Abstract

This study focused on current research on creative accounting and external auditors as well as prospective topics for future research. In the Web of Science Core Collection, a bibliometric and visualization tool for the Web of Science and viewer-based literature, 465 research articles dealing with creative accounting and external auditors authored between 1981 and 2022 were analyzed. Cluster analysis, all-keyword co-occurrence analysis, and bibliographic coupling mapping are all investigated in the study. This research enables us to propose future research paths that may be useful in reflecting on the significant impact that technology will have on the growth of creative accounting and external auditors. The survey discovered four main research trends: the first trend shown is ‘The Future of External Auditing and Financial Reporting Quality’ (red cluster). The second trend focuses on the future of auditors in detecting creative accounting (the green cluster). The third trend is Financial Statement Audit Quality Management for Earnings Management and Fraud Detection (blue and purple clusters). The fourth trend is related to Preventing the Next Financial fraud: A Global Creative Accounting (yellow cluster).

IMPACT statement

This research on the Evolution of Creative Accounting and External Auditors offers valuable insights into contemporary accounting practices. By employing a bibliometric analysis, the study contributes to the ongoing dialogue on financial integrity. The findings aim to inform regulatory bodies, practitioners, and academics, fostering a more resilient and transparent financial landscape.

1. Introduction

Creative accounting involves manipulating financial accounts in a way that violates generally accepted accounting principles (GAAP) (Abed et al., Citation2022). This can lead to a misleading representation of a company’s financial performance, causing uninformed decisions based on the presented information. External auditors play a crucial role in identifying and reporting instances of creative accounting to prevent such practices. As the auditor-auditee relationship can sometimes lead to undue influence, external auditors must maintain independence and objectivity (Ozcelik, Citation2020). Adequate resources and time are essential for auditors to conduct a thorough audit and minimize the risk of overlooking creative accounting methods (Christ et al., Citation2021). Regular auditor rotation can also help to reduce the likelihood of a close relationship developing between the auditor and the auditee.

Companies, in addition to external auditors, can establish effective internal controls to ensure accurate financial reporting and reduce the risk of creative accounting. Regulators also play a vital role in monitoring and enforcing accounting rules to ensure that corporations adhere to GAAP (Tobi et al., Citation2016).

The scientific literature provides clear evidence of the relationship between creative accounting and external auditors. Abueid et al. (Citation2022) emphasize the importance of external auditor independence and impartiality in detecting creative accounting practices. Additionally, Jarah et al. (Citation2022) have demonstrated the effectiveness of internal controls in preventing creative accounting. Sani and Owoade (Citation2021) found that companies with strong internal controls are less likely to engage in creative accounting activities. The role of regulators in monitoring and enforcing accounting rules has also been highlighted in the scientific literature, highlighting their crucial role in mitigating the risks associated with creative accounting (Akpanuko and Umoren, Citation2018; Mansur et al., Citation2022; Cheung & Lai, Citation2022; Larasati et al., Citation2019).

Even though there is a growing body of research on the complex relationship between creative accounting and external auditors, there is a noticeable lack of comprehensive literature reviews on this crucial topic. This study recognizes the paucity of information and emphasizes the importance of a thorough literature review in filling existing gaps, guiding future research endeavors, and providing a consolidated picture of the connection dynamics.

The gaps in the literature that have been highlighted indicate the need for a more nuanced and synthesized investigation of the intricate relationship that exists between innovative accounting practices and the role of external auditors. While individual studies provide valuable insights, a comprehensive review is essential to uncover unexplored avenues and potential research gaps. This will allow us to gain a better understanding of the impact that creative accounting has on financial reporting and the effectiveness of external auditors in mitigating such practices.

The goals and objectives of the study align with the awareness of the knowledge gaps. The primary purpose of the study is to assist future researchers by compiling various pieces of information about creative accounting and external auditors. The aim of this research is to establish a foundational resource that will facilitate more focused and informed inquiries on this critical topic. Additionally, the goal of the study is to identify specific gaps in the current body of literature, with the ultimate aim of identifying future research areas that will fill these gaps and contribute to the ongoing development of knowledge.

The study seeks to evaluate publishing patterns across countries, providing insights into geographical disparities in research output and potential regional priorities. In addition to addressing gaps in the existing body of literature, the study also aims to determine publication trends. The purpose of this research is to provide insights into the impact and legitimacy of different publishing outlets in the field by analyzing which publishers were referred to the most and least in the papers that were evaluated.

To achieve these goals, the research employs bibliometric approaches. It also conducts a comprehensive analysis of the existing literature to identify patterns, trends, and significant factors that are influencing the interaction between creative accounting and external auditors. The purpose of this bibliometric study is not only to highlight the development and trends in research on this issue but also to identify notable articles and authors, therefore providing a benchmark for academics and practitioners working in the field.

In conclusion, the purpose of the research is to investigate and address the relationship that exists between creative accounting and external auditors in order to contribute to the future advancement of creative management practices. Not only does the purpose of this literature review consist of highlighting the most relevant ideas that have an impact on creative accounting and external auditors, but it also aims to create a rigorous foundation for future study in the clusters that have been described. This research intends to make a significant contribution to the current dialogue in this important field by means of a methodical investigation of the gaps in the existing body of literature and the goals that have been specifically addressed.

2. Methodology

It is vital to identify research gaps and trends in the educational setting in order to have a better understanding of future research. The completion of a comprehensive study that will map international delay analysis research and provide the foundation for future studies has not yet been accomplished, despite the fact that there have been several inquiries into delay analysis. A literature review of delayed analytical methodologies in the context of creative accounting and external auditors will be done, and scientometric analyses will be used to look into the most important research questions. In the following sections, the methodology that the research will use to accomplish this objective will be described in depth. This study used the science mapping approach to identify current trends and research gaps, as well as the most relevant organisations, authors, sources, and nations around the issues concerning data collection and data analysis. Reviewing and presenting a sizable amount of scientific literature enabled this. The purpose of a scientific map, which is an approach that involves broad topic analysis and visualisation (Aladayleh et al., Citation2023; Alqudah et al., Citation2023; Qudah et al., Citation2023; Momani et al., Citation2023), is to identify the essential characteristics of a scientific subject; this is the objective of the scientific map. ‘Data Collection’, ‘Selection of Science Mapping Tool’, and ‘Scientometric Techniques’ are the three individual components that make up the overall research design.

2.1. Data tracking

The identification of research trends and gaps in the educational setting should shed light on future research. It is necessary to conduct a thorough study that not only maps international delay analysis research but also creates the foundation for future studies. This is despite the fact that several studies on delay analyses have been conducted. A scientometric analysis of the most concentrated research topics and a literature review on delay analysis approaches will be conducted as part of this study in order to evaluate the link between creative accounting and external auditors. The steps that are to be followed provide an overview of the approach that the research will take to accomplish this objective.

2.2. Selection of research database

In order to successfully locate academic works that are closely associated with creative accounting and external auditors, the most significant keywords were identified. Because of this, the bibliometric study made use of the publications that were found in the Web of Science Database in the categories that were considered essential. When the linked articles were expanded, it was discovered that the terms ‘creative accounting’ and ‘external auditors’ are used rather often in the titles, abstracts, and keywords of the articles. The use of creative accounting and external auditors, on the other hand, may assist a company in presenting a favourable financial picture to investors and other stakeholders. This is in addition to ensuring that the financial statements have been independently examined and are in accordance with accounting regulations. Nevertheless, it is of the utmost importance to emphasise that the use of creative accounting is not only unlawful but also has the potential to result in legal and financial repercussions for the company and its management.

2.3. Finding relevant materials

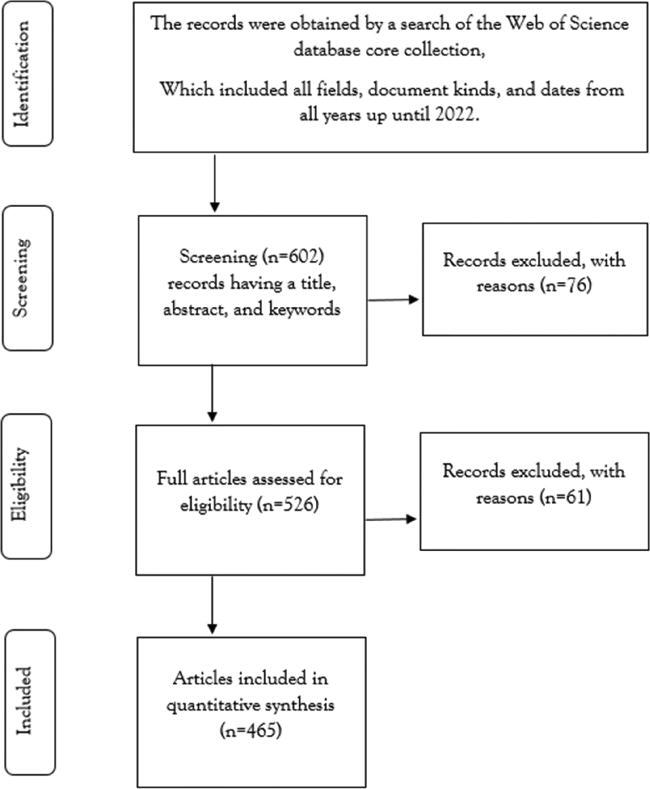

Researchers conducted a systematic search in the Web of Science Database, utilising all TITLE, ABSTRACT, and KEYWORD criteria as detailed in , focusing on ‘creative accounting’ and ‘external auditors’. They limited the search to English-language papers and reviews published between 1981 and 2022 (Web of Science, n.d.). The initial search yielded 602 publications, forming a substantial preliminary dataset. To refine this, various adjustments were made.

Firstly, a temporal constraint was imposed, limiting the timeframe to 1981–2022, justified by the historical scarcity of research in creative accounting and external auditors before 1981 (Hopper & Powell, Citation1985). Additionally, non-accounting journals were excluded using the WoS SSCI article screening criteria. Subsequently, each publication underwent meticulous scrutiny for relevance, incorporating manual screening procedures to eliminate irrelevant entries.

The data preparation for subsequent analysis involved employing specialised bibliometric techniques. The explicit relevance of the topic within the chosen literature domain determined the inclusion and exclusion criteria. Following a rigorous screening process, 465 articles and reviews were selected for further bibliometric and content analysis. Notably, this selection focused specifically on environmental accounting and encompassed papers and reviews published in WoS SSCI accounting journals.

The criteria for inclusion comprised a focus on the relevance of the publication to the topic, the English language, and a restriction on papers and reviews. Conversely, exclusion criteria involved filtering based on publication timeframe, journal type, and manual screening for relevance. This meticulous process ensured the selection of a refined dataset that aligns closely with the research question, thereby contributing to the study’s objectives.

illustrates the proportion of the top ten disciplines in terms of total contribution from total exported papers in various research fields. The business economics subject has the most documents with 375, followed by computer science with 19 research projects. The total number of documents may surpass 465 due to duplicate papers and those categorised in several categories at the same time.

Table 1. Research in the field of creative accounting and external auditors.

2.4. Tool selection for Science mapping

It is essential that the appropriate scientific mapping approach be used in every field of study that calls for examination. Although there are more programmes available, some of the most well-known ones include VOSviewer, Gephi, Citespace, HistCite, and Sci2. Additional tools are also accessible. For this particular bibliometric investigation, the tool that was used was VOSviewer. Through the use of mathematical techniques, this programme generates maps in two dimensions. In several bibliometric studies, it is used due to the fact that it provides helpful maps that are derived from network data for the purpose of graphical representations. In the form of networks and structures, it is possible to display a wide variety of data types, including authors, references, keywords, journals, organisations, and countries, as well as a number of other types of connections, such as co-authorship, co-occurrence, citation, bibliographic coupling, and co-citation.

Text-mining capabilities are also included in VOSviewer, which is one of the most widely used platforms and maps for showing data in an attractive visual manner. Following a comprehensive analysis of the software that was needed, it was concluded that VOSviewer is capable of satisfying the objectives of this investigation. As a consequence of this, the VOSviewer programme was used in order to evaluate the scientific papers that were gathered from the Database of Web of Science when the relevant keywords were utilised (Xie et al., Citation2020).

2.5. Scientometric Techniques

The use of VOSviewer allowed for the execution of a co-occurrence analysis of the authors’ keywords. The results of this research elucidate the keywords that are used the most often, as well as the connections that exist between them (keywords that appear in the same article together). Following the completion of the data processing, the researchers used Excel and VOSviewer to do data analysis in order to investigate the changes that occurred in the corpus of Creative Accounting or external auditors during the course of the study period (1982–2022). Excel is a data analysis application that is used for the purpose of examining descriptive data, which includes an examination of information pertaining to organisations, nations, and research fields. Due to the fact that it offers a great deal of flexibility for updating data in databases such as WOS, it was included in the study methodology. Additionally, we extracted each term from the dataset and transformed it into a co-occurrence network by using the information visualisation programme known as VOS-viewer. Because of this network, we were the ones who were able to comprehend the links that existed between words and academic pursuits. The VOSviewer was used in this investigation for the purpose of analysing and illustrating the bibliographic coupling of organisations as well as the co-occurrence of writers’ keywords.

3. Findings and discussions

3.1. WoS database on creative accounting and external auditors’ publications: evolution, contributors, and methodological issues

It is necessary to count the total number of publications published by a specific unit (such as authors, citations, journals, affiliations, publishers, and countries) over a predetermined time period in order to gauge the level of publishing activity. A comprehension of the extent and structure of the subject matter that is being investigated, as well as the most prominent journals, academic institutions, and nations that are reporting on it, may be obtained via the use of publication activity measures (Bautista-Bernal et al., Citation2021). In order to investigate the ways in which the body of literature on creative accounting and external auditors has evolved throughout the course of the study period (1982–2022), this section examines the results of the bibliometric analysis that are the most relevant. Four hundred sixty-five pieces were published in twenty-three different academic journals. Research is conducted to determine which academic institutions are the most important and successful, as well as the links between them.

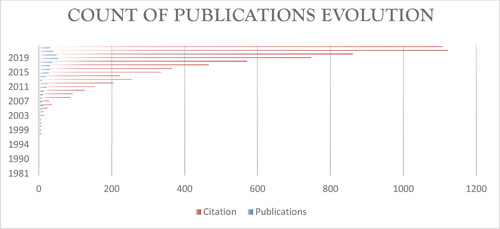

The results indicate that the body of literature about creative accounting and external auditors has expanded at an exponential pace over the last several years. During the first five years, the amount of publishing activity was quite low, with an average of one to three publications being produced each year, as shown in . The number of publications, on the other hand, has been on the rise since 2006. There were reported to have been a number of growth maxima in 2011 (n = 21), and then a declining trend (n = 9 in 2013). But the majority of citations were made in 2021, with 52 in 2019, 48 in 2020, and 39 in 2021. In 2019, there were 52 citations. (1222 references cited). This growth in the number of publications may be attributed to the previous three years. Given the recent uptick in publishing activity, it is possible that there is a need for accounting and external auditors who are inventive. The publishing activity is highlighted in .

A significant increase in the number of publications that are associated with creative accounting and external auditors has been seen over the course of the last several years. One of the most plausible explanations for this phenomenon is that it is the result of a confluence of factors, such as increased regulatory scrutiny and pressure on firms to maintain high financial reporting and transparency standards. In addition, improvements in technology and data analysis have made it easier for auditors to identify possible instances of creative accounting, which has led to a rise in the number of publications that are devoted to understanding this topic. Furthermore, the global financial crisis that occurred in 2008 and the aftermath of it have increased awareness of the importance of financial reporting and how it contributes to the security of the economy.

Contrarily, there are a number of approaches that may be used in order to investigate creative accounting and external auditors, and it is anticipated that studies in these areas will continue to develop and evolve over the course of time. However, the greater attention that has been paid to these issues is a cause for optimism since it highlights the need to deliver financial reporting that is both accurate and honest in order to protect investors and ensure that the integrity of financial markets is preserved. Furthermore, research on creative accounting and external auditors may be of assistance in detecting potential faults in the current system and providing suggestions on how to improve methodological approaches to financial reporting and auditing.

presents the journals and publishers that have published the greatest number of articles that demonstrate innovative accounting and work with external auditors. Auditing: A Journal of Practice and Theory is the first publication, and it has a higher citation (TC) rate (n = 947), despite having 20 articles and an h-index ranking of 17. On the other hand, Accounting Review has obtained a total of 867 citations, 15 publications, and an h-index of 11. On the other hand, these two journals make up 7.52 percent of the total number of articles. 57 publications, a 24 h-index, and 1813 total citations (TC) are all things that the American Accounting Association has to offer in contrast. Elsevier came in second place with a total of 1770 citations, 51 publications, and an h-index of 17.17. After everything is said and done, these two publishers are responsible for 23.22 percent of all publications. On the other hand, the American Accounting Association (n = 1813) continues to have higher rates of citations.

Table 2. Most relevant journals and publishers of publications citing creative accounting and external auditors.

Auditing: A Journal of Practice and Theory has also made contributions to a wide range of topics that are associated with creative accounting and external auditors. These topics include auditor independence, auditor-client relations, and the ability to identify and prevent fraudulent financial reporting. The use of technology in auditing is another issue that is discussed in this journal. Other themes include auditing laws and standard-setting. Within the realm of auditing and accounting research, Auditing: A publication of practice and theory is a publication that is held in very high esteem and is often cited as a reference.

The findings are shown in . The United States of America, England, Romania, Malaysia, Australia, Canada, and Germany were responsible for 289 out of the 465 articles, which is equivalent to 62.15 percent of the total. If the research is undertaken with reference to international territories and countries, It is possible that a strong academic and research infrastructure, funding opportunities, a demand for creative accounting and external auditors’ research, and high-quality publication channels are all factors that contribute to the high volume of scientific research on these keywords in the United States. The majority of the articles, 127, or 27.31 percent, were written in the United States.

Table 3. Most productive countries publishing on creative accounting and external auditors.

In the United States, scientific publications on creative accounting and external auditors have investigated a wide range of topics, including the impact of the Sarbanes-Oxley Act on auditor independence and the detection of financial reporting fraud, the role of external auditors in corporate governance, and the relationship between creative accounting practices and financial performance. Among the other subjects that have been investigated are the following: the effect of auditor rotation on audit quality; the use of data analytics in auditing; and the influence of audit firm features on the identification of fraudulent financial reporting. Studies have also been conducted on the function that external auditors have in identifying and preventing management from manipulating financial statements. These studies have been conducted.

lists the most significant authors in accordance with the total number of publications that the author has either written or co-authored as well as the quantity of citations gathered from the WoS database. Within the time frame that was under consideration today, each of the top writers produced at least nine articles. Peters GF had the most prolific authors and the finest academic reputation based on the number of publications. Additionally, Peters GF had an h-index of four and a g-index of thirty. On the other side, Clements DH was the publication that received the most citations (n = 178).

Table 4. The most relevant authors of publications citing creative accounting and external auditors.

Based on the data shown in , the most prominent publishing affiliations are all academic organisations. In Europe, there are 44 publications, whereas in the United States, there are 66 publications. Both the University System of Ohio and the State University System of Florida have produced a total of fourteen publications within their respective systems, making them the most prolific. On the other side, the majority of the top affiliations were affiliated with the United States of America, with the University of Denver earning the greatest number of citations (n = 44). The other two were of African and Australian descent, while the other two were of Asian descent.

Table 5. Top productive universities on creative accounting and external auditors.

Numerous universities and research institutes, both in the United States and elsewhere on the globe, have made significant contributions to the field of creative accounting and external auditors via the research that they have conducted. Research departments and centres in accounting and auditing are found in a number of colleges and universities. These departments and centres do research on a range of topics related to creative accounting and external auditors. In addition to providing practitioners with insights and ideas for improving accounting and auditing processes, these studies routinely contribute to the development of new theories and the refinement of existing ones. In addition, they regularly contribute to the formulation of new theories. As an additional point of interest, several educational institutions provide accounting and auditing programmes that train aspiring professionals in the fields of accounting and auditing to identify and resolve issues that are associated with creative accounting and external auditors.

3.2. VOSviewer software on creative accounting and external auditors’ publications: mapping and visualizing

Bibliographic coupling is a method of determining the degree of similarity between two sources by analysing the degree to which their reference lists overlap. Bibliometrics, which is the study of patterns and trends in scientific research and publication, makes frequent use of it in order to discover links between various sources and to analyse the structure of research areas. Comparing the reference lists of two different sources and counting the number of references that are shared between them is the method for determining bibliographic coupling. This information is presented in the form of a percentage or proportion of the total number of references included in each source. Comparing the reference lists of two different sources and counting the number of references that are shared between them is the method for determining bibliographic coupling. This information is presented in the form of a percentage or proportion of the total number of references included in each source. The presence of a high degree of bibliographic coupling between two sources is indicative of their connection to one another and the possibility that they belong to the same research tradition or subject matter. It is possible that a low quantity of bibliographic coupling indicates that the sources are not connected to one another or that they belong to different research traditions. The highest circle in corresponds to the journal of public economics, which is the publication that includes the two studies on creative accounting and external auditors. The map with the highest total link strength (9) on the map, the most articles published, and the highest total citations (124) in the management auditing journal follow it. Additionally, it has the highest overall link strength (3). Additionally, it has been cited the second-most than any other work (28). In conclusion, at least one reference must be taken from each of the 23 publications in order to satisfy the criteria. It was revealed that there were sixteen linkages and 105 total link strengths, which led to the formation of five separate clusters.

Figure 2. Collaboration of sources’ network visualizations on creative accounting and external auditors.

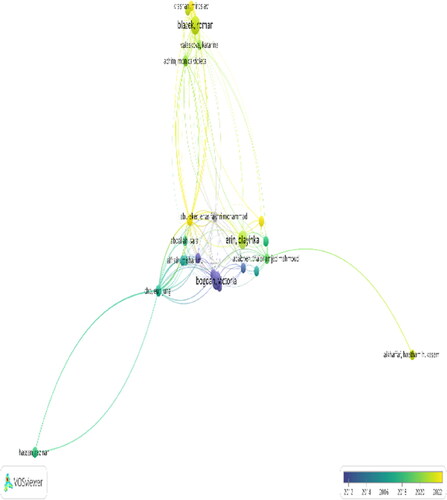

A representation of the organisation of regional and national cooperation may be seen in . The criteria of at least one article are used in order to create results, and up to fifty of the most relevant bibliographic links are supplied. Labels are used in order to identify objects, and rectangles are the pattern that is used the most often. Due to the fact that the size of the label and circle on an object relates to its weight, the item that has the biggest label and circle is the most significant. In this study topic, the distance between actual objects is a measure of how closely the countries are linked to one another, and the lines that connect the items are a representation of the links between them. It is possible to examine countries or regions that have similar characteristics, which is the primary benefit of the map. By way of illustration, countries that are located on the same continent have a great deal of similarities and seem to be in close proximity to one another on maps.

Figure 3. Collaboration of countries’ network visualizations on creative accounting and external auditors.

The United States of America is shown as the first enormous circle in , which is located in close proximity to Egypt, Tunisia, Denmark, Romania, South Korea, Kuwait, and Jordan. In the same vein, it is anticipated that 28.55 percent of all link strengths will be produced in the United States. The majority of the articles that were produced in this country were in the fields of management, accounting, business, public administration, computer science, engineering, education, educational research, government law, industrial relations, labour, ethics, social work, communication, public environmental health, occupational health, and health policy services. On the other hand, additional articles on the repercussions are responsible for around 28 percent of the research that has been published on creative accounting, external auditors, and the relationships between the participants. The findings were presented in a study that focused on the social links that are specific to creative accounting, as well as the consequences for research development and the environment. Additionally, there was a level of interest in the creation of systems for intelligent creative accounting as well as external auditors. It was said that this had already started in the United States, and it was thought to be spreading to other nations, such as Saudi Arabia and Iraq. This suggests that countries have been more active in producing literature in recent times. illustrates how issues of creative accounting and external auditors are intricately related to the five groups and historical eras that are now being discussed there.

illustrates the network of collaboration that exists inside the organisation. The results consist of at least one document and as many as fifty of the most significant bibliographic relationships between the documents. A circle and a label are the two basic symbols that are used to represent items in a symbolic manner. Up to fifty of the most significant bibliographic links are presented, and there is at least one document that is included in this collection. A circle and a label are the two basic symbols that are used to represent items in a symbolic manner. The results consist of a single document in addition to up to fifty of the most significant bibliographic relationships. A circle and a label are the two basic symbols that are used to represent items in a symbolic manner. Due to the fact that the size of an object’s label and circle correlate to its weight, the item that has the largest label and circle is the most important. The distance that separates the many elements that are the focus of this study reveals how closely they are related to one another, while the lines that connect them disclose the connections that exist between them. The most important advantage of the map is that it may be used to locate universities that have comparable characteristics. The research conducted resulted in the formation of nine clusters due to the fact that universities located on the same continent, for instance, have similar qualities and appear together on maps. The largest circle is a representation of the American University in Cairo (Egypt), which has the most citations (28). As can be seen in , Aarhus University (Denmark) is shown on the map by using one published article on creative accounting and external auditors, in addition to the allowable total link strength (65) of the map. Citations (20) and total link strength (33) follow this. It may be deduced from the fact that Egyptian universities are very well connected to one another that there is a dynamic exchange of approaches. In contrast, the University of Prague (Czech Republic) shows on the map that it has just published innovative accounting and external auditors. This information is in contrast to the previous statement.

Figure 4. Collaboration of universities’ network visualizations on creative accounting and external auditors.

Author bibliographic coupling, or ABC for short, is a type of bibliographic coupling that occurs when two authors cite the same article or articles in papers written by authors who are similar to them. According to the ABC assumption, the degree to which two authors’ research is similar increases in proportion to the number of references that they share within their collected works. An investigation has been conducted to determine the significance of document bibliographic links in the process of investigative text mining and data visualisation. The top 53 contributing writers are shown in , ranking them according to the number of papers that they mentioned. Khlif, Hichem, Holm, Claus, Kenfelja, Ivana, and Abdallah Sara are the writers who have received the most citations in publications pertaining to creative accounting and external auditors. They have received $67 for their work. There are an average of five article citations associated with creative accounting and external auditors for each of the top 53 authors. has yellow bubbles that correspond to the names of authors whose research focuses on the keywords that were just given. As an additional point of interest, Miroslav Krasnan is the author of the most recent research that has been published on creative accounting and external auditors.

3.3. Primary research interests in accounting and external auditors

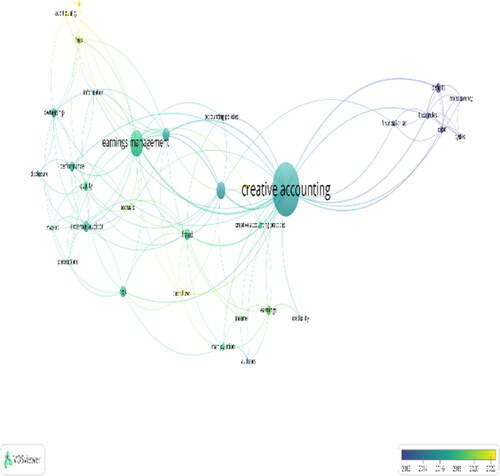

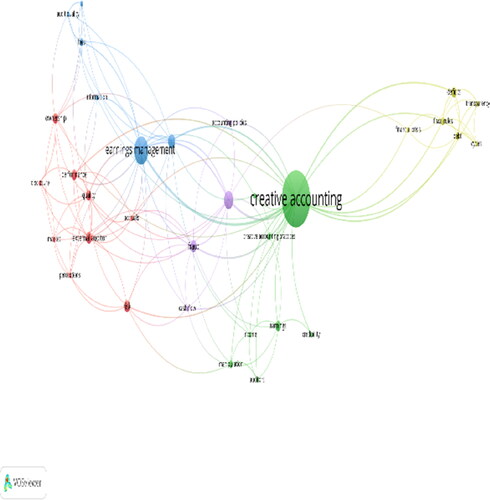

It was determined that the word ‘co-occurrence’ was mapped using VOSviewer in accordance with bibliometrics in order to uncover phrases that were often repeated. In order to discover occurrences of a phrase across all of the literature, the counting method that was used was the whole count. Furthermore, in order to identify which keywords are the most important, the minimum number of times a phrase appears was set at four, and the phrases that are most often used were selected in order to highlight the trends in creative accounting and external auditors. and illustrate the aspects that are shown in the literature that are most often repeated and rising. The frequency with which keyword mapping appears in the title, abstract, and keyword on its own determines the number of articles in which it is present. When doing bibliometric and scientometric research, it is usual practice to apply both mapping and clustering methods in order to get an understanding of the structure of networks. Through the use of intensity and the overlaying of images, we are able to bring to light the most sophisticated and growing phrases in the area, in addition to other words that need significant attention.

Figure 6. Co-occurrence of keywords network visualization on creative accounting and external auditors.

‘Co-occurrence’ was the phrase that was used in the research project in order to carry out a clustering analysis. Furthermore, it necessitates the clustering of things that are equivalent into analytical unit clusters. It is possible that the word associations that were developed are connected to a broad variety of scientific subjects. Identifying research tendencies is made easier with the help of the clustering process. The cluster analysis that was performed in this research was based on the frequency with which terms appeared in the data. On the basis of the number of connections between them and the strength of those connections, these clusters were found and categorised. In conclusion, 33 out of the 224 keywords were able to satisfy the criterion. It was revealed that there were four distinct clusters, 127 linkages, and a total of 194 link strengths. Each cluster is connected to the others in some way. Clusters that are located in the heart of the map () have a higher correlation with the keywords, while clusters that are located around the map have a lesser relationship with the keywords. Within the scope of this investigation, Cluster 1 has nine items, whereas Clusters 2, 3, and 4 each have eight, ten, and six items, respectively. The third and fifth categories were combined because they have characteristics that are comparable to one another and because they have the potential to profit from and develop developing trends in the future. On the other hand, illustrates those phrases such as ‘deficits’, ‘fiscal rules’, and ‘financial crisis’ started to become more prevalent after the financial crisis that occurred in 2008. As a consequence of this, artistic accounting was also accessible from the beginning of the year 2015. Terms such as ‘profit management’, ‘independence’, and ‘external fees’ came into existence between the years 2017 and 2020 as a direct consequence of this.

3.4. Research trends on creative accounting and external auditors

The techniques of co-occurrence analysis, which is a structural and multidimensional indicator, are among the most successful methods for recognising patterns and locating new study fields. According to Li et al. (Citation2016), the term ‘co-word analysis’ refers to the study of co-occurrences or the requirement of a large number of two words in a reading text in order to assess the cognitive and intellectual framework of a scientific issue. Immediately after the selection of the words that are going to be researched, a network of co-occurrences and similarity metrics is established. These similarity scores are used in a variety of statistical methods, such as clustering and multidimensional scaling (MDS), among others. On scientific maps, it is possible to show a variety of information, including author affiliations, articles, publications, and keywords. In order to determine the frequency with which keyword maps appear in articles, the co-occurrence of these maps in titles, abstracts, and keywords is taken into consideration. In bibliometric and scientometric research, two methods that are widely used to provide data about the structure of networks are mapping and exploratory factor analysis (Sedighi, Citation2016). Mapping is a method that offers information about the structure of networks.

For the purpose of analysing the co-occurrence of keywords, the authors used the programme VOSviewer to construct a representation of a network of objects. This representation of the network contained both the total number of connections and the connecting strengths of the items. There is a correlation between the size of the circles that are associated with each item and the significance of the words that are presented (Kristiana & Tukiran, Citation2021). The cluster was used to ascertain which areas of study pertaining to creative accounting and external auditors have made progress, as well as to project future trends in the field of creative accounting and research pertaining to external auditors. The application does in-depth research on bibliometric mappings, and it has the capability to show these mappings in a variety of different ways, each of which highlights a distinct component of the map. This research takes into consideration each and every term and adopts a method of counting that is quite rigorous (Sinkovics, Citation2016).

3.4.1. Cluster 1: ‘the Future of External Auditing and Financial Reporting quality’

Researchers identified a cluster titled ‘The Future of External Auditing and Financial Reporting Quality’, comprising nine key elements, with prominent keywords including ‘risk’, ‘ownership’, ‘disclosure’, and ‘perceptions’ (Christ et al., Citation2021; Cockcroft & Russell, Citation2018; Gray & Debreceny, Citation2014; Gupta & Kumar, Citation2020; Hoang, Citation2018; Jarah et al., Citation2022; Kristiana & Tukiran, Citation2021; Larson, Citation2020; Li et al., Citation2016). presents an analysis of Cluster 1 keywords, highlighting their frequency and linkages. The red cluster on the map suggests that further research in this domain is necessary, indicating the importance of ongoing exploration in the areas of external auditing and financial reporting quality.

Table 6. Cluster 1 keywords include creative accounting and external auditors.

Various factors are expected to shape the future landscape of external auditing and financial reporting quality (Christ et al., Citation2021). Technological advancements, increased regulatory scrutiny, and evolving stakeholder expectations are projected to have a significant impact on these domains (Cockcroft & Russell, Citation2018). The integration of artificial intelligence and data analytics in auditing is anticipated to enhance efficiency and effectiveness and provide real-time insights into financial performance (Gray & Debreceny, Citation2014). However, the adoption of such technologies also raises concerns, including ensuring data security and accuracy.

Moreover, the growing emphasis on sustainability and ESG (environmental, social, and governance) reporting will necessitate auditors to enhance their capabilities and methodologies for evaluating and verifying non-financial data (Hoang, Citation2018). This shift towards non-financial reporting aligns with broader societal trends and expectations for corporate responsibility. To address these challenges and ensure the integrity of the financial reporting process, greater coordination among auditors, corporations, and other stakeholders will be paramount. Building and maintaining trust in financial reporting will require collaborative efforts and transparent communication (Alsmady, Citation2022; Velte, Citation2022; Al-Qadasi et al., Citation2022).

The International Organisation for Standardisation (ISO) plays a crucial role in setting international standards for auditing (Li et al., Citation2016). ISO standards provide a framework for consistency and quality across various industries. Adhering to ISO standards in external auditing practices can enhance global comparability and contribute to the overall reliability of financial reporting.

Furthermore, the American Institute of Certified Public Accountants (AICPA) holds a significant position in shaping accounting practices in the United States (Christ et al., Citation2021). The AICPA’s guidance and standards contribute to the professionalism and ethical conduct of certified public accountants. As the landscape evolves, collaboration between standard-setting bodies, such as the AICPA, and global entities like ISO becomes increasingly important to ensure harmonisation and effectiveness in the auditing profession.

More research is likely to be done in the identified cluster to find out more about how risk, ownership, disclosure, and perceptions affect the quality of external auditing and financial reporting (Christ et al., Citation2021). The evolving role of technology, the impact of regulatory changes, and the integration of sustainability considerations will continue to be focal points. Future trends may also reveal innovative approaches to addressing emerging challenges, with an emphasis on maintaining the trust and credibility of financial reporting in a dynamic and complex business environment.

3.4.2. Cluster 2: ‘the Future of Auditors in Detecting Creative accounting’

The cluster titled ‘The Future of Auditors in Detecting Creative Accounting’ comprises eight items, with keywords such as ‘creative accounting practices’, ‘manipulation’, ‘accounting regulation’, and ‘credibility’ being prominent in this study (Christ et al., Citation2021; Cockcroft & Russell, Citation2018; Gray & Debreceny, Citation2014; Gupta & Kumar, Citation2020; Hoang, Citation2018; Jarah et al., Citation2022; Kristiana & Tukiran, Citation2021; Larson, Citation2020; Li et al., Citation2016). presents a detailed analysis of Cluster 2 keywords, highlighting their frequency and linkages. The green cluster on the map indicates an area that warrants closer examination in the future.

Table 7. Cluster 2 keywords include creative accounting and external auditors.

Technological advancements and the expanding capabilities of data analysis will significantly shape the future landscape of auditors’ role in detecting creative accounting. Auditors are poised to have access to larger and more intricate datasets as auditing procedures become increasingly automated (Christ et al., Citation2021). This enhanced capability will empower auditors to identify patterns and anomalies that may indicate creative accounting methods more effectively. The application of artificial intelligence and machine learning is anticipated to further streamline the detection of creative accounting techniques, minimising the potential for human error. This technological evolution is set to strengthen the legitimacy of financial reporting and instill greater trust among investors.

However, it is acknowledged that the escalating complexity of financial reporting and the rapid evolution of creative accounting methods will continue to pose challenges for auditors. Staying informed about industry advancements and adhering to best practices will be crucial for auditors to effectively address these challenges (Akpanuko and Umoren, Citation2018; Abed et al., Citation2022; Monteiro et al., Citation2022).

The International Organisation for Standardisation (ISO) plays a pivotal role in setting international standards for auditing (Li et al., Citation2016). ISO standards provide a framework for consistency and quality across various industries, including auditing. Adherence to ISO standards in auditing practices ensures a standardised and reliable approach, contributing to the overall effectiveness of auditors in detecting creative accounting methods.

Furthermore, the American Institute of Certified Public Accountants (AICPA) holds a significant position in shaping accounting practices in the United States (Christ et al., Citation2021). The AICPA’s guidance and standards contribute to the professionalism and ethical conduct of certified public accountants. As auditors navigate the evolving landscape of creative accounting, collaboration between the AICPA and global entities like ISO becomes increasingly important to foster uniformity and effectiveness in auditing practices.

Ongoing research in the identified cluster is likely to uncover insights into the evolving challenges auditors face in detecting creative accounting practices. The integration of advanced technologies, such as artificial intelligence and machine learning, will likely feature prominently in future trends, improving efficiency and accuracy in detecting and preventing creative accounting (Christ et al., Citation2021). Additionally, auditors may need to adapt continuously to emerging creative accounting methods, emphasising the importance of ongoing professional development and knowledge-sharing within the auditing community. Overall, these advancements aim to strengthen the auditors’ role in upholding the credibility and reliability of financial reporting practices.

3.4.3. Cluster 3: ‘financial Statement Audit Quality Management for Earnings Management and Fraud detection’

The cluster titled ‘Financial Statement Audit Quality Management for Earnings Management and Fraud Detection’ comprises ten items (Christ, Eulerich, Krane, & Wood, Citation2021; Cockcroft & Russell, Citation2018; Gupta & Kumar, Citation2020; Hoang, Citation2018; Jarah et al., Citation2022; Kristiana & Tukiran, Citation2021; Larson, Citation2020; Li et al., Citation2016; Saleh et al., Citation2023), with keywords such as ‘audit quality’, ‘accounting policies’, ‘fees’, and ‘financial statements’ being significant in this study (Sani & Owoade, Citation2021). The detailed analysis of Cluster 3 keywords is presented in , highlighting their frequency and linkages (Sedighi, Citation2016; Sinkovics, Citation2016). According to the map, the blue and purple clusters represent challenging areas that will demand extensive research in the near future (Tobi et al., Citation2016).

Table 8. Cluster 3 keywords include creative accounting and external auditors.

Moving forward, the future landscape of earnings management and fraud detection in financial statements will be characterised by an increased emphasis on audit quality (Mardessi, Citation2022; Nyakarimi, Citation2022; Maniatis, Citation2022; Achmad, Ghozali, & Pamungkas, Citation2022). As technology advances, organisations and auditors will need to adopt new techniques and methodologies to ensure that financial statements accurately reflect an organisation’s financial performance (Saleh, Marei, Ayoush, & Abu Afifa, Citation2022). This will involve the development of more complex audit methodologies and systems that leverage data analytics, machine learning, and artificial intelligence to uncover potential fraud and earnings management issues (Papadakis et al., Citation2020; Roszkowska, Citation2021).

Simultaneously, the regulatory environment is expected to become more stringent, with a greater emphasis on ensuring the reliability and integrity of financial statements (Moosa, Citation2022). Audit quality will play a crucial role in ensuring the accuracy and integrity of financial statements, enhancing public confidence in the financial system, and mitigating the risk of financial scandals in this context (Omer, Citation2022; Troilo, Citation2023).

To achieve this, external auditors must embrace a culture of continuous improvement, investing in ongoing training and professional development to strengthen their technical abilities and stay current on audit standards and best practices (Mardessi, Citation2022; Nyakarimi, Citation2022; Maniatis, Citation2022; Achmad, Ghozali, & Pamungkas, Citation2022).

In considering international standards, the International Organisation for Standardisation (ISO) will play a pivotal role (Zuo & Lin, Citation2022). ISO standards provide a framework for consistency and quality across various industries, including auditing (Turzo et al., Citation2022). Adhering to ISO standards in financial statement audit quality management ensures a standardised and reliable approach, contributing to the overall effectiveness of auditors in detecting and preventing earnings management and fraud (Monteiro et al., Citation2022).

Furthermore, the American Institute of Certified Public Accountants (AICPA) holds a significant position in shaping accounting practices in the United States (Ozcelik, Citation2020). The AICPA’s guidance and standards contribute to the professionalism and ethical conduct of certified public accountants (Saleh, Jawabreh, & Abu-Eker, Citation2023). As organisations and auditors navigate the evolving landscape of financial statement audit quality management, collaboration between the AICPA and global entities like ISO becomes increasingly important to foster uniformity and effectiveness in auditing practices.

In terms of findings and future trends, ongoing research in the identified cluster is likely to uncover insights into the challenges and opportunities associated with enhancing audit quality for earnings management and fraud detection in financial statements (Saleh et al., Citation2022). The integration of advanced technologies, regulatory changes, and evolving methodologies will likely be focal points (Ozcelik, Citation2020). Future trends may also reveal innovative approaches to addressing emerging challenges, with a sustained emphasis on the reliability and credibility of financial information (Saleh et al., Citation2023). These advancements aim to contribute to the stability and growth of the financial system.

3.4.4. Cluster 4: ‘preventing the next financial fraud: a global creative accounting’

A global effort is crucial to prevent the next financial crisis by addressing creative accounting and other types of financial misreporting as shown in . This requires proactive measures from governments, such as implementing stringent rules and accounting standards, investing in cutting-edge technologies to detect financial fraud, and promoting transparent financial reporting and corporate responsibility (Abdo et al., Citation2021; Abed et al., Citation2022; Jarah et al., Citation2022; Al-Qudah et al., Citation2022).

Table 9. Cluster 4 keywords include creative accounting and external auditors.

To achieve a more stable and trustworthy financial system, policymakers should prioritise preventative measures, such as encouraging ethical behaviour and openness (Nyakarimi, Citation2022; Saleh et al., Citation2023). This includes educating financial professionals about the risks of financial fraud and urging them to follow strong ethical standards (Saleh et al., Citation2022).

Strong and efficiently executed sanctions for financial fraud can also help prevent future cases (Moosa, Citation2022). Promoting the development of financial technology that prioritises security and transparency is another important measure (Roszkowska, Citation2021).

International standards, such as those from the International Organisation for Standardisation (ISO), are also crucial in preventing financial fraud (Zuo and Lin, Citation2022; Turzo et al., Citation2022). Abiding by ISO standards in financial reporting and accounting practices ensures a standardised and reliable approach, contributing to the overall effectiveness of efforts to prevent financial fraud globally (Monteiro et al., Citation2022).

The American Institute of Certified Public Accountants (AICPA) plays a significant role in shaping accounting practices, offering guidance and standards that contribute to the professionalism and ethical conduct of certified public accountants (Ozcelik, Citation2020; Saleh et al., Citation2023). These measures are vital in preventing financial fraud (Christ et al., Citation2021; Cockcroft and Russell, Citation2018).

3.5. Future study directions

Following the completion of a comprehensive examination, the bibliometric analysis provides us with assistance in identifying a number of gaps in the existing body of literature. In any literature review, gaps are a vital component that serve as an incentive for academic study to widen the area of creative accounting in general and specifically for external auditors. Gaps are also an essential component of any literature review. A systematic review came before the bibliometric analysis while it was being conducted. When it comes to the execution of institutional and structural changes to improve creative accounting and promote a competitive environment for external auditors, these disparities also serve as national policies for authorities to follow. These reforms are intended to improve efficiency and creativity in accounting. In the , you will find a sampling of potential questions that might be investigated further in the future.

Table 10. List of potential future study questions.

Cluster 1, which is concerned with these challenges, is concentrating its attention on the future of external auditing as well as the quality of financial reporting via its several areas of concentration. In order to improve the precision and effectiveness of financial reporting and auditing, the purpose of these questions is to collect information on the possible benefits that might be gained by using new technologies such as cognitive computing, big data analytics, and cloud computing. The purpose of the questions is to elicit information on the potential advantages that may be gained. When it comes to improving the overall quality of financial reporting, one method that is commonly considered is the introduction of environmental, social, and governance (ESG) issues into the auditing process. To begin, as was said earlier, Marshall and Lambert (Citation2018) performed a study to evaluate how the incorporation of cognitive computing into auditing procedures can considerably boost auditors’ capacities to detect and prevent financial fraud. This research was part of an investigation that was previously discussed. By using advanced algorithms, this purpose may be accomplished via the analysis of vast volumes of data, the identification of abnormalities and patterns, and the supply of real-time insights into financial data. All of these goals can be accomplished simultaneously. The use of big data analytics has the potential to enhance the consistency and comparability of financial reporting across enterprises and nations, according to the findings of Saleh et al. (Citation2022), who came to a similar conclusion. It is because of this that this will help to standardise financial reporting, which will, in turn, reduce the risk of financial fraud and promote greater openness in the reporting of financial information. According to Wang, Zhang, and Guo (Citation2022), the use of cloud computing makes it possible for auditors to have access to data from a wide range of sources in real time. This, in turn, improves the efficiency and speed with which the auditing process is carried out. Additionally, cloud computing has the potential to lower the costs involved with financial reporting and auditing, which would make these services more accessible to firms of various sizes. This would be a significant benefit for enterprises. According to Hoang, T. (Citation2018), including environmental, social, and governance (ESG) issues in the auditing process is a vital step towards enhancing the quality of financial reporting in general. Hoang made this remark. It is possible that auditors will be able to get a more thorough view of a company’s financial health and performance if environmental, social, and governance (ESG) problems are included in financial reporting, as well as if there is a greater emphasis placed on openness and accountability.

Cluster 2 is focusing its attention on the possibility of auditors in the future being able to recognise innovative accounting situations. The purpose of these questions is to shed light on the potential benefits that might be gained by developing creative accounting methods using modern technology such as natural language processing (NLP), text analytics, and artificial intelligence (AI). In addition, auditors may use behavioural analytics as a method to identify changes in accounting practices that may be indicative of creative accounting. This is another way that behavioural analytics is characterised. This is a situation that occurs rather often. As was noted earlier, Zengul et al. (Citation2021) used natural language processing (NLP) and text analytics in order to offer auditors important insights into financial data and to assist in the detection of patterns that may suggest creative accounting. This was done in order to provide auditors with the ability to better understand the data. Auditors are able to swiftly find areas of concern and study them further by examining large quantities of textual data, such as financial reports. This allows auditors to spot potential problems more quickly. In accordance with the findings of Papadakis et al. (Citation2020), the process of creative accounting identification has the potential to undergo a revolutionary transformation as a result of the use of artificial intelligence and machine learning algorithms. Real-time analysis of financial data, the identification of trends and irregularities, and the provision of auditors with recommendations that can be put into action are all things that these systems are capable of doing. Consequently, auditors will be able to identify possible problems in a more timely and accurate way as a consequence of this, which has the potential to significantly increase the efficacy and efficiency of the process of detecting creative accounting. Additionally, Brown-Liburd, Issa, and Lombardi (Citation2015) assert that auditors may utilise behavioural analytics as an additional way to identify changes in accounting practices that may imply creative accounting. This is a strategy that allows auditors to discover changes in accounting practices. Auditors have the option of using this process, which was outlined earlier. Auditors are able to uncover possible problems and do extra analysis on them by analysing changes in an individual’s behaviour, such as adjustments in the method by which financial data is obtained. This allows auditors to discover potential problems and examine them further. This situation makes it easy for auditors to identify imaginative accounting techniques that could otherwise go undiscovered. This is because auditors are able to recognise these processes.

Cluster 3 is concerned with the quality control of audits of financial statements for the purpose of earnings management and the prevention of fraud. This is done for the management of earnings. This set of questions is designed to elicit information on the potential benefits of using data visualisation tools and the procedures that are already in use for data analytics in order to identify and prevent fraudulent activity and manipulation of profits in the context of audits of financial statements. The purpose of this set of questions is to gather information. Additionally, it is said that auditors may use behavioural analytics as a method for identifying changes in financial data that may be indicative of fraudulent conduct or the manipulation of earnings. In the beginning, Grey and Debreceny brought attention to the fact that the use of data visualisation tools and contemporary data analytics methodologies in the process of auditing financial statements may have substantial benefits in terms of identifying and avoiding fraudulent activities and manipulations of profits. This was noted in the literature at an earlier point in time. Auditors are able to quickly uncover trends and discrepancies that may suggest earnings management or fraud by examining enormous volumes of financial data. This allows auditors to quickly identify any fraudulent activity. According to Roszkowska (Citation2021), auditors may also benefit from behavioural analytics since it enables them to monitor changes in financial data that may signal fraudulent behaviour or manipulation of earnings. This is one of the reasons why auditors may benefit from behaviour analytics. Based on the findings of Braswell and Daniels (Citation2017), this technique has the potential to assist auditors in identifying deviations from regular behaviour. These deviations may include transactions that are not typical or changes in financial data that are not in line with previous patterns. Auditors may also use this method to assist them in identifying transactions that are happening in an irregular manner.

The fourth cluster is concerned with preventing the next generation of financial dishonesty, which is a brilliant accounting method that is used all around the world. In order to enhance the level of awareness among staff members, as well as to avoid fraudulent financial practices and creative accounting, the questions are designed to gather information on the possible benefits of adopting techniques such as gamification and predictive analytics. The goal of the questions is to collect information. Additionally, the questions address the need for auditors and financial reporters to acquire a more in-depth grasp of the expanding threat that is offered by fraudulent financial practices and creative accounting. To begin, Moosa (Citation2022) pointed out that predictive analytics and gamification have the potential to be of assistance in the prevention of financial fraud. An additional benefit of creative accounting is that it has the potential to increase employee understanding and avoid the use of accounting practices that are unethical or unlawful. Cluster 4 is largely concerned with preventing the next financial fraud, which is a scam that incorporates creative accounting on a global scale. This is the primary focus of Cluster 4. The goal of these questions is to gather information on the potential benefits of using gamification and predictive analytics tactics in order to raise awareness among employees as well as prevent fraudulent financial practices and creative accounting. In addition, the questions emphasise the need for auditors and financial reporters to have a grasp of the growing threat presented by fraudulent techniques of financial reporting and creative accounting. In the beginning, Moosa (Citation2022) said that predictive analytics and gamification have the potential to be helpful in the prevention of financial fraud. In addition, creative accounting has the potential to raise employee understanding and steer clear of accounting practices that are unethical or illegal. In order to do this, it is necessary for them to be current on the most recent advancements in financial fraud and new accounting strategies. Additionally, they must incorporate technology like predictive analytics and gamification into their job in order to aid in spotting and preventing these issues.

In spite of the fact that technology improvements play a significant part in the formation of the areas of creative accounting and external auditors, it is of the utmost importance to maintain a clear and direct relationship between technological breakthroughs and the particular contributions that they make to the fundamental goals that are specified in each cluster. This guarantees that the subject matter is investigated in a manner that is both focused and unified. In order to preserve the logical consistency of the analysis, it is important to steer clear of tangential debates that diverge from the primary topic at hand.

3.6. Practical implications

This finding has significant implications for creative accounting and can have serious practical consequences, such as erroneous financial statements and poor decision-making based on the information presented. External auditors have a critical role in recognizing and combating unethical abuses. However, auditors must be unbiased and independent, with no undue influence from management or the auditee. To provide a thorough audit and limit the danger of overlooking inventive accounting methods, auditors should be given adequate resources and time. Regular auditor rotation can also serve to reduce the potential for auditor-auditee relationships resulting in undue influence. Internal controls can be implemented by businesses to reduce the risk of creative accounting and ensure accurate financial reporting. Furthermore, regulators are responsible for monitoring and enforcing accounting standards and ensuring company compliance.

This study also highlighted research findings demonstrating that creative accounting might have real-world effects by presenting a skewed perspective of a company’s financial success. External auditors play a critical role in discovering creative accounting methods in order to ensure accurate financial reporting and prevent misleading information. Auditors must be independent and uninfluenced by the auditee or management in order to preserve impartiality. Allocating sufficient resources and time for the audit is also critical, since this reduces the possibility of overlooking instances of creative accounting. Regularly rotating auditors might prevent excessive influence from emerging in the auditor-auditee relationship. Companies can put in place internal controls to protect against creative accounting, and authorities must enforce accounting rules and guarantee that companies follow them.

3.7. Limitations

This study significantly contributes to the enhancement of interconnected linkages and their impact on social creativity, technology, and the role of external auditors. Additionally, it broadens the exposure of research focused on creative accounting and external auditors. The recognition of the crucial roles played by company culture in influencing innovative accounting practices and the crucial involvement of external auditors in fostering effective interpersonal connections within organizations are two key takeaways from this investigation. However, it is imperative to acknowledge certain limitations within the study. The primary drawback stems from the reliance on the Web of Science (WoS) database for bibliometric analysis. Unfortunately, due to constrained financial resources, our organisation faced challenges in subscribing to the Web of Science database. This limitation prompts a recommendation for future research endeavours in the realm of creative accounting and external auditors to utilise a comprehensive approach by incorporating all reliable databases, including WoS and Scopus. This broader database utilisation ensures a more inclusive and robust analysis, enhancing the overall quality and reliability of scholarly investigations in this domain. The study adds a lot to our knowledge about how social creativity, technology, and the role of external auditors are all connected. However, it does have one major flaw that makes it clear that future research needs to use a wider range of databases to keep the field of creative accounting and external audit studies academically rigorous and complete.

4. Conclusion

This study presents a systematic classification of studies in the burgeoning field of creative accounting and external auditors, shedding light on the prevailing research areas. Utilising the extensive Web of Science (WoS) core collection database, a meticulous selection process was conducted, resulting in the identification of key publications and journals at the intersection of creative accounting and external auditors. These were then organised into four distinct clusters. This classification offers valuable insights for academics and researchers, serving as a comprehensive resource to delve into underlying assumptions, track the subject’s evolutionary trajectory, and understand theme development, contextual nuances, and methodological variations. The thorough analysis encompasses 465 publications.

The small number of qualitative studies conducted serves as important evidence that academic research in creative accounting and external auditors is still in its infancy. Despite its recent emergence in academic discourse since 1981, content analysis reveals a rapidly growing influence on economic studies and information systems sciences. While the subject’s increasing significance is evident, its impact in fields such as development studies and educational administration remains relatively low, emphasising the need for future exploration and integration into diverse academic domains.

This bibliometric research not only presents the current landscape of creative accounting and external auditors but also lays a foundation for future academic inquiries. The dynamic nature of the topic, as highlighted in this study, encourages researchers to explore uncharted dimensions. Moving forward, research in this field should focus on qualitative dimensions, interdisciplinary approaches, global comparative studies, longitudinal analyses, and practical implications to contribute meaningfully to the ongoing discourse. By addressing these areas, future researchers can deepen our understanding of creative accounting and external auditors, fostering practical applications and policy advancements in this critical domain.

Author contributions

Ayman Mohammad ALShanti conceived and developed the research idea, utilizing the Web of Science Core Collection for bibliometric analysis. He conducted cluster analysis, all-keyword co-occurrence analysis, and bibliographic coupling mapping, taking the lead in writing the manuscript and coordinating the team’s efforts. Mohammad Mahmoud Humeedat verified analytical methods and provided valuable insights for interpreting the results, offering critical feedback that enhanced the research and ensured a robust analysis. Hani Abdel Hafez Al-Azab also verified analytical methods, actively participated in designing and implementing the study, analyzed spectra, and contributed significantly to interpreting the results, enriching the overall research with his multifaceted contributions. Mohammad Zakaria AlQudah, a Ph.D. student from the University of Valencia, brought diverse perspectives to the study, contributing to analyzing and interpreting results, adding depth to the research through collaboration between different academic backgrounds. All authors discussed the results, provided feedback on the manuscript, and approved its final version for submission.

Disclosure statement

No potential conflict of interest was reported by the author(s).

Data availability statement

No data were generated or used in this work. The study did not involve the collection or analysis of original data. Therefore, there is no data available for sharing.

Additional information

Funding

Notes on contributors

Ayman Mohammad ALShanti

Ayman Mohammad ALShanti is a distinguished academic in the Department of Accounting and Accounting Information System at Amman University College, Al-Balqa Applied University, Jordan. His research focuses on accounting and information systems.

Hani Abdel Hafez Al-Azab

Hani Abdel Hafez Al-Azab is a dedicated professional in the Department of Accounting and Accounting Information System at Amman University College, Al-Balqa Applied University, Jordan. His expertise lies in the intersection of accounting and information systems.

Mohammad Mahmoud Humeedat

Mohammad Mahmoud Humeedat is a proficient researcher in the Department of Accounting and Accounting Information System at Amman University College, Al-Balqa Applied University, Jordan. His work contributes significantly to the field of accounting information systems.

Mohammad Zakaria AlQudah

Mohammad Zakaria AlQudah is a Ph.D. student in the Department of Accounting and Finance at the University of Valencia, Spain. His research interests revolve around accounting and finance, and he is committed to advancing knowledge in these areas.

References

- Abdo, K. K., Al-Qudah, H. A., Al-Qudah, L. A., & Qudah, M. Z. A. (2021). The effect of economic variables (workers ‘diaries abroad, bank deposits, gross domestic product, and inflation) on stock returns in the Amman Financial Market from 2005/2018. Journal of Sustainable Finance & Investment, 13(1), 1–24. https://doi.org/10.1080/20430795.2021.1883384

- Abed, I. A., Hussin, N., Ali, M. A., Haddad, H., Shehadeh, M., & Hasan, E. F. (2022). Creative accounting determinants and financial reporting quality: systematic literature review. Risks, 10(4), 76. https://doi.org/10.3390/risks10040076

- Abed, I. A., Hussin, N., Haddad, H., Almubaydeen, T. H., & Ali, M. A. (2022). Creative accounting determination and financial reporting quality: the integration of transparency and disclosure. Journal of Open Innovation: Technology, Market, and Complexity, 8(1), 38. https://doi.org/10.3390/joitmc8010038

- Abed, I. A., Hussin, N., Haddad, H., Al-Ramahi, N. M., & Ali, M. A. (2022). The moderating impact of the audit committee on creative accounting determination and financial reporting quality in Iraqi commercial banks. Risks, 10(4), 77. https://doi.org/10.3390/risks10040077

- Abueid, R., Aldomy, R. F., & Al-Hamad, A. A. S. A. (2022). Impact of creative accounting practices on financial statements: a case study of palestinian auditors and academics. Journal of Southwest Jiaotong University, 57(2), 22–39. DOI: https://doi.org/10.35741/issn.0258-2724.57.2.3

- Achmad, T., Ghozali, I., & Pamungkas, I. D. (2022). Hexagon fraud: Detection of fraudulent financial reporting in state-owned enterprises Indonesia. Economies, 10(1), 13. https://doi.org/10.3390/economies10010013

- Akpanuko, E. E., & Umoren, N. J. (2018). The influence of creative accounting on the credibility of accounting reports. Journal of Financial Reporting and Accounting, 16(2), 292–310. https://doi.org/10.1108/JFRA-08-2016-0064

- Aladayleh, K. J., A., Qudah, S. M. A., Bargues, J. L. F., & Gisbert, P. F. (2023). Global trends of the research on COVID-19 risks effect in sustainable facility management fields: a bibliometric analysis. Engineering Management in Production and Services, 15(1), 12–28. https://doi.org/10.2478/emj-2023-0002

- Al-Qadasi, A. A., Al-Jaifi, H. A. A., Al-Rassas, A. H., & Al-Qublani, A. A. (2022). The financial reporting systems quality (FRSQ) and institutional investors: The case of an emerging market. Cogent Business & Management, 9(1), 2050019. https://doi.org/10.1080/23311975.2022.2050019

- Al-Qudah, L. A., Ahmad Qudah, H., Abu Hamour, A. M., Abu Huson, Y., & Al Qudah, M. Z. (2022). The effects of COVID-19 on conditional accounting conservatism in developing countries: evidence from Jordan. Cogent Business & Management, 9(1), 2152156. https://doi.org/10.1080/23311975.2022.2152156

- Alqudah, M., Ferruz, L., Martín, E., Qudah, H., & Hamdan, F. (2023). The sustainability of investing in cryptocurrencies: A bibliometric analysis of research trends. International Journal of Financial Studies, 11(3), 93. https://doi.org/10.3390/ijfs11030093

- Alsmady, A. A. (2022). Quality of financial reporting, external audit, earnings power and companies performance: The case of Gulf Corporate Council Countries. Research in Globalization, 5, 100093. https://doi.org/10.1016/j.resglo.2022.100093

- Bautista-Bernal, I., Quintana-García, C., & Marchante-Lara, M. (2021). Research trends in occupational health and social responsibility: A bibliometric analysis. Safety Science, 137, 105167. https://doi.org/10.1016/j.ssci.2021.105167

- Braswell, M., & Daniels, R. B. (2017). Alternative earnings management techniques: What audit committees and internal auditors should know. Journal of Corporate Accounting & Finance, 28(2), 45–54. https://doi.org/10.1002/jcaf.22239

- Brown-Liburd, H., Issa, H., & Lombardi, D. (2015). Behavioral implications of Big Data’s impact on audit judgment and decision making and future research directions. Accounting Horizons, 29(2), 451–468. https://doi.org/10.2308/acch-51023

- Cheung, K. Y., & Lai, C. Y. (2022). External auditors’ trust and perceived quality of interactions. Cogent Business & Management, 9(1), 2085366. https://doi.org/10.1080/23311975.2022.2085366

- Christ, M. H., Eulerich, M., Krane, R., & Wood, D. A. (2021). New frontiers for internal audit research. Accounting Perspectives, 20(4), 449–475. https://doi.org/10.1111/1911-3838.12272