?Mathematical formulae have been encoded as MathML and are displayed in this HTML version using MathJax in order to improve their display. Uncheck the box to turn MathJax off. This feature requires Javascript. Click on a formula to zoom.

?Mathematical formulae have been encoded as MathML and are displayed in this HTML version using MathJax in order to improve their display. Uncheck the box to turn MathJax off. This feature requires Javascript. Click on a formula to zoom.Abstract

The study’s purpose is to examine the effects of corporate governance (CG) mechanisms on corporate performance (CP) and the moderating effect of the interaction between joint audit (JA) and accounting conservatism on this relationship in Egypt. From 2016 through 2020, the sample consisted of 61 non-financial Egyptian corporations listed. Panel data analysis with fixed-effect models was utilized to estimate the findings. The findings reveal that CG mechanisms as individual variables and CG index have a significant effect on CP by market- and accounting-based measures. The results also exhibit that the interaction between JA and accounting conservatism moderates and strengthens the relationship between the CG index and CP. The study’s unique contributions materialize in combining individual relationships into a comprehensive model. The model portrays the interaction between JA and accounting conservatism as a moderator in the relationship between CG mechanisms and CP. Furthermore, the study examines market- and accounting-based CP. The findings corroborate the literature and theoretical foundations of CG in emerging markets and focus on effective mechanisms for CG in various economic sectors. This study provides several practical implications for policymakers, auditors, corporations, shareholders, investors and practitioners, especially in emerging markets.

IMPACT STATEMENT

The interplay among corporate governance, joint audit, and accounting conservatism plays a critical role in a company’s performance. Nonetheless, the literature offering a comprehensive exploration of these interrelationships remains limited. Hence, our paper’s unique contributions materialize by combining individual relationships into a comprehensive model. The comprehensive model portrays the interaction between joint audit and accounting conservatism as a moderator in the relationship between corporate governance mechanisms (through a compound index for corporate governance) and corporate performance (through market- and accounting-based corporate performance). The sample consists of 305 firm-year observations spanning the Egyptian context from 2016 to 2020. Panel data analysis with fixed-effect models is utilized to estimate the findings. Supplementary analyses are performed to assess the study findings’ robustness and ensure that the main findings are robust with different measurements.

1. Introduction

Following the global financial crisis, which declared many firms bankrupt worldwide and highlighted failures in corporate governance (CG), there have been increasing calls from professionals and academics for greater implementation and monitoring of CG mechanisms to increase user confidence in published financial reports (Zhou et al., Citation2018). Furthermore, improved corporate performance (CP) and an investment environment that stimulates economic growth while protecting shareholder interests are critical (Puni & Anlesinya, Citation2020). Although the issue is receiving increased attention in emerging economies, many continue to face problems because of poor governance (Almaqtari et al., Citation2020; Boachie & Mensah, Citation2022). In the Egyptian context, the CG Code is according to the Organisation for Economic Co-operation and Development’s (OECD) CG Principles. However, implementation of the code has been poor, and compliance disclosure has been minimal (Amer et al., Citation2014; Soliman & Elsalam, Citation2013). The ‘European Bank for Reconstruction and Development’ (EBRD) ranks Egypt poorly in terms of competitiveness, investor protection and perceptions of corruption (EBRD, Citation2016). Thus, Egyptian firms require robust CG mechanisms.

The importance of implementing CG is demonstrated by its foundations, principles and mechanisms that govern the link between shareholders, board members and other stakeholders (Alawaqleh et al., Citation2021). The board of directors is regarded as the main pillar of CG (Baran & Forst, Citation2015). Therefore, board decisions significantly influence CP. The audit committee (AC) is a crucial oversight mechanism for financial reporting and disclosure (Huang & Thiruvadi, Citation2010). In this regard, Aldamen et al. (Citation2012) established a relationship between improved information quality and superior CP. Furthermore, audit firm size has a significant impact on CG effectiveness, making it a crucial mechanism for improved performance (Douma et al., Citation2006). Therefore, the study suggests promoting mechanisms to assist in implementing the tasks of executing, supervising and monitoring functions through joint audit (JA) and accounting conservatism, which could play a moderating role in the hows and whys of the relationship between CG and CP. The European Commission (EC) issued a report known as the ‘Green Paper’ in 2010 titled ‘Audit Policy: Lessons from Crises’ (EC, Citation2010). The EC proposed several regulatory procedures and mechanisms in this report. The most important of these mechanisms is the JA (EC, Citation2010; Lobo et al., Citation2016). JA is familiar with Egyptian industries because it has already been done either mandatorily or voluntarily (Financial Regulatory Authority [FRA], Citation2016). On the other hand, conservatism is one of the most significant accounting assumptions in the process of creating financial statements due to its considerable impact on determining business results and the financial status of firms. Furthermore, due to its clear influence on improving the suitability and reliability of the reports published (Cho & Choi, Citation2016; C.-M. Lin et al., Citation2018; Louis et al., Citation2012). The benefits of JA are consistent with the benefits of preparing financial reports with an appropriate level of conservatism.

The research gap and its problem lie in the scarcity of literature in this area in emerging markets. Furthermore, there has been no investigation of the correlation between CG mechanisms and CP or the impact of the interaction between JA and accounting conservatism on this relationship. Accordingly, this study is motivated by four major factors: Firstly, CG studies, as well as CP, remain significant and have become a source of concern for regulators and policymakers. As a result, it is necessary to investigate how the CG mechanisms and their role in monitoring CP affect the agency’s problems and investor protection. Therefore, this study provides an extension of previous studies in an attempt to deepen the literature and reduce discrepancies. Secondly, the empirical literature is inconclusive on the effects of the CG on CP; they differ across firms, sectors and nations (Akram & Abrar Ul Haq, Citation2022; Al-ahdal et al., Citation2021; Antounian et al., Citation2021; Boshnak et al., Citation2023; Nguyen & Dao, Citation2022; Wang et al., Citation2020). Further clarification in the Egyptian context of these relationships is thus necessary. Similarly, the empirical literature on the effects of JA and accounting conservatism is inconclusive (Alves, Citation2023; Hajawiyah et al., Citation2020; Lobo et al., Citation2016; Nasr & Ntim, Citation2018). Thirdly, the majority of previous literature examined the influence of the CG mechanisms on CP using the individual mechanisms of the CG (Haron et al., Citation2022; Puni & Anlesinya, Citation2020; Wang et al., Citation2020). Prior literature found mixed results because these studies ignored the idea that the effectiveness of a single mechanism depends on the effectiveness of other mechanisms. Therefore, this study uses a composite index for CG. Fourthly, various studies have been conducted in developed economies to assess the influence of specific CG mechanisms on CP. The available evidence and literature do not fully address this subject in emerging economies, in this case, Egypt. The majority of studies on this topic have focused on developed economies that have robust and well-enforced CG practices. However, the results of such research from developed countries may not be applicable to developing countries (Amer et al., Citation2014). It is contended that in developing countries that have different cultural, regulatory, CG and institutional contexts, the level and extent of voluntary compliance with CG codes can be expected to differ from that found in developed countries (Wang et al., Citation2020). The current study focuses on one of the Middle East and North Africa’s (MENA) fastest-growing economies, Egypt. The unique institutional, legal and investment settings in Egypt provide an interesting case for research. Moreover, most business practices of countries in the MENA region are inspired by Egypt’s business practices and take them as a model to develop their own business regulations and practices (Amer et al., Citation2014; Soliman & Elsalam, Citation2013). Therefore, the current study is unique and different from prior studies.

The current study attempts to answer the main research question: Does the interaction between JA and accounting conservatism moderate the relationship between CG mechanisms and CP? Hence, the study’s purpose is to examine the effects of CG mechanisms on CP and the moderating effect of the interaction between JA and accounting conservatism on this relationship. The analysis is based on a balanced database of 305 observations and runs from 2016 to 2020. The findings reveal that board independence and the CG index have a significant positive effect on return on assets and return on equity. However, board expertise has a significant positive effect on Tobin’s Q. Conversely, board independence, audit firm size and the CG index have a significant negative effect on Tobin’s Q. However, board expertise has a significant negative effect on return on assets and return on equity. The results also exhibit that the interaction between JA and accounting conservatism moderates and strengthens the relationship between CG index, CG mechanisms as individual variables and CP.

Consequently, the current study seeks to make the following contributions to the existing literature: First, the theoretical contribution materializes through the amalgamation of individual relationships into a comprehensive model that demonstrates the interaction between JA and accounting conservatism as a moderator in the relationship between CG and CP through a compound index for the CG. Second, the study results support the foundations of agency theories, resource dependence theory and signaling theory. The study contributes to the theoretical understanding and adds to the current literature on CG, CP, accounting conservatism and JA, thus advancing CG studies in this field. The study is significant because the critical role that CG plays in a company’s success deserves in-depth research on the various factors that relate CG to CP. Third, prior research has focused on one aspect of CP (Boachie & Mensah, Citation2022; Dahya & McConnell, Citation2007; Sheikh & Alom, Citation2021), but the current study examines market- and accounting-based CP. The study uses both measures to give more robust results about long- and short-term performance measurement. Finally, the study provides policymakers, auditors, corporations and practitioners with practical contributions. For policymakers, the findings of this study suggest that the adoption of JA can enhance CP in non-financial corporations listed in Egypt. Policymakers can promote JA as a mechanism for improving CP and encourage its adoption by companies. Policymakers can also develop regulations and guidelines that encourage companies to establish effective CG mechanisms. Auditors should pay attention to the quality and effectiveness of the CG mechanisms when assessing CP. Auditors can also provide feedback and recommendations to corporations on how to improve their CG mechanisms and performance. Corporates can evaluate their CG mechanisms and make necessary changes to enhance their performance. Corporations can also consider adopting JA as a mechanism for improving performance and enhancing CG. Practitioners can develop and implement strategies that enhance CP. Practitioners can also provide guidance and recommendations to companies on how to establish effective CG mechanisms and adopt JA.

2. Background of the study

There are many challenges facing companies, which result in many crises and damage to stakeholders, causing them to lose confidence in their financial statements (Haron et al., Citation2022). This has resulted in an increase in professional and academic demands to implement greater oversight and activate the role of CG mechanisms to ensure the restoration of confidence in the quality of published financial reports and to improve CP (Sheikh & Alom, Citation2021). With the increasing severity of the economic collapses and the worsening of many cases of bankruptcy of major companies in a number of East Asian countries in 1997, as well as some financial collapses of a number of American companies such as Enron in 2001, Worldcom in 2002 and finally the global financial crisis in 2008. This negatively affected the confidence of traders in the financial market (Amer et al., Citation2014) and the loss of stakeholders’ confidence in the information provided by auditing firms (Alanezi et al., Citation2012), especially after the collapse of the Arthur Anderson Auditing firm for its role in publishing misleading financial reports containing professional violations about Enron.

CG mechanisms are therefore increasingly important to reduce corporate risks and protect shareholders and other stakeholders (FRA, Citation2016). Researchers have described the benefits of internal and external CG mechanisms to companies. These mechanisms, and especially the board of directors, ACs and audit firm size, can increase users’ confidence in financial reports and enhance their usefulness, thereby helping users make investment decisions (Cho & Choi, Citation2016). The importance of implementing CG is demonstrated by its foundations, principles and mechanisms that govern the relationships between the board of directors, shareholders and other stakeholders (Alawaqleh et al., Citation2021). Therefore, board decisions significantly influence CP. Effective functioning and decisions by the board will preserve the firm’s assets and maximize shareholders’ wealth (FRA, Citation2016).

Accordingly, many questions were raised about the importance of CG mechanisms, the feasibility of external audits and the extent of their impact on the integrity and reliability of financial reports and improving CP (Boshnak et al., Citation2023). CG and external audit mechanisms emphasize the importance of relying on conservative accounting policies in preparing financial reports (Nasr & Ntim, Citation2018), as accounting conservatism is considered one of the basic principles on which accounting theory is based under the name of caution (Beaver & Ryan, Citation2005). Accounting conservatism affects the functions of measurement and accounting disclosure to ensure appropriate dealing with all risks and uncertainties associated with the company’s practice of economic activity (Watts, Citation2003). This has been reflected in the increase in accounting studies, especially in light of the increasing demands of stakeholders to follow more conservative accounting policies (Nasr & Ntim, Citation2018).

In order to improve the CP, increase the level of conservatism and strengthen trust and credibility in the financial statements and audit reports, some professional bodies have taken some preventive measures to prevent the recurrence of the crisis (Lobo et al., Citation2016; Velte, Citation2017; Zhou et al., Citation2018). Some legislation has been issued to control and monitor the performance of auditors, such as imposing greater oversight, activating CG mechanisms and the JA approach (André et al., Citation2015; Elmashtawy et al., Citation2023b). The EC issued a report known as the Green Paper in 2010 entitled ‘Review Policies, Lessons from the Crisis.’ The EC proposed many procedures and mechanisms to restore confidence in the published financial statements and in the independence of the external auditor (Holm & Thinggaard, Citation2015). The most important of these procedures and mechanisms are the ACs and the JA approach (Lobo et al., Citation2016). The EC has proposed mandatory JA as one of the solutions to give confidence in the auditor’s report and support the monitoring of auditing firms in the European Union (Alanezi et al., Citation2012; Velte, Citation2017). The responses of professional bodies to this proposal varied, as some indicated concern regarding the increase in the cost of the audit, the occurrence of conflicts between the auditors participating in the audit, or the occurrence of the phenomenon of market concentration (Lobo et al., Citation2016). On the other hand, some professional organizations have been keen to support JA to improve the CP, such as the International Federation of Auditors’ issuance of International Auditing Standard No. 600 regarding the use of another auditor, and the standard provides guidance to auditors when applying JA (Velte, Citation2017; Zerni et al., Citation2012).

Several studies argue that the interaction between JA and accounting conservatism affects improving audit quality, improving CP, enhancing auditor independence and reducing audit market concentration (Abdalwahab & Alkabbji, Citation2020; Akram & Abrar Ul Haq, Citation2022; Al Farooque et al., Citation2020; Almaqtari et al., Citation2020; Alqadasi & Abidin, Citation2018; Elmashtawy et al., Citation2023b; Hajawiyah et al., Citation2020; Lobo et al., Citation2016; Zerni et al., Citation2012). It is expected that different CG mechanisms will affect the choice of the type of audit and the application of conservative policies, as ACs and the Board of Directors influence the choice of the type of audit and the appropriate audit firm size (Alqadasi & Abidin, Citation2018). In addition to choosing to implement more conservative policies than not, which affects the CP in the short and long term (Nguyen & Dao, Citation2022). Furthermore, according to the replacement policy, the company may replace weak CG mechanisms by adopting more conservative policies or adopting JA in the presence of Big 4 audit firms and vice versa (Alawaqleh et al., Citation2021; Elmashtawy et al., Citation2023a). Therefore, the study argues that CG mechanisms have an impact on CP and that the interaction between JA and accounting conservatism moderates this relationship.

3. Theoretical literature review

The study generates hypotheses based on several modifications of prior research findings. In this study, the research variables are derived from agency theory, resource dependence theory and signaling theory, contributing to understanding how CG, CP, accounting conservatism and JA are related to one another. The agency theory identified the broad knowledge and deep understanding that the board, the AC and the audit firm size are important mechanisms for CG, which in turn better monitors management and protects the interests of shareholders, reducing the cost of the agency and improving CP (Fama & Jensen, Citation1983; Harvey Pamburai et al., Citation2015). CG mechanisms like the board of directors, the AC and the external audit enable shareholders to closely monitor managers, deter their opportunistic behavior and thus improve CP (Akram & Abrar Ul Haq, Citation2022; Sheikh & Alom, Citation2021). Strong governance characteristics of the board and AC help align the interests of shareholders and managers by improving CP and providing reliable financial information (Wang et al., Citation2020). J. W. Lin et al. (Citation2006) asserted that the board and AC, whose members are independent non-executive directors, can perform an effective monitoring function. Likewise, García-Sánchez et al. (Citation2017) suggest that an independent, expert and active AC improves its monitoring function and improves CP. Most empirical studies based their empirical models on agency theory to investigate the relationship between CG and CP (Boshnak et al., Citation2023; Mishra et al., Citation2021). Hence, the agency theory is an important basis for the present study because it recognizes the roles of the board, AC and JA as mechanisms to improve CP.

At the same time, the resource dependence theory assumes that the CG mechanisms assist the management in providing extensive management knowledge and other necessary resources, as well as providing advisory services regarding strategic decisions and thus improving CP (Coetzee et al., Citation2022; Greeff, Citation2019; Pfeffer, Citation2019). Pfeffer (Citation2019) suggested researchers adopt other theoretical perspectives to generate more productive results. Therefore, this study adopted the resource dependence theory to explain the role of directors in contemporary CG and to complement the agency theory. Resource dependence theory argues that directors are valuable resources for a company that can help it achieve business operations and carry out the monitoring function (Akram & Abrar Ul Haq, Citation2022; Dakhlallh et al., Citation2020). The theory posits that the board spans the boundary and gathers resources from the environment (Pfeffer, Citation2019). Therefore, boards have become an invaluable mechanism for firms to gain external resources. The board’s capacity to connect the company with uncontrollable resources required for its survival boosts the CP and value (Dakhlallh et al., Citation2020; Pfeffer, Citation2019). The resource dependence theory focuses on the resources supporting the company’s goals. Therefore, companies need to carefully choose their board composition, size and expertise to achieve their goal, which in turn protects and maximizes shareholders’ wealth and improves CP.

In contrast, signaling theory suggests that managers may make some critical decisions as a signal to shareholders and a tool to convince investors that the company has a high CP, such as selecting the Big 4 to conduct the audit process or adopting JA (Alves & Carmo, Citation2022; Jung & Cho, Citation2022). Signaling theory holds that well-performing companies can distinguish themselves from companies with poor performance by sending a credible signal about their quality to the stock markets, and this signal is credible to the public if the companies with poor performance are unable to imitate the companies with good performance in sending the same signal (Downes & Heinkel, Citation1982). This happens when the cost of that signal is high for weak companies, and that is why those companies avoid emulating companies with good performance, and then the signal is credible. The signaling theory indicates that the actions taken by the company’s management provide clues to investors about the management’s view of the company’s future (Mavlanova et al., Citation2012). As a result, the financial decisions made by management must not only be correct, but this administration must also work to persuade the market that they are good decisions and in the best interests of the company, and thus in the best interests of the investors (Taj, Citation2016). As a result of the preceding, it is clear that the signal theory does not only work on analyzing the financial decisions of the company but also allows for the study of induction systems that push or encourage the management of good companies to deliver the correct signals and, at the same time, deter the management of bad companies from using the same signals to distort the true value of their company.

4. Empirical literature review and hypotheses development

4.1. Board independence (BIND)

Board independence has been identified as a critical factor influencing the board’s competence to safeguard investors’ interests (Fama & Jensen, Citation1983). According to Carcello et al. (Citation2002), independent board members take their monitoring role more seriously and more independent boards are more responsible for monitoring. Furthermore, a conflict of interest exists between management and shareholders because management and ownership are separate. According to agency theory, the responsibility for protecting and monitoring shareholders’ interests rests with the board of directors (Jensen & Meckling, Citation1976). Board independence reduces agency costs, resulting in more monitoring and better CP (Fama & Jensen, Citation1983; Haron et al., Citation2022). The Egyptian Corporate Governance Code – Third Release (Citation2016) advises that the board be largely composed of independent directors, with a minimum of two independent members with technical and analytical skills (Egyptian Institute of Directors [EIOD], 2016). On another quest, independent board members are said to be ‘professional judges’ who play a critical role in protecting shareholders’ interests through effective decision-making (Antounian et al., Citation2021; Sheikh & Alom, Citation2021). Furthermore, independent directors must protect their reputation and professional lives, which forces them to be extremely cautious in protecting the interests of shareholders, as evidenced by increased investment efficiency, improved earnings reports and improved CP (Mura, Citation2007; Wang et al., Citation2020).

Several studies have been conducted to determine the relationship between board independence and CP. Based on Brown and Caylor (Citation2006), there is a direct relationship between board independence and CP. The findings of that study agreed with the findings of Puni and Anlesinya (Citation2020), which concluded that board independence has a positive influence on CP. The findings of that research, however, contrasted with the findings of the studies by Agrawal and Knoeber (Citation1996) and Haron et al. (Citation2022), which found an adverse relationship between board independence and CP. When compared to better-performing firms, underperforming firms were more likely to have an increased proportion of external managers, indicating decreased oversight. Whereas Amer et al. (Citation2014), Sheikh and Alom (Citation2021) and Wang et al. (Citation2020) deduced that board independence has no influence on CP. Therefore, the proposed hypothesis is:

Hypothesis 1 (H1): The percentage of independent directors on the board has a significant and positive effect on CP.

4.2. Board expertise (BEXP)

The inclusion of financial competence on the board demonstrates the board’s ability to effectively monitor (Bédard et al., Citation2004). A member with financial competence is defined in this study as a board member with accounting or finance qualifications or a member of any accounting professional association. According to Alfraih (Citation2016), a number of factors, including board expertise, determine the board’s effectiveness in monitoring operations. A director with financial understanding, according to Alqadasi and Abidin (Citation2018), is a sign of managerial talent. These directors, in theory, have extensive expertise and knowledge of financial reporting processes (Alfraih, Citation2016; Zied & Mohamed, Citation2013). According to Das et al. (Citation2020), as the ratio of directors’ expertise increases, the possibility of financial statement fraud decreases. In the same vein, Alawaqleh et al. (Citation2021) claim that board expertise improves CP because directors are more knowledgeable than others. As a result, a positive relationship between board expertise and CP is reasonable. Therefore, the following hypothesis is advanced:

Hypothesis 2 (H2): The percentage of the board’s financial expertise has a significant and positive effect on CP.

4.3. Audit committee independence (ACIND)

The Sarbanes-Oxley Act (Citation2002) mandates that all publicly traded corporations form and maintain a fully independent AC. The Blue Ribbon Committee (Citation1999) also suggested that ‘a director with no financial, family, or other material personal ties to management is more likely to be able to objectively examine the propriety of management accounting, internal control, and reporting processes’ (Klein, Citation2002). According to the Egyptian Corporate Governance Code – Third Release (Citation2016), an AC should be comprised of at least three members, with independent directors constituting the majority (EIOD, 2016). Furthermore, according to the notion of resource dependence, outside sources supply a corporation with an external route to increase performance (Pfeffer, Citation2019). As a result, the independent members help the AC better comprehend complex environments and provide numerous sources of expertise and experience (Amin et al., Citation2018; Elmashtawy et al., Citation2023a).

Prior literature supports the relevance of AC members being independent (Davidson et al., Citation2004). It is expected that the AC independent members enjoy a degree of freedom that makes them perform their monitoring duty better and improve CP, especially with no economic or personal ties with the company (Bananuka et al., Citation2018; Hsu & Petchsakulwong, Citation2010). In contrast, Davidson et al. (Citation2004), Kent et al. (Citation2010) and Lo et al. (Citation2010) discovered a negative relationship between AC members’ independence and CP. While Al Farooque et al. (Citation2020) reported that AC independence has no impact on CP. Considering the preceding, companies with an AC entirely comprised of independent directors are expected to be more motivated and capable of improving CP. Therefore, the following hypothesis is advanced:

Hypothesis 3 (H3): AC independence has a significant and positive effect on CP.

4.4. Audit committee expertise (ACEXP)

As part of its supervisory obligations, the AC members’ expertise is a crucial feature of its success. As a result, without experience, AC members would struggle to understand the financial information required effectively. The financial competence of AC members has also piqued the curiosity of governance regulators. The Sarbanes-Oxley Act (Citation2002), for example, requires the AC to comprise a minimum of one financially expert member and the remaining members to be financially literate, whereas the Blue Ribbon Committee asserts that an effective AC must be comprised of members with extensive financial knowledge (G. Krishnan & Visvanathan, Citation2009). In Egypt, the Egyptian Corporate Governance Code – Third Release (Citation2016) mandates that at least one member have competence in accounting and finance (EIOD, 2016). The resource dependence theory, on the other hand, suggests that this expertise is expected to help alleviate the agency’s problems (Alodat et al., Citation2022).

Several previous research findings indicate the value of AC members’ expertise. For example, Amin et al. (Citation2018) discovered a positive link between AC expertise and CP. Similarly, the studies of J. Krishnan et al. (Citation2011) and G. Krishnan and Visvanathan (Citation2009) have shown that having a minimum of one AC expert is favorably connected to CP. In recent decades, the literature has provided evidence that the positive impact of financial expert directors is solely attributed to accounting and auditing expertise (eg Alodat et al., Citation2022; Elmashtawy et al., Citation2023a; Zhou et al., Citation2018). Some studies, however, found no proof that AC expertise impacts CP (AbdulRahman & Ali, Citation2006). Hence, the following hypothesis is advanced:

Hypothesis 4 (H4): The financial expertise of the AC members has a significant and positive effect on CP.

4.5. Audit firm size (AFSIZE)

The failure of Arthur Andersen destabilizes the idea of providing superior auditing quality to the Big 4 over non-Big 4 audit firms. Nonetheless, some data points to the Big 4 as providing the highest quality audit service. Recently, some academics have questioned this notion, attempting to determine whether other audit tiers could provide the same or even higher levels of quality than the Big 4 (eg Boone et al., Citation2010; Chang et al., Citation2010; Lawrence et al., Citation2011). Regarding some previous literature (Abbott & Parker, Citation2000), the auditor selection process depends on a number of elements, such as the CG (the board and AC effectiveness), business risks (return on assets, current ratio and inverse interest coverage), and some control variables (firm size, leverage, cash assets, loss and sales growth).

Firms may prefer to have their audits performed by more qualified auditors (Wallace, Citation2004). This encourages corporations to seek out major auditors to offer investors certainty about the fair and correct presentation of information in financial reports as well as assurance from a publicly trusted audit firm (DeAngelo, Citation1981). Furthermore, the signaling effect contends that directors transfer additional information about their company and their own market conduct, which influences auditor selection and the demand for high-quality audits (Zerni et al., Citation2012). According to the signaling theory, firms with strong CG structures are probably going to require high-quality audits to reassure investors and signal the quality of their financial reports (Scholtz & Smit, Citation2015). As a result, CP varies according to the size of the auditing firm. Therefore, the following hypothesis is advanced:

Hypothesis 5 (H5): The presence of Big 4 audit firms has a significant and positive effect on CP.

4.6. The moderating effect of the interaction between JA and accounting conservatism on the association between CG and CP

Agency theory has identified that the external auditor is an important mechanism for CG, which in turn audits management, protects the shareholders’ interests and reduces the agency’s cost. In addition to the board’s role in selecting and appointing auditors, this leads to an improvement in CP (Elmashtawy et al., Citation2023a; Fama & Jensen, Citation1983; Zerni et al., Citation2012). According to agency theory, the separation of ownership and control in corporations creates problems in agencies because managers may act in their own interests rather than in the interests of shareholders. The JA approach is also supported by agency theory, which suggests that JA has more resources and expertise to maintain a high level of conservatism and improve CP. At the same time, resource dependence theory assumes that external auditors assist the board of directors in providing extensive management knowledge and other necessary resources, as well as advising on strategic decisions, thereby improving CP (Alodat et al., Citation2022; Pfeffer, Citation2019; Rezazade et al., Citation2023). Thus, the auditor’s role is to assure shareholders that the financial statements are accurate and reliable. Because of its greater resources and experience, the JA Approach may be better suited to provide this assurance. In contrast, signal theory suggests that managers may make critical decisions as a signal to shareholders as well as a tool to persuade investors that a company is of high quality, such as selecting the Big 4 to conduct the audit or JA adoption (Alves & Carmo, Citation2022; Lobo et al., Citation2016; Scholtz & Smit, Citation2015). According to signal theory, companies may use various signals to communicate their quality to external stakeholders, such as the board’s decision to adopt the JA, which may indicate that the company is committed to issuing high-quality financial statements and has hired two auditors.

The JA aims to increase the financial statements’ credibility by reducing the asymmetry of information and increasing capital market confidence (Deng et al., Citation2014). Furthermore, Ittonen and Trønnes (Citation2014) stated that the JA affects the company’s market value and thus increases stock returns, which is a positive indicator for investors. At the same time, the JA affects borrowing costs, which increases the company’s access to external financing on better terms (Deng et al., Citation2014). Lobo et al. (Citation2016) also emphasized the significance of the JA’s positive influence on CP. The positive effects of the JA will contribute to the activation of the company’s conservative accounting practices, resulting in the creation of additional investment opportunities for the company as a result of the cumulative effect of value storage due to the postponement of profit recognition in the current period (Watts, Citation2003). When compared to single audits, Zerni et al. (Citation2012) confirmed that corporations that activate the JA have a high level of conservatism and CP improvement.

It is supposed that there is a link between CG mechanisms and CP (Limijaya et al., Citation2021; Tsafack & Guo, Citation2021). Accounting conservatism is one of the governance mechanisms that limit managers’ ability to manipulate financial performance assessments by reducing information asymmetry, thereby improving the CP and future cash flows (Watts, Citation2003). Accounting conservatism, according to Francis et al. (Citation2009), provides appropriate information about the company’s expected future value, increasing the trading movement and performance of shares, improving the company’s image, attracting investors and improving CP. Accounting conservatism in financial statements influences CP through a variety of channels, the most important of which are reduced earnings management practices, reduced indebtedness contracts, reduced bankruptcy risks and increased stock returns (Sana’a, Citation2016; Watts, Citation2003). As a result, it is clear that there are indicators that show the positive influence of conservatism practices on improving CP, as well as the importance of JA at the level of conservatism practices because of its tangible impact in ensuring reasonable assurance about the quality of the financial report, on which different stakeholders rely when making investment decisions associated with the company. On the basis of the above justifications and the purpose of the study, it is suggested that the interaction between JA and accounting conservatism moderates the relationship between CG and CP. Depending on the foregoing discussions, the proposed hypothesis is:

Hypothesis 6 (H6): The interaction between JA and accounting conservatism moderates the association between CG and CP.

5. Research design

5.1. Data and sample consideration

The study population comprises 152 companies listed in the EGX 100 Index during the period from 2016 to 2020, since these companies are the most active and liquid companies listed on the market, according to the number of trading days and the number of transactions. In addition, this index provides an appropriate representation of all sectors of the economy. The study period from 2016 to 2020 was selected due to the third release of the CG code in 2016 in Egypt. Following prior studies (Alodat et al., Citation2022; Elmashtawy & Salaheldeen, Citation2022, Citation2023; Lobo et al., Citation2016; Puni & Anlesinya, Citation2020; Tsafack & Guo, Citation2021), the firms were selected based on the following sampling criteria to ensure a fair and quality comparison. 32 financial corporations were not included in the sample because of the specific nature of their businesses and the various regulatory requirements with which they must comply. 19 firms whose reports were missing or unavailable were removed from the analysis. Five corporations whose shares were not listed or traded during the research period were excluded from the analysis. Furthermore, 35 corporations that didn’t submit their annual financial reports by December 31st were also excluded. Thus, the final sample includes 61 non-financial corporations from 11 different sectors and 305 observations for the firm-year. Panel A of provides a summary of the sample selection process and Panel B of presents the industrial composition (by firm-year observations) of the final sample.

Table 1. Sample selection.

Secondary sources were used to collect the data, specifically financial reports, auditors’ reports and board of director reports. Panel data analysis with fixed-effect models was utilized to estimate the findings.

5.2. Variables definitions and measures

5.2.1. Dependent variable

The dependent variable is CP. The study measures CP using return on assets (ROA), return on equity (ROE) and Tobin’s Q. The study examines market- and accounting-based CP. ROA and ROE represent the corporation’s accounting-based performance in the short term, while Tobin’s Q represents the corporation’s market-based performance in the long term.

5.2.2. Moderating variable

The interaction between JA and accounting conservatism is considered the moderating variable. The study measures voluntary JA depending on the non-financial firms sampled that adopt voluntary JA. The study also measures accounting conservatism using the market-to-book value of net assets (MTB) model. This model was chosen for several reasons. First, it is one of the simplest and most common estimators of conservatism; second, it is a comprehensive measure that covers conditional and unconditional conservatism; and third, it reflects the cumulative effect of conservatism from the company’s establishment date until the measurement date as it links financial position elements to market variables.

5.2.3. Independent and control variables

The CG mechanisms are considered independent variables. The study relied on five variables to express the CG mechanisms, namely: board independence (BIND), board expertise (BEXP), audit committee independence (ACIND), audit committee expertise (ACEXP) and audit firm size (AFSIZE). In addition, the study adopted an index for the five variables to express the CG index (CGI). The control variables of the study are firm size (LSIZE), leverage (LEV) and liquidity (LIQ).

summarizes the definition and measurement of dependent, moderating, independent and control variables, along with evidence from prior studies that used the same measures.

Table 2. Variables description.

5.3. Models specification

The following statistical models were formulated to determine whether CG influences CP and whether the interaction between JA and MTB moderates the relationship between CG and CP.

(1)

(1)

The equation used in the present study to estimate the effect of CG mechanisms on CP includes , which represents the board characteristics,

which denotes audit variables, and

, which represents the control variables. The individual effect is measured by i, the temporal effect is measured by t, and the stochastic error is measured by

.

While,

(2)

(2)

(3)

(3)

(4)

(4)

Thus,

(5)

(5)

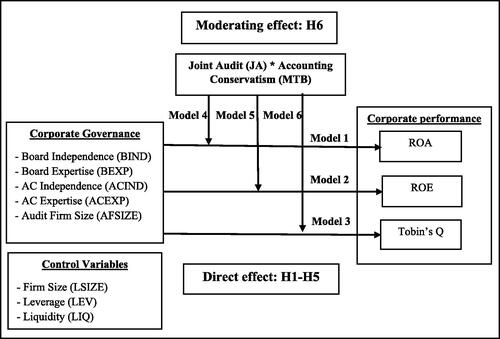

The direct effect models assess how CG can influence CP in the Egyptian exchange’s non-financial sector. The function of Model 1 is to measure the direct impact of CG (BIND, BEXP, ACIND, ACEXP, AFSIZE, CGI, JA and MTB) on ROA. The function of Model 2 is to measure the direct impact of CG (BIND, BEXP, ACIND, ACEXP, AFSIZE, CGI, JA and MTB) on ROE. The function of Model 3 is to measure the direct impact of CG (BIND, BEXP, ACIND, ACEXP, AFSIZE, CGI, JA and MTB) on Tobin’s Q. These three models answer hypotheses 1, 2, 3, 4 and 5.

Model 1:

Model 2:

Model 3:

The moderator effect models are to investigate the moderator influence of the interaction between JA and MTB on the association between CGI and CP in Egypt. As for Model 4, its function is to measure the moderating impact of the interaction between JA and MTB on the relationship between CGI and ROA. The function of Model 5 is to measure the moderating impact of the interaction between JA and MTB on the relationship between CGI and ROE. The function of model 6 is to examine the moderating impact of the interaction between JA and MTB on the relationship between CGI and Tobin’s Q. These three models answer hypothesis 6.

Model 4:

Model 5:

Model 6:

Based on the six models above, illustrates the relationships between CG, CP and the moderating function of the interaction between JA and MTB.

6. Empirical results and discussion

6.1. Descriptive statistics

shows the CP measurements descriptive statistics, where the mean of ROA is 0.04, and the minimum and maximum levels are −0.17 and 0.49, respectively. The mean ROE was around 1%, with a standard deviation of 0.78. Furthermore, the mean of Tobin’s Q is 1.05, with a minimum of 0.04 and a maximum of 17.23. The JA scales from 0 to 1, with a mean of 0.36 and a standard deviation (SD) of 0.48. This means that 36% of the sampled firms have a JA. While the mean MTB is 1.85, the minimum and maximum levels are 0.02 and 17.28, respectively. Concerning CG variables, the average BIND ratio is 17.6%, and it is partly distributed (SD 0.18), with zero as the minimum and 0.85 as the maximum. This suggests that the independent director ratio in Egyptian companies is low. While 17.3% of the board members have financial expertise (BEXP), with zero as the minimum and 0.8 as the maximum. This shows a low level of experience on the board. Moreover, the proportion of ACIND is 36.5%, with zero as the minimum and one as the maximum. In parallel, 34.5% of the AC members have financial expertise (ACEXP), with an SD of 23%. The average of AFSIZE was 0.69, and the SD was 0.56, indicating a wide variation in AFSIZE among the firms studied. Finally, the scale of CGI demonstrates an average of 3.82, with a minimum of 2 and a maximum of 5, which is considered a relatively high index.

Table 3. Descriptive statistics.

6.2. Correlation analysis

The correlation coefficient results are presented in . The highest correlation value discovered is 0.65, showing that the study has no multicollinearity problems. The results show that Tobin’s Q has a positive and significant relationship with JA and MTB (0.17 and 0.10, respectively). In contrast, it exhibits a negative and significant correlation with AFSIZE and CGI (−0.10 and −0.43, respectively). The results also demonstrate that while ROE has a positive and significant correlation with ROA and CGI (0.35 and 0.51, respectively), it exhibits a negative and significant correlation with MTB and AFSIZE (−0.10 and −0.14, respectively). Furthermore, ROA has a positive and significant correlation with ACIND and CGI (0.11 and 0.16, respectively) and a negative and significant correlation with ACEXP (−0.14). Importantly, JA exhibits a significant positive association with MTB, BEXP, ACEXP, AFSIZE and CGI. Meanwhile, MTB has a significant positive association with AFSIZE and CGI and a significant negative association with BEXP and ACEXP. The variance inflation factor (VIF) test findings, on the other hand, reveal a very low VIF for each variable (less than 1.30) and a large tolerance (at least 0.77), demonstrating that the independent variables are uncorrelated.

Table 4. Correlation matrix results.

6.3. Direct effect regression

The results in present an estimation of the direct effect models. The table indicates that JA has a significant negative influence across the models of ROA and ROE. In contrast, it has negative insignificance across the model of Tobin’s Q. This indicates that a JA is associated with a lower CP. The findings agree with the studies of Alanezi et al. (Citation2012), André et al. (Citation2015), Deng et al. (Citation2014) and Holm and Thinggaard (Citation2015). This could be because of the dependency or free-riding problem, in which the auditor involved in the audit process depends on the work of the other auditor. These findings are in accordance with the signal theory, in which the board uses the JA to improve the company’s image and attract new investors. Moreover, the results indicate that MTB has a significant negative effect across the models of ROA and ROE. This could be because the more conservative the board of directors is, the more the annual returns will be affected, which will affect the CP according to accounting-based measures. As for the long-term market measure, the results revealed that MTB has a positive but insignificant effect on Tobin’s Q. This result is in accordance with the agency theory and the studies (Abdalwahab & Alkabbji, Citation2020; Cui et al., Citation2021; Fariz et al., Citation2020).

Table 5. Direct effect regression results.

The results also suggest that BIND has a significant positive effect across ROA and ROE models at significant levels of 5% and 1%, respectively. This indicates that an increase in the percentage of independent board members is correlated with an improvement in short-term CP. This agrees with the resource dependence theory and the studies (Amer et al., Citation2014; Mishra et al., Citation2021; Wang et al., Citation2020). This is because an increase in the ratio of independent board members leads to more oversight and, thus, improved CP. In contrast, BIND has a significant negative across the model of Tobin’s Q at a significant level of 1%. This indicates that an increase in the percentage of independent board members is correlated with a decrease in long-term CP. The friendships between board members may have a long-term impact on the lack of effective monitoring and, as a result, the firm’s market performance. The results also indicate that BEXP has a significant negative influence across ROA and ROE models at significant levels of 10% and 1%, respectively. In contrast, it has a significant positive across the model of Tobin’s Q at a significant level of 1%. This indicates that increasing the financial experience of the board of directors is correlated with a decrease in short-term CP and an improvement in long-term CP. This could be due to the fact that as members’ financial experience increases, they become more conservative, resulting in a decrease in return at the expense of market value. Hence, as the financial experience of the board increases, so does the level of conservatism, and thus the market value exceeds the book value. It could also be due to the study sample’s low percentage of experienced members (see , where the average value of BEXP is 17%). This agrees with agency and signaling theories and is consistent with Alawaqleh et al. (Citation2021), Alfraih (Citation2016), Alqadasi and Abidin (Citation2018) and Das et al. (Citation2020).

Furthermore, the results also indicate that ACIND has a significant positive effect across the ROE model at a 10% significance level. This indicates that ACIND is associated with an improvement in the CP. This suggests that the increase in the AC independent member ratio leads to increased reporting process oversight, which affects performance improvement. The result agrees with resource independence theory and is consistent with previous literature findings by Al Farooque et al. (Citation2020) and Tornyeva and Wereko (Citation2012). Moreover, the results indicate that ACEXP has a significant negative influence on the ROA model at a 1% significance level and an insignificant influence on the ROE and Tobin’s Q models. This could be because of a decrease in expertise among the AC members of the Egyptian firms sampled. Looking at the results in , the average value of ACEXP is 34%. Furthermore, as AC members’ experience increases, they may become more conservative, resulting in a lower short-term return at the expense of long-term market value. The results agree with the signaling theory and are similar to the findings of the studies (Abdalwahab & Alkabbji, Citation2020; AbdulRahman & Ali, Citation2006; Amin et al., Citation2018; J. W. Lin et al., Citation2006).

The findings also indicate that AFSIZE has a significant negative influence on Tobin’s Q model at a 1% significance level and an insignificant positive influence on the ROA and ROE models. This suggests that the Big 4 are associated with lower long-run CP (Tobin’s Q) and high short-term CP (ROA and ROE). This is consistent with the agency and signal theories, according to which the board of directors selects the Big 4 audit firms as a signal to attract current or potential investors and enhance the company’s positive image, which may result in agency problems and a lack of conservatism. This is in accordance with Wallace (Citation2004). Concerning the effect of CGI across the conducted models, the outcomes in demonstrate that CGI has a significant positive impact on CP across the models of ROA and ROE at significant levels of 1% and 5%, respectively. This means a positive association between the CGI as a composite scale and CP across the accounting measures short-term (ROA and ROE). In contrast, the CGI has a significant negative impact on CP across the model of Tobin’s Q at significant levels of 1%, meaning a negative association between CGI as a composite scale and CP across the market measure long-term. This result shows that the presence of the CG mechanisms combined in the CGI positively affects the CP, especially in the case of short-term CP measurements. This finding is consistent with resource dependence theory and agrees with Mishra et al. (Citation2021). Overall, the models are appropriate, as denoted by the P-value. Adjusted R2 indicates that values varied from 62% to 84%, indicating that the models’ variables explain about 84% of the variability in CP. shows that hypotheses H1, H2, H3, H4 and H5 have been partially supported.

6.4. Moderating effect regression

results present an estimation of the moderating role of the interaction between JA and MTB on the relationship between CGI and CP. The results reveal that the interaction between JA and MTB moderates the relationship between CGI and CP. More precisely, the interaction between CGI, JA and MTB has a positive effect on improving CP across the conducted models (ROA, ROE and Tobin’s Q) at significant levels of 5%, 1% and 1%, respectively. This suggests that the interaction between JA and MTB has strengthened the relationship between CGI and CP across models of market- and accounting-based measures of CP. This also indicates that the positive relationship between CGI and CP is stronger in light of the JA and the increased level of conservatism. This result agrees with agency theory consistent with Mishra et al. (Citation2021), Nguyen and Dao (Citation2022) and Akram and Abrar Ul Haq (Citation2022). Hence, H6 is supported.

Table 6. Moderating effect regression result.

results present an estimation of the additional moderating role of the interaction between JA, MTB and CG mechanisms as individual variables. The results reveal that the interaction between JA, MTB and CG mechanisms as individual variables moderates the relationship between CG and CP. The interaction term between JA, MTB and CG mechanisms as individual variables had statistically positive and negative significance in both cases for market- and accounting-based measures of CP (ROA, ROE and Tobin’s Q). This indicates that the positive and negative relationship between CG mechanisms and CP is stronger in light of the interaction between JA, MTB and CG variables. The results also indicated that the explanatory power of the models is 88%, 74% and 91%, respectively, indicating the positive impact of inserting the interaction between JA, MTB and CG variables in the moderating model.

Table 7. Alternative moderating effect regression result.

6.5. Further analysis and robustness check

Additional analyses are performed to assess the robustness of the study inferences, and it is discovered that previous inferences are robust with different measurements for the key variables. Furthermore, those analyses provide novel findings about effective internal CG mechanisms that affect CP in Egypt, as well as new evidence from the moderating effect of the interaction between JA and MTB on the relationship between CG mechanisms and CP. Moreover, to address any potential endogeneity issue, the study has employed a two-stage model as developed by Heckman’s (Citation1976) procedure. The results indicate that the findings of the primary analysis are shown to be devoid of any self-selection bias.

6.5.1. Sensitivity analysis – audit type

To ensure the study findings robustness, the study divided the sample into companies that apply a single audit and companies that implement a JA and the impact of independent variables was investigated in each case (). The results indicate that MTB has a negative significance under the single audit and a positive significance under the JA, according to the models of ROA and ROE. This means that, under a single audit, the more conservative the firm is, the lower its performance (ROA and ROE). In contrast, the higher the level of conservatism in the JA, the higher the CP. Regarding Tobin’s Q, there is no difference in the effect of MTB under a single audit or a JA (positively significant at a level of 5%). Perhaps this reflects the market-based measure’s long-term nature.

Table 8. Further regression results.

The results also demonstrate that BIND has a significant positive influence under the single audit and a significant negative effect under the JA, in light of ROE and Tobin’s Q. The coefficient of BEXP was negative under the single audit, while it showed more positive results under the JA in light of the ROA, ROE and Tobin’s Q models. Furthermore, there is no significant variance between a single audit and a JA for ACIND and ACEXP. Meanwhile, according to ROE at the 1% level, AFSIZE has a positive significant effect on the single audit and a negative significant influence on the JA. Furthermore, the findings agree with previous literature (Gramling et al., Citation2011).

6.5.2. Sensitivity analysis –firm size

To ensure the study findings’ robustness, the study divided the sample into big firms and small firms, and the impact of independent variables and the interaction between JA, MTB and CG variables were investigated in each case. results indicate that the interaction between JA, MTB and CG variables is different between big and small firms, which have significant positive and negative effects, according to the models of ROA, ROE and Tobin’s Q. Furthermore, the previous findings of the sensitivity analysis confirm the results presented in and .

Table 9. Further moderating effect regression results.

6.5.3. Selection bias test – two-stage Heckman test

The results in provide the findings for the Heckman test. In all models of the analysis, the results presented in consistently demonstrate robust findings that align with the main models and the outcomes obtained from the OLS estimation. This consistency across different stages of the analysis helps to strengthen the validity of the results. Furthermore, the findings from the sample selection bias test provide reassurance that the prior estimation results are unlikely to be significantly influenced by potential self-selection bias. By conducting the Heckman test and accounting for selection bias, the results demonstrate that the main findings hold even after considering the potential impact of self-selection. Overall, these results contribute to the overall robustness and reliability of the study’s findings, providing more confidence in the effect of JA, MTB, board and AC attributes and firms’ specifics on CP.

Table 10. Two stage Heckman test.

7. Summary and conclusion

The study aimed to assess how CG mechanisms can influence CP. Also, investigate the moderator impact of the interaction between JA and accounting conservatism on the relationship between the CG index, CG mechanisms as individual variables and CP in Egypt. The study is attributed to a balanced database of 305 firm-year observations spanning from 2016 to 2020. The findings reveal that BIND and the CGI have a significant positive effect on ROA and ROE. However, BEXP has a significant positive effect on Tobin’s Q. Conversely, BIND, AFSIZE and CGI have a significant negative effect on Tobin’s Q. However, BEXP has a significant negative effect on ROA and ROE. Furthermore, it is found that JA and MTB have a significant effect on ROA and ROE. The results also indicate that ACIND has a significant effect on ROE, while ACEXP has a significant effect on ROA. In addition, the findings exhibit that the interaction between JA and MTB moderates and strengthens the relationship between CGI, CG mechanisms as individual variables and CP. Additional analyses were performed to assess the robustness of the study inferences, and it was discovered that previous inferences are robust with different measurements. This study makes the following distinct contributions to the existing literature: First, for theoretical contribution, it adds to the current literature and bridges an existing gap in the studies of CG, CP, accounting conservatism and JA, especially in the Egyptian context. The study is the first investigation into the interaction between JA and accounting conservatism and its moderating impact on CG and CP. Second, the majority of prior studies have focused on one CP attribute, but the current study examines market- and accounting-based CP by using ROA, ROE and Tobin’s Q measures to give more robust results about long- and short-term performance measurement. Third, the study corroborates different CG theories through the amalgamation of individual relationships into a comprehensive model that demonstrates the interaction between JA and accounting conservatism as a moderator in the relationship between CG and CP through a compound index for CG. Furthermore, the study is based on the Egyptian context, considered an emerging economy in MENA. Therefore, the findings acquired through this research have major significance for academicians, policymakers, auditors, corporations and practitioners.

8. Implications of the study

The study provides several implications for policymakers, auditors, corporations and practitioners. For policymakers, the findings of this study suggest that the interaction between JA and accounting conservatism can enhance CP in non-financial corporations listed on the Egyptian Exchange. Policymakers can promote JA as a mechanism for improving CP and encourage its adoption by companies. Policymakers can also develop regulations and guidelines that encourage companies to establish effective CG mechanisms. Auditors should pay attention to the quality and effectiveness of the CG mechanisms when assessing CP in non-financial corporations. Auditors can also provide feedback and recommendations to companies on improving their CG mechanisms and performance. Corporations can evaluate their governance and make necessary changes to enhance their performance. Corporations can also consider adopting JA as a mechanism for improving their performance and enhancing CG. Practitioners can develop and implement strategies that enhance CP. Practitioners can also provide guidance and recommendations to corporations on how to establish effective CG and adopt JA.

9. Limitations and future research directions

There are some limitations to the study. First, the analysis was conducted over five years and was applied to one country for non-financial firms; therefore, the conclusions cannot be generalized as all the variables affecting the results cannot be controlled. Second, there may be other CG mechanisms that influence CP. Also, the study did not address the effect of mandatory JA on CP or compare it with the effect of voluntary JA. Finally, the quantitative analysis of secondary data does not offer the capacity to interpret and clarify unforeseen relationships among certain variables and CP. Future research may attempt to replicate the model formulated in the present study in various countries and compare it over a longer period of time for a broader interpretation. Also, future research could consider extending this analysis to encompass both financial and non-financial firms. In addition, future research may investigate the impact of other CG mechanisms, such as shareholders’ rights and ownership structure, on CP by adopting a qualitative approach to exploring these effects. Future research propositions could be based on the investigation of instances where certain CG mechanisms exhibit negative or unexpected signs with CP. Finally, another possible proposition is an inductive approach to assessing the current research context by comparing both mandatory and voluntary JA.

Disclosure statement

No potential conflict on interest was reported by the author(s).

Additional information

Notes on contributors

Ahmed Elmashtawy

Ahmed Naeim Elmashtawy is an assistant lecturer at the Faculty of Commerce, Menoufia University, Egypt. He holds a Diploma in Research Methods and their Applications in Guiding and Evaluating Policies and Programs from the American University in Cairo. He is a Ph.D student in accounting at the University Malaysia Terengganu (UMT), Malaysia. His research interests include corporate governance, audit quality, big data, and corporate social responsibility.

Mohd Hassan Che Haat

Dr. Mohd Hassan Che Haat is an Associate Professor of Accounting, Universiti Malaysia Terengganu. His areas of expertise are accounting, Corporate Governance, and Auditing.

Shahnaz Ismail

Dr. Shahnaz Ismail is a Senior lecturer of Accounting, Universiti Malaysia Terengganu. Her areas of expertise are accounting, Corporate Governance, and Auditing.

Faozi A. Almaqtari

Dr. Faozi is an Assistant Professor and the head of the department of Accounting and Finance at A’Sharqiyah University in Oman. He has authored, co-authored, and reviewed various articles published in prestigious Scopus, ISI, and Web of Science journals. His research interests encompass a wide range of areas, including ESG, corporate governance, financial reporting, auditing, and the application of artificial intelligence in accounting.

References

- Abbott, L. J., & Parker, S. (2000). Auditor selection and audit committee characteristics. AUDITING: A Journal of Practice & Theory, 19(2), 1–25. https://doi.org/10.2308/aud.2000.19.2.47

- Abdalwahab, M. A. L.-R., & ALkabbji, R. F. (2020). Impact of external auditing quality and audit committees on accounting conservatism and the performance of industrial firms listed at the amman stock exchange. International Journal of Financial Research, 11(4), 556–562. https://doi.org/10.5430/ijfr.v11n4p556

- AbdulRahman, F. H., & Ali, M. (2006). Board, audit committee, culture and earnings management: Malaysian evidence. Managerial Auditing Journal, 21(7), 783–804. https://doi.org/10.1108/02686900610680549

- Agrawal, A., & Knoeber, C. R. (1996). Firm performance and mechanisms to control agency problems between managers and shareholders. The Journal of Financial and Quantitative Analysis, 31(3), 377–397. https://doi.org/10.2307/2331397

- Akram, F., & Abrar Ul Haq, M. (2022). Integrating agency and resource dependence theories to examine the impact of corporate governance and innovation on firm performance. Cogent Business & Management, 9(1), 1–22. https://doi.org/10.1080/23311975.2022.2152538

- Al-Ahdal, W. M., Almaqtari, F. A., Tabash, M. I., Hashed, A. A., & Yahya, A. T. (2021). Corporate governance practices and firm performance in emerging markets: Empirical insights from India and Gulf countries. Vision, 27(4), 526-537. https://doi.org/10.1177/09722629211025778

- Alanezi, F. S., Alfaraih, M. M., Alrashaid, E. A., & Albolushi, S. S. (2012). Dual/joint auditors and the level of compliance with international financial reporting standards (IFRS-required disclosure). Journal of Economic and Administrative Sciences, 28(2), 109–129. https://doi.org/10.1108/10264111211248402

- Alawaqleh, Q. A., Almasria, N. A., & Alsawalhah, J. M. (2021). The effect of board of directors and CEO on audit quality: Evidence from listed manufacturing firms in Jordan. Journal of Asian Finance, Economics and Business, 8(2), 243–253. https://doi.org/10.13106/jafeb.2021.vol8.no2.0243

- Aldamen, H., Duncan, K., Kelly, S., McNamara, R., & Nagel, S. (2012). Audit committee characteristics and firm performance during the global financial crisis. Accounting & Finance, 52(4), 971–1000. https://doi.org/10.1111/j.1467-629X.2011.00447.x

- Al Farooque, O., Buachoom, W., & Sun, L. (2020). Board, audit committee, ownership and financial performance – Emerging trends from Thailand. Pacific Accounting Review, 32(1), 54–81. https://doi.org/10.1108/PAR-10-2018-0079

- Alfraih, M. M. (2016). The effectiveness of board of directors’ characteristics in mandatory disclosure compliance. Journal of Financial Regulation and Compliance, 24(2), 154–176. https://doi.org/10.1108/JFRC-07-2015-0035

- Aljifri, K. (2014). The association between firm characteristics and corporate financial disclosures: Evidence from UAE companies. The International Journal of Business and Finance Research, 8(2), 101–124. https://ssrn.com/abstract=2322965

- Almaqtari, F. A., Shamim, M., Al-Hattami, H. M., & Aqlan, S. A. (2020). Corporate governance in India and some selected Gulf countries. International Journal of Managerial and Financial Accounting, 12(2), 165–185. https://doi.org/10.1504/IJMFA.2020.109135

- Alodat, A. Y., Salleh, Z., Hashim, H. A., & Sulong, F. (2022). Corporate governance and firm performance: Empirical evidence from Jordan. Journal of Financial Reporting and Accounting, 20(5), 866–896. https://doi.org/10.1108/JFRA-12-2020-0361

- Alqadasi, A., & Abidin, S. (2018). The effectiveness of internal corporate governance and audit quality: The role of ownership concentration – Malaysian evidence. Corporate Governance: The International Journal of Business in Society, 18(2), 233–253. https://doi.org/10.1108/CG-02-2017-0043

- Alves, S. (2023). Do female directors affect accounting conservatism in European Union? Cogent Business & Management, 10(2), 1–22. https://doi.org/10.1080/23311975.2023.2219088

- Alves, S., & Carmo, C. (2022). Audit committee, external audit and accounting conservatism: Does company’s growth matter? Journal of Governance and Regulation, 11(3), 17–27. https://doi.org/10.22495/jgrv11i3art2

- Amer, M., Ragab, A. A., & Ragheb, M. A. (2014). Board characteristics and firm performance: Evidence from Egypt. In Proceedings of 6th Annual American Business Research Conference (9–10 June 2014), Sheraton LaGuardia East Hotel, New York, USA (pp. 1–26). American Research and Publication International.

- Amin, A., Lukviarman, N., Suhardjanto, D., & Setiany, E. (2018). Audit committee characteristics and audit-earnings quality: Empirical evidence of the company with concentrated ownership. Review of Integrative Business and Economics Research, 7(1), 18–33.

- André, P., Broye, G., Pong, C., & Schatt, A. (2015). Are joint audits associated with higher audit fees? European Accounting Review, 25(2), 245–274. https://doi.org/10.1080/09638180.2014.998016

- Antounian, C., Dah, M. A., & Harakeh, M. (2021). Excessive managerial entrenchment, corporate governance, and firm performance. Research in International Business and Finance, 56(2), 101392. https://doi.org/10.1016/j.ribaf.2021.101392

- Bananuka, J., Nkundabanyanga, S. K., Nalukenge, I., & Kaawaase, T. (2018). Internal audit function, audit committee effectiveness and accountability in the Ugandan statutory corporations. Journal of Financial Reporting and Accounting, 16(1), 138–157. https://doi.org/10.1108/JFRA-07-2016-0062

- Baran, L., & Forst, A. (2015). Disproportionate insider control and board of director characteristics. Journal of Corporate Finance, 35(4), 62–80. https://doi.org/10.1016/j.jcorpfin.2015.08.006

- Beaver, W. H., & Ryan, S. G. (2005). Conditional and unconditional conservatism: Concepts and modeling. Review of Accounting Studies, 10(2-3), 269–309. https://doi.org/10.1007/s11142-005-1532-6

- Bédard, J., Chtourou, S. M., & Courteau, L. (2004). The effect of audit committee expertise, independence, and activity on aggressive earnings management. AUDITING: A Journal of Practice & Theory, 23(2), 13–35. https://doi.org/10.2308/aud.2004.23.2.13

- Black, B. S., Kim, W., Jang, H., & Park, K.-S. (2015). How corporate governance affect firm value? Evidence on a self-dealing channel from a natural experiment in Korea. Journal of Banking & Finance, 51(February 2015), 131–150. https://doi.org/10.1016/j.jbankfin.2014.08.020

- Blue Ribbon Committee. (1999). Report and recommendations of the Blue Ribbon Committee on improving the effectiveness of corporate audit committees. The Business Lawyer, 54(3), 1067–1095. http://www.jstor.org/stable/40687877

- Boachie, C., & Mensah, E. (2022). The effect of earnings management on firm performance: The moderating role of corporate governance quality. International Review of Financial Analysis, 83(October 2022), 102270. https://doi.org/10.1016/j.irfa.2022.102270

- Boone, J. P., Khurana, I. K., & Raman, K. K. (2010). Do the Big 4 and the Second-tier firms provide audits of similar quality? Journal of Accounting and Public Policy, 29(4), 330–352. https://doi.org/10.1016/j.jaccpubpol.2010.06.007

- Boshnak, H. A., Alsharif, M., & Alharthi, M. (2023). Corporate governance mechanisms and firm performance in Saudi Arabia before and during the COVID-19 outbreak. Cogent Business & Management, 10(1), 1–23. https://doi.org/10.1080/23311975.2023.2195990

- Brown, L. D., & Caylor, M. L. (2006). Corporate governance and firm valuation. Journal of Accounting and Public Policy, 25(4), 409–434. https://doi.org/10.1016/j.jaccpubpol.2006.05.005

- Carcello, J. V., Hermanson, D. R., Neal, T. L., & Riley, J. R., R. A. (2002). Board characteristics and audit fees. Contemporary Accounting Research, 19(3), 365–384. https://doi.org/10.1506/CHWK-GMQ0-MLKE-K03V

- Chang, H., Cheng, C. S. A., & Reichelt, K. J. (2010). Market reaction to auditor switching from Big 4 to third-tier small accounting firms. AUDITING: A Journal of Practice & Theory, 29(2), 83–114. https://doi.org/10.2308/aud.2010.29.2.83

- Cho, J., & Choi, W.-W. (2016). Accounting conservatism and firms’ investment decisions. Journal of Applied Business Research (JABR), 32(4), 1223–1236. https://doi.org/10.19030/jabr.v32i4.9732

- Ciftci, I., Tatoglu, E., Wood, G., Demirbag, M., & Zaim, S. (2019). Corporate governance and firm performance in emerging markets: Evidence from Turkey. International Business Review, 28(1), 90–103. https://doi.org/10.1016/j.ibusrev.2018.08.004

- Coetzee, P., Erasmus, L., Pududu, M., Malan, S., & Legodi, A. (2022). The power drivers of public sector audit committee effectiveness. South African Journal of Accounting Research, 37(1), 62–84. https://doi.org/10.1080/10291954.2022.2128556

- Cui, L., Kent, P., Kim, S., & Li, S. (2021). Accounting conservatism and firm performance during the COVID-19 pandemic. Accounting & Finance, 61(4), 5543–5579. https://doi.org/10.1111/acfi.12767

- Dahya, J., & McConnell, J. J. (2007). Board composition, corporate performance, and the Cadbury committee recommendation. Journal of Financial and Quantitative Analysis, 42(3), 535–564. https://doi.org/10.1017/S0022109000004099

- Dakhlallh, M. M., Rashid, N., Wan Abdullah, W. A., & Al Shehab, H. J. (2020). Audit committee and Tobin’s Q as a measure of firm performance among Jordanian companies. Journal of Advanced Research in Dynamical and Control Systems, 12(1), 28–41. https://doi.org/10.5373/JARDCS/V12I1/20201005

- Das, S., Gong, J. J., & Li, S. (2020). The effects of accounting expertise of board committees on the short- and long-term consequences of financial restatements. Journal of Accounting, Auditing & Finance, 37(3), 603–632. https://doi.org/10.1177/0148558X20934943

- Davidson, W., Xie, B., & Xu, W. (2004). Market reaction to voluntary announcements of audit committee appointments: The effect of financial expertise. Journal of Accounting and Public Policy, 23(4), 279–293. https://doi.org/10.1016/j.jaccpubpol.2004.06.001

- DeAngelo, L. E. (1981). Auditor size and audit quality. Journal of Accounting and Economics, 3(3), 183–199. https://doi.org/10.1016/0165-4101(81)90002-1

- Deng, M., Lu, T., Simunic, D. A. N. A., & Ye, M. (2014). Do joint audits improve or impair audit quality? Journal of Accounting Research, 52(5), 1029–1060. https://doi.org/10.1111/1475-679X.12060

- Douma, S., George, R., & Kabir, R. (2006). Foreign and domestic ownership, business groups, and firm performance: Evidence from a large emerging market. Strategic Management Journal, 27(7), 637–657. https://doi.org/10.1002/smj.535

- Downes, D. H., & Heinkel, R. (1982). Signaling and the valuation of unseasoned new issues. The Journal of Finance, 37(1), 1–10. https://doi.org/10.1111/j.1540-6261.1982.tb01091.x

- Egyptian Corporate Governance Code – Third Release. (2016, August). Issued by the Egyptian Institute of Directors (EIOD). https://eiod.org/wp-content/uploads/2023/05/The-Egyptian-CG-Code-Third-Release.pdf

- Egyptian Institute of Directors. (2016). Egyptian Corperate Governance Code (3rd ed.). Financial Regulatory Authority. http://www.eiod.org/

- Elmashtawy, A., Che Haat, M. H., Ismail, S., & Almaqtari, F. A. (2023a). Audit committee effectiveness and audit quality: The moderating effect of joint audit. Arab Gulf Journal of Scientific Research. Ahead-of-print. https://doi.org/10.1108/AGJSR-09-2022-0202

- Elmashtawy, A., Che Haat, M. H., Ismail, S., & Almaqtari, F. A. (2023b). The moderating effect of joint audit on the association between board effectiveness and audit quality: Empirical evidence from a developing country. The Bottom Line. Advance online publication.

- Elmashtawy, A., & Salaheldeen, M. (2022). Big data and business analytics: Evidence from Egypt. In M. Al-Emran, M. A. Al-Sharafi, & K. Shaalan (Eds.), International Conference on Information Systems and Intelligent Applications: ICISIA 2022. Lecture Notes in Networks and Systems (Vol. 550, pp. 503–512). Springer. https://doi.org/10.1007/978-3-031-16865-9_40

- Elmashtawy, A., & Salaheldeen, M. (2023). Big data techniques and internal control: Evidence from Egypt. In M. A. Al-Sharafi, M. Al-Emran, M. N. Al-Kabi, & K. Shaalan (Eds.), Proceedings of the 2nd International Conference on Emerging Technologies and Intelligent Systems: ICETIS 2022. Lecture Notes in Networks and Systems (Vol. 584, pp. 14–23). Springer. https://doi.org/10.1007/978-3-031-25274-7_2

- European Bank for Reconstruction and Development. (2016). Corporate governance legislation and practices in Egypt. https://www.ebrd.com/home

- European Commission. (2010). European Commission green paper on audit policy: Lessons from the crisis - Accountancy Europe. https://www.accountancyeurope.eu/audit/european-commission-green-paper-on-audit-policy-lessons-from-the-crisis/