ABSTRACT

This paper analyses the consequences of the EU Taxonomy Regulation which provides a classification system for sustainable economic activities and requires firms to disclose their activities according to this system. We examined the taxonomy-related disclosures of 45 Austrian nonfinancial companies for the first reporting year 2021 and conducted 19 semi-structured interviews with representatives of four groups of stakeholders: companies subject to the EU Taxonomy Regulation, financial companies, auditing companies, and nongovernmental organisations (NGOs). We structured our data around three topics: (i) consequences on reporting, (ii) capital-market consequences, and (iii) consequences on corporate actions and firms’ outcomes. Our results suggest that for the first reporting year, firms respond to the reporting mandate in an endeavour to comply; firms disclose the required key performance indicators (KPIs) but lack the necessary reporting infrastructure to provide detailed information. Regarding capital-market consequences, all interviewees emphasised the usefulness of clearly defined KPIs and the important role of lenders, expecting banks to integrate the taxonomy-related information in their financing decisions. Regarding corporate actions and firms’ outcomes, we found that the implementation of the EU Taxonomy Regulation has triggered internal discussions on companies’ strategic positioning with respect to sustainability and a race to the top among firms.

We examine the consequences of the EU Taxonomy Regulation on firms' reporting, capital-market effects and corporate actions and firms' outcomes.

We describe firms' reporting response in the first year of the new reporting mandate as an endeavour to comply.

Regarding capital-market consequences, all stakeholders highlighted the usefulness of clearly defined KPIs and the important role of lenders.

Regarding changes in corporate actions, companies have experienced internal discussions on their sustainability-related strategic positioning and a stronger competitive thinking in response to the implemementation of the new reporting requirements.

HIGHLIGHTS

1. Introduction

In recent years, the European Union (EU) has repeatedly adopted legislation to accelerate change towards a more sustainable economy and achieve net zero by 2050. Among the first steps was the adoption of the Non-Financial Reporting Directive (NFRD; European Parliament, & Council of the European Union, Citation2014), which requires certain large EU-based companies to disclose information on sustainability-related matters.Footnote1 In November 2019, the European Parliament adopted the Sustainable Finance Disclosure Regulation (SFDR, European Parliament, & Council of the European Union, Citation2019), which mandates financial market participants to provide disclosure on the sustainability of financial products.Footnote2

In June 2020, the European Parliament adopted the Taxonomy Regulation (EU Taxonomy hereafter, European Parliament, & Council of the European Union, Citation2020), which links the reporting requirements of the NFRD – and later, the CSRD – with the SFDR by providing a classification system for environmentally sustainable economic activities. It thus fosters a common understanding of the sustainability of economic activities with regard to six environmental objectives, namely, climate change mitigation, climate change adaptation, the sustainable use and protection of water and marine resources, the transition to a circular economy, pollution prevention and control, and the protection and restoration of biodiversity and ecosystems (EU Taxonomy, Article 9). Since the financial year 2021,Footnote3 nonfinancial firms subject to the NFRD have had to report the proportions of turnover, capital expenditures (CapEx), and operating expenses (OpEx) that are classified as environmentally sustainable and to provide additional qualitative information (EU Taxonomy, Article 8). Similar disclosure obligations apply to financial market participants that are subject to the SFDR.

The EU Taxonomy aims to promote the provision of comparable and transparent information to achieve comprehensive climate and sustainability goals (Recitals 11 and 12) and to direct capital flows towards more sustainable activities (Recital 6). These overarching goals are consistent with the consequences of sustainability reporting mandates discussed in the literature. In a recent literature review, Haji et al. (Citation2023, p. 193) call for more in-depth research to better understand these consequences. Specifically, they ask researchers to account for the specific design of the reporting mandate, broaden the research focus to other stakeholders, and examine the mechanisms underlying the documented changes in corporate actions and firms’ outcomes. Christensen et al. (Citation2021, p. 1232) also call for more research to better understand the “causal chain from the release of [sustainability] information to firms’ responses”.

In response to these open research questions, this paper applies a multimethod approach to study the consequences of the EU Taxonomy. First, we applied a quantitative content analysis to examine the taxonomy-related reporting of 45 Austrian nonfinancial companies subject to the regulation for the financial year 2021. Second, we conducted 19 semi-structured interviews with members of four groups of stakeholders: companies subject to the EU Taxonomy, financial companies, auditing companies, and nongovernmental organisations (NGOs). These interviews allow us to gain in-depth insights into the implementation of the new sustainability reporting mandate, its subsequent consequences, and the underlying mechanisms. We applied a qualitative content analysis with an inductive approach (Chiba et al., Citation2018; Thomas, Citation2006) and structured our results around three broad topics: (i) consequences on reporting, (ii) capital-market consequences, and (iii) consequences on corporate actions and firms’ outcomes.

To the best of our knowledge, this is the first in-depth investigation of stakeholders’ perceptions of this new type of regulation and its consequences. Our investigation offers three particularly useful findings. First, companies attempt to comply with the new reporting regulation. Almost all firms disclose the key performance indicators it requires, yet disclosure of qualitative information is substantially lower, presumably due to a lack of reporting infrastructure. Whereas the literature typically distinguishes between symbolic and substantive reporting in response to sustainability reporting mandates, we describe companies’ reporting response as an endeavour to comply. We believe that this reporting response is particularly prevalent for the first reporting years of a new reporting mandate. Second, our interview data highlight the importance of lenders; in contrast, the literature primarily focuses on the role of investors when discussing capital-market effects. Third, our findings also provide evidence for the mechanisms underlying real corporate actions and firms’ outcomes. All respondents emphasised that the implementation of the EU Taxonomy reporting requirements triggered internal discussions on the strategic positioning of companies with regard to sustainability and stronger competitive thinking. This finding enriches our understanding of how sustainability disclosure mandates can induce real effects (Hombach & Sellhorn, Citation2019). Our interview data indicates that these internal processes occur even prior to disclosure and thus before stakeholders’ reactions. Such insights not only contribute to theory but are also helpful to regulators considering the implementation of similar regulatory frameworks.

The remainder of the paper is structured as follows: in the next section, we provide an overview of the EU Taxonomy and the theory and related literature on sustainability reporting mandates. The research design is explained in Section 3, and the results of our quantitative and qualitative analyses are presented in Section 4. We discuss our main findings in Section 5. In the final section, we indicate the limitations of our study and provide an outlook for future research.

2. Theoretical background

2.1. The EU Taxonomy Regulation

The EU Taxonomy (Regulation 2020/852), which the European Parliament and the Council adopted in June 2020, applies to policy measures targeting sustainable financing activities, financial market participants within the scope of the SFDR, and companies subject to the NFRD (respectively the CSRD in the future). The EU Taxonomy provides a classification system to define environmentally sustainable economic activities with regard to the following six environmental objectives:

climate change mitigation,

climate change adaptation,

the sustainable use and protection of water and marine resources,

the transition to a circular economy,

pollution prevention and control, and

the protection and restoration of biodiversity and ecosystems.

For an economic activity to qualify as environmentally sustainable, it must meet three conditions:

the activity must contribute substantially to meeting at least one of the six environmental objectives (SC criteria),

the activity must not significantly harm any of the six environmental objectives (DNSH criteria), and

the activity must be carried out in compliance with minimum safeguards.

These conditions are further delineated in Articles 16–18. For both SC and DNSH conditions “technical screening criteria” are defined which are outlined in Appendix I (climate change mitigation) and Appendix II (climate change adaptation) of the delegated regulation (EU) 2021/2139 (European Commission, Citation2021c).Footnote4 Another delegated regulation specifies the content and presentation of the reporting requirements, (EU) 2021/2178 (European Commission, Citation2021b).

The EU Taxonomy distinguishes between taxonomy-eligible and taxonomy-aligned economic activities. An economic activity is taxonomy-eligible if it is described according to and has technical screening criteria set out in the Appendixes of the delegated regulations. In contrast, an economic activity is taxonomy-aligned if it is eligible, meets the technical screening criteria, and meets the minimum social safeguards. The industry sectors included in the Appendixes for the first two environmental objectives were selected for their impact on climate change. The selected industries account for almost 80% of direct greenhouse gas (GHG) emissions in Europe, but only for 40% of listed EU companies (European Commission, Citation2021a). Thus, there are economic activities in the EU economy that are not covered by the EU Taxonomy. These activities are not necessarily environmentally harmful or polluting.Footnote5

Article 8 of the EU Taxonomy links this framework with the SFDR and the NFRD (respectively the CSRD in the future) and obliges financial market participants subject to the SFDR and companies subject to the NFRD to disclose certain information in their nonfinancial statements. According to Article 8 of the EU Taxonomy a nonfinancial company must disclose three KPIs: the proportions of a company’s turnover, capital expenditure (CapEx), and operating expenditure (OpEx) associated with taxonomy-eligible or taxonomy-aligned activities, respectively. Financial and insurance companies must report their Green Asset Ratio (GAR), Green Investment Ratio (GIR) or Green Premium Ratio (GPR). Additionally, companies must provide information on the composition of their calculations’ numerator and denominator, a description of the particular economic activity, reference their financial reporting, and explain how double counting is avoided (Appendix 1 of the delegated regulation (EU) 2021/2178 (European Commission, Citation2021b)).

The implementation of the EU Taxonomy is gradually phased in. In the first phase, nonfinancial companies within its scope are required to disclose their taxonomy eligibility from 1 January 2022, covering financial year 2021 onwards, for activities that contribute to the mitigation of and adaptation to climate change. In the second phase, nonfinancial companies must disclose both eligibility and alignment from 1 January 2023, covering financial year 2022 onwards. In the third phase, the reporting requirements apply to all six environmental objectives.Footnote6 The EU Taxonomy is dynamic and will be further developed over time to include other industries and tighten the technical screening criteria.

2.2. Theory and related literature

Sustainability reporting mandates are typically justified by the regulators by their positive effects on (i) disclosure quantity and quality, (ii) capital markets, particularly on information asymmetry and liquidity, and (iii) corporate actions and firms’ outcomes, also referred to as “real effects” (Leuz & Wysocki, Citation2016, p. 530), that result in broader societal benefits. In a recent review of 131 archival studies, Haji et al. (Citation2023) identify a need for further research to better understand how sustainability reporting mandates induce these positive effects. In particular, the authors call for further studies to examine these effects not in isolation but in combination. Similarly, Baboukardos et al. (Citation2023, p. 159) ascertain that the “real effects” of corporate sustainability reporting mandates are “still unclear and mostly unexplored” and call for further studies to “provide a full picture”.

In general, companies have incentives to voluntarily disclose information as long as the marginal benefits of disclosure exceed the marginal costs (Verrecchia, Citation2001). Consequently, reporting mandates impact cost–benefit ratios by raising additional costs. These costs include direct costs of preparation, certification, and dissemination, and indirect costs arising from revealing proprietary information to competitors and noncompliance (Admati & Pfleiderer, Citation2000; Christensen et al., Citation2021; Leuz & Wysocki, Citation2016). They contribute to determining the level of compliance. Thus, compliance depends on the character of the regulatory regime: the precisions with which the reporting requirements are outlined, the scale of sanctions for noncompliance, and the likelihood of actual detection and enforcement (Peters & Romi, Citation2013). In addition, legitimacy theory posits that in voluntary settings, firms use sustainability disclosure to create an overly positive image of their sustainability performance (Cho & Patten, Citation2007), also referred to as greenwashing (Lyon & Maxwell, Citation2011; Lyon & Montgomery, Citation2015). Following this rationale, Patten (Citation2014, p. 212) argues that sustainability reporting mandates are needed “to transform [sustainability] reporting into a tool of transparency and accountability”. The effectiveness of a reporting mandate depends on its specification and institutional complementarities (Laine et al., Citation2021; Patten, Citation2014). The literature provides evidence for both substantive (e.g. Al-Dosari et al., Citation2023; Hummel & Rötzel, Citation2019; McCracken et al., Citation2018; Mion & Adaui, Citation2019; Samani et al., Citation2023) and symbolic (Bebbington et al., Citation2012; Birkey et al., Citation2018; Chauvey et al., Citation2015; Larrinaga et al., Citation2002; Luque-Vílchez & Larrinaga, Citation2016) reporting responses to sustainability reporting mandates. Researchers typically interpret increases in disclosure quantity or quality and the disclosure of key performance indicators as substantive reporting, and they interpret low reporting quality, increases in narrative rather than quantitative disclosures, and decreases in negative disclosure as symbolic reporting. Haji et al. (Citation2023) posit that heterogeneity in reporting regulations and enforcement mechanisms might explain the inconclusive nature of the evidence. However, more in-depth insights are needed to better understand firms’ reporting responses and to disentangle symbolic from substantive reporting.

The second potential consequences of sustainability reporting mandates are capital-market effects. Economic theory suggests that such mandates increase disclosure-related costs but decrease information asymmetry and estimation risk and increase the investor base, translating into higher liquidity, lower cost of capital, and ultimately higher firm value (Beyer et al., Citation2010; Christensen et al., Citation2021; Leuz & Wysocki, Citation2016). These positive effects depend strongly on the first-order consequences of the reporting mandate: firms’ sustainability disclosure. Thus, if firms respond to such reporting mandates only symbolically, as legitimacy theory suggests, these effects are limited. The literature provides evidence for both an increase in costs (Chen et al., Citation2018; Grewal et al., Citation2019; Hummel & Moesch, Citation2022) and positive effects on information asymmetry, liquidity, and firm value (Barth et al., Citation2017; Ioannou & Serafeim, Citation2019; Krueger et al., Citation2021). Again, deeper insights are needed to reconcile these conflicting findings and better understand how capital markets react to sustainability reporting mandates.

The third potential consequence refers to positive effects on corporate actions and firms’ outcomes, also referred to as “real effects” (Kanodia & Sapra, Citation2016; Leuz & Wysocki, Citation2016).Footnote7 Hombach and Sellhorn (Citation2019) introduce a theory of targeted transparency describing two channels through which positive real effects are induced. We refer to them as the transparency-action channel and the internal-information channel. In the transparency-action channel, firms respond to the disclosure mandate by changing their disclosures; stakeholders interpret these disclosures and act accordingly, which in turn causes firms to adjust their behaviour. The increased transparency enables stakeholders to monitor firms’ sustainability performance more effectively and punish low performers. Firms then react by improving their sustainability performance. Similar to the capital-market consequences, this effect requires a disclosure response to the mandate in the first place. In the internal-information channel, disclosure mandates induce changes in corporate actions by directly altering firms’ internal information sets. In this case, real effects can occur even before the information is released. Overall, empirical evidence tends to support the existence of such positive real effects (Barth et al., Citation2017; Chen et al., Citation2018; Christensen et al., Citation2017; Downar et al., Citation2021; Liu & Tian, Citation2021), yet the underlying mechanisms remain largely unclear.

3. Research method

3.1. Research approach

We adopted a multimethod approach to explore the implementation of the EU Taxonomy from the perspective of various groups of stakeholders. This approach is consistent with prior studies (Bebbington et al., Citation2012; Luque-Vílchez & Larrinaga, Citation2016) and comprises a content analysis of 45 firm disclosures in response to the reporting requirements of the EU Taxonomy and 19 interviews with representatives from four groups of stakeholders.

3.2. Quantitative content analysis

To assess firms’ disclosure response to the EU Taxonomy reporting requirements, we performed a quantitative content analysis of the annual or sustainability reportsFootnote8 of 45 Austrian nonfinancial firms that are subject to the EU Taxonomy. We start with 75 Austrian firms that are subject to the Austrian transposition of the NFRD according to a database query. We exclude 21 financial and insurance firms because the reporting requirements for firms of these industries differ substantially from those for nonfinancial firms. We also exclude nine companies that have 0% taxonomy eligibility due to their industry type. Our final sample thus comprises 45 nonfinancial Austrian firms for the reporting year 2021. These firms are from the manufacturing industry (38%), energy industry (16%), real estate industry (13%), information technology industry (11%) and transportation, construction and consumer goods industry (each 6-9%).

3.3. Interviews

3.3.1 Sample and methodology

We conducted 19 semi-structured interviews with 20 participantsFootnote9 to gain in-depth insights into the views, experiences, and perceptions of actors directly affected by the legislation and their understanding of its working (Dai et al., Citation2019). We acknowledge that, as always in qualitative research, the results are subject to our interpretation of the interview data. We aimed to objectify this process as much as possible by transcribing the interviews and coding and analysing the data repeatedly.

We used the responses in the expert consultations on the EU Taxonomy as a starting point to identify the groups of stakeholders relevant to our research objective. The groups providing the most responses are companies, industry associations, and NGOs, followed by consultancy and law firms, think tanks, and trade unions. We thus identify nonfinancial and financial companies, audit providers, and NGOs as the stakeholder groups most important to the EU Taxonomy. All these groups are directly affected by the regulation: (i) companies subject to the EU Taxonomy provide the disclosures; (ii) financial companies channel financing into taxonomy-aligned activities and provide bank-specific disclosures; (iii) auditing companies verify sustainability reports and provide advice on sustainability reporting; and (iv) NGOs challenge, comment on, and discuss the legislation from a broader perspective. We refrained from interviewing industry associations because we expect that their perceptions overlap with those of company representatives.

shows the distribution of the interviewees among the four groups and the duration of the interviews. Except for two NGOs, all organisations we interviewed are located in Austria. Regarding nonfinancial and financial companies, we contacted 15 firms subject to the EU Taxonomy, of which 10 agreed to participate in the study. Our selection of sample companies aims to represent various industries. For auditing companies, four out of the five companies we contacted agreed to participate in the study. For NGOs, we used extensive online research to identify those NGOs that have publicly commented on the EU Taxonomy to ensure in-depth knowledge about the regulation. Of the nine NGOs we contacted, four agreed to participate in the study. Except for one NGO (Interviewee D2 and D3), we did not conduct more than one interview with the same company. Our set of 19 interviews thus represents 18 different organisations.

Table 1. Sample description of the interviews.

We conducted the interviews in May and June 2022.Footnote10 All interviews were audio-recorded and then transcribed. Their duration ranged from 20 to 60 min. To determine the number of interviews, we used the concept of data saturation. We continued to conduct interviews until saturation was achieved and no new stakeholder perspectives emerged (Simpson et al., Citation2022). Considering the clear scope of the study and the quality of the expert interviews, we believe our number of interviews to be sufficient. Prior to the interviews, we presented an interview overview to the participants, that roughly defined the topics.Footnote11 During the interviews, we used a more detailed interview guidelineFootnote12 which contained specific questions but still allowed interviewees to introduce other topics and questions (Simpson et al., Citation2022).Footnote13 In line with the idea of progressive analysis (Simpson et al., Citation2022), we used our notes from the interviews to analyse the data during the collection phase and to include insights from previous interviews in subsequent interviews. This approach enabled us to identify emerging topics early (Clune & O’Dwyer, Citation2020; Simpson et al., Citation2022).

3.3.2. Coding and data analysis

To analyse the interview data, we applied a qualitative content analysis with an inductive approach (Chiba et al., Citation2018; Thomas, Citation2006). We followed Saldana’s (Citation2015) recommendations regarding the coding of interview data. First, we generated the initial set of codes from the interview guideline and the actual words in the transcripts with free or open coding (Clune & O’Dwyer, Citation2020; Simpson et al., Citation2022). We then re-read the transcripts and marked sentences and passages with the appropriate codes. If a passage or sentence covered more than one topic, it was assigned to more than one code. To code our data, we used the NVivo program.Footnote14 The number of codes that can be created in this manner is not limited. We generated 30 codes that were of potential interest for further analysis. Second, we followed prior research by collapsing the codes and clustered the codes into categories to find common themes and patterns (Clune & O’Dwyer, Citation2020; Farneti & Guthrie, Citation2009; O’Dwyer, Citation2004; Safari & Areeb, Citation2020; Sharma & Frost, Citation2020). To refine our coding, we read the interview data repeatedly and adjusted and even merged the categories constantly. This process resulted in 12 categories. Third, we grouped our categories in the three main topics that emerged from our literature review (Section 2.2), which resulted in seven final categories.Footnote15

4. Findings

We organise our findings along the three potential consequences of sustainability reporting mandates: (i) consequences on reporting, (ii) capital-market consequences, and (iii) consequences on corporate actions and firms’ outcomes.

4.1. Consequences on reporting

4.1.1. Compliance with the reporting mandate – quantitative evidence

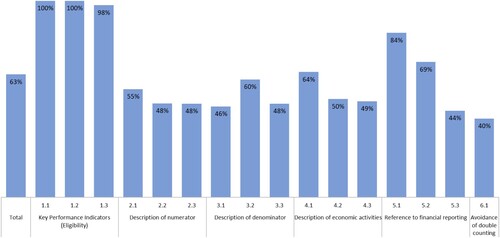

We manually assessed the disclosures of Austrian nonfinancial companies for the financial year 2021 based on a disclosure index that is outlined in . The index measures the presence (scored 1), partial presence (scored 0.5), and absence (scored 0) of disclosure items. The first three disclosure items refer to the disclosure of the key performance indicators, and the remaining disclosure items refer to additional qualitative information that companies are required to disclose. We calculate an overall disclosure rate based on the sum of the scoring of all disclosure items divided by the maximum obtainable score.Footnote16 The disclosure rate thus indicates the overall quality of firms’ taxonomy-related reporting and ranges between 0 and 100%.

Table 2. Disclosure index with scoring and reference.

and provide an overview of the results of the quantitative content analysis. On average, the sample firms achieve an overall disclosure rate of 63%, which is substantially higher than the disclosure rates that Bebbington et al. (Citation2012) and Luque-Vílchez and Larrinaga (Citation2016) found for Spanish companies but still substantially below full compliance (100%). Notably, the disclosure rates for the KPIs are very high, ranging on average between 98% and 100%. However, the disclosure rates for the qualitative disclosure categories are substantially lower. The disclosure rates for the description of the numerator, denominator, and economic activities are on average approximately 50%. For example, the average disclosure rates for the description of the denominator range between 46% (denominator of the turnover) and 60% (denominator of the CapEx). Among the other qualitative disclosure items, disclosure of reference to the financial reporting is the highest, whereas disclosure of the description of how double counting was avoided is the lowest. This finding could indicate that firms can more easily comply with disclosure requirements that are closely linked to traditional financial reporting, whereas firms experience greater difficulty in complying with reporting requirements that necessitate the implementation of new reporting processes. Because the qualitative disclosure items form the basis for the calculation of the KPIs, the low disclosure rates for the qualitative disclosure items, except for disclosure items 5.1–5.3, invites questions about the accuracy of the KPIs as disclosed. The descriptive statistics in also indicate that only few companies provide no information at all for some of the items (n with score of "0"). This finding indicates that companies are aware of the disclosure requirements because they report it to some extent.

Table 3. Results of the quantitative content analysis.

Overall, the high disclosure rates for quantitative information are typically interpreted as evidence of substantive reporting, which is consistent with the evidence provided by Hummel and Rötzel (Citation2019), Ioannou and Serafeim (Citation2019), and McCracken et al. (Citation2018). However, the overall disclosure quality is only 63%, which is substantially below full compliance and can be interpreted as an indication of a symbolic reporting response, consistent with Chauvey et al. (Citation2015), Larrinaga et al. (Citation2002), and Luque-Vílchez and Larrinaga (Citation2016). This discrepancy between high disclosure rates for the KPIs and lower disclosure rates for the qualitative disclosure items and the high disclosure of items that refer to financial reporting may indicate that companies lacked the reporting infrastructure necessary to provide detailed information on the sustainability of their economic activities. This reporting pattern may particularly relate to first-time compliance with the reporting requirements and thus are likely to change over the next years.

4.1.2. Compliance with the reporting mandate – qualitative evidence

Our interviewees emphasised how the precisely defined reporting requirements of the EU Taxonomy leave little room for greenwashing. For example, a representative from an auditing company stated.

[With the EU Taxonomy] a very [detailed] framework is given with all the criteria that are needed, yes. And of course, there is little room for manoeuvre as to whether something is green or not. (Interviewee C1)

However, interviewees from all groups of stakeholders stressed that there is still substantial room for improvement in the correctness and reliability of the information disclosed. They attributed the current shortcomings mostly to insufficient internal data availability (B1, B2, B3, B4, C1, C4, D1), documentation (A3, A6, D4) and reporting principles and practices (A1, A5, A6, D4). These problems are reflected in the low disclosure rates for the qualitative disclosure items, which indicate ambiguities. For example, a representative from a nonfinancial company explained.

We are now trying to set up sustainability reporting in addition to traditional financial reporting. But as with financial reporting, which has taken years to decades and has grown from a booklet to libraries, … I think it is undisputed that we are at the very beginning [with sustainability reporting]. (Interviewee A5)

These insights from the interviews and the findings from the quantitative content analysis together indicate that the high disclosure rates for the KPIs reflect the precisely defined reporting requirements whereas the rather low disclosure rates for the qualitative items reflect firms’ insufficient reporting systems. This suggests that sound sustainability management control systems are essential for high-quality sustainability reporting, which confirms existing literature (Herremans & Nazari, Citation2016). For example, our interviewees highlighted that the data used in sustainability reports are often logged and communicated in simple Excel spreadsheets. Here, the use of databases as a “single source of truth” and the implementation of a system of internal control is necessary to ensure that the data are of high quality.

We argue that firms’ disclosure patterns are indicative of neither a merely symbolic reporting response nor an entirely substantive one. Symbolic reporting is typically reflected by primarily narrative disclosure and the concealment of negative information, which contrasts with the high disclosure rates we observe for the precisely defined KPIs. Conversely, substantive disclosure is typically indicated by high disclosure quality and/or disclosure of quantitative information, which is in contrast to the rather low overall disclosure quality. Based on the insights from interviews, we thus describe the reporting response we observe as an endeavour to comply: companies aim to provide the required information but lack the reporting systems and processes needed to ensure the reliability of the information they report.

Such a reporting response is particularly prevalent for the first implementation years of a new reporting mandate. The interviewees referred to the complex reporting requirements, the relatively short-term implementation schedule, and the lack of support from administrative authorities as the main reasons for insufficient reporting systems. In addition, one interviewee emphasised that the implementation of the EU Taxonomy demands an integration of the taxonomy-related reporting requirements into their financial reporting infrastructure. Such an integration is particularly challenging when the existing reporting infrastructure does not fit with the classification of the company along economic activities, as a representative from a nonfinancial company stated.

Most large companies, including our company, work with SAP in accounting. Hence, whenever the SAP structure, in our case the SAP profit centre structure, matches with the economic activities, they [the KPIs] can be calculated relatively straightforward and with reasonable effort. But it’s always difficult if, for example, I have to split-up a profit centre somehow into taxonomy-eligible and non-eligible. (Interviewee A6)

Remarkably, all interviewees were supportive of the introduction of mandatory verification by an external assurance provider,Footnote17 claiming that this would compel companies to setup the suitable reporting infrastructure and raise the quality of sustainability information to the same level as the quality of financial information.Footnote18 For example:

It [mandatory assurance] would also be important to lift [sustainability reporting indicators] to the same level … as financial reporting indicators. This would add weight to [the sustainability reporting indicators] too. (Interviewee A2)

That [mandatory assurance] of course forces you to set up these processes in a way that increases reliability. (Interviewee A5)

and as I said, I believe that the profession would like to see guidelines developed in advance and not only during implementation [of mandatory assurance], which the auditors can use as a basis. And that makes sense, because otherwise quality and comparability would not be given. (Interviewee C4)

If you know that someone is looking at it, it is certainly a bit more accurate in terms of the documentation and the [data collection], I have to say quite honestly, I’m convinced of that. (Interviewee A3)

Mandatory audits … increase the pressure to engage with this and to build the infrastructure to generate the data. (Interviewee B4)

4.1.3. The integration of financial and sustainability reporting

Another important consequence of reporting that was raised by our interviewees is the integration of financial with sustainability reporting in response to the implementation of the taxonomy-related reporting requirements.

Almost all our interviewees stated that the EU Taxonomy has led to a stronger integration of financial and sustainability reporting systems. Our interviewees emphasised that this stronger integration does not merely reflect a gradual development from formerly voluntary to mandatory reporting requirements, since all companies were already in scope of the NFRD. Rather, they indicated that this integration is driven by the specific KPIs for which the EU Taxonomy requires disclosure. These KPIs link traditional accounting figures such as turnover, investments, and expenditures directly with sustainability aspects, thereby extending the traditional environmental KPIs that are mainly input-output oriented, such as quantity of GHG emissions, quantity of water consumption, and quantity of waste.

It is probably easier for the financial world to grasp when you have these three KPIs, because I think that up to now the difficulty in the financial world was that it hasn’t been quite clear how to deal with … environmental or employee indicators … . (Interviewee A2)

Probably the functions that have traditionally been in charge of the placing, operating on the stock market, on the financial markets, they deliver completely different criteria. And that probably contributed to a disconnect between the real environmental and economic and social impacts of the activities and the value of financial markets. (Interviewee D5)

So [in our company, the departments of] Controlling, Investor Relations, Sustainability – all the way up to the CFO and Co. were all involved, simply because it is a [shared] issue. (Interviewee A4)

The sustainability department took the lead in close coordination with the controlling department. Especially when it came to defining the key figures and generating the corresponding data from SAP. The review of the technical screening criteria and the DNSH criterion were also very complex and required cooperation with the teams from our operational areas … to be able to carry out all the review steps required. (Interviewee A6)

4.2. Capital-Market consequences

4.2.1. Investors

An important objective of sustainability reporting mandates in general and the EU Taxonomy specifically is to steer capital into green firms and projects. Therefore, capital-market related effects, in particular reductions in information asymmetry and increases in liquidity, are an important consequence of sustainability reporting mandates. These second-order consequences depend on firms’ reporting responses in the first place, the type of information disclosed, and the institutional environment (Haji et al., Citation2023). Ioannou and Serafeim (Citation2019) argue that the comparability and credibility of sustainability disclosures are particularly important for investors.

Thus, we are interested in whether the interviewees perceive the reporting requirements of the EU Taxonomy to impact investors’ decision-making. All interviewees regarded the KPIs as relevant to investors’ decision-making. They also emphasised the benefit of having uniform and clearly defined KPIs in place, in contrast to the vague reporting requirements of other sustainability reporting mandates, such as the NFRD. However, the interviewees found it difficult to fully assess the benefits of the KPIs for investors and other decision-makers at this stage because the first phase of the EU Taxonomy only requires organisations to disclose the taxonomy eligibility of their economic activities. For example:

It is a self-assessment process. And a lot of the documentation is internal. Only summaries are published externally, especially the KPIs according to Article 8 of the Regulation. I believe that these three KPIs give investors a quick overview of where the company stands. (Interviewee A6)

The interviewees also remarked that interpreting the KPIs requires a thorough understanding of the sector and the company assessed. The qualitative information that companies already need to disclose can be useful in this regard. The representatives of financial companies in particular emphasised that, from an investor’s point of view, the calculations underlying the ratios involved are so complex that it will be difficult for non-experts to use them to make investment decisions. For example:

You really have to be an industry expert or come from [a specific] industry or be very involved [in a specific industry] to really understand what is being reported. (Interviewee B3)

Unfortunately, as [is always the case with such things], the reporting structures are so complex that it is hardly understandable without fundamental knowledge of the company. And I fear that this will also happen with the Taxonomy that everything will be reported correctly, but it will be very difficult to assess what it really means. (Interviewee A5)

I believe that when [data from] several years are reported, the added value comes from the time series, because then you can see whether the direction [in which] a company [develops] is correct; i.e. whether the [relevant] percentages are increasing or not. (Interviewee A6)

Taken together, results from our interviews highlight the importance of comparable and transparent information for investors. However, our interviewees viewed the information disclosed by companies as comparable only to a limited extent and noted that expert knowledge and qualitative information is necessary to assess the taxonomy-related disclosures.

4.2.2. Lenders

Financial market participants play an important role in the transformation of the economy towards sustainability. In their capacity as lenders, they can channel capital into taxonomy-aligned activities. Yet only a limited number of studies have so far investigated the integration of sustainability information into bank loans (e.g. Neto & Branco, Citation2019; Thompson & Cowton, Citation2004). These few studies conclude that banks do not attribute great importance to the sustainability disclosures of their debtors, and financial institutions themselves disclose little information on the financing of environmentally and socially sensitive sectors (Neto & Branco, Citation2019). Our interviews reveal that the EU Taxonomy has compelled financial market participants to engage intensively with the economic activities of their clients. For example:

Of course, we have to look very carefully at what this means for our business. And what can I still finance and what can I no longer finance? What does it really mean when biomass power plants suddenly become evident as the largest CO2 emitters in our portfolio? … And then you look at how a biomass power plant actually works. (Interviewee B4)

So, you will probably do better in certain ratings if you achieve high ratios. You may get discounts on loans or other financing. At least that’s the theory now; it will probably also be incorporated into the models somewhere by investors. So, I think you can also get a competitive advantage, in some ways [as a result]. (Interviewee A2)

One of the NGO interviewees noted the pressure that banks already put on companies by requesting sustainability data.

I think this [demand that companies provide sustainability data to banks] will very much regulate access to capital in the future. This means that you’ll have to [provide such data] in order to get any money at all in the long term, or to get cheap money above all. (Interviewee D1)

However, the company representatives denied that they are under such pressure, emphasising that currently companies can obtain financing without difficulties. Even if they already obtain green financing, companies emphasise that such green bonds do not provide better financing conditions. For example,

at the moment it is still the case that, of course, companies of our size that have good access to the capital market … have no problems accessing capital, even without [disclosing EU Taxonomy KPIs]. (Interviewee A5)

I can only say that we have already signed a green financing instrument. We’re not doing this for better financing conditions. (Interviewee A1)

Until now, banks have defined their own criteria for green loans. In the past, these criteria were often not transparent. The EU Taxonomy now standardises and discloses these criteria and requirements. Notably, interviewees representing financial companies reported that banks already take the three EU Taxonomy KPIs into account in their lending practices. Whether the EU Taxonomy might lead to a discount in the financing conditions for companies with superior KPIs or a mark-up for companies with below-average KPIs remains an open question. Some of our interviewees expect the EU Taxonomy to become the new standard, and this will have negative consequences for companies that underperform in specific KPIs. Most of the interviewees emphasised that these developments are still in an early stage but will evolve significantly over the next few years.

Our interviews reveal a strong emphasis on lenders rather than equity investors. This focus on debt rather than equity financing may be attributed to a low stock market capitalisation, which is evident in Austria and other coordinated market economies (Hall & Soskice, Citation2001).

4.3. Corporate actions and firms’ outcomes

4.3.1. Strategic positioning

From our interviews, we observed several mechanisms which can induce real effects and provide further input to Hombach and Sellhorn’s (Citation2019) theory. The first mechanism refers to discussions on the strategic positioning of the firm induced by the implementation of the taxonomy-related reporting requirements. Results from our interviews, especially with nonfinancial companies, revealed that the implementation of the EU Taxonomy has pushed firms to start integrating sustainability into their internal processes. These changes have triggered internal discussions on the strategic positioning of the company and have contributed to putting sustainability at the top of the management’s agenda.

[We notice] strong momentum in the conviction of colleagues on why we have to do this now, why this much work is necessary now, because it is simply mandatory. We have to report it, so it’s no longer a discussion [about “if”], but much more a discussion of “OK, what's the best way to do this?” (Interviewee A4)

There are a lot of companies, like [organisation], that are thinking, “What can I change to be better or greener?” (Interviewee A3)

Auditing firms also highlighted how the implementation of the EU Taxonomy has initiated important internal discussions on the sustainability of the companies. For example:

And I think it’s been a long time since companies [last engaged in self-reflection] as intensively as they [have been doing] in the light of the EU Taxonomy. (Interviewee C3)

Interviewees from auditing firms and NGOs additionally noted the further potential of the EU Taxonomy to stimulate critical reflection among top management on the resilience of their company’s business model. For example:

The question is: … How is my business model structured? Will I still be around in ten years? … So, in this respect, the taxonomy is certainly something that can be seen as an opportunity, yes, to question one’s own business model and to question this business resilience. (Interviewee C1)

It is very important to note that these data are also suitable for corporate management in the long term. And, therefore, they can also add value for the company. (Interviewee D1)

The developments shown occur before companies disclose information. In other words, the EU Taxonomy is directly altering firms’ internal information sets, and this process results in discussions and potential changes regarding the strategic positioning of the company, i.e. corporate actions. The mechanism we observed here resembles the internal-information channel described by Hombach and Sellhorn (Citation2019). However, in contrast to Hombach and Sellhorn (Citation2019), it is not (only) the internal disclosure of the information that promotes these corporate actions, but also the mere implementation of the reporting requirements. Such a finding is difficult to crystallise in a purely quantitative study; our qualitative approach thus enhances the understanding of the mechanisms underlying real effects.

4.3.2. Competitive thinking

The second mechanism we observed relates to competitive thinking that is triggered by the disclosure of the three KPIs. The interviewees from auditing firms remarked that they had noticed stronger competitive thinking among companies about their sustainability performance. They reported that all companies they advise had compared their EU Taxonomy KPIs with those of domestic or foreign competitors and had obtained information on comparable companies from their auditors. We also made this observation in our interviews with company representatives, who compared their sustainability performance with that of their competitors.

We noticed last year that the companies were incredibly interested in whether we knew how the competitors presented themselves in the reporting. (Interviewee C3)

It appears that the attention paid to the three KPIs induces companies to focus on the competitiveness of their sustainability performance and adjust their activities accordingly, thereby triggering a “race to the top” among firms. Remarkably, although our interviewees emphasised the limitations of the comparability of these three KPIs (see 4.2.1), they nevertheless rely on these KPIs to some extent for comparative analyses.

Companies will compare themselves … with these KPIs. … There are also many companies declaring they want to be in a better position than their competitors. And I believe that this will push the companies to deal even more with the topic and perhaps transform their own activities even more quickly. (Interviewee C3)

So that could certainly be a push factor. … If in the end someone else can do it better, then I would like to benchmark myself and see what we can do. (Interviewee A3)

The same observation was also made in the interviews with financial companies about their role as reporters, as one representative stated:

We have our market, our region [that] we have to operate within. Of course, you have to think very carefully about whether you say: “Yes, we are now completely green and push these key figures because we are now reporting them and we want to be better than our competitors.” This affects our standing in the market and the perception of our customers. Ultimately, it is also a [decision] about the loans that we book or do not book. (Interviewee B4)

In this regard, the interviews reveal that companies also act as information recipients (i.e., stakeholders) in the transparency-action channel (Hombach & Sellhorn, Citation2019) and respond to their competitors’ disclosures. Similar to our findings on strategic positioning, this effect is particularly driven by the focus on only three KPIs that are universally applied to all nonfinancial companies and the GAR as an important KPI for financial companies.

4.3.3. Firms’ outcomes

Besides the mechanisms underlying the occurrence of real effects, we also asked the interviewees whether and how the implementation of the EU Taxonomy actually impacts the transformation of their real business activities and thus firms’ outcomes. Some interviewees argued that the specific design of the EU Taxonomy offers starting points for companies to adapt their economic activities towards sustainability. In particular, the technical screening criteria provide companies with guidance on how to make their business activities more sustainable, as an interviewee from an auditing company explained:

If I want to change a business model, then I need a starting point. … And as I said, [the EU Taxonomy], for example, is great at the end of the day, because then I have hard facts again, right? Then I can say, okay, that’s where I’m going from here. (Interviewee C4)

So, I think this is actually already happening, more so in larger companies, perhaps more slowly in smaller companies. … It is already the case that in large groups, the innovation departments also deal with the Taxonomy. Not because of the reporting, but because the innovation departments look at what is required, how it fits in with us, how we can implement it in our business process. … So definitely. (Interviewee B3)

The representatives of financial companies also emphasised the need for companies to transform and streamline their business models in line with the EU Taxonomy’s goals: some companies will adapt to the challenges these goals bring; others will not and may ultimately fail. They also acknowledged that as the EU Taxonomy’s overarching goal is to stimulate change towards more sustainability through disclosure, unsustainable companies need to be identified and cease to do business.

If you think about the objectives of the EU, if you think about the Green Deal, if you think that we want to become climate-neutral by 2040Footnote20, then that will mean that certain business models will simply no longer exist as they do today, or that certain business models will be different from how they are now. And that will really mean that we are at the beginning or almost in the middle of this transformation of our economy. (Interviewee B3)

The interviews reveal that companies are reacting (i) directly to the EU Taxonomy through strategic positioning and (ii) indirectly in response to the disclosure of other companies through a stronger competitive thinking. These indirect effects of the EU Taxonomy are precedents to changes in firms’ outcomes: the “real effects”. However, the time at which we conducted the interviews was very early to document such changes.

5. Summary of main findings and discussion

The results from our study reveal that the consequences of a sustainability reporting mandate are complex and depend on various factors, some of which have not been identified so far in the literature. Regarding first-order consequences on firms’ reporting, we describe firms’ response as an endeavour to comply, which differs from the symbolic and substantive reporting responses that have been defined in the literature so far. We assume that such a reporting response is particularly common for precisely defined and complex reporting mandates in the first reporting years thereby complementing results from prior studies. Our interview data reveal that firms lack the necessary reporting infrastructure. We expect firms to develop the reporting infrastructure needed to provide reliable information over the next few years. Our findings also indicate that the NFRD, which has required the disclosure of sustainability information since the financial year 2017, has not yet led to the implementation of high-quality sustainability reporting infrastructure. Future research could provide more in-depth insights into whether and how firms are setting up such reporting infrastructure, both voluntarily and in response to sustainability reporting mandates. Furthermore, the link of the taxonomy-related KPIs with key accounting numbers has already led to an integration of sustainability and financial reporting. We expect this integration to advance with the implementation of the CSRD, which requires the disclosure of sustainability information in firms’ management report. Future research could explore the connection between financial and sustainability reporting against the background of the European Sustainability Reporting Standards and the IFRS Sustainability Disclosure Standards. In addition, all interviewees highlighted that they expect the requirement for external assurance to further raise the quality of sustainability information. However, researchers currently know little about how assurance translates into better sustainability disclosure and which parameters potentially impact this relationship. The future requirement for mandatory assurance in the EU will provide ample opportunities to study this relationship in greater depth.

Regarding second-order capital-market consequences, all of our interviewees agreed that the taxonomy-related disclosures are useful for investors due to clearly defined KPIs. However, the understanding of the KPIs requires additional qualitative information and expert knowledge of the EU Taxonomy. It remains an avenue for future research to examine whether and how these KPIs will eventually be integrated into investment and financing decisions. Furthermore, due to the limited number of economic activities included in the delegated regulations and therefore classified as taxonomy eligible at the time of our interviews, our interviewees questioned the comparability of the KPIs. However, cross-sectional comparability is crucial for triggering second-order capital-market consequences. One potential solution is the implementation of an “Extended Taxonomy” that covers all economic activities, although this approach carries the risk of excessive regulation. Alternatively, data for several years will enable comparability over time and thus the observation of a company’s progress. However, this will be difficult to observe if technical screening criteria are continually tightened over time. Future research could explore the tensions that arise in the trade-off between comparability and adjustments of the criteria to account for technological progress.

Regarding corporate actions and firms’ outcomes, our findings shed light on the mechanisms underlying these so-called real effects. An important finding of our study is that implementing the EU Taxonomy reporting requirements has triggered discussions on the strategic positioning of the firms and has stimulated their competitive thinking about the three taxonomy-related KPIs. In response to the question of how these changes in corporate actions eventually materialise in firms’ outcomes, our interview data can only offer preliminary insights. These insights suggest that some companies have already begun to transform their real business activities. Future research could examine whether and how these changes vary across firm characteristics, such as firm size, industry, ownership structure, and sustainability performance. Furthermore, several of our interviewees commented that the EU Taxonomy needs to be accompanied by more direct regulatory instruments, such as carbon taxes or the prohibition of certain activities, to further accelerate the transition of the EU economy towards sustainability. It thus remains open for future research to examine these real effects, focusing on a broad set of performance indicators and contrasting these effects with other policy actions.

6. Conclusion

This paper analyses the consequences of the introduction of the EU Taxonomy from various stakeholder perspectives. To provide insights into the consequences of the EU Taxonomy implementation, we applied a multimethod approach including a quantitative content analysis of the taxonomy-related disclosures of Austrian nonfinancial companies for the first reporting year and semi-structured interviews with interviewees representing four groups of stakeholders: companies subject to the EU Taxonomy, financial companies, auditing companies, and NGOs. We structured the results from our interview data, consistent with Haji et al. (Citation2023), around three main consequences of a sustainability reporting mandate: the consequences on reporting, capital-market consequences, and the consequences on corporate actions and firms’ outcomes.

The paper contributes to existing debates over sustainability reporting mandates by providing in-depth insights into stakeholders’ assessments of a specific regulation. Although our study focuses exclusively on the EU Taxonomy, our findings go beyond this specific regulatory setting. Specifically, by describing firms’ reporting response as an endeavour to comply, we open up the traditional distinction in the literature of either substantive or symbolic reporting responses. We expect such a reporting response to occur particularly in the first years of a new reporting mandate that is characterised by complex and detailed reporting requirements, a short implementation period, and strong enforcement. Similar reporting responses may occur in the future regarding the implementation of the CSRD and the ESRS. Furthermore, the insights we gained from our interviews help to better understand the underlying mechanisms that shape the occurrence of real changes in corporate actions and firms’ outcomes in response to sustainability reporting mandates.

As always, this study is subject to some limitations. First, our quantitative content analysis and most of our interviews relate to Austrian firms. We thus cannot rule out the possibility that some of our findings might be specific to the Austrian context. In particular for capital-market consequences, the importance of lenders that our interview data show might relate to a general preference for debt over equity financing in Austria. Besides these institutional differences, all EU member states adhere to a consistent regulatory reporting environment. We are thus confident that our findings on the consequences on reporting and on corporate actions and firms’ outcomes also apply to firms in other EU member states.

Second, we conducted all interviews between May 2022 and February 2023, shortly after companies subject to the EU Taxonomy were due to release the first reports in line with the new regulation. This means that we collected our data in the first phase of the implementation, when companies only had to report taxonomy eligibility, rather than alignment, and only for two of the six environmental objectives. We are aware that both the regulation itself and stakeholders’ perceptions are still evolving.

These limitations create opportunities for future research. First, our data could usefully be complemented by data from firms located in other EU member states to enable broader inferences to be drawn. Such insights will enable the regulators to assess the effectiveness, potential shortcomings, and challenges of the EU Taxonomy on a broad scale. Second, the complete reporting mandate includes all six environmental objectives. Future disclosures along these additional four objectives offer valuable data for researchers to explore topics that have been less thoroughly researched due to a lack of data. Third, it could also be useful to contrast the data we collected at this early stage of the implementation of the EU Taxonomy with data obtained when companies are implementing the reporting requirements of the CSRD and the ESRS in the future.

Acknowledgements

We are grateful to Giovanna Michelon, the other Guest Editors, and two anonymous reviewers for their constructive comments and helpful feedback. We would like to thank participants at the internal accounting research seminar of the WU Vienna in Semmering, participants at the 45th EAA Annual Congress in Espoo, and participants at the 33rd CSEAR International Congress in St. Andrews for their helpful comments and discussion. We would also like to sincerely thank all of the interviewees for their participation in the study. In addition, we thank Nadja Ley and Alexander Zeinhofer for their valuable research assistance.

SUPPLEMENTAL ONLINE MATERIALS.docx

Download MS Word (23.7 KB)Disclosure statement

No potential conflict of interest was reported by the author(s).

Notes

1 In November 2022, the European Parliament adopted the Corporate Sustainability Reporting Directive (CSRD; European Parliament, & Council of the European Union, Citation2022), which revised the NFRD by substantially extending its scope and the reporting requirements.

2 For more information on the current state of sustainability reporting legislation in the EU, see Hummel and Jobst (Citation2024).

3 Due to the complexity of the EU Taxonomy, entry into force was phased. For further details, see section 2.1 in this article.

4 In June 2023, the European Commission published an amendment of the delegated regulation which includes technical screening criteria for additional activities related to environmental objectives 1 and 2 and for the four nonclimate environmental objectives (Annex 1–4 of the delegated regulation 2023/2486; European Commission, Citation2023). For the financial year 2023, companies only have to disclose their taxonomy eligibility with regard to the four nonclimate environmental objectives.

5 For instance, the telecommunication sector is currently not covered by the EU Taxonomy.

6 For financial companies, the transition period is always one year longer.

7 In achieving such societal benefits, reporting mandates thus compete with other, more direct political interventions such as carbon taxes and emissions trading schemes.

8 The Austrian transposition of the NFRD allows firms to provide the mandated information either in the management report within the annual report or in a separate sustainability report.

9 In one interview (A1), we interviewed two representatives from the same company at once.

10 Two interviews (B4 and D5) were conducted in February 2023.

11 See Appendix I of the supplemental online materials.

12 See Appendix II of the supplemental online materials.

13 We tested the interview guideline with other researchers and key experts prior to the start of the interview process and made minor adjustments to the guideline based on their feedback.

14 The programme does not code the data but primarily ensures efficient data storage and management (Saldana, Citation2015).

15 The remaining categories were excluded from this study. In Table I of the supplementary online materials, we provide descriptions of the categories and codes that are included in our final analysis.

16 The maximum score is 16 for companies that report positive taxonomy-eligible shares for all three KPIs (n = 38), 12 for companies that report positive taxonomy-eligible shares for only two KPIs (n = 6), and 8 for companies that report positive taxonomy-eligible shares for only one KPI (n = 1).

17 With the introduction of the CSRD, companies are now obliged to obtain limited assurance on the mandated sustainability information.

18 We note that the sustainability reports of all of our sample companies are voluntarily assured.

19 The involvement of both sustainability and accounting departments in implementing the EU Taxonomy reporting requirements is also reflected in the fact that our interviewees from nonfinancial firms include three financial and four sustainability experts.

20 On the basis of the Climate Protection Act, Austria has adopted a government agreement to achieve climate neutrality by 2040.

References

- Ackers, B., & Eccles, N. S. (2015). Mandatory corporate social responsibility assurance practices: The case of King III in South Africa. Accounting, Auditing & Accountability Journal, 28(4), 515–550. https://doi.org/10.1108/AAAJ-12-2013-1554

- Admati, A. R., & Pfleiderer, P. (2000). Forcing firms to talk: Financial disclosure regulation and externalities. The Review of Financial Studies, 13(3), 479–519. http://www.jstor.org/stable/2645994.

- Al-Dosari, M., Marques, A., & Fairbrass, J. (2023). The effect of the EU’s directive on non-financial disclosures of the oil and gas industry. Accounting Forum, 47(2), 166–197. https://doi.org/10.1080/01559982.2023.2198179

- Azam, Z., Warraich, K. M., & Awan, S. H. (2011). One report: Bringing change in corporate reporting through integration of financial and non-financial performance disclosure. International Journal of Accounting and Financial Reporting, 1(1), 50–71. https://doi.org/10.5296/ijafr.v1i1.831

- Baboukardos, D., Gaia, S., Lassou, P., & Soobaroyen, T. (2023). The multiverse of non-financial reporting regulation. Accounting Forum, 47(2), 147–165. https://doi.org/10.1080/01559982.2023.2204786

- Barth, M. E., Cahan, S. F., Chen, L., & Venter, E. R. (2017). The economic consequences associated with integrated report quality: Capital market and real effects. Accounting, Organizations and Society, 62, 43–64. https://doi.org/10.1016/j.aos.2017.08.005

- Bebbington, J., Kirk, E. A., & Larrinaga, C. (2012). The production of normativity: A comparison of reporting regimes in Spain and the UK. Accounting, Organizations and Society, 37(2), 78–94. https://doi.org/10.1016/j.aos.2012.01.001

- Beyer, A., Cohen, D. A., Lys, T. Z., & Walther, B. R. (2010). The financial reporting environment: Review of the recent literature. Journal of Accounting and Economics, 50(2-3), 296–343. https://doi.org/10.1016/j.jacceco.2010.10.003

- Birkey, R. N., Guidry, R. P., Islam, M. A., & Patten, D. M. (2018). Mandated social disclosure: An analysis of the response to the California transparency in supply chains Act of 2010. Journal of Business Ethics, 152(3), 827–841. https://doi.org/10.1007/s10551-016-3364-7

- Chauvey, J.-N., Giordano-Spring, S., Cho, C. H., & Patten, D. M. (2015). The normativity and legitimacy of CSR disclosure: Evidence from France. Journal of Business Ethics, 130(4), 789–803. https://doi.org/10.1007/s10551-014-2114-y

- Chen, Y.-Y., Hung, M., & Wang, Y. (2018). The effect of mandatory CSR disclosure on firm profitability and social externalities: Evidence from China. Journal of Accounting and Economics, 65(1), 169–190. https://doi.org/10.1016/j.jacceco.2017.11.009

- Chiba, S., Talbot, D., & Boiral, O. (2018). Sustainability adrift: An evaluation of the credibility of sustainability information disclosed by public organizations. Accounting Forum, 42(4), 328–340. https://doi.org/10.1016/j.accfor.2018.09.006

- Cho, C. H., & Patten, D. M. (2007). The role of environmental disclosures as tools of legitimacy: A research note. Accounting, Organizations and Society, 32(7-8), 639–647. https://doi.org/10.1016/j.aos.2006.09.009

- Christensen, H. B., Floyd, E., Liu, L. Y., & Maffett, M. (2017). The real effects of mandated information on social responsibility in financial reports: Evidence from mine-safety records. Journal of Accounting and Economics, 64(2-3), 284–304. https://doi.org/10.1016/j.jacceco.2017.08.001

- Christensen, H. B., Hail, L., & Leuz, C. (2021). Mandatory CSR and sustainability reporting: Economic analysis and literature review. Review of Accounting Studies, 26(3), 1176–1248. https://doi.org/10.1007/s11142-021-09609-5

- Clune, C., & O’Dwyer, B. (2020). Organizing dissonance through institutional work: The embedding of social and environmental accountability in an investment field. Accounting, Organizations and Society, 85(C), 1–25. https://doi.org/10.1016/j.aos.2020.101130

- Dai, N. T., Free, C., & Gendron, Y. (2019). Interview-based research in accounting 2000–2014: Informal norms, translation and vibrancy. Management Accounting Research, 42, 26–38. https://doi.org/10.1016/j.mar.2018.06.002

- Downar, B., Ernstberger, J., Reichelstein, S., Schwenen, S., & Zaklan, A. (2021). The impact of carbon disclosure mandates on emissions and financial operating performance. Review of Accounting Studies, 26(3), 1137–1175. https://doi.org/10.1007/s11142-021-09611-x

- European Commission. (2021a). FAQ: What is the EU Taxonomy and how will it work in practice? https://finance.ec.europa.eu/system/files/2021-04/sustainable-finance-taxonomy-faq_en.pdf.

- European Commission. (2021b). Commission Delegated Regulation (EU) of 6 July 2021 supplementing Regulation (EU) 2020/852 of the European Parliament and of the Council by specifying the content and presentation of information to be disclosed by undertakings subject to Articles 19a or 29a of Directive 2013/34/EU concerning environmentally sustainable economic activities, and specifying the methodology to comply with that disclosure obligation. Delegated Regulation (EU) 2021/2178. https://eur-lex.europa.eu/legal-content/EN/TXT/?uri = CELEX:32021R2178.

- European Commission. (2021c). Commission Delegated Regulation (EU) of 4 June 2021 supplementing Regulation (EU) 2020/852 of the European Parliament and of the Council by establishing the technical screening criteria for determining the conditions under which an economic activity qualifies as contributing substantially to climate change mitigation or climate change adaptation and for determining whether that economic activity causes no significant harm to any of the other environmental objectives. Delegated Regulation (EU) 2021/2139. https://eur-lex.europa.eu/legal-content/EN/TXT/?uri = CELEX:32021R2139.

- European Commission. (2023). Commission Delegated Regulation (EU) 2023/2486 of 27 June 2023 supplementing Regulation (EU) 2020/852 of the European Parliament and of the Council by establishing the technical screening criteria for determining the conditions under which an economic activity qualifies as contributing substantially to the sustainable use and protection of water and marine resources, to the transition to a circular economy, to pollution prevention and control, or to the protection and restoration of biodiversity and ecosystems and for determining whether that economic activity causes no significant harm to any of the other environmental objectives and amending Commission Delegated Regulation (EU) 2021/2178 as regards specific public disclosures for those economic activities. https://eur-lex.europa.eu/legal-content/EN/TXT/?uri = celex:32023R2486.

- European Parliament, & Council of the European Union. (2014). The disclosure of non-financial and diversity information by certain large undertakings and groups. Directive 2014/95/EU. https://eur-lex.europa.eu/legal-content/EN/TXT/?uri = CELEX:32014L0095.

- European Parliament, & Council of the European Union. (2019). Sustainability-related disclosures in the financial services sector. Regulation (EU) 2019/2088. https://eur-lex.europa.eu/eli/reg/2019/2088/oj.

- European Parliament, & Council of the European Union. (2020). Establishment of a framework to facilitate sustainable investment, and amending Regulation (EU) 2019/2088. Regulation (EU) 2020/852. https://eur-lex.europa.eu/legal-content/EN/TXT/?uri = CELEX%3A32020R0852.

- European Parliament, & Council of the European Union. (2022). Amending Regulation (EU) No 537/2014, Directive 2004/109/EC, Directive 2006/43/EC and Directive 2013/34/EU, as Regards Corporate Sustainability Reporting. Directive (EU) 2022/2464. https://eur-lex.europa.eu/legal-content/EN/TXT/?uri = CELEX:32022L2464.

- Farneti, F., & Guthrie, J. (2009). Sustainability reporting by Australian public sector organisations: Why they report. Accounting Forum, 33(2), 89–98. https://doi.org/10.1016/j.accfor.2009.04.002

- Grewal, J., Riedl, E. J., & Serafeim, G. (2019). Market reaction to mandatory nonfinancial disclosure. Management Science, 65(7), 2947–3448. https://doi.org/10.1287/mnsc.2018.3099

- Haji, A. A., Coram, P., & Troshani, I. (2023). Consequences of CSR reporting regulations worldwide: A review and research agenda. Accounting, Auditing & Accountability Journal, 36(1), 177–208. https://doi.org/10.1108/AAAJ-05-2020-4571

- Hall, P. A., & Soskice, D. (2001). An introduction to varieties of capitalism. In P. A. Hall, & D. Soskice (Eds.), Varieties of capitalism: The institutional foundations of comparative advantage (pp. 1–70). Oxford University Press.

- Herremans, I. M., & Nazari, J. A. (2016). Sustainability reporting driving forces and management control systems. Journal of Management Accounting Research, 28(2), 103–124. https://doi.org/10.2308/jmar-51470

- Hombach, K., & Sellhorn, T. (2019). Shaping corporate actions through targeted transparency regulation: A framework and review of extant evidence. Schmalenbach Business Review, 71(2), 137–168. https://doi.org/10.1007/s41464-018-0065-z

- Hummel, K., & Jobst, D. (2024). An overview of corporate sustainability reporting legislation in the European Union. https://ssrn.com/abstract=39.

- Hummel, K., & Moesch, S. (2022). Market reactions to the Swiss „responsible business initiative“ (RBI). Die Unternehmung, 76(3), 381–405. https://doi.org/10.5771/0042-059X-2022-3-381

- Hummel, K., & Rötzel, P. (2019). Mandating the sustainability disclosure in annual reports – evidence from the United Kingdom. Schmalenbach Business Review, 71, 205–247. https://doi.org/10.1007/s41464-019-00069-8

- Ioannou, I., & Serafeim, G. (2019). The consequences of mandatory corporate sustainability reporting. In A. McWilliams, D. E. Rupp, D. S. Siegel, G. K. Stahl, & D. A. Waldman (Eds.), The Oxford handbook of coporate social responsibility: Psychological and organizational perspectives (pp. 452–489). Oxford University Press.

- Kanodia, C., & Sapra, H. (2016). A real effects perspective to accounting measurement and disclosure: Implications and insights for future research. Journal of Accounting Research, 54(2), 623–676. https://doi.org/10.1111/1475-679X.12109

- Krueger, P., Sautner, Z., Tang, D. Y., & Zhong, R. (2021). The effects of mandatory ESG disclosure around the world. Swiss Finance Institute Research Paper Series, 21-44.

- Laine, M., Tregidga, H., & Unerman, J. (2021). Sustainability accounting and accountability. Routledge.

- Larrinaga, C., Carrasco, F., Correa, C., Llena, F., & Moneva, J. (2002). Accountability and accounting regulation: The case of the spanish environmental disclosure standard. European Accounting Review, 11(4), 723–740. https://doi.org/10.1080/0963818022000001000

- Lemma, T. T., Khan, A., Muttakin, M. B., & Mihret, D. G. (2019). Is integrated reporting associated with corporate financing decisions? Some empirical evidence. Asian Review of Accounting, 27(3), 425–443. https://doi.org/10.1108/ARA-04-2018-0101

- Leuz, C., & Wysocki, P. D. (2016). The economics of disclosure and financial reporting regulation: Evidence and suggestions for future research. Journal of Accounting Research, 54(2), 525–622. https://doi.org/10.1111/1475-679X.12115

- Liu, L., & Tian, G. G. (2021). Mandatory CSR disclosure, monitoring and investment efficiency: Evidence from China. Accounting & Finance, 61(1), 595–644. https://doi.org/10.1111/acfi.12588

- Luque-Vílchez, M., & Larrinaga, C. (2016). Reporting models do not translate well: Failing to regulate CSR reporting in Spain. Social and Environmental Accountability Journal, 36(1), 56–75. https://doi.org/10.1080/0969160X.2016.1149301

- Lyon, T. P., & Maxwell, J. W. (2011). Greenwash: Corporate environmental disclosure under threat of audit. Journal of Economics & Management Strategy, 20(1), 3–41. https://doi.org/10.1111/j.1530-9134.2010.00282.x

- Lyon, T. P., & Montgomery, A. W. (2015). The means and end of greenwash. Organization & Environment, 28(2), 223–249. https://doi.org/10.1177/1086026615575332

- McCracken, M., McIvor, R., Treacy, R., & Wall, T. (2018). A study of human capital reporting in the United Kingdom. Accounting Forum, 42(1), 130–141. https://doi.org/10.1016/j.accfor.2017.11.001

- Mion, G., & Adaui, C. R. L. (2019). Mandatory nonfinancial disclosure and its consequences on the sustainability reporting quality of Italian and German companies. Sustainability, 11(17), 1–28. https://doi.org/10.3390/su11174612