?Mathematical formulae have been encoded as MathML and are displayed in this HTML version using MathJax in order to improve their display. Uncheck the box to turn MathJax off. This feature requires Javascript. Click on a formula to zoom.

?Mathematical formulae have been encoded as MathML and are displayed in this HTML version using MathJax in order to improve their display. Uncheck the box to turn MathJax off. This feature requires Javascript. Click on a formula to zoom.Abstract

Purpose: We propose an extension of the Earned Value method that takes into account both intangible and undocumented factors of project cost increase that occur during project execution and the credibility/reliability of cost estimations.

Methodology: Credibility or reliability of cost estimations used in the Earned Value Method is modelled by means of Z-fuzzy numbers. They model both the information scope available to the experts and the credibility of the experts, their individual features and the nature of information sources used.

Findings: The proposed version of the Earned Value Method can provide substantially earlier and more reliable warnings about future cost overruns in projects.

Value: The proposed method may decrease the probability and impact of cost overrun risk in the everyday practice of project management. This is an important contribution, as considerable cost overruns occur in numerous projects.

1. Introduction

It is common knowledge that inherent elements of projects are risk and uncertainty, whatever the adopted definition of these notions might be [Citation1]. This means that situation in projects changes dynamically. Thus, independently of the quality of the project description and plan, project control plays a crucial role. Ideally, project control should provide early warnings about negative events which may be approaching so that there is enough time for a reaction. Of course, some negative events do not produce early signals, so no warning is possible (e.g. an accident caused by the heart attack of a seemingly healthy project team member), but in case of numerous negative events, it is possible to identify heralds which announce them, although sometimes in a hardly noticeable way (e.g. some hints pronounced by the customer may suggest a possible demand of scope change [Citation2,Citation3]). Project control should identify such early signals whenever possible.

A method that supports project control and, at least in theory, should provide early signals of future problems is the Earned Value method [Citation4]. The method is applied during project implementation at regular control moments. The name of the method comes from the planned cost of the work performed so far (till the control moment), which is called Earned Value. The method can be used to control both the cost and time of the project, but here we concentrate on its role in cost management. Its main role concerning project cost control is twofold. In each control moment, it helps to analyse:

the relation between the earned value (the planned cost of the work performed so far) and the actual cost of the work performed so far;

the relation between the budget available for the whole project (or activity) and the cost of the whole project (or activity) as estimated in the control moment. The second component consists of the cost incurred so far (known exactly) and the cost still to be incurred (which should be estimated in the control moment).

A widespread method of modelling the lack of knowledge or uncertainty is fuzzy numbers [Citation5]. Researchers have noticed the need and the advantages of applying fuzzy numbers to the Earned Value Method. However, surprisingly, most of the fuzzy applications cover item A, where less uncertainty and lack of knowledge are present: fuzzy numbers are most often used there to model the percentage completed of project activities [Citation6–13]. In a few cases, fuzziness is introduced in item B in the form of a fuzzy budget of the whole project as known in the control moment [Citation6,Citation13–15]. The most uncertain and the least known value, the cost still to be incurred as estimated in the control moment, is rarely modelled through a fuzzy number, and even if it is, the respective papers do not deepen the idea sufficiently and do not develop a mature project fuzzy control system [Citation16,Citation17].

Uncertainty may be due to a lack of knowledge but also to subjectivity. Certain values may depend on the perception of the persons asked to evaluate them, on their source of information and their background, and on their degree of pessimism, optimism, or hesitance [Citation18]. This problem may be of utmost importance especially in item B, in the estimation of the cost still to be incurred. Numerous factors influence the future cost [Citation3,Citation19,Citation20], but not all of them will be noticed and evaluated in the same way by everybody. Different project participants have various positions in the project, different access to information, and different perceptions and attitudes. Thus the fuzzy estimate of the cost still to be incurred may be biased by the person's features and position. The same statement, although usually to a smaller degree, can be considered to be true concerning the estimations of the values ‘percentage complete of an activity in the control moment’ or ‘total budget of the project as known in the control moment’. Modelling of such situations can be performed utilising so-called Z-numbers [Citation21], which are composed of two elements: a fuzzy estimate of an unknown value and the reliability of this estimation.

Again, this modelling tool has not remained unnoticed in the research on the Earned Value Method. However, surprisingly, in all the papers using Z-numbers in the Earned Value Method [Citation22,Citation23], they are applied exclusively to the modelling of percent complete of activities, and never to modelling the total project budget or the cost to be incurred in the future (a value which is most influenced by subjectivity). That is why the objective of this paper is to propose a Z-numbers-based version of the Earned Value Method where Z-numbers are used to model the cost to be still incurred.

Another reproach we can formulate concerning the known cases of usage of Z-numbers in Earned Value Method is a certain rigidity, which can be summarised in two items:

application of a pre-set dictionary, where usually five fixed linguistic terms defining various degrees of reliability are given, and the user is limited to this dictionary;

assuming that low reliability means giving a too-high estimate.

The assumption referred to in the second reproach can be defended in some cases: e.g. in the case of the existing applications of Z-numbers to the Earned Value Method, where the most serious mistake may consist in overestimating the actual percent complete. But in the case of the applications we have in mind, which is, above all, assessing the cost to be incurred in the future, both ways biases and distortions have to be considered.

Thus, the ultimate objective of this paper is to propose a Z-numbers-based version of the Earned Value Method where Z-numbers are used to model the cost to be still incurred and where they are used in a substantially more general way than it is known in the literature so far. The proposed method will be described and illustrated through an example.

2. Material and Methods

2.1. Outline of the Research Methods

The present paper is basically a conceptual one. In the first place, we use the methodology described in [Citation24]. Thus, we start from a focal theory – which is the Earned Value Method as it is described in the literature. We show that it is incomplete concerning an important aspect of project management, and then we introduce a new theory and show its added value concerning the mentioned important aspect of project management.

In [Citation24] four types of conceptual papers are identified: theory synthesis, theory adaptation, typology, and model. Our paper is of the ‘theory adaptation’ type. Thus we problematise the existing theory of the Earned Value Method and introduce into the method a new theoretical lens. The Earned Value method is the ‘domain theory’ (thus the theory being adapted [Citation24]). ‘Method theories’; thus, theories which will be used as a tool to expand the domain theory will be Z-numbers and project uncertainty management theories.

To provide a sufficient argument for our adaptation of the Earned Value Method, we adapt the framework for a good argument proposed in [Citation25]. According to that proposal, a good argument needs three components:

claims (the outcome of the research),

grounds (evidence and reasons used to support the claims and persuade the reader the claims provide some value-added)

warrants (the underlying assumptions which make the claims valid and acceptable).

Another warrant is that in many cases of projects, in the execution stage, unexpected phenomena take place, which change project parameters, especially cost, in a substantial way. What is more, although these phenomena are unexpected, they often have triggers [Citation29,Citation30], i.e. signals which announce their possible approach (e.g. conflicts with a supplier may be the trigger of the need to look for another, possibly a more expensive one). Information about triggers can and should be used, as far as possible, in any project cost control method.

The grounds will be presented when our proposal, thus a modification of the Earned Value Method, is described. To do this, we have to summarise first the Earned Value Method itself (the domain theory) and the other theories needed in the concept-building process.

2.2. Domain Theory and Method Theories

2.2.1. Fuzzy Numbers and Z-numbers

A fuzzy number represents a magnitude whose exact value is not known at the moment. Here we consider only the simplest form of fuzzy numbers, the so-called trapezoidal fuzzy numbers, which are usually sufficient for practical purposes. Triangular fuzzy numbers will also be taken into account as a special case of trapezoidal fuzzy numbers (with

). A trapezoidal fuzzy number

will thus be represented by four crisp numbers

, such that

is called the support of

and

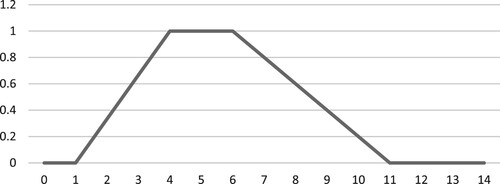

The so-called membership function , defined in (1) and based on experts’ opinions, represents for each x the possibility that, according to the experts, x will be the actual unknown magnitude.

(1)

(1)

Trapezoidal fuzzy numbers, named in the following also classical fuzzy numbers, are subject to arithmetical operations, which can be defined as follows:

Definition 1:

Let and

be two trapezoidal fuzzy numbers and

any of the arithmetical operations defined on crisp numbers. Then we define

as the trapezoidal fuzzy number determined by the crisp numbers

,

,

,

, where in the case of division the necessary non-zero assumptions have to be fulfilled.

Trapezoidal fuzzy numbers can also be compared to each other and ranked [Citation31]. The way to do so is far from being unequivocal, and we will not enter this subject deeper here. Let us merely indicate that if , then we can take it for granted that for each decision-maker it would be acceptable that

, but in other cases, the decision-maker would have to decide which ranking between the trapezoidal fuzzy numbers would be selected.

A Z-fuzzy number or a Z-number[Citation21] is a couple , where

are fuzzy numbers and the support of

, according to the original definition, is included in the interval [0,1].

represents the credibility of the expert opinion

or the possibility that evaluation

is correct. The closer to 1 numbers

are, the higher the credibility (accuracy possibility) of

. In the literature, it is proposed to choose

’s from a list of triangular fuzzy numbers, each of which corresponds to a linguistic expression, e.g.: ‘(credibility is) high’, ‘(credibility is) medium’, ‘(credibility is) low’, etc. An example of a ‘dictionary’ for the values

can be found in [Citation22] (Table ). Other examples can be found, e.g. in [Citation23].

Table 1. An example of a dictionary for credibility evaluation in Z-fuzzy numbers.

In the literature, a Z-fuzzy number is eventually expressed as a classical fuzzy number or even a crisp number to simplify the decision-making process. This transformation should maintain as much important information present in the original construct (the Z-fuzzy number) as possible. Hence, in [Citation32] it is proposed to transform the Z-fuzzy number into the following classical fuzzy number

:

(2)

(2)

where

is a crisp defuzzification of fuzzy number

. It can be the square root of the fuzzy centroid of

[Citation22] or any other crisp number being a kind of ‘mean’ of the fuzzy number

, e.g. [Citation33,Citation34]:

(3)

(3)

This way of defining and transforming Z-numbers can be applied to modelling magnitudes where important (dangerous for project success) errors in the estimation means ‘a too low value’ – for example, in the case of profits, revenues, etc. The underlying idea is that if we use a ‘dictionary’ similar to that from Table and

is different from ‘Certainly’, then evaluation

is considered not to be quite reliable, in the sense of ‘too high’. That is why we relax this evaluation, as a too high one, and shift the fuzzy number

’s membership function to the left (using operation (2)). Such an approach allows us to adjust too high evaluations of certain project’s ultimate outcomes, given in individual control moments. However, this approach would not be directly applicable in case of the need to adjust too low or simply errant (with unknown error direction) evaluations.

2.2.2. Earned Value Method – State of the art

The Earned Value Method [Citation35] is a project control method whose basic function is to deliver, at systematic control moments t = ϵ, … .,T (ϵ is the first moment – after the project began – when the project will be controlled, T is the last such moment before the project closure) during project realisation, the information about (Estimate at Completion), which is the total cost of the project estimated at the moment t. It is compared with

(Budget at Completion), which stands for the value of the total budget destined by the organisation for the project realisation as known in moment t. We assume here that

for all t, thus that the budget does not change during the project implementation. This assumption is not limiting in the sense that the rest of this paper can be easily modified for the rare cases when the project budget is changed after the project start.

If the value

is negative and of a high (according to the decision-maker) absolute value, it is a warning that the project will finish over budget, and the overrunning will be substantial. As t always falls before the project closure, there is time to undertake corrective actions or make certain decisions – for example, to acquire additional financial resources for the project (to increase the total project budget) or to change the project scope, implementation formula or required quality (to decrease the total project cost). Of course, the smaller t, the more time there is to ‘rescue’ the project, and the closer

is to the actual total project cost, the higher the quality of information available to the project manager in moment t.

There are several formulae for the calculation of [Citation35]. The most detailed way of calculating its value for the whole project consists in descending on the level of individual project activities, calculating

for each of them, and then making the total. Here we assume this approach is adopted (in practice, fairly often simplified calculations are performed on a higher level of WBS, but here we address project managers who are ready to put considerable effort into the method to obtain high-quality information – the existence of such managers is one of our warrants). So, in the rest of this section, the symbols

etc. refer both to single activities and their total, linked to the whole project.

As mentioned above, there exist different formulae for calculating , but practically all the formulae known from the literature are based on the following pieces of information:

: (Budgeted Cost of Work Performed) – the planned cost of the work actually performed till moment t, determined utilising the formula

(4)

(4) where

stands for the actual percentage of completion till the moment t.

: (Actual Cost of Work Performed) – the actual cost of the work actually performed till moment t – this information comes from financial documents, like invoices, payrolls, etc.;

The basic formula for is as follows:

(5)

(5)

The factor used in formula (5),

, is used for controlling the trend of the ratio between the planned and the actual cost of the work performed so far, and its inverse is called Cost Performance Index (CPI):

(6)

(6)

Formula (5) is a consequence of the simple assumption: the ratio between the planned and the actual cost of the work performed so far (till moment t); thus is equal to the yet unknown ratio between the total planned and total actual cost, calculated when the project is finished. It is obvious that this assumption is not always fulfilled: the activity in the future (after moment t) may take an unexpected course. Thus there exists a more general formula for

, which is always valid:

(7)

(7)

where

stands for Estimate to Complete in moment t, i.e. for the cost still to be incurred from the moment t till the end of the task (project). Obviously, formula (7) does not provide any ready solution; it simply makes it clear that the only problem of estimating

lies in ‘foreseeing’ the future in the form of

.

In each control moment t the analysis is based on the value (Variance at Completion)

(8)

(8)

represents the difference, estimated in the control moment t, between the total available funds for the project and its actual total cost. Its negative value is a warning, coming in the control moment t, of a funds shortage at the end of the project.

If we analyse the components of formulae (4)–(8), we conclude that practically all of them represent magnitudes whose values are or may not be exactly known at the moment t. In fact, only is always known exactly, as it comes directly from financial documents.

is known exactly only in the case of measurable activities (whose progress can be measured in clearly defined units, like metres or hours) and fixed scope. Numerous activities are difficult to measure (e.g. research activities), or their scope may be subject to changes, and in such cases,

can be only estimated in a biased way. Also, in the case of activity groups (e.g. whole projects), where the progress of each activity is measured in another way, giving an exact value of

might be complicated. As it was said in the Introduction, there exist several applications of the fuzzy approach to represent

may be uncertain too, although in most practical cases, it is fixed as a crisp value (plus a reserve) before the project start. In the Introduction, we also indicated a few literature items where BAC is represented by employing a fuzzy number. Surprisingly, the most uncertain values

have rarely been assumed to be fuzzy in the existing literature.

3. Results

3.1. Problematising the Earned Value Method

(the cost still to be incurred), and consequently

(the total cost) as well

(the variance to be expected at the completion of the project or activity) are magnitudes whose value most often cannot be determined with a high exactitude in the control moment t. Indeed, formula (5) is often used in practice. But even if the percent complete

of the task can be identified exactly, formula (5) is a rather doubtful estimation of

, which was discussed above.

refers entirely to the future; hence its value rarely follows directly from the knowledge available in the control moment t. It depends on events that have not happened yet (new contract negotiations, a new team member recruited, a change in the project scope, etc.) and on events that have occurred already, but their influence on the final total cost is not visible yet or is not certain (may occur to be true with some probability). If the customer has expressed dissatisfaction with project results or if there was a serious conflict with one of the project team members, this may or may not lead to substantial price or salary changes. Also,

is the total of various types of cost, like salaries, raw materials consumption, rent, etc. [Citation36], which behave in various ways and depend on various factors and events. That is why it is logical that

should be expressed as a total of fuzzy numbers (Definition 1), thus a fuzzy number. As mentioned in the Introduction, very few papers do so.

The subjectivity aspect is also important in the estimation of . The influence of certain events or facts on the cost still to be incurred will be estimated by individuals, and their judgment will be biased by their perception, position, and background. In the present versions of the Earned Value Method subjectivity is taken into account only in the estimation of

, which is described in the next subsection, and never in that of

or

. The subjectivity or individual features can be modelled utilising Z-numbers, thus we think Z-numbers should be used for modelling

and

.

3.2. Problematising the Present Z-numbers Usage in the Earned Value Method

As shown by the literature review in the Introduction, so far, Z-numbers have been used uniquely in the representation of the percentage completed of an activity or activity group. It has never been applied to the values which are much more uncertain, unknown, and prone to subjectivity, which is and

.

Even if we accept that Z-numbers are needed above all to represent the percentage complete of activity, their present usage is based on the assumption that low reliability means having chosen a too ‘high’ estimation . But low reliability can also consist in choosing a too ‘low’ percent complete estimation

. This is the first modification required.

But first of all, we think that Z-numbers should be used to assign various reliability/credibility degrees to various components of . Numerous cost items constituting or influencing

may be estimated with limited reliability: e.g. a unitary cost may be given by an expert of low expertise (such an estimation would be characterised by low reliability) or the final scope may be estimated based merely on rumours about the customer intentions – which will also be of low reliability. And, as stated above, it is essential to consider that the expert may be ‘wrong’ (as compared to the eventual situation at the project end) not only for various reasons but also in different ‘directions’. They may be pessimistic, rather pessimistic, hesitant, not caring enough, inexperienced, risk-tolerant, or risk-averse [Citation18]. As a result, they may give too high or too low values with a positive membership function value of

(Figure , membership functions of

may be shifted too far to the right or the left) or too wide or too narrow supports of

. Z-fuzzy numbers have the potential to express many different situations in this respect, but if so, the support of

should not be constrained to be included in the interval [0,1], which has been required so far (Section 2.2.1).

The next reproach which can be formulated concerning the hitherto usage of Z numbers in the EVA method is the application of a fixed dictionary (Table ) for . Having a fixed dictionary actually means that we might replace Z-numbers with crisp numbers, practically without any loss. With a fixed dictionary, no individual treatment of various information items coming from various sources (experts characterised by various features) would be possible. In our opinion, we should allow project managers to estimate the reliability individually in each case, having complete freedom in choosing the form of

. They will be then able to fully exploit the fuzziness of

. By limiting the project manager to a fixed dictionary, we lose the fuzziness potential of

.

We also lose the fuzziness potential if we limit ourselves to the usage of formulae similar to (3) to defuzzify . Again, the project manager should not be limited to a pre-set formula. They should be able to choose freely any other crisp ‘representant’ of

., for example by using relevant weights in formula (3) or other proposals existing in the literature (see, e.g. [Citation34]). Their choice might be determined, for example, by the features of the experts from whom the estimation

. stems. Only in this way, the information conveyed by

. will be fully exploited by project managers.

In the next section, we present our results, which provide a partial answer to the reproaches raised above.

3.3. Proposal of a Z-numbers-based EVA Method (ZG-EVM)

In this subsection, we are presenting our claims, thus the proposed result: the modified Ened Value Method making use of Z-numbers (the method will be called Z-Numbers Generalised Earned Value Method, abbreviated as ZG-EVM), and, as a byproduct, a modification of the Z-numbers theory.

3.3.1. Modification of the Z-numbers Theory

First, there is a need to introduce several credibility/reliability types into the definition of Z-numbers. We propose to choose . for each component

. through an analysis of the source (expert) of the estimation

., which should be conducted based on the following questions:

Is it possible that

is overestimated (i.e. higher than it should be)? If so, to which extent in the maximum and minimum case (the response should give two numbers

. and

. such that

. which should be used to pull down the estimation

. given by the expert to the ‘correct’ value through multiplying it by

. or

);

Is it possible that

. is underestimated (i.e. lower than it should be)? Ifo,which extent in the maximum and minimum case (the response should give two numbers

. and

such that

which should be used to pull up the estimation given by the expert to the ‘correct’ value through multiplyingt b or

.;

Can

be overestimated or underestimated? If so, to which extent in thmaximum and minimum case in both directions? (the response should give four respective numbers

. and

. such that

and

such that

as defined above).

The Z-number will then be transformed to a classical fuzzy number in two steps:

A set consisting of maximally four numbers

(some or all of them can be identical,

) belonging to the support of

will be selected as a representation of

. These numbers can be selected as in formula (3), using any other defuzzification method known from the literature [Citation34,Citation37].

would represent the reliability of

(the minimum of the support of the estimation

),

– that of

, etc. Such an approach allows the decision-maker to use all the fuzzy information on the reliability of

conveyed by

without having to use advanced fuzzy numbers theory;

Formula (9) will be applied to generate a fuzzy number

, which would represent the ‘correction’ of

, performed using the information contained in

(9)

(9)

3.3.2. Adaptation of the Earned Value Method (ZG-EVA Method)

In this subsection, we will present our main claim – the ZG-EVA method. In this method, we try to determine in each control moment t a traditional fuzzy number – it will be defined as the estimation of the final cost of the project task in question, based on all relevant and accessible (in the moment t) information. Of course, it will incorporate the value

, but for simplicity reasons, we will be talking only about

The procedure will be as follows:

For each control moment t:

Identify the set of all the factors that may have an influence on the value

: factors of various nature – documented, undocumented, tangible, intangible, etc. (e.g. number of units planned to be completed in the moment t, the initially planned unitary price, the actual average unitary price occurred so far, customer dissatisfaction, rumours about a rise in a resource price, planned number of hours needed to complete the task, rumours about one of the team members being largely underproductive, etc.)

Identify the values (and express them in the form of Z-numbers) resulting from the elements identified in A and possibly influencing

. Let us denote the cardinality of their set by

:

will then be the result of applying several arithmetical operations (Definition 1) on components

, where

stands for the estimation of a value being a component of

and

for its reliability/credibility. For example, if the element in question is customer dissatisfaction, the following values may be taken into account: the (yet not completely known, thus fuzzy) number of units which will have to be reworked (because the customer is not satisfied with their quality) and the (also not fully know, thus fuzzy) unitary cost of this rework. If the element in question is the rumours of one team member not being sufficiently productive, the resulting number may be the additional (also fuzzy) cost of recruiting another member who would replace the unproductive one.

would be determined by the project manager and will stand for the credibility/reliability of the estimation

(Section 3.3.1);

For each element

, the way of transforming it into a classical fuzzy number

(formula (9) should be selected);

Calculate

by applying respective arithmetical operations to

Compare it to

, which may be crisp or fuzzy, applying selected fuzzy numbers comparison methods.

3.4.3. Example

In the example, we demonstrate how the ZG-EVA method distinguishes itself against the versions of the Earned Value Methods known so far. The project in the example will be subject to three versions of the Earned Value Method:

Earned Value Method without the use of fuzzy numbers. Additionally, in this place also, the superiority of our approach with respect to the existing Z-numbers application (represented by the ZEVM method from [Citation22,Citation23]) to the Earned Value method will be visible.

Earned Value Method with EAC modelled employing classical fuzzy numbers.

ZG-EVA method in different scenarios (of a pessimistic, optimistic, or hesitant estimator). For simplicity reasons, we assume formula (3) uniquely for the calculations in (9).

The control of the task implementation was performed in several control moments, out of which we present two.

Control moment t = 1 (April 4.)

The invoice for 80% of the cable was received. It amounts to 90 K$.

A member of the team expresses his guess that from now on (for the 20 metres not invoiced yet), the price would be higher than planned by about 10%. When asked to specify the range of possible cost change, he stated that, in his opinion, the cost would be higher by at least 8% but no more than 12%, which can be described by fuzzy number

= (8%, 10%, 12%).

Additionally, we can consider the profile of the team member who was the source of this information. In the first scenario, we assume that he is known to be quite an optimistic person. We choose

(1.7, 1.8, 1.9), as the optimism in terms of costs means that the actual value is likely to become higher than forecasted. Thus the possible cost rise would be expressed through the Z-number = ((8%, 10%, 12%),(1.7, 1.8, 1.9)). In the second scenario, the team member is known to be a pessimistic person. In this case the cost increase is modelled by ((8%, 10%, 12%),(0.1, 0.2, 0.3)) Table .

Table 2. Results in the first control point in the example.

According to the information from the first column, 7.5 K$ can be expected to remain at the activity completion; according to the information from the second column, only 120–115.2 = 4.8 K$ can be expected to be left in the worst case. But it is possible that both these numbers are wrong, and 120–117.36 = 2.64 K$ (third column) or 120–113.04 = 6.96K$ (fourth column) are the numbers to be used in the decision-making process. The possibility to model ETC(t) as a fuzzy number corrected by the reliability degree increases substantially the information quality delivered by the Earned Value Method.

Control moment t = 2 (April 10)

A team member indicates that more cabling will be needed – by about 20% of length, which they express as . Again, we consider two scenarios – two sources of information: both would be hesitant, but the first one would be inclined towards optimism, with

, and the other one towards pessimism, with

Table .

Table 3. Results in the second control point in the example.

Six days have passed since the previous control moment, and a new piece of information has become known, but the classical Earned Value Method (ZEVM included) from the first column does not show any reaction: the documented, certain information items used in the formula (5) have not changed. The fuzzy versions of the Earned Value Method can take the new piece of information into account. Thanks to this (the second, third, and fourth column), we already (on the 10th of April, 20 days before the planned project completion) have the information that a substantial budget overrun is likely to occur. The estimation of its size will depend on the reliability of the estimation, which is not taken into account in the second column. The third and fourth columns deliver different information on the expected financial deficit. The choice of a wrong column means having to make our decisions based on wrong data.

Project end (April 30) 120 km of the cable have been delivered, and the activity is accepted as terminated. Its final cost is 150 K$.

If the non-fuzzy Earned Value Method or the ZEVM were used on April 10 we would be unaware of the serious financial problem approaching;

If we used a fuzzy Earned Value method without the usage of Z-numbers, already on April 10 (

) we would be warned that a substantial final deficit is likely. However, if we did not take into account the features of the estimators or generally the reliability of the estimation, our knowledge might be distorted. Let us suppose that the estimator was hesitant/optimistic. Only our approach (third column) would allow us to have

close to the ultimate value (!50 K$) already on April 10. The other ways of calculating

would deliver a much less accurate warning.

4. Conclusions

In this paper, we propose a procedure where Z-numbers are applied to the estimation of (the ultimate total cost of a project or activity estimated in an earlier moment t). Thanks to the approach, it will be possible to consider as components of

magnitudes of various credibility/reliability degrees and to adjust their estimations accordingly. Individual human features can be taken into account (various levels of pessimism or optimism, risk aversion or tolerance, experience or knowledge, etc.). It will be thus possible to have at our disposal fairly reliable early information of the total cost of the project long before this cost has actually been incurred.

Of course, the method proposed here requires a lot of effort and will be rather difficult to implement in organisations. However, one of our warrants was that in numerous cases, organisations would be ready to put a lot of effort into the implementation of an efficient project cost warning system. For projects which are critical for the organisation from the point of view of budget or profit, this effort will pay itself back. Another warrant was that there exist projects where numerous important and unexpected increases in project cost occur. If such projects are at the same time critical from the financial point of view, the implementation of the proposed method will pay itself back too. But obviously, the method is too effort-consuming to be used in all projects and organisations. In some cases, its usage may be limited to important milestones or gateways. Such a hybrid approach will be the object of further research.

An important limitation of the presented approach is the fact that only cost control is considered, and time-related problems are ignored. The time control aspect of the Earned Value Method in the context of the usage of Z-numbers will be the object of further research. Fuzzy numbers have been used in the Earned Value Method applied to time control [Citation39], but no Z-numbers applications exist in this area.

The usage of Z-numbers proposed here has been extended as compared to the literature. Instead of applying a fixed set of fuzzy numbers representing credibility/reliability, we sketch a more general approach, where credibility/reliability can be assessed using arbitrary fuzzy numbers. They should reflect the features of the estimation in question and of the person(s) who are their authors. When assessing credibility/reliability, we have to take into account psychological features, social position, experience, knowledge, etc., as well as the probability of events that influence the magnitudes in question. This seems to be a vast research area that has been merely sketched in this paper and should be further explored.

Disclosure statement

No potential conflict of interest was reported by the author(s).

Additional information

Funding

Notes on contributors

Dorota Kuchta

Dorota Kuchta MSc in Mathematics and Industrial Engineering, PhD and ScD in Management Science, Professor at Department of Computer Science and Management, Wroclaw University of Science and Technology, Poland. She is the author or co-author of over 200 publications and 5 books in project management, management science, and managerial accounting. Her research interests cover project management and optimization in situations of risk, uncertainty, or lack of information.

Adam Zabor

Adam Zabor MSc in Finance and Accounting, PhD Student in Management in the Department of Computer Science and Management, Wroclaw University of Science and Technology, Poland. Research interests include project management, particularly project control by means of Earned Value Management, and the use of fuzzy sets theory.

References

- Cleden, D. (2017). Managing project uncertainty. In Managing Project Uncertainty. doi:10.4324/9781315249896

- Joly M, Lebissonnais J, Muller J-LG. Matrisez le cout de vos projets manuel de coutenance. Paris: Afnor; 1995.

- Kuchta, D. (2021). Qualitative factors in the fuzzy earned value method. Advances in Intelligent Systems and Computing. doi:10.1007/978-3-030-51156-2_84

- Fleming, Q. W., & Koppelman, J. M. (1997). Earned value project management. Cost Engineering (Morgantown, West Virginia). doi:10.1016/s0263-7863(97)82251-x

- Zadeh, L. A. (1978). Fuzzy sets as a basis for a theory of possibility. Fuzzy Sets Syst. doi:10.1016/0165-0114(78)90029-5

- Abdelazeem, A. S., & Ibrahim, A. H. (2020). Evaluation of project cost and schedule performance using fuzzy theory-based polynomial function. Int J Construct Manag, 1–13. doi:10.1080/15623599.2020.1809061

- Doskocil R. Fuzzy logic: An instrument for the evaluation of project status || La lógica difusa: un instrumento para la evaluación del estado del proyecto. Revista de Métodos Cuantitativos Para La Economía y La Empresa. 2015;19(1):5–23.

- Eshghi A, Mousavi SM, Mohagheghi V. A new interval type-2 fuzzy approach for analyzing and monitoring the performance of megaprojects based on earned value analysis (with a case study). Neural Comput Appl. 2019;31(9):5109–5133. doi:10.1007/s00521-018-04002-x.

- Moradi N, Mousavi SM, Vahdani B. A new version of earned value analysis for mega projects under interval-valued fuzzy environment. J Opt Indust Eng. 2020;13(2):57–72. doi:10.22094/joie.2016.267.

- Mortaji STH, Bagherpour M, Noori S. Fuzzy earned value management using L-R fuzzy numbers. J Intell Fuzzy Syst. 2013;24(2):323–332. Available from https://www.scopus.com/inward/record.uri?eid=2-s2.0-84873585671&doi=10.3233%2FIFS-2012-0556&partnerID=40&md5=e5ff52d190b2aa35c58f7c71da26b769.

- Moslemi Naeni L, Salehipour A. Evaluating fuzzy earned value indices and estimates by applying alpha cuts. Expert Syst Appl. 2011;38(7):8193–8198. Available from https://www.scopus.com/inward/record.uri?eid=2-s2.0-79952441224&doi=10.1016%2Fj.eswa.2010.12.165&partnerID=40&md5=23b5e58441ffa6e151a2737aea113e97.

- Naeni LM, Shadrokh S, Salehipour A. A fuzzy approach for the earned value management. Int J Project Manage. 2011;29(6):764–772. Available from https://www.scopus.com/inward/record.uri?eid=2-s2.0-79960069130&doi=10.1016%2Fj.ijproman.2010.07.012&partnerID=40&md5=571aba0a240fa14f808272e8cb4afcc1.

- Salari M, Bagherpour M, Kamyabniya A. Fuzzy extended earned value management: A novel perspective. Journal of Intelligent and Fuzzy Systems. 2014a;27(3):1393–1406. doi:10.3233/IFS-131106.

- Zareei, A., Zaerpour, F., Bagherpour, M., Noora, A. A., & Vencheh, A. H. (2011). A new approach for solving fuzzy critical path problem using analysis of events. Expert Syst Appl. doi:10.1016/j.eswa.2010.06.018

- Zohoori B, Verbraeck A, Bagherpour M, et al. Monitoring production time and cost performance by combining earned value analysis and adaptive fuzzy control. Comput Indus Eng. 2019;127:805–821. Available from https://www.scopus.com/inward/record.uri?eid=2-s2.0-85057290667&doi=10.1016%2Fj.cie.2018.11.019&partnerID=40&md5=9540f90ed455072ffa154b6e83fa9781.

- Korenkova D. (2020). Fuzzy-interval modification of the earned value method in manufacturing digitalization project management. MATEC Web of Conferences, 311.

- Kuchta D. Fuzzyfication of the earned value method. WSEAS Trans Syst. 2005;4:12.

- Lock D. (2013). Project management. Available from http://search.ebscohost.com/login.aspx?direct=true&scope=site&db=nlebk&db=nlabk&AN=504684.

- Feylizadeh MR, Hendalianpour A, Bagherpour M. A fuzzy neural network to estimate at completion costs of construction projects. Int J Indust Eng Comput. 2012;3(3):477–484.

- Stanek S, Kuchta D. Increasing earned value analysis efficiency for IT projects. J Decision Syst. 2020: 1–9. doi:10.1080/12460125.2020.1783882.

- Zadeh, Lotfi A. (2011). A note on Z-numbers. Inf Sci (Ny). doi:10.1016/j.ins.2011.02.022

- Hendiani S, Bagherpour M, Mahmoudi A, et al. Z-number based earned value management (ZEVM): A novel pragmatic contribution towards a possibilistic cost-duration assessment. Comput Indust Eng. 2020;143; doi:10.1016/j.cie.2020.106430.

- Salari, M., Bagherpour, M., & Wang, J. (2014b). A novel earned value management model using Z-number. Int J Appl Dec Sci. doi:10.1504/IJADS.2014.058037

- Jaakkola, E. (2020). Designing conceptual articles: four approaches. AMS Rev. doi:10.1007/s13162-020-00161-0

- Hirschheim R. Some guidelines for the critical reviewing of conceptual papers: some guidelines for the critical reviewing of conceptual papers overview of the IS research perspectives section. J Assoc Inform Syst. 2008.

- Chaos Report. (2015). Available from https://www.standishgroup.com/sample_research_files/CHAOSReport2015-Final.pdf.

- Kerzner H. Project management: A systems approach to planning, scheduling, and controlling. New York (NY): John Wiley & Sons, Inc; 2005.

- Carvalho M. Risk and uncertainty in projects management: literature review and conceptual framework RECEBIDO. GEPROS. Gestão Da Produção, Operações e Sistemas. 2017;12:93–120. doi:10.15675/gepros.v12i2.1637.

- Kerzner H. (2013). Project Management Metrics, KPIs, and Dashboards: KERZNER: PROJECT MANAGEMENT METRICS, KPIS, AND DASHBOARDS.

- Larson, E. W., & Gray, C. F. (2011). Project management: The managerial process. McGraw-Hill Irwin International Edition, NY.

- Basiura, B., Duda, J., Gaweł, B., Opiła, J., Pełech-Pilichowski, T., Rębiasz, B., & Skalna, I. (2015). Ordering of fuzzy numbers BT - advances in fuzzy decision making: theory and practice (I. Skalna, B. Rębiasz, B. Gaweł, B. Basiura, J. Duda, J. Opiła, & T. Pełech-Pilichowski, editors). doi:10.1007/978-3-319-26494-3_2

- Kang B, Wei D, Li Y, et al. A method of converting Z-number to classical fuzzy number. Journal of Inform Comput Sci. 2012;9:703–709.

- Bohlender, G., Kaufmann, A., & Gupta, M. M. (1986). Introduction to fuzzy arithmetic, theory and applications. Math Comput. doi:10.2307/2008199

- Van Leekwijck, W., & Kerre, E. E. (1999). Defuzzification: criteria and classification. Fuzzy Sets Syst. doi:10.1016/s0165-0114(97)00337-0

- Fleming Q, Koppelman J. (2000). Earned Value Project Management (Vol. 39).

- Kuchta, D., & Zabor, A. (2021). Fuzzy uncertainty modelling in cost and cash flow forecasting in project. In Advances in intelligent systems and computing. doi:10.1007/978-3-030-51156-2_141

- Zadeh, L. A. (1965). Fuzzy sets. Inf Control. doi:10.1016/S0019-9958(65)90241-X

- Dałkowski TB, Kuchta D. Klasyczna i zmodyfikowana metoda earned value w zarządzaniu projektami. Badania Operacyjne i Decyzje. 2001;3/4:35–52.

- Ponz-Tienda J, Pellicer E, Yepes V. Complete fuzzy scheduling and fuzzy earned value management in construction projects. Journal of Zhejiang University SCIENCE A. 2012;13; doi:10.1631/jzus.A1100160.