Figures & data

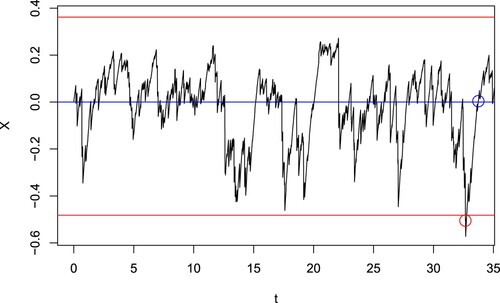

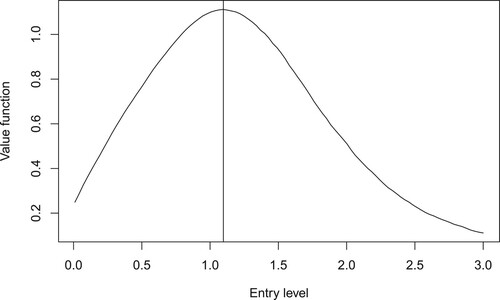

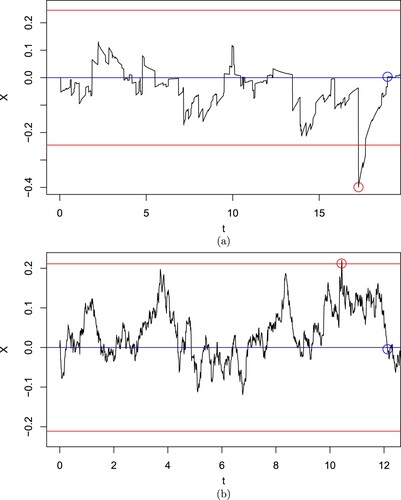

Figure 1. For the spread process X (black line), a trade is entered when the price passes , whichever happens first (red lines), and exited when it passes

(blue line). The value of the spread at the entry (red point) and exit (blue point) times are shown. Here,

.

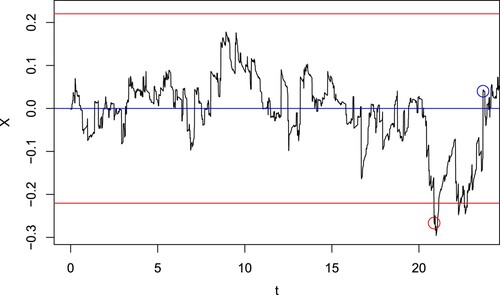

Figure 2. Estimated variance reduction factor R as a function of the number of time points for the control variates p. The parameters are ,

,

, r = 0.01.

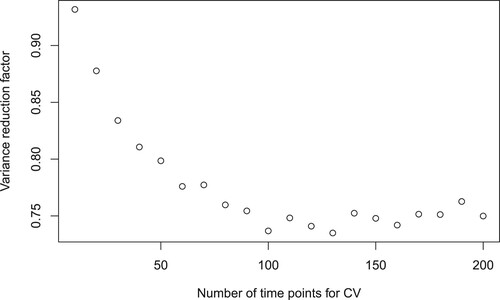

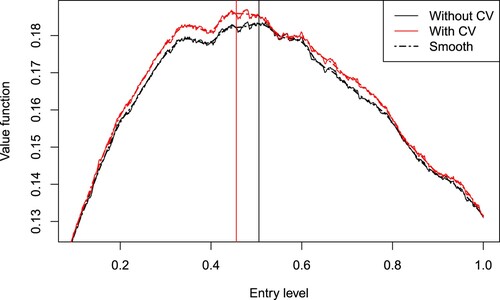

Figure 3. The estimate of the value function

and the optimal entry level

. The parameters are

,

,

, r = 0.01.

Table 1. For various values of , the optimal number of time points for the control variates

(searching over

) and the optimal variance reduction factor

are shown.

Figure 4. The estimate of the value function (solid lines) and the corresponding loess smooth (dashed lines) with (red lines) and without (black lines) control variates. The optimal entry level is

without using control variates, and

using the optimal number of control variates

. The parameters are

,

,

, r = 0.01.

Table 2. For various value of μ, the optimal entry levels and

are shown.

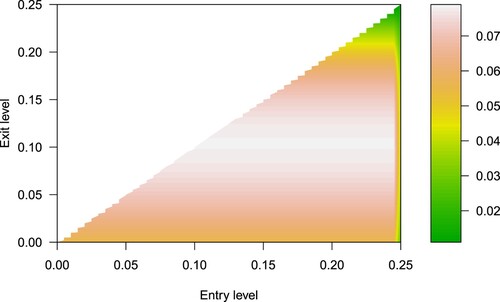

Figure 6. The estimate of the value function with entry level d and exit level c. The parameters are

,

,

, r = 1.

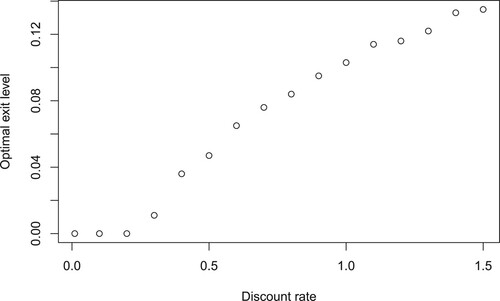

Figure 7. The optimal exit level for various value of discount rate

. The other parameters are

,

,

.

Figure 8. A sample path of the spread , where (a) b = 1 and (b) b = 100, using the optimal entry levels in the first and third row of Table .

Table 3. For various values of b, the optimal entry level d, the estimate of the optimal expected profit, and overshoot statistics are shown.

Table 4. For various values of ρ, the optimal entry levels , the estimate

of the optimal expected profit, and the estimated probability of which spread

is traded are shown.

Table 5. For various value of ρ, the optimal entry level and the estimate

of the optimal expected profit.