Abstract

The energy sector faces many challenges today, in particular from the current health (COVID-19) and resulting financial crises. However, a significant number of challenges existed prior to the outbreak of COVID-19. The approach here is to align academic and practitioner legal research and illuminate for the business world from a legal perspective what the key commercial risks are for the energy sector in the years ahead. A further aim of this article is to demonstrate to interdisciplinary energy researchers how these commercial risks can influence energy activity and decision-making across the world at local, national and international levels. Often those in science or social science do not realise the vital role law plays in reducing or increasing the risk profile of energy activity. And that, in essence, is what this article aims to address: the knowledge gap around law and risk and how interdisciplinary scholars should understand the issue of commercial risk in the energy sector. This article identifies how commercial risk for the energy sector will change due to what can be classed as ‘justice risks’. Resolving these justice risks will be necessary over the lifetime of a project from planning through construction, operation and decommissioning phases. For all stakeholders in the energy sector it is vital that there is a recovery and that new energy projects are built and that they contribute to a country’s 2030 energy and climate goals. As the world faces the ongoing challenges of the COVID-19, financial and energy-climate crises, ensuring engagement with justice risks can provide a pathway forward to ensure investors commit to investment. Energy, a key sector in the global economy, will be affected but at the same time can enable economic recovery. It can be stated, therefore, that energy has a dual nature – rather like the health sector – being part of the problem but also the solution to the current financial crises (ie the panacea).

1. Introduction

One of the key trends in energy law over the last few decades has been its promotion of incentives for new energy infrastructure.Footnote1 The world always needs new energy infrastructure for multiple reasons – for example, to further economic growth, to increase energy access, to reduce energy poverty, to replace aged infrastructure and to meet carbon dioxide reduction policies. This remains the case today and it will only increase after the present COVID-19 virus and resulting financial crisis.

Indeed, new energy investment will be seen as the catalyst to restart many economies across the world. The figure advanced by Bloomberg (2019) on new energy generation investment by 2050 is $13.3 trillion, and it is likely that the world will accelerate towards that figure much faster than planned due to the need to emerge from this current crisis. Also, a further $11.4 trillion will be put towards distribution and transmission,Footnote2 and a range of reports state that ca $40–50 trillion will be invested in the energy sector more broadly, which includes expenditure in extractives, waste management, electricity grids and upgrading existing infrastructure.

It is within this context that this article addresses this new scenario of increased energy investment activity and the issue of risk for this investment. The term ‘commercial risk’ is used to express this investment risk. There is a need to explore this issue of risk from a legal perspective, as it is the job of the lawyer to enable the project developer, investors and/or other capital providers to manage, as much as possible, the commercial as well as the political risk. This is in order to make the project financially viable and for them to make a reasonable return on their investment; it should be noted that it is not true in all cases that a project needs to make a return on investment to be built, and this will be discussed later.

It is important to realise in the debate that energy law is itself changing due to the energy transition and the resulting move to a low-carbon economy. There is now an emerging set of energy law principles that are aiming to guide developments in the energy sector from a legal perspective.Footnote3 The unique contribution made here is the identification of new ‘justice’ risks alongside general commercial risks of project development. Many commercial risks can be and are already quantified into project development costs and hence will or may be part of the borrowing cost, of the insurance, etc. However, new risks are emerging from society and the planned push for a more inclusive, just and equitable society, and these ‘justice’ risks will rise and increase in importance into the future. These risks will impact those in the legal profession, who will have to identify them for their clients, while researchers will have to explore these ‘justice risks’ in more depth. And, in this context, there has been work by practitioners and academics on energy law and justice produced very recently by the International Bar Association;Footnote4 this article builds on this new area in the literature which has been growing significantly since 2013.Footnote5

The viability of energy projects and the legal processes that need to be followed and addressed are vital in terms of whether a project happens or not. A project can fail for many reasons, and indeed in the project management research literature, ‘law’ is identified as a key reason why projects fail.Footnote6 In addition, there have been cases where completed projects have been partly built or even completed but never turned on due to legal issues that have not been resolved. All of these issues within law are what can be classed as commercial risk.

The impact of these commercial risks is very important for interdisciplinary energy scholars to realise, as often these risks are underappreciated by them in energy project development.

At this time, when the world is experiencing the COVID-19 health crisis and as a result is in the midst of an associated financial crisis, understanding risk is even more vital. This has traditionally been the area of lawyers and financiers; however, there is a need for more engagement on risk in energy by all stakeholders and scholars in the energy sector. This article contributes broadly to interdisciplinary research on the energy sector, and its novel contribution is to set out a new category of risk, ie justice risks, within commercial risks of an energy infrastructure project.

This article explores in brief what commercial risk is (in Section 2) and then identifies some of the key risks that will be realised post COVID-19 (in Section 3). However, it is proposed here that many of these risks can be placed in a new category of risk, and identified as ‘justice risks’. These justice risks have been on the rise since the last financial crisis of 2007–2009, and as a result of COVID-19 they will accelerate even further in their influence and will have to be fully incorporated into research and practice around energy project development. Section 4 presents these justice risks in more detail; Section 5, the conclusion, highlights some of the issues of importance in the context of these justice risks as the world faces the triple challenge of events from the health, the financial and the energy transition.

2. Commercial risk – a definition

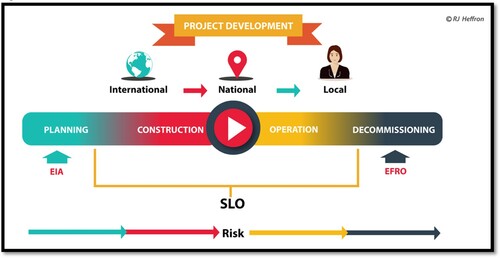

There are many definitions of commercial risk, and these may vary according to a company’s business sector. However, a broad and clear definition is one that states commercial risk covers all risk except political risk, with political risk commonly understood as expropriation, adverse government action (including change in law or tax regime), and political or civil disturbance.Footnote7 In terms of finance, at some point many state that commercial risk concerns repayment of finance, but again a broader understanding can be that commercial risk questions the viability of a project or activity. The different risks occur generally across four stages of a project and its associated activities, from planning to development to operation to the decommissioning stage. However, from the past it is clear that the decommissioning phase has not always been considered.Footnote8 These risks are expressed in .

Figure 1. Project risk across the project development in the energy sector.

Source: created by the author (RJ Heffron, 2020). Key: EIA – environmental impact assessment; SLO – social licence to operate; and EFRO – energy finance reserve obligation.

In the context of the energy sector and this article, commercial risk refers to energy projects in whichever stage they are at. It is proposed here that a definition of commercial risk has been lacking and that this is why there is a need for a concept of justice risk to be incorporated; this will ensure, for example, that the previously ignored issue of decommissioning is accounted for. However, of greater importance is that the justice risks provide a more holistic perspective of managing risk across the lifetime of a project, rather than the focus on commercial risk in the past, having been connected to planning and construction.

New energy infrastructure has more demands placed on it today. For example, currently new energy infrastructure is needed to further economic growth, to increase energy access, to replace aged infrastructure and to meet carbon dioxide reduction policies. The key purpose of energy law across the world currently concerns the development of new energy infrastructure. And legal theory highlights the different drivers of energy law (or evolution of energy law) and how we are in a phase where infrastructure and justice are the key drivers of the formulation of energy law, as opposed to issues such as economics, security and safety.Footnote9

The risk in energy project development continues across the project life cycle. There are key stages such as environmental impact assessments (EIA); the social licence to operate (SLO) which operates across the full project life cycle; and the energy finance research obligation (EFRO).

In terms of general commercial risks, all of these will typically be addressed as the subject matter of private-law contracts, and the essence of good risk management is to ensure the risk is contracted for, ie the risk is allocated among stakeholders relevant to the project. Who is a stakeholder is increasingly a very broad question that needs addressing, but in brief it includes public actors and all types of private actors that may be part of or affected by the project. And stakeholders can be populations across the world, as was highlighted in a recent Australian case – Gloucester Resources Limited v Minister for Planning [2019] NSWLEC 7. In this case, Judge Brian Preston considered stakeholders beyond the Australian border when deciding to not grant permission for a coal mine, ie people overseas would be affected by carbon dioxide emissions from coal; this is a form of cosmopolitan justice that is becoming part of legal decision-making.

For the interdisciplinary energy scholar, it is important to consider that many issues can arise that increase the risk to a project (whether it is being planned, constructed, in operation or decommissioned). In this article, the aim is to detail a new range of issues across the energy sector that are currently increasing the commercial risks in the sector; these risks – justice risks – are identified in the next section.

3. The rise of ‘justice risks’

As legal theory suggests in the evolution of energy law, the issue of ‘justice’ has become an emerging key driver of energy law formulation.Footnote10 It is becoming influential alongside infrastructure, as was highlighted in the previous section. In terms of business, there has been a focus around risks in terms of energy activities and, more specifically, energy project development. The combined issue of justice and risks as applied to energy project development has been underexplored, and also underappreciated in terms of commercial progress of energy projects, by the interdisciplinary energy community.

Irrespective of COVID-19 and the new 2020 financial crisis, the energy transition has been underway, and that is clear both from energy research and practitioner literature. However, what has been evolving is the role for justice in that transition and how it will be achieved.Footnote11 With greater justice, there will be a reduction in commercial risk. Generally, the search for justice is driven by a need to rebalance a relationship that has become unbalanced.Footnote12 That is why governments, companies, and individuals enter into contracts. It is also why one goes to court, to ensure compensation or behavioural change as a result of an imbalanced relationship. In this context, what is in essence at stake is that an individual’s or group’s rights are being infringed. If you can prove that, you can achieve change.

At its simplest, justice in the energy sector means the application of human rights across the energy life cycle (ie from extraction to production, operation, supply, consumption and waste management).Footnote13 When these rights are infringed, there is a call for justice. Such a right may already be enshrined in legislation, or society may be of the view that it should be and that public policy needs to change (and, following that, new legislation will reinforce that policy). An individual or group may then test whether the change has happened or will happen in the courts, such as is happening in the energy and climate change cases discussed later in this article.

At the core of these calls for more justice in the transition are five forms of justice, which are detailed below in brief (this article does not seek to go into depth on energy justice, as this has been achieved by the literature)Footnote14:

Distributive justice focuses on burdens, risks, costs and benefits;

Procedural justice assesses government and public decision-making and processes;

Restorative justice aims to rectify or ameliorate existing harms or injustices;

Recognition justice aims to ensure that all social groups participate in decision-making; and

Cosmopolitan justice focuses on the impact of actions taken in one country on people in other countries.

The aim here is to explore the recent phenomena that have arisen in terms of justice, and what is referred to here as justice risks. These are risks that emanate from a greater societal call for justice that is permeating how economies are run across the world. This can be seen across the interdisciplinary energy journals which have had special issues on ‘justice’, such as Nature Energy (2016), Energy Policy (2017) and Applied Energy (2018). In addition, there has been a notable and significant rise in the influential economics literature in terms of justice issues. Economics since the 2007–2009 financial crisis has started to engage with this issue in a significant way (one can follow the work of leading economists such as Joseph Stiglitz (2012), Thomas Piketty (2015), Walter Scheidel (2017) and Anthony Atkinson (2015)).Footnote15 Indeed, Thomas Piketty, in his recent book Capital and Ideology (2020, 670), decries the issue and states that despite living in a world of big data, public data on inequality is inadequate. Piketty (2020) notes the key issue of inequality and climate change emissions, and from this perspective he highlights how this will cost economies (and more likely developing ones) 5–20 per cent of lobal gross domestic product (GDP), if not more (he cites the Stern Review (2007) and the Intergovernmental Panel on Climate Change (IPCC 2018) report), demonstrating that these effects may be accelerated as a result of pollution and environmental damage since 2007.Footnote16

Justice risks are the risks that result from society seeking more fairness, inclusiveness and equitable solutions, and resolving inequality in a variety of ways. In essence, they aim to address a normative situation – the way society wants the world to be – to provide a future pathway for societal development. Not all are legislated for directly or in one place currently today, but together they demonstrate that they are now having a key influence on the way business is developing.

Conditions in society have been changing for multiple reasons, but the increase in data, the increased availability of technology, the financial crisis of 2007–2009, the COVID-19 pandemic and now the 2020 financial crisis have created what can be referred to as a ‘perfect storm of energy justice’Footnote17 whereby the opportunity for justice to permeate the energy sector has arisen; as Plato stated, ‘Accidents and calamities … are the universal legislators of the world’.Footnote18 In this context it is proposed that there is a new class of risks to energy activities and project development, and these are justice risks. Twelve justice risks are identified in ; these have their roots in the five forms of justice as mentioned earlier, but have been created by advances in societal conditions; and they apply across the lifetime of a given project (ie from planning to construction to operation to decommissioning).

4. Justice risks

In this section, each of the justice risks identified in Section 3 is detailed in turn. The discussion of these risks is not meant to be exhaustive; its purpose is rather to open the scholarship and practitioner debate on the subject and to identify the core issues for each of these justice risks. highlights that these justice risks are global, ie they are impacting on project development all over the world. also highlights that these justice risks apply across the project life cycle from planning to construction to operation to decommissioning. Finally, these justice risks, when resolved, address core justices issues such as procedural, distributive, restorative, recognition and cosmopolitan justice.

4.1. Economic justice – addressing inequality and government support

After the economic crisis of 2007–2009, a revision of economic thinking occurred. The education of economists across many countries has changed, and universities that once relied heavily on neoclassical economics are now accommodating more and broader economic perspectives. There has been an increased focus on inequality, for example in Thomas Piketty’s Capital in the Twenty-First Century,Footnote19 and Jean Tirole, a Nobel Prize-winning economist, stated in essence, in his book in Economics for the Common Good,Footnote20 that justice (via law) has a key role to play in ensuring that society can address the issues of the energy and climate crisis.

Changes to laws and government policy have increasingly begun to address issues of inequality across all parts of our societies, including the energy sector. A government can enhance the economic standing of a particular beneficiary or group of beneficiaries to achieve a particular purpose – for example, a policy of granting subsidies to owners of renewable energy assets in order to incentivise investment in such assets, thereby accelerating the growth of such low-carbon power generation and reducing carbon emissions. It is a form of procedural justice.

It has been argued that the role of government in transitioning to a sustainable economy includes: (1) funding for science-based research; (2) using fiscal policy to mobilise private capital into low-carbon investments; (3) public investment in sustainable infrastructure; (4) regulating behaviours to limit damage to and destruction of ecosystems; (5) partnering with the private sector; (6) measuring and monitoring progress towards sustainability targets; and (7) transferring sustainable technologies to developing countries.Footnote21

Fundamentally, however, the energy transition is a matter of energy policy. Broad-based policy support is the premise of all other forms of government support. And with 197 countries having adopted the Paris Agreement – see Section 4.10 – that broad political support appears to exist in abundance.

But bold, ambitious commitments alone are just sentiment without being supplemented by more detailed policies and measures to support the achievement of the commitments. A report from the World Economic Forum and Boston Consulting Group (BCG) called not just for ambitious policy goals but for ‘a meaningful price on greenhouse gas emissions, but also sector-specific regulations and incentives promoting remedies such as a switch from fossil fuels to renewable energies, electric mobility, efficiency, green building standards – supported by accelerated innovation’.Footnote22

While the Paris Agreement is a grand exercise of multilateralism in some senses, it ultimately requires individual countries to pursue their own carbon reduction programmes to achieve the collective goal. What has been done and what still needs to be done can only be analysed on an individual country basis. For example, in the UK, transition to a lower carbon economy has been government policy for more than 20 years. The Climate Change Act 2008 imposed legally binding targets for greenhouse gas reduction – initially set at an 80 per cent reduction (against 1990 levels) by 2050. In 2019, the UK government pledged the country would become net zero by 2050, and that pledge was enshrined into law by increasing – to 100 per cent – the greenhouse gas reduction targets in the Climate Chance Act.Footnote23 In furtherance of the targets the UK government has introduced ‘sector specific regulations and incentives’, but to date these have been mostly focussed on a transition from fossil fuel-based power generation to low-carbon forms of power generation.

The UK has had success in a transition to low-carbon power generation – notably the massive expansion of offshore wind and a steep decline in coal-fired power generationFootnote24 – but a sizeable portion of the UK’s power generation still comes from unabated carbon-emitting sources.Footnote25 And in any case, a total reduction in carbon emissions from power generation alone is not enough to achieve this. Other sectors including transport, heating of buildings and certain industries are major carbon emitters and have to play a role. In 2017 the UK government published its Clean Growth Strategy, which set out a range of support initiatives in key areas including green finance; business and industrial energy efficiency; domestic energy efficiency; heat; transport; smart, flexible power; natural resources; and the public sector. The nature of support for each initiative varies, ranging from funding for research to public investment in infrastructure, subsidy schemes and regulation aimed at changing consumer choices.Footnote26 The governments of some other countries have gone even further to support the energy transition.

However, not all countries have gone as far. The US famously expressed its intention to withdraw from the Paris Agreement. And the commitments of other major emitters including China, Russia and Saudi Arabia have been criticised as insufficient to achieve the objectives of the Paris Agreement.Footnote27 What is interesting is that many of the countries deemed to have made insufficient carbon reduction commitments are also countries perceived to have lower standards of access to justice, whereas many of the countries deemed to have made sufficient carbon reduction commitments are also countries perceived to have higher standards of access to justice.

In 2018 the United Nations (UN) secretary general called climate change ‘the most systemic threat to humankind’. And here in 2020, the world faces an altogether different systemic threat to humankind. Some fear that the political momentum behind the energy transition will be lost in the fight against COVID-19 and that carbon reduction measures will be deemed unnecessary expenses as recessions bite. But if global threats to humanity – be they pandemics, war, famine or indeed climate change – have one common thread, it is that they are solved through government action. The current COVID-19 pandemic and accompanying economic crisis is an opportunity for government stimulus packages to be applied towards the research, the sustainable infrastructure and the subsidy initiatives needed to support the energy transition. As former US President Barack Obama’s chief of staff Rahm Emanuel famously said, ‘You never want a serious crisis to go to waste. And what I mean by that is an opportunity to do things that you think you could not do before’.Footnote28

4.2. Taxation

Since the financial crisis of 2007–2009, society has started to reassess the role of taxation. The use of tax havens is now well documented, and there have been major leaks that have promoted change (the Panama Papers and the Paradise Papers).Footnote29 As a result, more scrutiny is now being paid to international transactions, particularly because energy companies were exposed as heavy users of tax havens. The Organisation for Economic Co-operation and Development (OECD) is aiming, through several initiatives, to examine the issues (particularly inequality) whereby the unfair world of international taxationFootnote30 is causing injustice in the energy sector (and especially in the mining sectorFootnote31).

Nevertheless, a fundamental problem with taxation has to do with how it is reported and manipulated in accounting practice and reporting, and that the direction of this relationship between tax and financial reporting is unclear. What is evident is that current tax systems across the world are deemed unfair, and reform is needed.Footnote32 In this era of multiple calls for increased transparency there will be significant hazards ahead for tax and auditing firms such as the Big Four.Footnote33 Additional obligations to justify decision-making and positions in tax and financial reporting are among the best solutions for the future, alongside increased transparency. Steps forward to correct an imbalanced system will have to be slow, and then in time considerations such as global taxes, as proposed by Piketty, might be realistic options.Footnote34

The emergence of COVID-19 has resulted in general turbulence in political and economic activity, and this creates change and uncertainty in the tax system. Therefore, there is an ongoing battle to ensure the tax system achieves its objectives. And this is mirrored by the increased interest in accounting information by other stakeholders – witness the increased interest by environmental, energy and climate change non-governmental organisations (NGOs) in accounting information regarding the energy companies’ accounts.Footnote35 Taxation is an area that will increase in importance in the future, and the focus will begin to broaden and be far more comprehensive than just on the aforementioned area of disclosure and transparency (and on the Extractive Industries Transparency Initiative). Moreover, how tax is reported, how much is paid, how it is earned and how potential tax revenue is managed will be key issues of concern – ie distributive justice will be of vital importance. Indeed, society overall will look at how to restore justice within national and international tax systems and how to correct the violations of human rights that occur due to the unjust international tax systems.Footnote36

4.3. Project finance

Project finance has been described as ‘the most widespread financial technique that financial markets have developed for the participation of private capital in unlisted infrastructure … ’.Footnote37 In and of itself, however, project finance is climate agnostic – it is best suited simply to whichever projects ensure and secure stable revenues over the long term. In essence there is a matter here of distributive justice by nature. Therefore, one of the core objectives of energy transition policy that seeks to uphold distributive justice must be to ensure that all forms of finance – including project finance – are directed towards low-carbon sustainable energy projects and away from other energy projects.Footnote38

The adoption of the UN Sustainable Development Goals (SDGs) and the Conference of the Parties to the United Nations Framework Convention on Climate Change (COP 21) Paris Agreement have increased attention on the role of finance in the transition to a low-carbon economy. The focus, however, has hitherto been concentrated on the investment decisions of institutional investors.

Since the first notable issuances by the World Bank in 2008, demand driven by institutional investors’ ever-growing focus on environmental, social and governance (ESG) criteria has seen the green bond market grow to over $250 billion annually.Footnote39 In the absence of regulation, the market responded with the emergence of voluntary standards, such as the Green Bond Principles and the Climate Bond Standards, against which issuers can have their issuances accredited by independent environmental rating agencies. Policymakers are now catching up; the EU has proposed a regulation on the establishment of a framework to facilitate sustainable investment.Footnote40 The purpose of the regulation is to create a taxonomy (ie classification criteria) for sustainable investments to encourage the movement of capital towards more sustainable investments. Once in force, the regulation will apply to financial market participants offering financial products as environmentally sustainable investments (eg asset managers and pension funds) and will be supplemented by other regulations, including one imposing new disclosure and transparency requirements around the integration of ESG criteria into investment decisions.Footnote41

But whilst green bonds are undoubtedly providing a major source of funding for a transition to a low-carbon economy, in most cases they are not a source of project finance in the true sense. Most green bonds are treasury bonds issued against the balance sheet of large financial institutions, governments and corporations.Footnote42 For the development of individual energy projects, loans – from both commercial lenders and development finance institutions – remain the dominant source of debt finance.

And the loan market now seems set to follow the trajectory of the bond market in the green finance space. A power transmission project in Uruguay, sponsored by Italian energy company Terna and financed by the Inter-American Development Bank and Banco Bilbao Vizcaya Argentaria (BBVA), claims to have closed the first limited-recourse project financing based on ‘green loans’, in 2017. The loans for that project were accredited against the Green Bond Principles. However, the Green Loan Principles were subsequently created under the auspices of the Loan Market Association, to establish a framework for green loan financing.Footnote43 The core tenet of the Green Loan Principles is that the proceeds of the loan must be used for a ‘Green Project’.Footnote44 In practice this means that an assessment of the risks, costs, and benefits to the environment – and therefore society as a whole – form part of the lending criteria. In the absence of a justice-based approach, a bank, in forming its lending criteria, would have no logical reason to assess risks, costs or benefits other than those to which it, as the lender, is directly exposed to (eg bankrupcty of the borrower).

Much like the Green Bond Principles, the Green Loan Principles are voluntary. Nevertheless, the development of law, policy and market practice for green bonds suggests that increased disclosure obligations on banks and financial institutions around environmental sustainability and climate risk are expected, creating an incentive for financial institutions to hold loans that have been independently accredited as ‘green’. If the green bond market is anything to go by, a rapid expansion in green loan financing should be expected and this could play a vital role in ensuring the just energy transition.

4.4. Bankruptcy

Financial underperformance is on the rise in the energy sector with the ongoing energy transition.Footnote45 Many would argue that it has been an issue in energy companies, which have tried to avoid environmental responsibilities.Footnote46 Bankruptcy in the energy sector is on the rise. In January 2019, California’s largest electric utility, Pacific Gas & Electric (PG&E), filed for bankruptcy, claiming liabilities of over $51 billion.Footnote47 The utility argued that its financial position had destabilised due to a heavy debt load as well as wildfire-related liabilities. California regulators, however, argued that the utility’s debt problem was of its own making. PG&E did not maintain an adequate and resilient infrastructure, which resulted in devastating wildfires in 2018 alone.

The wildfires were responsible for the complete destruction of several California towns and villages, and destroying over 19,000 homes. Damages have been estimated to exceed $30 billion, and the utility entered into a $13.5 million settlement with wildfire victims.Footnote48 On top of the civil liabilities, the utility also pled guilty to 84 criminal charges of involuntary manslaughter that resulted in the maximum fine of $4 million.Footnote49 However, although PG&E is an investor-owned utility, the climate costs from these events will fall on state and local governments, ratepayers, and taxpayers more generally. The costs are not limited to privately owned utilities.

This disaster has been termed the first climate change bankruptcy in the world. The human loss is incalculable. Unfortunately, the PG&E bankruptcy is only one dramatic data point regarding the future costs of climate change that will affect all utilities operating under the traditional central power station model. And indeed, bankruptcy will increase as more climate change issues are considered and increase the risk profile of new projects but also existing, operating projects. Both international and national climate assessments indicate that future weather events will be more extreme and more frequent. However, today’s utilities were built at a time that did not account for present climate risks or for future climate volatility. Although utilities regularly complain about regulatory costs associated with carbon emissions reductions, such compliance costs pale in comparison to the other financial risks ahead.

Risks to utilities are significant. Severe weather will cause more flooding and more wildfires, which, in turn, will cause more outages. Outages will lower efficiency, raise expenses and increase costs to consumers. Further, as noted by the PG&E example, failure to adequately protect against such events raises the real possibility of incurring extraordinary civil and criminal penalties. Additionally, continued exposure to these liabilities will lower a utility’s valuation and, as a consequence, raise its cost of capital.

Future climate-related costs to utilities involve compliance, planning, infrastructure investments and investments in resilience. McKinsey and Company estimates that the costs for US utilities to prepare against such events could be as much as $1 billion for each utility.Footnote50 The company also estimates that the cost of extreme weather events will be roughly $1.7 billion per utility. In short, McKinsey argues that investment in protecting against such future events is cost-effective.

There are various investment strategies that utilities can take to reduce risks and future liabilities. As part of their internal management, environmental planning, risk assessment and resilience planning should be mandatory. Additionally, utilities must rethink their business models. They cannot continue to build large central power stations, particularly those that burn fossil fuels. Additionally, investing in the future must involve improving the grid as well as making investments in energy efficiency and energy storage, and in decentralised distributed energy resources such as micro grids.Footnote51

The PG&E bankruptcy, in and of itself, is not an indication that bankruptcy threatens many utilities. Utilities will not go bankrupt overnight. The PG&E bankruptcy does, however, provide other lessons for all utilities. If attention is not paid to climate change, if climate change and resiliency investments are not made today, then financial exposure in the future will only increase. The smart utility of today, as well as the smart utility of the future, must not only make preventative investments in its central power station operations but must design new business models that decentralise generation as well as transmission and distribution and that increase energy efficiency and the use of renewable resources.

4.5. Disclosure and transparency

Several issues with an impact on the energy sector relate to disclosure and transparency. While increased transparency and disclosure of payments made to foreign governments and other similar information are in themselves positive developments, they also create more risks for the companies active in the energy sector. International accounting standards now require more disclosure specifically for energy projects.Footnote52 For example, the international Extractive Industries Transparency Initiative (EITI) requires signatory states and investors to disclose the details of their taxation relationship, beneficial owners of companies and so on, with the EITI Secretariat monitoring the submissions.

There are several emerging legal instruments that countries are utilising to increase disclosure and transparency. Many of these also create additional risk for energy companies. The ‘social licence to operate’ (SLO – the relationship between energy corporations and the local community, which is becoming formalised through a contract) requires more transparency between an energy project developer and the local community, and some projects have been stopped recently when the terms of the licence were not honoured, for example in high-profile cases in Colombia.Footnote53 The SLO, as shown in , applies over the duration of an energy project and it will be transformative in ensuring disclosure and transparency across the project life cycle.

The ‘energy finance reserve obligation’ (EFRO), also highlighted in , applies at the decommissioning phase of the project life cycle; however, if present from the outset it will affect cost calculations of a project from the first instance. An EFRO requires, through legislative change, an operator to place money in escrow equal to the estimated cost of decommissioning an energy asset, to ensure that clean-up will be funded even if the operator goes bankrupt or sells the asset to a company without the financial capacity to pay for it.Footnote54

However, the most urgent challenge in relation to disclosure and transparency that the energy industry is increasingly subject to is the so-called ‘environmental and social governance’ (ESG) movement and ESG disclosures. ESG can be defined as ‘criteria [that] are a set of standards for a company’s operations that socially conscious investors use to screen potential investments. Environmental criteria consider how a company performs as a steward of nature’.Footnote55 Unlike the traditional or normal corporate disclosures, ESG disclosure has its focus on non-financial disclosures.Footnote56 The World Bank, while providing a definition and definitive list of what ESG covers, states that key issues it includes are:

E: climate change, carbon emissions, pollution, resource efficiency, biodiversity;

S: human rights, labor standards, health & safety, diversity policies, community relations, development of human capital (health & education); and

G: corporate governance, corruption, rule of law, institutional strength, transparency.Footnote57

Various ESG disclosure obligations are rapidly becoming more prevalent in home states of major energy companies. The European Union, South Africa, Singapore, Hong Kong, and the United Kingdom, among others, have instituted specific sustainability reporting regulations.Footnote58

The European Union has in many ways been the leader behind ESG disclosure obligations. After the 2013 Directive 2013/34/EU,Footnote59 the European Union enacted the Directive 2014/95/EU disclosure of non-financial and diversity information by certain large undertakings and groups.Footnote60 This directive requires certain large companies to provide a non-financial statement containing information to the extent necessary for an understanding of the undertaking’s development, performance, position and impact of its activity, relating to, at minimum, environmental, social and employee matters, respect for human rights, anti-corruption and bribery matters.

The US, home to many major energy companies, has not been overly active in the area. Other than the US Securities and Exchange Commission (SEC) 2010 guidance on climate change disclosures, which tracks the traditional ‘materiality’ standards for disclosure to date, the SEC has never mandated or provided specific guidance related to ESG, despite some who are advocating for such disclosure rules.Footnote61 The key issue in respect is what is meant by ‘materiality’ under the SEC; Rule 10b-5 states that it is illegal to ‘make any untrue statement of a material fact or to omit to state a material fact necessary in order to make the statements made, in the light of the circumstances under which they were made, not misleading … ’.Footnote62 The question in this respect is whether specific guidance is needed given the universal nature of the ‘materiality’ standard that applies to any and all disclosure considerations, no matter what the topic. Are the risks related to ESG disclosure different than any other disclosure risk? Does the non-financial nature of ESG disclosure change things in this respect?

Disclosure obligations and perhaps the lack of clear and workable rules have also resulted in litigation around ESG disclosures. One example of this is the recent case against ExxonMobil. The New York state attorney general’s office’s investigations, based on the New York anti-fraud law ‘Martin Act’, against ExxonMobil led to a case against the company. The key claim was that ExxonMobil misled investors by fraudulently employing two sets of books to calculate profits and losses on investments and the risks it faced as governments act to reduce greenhouse gas emissions.Footnote63 The New York Supreme Court found for ExxonMobil, stating that the New York AG failed to establish that any investor was misled. It is noteworthy that the AG did not prove its case under the Martin Act which has no scienter requirement to prove fraud (unlike federal securities laws). The AG also chose not to appeal the case. Regardless of the outcome, these type of cases are on the increase and highlight the ESG risks the energy industry is facing today.

One of the difficulties energy companies face under the ESG disclosure obligations are the unclear boundaries for shareholder resolutions that seek to limit the business judgement of directors. Many such proposed resolutions are disguised as seeking only disclosure of good/bad ESG behaviour, yet their clear purpose and hoped-for effect is to limit the business choices available to a company and its directors. For US companies, the SEC imposed some boundaries in its 2010 communication. The boundaries, if any, for companies organised under the laws of EU nations and in other jurisdictions are less clear.

A corollary or subsidiary issue relating to shareholder resolutions is the enforcement risks and potential outcomes if (1) a company’s shareholders pass an aggressive ESG ‘disclosure’ resolution and (2) the activist shareholders behind it, who were expecting materially changed business outcomes, think that the outcomes and/or disclosures do not meet the spirit (ie their expectations) of the resolution.

So far, the success of attempts by activist shareholders to win proxy resolutions have been mixed at best. However, at ExxonMobil’s 2017 annual shareholder meeting, both Blackrock and Vanguard, together controlling approximately $12 trillion in assets, voted to require ExxonMobil to produce a report regarding climate change.Footnote64 Similarly, Blackrock sided with Occidental shareholders, supporting their proposals because ‘it was concerned about Occidental Petroleum’s pace of disclosure to date’.Footnote65

One of the key legal issues on the horizon is a corporation’s state law fiduciary duties and Employee Retirement Income Security Act (ERISA) duties to maximise its shareholders’ and employees’ value versus ESG considerations, which might be in direct tension with value maximisation.

4.6. Insurance

After a crisis, insurance is also more difficult to obtain. And in light of changes in the commercial world alongside climate change issues, insurance for energy projects has now become very difficult to obtain. In 2019, coal projects found it very difficult to get insurance.Footnote66 This will have a knock-on effect where there will be a rise in cases where the insurer of last resort – the state – will need to become much more active, and as a result, the public will increasingly question all the benefits of fossil fuel development and its continuation.

A key area here in terms of insurance is the future risk. Already investors are nervous, as emphasised by a recent letter written by a large and significant group of investors to the US Federal Reserve System, outlining the risks posed by climate change, the need for immediate action and how the financial regulator has a lead role to play.Footnote67 Indeed, it has long been recognised that action should have been taken earlier in terms of risk and climate change;Footnote68 however, no company would deem it satisfying to increase costs, and moreover, it has to be a premium that all companies are prepared to pay. There are, however, signs of change.

The global insurance industry, as stated, is beginning to increase the price of insurance for coal projects. Part of the challenge globally is the over-reliance on and technology lock-in to conventional energy sources. And there is a new challenge as well in more affordable low-carbon energy that also meets national energy and climate goals. There is a need for investment decisions to move towards a more long-term focus, and this is expressed as a key issue by the actuarial profession in terms of managing risk regarding climate change.Footnote69 In a similar way, a leading McKinsey report highlights that the lack of diversification in energy strategies by many companies and countries is a problem, and that these stakeholders need to realise opportunities from decarbonization, which are less risky,Footnote70 and in part due to current or anticipated future lack of availability of insurance.

Insurance risk is a justice risk that is fast emerging. It takes into account several of the other justice risks and will result in increased application of justice in energy decision-making. The capture of risk data is highlighting the exposure of conventional energy sources to climate risk that results in increasing insurance costs and, therefore, increasing borrowing costs. This is in part why early in 2020, the BlackRock Chairman and Chief Executive Officer stated, in his annual address to shareholders, that there will be a major reallocation of capital towards sustainable investments that will be driven by climate risk – and this is an important statement by a firm that manages nearly $7 trillion in assets.Footnote71 And indeed, it is also significant in this context that BP would later write off £17.5 billion in assets from their balance sheet.Footnote72

4.7. Environmental impact assessments

The environmental impact assessment (EIA) has been around since the 1980s, but only now has it really begun to assist in developing a low-carbon economy. A procedure that is required before an energy project can be permitted, it assesses the project’s environmental and social impacts in detail from an interdisciplinary perspective. This paper does not aim to go into particular depth on EIAs,Footnote73 but it does intend to focus on how EIAs are impacting energy project development and creating risk for those projects.

As shows, EIAs come into play at the outset in the project life cycle, at the planning phase, and impact on the project risk immediately – hence their importance. In essence, the EIA process concerns procedural justice at three levels – international, national and local:

‘International: in securing finance for the project this will require an EIA to be produced for the financing institution under international banking standards – the Equator principles (this may be different for a company who will finance the project in-house or a national company who avails of financing options within the country but the likelihood is there would remain some environmental impact statement produced);

National: Has to adhere to national EIA legislation and submit an Environmental Impact Statement (EIS) which has to be approved before the project receives permission to start; and

Local: The EIA process has to include several elements of public participation and involve these local stakeholders in the plans for the development of the project’.Footnote74

There also is an additional justice perspective, from a global point of view, where the EIA process has to be seen as a success as it has in essence promoted the philosophical ideal that people are all world citizens – ie cosmopolitan justice.Footnote75 This will be discussed further in the context of two cases in 2019, in Australia and Kenya.

The EIA process has placed certain limitations on development and ensured that development that does occur is achieved with environmental protection as a core aim from the beginning of the process. The legislation on EIAs has been changing periodically at national and international levels since it was introduced, and in particular over the last decade, such that there are now further obligations to (1) demonstrate a more independent process; (2) gather and utilise more data; (3) examine the cumulative impacts of the project (with existing projects in the same area); and (4) show consideration of alternatives (alternative projects). The EIA process has become more strict in application at the national level, and also at the international level, for example where international banking rules (known as the Equator Principles) now make the EIA a prerequisite for project financing. Further, year-on-year the amount of data required in EIAs is increasing, with more data collection on the socio-economic impacts of an energy project (such as will be highlighted below in relation to the case law). Initiatives like the Equator Principles, while not nationally enforced, are creating a momentum shift due to the international banks connecting non-compliance with these principles as a project with greater risk; therefore, they are no longer willing to support such projects. In this context what is deemed international ‘soft’ law in effect becomes ‘hard’ law.

It should be noted that there is additional support for EIA legislation at the international level, through an international agreement called the Aarhus Convention 1998 – known as the Convention on Access to Information, Public Participation in Decision-Making and Access to Justice in Environmental Matters. This agreement allows for public participation in energy projects, and public access to environmental data, and is an agreement signed by 39 countries but with 47 parties to it. The result is that there is added enforcement to national EIA legislation, but this was a convention advanced by the United Nations Economic Commission for Europe (UN ECE) so is limited mostly to the EU and neighbouring countries.

Two recent cases on EIAs demonstrate the new risk associated with the EIA, and its vital role in project development. The interesting issue here too is that one example is from the developed world and one from the developing world, which highlights that the EIA is bringing in change. The EIA demonstrates that the collection and utilisation of data are now changing the nature of what energy projects can be built by virtue of a failure by certain projects to make it through the EIA process; and this is expected to rise. Recent decision-making in the legal courts after EIAs were challenged, in particular in Australia and Kenya, demonstrated that the data on socio-economic benefits and other costings have proved inadequate and/or over-/under-estimated. Groups opposed to particular energy projects are increasingly able to obtain data that challenges that of the project developer.

In 2019, two coal projects were stopped, one in Australia and one in Kenya, because their EIAs were considered unsatisfactory. The key reasons for the failure were that the EIAs lacked completeness in terms of data provision, the poor assessment of the social and environmental impacts from the existing data, and that the projects’ positive economic contributions were overestimated.Footnote76 The amount of data that must be presented in the EIA process is growing, and the link between EIAs, data and justice has already been identified.Footnote77 These latter two cases and others highlight the rise of data, and data that is accessible, and they demonstrate how recent changes in EIA legislation around the world have risen to prominence and are again increasing the risk profile of energy projects.

4.8. Climate change action

Climate change has often been described as ‘the challenge of our generation’, with broad international consensus on the need to limit global temperature increases to 1.5°C above pre-industrial levels to reduce the risks and impacts of climate change. Indeed, 189 of the 197 signatories to the 2015 Paris Agreement on Climate Change have now ratified the treaty.Footnote78

Climate change litigation is increasingly being used as a tool to recover ‘the costs of climate-related damage and adaptation, but also as a means to promote and accelerate policy change and the transition towards a lower global carbon economy’Footnote79 – and this cost recovery can be described as an element of restorative justice. As of 12 April 2020, 1538 climate change litigation cases in at least 36 different countries had been reported globally. The vast majority of these cases (1188) were brought in the United States, with growing jurisprudence in other highly developed countries, including Australia, the United Kingdom and New Zealand.Footnote80 Cases have also been brought in the International Court of Justice, within the European Union courts, before the Inter-American Commission on Human Rights and before numerous UN committees. A more recent development has been the trend towards cases being brought in developing countries, including India, Pakistan, Uganda, Colombia and the Philippines.Footnote81

Governments are most commonly sued in non-US cases, with the case law showing that decisions relating to environmental assessment of projects and permitting of developments, greenhouse gas reductions and trading and human rights are most likely to be challenged in the courts. For example, in Urgenda Foundation v. State of the Netherlands,Footnote82 the Urgenda Foundation successfully used a combination of tort law and international law to argue that the Dutch government had breached its duty of care to the Dutch people, under Articles 2 and 8 of the European Convention on Human Rights, in failing to take sufficient actions to mitigate and prevent climate change.Footnote83 This decision was upheld in Court of Appeal of the Hague, with the court finding that the Dutch government was required to adopt stricter emissions reductions targets, reducing emissions by at least 25 per cent on 1990 levels by 2020.Footnote84

The case law in the United States highlights a much more diverse approach to climate change litigation. Most of these claims are founded upon a breach of federal or state legislation, or the constitution. However, there is also growing jurisprudence emerging that relies on common law tort claims, and novel arguments, such as the public trust doctrine, which ‘assigns the state responsibility for the integrity of a nation’s public trust resources for future generations’.Footnote85

Almost 20 per cent of the cases in the United States, and 1 in 7 cases elsewhere, are directly connected to projects and decisions in the energy sector.Footnote86 This figure seems low given that ca 77 per cent of global greenhouse gas emissions are either directly or indirectly linked to energy use. Not surprisingly, the cases that are brought often target the most carbon-intensive energy projects – particularly coal, gas and oil projects.

An increasing number of climate change cases are being brought in the energy sector against private corporations seeking to (i) hold them responsible for climate change damage resulting from their projects; (ii) force them to incorporate climate risk into their investment decisions; and (iii) disclose climate risks to their shareholders.Footnote87 It is this kind of climate change litigation that can expose justice risks by shifting away from a narrow, purely project-level focus to legal interventions that hold corporations directly to account for the climate consequences of their actions through novel forms of litigation.Footnote88

Governments, private corporations and investors must consider the climate impacts of projects in their decision-making during both the due diligence phase and the environmental assessment and approvals process. Once approved, proactive steps need to be taken to mitigate or prevent climate damage, and the exposure of companies to climate risks should be disclosed to shareholders. While this will not render a company free from climate litigation, a lack of disclosure will likely increase the potential for litigation risk.Footnote89 Importantly, many of these risks need to be assessed on a cumulative basis, meaning that the importance of climate change litigation will only continue to grow in the coming years.

4.9. Rules of foreign investment

Until relatively recently, the function and role of international energy arbitration was relatively unknown to interdisciplinary scholars and to the general public. This was true both for investment arbitration between the foreign investor and the host state where the energy investment takes place and for commercial arbitration between private companies. Today the situation is somewhat different, especially for the first area, investment arbitration.

Recent cases in countries like Bolivia, Kenya, and Peru highlight key legal issues such as the importance of EIAs, social licences to operate, and energy finance reserve obligations, as well as energy justice issues. An ongoing case in Nigeria between the Nigerian government and a foreign investor, with an award worth approximately $9.6 billion at stake, will be transformative on several issues.Footnote90 The first question is whether foreign investments should receive full protection, and the second question then arises whether an energy arbitration case should be subject to advances in public policymaking. The answer should be a resounding ‘yes’, especially as an energy case involves energy, environmental, and climate change issues and generally also includes closely related issues such as international development, finance, and taxation. The UK High Court stated in August 2019 that there was no public policy issue.

One of the areas where the tension is already mounting, and will probably continue to do so over the next few years, is the wave of national bans against coal-based power generation in Europe. The German company Uniper has indicated its readiness to initiate a case against the Dutch government’s legislative move to phase out coal-based power generation by 2030 on the back of the Energy Charter Treaty. The case would relate to Uniper’s coal-based generating facility in the Netherlands, which was commissioned in 2016. The investment decision for the project was made in 2007 with cooperation from the Netherlands government at the time.Footnote91

The potential Uniper case against Netherlands is but one example of the difficult issues raised by the ongoing energy transition. Regardless of how one wants to view the situation (public policy and climate urgency vs investor rights), the transition risks for energy companies are clearly illustrated through this case.

If the energy transition is to happen, rules around investor protection will have to recognise the transition and its foreseeability. The controversial issue in this respect is the role and responsibility of governments in soliciting certain type of investments into their respective countries and energy mixes, and the role and responsibility of private undertakings making the investments. This will be an area of transformation over the next decade and will put pressure on energy projects.

4.10. The 2015 Paris agreement

On 12 December 2015, meeting in Paris under the auspices of the UN Framework Convention on Climate Change, 195 nations signed what has been hailed as an historic climate agreement. The United States was a signatory to the agreement under the Obama administration, only to have that commitment reversed by the Trump administration and soon to be restored under the new Biden administration. The agreement was recognised as a ‘turning point, that this is the moment we finally determined we would save our planet’ and that the assembled nations ‘share a sense of urgency about this challenge and a growing realization that it is within our power to do something about it’.Footnote92

The signatories pledged to reduce carbon emissions with the intent of keeping global warming below 2°C while pursuing the more ambitious target of limiting temperature increases to 1.5°C from pre-industrial levels. The actual commercial costs of implementing the Paris Agreement are difficult, if not impossible, to determine because the issue is susceptible to political polemics. From the right, the agreement will cost tens, if not hundreds, of billions of dollars to implement. From the left, the costs will be more if the levels of carbon reduction are not achieved. Recent reports from the IPCC consistently argue that failure to address climate change now will be much more expensive in the future.Footnote93 Even the Trump administration’s climate report estimates that failure to address climate change will cost the United States 10 per cent of GDP by 2100.Footnote94

Although the short (11-page) agreement does not set legally binding emissions limits, the parties committed themselves to a regime that requires them to report on the progress of their commitments every five years beginning in 2020 (which has been delayed until 2021 due to COVID-19).Footnote95

The Paris Agreement advanced earlier efforts, such as the 1997 Kyoto Protocol in the Copenhagen Accord of 2009. The heart of the agreement requires signatory states to announce their ‘nationally determined contributions’ (NDCs) to emission reductions. The NDCs are accompanied by international norms to ensure transparency and accountability. Additionally, the NDCs are intended to encourage states to ratchet up their commitments to reduce carbon emissions every five years.

The NDCs form the heart of the agreement. They are determined by each signatory rather than negotiated internationally. Notably, NDCs are required of all signatories rather than a selected and limited group of developed nations. Although not legally binding, they are subject to publicity. They are recorded in a public registry that is available for public dissemination, and to date over 180 states have registered their NDCs.Footnote96

The technical, economic and political complexities of climate change meant that the conference would not, by itself, solve climate change problems, and the agreement was not cheered by everyone. Of most concern was the fact that even if every country’s pledge to reduce greenhouse emissions is honoured and implemented, they would not be sufficient to reach the climate goals set by the convention. There are, though, significant upsides to the agreement even if it fails to solve the problems of a warming Earth.

In addition to the widespread adoption and commitment to addressing climate change, the agreement, importantly, contains a human rights provision. Although it was not included as an operative article, it was included in the preamble. The human rights language directs participants to consider their environmental obligations regarding human rights, including the right to health, the rights of indigenous peoples, the rights of immigrant children, and the rights of other vulnerable populations.Footnote97

The conference was well attended, with over 19,000 government participants including 150 heads of state. Additionally, there were more than 6000 representatives of NGOs and businesses. This broad participation also generated a series of commitments from public actors from all levels of government and from the private sector.

Examples from the public sector include Mission Innovation, through which developed countries pledged over $19 billion per year in public finance by the year 2020 for clean energy research, and the Global Covenant of Mayors, which involves over 10,000 cities and local governments committed to carbon reductions.Footnote98 On the private side, the Breakthrough EnergyFootnote99 Coalition spearheaded by Bill Gates includes companies such as BNP Paribus, General Electric, Microsoft, and the Virgin Group. Breakthrough Energy is a coalition of investors in clean technologies and was initially funded with over $1 billion of capital.

The Paris Agreement may not eliminate the necessary level of carbon emissions; however, it derives its importance from the fact that it has been widely adopted, is perceived as an important initiative from multiple public and private actors, and has articulated for the world a vision of a future with a cleaner environment and cleaner energy resources.

4.11. Rise in imagery and data

There is a rise in the use of imagery and data across the world. Both are having an impact and increasing the risk profile of energy projects. These are also both areas of research growth as, particularly in law, both are utilised in and are valuable sources of evidence in legal courtrooms and prior legal proceedings.

For example, personal technology is having a big impact in terms of using imagery to change public policy; and it should be noted that images already play a role in both criminal and civil legal systems. The difference now, however, is that personal technology has caused images to be accessible to all and to be captured by all. That this should spread into mainstream society in terms of the effects of climate change should be no surprise, but it is having a major effect. Key issues around personal decisions on where to live, lifestyle, and tourism will change, and are already influencing societal development. The literature is growing in this area alongside the realisation of the effects of this imagery.Footnote100

The literature on imagery to date has concerned mainly communication and engagement practices;Footnote101 however, it is proposed here that the role of imagery has become more powerful. There are some who argue that in processes such as an EIA process, images are ‘made to fit’ the reality they are intended to serve.Footnote102 But local communities are increasingly utilising technology to hold energy companies accountable, and this is changing the behaviour of the energy companies who must ensure that what they do in one part of the world does not impact their business in another part of the world. Local communities can share and transmit images that become available to other local communities worldwide.

Data is also becoming more readily accessible, and this is informing and influencing behaviour. For example, the use of data (already highlighted in terms of EIA projects in section 4.7) is becoming influential in courtrooms. There will be an impact, then, on the risk profile of a project as the project developer’s data comes under increased scrutiny. However, data can also play a powerful role in a positive way and thus, for some projects, it will reduce the risk as it shows the benefits of such technology. For example, increasingly data is used to ensure more flexibility is utilised in the electricity system.Footnote103 Further, data is being utilised with artificial intelligence (AI) to capture consumer usage in terms of electricity consumption and energy storage technology, to increase consumer efficiency and reduce personal energy intensity. As technology grows around AI and battery storage technology, this style of data management will ensure that low-carbon energy becomes even more of a viable and competitive source of energy than conventional energy.

4.12. UN sustainable development goals

The SDGs were unanimously adopted by 193 UN member states on 25 September 2015 as part of UN Resolution 70/1, ‘Transforming Our World: the 2030 Agenda for Sustainable Development’.Footnote104 The SDGs were designed to follow on from the Millennium Development Goals and established the post-2015 global development agenda until 2030. They comprise 17 goals, with an associated 169 targets and 232 indicators, which are used to measure performance.

The SDGs are wide-ranging in their design, providing a clear link between sustainable development and the international human rights agenda. As a result, the SDGs have been described as ‘integrated and indivisible’.Footnote105 Despite this, there has been broad acknowledgement of the critical role that the energy transition will play in achieving the SDGs, with SDG 7 – to ‘ensure access to affordable, reliable, sustainable and modern energy for all’ – often described as a key enabler for all of the other SDGs.Footnote106 This reflects the interlinkages between energy and poverty eradication (SDG 1); reduction of inequalities (SDG 10); gender equality (SDG 5); jobs (SDG 8); climate change (SDG 13); food security (SDG 2); heath (SDG 3); education (SDG 4); clean water and sanitation (SDG 6); sustainable cities and communities (SDG 11); innovation, transport, and industrialisation (SDG 9); peace and security (SDG 16), refugees and other situations of displacement.Footnote107

Achieving SDG 7 means providing access to electricity for 840 million people globally, and significant improvements to energy efficiency, and also requires that clean cooking and heating fuels and technologies are provided to the 41 per cent of the global population who currently lack them.Footnote108 While achieving SDG 7 is not an insurmountable task, evidence suggests that progress is already too slow for the 2030 goals to be achieved.Footnote109 This problem is compounded when the enabler role of SDG 7 in achieving the other SDGs is considered. To achieve SDG 7, investment in this area needs to more than double the $US500 billion per annum currently being spent, to $US 1.2 trillion per annum until 2030.Footnote110 Under the Addis Ababa Action Plan, this investment will come not only from foreign aid but also from private businesses, international trade and finance, and both public and private domestic resources.Footnote111

The SDGs will facilitate the energy transition globally by accelerating the deployment of projects that reduce reliance on fossil fuels and help to mitigate climate change. This has seen countries increase their investment in energy efficiency measures, deploying more renewable energy projects and rolling out more transmission and distribution infrastructure to increase access to clean and reliable energy. For areas where grid-connected power is not possible, this is reflected in the growth of decentralised and distributed energy resources.Footnote112 Education and capacity-building projects that improve knowledge sharing and technology transfers,Footnote113 as well as those that better engage with local communities and stakeholders, are also being encouraged.

A further impact of the SDGs is that they have brought human rights considerations within the energy sector into much starker focus, right down to the individual project level. This means that particularly for companies and financiers operating in this sector, the global expectations around their conduct are rapidly changing, impacting their exposure to legal and regulatory, reputational, financial, environmental and social risks.Footnote114 In addition to companies being expected to comply with the UN Guiding Principles on Business and Human Rights, the International Finance Corporation (IFC) Performance Standards, the OECD Guidelines for Multinational Enterprises, the International Labour Organsiation (ILO) Core Conventions, and the Equator Principles, good corporate citizens are now expected to model the impacts of the SDGs on their projects throughout their operational processes and supply chains, as well as on their corporate governance decisions.Footnote115 Companies that adopt this approach not only reduce their project risk by improving their social licence to operate but also are more attractive to investors, financiers and host governments by facilitating a just, equitable and inclusive framework for economic development. This enables companies to ensure that their operations do not increase justice risks for their host communities and the environment.Footnote116

5. Conclusion

Prior to COVID-19 and the resulting financial crisis, the world faced the challenge of the energy transition. This latter issue had already added to and created risk in the energy sector following the impact of the financial crisis of 2007–2009. Fossil fuel projects are associated with more risk, and recent developments have added further risk while competition has begun to make an impact. Pre-COVID-19, low-carbon technology was playing a significant role in terms of competing against conventional energy sources in terms of cost. However, and in addition, low-carbon energy development has also been a way of diversifying an energy asset portfolio, and this perspective continued once it became more cost competitive. Now with the energy transition, the motivation for which is to ensure the world does not exceed a 1.5 to 2°C temperature rise, there is a further reason for additional low-carbon energy development. In particular, health and the impact of carbon dioxide emissions (particularly as suffered in urban areas) have been key drivers of the motivation to build more low-carbon energy. These latter reasons were key reasons why so many countries (195) signed and ratified the 2015 Paris Agreement, in which countries have all made a commitment to meet energy and climate goals for 2030. Hence, overall, through a variety of different initiatives, there was major momentum for change prior to the outbreak of COVID-19.

What change COVID-19 will bring was an additional key question for this article to consider. COVID-19 has had limited new impacts; rather, it has continued the impacts that were happening before. COVID-19 shines a light on the materialisation of effects of the last global financial crisis (2007–2009) and a range of other developments that have all materialised at the same time, so as to create a ‘perfect storm’ of justice risk issues (as highlighted in Section 3). To be specific, it is our prognosis that COVID-19 has primarily caused a financial crisis, and its effect is to accelerate the action that had already resulted prior to COVID-19. We propose that COVID-19 has acted and is acting as an ‘accelerant’ in ensuring that there is a just energy transition.

The new ‘justice risks’ categorised in this article (shown in ) move society beyond the traditional commercial risks that the energy sector considered previously. These justice risks are more equitable and inclusive and capture issues across the full energy project lifespan, from planning to construction to operation to decommissioning.

A further aim of the paper is to engage with scholars and practitioners from across the energy sector and highlight the role that these justice risks play in energy project development. For example, if project risk is not allocated to a project stakeholder prior to the development of a project, then it will not happen. This is a reason why carbon capture and storage has not yet happened in many countries: because between governments, companies and the public there has been no agreement of liability for the risk. The result of identifying insurmountable project risk results is major asset devaluation; that is a major worry across the energy sector and this is what COVID-19 may accelerate. Witness, for example, one recent example where BP conducted a major revaluation and announced that they have written off £17.5 billion in assets from their balance sheet.Footnote117

Increasingly, as identified in Section 4 where the 12 justice risks are detailed, these will be considered even greater risks post COVID-19. The demands for a sustainable recovery are growing, supported by the same major movements across society that push for an inclusive energy transition. Many countries are already adopting policy goals that aim to meet the UN SDGs, and these have instilled visions of societies that are more inclusive. COVID-19 has placed societies on hold, economic growth and development have slowed, and there is a push for a better world where development aims to be more inclusive. The 12 justice risks are an example of how this has materialised and is materialising in the energy sector, in particular around project development – with the 12 risks being economics; taxation; project finance; bankruptcy; disclosure and transparency; insurance; environmental impact assessments; climate change action; rules of foreign investment; the 2015 Paris Agreement; rise in technology – data and images; and the UN SDGs.

The changes in risk that we identify have resulted from a triad of issues: a health crisis (a pandemic), a financial recession (resulting from the pandemic and continuing from the economic crisis of 2007–2009), and an ongoing energy transition (that is largely technology driven). These risks aim to deliver a more inclusive and just society (ie with characteristics of fairness, equity and equality). A realignment of the energy mix of different countries will happen, and it will enforce change across the energy sector. It is proposed here that new energy projects in a more risk-conservative world post COVID-19, and in the midst of a financial crisis, will have to contend with a clear and new set of justice risks that will determine (a) whether a project will proceed in planning; (b) whether it will receive permission; and (c) what the necessary standards and requirements will be that the project has to meet.