Abstract

Over the last decade, rapid advances in information systems (ISs) have greatly reshaped and changed the nature of doing business and how its performance is measured, with Electronic Auditing (E-auditing) emerging as a pivotal element in improving organizational efficiency. This study addresses the challenges faced in manually implementing audits and underscores the necessity for transitioning to electronic audit systems. The manual approach has limitations regarding the accuracy of operations, so to enhance performance, E-auditing is now imperative. The purpose of the study is to evaluate E-auditing in the public sector of Saudi Arabia, utilizing DeLone and McLean’s information system model (DM ISM). The focus is on vital factors including information quality, system quality, service quality, system usage and user satisfaction and their influence on the performance of internal audit departments, particularly during the challenges posed by the recent COVID-19 pandemic. This research employs a quantitative approach, utilizing a self-administered survey questionnaire to collect data from E-auditing users in the Saudi public sector. The study applies partial least squares structural equation modelling (PLS-SEM) to validate the gathered data. Findings reveal that information quality and system quality significantly influence E-auditing usage. While service quality exhibits no marked effect on usage, the study establishes a strong relationship between E-auditing usage and user satisfaction. Effective E-auditing usage and satisfied users contribute convincingly to the improved performance of internal audit departments. The paper concludes with implications, limitations, and suggestions for future studies.

reviewing editor:

1. Introduction

Significant and rapid progress has been made in several fields of endeavor since the advent of information technology (IT) (Al-Tit et al., Citation2019; Huynh et al., Citation2021; Lutfi et al., Citation2022; Mhlanga, Citation2020). There is growing evidence that technology integration has given many business organizations a competitive advantage, enabling them to do better than their rivals (M. Al-Okaily et al., Citation2022; Kumar et al., Citation2021; Lutfi et al., Citation2022). Nevertheless, the handling of data and auditing remains unchanged in this era of electronic data operations, regardless of whether the data is handled manually or electronically (Al-Sukker et al., Citation2018; Alqudah et al., Citation2023). Methods used for auditing and gathering evidence may differ significantly depending on how accounting information is collected, classified, and stored (Alqudah et al., Citation2023; Alshira’h et al., Citation2020).

In addition to providing auditors with a cost-effective means of validating the accuracy of operations, the use of computers in audit operations offers auditors the advantage of ensuring accuracy more quickly than if operations were manually carried out (Almagrashi et al., Citation2023; Alqudah et al., Citation2023). Technology and systems are associated with risks so auditors need to understand them. As well as evaluating the availability and effectiveness of electronic evidence, they must consider the potential risks associated with such computerized systems (Almaiah et al., Citation2022; Alqudah et al., Citation2019; Alrawad et al., Citation2023). An auditor conducts audits of computerized systems and electronic commerce using various tools, generally known as ‘General Audit Software’. This type of software program is specifically designed in order to assess the effectiveness of remote communication systems, data integrity, and the individuals responsible for managing them (Alzoubi, Citation2019; Curtis & Payne, Citation2014; Mujalli & Almgrashi, Citation2020). The system is restricted to individuals authorized to access it for specific purposes.

A significant opportunity exists for the auditing profession to be enhanced through computers. Incorporating computers into audit operations has enabled auditors to offer a wide range of financial and accounting services to financial statement users and resolve financial and accounting challenges they face (Alzeban & Gwilliam, Citation2014; Jarah et al., Citation2022; Ta & Doan, Citation2022). As modern technologies are increasingly being embraced in accounting practices, enhancing the internal auditing profession’s performance is now necessary to remain competitive (Alqudah et al., Citation2023). Therefore, electronic internal audit has become an integral part of corporate governance given: firstly, the demands and expectations of global digital transformation; and secondly, the automation of numerous corporate activities, particularly following the COVID-19 pandemic’s repercussions (Lutfi et al., Citation2022; Tawfik et al., Citation2022).

The spread of COVID-19 hugely reshaped the practices of internal auditors, making face-to-face audits unfeasible (Bajary et al., Citation2023). It is subsequently becoming increasingly common for internal auditors to conduct E-audits, for which IT and data analytics are used to conduct procedures to determine whether internal controls are adequate, whether financial data is accurate, and how evidence is acquired electronically (Eulerich et al., Citation2021). In light of these changes, the acceptance of E-auditing has become more imperative than ever, as it offers an effective solution to the challenges posed by social distancing measures regarding auditing methodologies (M. Al-Okaily et al., Citation2022; Mujalli & Almgrashi, Citation2020).

As a result of a number of factors, the COVID-19 pandemic presented major obstacles for manual audits in Saudi Arabia (Baatwah & Al-Ansi, Citation2022). Lockdowns and social distancing policies restricted physical access to records and offices, making it challenging for auditors to gather and review documents on paper (M. Al-Okaily et al., Citation2022; Tawfik et al., Citation2022). Furthermore, real-time and effective data analysis and reporting were required for pandemic-related financial and operational decisions, which manual audits found difficult to do (Alqudah et al., Citation2023). In response to these challenges, the implementation of E-audits emerged as a vital breakthrough and led internal auditors to access and analyze digital records remotely, decreasing the need for physical presence and allowing ongoing monitoring of financial and operational data (Almagrashi et al., Citation2023). This transition enhanced the timeliness and accuracy of audit procedures, addressing the unique demands brought about through the COVID-19 pandemic (M. Al-Okaily et al., Citation2022; Alqudah et al., Citation2023).

Incorporating electronic internal audit practices is projected to enhance the efficiency of internal auditors, enabling them to undertake more productive tasks within shorter timeframes (Alqudah et al., Citation2023). Consequently, heightened efficiency empowers internal auditors to expand the scope of their responsibilities and execute them with greater effectiveness. As a consequence of this enhanced efficiency and effectiveness, stakeholders are more inclined to place trust in the outcomes of the electronic internal audit (Eulerich et al., Citation2021). As the auditing profession becomes more IT-dominated, the widespread shift from manual to electronic systems has become a crucial requirement (Pickard et al., Citation2020). Several of these methodologies depend heavily on cutting-edge technological processes to perform auditing and risk assessment (Lenz et al., Citation2017). Even though electronic internal audits seem reasonably straight forward, their limited acceptance is evident so potential users need to be more aware of their benefits (M. Al-Okaily et al., Citation2022; Alqudah et al., Citation2019).

Prevailing business models have undergone significant transformations due to globalization, widespread digitalization, information and knowledge competition, and dissemination (Lutfi, Citation2022). Furthermore, the current era has witnessed substantial investments in computerization for data processing across various activities, industries, and sectors. Essentially, these technological advances are intertwined with adopting technical methodologies and applications, resulting in many alterations in business processes (Lutfi, Citation2022). In simpler terms, IT and information systems (IS) have presented numerous opportunities and advantages for businesses of all types (Lutfi et al., Citation2022; Saad, Citation2023).

Internal audit departments in public sector organizations, in particular, face ongoing logistical challenges due to their smaller workforce and limited budgets, which are more pronounced than their counterparts in the private sector (Ghobakhloo et al., Citation2018; Saad, Citation2023). Public sector agencies must improve their service levels due to government legislation or regulations, monitoring obligations, cost-cutting efforts, procurement challenges, inventory controls, and limited resources. Despite similarities in experience requirements, these circumstances offer a more favorable environment for computer-based systems, as they entail fewer complications than private sector organizations (Lutfi et al., Citation2022). To meet their objectives, public institutions increasingly rely on E-auditing to improve their work and what they produce, collaborating closely with their IT departments. Pursuing market competitiveness, cost reductions, efficient management, enhanced service delivery, improved management functionality, and reduced errors drive this shift to e-accounting and auditing (Lutfi et al., Citation2022; Saad, Citation2023).

Thus, computerized ISs have become integral tools in many industries, contributing to the accomplishment of objectives and improved managerial efficiency (Elshaer & Saad, Citation2022; Saad, Citation2023). They are crucial in addressing business challenges and have emerged as indispensable elements in resolving issues organizations encounter (Bokhari, Citation2005; Lutfi, Citation2020). Enterprises heavily rely on cutting-edge technologies to overcome business-related hurdles (Alshira’h & Abdul-Jabbar, Citation2020), and it was the work of Saarinen (Citation1996) that provided evidence of the significant role of ISs in the success of work endeavors. Elsewhere, Thong and Yap (Citation1996) concentrated on how ISs at different levels contribute to accomplishing goals and overall better organizational functioning.

The significance of E-auditing in internal audit departments cannot be overstated, as it is a fundamental component of ISs. Here the integration, coordination, and control of activities is possible (M. Al-Okaily et al., Citation2022; Mahzan & Lymer, Citation2014; Mujalli & Almgrashi, Citation2020; Yang & Guan, Citation2004). E-auditing is an integral part of management information systems, responsible for the collection, analysis, categorization, addressing, and provision of diverse financial information to relevant beneficiaries, users, and managers, enabling them to make well-informed decisions (Al-Hiyari et al., Citation2019; Sayana & et al., 2003; Siew et al., Citation2020). Thus, this system integrates computer-based and IT-related resources to make possible the tracking and reporting of accounting activities and transactions.

Over the past several years, Saudi organizations have adopted E-auditing to improve their business operations’ efficiency and capabilities. Saudi Arabia’s government has responded to this growing trend by introducing initiatives and grants to address the limited resources organizations endure (Alharbi, Citation2022). However, Saudi organizations face the same challenges as their counterparts in other developing nations when it comes to leveraging the full potential of E-auditing, particularly in risk business analytics and decision support scenarios (Alharbi, Citation2022). These challenges stem from the complex decision-making modules and costs of implementing such systems. Despite these difficulties, E-auditing has generally resulted in the exploitation of real-time information for evaluating and analyzing operational data, leading to good decisions being made and improving the internal audit department’s performance (Bradford et al., Citation2020).

The motivation for this study lies in the paucity of studies concerning E-auditing in the internal audit department (Abdelrahim & Al-Malkawi, Citation2022; M. Al-Okaily et al., Citation2022; Alzeban & Gwilliam, Citation2014; Eulerich et al., Citation2021; Mujalli & Almgrashi, Citation2020; Park et al., Citation2019; Pizzi et al., Citation2021). Particularly in Saudi Arabia, more studies must be conducted as advised by Mujalli and Almgrashi (Citation2020). For instance, Park et al. (Citation2019) confirmed that studies had only addressed internal auditing. Pizzi et al. (Citation2021) have called for further empirical investigations into the factors influencing the motives behind this kind of study, particularly in Saudi Arabia’s increasingly electronic internal audit profession. This research area remains understudied according to Eulerich et al. (Citation2021) and M. Al-Okaily et al. (Citation2022). For this reason, it is imperative to conduct more research (Abdelrahim & Al-Malkawi, Citation2022; Mujalli & Almgrashi, Citation2020). Notably, many analyses (Abdelrahim & Al-Malkawi, Citation2022; M. Al-Okaily et al., Citation2022; Alqudah et al., Citation2019; Alzeban & Gwilliam, Citation2014; Bradford et al., Citation2020; Endaya & Hanefah, Citation2016; Eulerich et al., Citation2021; Park et al., Citation2019; Pizzi et al., Citation2021) have confirmed the scarce number of studies examining internal audit department practices. The recent COVID-19 pandemic presented major obstacles for manual audits in Saudi Arabia (Baatwah & Al-Ansi, Citation2022). Therefore to study the challenges that emerge in implementing of E-auditing in Saudi Arabia, requires not only ensuring the safety of internal auditors but moreover enhancing the timeliness and accuracy of audit procedures and outcomes.

Concerning results, there still needs to be more organized evaluation and ongoing debate regarding its effects on internal audit departments’ performance. This study undertakes a comprehensive literature review to examine studies demonstrating a direct relationship between E-auditing, IS, and internal audit departments’ performance. This study builds on prior studies that evaluated internal audit departments’ functioning using the DM ISM, for instance, Fadelelmoula (Citation2018) whose work was based on quality dimensions, E-auditing usage, and user satisfaction. Subsequently, this detailed research paper examines the relationships between certain variables with the expectation of explaining internal audit departments’ performance. While the impact of critical success factors on performance and enhancing it through improved decision-making in organizations has been acknowledged, what remains is the need to evaluate these factors, particularly in the context of adopting E-auditing practices. Based on the argument made above, the following research questions are posited:

RQ1. Is there a significant correlation between the construct of quality (information, system, and services) and E-auditing in the public sector of Saudi Arabia?

RQ2. Is there any significant correlation between E-auditing usage and users’ satisfaction?

RQ3. Does E-auditing usage and users’ satisfaction influence internal audit departments’ performance in Saudi Arabia?

2. Background

2.1. Internal audit function’s evolution

A study by PwC (Citation2018) emphasizes that the Internal Audit Function (IAF) must adapt and incorporate new technologies and digital knowledge to address digital challenges and risks effectively. As the business landscape has evolved over the past few decades, the IAF has undergone significant changes. As a result of the IAF’s expansion into organizational controls in the 1990s (Cooper et al., Citation1994; Gupta & Ray, Citation1992), it expanded its purview beyond finance and accounting. The role of internal auditors also changed during this period, as they began to serve as consultants and engage in increasingly frequent consulting for management (Krogstad et al., Citation1999).

IAF functions and responsibilities were transformed in the early 2000s by regulatory measures in response to corporate scandals in the United States (Betti & Sarens, Citation2021; Jones et al., Citation2017). The IAF shifted from a control-oriented approach to a risk-oriented process due to the notion of risk-taking that took center stage in corporate governance (Spira & Page, Citation2003). The IAF subsequently shifted its concentration from control-oriented activities to assurance activities, emphasizing internal controls and reducing its involvement in management’s interior consulting projects (Betti & Sarens, Citation2021). Following the global financial turmoil of the late 2000s, the IAF was questioned about its ability to protect society against economic crises (Betti & Sarens, Citation2021). Internal audit has thus become more visible (Fazli Aghghaleh et al., Citation2014) instead of being primarily hidden behind the scenes. A proactive role has been taken by the IAF in promoting enterprise risk management in organizations (Betti & Sarens, Citation2021). A notable increase in the IAF involvement in consulting activities occurred during the 2010s, concentrating on improving efficiency and business processes (Soh & Martinov-Bennie, Citation2011; Stewart & Subramaniam, Citation2010).

As a result of recent scholarly research (Soh & Martinov-Bennie, Citation2015), assurance activities remain fundamental to internal audit engagements, but consulting activities are increasingly on the rise. The internal auditor perceives these consulting activities as adding value to the organization (Stewart & Subramaniam, Citation2010) and so the auditor becomes a more strategic member (Betti & Sarens, Citation2021). IAF consultants and assurance specialists encounter a variety of challenges when executing both consulting and assurance tasks (Lenz & Hahn, Citation2015; Soh & Martinov-Bennie, Citation2011) including role ambiguity, as well as the possibility of independence and objectivity being undermined. According to Jones et al. (Citation2017) and Sarens et al. (Citation2012), the evolving organizational business milieu has affected the trajectory of internal audit development duties. IAF consultants tend to prioritize assurance activities following global financial scandals or economic crises (Stewart & Subramaniam, Citation2010), which correlates with the evolution of the economic and regulatory landscape. This makes it essential to analyze the influence of E-auditing on the IAF in light of these factors. Thus, as the IAF becomes increasingly prominent, it is worthwhile examining how the E-auditing and changing environment may affect it since the work milieu and strategic of the organizations are key inputs to the planning procedure of the IAF (IIA, Citation2017).

2.2. Quality of electronic internal audit

The perception of accounting audits has changed greatly given that auditing now serves as a control mechanism for many kinds of businesses and various domains such as finance, economics, law, and even the wider society (Alqudah et al., Citation2023; Alzoubi, Citation2019). Auditing is found in all types of entities, as it plays a crucial role in safeguarding and preserving an organization’s financial resources and aiding in decision-making (Sarhan et al., Citation2019; Almagrashi et al., Citation2023; Lenz & Hahn, Citation2015). Moreover, the audit profession is one that requires essential competencies and expertise to oversee the internal control systems of corporate entities. This oversight ensures the dissemination of reliable and precise information to both internal management and external stakeholders suitably and promptly, facilitating informed and logical decisions being made. Hence, the audit procedure should bolster service-oriented enterprises’ operations by verifying their activities’ efficacy and efficiency, thereby convincing shareholders that proper managerial practices are taking place (Alzeban & Gwilliam, Citation2014).

Internal auditing comprises a series of procedures designed for gathering, analyzing, and assessing data (audit documentation) to determine whether or not applicable standards are being followed. According to Janse van Rensburg and Coetzee (Citation2016), the essential components of an internal audit are the quantity and quality of the data gathered to support an opinion or proposal. While E-auditing was characterized as an aggregation and valuation procedure to assess if computers contribute to preserving an economic unit’s assets, it also validates the integrity of its data, fulfills its objectives successfully, and uses its resources efficiently. The internal auditor can deploy IT which assists in him or her doing their job more strategically (Alqudah et al., Citation2023).

3. Theoretical literature review

Extant literature has consistently demonstrated E-auditing’s successful outcomes, but this is contingent on crucial factors (A. Al-Okaily et al., Citation2021; Ghobakhloo & Tang, Citation2015; Hidayat Ur Rehman et al., Citation2023), and hence this study’s aim is to assess E-auditing by applying DM ISM the public sector in Saudi Arabia. Therefore, DM ISM (2003) is employed in the current study and it was chosen due to its ability to assess complex ISs and analyze the procedure for obtaining information involved that will be disseminated to specific parties. Accounted for here are the causal factors that may influence end-users. Previous research papers examining IS/IT performance using the DM ISM (1992) have identified six factors—namely, system quality (SYSQ), information quality (IQ), system use, user satisfaction, and personal and business effects—as indicators of different categories of IS success (DeLone & McLean, Citation1992). In an updated version of the model, DeLone and McLean incorporated the concept of service quality (SRVQ) and replaced the impacts on individuals and organizations with net benefits.

With this in mind, users’ perceptions of SYSQ and their experiences affect their attitudes and subsequent behaviors, according to the new model. Moreover, the model illustrates the relationships between IQ, SYSQ, and SRVQ with user intentions and satisfaction, which in turn influence the perception of net benefits for the user (DeLone & McLean, Citation1992, Citation2003). In addition to evaluating the effectiveness of IS, the model can be applied across various analytical levels depending on the tasks performed, making it a valuable framework for evaluating IS success. IS and SRVQ play a crucial role in the success of the overall system. When evaluating a successful model, it is essential to consider factors such as system usage, user satisfaction, and net benefit. To evaluate the application of the updated model in various contexts, including the adoption and utilization of E-auditing, the updated model is selected as the theory’s foundation. This research paper introduces novel factors that contribute to the perception of user satisfaction, distinct from the technical considerations of the system, such as SRVQ and IQ. As acknowledged in previous studies, the intention is to incorporate organizational aspects that play a role in the success of ISs usage (Cullen & Taylor, Citation2009; Urbach & & Frederik, 2010).

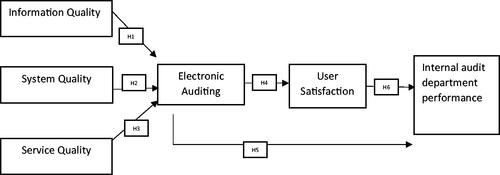

The primary objective of an IS is to establish connections among various businesses operating within a single supply chain (Cullen & Taylor, Citation2009; Purwati et al., Citation2021). This objective goes beyond the technical aspects of the system and encompasses dimensions that demonstrate the interaction and collaboration among IS users. Specifically, this study expands the existing IS framework by assessing the net benefits of E-auditing usage. This aspect has not been previously addressed in the literature on DM ISM. Despite the widespread use of IS success models for evaluating IS performance, applying such models to assess E-auditing at the organizational level has been largely overlooked (Ifinedo et al., Citation2010). Furthermore, there is a need to explore the relationship between IS success and workplace performance, considering the latter as the exogenous variable. Previous research conducted by Chou and Hong (Citation2013), Kharuddin et al. (Citation2015) and Xie et al. (Citation2014) has extensively explored the impact of IT/IS technologies on business and work performance, employing the DM ISM theory as their framework. These studies have consistently demonstrated the robustness of this particular theory in explaining the links between innovation and enhanced organizational performance. This study aims to take this knowledge and examine how three exogenous factors, namely SRVQ, IQ, and SYSQ, affect E-auditing adoption, user satisfaction, and business performance. Both user satisfaction and business performance are explicitly studied in this paper with reference to E-auditing systems. The proposed theoretical research framework is presented in .

4. Empirical literature review and hypotheses development

4.1. Information quality (IQ)

Literature on IS is replete with studies focusing on IQ, which is considered a crucial factor in influencing businesses’ implementation of IT. Information quality refers to the system’s ability to provide users with accurate, timely and complete information that is relevant to those who need it. IT quality assurance aims to assess the quality of output information generated by IT (DeLone & McLean, Citation1992, Citation2003), reducing transactional errors and producing accurate and valuable information. There have been inconsistent findings in previous studies examining the relationship between intelligence and IT adoption, preventing a definitive conclusion being drawn (Li & Wang, Citation2021). Bradford et al. (Citation2020) found that IQ significantly impacted E-auditing, whereas other research found that IQ had no outstanding bearing on technology (Daoud & Triki, Citation2013; Jaoua et al., Citation2022). Al-Hiyari et al. (Citation2013) argued that various dimensions of IQ also had little effect on IT adoption. Here the following hypothesis is put forward for testing:

H1. IQ has a significant impact on E-auditing usage.

4.2. System quality (SYSQ)

SYSQ is a significant construct within the DM ISM model. It refers to the system’s technical efficiency, encompassing user-friendliness, response time, reliability, flexibility, and safety (DeLone & McLean, Citation1992, Citation2003). High-quality E-auditing systems can evaluate users’ needs based on their perceptions of the system’s ease of use. System quality is regarded as a crucial determinant of E-audit IS adoption by organizations, as indicated by DeLone and McLean (Citation2003). They argued that effective utilization and well-designed IS can enhance efficiency, even without direct theoretical support. Numerous studies have investigated this relationship and have reported mixed results. The current study investigates the influence of SYSQ as a determinant of the DM ISM on using E-auditing within internal audit departments in order to enhance decision-making processes and overall performance.

Building on prior studies, substantial evidence indicates a significant association between system qualities and IS usage (A. Al-Okaily et al., Citation2021; Almaiah et al., Citation2022; Lutfi et al., Citation2022; Saad, Citation2023). In particular, Lutfi et al. (Citation2022), conducted a study on post-IS usage and observed that system quality exerts an extraordinary impact on IS utilization. This observation aligns with the findings of Xu et al. (Citation2013), who explored the effects of system quality on IS adoption using a 3Q model, i.e. the integrated technology model proposed by Nelson et al. (Citation2005). Their research revealed a meaningful influence of SYSQ on IT use. Furthermore, Negash et al. (Citation2003) discovered affirmative evidence for the utilization of SYSQ in web-based customer support systems and their significance in organizational contexts. Despite the valuable insights gained from these studies, much more examination of constructs in diverse contexts and countries needs to be done to prove the generalizability of the findings. Therefore, the following hypothesis was put forward for testing:

H2. SYSQ has a significant impact on E-auditing usage.

4.3. Service quality (SRVQ)

This study’s third variable under investigation is the SRVQ of the DM ISM. SRVQ is composed of two indicators, namely assurance and empathy. The IS provides knowledge and information free from risks and hazards (A. Al-Okaily et al., Citation2021; Alrawad et al., Citation2023; Lutfi et al., Citation2022). Moreover, the system should be user-friendly so that users’ needs are communicated effectively. SRVQ is a measure that assesses the quality of services offered by the IS, and marketing entities employ it to evaluate service quality (Dehghanpouri et al., Citation2020). It is considered a significant determinant of IS effectiveness because it assists users through the IS department. System reliability, support empathy, and responsiveness are commonly employed to gauge SRVQ (Alsmadi et al., Citation2020).

Over the years, the analysis of IT services has become increasingly important, particularly in terms of service quality, which plays a crucial role in the competitiveness of ISs. Arshah et al. (Citation2012) emphasized that the effectiveness of SRVQ, particularly in the context of E-auditing, leads to and enhances the integration of systems across various departments. This lets the internal audit department do its job properly and this, in turn, means that the internal audit department and its parent organization are functioning well. Chang et al. (Citation2012) identified a positive correlation between SRVQ and the utilization of IS. However, some studies, such as those conducted by Lutfi et al. (Citation2022) and Petter et al. (Citation2008), did not find a significant relationship between them. Therefore, mixed findings persist regarding this association. Consequently, the dimensions of service quality proposed by the DM ISM may carry varying weights based on the analysis and contextual findings. This present work suggests the following hypothesis for testing:

H3. Service quality has a significant impact on E-auditing usage.

4.4. E-auditing usage

The existing literature on ISs elucidates the concept of the system as the extent of effort individuals make to utilize an IS, which is directly linked to the system’s output within a given timeframe (Trice & Treacy, Citation1988). The utilization of an IS predominantly hinges upon the user’s evaluation of the system’s efficacy, whereby if they are persuaded that it enhances task performance, this, in turn, leads to heightened satisfaction and frequency of use (Bokhari, Citation2005). User satisfaction is characterized as the degree to which individuals perceive the information furnished by the system as meeting their requirements, stemming from their interaction with the information search process, overall contentment, and the consequences of their decisions (Almaiah et al., Citation2022; Chou et al., Citation2014).

Several studies have linked user satisfaction with e-accounting usage (Kim et al., Citation2017; Samelson et al., Citation2006), which contributes to enhanced efficiency, performance, and productivity (Almaiah et al., Citation2022; Lin, Citation2010). Several special measures have been proposed to assess user satisfaction and usage, including the length, frequency, and level of the latter (Chou et al., Citation2014; Lutfi et al., Citation2022; Ramli, Citation2013). Other studies have evaluated user satisfaction in the same domain (Hsu et al., Citation2015; Wixom & Todd, Citation2005), including service satisfaction, service quality satisfaction, information satisfaction, and overall e-accounting satisfaction. Furthermore, prior studies consistently reported a positive correlation between using e-accounting systems and user satisfaction. The present study detected a positive correlation between user satisfaction with E-auditing and using such systems. This leads to the following hypotheses:

H4. E-auditing use has a significant impact on user satisfaction with the system.

H5. E-auditing use has a significant impact on internal audit departments’ performance.

4.5. User satisfaction

User satisfaction is a crucial factor to take into account in DM ISM. It encompasses indicators such as repeat purchases and visits, where the former signifies the disparity between required and acquired information (Alsyouf & Ishak, Citation2018; Sabah et al., Citation2021). Furthermore, information satisfaction stems from comparing the needs of an IS with the performance outcome. Conversely, repeat purchase denotes the overall satisfaction with the system, as evaluated through the level of IS and system satisfaction and the benefits derived from the input-output process (A. Al-Okaily et al., Citation2021; Lutfi et al., Citation2022; Saad, Citation2023). In research and especially that carried out in academia, performance pertains to the outcome accomplished through a user’s interaction with a given system (Petter et al., Citation2008; Petter & McLean, Citation2009). In E-auditing, system performance evaluation revolves around the ability to deliver accurate, precise, and dependable information (Alqudah et al., Citation2023; Pizzi et al., Citation2021). Bradford et al. (Citation2020) found that satisfaction with E-auditing positively increases a user’s perception of its benefits. Furthermore, Lutfi et al. (Citation2022) in their investigation, noted that the effectiveness of system usage is contingent on user satisfaction. Hence, the frequency and extent of employing electronic methods and user contentment directly influence improved performance. On this basis, this study proposes that:

H6. User satisfaction has a significant impact on internal audit departments’ performance.

5. Research design

This study applied the quantitative research method to explain the influence of information quality, system quality, service quality, system usage, and user satisfaction on the performance of internal audit departments. The study followed the positivist paradigm. The authors used the main data extracted from the survey findings because the primary data has not been subjected to human intervention, enhancing its validity, allowing for more effective interpretation, focusing on pertinent research questions, and maintaining the data’s decency (Wiredu et al., Citation2023).

5.1. Measurement instrument

In order to collect data for this study, a survey questionnaire and participant setting were adopted to elicit people’s actual perceptions of information quality, system quality, service quality, system usage, and user satisfaction regarding the performance of internal audit departments. A questionnaire initially was developed in English and later translated into Arabic to test the hypotheses. The questionnaire items were drawn from prior literature in IS, and the researcher has modified the questions in order to ensure they are relevant to the topic. Six experts in the field of E-auditing and IS were consulted. Subsequently, a pre-test or pilot test was conducted to assess comprehensibility, clarity, relevance, and ensure there was no ambiguity in the questions, following the recommendations of previous studies (Almaiah et al., Citation2022; Alsmadi et al., Citation2020). The questionnaire underwent a comprehensive review and evaluation by seven managers of Saudi internal audit departments. Based on the feedback received, certain items were changed to enhance the questionnaire’s readability.

In view of the fact that the questionnaire was initially designed with the English language in mind, and Arabic is the native language spoken in Saudi Arabia, the questions were translated into Arabic. Two Saudi linguist teachers and two academics in Saudi universities confirmed the translation procedure. When developing questionnaire items, it is an extremely important to use a prose style that is easily understood. Consequently, this study took into account the advantages of a ‘back translation’ technique since it is one of the most frequently employed techniques, one that validates the quality of translation and confirms that problems have been dealt with (Ozolins, Citation2008; Saunders et al., Citation2019).

Internal audit department serves as the dependent variable in this study. Quality dimensions (information quality, service quality and system quality) are the independent latent variables. E-auditing and user satisfaction functioned as mediating variables. Responses to the items were collected using a 5-point Likert scale, with values ranging from 1 for ‘strongly disagree’ to 5 for ‘strongly agree’. displays the measurement predictors applied in this research and their source.

Table 1. Constructs, measurements and their source.

5.2. Sample, data collection procedure and Ethical considerations

The sample chosen for the present study comprises employees of internal audit departments who use E-auditing systems. The decision made about the sample size is subject to the diverse nature of the population and the precision of the findings. Nevertheless, the well accepted rule of thumb concerning sample size for studies using SEM for data analysis is a minimum number of measured variables * 10 (Hair, Citation2013). This study employs a single variable that incorporates 21 statements; the minimum sample size should be 21*10 = 210. Thus, the minimum sample size for this study should not be below 210 in any case. Moreover, Kline (Citation2011) suggested having a minimum sample size of 200 when undertaking SEM analysis. The questionnaires were administered both in-person and through Google Forms. Every respondent was only allowed to complete the survey one time. Respondents who provided their email addresses from the organization’s website were invited to take part. The ethical guidelines given the involvement of humans had to be respected and appropriately followed. These include giving informed permission, upholding human rights, shielding respondents from harm, maintaining the anonymity of their comments and identification, and maintaining one’s integrity as a professional researcher. Participants were allowed to choose whether or not to take part and there was no coercion. The responses obtained were kept confidential. Upon request, the data will be made available for use in academic projects. Seven hundred surveys with twenty-one questionnaires were sent online to various Saudi public sector organizations. 213 respondents completed questionnaires and this represented a response rate of 32.76%. displays the respondents’ return details.

Table 2. Questionnaire delivery and return details.

6. Data processing and analysis

PLS-SEM analysis was chosen to test the formulated hypotheses due to its ability to handle multivariate relationships among exogenous and endogenous variables within a single model. This approach is well-suited for complex models involving mediating/moderating relationships, even when dealing with small-sized samples, making it a viable option in certain scenarios where CB-SEM and other techniques may be impractical. SPSS software was employed using the data responses obtained from managers of internal audit departments and internal auditors. Each questionnaire item received a unique code, which was cross-referenced with the entries in SPSS to minimize errors. To enhance additional statistical analysis, any conflicting data was removed during the data cleaning process. The PLS-SEM approach was employed for inferential evaluation, aligning with the study’s objectives. PLS-SEM is robust enough to manage correlations between latent variables, regardless of normality issues, as opposed to covariance-based SEM (CB-SEM) (Hair et al., Citation2019).

6.1. Demographic characteristics of respondents

summarizes the study respondents’ demographic characteristics. Primarily they were in the 30–39 age group, with 73.7% being males and 26.3% females. A Bachelor’s degree was evident for 72.8% of the participants. About 66.7% of internal auditors had worked in the job for between 5 and 9 years while 80.8% of respondents are internal auditors. Approximately 10.3% are internal audit department managers while 8.9% are assistant managers of the department. According to the descriptive analysis, 17.4% of public sector agencies have one to four internal audit employees, 56.3% have five to ten internal audit employees, 31.9% have eleven to fifteen internal audit employees and 4.7% have more than sixteen internal audit employees.

Table 3. Participants’ characteristics.

6.2. Measurement model assessment

6.2.1. Construct reliability, indicator reliability, and convergent validity

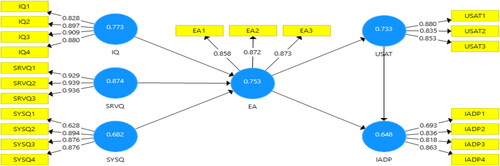

The PLS-SEM results commenced with the model’s assessment to evaluate its fitness by examining the factor loadings (FL) (Ockey & Choi, Citation2015). According to Hair et al. (Citation2019), FL values above 0.5 are considered good. In and , it was observed that the majority of FL were above 0.8, with a few loadings exceeding 0.6. This finding confirmed the reliability of the measures used in the study. In order to ensure internal consistency, the researcher examined Cronbach’s alpha (CA) values, aiming for values greater than 0.7, as suggested by Hair et al. (Citation2019). displays all constructs and they have CA alpha values exceeding 0.7. However, Cronbach’s alpha has been criticized for its underestimation issues. For this reason, it is advised to assess composite reliability (CR) and rho_Alpha alongside CA. For confirmatory purposes, both CR and rho should be above 0.7 according to Hair et al. (Citation2019). indicates acceptable CR and rho_Alpha values for all constructs, satisfying this requirement as well. Moreover, convergent validity was performed and this refers to the degree of association between a measure and similar conceptual measures (Hair et al., Citation2019). A construct is considered to possess convergent validity when its average variance extracted (AVE) is greater than 0.5 (Hair et al., Citation2019). demonstrates that all reflective measures met the minimum requirement, ensuring their convergent validity. The predictive relevance of the measurement model is established by assessing its predictive validity, specifically through the calculation of communality values (H2). In , all H2 values for all blocks are positive, subsequently confirming the predictive relevance of the measurement model (Hair et al., Citation2019).

Table 4. Reliability, validity and quality of the measurement model.

6.2.2. Discriminant validity

In order to assess discriminant validity, different tests towards the end of the measurement model were conducted. Discriminant validity (DV) is defined as the extent to which a specific latent construct varies from other latent variables (Duarte & Raposo, Citation2010). Many approaches can confirm the requirements of discriminant validity. One approach to evaluating it is through the cross-loadings of confirmatory factor analysis (CFA). The phenomenon where an item demonstrates higher loadings on its own parent compared to other constructs involved in the research is referred to as cross-loadings. The issue of discriminant validity arises when an item demonstrates better loading onto a different construct in comparison to its own parent construct (Hair et al., Citation2019). The difference of loading less than 0.10 suggests that the item is cross-loading onto the other construct, which could potentially undermine the discriminant validity (Hair et al., Citation2019). Looking at , it can be observed that none of the measurement loadings cross-loaded with any other variable included in the study. This finding supports the discriminant validity of the measurement model.

Table 5. Cross-loadings.

The Fornell-Larcker criterion provides another method for assessing discriminant validity. It involves comparing the square root of the communality values (highlighted in bold and italic font on the diagonal) with the correlations presented in . According to the criterion proposed by Fornell and Larcker (Citation1981), if the square root of the communality for a particular construct is greater than the correlation between that construct and any other variable, it confirms adequate discriminant validity (Garson, Citation2012).

Table 6. Discriminant validity – Fornell–Larcker criteria.

To further ensure discriminant validity, the researchers employed HTMT ratios as a more reliable measure. The recommended threshold for HTMT ratios is generally set to less than 0.85 (Hair et al., Citation2019). Referring to , it is observed that all constructs in the study had HTMT ratios below 0.85. This finding further confirms the discriminant validity of the measures used in the study.

Table 7. Discriminant validity – HTMT ratios.

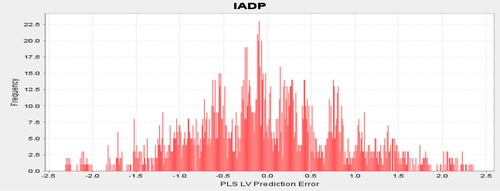

6.2.3. Measurement model robustness

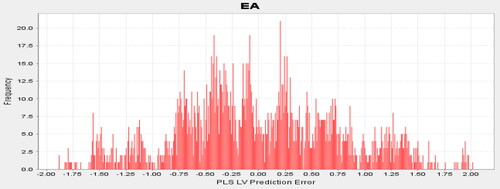

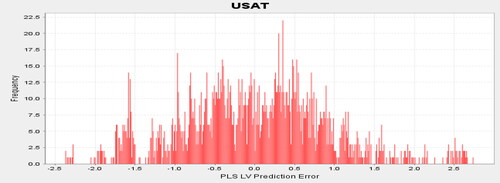

To assess the robustness of the measurement model, the researchers utilized the PLS Predict methodology, following the recommendation of Sarstedt et al. (Citation2019). Thus, PLS Predict utility in SmartPLS was employed and it produced a value of r = 10 and k = 10, the objective being to examine the robustness of the measurement model. The analysis was conducted based on the method presented by Shmueli et al. (Citation2019). display that the prediction errors were symmetrically distributed, and therefore the Root Mean Square Error (RMSE) was deemed to be a performance measure. Additionally, Mean Absolute Error (MAE) served to eliminate any potential ambiguities. indicates that all the indicators of the endogenous variables (EA, USAT and IADP) outperformed the naïve benchmarks, as evidenced by Q2 being greater than 0 for both PLS-SEM and linear regression model (LM) benchmarks. A cross-validated predictive ability test (CVPAT) was conducted by comparing the RMSE and MAE performance measures. Results revealed that all PLS values were lower than those of LM for both RMSE and MAE, strongly suggesting the high predictive relevance of the measurement model (Shmueli et al., Citation2019).

Table 8. PLS predict assessment.

A comparison of the Q2 values between PLS and LM models was executed, as shown in . It was observed that the Q2 value for PLS was higher than that of LM, and all Q2 values remained positive even after the comparison. Meanwhile the overall Q2 values for the endogenous variables EA (0.435), USAT (0.197), and IADP (0.274) were positive. Based on these comparisons, it can be confidently concluded that the PLS-Predict for the study model met the required criteria to a high degree. Consequently, the predictive relevance and accuracy of the measurement model can be confidently established, aligning with the findings of Shmueli et al. (Citation2019).

6.3. Structural model assessment

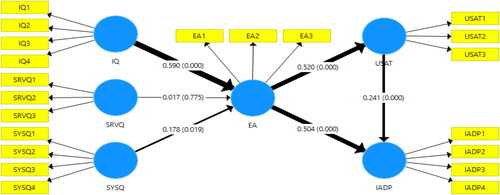

The structural model assessment involved examining the relationships between constructs based on the existing literature (Hair et al., Citation2019). In this study’s model only direct effects were conceptualized. To test those direct effect hypotheses, the study utilized 5000 subsamples of bias-corrected bootstrapping with 95% confidence intervals. For more detailed information please see and .

6.3.1. Hypotheses testing

Regarding hypotheses testing, H1 was supported since IQ had a positive and significant influence on EA (β = .590, t = 11.091, p < .001), with a large effect size (F2 = .472). Similarly, H2 was also supported as SYSQ had a positive and significant influence on EA (β = .178, t = 2.347, p = .019), with a small effect size (F2 = .048). However, as displayed in , which recommended a positive influence of SRVQ on EA (β = .017, t = .286, p = .775), was not supported because the relationship was not significant with literally no effect at all (F2 = .000). Meanwhile, EA had a positive and significant influence on USAT (β = .520, t = 10.274, p < .001), with a large effect size (F2 = .370), thereby providing support to H4. Additionally, EA moreover had a positive and significant influence on IADP (β = .504, t = 8.365, p < .001), with a moderate effect size (F2 = .329), thus supporting H5. Finally, as displayed in , which proposed a positive influence of USAT on IADP (β = .241, t = 3.637, p < .001), was supported as well with a small effect size (F2 = .076).

Table 9. Hypotheses testing results.

6.3.2. Coefficient of determination

The coefficient of determination (R2) is a measure of the predictive power of the model, indicating the amount of variance explained by the predictors in the outcome variables. Cohen (Citation1988) classified R2 values as small (R2 = 0.20), medium (R2 = 0.50), and large (R2 = 0.80). In this study, the variables IQ, SYSQ and SRVQ collectively explained 45.7% of the variance (R2 = .457) in EA, which hinted at a medium effect size. Similarly, the variable EA accounted for 27% of the variance (R2 = .270) in USAT, which corresponds to a small effect size. As well, the variables EA and USAT jointly explained 43.8% of the variance (R2 = .438) in IADP, which was a moderate effect size. Consequently, based on the R2 values, the model demonstrated moderate predictive power for EA and IADP, and small predictive power for USAT (see ).

Table 10. R-squared index.

6.3.3. Effect size

As indicated by F2, information is provided about the contribution of each predictor to the variance explained in the outcome variables. Cohen (Citation1988) categorized F2 values as weak (F2 = .02), moderate (F2 = .15), and large (F2 = .35). Judging by what is shown in , it can be observed that all types of effect sizes in this study were available. Suggested here is that the individual predictors had a mixed impact on the variance explained in the outcome variables.

Table 11. Effect sizes of the latent variables.

6.3.4. Predictive relevance of the structural model

The predictive relevance of the structural model was assessed using Q2, which serves as a measure of its predictive quality. A positive value of Q2 (> 0) indicates acceptable or good quality and predictive relevance of the structural model. Chin (Citation1998) categorized Q2 values as poor (0.02), average (0.15), and strong (0.35), as displayed in . The outcome variables of this had above average predictive relevance.

Table 12. Predictive relevance.

6.3.5. Path collinearity

Also known as Variance Inflation Factor (VIF) or Common Method Bias. In this study, VIF values were examined to ensure they remained below 3.3. Elevated VIF values may indicate pathological collinearity and common method bias (Kock, Citation2015). As indicated in , the VIF values observed fell within an acceptable range, and so the study model was free of pathological contamination and common method bias. This reflects the quality of both the measurement and structural models (Kock, Citation2015).

Table 13. Collinearity diagnostics.

6.3.6. Robustness assessment of the structural model

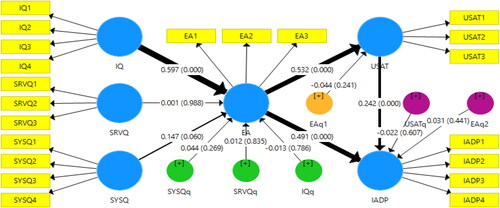

To assess the robustness of the PLS-SEM model, non-linearity was taken into account by following Hair et al. (Citation2019) and Sarstedt et al. (Citation2019).

6.3.6.1. Non-linear effects (quadratic effects)

One aspect of robustness is examining non-linear effects, particularly the mirage effects, where a relationship may appear to be linear but is actually non-linear. To ensure linearity and rule out mirage influences, the current study conducted an examination of the quadratic effects, which involved creating interaction terms with the predictor variables, as demonstrated in and . The analysis utilized bias-corrected bootstrapping with 5000 samples (Shmueli et al., Citation2019) to assess the importance of these quadratic/non-linear effects. Results indicated that none of the quadratic effects were significant, which was further supported by the confidence interval (CI) values. Additionally, F2 values were examined and found to be less than the lowest effect size of 0.02 as defined by Cohen (Citation1988). Since all F2 values fell within an acceptable range, it can be confidently concluded that all relationships in our model were linear and did not exhibit any quadratic effects. Thus, the studied model can be considered robust in terms of linearity (see and ).

Table 14. Assessment of non-linear/quadratic effects.

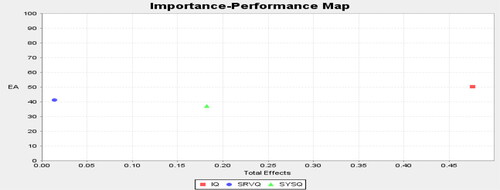

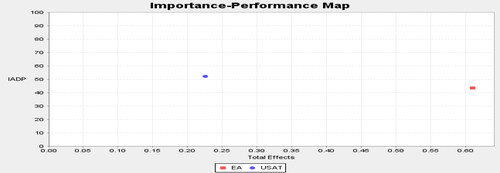

6.3.7. Importance-performance map analysis (IPMA)

IPMA is a crucial evaluation technique in PLS-SEM, one that provides valuable insights from the path model. While path estimates indicate the importance of variables, IPMA focuses on assessing the performance of those variables and their indicators. By comparing the total effect (importance) and the average value of predictor variable scores (performance), the IPMA generates a graph known as the importance-performance map. This map identifies areas of high priority or those that require management attention, which are typically characterized by variables with high importance but poor performance.

In this study, the IPMA was conducted for all three outcome variables. illustrates that all direct constructs linked to EA (i.e. IQ, SYSQ and SRVQ) reflected moderate performance in driving the EA. IQ had the highest effect (importance), SYSQ had moderate importance while SRVQ had the lowest importance which was due to its non-significant impact in the hypotheses testing phase. As displayed in , EA had a high importance but moderate performance driving the USAT. Similarly, as depicted in , EA had high importance and moderate performance, while USAT exhibited moderate importance and performance.

7. Empirical results and discussion

This research study contributes to the existing literature on assessing the quality constructs within the DM model and their significant influence on utilizing E-auditing excluding service quality. Previous research findings regarding the substantial influence of IQ and SYSQ on usage and user satisfaction (Jaafreh, Citation2017; Yakubu & Dasuki, Citation2018) were supported in this study. However, the significant effect of SRVQ on E-auditing usage was not confirmed, thus rejecting the hypothesis. These findings align with certain previous studies, for instance, Ghobakhloo and Tang (Citation2015) and Marble (Citation2003), but differ from the DM model’s contention that service quality is a significant dimension for evaluating the system’s utilization and efficiency. As a result of communication issues, unfulfilled promises, and delays in technical support, several respondents expressed dissatisfaction with the offered E-auditing services. This outcome may also be explained by the study being conducted in a developing nation, since employees in these organizations are often under-trained in technical ISs, hindering their effective and comprehensive use of system tools and features. Based on this finding, additional technical training sessions are needed that go beyond basic computer skills.

In contrast to what the proposed hypothesis suggested, the findings reported in this work rejected the influence of SRVQ on the adoption of E-auditing. This finding deviates from the predictions made by DMIS, which posits that higher service quality would enhance workers’ inclination to use E-auditing. Nevertheless, it is worth noting that this prediction has garnered substantial support from prior pioneering studies. Despite the disparity with the previous prediction, the study’s findings are consistent with other work that has reported the non-significance of service quality in facilitating innovation adoption (Ghobakhloo & Tang, Citation2015; Lutfi et al., Citation2022). One plausible explanation for this discrepancy is that, as revealed by our study, businesses were compelled to adopt E-auditing primarily due to the pressures exerted by the COVID-19 pandemic. Consequently, the adoption decision was driven more by the necessity to cope with uncertainty and lockdown situations rather than carefully considering the potential benefits. In essence, auditing embraced electronic systems to enhance their reputation in their industry, maintain workflow continuity, or avoid falling behind in the competitive landscape, irrespective of the quality of services offered by E-auditing systems.

Moving to the other findings of this study, they confirm the positive correlation between using E-auditing systems and user satisfaction. There is a relationship between IQ, SYSQ, E-auditing usage, and the ultimate improvement in user satisfaction. Among these factors, SYSQ was the strongest predictor of E-auditing usage. This can be attributed to variations in the significance of different constructs within the IS success model, which depend on organizational attributes (Heo & Han, Citation2003). It is worth noting that organizations with centralized computing systems place more importance on SYSQ than information quality (Petter et al., Citation2008). These findings align with previous studies (Hsu et al., Citation2015; Lutfi et al., Citation2022; Saad, Citation2023), which emphasize the flexibility of electronic systems and their system reliability features. Such factors motivate users to engage with E-auditing systems and actively participate, ultimately leading to higher levels of user satisfaction (USAT). In line with prior research (M. Al-Okaily et al., Citation2022; Bradford et al., Citation2020), it has been established that electronic systems can enhance work performance. This finding underscores the significant role of using E-auditing systems leading to satisfaction in bolstering decision-making capabilities and outcomes and improving the quality of information. This is supported by the assumption that the department responsible for E-auditing effectively satisfies users’ needs (Pedrosa et al., Citation2020). Empirical evidence reported by Ouiddad et al. (Citation2018) strongly suggests that adopting IS contributes to enhanced ways of working.

This study conducted an empirical investigation of the factors that enhance internal audit departments’ performance. In order to effectively and meaningfully deploy E-auditing in the workplace, organizations need to employ a sophisticated process that encompasses contextual explanation. This necessitates the utilization and combination of potential data sources, thereby requiring collaboration among stakeholders and domain experts in E-auditing systems to comprehend this kind of auditing and its implications. It is also necessary to examine the quality of E-auditing sources and resources in greater depth. The findings of this study demonstrated the utility of the theoretical framework for assessing the ability of E-auditing to enhance work performance in Saudi public agencies’ internal audit departments, suggesting further research is necessary in this area. Through the efficient application of the system, E-auditing can improve the quality of decision-making, even in the face of complex problems, through the association between constructs based on DM ISM. Consequently, executing E-auditing does improve work performance and competitiveness.

This study provides valuable insights into the factors contributing to better work performance through E- auditing. Internal audit departments can effectively monitor various issues and transactions with the help of E-auditing, which enables them to exercise managerial control. As a result, they can make informed, accurate, and evidence-based decisions. A new dimension to the literature on technology and innovation is the addition of decision-making quality variables, as proposed by DeLone and McLean (Citation2003). The present study can be conducted in other contexts and countries with similar economic and social circumstances. Given the small sample size, however, caution should be exercised when applying these findings to other developing nations. The internal audit department’s information processing and sourcing play a vital role in an uncertain, information-requiring environment. In this regard, using E-auditing can extend such abilities, making the internal audit department adept at gathering, analyzing, and relaying information and ensuring that the best performance is produced.

8. Summary and conclusions

The ability of E-auditing to enhance internal audit departments’ performance makes it valuable. Despite its significance, the topic has received little research attention and is viewed primarily as a decision-making tool. Several factors and their interconnections can also influence performance outcomes. Thus, the main objective of this study was to empirically examine a proposed model of E-auditing’s IQ, SYSQ, and SRVQ, which ultimately impact system utilization and USAT. 213 people who work in the internal audit departments of Saudi public sector organizations and have had experience in E-auditing technologies comprised the sample of this study.

8.1. Theoretical contribution

From a theoretical standpoint, this study makes significant contributions to innovations and E-auditing literature. Using the internal audit departments in Saudi Arabian public sector organizations as the sample, it provides a deeper understanding of E-auditing adoption, use, and impact on workplace practices. This is one of the first studies to empirically and theoretically examine the factors influencing E-auditing usage and its subsequent impact on work performance. While the existing literature has extensively covered various technological advances, the specific context of E-auditing has received limited attention. As a result, this research enriches the current knowledge base by presenting a comprehensive conceptual model rooted in robust theories such as the DM ISSM to elucidate how various quality factors influence E-auditing adoption and user satisfaction, ultimately determining its impact and benefits. Consequently, the enhanced DM ISSM model exhibits improved predictive and explanatory capabilities, offering valuable insights to academic researchers and field practitioners.

8.2. Practical contribution

The findings of this research paper have significant practical implications for government agencies, decision-makers, E-auditing vendors or consultants, and organizations themselves. In terms of the benefits of E-auditing usage, this study has established a special connection between adopting E-auditing and work performance. This indicates that businesses that effectively utilize E-auditing would experience favorable outcomes across various operational aspects, enhancing their competitiveness, productivity, and the generation of accurate information for timely decision-making. Consequently, this research serves to reinforce earlier studies by providing support for this association. Hence, decision-makers must recognize the crucial role of E-auditing usage in facilitating the growth and sustainability of their work. Concerning the COVID-19 pandemic as it was experienced in the Saudi Arabian public sector, pressure to utilize technology in all tasks such as E-auditing has risen, especially for duties that demand stability, consistency and steady performance. The cooperation of pertinent organizations to promote its benefits throughout disruptive events like the recent pandemic makes it possible to expand the use of E-auditing. What sets this study apart is its focus on the operational and transactional capabilities of E-auditing, which contribute to improving work performance. The study’s findings in general align with the assumptions of the fundamental model of DM ISSM (2003) and its perceptions and expansions about the factors affecting work performance.

8.3. Limitations and avenues for future research

Notwithstanding this paper’s contribution, it does have some limitations so it is essential to acknowledge them. One limitation is the small size of the sample. In order to enhance the robustness of the findings, future studies could increase the sample size and include more diverse groups or types of participants. Another limitation is the specific context in which the study was conducted, concentrating on Saudi Arabian public sector organizations. Consequently, the generalizability of our results to other contexts and countries may be limited. To address this limitation, future research could incorporate samples from other developing countries, such as those in Africa and Asia. Additionally, the cross-sectional study design used in our research restricts the assessment of responses over different periods of time. Certain constructs, such as usage, require an extended timeframe for accurate measurement. Prior studies in the field of decision-making have acknowledged this limitation. Therefore, future research could employ comparative studies or investigate the developmental trajectory of E-auditing usage from pre-adoption to post-adoption stages.

Moreover, our study includes new factors in the model, specifically the representation of work performance as a net benefit derived from E-auditing usage. Subsequent research could explore the net benefits of the system by considering additional factors such as E-auditing’s effectiveness or its impact on decision-making processes. The findings emphasize the significance of E-auditing adoption in maintaining a competitive advantage. In order to enhance the external validity of these findings, future research endeavors should aim to replicate this study. It is worth considering the possible influence of other variables such as training, user experience, E-auditing maturity, and quality of internal controls, on the strategic benefits and overall workplace performance associated with E-auditing. Analyzing these factors could provide valuable insights for further understanding this phenomenon. To sum up, conducting longitudinal studies on E-auditing would be beneficial for generating conclusive evidence.

Furthermore, the data for this study was gathered in the form of answers to a survey that was solely quantitative in design. While this method can provide valuable numerical data, it is important to recognize the context in which data was collected and the nature of the research objectives. In some cases, using qualitative approaches in tandem with quantitative ones can offer a more comprehensive understanding of the topic. While this study determines the influence of information quality, system quality, service quality, system usage, and user satisfaction on the performance of internal audit departments aimed the Covid-19 in Saudi Arabia, qualitative methods can assist in explaining the ‘why’ and ‘how’ factors behind the numbers, based on people’s perceptions and experiences, insights, and other themes that might not be proven via quantitative data alone. Combining both approaches can lead to a more well-rounded and thorough analysis. With this in mind, future research should collect other forms (i.e. qualitative) of evidence regarding participants’ perspectives, thoughts, beliefs, etc., about those factors that greatly shape their E-auditing usage.

Lastly, the present study’s limitations stem from the researcher’s assumption that participants will be able to accurately and correctly report various levels of E-auditing usage post-COVID-19 at the level of an institution because it was impossible to obtain data on actual e-auditing usage. Thus, the author precisely concentrated on the envisioning of E-auditing in Saudi Arabian’s public sector setting due to its unique milieu post-COVID-19. For this reason, it may not be possible to generalize findings to other contexts. Thus, future studies could investigate E-auditing usage at a more precise level. For example, which particular E-auditing formats are deployed by audit firms of various sizes, including the Big 4, regional, and international businesses?

Informed consent

A survey statement was provided on the questionnaire to assure participants’ confidentiality about their contributions towards this paper.

Disclosure statement

No potential conflict of interest was reported by the author(s).

Data availability statement

The datasets used during the current study are available from the corresponding author on reasonable request.

Additional information

Notes on contributors

Abdulwahab Mujalli

Abdulwahab Mujalli is currently working as an Assistant Professor of Internal Auditing & Accounting in the Department of Accounting at the College of Business, Jazan University, Saudi Arabia. His primary research areas encompass topics related to internal auditing, corporate governance, International Financial Reporting Standards (IFRS), Accounting Information Systems, and Accounting Education.

References

- Abdelrahim, A., & Al-Malkawi, H.-A N. (2022). The influential factors of internal audit effectiveness: A conceptual model. International Journal of Financial Studies, 10(3), 1. https://doi.org/10.3390/ijfs10030071

- Al-Hiyari, A., Hamood Hamood Al-Mashregy, M., Mat, N. K. N., & Esmail Alekam, J. M. (2013). Factors that affect accounting information system implementation and accounting information quality: A survey in University Utara Malaysia. American Journal of Economics, 3(1), 27–27.

- Al-Hiyari, A., Al Said, N., & Hattab, E. (2019). Factors that influence the use of computer assisted audit techniques (CAATs) by internal auditors in Jordan. Academy of Accounting and Financial Studies Journal, 23(3), 1–15.

- Al-Okaily, A., Al-Okaily, M., Ai Ping, T., Al-Mawali, H., & Zaidan, H. (2021). An empirical investigation of enterprise system user satisfaction antecedents in Jordanian commercial banks. Cogent Business & Management, 8(1), 1918847. https://doi.org/10.1080/23311975.2021.1918847

- Al-Okaily, M., Alqudah, H. M., Al-Qudah, A. A., & Alkhwaldi, A. F. (2022). Examining the critical factors of computer-assisted audit tools and techniques adoption in the post-COVID-19 period: Internal auditors perspective. VINE Journal of Information and Knowledge Management Systems, (ahead-of-print). https://doi.org/10.1108/VJIKMS-12-2021-0311

- Al-Tit, A., Omri, A., & Euchi, J. (2019). Critical success factors of small and medium-sized enterprises in Saudi Arabia: Insights from sustainability perspective. Administrative Sciences, 9(2), 32. https://doi.org/10.3390/admsci9020032

- Al-Sukker, A., Ross, D., Abdel-Qader, W., & Al-Akra, M. (2018). External auditor reliance on the work of the internal audit function in Jordanian listed companies. International Journal of Auditing, 22(2), 317–328. https://doi.org/10.1111/ijau.12122

- Alharbi, R. K. (2022). Saudi Arabia’s small and medium enterprises (SMES) sector post-Covid-19 recovery: Stakeholders’ perception on investment sustainability. International Journal of Organizational Analysis, 31(6), 2222–2238. https://doi.org/10.1108/IJOA-10-2021-2993

- Almagrashi, A., Mujalli, A., Khan, T., & Attia, O. (2023). Factors determining internal auditors’ behavioral intention to use computer-assisted auditing techniques: An extension of the UTAUT model and an empirical study. Future Business Journal, 9(1), 74. https://doi.org/10.1186/s43093-023-00231-2

- Almaiah, M. A., Rahmi, A. Al., Alturise, F., Hassan, L., Lutfi, A., Alrawad, M., Alkhalaf, S., Rahmi, W. M. Al., Al-Sharaieh, S., & Aldhyani, T. H. H. (2022). Investigating the effect of perceived security, perceived trust, and information quality on mobile payment usage through near-field communication (NFC) in Saudi Arabia. Electronics, 11(23), 3926. https://doi.org/10.3390/electronics11233926

- Almaiah, M. A., Rahmi, A. M. Al., Alturise, F., Alrawad, M., Alkhalaf, S., Lutfi, A., Rahmi, W. M. Al., & Awad, A. B. (2022). Factors influencing the adoption of internet banking: An integration of ISSM and UTAUT with price value and perceived risk. Frontiers in Psychology, 13, 919198. https://doi.org/10.3389/fpsyg.2022.919198

- Almaiah, M., Alfaisal, R., Salloum, S., Al-Otaibi, S., Al Sawafi, O., Al-Maroof, R., Lutfi, A., Alrawad, M., Mulhem, A., & Awad, A. (2022). Determinants influencing the continuous intention to use digital technologies in higher education. Electronics, 11(18), 2827. https://doi.org/10.3390/electronics11182827

- Almaiah, M., Alfaisal, R., Salloum, S., Al-Otaibi, S., Shishakly, R., Lutfi, A., Alrawad, M., Mulhem, A., Awad, A., & Al-Maroof, R. (2022). Integrating teachers’ TPACK Levels and students’ learning motivation, technology innovativeness, and optimism in an IoT acceptance model. Electronics, 11(19), 3197. https://doi.org/10.3390/electronics11193197

- Almaiah, M. A., Hajjej, F., Lutfi, A., Al-Khasawneh, A., Shehab, R., Al-Otaibi, S., & Alrawad, M. (2022). Explaining the factors affecting students’ attitudes to using online learning (Madrasati platform) during COVID-19. Electronics, 11(7), 973. https://doi.org/10.3390/electronics11070973

- Alqudah, H., Lutfi, A., Abualoush, S. h., Al Qudah, M. Z., Alshira’h, A. F., Almaiah, M. A., Alrawad, M., & Tork, M. (2023). The impact of empowering internal auditors on the quality of electronic internal audits: A case of Jordanian listed services companies. International Journal of Information Management Data Insights, 3(2), 100183. https://doi.org/10.1016/j.jjimei.2023.100183

- Alqudah, H. M., Amran, N. A., & Hassan, H. (2019). Factors affecting the internal auditors’ effectiveness in the Jordanian public sector: The moderating effect of task complexity. EuroMed Journal of Business, 14(3), 251–273. https://doi.org/10.1108/EMJB-03-2019-0049

- Alrawad, M., Lutfi, A., Almaiah, M. A., Alsyouf, A., Al-Khasawneh, A. L., Arafa, H. M., Ahmed, N. A., AboAlkhair, A. M., & Tork, M. (2023). Managers’ perception and attitude toward financial risks associated with SMEs: Analytic hierarchy process approach. Journal of Risk and Financial Management, 16(2), 86. https://doi.org/10.3390/jrfm16020086

- Alshira’h, A. F., & Abdul-Jabbar, H. (2020). Moderating role of patriotism on sales tax compliance among Jordanian SMEs. International Journal of Islamic and Middle Eastern Finance and Management, 13(3), 389–415. https://doi.org/10.1108/IMEFM-04-2019-0139

- Alshira’h, A. F., Alsqour, M., Lutfi, A., Alsyouf, A., & Alshirah, M. (2020). A socio-economic model of sales tax compliance. Economies, 8(4), 88. https://doi.org/10.3390/economies8040088

- Alsmadi, A., Abdalmajeed, M. S., Oudat., & H., Hasan. (2020). Islamic finance value versus conventional finance, dynamic equilibrium relationships analysis with macroeconomic variables in the jordanian economy: An Ardl approach. Change Management, 130(1), 1–14.

- Alsyouf, A., & Ishak, A. K. (2018). Understanding EHRs continuance intention to use from the perspectives of UTAUT: Practice environment moderating effect and top management support as predictor variables. International Journal of Electronic Healthcare, 10(1/2), 24. https://doi.org/10.1504/IJEH.2018.092175

- Alzeban, A., & Gwilliam, D. (2014). Factors affecting the internal audit effectiveness: A survey of the Saudi public sector. Journal of International Accounting, Auditing and Taxation, 23(2), 74–86. https://doi.org/10.1016/j.intaccaudtax.2014.06.001

- Alzoubi, A. (2011). The effectiveness of the accounting information system under the enterprise resources planning (ERP). Research Journal of Finance and Accounting, 2(11), 10–19.

- Alzoubi, E. S. S. (2019). Audit committee, internal audit function and earnings management: Evidence from Jordan. Meditari Accountancy Research, 27(1), 72–90. https://doi.org/10.1108/MEDAR-06-2017-0160

- Arshah, R. A., Desa, M. I., & Hussin, A. R. C. (2012). Establishing important criteria and factors for successful integrated information system. Research Notes in Information Science, 10(0), 22–32. https://doi.org/10.4156/rnis.vol10.issue0.4

- Baatwah, S. R., & Al-Ansi, A. A. (2022). Dataset for understanding the effort and performance of external auditors during the COVID-19 crisis: A remote audit analysis. Data in Brief, 42, 108119. https://doi.org/10.1016/j.dib.2022.108119

- Bajary, A. R., Shafie, R., & Ali, A. (2023). COVID-19 pandemic, internal audit function and audit report lag: Evidence from emerging economy. Cogent Business & Management, 10(1), 2178360. https://doi.org/10.1080/23311975.2023.2178360

- B., J., Cooper, Leung, P., & Mathews, C. (1994). Internal audit: An Australian profile. Managerial Auditing Journal, 9(3), 13–19. https://doi.org/10.1108/02686909410054736

- Betti, N., & Sarens, G. (2021). Understanding the internal audit function in a digitalised business environment. Journal of Accounting & Organizational Change, 17(2), 197–216. https://doi.org/10.1108/JAOC-11-2019-0114

- Bokhari, R. H. (2005). The relationship between system usage and user satisfaction: A meta-analysis. Journal of Enterprise Information Management, 18(2), 211–234. https://doi.org/10.1108/17410390510579927

- Bradford, M., Henderson, D., Baxter, R. J., & Navarro, P. (2020). Using generalized audit software to detect material misstatements, control deficiencies and fraud: How financial and IT auditors perceive net audit benefits. Managerial Auditing Journal, 35(4), 521–547. https://doi.org/10.1108/MAJ-05-2019-2277

- Chang, Y-k., Zhang, X., Azura Mokhtar, I., Foo, S., Majid, S., Luyt, B., & Theng, Y-l (2012). Assessing students’ information literacy skills in two secondary schools in Singapore. Journal of Information Literacy, 6(2), 19–34. https://doi.org/10.11645/6.2.1694

- Chin, W. W. (1998). The partial least squares approach to structural equation modeling. Modern Methods for Business Research, 295(2), 295–336.

- Chou, H.-W., Chang, H.-H., Lin, Y.-H., & Chou, S.-B. (2014). Drivers and effects of post-implementation learning on ERP usage. Computers in Human Behavior, 35, 267–277. https://doi.org/10.1016/j.chb.2014.03.012

- Chou, J.-S., & Hong, J.-H. (2013). Assessing the impact of quality determinants and user characteristics on successful enterprise resource planning project implementation. Journal of Manufacturing Systems, 32(4), 792–800. https://doi.org/10.1016/j.jmsy.2013.04.014

- Cohen, J. (1988). Statistical power analysis for the behavioral sciences (pp. 18–74). Lawrence Erlbaum Associates.

- Cullen, A. J., & Taylor, M. (2009). Critical success factors for B2B E-commerce use within the UK NHS pharmaceutical supply chain. International Journal of Operations & Production Management, 29(11), 1156–1185. https://doi.org/10.1108/01443570911000177

- Curtis, M. B., & Payne, E. A. (2014). Modeling voluntary CAAT utilization decisions in auditing. Managerial Auditing Journal, 29(4), 304–326. https://doi.org/10.1108/MAJ-07-2013-0903