?Mathematical formulae have been encoded as MathML and are displayed in this HTML version using MathJax in order to improve their display. Uncheck the box to turn MathJax off. This feature requires Javascript. Click on a formula to zoom.

?Mathematical formulae have been encoded as MathML and are displayed in this HTML version using MathJax in order to improve their display. Uncheck the box to turn MathJax off. This feature requires Javascript. Click on a formula to zoom.ABSTRACT

This study evaluates the nexus of enterprise value and trade-credit strategies. Fixed-effects modeling is used for the baseline outcomes, and a difference-in-difference approach is applied as a quasi-natural experiment. The estimates are robust to alternative measures and distant covariates. The findings validate that enterprise value has a positive (negative) impact on trade-credit (supplies), (demand). The said effect is more pronounced in SOEs, revealing a critical role in capital mobilization. The additional analyses show that financially constrained and equity reliant firms are more likely to exploit firm value in trade-credit management. The micro aspect of this study suggests that enterprise value can allow managers to shape non-price competitive strategies and it also offers incentives to maintain financial slack. On a macro level, the study suggests that enterprise value has a critical role in capital mobilization and enhancing the purchasing power in the overall economy.

1. Introduction

Trade credit is an important debt arrangement of informal financing that locks the parties into reciprocal terms, and the viability of these credits ultimately elevates purchasing power in the overall economic setting (Dass, Kale, & Nanda, Citation2015). Informal financing has a criticalrole in emerging and transition economies due to centralized resource handling and weak institutional setting (Chen, Arnoldi, & Chen, Citation2019). Credit-worthy suppliers exploit trade-credit provisions to shape an enduring product–market relationship with financially constrained trading allies (Wilner, Citation2000). Fabbri and Klapper’s (Citation2016) cross-sectional survey approves that trading allies’ bargaining power has a great impact on trade-credit provisions. According to Daripa and Nilsen (Citation2011), trading allies need to borrow for finance operation, but one of the parties has bargaining power; a higher borrowing rate offers power to delay production and generates negative externalities for another party, opposing to that, the lowest borrowing has an attachment with bargaining power to subsidize another party. Extant literature approves that enterprise financial capacity is one of the generic forces in trade credit policies (Cheng & Pike, Citation2003), if a retailer is not constrained by capital, they may fund business transactions by lending customers and less borrowing from suppliers (Chen, Citation2015).

Many studies have been investigated the impact of debt financing on enterprise trade-credit policies (Casey & O’Toole, Citation2014; Chong & Yi, Citation2011; Shenoy & Williams, Citation2017; Shahzad, Ali & Zhao, Citation2021a;Tang & Moro, Citation2020) which is a unidimensional treatment of this topic. The role of the capital market is mostly disregarded, the possible reason is that the trade credits are highly exposed in small and private enterprises (Martínez-Sola, García-Teruel, & Martínez-Solano, Citation2014), and these firms are less efficient in the stock exchange (Guariglia, Liu, & Song, Citation2011). Few studies have been focused on the trade credit strategies of large and public enterprises (Cull, Xu, & Zhu, Citation2009; Molina & Preve, Citation2012; Murfin & Njoroge, Citation2015; Shahzad, Liu, Mahmood, & Luo, Citation2021b). These enterprises are highly exposed in the stock market, especially in an economy whose creditors’ rights are poorly enforced (Shahzad, Luo, Liu, Faisal, & Ullah, Citation2020). Advancing the viewpoint, Shang’s (Citation2020) study on the nexus between stock liquidity and trade-credit policies provides valuable footprints to unfold the role of the stock market on informal financing. It is an important research area suggesting the economy in the pursuit of optimal capital redistribution. One area, still far from resolved, many studies have been approved that enterprise value has a strong impact on high stock liquidity (Cheung, Chung, & Fung, Citation2015) and minimum equity floatation cost (Claessens, Ueda, & Yafeh, Citation2014; Hennessy & Whited, Citation2007). It also exerts motivation to shape investors’ enthusiasm to buy stock with higher return (Green & Jame, Citation2013) and managers always seek the advantage of higher enterprise value to secure financial flexibility through conservative leverage policies (Mallick & Yang, Citation2011; Vo & Ellis, Citation2017). Consistent with the aforementioned literature, if enterprise value ameliorates stock trading, then it may impact firms’ capacity to mobilize capital through trade-credit policies. It may allow firms to extend debtors’ collection tenure and shorten the creditors payment period because of the financial viability through stock trading. In this context, the role of enterprise value in capital redistribution has invaluable importance for emerging economies. The existing studies on enterprise value have failed to appropriately investigate the linkage between enterprise value and trade-credit policies. Thus, this study investigates whether enterprise value impacts trade-credit policies, and it explores how enterprise value elevates the capacity to produce trade-credit supplies on one hand and alleviates the superfluous usage of trade-credits from operating suppliers on the other hand. The empirical investigation in this domain can be beneficial for managers to exploit enterprise value as a strategic weapon to secure financial flexibility and to design non-price competitive strategies. Moreover, the study can be beneficial to rationalize the role of capital redistribution from the stock market to those economic sectors that are financially constrained.

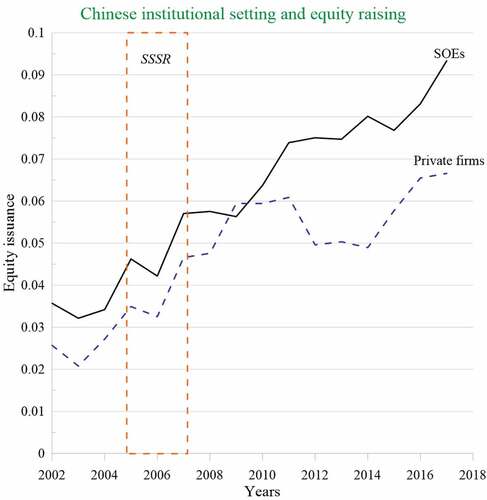

The study is based in China. The enforcement of bankruptcy laws is ambiguous regarding creditors’ rights and political intervention often leads to difficulty recovering debts (Hanley, Liu, & Vaona, Citation2015). In 2005, the Chinese government introduced split share structure reforms (SSSR) to strengthen the stock market and facilitate private investors through various deregulations. SSSR was implemented from 2005 to 2007 to ensure that a large number of previously non-tradable shares could be freely traded in the capital market (Li & Zhang, Citation2011). These reforms eased equity trading, reduced the conflict of interests with private investors (Hou, Kuo, & Lee, Citation2012), and ameliorate enterprise value. The corresponding growth of the stock market in China offers an ideal setting for our study.

The study’s contributions are as follows. First, the previous literature was skewed to the association between the debt market and enterprise trade-credit strategies. Using the information on enterprise value, we diverge this unidimensional treatment and intend to unfold the role of the stock market through the nexus between enterprise value and trade credit policies. Extant studies contribute to the determinants of trade credit policies (Deloof & Jegers, Citation1999; Giannetti, Burkart, & Ellingsen, Citation2011); among these studies, we introduced enterprise value as a significant predictor of enterprises’ trade credit policies. It implies an important contribution to the literature on the in-kind theory of financing. Drawing from the recent literature that discusses the association between enterprise value on enterprise financial outcomes (Panda & Nanda, Citation2018; Shyu, Citation2013), this study identifies trade-credit strategies as another important policy that enterprises may regulate based on the enterprise value. The literature has already been approved that non-financial firms perform informal banking to redistribute capital through trade-credit provisions (Garcia-Appendini & Montoriol-Garriga, Citation2013; Shahzad et al., Citation2021b), this study highlights the importance of enterprise value as an important driver to shape an effective capital redistribution system in the overall economic setting.

The remainder of the paper is organized as follows. Section 2 provides a theoretical framework for this study; section 3 discusses the materials and methods; section 4 presents the results, and section 5 concludes.

2. Literature review and hypothesis development

Trade credit financing has an advantage in reclaiming value from the existing assets that ultimately offers bargaining power on trading allies (the competitive advantage theory of finance; Schwartz, Citation1974). Firstly, the credible commitments lock the parties into mutual benefits that are symmetrically distributed (Hill & Jones, Citation1992), and thus, if managers drive down the prices charged, then suppliers demand a similar ex-ante agreement as insurance to this risk. Secondly, if operating suppliers are in financial distress, the minimum trade credit demand alleviates the crises (the theory of financial distress; Gordon, Citation1971). The price discrimination theory predicts that firms can shape a strong competitive advantage by producing high trade credit provisions to debtors (Narasimhan, Citation1984). In this context, firms’ capacity to produce more trade credits and minimum utilization can shape strong and reciprocal bargaining powers among trading allies.

Enterprise financial capacity influences the trade-credit strategies (Schwartz, Citation1974) and many studies have been approved the role of the credit market in the capital mobilization through the nexus between debt financing and trade-credit provisions (Casey & O’Toole, Citation2014; Chong & Yi, Citation2011; Cull et al., Citation2009; Lin & Chou, Citation2015; Nilsen, Citation2002). Extant literature is focusing on the trade credit policies of public and large enterprises (Abdulla, Dang, & Khurshed, Citation2017; Molina & Preve, Citation2009; Murfin & Njoroge, Citation2015; Shahzad et al., Citation2021b; Shenoy & Williams, Citation2017). These enterprises are resourceful to distribute cash flow as a dividend (Michaely & Roberts, Citation2012) and cheaper access to external financing allows them to use more equity and less debt (Brav, Citation2009). The previous literature has been approved the association between the stock market listing and trade-credit provisions (Abdulla, Dang, & Khurshed, Citation2020; Lewellen, McConnell, & Scott, Citation1980); however, the debate is inconsequential. The recent study of Shang (Citation2020) unfolds the role of the capital market through the nexus between stock liquidity and trade-credit policies; stock liquidity ameliorates equity raising, and thus, it allows firms to produce more trade-credit supplies and alleviate trade-credit demand. Advancing the viewpoint, investors’ sentiments have great attachment with an enterprise value (Durnev, Morck, & Yeung, Citation2004; Whitwell, Lukas, & Hill, Citation2007) that investors’ value creation escalates firms’ capacity in stock trading (de Lange & Valliere, Citation2020). Despite the growing evidence for the impact of enterprise value on firms’ financial choices (Lin & Chang, Citation2011; Marchica & Mura, Citation2010), prior literature has not examined whether enterprise value plays a significant role to redistribute capital through trade credit provisions.

2.1. Corporate value and trade-credit policies

Equity raising can be a costly option in the presence of adverse selection costs, especially in emerging economies (Sercu & Vanpee, Citation2007). Enterprise value has a great attachment with stock liquidity (Cheung et al., Citation2015) that ultimately reduces equity flotation cost (Asem, Chung, Cui, & Tian, Citation2016). Insurance to shareholder rights and dividend pay-out alleviate financial frictions and it ultimately controls marginal equity flotation cost (Claessens et al., Citation2014; Hackbarth, Hennessy, & Leland, Citation2007). Firm value has a strong impact on investors’ enthusiasm to invest more in those shares which can produce high valuation ratios (Green & Jame, Citation2013). Firm value has an imperative role to improve the quality of information disclosure that controls the hazards of equity financing (Bachoo, Tan, & Wilson, Citation2013; Lambert, Leuz, & Verrecchia, Citation2007). On the other side, the association between enterprise value and conservative leverage policies has been approved in various studies (Mallick & Yang, Citation2011; Marchica & Mura, Citation2010; Vo & Ellis, Citation2017). Consistent with this literature, we evaluated our panel data to understand whether enterprise value has a different impact on debt and equity raising, the results are plotted in .

Figure 1. It presents financial securities raising in our sample firms as per Tobin’s q ratio division. The sample firms above (below) the median value of Tobin’s q ratio in each year are assumed as high (low) enterprise value firms. Figure 1a. depicts equity issuance in this setting and debt financing is plotted in 1b.

The estimations in validate that enthusiasm of equity raising is greater in enterprises whose Tobin’s q is higher compared to the lower Tobin’s q and the practice is consistent over years. Contrary, the estimates in portray the opposite of it that firms’ debt undertaking is lower in the presence of high Tobin’s q. The aforementioned literature and empirical estimates in our panel data offer a strong indication that firms are more enthusiastic to raise their capital through stock trading when they produce high corporate value. Besides, high investment in accounts receivables (Martínez-Sola, García-Teruel, & Martínez-Solano, Citation2013) and less usage of suppliers’ financing (Yazdanfar & Öhman, Citation2016) is mostly documented in profitable firms. Consistent with the previous predictions that enterprise financial capacity exerts strong motivation to utilize and produce trade credit financing (Schwartz, Citation1974); however, if enterprise value is linked with equity raising, it would allow high debtor’s collection period and minimum creditors payment tenure. We postulate the following hypotheses:

Hypothesis 1: The nexus of enterprise value and debtors’ collection period is positive that ultimately increases trade-credit supplies.

Hypothesis 2: The nexus of enterprise value and creditors’ payment period is negative that ultimately decreases trade-credit demand.

2.2. Financial flexibility

Financial flexibility is an enterprise’s ability to adjust the dynamic financial situations, it allows prompt fundraising and it can fill the immediate credit shortfalls. Firms are anxious to shape the financial structure that can reserve their financial flexibility (Graham & Harvey, Citation2001). In this context, managers are more enthusiastic about sizeable cash holding through conservative leverage policies and trade credit provisions (DeAngelo & DeAngelo, Citation2007; Howorth & Reber, Citation2003), and it maintains enterprises’ investment potential (Arslan-Ayaydin, Florackis, & Ozkan, Citation2014). Many studies have been unfolded that trade-credit policies are invaluable to maintain financial flexibility (Bastos & Pindado, Citation2013; McGuinness, Hogan, & Powell, Citation2018). However, if predictions of hypotheses 1 and 2 are valid, the said linkage between enterprise value and trade credit policies should be pronounced to the firms that lack financial flexibility. We postulate the following hypothesis:

Hypothesis 3: The said nexus of corporate value and trade credit policies as prophesized in hypotheses 1 and 2 is more visible to the firms that lack financial flexibility.

3. Material and methods

3.1. Data source

The financial statement data are sourced from the China Stock Market and Accounting Research (CSMAR) database, which has an extensive and accurate repository of the financial statements of all enterprises listed on the Shanghai and Shenzhen stock exchange, since 1990. Consistent with the established data selection practice (Shahzad et al., Citation2021e), we dropped financial and utility firms due to their unique business setting, and all observations with negative equity and sales, and firms without data for a minimum of five accounting years. This gave us a sample of 14,666 firm-years observations, covering 2002–2017. presents the detailed description of our sample.

Table 1. Final smaple description

3.2. Variable measurement

Customers’ collection days (CCD) and suppliers’ payment days (SPD) are used to measuring trade credit supply and demand, respectively (Cheng & Pike, Citation2003; Niskanen & Niskanen, Citation2006; Shahzad et al., Citation2021b; Shang, Citation2020). The variable CCD was measured as the ratio of account receivables to net sales and multiplied by 360 days, the highest days represent that firm is extending customers’ collection days, and thus, it increases trade credit supply. The variable SPD is the ratio of account payables to the net sales multiplied by 360 days, the minimum days represents that firm is faster to repay to the operating suppliers, and thus, it decreases trade credit demand.

Tobin’s q ratio is used to measure corporate value, it represents the firms’ market valuation over the book value and it is one of the most effective proxies to capture corporate competitive advantage (Belo, Gala, Salomao, & Vitorino, Citation2022). Tobin’s q score greater than 1.0 generates more attraction for high growth investors, a higher q ratio represents the investment growth. Therefore, we prefer to use Tobin’s q ratio as the proxy for corporate value rather than accounting-based measures i.e., return on assets (ROA) and return on equity (ROE). Tobin’s q ratio is measured by the sum of corporate equity value, the book value of long-term loans, and net current liabilities and divided by total assets. This is the most simplified version which is consistently used in the previous literature (Cao, Lorenzoni, & Walentin, Citation2019; Fang, Noe, & Tice, Citation2009). We also used earning per share (EPS) as an alternative measure to robust each specification. EPS is the part of corporate profit that is allotted to the common shareholders, it is measured by taking the difference between net profit attributable to shareholders and dividends paid for preferred equity divided by the total number of common shares outstanding. EPS is one of the most attractive indicators for potential investors to buy or hold stock and is commonly used in previous studies (Al-Najjar & Anfimiadou, Citation2012). Besides the main explanatory variable, several control variables were applied in the empirical analysis to control firm-specific and year dummies were incorporated to control the systematic period effect. carries the detail.

Table 2. Variable definition

3.3. Research model

EquationEquation (1)(1)

(1) defines the baseline regression model to evaluate the nexus between corporate value and trade credit policies.

The term TCP represents the trade credit policies where CCD is customers’ collection days and SPD is the suppliers’ payment days. The term FV represents a firm’s value and the term represents a set of all control variables defined in . The term

is used to control industry effect and the term

represents time effect. The term

represents the error term. The term i represents firm and t is used to represent the specific year. The fixed-effect regression modeling is applied for estimations. The one period lag allows us to control omitted variables issues; however, the estimates can be challenged because fixed-effect regression is limited to address reverse causality issues (Shahzad, Fukai, Mahmood, Jing, & Ahmad, Citation2020). Therefore, the difference-in-difference (DID) approach is applied to robust the estimates. The DID is a quasi-experimental approach that evaluates the changes in outcomes over time between the treated and controlled group and it controls the unobserved variables that biased outcomes of the causal effects.

4. Results

4.1. Descriptive Analysis

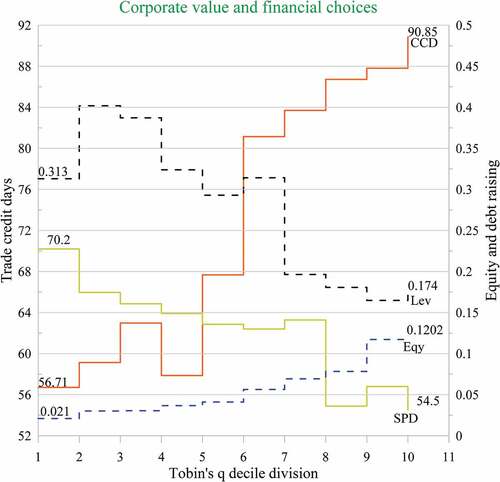

reports the descriptive estimates that are consistent with the previous studies (Cai, Chen, & Xiao, Citation2014; Cull et al., Citation2009; Shahzad et al., Citation2021d). We divided our panel data into equal deciles of Tobin’s ratio and we evaluated financing of the sample firms. The results are plotted in . The estimates approved that equity raising is higher compared to debt financing in the upper decile of Tobin’s q ratio. It offers strong empirical evidence to our baseline prophesies that firms whose corporate value is higher are likely to raise financing by stock trading. Next, we evaluated CCD and SPD in this setting, the curve of CCD is growing in the upper decile Tobin’s q, and on the contrary, the curve of SPD is declining. The panel data support our baseline predictions as prophesized in H1 and H2. However, these are univariate estimates that can be challenged in the presence of various firm-specific covariates, and thus, we perform regression analysis. We verified multicollinearity issues in our panel data through the Pearson correlation test, the score among covariates was not strong to cause multicollinearity issues. The result is not reported in the interest of brevity.

Table 3. Descriptive analysis

Figure 2. It reports enterprise financial choices as per the decile division of the Tobin’s q ratio. The term CCD represents customers’ collection days, SPD represents suppliers’ payment days, Lev represents leverage ratio, and Eqy represents equity issuance ratio. The variables have been defined in variable measurement section.

4.2. Trade credit policies and enterprise value

reports the baseline estimations for H1 and H2, the estimates for control variables are statistically significant and consistent with the previous studies as reported in . The baseline regression outcomes on the trade credit supplies are reported in column 1, where the coefficient value of Tobin’s q is positive (0.781) and significant at a one percent confidence level. The regression outcomes on the trade credit demand are reported in column 2, where the coefficient of Tobin’s q is significantly negative (−1.230). The estimates produce strong support in the favour of H1 and H2. The estimates are consistent with the previous studies that have been approved that profitable firms engage high investment in accounts recievable (Martínez-Sola et al., Citation2013) and minimum creditors payment tenure (Yazdanfar & Öhman, Citation2016). We robust each specification with an alternative proxy of corporate value (EPS), the estimates are reported in columns 3 and 4 which remained consistent.

Table 4. Regression estimates for the nexus of firm value and trade-credit strategies

4.3. Chines institutional setting and the nexus between corporate value and trade-credit policies

In China, state-owned enterprises (SOEs) benefit from soft budget constraints (Lin & Li, Citation2004), which provide them greater choice in stock trading (Yangyang Chen, Rhee, Veeraraghavan, & Zolotoy, Citation2015). State ownership plays a dominant role in the capital market, and it gradually assists firms to alleviate capital shortages (Lin, Cai, & Li, Citation1998). The probability of survival in SOEs has a great attachment with government reputation in ensuring that the investment does not fail (Borisova, Fotak, Holland, & Megginson, Citation2015), and it ultimately reduces the expected risk premium (Faccio, Masulis, & Mcconnell, Citation2006). Government engagement in stock trading can therefore elevate investors’ enthusiasm to invest more in SOEs and enjoy the benefits attached with government affiliation. Consequently, SOEs equity offering is predicted to higher (Ding & Suardi, Citation2019), therefore, investors intend to buy less equity which is offered by private enterprises. We split our panel data as per institutional setting and evaluated equity issuance in SOEs and private firms. As prophesized, the equity issuance was found to be higher in SOEs than the private firms, plots the results. A substantial improvement was found after the implementation of SSSR (2005–07), however, the equity raising remained higher in SOEs. Therefore, we expect that the institutional setting may impact our baseline predictions, and the explanatory power of H1 and H2 could be more visible in SOEs than the private enterprises.

The SUEST analysis is the most effective and reliable approach to evaluate the difference between two groups (Sun, Mao, & Yin, Citation2020); therefore, we applied the SUEST test to evaluate the differing impact in SOEs and private firms. carries the results. We report the estimates for H1 in Panel A. The coefficient value of Tobin’s Q ratio is higher in SOEs compared to private firms (3.397 > 0.919) and the inter-group SUEST test of two sets of regression coefficients is 3.60 which is statistically significant, the estimates receive significant support that the explanatory power of H1 is different in both groups. The estimates for H2 are reported in Panel B, consistently, the explanatory power of H2 remains higher in SOEs. These estimates provide greater insight to evaluate the impact of institutional setting on H1 and H2, it can be seen that the prophecies on the linkage between corporate value and trade-credit policies remain significant but highly visible in SOEs. The results are consistent with the previous studies in the same framework (Shahzad, Liu, & Luo, Citation2022).

Table 5. The impact of institutional setting on the nexus of firm value and trade-credit strategies

4.4. Endogeneity concerns

To control the endogeneity, we 1) use a lagged variable approach and 2) apply a difference-in-difference (DID) model to address the reverse causality issues. carries the results. First, we examine the validity of our baseline equation with one and three-year lags; the estimates remain consistent at a 1% confidence level. The results in columns 1 to 4 confirm the validity of H1 and H2 between distantly lagged Tobin’s q ratios.

Table 6. Endogeneity analysis

Next, the predictions in H1 and H2 may reflect the problem of reverse causality; that is, enterprise capacity to raise equity may attract investors, which could challenge our conclusion. Therefore, to address this problem, we consider China’s split share structure reforms (SSSR) as an exogenous policy impact and apply the DID model. SSSRs were implemented from 2005 to 2007 to ensure that a large number of previously non-tradeable shares could be freely traded in the capital market and do not cover micro-enterprises instead. These reforms improved the Chinese stock market’s efficiency (Beltratti, Bortolotti, & Caccavaio, Citation2012) and ameliorated equity trading (Li & Zhang, Citation2011). These economic decisions were implemented for different reasons to corporate trade-credit policies; therefore, the exogenous shocks of SSSR offer an ideal setting to apply quasi-natural experiments and control the reverse causality issues. We apply EquationEquation (2)(2)

(2) for DID test.

We set the companies that implemented the SSSR in 2005 as the treatment group (Treat = 1), and those that did not implement it by the end of 2006 as the control group (Treat = 0). The sample period includes 2 years – 2004 when companies in neither group had implemented SSSR (Post = 0) and 2006 when the treatment group had finished implementing SSSR, whereas the control group had still not implemented it (Post = 1). This practice is consistent with the previous studies (Shahzad, Liu, Pang, & Luo, Citation2021c). The results are depicted in (column 5 for H1 and column 6 for H2). The regression coefficient for Treat × Post is significantly positive in column 05 (4.452) and the negative coefficient can be found in column 06 (−3.245). The exogenous shocks of SSSR do not impact the significance of our predictions. These estimates help to alleviate the reverse causality problem in our results.

4.5. Financial flexibility

As prophesized in H3, we expect the impact of enterprise value is more visible in those enterprises that lack financial flexibility. To confirm this prediction, we evaluate EquationEquation (1)(1)

(1) in 1) financially constrained and 2) enterprises that heavily relied on external financing, especially stock trading.

4.5.1. Financial constraints

Whited and Wu (Citation2006)’s WW Index for the measurement of financial constraints is based on firm-specific financial information and widely common in the previous literature. We report the detail specification in EquationEquation (3)(3)

(3) .

The term CFR represents cash flow ratio which is measured by cash from operating activities divided by total assets; the term DD denotes dividend dummy that equal to 1 if a firm is paying dividends in the current year, and 0 otherwise; the term LTLev represents long-term debt ratio which is measured by long-term debts divided by total assets. The term IndSG denotes industry-wise sales growth which is measured by firm’s sale in a current year divided by total industrial sales; Size is measured by the natural log value of total assets, and the term SGrow represents firm-level sale growth which is the ratio of change in sales to the sales in the beginning year. We also applied Hadlock and Pierce’s (Citation2010)’s SA Index that is a common approach to evaluate financial constraints based on a firm’s age and size. EquationEquation (4)(4)

(4) carries the detailed specification.

These indexes relate inversely with enterprise financial status; it implies that a higher score represents extreme financial constraints. Therefore, we ranked firms into equal quartiles of these indexes and create dummies for the upper quartile; the dummy of WWD is equal 1 if WW Index is in the highest quartile, and 0 otherwise; the dummy of SAD is equal 1 if SA Index is in the highest quartile, and 0 otherwise. We incorporate the dummies of WWD and SAD in EquationEquation (1)(1)

(1) and interact with Tobin’s q. The interaction terms (Tobin’s q × WWD and Tobin’s q × SAD) are the variable of the main interest and we expect that the coefficient values of the interaction terms remain consistent with the baseline estimates as reported in . We report the regression estimates in .

Table 7. The impact of financial flexibility on the nexus of firm value and trade-credit strategies

The coefficient values of the interaction terms are significant and the positive and negative coefficient values are consistent with the baseline estimations. The results remain consistent with the alternative interaction term (Tobin’s q × SAD).

4.5.2. External financial dependency

As prophesized in H3, we expect that firms tend to avail the advantage of their market value if they rely on external financing, especially managers who seek motivation to exploit the firm’s value into stock trading. To receive empirical evidence, we followed Petersen & Rajan’s (Citation1997) approach and incorporate the proxies for finance and equity dependence. We report the specification in EquationEquation (5)(5)

(5) .

The term FinDep represents financial dependence; Capex is the ratio of capital expenditures to total assets; CFR is the ratio of cash flow from operation to total assets; the term EqDep represents equity dependence; EQI represents the ratio of the amount received from the equity issuance to total assets, and the term EQP represents the ratio of amount paid to buy common and preferred stock to total assets. We incorporated these variables in EquationEquation (1)(1)

(1) and interact with Tobin’s q ratio to evaluate H3. As prophesized, we expect that the interaction terms remain significant and consistent with the baseline predictions. The results are reported in .

Table 8. External financial dependency and the nexus of firm value and trade credit strategies

The coefficient value of the interaction term (FinDep × Tobin’s q) is significantly positive in column 1 (0.072) and negative in column 2 (−0.016); the estimates are consistent with the baseline predictions and offer strong support for H3. The explanatory power of Tobin’s q improves as soon as interacted with equity dependence, the estimates are reported in columns 3 (EqyDep × Tobin’s q = 0.641) and in column 4 (EqyDep × Tobin’s q = −0.316). The empirical outcomes of receive strong support for H3.

5. Conclusion

The study investigated the nexus of enterprise value and trade-credit policies. The findings approve that enterprise value significantly impacts trade-credit provisions; it allows firms to extend debtors’ collection tenure and reduce creditors’ payment days. Our main argument is that enterprise value impacts trade-credit provisions because of financial viability from the stock market; the previous theories have been approved that enterprise financial strength is a generic driving force in capital redistribution through informal financing (Cheng & Pike, Citation2003; Psillaki & Eleftheriou, Citation2015). Consistent with the resource-based theory of the firm (Barney, Citation1996), the said nexus between trade-credit policies and enterprise value is highly visible in SOEs. Many studies have been argued that Chinese SOEs have greater choices in stock trading (Chen, Wang, Li, Sun, & Tong, Citation2015), government reputation offers strong investors’ protection (Borisova et al., Citation2015), and equity offering is higher compared to the private corporations (Ding & Suardi, Citation2019). These studies offer strong support to our argument that SOEs are more exposed to exploit their value to mobilize capital through trade-credit provisions. Managers secure enterprise financial flexibility to improve investment potential (Arslan-Ayaydin et al., Citation2014), thus the extant literature is focusing on the importance of trade-credit provisions (Bastos & Pindado, Citation2013; McGuinness et al., Citation2018). In such context, we show that managers are more anxious to exploit enterprise value in financially constrained firms, especially when firms are highly reliant on equity trading; they seek motivation to extend debtors’ collection period and reduce creditors’ payment days.

Our findings unfold that enterprise value drives managers’ enthusiasm to shape trade-credit policies; it ultimately establishes the informal banking channel for capital redistribution in the overall economic sectors. In such a context, the study offers important policy implications. The stock market has a great attachment with economic growth (Levine, Citation2003) and trade credits enhance enterprise purchasing power (Lin & Zhang, Citation2020). The affiliation between enterprise value and trade credit provisions mobilize capital from the stock market to those economic sectors which are constrained to participate in the stock exchanges. The said affiliation is very important for emerging economies where financial opportunities are not equal due to weak governance settings. On a micro level, managers and board of directors should focus to improve enterprise value, doing so, they can avoid superfluous debt utilization and secure financial flexibility that can be utilized to address enterprise growth. Besides, high enterprise value can allow managers to shape a non-price competitive strategy through trade credit provisions for their customers against those rivals whose enterprise value is lower.

We applied this study in China where the large enterprises mostly operate under government ownership and receive motivation from political agenda i.e., employment issues, social development, and these corporations are managed by government bureaucrats. Many SOEs operate government-sponsored projects and do not focus on shareholder value (Lin, Lu, Zhang, & Zheng, Citation2020), therefore, our conclusion can be challenged in these enterprises. We did not cover this aspect because CSMAR does not such information on SEOs. Besides, enterprise value is not the only factor that can drive investors’ sentiments in the stock exchange. Earning management and governance quality are other important drivers to investment choices. Emerging scholars should focus on these aspects to explore the role of the stock market and capital redistribution through informal banking in the future.

Data Availability Statement

The data support the findings of this study are openly available in CSMAR at http://www.gtadata.com

Disclosure statement

Authors bear no conflict of interest in any part of paper including designing, results, interpretations, and policy implications. No third party is involved in the design of the study; in the collection, analyses, or interpretation of data; in writing of the manuscript, or in the decision to publish the results.

Additional information

Funding

Notes on contributors

Umeair Shahzad

Umeair Shahzad has been working with Economics of Innovation and New Technology, Journal of Business Economics and Management, Sustainability, Technology Analysis and Strategic Management, International Journal of Finance and Economics, Managerial and Decision Economics, and Journal of Asian Finance, Economics, and Business for over two years. He is a Ph.D. candidate at the School of Management, Ocean University of China. His research interests cover the basic theory of finance, corporate finance, and enterprise innovation.

Jing Liu

Jing Liu is a lecturer at the School of Accounting, Henan University of Economics and Law, and a Ph.D. candidate at the School of Management, Ocean University of China. Her research interests cover the basic theory of finance, corporate finance, and enterprise innovation. Her research has been published in Technology Analysis and Strategic Management, Economics of Innovation and New Technology, International Journal of Finance and Economics, and Journal of Asian Finance, Economics, and Business.

Fukai Luo

Fukai Luo is a professor at the School of Management, Ocean University of China. He earned his Ph.D. from the School of Accounting, South-eastern University of Finance and Economics. His research interest covers basic financing theory, capital theory, and capital allocation. His research has been published in the Technology Analysis and Strategic Management and International Journal of Finance and Economics, Managerial and Decision Economics, Journal of Asian Finance, Economics, and Business. He is the author of (1) Principles of Finance (2nd Edition), Beijing: China Financial Economics Press, 2020-09-01, (2) Boundaries of Finance (2nd Edition), Beijing: Economics Management Press, 2017-08-01, (3) A Study on Financial Management of Famous Enterprises in Shandong Province, Qingdao: Ocean University of China Press, 2009-04-01, (4) “Financial Theory” Subject Research, Beijing: Economics Management Press, 2004-07-01, and (5) Strategic Financial Management, Qingdao: Ocean University of China Press, 2000-05-01.

References

- Abdulla, Y., Dang, V. A., & Khurshed, A. (2017). Stock market listing and the use of trade credit: Evidence from public and private firms. Journal of Corporate Finance, 46, 391–410.

- Abdulla, Y., Dang, V. A., & Khurshed, A. (2020). Suppliers’ listing status and trade credit provision. Journal of Corporate Finance, 60, 101535.

- Al-Najjar, B., & Anfimiadou, A. (2012). Environmental policies and firm value. Business Strategy and the Environment, 21(1), 49–59.

- Arslan-Ayaydin, Ö., Florackis, C., & Ozkan, A. (2014). Financial flexibility, corporate investment and performance: Evidence from financial crises. Review of Quantitative Finance and Accounting, 42(2), 211–250.

- Asem, E., Chung, J., Cui, X., & Tian, G. Y. (2016). Liquidity, investor sentiment and price discount of SEOs in Australia. International Journal of Managerial Finance, 12(1), 25–51.

- Bachoo, K., Tan, R., & Wilson, M. (2013). Firm value and the quality of sustainability reporting in Australia. Australian Accounting Review, 23(1), 67–87.

- Barney, J. B. (1996). The resource-based theory of the firm. Organization Science, 7(5), 469.

- Bastos, R., & Pindado, J. (2013). Trade credit during a financial crisis: A panel data analysis. Journal of Business Research, 66(5), 614–620.

- Belo, F., Gala, V., Salomao, J., & Vitorino, M. A. (2022). Decomposing firm value. Journal of Financial Economics, 143(2), 619–639. (No. 26112). https://doi.org/10.1016/j.jfineco.2021.08.007

- Beltratti, A., Bortolotti, B., & Caccavaio, M. (2012, September 1). The stock market reaction to the 2005 split share structure reform in China. Pacific Basin Finance Journal, 20(4), 543–560.

- Borisova, G., Fotak, V., Holland, K., & Megginson, W. L. (2015). Government ownership and the cost of debt: Evidence from government investments in publicly traded firms. Journal of Financial Economics, 118(1), 168–191.

- Brav, O. (2009). Access to capital, capital structure, and the funding of the firm. The Journal of Finance, 64(1), 263–308.

- Cai, G., Chen, X., & Xiao, Z. (2014). The roles of bank and trade credits: Theoretical analysis and empirical evidence. Production and Operations Management, 23(4), 583–598.

- Cao, D., Lorenzoni, G., & Walentin, K. (2019). Financial frictions, investment, and Tobin’s q. Journal of Monetary Economics, 103, 105–122.

- Casey, E., & O’Toole, C. M. (2014). Bank lending constraints, trade credit and alternative financing during the financial crisis: Evidence from European SMEs. Journal of Corporate Finance, 27, 173–193.

- Chen, X. (2015). A model of trade credit in a capital-constrained distribution channel. International Journal of Production Economics, 159, 347–357.

- Chen, X., Arnoldi, J., & Chen, X. (2019). Chinese culture, materialism and corporate supply of trade credit. China Finance Review International, 10(2), 197–212.

- Chen, Y., Rhee, S. G., Veeraraghavan, M., & Zolotoy, L. (2015). Stock liquidity and managerial short-termism. Journal of Banking and Finance, 60, 44–59.

- Chen, Y., Wang, S. S., Li, W., Sun, Q., & Tong, W. H. S. (2015). Institutional environment, firm ownership, and IPO first-day returns: Evidence from China. Journal of Corporate Finance, 32, 150–168.

- Cheng, N. S., & Pike, R. (2003). The trade credit decision: Evidence of UK firms. Managerial and Decision Economics, 24(6–7), 419–438.

- Cheung, W. M., Chung, R., & Fung, S. (2015). The effects of stock liquidity on firm value and corporate governance: Endogeneity and the REIT experiment. Journal of Corporate Finance, 35, 211–231.

- Chong, B.-U., & Yi, H.-C. (2011). Bank loans, trade credits, and borrower characteristics: Theory and empirical analysis. Asia-Pacific Journal of Financial Studies, 40(1), 37–68.

- Claessens, S., Ueda, K., & Yafeh, Y. (2014). Institutions and financial frictions: Estimating with structural restrictions on firm value and investment. Journal of Development Economics, 110, 107–122.

- Cull, R., Xu, L. C., & Zhu, T. (2009). Formal finance and trade credit during China’s transition. Journal of Financial Intermediation, 18(2), 173–192.

- Daripa, A., & Nilsen, J. (2011). Ensuring sales: A theory of inter-firm credit. American Economic Journal: Microeconomics, 3(1), 245–279.

- Dass, N., Kale, J. R., & Nanda, V. (2015). Trade credit, relationship-specific investment, and product market power. Review of Finance, 19(5), 1867–1923.

- de Lange, D., & Valliere, D. (2020). Investor preferences between the sharing economy and incumbent firms. Journal of Business Research, 116, 37–47.

- DeAngelo, H., & DeAngelo, L. (2007). Capital structure, payout policy, and financial flexibility ( No. working paper no. FBE).

- Deloof, M., & Jegers, M. (1999). Trade credit, corporate groups, and the financing of Belgian firms. Journal of Business Finance & Accounting, 26(7&8), 945–966.

- Ding, M., & Suardi, S. (2019). Government ownership and stock liquidity: Evidence from China. Emerging Markets Review, 40, 100625.

- Durnev, A., Morck, R., & Yeung, B. (2004, February 1). Value-enhancing capital budgeting and firm-specific stock return variation. Journal of Finance, 59(1), 65–105.

- Fabbri, D., & Klapper, L. F. (2016). Bargaining power and trade credit. Journal of Corporate Finance, 41, 66–80.

- Faccio, M., Masulis, R. W., & Mcconnell, J. J. (2006). Political connections and corporate bailouts. Journal of Finance, 61(6), 2597–2635.

- Fang, V. W., Noe, T. H., & Tice, S. (2009). Stock market liquidity and firm value. Journal of Financial Economics, 94(1), 150–169.

- Ferrando, A., & Mulier, K. (2013). Do firms use the trade credit channel to manage growth? Journal of Banking and Finance, 37(8), 3035–3046.

- Garcia-Appendini, E., & Montoriol-Garriga, J. (2013). Firms as liquidity providers: Evidence from the 2007-2008 financial crisis. Journal of Financial Economics, 109(1), 272–291.

- Giannetti, M., Burkart, M., & Ellingsen, T. (2011). What you sell is what you lend? Explaining trade credit contracts. The Review of Financial Studies, 24(4), 1261–1298.

- Gordon, M. J. (1971). Towards a theory of financial distress. The Journal of Finance, 26(2), 347–356.

- Graham, J. R., & Harvey, C. R. (2001). The theory and practice of corporate finance: Evidence from the field. Journal of Financial Economics, 60(2–3), 187–243.

- Green, T. C., & Jame, R. (2013). Company name fluency, investor recognition, and firm value. Journal of Financial Economics, 109(3), 813–834.

- Guariglia, A., Liu, X., & Song, L. (2011). Internal finance and growth: Microeconometric evidence on Chinese firms. Journal of Development Economics, 96(1), 79–94.

- Hackbarth, D., Hennessy, C. A., & Leland, H. E. (2007). Can the trade-off theory explain debt structure? The Review of Financial Studies, 20(5), 1389–1428.

- Hadlock, C. J., & Pierce, J. R. (2010). New evidence on measuring financial constraints: Moving beyond the KZ index. The Review of Financial Studies, 23(5), 1909–1940.

- Hanley, A., Liu, W.-H., & Vaona, A. (2015). Credit depth, government intervention and innovation in China: Evidence from the provincial data. Eurasian Business Review, 5(1), 73–98.

- Hennessy, C. A., & Whited, T. M. (2007). How costly is external financing? Evidence from a structural estimation. Journal of Finance, 62(4), 1705–1745.

- Hill, C. W. L., & Jones, T. M. (1992). Stakeholder‐agency theory. Journal of Management Studies, 29(2), 131–154.

- Hosseini-Motlagh, S. M., Nematollahi, M., Johari, M., & Sarker, B. R. (2018). A collaborative model for coordination of monopolistic manufacturer’s promotional efforts and competing duopolistic retailers’ trade credits. International Journal of Production Economics, 204, 108–122.

- Hou, W., Kuo, J. M., & Lee, E. (2012). The impact of state ownership on share price informativeness: The case of the split share structure reform in China. British Accounting Review, 44(4), 248–261.

- Howorth, C., & Reber, B. (2003). Habitual late payment of trade credit: An empirical examination of UK small firms. Managerial and Decision Economics, 24(6–7), 471–482.

- Lambert, R., Leuz, C., & Verrecchia, R. E. (2007). Accounting information, disclosure, and the cost of capital. Journal of Accounting Research, 45(2), 385–420.

- Levine, R. (2003). Stock market liquidity and economic growth: Theory and evidence. In Luigi, Paganetto, and Edmund S., Phelps. (eds.). Finance, research, education and growth (pp. 3–24). London: Palgrave Macmillan.

- Lewellen, W. G., McConnell, J. J., & Scott, J. A. (1980). Capital market influences on trade credit policies. Journal of Financial Research, 3(2), 105–113.

- Li, X., & Zhang, B. (2011). Has split share structure reform improved the efficiency of the Chinese stock market? Applied Economics Letters, 18(11), 1061–1064.

- Lin, J. Y., Cai, F., & Li, Z. (1998). Competition, policy burdens, and state-owned enterprise reform. The American Economic Review, 88(2), 422–427.

- Lin, F. L., & Chang, T. (2011). Does debt affect firm value in Taiwan? A panel threshold regression analysis. Applied Economics, 43(1), 117–128.

- Lin, T. T., & Chou, J. H. (2015). Trade credit and bank loan: Evidence from Chinese firms. International Review of Economics and Finance, 36, 17–29.

- Lin, Y. F., & Li, Z. (2004). Policy burden, moral hazard and soft budget constraint. Economic Research Journal, 2, 17–27.

- Lin, K. J., Lu, X., Zhang, J., & Zheng, Y. (2020). State-owned enterprises in China: A review of 40 years of research and practice. China Journal of Accounting Research, 13(1), 31–55.

- Lin, Q., & Zhang, T. (2020). Trade credit in economic fluctuations and its impact on corporate performance: A panel data analysis from China. Applied Economics, 52(1), 1–18.

- Mallick, S., & Yang, Y. (2011). Sources of financing, profitability and productivity: First evidence from matched firms. Financial Markets, Institutions & Instruments, 20(5), 221–252.

- Marchica, M.-T., & Mura, R. (2010). Financial flexibility, investment ability, and firm value: Evidence from firms with spare debt capacity. Financial Management, 39(4), 1339–1365.

- Martínez-Sola, C., García-Teruel, P. J., & Martínez-Solano, P. (2013). Trade credit policy and firm value. Accounting & Finance, 53(3), 791–808.

- Martínez-Sola, C., García-Teruel, P. J., & Martínez-Solano, P. (2014). Trade credit and SME profitability. Small Business Economics, 42(3), 561–577.

- McGuinness, G., Hogan, T., & Powell, R. (2018). European trade credit use and SME survival. Journal of Corporate Finance, 49, 81–103.

- Michaely, R., & Roberts, M. R. (2012). Corporate dividend policies: Lessons from private firms. The Review of Financial Studies, 25(3), 711–746.

- Molina, C. A., & Preve, L. A. (2009). Trade receivables policy of distressed firms and its effect on the costs of financial distress. Financial Management, 38(3), 663–686.

- Molina, C. A., & Preve, L. A. (2012). An empirical analysis of the effect of financial distress on trade credit. Financial Management, 41(1), 187–205.

- Murfin, J., & Njoroge, K. (2015). The implicit costs of trade credit borrowing by large firms. The Review of Financial Studies, 28(1), 112–145.

- Narasimhan, C. (1984). A price discrimination theory of coupons. Marketing Science, 3(2), 128–147. Retrieved from http://www.jstor.org/stable/183747

- Nilsen, J. H. (2002). Trade credit and the bank lending channel. Journal of Money, Credit, and Banking, 34(1), 226–253.

- Niskanen, J., & Niskanen, M. (2006). The determinants of corporate trade credit policies in a bank-dominated financial environment: The case of finnish small firms. European Financial Management, 12(1), 81–102.

- Panda, A. K., & Nanda, S. (2018). Working capital financing and corporate profitability of Indian manufacturing firms. Management Decision, 56(2), 441–457.

- Petersen, M. A., & Rajan, R. G. (1997). Trade credit: Theories and evidence. The Review of Financial Studies, 10(3), 661–691.

- Psillaki, M., & Eleftheriou, K. (2015). Trade credit, bank credit, and flight to quality: Evidence from French SMEs. Journal of Small Business Management, 53(4), 1219–1240.

- Schwartz, R. A. (1974). An economic model of trade credit. The Journal of Financial and Quantitative Analysis, 9(4), 643.

- Sercu, P., & Vanpee, R. (2007). Home bias in international equity portfolios: A review. Available at SSRN 1025806. https://dx.doi.org/10.2139/ssrn.1025806

- Shahzad U, Ali A, & Zhao L. (2021a). The nexus of debt financing and corporate innovation by exploring market competition’s moderating and enterprise maturity’s influential role: evidence from China. Spanish Journal of Finance and Accounting / Revista Española de Financiación y Contabilidad, 1–27. doi:10.1080/02102412.2021.1999145

- Shahzad, U., Fukai, L., Mahmood, F., Jing, L., & Ahmad, Z. (2020). Reliable and advanced predictors for corporate financial choices in Pakistan. The Journal of Asian Finance, Economics and Business, 7(7), 73–84.

- Shahzad U, Liu J, and Luo F. (2022). STOCK LIQUIDITY AND CORPORATE TRADE CREDIT STRATEGIES: EVIDENCE FROM CHINA. Journal of Business Economics and Management, 23(1), 40–59. doi:10.3846/jbem.2021.15655

- Shahzad, U., Liu, J., Mahmood, F., & Luo, F. (2021b). Corporate innovation and trade credit demand: Evidence from China. Managerial and Decision Economics, 42(6), 1591–1606. 10.1002/mde.3329

- Shahzad U, Liu J, Pang T, and Luo F. (2021c). Institutional investors and the moral hazards of technology investment: Evidence from China. Economics of Innovation and New Technology, 1–27. doi:10.1080/10438599.2021.1908896

- Shahzad, U., Luo, F., & Liu, J. (2021d). Debt financing and technology investment Kuznets curve: Evidence from China. International Journal of Finance & Economics, 1–15. doi:10.1002/IJFE.2448

- Shahzad, U., Luo, F., Liu, J., Faisal, M., & Ullah, H. (2020). The most consistent and reliable predictors of corporate financial choices in Pakistan: New evidence using BIC estimation. International Journal of Finance & Economics, Ijfe, 27(1), 237–257. doi:10.1002/ijfe.2149

- Shahzad U, Luo F, Pang T, Liu J, and Nawaz T. (2021e). Managerial equity incentives portfolio and the moral hazard of technology investment. Technology Analysis & Strategic Management, 33(12), 1435–1449. 10.1080/09537325.2021.1876223

- Shang, C. (2020). Trade credit and stock liquidity. Journal of Corporate Finance, 62, 101586.

- Shenoy, J., & Williams, R. (2017). Trade credit and the joint effects of supplier and customer financial characteristics. Journal of Financial Intermediation, 29, 68–80.

- Shyu, J. (2013). Ownership structure, capital structure, and performance of group affiliation: Evidence from Taiwanese group-affiliated firms. Managerial Finance, 39(4), 404–420.

- Sun, B., Mao, H., & Yin, C. (2020). Male and female users’ differences in online technology community based on text mining. Frontiers in Psychology, 11. doi:10.3389/fpsyg.2020.00011

- Tang, Y., & Moro, A. (2020). Trade credit in China: Exploring the link between short term debt and payables. Pacific Basin Finance Journal, 59, 101240.

- Vo, X. V., & Ellis, C. (2017). An empirical investigation of capital structure and firm value in Vietnam. Finance Research Letters, 22, 90–94.

- Whited, T. M., & Wu, G. (2006). Financial constraints risk. Review of Financial Studies, 19(2), 531–559.

- Whitwell, G. J., Lukas, B. A., & Hill, P. (2007). Stock analysts’ assessments of the shareholder value of intangible assets. Journal of Business Research, 60(1), 84–90.

- Wilner, B. S. (2000). The exploitation of relationships in financial distress: The case of trade credit. Journal of Finance, 55(1), 153–178.

- Yazdanfar, D., & Öhman, P. (2016). The impact of trade credit use on firm profitability: Empirical evidence from Sweden. Journal of Advances in Management Research, 13(2), 116–129.