Abstract

This study explores the factors that influence Vietnamese mobile banking users’ word-of-mouth behavior and sheds light on the impact of customer satisfaction, system quality, and individual performance. The data collected from 297 customers was analyzed through Smart PLS 4.0 utilization. The study findings reveal the direct and significant effect of customer satisfaction on word-of-mouth behavior. In addition, individual performance and mobile banking system quality have been found to be positive factors influencing customer satisfaction. The study also highlights the mediating role of customer satisfaction in the relationship between system quality, individual performance and word-of-mouth, which has not been explored in the prior studies. These results make substantial contributions to the existing literature on signaling theory in business management and hold important policy implications for Vietnamese commercial banks.

1. Introduction

Fierce competition in the banking industry has put pressure on banks to introduce more advanced new service delivery channels to bring customers higher values. Among them, mobile banking has emerged as one of the latest service delivery channels based on technological breakthroughs in the banking sector (Sharma & Sharma, Citation2019), bringing benefits to both customers and banks (Malaquias & Hwang, Citation2019). The movement of consumers’ behaviors are also significantly enhanced by the COVID-19 pandemic (Ali et al., Citation2023) and the positive attitude toward mobile banking as well as the tendency to use e-banking are expanded even after the post-pandemic stage (Khan et al., Citation2023). This explains why mobile banking is currently one of the markets with the strongest growth rates in the banking industry, especially in emerging economies (Khoa, Citation2020). According to a report by Degenhard (Citation2021), about 1.9 billion people are using mobile banking services in the world and this number is expected to grow to 2.5 billion by 2024.

Vietnam’s mobile banking market began in 2003 but not until 2010 that it truly developed with the participation of many financial giants. The online banking penetration rate in Vietnam has increased rapidly in recent years, reaching 37.1% in 2023, and is projected to continue its growth in the period 2024–2029 with a total of 12.8% points (Degenhard, Citation2023). In the third quarter of 2023, the transaction value conducted via mobile banking channel reached 13,724.851 trillion Vietnamese dong, an increase of 12.5% over the same period in 2022 (State Bank of Vietnam, Citation2024). This demonstrates that the mobile banking market is very potential and has a lot of room for development. However, like many other developing countries, mobile banking in Vietnam is still in the early stages of development and faces numerous limitations. For instance, the expansion of the customer base is not progressing as expected (Jamshidi et al., Citation2018); According to PwC (Citation2020), 40% of customers cease using a bank after having a negative experience, or encountering transaction interruptions due to poor internet quality or online fraud (Basu et al., Citation2024).

Many current studies discuss that trust in traditional banks may not lead to the adoption of mobile banking. Instead, assurances regarding infrastructure and the influence of early adopters’ experiences may help mobile banking users overcome this stagnation (Basu et al., Citation2024). In other words, the promotion of intention to use technology relies on user readiness, influenced by their experiences with electronic services and their expectations (Basu et al., Citation2024; Manu et al., Citation2021). Users may exhibit supportive psychological attitudes towards services (Lemon & Verhoef, Citation2016), and share online banking experiences on social media, with relatives, or friends (Sampaio et al., Citation2017), which could influence the intention to use for non-users (Basu et al., Citation2024). Therefore, researching factors affecting post-experience satisfaction and word-of-mouth behavior in mobile banking plays a crucial role in promoting intention and usage behavior, especially in developing countries.

Previous studies on mobile banking mostly focused on adoption intention, while post-adoption behaviors remain underexplored (Ciunova-Shuleska et al., Citation2022). Additionally, the intention to continue usage is the most predicted behavior post-mobile banking adoption (Mishra et al., Citation2023), while research on customer word-of-mouth behavior remains relatively scarce.

Extant literature confirms word of mouth (WOM) is an important factor affecting the attitude and transacting intention in mobile banking (Sreejesh et al., Citation2016) that the service providers need to take into consideration. There have been a few previous studies on the role of word of mouth in influencing consumer intention and behavior. For example, Mehrad and Mohammadi (Citation2017) demonstrated that word-of-mouth (WOM) has a positive impact on attitudes and intention to use mobile banking; Farzin et al. (Citation2021) showed that WOM mediates the relationship between adoption intention and actual usage behavior of mobile banking users. Another aspect of word-of-mouth behavior is electronic word-of-mouth (eWOM), which Augusto and Torres (Citation2018) validated its relationship to brand identification and brand equity of mobile banking, thereby making customers willing to pay a higher price for the bank. Additionally, Sreejesh et al. (Citation2016) proved eWOM positive impact on attitudes towards mobile banking, and Shankar et al. (Citation2020) presented that eWOM helps enhance the trust and usage intention of users with mobile banking.

However, most of these studies have examined the role of WOM in the pre-mobile banking stage, which means that they emphasized exploring how WOM influences consumer intention and behavior (Augusto & Torres, Citation2018; Shankar et al., Citation2020; Sreejesh et al., Citation2016). Casaló et al. (Citation2008) explored the impact of satisfaction and website usability on positive word-of-mouth behavior and customer loyalty in e-banking business, however, without considering the factors of system quality and individual performance of e-banking users. There is a shortage of research examining word of mouth as an outcome after customers use mobile banking and we take this as a gap to be addressed in this study. We argue that the results after using mobile banking will affect the satisfaction of users. Higher user satisfaction rate will lead to word-of-mouth behavior about the positive aspects of this financial trading channel. This can motivate potential customers to trust mobile banking and motivate them to use it. To address this gap, we used The Hierarchy of Effects Model (HEM) (Lavidge & Steiner, Citation1961) and the signaling theory (Spence, Citation1973) to develop models and research hypotheses. The main purpose of this study is to investigate the impact of individual performance and system quality factors on word-of-mouth behavior through the mediating role of customer satisfaction with mobile banking. The research results serve as the basis for us to propose some implications for mobile banking service providers to develop the mobile banking market in Vietnam.

The rest of the paper is organized as follows. Section 2 provides a theoretical overview and develops research hypotheses. Section 3 describes the research methods used in the paper. Section 4 presents the main research results, while discussions on the results and implications will be presented in Section 5. Finally, Section 6 draws some limitations and suggestions for future research.

2. Literature reviews

2.1. Mobile banking

Mobile banking has been described as one of the most important and promising technological breakthroughs in terms of growth potential in the banking business as well as mobile commerce (Jamshidi et al., Citation2018). Mobile banking allows customers to perform financial transactions (balance inquiries, money transfers, bill payments, etc) via mobile devices, smartphones, or personal digital assistants. (PDA) (Lin, Citation2013). Mobile banking contributes to the value creation for customers by helping them not to rely on specific space, time, or place of transactions (Choudrie et al., Citation2017; Lin, Citation2013). For banks, mobile banking is a channel to provide the most effective service to customers with the best quality in a wide range, while helping to overcome limitations in branch expansion (Alalwan et al., Citation2017); thereby helping banks quickly gain a competitive advantage (Jamshidi et al., Citation2018). This explains why mobile banking has become a widely researched topic in recent years, especially in developing countries. During the time of limited financial infrastructure, mobile banking undoubtedly brings high efficiency to banks, thereby ensuring the growth of the national economy (Malaquias & Hwang, Citation2019).

2.2. Word of mouth behavior

Word of mouth (WOM) has long been recognized in many studies about consumer behavior as a form of informal communication that influences decision-making in pursuit of consumer goals (Augusto & Torres, Citation2018; Cheung & Thadani, Citation2012). There are many definitions of word of mouth by different authors. In this study, word of mouth was defined as a form of informal verbal communication that occurs between individuals, either through telephone, email, mailing lists, or any other method of communication about a service or goods (Goyette et al., Citation2010). Word of mouth is known as the oldest means of exchanging opinions about the various goods and services offered in the market (Goyette et al., Citation2010). Word-of-mouth opinions can be both positive and negative (Goyette et al., Citation2010; Shankar et al., Citation2020). Among them, positive word of mouth has been recognized as an effective promotional device (Hogan et al., Citation2004). Compared with the information provided by businesses, consumers are more likely to trust the information shared by other consumers (Kim et al., Citation2015). The scope of this study is limited to examining the impact of positive word of mouth on customers after using mobile banking.

2.3. Research model

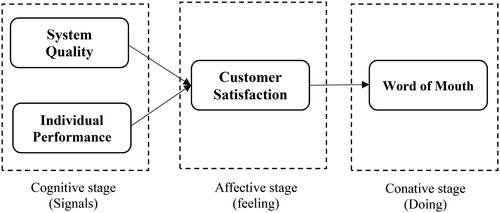

The research model of this paper is developed based on the Hierarchy of Effects Model (HEM) of Lavidge and Steiner (Citation1961) and the signaling theory (Spence, Citation1973) explaining customer behavior. The HEM model shows that customers’ behavior has progressed in three stages: (a) cognitive, (b) affective, and (c) conative stages (Pérez & Rodriguez del Bosque, Citation2015a). The cognitive stage is the user’s perception of the company or brand. The effective stage is the stage that deals with the customer’s emotions, while the conative stage deals with the customer’s behaviors and actions (Pérez & Rodríguez del Bosque, Citation2015b). Meanwhile, the signaling theory indicates how individuals communicate information to others in the context of the uncertainty (Spence, Citation1973). The theory application is also extensively adapted to show that effective signals about a firm’s product and service quality can change the consumer’s perception as well as their behavior (Li et al., Citation2015). Different signals can be conveyed to recipients such as: website quality, price, brand, or promotion… and these signals can change their perception and behavior (Dang et al., Citation2020; Li et al., Citation2015).

The combination of the HEM theory and the signaling theory in this study provides a clear understanding of consumer decision-making processes in the context of uncertain information, especially in the early stages of mobile banking development in countries facing issues such as bad experiences with mobile banking (PwC, Citation2020), transaction interruptions due to internet quality, and online fraud (Basu et al., Citation2024). On the other hand, to investigate the motivations leading to word-of-mouth behavior of mobile banking users, the integrated HEM-signaling theory model contributes to explaining how users perceive signals about mobile banking after experiencing it (cognitive stage) to change their perceptions (affective stage) and make word-of-mouth decisions about mobile banking (conative stage).

Based on the guidance of the integrated HEM-signaling theory model, in this study the variables of the customer’s cognitive stage include two signals of ‘System quality’ and ‘Individual performance’ that mobile banking brings to customers; and based on that perception, customers will form emotions in stage 2, the effective stage. ‘Customer satisfaction’ is the variable that reflects that emotion in the effective stage; while ‘Customer word of mouth behavior’ is the variable of the conative stage, showing the actions and results after the customer is satisfied with the mobile banking service. Therefore, this study uses the conceptual HEM model and signaling theory to develop a research model consisting of four factors: System quality, individual performance, satisfaction, and customer word-of-mouth behavior. We focus on exploring the relationship between system quality, and individual performance to customer satisfaction; and the relationship between customer satisfaction and word-of-mouth behavior ().

2.4. Research theory development

2.4.1. Customer satisfaction and word of mouth

Customer satisfaction is a general measure of the success or effectiveness of an information system (Chatterjee et al., Citation2018; Chung & Kwon, Citation2009; DeLone & McLean, Citation2003; Geebren et al., Citation2021; Tam & Oliveira, Citation2017). In a web-based system, customer satisfaction depends on many factors including design, content, website interface, navigation, and information structure (Chung & Kwon, Citation2009). Tam and Oliveira (Citation2016) emphasized that user satisfaction is a result of the overall quality provided by service providers in the context of mobile banking. Satisfaction is an important factor in motivating customers to continue using the company’s products and services (Zhou, Citation2013), increasing customer loyalty (Berraies et al., Citation2017), enhancing positive word-of-mouth behavior (Casaló et al., Citation2008; Sampaio et al., Citation2017), and improving business performance (Fornell, Citation1992).

In the context of mobile banking, since this is the newest type of transaction channel in the banking sector, it also contains many hidden risks (Malaquias & Hwang, Citation2019). Therefore, before adopting new technology, consumers often want to know the experience of existing users (Augusto & Torres, Citation2018) about the features, utility, and performance of this type of transaction channel to further reinforce trust to decide whether to use it (Shankar et al., Citation2020). In the post-use phase, consumers engage in word-of-mouth with various goals and intentions, mainly to help other consumers, and prevent future errors (Laughlin & MacDonald, Citation2010), reduce anger or cognitive dissonance (Velázquez et al., Citation2015).

Customers’ positive word-of-mouth behavior has been proven to be one of the important consequences of satisfaction in the online shopping (Zhang et al., Citation2017) and the e-banking sector (Casaló et al., Citation2008; Sampaio et al., Citation2017). According to the HEM theory approach, word-of-mouth behavior is the result of the conative stage (doing), which is formed from customers’ perceptions (satisfied/dissatisfied) after using the product or service (effective stage – feeling). In this study, we argue that satisfied customers after using mobile banking will lead to positive word-of-mouth behavior about this type of service to relevant people. Therefore, the research hypothesis is posed as:

H1: Satisfaction has a positive effect on word-of-mouth of customers using mobile banking

2.4.2. System quality and customer satisfaction using mobile banking

System quality was mentioned for the first time in the success model of D&M information systems (Delone & McLean, Citation1992) as an independent variable that has an impact on customer satisfaction and intention to use mobile banking. System quality measures the technical success of an information system (Delone & McLean, Citation1992), as measured by ease of use, functionality, reliability, data quality, and user-friendliness (Ali et al., Citation2023; Chatterjee et al., Citation2018; DeLone & McLean, Citation2003; Tam & Oliveira, Citation2017).

In the context of e-commerce, system quality plays an even more important role due to the anonymity of service providers (Choudrie et al., Citation2017) and can be an important signal that banks need to convey to mobile banking users. Besides, when one intends to use IS/IT, they usually try to understand the quality of that system in all aspects (cognitive stage) and expect the system to meet the performance characteristics with less effort (Chatterjee et al., Citation2018), results in a better operating system experience (Khan et al., Citation2023) and in that case, user satisfaction (in effective stage) tends to increase (Tam & Oliveira, Citation2017). On the contrary, without these features, users may doubt the quality and ability to provide services of the provider as this may increase the difficulty in using the device and may hamper users’ intention to use the mobile banking (Sharma & Sharma, Citation2019). This explains why Sharma and Sharma (Citation2019) study did not show a direct relationship between system quality and satisfaction and intention to use mobile banking, while Lee and Chung (Citation2009) and Tam and Oliveira (Citation2017) found the opposite when system quality significantly impacts user satisfaction with mobile banking. Based on the above arguments, it can be assumed that higher system quality can increase the satisfaction of mobile banking users. Therefore, the hypothesis is:

H2: System quality has a positive impact on customer satisfaction using mobile banking

2.4.3. Individual performance and customer satisfaction

Performance may be interpreted in many different ways. Some authors associate performance with effectiveness (Manzoor, Citation2012) and productivity (Adler & Benbunan-Fich, Citation2012); or a combination of both task effectiveness and task efficiency (Tam & Tiago, Citation2015). In the field of IS/IT, Hou (Citation2012) argues that the ‘individual performance impact of IS refers to the actual performance of an individual using that system’. According to Goodhue and Thompson (Citation1995), individual performance is the result of the relevant use between technology and the task it supports.

Individual performance is also applied in many theoretical models in IS/IT industry with different names and different variable positions. Among them, some authors use individual performance as the dependent variable, which is considered the outcome after using IS/IT (Delone & McLean, Citation1992; Goodhue & Thompson, Citation1995). Some other authors consider individual performance as an independent variable, which is a predictor of intention and/or behavior to use IS/IT (pre-adoption) such as Davis (Citation1989) with the ‘Perceived usefulness’ variable, Thompson et al. (Citation1991) with the ‘Job fit’ variable, Venkatesh et al. (Citation2003), and Venkatesh et al. (Citation2012) with the ‘performance expectancy’ variable. In this paper, individual performance is studied as an independent variable in a cognitive stage of HEM, and is considered under both the effectiveness and work-related efficiency of the individuals using mobile banking. Accordingly, individual performance refers to the benefits a mobile banking transaction can bring to the performer: saving time in completing the task, enhancing work efficiency, and improving decision-making progress (Delone & McLean, Citation1992).

To the best of our knowledge, most of the previous studies on mobile banking have focused on the relationship between performance and behavior to use mobile banking in the pre-adoption stage, such as: attitude (Khan et al., Citation2023); intention (Farah et al., Citation2018; Farzin et al., Citation2021; Hanafizadeh et al., Citation2014), and use (Malaquias & Hwang, Citation2019); there are not many studies demonstrating a positive relationship between performance and customer satisfaction at the post-adoption stage. However, Suhartanto et al. (Citation2019) demonstrated that perceived usefulness significantly impacts users’ satisfaction and intention to use mobile banking. At the post-adoption stage, Sampaio et al. (Citation2017) has proven that the benefits brought by mobile banking have a positive impact on customer satisfaction, such as ease of use, friendliness, and convenience (time-saving, access to information). Karjaluoto et al. (Citation2019) also shows that perceived benefits (regarding pragmatic and emotional values) have a positive impact on the overall satisfaction and commitment of customers using mobile financial services apps, especially the pragmatic values (effectiveness, usefulness, features, necessity, and convenience). This allows us to come up with the idea that when the use of mobile banking brings users an improvement in performance and efficiency (time-saving, convenient, and useful), users will feel more satisfied. Therefore, the hypothesis is:

H3: Individual performance has a positive impact on customer satisfaction in using mobile banking.

2.4.4. Mediating role of customer satisfaction

The mediating role of customer satisfaction in this study is developed based on the Signaling theory (Spence, Citation1973). This theory justifies how individuals communicate information to others in the context of uncertainty (Spence, Citation1973). In the fields of business, signalling theory has been extensively adapted to justify how firms convey information about their product and service quality to consumers (Li et al., Citation2015). Researchers have also explored that effective signals can change the consumer’s perception as well as their behavior (Dang et al., Citation2020). Thus, the behavior of WOM is predicted as customer’s behavior after perceiving satisfaction from experience on the signal of the system quality and individual performance in using mobile banking.

In addition, Sampaio et al. (Citation2017) also indicated that customers tend to recommend their satisfaction and benefits of mobile banking to friends and other customers. This recommendation of experienced customers is WOM which is defined as the willingness of the customer to suggest a product/service based on their experience. In the context of mobile banking, several previous studies have also confirmed that customer satisfaction is positively correlated with word of mouth (Casaló et al., Citation2008; Sampaio et al., Citation2017; Zhang et al., Citation2017). While meeting system quality and individual performance may result in a positive WOM, this relationship ultimately depends upon meeting customer satisfaction. In other words, while a customer might experience good system quality and high individual performance, these experiences themselves are not as integral to their positive WOM as the customer behavior, which depends on their perceived feelings as well. Hence, customer satisfaction as perception in signaling theory is likely to mediate the effect of customer benefit received from system quality and individual performance signals on WOM behaviors.

A paucity of recent studies has also explored something related to these mediating relations, that is the studies of Trivedi and Yadav (Citation2018) and de Oña (Citation2021). Trivedi and Yadav (Citation2018) found that the e-satisfaction has mediated the effect of security, ease of use, trust and privacy concerns on the online repurchasing behavior of Gen Y in India. de Oña (Citation2021) and Inan et al. (Citation2023) have examined and confirmed the significant mediating role of customer satisfaction in the relationship between service quality and behavioral intentions. Hence, besides strongly supported by signaling theory, these above empirical findings also support the prediction of the mediating role of customer satisfaction in the relationship between system quality as well as individual performance and WOM. Accordingly, the following hypotheses have been developed:

H4a: Customer satisfaction mediates the relationship between system quality and Word of mouth.

H4b: Customer satisfaction mediates the relationship between individual performance and Word of mouth.

3. Research methodology

In this part, we presented the research methodology with 3 key steps. The first step emphasizes on measures justification, the second step presented data collection method and the last one is data processing Method and Respondent Profile as follows:

3.1. Measures

The variables and items in this study were collected from previous research documents related to mobile banking to select the most suitable scales, measuring 02 independent variables (System quality, Individual performance), 01 mediating variable (Customer satisfaction), and 01 dependent variable (Word of mouth behavior), which are shown in . The variable ‘System quality’ consists of 5 scales, inherited from the study of Tam and Oliveira (Citation2017). The variable ‘Individual performance’ includes 03 scales inherited from Tam and Oliveira (Citation2017). The variable ‘Customer satisfaction’ has 03 inherited scales of Sharma and Sharma (Citation2019) and 01 inherited scale Tam and Oliveira (Citation2017). The variable ‘Word of mouth’ includes 03 scales inherited from Mehrad and Mohammadi (Citation2017).

Table 1. Variables and items of the research model.

3.2. Data collection method

We use the reverse translation method to ensure the reliability of the questionnaire (Bulmer & Warwick, Citation2005). The questionnaire was translated from English to Vietnamese by a group of English experts, then translated again from Vietnamese into English by another group of experts, and then compared the two translations to adjust for the semantical difference. The questions are designed as closed-ended questions, using a 7-point Likert scale from 1 (Strongly disagree) to 7 (Strongly agree).

The sample of this study is individual customers between the ages of 18–40. This consumer group is considered as a suitable customer group for mobile banking by possessing the following characteristics: spending a lot of time with their mobile phones, being early adapters to new technology, and frequently useingtechnology as well as services on major mobile platforms (Kumar & Lim, Citation2008; Malaquias & Hwang, Citation2016; Sbarcea, Citation2019).

Regarding the sample size, the study used the structural model analysis method PLS-SEM (Partial Least Squares – SEM) to assess the measurement model and the structural model. This technique does not require normally distributed data and can be performed with small sample sizes, and a sample size of 100–200 is often a good start for performing path modeling (Hoyle, Citation1995). For this study, we originally planned to have a sample size of 500

Since it is impossible to obtain a complete list of customers aged 18–40 in Vietnam, a non-probability convenience sampling technique was used to collect the research sample. We conduct the survey simultaneously through the internet and hand out the survey in person. Direct surveys are mainly used in the Northern region. We have tried to reach out to mobile banking users in many provinces/cities in the region with the support of collaborators in some provinces/cities with a higher level of development such as Hanoi, Hung Yen, Bac Giang, Nam Dinh, Thanh Hoa, Hai Duong, Hai Phong. 250 surveys were initially distributed and 176 answers were collected (response rate reached 70.4%). Regarding online surveys, we create surveys via the link: http://docs.google.com and conduct surveys via Facebook to better reach customers in the central and southern regions. Facebook was chosen because it is the most popular social network in Vietnam with 52.6 million users by 2023 (Degenhard, Citation2024). After a month of conducting the survey, there were 205 respondents. Thus, with both forms of survey, a total of 381 answers were collected, after removing 23 answers with invalid survey subjects, the author group obtained 358 valid responses. However, in order to objectively assess the customer’s trust and performance in using mobile banking, this study only uses the questionnaires of the respondents with 1 year or more experience in using mobile banking. For this questionnaire, the number of responses that met this criterion was 297. This number of responses met the minimum size required to ensure the reliability of the analytical results (Hoyle, Citation1995).

3.3. Data processing method and respondent profile

In this study, after using SPSS 22.0 for cleaning data and descriptive analysis (), we use Smart PLS-SEM based on smart PLS Software 4.0 because it is suitable and powerful to examine the predictable model (Hair et al., Citation2019). Accordingly, the data will be analyzed in two stages: First, the measurement model analysis is evaluated to determine the reliability and validity of the scale, calculate the value of the scale, as well the distinction of variables. Second, analyze the structural model to examine the relationship between the latent variables and the mediating impact of the satisfaction factor on the dependent variable ‘Word of mouth’ in the research model.

Table 2. Survey sample characteristics.

The survey sample statistics show that the majority of respondents are male (64.3%) and the common age is 18–30 (accounting for 87.9%). Most of the respondents (81.5%) have a bachelor’s degree, only a few have a high school diploma (10.8%) and 7,8% of them have a master’s degree or higher. In terms of income structure, most of the surveyed sample structure has low income (under 10 million/month, accounting for 71.4%) and medium income level (from 11 to 20 million, accounting for 17.8%). Regarding the experience of using mobile banking, up to 86.2% of the respondents have only 1–5 years of experience, and the rest (13.8%) have more than 5 years of experience. Regarding the frequency of mobile banking usage, the most common answer is weekly use (45.5%), but also 27.3% of respondents have a high frequency of use (daily use), and the remaining 26.3% have a low frequency of use (use monthly).

On the other hand, Common Method Variance (CMV) is a possible kind of bias that may happen in data collection. Hence, based on the study of Podsakoff et al. (Citation2003), this research controlled CMV by both methods, procedural and statistical control. Firstly, with the procedural control, the survey questionnaire did not include any question asking about the name or the personal information of the respondent, and this is also assured to treat confidentiality for research purpose only. Hence, respondents were assured anonymity and were also told that there were no right or wrong answers. The questionnaire is also presented by the transparent term with added information to explain clearly. Secondly, in terms of the statistical control, we applied Harman’s Single Factor Test to our dataset to address potential common method bias. The exploratory factor analysis (EFA) indicated that the total variance explained by a single factor is 44.202%, which falls below the 50% threshold as suggested by Mahmud et al. (Citation2017). Based on these findings, we conclude that common method bias does not pose a significant issue in our dataset. Refer to Appendix A for detailed results.

4. Findings

4.1. Assessing measurement model

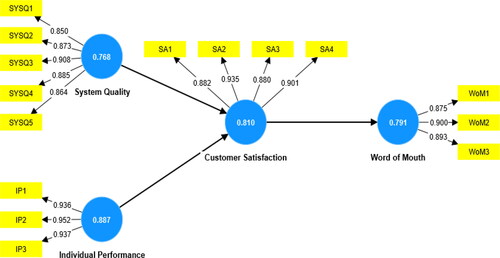

The assessment of the measurement model assessing process in PLS-SEM is performed by the reliability statistics of internal consistency, convergent value, and discriminant value. Since latent variables in the research model are reflective variables, the convergent value of the scales in measuring each variable reflecting the relevance of these scales will be measured based on Outer loading criteria and the Average variance extracted (AVE) (Hair et al., Citation2016). Accordingly, the outerloading value needs to be greater than or equal to 0.7 and the AVE needs to be greater than or equal to 0.5 (Hair et al., Citation2016).

To assess the consistency of the scales of each variable, this study applies both Composite Reliability – CR and Cronbach Alpha (Hair et al., Citation2016; Henseler et al., Citation2009). Accordingly, both of these criteria need to reach values greater than 0.6 for exploratory studies and will reach good reliance when these two values are greater than 0.7 (Hair et al., Citation2016).

From , it can be seen that the outer loading coefficient of all observed variables in the research model has a value greater than 0.7, showing that the items are qualified (Sarstedt et al., Citation2014). On the other hand, the results from also show that the Cronbach alpha coefficients of all variables in the research model range (0.868–0.936); CR coefficients of 04 variables are in the range (0.919–0.959), which means that the scales of each variable ensure consistent reliability (Hair et al., Citation2016). The AVE of the variables ranges from 0.768 to 0.887, which is qualified according to Hair et al. (Citation2016). Therefore, the consistency and convergence of the scale as well as the validity of the variables in the research model are guaranteed to be used for correlation analysis (Hair et al., Citation2016).

Table 3. Measurement model assessing results.

Discrimination indicates how different a scale is when compared to other scales in the model. To test the discriminant of the variables in the research model, the square root index of AVE (Fornell & Larcker, Citation1981) and the HTMT index HTMT (Henseler et al., Citation2015) can be used simultaneously. Discrimination between constructs is guaranteed when the square root of average variance extracted (AVE) of each latent variable is greater than all the correlations between the latent variables. Besides, the HTMT value must be guaranteed to be less than 0.85 according to Kline (Citation2015) or less than 0.9 as suggested by Henseler et al. (Citation2015).

The results from and show that the square root of the average variance extracted (AVE) of each variable is larger than the correlation coefficients with all other corresponding variables. This indicates that each latent variable in the model better explains the variance of its own scales than the variance of the other latent variables (Hair et al., Citation2014). The HTMT index of each pair of structures is less than 0.85; therefore, criteria for discriminant validity were established (Kline, Citation2015). In other words, the model ensures the reliability of the difference between the variables to conduct further analysis ().

Table 4. Discriminant validity (Fornell and Larcker).

Table 5. Discriminant validity (HTMT).

4.2. Assessing structural model

The assessment of the structural model in this study was carried out according to the approach of Hair et al. (Citation2016); whereby the criterion is evaluated including the test for multicollinearity (VIF), path coefficient (β), effect size (f2), coefficient of determination (R2), and testing of hypotheses. First, to ensure that the model does not have multicollinearity, the VIF index needs to be less than 5 (Hair et al., Citation2016). The results show that all VIF values are between 1,000 and 1,448, thus confirming that multicollinearity was not a concern in this study. In addition, the VIF values in this study are also qualified based on Paul Allison’s suggestion that the accepted cut-off for VIF is 2.5 (Allison, Citation2012). Hence, there is no multicollinearity problem among the variables and it ensures the reliability of the study.

Table 6. Structural Model evaluation and hypothesis testing results.

Next, to evaluate the PLS-SEM structural model, the Bootstrapping procedure was performed with a magnification factor of 5000 subsamples (Chin, Citation1998). After assessing the main measurement model as the external model, the study conducts the assessment of the internal model (structural model) to be analyzed to specifically estimate the relationship between latent variables. To evaluate the model as well as test the research hypotheses, the indexes used include the Path Coefficients, T-Value, P-Value, the effect size f2, and the confidence interval CI and R2 (Hair et al., Citation2016).

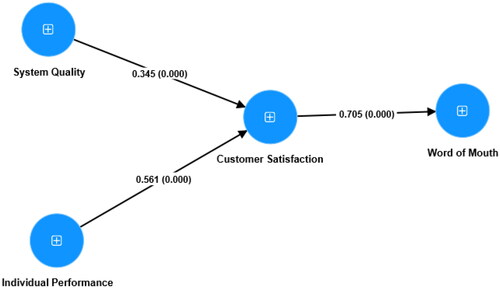

shows the results after testing the research hypotheses in the model, according to which all hypotheses H1, H2, and H3 are supported by having T Values >1.65, P Values < 0.05, and zero excluding in Confident Intervals (Hair et al., Citation2016). This means that banks can enhance customer satisfaction by improving the system quality and individual performance that mobile banking applications can bring to customers, thereby promoting their word-of-mouth behaviors about mobile banking. The two indirect effects which are H4a and H4b are also supported with all qualified criteria of T Values, P value and confidence interval. These findings supported the mediating role of customer satisfaction in the relationship between system quality as well as individual performance and word of mouth.

According to J. Cohen (Citation1988), f2 at the values of 0.02, 0.15, and 0.35 respectively represent insignificant, moderate, and strong effect sizes. The results from show that customer satisfaction has the strongest and most positive impact on customer word-of-mouth behavior about mobile banking with a coefficient f2 of 0.988.

Table 7. Effect size (f2) and R2.

Among the factors affecting customer satisfaction, individual performance has a strong impact (f2= 0.617), and system quality has an average effect size with the coefficient f2 = 0.234.

The coefficient of determination (R2) represents the percentage of variation on endogenous variables that is explained by exogenous variables in the research model (Hair et al., Citation2014). (The Adjusted R Square value of the Customer’s Satisfaction (SA) variable is 0.646 and that of the Word of Mouth (WOM) is 0.495, corresponding to the strong (SA) and mediate (WOM) levels of explanation as suggested by Cohen (Citation1988). This shows that the exogenous variables in the model explained 49.5% of the variation of ‘word of mouth’ and 64.6% of the variation of ‘customer satisfaction’ using mobile banking. In addition, to examine the level of predictive accuracy of the path model comparing the original values (Chin, Citation1998), the predictive relevance (Q2) was applied to reflective endogenous constructs. The predictive relevance of exogenous constructs is confirmed when Q2 is greater than zero (Hair et al., Citation2016). The predictive relevance was considered as small, medium and large when the Q2 values are 0.02, 0.15 and 0.35 accordingly for an endogenous construct (Hair et al., Citation2016). The finding in this study indicated that predictive relevance of customer satisfaction is 0.642 and word of mouth is 0.44. Hence, the research model in the present study has a large level of predictive relevance for customer satisfaction and worth of mouth ().

5. Discussion and implications

5.1. Discussion

This study aims to examine the impact of individual performance factors and system quality on word-of-mouth behavior about mobile banking through the mediating role of customer satisfaction. The results of this study are significant for promoting the strong development of mobile banking in Vietnam in the post-pandemic context. With the rapid development of mobile banking in Vietnam, many banks have been implementing strategies and tactics to increase their market share in the mobile banking market and focus on customer satisfaction. Customer satisfaction can lead to positive results such as increasing usage of mobile banking, loyalty to the bank, and positive word of mouth about mobile banking to those around. Word of mouth is an effective form of promotion to potential customers because of its reliability (Hogan et al., Citation2004; Kim et al., Citation2015).

The results of this study support all three hypotheses (H1, H2, H3) on motivations affecting customer satisfaction and word-of-mouth behavior about mobile banking. Our research model explains a 64.6% variation in ‘Customer satisfaction’ using mobile banking and a 49.5% variation of ‘Word of mouth’. These indicators are higher than some previous studies related to satisfaction (Chatterjee et al., Citation2018; Gao & Bai, Citation2014; Karjaluoto et al., Citation2019) and word-of-mouth behavior of customers (Casaló et al., Citation2008) in the mobile banking sector. From this study, the direct and causal relationship between customer satisfaction and their word-of-mouth behavior has been proved both conceptually and empirically with a path coefficient of 0.705 and an effect size of f2 of 0.988, which is at a very high level according to Cohen (Citation1988) principle. This result once again confirms the relationship in previous studies which also exists in mobile banking (Casaló et al., Citation2008; Sampaio et al., Citation2017) and online store (Zhang et al., Citation2017).

On the other hand, this finding also sheds light on the mediating role of customer satisfaction in the relationship between system quality as well as individual performance, and word of mouth. Word of Mouth (WOM) has long been recognized as one of the most important factors that influence decision-making in pursuit of consumer goals (Augusto & Torres, Citation2018; Cheung & Thadani, Citation2012). Enhancing high positive word of mouth is much more important for firms to attract customers in the context of information overload in our society. We provide initial evidence to justify the mediating mechanism of customer satisfaction in the relationship between system quality and WOM as well as between individual performance and WOM. Hence, this finding suggests an effective way for the firm to enhance positive word-of-mouth channels by improving system quality and leveraging individual performance to satisfies users. This is also an important empirical study to advance knowledge and provide a foundation for extending the application of signaling theory in business management (Li et al., Citation2015; Spence, Citation1973).

Regarding the factors affecting customer satisfaction using mobile banking, although there have been a few previous studies on the relationship between the benefits of mobile banking and customer satisfaction, this study is the first to test the relationship between individual performance (both effectiveness and efficiency) and customer satisfaction after using mobile banking (post-adoption). As expected, the research results show that individual performance is the strongest factor affecting customer satisfaction (path coefficient is 0.561, effect size f2=0.617). Accordingly, the path coefficient is presented as a standardised beta coefficient and has a positive value (0.561) that indicates the positive relationship between individual performance and customer satisfaction. In addition, the effect size (f2) (0 .617) is greater than 0.35 which asserts the large effect size of individual performance on customer satisfaction (Cohen, Citation1988). This result is quite similar to the previous study by Sampaio et al. (Citation2017) and Karjaluoto et al. (Citation2019). In fact, the prevalence of mobile banking services compared to other types of banking services brings users significant benefits such as quick, immediate, and personalized services (Farzin et al., Citation2021), which helps them perform tasks better and may lead to higher levels of satisfaction (Tam & Oliveira, Citation2017).

Besides, ‘System Quality’ also positively impacts customer satisfaction with a path coefficient of 0.345 and f2 = 0.234. This means that customers are very concerned about the technical aspects of the mobile banking system such as ease of use, user-friendly interface, and reliable and stable operation. In the context of developing countries where issues with mobile banking service experiences are still prevalent (PwC, Citation2020) and transaction interruptions occur (Basu et al., Citation2024), the quality of the mobile banking system has a greater influence on user satisfaction. This result coincides with many previous studies by Tam and Oliveira (Citation2017), Sharma et al. (Citation2017), Zhou (Citation2013) but is in contrast with the research results of Sharma and Sharma (Citation2019), Chatterjee et al. (Citation2018). The confirmation of the two hypotheses H2 and H3 implies that Vietnamese consumers are most interested in the effectiveness and efficiency that mobile banking brings to their work, besides the experience of friendliness, ease of use, and the features that mobile banking applications offer. The higher the customer satisfaction with individual performance and system quality of mobile banking, the greater the customer satisfaction using this service.

5.2. Theoretical implications

With the increasing prevalence of smartphones and mobile applications, mobile banking is predicted to become even more widespread in the near future (Khan et al., Citation2023). However, for countries in the early stages of mobile banking development, providing a word-of-mouth channel about mobile banking will help users feel more confident and better exploit the benefits of this service. To understand the mechanism leading to word-of-mouth behavior about mobile banking through the mediating role of customer satisfaction, we have proposed a research model based on the combination of two foundational theories, HEM and the Signaling theory, with factors of system quality, individual performance, satisfaction, and word-of-mouth behavior.

Firstly, this novel study extended the adoption of signaling theory and HEM in business management with a solidly confirmed research model, remarkably in the context of information exlosion (Li et al., Citation2015; Spence, Citation1973). It is also initial evidence to explain the mediating mechanism of customer satisfaction in the relationship between system quality and WOM as well as between individual performance and WOM. It is not simply only about product or service quality itself, this reminds researchers to pay more attention to the realistic benefit for customers which is individual performance. The favorable perception and positive behaviors are only generated when customers have real benefits from their experience. Hence, the exploitation of the direct effect of individual performance besides system quality on customer satisfaction and its indirect effect on word of mouth sheds new light on our understanding of the relationship between organizational signals and customers’ perceptions and between their perceptions and behaviors.

5.3. Practical implications

Once the most cash-dependent country in Southeast Asia, Vietnam has witnessed significant growth in non-cash payments in recent years (Statista, Citation2023). This result can be attributed to the efforts of relevant parties (Government, State Bank, banks, interagency bodies, etc.) in establishing legal frameworks and mechanisms to promote people’s adoption of mobile banking behaviors.

In terms of practical implications, the results of this study have an important role for bank managers, especially banks that consider mobile banking as their main direction in the growth strategy in Vietnam’s banking market. Although mobile banking is only in the early stages of development, competition between banks is becoming tougher. Enhancing customer satisfaction and word-of-mouth behavior is essential to increase banks’ competitiveness.

In the context of a developing country where the poorly individual performance in finance management is one of the biggest social problems and word-of-mouth becomes one of the most powerful communication channels, the findings of this study bring a significant contribution to business practitioners in the Vietnamese banking industry. The study sheds light on the importance of customer satisfaction in driving word-of-mouth behavior and recommends that banks focus on improving individual performance and mobile banking system quality. This is valuable and empirical evidence reminds banking managers to focus on solving the most concern problem in personal finance management in Vietnam. This problem is also highlighted by the chairman of the Vietnam Financial Consultants Association (VFCA) (Vietnam News, Citation2023). He has indicated ‘the problems faced by individuals in securing their financial future and achieving their financial goals have been exacerbated by unreliable and shallow resources on personal finance available on the Internet’. Hence, bank managers should strengthen their bank’s service quality and customer performance by enriching their mobile apps functions and contents, such as guidelines to improve finance management knowledge and skills. This is a remarkable contribution for business practitioners and customers as well as because ‘over 80 percent of respondents admit to having little interest and knowledge in personal finance’ in Vietnam (Vietnam News, Citation2023).

In addition, Vietnam banks need to focus on designing mobile banking applications with high quality, easy access, compatible with various operating system platforms on mobile devices, improving the ease of use and navigation of mobile banking applications; smoothening the access and search process about the services mobile banking application provides to customers. In addition, mobile banking applications need to help users complete transactions more quickly and easily than other forms of transactions. Next, the application needs to provide its users with various ways to carry out transactions so that it can serve a wide range of users. For example: in addition to the basic services such as wire transfer, QR pay, bill payment (electricity, internet, …), and ordering services (booking air tickets, hotel rooms, ordering flowers, …); other additional features should also be taken into consideration, such as online loan support; interest calculation tools; open an online savings account; withdraw money at ATM without using a physical ATM card, transfer money internationally, etc. This study assists the development of these strategies and policies and thereby provides better system quality and also considers enhancement of higher individual performance for customers. Bank managers should also invest in longer-lasting relationship policies with customers. Customer satisfaction in using banking mobile apps helped customers generate positive word of mouth.

6. Limitations and further research

Besides the significant contribution, this study also has some limitations. Firstly, we focus mainly on young customers in the age group of 18–40 years old; Therefore, future research could expand the survey subjects to different age groups and clarify the differences regarding the behavior of customers using mobile banking at different ages. Second, we only focus on the satisfaction and word-of-mouth behavior of customers using mobile banking, while the behavior of customers using banking services on other technologies may differ. Third, this study focuses mainly on the role of individual performance and system quality on satisfaction and word-of-mouth behavior of mobile banking users; future studies can expand the scope of research to other factors that can affect customer satisfaction and word-of-mouth behavior such as information quality, brand value, cost, customer’s characteristics or other control variables.

Disclosure statement

No potential conflict of interest was reported by the author(s).

Additional information

Funding

Notes on contributors

Duong Luu Thi Thuy

Duong Luu Thi Thuy graduated with the PhD degree from Thuongmai University (TMU) in 2021. Currently She is a senior Lecturer of TMU and her research areas are strategic management, Innovation, customer behaviors and competitive advantage. Email: [email protected]

Uyen Nguyen Thi

Uyen Nguyen Thi graduated with the PhD degree from Universiti Sains Malaysia (University of Science, Malaysia – USM) in 2019. Currently, She is a senior Lecturer of Thuongmai University. Her research interests are the areas of strategic management, customer behaviors, Innovation and entrepreneurship, corporate governance and sustainable competitive advantage and development. Email: [email protected]

Quyen Vo Hanh

Quyen Vo Hanh is a Lecturer in Business Administration at Thuong Mai University. Holding a Master’s degree in International Business, Quyen’s research interests lie in strategic management, sustainable development, and digital transformation. Email: [email protected]

Nguyet Nguyen Thi My

Nguyet Nguyen Thi My graduated with the PhD degree from Thuongmai University in 2019. Currently, She is a senior Lecturer of Thuongmai University. Her research area involves strategic management, business management, customer behaviors, innovation. Email: [email protected]

References

- Adler, R. F., & Benbunan-Fich, R. (2012). Juggling on a high wire: Multitasking effects on performance. International Journal of Human-Computer Studies, 70(2), 1–18. https://doi.org/10.1016/j.ijhcs.2011.10.003

- Alalwan, A. A., Dwivedi, Y. K., & Rana, N. P. (2017). Factors influencing adoption of mobile banking by Jordanian bank customers: Extending UTAUT2 with trust. International Journal of Information Management, 37(3), 99–110. https://doi.org/10.1016/j.ijinfomgt.2017.01.002

- Ali, A., Hameed, A., Moin, M. F., & Khan, N. A. (2023). Exploring factors affecting mobile-banking app adoption: A perspective from adaptive structuration theory. Aslib Journal of Information Management, 75(4), 773–795. https://doi.org/10.1108/AJIM-08-2021-0216

- Allison, P. (2012). When can you safely ignore multicollinearity. Statistical Horizons, 5(1), 1–2.

- Augusto, M., & Torres, P. (2018). Effects of brand attitude and eWOM on consumers’ willingness to pay in the banking industry: Mediating role of consumer-brand identification and brand equity. Journal of Retailing and Consumer Services, 42(January), 1–10. https://doi.org/10.1016/j.jretconser.2018.01.005

- Basu, B., Sebastian, M. P., & Kar, A. K. (2024). What affects the promoting intention of mobile banking services? Insights from mining consumer reviews. Journal of Retailing and Consumer Services, 77, 103695. https://doi.org/10.1016/j.jretconser.2023.103695

- Berraies, S., Ben Yahia, K., & Hannachi, M. (2017). Identifying the effects of perceived values of mobile banking applications on customers. International Journal of Bank Marketing, 35(6), 1018–1038. https://doi.org/10.1108/IJBM-09-2016-0137

- Bulmer, M., & Warwick, D. P. (2005). Social research in Developing Countries: Surveys and Censuses in the third world. Routledge, Taylor & Francis Group.

- Casaló, L. V., Flavián, C., & Guinalíu, M. (2008). The role of satisfaction and website usability in developing customer loyalty and positive word-of-mouth in the e-banking services. International Journal of Bank Marketing, 26(6), 399–417. https://doi.org/10.1108/02652320810902433

- Chatterjee, S., Kar, A. K., & Gupta, M. P. (2018). Success of IoT in Smart Cities of India: An empirical analysis. Government Information Quarterly, 35(3), 349–361. https://doi.org/10.1016/j.giq.2018.05.002

- Cheung, C. M. K., & Thadani, D. R. (2012). The impact of electronic word-of-mouth communication: A literature analysis and integrative model. Decision Support Systems, 54(1), 461–470. https://doi.org/10.1016/j.dss.2012.06.008

- Chin, W. W. (1998). The partial least squares approach to structural formula modeling. In G. A. Marcoulides (Ed.), Modern methods for business research (Vol. 295, pp. 295–336). Mahwah, New Jersey: Lawrence Erlbaum Associates, Publishers.

- Choudrie, J., Junior, C., Mckenna, B., & Richter, S. (2017). Understanding and conceptualising the adoption, use and di ff usion of mobile banking in older adults: A research agenda and conceptual framework. Journal of Business Research, 88(June), 449–465. https://doi.org/10.1016/j.jbusres.2017.11.029

- Chung, N., & Kwon, S. J. (2009). Effect of trust level on mobile banking satisfaction: A multi-group analysis of information system success instruments. Behaviour & Information Technology, 28(6), 549–562. https://doi.org/10.1080/01449290802506562

- Ciunova-Shuleska, A., Palamidovska-Sterjadovska, N., & Prodanova, J. (2022). What drives m-banking clients to continue using m-banking services? Journal of Business Research, 139, 731–739. https://doi.org/10.1016/j.jbusres.2021.10.024

- Fornell, C., & Larcker, D. F. (1981). Evaluating structural equation models with unobservable variables and measurement error. Journal of Marketing Research, 18(3), 382–388. https://doi.org/10.1177/002224378101800312

- Cohen, J. (1988). tatistical power analysis for the behavioural sciences (2nd ed.). Lawrence Erlbaum Associates.

- Cohen, J. (1988). Statistical power analysis for the behavioral sciences (2nd ed.). Lawrence Erlbaum Associates, Publishers.

- Goodhue, D. L., & Thompson, R. L. (1995). Task-technology fit and individual performance. MIS Quarterly, 19(2), 213–236. https://doi.org/10.2307/249689

- Dang, V. T., Nguyen, N., & Pervan, S. (2020). Retailer corporate social responsibility and consumer citizenship behavior: The mediating roles of perceived consumer effectiveness and consumer trust. Journal of Retailing and Consumer Services, 55(February), 102082. https://doi.org/10.1016/j.jretconser.2020.102082

- Davis, F. (1989). Perceived usefulness, perceived ease of use, and user acceptance of information technology. MIS Quarterly, 13(3), 319–340. https://doi.org/10.2307/249008

- de Oña, J. (2021). Understanding the mediator role of satisfaction in public transport: A cross-country analysis. Transport Policy, 100, 129–149. https://doi.org/10.1016/j.tranpol.2020.09.011

- Degenhard, J. (2021). Forecast of the online banking penetration in Vietnam from 2010 to 2025. Statista.com. Retrieved from https://www.statista.com/forecasts/1150450/online-banking-penetration-forecast-in-vietnam.

- Degenhard, J. (2023). Penetration rate of online banking in Vietnam 2013-2028. Retrieved April 20, 2023, from https://www.statista.com/forecasts/1150450/online-banking-penetration-forecast-in-vietnam.

- Degenhard, J. (2024). Number of Facebook users in Vietnam from 2019 to 2028 (in millions). Retrieved January 30, 2024, from https://www.statista.com/forecasts/1136459/facebook-users-in-vietnam.

- Delone, W. H., & McLean, E. R. (1992). The quest for the dependent variable. Information Systems Research. Information Systems Research, 3(1), 60–95. https://doi.org/10.1287/isre.3.1.60

- DeLone, W. H., & McLean, E. R. (2003). The DeLone and McLean model of information systems success: A ten-year update. Journal of Management Information Systems, 19(4), 9–30. https://doi.org/10.1080/07421222.2003.11045748

- Farah, M. F., Hasni, M. J. S., & Abbas, A. K. (2018). Mobile-banking adoption: Empirical evidence from the banking sector in Pakistan. International Journal of Bank Marketing, 36(7), 1386–1413. https://doi.org/10.1108/IJBM-10-2017-0215

- Farzin, M., Sadeghi, M., Yahyayi Kharkeshi, F., Ruholahpur, H., & Fattahi, M. (2021). Extending UTAUT2 in M-banking adoption and actual use behavior: Does WOM communication matter? Asian Journal of Economics and Banking, 5(2), 136–157. https://doi.org/10.1108/AJEB-10-2020-0085

- Fornell, C. (1992). Customer satisfaction barometer: Swedish the experience thanks. Journal of Marketing, 56(1), 6–21. https://doi.org/10.1177/002224299205600103

- Gao, L., & Bai, X. (2014). An empirical study on continuance intention of mobile social networking services: Integrating the IS success model, network externalities and flow theory. Asia Pacific Journal of Marketing and Logistics, 26(2), 168–189. https://doi.org/10.1108/APJML-07-2013-0086

- Geebren, A., Jabbar, A., & Luo, M. (2021). Examining the role of consumer satisfaction within mobile eco-systems: Evidence from mobile banking services. Computers in Human Behavior, 114(July 2020), 106584. https://doi.org/10.1016/j.chb.2020.106584

- Goyette, I., Ricard, L., Bergeron, J., & Marticotte, F. (2010). e-WOM Scale: Word-of-Mouth Measurement Scale for e-Services Context *. Canadian Journal of Administrative Sciences / Revue Canadienne des Sciences de l’Administration, 27(1), 5–23. https://doi.org/10.1002/cjas.129

- Hair, J. F., Sarstedt, M., Hopkins, L., & Kuppelwieser, V. G. (2014). Partial least squares structural equation modeling (PLS-SEM): An emerging tool in business research. European Business Review, 26(2), 106–121. https://doi.org/10.1108/EBR-10-2013-0128

- Hair, J. F., Hult, G. T. M., Ringle, C. M., & Sarstedt, M. (2016). A Primer on Partial Least Squares Structural Equation Modeling (PLS-SEM) (2nd ed.). SAGE.

- Hair, J. F., Ringle, C. M., Gudergan, S. P., Fischer, A., Nitzl, C., & Menictas, C. (2019). Partial least squares structural equation modeling- based discrete choice modeling: An illustration in modeling retailer choice. Business Research, 12(1), 115–142. https://doi.org/10.1007/s40685-018-0072-4

- Hanafizadeh, P., Behboudi, M., Abedini Koshksaray, A., & Jalilvand Shirkhani Tabar, M. (2014). Mobile-banking adoption by Iranian bank clients. Telematics and Informatics, 31(1), 62–78. https://doi.org/10.1016/j.tele.2012.11.001

- Henseler, J., Ringle, C. M., & Sinkovics, R. R. (2009). The use of partial least squares path modeling in international marketing. Advances in International Marketing, 20, 277–319. https://doi.org/10.1108/S1474-7979(2009)0000020014

- Henseler, J., Ringle, C. M., & Sarstedt, M. (2015). A new criterion for assessing discriminant validity in variance-based structural equation modeling. Journal of the Academy of Marketing Science, 43(1), 115–135. https://doi.org/10.1007/s11747-014-0403-8

- Hogan, J. E., Lemon, K. N., & Libai, B. (2004). Quantifying the ripple: Word-of-mouth and advertising effectiveness. Journal of Advertising Research, 44(3), 271–280. https://doi.org/10.1017/S0021849904040243

- Hou, C. (2012). Examining the effect of user satisfaction on system usage and individual performance with business intelligence systems: An empirical study of Taiwan’s electronics industry. International Journal of Information Management, 32(6), 560–573. https://doi.org/10.1016/j.ijinfomgt.2012.03.001

- Hoyle, R. H. (1995). Structural equation modeling: Concepts, issues, and applications. In The structural equation modeling approach: Basic concepts and fundamental issues (pp. 1–15). Sage Publications, Inc.

- Inan, D. I., Hidayanto, A. N., Juita, R., Soemawilaga, F. F., Melinda, F., Puspacinantya, P., & Amalia, Y. (2023). Service quality and self-determination theory towards continuance usage intention of mobile banking. Journal of Science and Technology Policy Management, 14(2), 303–328. https://doi.org/10.1108/JSTPM-01-2021-0005

- Jamshidi, D., Keshavarz, Y., Kazemi, F., & Mohammadian, M. (2018). Mobile banking behavior and flow experience: An integration of utilitarian features, hedonic features and trust. International Journal of Social Economics, 45(1), 57–81. https://doi.org/10.1108/IJSE-10-2016-0283

- Laughlin, J. D., & MacDonald, J. B. (2010). Identifying market mavens online by their social behaviors in community-generated media. Academy of Marketing Studies Journal, 14(1), 55–71.

- Karjaluoto, H., Shaikh, A. A., Saarijärvi, H., & Saraniemi, S. (2019). How perceived value drives the use of mobile financial services apps. International Journal of Information Management, 47(September 2017), 252–261. https://doi.org/10.1016/j.ijinfomgt.2018.08.014

- Khan, S., Khan, S. U., Khan, I. U., Khan, S. Z., & Khan, R. U. (2023). Understanding consumer adoption of mobile payment in Pakistan. Journal of Science and Technology Policy Management, 2023, 110. https://doi.org/10.1108/JSTPM-07-2021-0110

- Khoa, B. T. (2020). The Impact of the Personal Data Disclosure’s Tradeoff on the Trust and Attitude Loyalty in Mobile Banking Services. Journal of Promotion Management, 27(4), 585–608. https://doi.org/10.1080/10496491.2020.1838028

- Kim, W. G., Lim, H., & Brymer, R. A. (2015). The effectiveness of managing social media on hotel performance. International Journal of Hospitality Management, 44, 165–171. https://doi.org/10.1016/j.ijhm.2014.10.014

- Kline, R. B. (2015). Principles and practices of structural equation modelling (4th ed.). The Guilford Press.

- Kumar, A., & Lim, H. (2008). Age differences in mobile service perceptions: Comparison of Generation Y and baby boomers. Journal of Services Marketing, 22(7), 568–577. https://doi.org/10.1108/08876040810909695

- Lavidge, R. J., & Steiner, G. A. (1961). A model for predictive measurements of advertising effectiveness. Journal of Marketing, 25(6), 59–62. https://doi.org/10.2307/1248516

- Lee, K. C., & Chung, N. (2009). Understanding factors affecting trust in and satisfaction with mobile banking in Korea: A modified DeLone and McLean’s model perspective. Interacting with Computers, 21(5-6), 385–392. https://doi.org/10.1016/j.intcom.2009.06.004

- Lemon, K. N., & Verhoef, P. C. (2016). Understanding customer experience throughout the customer journey. Journal of Marketing, 80(6), 69–96. https://doi.org/10.1509/jm.15.0420

- Li, H. F., Fang, Y. L., Wang, Y. W., Lim, K. H., & Liang, L. (2015). Are all signals equal? Investigating the differential effects of online signals on the sales performance of e-marketplace sellers. Information Technology & People, 28(3), 699–723. Retrieved from https://doi.org/10.1108/09593840510615888

- Lin, H. F. (2013). Determining the relative importance of mobile banking quality factors. Computer Standards & Interfaces, 35(2), 195–204. https://doi.org/10.1016/j.csi.2012.07.003

- Mahmud, I., Ramayah, T., & Kurnia, S. (2017). To use or not to use: Modelling end user grumbling as user resistance in pre-implementation stage of enterprise resource planning system. Information Systems, 69, 164–179. https://doi.org/10.1016/j.is.2017.05.005

- Malaquias, R. F., & Hwang, Y. (2016). An empirical study on trust in mobile banking: A developing country perspective. Computers in Human Behavior, 54, 453–461. https://doi.org/10.1016/j.chb.2015.08.039

- Malaquias, R. F., & Hwang, Y. (2019). Mobile banking use: A comparative study with Brazilian and U.S. participants. International Journal of Information Management, 44(May 2018), 132–140. https://doi.org/10.1016/j.ijinfomgt.2018.10.004

- Manu, C., Sreejesh, S., & Paul, J. (2021). Tell us your concern, and we shall together address! Role of service booking channels and brand equity on post-failure outcomes. International Journal of Hospitality Management, 96, 102982. https://doi.org/10.1016/j.ijhm.2021.102982

- Manzoor, Q. (2012). Impact of employees motivation on organizational effectiveness. Business Management and Strategy, 3(1), 1–12. https://doi.org/10.5296/bms.v3i1.904

- Mehrad, D., & Mohammadi, S. (2017). Word of Mouth impact on the adoption of mobile banking in Iran. Telematics and Informatics, 34(7), 1351–1363. https://doi.org/10.1016/j.tele.2016.08.009

- Mishra, A., Shukla, A., Rana, N. P., Currie, W. L., & Dwivedi, Y. K. (2023). Re-examining post-acceptance model of information systems continuance: A revised theoretical model using MASEM approach. International Journal of Information Management, 68(April 2022), 102571. https://doi.org/10.1016/j.ijinfomgt.2022.102571

- Pérez, A., & Rodríguez del Bosque, I. (2015a). An integrative framework to understand How CSR affects customer loyalty through identification, emotions and satisfaction. Journal of Business Ethics, 129(3), 571–584. https://doi.org/10.1007/s10551-014-2177-9

- Pérez, A., & Rodríguez del Bosque, I. (2015b). Corporate social responsibility and customer loyalty: Exploring the role of identification, satisfaction and type of company. Journal of Services Marketing, 29(1), 15–25. https://doi.org/10.1108/JSM-10-2013-0272

- Podsakoff, P. M., MacKenzie, S. B., Lee, J. Y., & Podsakoff, N. P. (2003). Common method biases in behavioral research: A critical review of the literature and recommended remedies. The Journal of Applied Psychology, 88(5), 879–903. https://doi.org/10.1037/0021-9010.88.5.879

- PwC. (2020). Retail Banking 2020: Evolution or revolution? PwC, 109, 164.

- Sampaio, C. H., Ladeira, W. J., & Santini, F. D. O. (2017). Apps for mobile banking and customer satisfaction: A cross-cultural study. International Journal of Bank Marketing, 35(7), 1133–1153. https://doi.org/10.1108/IJBM-09-2015-0146

- Sarstedt, M., Ringle, C. M., Smith, D., Reams, R., & Hair, J. F. (2014). Partial least squares structural equation modeling (PLS-SEM): A useful tool for family business researchers. Journal of Family Business Strategy, 5(1), 105–115. https://doi.org/10.1016/j.jfbs.2014.01.002

- Sbarcea, I. R. (2019). Banks digitalization - A challenge for the Romanian banking sector. Studies in Business and Economics, 14(1), 221–230. https://doi.org/10.2478/sbe-2019-0017

- Shankar, A., Jebarajakirthy, C., & Ashaduzzaman, M. (2020). How do electronic word of mouth practices contribute to mobile banking adoption? Journal of Retailing and Consumer Services, 52(June 2019), 101920. https://doi.org/10.1016/j.jretconser.2019.101920

- Sharma, S. K., Gaur, A., Saddikuti, V., & Rastogi, A. (2017). Structural equation model (SEM)-neural network (NN) model for predicting quality determinants of e-learning management systems. Behaviour & Information Technology, 36(10), 1053–1066. https://doi.org/10.1080/0144929X.2017.1340973

- Sharma, S. K., & Sharma, M. (2019). Examining the role of trust and quality dimensions in the actual usage of mobile banking services: An empirical investigation. International Journal of Information Management, 44(September 2018), 65–75. https://doi.org/10.1016/j.ijinfomgt.2018.09.013

- Spence, M. (1973). Job market signaling. The Quarterly Journal of Economics, 87(3), 355–374. https://doi.org/10.2307/1882010

- Sreejesh, S., Anusree, M. R., & Mitra, A. (2016). Effect of Information Content and Form on Customers’ Attitude and Transaction Intention in Mobile Banking: Moderating Role of Perceived Privacy Concern. International Journal of Bank Marketing, 34(7), 1092–1113. https://doi.org/10.1108/IJBM-07-2015-0107

- State Bank of Vietnam. (2024). Domestic payment transactions via Internet and Mobile Banking in Vietnam. Retrieved January 29, 2024, from https://www.sbv.gov.vn/webcenter/portal/vi/menu/trangchu/tk/hdtt/gdiam?_afrLoop=42835537099369466#%40%3F_afrLoop%3D42835537099369466%26centerWidth%3D80%2525%26leftWidth%3D20%2525%26rightWidth%3D0%2525%26showFooter%3Dfalse%26showHeader%3Dfalse%26_adf.ctrl-state%3D2m3c87qmg_185.

- Statista. (2023). Quarterly value of domestic transactions via mobile banking in Vietnam from 1st quarter 2020 to 1st quarter 2023(in trillion Vietnamese dong). Retrieved January 30, 2024, from https://www.statista.com/statistics/1325309/vietnam-mobile-banking-transaction-value-by-quarter/.

- Suhartanto, D., Dean, D., Ismail, T. A. T., & Sundari, R. (2019). Mobile banking adoption in Islamic banks: Integrating TAM model and religiosity-intention model. Journal of Islamic Marketing, 11(6), 1405–1418. https://doi.org/10.1108/JIMA-05-2019-0096

- Tam, C., & Oliveira, T. (2016). Understanding the impact of m-banking on individual performance: DeLone & McLean and TTF perspective. Computers in Human Behavior, 61, 233–244. https://doi.org/10.1016/j.chb.2016.03.016

- Tam, C., & Oliveira, T. (2017). Understanding mobile banking individual performance: The DeLone & McLean model and the moderating effects of individual culture. Internet Research, 27(3), 538–562. https://doi.org/10.1108/IntR-05-2016-0117

- Tam, C., & Tiago, O. (2015). Literature review of mobile banking and individual performance. International Journal of Bank Marketing, 35(7), 1044–1067. https://doi.org/10.1108/IJBM-09-2015-0143

- Thompson, R. L., Higgins, C. A., Howell, J. M., Thompson, B. R. L., Higgins, C. A., Na, C., & Howell, J. M. (1991). Personal computing: Toward a conceptual model of utilization. MIS Quarterly, 15(1), 125–143. https://doi.org/10.2307/249443

- Trivedi, S. K., & Yadav, M. (2018). Predicting online repurchase intentions with e-satisfaction as mediator: A study on Gen Y. VINE Journal of Information and Knowledge Management Systems, 48(3), 427–447. https://doi.org/10.1108/VJIKMS-10-2017-0066

- Velázquez, B. M., Blasco, M. F., & Gil Saura, I. (2015). ICT adoption in hotels and electronic word-of-mouth. Academia Revista Latinoamericana de Administración, 28(2), 227–250. http://dx.doi.org/10.1108/ARLA-08-2013-0115%5Cn

- Venkatesh, V., Morris, M. G., Davis, G. B., Davis, F. D. (2003). User acceptance of information technology: Toward a unified view. MIS Quarterly, 27(3), 425–478. https://doi.org/10.1016/j.inoche.2016.03.015

- Venkatesh, V., Walton, S. M., & Thong, J. Y. L. (2012). Quarterly Consumer Acceptance and Use of Information Technology: Extending the Unified Theory of Acceptance and Use of Technology1. Retrieved from http://about.jstor.org/terms.

- Vietnam News. (2023). Personal finance planning vital yet neglected in Vietnam: Forum. Retrieved November 21, 2023, from https://vietnamnews.vn/economy/1552115/personal-finance-planning-vital-yet-neglected-in-viet-nam-forum.html.

- Zhang, X., Ma, L., & Wang, G. S. (2017). Investigating consumer word-of-mouth behaviour in a Chinese context. Total Quality Management & Business Excellence, 30(5–6), 579–593. https://doi.org/10.1080/14783363.2017.1317587

- Zhou, T. (2013). An empirical examination of continuance intention of mobile payment services. Decision Support Systems, 54(2), 1085–1091. https://doi.org/10.1016/j.dss.2012.10.034