?Mathematical formulae have been encoded as MathML and are displayed in this HTML version using MathJax in order to improve their display. Uncheck the box to turn MathJax off. This feature requires Javascript. Click on a formula to zoom.

?Mathematical formulae have been encoded as MathML and are displayed in this HTML version using MathJax in order to improve their display. Uncheck the box to turn MathJax off. This feature requires Javascript. Click on a formula to zoom.Abstract

This paper investigates the extent of “greenness” of South African REITs; and whether green investments have any significant effects on the REITs return performance at the aggregate level. It used publicly-accessible green buildings and financial data obtained from the Green Building Council of South Africa’s (GBCSA) website and financial reports of 27 REITs that operate in South Africa, respectively. With only 11 REITs having green buildings in their portfolios, the results show phenomenal growth in the cumulative amount of green Gross Lettable Area (GLA) in under a decade – from a paltry 38,133 square metres of GLA in 2013, to over two million square metres of GLA in 2021. From panel analyses, consistent regression results show that green variables were positive and statistically significant across most of the estimated models. The statistically significant results imply that increased investments in green infrastructures have positive effects on REITs’ return performances. The study has implications for research and practice as far as the investments by REITs in green buildings in South Africa is concerned.

Introduction

In recent years, society has become more concerned with the environmental changes happening around the world. The World Health Organization (WHO) believes that climate change is the greatest threat to global health in the 21st century (WHO, Citation2015). The organization argues that the operation and construction of buildings is a leading user of energy and contributor of greenhouse gas emissions, among others. Evidence presented show that carbon dioxide emissions from building operations reached an all-time high, as well as accounting for 30% of global final energy consumption in 2021 (UNEP, Citation2021). As such, investors are increasingly encouraged to take Environmental, Social and Governance (ESG) considerations before committing to investments (UNEP, Citation2021).

In response to the impact that buildings have on the environment, there has been a push from governments, companies, and individuals to make the construction and operation of buildings more sustainable and durable (Little, Citation2022). In 2015, the United Nations (UN) adopted a set of Sustainable Development Goals (SDGs) as a world-wide call to act to end poverty, safeguard the planet, and ensure that by 2030 all people enjoy peace and prosperity (UNDP, Citation2015). These goals have been adopted at a country and business level. There are 17 SDGs and together they form part of the idea of ESG. These internationally recognised goals help make ESG reporting more standardised across the world. One such industry-lead organisation promoting this is the Global Real Estate Sustainability Benchmark (GRESB). GRESB aims to provide actionable and transparent ESG data on companies and individual assets to the financial markets. These ESG assessments are done in line with what industries consider to be the main issues, as well as with the UN’s SDGs.

In South Africa, commercial buildings use up to 15% of Eskom’s (a national electricity public utility company) energy output (Eskom, Citation2021). Considering that these buildings may be only occupied and in use for 9–12 hours a day, this energy consumption is considerably high. More efficient use of energy and other resources in these buildings and the real estate industry in general can reduce these consumption patterns, and in doing so decrease the demand for increasingly scarce resources. The ESG reporting and framework is rapidly improving in South Africa (Singhania & Saini, Citation2022). The adoption of ESG reporting by large companies, including REITs, is a key driver behind this rapid improvement.

With investors and the public more concerned with the environmental impact that businesses and products have, the real estate industry has had to adapt, making green buildings more popular. GBCSA (Citation2022) defines a green building as that which adopts structures and processes that address environmental and sustainability aspects of designing, constructing, and operating a building. GBCSA (Citation2022) data show that from 2016 to 2022 there has been a significant increase in the number of green certified buildings in South Africa. GBCSA certified green buildings when compared to the industry norm, save between 30 and 40% energy and carbon emissions every year; and between 20 and 30% on water usage every year (WGBC, 2022). These clear environmental benefits mean that the adoption of green buildings falls within most companies’ ESG goals. Since the passing of REIT legislation in 2013 in South Africa, the REIT sector has led the real estate industry in adopting green buildings. As of December 2021, 11 REITs own a total of 242 green certified buildings, out of over 740 total number of green buildings in the country (GBCSA, Citation2021).

In the real estate industry, the effect that green buildings have on financial performance has mainly been investigated at the individual building level. Leskinen et al. (Citation2020) reviewed over 70 peer-reviewed studies that covered several countries and found that green certificates might increase the rental income and decrease the operating expenses, vacancy, and risks of a property. They suggested that together with the brand value of certificates, these enhancements should lead to an increase in property value. Similarly, Liu et al. (Citation2018) only consider the costs, benefits, and economic viability of green buildings at a building level in their comprehensive review of the existing studies. They demonstrate that green building investments are more likely to be seen as profitable from the building life cycle perspective, whereas the economic viability of “going green” remains controversial for developers and occupants.

The value that these buildings have for investors at a REIT level is an understudied area globally, especially in emerging economies such as South Africa. According to the South African government’s National Energy Act (RSA, Citation2008), all public and private entities with a net total floor area of over 1,000 square meters and 2,000 square meters, respectively, had to comply and display energy performance certificates by December 7, 2022. With needed investments toward energy efficient technologies, such as heating, ventilation, air conditioning (HVAC), and LED lighting; green buildings are envisaged to reduce energy and water bills, reduce waste disposal costs, reduce absenteeism, and improve staff productivity, better staff retention and recruitment, stay ahead of regulation, and promote investor relations, branding, and public relations (Swanepoel, Citation2022).

The main contribution of this paper is to provide a useful exploration of the extent of “greenness” of South African REITs; and whether green investments have any significant effect on the 11 JSE-listed REITs return performance in the context of South Africa. This adds an African and developing country example to this existing body of knowledge. This research is timely since none of the existing research has focused on Africa and other developing countries.

The paper also comes at an opportune time, given that South Africa is facing an existential threat from the prevailing energy crisis. A recent study by the South African Property Owners Association (SAPOA, Citation2023) that represents an estimate 90% of the country’s commercial and industrial real estate companies in the country, revealed the challenges that commercial and industrial companies face due to the continuing energy crisis. The study was conducted nationwide whereby the majority (61.18%) of the sampled firms experienced daily load shedding, while 34.12% experienced loadshedding a few times a week in the previous year. With loadshedding taking between 2 and 4 hours, most firms have had to invest in either diesel generators (83.05%) and solar (49.15%), with some firms investing in both diesel generators and solar concurrently. With loadshedding impact and the risks of fire being moderate (25.42%), serious (44.07%), and very serious (28.81%), firms have incurred huge direct and indirect costs, notwithstanding the fact that they still cannot operate at their optimum. These events have encouraged REITs that are facing rising costs of water and electricity, such as Liberty Two Degree (L2D), to invest in green technology to augment their buildings’ efficiency (L2D, Citation2022).

The paper consists of six sections with the introduction as the first section, which gives an overview of how green buildings are gaining interest globally and in South Africa. The second section reviews the relevant literature in key areas, including sustainability, ESG, the South African REIT sector, and existing research relating to the relationship between REITs’ greenness and financial performance. The third section covers the data and methods used for the study, while the fourth section covers the presentation of results. The fifth section discusses the results, as well conclusions.

Literature Review

ESG Trends in REITs’ Markets

Sustainability is a component of ESG goals whereby the purpose is to improve business value and operations through intentional environmental and social proactiveness (Wu & Feng, Citation2021). ESG has stemmed from previous concepts that focused on corporate strategy involving the adaptation and implementation of sustainable decision-making in REITs, such as corporate social responsibility (CSR) and socially responsible investment (SRI). In the global real estate and REITs’ markets, the recent objectives of sustainability are reducing carbon footprints (i.e., net-zero) of buildings and combating climate change risks. The growth in sustainability has led to a mushrooming global green building industry.

As a result of ESG becoming a new trend in international REITs’ markets (Newell & Marzuki, Citation2022), the development of the Global Real Estate Sustainability Benchmark (GRESB, Citationn.d.), the European Public REIT Association (EPRA) and the JLL Global Real Estate Transparency Index (GRETI) has been established as ESG reporting benchmarks from the combined effort of global investor initiatives (Egan, Citation2018). ESG data disclosure is critical for investors, lenders, and industry experts to quantify and measure how REITs are implementing and performing as a result of ESG practices. ESG reporting frameworks use non-financial reporting methods and are measured using the transparency of data disclosed. The non-financial metrics, which are used in ESG reporting frameworks, are based on carbon dioxide emissions, energy and water consumption, and waste management. Wu and Feng (Citation2021) believe that higher transparency of disclosing ESG data can be beneficial amongst competing companies. Greater transparency allows REITs to effectively analyze carbon footprints, resilience to climate risks, and re-evaluate the efficiency of ESG practices in business operations. In essence, ESG performance is crucial for firms’ performance (in terms of investments, lending, and public image, etc.) and their stakeholders (Khan, Citation2022).

Vast variations in ESG reporting transparency are present globally, but specifically within emerging economies. The reason for the variations in ESG reporting across international REIT markets is due to the differences in sustainable metrics and standards in individual countries. It is known that developed economies have innovated and implemented sustainable development and governance into corporate strategies at a much faster pace than emerging economies. ESG reporting are dependent on green building standards which have been introduced by regulatory green building councils at different times over the last decade. However, as technology and information has spread due to the global professional bodies and investor initiatives, this has meant an increase in use of uniform certification tools, such as Leadership in Energy and Environmental Design (LEED) (USGBC, Citation2008a), Building Research Establishment Environmental Assessment Methodology (BREEAM) (BRE, Citation1998), Energy Star (USDE, Citation1992), National Australian Built Environment Rating System (NABERS) (NSW Government, Citation2003), Green Star (GBCA, Citation2003), and Excellence in Design for Greater Efficiency (EDGE) (Edge, Citation2017). Ultimately, an easier comparison of green buildings and their accompanying definitions and comparability from around the world is unfolding (Mattoni et al., Citation2018).

In South Africa, the main rating tools used by the GBCSA when certifying buildings are Green Star, Net Zero, Energy Water Performance (EWP), and EDGE (GBCSA, Citation2022). South Africa’s growth in the green building industry is greater than that of some developed countries which are known for sustainable building practices. This growth is caused by a confluence of factors, such as rising energy costs, rising water costs, rising operating costs, and pressure for businesses to act in a more socially and environmentally responsible way (U.S. Department of Commerce, Citation2020). This assertion supports research that has concluded that emerging economies have more dynamic ESG activities (Newell & Marzuki, Citation2022). Furthermore, the GBCSA has been identified by the World Green Building Council as the fastest growing member, with the number of certified buildings rising from 50 certified green buildings in 2016 to over 740 in early 2022 (GBCSA, Citation2021; WGBC, 2022). Originally developed in Australia (GBCA, Citation2003), illustrates the rating score and respective rating star of green building certifications in South Africa.

REITs

REITs’ Fundamentals

REIT legislation was introduced to provide accessibility to yields of real estate investment without direct real estate ownership. The main purpose was to remove double taxation at the firm level and only apply taxation on distributable earnings to shareholders. REIT legislation provides unitization of real estate which counteracts the illiquid and heterogeneous nature of real estate investment. REITs are primarily funded by large institutional investors through listing on stock exchanges. The benefits of investing in REITs are liquidity, shareholder value (capital appreciation and cash flow), transparency obligations, management structure, no shareholder liability, and low leverage (National Association of Real Estate Investment Trust, NAREIT, Citation2011). The fundamentals of REIT legislation are to regulate the minimum required percentage of revenue generated from property operations, debt leverage ratio, and the minimum required percentage of distributable profits paid in dividends to shareholders. These regulations limit the capacity in which REITs can invest and diversify their portfolio. When considering the importance of ESG goals, investment strategies have changed over the last decade. The determinants of REITs performance are measured using liquidity, leverage, risk, firm size and portfolio diversification. In slightly over six decades since the first REITs was established in the United States (U.S.) in 1960, over 40 countries have adopted the U.S.-based REIT approach to real estate investment (NAREIT, Citation2023).

Sustainable Investment Decision-Making by REITs

Investment decisions in REITs are limited by different degrees of legislation. Although, fundamentals of REITs’ capital structures provide the same determinants of investment analysis, varying REITs’ legislation across different REITs’ markets determine different corporate governance mechanisms. This results in different leverage ratios, levels of operating risk and investment strategies between REIT markets. Differentiation of investment decisions between the capital structure of a portfolio and individual property needs to be established. Capital structure is determined through legislation and the determinants of portfolio investment decisions are based on the capital structure of the firm. These determinants are leverage and firm size (Morri & Parri, Citation2017). Managing the capital structure of the firm is the responsibility of corporate governance and senior management.

Investment decisions on individual properties is determined through Return on Assets (ROA) and Return on Equity (ROE). Chen et al. (Citation2018) describes the responsibilities of REIT corporate governance to be firm profitability, organizational operation, firm growth, leverage management, and ROE. Investment decisions are primarily based around these five factors, with leverage being the most critical. REITs are regulated by leverage which presents management with a duty to strategize for long-term stability and profitability, whilst extracting short-term performance from individual properties in the portfolio. The management structure of a REIT does not directly correlate with long-term performance.

South African REITs

In May 2013, REITs in South Africa became regulated by the JSE through listing and trading requirements. An amendment was introduced under the Income Tax Act to allow listed property trading to be in alignment with international standards. Prior to 2013, investors in listed property companies were being double taxed at company level and investors were incurring income tax on their investment. The tax law amendment of section 25BB resulted in income taxation pass-through at the company level and income taxation placed only on shareholders’ investment. Following the formalized structure of the REIT sector, the South African REIT (SAREIT) association was founded in 2013 as the professional body of the sector to represent the listed property companies. From February 2023, there were 27 public REITs in South Africa which, are listed on the JSE (see SAREIT Citation2023 for a full list of these REITs). The most common type of South African REITs are diversified portfolios (i.e., Growthpoint, Fortress, Redefine, Investec, and Emira) making up 50% of South African REITs. The second most common type of REITs in South Africa are retail (Accelerate, Hyprop, Octodec, Resilient, and Vukile), making up 29% of South African REITs (SAREIT, Citation2023).

Existing Research on REITs Greenness and Financial Performance

Although several research across the world has investigated the effects of ESG’s components on REITs’ operational and financial performance, little research has focused on the REIT level. REIT-level focused research includes Aroul et al. (Citation2021), Bienert and Cajias (Citation2020), Eichholtz et al. (Citation2019), Morri et al. (Citation2020), Newell and Marzuki (Citation2022), Sah et al. (Citation2013) and Wu and Feng (Citation2021). Eichholtz et al. (Citation2012) explored the relationship between the greenness of U.S. REIT’s portfolio and their operating and market performance between 2000 and 2011. Their results showed a positive relationship between operating and market performance (measured by ROA and ROE) and greenness. Eichholtz et al. (Citation2019) found that in a sample of 211 REITs in the U.S. for the period 2006–2015, REITs with higher environmental performance have lower cost of debt resulting in better operational performance. Aroul et al. (Citation2021) found a positive relationship between REITs ESG scores and operational performance from a sample of United States publicly listed REITs for the period 2019–2020.

Using sampled data from 2019 and 2020 GRESB ESG reports, Wu and Feng (Citation2021) found that REITs with higher ESG disclosure levels had greater financial flexibility (i.e., lower cost of debt, higher credit ratings, and higher unsecured debt to total debt ratio) and firm value. REITs that perform well on the ESG scales/scores had higher operational efficiency and were associated with better operational performance. Newell and Marzuki (Citation2022) investigated a global perspective of the levels of ESG reporting transparency in 99 global real estate markets over 2016–2020. Using the JLL GRETI sustainability index, they show that more is needed towards elevating the stature of environmental sustainability in the context of an increasing focus on ESG and specifically on climate risk mitigation, climate resilience, and zero-carbon in real estate investment. Sah et al. (Citation2013) found evidence of a positive impact on firm value as measured using Tobin’s Q ratio, and that green REITs had a higher return on assets than their less-green peers. They also found evidence of superior stock performance by green REITs over their non-green peers, using Jensen’s alpha as a measure. In their Singaporean study, Ho et al. (Citation2013) found that “green” buildings impact the operational and financial performance of REITs. However, different measures of “greenness” of REIT’s property portfolio will yield different set of results, and observed effects will vary across the different property types namely: office, retail, and residential. Ooi and Dung (Citation2019), using Green Mark certification as a measure of the proportion of green real estate in the asset portfolios of publicly traded REITs in Singapore, found a significant relation between the ‘‘greenness’’ of the portfolio and its operating performance. They specifically found that REITs with more green assets registered higher ROA and operating margin; however, they did not observe any positive abnormal return (alpha) associated with portfolio greenness. Morri et al. (Citation2020) demonstrate a positive relationship between greenness indicators and operating performance in European REITs, although the impact on ROE and ROA differs depending on the GRESB variable analyzed.

Table 1. Green Star South African ratings tool scores.

Data and Methods

Data

The paper used green buildings and financial data obtained from the GBCSA’s website and publicly available financial reports of REITs that operate in South Africa. The financial performance data were obtained from the annual financial statements for JSE-listed REITs (EquityRT, Citation2022). Out of the possible 27 REITs that are listed at the JSE, the paper focussed on 11 REITs that had green buildings in their portfolios. Once the 11 sampled REITs with certified green buildings were identified, the focus turned to measuring the number of green buildings per REIT and the GLA of such green buildings. The data was collected for each of the REITs as shown below (). The data was captured annually. Growthpoint, Investec, and Redefine were the first REITs to start investing in green buildings.

Table 2. Eleven REITs with green buildings in their portfolio in South Africa.

shows the specific variables that were collected. In , except for the green variables, all the other variables were obtained or calculated from the financial data in the REITs’ annual reports and EquityRT database.

Table 3. Description of model variables.

The use of ROA and ROE as dependant variables in the estimated regression models was to provide a robust picture regarding the relationship of REITs’ greenness and their return performance. It is worth noting that ROA measures of return performance as the net income produced by the firm, relative to portfolio performance; whereas ROE measures the return performance as the net income produced by the firm, relative to the utilization of shareholder investment. Funds From Operations (FFO) is also highly recommended as a precise estimate for REITs’ financial performance. However, it was not possible to use it as a dependent variable in the present study since FFO is not consistently reported by SA REITs. Components, such as depreciation and amortization, that would otherwise be used to calculate FFO are also not reported consistently by SA REITs.

Increased investments in “greenness” are meant to increase asset performance and value, as well as decrease operational costs through careful measuring, monitoring, and automating building’s energy systems (Ho et al., Citation2013). The inclusion of control variables, including the Covid-19 dummy, was to assist with the statistical isolation of any variance of the financial performance variables (i.e., ROA and ROE) resulting from the specific roles of the green variables as postulated by various authors (Eichholtz et al., Citation2012; Hart & Ahuja, Citation1996; Ho et al., Citation2013; Russo & Fouts, Citation1997).

The three green variables were calculated as shown below. These calculations have been adopted from various studies in developed countries (Eichholtz et al., Citation2012; Morri et al., Citation2020; Ooi & Dung, Citation2019). The data needed for “greenness” calculations was obtained from the GBCSA’s annual reports.

To obtained percentage of green buildings (Green_BLD), EquationEquation (1)(1)

(1) was used where it was calculated as ratio of the number of South African-based GBCSA certified buildings to the number by the total number of properties owned by a REIT in the same year.

(1)

(1)

To obtain a percentage of GLA that is green (Green_GLA), EquationEquation (2)(2)

(2) was used, where it was calculated as a ratio of the sum of the gross floor area (GFA) of green certified buildings to the sum of the total GFA of all buildings owned by a REIT in the same year.

(2)

(2)

To obtain portfolio green building score, EquationEquation (3)(3)

(3) was used, where it was calculated as a ratio of the number of stars given to each certified building to the total number of properties in the respective REIT’s portfolio.

(3)

(3)

In EquationEquations (1)–(3) above, i stands for REIT i (for i = 1–11) and t denotes the year t (for t varying for each REIT, see ).

Choice of Analytical Techniques

The paper employed descriptive, correlation, and regression analyses. Descriptive analysis is in the form of univariate statistics (see Appendix A) and charts. Multiple regression models (EquationEquations (4)(4)

(4) and Equation(5)

(5)

(5) ), adopted from Ho et al. (Citation2013), were used to estimate the relationship between the dependent variables (i.e., ROA and ROE) and the green explanatory variables, with several other explanatory variables acting as control variables. The analysis comprised of estimating a panel model from REITs’ annual data. The following hypotheses were tested in the research:

H0: Green buildings do not have a significant impact on the return performance of REITs.

H1: Green buildings have a significant impact on the return performance of REITs.

A Panel Model for Annual Data

The following unbalanced panel data models were estimated.

(4)

(4)

(5)

(5)

Where:

In EquationEquations (4)(4)

(4) and Equation(5)

(5)

(5) , for i = 1…N REITs, and t = 1…T years, ROAi,t and ROEi,t are the dependant variables, estimated in turn, thus, shown as either or in EquationEquations (4)

(4)

(4) and Equation(5)

(5)

(5) (this was informed by diagnostics tests that were run – see ahead for further explanation). The

are constants that are independent of i and t; β1 – β9 are regression coefficients that are independent of i and t; and e are the error terms that are i.i.d. with N∼ (0, δ2). Necessary Hausman tests were conducted to test whether fixed effects or random effects were present. These steps ensured robust models were estimated. Ho et al. (Citation2013) and Ooi & Dung (Citation2019) followed the same steps. Data was analysed in R software.

Results and Discussions

Descriptive Results

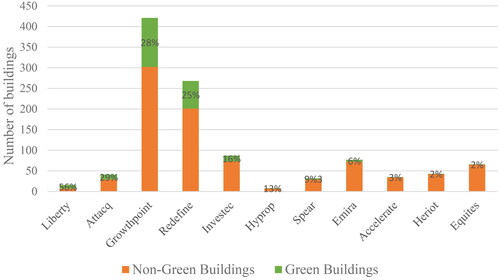

This section focuses on the description of the REITs’ dynamics across sectors using several descriptive plots. shows the share of non-green and green buildings across the different REITs. Growthpoint has the largest number of buildings (= 409) followed by Redefine with 272 buildings. The last two REITs with the lowest number of buildings are Liberty and Hyprop with 16 and 8 buildings, respectively. also shows that 28% of Growthpoint’s 409 buildings are green, while 25% of Redefine’s 272 buildings are green. However, Liberty and Attacq have the highest proportion of green buildings in their total portfolio of 56% (as a ratio of 16 buildings) and 34% (as the ratio of 41 buildings), respectively.

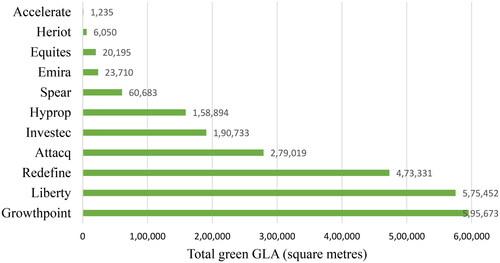

shows the total green GLA per REIT. The figure shows that Accelerate has the lowest green GLA of 1,235 square metres, while Growthpoint has the highest green GLA of 595,673 square metres. The results show that Growthpoint, Liberty, and Redefine as the three leading REITs with the largest total green GLA, respectively, contribute over 70% to the South African REITs total green GLA.

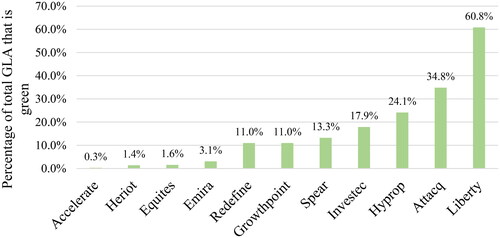

shows the percentage of GLA to total GLA across the different REITs. The figure shows that 60.8% of Liberty’s total GLA is green, while only 0.3% of Accelerate’s total GLA is green. The figure reveals that while Growthpoint has the highest green GLA as shown in , its share of green GLA to its total GLA is 11%.

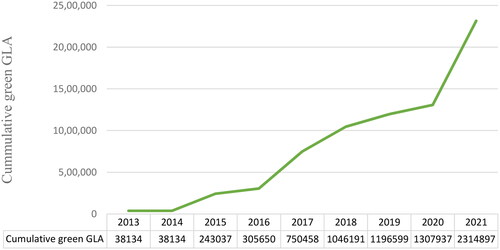

illustrates the cumulative green GLA owned by SAREIT from 2013 to 2021. The figure illustrates the exponential growth in the amount of green GLA in under a decade – from a paltry 38,133 square metres in 2013 to over two million square metres of GLA in December 2021. The figure showed that investments in green buildings peaked after 2016 – with a steeper increase after 2020. Scrutiny of yearly investments shows that this exponential growth is explained by a few REITs, that is, Attacq, Growthpoint, and Redefine. However, the exponential of growth of South Africa’s total green GLA appear little compared to the United States’s green GLA of about 23 million square metres in 2022 (USGBC, 2022).

Correlation Results

presents pairwise correlation coefficients of the variables used in this paper. Most of the coefficients in are statistically significant. The debt-to-equity ratio is negatively and statistically significant with the price-to-book ratio, GDP growth rate, and all-property index. The debt-to-equity ratio is negatively related to the log of market cap, but the relationship is statistically insignificant. The log of market cap has a positive and statistically significant relationship with the price-to-book ratio, GDP growth rate, and all-property index. Price-to-book ratio has a positive and statistically significant relationship with the GDP growth rate and all-property index, whereas the GDP growth rate has a positive and statistically significant relationship with all-property index as well. The size of these coefficients does not indicate any potential multicollinearity in the model variables.

Table 4. Correlation coefficients.

Regression Modelling Results

Panel Model Results – ROA as the Dependent Variables

The paper estimated three models – ROA (1), ROA (2), and ROA (3) – where ROA as the dependent variable were regressed on the green and control variables. As indicated earlier that the three green variables were highly collinear; ROA (1), ROA (2), and ROA (3) models had percentage of green buildings, percentage of GLA, and portfolio green building score as the green explanatory variables, respectively.

Hausman tests returned statistically significant (p < .05) chi-square values for each of the three panel models; ROA (1), ROA (2), and ROA (3), suggesting that fixed effects models were appropriate for each of the three models. shows the fixed model results where ROA is the dependent variable. Overall, the fixed effects model results in are consistent across all the models. The results show that, at the minimum, 44.2% of REITs’ return performance (measured as ROA) is explained by the regressors.

Table 5. Panel model results with ROA as the dependent variable.

All the coefficients for the green variables are positive and statistically significant across all models, implying that increased investments in green infrastructures have a positive effect on REITs’ return performance. There is a mixed picture regarding the contribution of the control variables. Log of market cap has positive contributions to REITs’ return performance across all models, while GDP growth rate has a positive contribution in ROA (1) and ROA (3). Expectedly, Covid-19 negatively affected REITs’ return performance variable, but only in ROA (2).

Diagnosis tests were performed to test the robustness, including meeting ordinary least squares (OLS) assumptions, of the results obtained from the estimated models. The multicollinearity test showed that the highest variance inflation factor (VIF) for the explanatory variables in ROA (1), ROA (2), and ROA (3) was under the recommended value of 5, suggesting a lack of multicollinearity. Histogram plots of standardized residuals for ROA (1), ROA (2), and ROA (3) were all fairly-normal, implying a lack of heteroscedasticity. Overall, these diagnostics results indicate that the estimated models were well fitted.

Panel Model Results – ROE as the Dependent Variables

Because of the high collinearity between the green variables, the paper estimated three models; ROE (1), ROE (2), and ROE (3), where ROE as the dependent variable were regressed on the green and the control variables. ROE (1), ROE (2), and ROE (3) models had a percentage of green buildings, percentage of GLA, and portfolio green building score as the green explanatory variables, respectively.

Hausman test results for ROE (1), ROE (2), and ROE (3) returned statistically insignificant (p > .05) chi-square values – suggesting that random effects models were appropriate for ROE (1), ROE (2), and ROE (3) estimations. shows the random effects model results where ROE is the dependent variable. Model fit was 39% for all three models. In , none of the green variables’ coefficients are statistically significant. In the three models, the price-to-book ratio and GDP growth rate were statistically significant and showed a positive impact on REITs’ return on equity. The Covid-19 variable’s coefficients were negative and statistically significant in all the estimated models. This implies that the Covid-19 pandemic had a dampening effect on REITs’ return performance (ROE in this case).

Table 6. Panel model results with ROE as the dependent variable.

Diagnosis tests were performed to test the robustness, including meeting OLS assumptions, of the results obtained from the estimated models. The multicollinearity test showed that the highest VIF for the explanatory variables was under the recommended value of 5 that imply lack of multicollinearity. Histogram plots of standardized residuals for the panel models were normal, implying a lack of heteroscedasticity. Overall, these diagnostics results indicate that the estimated models were well fitted.

Conclusions

This paper explored the extent of “greenness” of each South African REIT, as well as if there are any significant effects from green investments on the REITs return performance. Descriptive statistics show that as of December 2021, of the 27 REITs operating in South Africa, only 11 have green portfolios. These 11 REITs own a total of 242 green certified buildings of the current over 740 total number of green buildings in South Africa.

With investments in the green GLA experiencing exponential growth under a decade, from a paltry 38,133 square meters in 2013 to over two million square meters of GLA in December 2021, there are varying evidence of green investments across the different REITs that are worth pointing out. A closer examination of the data reveals interesting findings on the actual number of green buildings, total GLA, as well as actual and proportion of green GLA per REITs. For instance, Growthpoint has the highest proportion of green building at 28% (= out of 409 buildings), followed closely by Redefine’s proportion of 25% (= 67 green buildings) out of its 272 total buildings. In terms of green GLA, Accelerate has the lowest green GLA of 1,235 square meters, while Growthpoint has the highest green GLA of 595,673 square meters. Moreso, results show that Growthpoint, Liberty, and Redefine as the three leading REITs with the largest total green GLA, respectively, contribute over 70% to the South African REITs total green GLA.

The second part of the results from regression analyses were more informative. Controlling for several indicators, such as firm size, the paper included sector leaders and more recently listed REITs from 2014 through to 2017, providing a broad perspective into the South African REIT sector. At the panel level, regression results show that all the estimated models were robust and consistent on the role of green investments on REITs’ operational and financial performances. Where ROA was the proxy for REIT’s return performance, all the coefficients for the three green variables – percentage of green buildings, percentage of GLA, and portfolio green building score – of the three models estimated were positive and statistically significant (p < .05). Where ROE was the dependent variable, regression results while robust, indicated that none of the green variables was statistically significant. The statistically significant results of green variables, where ROA was the dependent variable, while insignificant, where ROE was the dependent variable, could be explained by the fact that the number of buildings, which was used as an input when calculating the green variables, was highly correlated (r = 0.901, p < .01) with total assets, which was an input in the calculation of ROA. Actually, equity, which was an input in the calculation of ROE, had a negative and insignificant correlation coefficient with the number of buildings. The statistically significant results support the hypothesis that green investing does have a significant positive impact on REITs’ return performance.

The effects of the control variables were mixed. For instance, the Covid-19 dummy was negative and statistically significant in some of the models and in this case, it implies that the Covid-19 pandemic had a dampening effect on REITs’ return performances. It is also important to speculate on the results that were significant (or insignificant) in ROA models, but insignificant (or significant) in the ROE models. There are quite several factors, such as market conditions, economic conditions, and the company’s changing capital structure and costs of assets, that influence the company’s ROA and ROE. The nuanced influence of these factors could explain the varying results in the ROA and ROE models in this paper. That is why it is advisable to use more than one measure, that is, ROA, ROE, and FFO, where possible, to get a full picture of a company’s overall financial health (Birken and Curry, Citation2023).

The results in this paper concur with similar studies in other countries. These include works by Ooi & Dung (Citation2019) and Ho et al. (2020) in Singapore, Morri et al. (Citation2020) in Europe, and Eichholtz et al. (Citation2012) and Sah et al. (Citation2013) in the U.S. This paper is timely as it adds an African and developing country contribution to this existing body of knowledge. To the industry, this paper supports the call for South African REITs to prioritize investing in green buildings as there is evidence that green buildings do have a significant impact on REITs’ return performance. The paper also offers support to the efforts of GBCSA that aims to transform the built environment for people and planet to thrive (GBCSA, Citation2022). The paper is also timely given that South Africa is facing an existential threat from the prevailing energy crisis.

This paper’s scope was limited by REIT’s legislation and the green building industry that are both relatively new in South Africa. This meant that only 11 out of 27 REITs have financial and green data reported in their financial annual reports. As such measures of financial performance, such as Funds from Operations (FFO), that are highly recommended as precise estimates of REITs’ financial performance could not be obtained. Similarly, extending the paper’s scope to cover individual REITs financial performance spread across several industrial sectors was not possible. When the SA REIT sector is mature, the authors recommend that future research should focus on these research areas.

References

- Aroul, R. R., Sabherwal, A. S., & Villupuram, S. V. (2021). ESG, operational efficiency and operational performance: Evidence from real estate investment trusts. Managerial Finance, 48(8), 1206–1220. https://doi.org/10.1108/MF-12-2021-0593

- Bienert, S., & Cajias, M. (2020). Does sustainability pay off for European listed real estate companies? The Dynamics between risk and provision of responsible information. Journal of Sustainable Real Estate, 3(1), 211–231. https://doi.org/10.1080/10835547.2011.12091823

- Birken, E. G., Curry, B. (2023). Understanding return on assets (ROA) https://www.forbes.com/advisor/investing/roa-return-on-assets/#:∼:text=Limitations%20of%20ROA&text=A%20company’s%20ROA%20is%20influenced,a%20company’s%20overall%20financial%20health

- Building Research Establishment (BRE). (1998). Building research establishment environmental assessment method (BREEAM). https://bregroup.com/

- Cajias, M., Fuerst, F., & Geiger, P. (2020). A Class of its own: The role of sustainable real estate in a multi-asset portfolio. Journal of Sustainable Real Estate, 8(1), 190–218. https://doi.org/10.1080/10835547.2016.12091884

- Chen, K. K., Khong, K. W., Ramachandran, J., Subramanian, R., & Yeoh, K. K. (2018). Corporate governance and performance of REITs. A combined study of Singapore and Malaysia. Managerial Auditing Journal, 33(67), 586–612. https://doi.org/10.1108/MAJ-09-2016-1445

- Excellence in Design for Greater Efficiencies (EDGE). (2017). Edge. https://edgebuildings.com

- Egan, J. (2018). REIT investors put more focus on environmental, social and governance issues, according to new reports. https://www.wealthmanagement.com/reits/reit-investors-put-more-focus-environmental-social-and-governance-issues-according-new-reports

- Eichholtz, P., Holtermans, R., Kok, N., & Yönder, E. (2019). Environmental performance and the cost of debt: Evidence from commercial mortgages and REIT bonds. Journal of Banking & Finance, 102, 19–32. https://doi.org/10.1016/j.jbankfin.2019.02.015

- Eichholtz, P., & Kok, N., & Yönder, E. (2012). Portfolio greenness and the financial performance of REITs. Journal of International Money and Finance, 31(7), 1911–1929. https://doi.org/10.1016/j.jimon?n.2012.05.014

- Eskom. (2021, March 31). Eskom integrated report. www.eskom.co.za/wpcontent/uploads/2021/08/2021IntegratedReport.pdf

- EquityRT database. (2022). EquityRT database. https://equityrt.com/

- GBCSA. (2022). Top 5 green building trends for 2020. https://gbcsa.org.za/top-5-green-building-trends-for-2020/

- Green Building Council of Australia (GBCA). (2003). Green star. https://new.gbca.org.au/

- GBCSA. (2021). Integrated annual report. https://gbcsa.org.za/wp-content/uploads/2022/08/GBCSA-2021-Integrated-Report.pdf

- GRESB. (n.d.). GRESB, the global ESG benchmark. https://www.gresb.com/nl-en/#:∼:text=GRESB%20is%20a%20mission%2Ddriven,tools%2C%20and%20regulatory%20reporting%20solutions.

- Hart, S., & Ahuja, G. (1996). Does it pay to be green? An empirical examination of the relationship between emission reduction and firm performance. Business Strategy and the Environment, 5(1), 30–37. https://doi.org/10.1002/(SICI)1099-0836(199603)5:1 < 30::AID-BSE38 > 3.0.CO;2-Q

- Ho, H. K., Rengarajan, S., & Han Lum, Y. (2013). Green” buildings and real estate investment trust’s (REIT) performance. Journal of Property Investment & Finance, 31(6), 545–574. https://doi.org/10.1108/JPIF-03-2013-0019

- IEA & UNEP. (2021). Global status report for buildings and construction: Towards a zero-emissions, efficient and resilient buildings and construction sector. https://wedocs.unep.org/20.500.11822/34572

- Khan, M. A. (2022). ESG disclosure and firm performance: A bibliometric and meta analysis. Research in International Business and Finance, 61, 101668. https://doi.org/10.1016/j.ribaf.2022.101668

- Leskinen, N., Vimpari, J., & Junnila, S. (2020). A review of the impact of green building certification on the cash flows and values of commercial properties. Sustainability, 12(7), 2729. https://doi.org/10.3390/su12072729

- L2D. (2022). Integrated annual report. https://www.liberty2degrees.co.za/investors/integrated-reports/

- Little, A. (2022). Why industry cannot afford to ignore ESG. Built Environment Journal. https://ww3.rics.org/uk/en/journals/built-environment-journal/why-industry-cannot-afford-to-ignore-esg.html

- Liu, H., Wu, J., & Zhang, L. (2018). Turning green into gold: A review on the economics of green buildings. Journal of Cleaner Production, 172(22), 34–2245. https://doi.org/10.1016/j.jclepro.2017.11.188

- Mattoni, B., Guattari, C., Evangelisti, L., Bisegna, F., Gori, P., & Asdrubali, F. (2018). Critical review and methodological approach to evaluate the differences among international green building rating tools. Renewable and Sustainable Energy Reviews, 82, 950–960. https://doi.org/10.1016/j.rser.2017.09.105

- Morri, G., Anconetani, R., & Benfari, L. (2020). Greenness and financial performance of European REITs. Journal of European Real Estate Research, 14, 40–61. https://doi.org/10.1108/JERER-05-2020-0030

- Morri, G., & Parri, E. (2017). US REITs capital structure determinants and financial economic crisis effects. Journal of Property Investment & Finance, 35(6), 556–574. https://doi.org/10.1108/JPIF-07-2016-0055

- National Association of Real Estate Investment Trusts (NAREIT). (2011). The Investor’s Guide to REITs, NAREITs Guide to the Real Estate Investment Trust Industry.

- National Association of Real Estate Investment Trusts (NAREIT). (2023). Global real estate investments. https://www.reit.com/investing/global-real-estate-investment

- Newell, G., & Marzuki, M. J. (2022). The increasing importance of environmental sustainability in global real estate investment markets. Journal of Property Investment & Finance, 40(4), 411–429. https://doi.org/10.1108/JPIF-01-2022-0005

- NSW Government. (2003). National Australian built environment rating system (NABERS). https://www.nabers.gov.au

- Ooi, J. T. L., & Dung, D. D. Q. (2019). Finding superior returns in green portfolios: Evidence from Singapore REITs. Journal of Sustainable Real Estate, 11(1), 191–215. https://doi.org/10.22300/1949-8276.11.1.191

- Republic of South Africa (RSA). (2008). National Energy Act (No, A., 34. of 2008), Government Gazette. Vol. 521, No 31638, 24 November.

- Russo, M., & Fouts, P. (1997). Russo M. V., P. A. Fouts: 1997, A resource-based perspective on corporate environmental performance and profitability. Academy of Management Journal, 40(3), 534–559. https://doi.org/10.2307/257052

- Sah, V., Miller, N., & Ghosh, B. (2013). Are green REITs valued more? Journal of Real Estate Portfolio Management, 19(2), 169–177. https://doi.org/10.1080/10835547.2013.12089948

- SAPOA. (2023). The impact of load shedding on the commercial real estate industry. Retrieved May 27, 2023, from https://propertywheel.co.za/2023/03/sapoa-survey-the-impact-of-load-shedding-on-the-commercial-real-estate-industry/

- SAREIT. (2023). Our members. https://sareit.co.za/members/

- Singhania, M., & Saini, N. (2022). Quantification of ESG regulations: A cross-country benchmarking analysis. Vision: The Journal of Business Perspective, 26(2), 163–171. https://doi.org/10.1177/09722629211054173

- Swanepoel, R. (2022). The benefits of ‘green building’. https://www.sa-green-info.co.za/portal/article/3136/the-benefits-of-green-building

- U.S. Department of Commerce. (2020). Environmental data. U.S. Department of Commerce. https://www.commerce.gov/data-and-reports/environmental-data

- UNDP. (2015). The SDGs in action. UNDP https://www.undp.org/sustainable-development-goals

- United Nations Environment Program (UNEP). (2021). 2021 Global status report for buildings and construction: Towards a zero-emission, efficient and resilient buildings and construction sector.

- United States Department of Energy (USDE). (1992). Energy star. https://www.energy.gov/

- United States Green Building Council (USGBC). (2008a). Leadership in energy and environmental design. US Green Building Council. www. usgbc.org/LEED.

- United States Green Building Council (USGBC). (2008b). USGBC reaches 23 million square feet of LEED certified net zero space. https://www.cleanlink.com/news/article/USGBC-Reaches-23-Million-Square-Feet-of-LEED-Certified-Net-Zero-Space–28621.

- WHO. (2015). WHO calls for urgent action to protect health from climate change – Sign the call. https://www.who.int/news/item/06-10-2015-who-calls-for-urgent-action-to-protect-health-from-climate-change-sign-the-call

- Wu, Z., & Feng, Z. (2021). ESG disclosure, REIT Debt financing and firm value. The Journal of Real Estate Finance and Economics, 67(3):1–35. https://doi.org/10.1007/s11146-021-09857-x