Abstract

Research and debates around mineral extraction in the context of social-ecological transformation have to date dedicated limited attention to price-making. Drawing on the provisioning systems approach, this article assesses price-making in mineral provisioning as contested processes. We argue that price-making is not an objective or solely technical process taking place on abstract markets but rather it is, first, reflective of power struggles over specific rules and devices between different actors, embedded in social relations, network practices, and institutions and, second, linked to the materialities of commodities and the territorial and organizational forms of their provisioning. Empirically, we analyze the “electric vehicle metals” copper, cobalt, and lithium for which derivative markets are intensifying their role as price-determination institutions linked particularly to the interest of financial actors in getting price exposure. The article criticizes current shifts to benchmark- and derivative markets-based price-determination. This approach focuses on short-term demand and supply considerations without considering local producer-region production specificities, broader economic impacts, and environmental and social costs and risks. Moreover, it fails to address the long-term insecurities related to resource depletion. With financial actors dominating price-determination on derivative markets, prices deviate even from such a narrow fundamental demand and supply perspective, increasing volatility and short-termism. Alternative price-making mechanisms are needed, together with other policies for social-ecological transformation which requires political regulation embedded in democratic decision-making. Methodologically, the article is based on production, trade, and financial data and semi-structured interviews with representatives of price-determination institutions, metal-provisioning systems, and producer countries.

Introduction

Climate change and environmental degradation require a comprehensive social-ecological transformation. This transition involves significant changes in provisioning systems across various sectors, including critically the transport sector (IEA Citation2023). The shift to electro-mobility is portrayed as a central strategy for such a transformation and high hopes are placed on new technologies around batteries for electric vehicles (EVs). This shift has however been criticized for being too narrow as broader mobility changes away from an individual-based, car-dominated, high-carbon transport system are needed (Keil and Steinberger Citation2023). Moreover, the transition to electro-mobility is in itself contradictory as the EV provisioning system depends on hardware and infrastructure that are resource-intensive. The prospective increase in battery production is a key demand driver of metals such as copper, cobalt, and lithium (IEA Citation2023). Financial actors have proclaimed “green mobility” to cause a “commodity super-cycle,”Footnote1 which triggers new extraction projects.

Expanding minerals extraction is problematic from environmental, social, and economic perspectives, ranging from severe environmental and human-rights violations at places of extraction (e.g., Bebbington et al. Citation2018; Prause and Dietz Citation2022) to macroeconomic development challenges related to commodity dependence (e.g., Ocampo Citation2017; van der Ploeg Citation2011). There is also a growing body of literature that focuses explicitly on the problematic impacts of increased mineral extraction due to ongoing “green transitions.” This literature highlights the contradictions behind these transitions as “green extractivism” or “green colonialism” because they recreate uneven development outcomes by externalizing negative environmental, social, and economic consequences of resource extraction linked to “green futures” to the global South (e.g., Dorn Citation2021; Voskoboynik and Andreucci Citation2022).

Research and debates around mineral extraction and social-ecological transformation have however neglected price-making processes for “critical” minerals required for “green technologies.” Price-making in minerals, and other commodities, involves price determination of a “world price” which is used as a benchmark in price-setting in contracts for various purchasing and sales transactions from raw to processed commodities. These price-making processes importantly affect mineral extraction, production, trade, and use of these exhaustible resources. They further influence the distribution of value, costs, and risks among actors engaged in mineral provisioning and co-constitute power and governance structures. This lacuna is particularly problematic as commodity-derivatives markets, particularly the London Metal Exchange (LME), are currently intensifying their role as key price-determination institutions for so-called EV metals. As these derivative markets are becoming more financialized in terms of an increased share of financial actors and financial trading practices by both financial and physical actors, this process links the financial and physical spheres of mineral-provisioning systems in new ways. In particular, rising price volatility and short-termism of trading on these markets amplifies instability and risks of uneven and unsustainable outcomes. Hence, it is crucial to examine price-making processes, exploring how and by whom prices are determined and set, to develop a comprehensive understanding of the broader implications of current “green transitions.”

Drawing on the provisioning systems approach, this article assesses price-making in mineral provisioning as contested processes. Provisioning systems must not be reduced to technical arrangements of production, distribution, and consumption because they are constituted by political, social, and cultural—as well as physical and socio-metabolic—elements (Brand-Correa and Steinberger Citation2017; O’Neill et al. Citation2018). Such an approach also focuses on the processes through which markets are created and sustained and rules and norms constructed, by whom, and whose interests are reflected, thereby countering the tendency to treat (financial) markets as “abstract” and “objective” places (see also Muellerleile Citation2018). In this regard, price-making is not an objective or solely technical process taking place on abstract markets tending toward some equilibrium driven by demand and supply. Rather, we argue, it is, first, reflective of power struggles over specific rules and devices between different actors who are embedded in social relations, network practices, and institutions (Beckert Citation2011) and, second, linked to the materialities of commodities and the territorial and organizational forms of their provisioning.

Empirically, we analyze the provisioning and price-making systems of the EV metals copper, cobalt, and lithium, which are critical resources for electric mobility. We examine current developments around LME and its changing role in price-determination and the struggles between physically-oriented and financial interests (Seddon Citation2020). The article criticizes prevailing shifts to benchmark- and derivative markets-based price determination. Current price determination focuses on narrow demand and supply considerations, and do not examine local producer-region specificities; broader economic, environmental, and social costs and risks; and long-term insecurities related to resource depletion which are paramount for social-ecological transformation. With financial actors dominating the determination of prices on derivative markets, prices deviate even from such a narrow fundamental demand and supply perspective, which increases volatility and short-termism. Alternative price-making mechanisms are needed, ideally through new democratically institutionalized international commodity agreements (ICAs) between producer and consumer countries. This would contribute to politicizing provisioning systems and opening new spheres of democratic decision-making around issues as important as commodity prices.

Methodologically, the article uses production, trade, and financial data, industry studies, and company reports, as well as 96 semi-structured interviews that we carried out between 2021 and 2023. The interviews were conducted with price-determination actors (representatives from LME and price reporting agencies (PRAs) and financial sector and financial market experts); metal-sector actors (representatives from mining companies, commodity-trading firms, industry associations, and industry experts); and producer-country actors (representatives from ministries and other state institutions, sector associations, artisanal mining cooperatives, industry groups, and non-governmental organizations (NGOs)). The interviews focused on actors in the central metal-trading and finance hubs of London and Switzerland (Geneva and Zug cantons), as well as actors in established and emerging producer countries in Africa for copper (Zambia), cobalt (Democratic Republic of Congo (DRC)), and lithium (Zimbabwe).

The article proceeds as follows. The next section discusses our theoretical perspective, and we then provide an overview of price-making in copper, cobalt, and lithium. The fourth section discusses problems of current price-making related to social-ecological transformation and the final section concludes and provides a short outlook on alternative price-making systems.

Provisioning systems, (financial) markets, and price-making

Several different approaches exist for studying provisioning systems. We draw on the social provisioning perspective (SPP) and the system of provision (SoP) approach which are both based in political economy and heterodox economics traditions. Both concepts, and more generally provisioning system approaches, enable a multidimensional perspective on needs satisfaction that goes beyond a reductionist understanding of the economy as composed of market interactions and individual consumption choices (Bärnthaler et al. Citation2022). They stress the collective role of these systems relevant to the provision of goods and services and for understanding “who gets what, how and why” (Bayliss and Fine Citation2020). Provisioning systems focus on a “social and processual-historical account as to how the economy is organised and reproduced” (Jo and Todorova Citation2018, 35), which is an outcome of interactions and struggles between different actors, social groups, and nature. As Bärnthaler et al. (Citation2022) state, SPP tends to be more abstract in scope, offering a particular way of thinking of economies in terms of what is actually there (e.g., Peck Citation2013), while SoP tends to focus on the unique political economy of particular sectors or commodities (e.g., food, water, schools, shelter, health services) (e.g., Bayliss and Fine Citation2020). SoP is particularly useful for understanding “how resource use [and other outcomes] is impacted by a very specific system of provision in each place and time” (Fanning, O’Neill, and Büchs Citation2020, 5).

Three aspects of the provisioning systems approach are particularly important for our analysis. First, provisioning systems integrate social and ecological spheres by intermediating between human well-being and biophysical processes, drawing on social-metabolic and political-economy perspectives (Plank et al. Citation2021; Schaffartzik et al. Citation2021). Second, they combine production, distribution, and consumption and the ways in which they are interrelated and depend on the systems by which goods or services are provided. They therefore encompass production processes from raw materials, where minerals play a crucial role, to all intermediate steps until consumption, its cultural meanings, and “waste” (Fanning, O’Neill, and Büchs Citation2020). Finally, provisioning systems are not abstract or objective but are politically made based on regulations, infrastructures, institutions, technologies, and social and cultural norms. This also refers to a normative dimension and highlights the possibility to re-make provisioning systems and opens them up to political debate and contestation (Brand-Correa and Steinberger Citation2017; Jo and Todorova Citation2018; O’Neill et al. Citation2018).

Prices play a crucial role in the coordination of consumption, distribution, and production processes and they are a key channel of provisioning, with different systems in place to determine and set prices for specific goods and services. Polanyi (Citation1992) stressed that prices and their volatility in market economies are an outcome of particular institutional settings (termed “price-making markets”; Polanyi Citation1992, 36), which do not emerge spontaneously. He, therefore, argued for bringing to the fore the questions of market construction and organization in studies of price formation over a focus on “mere random acts of exchange” (Polanyi Citation1992, 36). This links to Veblen (Citation1909) who saw “price systems” not as abstract demand and supply interactions, but institutions, which serve to organize and coordinate flows of capital and embody interests of powerful groups (Jo Citation2016). Also, political economy and heterodox economics approaches stress the role of institutions in price-making. Classical political economy, post-Keynesianism, and institutional economics see prices as determined in production activities (related to production factors) and through the activities of specific actors and institutions (Jo Citation2016). For instance, post-Keynesian economists such as Kalecki (Citation1971) and Eichner (Citation1976) described prices as cost-based and determined by firms through setting markups over costs, depending on the level of concentration and market power and their institutional environment. Pricing is therefore not a process that takes place on abstract markets, but within the context of production, and also distribution and consumption, of specific goods and services, constructed and organized by political and social forces. Hence, prices are based on contested price-making processes that are reflective of power struggles over specific rules between diverse physical, financial, and state actors, embedded in institutional contexts and the materiality of goods and services (Beckert Citation2011).

These perspectives on prices are also discernible in the provisioning systems literature. Jo (Citation2016, 17) argues that “markets and society in general are administered and planned for the sake of those who control the institutions of the price system.” Linked to this, Bayliss and Fine (Citation2020) state that there are inherent tensions to pricing processes, due to their distributional impacts. As such, the concept of provisioning rejects the mainstream market-price mechanism on the basis that pricing processes serve to organize and control the material basis of provisioning systems and are, therefore, highly contextual. Jo (Citation2016, 12) emphasizes “a theory not derived from the actual provisioning process [should] be rejected.” Hence, studies of price-making should avoid decontextualized generalizations, but rather embrace the particularity of socially constructed power structures within which prices are determined and set in specific provisioning systems.

Less attention has however been paid to the processes, strategies, and practices through which prices are actively “made” and related institutions, infrastructures, and actors. This is important for industrial goods where prices directly related to production costs and market power through markup pricing play a central role, but even more so for commodities, where benchmark-based pricing is dominant. The “world prices” of commodities, which serve as reference prices in various contracts between actors involved in physical transactions from extraction to processing and end use, are seemingly determined through market exchanges by “global” commodity buyers and sellers. These commodity price-making systems are therefore typically described as abstract markets on which prices “are basically determined at each point in time by the intersection of the short-run supply and demand curves” (Radetzki and Wårell Citation2020, 91). Since the 1980s, derivative-commodity exchanges, as financial markets linked to the physical production system, have become the central “price-discovery” institution for commodities. These exchanges are considered the best venues for commodity-price discovery because they efficiently gather and transparently incorporate all available information from multiple actors and locations (Radetzki and Wårell Citation2020; for a critical discussion see Ederer, Heumesser, and Staritz Citation2016 and UNCTAD Citation2011). In the metals industry, price determination via derivative markets is deeply engrained as inevitable. In the words of the Senior Vice President of Market Development at LME, “reference pricing and exchange trading are natural steps in the evolution of a commodities market.”Footnote2

This framing is problematic, as it assumes not only a certain “natural” trajectory of price-making processes, with price-making based on financial markets as the most desirable (“mature”) outcome. Such a narrative bypasses the role of institutions, actors’ interests, and related market power that actively shape these very processes as well as the outcomes of (financial) trading on derivative markets on commodity-price levels and volatilities. There is ample critical literature, also from the provisioning systems perspective, on the financialization of commodity markets, particularly in food sectors, and related outcomes.Footnote3 However, only limited research assesses price-making processes per se in agricultural commodities (Bargawi and Newman Citation2017; Newman Citation2009; Purcell Citation2018; Staritz et al. Citation2018 2022), but with less attention on the institutions and infrastructures behind “world prices” and no focus on mineral sectors.

We argue that price-making does not take place on abstract markets but is, first, based on struggles between different actors and institutions that favor certain standards, devices, and institutions of price-making over others. These price struggles take place at two levels—actors struggle over (money) prices per se that are settled in acts of exchange, but also over the ability to influence how prices are made and controlled in markets or other venues (Polanyi Citation1992). Generally, large, often monopsonistic, physical, and financial actors dominate these processes. Second, price-making is linked to specific materialities of commodities and territorial and organizational forms of their provisioning. Price determination crucially depends on standardization and commodification, aimed at producing an abstract, homogeneous commodity suited to investors’ (speculative) needs (Bernards Citation2021). Such processes enable the creation of a global, single market in which commodities can be traded in standardized abstract form from raw material extraction to processed goods. However, standardization and de-contextualization of commodities depend on the material complexity of specific resources and production systems and have limits (Bernards Citation2021).

We conceptualize price-making as a contested process, with particular attention to the interconnections between price-making institutions and the provisioning systems of specific commodities. This approach considers the materialities of metals, territorial and organizational forms of provisioning, physical actors’ interests, and financial interests aiming to create a single, global market for simplified financial accumulation strategies. Such a single, global (financial) market stands in strong contrast to the material, political, social, and cultural dimensions of specific provisioning systems, and the needs-centered approach of provisioning.

Price-making in EV metals

Establishing commodity prices on a case-by-case basis would be a lengthy and expensive process for actors that deal with physical commodities. For many internationally tradable commodities common quality standards have been agreed on, and, thus, price benchmarks can be determined on a global level for standardized commodities and applied in price-setting practices in physical transactions. “World prices” in these systems are increasingly determined on derivative markets, but price indices by PRAs also play a role and serve as underlying prices for derivative markets. Price-making processes are contested and the outcome of struggles between physically-oriented and financial interests in the context of broader financialization processes. They are also affected by the materiality of specific metals that can create limits to standardization and hence commodification and financialization, and the (changing) territoriality and organizational forms of their provisioning, leading to different power relations.

Derivative markets as dominant price-determination institutions

The world prices of major metals are determined at specific commodity-derivative markets, which are spaces where the financial and physical spheres of commodity markets meet. It is at these markets that commercial or physical actors (miners, international traders, manufacturers) and financial actors (banks, institutional investors, hedge and mutual funds) conduct trade in financial derivatives. Derivatives are contracts, the value for which is linked to an underlying asset and can therefore constitute a right (“options”) or an obligation (“futures”) to purchase or sell a particular commodity at a specified point in time in the future, at a predetermined price. Derivative markets perform two key functions for physical actors: (1) “price discovery” providing global price benchmarks to be used either on spot markets, where metals are traded immediately, or as a reference in physical contracts and (2) hedging against price risks that emerge in physical trade. Through these functions, derivative markets also enable exposure to commodity-price movements for speculative purposes.

Metal-derivative markets are traditionally linked to physical metal trading due to warehouse systems, which ensure that spot prices for metal deliveries from these warehouses are equal to the prices of expiring futures contracts (Adams, Gilbert, and Stobart Citation2019).Footnote4 For this purpose, so-called physically-settled contracts require a standardized materiality which need to be storable, transportable, and substitutable to most users, and this characterization is the case for many base metals such as copper (Radetzki and Wårell Citation2020). However, rates of physical settlement are very low (at LME, less than 5%), since the majority of members use derivative markets not for physical trade, but for price-risk management or speculation (Adams, Gilbert, and Stobart Citation2019). More recently, metal exchanges also introduced cash-settled contracts. These contracts are paid off in cash at their expiration date based on spot-reference prices obtained from PRAs. This allows the expansion of derivative trading to minor metals such as cobalt or lithium which do not fulfill the feasibility conditions due to limited standardization or storability.

There are three major derivative exchanges for metals—LME, Continental Mercantile Exchange (CME) in New York, and Shanghai Futures Exchange (SHFE)—that all emerged primarily around copper trade. The LME has the longest tradition and was established in the context of surging metal imports to the UK in the 1870s and remains the dominant institution for world-price benchmarks of base metals (Seddon Citation2020). In the context of liberalization and deregulation, particularly since the early 2000s, commodity-derivative markets have become financialized, which is understood as the increased presence of nontraditional financial actors using novel financial trading strategies and instruments (van Huellen Citation2020). Financialization has resulted in a stronger correlation of price dynamics in commodities and other financial assets, including stocks and bonds (Kang, Tang, and Wang Citation2023). While there is ongoing debate about the impact of financialization on price levels and volatility, studies indicate that financial trading strategies have accelerated volatility and boom-bust cycles and contributed to a partial detachment from underlying fundamentals (e.g., Cheng and Xiong Citation2014; Gilbert Citation2018; Newman and van Huellen Citation2022). Moreover, financial trading strategies are integrated into the business models of physical actors, such as international traders and mining companies, who engage in financial activities alongside physical trade (Baines and Hager Citation2021; Staritz et al. Citation2018, Citation2022).

Price-making in copper

Copper is the key example of price determination at derivative markets as it is easily standardized and there are a large number of mining, smelting, and refining companies and international traders. Copper is mainly extracted in Chile (26%), Peru (11%), DRC (9%), and China (9%) (Reichl and Schatz Citation2023). There are many mining companies and the largest five (Codelco, BHP, Freeport-McMoRan, Glencore, Southern Copper) collectively held a market share of 35% in 2020.Footnote5 Smelting and refining are primarily operated by large Chinese companies (ICSG Citation2023) and international traders such as Glencore, Trafigura, and IXM manage the global trade of the different copper products among the many actors involved. They usually organize their activities from centralized trading departments located in logistic and finance hubs such as Switzerland (in Geneva and Zug cantons) and London.

Derivative markets became the central price-determination institution for copper worldwide in the 1980s, with the LME Official Settlement Price of futures contracts on copper cathodes (99.99% copper content) being the central benchmark price in physical contracts. Copper futures were introduced at the LME in 1877, quickly gaining global acceptance. Nevertheless, attempts of producer cartelization of global South copper-producing countries occurred after World Wars I and II with the aim of stabilizing prices. Until the 1980s, North American copper relied on an independent pricing system, based on annually fixed producers’ prices. As the sector became more internationalized, copper contracts were introduced at the CME in 1988, focusing on intra-regional trade in North America. With China’s growing dominance, SHFE joined in 1999, primarily for intra-China trade. In 2021, the LME maintained dominance with 70% of global copper derivatives trading volume (LME, CME, SHFE data).Footnote6

The emergence of the LME price as the dominant global benchmark was closely tied to hedging requirements of new transnational companies operating in an increasingly fragmented industry.Footnote7 With a multitude of bilateral transactions, hedging became crucial for traders, smelters, refiners, and other independent actors, particularly for those with risks on both sides of the market.Footnote8 Traders, in particular, have embraced the “agency model,” which includes, among traditional trade services, offering hedging and financial solutions to other physical actors, hence increasingly resembling financial actors. This trend gained traction following the 2008 financial crisis as commercial banks scaled back their involvement in commodity sectors (Perks Citation2016). As a trader explained, “A lot of commodity marketing at the end of the day is different versions of financing, price-risk management, and logistics. So, if you look at like, what do we offer our customers? We manage logistics for them. We manage price-risk management, right? So, we help them hedge…We also finance.”Footnote9

Mining companies, driven by shareholder preferences, are the physical actors least likely to use hedging. As stated by a PRA data analyst, “The bigger you go, there’s definitely a very, very limited interest in hedging. So, if you buy BHP or Rio Tinto, they’re not hedging anything.”Footnote10 A copper-market consultant further elaborated, “Mining companies have a checkered history [with hedging], they have in the past hedged, but because they have not kept control over their hedging practices it has often ended as massive speculative activity.”Footnote11 However, even actors who do not hedge rely on LME benchmarks. Across the industry, using LME copper benchmarks has become the standard practice for conducting business with major players.Footnote12 As a copper trader explained, “So when we produce, we have mines in Chile, we have mines in the DRC, we have production that we have exposure to something in Zambia for example…So, the common benchmark for everybody is the LME price.”Footnote13

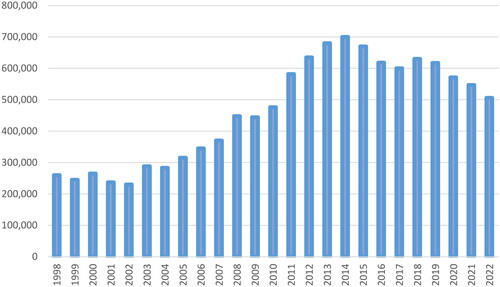

As the pivotal venue for copper-price determination, restructuring and struggles at the LME influence price-making. The LME historically had a strong physical trade orientation, which is still reflected in the exchange’s infrastructure today (e.g., daily contract-expiration dates instead of more standardized contracts, open-outcry instead of electronic trading, physically-settled instead of cash-settled futures) (Seddon Citation2020). This orientation has been contested by financial actors since the 1980s and changes in the UK regulatory frameworks and competition from more “financial investor friendly” exchanges accelerated this shift. As Seddon (Citation2020) shows, the ratio of LME trading volumes to world refined copper production jumped from 40 in 1982 to 1750 in 1993.Footnote14 Financial actors outnumbered industrial actors as LME members as early as 1990s, a process that was advanced by the exchange’s increasingly financialized infrastructure after the 2001 demutualization (separation of ownership and trading rights) and the 2011 sale of LME holdings to the Hong Kong Exchange and Clearing (HKEX) (Seddon Citation2020). Between the late 1990s and mid-2015, the average daily trading volume per year increased from around 200,000 contracts to 700,000 contracts, but declined thereafter to 500,000 lots in 2022, related to the COVID-19 crisis (). As a copper trader explained, “[the] volume of physical copper is absolutely minimal compared to the volumes traded on the LME…So there I think we’ve seen a drastic change in the key players of the market and the proportions that they occupy in that space.”Footnote15 The importance of speculators at the LME is evident in the publicly available Commitments of Traders Report (COTR), which shows the open interest that is total number of futures contracts held by different derivatives-market participants at a point in time. In copper futures, financial actors hold the majority of open positions, comprising 70% of long positions (buying futures) and 59% of short positions (selling futures) in April 2022.Footnote16

Figure 1. LME average daily trading volume (in number of lots).

Source: HKEX Investor Presentation (2016) and HKEX Annual reports 2016 to 2022.

The LME copper price is directly used in bilateral contracts between miners, smelters, refiners, end-users, and traders.Footnote17 Even though most contracts are long-term, prices are flexible and typically set as the monthly average of daily LME official settlement prices. Hence, LME prices are transmitted to all actors who extract, process, trade, or use copper as inputs. They are also used by the governments of producer countries as the basis to calculate taxes from extractive industries (Musselli Citation2019).Footnote18 In other words, these prices determine essential parts of revenues and costs for these actors and impact the distribution of value, costs, and risks.

Price-making in cobalt and lithium

Cobalt and lithium, as minor metals with specialized uses, had a mine production of 134.5 thousand metric tonnes and 232.5 thousand metric tonnes, respectively, much less than copper’s 21 million metric tonnes in 2021 (Reichl and Schatz Citation2023). The DRC is the leading producer of cobalt (69% of global supply in 2021) (Reichl and Schatz Citation2023), of which 18 to 30% comes from artisanal and small-scale mining (ASM) (World Bank Citation2020). Almost 90% of lithium comes from just three countries in 2021—Australia, Chile, and China (Reichl and Schatz Citation2023). However, new extractive frontiers are opening for cobalt (particularly in Indonesia) and over 100 new lithium-extractive projects were announced or already developed in 2022 (Fitch Solutions Citation2022).

Cobalt concentrate can be processed in two ways—with cobalt metal used in superalloys and other metallurgical applications (20% of total refined cobalt volume) and with cobalt hydroxide, oxide, and sulfate used for batteries, catalysts, and paint (80% of total refined cobalt volume) (Darton Commodities Citation2021). Lithium is processed into two forms: carbonate (extracted largely from brines, primarily in South America) and hydroxide (commonly extracted from hard rock from, for example, Australia and Zimbabwe). Both provisioning systems are currently dominated by a few large, often vertically integrated actors. In cobalt, Glencore, Eurasian Resources Group, and China Molybdenum were the largest producers in 2020 (Darton Commodities Citation2021). In lithium, the Latin American big four producers (Albemarle, Livent, Tianqi Lithium, and SQM), along with Australian companies, play a key role.Footnote19 In both metals, Chinese companies have a growing presence, controlling 35% of global mine supply of cobalt and 70% of global refined cobalt output in 2020 (Darton Commodities Citation2021), and 60% of lithium refining (LaRocca Citation2020).

While international traders play a central role in cobalt (as some are also miners),Footnote20 they had a small role in lithium (outside of China) but this is changing. As a PRA data analyst explained for lithium, “[i]t’s probably rapidly changing right now, but everything’s been done on a very long-term basis…So there hasn’t really been a lot of room for traders to play that sort of classic role.”Footnote21 Generally, market structures are changing linked to the demand shift to lithium-ion batteries that today account for around 60% of lithium and 30% of cobalt demand (IEA Citation2023). Thus, new EV-related actors enter both markets—battery producers (e.g., CATL, LG Energy Solutions) and automakers (e.g., BMW, General Motors)—completing long-term off-take agreements and investing in mining and refining to secure volumes given the tight supply.Footnote22 In this context, more traders aim to enter both sectors. These developments challenge existing power balances, generally moving power away from producers to end-users, which affects price-making.Footnote23

Historically, in both metals leading producers determined prices. In cobalt, the state-owned company Gécamines in DRC determined the cobalt price as a producer price in the 1970s. Liberalization of the mining sector and privatization of Gécamines led to the entry of more private mining companies since the late 1990s in DRC, which used primarily long-term supply contracts, but with annual “market prices” (Campbell Citation2020). Before 2021, the majority of lithium transactions were conducted on fixed prices determined by leading producers (e.g., SQM, Albemarle).Footnote24 However, the demand surge for lithium in 2017 and 2018 due to the growing market for EVs led to the emergence of spot markets which allow for high margins from selling lithium outside of long-term contracts with fixed prices.

In both cases, these changes resulted in more frequent transactions and a need for price indicators as benchmarks in contracts, creating opportunities for the entry of PRAs. Numerous PRAs exist in metal markets and price assessments are reported for different frequencies (spot, weekly, monthly) and published for subscribing customers (Johnson Citation2018). While the cobalt metal-price index of the PRA Metal Bulletin (now Fastmarkets) became the global benchmark in the early 2000s,Footnote25 there is not a single dominant PRA index for lithium yet, as this process started only recently.Footnote26 PRAs employ a “journalistic price-determination” method, editing price information polled from different types of industry actors based on their physical transactions as well as from financial actors and secondary sources (Adams, Gilbert, and Stobart Citation2019).

Some industry actors are critical of the power certain physical actors have in providing primary data, especially in markets dominated by few large physical actors. A cobalt trader stated, “[PRAs] are very much dependent on what these players are reporting back to them in terms of actual transactions that have been concluded, and where people are making offers and bids” and further added “there are players who have certain interests in the market and at some point, have an interest to see prices moving up, have an interest to see prices moving down. So sometimes the feedback provided is a bit colored to reflect that.”Footnote27 But besides physical actors, financial actors also have a role as a PRA data analyst outlined, “[Some PRAs] are collecting prices only from trading companies, or people like financial institutions [that] are not using those products [metals] as products.”Footnote28 The interviewee specifically remarked that traders “don’t care about what grade the lithium is, or what grade the cobalt is, they want to make money on buying it low and selling it high.” But also, PRA data analysts have agency in price determination as they subjectively interpret primary data in the context of their own methodologies. Hence, while PRAs state their aim as providing transparency on markets and acting as a “mirror to the trade,” they do not just “mirror” trade, but actively influence its image (Fattouh Citation2011).

Derivative markets appeared not to be a suitable institution for price determination after the break-up of the producer-price regimes in cobalt and lithium. Volumes in cobalt and lithium are small, with a few large companies still dominating extraction and processing that have limited hedging needs and both metals do not allow for easy standardization due to different intermediate and end products. Moreover, refined lithium is not easily storable.Footnote29 The LME nevertheless introduced physically-settled futures for cobalt in 2010, which was not successful as the underlying cobalt metal lost its relevance in comparison to cobalt chemicals used in batteries and as the low liquidity was not considered to be reflective of the market by its users.Footnote30 Further, the LME could not guarantee that the delivery of cobalt from its warehouses was free of child labor from ASM in DRC (Bernards Citation2021). The strong interests of financial actors in gaining exposure to the price movements of EV metals, as well as the interest of LME and other exchanges in boosting trading volumes, contributed to the establishment of lithium-futures contracts.Footnote31 As one commentator explained for lithium, “a lot of people today, if they are expressing a bullish view on growth of the lithium market, they have to buy, for example, Albemarle shares…But if they can buy lithium futures themselves, that would be a more direct way of expressing that view.”Footnote32

The LME introduced cash-settled futures contracts for cobalt in 2019 and for lithium in 2021. Cash-settled futures are favored by financial actors who do not take delivery or sell physical metal.Footnote33 The objectives behind the new contracts were to attract greater liquidity and establish a venue for price-risk management and speculation. Yet, neither physical nor financial actors have taken up the new LME contracts. This outcome was initially related to the limited hedging interests of major vertically integrated physical actors who had considerable power through producer prices and now in the PRA pricing process. This is, however, changing with new actors entering (battery producers, automakers, international traders) that have a greater interest in hedging.Footnote34 These actors, in addition to financial actors, actually started trading the CME’s cash-settled contracts in 2022 (Spilker Citation2022). This is linked primarily to the simplified, financial actor-friendly trading structure compared to LME contracts, which attracts speculative investors and so supports liquidity.Footnote35 But also, traditional physical actors see derivative markets increasingly as a necessity in the context of increasing market instability and the demands by banks and other financiers for financial hedging. As one commentator said about established lithium producers, “[t]hey can’t raise any capital. They can’t convince their bankers that there is any certainty over the future price because there is no futures market. Then they come back running [to the LME].”Footnote36

Cobalt and lithium illustrate the contestation around the establishment of commodity-derivative markets. In the case of cobalt, cobalt became the underlying metal for futures contracts due to its importance for European metal, cement, and ceramic industries and the influence of dominant physical actors. However, this choice is no longer consistent with growing demand for cobalt chemicals in the EV industry.Footnote37 For lithium, the selection of PRA pricing was a contentious matter. The PRA Fastmarkets was chosen despite the fact that it was not the market leader at that time. The decision was based on Fastmarkets’ methodology, size, experience, previous relationship with other cash-settled futures such as cobalt, and, likely also its willingness to provide a weekly price. Increasing the frequency of pricing allows for a closer reflection of movements in the emerging spot market and was favored by shareholders of lithium-producing companies who demanded variable and short-term price-setting in contracts in order to be exposed to lithium-price movements. But this reporting frequency did not reflect the lithium market at that time (2021) as it would go through periods of low liquidity, as stated by a PRA data analyst “[t]hat’s just not how the [lithium] market works. These are not yet liquid spot markets…There were days and probably weeks when things just wouldn’t trade. So where is that number coming from?”Footnote38

Cobalt and lithium are mainly traded in long-term contacts (70–80% of total trade), but now increasingly with flexible prices based on PRA benchmarks. The expanded use of benchmarks in contracts and state regulations means that dynamics within price-determination processes are transmitted to actors and locations involved in cobalt and lithium extraction and processing.Footnote39 Successful establishment of futures markets would not change the use of PRA benchmarks in physical trade but would add price-risk management and speculation possibilities for physical and financial actors. This situation could feedback into PRA price determination, as seen for instance in the Brent oil market in which the futures contracts became the major source of price determination by PRAs (Fattouh Citation2011; Liu, Schultz, and Swieringa Citation2015). Financialization dynamics on futures markets could therefore directly influence PRA prices and impact price dynamics in physical trade.

Summary

As summarized in , while the LME is the dominant price-determination institution in copper, PRA pricing remains predominant in cobalt and lithium. Crucially, the materiality of metals, technology, and dominant physical actor interests’ matter. Copper’s physical properties make it conducive for physically-settled futures and multiple processing steps and actors involved create exposure to price risks, and therefore, a need for price-risk management. Physical actors, however, also pursue speculative strategies as they enable profits beyond physical transactions. In contrast, cobalt and lithium present challenges in standardization and they have only recently emerged as globally traded commodities. Price-making processes for both materials have evolved from fixed producer pricing to PRA benchmarks, which represent the interests of major physical actors to benefit from short-term price hikes. The recently created derivative markets, linked to financial actors and LME’s interests, are not yet broadly used. Physical actors’ interests are crucial in actually enabling such contracts to work, as they bring liquidity and a link to physical provisioning. Hedging needs, together with speculative activities, may however increase with new physical actors, and established actors might seek price-risk management due to increased instability.

Table 1. Price-making in copper, cobalt, and lithium-provisioning system.

Established price-determination institutions like the LME have undergone significant changes due to struggles between more physically-oriented and financial interests. Although LME maintains its links to physical metals trade, it has become more financialized and characterized by the dominance of financial actors in trading as indicated by open interest data, which has been supported by the introduction of cash-settled futures and the increasing importance of electronic trading. Moreover, sector participants, especially traders, also emphasize that speculative strategies are increasingly pursued by physical actors.Footnote40 As one copper trader stated, “So we trade a lot of these on a financial basis, because essentially, if you just try to trade physical copper cathode on the stand-alone basis it’s very, very difficult to make money.”Footnote41 The cooperation between LME and PRAs allows for cash-settled futures in which the latter provide benchmarks through journalistic price-determination methods. This shift fundamentally alters the price-determination principle at LME and enables the inclusion of a broader range of metals. Also, PRAs are not protected from financial interests as their methodologies incorporate financial data and opinions not only from dominant physical actors, but also from financial actors. Finally, the increased frequency of price reporting was initially specific to the interest of financial actors.

Despite the different levels of relevance of derivative markets for the three metals, for all of them, there has been generally a shift toward the use of benchmarks and a tendency toward variable and more short-term pricing strategies, even if contracts remain long term. This transmits short-term fluctuations of “world prices” determined at LME or though PRAs more strongly to actors and locations engaged in extraction and processing.

Problems of benchmark- and exchange-based price-making

Price-making has important distributional outcomes, as different price-determination institutions, benchmarks, and price-setting practices affect diverse actors and locations in varied ways. The shift to benchmark- and exchange-based price determination raises concerns, both generally and specifically for social-ecological transformation.

First, recent changes in price-making increase volatility through a higher frequency of transactions and price-setting, also driven by the availability of recurrent and shorter-term price benchmarks (bi-weekly, weekly, daily). These price dynamics are increasingly transmitted to all parts of mineral-provisioning systems. While some actors favor exposure to shorter-term price volatility (shareholders of mining companies, international traders, and financial actors) due to new profit opportunities through physical and financial transactions, other actors face higher exposure to price fluctuations with constrained ability to manage price risks. In particular, actors in producer countries such as local mining companies and ASM often have limited access to and capabilities for any form of price-risk management. This situation includes governments facing large variations in tax and royalty incomes. Further, extraction, processing, and consumption decisions are more likely to be driven by volatile price and profit considerations. This, in turn, may lead to unsustainable and speculative extractive investment and production decisions, accelerating boom-bust cycles.

Second, benchmark-based price determination at LME and through PRAs (as well as earlier producer-based price determination for cobalt and lithium) revolves around short-term demand and supply considerations, neglecting broader economic, social, and environmental costs and long-term insecurities related to resource depletion, all of which are paramount for social-ecological transformation. These costs are largely externalized in derivative markets and in PRA assessments. A more comprehensive approach would require metal prices to be based on extraction and production activities and incorporate all societal externalities, including social and environmental costs linked to extraction. Moreover, derivative market-based and PRA price determination provide no price mechanisms that deal with long-term insecurity, especially scarcity and depletion of nonrenewable resources, which is crucial in the context of climate change and environmental degradation.

Third, benchmark prices fail to account for actual local cost structures and local extractive and production activities, making it difficult to consider LME prices as standardized. While LME defines a particular product characteristic, it disregards the specific standards of production and, thereby, the complexity and reality of local provisioning systems. This practice also has problematic implications for adopting socially and environmentally sustainable standards, which may (and should) increase costs of local production. As these standards, together with local differences, are not priced in the benchmark created on international markets, they generate competitive disadvantages. Clearly, competition also exists without a price benchmark, but with benchmark-price negotiations it is reduced to discounts and premia. This can be a rather narrow range, given that production costs can rapidly change due to technological, natural, environmental, and social factors and dominant actors tend to influence these price components in their favor.

Fourth, the increasing influence of financial actors and trading strategies, also among physical actors, weakened the links between metal prices and underlying fundamentals, which may accelerate volatility and boom-bust cycles. This situation is evident in derivative markets, where institutional changes as shown for LME financialized these markets (Chen, Zhu, and Zhong Citation2019). Some physical actors expressed concerns about price determination being heavily influenced by “modern speculators,” such as high-frequency traders, and that metal-price dynamics have become increasingly interlinked with other assets as “the speculative part of pricing and volume in copper has increased dramatically over last 10–15 years; that’s why you can see moves in copper such as a sudden increase or fall US$300 per ton in a day with absolutely no change in physical supply and demand—it’s probably a black box algorithm.”Footnote42 Also, a PRA data analyst explained, “Copper is highly financialized, it’s not always trading on direct physical market fundamentals, but it trades on factors which ultimately will impact fundamentals.”Footnote43 Consequently, prices may not accurately reflect demand and supply conditions in specific metal markets (Cheng and Xiong Citation2014; Gilbert Citation2018; Newman and van Huellen Citation2022) and therefore even fail to reflect a narrow perspective on fundamentals. Related to this, the promotion of derivative markets as institutions to address price risks becomes problematic, given that these very institutions may accelerate price risks. Financialization is not as pronounced for PRAs, but financial data and the views of financial actors can also play an important role in their methodologies. Further, PRAs enable and benefit from the creation of cash-settled futures, which are favored by financial actors and might lead to price determination dominated by derivative markets.

Finally, the key price-determination institutions (exchanges, PRAs) lack transparency and are closely tied to powerful interests. More generally, they lack democratic legitimacy. Although commodity exchanges are presented as open marketplaces, there are high entry barriers (know-how, technology, access to finance, costs) which have increased due to the prevalence of sophisticated trading strategies (e.g., algorithmic and high-frequency trading). The exchanges are dominated by a small number of actors who transitioned from being physically-based to increasingly pursuing more complex financial activities. Similarly, PRAs present themselves as passive actors, but they hold significant power through their methodologies and reliance on the views of dominant industry actors for price reporting. More generally, price-making in metal markets is frequently discussed in relation to the concept of “maturity.” Mature markets (such as copper) are considered to be those with dominant global benchmarks, standardized contracts, and liquid futures, while immaturity is linked to greater discretion of physical actors, benchmarks not being (fully) adopted in contracts, or undeveloped derivative markets (cobalt and lithium). As shown in the discussion above, this framing overlooks the role of institutions, actors, and interests in shaping these price-makin processes and rejects the assumption of a “natural” trajectory of market maturity.

Conclusion

This article makes two broad arguments. First, understanding existing price-making processes for EV metals is crucial to inform academic and policy debates on mineral extraction and related distributional outcomes linked to social-ecological transformation. Second, price-making is a contested process and current shifts to benchmark- and exchange-based price determination are problematic given their narrow focus on short-term demand and supply considerations and a shift away from fundamentals that moves toward increased volatility and short-termism in the context of financialization processes. Consequently, a social-ecological transformation requires alternative price-making mechanisms that consider broader economic, social, and environmental costs and risks and longer-term insecurity related to resource depletion.

As the previous section outlined, current price-making systems, and financial markets more generally, are not suitable to pricing minerals in a sustainable manner. Re-regulation of derivative markets is crucial to reduce financialization and align prices and trading with fundamentals. However, this is not enough, as these markets have intrinsic limitations in determining commodity prices. They fail to adequately reflect longer-term and insecure factors and are dominated by certain actors. PRAs also possess intrinsic limitations given their journalistic methodologies based on the views of powerful physical, and potentially also financial, actors. Furthermore, these institutions do not internalize social and environmental costs, which is even more problematic if these externalities are of long-term and insecure nature—just as costs related to environmental degradation and resource depletion. Addressing these challenges necessitates alternative price-determination mechanisms. These arrangements require the involvement of states, ideally through new democratically institutionalized ICAs between producer and consumer countries. This would contribute to politicizing price-making and provisioning systems more generally and opening new spheres of democratic decision-making.

Historically, ICAs were used in several commodity sectors, and they could be brought back as sustainable ICAs. As ICAs included already by design an element on “sustainable pricing,” including considerations on balanced extraction into the determination of a price range is thus not beyond conception. Gilbert (Citation1997, 2) notes that the boom of ICAs in the 1970s was not only related to resource sovereignty after decolonization but was also accompanied by discussions on sustainable resource use linked to scenarios developed by the Club of Rome on the increasing scarcity of nonrenewable resources. However, actual ICAs focused primarily on price stabilization or increases and did not target a strong reduction of commodity extraction and consumption. Historical experiences with ICAs also demonstrated difficulties in achieving collective decision-making, both between and among producer and consumer countries. Further, ICAs do not guarantee a fair distribution and participation within producer countries.

Sustainable ICAs would therefore need to be democratically legitimated and in a broader way representative of all stakeholders. Apart from economic (distributional) aspects and social and environmental concerns, questions of inclusion, representation, and democracy, as well as recognition of diverse ways of living, are important. Currently, the decision-making processes around commodity price-making and resource politics more generally are largely exclusive. The sustainable use of natural resources demands the inclusion of potentially affected people and the control over decision-making power and problem-solving (Pichler et al. Citation2016). Failure to include these aspects could undermine the objectives of a social-ecological transformation, rendering “green technologies” inadequate in achieving justice and sustainability. It is, however, also evident that alternative price-making systems require supportive policies such as public agencies that can potentially store physical commodities and stabilization of exchange rates, which was the context of the ICAs in the postwar period. In parallel, other policies are needed such as taxes on polluting activities, direct regulation of extraction levels, and mandatory social and environmental standards in extraction and production.

These are clearly complex issues as they address several policy areas and key justice questions concerning the use and distribution of exhaustible resources between different actors, scales (local, regional, national, global), countries/regions (global North versus global South, producer versus consumer countries) and generations. Determining how exhaustible resources are distributed and priced requires discussions about democratic processes to address global issues and rectify existing power asymmetries. Although initiating such debates may currently appear politically challenging, they remain essential. As this article shows, the current mechanisms for price-making of EV metals through benchmarks and derivative markets are inadequate for addressing these critical concerns around social-ecological transformation.

Acknowledgements

We wish to thank all interview partners who took the time to discuss with us developments and problems around price-making in copper, cobalt, and lithium. Without their time and insights, this work would not have been possible. Financial support from the Jubilee Grant 18313 of the Austrian National Bank is gratefully acknowledged. We also thank Luisa Leisenheimer for great research support and the special issue editors Richard Bärnthaler and Andreas Novy and three anonymous reviewers for very useful comments on an earlier version of the article.

Disclosure statement

No potential conflict of interest was reported by the authors.

Additional information

Funding

Notes

3 For an overview, refer to, for example, Bayliss and Fine (Citation2020).

4 For instance, at LME, futures contracts are settled through delivery into a worldwide network of warehouses chosen by the seller. In this process, the buyer does not get matched with a particular seller but receives a warrant. This warrant can be easily exchanged for cash when required (Adams, Gilbert, and Stobart Citation2019).

6 See for LME data https://www.lme.com/en/Market-data/Reports-and-data/Commitments-of-traders/Copper, for CME data https://www.cmegroup.com/tools-information/quikstrike/commitment-of-traders-agricultural.html, and for SHFE data https://www.shfe.com.cn/eng/reports/statistical/monthly/?paramid=monthstat

7 Hedging is the process of removing the risk of price movements in physical commodity transactions by entering into offsetting financial transactions on derivatives markets and thereby locking in a future price in the derivatives market.

8 Interview with copper market consultant, UK (London), November 25, 2021.

9 Interview (online) with copper trader (1), Switzerland (Zug canton), December 10, 2021.

10 Interview (online) with data analyst at PRA (2), UK (London), December 7, 2021.

11 Interview with copper-market consultant, UK (London), November 26, 2021.

12 Interview with representative of mining-industry association, Zambia (Lusaka), June 13, 2022.

13 Interview (online) with copper trader (1), Switzerland (Zug canton), December 10, 2021.

14 The LME publishes only limited data free of charge. Fee-based historical data are not available before 2000. The historical data in Seddon (Citation2020) were obtained through personal access to internal rather than publicly available LME documents.

15 Interview (online) with copper trader (5), Switzerland (Geneva canton), December 6, 2021.

16 Authors’ calculations based on LME data.

17 Interviews with copper traders (2 and 3) (online), Switzerland (Geneva canton), December 7, 2021; copper mine and smelter representative, Zambia (Kitwe), June 21, 2022; mine manager, DRC (Lubumbashi), May 8, 2022.

18 Interviews with provincial office of state agency, DRC (Lubumbashi), May 5, 2022 and representatives of state agency, Zambia (Lusaka), June 15, 2022.

20 Interview with civil society industry expert, DRC (Lubumbashi), May 23, 2022.

21 Interview with data analyst at PRA (3), UK (London), November 22, 2021.

22 Interviews with data analyst at PRA (3), UK (London), November 22, 2021 and cobalt trader (2) (online), UK (London), November 25, 2021.

23 Interviews with financial institution manager, UK (London), November 23, 2021 and financial institution director, UK (London), November 22, 2021.

24 Interview (online) with partner in lithium business consulting firm, Chile (Santiago), December 10, 2021.

25 Interviews with cobalt trader (1), UK (London), November 23, 2021 and mine manager, DRC (Lubumbashi), May 8, 2022.

26 Interview with senior data officer at PRA (1), UK (London), November 23, 2021.

27 Interview with cobalt trader (2) (online), UK (London), November 25, 2021.

28 Interview with senior data officer at PRA (1), UK (London), November 23, 2021.

29 Interview with financial institution manager, UK (London), November 23, 2021.

30 Interviews with cobalt trader (1), 23.11.2021, UK (London), November 23, 2021 and cobalt trader (2) (online), UK (London), November 25, 2021.

31 Interview with senior data officer at PRA (1), UK (London), November 23, 2021.

32 Interview with financial institution director, UK (London), November 22, 2021.

33 Interview with financial institution manager, UK (London), November 23, 2021.

34 Interview (online) with partner in lithium business consulting firm, Chile (Santiago), December 10, 2021 and data analyst at PRA (3), UK (London), November 22, 2021.

35 Interviews with financial institution manager, UK (London), November 23, 2021; cobalt trader (2), (online), UK (London), November 25, 2021 and copper-market consultant, UK (London), November 25, 2021.

36 Interview with financial institution director, UK (London), November 22, 2021.

37 Interview with cobalt trader (1), UK (London), November 23, 2021.

38 Interview with senior data officer at PRA (1), UK (London), November 23, 2021.

39 Interview with representative of provincial office of state agency, DRC (Lubumbashi), May 28, 2021.

40 Interviews with financial institution manager, UK (London), November 23, 2021 and copper trader (4) (online), Switzerland (Geneva canton), December 8, 2021.

41 Interview (online) with copper trader (4), Switzerland (Geneva canton), December 8, 2021.

42 Interview (online) with copper trader (5), Switzerland (Zug canton), December 6, 2021.

43 Interview (online) with data analyst at PRA (2), UK (London), December 7, 2021.

References

- Adams, R., C. Gilbert, and C. Stobart. 2019. Modern Management in the Global Mining Industry. Bingley: Emerald Publishing.

- Baines, J., and S. Hager. 2021. “Commodity Traders in a Storm: Financialization, Corporate Power and Ecological Crisis.” Review of International Political Economy 29 (4): 1–17. doi:10.1080/09692290.2021.1872039.

- Bargawi, H., and S. Newman. 2017. “From Futures Markets to the Farm Gate: A Study of Price Formation along Tanzania’s Coffee Commodity Chain.” Economic Geography 93 (2): 162–184. doi:10.1080/00130095.2016.1204894.

- Bärnthaler, R., M. Haderer, A. Novy, and C. Schneider. 2022. Shaping Provisioning Systems for an Eco-Social Transformation. Vienna: International Karl Polanyi Society. https://www.karlpolanyisociety.com/wp-content/uploads/2023/01/Polanyi-Paper-003_2022-B%C3%A4rnthaler-et-al_Provisioning.pdf

- Bayliss, K., and B. Fine. 2020. “A Guide to the Systems of Provision Approach.” In A Guide to the Systems of Provision Approach: Who Gets What, How and Why, edited by K. Bayliss and B. Fine, 1–28. London: Palgrave Macmillan. doi:10.1007/978-3-030-54143-9_1.

- Bebbington, A., A.-G. Abdulai, D. Humphreys Bebbington, M. Hinfelaar, and C. Sanborn. 2018. Governing Extractive Industries: Politics, Histories, Ideas. Oxford: Oxford University Press.

- Beckert, J. 2011. “Where Do Prices Come from? Sociological Approaches to Price Formation.” Socio-Economic Review 9 (4): 757–786. doi:10.1093/ser/mwr012.

- Bernards, N. 2021. “Child Labour, Cobalt and the London Metal Exchange: Fetish, Fixing and the Limits of Financialization.” Economy and Society 50 (4): 542–564. doi:10.1080/03085147.2021.1899659.

- Brand-Correa, L., and J. Steinberger. 2017. “A Framework for Decoupling Human Need Satisfaction from Energy Use.” Ecological Economics 141: 43–52. doi:10.1016/j.ecolecon.2017.05.019.

- Campbell, G. 2020. “The Cobalt Market Revisited.” Mineral Economics 33 (1-2): 21–28. doi:10.1007/s13563-019-00173-8.

- Chen, J., X. Zhu, and M. Zhong. 2019. “Nonlinear Effects of Financial Factors on Fluctuations in Nonferrous Metals Prices: A Markov-Switching VAR Analysis.” Resources Policy 61: 489–500. doi:10.1016/j.resourpol.2018.04.015.

- Cheng, I.-H., and W. Xiong. 2014. “Financialization of Commodity Markets.” Annual Review of Financial Economics 6 (1): 419–441. doi:10.1146/annurev-financial-110613-034432.

- Darton Commodities. 2021. Cobalt Market Review 2020–2021. Guildford: Darton Commodities.

- Dorn, F. 2021. Der Lithium-Rush: Sozial-ökologische Konflikte um einen strategischen Rohstoff in Argentinien (The Lithium Rush: Socio-Ecological Conflicts Over a Strategic Raw Material in Argentina). Munich: Oekom Verlag.

- Ederer, S., C. Heumesser, and C. Staritz. 2016. “Financialization and Commodity Prices: An Empirical Analysis for Coffee, Cotton, Wheat and Oil.” International Review of Applied Economics 30 (4): 462–487. doi:10.1080/02692171.2015.1122745.

- Eichner, A. 1976. The Megacorp and Oligopoly. Baltimore, MD: Johns Hopkins University Press.

- Fanning, A., D. O’Neill, and M. Büchs. 2020. “Provisioning Systems for a Good Life within Planetary Boundaries.” Global Environmental Change 64: 102135. doi:10.1016/j.gloenvcha.2020.102135.

- Fattouh, B. 2011. An Anatomy of the Crude Oil Pricing System. Oxford: Oxford Institute for Energy Studies. https://www.oxfordenergy.org/wpcms/wp-content/uploads/2011/03/WPM40-AnAnatomyoftheCrudeOilPricingSystem-BassamFattouh-2011.pdf

- Fitch Solutions. 2022. “Lithium Global Competitive Landscape and New Project Pipeline.” Fitch Solutions, August 8. https://bit.ly/3sUobah

- Gilbert, C. 2018. “Investor Sentiment and Market Fundamentals: The Impact of Index Investment on Energy and Metals Markets.” Mineral Economics 31 (1–2): 87–102. doi:10.1007/s13563-017-0135-6.

- Gilbert, C. 1997. Manipulation of Metals Futures: Lessons from Sumitomo. London: Centre for Economic Policy Research. https://cepr.org/publications/dp1537

- International Copper Study Group (ICSG). 2023. World Copper Factbook 2022. Lisbon: ICSG. https://icsg.org/copper-factbook/

- International Energy Agency (IEA). 2023. Global EV Outlook 2023. Paris: IEA. https://www.iea.org/reports/global-ev-outlook-2023

- Jo, T.-H. 2016. “What If There Are No Conventional Price Mechanisms?” Journal of Economic Issues 50 (2): 327–344. doi:10.1080/00213624.2016.1176474.

- Johnson, O. 2018. The Price Reporters: A Guide to PRAs and Commodity Benchmarks. London: Routledge.

- Jo, T.-H., and Z. Todorova. 2018. “Social Provisioning Process: A Heterodox View of the Economy.” In The Routledge Handbook of Heterodox Economics, edited by T.-H. Jo, L. Chester and C. D’Ippoliti, 29–40. London: Routledge. https://corescholar.libraries.wright.edu/econ/302.

- Kalecki, M. 1971. “Costs and Prices.” In Selected Essays on the Dynamics of the Capitalist Economy, edited by M. Kalecki, 43–62. Cambridge: Cambridge University Press.

- Kang, W., K. Tang, and N. Wang. 2023. “Financialization of Commodity Markets Ten Years Later.” Journal of Commodity Markets 30: 100313. doi:10.1016/j.jcomm.2023.100313.

- Keil, A., and J. Steinberger. 2023. “Cars, Capitalism and Ecological Crises: Understanding Systemic Barriers to a Sustainability Transition in the German Car Industry.” New Political Economy 29 (1): 90–110. doi:10.1080/13563467.2023.2223132.

- LaRocca, G. 2020. Global Value Chains: Lithium in Lithium-ion Batteries for Electric Vehicles. Washington, DC: Office of Industries of the United States International Trade Commission. https://www.usitc.gov/publications/332/working_papers/no_id_069_gvc_lithium-ion_batteries_electric_vehicles_final_compliant.pdf

- Liu, W., E. Schultz, and J. Swieringa. 2015. “Price Dynamics in Global Crude Oil Markets.” Journal of Futures Markets 35 (2): 148–162. doi:10.1002/fut.21658.

- Muellerleile, C. 2018. “Calming Speculative Traffic: An Infrastructural Theory of Financial Markets.” Economic Geography 94 (3): 279–298. doi:10.1080/00130095.2017.1307100.

- Musselli, I. 2019. Curbing Commodity Trade Mispricing: Simplified Methods in Host Countries. Bern: Centre for Development and Environment, University of Bern. https://core.ac.uk/reader/227727990

- Newman, S. 2009. “Financialization and Changes in the Social Relations along Commodity Chains: The Case of Coffee.” Review of Radical Political Economics 41 (4): 539–559. doi:10.1177/0486613409341454.

- Newman, S., and S. van Huellen. 2022. Understanding Commodity Markets to Effectively Address Price Increases and Volatility in a Post-COVID-19 World. Vienna: Austrian Research Foundation for International Development.

- O’Neill, D., A. Fanning, W. Lamb, and J. Steinberger. 2018. “A Good Life for All within Planetary Boundaries.” Nature Sustainability 1 (2): 88–95. doi:10.1038/s41893-018-0021-4.

- Ocampo, J. 2017. “Commodity-Led Development in Latin America.” In Alternative Pathways to Sustainable Development: Lessons from Latin America, edited by G. Carbonnier, H. Campodónico, and S. Vázquez, 51–76. Leiden: Brill Nijhoff.

- Peck, J. 2013. “For Polanyian Economic Geographies.” Environment and Planning A: Economy and Space 45 (7): 1545–1568. doi:10.1068/a45236.

- Perks, R. 2016. “I Loan, You Mine: Metal Streaming and Off-Take Agreements as Solutions to Undercapitalisation Facing Small-Scale Miners?” The Extractive Industries and Society 3 (3): 813–822. doi:10.1016/j.exis.2016.04.007.

- Pichler, M., C. Staritz, K. Küblböck, C. Plank, W. Raza, and F. Peyré. 2016. Fairness and Justice in Natural Resource Politics. London: Routledge.

- Plank, C., S. Liehr, D. Hummel, D. Wiedenhofer, H. Haberl, and C. Görg. 2021. “Doing More with Less: Provisioning Systems and the Transformation of the Stock-Flow-Service Nexus.” Ecological Economics 187: 107093. doi:10.1016/j.ecolecon.2021.107093.

- Polanyi, K. 1992. “The Economy as Instituted Process.” In The Sociology of Economic Life, edited by M. Granovetter and R. Swedberg, 29–51. Boulder, CO: Westview Press.

- Prause, L., and K. Dietz. 2022. “Just Mobility Futures: Challenges for E-mobility Transitions from a Global Perspective.” Futures 141: 102987. doi:10.1016/j.futures.2022.102987.

- Purcell, T. 2018. “‘Hot Chocolate’: Financialized Global Value Chains and Cocoa Production in Ecuador.” The Journal of Peasant Studies 45 (5–6): 904–926. doi:10.1080/03066150.2018.1446000.

- Radetzki, M., and L. Wårell. 2020. A Handbook of Primary Commodities in the Global Economy. Cambridge: Cambridge University Press.

- Reichl, C., and M. Schatz. 2023. World Mining Data 2023. Vienna: Federal Ministry of Austria Finance. https://world-mining-data.info/wmd/downloads/PDF/WMD2023.pdf

- Schaffartzik, A., M. Pichler, E. Pineault, D. Wiedenhofer, R. Gross, and H. Haberl. 2021. “The Transformation of Provisioning Systems from an Integrated Perspective of Social Metabolism and Political Economy: A Conceptual Framework.” Sustainability Science 16 (5): 1405–1421. doi:10.1007/s11625-021-00952-9.

- Seddon, J. 2020. “Merchants against the Bankers: The Financialization of a Commodity Market.” Review of International Political Economy 27 (3): 525–555. doi:10.1080/09692290.2019.1650795.

- Spilker, G. 2022. “Cobalt Growth in 5 Charts.” CME Group, December 14. https://www.cmegroup.com/articles/2022/cobalt-growth-in-5-charts.html

- Staritz, C., S. Newman, B. Tröster, and L. Plank. 2018. “Financialization and Global Commodity Chains: Distributional Implications for Cotton in Sub-Saharan Africa.” Development and Change 49 (3): 815–842. doi:10.1111/dech.12401.

- Staritz, C., B. Tröster, J. Grumiller, and F. Maile. 2022. “Price-Setting Power in Global Value Chains: The Cases of Price Stabilisation in the Cocoa Sectors in Côte d’Ivoire and Ghana.” The European Journal of Development Research 35 (4): 1–29. doi:10.1057/s41287-022-00543-z.

- United Nations Conference on Trade and Development (UNCTAD). 2011. Price Formation in Financialized Commodity Markets: The Role of Information. Geneva: UNCTAD. https://unctad.org/system/files/official-document/gds20111_en.pdf

- van der Ploeg, F. 2011. “Natural Resources: Curse or Blessing?” Journal of Economic Literature 49 (2): 366–420. doi:10.1257/jel.49.2.366.

- van Huellen, S. 2020. “Too Much of a Good Thing? Speculative Effects on Commodity Futures Curves.” Journal of Financial Markets 47: 100480. doi:10.1016/j.finmar.2018.12.001.

- Veblen, T. 1909. “The Limitations of Marginal Utility.” Journal of Political Economy 17 (9): 620–636. doi:10.1086/251614.

- Voskoboynik, D., and D. Andreucci. 2022. “Greening Extractivism: Environmental Discourses and Resource Governance in the ‘Lithium Triangle.’” Environment and Planning E: Nature and Space 5 (2): 787–809. doi:10.1177/251484862110063.

- World Bank. 2020. 2020 State of the Artisanal and Small Scale Mining Sector. Washington, DC: World Bank. https://shorturl.at/crzR9