?Mathematical formulae have been encoded as MathML and are displayed in this HTML version using MathJax in order to improve their display. Uncheck the box to turn MathJax off. This feature requires Javascript. Click on a formula to zoom.

?Mathematical formulae have been encoded as MathML and are displayed in this HTML version using MathJax in order to improve their display. Uncheck the box to turn MathJax off. This feature requires Javascript. Click on a formula to zoom.ABSTRACT

This study examines the influence of qualified foreign institutional investors (QFIIs) on investee companies’ audit fees. Using data from China, we find that ownership by QFII-licensed investors is positively associated with audit fees. Besides, audit fees are higher in companies with QFIIs than in those without, and the demand for more extensive audits increases with the number of QFIIs. Notably, the demand for more extensive auditing procedures is mainly attributable to QFIIs from jurisdictions with strong governance institutions or is driven by QFIIs from jurisdictions that are geographically distant from China. Our cross-sectional analysis reveals that this positive influence is more prominent when investee companies exhibit lower earnings quality or a weak sense of corporate social responsibility. Finally, our mediation analysis suggests that QFIIs can enhance firm value and that a portion of this effect is due to the increased audit effort driven by QFIIs.

1. Introduction

Foreign institutional investors have played an increasingly critical role in business strategies and the integration of the global economy (Tee et al., Citation2017). According to the Global Financial Stability Report released by the International Monetary Fund (IMF) in 2015, a substantial percentage of assets managed by the world’s top 500 fund managers is distributed globally.Footnote1 Cross-border linkages driven by foreign institutional investors have facilitated international capital flows and efficient allocation of human capital resources. The increasing importance of foreign investors indicates that they now control a significant proportion of global resources and equity, particularly in developing countries (Ferreira et al., Citation2010; Tee et al., Citation2017). Prior research finds that foreign investors have generated numerous favourable effects for investee companies, including, for example, bringing advanced technological innovation (Luong et al., Citation2017), enhancing reporting transparency (He et al., Citation2013), achieving informational and functional efficiency of capital markets (Gul et al., Citation2010), and facilitating the spread of social norms (Dyck et al., Citation2019).

Since foreign investors largely influence investee companies’ management practice and social awareness, and among other factors, we begin to concentrate on their role in investee companies’ audit process. Specifically, we aim to investigate foreign investors’ demand on audit efforts from auditors (proxied by the fees charged by auditing firms). A pioneering study by Simunic (Citation1980) documents that the amount paid in audit fees by the client company largely depends on the efforts of auditors, which in turn depend on auditors’ assessment of the client company’s complexity and risk level. Over the past decades, practitioners and academic researchers have explored the influence of both firm fundamental and external factors as possible determinants of audit fees (Jha & Chen, Citation2015; Kim et al., Citation2015; Tee et al., Citation2017). More specifically, Taylor and Simon (Citation1999) find that the increased litigation pressures and external monitoring will increase the demand for more audit effort, hence exerting upward pressures on audit fees. The influence of senior executives’ demographic and firm fundamental characteristics have also been evidenced (Quan et al., Citation2021). These factors have a potential influence on the efforts of the auditor or the risk of litigation, both of which ultimately influence the fees charged by auditors. However, whether and – if so – how foreign investors may influence investee firms’ audit fees and implications of foreign investors for audit markets has received little attention in prior literature.

China provides an ideal environment to investigate our research question. First, the Qualified Foreign Institutional Investor (QFII) Program by the China Securities Regulatory Commission (CSRC) has attracted many overseas investment entities from around the world to invest in the China A-share stock market since its launch in 2002; particularly, a large majority of these overseas investors originate from well-governed economies. This scheme grants foreign investors an opportunity to access the Chinese market, which significantly facilitates the integration of economic resources. Moreover, these offshore investors are expected to play a critical part in improving corporate policies. For instance, Huang and Zhu (Citation2015) find that QFIIs have incentives to help increase the compensation to minority tradable shareholders and mitigate agency problems of Chinese firms. Also, foreign institutions from high-quality institutional contexts (i.e. US and/or countries with strong investor protection mechanisms) investing in corporations from countries characterised by weak governance institutions and high information asymmetry will enhance investee firms’ reporting quality, governance, and valuations (Aggarwal et al., Citation2011; Beuselinck et al., Citation2017). As noted by Kim et al. (Citation2020), QFIIs help reduce Chinese listed companies’ stock price crash risk via external monitoring. Foreign investors often face heightened agency problems because they have limited access to information validation and executive team monitoring, mainly due to their unfamiliarity with local industry and the physical distance from investees. Prior studies have widely established that extensive and high-quality auditing services can mitigate the information asymmetry between corporate executives and outside information users by allowing outsiders to verify the validity and enhance the readability of financial statements (DeFond & Zhang, Citation2014). The need to facilitate external monitoring may drive the demand for additional audit services (Tee et al., Citation2017). Inspired by this strand of literature, we posit that once QFIIs have invested in overseas companies located in countries with inferior governance, such as China, they have strong motives to push the management to utilise additional audit services to facilitate monitoring, overcome their information disadvantages, and protect investment stakes, hence driving up audit fees.

Second, although China has already achieved remarkable economic progress and become the largest emerging economy, its poor minority shareholder protection still raises severe concerns (Yuan et al., Citation2009). An Enterprise Risk Report by Deloitte reveals that under the current economic system in China, most listed companies’ governance systems are under the leadership of the government and only serves the interests of the ultimate controlling shareholder rather than those of a broader group of stakeholders. It is not a firm’s self-initiated behaviour, and it lacks internal motivation for achieving strategic goals and management improvement, thereby exhibiting high litigation risk, unexpected loss, and audit risk.Footnote2 Thus, companies should focus on establishing an effective governance environment, identifying the areas for value improvement, and pursuing higher-quality audit efforts. Analysing the extent to which QFIIs impact Chinese companies’ auditing procedures may provide essential insights into mechanisms that induce changes in governance controls.

Third, given the increasingly crucial role of QFIIs in China, they may have been provided with a higher latitude of action or a bigger “say” in corporate activities. QFIIs are more financially sophisticated, with advanced management skills, in-depth investment knowledge, and a strong sense of investor protection and governance awareness (Li et al., Citation2021b). Thus, China and Chinese management teams, collectively characterised as a latecomer to the international markets, may attempt to rely on QFIIs to effectively implement governance practices and facilitate audit procedures because QFIIs, who have the ability and expertise, play an important part in influencing advising duties and monitoring processes in China.

Using data from China, we find that QFII ownership is positively connected with audit fees. Besides, we reveal that the audit fees for companies with QFIIs tend to be higher than for companies without, and that the more QFIIs there are, the higher the total fees that a company pays to its auditor. We then explore why QFIIs demand additional audit efforts in investee companies, hence driving up audit fees. First, the motive for QFIIs to induce the management team to utilise more extensive audit services may be attributable to their home countries’ high-quality governance. The overwhelming majority of QFIIs in China are from well-governed jurisdictions, such as countries in Western Europe and the United States,Footnote3 where better governance practices and audit efforts are seen as desirable (Firth et al., Citation2012; Gong et al., Citation2013),Footnote4 and they are more accustomed to higher-standard codes of conduct and better governance practice in their home countries. As a result, these overseas investors are highly likely to transplant their practice to their investee firms, thus they are more likely to require investees in inferior governance countries to use more audit services. Second, investing in a foreign market is accompanied by additional risk and investment uncertainty due to a lack of transparent and sufficient information for the fair evaluation of their prospective investees; when compared to local investors, overseas investors are naturally characterised by information disadvantages (Li et al., Citation2021b). As extensive audit efforts are considered as a vital monitoring mechanism that mitigates the degree of information asymmetry between managers and outside investors (Tee et al., Citation2017), once QFIIs have invested in overseas companies they have incentives to demand additional audits to address their concerns that arise from geographical distances. Our results suggest that this positive influence is mainly driven by QFIIs from regions with stronger governance institutions and QFIIs from geographically remote countries relative to China.

Next, we find that the positive influence of QFIIs on audit fees is more prominent for investees that engage in a higher degree of earnings management than for those that engage in a lower degree of earnings management. Also, the increase in audit fees linked to QFIIs is more salient in investees with low initial corporate social responsibility (CSR) consciousness than among those with high CSR. Our finding is robust to various sensitivity tests and endogeneity. Finally, our path analysis indicates that QFIIs improve shareholder value, and that a proportion of such enhancement occurs via the higher audit fees that a client pays to its auditor.

This study offers three strands of contributions to the extant literature. First, we provide new insights into the literature exploring the role of foreign investors. Previous research largely focuses on their impact on financial stability (Schuppli & Bohl, Citation2010), CSR (Dyck et al., Citation2019), and dividend policy (Cao et al., Citation2017). Our study highlights the role of foreign investors in influencing the demand for investees’ auditing services in China where governance and minority shareholder protection mechanisms are either weak or difficult to effectively enforce. Even though China differs from other emerging markets from some aspects, this article opens up avenues for future research – focusing on the everchanging changes in corporate governance practices in jurisdictions or countries, where monitoring mechanisms are relatively ineffective.

Second, this study adds to those on the determinants of audit pricing. For example, existing literature has well established that audit fees are influenced by litigation pressure and regulatory monitoring (Taylor & Simon, Citation1999), auditees’ size and financial conditions (Owusu-Ansah et al., Citation2010), and social capital (Jha & Chen, Citation2015). We employ a panel data sample consisting of QFIIs from 23 countries and reveal that the positive influence is mainly driven by investors from jurisdictions with stronger governance institutions, or by investors from physically remote nations relative to China. We shed light on possible channels through which foreign investors engage in monitoring investees worldwide and, hence, their governance practices regarding auditing travel around the world.

Third, we echo the call to explore the financial implications of audit work and foreign investors. Prior literature mainly focuses on the influence of audit work on firm value (Asthana, Citation2014; Chan & Li, Citation2008). Notably, we extend this strand of studies and demonstrate that the increased audit effort driven by QFIIs is valued positively by the market, highlighting the key role of QFIIs in achieving broader economic and governance objectives.

This study is organised as follows. Section 2 reviews related literature and develops hypotheses. Research design is described in Section 3. Section 4 discusses results. Section 5 investigates the investors’ valuation of firms with increased audit efforts. Section 6 draws conclusions.

2. Related studies and hypothesis development

2.1. Background

China partly opened its domestic capital market to international institutional investors by introducing a scheme for the distribution of investment quotas to QFIIs officially authorised by the CSRC in November 2002. This scheme aims to gradually develop the domestic capital markets and allows QFIIs to buy and sell Chinese Yuan (CNY)-denominated A-shares on the Shanghai Stock Exchange (SSE) and Shenzhen Stock Exchange (SZSE). Since then, international investors in the domestic A-share market have risen dramatically with regard to foreign investment quotas and the number of QFIIs. For example, in July 2003, there was only one licensed investment entity with an initial investment quota of $800 million which was made by UBS AG (which obtained the first QFII license in China); however, in January 2019, this number increased to 308 QFIIs with a total quota of $300 billion.Footnote5

Once they have placed investments in overseas firms, these offshore investment entities have a strong motivation to monitor the investees so as to maximise the value of their investments (Kim et al., Citation2019). Recent years have seen significantly increased capital inflows and resources by QFIIs to emerging markets. One concern that emerges in the Chinese context and increasingly attracts outside investors’ and auditors’ attention is the severe risk of expropriation by the government, ultimately destroying firm value and economic development (Cull & Xu, Citation2005; Liu, Citation2021). Li et al. (Citation2021a) find that QFIIs can address severe control deficiencies in Chinese listed firms, potentially mitigating the expropriation risk and driving up operating performance. Gul et al. (Citation2010) find that stock price synchronicity is lower for companies that issue shares to both domestic and international investors than for companies that issue shares solely to domestic investors, thus confirming the positive influence of the entrance of foreign investors on the information environment. These studies broadly highlight a common point that foreign investors are proactively involved in monitoring investee companies worldwide and, hence, they may impose their governance awareness on their investees. However, the influence of QFIIs, an increasingly important external monitoring mechanism, on companies’ audit fees and procedures has received little attention in the literature. Here, we fill this void by investigating whether and how QFIIs influence investees’ audit efforts.

2.2. QFIIs and their influence on audit fees

Grounded on the agency theory (Jensen & Meckling, Citation1976), potential opportunistic behaviours by corporate management team tend to drive severe conflicts of interests between outside investors and insiders, which ultimately destroys shareholder value. Information asymmetry is perceived as a leading cause of the agency issue as the management tend to hide information from outside investors. Compared with domestic investors, foreign investors face severe information asymmetry because they are physically distant from the investee firms and unfamiliar with the local investment environments and regulations (Li et al., Citation2021b). Severe information asymmetry prevents foreign investors from effectively monitoring the investees as it is difficult for them to understand, interpret, and validate the accounting and financial information. Hence, foreign investors may have a higher demand for procedures to mitigate the information asymmetry.

Prior research shows that extensive and high-quality auditing serves as an effective mechanism to mitigate the above information asymmetry and increase financial integrity and readability of financial disclosure (Kim et al., Citation2019; Tee et al., Citation2017). Thus, an increasing strand of literature argues that foreign institutional investors demand more extensive auditing and more transparent accounting information to prevent expropriation by corporate insiders and they could exert significant influence over investees’ business strategies and governance practices. For example, both Ben-Nasr et al. (Citation2015) and Huang and Zhu (Citation2015) note that the openness of domestic capital markets to international investment institutions induces a greater demand for high-quality governance and increased corporate transparency. Kim et al. (Citation2019) report that companies with higher international institutional ownership are more likely to employ Big Four auditors, perceived to provide diligent auditing and extensive audit efforts, to mitigate the information asymmetry that these offshore investment entities face when investing overseas. Based on the aforementioned literature we postulate that, once foreign investors have invested in overseas firms, such as those in China, they have strong incentives to compel the executive team to utilise more extensive and higher-quality audit services to reduce information asymmetry and relevant expropriation risk. Hence, from the demand-side perspective, foreign investors may demand increased audit efforts, which drives up audit fees.

From the supply-side perspective, however, it is possible that with an increase in foreign ownership, QFII-licensed investors may have incentives to actively monitor corporate activities (i.e. financial reporting processes and internal control) and mitigate the inherent risk of material misstatements (Lel, Citation2019). For example, Bradshaw et al. (Citation2004) show that non-US companies with a higher degree of US ownership employ accounting methods consistent with the US Generally Accepted Accounting Principles (GAAP), suggesting that US investors (as foreign investors) actively engage in monitoring by requiring more transparent accounting information from investee companies. Accordingly, external auditors may charge less risk premium or reduce the level of substantive checking, because they perceive companies with the presence of foreign investors as having lower inherent risk and undergoing stronger scrutiny, eventually leading to lower audit fees.

Although the demand-side and supply-side perspectives may produce mixed findings, we argue that the demand for high-quality and more extensive audits is more conceptually appealing because an international study by Kim et al. (Citation2019), who employ a larger sample consisting of 40 non-US countries, provides strong supporting evidence that foreign investors tend to compel investee firms to hire reputable auditing firms to mitigate their information asymmetry problems when placing their investments overseas. Thus, QFIIs may have incentives to compel Chinese companies to utilise more extensive audit services due to China’s inferior governance and weak shareholder protection, driving up audit fees. Thus:

H1: QFII ownership is positively related to investee companies’ audit fees.

Indeed, prior literature documents that institutional investors located in well-governed jurisdictions have stronger incentives and the ability to monitor their investees, when compared to those located in jurisdictions with inferior governance practices and weak enforcement (Kim et al., Citation2019; Luong et al., Citation2017). For instance, international institutional investors from jurisdictions with high governance quality can act as active monitors in investee firms, provide insurance for the corporate executive team against innovation failures, and promote knowledge spillovers, thereby playing a more effective role in influencing investees’ innovation-related policies (Luong et al., Citation2017). Overseas investors from countries with a higher level of shareholder protection can significantly promote the governance efficacy of investee firms (Aggarwal et al., Citation2011). Moreover, QFIIs who are from regions with higher regulatory quality tend to transplant their social awareness to investees, thereby driving up overall social awareness, particularly when the monitoring mechanisms of the investees’ jurisdictions are weak (Li et al., Citation2021b).

The common theme of this strand of the literature is that foreign investors from high-quality governance markets are more active in developing a higher standard of governance practices in investee companies because they are more accustomed to high codes of conduct and governance norms in their home countries. However, foreign investors from countries with inferior governance systems may be less likely to influence investees to enhance their governance controls and practices (Kim et al., Citation2019). In sum, we argue that QFIIs exhibit a greater demand for more extensive and higher-quality audit efforts when they are originating from jurisdictions with more effective governance institutions. Thus:

H2: The positive influence of QFII ownership on investee companies’ audit fees is more salient when the ownership by QFIIs from jurisdictions with better governance quality is higher.

H3: The positive influence of QFII ownership on investee companies’ audit fees is more pronounced when the ownership by QFIIs from physically remote jurisdictions relative to China is higher.

3. Research design

3.1. Data collection and sample construction

We start with all Chinese A-share companies listed on either the SSE or the SZSE between 2005 and 2017. Audit data (i.e. audit fees, name of the auditing firm, audit opinion, audit report issue date), financial variables and governance variables are taken from the China Stock Market and Accounting Research (CSMAR) database. We extract the data on QFIIs’ identities and ownership from the Wind-Financial Terminal and the State Administration of Foreign Exchange.Footnote6 We then exclude firm-year observations in the financial sector (CSRC code: J66–J69), leading to a final sample of 22,170 observations for 2,804 firms during the sample period.

3.2. Model and variable definitions

To test our hypotheses, we follow the empirical framework of prior research on audit fees (Jha & Chen, Citation2015) and estimate the following ordinary least squares (OLS) regression:

(1)

(1) where AUDITFEE is measured as the natural logarithm of total audit fees for company i in year t. QFIIOWN is the percentage of outstanding shares owned by QFIIs. We also employ QFIIDUMMY which is a categorical variable assigned a value of one if a company has at least one QFII, and zero otherwise. Moreover, QFIINUM, computed as the natural logarithm of the total number of QFIIs of a company, is introduced as an alternative key independent variable. Given our hypothesis, we expect β1 to be significantly positive.

We refer to prior studies (Bryan & Mason, Citation2020; Ge & Kim, Citation2020; Hay et al., Citation2006; Jha & Chen, Citation2015; Lobanova et al., Citation2020; Wang et al., Citation2020) and control for a set of variables (CONTROL) known to influence audit fees. The company size (SIZE) is measured by the natural logarithm of the book value of total assets. Accounts receivable and inventory require subjective judgement in determining their values and, accordingly, are difficult and risky to audit (Pratt & Stice, Citation1994). To reduce the probability of audit failure, auditors may need to pay more efforts to improve audit quality (Carcello et al., Citation2002). Thus, we use RECEIVABLE, computed as the accounts receivable scaled by total assets, as well as INVENTORY, computed as the ratio of inventory to total assets, as proxies for corporate complexity. Next, we employ four variables to capture business risk: (i) total liabilities divided by total assets (LEVERAGE); (ii) a loss indicator (LOSS); (iii) the ratio of net income to total assets (ROA), and (iv) the current ratio (CRATIO). A firm’s growth potential is captured by Tobin’s Q. We control for the volatility of operating cash flows scaled by the book value of total assets (CFO_VOLATILITY), as well as the volatility of pre-tax earnings divided by the book value of total assets (EBT_VOLATILITY) in the previous five years. We also control for the state/government control (SOE) status.

Next, we follow Carcello et al. (Citation2002) and control for INDEPENDENCE, measured as the proportion of independent directors sitting on the board, and MEETING, computed as the natural logarithm of the total number of board meetings held each year. We also include BOARDSIZE and analyst coverage (ANALYST). Finally, we control for several auditor-specific attributes: BIG4, OPINION, and AUDITLAG. BIG4 is a categorical variable set to one if a client-company is audited by a Big Four auditor, and zero otherwise. OPINION is a categorical variable assigned a value of one if a client-company receives an audit opinion that is neither an unqualified opinion nor an unqualified opinion with additional language, and zero otherwise. AUDITLAG is computed as the natural logarithm of the number of days between the fiscal year-end date and the audit report issue date. Standard errors are clustered by firm and year (Petersen, Citation2009; Thompson, Citation2011). The variable construction and data sources are displayed in Appendix A.

4. Results and discussions

4.1. Univariate results

Panel A of displays the annual distribution. It shows that our sample size gradually increases, from 1,046 observations in 2005 to 2,584 observations in 2017. Notably, the percentage of companies with QFIIs increased to about 9.83% in 2017, up from 2.68% in 2005, suggesting that the QFII programme has significantly facilitated foreign investment in the domestic capital market. Panel B shows that the CSRC industries with larger representation are Manufacturing (58.290%) and Wholesale and Retail Trade (6.698%).

Table 1. Sample distribution

shows that AUDITFEE, a proxy for audit effort, varies from 9.210 to 18.198, with a mean (median) value of 13.592 (13.459). This suggests that more than half of our sample firms have audit fees lower than the average level. Next, the mean value of QFIIDUMMY indicates that 8.7% of our sample firms have at least one QFII. The correlation coefficients between pairs of variables are displayed in Online Appendix D.

Table 2. Descriptive statistics.

4.2. Regression results and discussions

4.2.1. Effect of QFIIs on audit fees

To examine the link between QFIIs and audit fees, we specify Equationequation (1(1)

(1) ) and display the results in . Model 1 presents the results of the baseline OLS regression; QFIIOWN attracts a significantly positive coefficient (0.0149 with t-stat = 4.52), indicating that QFII ownership is positively associated with audit fees potentially due to additional audit efforts demanded by foreign investors. For example, auditors may pay particular attention to reporting completeness, valuation and allocation, classification and understandability, cut-off testing, and rights and obligations testing. This finding is also economically significant. A one-standard-deviation (0.873) increase in foreign ownership, denoted by QFIIOWN, translates into, approximately, a 1.301-percentage point (0.0149 × 0.873) increase in AUDITFEE.Footnote7 This evidence is supportive of H1. Similarly, the estimate on QFIIDUMMY is significantly positive in column 2, implying that audit fees tend to be higher for companies with QFIIs than for companies without.Footnote8 In column 3, we find a significantly positive coefficient on QFIINUM, reaffirming the positive link.Footnote9

Table 3. Foreign investors and audit fees.

4.2.2. Role of governance quality of QFIIs’ countries of domicile

Next, we examine why QFIIs demand high-quality audit efforts. We first conjecture that QFIIs transplant their strong corporate governance motivation and high standards of codes of conduct to companies in which they invest; foreign investors, who have such governance awareness driven by the institutional quality, may demand that the executive team uses more extensive audit services, particularly when investees are located in jurisdictions with inferior governance and weak minority shareholder protection. As such, we follow Li et al. (Citation2021b) to employ the Worldwide Governance Indicator (WGI) from the World Bank as a proxy for institutional quality, and compute the median WGI score for each year.Footnote10 Next, we create two continuous variables. QFII_HIGHWGI_OWN is measured as the sum of the percentage of outstanding shares held by QFII-licensed entities originating from regions or countries with a high degree of institutional quality (with a WGI score equal to or above the median level of WGI in a given fiscal year). Similarly, QFII_LOWWGI_OWN is the sum of the percentage of outstanding shares held by QFII-licensed entities domiciled in jurisdictions or countries with relatively low institutional quality (with a WGI index score below the median WGI).

We substitute QFII_HIGHWGI_OWN and QFII_LOWWGI_OWN for QFIIOWN in EquationEq. (1(1)

(1) ) and report the estimates in column 1 of . The estimate on QFII_HIGHWGI_OWN is positive and highly significant (0.0177 with t-stat = 2.75), while that on QFII_LOWWGI_OWN is less significant (0.0112 with t-stat = 1.66). Notably, QFII_HIGHWGI_OWN attracts a slightly larger coefficient than QFII_LOWWGI_OWN in terms of the magnitude, suggesting that compared to QFIIs from jurisdictions with low institutional quality ratings, those from well-governed countries may demand more extensive auditing procedures, consistent with their motives.

Table 4. Channels through which foreign investors influence audit fees.

Then, we follow La Porta et al. (Citation2008) and Spamann (Citation2010) to use the anti-director rights index score as a proxy for a country's shareholder protection level and governance quality. Specifically, we create two variables – namely, QFII_HIGHSP_OWN and QFII_LOWSP_OWN – to capture the influence of QFIIs from high shareholder protection jurisdictions and QFIIs from weak shareholder protection countries on audit fees. The former one is measured as the sum of the percentage of outstanding shares held by QFIIs from countries with a higher level of shareholder protection (with an anti-director rights index score equal to or above the median level). The latter is measured as the sum of the percentage of outstanding shares held by QFIIs from countries with weaker shareholder protection (with an anti-director rights index score below the median level).

We modify our main variable of interest from QFIIOWN to QFII_HIGHSP_OWN and QFII_LOWSP_OWN in EquationEq. (1(1)

(1) ) and re-run the equation. In column 2, the positive estimate on QFII_HIGHSP_OWN is highly significant, while that on QFII_LOWSP_OWN is less significant. This evidence implies that the positive influence of QFIIs may be mainly driven by QFIIs from jurisdictions with better shareholder protection. In summary, the results presented in columns 1 and 2 of conform with H2.

4.2.3. Role of geographical distance between QFIIs’ countries of domicile and China

We further explore why QFIIs have incentives to push the executive team to utilise additional auditing services. We follow Li et al. (Citation2021b) and measure the level of information asymmetry by employing the physical distance between QFIIs’ countries of domicile and China as a proxy for such investment uncertainty. Specifically, we classify QFIIs into those from geographically distant jurisdictions (with geographic distance equal to or greater than the sample median geographic distance between QFIIs’ countries of domicile and China) and those from geographically proximate nations (with geographic distance below the median geographic distance). Next, we create two variables to capture the magnitude of QFIIs’ influence. QFII_DISTANT_OWN is the sum of the percentage of outstanding shares held by QFIIs from geographically distant countries. QFII_CLOSE_OWN is the sum of the percentage of outstanding shares held by QFIIs from close countries.

We substitute QFII_DISTANT_OWN and QFII_CLOSE_OWN for QFIIOWN in Equation (1). In column 3 of , we observe that the coefficient on QFII_DISTANT_OWN is positive and highly significant, while that on QFII_CLOSE_OWN is insignificant. From this, we can confirm that QFIIs from geographically remote countries tend to demand additional audit efforts (thereby higher audit fees) to mitigate the risk and investment uncertainty driven by the physical distance from the investee companies in China. Notably, this result may be driven by foreign investors from North America or European countries because, in an unreported analysis, we empirically reveal that the coefficients of QFIIs from these regions are both significantly positive compared to that of QFIIs from geographically close regions. Also, our data reveal that approximately 15.83% of the QFIIs locate in North America and 52.09% are situated in European countries (i.e. 17.62% from the UK, 10.24% from Switzerland, and 8.11% from France). These results indicate that our finding is not solely driven by QFIIs from either North America or any single country from Europe. Thus, H3 is supported. Overall, our evidence indicates that monitoring by QFIIs appears to be an underlying mechanism through which these investors could enhance investees’ audit quality.

4.3. Additional analysis: roles of earnings quality and CSR

4.3.1. Role of investee firms’ discretionary accruals in the link between QFIIs and audit fees

Next, we investigate the scope of the influence of QFIIs on audit fees by looking into the role of an investees’ initial earnings quality. Prior research mainly uses measures of discretionary accruals as surrogates for earnings quality (Kim et al., Citation2012). Companies that aggressively use discretionary accruals to manage earnings are more likely to diminish the extensiveness of the external audit and exhibit lower audit quality (Chen et al., Citation2011), implying that a company's initial earnings quality may affect the scope of the stakeholders’ monitoring role in corporate activities. Previous studies note that companies with severe earnings management are associated with severe agency problems and poor governance (Rezaee & Tuo, Citation2019; Richardson, Citation2000), and are thus perceived to be riskier. Consequently, investors require them to use high-quality audit services because of their high inherent risks. We thus posit that for investees aggressively engaging in earnings management, QFIIs may face more severe investment uncertainty, which gives them strong incentives to require more extensive auditing procedures in the post-investment period. This drives up audit fees.

To validate our conjecture, we test whether investees’ discretionary accounting accruals may play a part in the relation between QFII ownership and audit fees. We follow Kim et al. (Citation2012) to augment the modified Jones model by including the one-year-lagged return on assets as an explanatory variable. We use the residuals from the annual cross-sectional industry regression model as our estimates of a firm's discretionary accruals. We then follow Kousenidis et al. (Citation2013) and partition our sample firms into two groups that correspond to firms with high and low levels of earnings management, respectively. Specifically, first, we calculate the median of the absolute value of discretionary accounting accruals for each year and industry. Next, we sort a firm into a high (low) discretionary accrual group which is characterised by a higher (lower) level of earnings management if the firm's absolute value of accounting discretionary is equal to or above (below) the median. We re-run our baseline model separately for each subgroup and test the difference in the estimated coefficient on QFIIOWN across subgroups. Notably, the estimate on QFIIOWN in column 1 of is significantly positive, while that on QFIIOWN in column 2 is insignificant. Consistent with our prediction, when investee companies exhibit relatively poor accounting quality, QFIIs have greater incentives to demand more audit effort, resulting in higher audit fees; however, in companies with better accounting quality, QFIIs have no significant influence on the demand for additional audit procedures.

Table 5. Cross-sectional analysis: roles of investees’ initial discretionary accruals and CSR.

4.3.2. Role of investee firms’ CSR performance in the link between QFIIs and audit fees

Relatedly, CSR has attracted extensive attention from academics and policymakers in understanding companies’ motivation for engaging in CSR, with a particular strand in the CSR literature focusing on information environment enhancement. Drawing upon the legitimacy view, a corporation actively discloses CSR information to various stakeholders so that it can legitimate itself and present a good CSR image (Cho et al., Citation2012). Indeed, CSR plays a critical role in reducing information asymmetry among stakeholders and therefore enhances earning capacity and corporate integrity (Li & Wang, Citation2021). Based on Chinese data, Ye and Zhang (Citation2011) note that companies with better CSR exhibit lower costs of debt because the CSR improvement reduces business risks and information asymmetry by generating positive moral and social capital as well as building public trust among a wide range of stakeholders. This responsibility and foresight can lead to a reduction in audit risks and audit scope, hence decreasing audit fees (Wang et al., Citation2020). High CSR firms are less likely to undertake activities prone to external censure, so litigation risk from investors may, therefore, decrease (Brooks et al., Citation2019). However, a different view may emerge. The agency theory argues that high CSR performance may reflect poor incentives among top executives that could impede prospective investment opportunities (Bhandari & Javakhadze, Citation2017). CSR activities may also be used for personal interests and reputation building at the expense of shareholder wealth (Krüger, Citation2015). Meanwhile, a large volume of empirical evidence regarding Chinese firms’ CSR supports its positive implications for financial activities (Du et al., Citation2019; Li et al., Citation2021b), thus mitigating QFIIs’ concerns in terms of their investees’ litigation risk and business environments.

Hence, we argue that QFIIs may have less need to require additional audit work and related due diligence services in companies with higher CSR scores since they may perceive high CSR companies as having lower operating uncertainty and risk. Instead, they may demand more extensive audit effort in low CSR companies because low CSR companies will exhibit a high litigation risk, hence driving up audit fees.

To test our conjecture, we collect CSR scores from the Hexun website,Footnote11 and then divide our sample into two groups that correspond to companies with high CSR and companies with low CSR, based on our sample median CSR score of each year, respectively. Next, we re-estimate our baseline model for each subgroup and display these results in columns 3 and 4 of . We find that QFIIOWN has a positive and highly significant coefficient in the low CSR group (column 4), while that QFIIOWN has an insignificant coefficient in the high CSR group (column 3). The evidence implies that QFIIs tend to compel the management team to utilise more extensive audit effort in local firms with relatively lower initial CSR, thereby resulting in higher audit fees.

4.4. Robustness

4.4.1. Sensitivity tests

Here, we adopt several robustness checks to test the validity of our main finding. First, we test the influence of QFIIs on the probability of appointing a Big Four auditor (BIG4) by specifying a probit model. To mitigate the concern that our key finding is solely driven by Big Four involvements rather than by QFIIs, we sort our sample into two groups: one is with Big Four auditors and the other is without Big Four auditors. Next, we control for additional factors known to influence audit fees, including the absolute value of discretionary accruals, the size and the independence of the audit committee. We also exclude companies in the manufacturing sector and adopt different timeframes to address the estimation bias driven by specific industries or years. To address concerns regarding omitted time-invariant firm-level factors, we employ a firm fixed-effect model and change analysis. Overall, the coefficient on our key independent variable remains significantly positive, thereby supporting H1. For details, please see Online Appendices A and B.

4.4.2. Endogeneity

The possible endogenous link between QFIIs and the demand for more extensive audit effort may, however, drive severe endogeneity issues. First, the unobservable heterogeneity may bias our results. Such heterogeneity appears when there are unobservable firm-level characteristics that influence both QFIIs and determinants of audit fees. Second, reverse causality is a source of endogeneity. Institutional investors may tend to invest in overseas companies that are willing to pay a higher audit fee because this implies additional audit effort has been performed in terms of a company's financial statements (Tee et al., Citation2017). Third, the dynamic link between the dependent variable and the independent variable may result in endogeneity issues in our empirical setting.

Hence, we first conduct the PSM method to address the potential concerns that firms with the existence of QFIIs are fundamentally different from those without. Specifically, we first run a probit model to estimate the probability of the presence of QFIIs using the full sample and calculate the propensity score for each observation. With replacement, we match a QFII firm to a non-QFII firm using the nearest neighbour matching technique based on an array of variables employed in Equation (1). We set a caliper distance at 0.001. After matching, we follow Armstrong et al. (Citation2010) to carry out a covariate balance test to ensure the validity of our matching criteria in the treatment and control firms. Finally, we re-run Equation (1) based on the PSM sample to examine the validity of our main finding.

Panel A of shows that the observable firm characteristics of the control sample are largely similar to those of the treatment sample after matching, implying a well-balanced sample. Panel B shows that the estimate on QFIIOWN is significantly positive, reaffirming H1.Footnote12

Table 6. PSM analysis.

To further address the concern related to the potential imbalance among covariates, we employ an entropy balancing approach, a reweighting technique that incorporates covariate balance into the weight function when carrying out the matching procedure. Online Appendix C shows that QFIIOWN continues to attract a significantly positive coefficient.

Next, the dynamic nature of our variables, according to which the current values of the independent variables are a function of past values of the explained variable, may drive endogeneity issues in our empirical setting. Following Kim et al. (Citation2015), we include the one-year-lagged total audit fees (AUDITFEE) as an independent variable in Equation (1) to implement the dynamic GMM estimation. We employ the Arellano–Bond system GMM method, which includes a procedure of two models. One is the dynamic regression that is transformed into a first-differenced mode. The other is the dynamic regression that is transformed into a level form (Arellano & Bover, Citation1995; Blundell & Bond, Citation1998).Footnote13

The result from the dynamic panel system GMM approach presented in column 1 of shows that QFIIOWN attracts a significantly positive estimate. To assess whether the instruments are exogenous, we adopt the Hansen test and find a p-value of 0.120 for the difference-in-Hansen examination of exogeneity, which validates the use of our instruments.

Table 7. Dynamic GMM estimation.

5. Does the market value the increased audit effort driven by QFIIs?

Prior research suggests that the market highly values the extensive auditing procedures because investors generally refer to additional audit efforts as an insurance tool against litigation and information risk and managerial incentive problems (Caramanis & Lennox, Citation2008; Mao & Yu, Citation2015), potentially enhancing firm value (Asthana, Citation2014). We thus argue that market participants may positively value firms with increased audit fees driven by QFIIs.

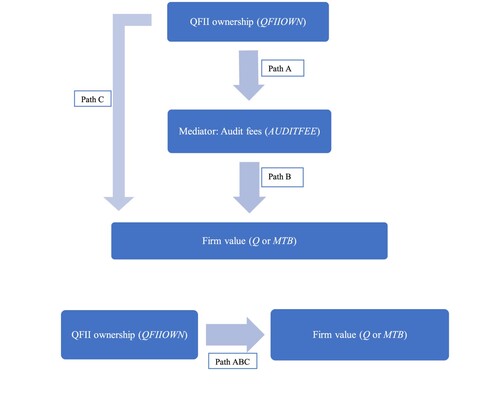

To verify our conjecture, we follow the procedures in Cook et al. (Citation2019) to carry out a mediation analysis. We employ the Tobin's Q and the market-to-book (MTB) ratio as proxies for firm value, which is the outcome variable. QFII ownership is the treatment variable, while the audit fee is the mediator. demonstrates the intuition behind the mediation analysis and shows a causal diagram of the mediating effect. First, Path A corresponds to the effect of QFII ownership on the mediator – audit fees, and Path B illustrates the effect of the mediator on firm value. Second, Path C corresponds to the direct effect of QFII ownership on firm value. Finally, Path ABC represents the total effect of QFII ownership on firm value, thus incorporating both direct and indirect effects.

The results of the mediation analysis are reported in . Consistent with our findings in , columns 1 and 3 show that the treatment (QFIIOWN) is significantly related to the mediator (AUDITFEE), evidenced by the significantly positive coefficient on QFIIOWN. When the effect of the mediator is considered in columns 2 and 4, the treatment (QFIIOWN) is positively associated with Q and MTB, indicating that a higher QFII ownership increases firm value. Notably, the mediating effect reveals that the effect of QFII ownership on firm value is weakened when the mediator is included in the model.Footnote14 The result of the mediation test (Baron & Kenny, Citation1986) presented in Panel B indicates that the total effect of QFIIOWN on Q is 0.0236 (z-stat = 2.67), and its mediating effect (i.e. the indirect effect that operates through audit fees) is 0.0027 (z-stat = 4.14), both highly significant, thus accounting for a certain part (11.44%) of the overall improvement in Q. Similarly, the result that employs MTB as a performance proxy is consistent with the one that uses Q as an outcome variable. That is, approximately 8.95% of the total effect of QFII ownership on firm value operates indirectly through the impact on audit fees. Overall, our mediation analysis reveals that QFIIs improve future firm value, and that a portion of this influence occurs via the higher audit fees that a client company pays to its auditor.

Table 8. Mediating effect of audit fees on the link between foreign ownership and firm value.

6. Conclusions

In this study, we explore the impact of QFIIs on auditing procedures within the Chinese context. We reveal that these offshore owners demand more audit efforts to reduce the high degree of information asymmetry they face in overseas markets, hence driving up audit fees. Our findings highlight the monitoring role of QFIIs, and we find that the demand for more extensive and high-quality auditing procedures is mainly driven by QFIIs from jurisdictions with strong governance institutions or is driven by QFIIs from remote countries relative to China. In addition to achieving good governance objectives, we shed light on the economic implications of audit efforts and QFIIs. However, this study is still subject to some limitations. Future studies could explore the effects of foreign investors on other governance or information environment issues such as analyst forecasting accuracy and dispersion. Besides, we restrict our analysis to the listed firms on China's A-share market. The China Interbank Bond Market Direct scheme was launched in 2016, providing international financial institutions access to a wide variety of fixed income instruments in the Chinese bond market. Thus, it may be imperative that future studies examine the link between QFIIs and fixed income issues.

Supplemental Material

Download MS Word (71 KB)Acknowledgments

We thank Professor Carol Tilt (the Editor) and two anonymous referees for constructive suggestions. We are grateful to Tianlong Wu because of a part of the data collection carried out between 2017 and 2019. The initial draft of this study was completed in early 2020. This study was invited to the presentation at the 2022 European Financial Management Association (EFMA) Annual Meeting. Send correspondence to the first author at [email protected] or [email protected]. All errors remain our responsibility.

Data availability statement

The data that support the findings of this study are publicly available from the sources noted in the text.

Disclosure statement

No potential conflict of interest was reported by the author(s).

Notes

3 Approximately 49.24% of QFIIs come from Western Europe, and 13.77% are from the US.

4 Similarly, Jia et al. (Citation2020) report that 95.83% of QFIIs in Chinese listed firms come from economies deemed as advanced by the IMF.

5 See http://www.safe.gov.cn/en/2019/0118/1486.html and http://www.csrc.gov.cn/pub/newsite/gjb/sczr/qfiiylb/201906/t20190628_358352.html.

7 The coefficient on QFIIOWN is 0.0149 in Model 1 of , and the standard deviation of QFIIOWN is 0.873, as shown in ; this is calculated as 0.0149 × 0.873=0.01301 (1.301%). Notably, 8.7% of sample firms are with the presence of QFIIs (thus with QFII ownership greater than zero) while the rest of the sample firms are with QFII ownership of zero. Thus, it may appear to be a “modest” improvement. We then re-run Eq. (1) based only on firm-years with QFIIs, and find that the coefficient on QFIIOWN is 0.0143. shows that the standard deviation of QFIIOWN (when QFIIDUMMY = 1) is 2.310. Economically, a one-standard-deviation (2.310) increase in QFIIOWN translates into about 3.303% (0.0143 × 2.310) increase in AUDITFEE, indicating a significant improvement.

8 We also test the parallel trends assumption by matching “each firm-year with QFIIs” to “an observation without QFIIs” within the same year, the same industry, and the nearest firm size. After matching, we find that AUDITFEE for firms with QFIIs in the year prior to QFII involvement is 13.7742 and that for firms without QFII involvement is 13.7235. The difference between these mean values is not statistically significant, which is evidenced by a p-value of 0.1250, indicating that the parallel trends condition is likely to be met.

9 We thank an anonymous referee for the following suggestion. We further re-run the baseline regression model by inserting SIZE, ANALYST, and BIG4 one by one and find that the key finding remains unchanged.

10 Following Del Bosco and Misani (Citation2016), we averaged the six indicators (using equal weights) to build a WGI index as a comprehensive institutional quality measure. Higher WGI scores indicate stronger governance quality.

11 The Hexun platform, a leading rating agency, provides numeric scores of Chinese listed companies' CSR-engagement (Shahab et al., Citation2019). Firms are totally scored from 0 to 100, with higher values corresponding to better CSR. CSR engagements are categorised as shareholder protection, employee contributions, suppliers' and customers' rights, environments, and society. See http://stockdata.stock.hexun.com/zrbg/Plate.aspx?date=2017-12-31.

12 We also conducted the PSM method with the “no replacement” technique and our key finding is not affected.

13 First-differencing the dynamic model helps address the concern that unobserved heterogeneity and omitted factors may have an influence on audit fees.

14 For example, in column 2 of where the dependent variable is Q, the coefficient on AUDITFEE is 0.1752 and significant at the 1% level, while that on QFIIOWN is 0.0209 and its significance reduces from the 1% level in column 1 to the 10% level in column 2 which additionally controls for AUDITFEE.

References

- Aggarwal, R., Erel, I., Ferreira, M., & Matos, P. (2011). Does governance travel around the world? Evidence from institutional investors. Journal of Financial Economics, 100(1), 154–181. https://doi.org/10.1016/j.jfineco.2010.10.018

- Arellano, M., & Bover, O. (1995). Another look at the instrumental variable estimation of error-components models. Journal of Econometrics, 68(1), 29–51. https://doi.org/10.1016/0304-4076(94)01642-D

- Armstrong, C. S., Jagolinzer, A. D., & Larcker, D. F. (2010). Chief executive officer equity incentives and accounting irregularities. Journal of Accounting Research, 48(2), 225–271. https://doi.org/10.1111/j.1475-679X.2009.00361.x

- Asthana, S. (2014). Abnormal audit delays, earnings quality and firm value in the USA. Journal of Financial Reporting and Accounting, 12(1), 21–44. https://doi.org/10.1108/JFRA-09-2011-0009

- Baik, B., Kang, J.-K., & Kim, J.-M. (2010). Local institutional investors, information asymmetries, and equity returns⋆. Journal of Financial Economics, 97(1), 81–106. https://doi.org/10.1016/j.jfineco.2010.03.006

- Baron, R. M., & Kenny, D. A. (1986). The moderator–mediator variable distinction in social psychological research: Conceptual, strategic, and statistical considerations. Journal of Personality and Social Psychology, 51(6), 1173–1182. https://doi.org/10.1037/0022-3514.51.6.1173

- Barroso, R., Ali, B. C., & Lesage, C. (2016). Blockholders’ ownership and audit fees: The impact of the corporate governance model. European Accounting Review, 27(1), 149–172. https://doi.org/10.1080/09638180.2016.1243483

- Ben-Nasr, H., Boubakri, N., & Cosset, J.-C. (2015). Earnings quality in privatized firms: The role of state and foreign owners. Journal of Accounting and Public Policy, 34(4), 392–416. https://doi.org/10.1016/j.jaccpubpol.2014.12.003

- Beuselinck, C., Blanco, B., & García Lara, J. M. (2017). The role of foreign shareholders in disciplining financial reporting. Journal of Business Finance & Accounting, 44(5-6), 558–592. https://doi.org/10.1111/jbfa.12239

- Bhandari, A., & Javakhadze, D. (2017). Corporate social responsibility and capital allocation efficiency. Journal of Corporate Finance, 43, 354–377. https://doi.org/10.1016/j.jcorpfin.2017.01.012

- Blundell, R., & Bond, S. (1998). Initial conditions and moment restrictions in dynamic panel data models. Journal of Econometrics, 87(1), 115–143. https://doi.org/10.1016/S0304-4076(98)00009-8

- Bradshaw, M. T., Bushee, B. J., & Miller, G. S. (2004). Accounting choice, Home Bias, and U.S. Investment in Non-U.S. Firms. Journal of Accounting Research, 42(5), 795–841. https://doi.org/10.1111/j.1475-679X.2004.00157.x

- Brooks, L. L. Z., Gill, S., & Wong-On-Wing, B. (2019). Corporate social responsibility risk and auditor–client retention. International Journal of Auditing, 23(1), 95–111. https://doi.org/10.1111/ijau.12148

- Bryan, D. B., & Mason, T. W. (2020). Independent director reputation incentives, accruals quality and audit fees. Journal of Business Finance & Accounting, 47(7-8), 982–1011. https://doi.org/10.1111/jbfa.12435

- Cao, L., Du, Y., & Hansen, JØ. (2017). Foreign institutional investors and dividend policy: Evidence from China. International Business Review, 26(5), 816–827. https://doi.org/10.1016/j.ibusrev.2017.02.001

- Caramanis, C., & Lennox, C. (2008). Audit effort and earnings management. Journal of Accounting & Economics, 45(1), 116–138. https://doi.org/10.1016/j.jacceco.2007.05.002

- Carcello, J. V., Hermanson, D. R., Neal, T. L., & Riley, Jr., R. A. (2002). Board characteristics and audit fees. Contemporary Accounting Research, 19(3), 365–384. https://doi.org/10.1506/CHWK-GMQ0-MLKE-K03V

- Chan, K. C., & Li, J. (2008). Audit committee and firm value: Evidence on outside top executives as expert-independent directors. Corporate Governance: An International Review, 16(1), 16–31. https://doi.org/10.1111/j.1467-8683.2008.00662.x

- Chen, H., Chen, J. Z., Lobo, G. J., & Wang, Y. (2011). Effects of audit quality on earnings management and cost of equity capital: Evidence from China*. Contemporary Accounting Research, 28(3), 892–925. https://doi.org/10.1111/j.1911-3846.2011.01088.x

- Cho, C. H., Guidry, R. P., Hageman, A. M., & Patten, D. M. (2012). Do actions speak louder than words? An empirical investigation of corporate environmental reputation. Accounting, Organizations and Society, 37(1), 14–25. https://doi.org/10.1016/j.aos.2011.12.001

- Clinch, G., Stokes, D., & Zhu, T. (2012). Audit quality and information asymmetry between traders. Accounting & Finance, 52(3), 743–765. https://doi.org/10.1111/j.1467-629X.2011.00411.x

- Cook, K. A., Romi, A. M., Sánchez, D., & Sánchez, J. M. (2019). The influence of corporate social responsibility on investment efficiency and innovation. Journal of Business Finance & Accounting, 46(3-4), 494–537. https://doi.org/10.1111/jbfa.12360

- Cull, R., & Xu, L. C. (2005). Institutions, ownership, and finance: The determinants of profit reinvestment among Chinese firms. Journal of Financial Economics, 77(1), 117–146. https://doi.org/10.1016/j.jfineco.2004.05.010

- DeFond, M., & Zhang, J. (2014). A review of archival auditing research. Journal of Accounting and Economics, 58(2-3), 275–326. https://doi.org/10.1016/j.jacceco.2014.09.002

- Del Bosco, B., & Misani, N. (2016). The effect of cross-listing on the environmental, social, and governance performance of firms. Journal of World Business, 51(6), 977–990. https://doi.org/10.1016/j.jwb.2016.08.002

- Du, J., Bai, T., & Chen, S. (2019). Integrating corporate social and corporate political strategies: Performance implications and institutional contingencies in China. Journal of Business Research, 98, 299–316. https://doi.org/10.1016/j.jbusres.2019.02.014

- Dyck, A., Lins, K. V., Roth, L., & Wagner, H. F. (2019). Do institutional investors drive corporate social responsibility? International evidence. Journal of Financial Economics, 131(3), 693–714. https://doi.org/10.1016/j.jfineco.2018.08.013

- Ferreira, M. A., Massa, M., & Matos, P. (2010). Shareholders at the gate? Institutional investors and cross-border mergers and acquisitions. Review of Financial Studies, 23(2), 601–644. https://doi.org/10.1093/rfs/hhp070

- Firth, M., Rui, O. M., & Wu, X. (2012). How do various forms of auditor rotation affect audit quality? Evidence from China. The International Journal of Accounting, 47(1), 109–138. https://doi.org/10.1016/j.intacc.2011.12.006

- Ge, W., & Kim, J. B. (2020). How does the executive pay gap influence audit fees? The roles of R&D investment and institutional ownership. Journal of Business Finance & Accounting, 47(5-6), 677–707. https://doi.org/10.1111/jbfa.12426

- Gong, G., Ke, B., & Yu, Y. (2013). ’Home country investor protection, ownership structure and cross-listed firms’ compliance with sox-mandated internal control deficiency disclosures. Contemporary Accounting Research, 30(4), 1490–1523. https://doi.org/10.1111/1911-3846.12000

- Gul, F. A., Kim, J.-B., & Qiu, A. A. (2010). Ownership concentration, foreign shareholding, audit quality, and stock price synchronicity: Evidence from China. Journal of Financial Economics, 95(3), 425–442. https://doi.org/10.1016/j.jfineco.2009.11.005

- Hay, D. C., Knechel, W. R., & Wong, N. (2006). Audit fees: A meta-analysis of the effect of supply and demand attributes*. Contemporary Accounting Research, 23(1), 141–191. https://doi.org/10.1506/4XR4-KT5V-E8CN-91GX

- He, W., Li, D., Shen, J., & Zhang, B. (2013). Large foreign ownership and stock price informativeness around the world. Journal of International Money and Finance, 36, 211–230. https://doi.org/10.1016/j.jimonfin.2013.04.002

- Huang, W., & Zhu, T. (2015). Foreign institutional investors and corporate governance in emerging markets: Evidence of a split-share structure reform in China. Journal of Corporate Finance, 32, 312–326. https://doi.org/10.1016/j.jcorpfin.2014.10.013

- Jensen, M. C., & Meckling, W. H. (1976). Theory of the firm: Managerial behavior, agency costs and ownership structure. Journal of Financial Economics, 3(4), 305–360. https://doi.org/10.1016/0304-405X(76)90026-X

- Jha, A., & Chen, Y. (2015). Audit fees and social capital. The Accounting Review, 90(2), 611–639. https://doi.org/10.2308/accr-50878

- Jia, N., Shi, J., Wang, C., & Wang, Y. (2020). Parasites and paragons: Ownership reform and concentrated interest among minority shareholders. Journal of Management Studies, 57(1), 129–162. https://doi.org/10.1111/joms.12537

- Kang, J. K., & Kim, J. M. (2008). The geography of block acquisitions. The Journal of Finance, 63(6), 2817–2858. https://doi.org/10.1111/j.1540-6261.2008.01414.x

- Kim, J.-B., Li, X., Luo, Y., & Wang, K. (2020). Foreign investors, external monitoring, and stock price crash risk. Journal of Accounting, Auditing & Finance, 35(4), 829–853. https://doi.org/10.1177/0148558X19843358

- Kim, J.-B., Pevzner, M., & Xin, X. (2019). Foreign institutional ownership and auditor choice: Evidence from worldwide institutional ownership. Journal of International Business Studies, 50(1), 83–110. https://doi.org/10.1057/s41267-018-0160-x

- Kim, Y., Li, H., & Li, S. (2015). CEO equity incentives and audit fees. Contemporary Accounting Research, 32(2), 608–638. https://doi.org/10.1111/1911-3846.12096

- Kim, Y., Park, M. S., & Wier, B. (2012). Is earnings quality associated with corporate social responsibility? The Accounting Review, 87(3), 761–796. https://doi.org/10.2308/accr-10209

- Klun, M., & Slabe-Erker, R. (2009). Business views of the quality of tax, environment and employment regulation and institutions: The Slovenian case. International Review of Administrative Sciences, 75(3), 529–548. https://doi.org/10.1177/0020852309337688

- Kousenidis, D. V., Ladas, A. C., & Negakis, C. I. (2013). The effects of the European debt crisis on earnings quality. International Review of Financial Analysis, 30, 351–362. https://doi.org/10.1016/j.irfa.2013.03.004

- Krüger, P. (2015). Corporate goodness and shareholder wealth. Journal of Financial Economics, 115(2), 304–329. https://doi.org/10.1016/j.jfineco.2014.09.008

- La Porta, R., Lopez-de-Silanes, F., & Shleifer, A. (2008). The economic consequences of legal origins. Journal of Economic Literature, 46(2), 285–332. https://doi.org/10.1257/jel.46.2.285

- Lel, U. (2019). The role of foreign institutional investors in restraining earnings management activities across countries. Journal of International Business Studies, 50(6), 895–922. https://doi.org/10.1057/s41267-018-0195-z

- Li, Z., Wang, B., Wu, T., & Zhou, D. (2021a). The influence of qualified foreign institutional investors on internal control quality: Evidence from China. International Review of Financial Analysis, 78, 101916. https://doi.org/10.1016/j.irfa.2021.101916

- Li, Z., & Wang, P. (2021). Flotation costs of seasoned equity offerings: Does corporate social responsibility matter? European Financial Management. https://doi.org/10.1111/eufm.12327

- Li, Z., Wang, P., & Wu, T. (2021b). Do foreign institutional investors drive corporate social responsibility? Evidence from listed firms in China. Journal of Business Finance & Accounting, 48(1-2), 338–373. https://doi.org/10.1111/jbfa.12481

- Liu, Y. (2021). Investor protection and audit fees: Evidence from the E-interaction platform in China. Accounting and Business Research, 1–23. https://doi.org/10.1080/00014788.2021.1938961

- Lobanova, O., Mishra, S., Raghunandan, K., & Aidov, A. (2020). Dual–class ownership structure and audit fees. International Journal of Auditing, 24(1), 163–176. https://doi.org/10.1111/ijau.12185

- Luong, H., Moshirian, F., Nguyen, L., Tian, X., & Zhang, B. (2017). How do foreign institutional investors enhance firm innovation? Journal of Financial and Quantitative Analysis, 52(4), 1449–1490. https://doi.org/10.1017/S0022109017000497

- Mao, M. Q., & Yu, Y. (2015). Analysts’ cash flow forecasts, audit effort, and audit opinions on internal control. Journal of Business Finance & Accounting, 42(5-6), 635–664. https://doi.org/10.1111/jbfa.12117

- Owusu-Ansah, S., Leventis, S., & Caramanis, C. (2010). The pricing of statutory audit services in Greece. Accounting Forum, 34(2), 139–152. https://doi.org/10.1016/j.accfor.2010.04.001

- Petersen, M. A. (2009). Estimating standard errors in finance panel data sets: Comparing approaches. Review of Financial Studies, 22(1), 435–480. https://doi.org/10.1093/rfs/hhn053

- Pratt, J., & Stice, J. D. (1994). The effects of client characteristics on auditor litigation risk judgments, required audit evidence, and recommended audit fees. The Accounting Review, 69, 639–656. https://www.jstor.org/stable/248435

- Quan, X., Ke, Y., Zhang, L., & Zhang, J. (2021). Are ex-military executives trustworthy? Evidence from audit fees. Accounting Forum, 1–26. https://doi.org/10.1080/01559982.2021.1992152

- Rezaee, Z., & Tuo, L. (2019). Are the quantity and quality of sustainability disclosures associated with the innate and discretionary earnings quality? Journal of Business Ethics, 155(3), 763–786. https://doi.org/10.1007/s10551-017-3546-y

- Richardson, V. J. (2000). Information asymmetry and earnings management: Some evidence. Review of Quantitative Finance and Accounting, 15(4), 325–347. https://doi.org/10.1023/A:1012098407706

- Schuppli, M., & Bohl, M. T. (2010). Do foreign institutional investors destabilize China’s A-share markets? Journal of International Financial Markets, Institutions and Money, 20(1), 36–50. https://doi.org/10.1016/j.intfin.2009.10.004

- Shahab, Y., Ntim, C. G., Chen, Y., Ullah, F., Li, H. X., & Ye, Z. (2019). Chief executive officer attributes, sustainable performance, environmental performance, and environmental reporting: New insights from upper echelons perspective. Business Strategy and the Environment, 29(1), 1–16. https://doi.org/10.1002/bse.2345

- Simunic, D. A. (1980). The pricing of audit services: Theory and evidence. Journal of Accounting Research, 18(1), 161–190. https://doi.org/10.2307/2490397

- Spamann, H. (2010). The “antidirector rights index” revisited. Review of Financial Studies, 23(2), 467–486. https://doi.org/10.1093/rfs/hhp067

- Taylor, M. H., & Simon, D. T. (1999). Determinants of audit fees: The importance of litigation, disclosure, and regulatory burdens in audit engagements in 20 countries. The International Journal of Accounting, 34(3), 375–388. https://doi.org/10.1016/S0020-7063(99)00017-5

- Tee, C. M., Gul, F. A., Foo, Y.-B., & Teh, C. G. (2017). Institutional monitoring, political connections and audit fees: Evidence from Malaysian firms. International Journal of Auditing, 21(2), 164–176. https://doi.org/10.1111/ijau.12086

- Thompson, S. B. (2011). Simple formulas for standard errors that cluster by both firm and time. Journal of Financial Economics, 99(1), 1–10. https://doi.org/10.1016/j.jfineco.2010.08.016

- Wang, F., Xu, L., Guo, F., & Zhang, J. (2020). Loan guarantees, corporate social responsibility disclosure and audit fees: Evidence from China. Journal of Business Ethics, 166(2), 293–309. https://doi.org/10.1007/s10551-019-04135-6

- Ye, K., & Zhang, R. (2011). Do lenders value corporate social responsibility? Evidence from China. Journal of Business Ethics, 104(2), 197–206. https://doi.org/10.1007/s10551-011-0898-6

- Yuan, R., Xiao, J. Z., Milonas, N., & Zou, J. H. (2009). The role of financial institutions in the corporate governance of listed Chinese companies*. British Journal of Management, 20(4), 562–580. https://doi.org/10.1111/j.1467-8551.2008.00602.x