Abstract

This study explores whether risk mediates the relationship between good corporate governance (GCG), Sharia capital structure, and Sharia financing structure on the financial performance of Islamic banks in Indonesia. The research utilized purposive sampling, selecting a sample of nine banks from 2014 to 2021. The data analysis technique employed a licensed Smart Partial Least Squares (PLS) program. The initial findings reveal that GCG significantly reduces risk but does not directly impact financial performance. Second, the composition of Sharia capital structures has a limited influence on risk but significantly hinders financial performance. Third, the Sharia financing structure significantly and negatively impacts risk and financial performance. Fourth, risk has a significant negative effect on financial performance. Fifth, Islamic bank risk mediates the relationship between Sharia financing structure and financial performance. It also mediates the relationship between GCG and financial performance but does not mediate the relationship between Sharia capital structure and financial performance. These results suggest that to enhance financial performance and minimize risks, the management of Islamic banks should prioritize improving financing practices and implementing GCG measures. The findings of this study can be applied by Islamic banks worldwide. The study identifies nine types of Islamic bank risks that can be employed to assess the risk profile of Islamic banks and even to create a comprehensive risk profile. This multidimensional framework illuminates the intricate interplay between these variables within Islamic banks, offering valuable insights for researchers and practitioners in this field.

IMPACT STATEMENT

We believe that our research significantly contributes to the public interest and has far-reaching societal impact. This findings can be leveraged by academics, researchers, and practitioners to build upon and refine existing theories and practices.

JEL CLASSIFICATION:

1. Introduction

The development of Islamic banks in Indonesia serves as a benchmark for the success of the Sharia economy. One notable indicator of the success of Islamic banks is reflected in their financial performance. Financial performance analysis assesses how much a company appropriately adheres to financial implementation rules. Munawir (Citation2010) explains that financial performance is a valuable foundation for evaluating a company’s financial condition, conducted through an analysis of financial ratios. Both management and stakeholders require insights from financial performance measurements to gauge the company’s condition and success in executing its operational activities.

Keown (Citation2001) explains that financial ratios crucial for identifying the financial performance of banks include liquidity ratios, profitability ratios, solvency ratios, business efficiency ratios, debt ratios, and market value ratios. According to Sofyan (Citation2002), the most influential and significant indicator for evaluating all activities in the banking industry is profitability indicators, which can be measured using return on equity (ROE) and return on asset (ROA) data. Other ratio indicators determining financial performance in Islamic banks include the capital adequacy ratio (CAR), non-performing financing (NPF), financing to deposit ratio (FDR), operating expenses to operating income, and net operating margin (NOM).

Darmawi (Citation2011) explains that the factors influencing financial performance, as used to assess bank health, include capital, asset quality, management, earnings, liquidity, and sensitivity to the market (CAMEL). Regulatory guidelines about assessing banks’ soundness, as outlined in Circular Letter No.9/24/DPbS concerning the system for evaluating the soundness level of Islamic Banks based on Sharia Principles, allow for evaluation based on the CAMEL factors. The assessment of the soundness level of Islamic banks and Sharia business units is governed by Financial Services Authority Regulation Number 8/POJK.03//Citation2014 This regulation stipulates that Islamic banks can undergo individual health-level assessments, including risk profile, good corporate governance, earnings (profitability), and capital (RGEC).

2. Background

In the regulations governing capital structure and financing structure, an integral aspect influencing corporate governance is delineated by Bank Indonesia in PBI No. 11/33/PBI/2009 (Bank Indonesia, Citation2009). Bank governance, as outlined in these regulations, is distinguished by its commitment to principles such as accountability, transparency, responsibility, and professionalism, all rooted in a dedication to fairness. Corporate governance holds paramount importance within companies, especially in the context of bank performance. Empirical findings from hypothesis testing substantiate the positive influence of Good Corporate Governance (GCG) on the financial performance of Islamic banks (Bank Indonesia, Citation2009). A study by Ledi and Xemalordzo (Citation2023) revealed that sound corporate governance practices augment both the corporate image and performance of firms.

Al Kayed (Citation2014) elucidates that capital factors are represented by capital structure, which pertains to the selection of funding comprising equity or liabilities, exerting a significant impact on financial performance. According to agency theory, implementing capital structure mitigates conflicts among stakeholders, particularly between investors and managers. The study validates findings from Larasati (Citation2016), indicating that elevated capital ratios lead to a deterioration in performance. This is attributed to the higher required return on shares, resulting in an escalation of the cost of equity capital, consequently leading to a reduction in company profits and, therefore, a decline in overall company performance.

The research findings by Dahlia (Citation2021) indicate that financing and liquidity risks do not significantly impact Islamic banks’ financial performance. However, it is observed that simulated and liquidity risks affect the financial performance of Islamic banks. Islamic banks engage in risk management to optimize the trade-off between risk and revenue, aiding in the strategic planning and development of financing in an appropriate and efficient manner.

The capital structure theory employing the Modigliani-Miller (MM) approach posits that as the proportion of capital from debt increases, so does the risk faced by the company. However, this theory is predominantly applicable to conventional banks. In contrast, the same principles do not apply to Islamic banks, where a higher capital structure does not translate to higher risk. This is because Islamic banks’ capital is sourced not from debt and owner’s equity but rather from temporary shirka funds (Roziq et al., Citation2021).

Research by Roziq et al. (Citation2021) demonstrates that capital adequacy significantly impacts profitability, indicating that higher available capital leads to increased profits for Islamic banks. Additionally, research by Parasthiwi and Budiasi reveals that credit risk has not been effective in moderating the influence of capital adequacy (CAR) on profitability (ROA). Similarly, Ratri Utami and Utami (Citation2021) research states that problematic financing fails to moderate CAR with ROA. Financing constitutes one of the fund distribution products at Islamic banks, necessitating careful attention to controlling and supervising profit-sharing financing products. Inadequate control and supervision increase the risk of occurrences, thereby affecting the financial performance of Islamic banks. This assertion is supported by Dwi Fazriani and Gusliana Mais (Citation2019) research, which indicates that mudarabah financing, musharaka financing, and murabahah financing positively influence ROA through risk as an intervening variable.

Through credit risk, independent commissioners, the board of directors, and managerial ownership influence profitability. In other words, credit risk can serve as an intervening variable for Good Corporate Governance (GCG). Therefore, this study establishes that the effective implementation of GCG, coupled with sound risk management, has the potential to enhance bank profitability. The handling and managing of existing risks, particularly credit risk, are essential in realizing GCG. Maintaining bank risks within minimal limits is a crucial indicator of the successful implementation of GCG. This assertion is supported by the findings of other studies, which suggest that risk management can function as an intervening variable between GCG and performance (Aryani, Citation2019).

This research aims to address issues about the financial performance of Islamic banks by examining influencing factors, specifically the Islamic capital structure, Islamic financing structure, and GCG. The study incorporates intermediary variables, represented by Islamic bank risk variables, to establish connections between these elements. Efficient and effective implementation of Sharia capital structure, Sharia financing structure, and GCG is expected to impact bank risks, ultimately minimizing losses arising from operational risks. The adept management of risks within Islamic banks is anticipated to indirectly influence financial performance, concluding that Islamic banks are positioned favorably. Researchers conducted this study to analyze the influence of Sharia capital structure, Sharia financing structure, and GCG on financial performance through the lens of risk.

This research addresses several factors that influence financial performance: the Sharia capital structure, Sharia financing structure, good corporate governance, and risk. The anticipated benefits of this research are as follows:

The study aims to enhance academic understanding of the impact of Sharia capital structure, Sharia financing structure, and good corporate governance on financial performance through risk.

This research can provide insights into the factors influencing financial performance, specifically by examining the effects of Sharia capital structure, Sharia financing structure, and good corporate governance on the financial performance of Islamic banks through Islamic bank risk.

The findings of this research are expected to offer valuable insights for management decision-making in terms of risk management, thereby influencing the financial performance of Islamic banks.

This research is intended to serve as a reference for future studies or further research exploring the influences of risk and financial performance from various aspects, particularly in Sharia financial accounting.

3. Theoretical literature review

3.1. Financial performance

According to regulations and guidelines, financial performance analysis assesses the extent to which a company adheres to proper and accurate financial management practices. This evaluation comprehensively examines the company’s financial statements and other relevant factors that support the assessment of financial performance. Mutasowifin (Citation2014), emphasized that financial performance analysis determines the degree to which a company has adhered to financial rules. In this context, a regulation issued by the Financial Services Authority, SEOJK No. 05, Citation2019, delineates financial entities’ Health Level Assessment System. Within this framework, profitability factors are analyzed, primarily utilizing the operational efficiency ratio as a key metric and complemented by the monitoring ratio, which includes the return on asset and return on equity ratios.

3.2. Sharia capital structure

Capital structure is the combination of a company’s debt and equity that it employs to finance its assets. In Islamic banks, the components of capital structure are derived from three sources: liabilities, temporary shirka funds, and equity (Wahyulaili et al., Citation2018). Statement of Financial Accounting Standards number 105 (Citation2017) concerning Mudarabah Accounting and number 106 (Citation2017) managing musharaka Accounting, defines temporary shirka fund as funds received as investments within a specified period from individuals and other parties where the bank has the right to manage and invest the funds. The distribution of investment returns is based on a pre-agreed arrangement. Examples of temporary shirka funds include receipts from investment funds such as mudarabah muthlaqa, mudarabah muqayyada, musharaka, and other similar accounts. The relationship between the bank and the fund owner is a partnership based on the contract of mudarabah muthlaqa, mudarabah muqayyada, or musharaka.

3.3. Sharia financing structure

The financing structure illustrates the composition of financing between those derived from fixed-profit buying and selling patterns, variable profit-sharing patterns, and rental patterns. These patterns have become integral financing products within Islamic banks. This financing structure significantly impacts the profits generated, thereby influencing the bank’s financial performance (Muhammad, Citation2021). In fund allocation, Islamic banks can offer various forms of financing, including mudarabah and musharaka financing (with a profit-sharing pattern), murabahah and salam (involving buying and selling patterns), istishna (similar to salam), and ijarah (involving operational and financial lease patterns).

3.4. Good corporate governance

Bank Indonesia regulates the implementation of Corporate Governance (GCG) in Islamic banks through regulation no. 11/33/PBI/2009 (Bank Indonesia, Citation2009), which delineates the standards for GCG in Islamic banks and Sharia business units. Article 2 of this regulation mandates that all Islamic banks integrate GCG principles into every facet of their business activities across all organizational levels. GCG serves as a framework of laws, regulations, and rules that must be diligently followed, promoting the efficient utilization of company resources and generating sustainable, long-term economic value for both shareholders and society.

Islamic banks, as part of their commitment to GCG, regularly conduct self-assessments to implement the five core principles of GCG. These principles are thoroughly evaluated through eleven assessment factors, as outlined in the Circular Letter issued by the Financial Services Authority under no. 10/SEOJK.03/2014 (Financial Services Authority (OJK), Citation2014) regarding assessing the Health Level of Islamic banks and Sharia Business Units. These factors are categorized into five distinct groups. The hierarchy of these ranking categories signifies the degree to which GCG principles are effectively applied in practice.

3.5. Risk

Risk is essentially the potential for loss arising from a specific event. This concept is governed by the Financial Services Authority Regulation No. 65/POJK.03/2016 (Financial Services Authority (OJK), Citation2016), which outlines guidelines for Risk Management in Islamic banks and Sharia Business Units. The Financial Services Authority Regulation further strengthens this regulatory framework: No. 8/POJK.03/2014 2014) outlines protocols for assessing the health level of banks and Sharia Business Units. According to these regulations, banks are required to manage ten distinct types of risks, namely market, credit, operational, liquidity, legal, reputation, compliance, rate of return, strategy, and equity investment risks.

4. Empirical literature review and hypotheses development

4.1. Good corporate governance and financial performance

The relationship between good corporate governance and financial performance is empirically supported by the research conducted by Ekaningsih and Afkarina (Citation2021). Their study demonstrates that the implementation of better Corporate Governance (GCG) leads to an improvement in bank profitability, as measured by Return on Assets (ROA). Additionally, the research conducted by Ledi and Xemalordzo (Citation2023) reveals that good corporate governance practices not only enhance the corporate image but also contribute to the overall performance of firms.

Hypothesis 1:

Good corporate governance has a significant effect on financial performance.

4.2. Good corporate governance and risk

The relationship between good corporate governance and risk is empirically supported by the findings of research conducted by Komang Hevy (Citation2019). The study indicates that the impact of good corporate governance, represented by independent commissioners, has a mitigating effect on credit risk. This is attributed to the supervision carried out by independent commissioners, serving as a crucial indicator in adhering to the principle of prudence (prudential banking practices), thereby minimizing the credit risk faced. Consistent with the research conducted by Elamer et al. (Citation2020), the Sharia supervisory board, block ownership, board independence, and country-level governance quality exhibit statistically significant and positive associations with operational risk disclosures. Furthermore, Chouaibi et al. (Citation2023) revealed that governance performance influences financial risk disclosure.

Hypothesis 2:

Good corporate governance has a significant effect on risk.

4.3. Risk and financial performance

The relationship between risk and financial performance is empirically reinforced by the research conducted by Almunawwaroh and Marliana (Citation2018). Their findings indicate that Non-Performing Loans (NPF) negatively affect profitability. This relationship is further substantiated by the results of Marlina and Diana (Citation2021)’s research, which demonstrates that an elevated risk of problematic financing (NPF) leads to a reduction in profitability (measured by Return on Assets, ROA). Additionally, the study conducted by Kwashie et al. (Citation2022) reveals that non-performing loans harm financial performance.

Hypothesis 3:

Risk has a significant effect on financial performance.

4.4. Sharia capital structure and financial performance

The relationship between Sharia capital structure and financial performance is empirically reinforced by the results of research conducted by Mardhatillah et al. (Citation2020). This study demonstrates the impact of capital structure, represented by the debt-to-asset ratio, on financial performance proxied by the net profit margin. Moreover, the research conducted by Rehman et al. (Citation2023) reveals that structural capital efficiency is significantly associated with earnings per share, return on assets, and return on equity.

Hypothesis 4:

Sharia capital structure has a significant effect on financial performance.

4.5. Sharia capital structure and risk

The relationship between Sharia capital structure and risk is empirically supported by the results of research conducted by Fadlurrahman et al. (Citation2021). Their study asserts that capital (CAR) significantly influences non-performing financing (NPF). Increased capital value is associated with decreased problematic financing for business units (BUS), and vice versa. This finding is consistent with the research conducted by Rahayu et al. (Citation2022), which indicates that each time the capital adequacy ratio increases, financing in arrears also increases. Additionally, the study conducted by Fatouh et al. (Citation2023) reveals that an increase in banks’ leverage ratio does not result in an increase in asset risk.

Hypothesis 5:

Sharia capital structure has a significant effect on risk.

4.6. Sharia financing structure and financial performance

The relationship between Sharia financing structure and financial performance is empirically supported by the research conducted by Indah Prihandini and Safira (Citation2019). This study demonstrates that as mudarabah financing, a form of Sharia financing, increases, the profitability of BPRS, proxied by Return on Assets (ROA), also increases. Consistent with the research conducted by Agustin and Bustaman (Citation2020), successful implementation of mudarabah financing using a profit-sharing system by customers can lead to increased profits. Furthermore, the study conducted by Kulmie et al. (Citation2023) concludes that both murabahah and mudarabah are crucial for the performance and profitability of Islamic banks.

Hypothesis 6:

Sharia financing structure has a significant effect on financial performance.

4.7. Sharia financing structure and risk

The relationship between Sharia financing structure and risk is empirically supported by the research conducted by Dwi Fazriani and Gusliana Mais (Citation2019). Their study indicates that increased mudarabah financing provided to customers reduces the risk of bad credit or non-performing financing (NPF). In contrast, musharaka financing positively impacts NPF, meaning that a higher level of musharaka financing provided by banks to their customers is associated with an increased risk of bad credit. Furthermore, the study conducted by Al Rahahleh et al. (Citation2019) concludes that bank capital and financing expansion significantly negatively impact the credit risk level of Islamic Banks (IBs) in Malaysia.

Hypothesis 7:

Sharia financing structure has a significant effect on risk.

4.8. Research conceptual framework

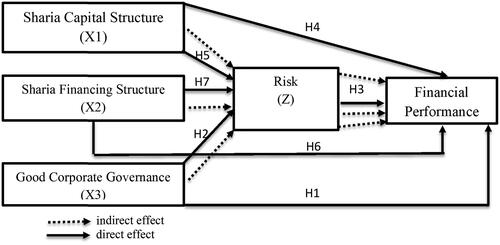

Based on the explanation of the relationship between these variables, the research hypothesis can be described in a concise research framework regarding the influence of Sharia capital structure, Sharia financing structure, and good corporate governance on financial performance through Islamic bank risk as illustrated in .

5. Methodology

5.1. Research type

This research adopts a quantitative method with an explanatory approach, specifically aimed at elucidating the relationships between research variables by testing previously formulated hypotheses. Path analysis is employed to examine whether the hypotheses align with the results of data analysis.

5.2. Population, sample, and method of sampling

The population in this research comprises all 12 Islamic banks in Indonesia registered with the Financial Services Authority. The sampling technique used is purposive sampling based on specific criteria, which include:

Sharia Banks registered with the Financial Services Authority

Islamic banks with consecutively published annual financial reports from 2014 to 2021.

Published annual financial reports containing the required data related to research variables.

Utilizing the purposive sampling method, three Islamic banks did not meet the research sample criteria. As a result, the banks that fulfilled the sample criteria amounted to nine Islamic banks. The sampling covered eight years, resulting in a total of 72 observation data points.

5.3. Data

The type of data utilized in this research is secondary data, specifically financial data obtained from annual financial reports related to the variables under investigation. The data collection technique employed is documentation, which involves exploring secondary data sourced from documents and financial reports. The necessary documents or reports for this research are financial reports published on the official websites of each of the nine Islamic banks, encompassing annual report data from 2014 to 2021.

5.4. Variables

summarizes the variable names, types (notated as X for independent variables, Z for intervening variables, and Y for dependent variables), indicators, measurements, and scales.

Table 1. Variables, indicators, measurements and scales.

5.5. Technique of data analysis

The analysis technique in this study uses a structural equation model utilized for hypothesis testing through a licensed Smart Partial Least Squares (PLS) program. According to Willy and Jogiyanto (Citation2015), the formal PLS model defines the formed variable as a linear aggregate of the indicators. The weighted estimates used to generate variable score components are derived from the specifications outlined in the inner and outer models. The steps of analysis using the PLS method are outlined as follows:

Step 1: Designing a Structural Model (Inner Model)

Step 2: Designing the Measurement Model (Outer Model)

Step 3: Evaluating the coefficient of determination R2

Step 4: Examining the effect size f2

Step 5: Assessing the predictive relevance of Q2

Step 6: Analyzing the effect size q2

Step 7: Conducting Hypothesis Testing

6. Empirical results and discussion

6.1. Outer model analysis

The validity test comprises convergent and discriminant validity, while the reliability test is expressed by calculating composite reliability and Cronbach’s Alpha values. The results of the outer model in indicate that indicators do not meet the validity requirements, as their values exceed 0.70. Therefore, indicators that fail to meet the criteria require modifying by re-evaluating and removing problematic ones, prioritizing those with negative results. This process aims to obtain variable indicators that meet the validity requirements, ensuring valid and reliable results.

6.2. Convergent validity test

The convergent validity test is evaluated based on the appropriateness of the relationship between the component value and the constructed value calculated using smart-PLS. The results of processing with the PLS algorithm for outer loading are presented in .

Table 2. Outer loading.

reveals that all measurement variables, namely Sharia capital structure, Sharia financing structure, GCG, risk, and financial performance, demonstrate that the outer loading values, after the modification process, obtain a validity test value of more than 0.7. This indicates that each variable in the study has been adequately explained by its indicators, meeting the requirements for convergent validity and allowing for further testing.

displays the AVE values for the measured variables, including good corporate governance, financial performance, risk, Sharia capital structure, and Sharia financing structure, all of which have values > 0.50. This indicates that all variables have surpassed the critical AVE value, meeting the model’s criteria for effective measurement explanation.

Table 3. Average variance extracted (AVE).

6.3. Discriminant validity test

The results of the Fornell-Larcker criterion calculations reveal that the Average Variance Extracted (AVE) root value for each construct exceeds the correlation value between any two constructs. Score in bold indicates strong discriminant validity. The discriminant validity values, as determined by the Fornell-Larcker criterion in this research model, are presented in .

Table 4. Validity of Fornel-Larcker Criterion Discriminants.

In addition to scrutinizing the calculation results of the Fornell-Larcker criterion, the discriminant validity can also be assessed based on the cross-loading values. Specifically, the loading score obtained on the same indicator block must surpass the correlation value between latent variables. Score in bold indicates strong discriminant validity. The cross-loading values for the hypotheses in this research are presented in .

Table 5. Cross loading.

6.4. Reliability test

The results of the reliability tests, including composite reliability and Cronbach’s Alpha calculations, are presented in .

Table 6. Construct validity and reliability.

shows the composite reliability alpha values for all variables, namely GCG, financial performance, risk, Sharia financing structure, and Sharia capital structure, which are above 0.70. Therefore, these values are good and have met the expected reliability criteria, making them valid and fairly reliable.

6.5. Variance inflation factors

reveals that the VIF value for each variable is less than 5 in the relationships between variables. Therefore, these values can be considered satisfactory and have met the expected VIF criterion of being less than 5.

Table 7. Values variance inflation factor.

6.6. Coefficient of determination (R2)

displays the adjusted R-square value for Islamic Bank risk, which is 0.300, indicating a moderate fit between strong and weak models. When presented, this value translates to 30%. This implies that Sharia’s capital structure, Sharia financing structure, and GCG collectively influence 30% of the adjusted R-square value for Islamic Bank risk.

Table 8. R Square.

Regarding the adjusted R-square, financial performance registers a value of 0.213, signifying a moderately fitted model positioned between a strong and weak model. When presented, this value translates to 21.3%. This interpretation suggests that 21.3% of the adjusted R-square for financial performance is influenced by Sharia’s capital structure, Sharia’s financing structure, and GCG. Islamic bank risk also affects financial performance, as risk is a predictor of financial performance in this study.

6.7. Q-square test

The Q-Square test evaluates the predictive relevance derived from blindfolding values. A Q2 value of 0.172 indicates accurate predictive relevance and signifies that structural models can explain 17.2% of the data variance in the study.

6.8. Effect size (f2)

The f-square results are presented in , subsequently adjusted based on the criterion of f2 values. indicates that the relationships between variables, as measured by f2, exhibit two levels of influence: moderate and small. The moderate influence is evident in the variable association of Islamic financing structure to financial performance with a value of 0.235, and Islamic financing structure to Islamic bank risk, represented by an f2 value of 0.319.

Table 9. Effect size (f2).

Meanwhile, the impact of the relationships between smaller variables is indicated by the connection between GCG and financial performance with an f2 value of 0.000; the relationship between Islamic bank risk and financial performance with an f2 value of 0.106; the relationship between Islamic capital structure and financial performance with an f2 value of 0.064; GCG and risk with an f2 value of 0.094; and the relationship between Islamic capital structure and Islamic bank risk with an f2 value of 0.003.

6.9. Evaluation of indirect effect

The results of indirect effect testing are presented in .

Table 10. Indirect effect.

6.10. Test the hypothesis

presents the results of the hypothesis tests examining the relationships between variables.

Table 11. Path coefficients.

6.11. Discussion

A detailed discussion was conducted based on the results of research and data processing with SmartPLS, as presented in . Testing good corporate governance (GCG) results on financial performance reveals a negative relationship of −0.005. This relationship is supported by a t-statistic of 0.061, indicating a value below 1.96 and signifying an insignificant relationship, with a p-value of 0.951 > 0.05. Therefore, it can be concluded that GCG on financial performance has a negative and non-significant effect, leading to the rejection of the hypothesis.

This conclusion is reinforced by the findings of Harmaen and Mangantar (Citation2022), whose research on the impact of GCG, measured using commissioners, boards of directors, and Sharia supervisory boards, resulted in test outcomes that showed an insignificant influence on financial performance. This finding contrasts with the results of a study conducted by Ledi and Xemalordzo (Citation2023) which revealed that good corporate governance practices enhance both the corporate image and the performance of firms.

The Good Corporate Governance (GCG) test results on risk reveal a negative relationship of −0.256. This relationship is supported by a t-statistic of 4.466, indicating a value above 1.96, signifying a significant relationship, with a p-value of 0.000 < 0.05. Therefore, it can be concluded that GCG against Islamic bank risks has a negative and significant effect, and the hypothesis is accepted. Research conducted by Aryani (Citation2019) aligns with this, emphasizing that GCG, proxied with an independent commissioner, has a negative effect on credit risk. This is because GCG supervision conducted by an independent commissioner is an essential indicator in applying prudential banking principles, allowing for the minimization of credit risk. This is by research by Elamer et al. (Citation2020), which found that the Sharia supervisory board, block ownership, board independence, and country-level governance quality are statistically significant and positively associated with operational risk disclosures. Furthermore, Chouaibi et al. (Citation2023) revealed that governance performance affects financial risk disclosure.

The results of testing Islamic bank risk on financial performance reveal a negative relationship of −0.343. This relationship is supported by a t-statistic of 2.563, indicating a value above 1.96, signifying a significant relationship, with a p-value of 0.011 < 0.05. Therefore, it can be concluded that the risk of Islamic banks on financial performance has a negative and significant effect, and the hypothesis is accepted. This finding is consistent with research by Suprianto et al. (Citation2020) which asserts that bank risk negatively affects the profitability of Sharia (Islamic) banks in Indonesia. This is further reinforced by the research conducted by Danny and Gusliana (Citation2020) on the influence of Non-Performing Financing (NPF) on financial performance, stating a negative and significant impact on profitability. Additionally, research by Kwashie et al. (Citation2022) revealed that non-performing loans adversely impact financial performance.

The results of testing the Sharia capital structure on financial performance reveal a negative relationship of −0.221. This relationship is supported by a t-statistic of 2.575, indicating a value above 1.96 and signifying a significant relationship, with a p-value of 0.010 < 0.05. Therefore, it can be concluded that the Sharia capital structure has a negative and significant effect on financial performance, and the hypothesis is accepted. This research aligns with Mardhatillah et al.’s (Citation2020) findings, which demonstrate the influence of capital structure, proxied by the debt-to-asset ratio, on financial performance proxied by net profit margin. Additionally, a study by Rehman et al. (Citation2023) revealed that structural capital efficiency is significantly associated with earnings per share, return on assets, and return on equity.

The results of testing the Sharia capital structure on risk reveal a negative relationship of 0.047. This relationship is supported by a t-statistic of 0.519, indicating a value below 1.96 and signifying an insignificant relationship, with a p-value of 0.604 > 0.05. Therefore, it can be concluded that the Sharia capital structure has a positive and non-significant effect on Islamic bank risks, leading to the rejection of the hypothesis. This finding aligns with the results of a study conducted by Asmara (Citation2019), where statistical testing on Islamic banks’ capital, measured using the capital adequacy ratio (CAR), did not affect non-performing financing (NPF). Additionally, the results of a study by Fatouh et al. (Citation2023) found that the banks’ leverage ratio did not increase asset risk.

The results of testing the Sharia financing structure on financial performance reveal a negative relationship of −0.491. This relationship is supported by a t-statistic of 6.836, indicating a value above 1.96 and signifying a significant relationship, with a p-value of 0.000 < 0.05. Therefore, it can be concluded that the structure of Sharia financing has a negative and significant effect on financial performance, and the hypothesis is accepted. This finding aligns with the results of research conducted by Alimatul (Citation2020), which stated that musharaka financing significantly negatively affects profitability (ROA). Additionally, a study by Kulmie et al. (Citation2023) concluded that both Murabahah and Mudarabah are vital for the performance and profitability of Islamic banks.

Testing the Sharia financing structure against risk reveals a negative relationship of -0.474. This relationship is supported by a t-statistic of 6.056, indicating a value above 1.96 and signifying a significant relationship, with a p-value of 0.000 < 0.05. Thus, it can be concluded that the structure of Islamic financing has a negative and significant effect on Islamic bank risks, and the hypothesis is accepted. This finding is consistent with research conducted by Dwi Fazriani and Gusliana Mais (Citation2019) which found that mudarabah and murabahah financing have a negative impact on risks, as proxied by problematic financing risks. Additionally, a study by Al Rahahleh et al. (Citation2019) concluded that bank capital and financing expansion significantly and negatively impact the credit risk level of Islamic Banks in Malaysia.

Risk exhibits a positive indirect relationship with GCG and financial performance, with a coefficient of 0.088 (refer to ). However, the intervening relationship in this study is considered weak as the coefficient value is below 0.5. The t-statistic value for the intervening variable relationship is 1.970, falling below the threshold of 1.96, and the p-value is 0.049, below the significance level of 0.05. Therefore, it can be concluded that there is a significant positive effect relationship between risk as an intervening variable and the connection between GCG and financial performance. The statistical tests conducted in this study suggest that Islamic bank risk can mediate the relationship between GCG and financial performance, aligning with Aryani’s (Citation2019) study on the influence of GCG on profitability through credit risk.

Risk demonstrates a positive indirect relationship between the Islamic financing structure and financial performance, with a coefficient value of 0.163. The intervening relationship in this study is considered weak, as the coefficient value falls below 0.5. However, the intervening variable relationship yields a t-statistic value of 2.405, surpassing 1.96, and a p-value of 0.017, less than 0.05. Consequently, it can be concluded that the relationship has a positive and significant effect. The results of statistical tests indicate that Islamic bank risk, as an intervening variable, can mediate the relationship between the Islamic financing structure and financial performance. This finding aligns with a study conducted by Dwi Fazriani and Gusliana Mais (Citation2019), which asserts that musharaka financing and murabahah financing positively impact financial performance, proxied through the ROA ratio, with Islamic bank risk, proxied by NPF as an intervening variable.

Risk exhibits a negative indirect relationship between Islamic capital structure and financial performance, with a coefficient of −0.016. The intervening relationship in this study is deemed weak, as the coefficient value falls below 0.5. This intervening variable relationship yields a t-statistic value of 0.454, below 1.96, and a p-value of 0.650, surpassing 0.05. Consequently, it can be concluded that the relationship is insignificant (refer to ). The results of statistical tests indicate that risk, as an intervening variable, cannot mediate the relationship between Sharia capital structures and financial performance. These findings align with the results of a study conducted by Jayanti and Sartika (Citation2021), which similarly demonstrated that credit risk cannot moderate the relationship between capital adequacy and profitability. In other words, the credit risk level cannot mediate between capital adequacy and profitability.

7. Summary and conclusion

This study has outlined a comprehensive framework for understanding the intricate dynamics within Islamic banks. The results suggest that Sharia capital and financing structures directly impact financial performance, leading to anticipated negative effects. Furthermore, the study indicates that GCG is not expected to influence financial performance directly. Moreover, the research explores the interactions between these variables and risk, suggesting that Sharia capital structure is unlikely to have a direct positive influence on risk. In contrast, Sharia financing structure and GCG are expected to negatively affect risk directly. The study also anticipates that risk will directly and negatively affect financial performance. The hypotheses propose that risk may serve as a mediator, positively influencing the relationship between Sharia financing structure, GCG, and financial performance. This multidimensional framework sheds light on the complex interplay among these variables within Islamic banks, providing valuable insights for researchers and practitioners in this field.

7.1. Implication for practice

This multidimensional framework illuminates the intricate interplay among these variables within Islamic banks, offering valuable insights for practitioners in this field. Islamic bank management is tasked with optimizing the utilization of acquired capital funds, particularly in the distribution of funds for financing, to effectively manage, minimize, and control risks, thereby enhancing the financial performance of Islamic banks. The findings of this study have global applicability for Islamic banks. The study identifies nine types of Islamic bank risks that can be utilized to assess Islamic banks’ risk profiles and even formulate a comprehensive risk profile.

7.2. Limitations and directions for future research

This research does not encompass all Islamic banks in Indonesia, as they fail to meet the criteria for inclusion as research samples. Additionally, Sharia business units within conventional banks that were not included as sample criteria are excluded. This multidimensional framework illuminates the intricate interplay among these variables within Islamic banks, offering valuable insights to researchers in this field. Subsequently, researchers can explore whether other variables may mediate the relationships within Islamic capital structures. Furthermore, researchers can incorporate additional variables, such as Sharia (Islamic) good corporate governance and Sharia maqhasid performance. To enhance the study, it is recommended to include more data from Islamic banks in other countries.

Authors’ contributions

Ahmad Roziq: Creation of ideas, hypotheses, results, discussions, article reports and revision. Zakiyyah Ilma Ahmad: collecting, processing, running data in SmartPLS and revision.

Tool for data analysis

The data analysis technique employed in this study involves using a licensed Smart Partial Least Squares (PLS) program.

Acknowledgments

We are indebted to the University of Jember and STIES Babussalam for providing the support needed for this research. We appreciate the reviews and comments made by reviewers on this paper.

Disclosure statement

The research has no conflicts of interest to declare. Any errors are our responsibility.

Data availability

The data supporting the findings of this study are available from the corresponding author and second author upon reasonable request.

Additional information

Funding

Notes on contributors

Ahmad Roziq

Ahmad Roziq competes in financial accounting, Islamic accounting, and Islamic banking. He is a lecturer and researcher at the University of Jember and an Internal Auditor at BAZNAS in Jember, Indonesia.

Zakiyyah Ilma Ahmad

Zakiyyah Ilma Ahmad specializes in Islamic accounting, economics, and banking. She is a lecturer at ST IES Babussalam Jombang, Indonesia.

References

- Agustin, H., & Bustaman, N. (2020). The effect of Bank Ownership Structure and Financing Income on the Profitability of Islamic Commercial Banks in Indonesia. Journal of Tabarru : Islamic Banking and Finance, 3(2), 86-94.

- Al Kayed, L. (2014). The relationship between capital structure and performance of Islamic banks. Journal of Islamic Accounting and Business Research, 5(2014).[Emerald]

- Al Rahahleh, N., Ishaq Bhatti, M., & Najuna Misman, F. (2019). Developments in risk management in Islamic finance: A review. Journal of Risk and Financial Management, 12, 37. https://doi.org/10.3390/jrfm12010037

- Alimatul, F. (2020). Musharaka financing analysis on the profitability (ROA) of Islamic Banks. Journal of Islamic Economics, 11, 1–16.

- Almunawwaroh, M., & Marliana, R. (2018). The effect of CAR, NPF, and FDR on the profitability of Islamic Banks in Indonesia. Amwaluna : Journal of Islamic Economics and Finance, 2.

- Aryani, K. H. (2019). The effect of good corporate governance on banks profitability with credit risk as an intervening variable. Journal of Distribution, 7, 63–80.

- Asmara, K. (2019). Analysis of Internal and External Factors on Non Performance Financing (NPF) of Syraih Banking in Indonesia. OECONOMICUS Journal of Economics, 4(1), 21–34. https://doi.org/10.15642/oje.2019.4.1.21-34

- Bank Indonesia. (2009). Regulation on Implementing Good Corporate Governance for Islamic banks and Sharia Business Units (Number 11/3).

- Chouaibi, J., Benmansour, H., Ben Fatma, H., & Zouari- Hadiji, R. (2023). Does environmental, social, and governance performance affect financial risk disclosure? Evidence from European ESG Companies. Competitiveness Review. Emerald Publishing Limited.

- Dahlia, M. Y. (2021). The effect of financing risk and liquidity risk on the financial performance of Islamic Banking Listed on the Indonesia Stock Exchange 2015-2019. Journal of Applied Economics, Management and Business Sciences, 1, 311–317.

- Danny, S., & Gusliana, R. (2020). Analysis of the effect of CAR, NPF, FDR, bank size, and BOPO on the financial performance of Islamic Banks in Indonesia. Journal of Accounting and Management, 17, 25–37.

- Darmawi. (2011). Banks management (eleventh printing). Salemba Empat.

- Dwi Fazriani, A., & Gusliana Mais, R. (2019). The effect of Mudarabah, Musharaka, and Murabahah financing on return on assets through non-performing financing as an intervening variable (at Islamic Commercial Banks Registered in the Financial Services Authority). Journal of Accounting and Management, 16.

- Ekaningsih, L. A. F., & Afkarina, F. I. (2021). Good corporate governance its effect on the financial performance of Islamic Banking in Indonesia. Asersi : Journal of Applied Accounting and Business, 1.

- Elamer, A. A., Ntim, C. G., Abdou, H. A., & Pyke, C. (2020). Sharia Supervisory boards, governance structures and operational risk disclosures: Evidence from Islamic Banks in MENA Countries. Global Finance Journal, 46, 100488. https://doi.org/10.1016/j.gfj.2019.100488

- Fadlurrahman, A., Tristiarto, Y., & Fadila, A. (2021). Analysis of determinants of problem financing in Islamic commercial banks in Indonesia. Correlation: National Research Conference on Economics, Management and Accounting, 2.

- Fatouh, M., Giansante, S., & Ongena, S. (2023). Leverage ratio, risk-based capital requirements, and risk-taking in the United Kingdom. Financial Markets, Institutions & Instruments, 33(1), 31–60. https://doi.org/10.1111/fmii.12185

- Financial Services Authority (OJK). (2014). Health Level Assessment of Islamic Banks and Sharia Business Units (8/POJK/03).

- Financial Services Authority (OJK). (2016). Regulation on Implementing Risk Management for Islamic Banks and Sharia Business Units (POJK Number 65/P).

- Financial Services Authority (OJK). (2019). POJK Number 10/POJK.03/2019 concerning Sharia Finance Company Business Operators and Sharia Business Units of Financing Companies.

- Harmaen, T., & Mangantar, M. (2022). The effect of good corporate governance on the financial performance of Islamic Banking in Indonesia for the 2014-2018 period. Journal of EMBA, 10.

- Indah Prihandini, U. P., & Safira, S. (2019). Analysis of Mudarabah Financing, Musharaka Financing and Murabahah Financing on financial performance. Journal of Economics and Social Sciences, 8 N.

- Jayanti, E. D., & Sartika, F. (2021). The effect of capital adequacy and distribution on profitability with credit risk as an intervening variable. Accountable, 18(4).

- Keown, A. J. (2001). Basics of Financial Management Book 1 (Jakarta: Salemba Empat).

- Komang Hevy, A. (2019). The effect of good corporate governance on banking profitability with credit risk as an intervening variable. Journal of Distribution, 7N.

- Kulmie, D. A., Abdirahman Abdulle, M., Sheikh Hussein, M., & Abdi Mohamud, H. (2023). Effects of Islamic modes of financing on profitability of banking institutions. International Journal of Business and Management, 18(5), 237. https://doi.org/10.5539/ijbm.v18n5p237

- Kwashie, A. A., Tawiah Baidoo, S., & Ayesu, E. K. (2022). Investigating the impact of credit risk on financial performance of commercial banks in Ghana. Cogent Economics & Finance, 10(1). https://doi.org/10.1080/23322039.2022.2109281

- Larasati, A. E. D. (2016). The influence of capital structure and bank characteristics on the financial performance of Sharia Banks. Diponegoro Journal of Accounting, 5.

- Ledi, K. K., & Xemalordzo, E. A. (2023). Rippling effect of corporate governance and corporate social responsibility synergy on firm performance: The mediating role of corporate image. Cogent Business & Management, 10(2), 2210353. [Tandfonline] https://doi.org/10.1080/23311975.2023

- Mardhatillah, B. A., Waluyo, B., & Fatah, D. A. (2020). The Effect of Corporate Social Responsibility (CSR) and Capital Structure on Profitability of Islamic Commercial Banks in Indonesia. SERAMBI: Jurnal Ekonomi Manajemen Dan Bisnis Islam, 2(3), 177–186. https://doi.org/10.36407/serambi.v2i3.238

- Marlina, I., & Diana, N. (2021). The effect of Murabahah Financing, Operational Efficiency (BOPO) and Problem Financing (NPF) on Profitability (ROA) at Islamic Commercial Banks for the 2015-2019. Journal of Ekombis, 7(1).

- Muhammad, W. H. (2021). Analysis of Financing at Sharia Bank. Medan: Merdeka Kreasi.

- Munawir. (2010). Financial report analysis. Liberty.

- Mutasowifin, A. (2014). Digest of financial performance analysis. Mahameru Publishing House.

- PSAK 105. (2017). Mudarabah Accounting.

- PSAK 106. (2017). Musharaka Accounting.

- Rahayu, A., Sumantri, F., Anggriawan Latumanase, F., Maulana, D., & Prasetyo, A. (2022). The effect of CAR, BOPO, and FDR on NPF at Bank Syariah Indonesia for the Period 2016-2021. Journal of Equity.

- Ratri Utami, D., & Utami, T. (2021). The effect of profit-sharing financing and bank health level on financial performance with problem financing as a moderating variable. Nominal. Barometer: Accounting and Management Research, 10.

- Rehman, W. U., Saltik, O., Degirmen, S., Metin, O., & Hina, S. (2023). Dynamics of intellectual capital and financial performance in Asian Banks. Arab Gulf Journal of Scientific Research. https://www.emerald.com/ insight/1985-9899.htm. https://doi.org/10.1108/AGJSR-12-2022-0287

- Roziq, A., Marizca, A., & Kustono, A. (2021). Testing the efficiency of the capital structure and asset structure of the bank. Asian Journal of Economics, Business and Accounting, 105–112.

- Roziq, A., Sumartin, D. P., & Sulistiyo, A. (2021). Capital, efficiency, non-performing finance, and profitability: Islamic Banks in Indonesia. Journal of International Management (IJM).

- Sofyan, S. (2002). The effect of market structure on banking performance in Indonesia. Business & Management Research Media, 2N, 194–219.

- Suprianto, E., Setiawan, H., & Rusdi, D. (2020). The effect of non-performing financing (NPF) on the profitability of Islamic Banks in Indonesia. Accounting Research Center.

- Wahyulaili, K., Puspitasari, N., & Singgih, M. (2018). Analysis of the Effect of Sharia Business Good Corporate Governance, Company Size and Capital Structure on Islamic Banking Performance (Study on Islamic Banks in Indonesia in 2012-2017).

- Willy, A. D., & Jogiyanto . (2015). Partial least square (PLS) alternative structural equation modeling (SEM) in business research. C.V Andi Offset.