Abstract

This investigation aims to conduct a bibliometric analysis to amalgamate the publication patterns of auditing practices. As a result, this research scrutinizes the historical, contemporary, and forthcoming studies on auditing practices. The content is sourced from the Scopus database, and following the application of specific selection criteria, a total of 516 documents are chosen for bibliometric scrutiny. Citation analysis is employed to identify the most influential publications and contributors. In order to determine the most productive authors and sources, an analysis of productivity is undertaken. The bibliometric analysis used to discover five principal thematic clusters in auditing practice research. The themes that are extensively referenced include the legitimacy of audits, their function, archival auditing, the proliferation of audits, audit technologies, and the analysis of big data. By means of co-citation analysis, the works that are most frequently referenced are identified, while co-occurrence analysis is employed to identify the current themes that are trending in research on auditing practices. The present trends and clusters of themes encompass sustainability assurance, the role of auditors in financial crises, blockchain technology, professional skepticism, and the detection of fraudulent activities. The future directions for research are presented in the academic papers.

REVIEWING EDITOR:

1. Introduction

Auditing, which encompasses the systematic examination of financial, operational, or compliance information, is of utmost importance in ensuring the accuracy and reliability of such information (Castka & Searcy, Citation2023; Wilks & Zimbelman, Citation2004). As per Rasso (Citation2015), this process entails various types of audits, namely financial audits, operational audits, and compliance audits, each serving the purpose of assuring stakeholders that the audited information is fairly presented and in accordance with relevant standards or regulations (Soh et al., Citation2023). Consequently, according to Thakur and Kushwaha (Citation2023), the foundations of auditing practices are constructed upon a set of principles, standards, and methodologies that serve as guiding principles for auditors in the execution of their duties (Kushwaha et al., Citation2023). As per Hurtt (Citation2010), auditors must maintain both factual and perceptual independence, thereby ensuring that their objectivity and integrity are not compromised by any relationships or interests they may possess (Amiri et al., Citation2023). Carcello and Nagy (Citation2004) stated that auditing, as an integral part of the financial reporting system, plays a critical role in assuring the reliability and accuracy of financial information (Han et al., Citation2023).

Throughout the years, the field of auditing has undergone significant developments in response to changes in business environments, regulatory frameworks, and technological advancements (Carcary, Citation2020; Turetken et al., Citation2020). According to Maffei et al. (Citation2021), the origins of auditing can be traced back to ancient civilisations, where the maintenance of records and verification of transactions served as vital elements in facilitating trade and governance (Nugrahanti, Citation2023). However, Sikka (Citation2009) found that the modern auditing profession emerged as a result of the need for independent assurance following corporate frauds and scandals such as the cases involving Enron and WorldCom (Wilson et al., Citation2021). The establishment of auditing standards and regulatory bodies marked a pivotal milestone in shaping contemporary auditing practices (Imana et al., Citation2021; Parker et al., Citation2019). Consequently, Humphrey et al. (Citation2009) found that when researching auditing practices, it is imperative to remain up-to-date with the latest standards, regulations, and industry advancements (Ferry et al., Citation2023).

According to Messier et al. (Citation2005), the ever-evolving nature of auditing practices, influenced as it is by the continuous advancements in technology, the frequent changes in regulations, and the constant ethical considerations that auditors have to grapple with, highlights the imperative for auditors to consistently adapt and enhance their skills in order to stay relevant and effective (Beck et al., Citation2020; Landers & Behrend, Citation2023). Given the dynamic nature of the business landscape (Amin et al., Citation2023; Kolk & Perego, Citation2010), which is subject to ongoing transformations, it is expected that future research endeavours in the field of auditing will be primarily focused on the integration and utilisation of emerging technologies (Appelbaum et al., Citation2020), the examination of the impact of regulatory reforms on auditing practices, and the perpetual pursuit of ethical excellence within the auditing profession (Robson et al., Citation2007; Perego & Kolk, Citation2012). Hence, it becomes absolutely crucial for researchers in this field to stay up-to-date with the latest developments in these areas so as to ensure the sustained effectiveness and relevance of their auditing methodologies and approaches (Cohen et al., Citation2008; Rönkkö et al., Citation2023).

Today, with the given facts and benefits of auditing practices, the topic has gotten attention from researchers from every country. However, there need to be more bibliometric studies which have gotten lots of attention in various domains (Dai & Vasarhelyi, Citation2017; Kotb et al., Citation2020; Krieger et al., Citation2021; Tetteh et al., Citation2023) and not available in the literature so far. The domain of audit is in a state of perpetual transformation, characterized by the continual introduction of novel technologies, regulations, and business methodologies. Conducting a bibliometric analysis on auditing procedures holds the potential to furnish significant insights into this dynamic domain through the provision of a quantitative assessment of the research terrain. Through the examination of publication dates, keywords, and citation trends, a bibliometric investigation has the capacity to unveil the most dominant research themes and emergent tendencies within auditing procedures. This analytical approach aids in the identification of areas where knowledge is expanding and where comprehension gaps exist. A bibliometric exploration of auditing practices can furnish a comprehensive overview of the research domain, offering valuable insights. Such insights can be leveraged by researchers, policymakers, and practitioners to remain abreast of the latest advancements and to make well-informed decisions regarding the future trajectory of auditing.

This study addresses the following research questions:

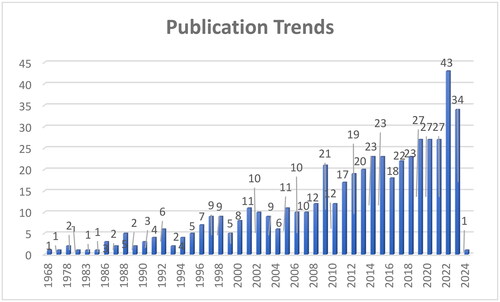

R.Q. 1: What are the publication trends of research on auditing practices?

R.Q. 2: Which are the most influential contributors of research on auditing practices?

R.Q. 3: What are the most trending topics and themes of research on auditing practices?

R.Q. 4: What are the future research propositions of auditing practices?

Therefore, this study conducts a bibliometric analysis of literature on auditing practices. It also expresses the past, present and future research propositions on auditing practices. first, these investigations unearth discernible patterns and prevailing trends within the realm of auditing practices research. This includes the identification of emerging themes, popular topics, and shifts in emphasis witnessed over time. Second, it finds out the most impactful authors, institutions, nations, articles, and sources of auditing practices research. It also aims to discover the popular themes and present future research directions. By availing themselves of this information, researchers and practitioners can ensure that they remain cognizant of the current state of affairs within this discipline (Quick et al., Citation2023). Third, these investigations can assist in the accurate delineation of the networks composed of researchers, institutions, and countries that contribute to the field of auditing practices (Singh et al., Citation2021). The comprehension of these networks can, in turn, facilitate collaboration amongst the relevant stakeholders, underscore the contributions of influential individuals, and identify areas wherein research gaps exist, or collaboration is imperative (Pimentel et al., Citation2023). Fourth, bibliometric studies that focus on research pertaining to auditing practices present an all-encompassing and methodical approach to understanding the landscape of academic contributions within this domain. Fifth, this study prove to be invaluable in guiding future research endeavours, fostering collaboration, and promoting the overall advancement of knowledge within the field of auditing practices (Ferry, Midgley, Murphie, et al., 2023).

2. Background of auditing practices

The term ‘audit’ is derived from the Latin word ‘audire’, which translates to ‘to hear’. Evidence from early civilizations such as Mesopotamia, Egypt, and Greece indicate the presence of auditing procedures primarily focused on verifying the accuracy of financial accounts. During this period, auditing practices were characterized by a lack of uniformity and standardized processes (Larasati et al., Citation2019). The early 1900s marked a significant milestone with the establishment of professional organizations like the American Institute of Certified Public Accountants (AICPA) that set forth comprehensive auditing guidelines. The primary objective of these standards was to promote uniformity and reliability in financial reporting, ultimately enhancing stakeholders’ confidence (Alharasis et al., Citation2023b). Over time, the scope of audits expanded beyond mere procedural checks to encompass a holistic evaluation of the fairness and precision of financial statements. The landscape of auditing underwent a paradigm shift as technological innovations, particularly in the realm of data analytics, revolutionized the audit process (Hurtt, Citation2010; Ali & Meah, Citation2021).

The roots of auditing can be traced back to ancient eras when merchants engaged in verifying financial transactions and records (Alharasis et al., Citation2023a). However, the modernization of auditing practices gained momentum during the industrial revolution, a period marked by the rapid growth and increasing complexity of businesses (Kotb et al., Citation2020). This evolution necessitated the establishment of mechanisms for independent validation of financial records to instill trust and credibility. Professional bodies like the American Institute of Certified Public Accountants (AICPA) have been instrumental in formulating auditing standards to provide a framework for auditors in carrying out their responsibilities (Bakri, Citation2021). These standards play a pivotal role in ensuring uniformity, impartiality, and dependability throughout the auditing process. On a global scale, the International Auditing and Assurance Standards Board (IAASB) plays a crucial role in setting forth auditing standards that are widely embraced across diverse jurisdictions. The advent of cutting-edge technologies, particularly in the realms of data analytics and automation, has brought about a significant transformation in auditing methodologies (Lombardi et al., Citation2022). Auditors now leverage sophisticated software tools to effectively scrutinize extensive sets of financial data, thereby facilitating the swift identification of potential risks and irregularities. Consequently, this shift has given rise to data-centric auditing approaches and techniques, underscoring the growing importance of leveraging data-driven insights in the auditing domain (Alharasis et al., Citation2023c).

Auditing practices are informed by a variety of theories and frameworks that assist auditors in verifying the precision and dependability of financial data. The Agency Theory posits that conflicts of interest can emerge between principals and agents (Yoon et al., Citation2015). Through auditing, these conflicts are alleviated by offering assurance to principals that agents are prioritizing their interests and that financial statements accurately depict the company’s performance (Power, Citation2003). Stewardship Theory underscores the obligation of management to stakeholders. Auditing guarantees that management upholds its stewardship duties by truthfully presenting financial data and revealing pertinent details about the organization’s undertakings. The Positive Accounting Theory centers on elucidating accounting practices through economic and political circumstances (Thottoli & Kv, Citation2022). Auditing methodologies might be impacted by the incentives and drives of various involved parties, alongside regulatory demands. A risk-centered strategy is often adopted in auditing practices, entailing an evaluation of the risks of substantial misstatements in financial statements and the creation of audit procedures to tackle these risks. This strategy aids auditors in efficiently allocating their resources and concentrating on areas with heightened risks of inaccuracies or fraud (Stack & Malsch, Citation2022). The Expectation Gap Theory alludes to the contrast between the public’s anticipations of auditors and their actual performance. Auditing methodologies endeavor to diminish this gap by offering transparent communication regarding the nature and constraints of audit procedures, as well as the duties of auditors (Parker et al., Citation2019). The Behavioral Theory examines human conduct and cognitive predispositions that could impact auditor discernment and decision-making. Auditors are coached to identify and alleviate biases to ensure impartiality and professionalism in their endeavors (Sharma et al., Citation2022).

3. Bibliometric study method

This research adheres to the methodologies outlined by Donthu et al. (Citation2021) in their comprehensive guidelines for executing a bibliometric analysis. Entitled ‘How to perform a bibliometric analysis: A comprehensive guide and recommendations’, the study by Donthu et al. (Citation2021) provides a significant reservoir of knowledge for scholars’ keen on understanding and executing bibliometric investigations. Donthu et al. (Citation2021) introduce a structured framework comprising four key stages that researchers can utilize to carry out bibliometric research. From the inception of defining search terminologies to the meticulous selection of documents, subsequent analysis, and the intricate process of synthesizing the existing literature, we meticulously adhered to the guidelines delineated by Donthu et al. (Citation2021).

3.1. Defining the search term

Defining search terms plays a crucial role in the process of conducting research, as it enables the exploration of a comprehensive range of documents authored by diverse researchers who employ varying terminologies within a particular thematic domain. Consequently, in our study, we have sought the guidance and expertise of scholars in the field, as well as consulted relevant literature, in order to identify and utilise the search terms ‘audit, auditing, scrutiny, inspection, and review’ to effectively locate publications pertaining to the subject of auditing (as outlined in Table-1). Furthermore, we have also employed the terms ‘practices, process, procedure, and method’ to narrow down our search and exclusively include publications that specifically address auditing practices.

3.2. Inclusion and Exclusion of the documents

provides a comprehensive explanation of the terms used in the document search as well as the criteria for inclusion. In order to conduct our research, we utilised the Scopus database, which is renowned for housing an extensive collection of peer-reviewed articles. By employing the search terms ‘auditing’ and ‘practices’, we were able to identify a total of 875 documents published within the Scopus database between the years 1968 and 2024. These documents spanned various subject areas such as business, economics, arts, and social science. However, in order to ensure the accuracy and relevance of our analysis, we excluded 250 documents that did not fall within the subject above areas.

Table 1. Filtering Criteria/Search Term and Inclusion and Exclusion of Document.

Furthermore, we applied further exclusion criteria by limiting our analysis to only articles and reviews, which resulted in the elimination of an additional 98 documents. Additionally, we removed ten articles written in languages other than English. Lastly, we identified and removed one document that needed complete bibliographic information. As a result of these rigorous exclusion and refinement processes, we ultimately included 516 documents in our analysis.

3.3. Bibliometric analysis

Bibliometric analysis, a methodological approach that enables the symmetrisation and synthesis of the vast body of literature within specific subject areas, proves to be an essential tool in this study. A Scopus analyser is employed to provide insightful and comprehensive reports and investigate the publication trends in the research field of auditing practices. Furthermore, citation analysis is utilised to identify and report on the most prolific and impactful contributors within this field. Additionally, the application of Bibliographic Coupling allows for the exploration of various thematic clusters that emerge from the extensive research on Auditing Practices. Building upon this, Co-occurrence analysis is employed to analyse the usage patterns of different keywords and to identify thematic trends within the realm of Auditing Practices research. Moreover, the implementation of a co-citation network facilitates the visualisation of the intricate web of citation patterns among related papers in this field. Finally, Authorship analysis serves the purpose of demonstrating the intricate social collaboration amongst authors and institutions involved in Auditing Practices research.

4. Bibliometric results and interpretation

4.1. Productivity analysis

illustrates the prevailing trends in the publication of research on Auditing Practices. It is worth noting that the commencement of research publication on Auditing Practices can be traced back to the year 1968. However, it is imperative to acknowledge that during the subsequent two decades, the pace at which research publications emerged could have been much higher, with an average of only one to two publications per year. Nevertheless, there was a noticeable shift in 2009 when the research on Auditing Practices garnered increased attention, resulting in the publication of a substantial number of papers, specifically 21 in total. This upward trajectory in research output has been sustained, with a commendable number of publications being produced annually. Notably, the pinnacle of productivity was observed in the years 2022 and 2023, which witnessed a significant surge in the number of published papers. This surge can be attributed to the integration of novel technologies, such as artificial intelligence, into the auditing process. Consequently, the last decade has witnessed a commendable average of 20-25 publications per year, signifying a substantial improvement in the realm of research on Auditing Practices. The surge above in research output during the years 2022 and 2023 is particularly noteworthy, as it exemplifies an exponential rise facilitated by the utilisation of cutting-edge technologies and the incorporation of artificial intelligence in the auditing process.

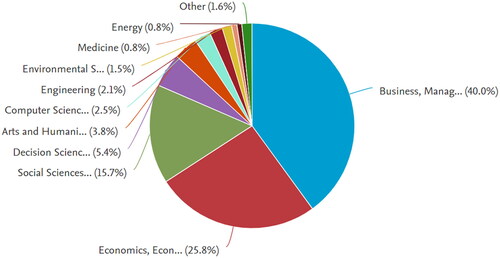

provides a visual representation of the publications related to Auditing Practices, categorised by subject area. The figure reveals that a significant proportion of the publications, precisely 40%, fall within the domain of business management. This indicates that a large number of studies are from business management domain. Further, the theme belongs to the core area of business management. Following closely behind, we observe that 25.8% of the publications are concentrated in the field of economics, while an additional 15.7% are attributed to the subject area of social sciences. Economics being the part of humanities discipline has got good number of publications as finance is also a core area of economics. Business management is a part of social science discipline therefore, there is a good number of publications in the social science subject area. It is worth noting that a substantial amount of research has been conducted in the realm of decision sciences, accounting for 5.4% of the publications. Similarly, the domain of computer sciences also contributes significantly, amounting to 2.5% of the total publications. Although the representation of arts and humanities within the research on Auditing Practices stands at a relatively modest 3.8%, it is crucial to acknowledge the potential for future studies in this area due to its interdisciplinary nature. Furthermore, we observe a noteworthy upward trend in the publications pertaining to engineering, which accounts for 2.1% of the total publications. Additionally, the subject areas of environmental sciences and medicine exhibit an increasing trend as well, contributing 1.5% and 0.8%, respectively, to the research on Auditing Practices. This data suggests a growing interest and emphasis on the exploration of Auditing Practices within these specific fields.

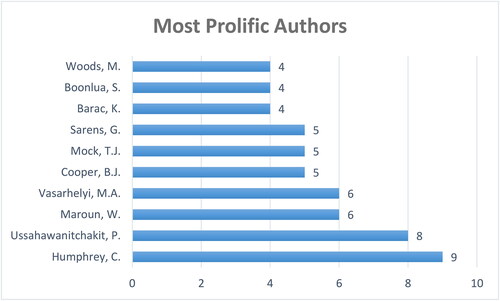

presents a visual representation of the authors who have made significant contributions to the field of Auditing Practices. The author who stands out as the most productive and prolific is Humphrey C. from Manchester Business School, United Kingdom. Following closely is Ussahawanitchakit P. from Mahasarakham University, Thailand. Notably, Maroun W. from the University of the Witwatersrand, South Africa and Vasarhelyi M.A. from Rutgers, The State University of New Jersey, United States, also demonstrate high productivity as they have each published three works in this particular area of research. Scholars of this area can go through the publications of Humphrey C. and Ussahawanitchakit P. as they have rich publications. They have also covered many aspects of auditing practices in their works. Humphrey C. works covers innovation in auditing, auditing change, global audit and crisis, and public audit process. Ussahawanitchakit P. studies covers internal audit judgement, audit morality, sustainable audit, audit intelligence, audit excellence, and audit proficiency.

4.2. Citation analysis

presents a comprehensive overview of the most influential contributors to the field of Auditing Practices, including authors, organisations, and countries. The author who has made the greatest impact is Vasarhelyi Miklos A. from The State University of New Jersey, United States, who has garnered an impressive 764 citations through six publications. The most cited work is Dai & Vasarhelyi (Citation2009), which has studied blockchain-based auditing. Following closely behind is Humphrey C. from Manchester Business School, United Kingdom, with 749 citations and nine publications. The most cited work is Humphrey et al. (Citation2010) focusing global audit profession. In terms of institutions, Boston College, United States, stands out as the most cited institute, accumulating 610 citations across three publications. Meanwhile, Northeastern University, United States, emerges as the second most highly cited institution, having amassed 577 citations through four publications. Notably, both of these institutions have displayed a high level of productivity in their research on Auditing Practices. As for countries, the United States takes the lead as the most highly cited and productive nation, boasting 4,954 citations from 136 publications. The United Kingdom follows closely behind, with 2,460 citations from 90 publications.

Table 2. Most influential contributors of research on Auditing Practices.

The journals with the most citations are documented in . The journal that has had the greatest impact is the ‘Managerial Auditing Journal’, which has received 1048 citations from 44 publications. Following closely is the ‘Auditing’ journal, with 1027 citations from 22 publications. The aim and objectives of these journals are auditing, finance, and governance therefore, most of the auditing practices related articles are accepted by these journals. The most referenced articles in the ‘Managerial Auditing Journal’ are the works of Carcello and Nagy (Citation2004), who conducted a study on the correlation between auditor specialisation and fraudulent financial reporting. The journals with the highest number of citations per document are ‘Business Strategy and The Environment’ and ‘Law and Policy’. ‘Management Science’ and ‘Journal of Business Ethics’ are the journals with the highest h-index and Q1 rating, focusing on publishing research on Auditing Practices. Lastly, among the top journals, Management Science and Accounting Review possess the highest SJR scores.

Table 3. Most impactful sources of research on Auditing Practices.

presents the most influential publications in the realm of auditing practices. The studies that have had the greatest impact are those conducted by Chung and Kallapur (Citation2017), Kolk and Perego (Citation2015), and Cohen et al. (Citation2002). Chung and Kallapur (Citation2017) conducted a study on the significance of clients and their association with abnormal accruals according to the Jones model. Their findings suggest that the incentives for auditors to compromise their independence should increase as the opportunities for clients and the incentives to manipulate earnings become more prevalent while decreasing in the presence of strong corporate governance and auditor expertise. Kolk and Perego (Citation2015) have investigated the factors that influence voluntary decisions to provide social, environmental, and sustainability reports. Their research indicates that the likelihood of selecting a large accounting firm as an assurance provider increases for companies located in countries that prioritise the interests of shareholders and have a lower level of litigation. The study conducted by Cohen et al. (Citation2002) has focused on the relationship between corporate governance and the audit process. They have examined the impact of various corporate governance factors, such as the board of directors and the audit committee, on the audit process. Their findings indicate that auditors consider corporate governance factors to be particularly important during the client acceptance phase and in an international context.

Table 4. Most influential publications in research on Auditing Practices.

4.3. Co-citation analysis

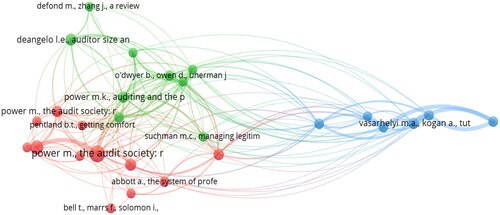

illustrates the co-citation networks of authors who cite research in Auditing Practices. The diagram reveals the presence of three distinct clusters consisting of frequently referenced documents. The cluster consisting of green nodes highlights the significant references made to DeAngelo (Citation1981), Humphrey and Moizer (Citation1990), Power (Citation2003), Khalifa et al. (Citation2007), and DeFond and Zhang (Citation2014). These references primarily revolve around the topics of discourse and audit change, audit quality, audit legitimacy, audit function, and archival auditing. Furthermore, a significant portion of the literature delves into the critical aspects of audit quality, exploring the different dimensions and indicators that contribute to the overall effectiveness and reliability of audit processes. The cluster represented by red nodes indicates the high number of references made to Power (Citation1997), Power (Citation1999), Power (Citation2003), and Robson et al. (Citation2007). The main focus of these references lies in the areas of audit society, audit explosion, and audit technologies. These references delve into the intricate workings of how audits are conducted within society, the significant increase in audit practices over time, and the advancements in technologies utilized in the audit processes. Lastly, the cluster denoted by blue nodes demonstrates the extensive references to Earley (Citation2015), Vasarhelyi et al. (Citation2015), Yoon et al. (Citation2015), and Eilifsen et al. (Citation2020). The references provided predominantly focus on the intricate and multifaceted subjects pertaining to the analysis of data, the vast and complex field of big data, the sophisticated methodologies of big data analytics, and the efficient application of cutting-edge audit technology.

4.4. Bibliographic Coupling

indicates the thematic clusters of research on Auditing Practices. Based on the existing documents in this field, there are five major thematic clusters presented with the help of bibliographic coupling. These five clusters include sustainability assurance, financial crisis and auditor, blockchain technology, professional skepticism, and fraud detection.

Table 5. Thematic clusters of research on Auditing Practices.

The thematic cluster ‘Sustainability Assurance’ includes 47 papers with 2201 citations. The most frequently referenced publications within this particular group of works are those authored by Kolk and Perego in 2010 and 2012. Kolk and Perego (Citation2010) embarked on a thorough and all-encompassing examination pertaining to the myriad of factors that wield influence over the decision-making process associated with the adoption of sustainability assurance statements. Their investigation delved deeply into the voluntary choices made by organizations to ensure the accuracy and reliability of their social, environmental, and sustainability reports (Tumwebaze et al., Citation2022). The outcomes of their research shed light on the correlation between the inclination to adopt sustainability assurance statements and the operational landscape of companies situated in regions where stakeholder engagement is highly prioritized and governance enforcement mechanisms are comparatively less rigid, as indicated by Dai and Vasarhelyi (Citation2017). Furthermore, the scholarly work of Perego and Kolk (Citation2012) garnered considerable attention within academic circles for its profound focus on the procedural aspects involved in integrating assurance practices aimed at establishing and upholding organizational accountability in the realm of sustainability. Moreover, their exploration extended to scrutinizing the intricate ways in which the advancement of auditing practices, including the diversification of assurance standards and the profile of assurance providers, exerts an influence on the caliber of sustainability assurance statements (Parmoodeh et al., Citation2023). Through their meticulous examination, it became evident that the adoption of assurance practices is steered by a complex interplay between external institutional pressures and the internal reservoir of resources and capabilities within organizations, a revelation supported by the works of Kend and Nguyen (Citation2020).

The thematic cluster labelled as ‘Financial Crisis and Auditor’ encompasses a total of 41 scholarly papers, which have garnered a total of 1927 citations. Among the most frequently cited works within this cluster are Sikka (Citation2009) and Humphrey et al. (Citation2009), which have been acknowledged for their significant contributions to the field. Sikka (Citation2009) conducted a comprehensive study focusing on the intriguing phenomenon of auditors choosing to remain silent during periods of financial crises, aiming to spark critical conversations and debates surrounding contemporary auditing practices in the specific context of such turbulent times (Appelbaum et al., Citation2020). Through his meticulous research and analysis, Sikka (Citation2009) uncovered compelling insights that shed light on how the deepening financial crisis has inevitably brought forth crucial inquiries regarding the fundamental roles and perceived value of external audits within the financial landscape (Parmoodeh et al., Citation2023). The revelation that the endorsement of audit opinions lacking any qualifications failed to instill confidence in the market was particularly striking, especially considering the subsequent occurrences where numerous financial institutions either faced collapse or had to seek governmental intervention shortly after receiving such unqualified endorsements (de Ricquebourg & Maroun, Citation2023). On the other hand, Humphrey et al. (Citation2009) delved into a different aspect of the financial crisis, specifically examining its impact on the intricate relationships existing between regulators operating within the global audit domain (Landers & Behrend, Citation2023). Their research efforts focused on the active responses exhibited by regulatory bodies in light of the crisis, as well as the evolving dynamics and competing forces at play among key regulatory entities and professional stakeholders within the expansive global audit landscape, leading to far-reaching consequences and implications (Costanza-Chock et al., Citation2022).

The cluster focused on ‘Blockchain Technology’ encompasses a total of 36 scholarly articles, which have garnered a cumulative 1533 citations. Among these papers, the works by Dai and Vasarhelyi (Citation2017) as well as Maffei et al. (Citation2021) stand out as the most frequently cited pieces of literature in the field. Dai and Vasarhelyi (Citation2017) undertook a thorough and exhaustive examination within the domain of blockchain-based accounting and assurance, aiming to spark a scholarly conversation on the transformative potential of blockchain technology in establishing a dynamic, real-time, verifiable, and transparent accounting ecosystem (Faccia et al., Citation2019). Their research outcomes suggest a paradigm shift in current auditing methodologies, envisioning a future where blockchain could potentially revolutionize traditional practices, resulting in a more precise and efficient automated assurance framework (Parmoodeh et al., Citation2023). Similarly, Maffei et al. (Citation2021) explored the implications of integrating blockchain technology in the realms of accounting and auditing, meticulously evaluating both the advantages and drawbacks associated with this innovation, consequently shedding light on emerging risks and challenges that may surface (Lombardi et al., Citation2022). It is crucial to highlight the significant emphasis in their study on the irreplaceable role of accountants’ and auditors’ professional judgment and expertise, underscoring the limitations of relying solely on the impersonal and standardized operations facilitated by blockchain technology (Han et al., Citation2023).

The thematic cluster titled ‘Professional Skepticism’ consists of a total of 27 papers, which have been cited 1204 times. The most frequently cited works within this cluster are those authored by Hurtt (Citation2010) and Rasso (Citation2015). Hurtt (Citation2010) has undertaken significant work in the development of a comprehensive scale aimed at facilitating the quantification of professional skepticism within the realm of professions. The assertion put forth by the author suggests that professional skepticism can be construed as a nuanced and multi-faceted personal attribute, capable of materializing in the form of both an inherent characteristic and a temporary disposition (Landers & Behrend, Citation2023). The meticulously validated scale has been meticulously crafted to gauge an individual’s degree of inherent professional skepticism, drawing inspiration from a diverse array of attributes sourced from the domains of audit standards, psychology, philosophy, and consumer behavior research (de Ricquebourg & Maroun, Citation2023). Conversely, Rasso (Citation2015) directs attention towards the scrutiny of guidelines pertaining to the documentation of audit evidence, with the overarching goal of refining the acquisition and analysis of evidence by leveraging high-level construal techniques (Costanza-Chock et al., Citation2022). The empirical observations made by the author suggest that auditors are inclined to demonstrate heightened levels of professional skepticism when adhering to documentation guidelines that advocate for high-level construal, as opposed to those following instructions endorsing low-level construal, alongside auditors who operate without any specific documentation directives (Stack & Malsch, Citation2022).

The thematic cluster entitled ‘Fraud Detection’ encompasses a collection of 17 scholarly articles, which have garnered a total of 982 citations. Among the research articles that have garnered the highest number of citations in this particular cluster are the scholarly works authored by Carcello and Nagy (Citation2004) alongside Jeffrey and Zimbelman (Citation2004), indicating their significant impact and recognition within the academic community. Carcello and Nagy (Citation2004) conducted a meticulous investigation delving into the influence exerted by the size of a client on the dynamics of the relationship between auditors specializing in specific sectors and the prevalence of deceptive financial reporting, as noted by Appelbaum et al. (Citation2020). The outcomes of their study unveiled a compelling correlation, elucidating that clients operating on a larger scale possess a heightened level of bargaining power, thereby enhancing their capacity to sway auditors towards embracing more aggressive accounting methodologies, as highlighted by Imana et al. (Citation2021). Moreover, the possession of specialized industry knowledge by auditors could pose intricate challenges for larger clients, who typically navigate across diverse sectors and manifest greater intricacy in their operations. In a distinct vein, Jeffrey and Zimbelman (Citation2004) shifted their focus towards an in-depth exploration of strategic reasoning frameworks aimed at fortifying the detection and mitigation of fraudulent financial reporting, as underscored by Ferry et al. (Citation2023). Their investigation honed in on the strategic underpinnings of fraudulent behaviors, proposing specific amendments in auditing protocols that would streamline the integration of strategic reasoning by auditors operating in this domain, as posited by Hezam et al. (Citation2023). Emphasizing the criticality of three pivotal audit functions - namely fraud risk evaluation, audit strategizing, and audit plan execution - as essential constituents for the identification and deterrence of deceptive practices, as articulated by Beck et al. (Citation2020).

4.5. Co-occurrence analysis

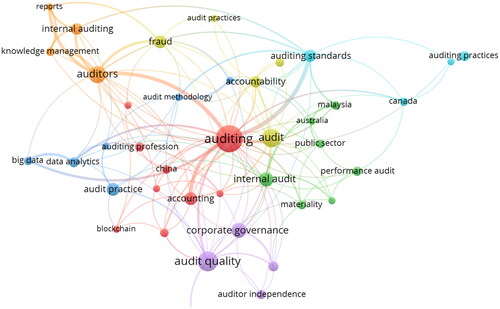

illustrates the thematic patterns that arise from Auditing Practices. During the given period, six clusters were identified for the prevalent keywords. The size of the nodes corresponds to the frequency of their occurrences. The interconnecting lines between the nodes indicate their co-occurrence within the same publication. A shorter distance between two nodes signifies a greater number of co-occurrences between the respective keywords. The red node, pertaining to the realm of service quality research, is composed of the frequently recurring keywords related to artificial intelligence, blockchain, and financial reporting. This particular node serves as a focal point for exploring the intricate dynamics of these cutting-edge technologies in the context of enhancing service quality within various industries. Moving forward, the green nodes encapsulate a set of the most pertinent themes within the domain of internal audit, performance audit, and materiality. These themes are crucial in understanding the key factors influencing the effectiveness and efficiency of auditing practices within organizations. Transitioning to the ocean blue nodes, we find a cluster of nodes that are intricately linked to big data, data analytics, and audit practice as their primary themes. These nodes shed light on the significance of leveraging data-driven approaches to enhance the audit process and drive better decision-making. Similarly, the purple nodes stand out with their focus on audit quality, corporate governance, and auditor independence. These themes underscore the importance of upholding integrity and professionalism in the auditing profession. On the other hand, the yellow nodes symbolize the core themes of accountability, fraud detection, and best practices in auditing. These nodes play a crucial role in promoting transparency and ethical conduct in the audit ecosystem. Shifting our attention to the orange nodes, we encounter a cluster of nodes that delve into the realms of internal auditing and knowledge management. These themes highlight the importance of continuous learning and development within the internal audit function. Lastly, the aqua blue nodes are closely associated with the themes revolving around accounting standards and auditing practices. These nodes offer valuable insights into the evolving regulatory landscape and best practices in the field of auditing.

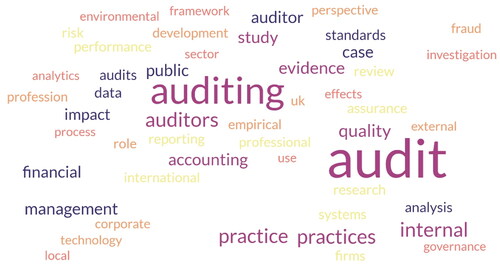

demonstrates the word cloud pertaining to the subject matter of Auditing Practices. The utilisation of a word cloud in the context of the discussed article serves the purpose of examining the prevalent terms found within the title of said article and providing a visually condensed representation of the text documents. Cloud analysis has led to the identification and categorization of four clearly delineated clusters within the dataset. The nomenclature that enjoys the highest frequency of occurrence within the realm of keywords is visually represented in a hue reminiscent of the color violet. Within the confines of this specific time frame under consideration, the research landscape is predominantly characterized by the exploration of various keywords such as internal audit, quality assurance, corporate governance, utilization of technology, external audit practices, detection of fraudulent activities, establishment of frameworks, examination of environmental perspectives, design of reporting systems, and adherence to accounting standards.

5. Future research directions

The future research directions of research on auditing practices are presented in this scholarly article, drawing from a comprehensive analysis of thematic clusters and the identification of thematic trends. Moreover, this article also offers the presentation of some innovative themes that have emerged through invaluable consultation with esteemed experts in the field and past studies. The existing literature is found to be lacking in suggested future research avenues, with relatively fewer studies conducted in this area, thus highlighting the pressing need for further investigation in contemporary times.

5.1. Integrated reporting and sustainability auditing

The significance of integrated reporting and sustainability auditing has been on the rise in the corporate world due to the growing recognition of the necessity for organisations to take into account environmental, social, and governance (ESG) factors in their decision-making processes. The field has since developed, and new areas of research have emerged (Grossi et al., Citation2020). Further investigation is needed to advance the development and enhancement of global standards and frameworks for integrated reporting and sustainability auditing. This includes exploring methods to improve comparability and consistency in reporting practices. Furthermore, research is required on methodologies for assessing and reporting the impact of sustainability initiatives, specifically examining how organisations contribute to broader societal and environmental objectives (Tiberius & Hirth, Citation2019). Future research could investigate the integration of emerging technologies, such as blockchain and artificial intelligence, into the processes of integrated reporting and sustainability auditing to enhance transparency, accuracy, and efficiency (Mökander & Floridi, Citation2021). Research is also needed on effective strategies for involving stakeholders in the reporting process and enhancing communication of sustainability performance. This involves understanding the requirements and expectations of different stakeholders. Additionally, considering the growing emphasis on climate-related risks and opportunities, research could focus on the implementation and effectiveness of the recommendations put forth by the Task Force on Climate-related Financial Disclosures (Frishammar et al., Citation2019).

5.2. Financial crisis and auditor

The future investigation regarding the financial crisis and auditors may entail the exploration of various approaches through which auditors can enhance their involvement in the early identification of financial irregularities and possible indicators of crisis (Christ et al., Citation2021). This could entail the scrutiny of the efficacy of auditing procedures as well as the utilisation of advanced technologies such as data analytics and artificial intelligence. The study would also delve into the examination of how alterations in regulatory frameworks in response to financial crises impact the behaviour of auditors (Kend & Nguyen, Citation2020). This may encompass an analysis of the influence of regulatory reforms on the quality of audits, the independence of auditors, and their ability to identify and prevent financial mismanagement (Parmoodeh et al., Citation2023). Furthermore, future research endeavours could delve into the investigation of the ethical aspects of auditing, particularly within the context of financial crises (Faccia et al., Citation2019). This would involve exploring how auditors navigate ethical dilemmas, conflicts of interest, and the pressures exerted by clients during periods of economic turmoil. Additionally, the examination of the role played by corporate governance structures and mechanisms of auditor oversight in the prevention and mitigation of the impact of financial crises is warranted (Lombardi et al., Citation2022). The effectiveness of board oversight, audit committees, and regulatory bodies in ensuring the quality of audits would need to be assessed.

5.3. Blockchain and Distributed Ledger Technology

The potential future research directions in the field of Blockchain and Distributed Ledger Technology (DLT) revolve around the enhancement of scalability, which continues to pose a significant challenge (Otia & Bracci, Citation2022). Research endeavours are focused on the development of scalable consensus algorithms, sharding techniques, and layer-two solutions, such as state channels and sidechains, in order to improve transaction throughput (Hezam et al., Citation2023). In addition, facilitating communication and data exchange among different blockchain networks is of utmost importance for the widespread adoption of DLT (Bustos-Contell et al., Citation2022). Consequently, research efforts are directed towards the establishment of standards and protocols that enable interoperability, such as cross-chain communication mechanisms. Moreover, there is a need for research on the economic models and governance structures of blockchain networks (Blanchard et al., Citation2023). This entails the investigation of incentive mechanisms for participants, the exploration of decentralised autonomous organisations (DAOs), and the design of effective governance protocols. Furthermore, investigations on the user experience of interacting with blockchain technology must be enhanced to promote broader adoption (Thottoli & Kv, Citation2022).

5.4. Audit Quality and Professional Skepticism

The future study in the domains of Audit Quality and Professional Skepticism is currently investigating the effects of emerging technologies, such as artificial intelligence, machine learning, and blockchain, on the quality of audits (Tumwebaze et al., Citation2022). Researchers are examining the efficacy of automated auditing tools in either enhancing or challenging professional skepticism. Furthermore, research should delve deeper into the psychological factors that influence auditors’ professional skepticism (Van Hoa et al., Citation2022). In the future, scholars may explore the extent to which organisational culture fosters a sceptical mindset among auditors. Moreover, researchers may aim to evaluate the impact of recent regulatory changes on the quality of audits and professional skepticism (Khatib et al., Citation2022). Future research may also explore the effectiveness of regulatory measures in promoting auditor independence and objectivity (Minkkinen et al., Citation2022). Additionally, scholars may investigate how the relationships between clients and auditors influence professional skepticism and audit quality. Lastly, researchers may examine the impact of long-term client relationships on auditor independence.

5.5. Fraud detection and forensic auditing

The future research directions for fraud detection and forensic auditing entail investigating the integration of behavioural analytics in order to identify anomalous patterns or deviations in user behaviour that could potentially indicate fraudulent activities (Stack & Malsch, Citation2022). Additionally, there is a need for further exploration of advanced machine learning and artificial intelligence techniques for fraud detection. This may encompass the utilisation of deep learning, reinforcement learning, and ensemble methods (Ferry et al., Citation2022). Moreover, future research should also concentrate on the study of explainable artificial intelligence in fraud detection models, as this would greatly enhance transparency and interpretability, which are of utmost importance in the field of forensic auditing. Furthermore, future research endeavours may also emphasise the continued exploration of big data analytics in order to effectively process and analyse vast quantities of data in a timely manner, thereby enabling the prompt detection of fraudulent activities (Levytska et al., Citation2022). Additionally, there is a need for a comprehensive study on the development of predictive models that possess the ability to anticipate potentially fraudulent activities based on historical data, thereby enabling organisations to mitigate risks (Costanza-Chock et al., Citation2022) proactively. Finally, it is crucial to explore real-time monitoring systems and continuous auditing techniques that can effectively detect instances of fraud as they occur or in a timely manner after that, thereby enabling organisations to rapidly respond to such events (Sharma et al., Citation2022).

6. Implications

This research makes significant contributions to the field of auditing and financial management literature in a multitude of ways. By capitalising on potential synergies in auditing practices research, the future research directions and findings of this study serve as valuable resources for scholars and researchers in the field of finance, enabling them to conduct a wide range of studies in the future. Additionally, it allows them to develop a comprehensive roadmap for investigating auditing practices within the realm of accounting and finance. The results of this research unveil the influential contributors and emerging themes that hold the potential to assist researchers in identifying more robust resources that facilitate a deeper understanding of various phenomena associated with auditing practices. Consequently, this research underscores the significance of employing bibliometric analysis as a pivotal and noteworthy tool for suggesting novel themes and exploring lesser-explored areas within the realm of auditing practices. Lastly, the outcome of this study also yields insightful information about the existing literature on auditing practices, benefiting auditors, researchers, scholars, and other stakeholders alike.

7. Conclusion

This study has presented the current state of research and future research proposals concerning the examination of auditing practices. The knowledge acquired from the most productive and influential contributors assists researchers in referencing these contributors in their subsequent research endeavours. Familiarising oneself with the most influential publications and sources proves beneficial when referencing previous works and selecting target journals for future publications in the field of auditing practices. Understanding various themes and trends in these themes aids in selecting more suitable research topics. The exploration of future research dimensions enhances future research and addresses gaps in the existing literature. The year with the highest productivity is 2022, and the author with the most significant influence is Humphrey C. from Manchester Business School in the United Kingdom. The most influential author is Vasarhelyi Miklos A. from The State University of New Jersey in the United States. The most influential institution is Northeastern University, also located in the United States. Furthermore, the most influential works include Chung and Kallapur’s publication in 2017, Kolk and Perego’s publication in 2015, and Cohen et al.’s publication in 2012. The most influential and productive source of research on auditing practices is the Managerial Auditing Journal. The highly referenced themes include audit legitimacy, audit function, archival auditing, audit explosion, audit technologies, and big data analytics. The current trends and clusters of themes consist of sustainability assurance, the financial crisis and auditors, blockchain technology, professional scepticism, and fraud detection. The findings of this study also provide valuable insights into the existing literature on auditing practices, benefiting auditors, researchers, and scholars.

The limitation of this study pertains to the utilisation of data extracted solely from the Scopus database. It is worth noting that certain journals in the field of social sciences exist whose publications need to be catalogued within the confines of the Scopus database. Consequently, these particular articles have been excluded from the purview of this study. It is thus recommended that future research endeavours encompass the inclusion of documents emanating from both the Scopus and Web of Science databases. Moreover, it is essential to recognise that this study solely offers a glimpse into the subject matter based on the bibliographic information derived from the documents under examination. In order to obtain a more comprehensive understanding of research pertaining to auditing practices, it is suggested that future research endeavours adopt a mixed methodology that combines bibliometric investigation and a systematic literature review.

Author contributions

Amar Johri: Conceptualization and designing, Methodology, Formal analysis and interpretation of data, Writing – original draft, Writing – review & editing.

Raj Kumar Singh: Conceptualization and designing, Methodology, Formal analysis and interpretation of data, Writing – original draft, Writing – review & editing.

All authors agree to be accountable for all aspects of the work.

Disclosure statement

No potential conflict of interest was reported by the author(s).

Data availability statement

The data will be made available on request.

Additional information

Notes on contributors

Amar Johri

Dr. Amar Johri is an Assistant Professor in the College of Administrative and Financial Sciences, at Saudi Electronic University, Kingdom of Saudi Arabia since September 2019. He has more than 17 years of experience in academics. He obtained his doctorate (PhD) from Graphic Era University, Dehradun, Uttarakhand, India. His research interests include financial services, financial markets, banking, investment, accounting, and general management. He has published around 35 research papers in national and international journals (including Scopus Q1, Q2 indexed journals, Web of Science: SSCI, SCIE, Q1, Q2, Q3 & ESCI journals, ABDC and ABS category journals, and Proceedings of International Conferences of repute) and has presented around 19 research papers in national and international conferences. He has worked on various research projects and is currently working on a few more research projects. He has been chair of the technical sessions and honored as a chief guest (valedictory session) at the international conference. He has also authored an accounting book. He delivers and conducts sessions on financial planning, financial literacy, investment decisions, corporate finance, accounting information systems and corporate accounting. He is the reviewer of various reputed journals including Web of Science and Scopus indexed journals. His area of teaching interest includes the subjects of finance, accounting and taxation.

Raj Kumar Singh

Dr. Raj Kumar Singh (Ph. D., UGC-NET, MBA, and M.A.-Eco), alumni IIM Indore is presently working as an Associate Professor of Management in the School of Management-MBA, Graphic Era Hill University, Dehradun, India. He has contributed over 15 years in teaching and corporate. His leading publications are in national and international Scopus, ABDC, and Thomson Reuters indexed journals. His research domains are marketing, digital marketing, entrepreneurship, and bibliometric analysis. He is the guest reviewer of various Scopus and Thomson Reuters indexed journals. He has delivered several lectures at All India Radio and the Ministry of Agriculture in association with NABARD. He is running an NGO - Manav Utthan Society, India, conducted hundreds of programs for social upliftment across India.

References

- Castka, P., & Searcy, C. (2023). Audits and COVID-19: A paradigm shift in the making. Business Horizons, 66(1), 1–20. https://doi.org/10.1016/j.bushor.2021.11.003

- Rönkkö, J., Lilja, M., & Oulasvirta, L. (2023). Voluntary adoption of the International Standards on Auditing (ISA) in local government audits—empirical evidence from Finland. Public Money & Management, 43(3), 277–284. https://doi.org/10.1080/09540962.2022.2131290

- Abbas, A. F., Jusoh, A., Mas’ Od, A., Alsharif, A. H., & Ali, J. (2022). Bibliometrix analysis of information sharing in social media. Cogent Business & Management, 9(1), 2016556. https://doi.org/10.1080/23311975.2021.2016556

- Alharasis, E. E., Alhadab, M., Alidarous, M., Jamaani, F., & Alkhwaldi, A. F. (2023). The impact of COVID-19 on the relationship between auditor industry specialization and audit fees: Empirical evidence from Jordan. Journal of Financial Reporting and Accounting. Ahead-of-print. https://doi.org/10.1108/JFRA-01-2023-0052

- Alharasis, E., Alidarous, M., Alkhwaldi, A. F., Haddad, H., Alramahi, N., & Al-Shattarat, H. K. (2023). Corporates’ monitoring costs of fair value disclosures in pre-versus post-IFRS7 era: Jordanian financial business evidence. Cogent Business & Management, 10(2), 2234141. https://doi.org/10.1080/23311975.2023.2234141

- Alharasis, E. E., Prokofieva, M., & Clark, C. (2023). The moderating impact of auditor industry specialisation on the relationship between fair value disclosure and audit fees: Empirical evidence from Jordan. Asian Review of Accounting, 31(2), 227–255. https://doi.org/10.1108/ARA-03-2022-0050

- Ali, M. H., & Meah, M. R. (2021). Factors of audit committee independence: An empirical study from an emerging economy. Cogent Business & Management, 8(1), 1888678. https://doi.org/10.1080/23311975.2021.1888678

- Amin, R., Kushwaha, B. P., & Miah, M. H. (2023). The process optimisation method of the optimal online sales model of information product demand concerning the spillover effect. Journal of International Logistics and Trade, 21(2), 62–83. https://doi.org/10.1108/JILT-06-2022-0013

- Amiri, A. M., Kushwaha, B. P., & Singh, R. (2023). Visualisation of global research trends and future research directions of digital marketing in small and medium enterprises using bibliometric analysis. Journal of Small Business and Enterprise Development, 30(3), 621–641. https://doi.org/10.1108/JSBED-04-2022-0206

- Appelbaum, D., Budnik, S., & Vasarhelyi, M. (2020). Auditing and accounting during and after the COVID-19 crisis. The CPA Journal, 90(6), 14–19.

- Bakri, M. A. (2021). Moderating effect of audit quality: The case of dividend and firm value in Malaysian firms. Cogent Business & Management, 8(1), 2004807. https://doi.org/10.1080/23311975.2021.2004807

- Beck, N., van Bommel, A. C., Eddes, E. H., van Leersum, N. J., Tollenaar, R. A., & Wouters, M. W. (2020). The Dutch Institute for Clinical Auditing: Achieving Codman’s dream on a nationwide basis. Annals of Surgery, 271(4), 627–631. https://doi.org/10.1097/SLA.0000000000003665

- Blanchard, M. A., Contreras, A., Kalkan, R. B., & Heeren, A. (2023). Auditing the research practices and statistical analyses of the group-level temporal network approach to psychological constructs: A systematic scoping review. Behavior Research Methods, 55(2), 767–787. https://doi.org/10.3758/s13428-022-01839-y

- Boiral, O., & Gendron, Y. (2008). Sustainable development and certification practices: Lessons learned and prospects. Business Strategy and the Environment, 20(5), 331–347. https://doi.org/10.1002/bse.701

- Bustos-Contell, E., Porcuna-Enguix, L., Serrano-Madrid, J., & Labatut-Serer, G. (2022). Female audit team leaders and audit effort. Journal of Business Research, 140, 324–331. https://doi.org/10.1016/j.jbusres.2021.11.003

- Carcary, M. (2020). The research audit trail: Methodological guidance for application in practice. Electronic Journal of Business Research Methods, 18(2), pp166–177.

- Carcello, J. V., & Nagy, A. L. (2004). Client size, auditor specialisation and fraudulent financial reporting. Managerial Auditing Journal, 19(5), 651–668. https://doi.org/10.1108/02686900410537775

- Carcello, J. V., & Nagy, A. L. (2005). Audit firm tenure and fraudulent financial reporting. AUDITING: A Journal of Practice & Theory, 23(2), 55–69. https://doi.org/10.2308/aud.2004.23.2.55

- Christ, M. H., Eulerich, M., Krane, R., & Wood, D. A. (2021). New frontiers for internal audit research. Accounting Perspectives, 20(4), 449–475. https://doi.org/10.1111/1911-3838.12272

- Chung, H., & Kallapur, S. (2017). Client importance, nonaudit services, and abnormal accruals. The Accounting Review, 78(4), 931–955. https://doi.org/10.2308/accr.2003.78.4.931

- Cohen, J. R., Krishnamoorthy, G., & Wright, A. M. (2008). Form versus substance: The implications for auditing practice and research of alternative perspectives on corporate governance. AUDITING: A Journal of Practice & Theory, 27(2), 181–198. https://doi.org/10.2308/aud.2008.27.2.181

- Cohen, J., Krishnamoorthy, G., & Wright, A. M. (2002). Corporate governance and the audit process. Contemporary Accounting Research, 19(4), 573–594. https://doi.org/10.1506/983M-EPXG-4Y0R-J9YK

- Costanza-Chock, S., Raji, I. D., & Buolamwini, J. (2022). Who audits the auditors? Recommendations from a field scan of the algorithmic auditing ecosystem [Paper presentation]. Proceedings of the 2022 ACM Conference on Fairness, Accountability, and Transparency (pp. 1571–1583). https://doi.org/10.1145/3531146.3533213

- Dai, J., & Vasarhelyi, M. A. (2009). Imagineering Audit 4.0. Journal of Emerging Technologies in Accounting, 13(1), 1–15. https://doi.org/10.2308/jeta-10494

- Dai, J., & Vasarhelyi, M. A. (2017). Toward blockchain-based accounting and assurance. Journal of Information Systems, 31(3), 5–21. https://doi.org/10.2308/isys-51804

- DeHoratius, N., & Raman, A. (2010). Inventory record inaccuracy: An empirical analysis. Management Science, 54(4), 627–641. https://doi.org/10.1287/mnsc.1070.0789

- de Ricquebourg, A. D., & Maroun, W. (2023). How do auditor rotations affect key audit matters? Archival evidence from South African audits. The British Accounting Review, 55(2), 101099. https://doi.org/10.1016/j.bar.2022.101099

- DeAngelo, L. E. (1981). Auditor size and audit quality. Journal of Accounting and Economics, 3(3), 183–199. https://doi.org/10.1016/0165-4101(81)90002-1

- DeFond, M., & Zhang, J. (2014). A review of archival auditing research. Journal of Accounting and Economics, 58(2-3), 275–326. https://doi.org/10.1016/j.jacceco.2014.09.002

- Donthu, N., Kumar, S., Mukherjee, D., Pandey, N., & Lim, W. M. (2021). How to conduct a bibliometric analysis: An overview and guidelines. Journal of Business Research, 133, 285–296. https://doi.org/10.1016/j.jbusres.2021.04.070

- Earley, C. E. (2015). Data analytics in auditing: Opportunities and challenges. Business Horizons, 58(5), 493–500. https://doi.org/10.1016/j.bushor.2015.05.002

- Eilifsen, A., Kinserdal, F., Messier, W. F., Jr, & McKee, T. E. (2020). An exploratory study into the use of audit data analytics on audit engagements. Accounting Horizons, 34(4), 75–103. https://doi.org/10.2308/HORIZONS-19-121

- Faccia, A., Al Naqbi, M. Y. K., & Lootah, S. A. (2019). Integrated cloud financial accounting cycle: How artificial intelligence, blockchain, and XBRL will change the accounting, fiscal and auditing practices. Proceedings of the 2019 3rd International Conference on Cloud and Big Data Computing (pp. 31–37).

- Ferry, L., Midgley, H., Murphie, A., & Sandford, M. (2023). Auditing governable space—A study of place-based accountability in England. Financial Accountability & Management, 39(4), 772–789. https://doi.org/10.1111/faam.12321

- Ferry, L., Midgley, H., & Ruggiero, P. (2023). Regulatory space in local government audit: An international comparative study of 20 countries. Public Money & Management, 43(3), 233–241. https://doi.org/10.1080/09540962.2022.2129559

- Ferry, L., Radcliffe, V. S., & Steccolini, I. (2022). The future of public audit. Financial Accountability & Management, 38(3), 325–336. https://doi.org/10.1111/faam.12339

- Frishammar, J., Richtnér, A., Brattström, A., Magnusson, M., & Björk, J. (2019). Opportunities and challenges in the new innovation landscape: Implications for innovation auditing and innovation management. European Management Journal, 37(2), 151–164. https://doi.org/10.1016/j.emj.2018.05.002

- Grossi, G., Meijer, A., & Sargiacomo, M. (2020). A public management perspective on smart cities:’Urban auditing for management, governance and accountability. Public Management Review, 22(5), 633–647. https://doi.org/10.1080/14719037.2020.1733056

- Han, H., Shiwakoti, R. K., Jarvis, R., Mordi, C., & Botchie, D. (2023). Accounting and auditing with blockchain technology and artificial Intelligence: A literature review. International Journal of Accounting Information Systems, 48, 100598. https://doi.org/10.1016/j.accinf.2022.100598

- Hezam, Y. A. A., Anthonysamy, L., & Suppiah, S. D. K. (2023). Big data analytics and auditing: A review and synthesis of literature. Emerging Science Journal, 7(2), 629–642. https://doi.org/10.28991/ESJ-2023-07-02-023

- Humphrey, C., Loft, A., & Woods, M. (2009). The global audit profession and the international financial architecture: Understanding regulatory relationships at a time of financial crisis. Accounting, Organisations and Society, 34(6-7), 810–825. https://doi.org/10.1016/j.aos.2009.06.003

- Humphrey, C., Kausar, A., Loft, A., & Woods, M. (2010). Regulating audit beyond the crisis: A critical discussion of the EU Green Paper. European Accounting Review, 20(3), 431–457. https://doi.org/10.1080/09638180.2011.597201

- Humphrey, C., & Moizer, P. (1990). From techniques to ideologies: An alternative perspective on the audit function. Critical Perspectives on Accounting, 1(3), 217–238. https://doi.org/10.1016/1045-2354(90)03021-7

- Hurtt , R. K. (2008). Development of a scale to measure professional skepticism . AUDITING: A Journal of Practice & Theory , 29 (1 ), 149 –171 . https://doi.org/10.2308/aud.2010.29.1.149

- Hurtt, R. K. (2010). Development of a scale to measure professional skepticism. AUDITING: A Journal of Practice & Theory, 29(1), 149–171. https://doi.org/10.2308/aud.2010.29.1.149

- Imana, B., Korolova, A., & Heidemann, J. (2021). Auditing for discrimination in algorithms delivering job ads [Paper presentation]. Proceedings of the Web Conference 2021 (pp. 3767–3778 ). https://doi.org/10.1145/3442381.3450077

- Jeffrey, T. W., & Zimbelman, M. F. (2004). Decomposition of fraud‐risk assessments and auditors’ sensitivity to fraud cues. Contemporary Accounting Research, 21(3), 719–745. https://doi.org/10.1506/HGXP-4DBH-59D1-3FHJ

- Kend, M., & Nguyen, L. A. (2020). Big data analytics and other emerging technologies: The impact on the Australian audit and assurance profession. Australian Accounting Review, 30(4), 269–282. https://doi.org/10.1111/auar.12305

- Khalifa, R., Sharma, N., Humphrey, C., & Robson, K. (2007). Discourse and audit change: Transformations in methodology in the professional audit field. Accounting, Auditing & Accountability Journal, 20(6), 825–854. https://doi.org/10.1108/09513570710830263

- Khatib, S. F. A., Abdullah, D. F., Al Amosh, H., Bazhair, A. H., & Kabara, A. S. (2022). Shariah auditing: Analysing the past to prepare for the future. Journal of Islamic Accounting and Business Research, 13(5), 791–818. https://doi.org/10.1108/JIABR-11-2021-0291

- Khatib, S. F., Abdullah, D. F., Hendrawaty, E., & Elamer, A. A. (2022). A bibliometric analysis of cash holdings literature: Current status, development, and agenda for future research. Management Review Quarterly, 72(3), 707–744. https://doi.org/10.1007/s11301-021-00213-0

- Kolk, A., & Perego, P. (2010). Determinants of the adoption of sustainability assurance statements: An international investigation. Business Strategy and the Environment, 19(3), 182–198. https://doi.org/10.1002/bse.643

- Kolk , A. , & Perego , P. (2015). Determinants of the adoption of sustainability assurance statements: An international investigation . Business Strategy and the Environment , 19(3), 182–198. https://doi.org/10.1002/bse.643

- Kotb, A., Elbardan, H., & Halabi, H. (2020). Mapping of internal audit research: A post-Enron structured literature review. Accounting, Auditing & Accountability Journal, 33 (8 ), 1969 –1996 . https://doi.org/10.1108/AAAJ-07-2018-3581

- Krieger, F., Drews, P., & Velte, P. (2021). Explaining the (non-) adoption of advanced data analytics in auditing: A process theory. International Journal of Accounting Information Systems, 41, 100511. https://doi.org/10.1016/j.accinf.2021.100511

- Kushwaha, B. P., Shiva, A., & Tyagi, V. (2023). How Investors’ Financial Well-being Influences Enterprises and Individual’s Psychological Fitness? Moderating Role of Experience under Uncertainty. Sustainability, 15(2), 1699. https://doi.org/10.3390/su15021699

- Landers, R. N., & Behrend, T. S. (2023). Auditing the AI auditors: A framework for evaluating fairness and bias in high stakes AI predictive models. The American Psychologist, 78(1), 36–49. https://doi.org/10.1037/amp0000972

- Larasati, D. A., Ratri, M. C., Nasih, M., & Harymawan, I. (2019). Independent audit committee, risk management committee, and audit fees. Cogent Business & Management, 6(1), 1707042. https://doi.org/10.1080/23311975.2019.1707042

- Levytska, S., Pershko, L., Akimova, L., Akimov, O., Havrilenko, K., & Kucherovskii, O. (2022). A risk-oriented approach in the system of internal auditing of the subjects of financial monitoring. International Journal of Applied Economics, Finance and Accounting, 14(2), 194–206. https://doi.org/10.33094/ijaefa.v14i2.715

- Lombardi, R., de Villiers, C., Moscariello, N., & Pizzo, M. (2022). The disruption of blockchain in auditing–a systematic literature review and an agenda for future research. Accounting, Auditing & Accountability Journal, 35(7), 1534–1565. https://doi.org/10.1108/AAAJ-10-2020-4992

- Maffei, M., Casciello, R., & Meucci, F. (2021). Blockchain technology: Uninvestigated issues emerging from an integrated view within accounting and auditing practices. Journal of Organizational Change Management, 34(2), 462–476. https://doi.org/10.1108/JOCM-09-2020-0264

- Messier, W. F., Jr, Reynolds, J. K., Simon, C. A., & Wood, D. A. (2002). The effect of using the internal audit function as a management training ground on the external auditor’s reliance decision. The Accounting Review, 86(6), 2131–2154. https://doi.org/10.2308/accr-10136

- Messier, W. F., Jr, Martinov-Bennie, N., & Eilifsen, A. (2005). A review and integration of empirical research on materiality: Two decades later. AUDITING: A Journal of Practice & Theory, 24(2), 153–187. https://doi.org/10.2308/aud.2005.24.2.153

- Minkkinen, M., Niukkanen, A., & Mäntymäki, M. (2022). What about investors? ESG analyses as tools for ethics-based AI auditing. AI & Society, 39(1), 329–343. https://doi.org/10.1007/s00146-022-01415-0

- Mökander, J., & Floridi, L. (2021). Ethics-based auditing to develop trustworthy AI. Minds and Machines, 31(2), 323–327. https://doi.org/10.1007/s11023-021-09557-8

- Nugrahanti, T. P. (2023). Analysing the evolution of auditing and financial insurance: Tracking developments, identifying research frontiers, and charting the future of accountability and risk management. West Science Accounting and Finance, 1(02), 59–68. https://doi.org/10.58812/wsaf.v1i02.119

- Otia, J. E., & Bracci, E. (2022). Digital transformation and the public sector auditing: The SAI’s perspective. Financial Accountability & Management, 38(2), 252–280. https://doi.org/10.1111/faam.12317

- Parker, L. D., Jacobs, K., & Schmitz, J. (2019). New public management and the rise of public sector performance audit: Evidence from the Australian case. Accounting, Auditing & Accountability Journal, 32(1), 280–306. https://doi.org/10.1108/AAAJ-06-2017-2964

- Parmoodeh, A. M., Ndiweni, E., & Barghathi, Y. (2023). An exploratory study of the perceptions of auditors on the impact of Blockchain technology in the United Arab Emirates. International Journal of Auditing, 27(1), 24–44. https://doi.org/10.1111/ijau.12299

- Perego, P., & Kolk, A. (2012). Multinationals’ accountability on sustainability: The evolution of third-party assurance of sustainability reports. Journal of Business Ethics, 110(2), 173–190. https://doi.org/10.1007/s10551-012-1420-5

- Pimentel, E., Lesage, C., & Ali, S. B. H. (2023). Auditor independence in kinship economies: A MacIntyrian perspective. Journal of Business Ethics, 183(2), 365–381. https://doi.org/10.1007/s10551-022-05073-6

- Power, M. (1997). The audit society: Rituals of verification. OUP Oxford.

- Power, M. (1999). The audit society: Rituals of verification. British Journal of Educational Studies, 47, 92–93.

- Power, M. (2003). Evaluating the audit explosion. Law & Policy, 25(3), 185–202. https://doi.org/10.1111/j.1467-9930.2003.00147.x

- Power, M. K. (2003). Auditing and the production of legitimacy. Accounting, Organisations and Society, 28(4), 379–394. https://doi.org/10.1016/S0361-3682(01)00047-2

- Power, M. (2011). Modelling the micro-foundations of the audit society: Organizations and the logic of the audit trail. Academy of Management Review, 46(1), 6–32. https://doi.org/10.5465/amr.2017.0212

- Quick, R., Zaman, M., & Mandalawattha, G. (2023). Auditors’ application of materiality: Insight from the UK. Accounting Forum, 47(1), 24–46. https://doi.org/10.1080/01559982.2021.2019958

- Rasso, J. T. (2015). Construal instructions and professional skepticism in evaluating complex estimates. Accounting, Organisations and Society, 46, 44–55. https://doi.org/10.1016/j.aos.2015.03.003

- Robson, K., Humphrey, C., Khalifa, R., & Jones, J. (2003). Transforming audit technologies: Business risk audit methodologies and the audit field. Accounting, Organizations and Society, 32(4-5), 409–438. https://doi.org/10.1016/j.aos.2006.09.002

- Robson, K., Humphrey, C., Khalifa, R., & Jones, J. (2007). Transforming audit technologies: Business risk audit methodologies and the audit field. Accounting, Organisations and Society, 32(4-5), 409–438. https://doi.org/10.1016/j.aos.2006.09.002

- Sharma, N., Sharma, G., Joshi, M., & Sharma, S. (2022). Lessons from leveraging technology in auditing during COVID-19: An emerging economy perspective. Managerial Auditing Journal, 37(7), 869–885. https://doi.org/10.1108/MAJ-07-2021-3267

- Sikka, P. (2007). The internet and possibilities for counter accounts: some reflections. Accounting, Auditing & Accountability Journal, 19(5), 759–769. https://doi.org/10.1108/09513570610689686

- Sikka, P. (2009). Financial crisis and the silence of the auditors. Accounting, Organisations and Society, 34(6-7), 868–873. https://doi.org/10.1016/j.aos.2009.01.004

- Singh, R. K., Kushwaha, B. P., Chadha, T., & Singh, V. A. (2021). The influence of digital media marketing and celebrity endorsement on consumer purchase intention. Journal of Content Community and Communication, 14(8), 145–158. https://doi.org/10.31620/JCCC.12.21/12

- Soh, W. G., Antonacopoulou, E. P., Rigg, C., & Bento, R. (2023). Embedding a “Reflexive Mindset”: Lessons from reconfiguring the internal auditing practice. Academy of Management Learning & Education, 22(1), 88–111. https://doi.org/10.5465/amle.2021.0182

- Stack, R., & Malsch, B. (2022). Auditors’ professional identities: Review and future directions. Accounting Perspectives, 21(2), 177–206. https://doi.org/10.1111/1911-3838.12289

- Tetteh, L. A., Agyenim-Boateng, C., & Simpson, S. N. Y. (2023). Institutional pressures and strategic response to auditing implementation of sustainable development goals: The role of public sector auditors. Journal of Applied Accounting Research, 24(2), 403–423. https://doi.org/10.1108/JAAR-05-2022-0101

- Thakur, J., & Kushwaha, B. P. (2023). Artificial intelligence in marketing research and future research directions: Science mapping and research clustering using bibliometric analysis. Global Business and Organizational Excellence, 43(3), 139–155. https://doi.org/10.1002/joe.22233

- Thottoli, M. M., & Kv, T. (2022). Characteristics of information communication technology and audit practices: Evidence from India. VINE Journal of Information and Knowledge Management Systems, 52(4), 570–593. https://doi.org/10.1108/VJIKMS-04-2020-0068

- Tiberius, V., & Hirth, S. (2019). Impacts of digitisation on auditing: A Delphi study for Germany. Journal of International Accounting, Auditing and Taxation, 37, 100288. https://doi.org/10.1016/j.intaccaudtax.2019.100288

- Tumwebaze, Z., Bananuka, J., Kaawaase, T. K., Bonareri, C. T., & Mutesasira, F. (2022). Audit committee effectiveness, internal audit function and sustainability reporting practices. Asian Journal of Accounting Research, 7(2), 163–181. https://doi.org/10.1108/AJAR-03-2021-0036

- Turetken, O., Jethefer, S., & Ozkan, B. (2020). Internal audit effectiveness: Operationalisation and influencing factors. Managerial Auditing Journal, 35(2), 238–271. https://doi.org/10.1108/MAJ-08-2018-1980