?Mathematical formulae have been encoded as MathML and are displayed in this HTML version using MathJax in order to improve their display. Uncheck the box to turn MathJax off. This feature requires Javascript. Click on a formula to zoom.

?Mathematical formulae have been encoded as MathML and are displayed in this HTML version using MathJax in order to improve their display. Uncheck the box to turn MathJax off. This feature requires Javascript. Click on a formula to zoom.Abstract

This study investigates the impact of innovation dimensions on the export activities of Vietnamese manufacturing and processing enterprises, considering the moderating role of environmental uncertainty. By applying the Probit Effect Random Regulatory Model (RE Probit) and xtTobit, the study utilizes three different sources of secondary data in the period 2016–2019: the General Statistics Office (GSO)’s annual enterprise census, the Survey on the use of technology in the production of manufacturing and processing companies by GSO, and the Provincial Competitiveness Index (PCI) of the Vietnam Chamber of Commerce and Industry (VCCI) to determine the correlation between the research variables. The research findings demonstrate that innovation positively affects both the propensity and intensity of exports. Specifically, when compared to non-innovative firms, those that prioritize innovation observe a notable 12.4% increase in export propensity and a 1.4% enhancement in export intensity. Moreover, the study highlights the moderating role of environmental uncertainty, encompassing challenges related to basic infrastructure, transport infrastructure, communication infrastructure, and institutional environment, in mitigating the impact of innovation on export outcomes. These results provide a comprehensive understanding of how process and product innovation affect export propensity and intensity while considering the complexities introduced by environmental uncertainty. Consequently, the study offers several implications that can aid policymakers in enhancing export performance, particularly in dynamic and changing environments.

IMPACT STATEMENT

This research investigates the impact of innovation on the exports of Vietnamese manufacturing and processing enterprises, specifically looking at how environmental uncertainty moderates this relationship. Innovation is a notable driver of economic growth and development and affects the ability to compete in global markets, especially for firms in Vietnam - an emerging economies country with various changes. Therefore, by examining the moderating role of environmental uncertainty, the study broadens our understanding of the conditions under which innovation is most effective in boosting exports. The findings of this research are important for policymakers, business leaders, and anyone interested in understanding how innovation can contribute to the growth and success of businesses in Vietnam and other emerging economies.

1. Introduction

Innovation and export are critical factors for the growth of enterprises (Filatotchev et al., Citation2009). In terms of the resource-based view (RBV), much of the literature has regarded firms as an idiosyncratic bundle of resources that confer an enduring competitive advantage (Chabowski et al., Citation2018). Despite theoretical statements about the positive impact of innovation on firm exports, empirical findings are mixed. While many studies report evidence of positive effects of innovation on exports such as: Azar and Ciabuschi (Citation2017), several studies have found a statistically insignificant relationship between these two variables (Aw et al., Citation2007; Ayllón & Radicic, Citation2019), and some have revealed a negative relationship (Bernardini Papalia et al., Citation2018; Rialp-Criado & Komochkova, Citation2017). These divergent results raise the question of how innovation is related to export performance in different contexts.

When examining the relationship between innovation and exports, scholars suggest that it is crucial to consider the moderating role of environmental uncertainty (Chan et al., Citation2016; Yi et al., Citation2013). Environmental uncertainty can limit a firm’s ability to pursue innovative activities from internal resources, making innovation costlier and riskier, thereby harming the firm’s financial performance and competitiveness (Zahra & Bogner, Citation2000). However, while past research has primarily examined uncertainty in the relationship between several factors and organizational performance, such as top-management board diversity (Cannella et al., Citation2008), supply chain strategy (Qi et al., Citation2011), and social capital (Liu, Citation2017), the association between innovation and export performance is not mentioned. Despite some scholars having made further analyses of the moderating role of environmental uncertainty, there are still conflicting findings. Specifically, while Oke et al. (Citation2012) found that innovation strategies tend to be more effective as environmental uncertainty increases, Rialp-Criado and Komochkova (Citation2017) argued that export intensity has gradually declined based on the severity of each difficulty.

This paper seeks to make two contributions to the literature on innovation, exports, and environmental uncertainty. Firstly, while the correlation between innovation and export performance is recognized, research implies that the moderating role of environmental uncertainty in this relationship is limited, therefore, this study aims to analyze the effects of various dimensions of innovation on export propensity and intensity through the moderating role of environmental. Secondly, this research provides a context-specific contribution, focusing on Vietnam—a leading exporter country. Specifically, Vietnam’s manufacturing and processing industry plays a crucial role in the country’s economy, and notably aims to achieve international competitiveness through innovation. This research can provide scholarly and practical value to researchers and practitioners who have an interest in environmental uncertainty and their role in innovation and export. More broadly, given the prevalence of environmental uncertainty in other countries, the authors expect the research results to be of relevance to emerging economies.

The remainder of this paper is structured as follows. Section 2 provides a comprehensive review of the relevant literature. While Section 3 outlines the research methodology, Section 4 presents the research results, which are discussed in Section 5. Finally, conclusions, limitations, and suggestions are given out in Section 6.

2. Literature review and research hypotheses

2.1. The relationship between innovation and export

Innovation has become a fascinating field among researchers and can be approached in different fields. Notably, innovation is considered a fundamental element of a growth strategy for businesses to gain a competitive advantage in international markets (Kafetzopoulos et al., Citation2019). Innovation can be classified into different forms (technological innovation and non-technological innovation) (Rogers & Rogers, Citation1998) or categories (product innovation, process innovation, organizational innovation, and marketing innovation) (OECD, Citation2005). To effectively evaluate the role of innovation on firms’ export performance as well as to guarantee the consistent of the research results with the secondary data of Vietnamese manufacturing and processing enterprises, the authors focus on the analysis of technological innovation, which encompasses both product and process innovation since these factors are often associated with practicality research within enterprises as well as are commonly used in previous studies, such as Kelly et al. (Citation2021).

In the trend of globalization and international economic integration, exports have become an essential activity in the development strategy of enterprises, which is of interest to many domestic and foreign scholars (Estrin et al., Citation2008). Export is a crucial element of international business as it involves marketing and sales activities implemented by enterprises on a global scale (Paul & Mas, Citation2020), and refers to the movement of goods and services across national borders (Young et al., Citation1989). In research on export performance, most empirical studies examine two key aspects: export propensity and intensity (Martineau & Pastoriza, Citation2016). This approach has also been used by López Rodríguez and Serrano Orellana (Citation2020) when investigating the effects of general firms and human capital on exports. Specifically, export intensity is measured by comparing exports with export intensity in terms of sales is widely recognized as a significant measure in empirical studies (Larimo, Citation2013). Therefore, through the available manufacturing and processing industries data in Vietnam, this research will only measure export propensity and intensity (expressly, export intensity measured by revenue), and exclude export scope as an indicator.

The advantages of innovation to exporting have been extensively acknowledged. Numerous scholars have highlighted that innovation can serve as a strategic tool for companies to expand their market share and enter new markets (Wang et al., Citation2008). Moreover, innovation enables firms to create unique products and services, enhance quality, minimize costs, and adapt internal structures to address technological advancements and environmental unpredictability. As a result, product values (including subsequent services) will increase foreign customer satisfaction and willingness to pay for that product, thereby businesses have more production and export incentives (Golovko & Valentini, Citation2011). These benefits lead to increased competitiveness and market influence, as well as support in expanding its operations as well as establishing a firm’s presence in the export markets (Azar & Ciabuschi, Citation2017). Smith et al. (Citation1992) also consider innovation a crucial factor in promoting firms’ participation in exporting as innovation can enhance their position in the international market through productivity growth and commodity development. The impact of innovation on export activities, encompassing both export propensity and intensity is typically examined through product innovation and process innovation. Empirical evidence suggests that introducing product and process innovations positively affects a firm’s export performance (Wagner, Citation2012). Notably, empirical findings by Nguyen et al. (Citation2008) demonstrate a positive relationship between innovation and export intensity dimensions. This positive relationship stems from the various benefits that product and process innovations offer, motivating enterprises to expand internationally (Cheng et al., Citation2010). In line with these findings, it has been observed that firms implementing innovation are significantly positively associated with firm performance and export performance (Phan, Citation2019; Edeh et al., Citation2020). The specific role played by each dimension of innovation on export performance is shown as follows:

2.1.1. The effect of product innovation on exports

Product innovation is defined as development driven by a desire to improve the properties and performance of finished products that help businesses enhance their competitiveness (Bergfors & Larsson, Citation2009). Therefore, firms have a strong incentive to expand into global markets to maximize profits and obtain higher returns on investment (Teece, Citation1986). Furthermore, Roper and Love (Citation2002) found a positive effect of product innovations on export propensity and intensity in manufacturing firms in the UK and Germany.

2.1.2. The effect of process innovation on exports

Process innovation is defined as development driven by internal production objectives (Bergfors & Larsson, Citation2009). In addition, Cheng et al. (Citation2010) demonstrate that process innovation helps firms save resources and production costs, and improve their overall market performance, which is difficult to copy by competitors. Moreover, Filatotchev and Piesse (Citation2009) point out that thriving on process innovation tends to be more productive and more likely to gain a favorable position in the global export process.

In summary, literature and empirical studies all show great consistency in the positive impact of innovation on the export performance of processing and manufacturing enterprises. Therefore, the authors propose the following hypothesis:

Hypothesis 1: Innovation has a positive impact on exports in the processing and manufacturing enterprises in Vietnam.

2.2. The moderating role of environmental uncertainty

In many studies, environmental uncertainty has been identified as an important mediating factor that affects the relationship between firm performance and its internal and external effects (Yu et al., Citation2016). In which, environmental uncertainty is a situation that arises in an unpredictable business environment (Latan et al., Citation2018). In line with this view, Miller (Citation1993) categorizes uncertainty into three types: general, industry, and corporation environmental uncertainty. Due to the research data assessment, this research adopts Miller’s conceptualization of environmental uncertainty, which shares similarities with previous studies (Eifert et al., Citation2005). This research not only confirms the moderating role of environmental uncertainty but also measures its impacts on the relationship between innovation and export at the enterprise level through an objective method. This method has also been used in previous research by Zhang et al. (Citation2020) when measuring the moderating effects of environmental uncertainty in the relationship between corporate environment and financial performance.

The study of the moderating role of environmental uncertainty in the relationship between innovation and export is of significant interest due to its practical implications. According to institutional theory, the socio-economic environment greatly affects internationalization (Scott, Citation2008). Specifically, this theory suggests that the external institutional environment shapes the behavior of leaders and thereby influences organizational decisions (Rialp-Criado & Komochkova, Citation2017). In emerging economies like Vietnam, institutions can change rapidly and unpredictably, making them a significant source of environmental uncertainty (Xu et al., Citation2013).

By applying the above theory, institutional constraints can directly or indirectly shape the export behavior of enterprises through factors associated with export activities, such as innovation. This point of view shares similarities with the research of Peng et al. (Citation2008). Moreover, Yi et al. (Citation2013) show that the institutional environment moderates the relationship between innovation and exports. Specifically, a favorable regulatory regime and low transaction costs provide companies operating in a developed institutional environment with more opportunities to invest in innovation and pursue export strategies, thereby enhancing the role of innovation in internationalization.

Similarly, Efthyvoulou and Vahter (Citation2016) reveal that firms investing in innovation often encounter financial difficulties that limit their access to basic economic resources such as land and labor, thereby indirectly affecting the relationship between innovation and export. Therefore, it is important to consider institutional constraints and their moderating effect on the relationship between innovation and export in emerging economies like Vietnam.

In summary, firms that face challenges during times of uncertainty, need to adopt various dimensions of innovation to ensure their survival, potentially impacting their export performance. The institutional theory perspective suggests that the external environment and its constraints can shape a company’s behavior and affect its decisions related to innovation and internationalization. This raises the question of whether environmental uncertainty moderates the relationship between innovation and export performance.

Hypothesis 2: The relationship between innovation and export performance is moderated by environmental uncertainty.

3. Research methodology

3.1. Sample and data collection

To achieve the objectives of the study, data was compiled from three different sources:

Firstly, the Vietnam annual Enterprise Survey (VES) data (covering the period 2016-2019) collected by the General Statistics Office of Vietnam (GSO) are used to compiled essential information related to Vietnamese enterprises such as human capital, enterprise size, capital intensity, two-digit industry, and type of enterprise.

Secondly, the study also uses the survey data set on the use of technology in the manufacturing and processing enterprises (covering the period 2016-2019), which were conducted by the General Statistics Office of Vietnam (GSO) to collect information related to enterprises in the manufacturing and processing industry (innovation, export, environmental uncertainty).

Lastly, the study uses the set of Provincial Competitiveness Index (PCI) data which were conducted by the Vietnam Chamber of Commerce and Industry (VCCI) with the support of the United States Agency for International Development (USAID) to collect information from the institutional environment. This dataset includes several indicators representing the business environment or economic institutions supporting the research market.

3.2. Variables and measurements

3.2.1. Independent variables

Similar to prior research (Becker & Egger, Citation2013), innovation is measured using three indicator variables: innovation, product innovation, and process innovation, which are all assigned a value of 0 or 1.

3.2.2. Dependent variable

This study measures exports using both export propensity (EP) and export intensity (EI) as dependent variables. Export propensity is defined as a binary variable, assigned a value of 1 if the enterprise engages in exporting in the year of study and 0 otherwise. Export intensity is calculated as the ratio of export sales to total sales. This measurement method is consistent with previous research by Aristei et al. (Citation2013), Falk and de Lemos (Citation2019).

3.2.3. Moderating variable

The measurement of environmental uncertainty is based on two dimensions, which are the general environment and the corporate environment. The uncertainty of the industry environment is excluded as it is assumed to be relatively similar within the same manufacturing and processing industry. The uncertainty of the environment is composed of eight difficulty factors, including local institutional environment, basic infrastructure, transport infrastructure, communication infrastructure, finance, labor resources, skilled labor, and machinery/technological equipment.

The difficulty in the local institutional environment is calculated by taking the inverse of the PCI (Provincial Competitiveness Index). This measure is consistent with previous studies by Slangen and Beugelsdijk (Citation2010). The PCI index used in this study consists of ten sub-indices, including Market Entry, Land Access, Transparency, Time Cost, Informal Cost, Fair Competition, Dynamicity, Support Services Enterprises, Labor Training, and Legal Institutions.The other difficulty factors, including basic infrastructure, transport infrastructure, communication infrastructure, finance, labor resources, skilled labor, and machinery/technological equipment, are based on survey data on the use of technology in the production of manufacturing and processing enterprises. These variables are measured on a scale of 0 to 10, where 0 indicates irrelevance, 1 indicates less importance, and 10 indicates very high importance.

3.2.4. Control variable

The study utilized the collected annual enterprise survey data to measure the following variables: enterprise size, human capital, capital intensity, type of enterprise, year, and two-digit industry.

Enterprise size: was calculated by the natural logarithm of the number of employees in that enterprise on December 31 of each year. Previous studies have demonstrated a positive correlation between firm size and export (Ayllón & Radicic, Citation2019).

Human capital: was measured by the natural logarithm of the ratio of total wages to employees (million VND), reflecting the quality of the labor force. Studies have shown that better-quality labor has a positive impact on export (Amadu & Danquah, Citation2019).

Capital intensity: was measured by the natural logarithm of the ratio of total capital to total employees (million VND). Empirical study have found a positive relationship between capital intensity and export (Wu et al., Citation2021).

Type of enterprise: was categorized into FDI enterprises, state-owned enterprises and non-state enterprises (GSO, 2015) using two dummy variables, with state-owned enterprises serving as the reference category. Different types of enterprises have specific characteristics that can affect export (Majumdar et al., Citation2012).

Year: year dummy variables are included to capture the time effects related to exchange rate and other time-varying factors on exports.

Two-digit industry: Two-digit industry dummy variables are included to regulate industry-specific characteristics that can affect the changes in firms’ export performance.

provides an overview of the variables in the study.

Table 1. Summary of the variable scales used in this paper.

3.3. Model formulation

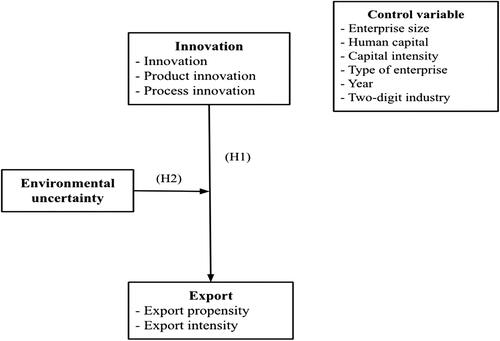

Based on the above theoretical backgrounds and hypotheses, this study proposes the following integrated model ().

3.4. Method

The research employs advanced statistical models to measure export propensity and intensity. The export propensity (a binary variable) is measured using a random-effects probit (RE Probit) regression model. This model is considered an effective approach as binary dependent variables with specific differences among firms that are not directly observable (Roberts & Tybout, Citation1997). The use of the RE Probit model for measuring export propensity is also supported in the study of Ayllón and Radicic (Citation2019). On the other hand, the export intensity (a dependent variable measured by the ratio of export to revenue) is subjected to the Tobit regression model developed by Tobin (Citation1958). This model is deemed appropriate for estimating models with censored dependent variables that are restricted in the range from 0 to 1 (Gujarati, Citation2004).

4. Results

4.1. Descriptive statistics results

As most variables in the study are binary and hierarchical, meaningful correlation coefficients could not be derived (Greenacre, Citation2017). Therefore, the authors will not consider the correlation coefficient matrix of variables when presenting the research results. provides descriptive statistics of the main variables in the model. The sample consists of 46% of companies engaged in exporting, with an average export intensity of 29%. Additionally, 92% of the enterprises reported innovation, with 81% and 68% reporting product and process innovation, respectively. The enterprises also reported facing various difficulties, with the machinery and technological equipment sector having the highest difficulty score of 5.92.

Table 2. Descriptive statistics.

4.2. The effect of innovation on export propensity and intensity

As mentioned in Section 3.4, this study employs the RE Probit regression model to analyze export propensity and the xtTobit model to investigate export intensity. Specifically, while models 1, 2, and 3 show the impact of innovation, product innovation, and process innovation on export, model 4 includes both independent variables (product innovation and process innovation) to compare their effects on firms’ exports.

Before testing the hypotheses based on the model outcomes, it is necessary to examine the issue of multicollinearity. Given that the majority of variables in this study are binary and hierarchical, the correlation coefficients lack substantive meaning (Greenacre, Citation2017). Consequently, in the presentation of research findings, the correlation coefficient matrix of variables will be disregarded by the authors. Instead, the degree of multicollinearity among the independent variables in the regression model was retested using the VIF method (Variance Inflation Factor) (O’brien, Citation2007). The figures required to detect such an issue arepresented in .

Table 3. The results of variance inflation (VIF).

If the Variance Inflation Factor (VIF) is more than 10, there will be a cause of concern for multicollinearity problem (Montgomery et al., Citation2021). In , VIF amounts are less than 10, and even less than 5. This shows there is no seriousmulticollinearity problem that may affect the model of the study outcomes. In other words, the interactions among independent variables are not strong enough to create noise that leads tomodel misspecification.

After testing for multicollinearity, a Breusch-Pagan test for heteroscedasticity was conducted. The fear of testing for heteroscedasticity is the existence of homogeneity of variance of the residuals. This is one of the conditions to be observed before employing and multivariate regression analysis. The results of the Breusch-Pagan test are presented in . The results show a chi-square value above the critical value, implying that the hypothesis for homoscedasticity could be rejected. According to Belsley (Citation1980), the homoskedasticity assumption is needed to show the efficiency of OLS. The heteroskedasticity test shows that the variances of the OLS estimators are biased. Thus, the usual OLS t-statistics and confidence intervals are no longer valid for inference problems. Using an OLS estimator without adjustment will render estimations biased.

Table 4. The results of a Breusch-Pagan test.

The direct effect of innovation on export propensity and intensity is presented in . research results show the regression coefficients of 0.601 and 0.053 with the same significance level of 1%, which indicates that innovation has a positive impact on both export propensity and intensity. In other words, firms that innovate have a 12.4% higher probability of participating in exports and 1.4% more export intensity than non-innovative firms. Moreover, the regression results of models (2) and (3) also show that product innovation and process innovation have a positive influence on export propensity and intensity. However, the regression results of process innovation only recorded statistical significance in the relationship to export propensity (with a coefficient of 0.265) but did not find a significant effect of process innovation on export intensity. In addition, through the results in model (4), it can be seen that innovation has a higher impact on export propensity than export intensity. Specifically, comparing the influence of product innovation and process innovation on export propensity, with statistical significance at 1% and regression coefficient at 0.274, the results confirm a stronger correlation than the effect of innovation on export propensity (with a regression coefficient of 0.240). Meanwhile, when comparing the influence of product innovation and process innovation on export intensity, the results in only show a statistically significant relationship between product innovation and export propensity (1%), by the same level of impact (0.027). The results are significant at 1%, Wald chi2 has a probability of 0.000, which signifies that these models have a good fit.

Table 5. Result of the impact from innovation to export propensity and intensity.

In conclusion, these findings support hypothesis H1, indicating that innovation has a positive impact on export in processing and manufacturing enterprises in Vietnam.

4.3. The moderating role of environmental uncertainty

and provide an analysis of the relationship between innovation and export in the presence of environmental uncertainty. Eight models were generated for each innovation variable, representing an interaction between innovation and a variable in environmental uncertainty. It was ensured that all interacting variables were not considered simultaneously to avoid multicollinearity and high standard error (Arouri et al., Citation2015). The results are significant at 1%, Wald chi2 has a probability of 0.000, which signifies that these model have a good fit.

Table 6. The moderating role of environmental uncertainty in the linkage between Innovation and export.

Table

Table 7. The moderating role of environmental uncertainty in the linkage between product innovation and export.

Table

Table 8. The moderating role of environmental uncertainty in the linkage between process innovation and export.

Table

The regression results in indicate that when businesses innovate, the difficulties in basic infrastructure, transport infrastructure, communication infrastructure, and institution environment act as moderators in reducing the impact of innovation on both export propensity and intensity. However, the moderating role of other difficulties (finance, labor resources, skilled labor) was not found significant in the study.

4.3.1. The moderating role of environmental uncertainty in the linkage between innovation and export

4.3.1.1. Concerning export propensity

In terms of the difficulty of the local institutional environment, the interaction variable is negatively correlated with the export trend at 1%. Regarding the difficulty of basic infrastructure, the regression analysis reveals a statistically significant regression coefficient of −0.076 at a 5% significance level. The corresponding marginal effect of −0.032 indicates that when an enterprise that has innovated encounters a 1-point increase in basic infrastructure difficulties, there is a 3.2% decrease in the probability of participating in exporting. Regarding transport infrastructure difficulties, the regression analysis reveals a statistically significant regression coefficient of −0.087 at a 1% significance level. Additionally, the marginal effect indicates that when an enterprise that has innovated encounters a 1-point increase in transport infrastructure difficulties, there is a 3.2% decrease in the probability of participating in exporting. In terms of the difficulty of communication infrastructure, the results indicate a negative correlation between the interaction variable and the export trend at a significance level of 5%. Specifically, for enterprises in the processing and manufacturing industries that have embraced innovation, encountering a 1-point increase in the difficulty of communication infrastructure results in a 3.4% reduction in the probability of exporting.

4.3.1.2. Concerning export intensity

In terms of difficulty of the local institutional environment, shows the regulatory role of local institutional constraints in mitigating the effect of innovation on export intensity by 1.5%. In terms of basic infrastructure constraints, shows the moderating role of basic infrastructure constraints in mitigating the effect of innovation on export intensity with a regression coefficient of −0.009 and is statistically significant at 1%. In terms of difficulty of transport infrastructure, with the regression coefficient of the interaction variable −0.012, statistically significant at 1%, the results indicate the moderating role of the transport infrastructure difficulty in reducing the effect of innovation on export intensity by 0.4%. In terms of difficulty of communication infrastructure, the interaction variable is negatively correlated with the export trend at the significance level of 1% and has a regression coefficient of −0.008, showing the moderating role of the difficulty in communication infrastructure reduces the effect of innovation on export intensity by 0.4%. In terms of difficulty of machinery/technological equipment, the interaction variable is negatively correlated with the export intensity at a 1% significance level and has a regression coefficient of −0.007 thereby reducing the export intensity by 0.4%.

4.3.2. The moderating role of environmental uncertainty in the correlation between product innovation and export

The results presented in indicate that when enterprises conduct product innovation, most difficulties have a moderating role in mitigating the impact of product innovation on export propensity and intensity, except for difficulties in labor resources for export propensity and difficulties in communication infrastructure, finance, and labor resources on export intensity.

4.3.3. The moderating role of environmental uncertainty in the correlation between process innovation and export

The research results in highlight that when enterprises face difficulties in labor resources, skilled labor, machinery, technological equipment, and institutional environment, process innovation is not statistically significant in terms of exporting. Therefore, it suggests that process innovation is no longer an advantage for a firm to engage in exporting. This observation helps explain why, when enterprises face these difficulties, they are unable to increase their export intensity through process innovation. The paper also indicates that the difficulty of finance reduces the impact of innovation on export propensity, and the difficulty in transport infrastructure, communication infrastructure, finance, and institutional environment reduces the impact of process innovation on export intensity. However, research has not found any moderating role of other difficulties.

In summary, most difficulties have a moderating role in reducing the impact of one of the three dimensions of innovation on export propensity and intensity. Therefore, the research results support Hypothesis 2, stating that environmental uncertainty has a moderating role in mitigating the impact of innovation on exports. The study also shows that control variables such as size, human capital, capital intensity, and FDI enterprises have statistical significance and a positive effect on export, while non-state firms do not affect export.

5. Discussion

The findings of this study demonstrate that all three dimensions of innovation have a positive influence on export propensity, consistent with a previous study by Gajewski and Tchorek (Citation2017). The benefits of innovation for export propensity include the development of differentiated products and services, improved quality, reduced costs in response to technological advancements, and the ability to penetrate and expand export markets (Azar & Ciabuschi, Citation2017). Furthermore, the study reveals that product innovation has a stronger positive effect on export propensity compared to process innovation. This can be attributed to product innovation’s ability to create barriers to imitation, establish a precedent advantage (Love & Roper, Citation2015), and ultimately lead to competitive advantage (Rodríguez & Rodríguez, Citation2005), as supported by a prior study by Nguyen et al. (Citation2008).

The results also indicate a positive impact of innovation and product innovation on export intensity, consistent with previous research conducted by Becker and Egger (Citation2013). Conversely, the effect of process innovation on export intensity is not significant, aligning with prior studies suggesting that process innovation may not directly impact internationalization (Tsukanova, Citation2019), or may only influence export when accompanied by product innovation (Becker & Egger, Citation2013; Tsukanova, Citation2019).

Additionally, the research demonstrates that environmental uncertainty negatively affects the relationship between innovation and exports, specifically in terms of export propensity and intensity. This finding aligns with the study by Yi et al. (Citation2013), which analyzed panel data of manufacturing companies in China from 2005 to 2007 and indicated that the institutional environment plays a regulatory role in mitigating the impact of innovation on exports.

The research further reveals that Vietnamese enterprises in the manufacturing and processing industry face several difficulties impeding the impact of innovations on export propensity and intensity. Regarding the moderating role of the local institutional environment, developing countries like Vietnam often lag behind in regulatory institutions and business environments, influenced by volatile factors that affect companies’ internationalization capabilities (Peng et al., Citation2008). In such environments, firms not only face the costs associated with innovation but also encounter taxes and informal costs, which may necessitate adjustments to their innovation and export strategies (Wu et al., Citation2021). Additionally, high levels of corruption or ineffective legal systems can lead to unfair competition and hinder innovation efficiency (Rialp-Criado & Komochkova, Citation2017). Moreover, constraints on technology and internationalization can discourage firms from pursuing innovation, resulting in underutilization of the potential benefits of innovation (Anokhin & Schulze, Citation2009).

Strong basic infrastructure facilitates connections between companies, customers, and suppliers, encourages the adoption of modern technologies, and provides efficient communication channels, all of which promote internationalization (Rialp-Criado & Komochkova, Citation2017). Modern and efficient transportation infrastructure meets the needs of transportation, ensuring smooth internationalization processes (Oviatt & McDougall, Citation2005). However, if enterprises face infrastructure challenges, goods may not reach customers, thus negatively impacting the export process.

With regards to the moderating role of financial difficulties, the results of this study align with the findings of Efthyvoulou and Vahter (Citation2016) for SMEs in China. Companies investing in innovation often face financial constraints, limiting their access to other essential economic resources such as capital and labor, which can have a negative effect on the relationship between innovation and export. Additionally, several studies have shown that corporate financial capital plays a moderating role by enhancing the impact of innovation on firm performance (Kijkasiwat & Phuensane, Citation2020).

While the study did not find evidence supporting the moderating role of labor resource constraints, enterprises may choose to increase labor intensity to meet short-term production requirements for export, thereby influencing the export process. Regarding the moderating role of skilled labor constraints, enterprises facing this difficulty may encounter challenges in meeting the labor requirements for innovation, thereby diminishing the benefits of innovation or impeding innovation adoption (Rialp-Criado & Komochkova, Citation2017). Consequently, these factors can contribute to a decline in export performance.

Furthermore, difficulties in machinery and technological equipment play a significant role in shaping business strategies. Technological machinery and equipment are crucial input resources that determine the success or failure of process innovation, while product innovation also relies on the involvement of machinery and technological equipment to create new or improved products. When enterprises face challenges in accessing or utilizing machinery and technological equipment, it can reduce innovation efficiency, increase risks, and ultimately impact export activities (Flor & Oltra, Citation2005).

6. Conclusion

This study aims to investigate the impact of innovation dimensions on export activities in manufacturing and processing enterprises in Vietnam through the moderating role of environmental uncertainty. Through the application of the regression models to analyze three different secondary datasets, the research results show that innovation has a positive influence on both the propensity and intensity of exports, specifically, in comparison to non-innovative firms, those that prioritize innovation experience a 12.4% increase in the export propensity, along with a 1.4% boost in export intensity. In addition, the presence of environmental uncertainty (the difficulties in basic infrastructure, transport infrastructure, communication infrastructure, and institution environment) plays a moderating role in reducing the impact of innovation on export outcomes. Notably, the findings highlight the importance of product innovation in achieving greater success in international markets.

The findings of this research provide detailed insights into the impact of innovation on exports through the moderating role of environmental uncertainty, which can be used for practical implications to help policymakers and practitioners in promoting internationalization and competitiveness within firms, especially those in uncertain environments. Recognizing the importance of innovation in export strategies and the impact of environmental uncertainty can help managers develop business strategies that improve business performance.

However, limitations are inevitable, due to the limited data access, the measurement of innovation using only product and process innovation dimensions as well as this research only considering two dimensions of exports. Future research is encouraged to expand the scope of data to other industries and use a longer period sample to obtain more generalizable and accurate results in the research relationships.

Public Interest Statement.docx

Download MS Word (12 KB)Disclosure statement

No potential conflict of interest was reported by the author(s).

Additional information

Funding

Notes on contributors

Hue Thi Hoang

Hue Thi Hoang has been a lecturer at National Economics University for more than 10 years. She holds a bachelor’s degree and a PhD degree in Human Resource Management. She has authored and co-authored numerous research papers in Human Resource Management, Human Resource Development, and Innovation and Business Development.

Ngan Hoang Vu

Ngan Hoang Vu, currently an Associate Professor, completed her doctoral dissertation at Paris Descartes University (Paris V) in France in 1998 and has been working for nearly 30 years at the National Economics University (NEU) in Vietnam since. She has authored and co-authored numerous papers in Human Resource Management, Human Resource Development, Labor Markets, and Labor Productivity.

Hang Thu Nguyen

Hang Thu Nguyen has a bachelor’s degree in Human Resource Management from National Economics University. She has co-authored several research papers on Innovation, Environmental Uncertainty.

Hanh Thi Hai Nguyen

Hanh Thi Hai Nguyen is currently a lecturer at National Economics University. She is a PhD student at Vrije Universiteit Amsterdam. She has authored and co-authored numerous researches in Management, Organizational Behavior, and Sociology.

Bao Quoc Mai

Bao Quoc Mai is currently a lecturer at National Economics University. He holds a Master of Labor Economics. Bao does research in Human Resource Management, Human Resource Development, Organizational Behavior, and Labor Economics.

References

- Amadu, A. W., & Danquah, M. (2019). R&D, human capital and export behavior of manufacturing and service firms in Ghana. Journal of African Business, 20(3), 1–21. https://doi.org/10.1080/15228916.2019.1581003

- Anokhin, S., & Schulze, W. S. (2009). Entrepreneurship, innovation, and corruption. Journal of Business Venturing, 24(5), 465–476. https://doi.org/10.1016/j.jbusvent.2008.06.001

- Aristei, D., Castellani, D., & Franco, C. (2013). Firms’ exporting and importing activities: Is there a two-way relationship? Review of World Economics, 149(1), 55–84. https://doi.org/10.1007/s10290-012-0137-y

- Arouri, M., Nguyen, C., & Youssef, A. B. (2015). Natural disasters, household welfare, and resilience: Evidence from rural Vietnam. World Development, 70, 59–77. https://doi.org/10.1016/j.worlddev.2014.12.017

- Aw, B. Y., Roberts, M. J., & Winston, T. (2007). Export market participation, investments in R&D and worker training, and the evolution of firm productivity. The World Economy, 30(1), 83–104. https://doi.org/10.1111/j.1467-9701.2007.00873.x

- Ayllón, S., & Radicic, D. (2019). Product innovation, process innovation and export propensity: Persistence, complementarities, and feedback effects in Spanish firms. Applied Economics, 51(33), 3650–3664. https://doi.org/10.1080/00036846.2019.1584376

- Azar, G., & Ciabuschi, F. (2017). Organizational innovation, technological innovation, and export performance: The effects of innovation radicalness and extensiveness. International Business Review, 26(2), 324–336. https://doi.org/10.1016/j.ibusrev.2016.09.002

- Becker, S. O., & Egger, P. H. (2013). Endogenous product versus process innovation and a firm’s propensity to export. Empirical Economics, 44(1), 329–354. https://doi.org/10.1007/s00181-009-0322-6

- Belsley, D. A. (1980). On the efficient computation of the nonlinear full-information maximum-likelihood estimator. Journal of Econometrics, 14(2), 203–225. https://doi.org/10.1016/0304-4076(80)90091-3

- Bergfors, M. E., & Larsson, A. (2009). Product and process innovation in process industry: A new perspective on development. Journal of Strategy and Management, 2(3), 261–276. https://doi.org/10.1108/17554250910982499

- Bernardini Papalia, R., Bertarelli, S., & Mancinelli, S. (2018). Innovation, complementarity, and exporting. Evidence from German manufacturing firms. International Review of Applied Economics, 32(1), 3–38. https://doi.org/10.1080/02692171.2017.1332576

- Cannella, A. A., Jr., Park, J. H., & Lee, H. U. (2008). Top management team functional background diversity and firm performance: Examining the roles of team member colocation and environmental uncertainty. Academy of Management Journal, 51(4), 768–784. https://doi.org/10.5465/AMJ.2008.33665310

- Chabowski, B., Kekec, P., Morgan, N. A., Hult, G. T. M., Walkowiak, T., & Runnalls, B. (2018). An assessment of the exporting literature: Using theory and data to identify future research directions. Journal of International Marketing, 26(1), 118–143. https://doi.org/10.1509/jim.16.0129

- Chan, H. K., Yee, R. W., Dai, J., & Lim, M. K. (2016). The moderating effect of environmental dynamism on green product innovation and performance. International Journal of Production Economics, 181, 384–391. https://doi.org/10.1016/j.ijpe.2015.12.006

- Cheng, C. F., Lai, M. K., & Wu, W. Y. (2010). Exploring the impact of innovation strategy on R&D employees’ job satisfaction: A mathematical model and empirical research. Technovation, 30(7–8), 459–470. https://doi.org/10.1016/j.technovation.2010.03.006

- Edeh, J. N., Obodoechi, D. N., & Ramos-Hidalgo, E. (2020). Effects of innovation strategies on export performance: New empirical evidence from developing market firms. Technological Forecasting and Social Change, 158, 120167. https://doi.org/10.1016/j.techfore.2020.120167

- Efthyvoulou, G., & Vahter, P. (2016). Financial constraints, innovation performance and sectoral disaggregation. The Manchester School, 84(2), 125–158. https://doi.org/10.1111/manc.12089

- Eifert, B., Gelb, A., & Ramachandran, V. (2005). Business environment and comparative advantage in Africa: Evidence from the investment climate data. The World Bank.

- Estrin, S., Meyer, K. E., Wright, M., & Foliano, F. (2008). Export propensity and intensity of subsidiaries in emerging economies. International Business Review, 17(5), 574–586. https://doi.org/10.1016/j.ibusrev.2008.04.002

- Falk, M., & de Lemos, F. F. (2019). Complementarity of R&D and productivity in SME export behavior. Journal of Business Research, 96, 157–168. https://doi.org/10.1016/j.jbusres.2018.11.018

- Filatotchev, I., & Piesse, J. (2009). R&D, internationalization and growth of newly listed firms: European evidence. Journal of International Business Studies, 40(8), 1260–1276. https://doi.org/10.1057/jibs.2009.18

- Filatotchev, I., Liu, X., Buck, T., & Wright, M. (2009). The export orientation and export performance of high-technology SMEs in emerging markets: The effects of knowledge transfer by returnee entrepreneurs. Journal of International Business Studies, 40(6), 1005–1021. https://doi.org/10.1057/jibs.2008.105

- Flor, M., & Oltra, M. J. (2005). The influence of firms’ technological capabilities on export performance in supplier-dominated industries: The case of ceramic tiles firms. R&D Management, 35(3), 333–347. https://doi.org/10.1111/j.1467-9310.2005.00393.x

- Gajewski, P., & Tchorek, G. (2017). What drives export performance of firms in Eastern and Western Poland? European Planning Studies, 25(12), 2250–2271. https://doi.org/10.1080/09654313.2017.1355890

- Golovko, E., & Valentini, G. (2011). Exploring the complementarity between innovation and export for SMEs’ growth. Journal of International Business Studies, 42(3), 362–380. https://doi.org/10.1057/jibs.2011.2

- Greenacre, M. (2017). Correspondence analysis in practice. CRC Press.

- Gujarati, D. N. (2004). Basic econometrics (4th ed.). McGraw-Hill Companies.

- Kafetzopoulos, D., Psomas, E., & Skalkos, D. (2019). Innovation dimensions and business performance under environmental uncertainty. European Journal of Innovation Management, 23(5), 856–876. https://doi.org/10.1108/EJIM-07-2019-0197

- Kelly, B., Papanikolaou, D., Seru, A., & Taddy, M. (2021). Measuring technological innovation over the long run. American Economic Review: Insights, 3(3), 303–320. https://doi.org/10.1257/aeri.20190499

- Kijkasiwat, P., & Phuensane, P. (2020). Innovation and firm performance: The moderating and mediating roles of firm size and small and medium enterprise finance. Journal of Risk and Financial Management, 13(5), 97. https://doi.org/10.3390/jrfm13050097

- Larimo, J. (2013). Small and medium-size enterprise export performance: Empirical evidence from Finnish family and non-family firms. International Studies of Management & Organization, 43(2), 79–100. https://doi.org/10.2753/IMO0020-8825430204

- Latan, H., Jabbour, C. J. C., de Sousa Jabbour, A. B. L., Wamba, S. F., & Shahbaz, M. (2018). Effects of environmental strategy, environmental uncertainty and top management’s commitment on corporate environmental performance: The role of environmental management accounting. Journal of Cleaner Production, 180, 297–306. https://doi.org/10.1016/j.jclepro.2018.01.106

- Liu, C. H. (2017). The relationships among intellectual capital, social capital, and performance-the moderating role of business ties and environmental uncertainty. Tourism Management, 61, 553–561. https://doi.org/10.1016/j.tourman.2017.03.017

- López Rodríguez, J., & Serrano Orellana, B. (2020). Human capital and export performance in the Spanish manufacturing firms. Baltic Journal of Management, 15(1), 99–119. https://doi.org/10.1108/BJM-04-2019-0143

- Love, J. H., & Roper, S. (2015). SME innovation, exporting and growth: A review of existing evidence. International Small Business Journal: Researching Entrepreneurship, 33(1), 28–48. https://doi.org/10.1177/0266242614550190

- Majumdar, S. K., Vora, D., & Nag, A. K. (2012). Legal form of the firm and overseas market choice in India’s software and IT industry. Asia Pacific Journal of Management, 29(3), 659–687. https://doi.org/10.1007/s10490-010-9223-7

- Martineau, C., & Pastoriza, D. (2016). International involvement of established SMEs: A systematic review of antecedents, outcomes and moderators. International Business Review, 25(2), 458–470. https://doi.org/10.1016/j.ibusrev.2015.07.005

- Miller, K. D. (1993). Industry and country effects on managers’ perceptions of environmental uncertainties. Journal of International Business Studies, 24(4), 693–714. https://doi.org/10.1057/palgrave.jibs.8490251

- Montgomery, D. C., Peck, E. A., & Vining, G. G. (2021). Introduction to linear regression analysis. John Wiley & Sons.

- Nguyen, A. N., Pham, N. Q., Nguyen, C. D., & Nguyen, N. D. (2008). Innovation and exports in Vietnam’s SME sector. The European Journal of Development Research, 20(2), 262–280. https://doi.org/10.1080/09578810802060801

- O’brien, R. M. (2007). A caution regarding rules of thumb for variance inflation factors. Quality & Quantity, 41(5), 673–690. https://doi.org/10.1007/s11135-006-9018-6

- OECD. (2005). Guidelines for collecting and interpreting innovation data: The measurement of scientific and technological activities. Oslo Manual., 3, 1–165. European Commission.

- Oke, A., Walumbwa, F. O., & Myers, A. (2012). Innovation strategy, human resource policy, and firms’ revenue growth: The roles of environmental uncertainty and innovation performance. Decision Sciences, 43(2), 273–302. https://doi.org/10.1111/j.1540-5915.2011.00350.x

- Oviatt, B. M., & McDougall, P. P. (2005). Defining international entrepreneurship and modeling the speed of internationalization. Entrepreneurship Theory and Practice, 29(5), 537–553. https://doi.org/10.1111/j.1540-6520.2005.00097.x

- Paul, J., & Mas, E. (2020). Toward a 7-P framework for international marketing. Journal of Strategic Marketing, 28(8), 681–701. https://doi.org/10.1080/0965254X.2019.1569111

- Peng, M. W., Wang, D. Y., & Jiang, Y. (2008). An institution-based view of international business strategy: A focus on emerging economies. Journal of International Business Studies, 39(5), 920–936. https://doi.org/10.1057/palgrave.jibs.8400377

- Phan, T. T. A. (2019). Does organizational innovation always lead to better performance? A study of firms in Vietnam. Journal of Economics and Development, 21(1), 71–82. https://doi.org/10.1108/JED-06-2019-0003

- Qi, Y., Zhao, X., & Sheu, C. (2011). The impact of competitive strategy and supply chain strategy on business performance: The role of environmental uncertainty. Decision Sciences, 42(2), 371–389. https://doi.org/10.1111/j.1540-5915.2011.00315.x

- Rialp-Criado, A., & Komochkova, K. (2017). Innovation strategy and export intensity of Chinese SMEs: The moderating role of the home-country business environment. Asian Business & Management, 16(3), 158–186. https://doi.org/10.1057/s41291-017-0018-2

- Roberts, M. J., & Tybout, J. R. (1997). What makes exports boom? The World Bank.

- Rodríguez, J. L., & Rodríguez, R. M. G. (2005). Technology and export behaviour: A resource-based view approach. International Business Review, 14(5), 539–557.

- Rogers, M., & Rogers, M. (1998). The definition and measurement of innovation (Vol. 98). Melbourne Institute of Applied Economic and Social Research.

- Roper, S., & Love, J. H. (2002). Innovation and export performance: Evidence from the UK and German manufacturing plants. Research Policy, 31(7), 1087–1102. https://doi.org/10.1016/S0048-7333(01)00175-5

- Scott, W. R. (2008). Institutions and organizations: Ideas and interests (3rd ed.). Sage.

- Slangen, A. H., & Beugelsdijk, S. (2010). The impact of institutional hazards on foreign multinational activity: A contingency perspective. Journal of International Business Studies, 41(6), 980–995. https://doi.org/10.1057/jibs.2010.1

- Smith, K. G., Grimm, C. M., & Gannon, M. J. (1992). Dynamics of competitive strategy. Sage Publications.

- Teece, D. J. (1986). Profiting from technological innovation: Implications for integration, collaboration, licensing, and public policy. Research Policy, 15(6), 285–305. https://doi.org/10.1016/0048-7333(86)90027-2

- Tobin, J. (1958). Estimation of relationships for limited dependent variables. Econometrica, 26(1), 24–36. https://doi.org/10.2307/1907382

- Tsukanova, T. (2019). Home country institutions and export behaviour of SMEs from transition economies: The case of Russia. European J. of International Management, 13(6), 811–842. https://doi.org/10.1504/EJIM.2019.102836

- Wagner, S. M. (2012). Tapping supplier innovation. Journal of Supply Chain Management, 48(2), 37–52. https://doi.org/10.1111/j.1745-493X.2011.03258.x

- Wang, C. H., Lu, I. Y., & Chen, C. B. (2008). Evaluating firm technological innovation capability under uncertainty. Technovation, 28(6), 349–363. https://doi.org/10.1016/j.technovation.2007.10.007

- Wu, L., Wei, Y., & Wang, C. (2021). Disentangling the effects of business groups in the innovation-export relationship. Research Policy, 50(1), 104093. https://doi.org/10.1016/j.respol.2020.104093

- Xu, D., & Meyer, K. E. (2013). Linking theory and context: ‘Strategy research in emerging economies’ after Wright et al. (2005). Journal of Management Studies, 50(7), 1322–1346. https://doi.org/10.1111/j.1467-6486.2012.01051.x

- Yi, J., Wang, C., & Kafouros, M. (2013). The effects of innovative capabilities on exporting: Do institutional forces matter? International Business Review, 22(2), 392–406. https://doi.org/10.1016/j.ibusrev.2012.05.006

- Young, S., Hammill, J., Wheeler, C., & Davies, J. R. (1989). International market entry and development: Strategies and management. Harvester Wheatsheaf, Hemel Hempstead.

- Yu, C. L., Wang, F., & Brouthers, K. D. (2016). Competitor identification perceived environmental uncertainty and firm performance. Canadian Journal of Administrative Sciences / Revue Canadienne Des Sciences de L’Administration, 33(1), 21–35. https://doi.org/10.1002/cjas.1332

- Zahra, S. A., & Bogner, W. C. (2000). Technology strategy and software new ventures’ performance: Exploring the moderating effect of the competitive environment. Journal of Business Venturing, 15(2), 135–173. https://doi.org/10.1016/S0883-9026(98)00009-3

- Zhang, Y., Wei, J., Zhu, Y., & George-Ufot, G. (2020). Untangling the relationship between Corporate Environmental Performance and Corporate Financial Performance: The double-edged moderating effects of environmental uncertainty. Journal of Cleaner Production, 263, 121584. https://doi.org/10.1016/j.jclepro.2020.121584