterion.

Table 3. Heterotrait-monotrait ratio (HTMT)–matrix.

Table 4. Summary of hypothesis testing.

In addition, to examine the discriminant validity using the PLS approach, values of heterotrait–monotrait correlations less than 0.900 will be acceptable (Henseler et al., Citation2015). The results demonstrate that the measurement scales were reliable and valid. As a result, the validity of the research model was established. Additionally, both the model’s predictive power and causal relationships between the variables’ constructs were statistically significant ( and ).

shows that the R-squared value for the estimated equation is 0.518, which is significant at the 1 percent level of probability. Thus, 51.8% of the variation in bank performance is described by CSR, customer satisfaction, and environmental performance.

This study determined that corporate governance statistically positively affects CSR. In particular, this study investigates the intervening role of environmental performance and customer satisfaction in the relationship between CSR and bank performance in commercial banks in Vietnam. Based on the obtained evidence, managers must realize the importance of corporate governance and CSR and apply them to increase their performance in practice.

5. Discussions

Corporate governance has a positive effect on CSR with a path coefficient of 0.485. This means that corporate governance increases by one unit, CSR can be improved by 0.485 units, and other things being equal. These findings are consistent with those of Aboud and Yang (Citation2022), Bolourian et al. (Citation2021), and Zaman et al. (Citation2022). In recent years, there has been increasing pressure on corporations to prioritize CSR, with corresponding strict legal frameworks evolving to define firms’ social obligations (Aboud & Yang, Citation2022; Filatotchev & Nakajima, Citation2014). The fulfillment of these commitments depends on a company’s competitiveness and survival capabilities to protect the interests of stakeholders. Corporate governance plays a pivotal role in helping managers and boards of directors effectively identify and meet these social responsibilities. In the financial realm, it is recognized that monitoring and regulating managerial conduct, alongside efforts in other sectors, are crucial for enhancing CSR awareness. Robust corporate governance mechanisms act as safeguards against self-serving behaviors by managers, which could harm the company.

The hypothesis testing conducted in this study reveals that CSR positively impacts customer satisfaction, environmental performance, and bank performance. As a multifaceted concept, CSR encompasses various activities that banks undertake to deliver benefits to customers while simultaneously creating value for them. As in other industries in the banking sector, CSR initiatives contribute significantly to the community’s long-term development.

Recognizing the importance of CSR, commercial banks have realized that integrating CSR into their operations is crucial for their growth. This awareness stems from increasing recognition and appreciation among customers regarding firms’ roles in societal development. Customers are susceptible to issues such as pricing, product and service quality, policies, and promotions, particularly in the consumption of intangible financial services. In response, banks are compelled to make robust commitments by embedding CSR into their organizational strategies to foster customer trust and attain a sustainable competitive advantage in the long run.

The complicated and prolonged development of the COVID-19 pandemic has seriously affected many economic sectors. However, many banks still achieve positive performance. Because banks have become more socially responsible and have stayed with and helped firms through the long pandemic, they have achieved this result. In practice, the Joint Stock Commercial Bank for Investment and Development of Vietnam (BIDV) in unfavorable conditions, its activities in 2021 have remained stable, and its performance has grown well compared to the previous year. Its credit quality is controlled within the limits proposed by the State Bank. Specifically, the bank’s consolidated pre-tax profit in the first nine months of 2021 reached VND 10,733 billion, up 52% over the same period last year, thus completing 83% of the year’s plan. BIDV’s total consolidated assets are currently valued at over VND 1,686 billion, an increase of 11.2% compared to the beginning of the year. Credit balance increased significantly, focusing on capital flows in the manufacturing sector. In addition, customer loans exceeded VND 1,328 million, up to 9.4%. The growth rate was similar to that in 2019 and earlier and more positive than that in the same period in 2020. The non-performing loan ratio is 1.39%, which is 0.15% lower than that at the beginning of the year. In the future, BIDV will continue to maximize revenue to increase non-interest income sources, enhance e-banking services, control costs, and other financial services income. The Vietnam Maritime Commercial Joint-Stock Bank (MSB) has a total consolidated income of more than 7,669 billion VND, an increase of over 59% compared to the same period in 2020. Net interest income is more than 4,523 billion VND, an increase of more than 37%. Revenue from service activities rose almost five-fold from the same period in 2020, reaching VND 2,448 billion. This was because of an increase in insurance sales. The MSB’s total consolidated assets reached more than 195,500 billion VND, an increase of more than 10% compared to the beginning of 2021. Again, the non-performing loan ratio in the MSB is only 1.31%, which is well within the acceptable level given by the state bank.

As for the Vietnam International Commercial Joint Stock Bank (VIB), its total operating income from the beginning of 2021 has reached over 10,300 billion VND. Its annual report shows a pre-tax profit of more than VND 5,300 billion, an increase of 32% compared to the same period of 2020. The restructuring of loans to support customers had a temporary impact on the bank’s performance in the third quarter of 2021, but most customers planned to repay loans earlier because of the bank’s aid. This creates a positive impact on bank performance in the fourth quarter of 2021. Regarding the Binh Commercial Joint-Stock Bank (ABBank), pre-tax profit also reached VND 1,556 billion, completing 78.9% of the year’s plan. Its general director asserts that banks’ operations during the epidemic period are much more challenging to manage than under normal conditions. Because banks must balance their efficiency with the responsibility to share the burden with customers, the bank has to change its short-term policy in the best way possible.

As can be seen, the customer is concerned about banks’ after-sale services, in addition to the quality and price of financial services. In a highly competitive market, customer perceptions of CSR require more attention. The more the firms participate in social programs and sponsor humanitarian programs, the more loyal customers they will have. Hence, CSR creates benefits for both banks and communities.

6. Conclusions and limitations

This study used qualitative and quantitative methods to estimate the effect of corporate governance on CSR and its influence on bank performance, incorporating two mediators: customer satisfaction and environmental performance. This study examines the direct relationship between corporate governance and CSR and the mediating roles of customer satisfaction and environmental performance on the link between CSR and bank performance, aiming to address a gap in the literature. Drawing on agency and stakeholder theories, this study confirms that corporate governance positively influences CSR, thereby offering practical implications for firms with effective corporate governance mechanisms to fulfill their societal and stakeholder responsibilities.

Moreover, the study implies that commercial banks must actively engage in CSR activities to achieve their financial objectives given the indirect effect of CSR on bank performance. Although numerous studies have explored the impact of CSR on performance, few have investigated the potential mediator or moderator factors influencing this relationship. Furthermore, much of the existing CSR literature focuses on developed countries. To address this gap, our study examines the relationship between CSR and performance in the Vietnamese context, considering the mediating roles of customer satisfaction and environmental performance.

Despite obtaining specific results, this study is subject to limitations, such as the small sample size. Therefore, future research should encompass the entire banking system in Vietnam, including commercial banks, wholly foreign-owned banks, and joint-venture banks. Additionally, researchers should explore other indirect relationships to refine the model further.

Author contributions

The author was involved in the conception and design, or analysis and interpretation of the data, the drafting of the article, revising it critically for intellectual content, and the final approval of the version to be published.

Disclosure statement

In accordance with the Taylor and Francis policy and my ethical obligation as a researcher, I am reporting that I receive no funding from any organizations that may be affected by the research reported in the enclosed article. I have disclosed those interests fully to Taylor and Francis, and I have in place an approved plan for managing any potential conflicts arising from that involvement. The authors (s) declare no conflicts of interest regarding the publication of this article.

Data availability statement

The derived data supporting the findings of this study are available from the corresponding author, N. On request.

Additional information

Notes on contributors

Quoc Trung Nguyen Kim

Quoc Trung Nguyen Kim is currently a lecturer of the Faculty of Accounting - Auditing; the University of Finance—Marketing, Vietnam. He is interested in researching the banking sector and finance and accounting. His fields of research and teaching are banking, finance, and governance. He has written a total of some articles in various international journals and conferences, including International Journal of Economics and Finance Studies, Cogent Business & Management, and has served as a reviewer of some international journals listed in Scopus, such as Cogent Economics and Finance, International Journal of Law and Management.

References

- Aboud, A., & Yang, X. (2022). Corporate governance and corporate social responsibility: New evidence from China. International Journal of Accounting & Information Management, 30(2), 1–14. https://doi.org/10.1108/IJAIM-09-2021-0195

- Ali, H. Y., Danish, R. Q., & Asrar-Ul-Haq, M. (2020). How corporate social responsibility boosts firm financial performance: The mediating role of corporate image and customer satisfaction. Corporate Social Responsibility and Environmental Management, 27(1), Article 166–177. https://doi.org/10.1002/csr.1781

- Anh, N. V., & Phuong Thao, N. T. (2021). Impact of CSR activities towards adoption of mobile banking. Cogent Business & Management, 8(1), 1962486. https://doi.org/10.1080/23311975.2021.1962486

- Barnett, M. L. (2007). Stakeholder influence capacity and the variability of financial returns to corporate social responsibility. Academy of Management Review, 32(3), 794–816. https://doi.org/10.5465/amr.2007.25275520

- Bauwhede, H. V. (2009). On the relation between corporate governance compliance and operating performance. Accounting and Business Research, 39(5), 497–513. https://doi.org/10.1080/00014788.2009.9663380

- Bhagat, S., & Bolton, B. (2008). Corporate governance and firm performance. Journal of Corporate Finance, 14(3), 257–273. https://doi.org/10.1016/j.jcorpfin.2008.03.006

- Bhasin, M. L., & Shaikh, J. M. (2013). Economic value added and shareholders’ wealth creation: The portrait of a developing Asian country. International Journal of Managerial and Financial Accounting, 5(2), 107–137. https://doi.org/10.1504/IJMFA.2013.053208

- Birindelli, G., Ferretti, P., Intonti, M., & Iannuzzi, A. P. (2013). On the drivers of corporate social responsibility in banks: Evidence from an ethical rating model. Journal of Management and Governance, 19(2), 1–41. https://doi.org/10.1007/s10997-013-9262-9

- Bolourian, S., Angus, A., & Alinaghian, L. (2021). The impact of corporate governance on corporate social responsibility at the board-level: A critical assessment. Journal of Cleaner Production, 291, 125752. https://doi.org/10.1016/j.jclepro.2020.125752

- Bonnafous-Boucher, M., & Rendtorff, J. D. (2016). Stakeholder theory as a theory of organizations. In Stakeholder theory (pp. 41–51). Springer.

- Brammer, S. J., & Pavelin, S. (2006). Corporate reputation and social performance: The importance of fit. Journal of Management Studies, 43(3), 435–455. https://doi.org/10.1111/j.1467-6486.2006.00597.x

- Carroll, A. B., & Shabana, K. M. (2010). The business case for corporate social responsibility: A review of concepts, research and practice. International Journal of Management Reviews, 12(1), 85–105. https://doi.org/10.1111/j.1468-2370.2009.00275.x

- Cherian, J., Umar, M., Thu, P. A., Nguyen-Trang, T., Sial, M. S., & Khuong, N. V. (2019). Does corporate social responsibility affect the financial performance of the manufacturing sector? Evidence from an emerging economy. Sustainability, 11(4), Article 1182. https://doi.org/10.3390/su11041182

- Chuang, S.-P., & Huang, S.-J. (2018). The effect of environmental corporate social responsibility on environmental performance and business competitiveness: The mediation of green information technology capital. Journal of Business Ethics, 150(4), 991–1009. https://doi.org/10.1007/s10551-016-3167-x

- Conrad, K., & Morrison, C. J. (1985). The impact of pollution abatement investment on productivity change: An empirical comparison of the US, Germany, and Canada. National Bureau of Economic Research Cambridge, Mass., USA. https://www.nber.org/papers/w1763

- Darnall, N., Henriques, I., & Sadorsky, P. (2008). Do environmental management systems improve business performance in an international setting? Journal of International Management, 14(4), 364–376. https://doi.org/10.1016/j.intman.2007.09.006

- Dawadi, S., Shrestha, S., & Giri, R. A. (2021). Mixed-methods research: A discussion on its types, challenges, and criticisms. Journal of Practical Studies in Education, 2(2), 25–36. https://doi.org/10.46809/jpse.v2i2.20

- Eccles, R. G., Ioannou, I., & Serafeim, G. (2014). The impact of corporate sustainability on organizational processes and performance. Management Science, 60(11), 2835–2857. https://doi.org/10.1287/mnsc.2014.1984

- Eklof, J., Podkorytova, O., & Malova, A. (2020). Linking customer satisfaction with financial performance: An empirical study of Scandinavian banks. Total Quality Management & Business Excellence, 31(15-16), Article 1684–1702. https://doi.org/10.1080/14783363.2018.1504621

- Eriqat, I. O. A., Tahir, M., & Zulkafli, A. H. (2023). Do corporate governance mechanisms matter to the reputation of financial firms? Evidence of emerging markets. Cogent Business & Management, 10(1), 2181187. https://doi.org/10.1080/23311975.2023.2181187

- Esteban-Sanchez, P., de la Cuesta-Gonzalez, M., & Paredes-Gazquez, J. D. (2017). Corporate social performance and its relation with corporate financial performance: International evidence in the banking industry. Journal of Cleaner Production, 162, 1102–1110. https://doi.org/10.1016/j.jclepro.2017.06.127

- Fama, E. F., & Jensen, M. C. (1983). Agency problems and residual claims. The Journal of Law and Economics, 26(2), 327–349. https://doi.org/10.1086/467038

- Farooq, U., Tabash, M. I., Anagreh, S., & Alnahhal, M. (2021). Assessing the impact of COVID-19 on corporate investment behavior. Emerging Science Journal, 5(0), 130–140. https://doi.org/10.28991/esj-2021-SPER-11

- Filatotchev, I., & Nakajima, C. (2014). Corporate governance, responsible managerial behavior, and corporate social responsibility: Organizational efficiency versus organizational legitimacy? Academy of Management Perspectives, 28(3), 289–306. https://doi.org/10.5465/amp.2014.0014

- Fornell, C., & Larcker, D. F. (1981). Evaluating structural equation models with unobservable variables and measurement error. Journal of Marketing Research, 18(1), 39–50. https://doi.org/10.1177/002224378101800104

- Fornell, C., Mithas, S., Morgeson, F. V., III,., & Krishnan, M. S. (2006). Customer satisfaction and stock prices: High returns, low risk. Journal of Marketing, 70(1), 3–14. https://doi.org/10.1509/jmkg.70.1.003.qxd

- Freeman, R. E. (1984). Strategic management: A stakeholder approach. Cambridge University Press.

- Freeman, R. E., & Dmytriyev, S. (2017). Corporate social responsibility and stakeholder theory: Learning from each other. Symphonya. Emerging Issues in Management, 1(1), 7–15. https://doi.org/10.4468/2017.1.02freeman.dmytriyev

- Friedland, J., & Jain, T. (2022). Reframing the purpose of business education: Crowding-in a culture of moral self-awareness. Journal of Management Inquiry, 31(1), 15–29. https://doi.org/10.1177/1056492620940793

- Gennaioli, N., Shleifer, A., & Vishny, R. W. (2013). A model of shadow banking. The Journal of Finance, 68(4), 1331–1363. https://doi.org/10.1111/jofi.12031

- Gulema, T. F., & Roba, Y. T. (2021). Internal and external determinants of corporate social responsibility practices in multinational enterprise subsidiaries in developing countries: Evidence from Ethiopia. Future Business Journal, 7(1), 7. https://doi.org/10.1186/s43093-021-00052-1

- Hair, J. F., Matthews, L. M., Matthews, R. L., & Sarstedt, M. (2017). PLS-SEM or CB-SEM: Updated guidelines on which method to use. International Journal of Multivariate Data Analysis, 1(2), 107–123. https://doi.org/10.1504/IJMDA.2017.087624

- Harrison, J. S., Barney, J. B., Freeman, R. E., & Phillips, R. A. (2019). The Cambridge handbook of stakeholder theory. Cambridge University Press.

- Hart, S. L. (1995). A natural-resource-based view of the firm. The Academy of Management Review, 20(4), 986. https://doi.org/10.2307/258963

- Henseler, J., Ringle, C. M., & Sarstedt, M. (2015). A new criterion for assessing discriminant validity in variance-based structural equation modeling. Journal of the Academy of Marketing Science, 43(1), 115–135. https://doi.org/10.1007/s11747-014-0403-8

- Hunjra, A. I., Jebabli, I., Thrikawala, S. S., Alawi, S. M., & Mehmood, R. (2024). How do corporate governance and corporate social responsibility affect credit risk? Research in International Business and Finance, 67, 102139. https://doi.org/10.1016/j.ribaf.2023.102139

- Indraneel, C. (2010). Agency problems in corporate finance [University of Pennsylvania]. https://repository.upenn.edu/entities/publication/db22d2fa-6e46-4dcc-9dee-d7b2401a98c2

- Jamali, D., Safieddine, A. M., & Rabbath, M. (2008). Corporate governance and corporate social responsibility synergies and interrelationships. Corporate Governance: An International Review, 16(5), 443–459. https://doi.org/10.1111/j.1467-8683.2008.00702.x

- Jansson, E. (2005). The stakeholder model: The influence of the ownership and governance structures. Journal of Business Ethics, 56(1), 1–13. https://doi.org/10.1007/s10551-004-2168-3

- Jo, H., & Harjoto, M. A. (2012). The causal effect of corporate governance on corporate social responsibility. Journal of Business Ethics, 106(1), 53–72. https://doi.org/10.1007/s10551-011-1052-1

- Joseph, Z., & Tranos, Z. (2018). Corporate governance and organisational performance. International Journal of Business and Management Studies, 10(1), 16–29.

- Kao, M.-R., Liu, C.-Y., Huang, Y.-C., & Chang, N.-J. (2010). A research of the relationship among business green management, environmental performance and competitive advantage. Journal of Management & Systems, 17(2), 255–278.

- Komath, M. A. C., Doğan, M., & Sayılır, Ö. (2023). Impact of corporate governance and related controversies on the market value of banks. Research in International Business and Finance, 65, 101985. https://doi.org/10.1016/j.ribaf.2023.101985

- Kraus, S., Rehman, S. U., & García, F. J. S. (2020). Corporate social responsibility and environmental performance: The mediating role of environmental strategy and green innovation. Technological Forecasting and Social Change, 160, 120262. https://doi.org/10.1016/j.techfore.2020.120262

- Kurucz, E. C., Colbert, B. A., & Wheeler, D. (2008). The business case for corporate social responsibility. The Oxford Handbook of Corporate Social Responsibility., 83–112.

- Ledi, K. K., & Ameza-Xemalordzo, E. (2023). Rippling effect of corporate governance and corporate social responsibility synergy on firm performance: The mediating role of corporate image. Cogent Business & Management, 10(2), 2210353. https://doi.org/10.1080/23311975.2023.2210353

- Luo, X., & Bhattacharya, C. B. (2006). Corporate social responsibility, customer satisfaction, and market value. Journal of Marketing, 70(4), 1–18. https://doi.org/10.1509/jmkg.70.4.001

- Maqbool, S., & Zameer, M. N. (2018). Corporate social responsibility and financial performance: An empirical analysis of Indian banks. Future Business Journal, 4(1), 84–93. https://doi.org/10.1016/j.fbj.2017.12.002

- Martínez, P., & Del Bosque, I. R. (2013). CSR and customer loyalty: The roles of trust, customer identification with the company and satisfaction. International Journal of Hospitality Management, 35, 89–99. https://doi.org/10.1016/j.ijhm.2013.05.009

- Mazurkiewicz, P. (2005). Corporate self-regulation and multi-stakeholder dialogue. In E. Croci (Ed.), The handbook of environmental voluntary agreements: Design, implementation and evaluation issues (pp. 31–45). Springer. https://doi.org/10.1007/1-4020-3356-7_2

- Moon, S.-G., & deLeon, P. (2007). Contexts and corporate voluntary environmental behaviors: examining the EPA’s green lights voluntary program. Organization & Environment, 20(4), 480–496. https://doi.org/10.1177/1086026607309395

- Nikolova, V., & Arsić, S. (2017). The stakeholder approach in corporate social responsibility. Engineering Management, 3(1), 24–35.

- Nizam, E., Ng, A., Dewandaru, G., Nagayev, R., & Nkoba, M. A. (2019). The impact of social and environmental sustainability on financial performance: A global analysis of the banking sector. Journal of Multinational Financial Management, 49, 35–53. https://doi.org/10.1016/j.mulfin.2019.01.002

- Ntim, C. G., & Soobaroyen, T. (2013). Corporate governance and performance in socially responsible corporations: New empirical insights from a Neo-Institutional framework. Corporate Governance: An International Review, 21(5), 468–494. https://doi.org/10.1111/corg.12026

- Orlitzky, M., Schmidt, F. L., & Rynes, S. L. (2003). Corporate social and financial performance: A meta-analysis. Organization Studies, 24(3), 403–441. https://doi.org/10.1177/0170840603024003910

- Rahman, N., & Post, C. (2012). Measurement issues in environmental corporate social responsibility (ECSR): Toward a transparent, reliable, and construct valid instrument. Journal of Business Ethics, 105(3), 307–319. https://doi.org/10.1007/s10551-011-0967-x

- Rashid, M., Abdeljawad, I., Manisah Ngalim, S., & Kabir Hassan, M. (2013). Customer‐centric corporate social responsibility: A framework for Islamic banks on ethical efficiency. Management Research Review, 36(4), 359–378. https://doi.org/10.1108/01409171311314978

- Ratmono, D., Nugrahini, D. E., & Cahyonowati, N. (2021). The effect of corporate governance on corporate social responsibility disclosure and performance. The Journal of Asian Finance, Economics and Business, 8(2), 933–941.

- Rhou, Y., Singal, M., & Koh, Y. (2016). CSR and financial performance: The role of CSR awareness in the restaurant industry. International Journal of Hospitality Management, 57, 30–39. https://doi.org/10.1016/j.ijhm.2016.05.007

- Sánchez-Medina, P. S., Díaz-Pichardo, R., Bautista-Cruz, A., & Toledo-López, A. (2015). Environmental compliance and economic and environmental performance: Evidence from handicrafts small businesses in Mexico. Journal of Business Ethics, 126(3), 381–393. https://doi.org/10.1007/s10551-013-1945-2

- Sharma, A. (2022). Interrelationship between corporate governance and corporate social responsibility. Available at SSRN 4294364. https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4294364

- Siddiqui, F., YuSheng, K., & Tajeddini, K. (2023). The role of corporate governance and reputation in the disclosure of corporate social responsibility and firm performance. Heliyon, 9(5), e16055. https://doi.org/10.1016/j.heliyon.2023.e16055

- Tops, D. (2017). Corporate social responsibility, agency problems and social pressure [Tilburg University]. http://arno.uvt.nl/show.cgi?fid=144938

- Vu, M.-C., Phan, T. T., & Le, N. T. (2018). Relationship between board ownership structure and firm financial performance in transitional economy: The case of Vietnam. Research in International Business and Finance, 45(October 2018), 512–528. https://doi.org/10.1016/j.ribaf.2017.09.002

- Williamson, D., Lynch-Wood, G., & Ramsay, J. (2006). Drivers of environmental behaviour in manufacturing SMEs and the implications for CSR. Journal of Business Ethics, 67(3), 317–330. https://doi.org/10.1007/s10551-006-9187-1

- Wu, L., Shao, Z., Yang, C., Ding, T., & Zhang, W. (2020). The impact of csr and financial distress on financial performance—evidence from Chinese listed companies of the manufacturing industry. Sustainability, 12(17), Article 6799. https://doi.org/10.3390/su12176799

- Xu, E. G., Graves, C., Shan, Y. G., & Yang, J. W. (2022). The mediating role of corporate social responsibility in corporate governance and firm performance. Journal of Cleaner Production, 375, 134165. https://doi.org/10.1016/j.jclepro.2022.134165

- Xu, J., & Jin, Z. (2022). Exploring the impact of the COVID-19 pandemic on firms’ financial performance and cash holding: New evidence from China’s agri-food sector. Agronomy, 12(8), 1951. https://doi.org/10.3390/agronomy12081951

- Ye, M., Wang, H., & Lu, W. (2021). Opening the ‘black box’ between corporate social responsibility and financial performance: From a critical review on moderators and mediators to an integrated framework. Journal of Cleaner Production, 313, 127919. https://doi.org/10.1016/j.jclepro.2021.127919

- Yoon, B., & Chung, Y. (2018). The effects of corporate social responsibility on firm performance: A stakeholder approach. Journal of Hospitality and Tourism Management, 37, 89–96. https://doi.org/10.1016/j.jhtm.2018.10.005

- Zaman, R., Jain, T., Samara, G., & Jamali, D. (2022). Corporate governance meets corporate social responsibility: Mapping the Interface. Business & Society, 61(3), 690–752. https://doi.org/10.1177/0007650320973415