?Mathematical formulae have been encoded as MathML and are displayed in this HTML version using MathJax in order to improve their display. Uncheck the box to turn MathJax off. This feature requires Javascript. Click on a formula to zoom.

?Mathematical formulae have been encoded as MathML and are displayed in this HTML version using MathJax in order to improve their display. Uncheck the box to turn MathJax off. This feature requires Javascript. Click on a formula to zoom.Abstract

The aim of the study was to investigate the mediating effect of corporate sustainability on corporate governance and performance of banks in Ghana from the post banking crisis perspective. Adopting the purposive sampling technique, 302 key and senior management personnel from all the 23 banks constituted the study sample. The study explored primary data through the use of structured questionnaire to obtain data. In analyzing the data, Partial Least Square Structural Equation Modelling (PLS- SEM) was employed. The study revealed that, corporate governance has insignificant positive effect on bank performance; bank sustainability has significant positive effect on performance and sustainability mediates the corporate governance and bank performance nexus. The study has made significant contributions to both theoretical and empirical literature and has also advanced the on-going discourse on sustainability. Again, it will influence the development of further policies; reemphasizing the sectors’ policies on corporate governance, sustainability performance and disclosures and influence related managerial decisions and strategies. The implication of the study from theoretical dimension, the study has extended literature on agency, stakeholder and signaling theories. For policy development and practice, the study will have significant implications on future policies as well as managerial decisions and strategies on corporate governance and sustainability in the banking sector.

IMPACT STATEMENT

Corporate governance is consistently viewed as very crucial in the corporate world especially in the banking industry. Gradually, sustainability has not only emerged as a global concern, but the corporate world has embraced the concept with heighten recognition, advocacy and investment in corporate sustainability. In Ghana, the 2017 – 2018 banking sector crisis attracted several criticisms on the governance structures while stakeholders also raised several concerns on the sustainability of the sector after the crisis. Though, there have been some reforms in the sector to address these issues, it is not certain as to whether the corporate governance in the post crisis era influences performance and whether sustainability plays any significant role. This paper investigates the mediating effect of corporate sustainability on corporate governance and performance of banks in Ghana from the post banking crisis perspective and aims to provide empirical evidence to guide policy directions and operations in the Ghanaian banking sector.

JEL CLASSIFICATIONS:

1. Introduction

Repercussions of bank distress and failures are not limited to the individual banks but the entire economy in which they operate. Banking crisis similar to most corporate failures in the past have been attributed to weaknesses in corporate governance. For instance, in Ghana, the recent banking crisis witnessed the takeover of two indigenous banks – Capital bank Limited and UT bank Limited by GCB Bank Limited and the consolidation of five other banks – Unibank, Royal bank, Sovereign bank, Construction bank and Beige bank into Consolidated Bank Ghana and these have been ascribed mainly to poor governance. The occurrence of these scandals, continuously bring corporate governance into the limelight. Though several theoretical and empirical works exist on corporate governance, the concept consistently emerge in most corporate discourse relating to corporate failures and corporate performance which also awakens the interest of researchers. The regulator, Bank of Ghana, also emphasizes the critical role of effective governance in the sector with the introduction of several reforms in the post crisis period which include the corporate governance directive to reinforce good corporate governance practices in the sector.

In addition to promoting good corporate governance practices in the banking sector, corporate sustainability has also emerged in the corporate world. Since sustainability has become a global issue which continuously rank high on the agenda of global organizations, government, corporate world and several other stakeholders, business executives have embraced the concept and promptly integrated them into their corporate strategies to enable them become competitive both locally and internationally. In Ghana, the banking sector like other sectors of the economy, is swiftly embracing sustainability practices and disclosures. It has become very crucial for the banks in the post crisis period, an era of globalization and keen competition in the banking industry.

Considering the critical role of banks in an emerging economy like Ghana, the sector has to be competitive and sustainable to facilitate economic growth. In Ghana, the banking sector constitute about 85% of the total asset base of the Ghanaian financial sector (Bank of Ghana, Citation2018) which affirms the significant role of the sector. The Government of Ghana’s commitment to several banking reforms which include an estimated cost of 14 billion Ghana Cedis, representing 3.5% of Gross Domestic Product (PricewaterhouseCoopers and Association of Bankers, 2019) is also evident that the sector is crucial and such a study is pertinent.

Theoretically, the stakeholder and signaling theories projects corporate governance and sustainability respectively. In the view of the stakeholder theory, the firm has several stakeholders beyond owners and managers as presented by agency theory. They have varied interest which may be conflicting and therefore the need for corporate governance. While with the signaling theory it is proposed that some mechanisms are instituted to facilitate the conveyance of information to relevant stakeholders and also addressing any possible information asymmetries and subsequently sending positive signals. Sustainability practices and disclosures create good image and reputation for the firm and this can be viewed through the lens of signaling theory.

Undoubtedly, several empirical studies exist on corporate governance practices and performance (Aggarwal, Citation2013; Alodat et al., Citation2022; Atuahene, Citation2016; Boachie, Citation2023; Kyereboah-Coleman, Citation2007; Ntim & Soobaroyen, Citation2013; Owiredu & Kwakye, Citation2020; Sarpong-Danquah et al., Citation2022; Sheikh & Karim, 2015; Tornyeva & Wereko, Citation2012). However, prior study by Boachie (Citation2023) on corporate governance and financial performance of banks in Ghana: the moderating role of ownership structure focused on 23 banks in Ghana for the period 2006 to 2018. The findings suggests that audit independence, chief executive officer (CEO) duality, non-executive directors and banks size have a positive impact on performance. The study limited corporate governance of banks to audit independence, chief executive officer (CEO) duality and non-executive directors. It also focused solely on financial performance of the banks with more emphasis on the pre banking crisis and the banking crisis eras. And these limitations have resulted in gaps relating to the post banking crisis period and mediation effect on the corporate governance performance nexus which has necessitated this present study. Again, Sheikh and Karim (2015) studied effects of internal government indicators on performance of commercial banks in Pakistan, again, the study adopted limited corporate governance indicators while the study was also limited to the Pakistan and commercial banks in Pakistan. These limitations result in contextual gaps which the current study sought to address. Sarpong-Danquah et al. (Citation2022) also explored corporate governance and the performance of manufacturing firms in Ghana: Does ownership structure matter? The outcome of the study suggested that board size, audit committee independence, and size have positive and significant effect on firm performance but suggest negative relationship between board remuneration and performance. While block ownership moderates the corporate governance-firm performance nexus of manufacturing firms in Ghana. Though the study was conducted in the Ghanaian setting, the manufacturing and banking sectors vary significantly, thereby, serving as the motivation for the conduct of a similar study in the banking sector to aid policy directions.

Earlier researchers have also conducted several studies on corporate governance and sustainability (Elmghaamez et al., Citation2023; Ghosh et al., Citation2023; Munir et al., Citation2019; Shakil et al., Citation2019; Tjahjadi et al., Citation2021; Tran et al., Citation2021). Munir et al. (Citation2019) established the relationship between corporate governance, corporate sustainability and financial performance of firms listed on Australian Securities Exchange (ASX). The study revealed that, corporate governance is positively related to corporate sustainability performance and corporate sustainability performance enhances performance while corporate sustainability performance mediates the link between corporate governance and financial performance. The study relates to firms from various sectors on the Australia Securities Exchange and did not specifically focus on the banking sector and also, the study was limited to financial performance. The study on ESG disclosure and financial performance of multinational enterprises: The moderating effect of board standing committees was carried out by Elmghaamez et al. (Citation2023) which revealed a positive relationship between ESG disclosure and accounting performance indicators for large-sized multinational enterprises. The study concentrated on top multinational enterprises from 40 different countries and also explored 13 industries. Though the scope of this study is broad, it creates a contextual gap which requires the conduct of a similar study with specific emphasis on Ghana as a country and the banking sector as an industry given its critical role in the economy. Contrary to other studies, Shakil et al. (Citation2019) explored ‘Do environmental, social and governance performance affect the financial performance of banks? A cross-country study of emerging market banks’ and opined that, there is insignificant relationship between governance and banks’ performance. The focus on financial performance give rise to gaps relating to operational and market performance which needs to be bridged. In contrast to previous studies, Lee (Citation2006) and Becchetti et al. (Citation2005) present another school of thought that, there is no evidence of a significant association between corporate sustainability and financial performance.

The inconclusiveness on these debates on corporate governance performance link and corporate governance corporate sustainability link, gaps identified in literature, arguments underlying the study from the stakeholder and signaling theoretical perspectives as well as the recent developments in the sector have strongly motivated this study. The study aimed at, further exploring the influence of corporate governance on performance of banks in the post crisis period; effect of sustainability on performance of banks in the post crisis period; and the mediating effect of corporate sustainability on the corporate governance performance nexus of banks. Consequently, the study addresses the questions, what is the influence of corporate governance on performance of banks? does sustainability affect performance of banks? and to what extent does, sustainability mediate corporate governance performance of banks nexus.

The study makes significant contributions to literature and policy direction. First of all, the output of this study enhances and broaden the literature on corporate governance of banks and corporate governance as a whole. Exploring the mediation effect of sustainability on corporate governance and performance dimension introduces a novel perspective to the vast discourse on corporate governance performance nexus and consequently enriching literature. Again, the mediation effect of sustainability outlook provides significant insights for policy formulation for the banking sector. Finally, it also serve as a guide for management and those charged with governance responsibilities in the Ghanaian banking sector, in devising their strategies and decisions relating to corporate governance and corporate sustainability practices.

2. Background of the study

Prior to the banking sector crisis in Ghana, banks had structures and systems in place for corporate governance. These practices were in place until the emergence of the 2017 to 2018 banking sector crisis which pointed out weaknesses in the governance structure of the banks. Reports indicated that, deficiencies in corporate governance practices of the banks accounted for most of the bank distress and failures. According to Amidu (Citation2007), inadequate corporate governance practices such as ineffective board practices, insider related credit abuses, poor risk appreciation and internal control failures have been outlined as the causes of the bank failures and distress in the past. Similarly, the recent 2017 banking sector crisis, according to Frimpong (Citation2018), the Bank of Ghana identified poor corporate governance, lack of oversight and supervision, lack of enforcement of regulatory compliance, undue political influences and lack of continuous reporting as the causes of the crisis. While Obuobi et al. (Citation2020), also attributes the 2017 financial sector crisis in Ghana and the subsequent clean-up exercise carried out in the sector to corporate governance challenges, false financial reporting, mischievous insiders’ trading and banking activities, as well as a deterioration of the country’s regulatory and supervisory framework.

These deficiencies gave birth to 2018 Corporate Governance for Banks, Savings and Loans Companies, Finance Houses and Financial Holding Companies. With some amendments made to the corporate governance structures for the banking sector to address the challenges.

The banks therefore, had to resort to restructuring of their governance systems with strict adherence to the provisions of the corporate governance directive. These provisions were to ensure financial institutions adopt sound corporate governance principles and best practices to enable them under take their licensed business in a sustainable manner. In addition to promoting good corporate governance practices, several efforts have also been made by the regulator and the banks to promote sustainable banking in the sector with sustainability forming an integral part of the strategies of most banks. Efforts to promote sustainability performance of banks in Ghana gave rise to the introduction of the Ghana Sustainable Banking Principles (GSBPs) in 2019 after the sector’s crisis. Again, recent annual reports of banks reveal that banks in Ghana are rapidly paying significant attention to sustainability performance and disclosures. These developments in the Ghanaian banking industry during and after the crisis have necessitated enquiry into the mediating role of sustainability on the association between corporate governance and performance of banks in Ghana in the post banking crisis era.

On the backdrop that, poor corporate governance practices have been an attribute of corporate failures; the crucial role of the sector in developing economies such as Ghana; the contextual research gaps existing in current literature, inconclusiveness of the findings of prior studies and the scarcity of empirical evidence on the mediating role of sustainability in the corporate governance performance of banks nexus, it is imperative for the current study to further explore the mediating role of sustainability on corporate governance and performance of banks in Ghana from the post banking sector crisis perspective.

3. Literature review and hypotheses development

3.1. Theoretical review

Government, International bodies and the corporate world place much emphasis and advocates for disclosures and compliance with best practices of corporate governance at both national and company levels, which has become unavoidable requisite to attract foreign investors, who make informed decisions regarding investment based on such reports (Amartey et al., Citation2019). Such emphasis on corporate governance among corporate bodies could be as a result of the relevance of these practices to such organisations.

Theoretically, agency theory discusses the principal agent relationship and emphasizes wealth creation by the agent for the principal. However, the interests of other stakeholders of the firm especially the agent, who controls the firm’s resources, have the tendency to pursue their personal stake in the firm amidst scarce resources of the firm. Some school of thought hold the position that, the competitive nature of these interests would result in effective and efficient employment of the firm’s resources while another school of thought which do not subscribe to the principle of the theory argue that, these competing interests will only result in conflicts and additional cost to address these conflicts, thereby diverting the scarce resources of the firm which could have been put into productive use to create wealth and ensure economic sustainability of the firm. With reference to agency theory principle, the existence of good governance structures will resolve the agency problem and facilitate the realisation of the corporate goal of creating wealth for shareholders, and this underscores the hypothesis, corporate governance has significant positive effect on bank performance.

The stakeholder theory also draws attention to the fact that, the stakeholders of the firm has a broader scope which goes beyond shareholders, the principals as described in the agency theory. The theory recognizes the significant role of these internal and external stakeholders in sustaining the firm, therefore the need to safeguard their stake in the firm with the scarce resources of the firm. It is argued that, the diversity presented in the stakeholder theory can enable the firm to leverage on varied resources, expertise and perspectives to create wealth for owners and promote other stake such as social and environmental sustainability. To address these stakes which are competitive and probably conflicting, controls mechanisms such as a diversified board of directors are required. Stakeholder theory indicates the significant role of various stakeholders in achieving the ultimate goal of making profit and other corporate goals, hence emphasizes the hypothesis that, bank sustainability has significant positive effect on bank performance.

While the signaling theory underpin sustainability which is fundamentally concerned with reducing information asymmetry between two parties (Spence, Citation2002). When there is information asymmetry, firms are likely to be affected adversely with respect to the firm’s reputation and competition in the market which consequently generate some conflicts. Management of the firm employ various strategic tools to avert the consequence of information asymmetry on the firm and possibly addressing the issue of information asymmetry. Sustainability practices and disclosures conveys positive information to stakeholders, enhance the firm’s public reputation and subsequently make them competitive locally and international. The argument of the signaling theory project the hypothesis that, bank Sustainability mediates the relationship between corporate governance and bank performance. Positive signals conveyed through corporate sustainability and corporate governance result in positive outcomes such as improved performance.

3.2. Empirical review and hypotheses development

3.2.1. Corporate governance and performance

Significant recognition and advocacy for effective corporate governance in the corporate world has resulted in extant literature on corporate governance as well as corporate governance and corporate performance (Adusei, Citation2011; Afriyie et al., Citation2021; Alodat et al., Citation2022; Atuahene, Citation2016; Bhagat & Bolton, Citation2008; Donnir et al., Citation2023; Fariha et al., Citation2022; Kyereboah-Coleman, Citation2007; Ntim & Soobaroyen, Citation2013; Sarpong-Danquah et al., Citation2022; Suadiye, Citation2017; Tornyeva & Wereko, Citation2012).

Theoretically, the agency theory portrays the effective corporate governance influences corporate performance with the governance mechanisms mitigating the agency problems. According to Suadiye (Citation2017) the assertion that good corporate governance mechanisms are critical in the performance of corporate bodies is affirmed. Similarly, Alodat et al. (Citation2022) suggest that corporate governance influences Tobins Q and return on assets ROA as measures of performance. Consistent with the work of prior researchers, Sarpong-Danquah et al. (Citation2022) conducted a study to investigate the moderating role of ownership structure in the corporate governance and financial performance nexus of 7 manufacturing firms in Ghana with the review period being the year 2006 to 2019. Using secondary data and Generalised Least Square (GLS, the results of the study revealed positive and significant effect of board size, audit committee independence and size on firm performance and negative relationship between board remuneration and performance. The study is related to the Ghanaian context, limited to the manufacturing sector and also explored the moderating role of ownership structure of the firm but failed to investigate any mediating effect on the corporate governance performance nexus. This creates a gap in existing literature, in view of that, this current study seeks to also replicate a similar study in the banking sector of Ghana by probing the relationship between corporate governance practices of banks and their performance. Additionally, the study also seeks to assess whether sustainability practices of the banks have any mediating effect on the link between corporate governance and performance of banks in Ghana. Again, Donnir et al. (Citation2023) also studied the banking sector of Ghana by focusing on corporate governance and employee confidence in the Ghanaian banking sector, mediating role of corporate reporting disclosures of banks. Stratified and purposive sampling techniques was used to draw a sample of 276 employees from all the 23 banks in Ghana while employing Partial Least Square Structural Equation Modelling PLS SEM to analyse primary data obtained through the administration of questions. The findings of the study revealed that corporate governance significantly relates with employees confidence which gives an indication that the morale of employees is high and has the tendency to influence the performance of the banks. Though the study is focused on the banking sector, it explored the relationship of corporate governance and employee confidence without studying performance of banks, however, the current study addressed such limitation.

In contrast, the study of Harvey Pamburai et al. (Citation2015) on, An analysis of corporate governance and company performance: A South African perspective explored multiple regression. The study examined the link between corporate governance and performance of 158 companies listed on the Johannesburg Securities Exchange for the year 2012 and found out that board size is negatively and significantly related to Economic Value Added (EVA) while frequency of board meetings is negatively and significantly related to both the Return on Asset (ROA) and the Tobin’s Q. The focus of the study on firms from all sectors and not sector specific as well as the limitation of the study to South Africa presents some gaps in literature. Therefore, the present study mitigates these limitations. Similarly, Saidat et al. (Citation2019) studied the relationship between corporate governance and financial performance: evidence from Jordanian family and non family firms. The study sample comprised of non financial firms listed on Amman Stock Exchange (ASE) for the period 2009–2015. The outcome of the study opined that, board size has significant negative relationship with performance of family firms. Financial firms which includes banks were excluded from the study hence the dire need to explore the financial sector specifically banks in the Ghanaian context which the study focuses on.

Drawing from the precepts of agency, performance is enhanced through wealth creation with the operation of effective control systems as well as the varied conclusions presented in empirical literature, it is hypothesized that;

H1: Corporate governance has significant positive effect on bank performance

3.2.2. Corporate sustainability and performance

From the stakeholder theory perspective, the representation various stakeholders and the interests with the operation of effective governance mechanism promote performance. In addition to this theoretical stance, empirically, literature argues that, sustainability performance enhances financial performance of businesses in the long run (Artiach et al., Citation2010; Charlo et al., Citation2017; King & Lenox, Citation2001; Lee et al., Citation2015). According to Lee et al. (Citation2015) sustainability practices of firms that are related to reduction in carbon emission and energy consumption results in financial gains. Similarly, King and Lenox (Citation2001) opined that firms benefit from competitive advantage and long-term investment when sustainability practices are geared towards mitigating the repercussions of global warming. It is therefore evident that, there is an association between corporate sustainability and firm performance. Artiach et al. (Citation2010) in their study on the determinants of corporate sustainability performance concluded that leading CSP firms are significantly larger, have higher levels of growth and a higher return on equity than conventional firms.

Inconsistent with literature, Matuszewska-Pierzynka (Citation2021) examined the relationship between corporate sustainability performance and corporate financial performance: evidence from U.S. companies. The sample comprised of 59 largest U.S. companies listed in the Fortune 500 ranking were sampled within the period 2015–2020. Based on the study, the conclusions was drawn that there is no positive relationship between corporate sustainability performance (CSP) corporate financial performance (CFP). The study was conducted in U.S., a developed economy, it is therefore prudent to conduct similar study in a developing economy like Ghana.

Based on the principles of stakeholder theory, which argues that, performance is improved through effective governance and control structures which take into consideration the various stakeholders of the firm and their varied interests, gaps in literature and the inconclusiveness of the findings of prior empirical works on the corporate sustainability and performance nexus serve as the basis for proposing the hypothesis stated below:

H2: Bank Sustainability has significant positive effect on bank performance

3.2.3. Mediating role of sustainability

The Signaling theory provides theoretical foundations which suggest that, corporate sustainability performance and disclosures convey positive signals to stakeholders such as investors to inject more capital into the business, thereby enhancing performance. Empirical evidence supports the position that, corporate governance affects corporate performance (Alodat et al., Citation2022; Atuahene, Citation2016; Ntim & Soobaroyen, Citation2013; Sarpong-Danquah et al., Citation2022; Suadiye, Citation2017). Hussain et al. (Citation2018) also suggest that, when effective corporate governance mechanisms are in place, they rekindle the confidence of stakeholders in the firm’s sustainability performance and subsequently enhance their performance. Corporate sustainability practices and disclosures are also viewed as an avenue to increase transparency, project good corporate image and reputation, enhance firm value, leverage on the competitive advantage it presents to the firm coupled with the enhanced employee motivation (Herzig & Schaltegger, Citation2011). This is evident that there is interrelationship between corporate governance, corporate performance and corporate sustainability hence the study of the mediating effect of bank sustainability on corporate governance and bank performance.

Munir et al. (Citation2019) studied the relationship between corporate governance, corporate sustainability and financial performance of 425 firms listed on the Australian Securities Exchange using structural equation modeling approach. The study concluded that, corporate sustainability performance mediates the link between corporate governance and financial performance.

Based on the theoretical underpinning of the signaling theories, the inadequacy of comprehensive literature and similar studies in the sector, research gaps presented in earlier empirical literature as well as existing empirical evidence from Munir et al. (Citation2019); Herzig and Schaltegger (Citation2011) and Hussain et al. (Citation2018), it is postulated that:

H3: Bank Sustainability mediates the relationship between corporate governance and bank performance

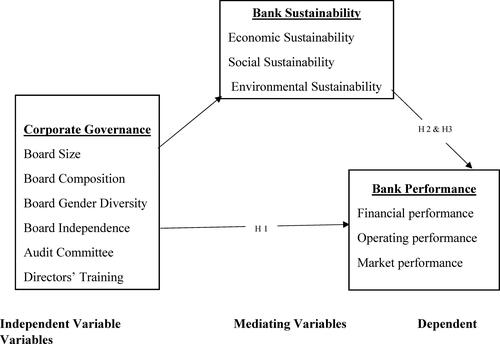

3.3. Conceptual framework

presents the conceptual framework of the study with corporate governance being the independent variable and bank performance, the dependent variable. The framework project the relationship between corporate governance and bank performance while presenting bank sustainability as the mediating variable, which mediates the corporate governance and bank performance relationship.

4. Methodology

The study adopted the quantitative research study approach and explored primary data sources. The study focused on all the 23 banks that exist and operates in the Ghanaian banking sector after the 2017 crisis in the sector. In constituting the study sample, 302 key and senior management personnel from all the 23 banks made up the sample for this study. The purposive sampling technique was considered more appropriate and suitable to select the sample since these key and senior management of the banks were sampled on the basis that, they are privy to the bank’s strategies and practices of corporate governance, corporate sustainability and performance. Using primary data, data were obtained from the administration of structured questionnaire to solicit data on the bank’s corporate governance, sustainability and performance. The questionnaires were structured based on the study constructs – corporate governance, corporate sustainability and performance with several questions which measure the various indicators of the study’s constructs. Data gathered were therefore analyzed using Partial Least Square Structural Equation Modelling (PLS- SEM) due its predictive orientation. With the analysis being facilitated with the application of SMART- PLS software.

4.1. Research variables

The independent, dependent and mediating variables for the study are presented in with their respective indicators and operational definitions.

Table 1. Measurement and operational definition of variables.

Estimation of Study Model

The estimation models for the study are presented below:

(1)

(1)

(2)

(2)

Where model 1; bank performance is a function of corporate governance and model 2, bank performance is a function of sustainability.

5. Analysis of data and empirical results

5.1. Reflective measurement model

5.1.1. Indicator reliability, internal consistency reliability and convergent validity

The validity and reliability assessment of a reflective measurement model of the study which is made up of corporate governance, bank performance and bank sustainability, the indicator reliability, internal consistency (Composite Reliability), convergent and discriminant validity are measured. Construct reliability is measured on the basis that, consistently or repeatedly reflective items evaluate the intended outcome. According to Hair et al. (Citation2011), factor loadings of constructs which meet or are greater than the threshold of 0.70 establishes the indicator or factor reliability of the study constructs. presents factor loadings which ranges from 0.659 to 0.912 and suggest the reliability of factors or indicators of the study constructs.

Table 2. Factor loading, internal reliability and convergent validity.

In assessing the internal consistency reliability, Cronbach Alpha (CA) and Composite Reliability (CR) are used. Ramayah et al. (Citation2018) suggest CR should be in within the range of 0.70 and 0.90. While Hair et al. (Citation2017) is of the view that, the Cronbach’s alpha value, must be exceed the 0.70 threshold as evidence of inter-item consistency of the construct indicators. With reference to , the minimum and maximum Cronbach’s Alpha (CA) are 0.817 and 0.861 respectively which falls within the range 0.70 to 0.90 hence the construct measures are internally reliable. The Composite Reliability (CR) as presented in projects CR which ranges from 0.881 to 0.915 also establishing the internal consistency of the construct indicators of the study.

Convergent validity is a measure of how effectively the individual indicators reflect a construct and also converge with the other constructs’ indicators. Convergent validity is measured using the Average Variance Extracted (AVE) and according to Hair et al. (Citation2017), an appropriate AVE measures should present variance exceeding 0.50. It can therefore be concluded that, the constructs of this study have convergent validity with AVE of 0.645, 0732 and 0.645 as shown in .

5.1.2. Discriminant validity

5.1.2.1. Fornell and Lacker criterion

Discriminant validity describes how distinct each construct is from the other components in the study (Ramayah et al., Citation2018). Fornell and Larcker (Citation1981) suggest that, the discriminant validity of the study constructs is established with the AVE when each construct’s AVE square root value is larger than other correlation values among the reflective latent constructs. From , the AVE square root values for the constructs bank performance, bank sustainability and corporate performance are 0.885, 0.855 and 0.803 respectively which are greater than the correlation values. Therefore, it is concluded that, the study constructs have discriminant validity.

Table 3. Discriminant validity- Fornell and Larcker criterion.

5.1.3. Heterotrait -monorait ratio (HTMT)

The HTMT is used to assess discriminant validity of the study constructs where an HTMT ratio of correlation lower than 0.9 is acceptable. According to Henseler et al. (Citation2015), in assessing discriminant validity using HTMT ratio, these two methods can be explored: by comparing with the threshold of either 0.85 or 0.90. It was further suggested that, the threshold of 0.90 threshold is proposed for constructs which are conceptually very similar and 0.85 threshold for constructs which are conceptually more distinct and secondly by applying the inference statistic, the hypothesis HTMT of 1 should be rejected. Therefore, with reference to , HTMT ratios of correlation are 0.899, 0.659 and 0.733 establish discriminant validity among the study constructs.

Table 4. Discriminant validity - Heterotrait -monorait ratio (HTMT).

5.2. Structural model assessment

5.2.1. Indicator multicollinearity

Multicollinearity arises with the occurrence of high interrelations among independent constructs in multiple regression model. The Variance Inflation Factor (VIF) statistic is therefore, used to evaluate indicator multicollinearity (Fornell & Bookstein, Citation1982). According to Becker et al. (Citation2015), there is the tendency of collinearity issues among predictor contructs when VIF values exceeds 5, but when VIF records less values of 3 to 5, collinearity can also occur. records VIF range of 1.589 to 3.175 with the highest VIF of 3.175 which does not exceed 5, hence indicative of the absence of multicollinearity issues.

Table 5. Indicator multicollinearity.

5.2.2. The goodness of fit (model’s predictive)

presents R2 value of 0.682 which indicates that 68.2% variation in bank performance is accounted for by corporate governance. , the structural equation model (Goodness of fit model) further depicts the models and their predictiveness presented in this study. The results supports the agency theory which focuses on wealth creation by the agent(management) for the principal(owners) where internal and external control mechanisms such as board of directors, audit committee and external auditor are put in place to check conflict of interest which is highly probable in the principal agent relationship. The finding is also consistent with empirical works by Alodat et al. (Citation2022) and Suadiye (Citation2017).

Table 6. Goodness fit.

5.2.3. Hypothesis testing

The hypothesis 1 postulates that, corporate governance has significant effect on bank performance. However, the hypothesis was rejected based the results (β = 0.093, t = 1.237, p = 0.217) and the conclusion drawn that, corporate governance influence bank performance positively but insignificantly. While hypothesis 2 suggests bank sustainability has significant positive effect on bank performance. The results from (β = 0.763, t = 14.319, p = 0.000) affirms the position of hypothesis 2, thereby concluding that bank sustainability significantly influence bank performance positively.

Table 7. Direct relationship result.

5.2.4. Mediation relationship

The mediation analysis, introduces Bank sustainability as the mediator to mediate the relationship between corporate governance and bank performance. presents the mediation result on the direct effect which is insignificant (β = 0.093, p = 0.217) while total effect is significant (β = 0.581, p = 0.000) as well as the indirect effect (β = 0.487, t = 10.167, p = 0.000). In Baron and Kenny (Citation1986) causal steps approach, there should be an association between the independent and dependent variable as a pre-requisite for mediation, however, Hayes (Citation2013) and (Zhao et al., Citation2010) contend this position and posit that there is no need for such association before considering mediation, hence mediation analysis in this study. It is evident from the results presented in that, bank sustainability partially mediates corporate governance and bank performance.

Table 8. Mediation analysis result.

6. Discussion of findings and implications

The findings of the study suggest that corporate governance has no significant influence on bank performance and is not in harmony with the agency theory. When the corporate governance is not effective, the agency cost will outweigh the returns from the control mechanisms which will not result in any significant impact on performance. However, the stakeholder theory could underline this outcome since the theory does not solely focus on the wealth creation for owners of the firm but considering the interest of the various stakeholders could account for less influence of governance mechanisms of the firm on its financial, operational and market performance. This outcome could also be attributed to ineffective cost of maintaining the governance mechanisms which does not correspond with the benefits associated. The implication is that, management of the banks will be guided by this outcome in establishing corporate governance by paying critical attention to the cost benefit analysis.

Again, the study concludes that bank sustainability predicts bank performance this confirms the arguments of the signaling theory. The positive signals of bank sustainability practices communicated to stakeholders gives them a competitive advantage which the leverage on to obtain some gains both in the short run and long run. From practical and policy perspective, this will send a strong signal to policy makers to come out with directives on corporate governance and sustainability practices and disclosures in the banking sector. Management of the banks will also be guided by these findings in devising their corporate strategies by integrating not only governance but including sustainability. The study is consistent with some literature such as Charlo et al. (Citation2017); Lee et al. (Citation2015); Artiach et al. (Citation2010), however, contradicts the findings of (Becchetti et al., Citation2008; Lee, Citation2006; Matuszewska-Pierzynka, Citation2021).

Finally, study concludes on the partial mediating effect of bank sustainability on the corporate governance and bank performance nexus. These findings advance the literature on corporate governance especially in the banking sector by introducing new perspective. This study further explored mediating role of bank sustainability thereby contributing new perspective to the literature on corporate governance of banks. Similar to other studies, the outcomes of the current study are in line with the findings of (Hussain et al., Citation2018; Munir et al., Citation2019).

7. Summary and conclusion

In the corporate world, corporate sustainability continues to emerge while advocacy for effective corporate governance persistent with corporate performance being targeted through various strategies. The study examined the mediating effect of corporate sustainability on corporate governance and performance of banks in Ghana from the post Ghanaian banking crisis perspective. The findings of the study established that, corporate governance has insignificant positive effect on bank performance; bank sustainability has significant effect on bank performance and bank sustainability partially mediates the corporate governance and bank performance relationship.

Theoretically and empirically, this study has contributed to literature on corporate governance and sustainability. It has also advanced the global discourse on sustainability which is a fast emerging concept across the globe and corporate world. Further, significant contribution has been made on the reviewed theories by presenting varied perspectives which enhance the theories. Again, the findings will serve as a reference point for policy makers such as Bank of Ghana and Ghana Stock Exchange in the development of further policies which focus on corporate governance and sustainability of banks. This outcome will serve as basis for reemphasizing the sectors’ policies on corporate governance, sustainability performance and disclosures. Managerial decisions and strategies will be guided by the outcome of this study.

Undoubtedly, the findings of the study have implications for policy directions and managerial decisions and strategies in the banking sector. Based on the empirical evidence that, sustainability influences performance, this will influence regulators and stakeholders of the banking sector to place much emphasis on the provisions of Sustainable Banking Principle and Sector Guidance Notes issued by Bank of Ghana. It will also promote advocacy for sustainability practices and speed up the disclosure rate in the sector. This will also draw the attention of policy makers to other sectors of the economy. Management of banks will be guided by the research output in formulating strategies related to sustainability and corporate governance by critically capturing them in their annual budgets.

The current study focused solely on the banking sector; composite measure of corporate governance was used and the study was also limited to Ghana thereby limiting the scope and subsequently affecting the generalization of the study’s findings. In line with these limitations, future studies should consider similar studies by focusing on the individual corporate governance measures. Again, future researchers should introduce other mediators to explore their effect on corporate governance and performance and consider replicating the study in other sectors of economy such as mining, manufacturing and telecommunication.

Author contributions statement

The authors, Sharon Donnir and Kingsley Tornyeva, confirm contribution to the research paper as follows: conception and design of the study was initiated by Donnir; data collection was carried out by Donnir and Tornyeva; analysis and interpretation of results performed by Donnir; draft manuscript was prepared by Donnir and Tornyeva; Tornyeva critically revised the article and both authors finally reviewed the results and approved the final version of the manuscript.

Disclosure statement

No potential conflict of interest was reported by the author(s).

Data availability statement

Data is available on request from the authors.

Additional information

Notes on contributors

Sharon Donnir

Sharon Donnir is a lecturer and researcher in the Accounting Department, University of professional Studies, Accra, Ghana. She is also a PhD student at Open University of Malaysia, Accra Institute of Technology. Her research interests include corporate governance, auditing and sustainability reporting.

Kingsley Tornyeva

Kingsley Tornyeva is a chartered accountant with a considerable number of years of experience in academia and industry. He has been involved in accounting, financial management, risk management and strategy at senior management level in the financial services sector. He has research interest in accounting, finance and corporate governance.

References

- Adusei, M. (2011). Board structure and bank performance in Ghana. Journal of Money, Investment and Banking, 19(1), 1–15.

- Afriyie, E. Y., Aidoo, G. K. A., & Agboga, R. S. (2021). Corporate governance and its impact on financial performance of commercial banks in Ghana. Journal of Southwest Jiaotong University, 56(4), 58–69. https://doi.org/10.35741/issn.0258-2724.56.4.7

- Aggarwal, P. (2013). Impact of corporate governance on corporate financial performance. IOSR Journal of Business and Management, 13(3), 1–5. https://doi.org/10.9790/487X-1330105

- Alodat, A. Y., Salleh, Z., Hashim, H. A., & Sulong, F. (2022). Investigating the mediating role of sustainability disclosure in the relationship between corporate governance and firm performance in Jordan. Management of Environmental Quality: An International Journal. Ahead-of-print. https://doi.org/10.1108/MEQ-07-2021-0182

- Amartey, L. A., Yu, M., & Chukwu-Lobelu, O. (2019). Corporate governance in Ghana: An analysis of board accountability in Ghanaian listed banks. Journal of Financial Regulation and Compliance, 27(2), 126–140. https://doi.org/10.1108/JFRC-12-2017-0111

- Amidu, M. (2007). Determinants of capital structure of banks in Ghana; An empirical approach. Baltic Journal of Management, 2(1), 67–79. https://doi.org/10.1108/17465260710720255

- Artiach, T., Lee, D., Nelson, D., & Walker, J. (2010). The determinants of corporate sustainability performance. Accounting & Finance, 50(1), 31–51. https://doi.org/10.1111/j.1467-629X.2009.00315.x

- Atuahene, R. A. (2016). Corporate governance and financial performance: Evidence from the Ghanaian banking sector [DBA thesis, University of Bradford]. The University of Bradford Open Access repository. http://hdl.handle.net/10454/15020

- Bank of Ghana. (2018). Corporate governance directive 2018 for banks, savings and loans companies, finance houses and financial holding companies. www.bog.gov.gh

- Baron, R. M., & Kenny, D. A. (1986). The moderator–mediator variable distinction in social psychological research: Conceptual, strategic, and statistical considerations. Journal of Personality and Social Psychology, 51(6), 1173–1182. https://doi.org/10.1037/0022-3514.51.6.1173

- Becchetti, L., Di Giacomo, S., & Pinnacchio, D. (2005). Corporate social responsibility and corporate performance: evidence from a panel of U.S. listed companies, Working paper, (CE IS). http://www.ssrn.com/abstract=871402

- Becchetti, L., Di Giacomo, S., & Pinnacchio, D. (2008). Corporate social responsibility and corporate performance: evidence from a panel of US listed companies. Applied Economics, 40(5), 541–567. https://doi.org/10.1080/00036840500428112

- Becker, J. M., Ringle, C. M., Sarstedt, M., & Völckner, F. (2015). How collinearity affects mixture regression results. Marketing Letters, 26(4), 643–659. https://doi.org/10.1007/s11002-014-9299-9

- Bhagat, S., & Bolton, B. (2008). Corporate governance and firm performance. Journal of Corporate Finance, 14(3), 257–273. https://doi.org/10.1016/j.jcorpfin.2008.03.006

- Boachie, C. (2023). Corporate governance and financial performance of banks in Ghana: the moderating role of ownership structure. International Journal of Emerging Markets, 18(3), 607–632. https://doi.org/10.1108/IJOEM-09-2020-1146

- Charlo, M. J., Moya, I., & Muñoz, A. M. (2017). Financial performance of socially responsible firms: The short-and long-term impact. Sustainability, 9(9), 1622. https://doi.org/10.3390/su9091622

- Donnir, S., Tornyeva, K., Ayamga, T., & Tagoe, F. (2023). Corporate governance and employee confidence in the Ghanaian banking sector: Mediating role of corporate reporting disclosures. Cogent Business & Management, 10(2), 1–20. https://doi.org/10.1080/23311975.2023.2242157

- Elmghaamez, I. K., Nwachukwu, J., & Ntim, C. G. (2023). ESG disclosure and financial performance of multinational enterprises: The moderating effect of board standing committees. International Journal of Finance & Economics. In Press. https://doi.org/10.1002/ijfe.2846

- Fariha, R., Hossain, M. M., & Ghosh, R. (2022). Board characteristics, audit committee attributes and firm performance: empirical evidence from emerging economy. Asian Journal of Accounting Research, 7(1), 84–96. https://doi.org/10.1108/AJAR-11-2020-0115

- Fornell, C., & Bookstein, F. L. (1982). Two structural equation models: LISREL and PLS applied to consumer exit-voice theory. Journal of Marketing Research, 19(4), 440–452. https://doi.org/10.1177/002224378201900406

- Fornell, C., & Larcker, D. F. (1981). Structural equation models with unobservable variables and measurement error: Algebra and statistics. Sage Publications Sage CA.

- Frimpong, S. (2018). Working capital policies and value creation of listed non-financial firms in Ghana: a panel FMOLS analysis. Business and Economic Horizons, 14(4), 725–742. https://doi.org/10.15208/beh.2018.51

- Ghosh, S., Pareek, R., & Sahu, T. N. (2023). How far corporate governance and firms’ characteristics are relevant toward environmental sustainability? An empirical investigation. Rajagiri Management Journal, 17(2), 183–197. https://doi.org/10.1108/RAMJ-02-2022-0027

- Hair, J. F., Hult, G. T. M., Ringle, C. M., & Sarstedt, M. (2017). A Primer on Partial Least Squares Structural Equation Modeling (PLS-SEM). (2nd ed.). Thousand Oaks, CA: Sage Publications Inc.

- Hair, J. F., Ringle, C. M., & Sarstedt, M. (2011). PLS-SEM: Indeed a silver bullet. Journal of Marketing Theory and Practice, 19(2), 139–152. https://doi.org/10.2753/MTP1069-6679190202

- Harvey Pamburai, H., Chamisa, E., Abdulla, C., & Smith, C. (2015). An analysis of corporate governance and company performance: a South African perspective. South African Journal of Accounting Research, 29(2), 115–131. https://doi.org/10.1080/10291954.2015.1006482

- Hayes, A. F. (2013). Introduction to mediation, moderation, and conditional process analysis: A regression-based approach. Guilford Press.

- Henseler, J., Ringle, C. M., & Sarstedt, M. (2015). A new criterion for assessing discriminant validity in variance-based structural equation modeling. Journal of the Academy of Marketing Science, 43(1), 115–135. https://doi.org/10.1007/s11747-014-0403-8

- Herzig, C., & Schaltegger, S. (2011). Corporate sustainability reporting. In J. Godemann & G. Michelsen (Eds.), Sustainability communication: Interdisciplinary perspectives and theoretical foundation (pp. 151–169). London, New York: Springer Science+Business Media. https://doi.org/10.1007/978-94-007-1697

- Hussain, N., Rigoni, U., & Orij, R. P. (2018). Corporate governance and sustainability performance: Analysis of triple bottom line performance. Journal of Business Ethics, 149(2), 411–432. https://doi.org/10.1007/s10551-016-3099-5

- King, A. A., & Lenox, M. J. (2001). Does it really pay to be green? An empirical study of firm environmental and financial performance: An empirical study of firm environmental and financial performance. Journal of Industrial Ecology, 5(1), 105–116. https://doi.org/10.1162/108819801753358526

- Kyereboah-Coleman, A. (2007). Relationship between corporate governance and firm performance: An African perspective [Doctoral dissertation]. Stellenbosch University. https://scholar2.stb.sun.ac.za/handle/10019.1/696

- Lee, K.-H., Min, B., & Yook, K.-H. (2015). The impacts of carbon (CO2) emissions and environmental research and development (R&D) investment on firm performance. International Journal of Production Economics, 167, 1–11. https://doi.org/10.1016/j.ijpe.2015.05.018

- Lee, D. D. (2006). An analysis of the sustainability investment strategy employing the Dow Jones world sustainability index [PhD Monash University, Clayton].

- Matuszewska-Pierzynka, A. (2021). Relationship between corporate sustainability performance and corporate financial performance: Evidence from US companies. Equilibrium. Quarterly Journal of Economics and Economic Policy, 16(4), 885–906. https://doi.org/10.24136/eq.2021.033

- Munir, A., Khan, F. U., Usman, M., & Khuram, S. (2019). Relationship between corporate governance, corporate sustainability and financial performance. Pakistan Journal of Commerce & Social Sciences, 13(4), 915–933. http://hdl.handle.net/10419/214258.

- Ntim, C. G., & Soobaroyen, T. (2013). Corporate governance and performance in socially responsible corporations: New empirical insights from a neo institutional framework. Corporate Governance: An International Review, 21(5), 468–494. https://doi.org/10.1111/corg.12026

- Obuobi, B., Nketiah, E., Awuah, F., & Amadi, A. G. (2020). Recapitalization of banks: Analysis of the Ghana banking industry. Open Journal of Business and Management, 8(1), 78–103. https://doi.org/10.4236/ojbm.2020.81006

- Owiredu, A., & Kwakye, M. (2020). The effect of corporate governance on financial performance of commercial banks in Ghana. International Journal of Business and Social Science, 11(5), 18–27. doi/ https://doi.org/10.30845/ijbss.v11n5p3

- Ramayah, T. J. F. H., Cheah, J., Chuah, F., Ting, H., & Memon, M. A. (2018). Partial least squares structural equation modeling (PLS-SEM) using smartPLS 3.0. An updated guide and practical guide to statistical analysis (2nd ed.). Kuala Lumpur, Malaysia: Pearson.

- Saidat, Z., Silva, M., & Seaman, C. (2019). The relationship between corporate governance and financial performance: Evidence from Jordanian family and nonfamily firms. Journal of Family Business Management, 9(1), 54–78. doi/ https://doi.org/10.1108/JFBM-11-2017-0036

- Sarpong-Danquah, B., Oko-Bensa-Agyekum, K., & Opoku, E. (2022). Corporate governance and the performance of manufacturing firms in Ghana: Does ownership structure matter? Cogent Business & Management, 9(1), 2101323. https://doi.org/10.1080/23311975.2022.2101323

- Shakil, M. H., Mahmood, N., Tasnia, M., & Munim, Z. H. (2019). Do environmental, social and governance performance affect the financial performance of banks? A cross-country study of emerging market banks. Management of Environmental Quality: An International Journal, 30(6), 1331–1344. https://doi.org/10.1108/MEQ-08-2018-0155

- Sheikh, N. A., & Karim, S. (2022). Effects of internal governance indicators on performance of commercial banks in Pakistan. Pakistan Journal of Social Sciences, 35(1), 77–90. http://pjss.bzu.edu.pk/index.php/pjss/article/view/292

- Spence, M. (2002). Signaling in retrospect and the informational structure of markets. American Economic Review, 92(3), 434–459. https://doi.org/10.1257/00028280260136200

- Suadiye, G. (2017). The effects of corporate governance practices on firm performance: empirical evidence from Turkey. International Journal of Research in Commerce and Management, 8(11), 45–50.

- Tjahjadi, B., Soewarno, N., & Mustikaningtiyas, F. (2021). Good corporate governance and corporate sustainability performance in Indonesia: A triple bottom line approach. Heliyon, 7(3), e06453. https://doi.org/10.1016/j.heliyon.2021.e06453

- Tornyeva, K., & Wereko, T. (2012). Corporate governance and firm performance: Evidence from the insurance sector of Ghana. European Journal of Business and Management, 4(13), 95–112.2222.

- Tran, M., Beddewela, E., & Ntim, C. G. (2021). Governance and sustainability in Southeast Asia. Accounting Research Journal, 34(6), 516–545. doi/ https://doi.org/10.1108/ARJ-05-2019-0095

- Zhao, X., Lynch, J. G., Jr., & Chen, Q. (2010). Reconsidering Baron and Kenny: Myths and truths about media-tion analysis. Journal of Consumer Research, 37(2), 197–206. https://doi.org/10.1086/651257