?Mathematical formulae have been encoded as MathML and are displayed in this HTML version using MathJax in order to improve their display. Uncheck the box to turn MathJax off. This feature requires Javascript. Click on a formula to zoom.

?Mathematical formulae have been encoded as MathML and are displayed in this HTML version using MathJax in order to improve their display. Uncheck the box to turn MathJax off. This feature requires Javascript. Click on a formula to zoom.Abstract

Earnings management has been a subject of extensive research, experiencing substantial growth recently and anticipated to continue in the years ahead. This paper employs bibliometric analysis, examining the Scopus database of publications from 1993 to 2021, to enhance our understanding of earnings management. There is a remarkable growth in earnings management research, with 54% of publications emerging from 2016 to 2021, peaking at 226 papers in 2021. Kim Y. and Alahada M. are leading contributors with ten publications each, while Kim J.-B. stands out with an impressive 1,056 citations across eight documents. Active contributors to earnings research are from the US, China, the UK, and Australia. In addition, this paper discusses four distinct themes within earnings management, including the motives and characteristics of earnings management activities, real and accrual-based earnings management, the relationship between corporate governance and earnings management, and earnings management and market performance. More importantly, it highlights future research opportunities, emphasizing the need to explore real earnings management as an alternative measurement and addressing topics like gender diversity, family firms, and leverage in understanding the magnitude of earnings management. Notably, the study’s findings provide insights to develop the research on earnings management, especially in the emerging market finance context.

Introduction

Over the past decades, earnings management (EM) has received the considerable attention of many scholars, practitioners, and regulators since it could result in less confidence and transparency in the financial market (Nguyen et al., Citation2021). The study of Hepworth was the first to introduce earnings management in 1953 (Hepworth, Citation1953). Following that, Healy’s research (1985) is crucial as it was the first to measure EM based on discretionary accruals- the unobserved part of total accruals. The studies of DeAngelo (Citation1986), Jones (Citation1991), Dechow and Sloan (Citation1991), Friedlan (Citation1994), etc. continued to make significant progress to develop models detecting EM behaviors more effectively. The latest knowledge working on this area has been paying much attention to real activities as an alternative measurement of EM (Cohen & Zarowin, Citation2010; Roychowdhury, Citation2006; Zang, Citation2012).

Numerous studies have also explained different motives that led managers to manipulate earnings. Burgstahler and Dichev (Citation1997), Roychowdhury (Citation2006), Prevost et al. (Citation2008), and Tran and Duong (Citation2020) found evidence that managers inflate earnings to avoid reporting profit losses and decreases. Other scholars demonstrated that managers involved in EM behaviors due to different reasons such as avoiding the degree of corporate tax (Pipatnarapong, Citation2020), adapting to market analysts’ forecasts (Athanasakou et al., Citation2009; Mindak et al., Citation2016; Nelson et al., Citation2002; Porter & Kraut, Citation2013), increasing the stock prices (Nelson et al., Citation2002; Das et al., Citation2011; Putman et al., Citation2009) or meeting investors’ expectations (Hong & Linh, Citation2020; Peek, Citation2004). In addition, it is also evident that the level of compensation and remuneration scheme is one of the most important motivations for managers to adjust profits (Bergstresser & Philippon, Citation2006; Cornett et al., Citation2009; Dye, Citation1988; Dechow & Sloan, Citation1991). Managers tend to practice earnings to gain more benefits or maximize their renewal salaries and bonuses, especially in the final year of their contracts. Recently, Assenso-Okofo et al. (Citation2021) suggested that executive bonus increases in relation to EM, and therefore, managers may become involved in EM to increase their compensation.

In the existing literature, EM is a complex phenomenon presenting both positive and negative effects. Schipper (Citation1989), Healy and Wahlen (Citation1999) stated that EM is the alteration of firms’ reported economic performance by insiders to either ‘mislead some stakeholders’ or to ‘influence contractual outcomes’. For instance, insiders can use their discretion in financial reporting to overstate the true level of earnings and hide unfavorable earnings realizations (e.g. earnings losses or decreases) that would prompt outsiders to act against insiders. In extensive EM, financial reports inaccurately reflect firm performance and weaken outsiders’ ability to govern the firm (Leuz et al., Citation2003) or diminish investors confidence, resulting in a decline in trading volume (Le et al., Citation2023). However, EM has a significant effect in some situations, especially when firms encounter crises. Lisboa and Kacharava (Citation2018) confirmed that CEOs could disclose financial reports with optimistic earnings to reassure investors about their ongoing concerns during financial turbulence. Managers may record upward earnings to maintain the relationship with stakeholders such as banks and creditors to avoid bankruptcy. Inversely, they can manage earnings downward to reduce taxes or avoid stricter regulations and supervision during the crisis periods (Hamza & Zaatir, Citation2021). In addition, firms that engage in EM tactics tend to promote CSR activities and reporting as an entrenchment strategy to deliberately divert stakeholders’ attention to and promote higher prospects of the firm’s performance (Jian et al., Citation2023; Prior et al., Citation2008; Palacios-Manzano et al., Citation2021).

Therefore, I use bibliometric analysis of 1981 Scopus-indexed publications between 1993 and 2021 to fulfill the lack of systematic review on this topic. The following research questions (RQ) address:

RQ1. What is the total volume and growth trajectory of research on EM?

RQ2. Who are the key authors in the EM literature?

RQ3. Which are the most influential papers, leading countries and institutions in the EM area?

RQ4. What are the main schools of thought in EM research?

RQ5. What are the latest topics in EM research that have received the greatest attention in the literature?

This review takes on profound significance as it not only enriches understanding but also facilitates the development of EM theory, offers a comprehensive overview of existing studies, and extends new directions for further research. What makes my paper different from previous bibliometric publications is the Scopus database and the different time range (from 1993 to 2021) to explain clearer different schools of thought, and represent research gaps that shed light on further research. The results demonstrate the emerging trend of research on EM, particularly from 2017 to 2021. Based on the number of documents, number of citations, and the average of citations, this paper outlines the most productive authors, leading countries and institutions, and the research cluster network. Notably, this review calls the future directions of EM in terms of ‘real earnings management’, ‘gender diversity’, ‘family firms’, ‘leverage’ and different dimensions of EM in emerging markets.

The rest of this paper is structured as follows: Section “Conceptual framework’ explores the conceptual framework of EM. Research methodology is detailed in Section “Research methodology ”, while Section “Research results and discussions” demonstrates the results of an extensive bibliometric review and keyword analysis. Finally, in Section“Conclusions and limitations”, I unveil empirical findings and discuss further research directions from my analyses.

Conceptual framework

Earnings management definitions

Healy and Wahlen (Citation1999) stated ‘Earnings management occurs when management uses judgment in financial reporting and in structuring transactions to alter financial reports to either mislead some stakeholders about the underlying economic performance of the company or to influence contractual outcomes that depend on reported accounting numbers’. Other scholars defined EM as the flexible application of accounting policies to reach a target profit. For example, a firm can accelerate the recognition of sales income through credit sales or postpone loss recognition by postponing the creation of loss reserves (Teoh et al., Citation1998a); or they can change shipment timetables and defer spending for research and development (R&D) and maintenance to manage earnings (Dechow & Skinner, Citation2000; Fudenberg & Tirole, Citation1995). Ronen and Yaari (Citation2008) classify EM into three distinct groups: White EM (which enhances the transparency of financial reports); gray EM (which could be either opportunistic or efficiency-enhancing) and black EM (which involves absolute misrepresentation or reduces transparency in financial statements). According to Cohen and Zarowin (Citation2010), EM is divided into two basic categories: EM through accrual accounting variables and EM through the mediation of actual transactions. In short, it should be noted that the term ‘earnings management’ has broad definitions, including many different motives, measures and techniques firm managers perform to achieve management goals.

Accrual-based earnings management and real earnings management

Accrual-based indicators are the primary proxies of earnings management used in most research. Healy (Citation1985) tests EM by comparing the mean total accruals across the EM division variable (measured by the lagged value of the company’s total assets). In 1991, Jones offered a model that departs from the assumption of continuous nondiscretionary accruals. This method aims to take into consideration how nondiscretionary accruals are affected by shifting economic conditions. Dechow et al. (Citation1995) compared various accrual-based models to examine EM behavior. They concluded that more research on the topic was necessary to develop better models that provide more effective tests to identify earning management that are more precisely defined. Then, Dechow et al. (Citation1995) modified the Jones Model (1991) to eliminate the conjectured tendency of the Jones Model to overestimate discretionary accruals when discretion is used to determine revenues. In addition, managers can alter real activities to accrual processes to control earnings. Real activity manipulation, as Roychowdhury (Citation2006) describes it, is when managers deviate from standard operating procedures in an effort to deceive at least a few stakeholders into thinking that specific financial reporting objectives have been achieved naturally. Graham et al. (Citation2005) showed that real activity manipulation lowers business value since actions done now to boost profitability may hurt cash flows in the future.

Financial executives are more likely to influence earnings through real actions rather than accruals (Bruns & Merchant, Citation1990; Graham et al., Citation2005). There are at minimum two reasons why this can be the case. Firstly, accounting fraud is more likely to be investigated by auditors or regulators than actual pricing and production decisions. Secondly, there is a danger involved in only depending on accrual manipulation. Although real EM may diminish a company’s future worth (Bhojraj et al., Citation2009; Cohen & Zarowin, Citation2010), neither regulators nor auditors have the authority to stop a company from using real EM. Since real EM is subject to less scrutiny from regulators and auditors than accrual-based management, its costs are lower (Francis, Citation2011). According to Enomoto et al. (Citation2015), managers favor real EM over accrual-based EM in nations with higher investor protection. However, accrual-based EM would become quite attractive if the legal responsibilities of directors and officers were shifted (Chang & Chen, Citation2018). In addition, whether real earnings management is efficient or opportunistic is a question of many controversies (Gunny, Citation2010; Habib et al., Citation2022). Therefore, the choice of different means of EM should be further examined ().

Table 1. Basic differences between accruals-based earnings management and real earnings management.

Measurement of earnings management

The very first measure of accrual- based earnings management is proposed by Healy (Citation1985). The model was build on the assumption that nondiscretionary accruals are constant and discretionary one mean value is zero across the estimation period. The model calculated total accruals, taking into account CEO salaries and bonuses as factors influencing the earnings manipulation by the following equation:

where

depreciation in year t;

extraordinary items in year t;

change in accounts receivables in year t;

change in inventory in year t;

change in accounts payables in year t;

dummy variables =1(0) if bonus plan defined after (before) extraordinary items;

dummy variables =1(0) if bonus plan defined after (before) income taxes.

Following, Jones (Citation1991) employed lagged value to estimate the discretionary accruals. Then, the residuals of the model were determined by taking the actual minus the estimated values.

where:

Total accruals equal change in current assets minus change in current liabilities minus depreciation of firm i in year t;

Total assets of firm i in year t – 1;

Change in sales of firm i in year t;

Property, plant, and equipment of firm i in year t

Jones (Citation1991) proposed the most influential measure of accrual- based earnings management. After that, many scholars such as Dechow et al. (Citation1995) modified the Jones model to estimate discretionary and nondiscretionary accruals. Rather than exploiting accruals, real earnings management aims to beautiful firm performance by structuring real activities. Roychowdhury (Citation2006) was received much attention as he defined REM based on three equations, including the abnormal discretionary expenses, the abnormal production costs, and the abnormal cash flows from operations, are adopted to examine the level of real earnings management.

EquationEquation (1)(1)

(1) derives the abnormal discretionary expenses (REM_DISEXP) from the following formula:

(1)

(1)

Where:

DISEXPit: The sum of research and development expense, selling expense, general and administration expense of firm I in year t; research and development expense equals zero if not found; Ait-1: Total assets of firm i in year t-1; Salesit-1: Sales of firm i in year t-1; εit: disturbance term; α1, α2 are regression parameters.

EquationEquation (2)(2)

(2) estimates the abnormal production costs (REM_PROD) according to the formula below:

(2)

(2)

Where:

PRODit: The sum of the cost of goods sold and change in inventory of firm i in year t; Ait-1: Total assets of firm i in year t-1; Salesit: Sales of firm i in year t; ΔSalesit: Sales of firm i in year t less sales of firm i in year t-1; ΔSalesit-1: Sales of firm i in year t-1 less sales of firm i in year t-2; εit: disturbance term; α1, α2, α3, α4 are regression parameters.

EquationEquation (3)(3)

(3) calculates the abnormal cash flows from operations (REM_CFO) as follows:

(3)

(3)

Where:

CFOit: Cash flows from operations of firm i in period t; Ait-1: Total assets of firm i in year t-1; Salesit: Sales of firm i in year t; ΔSalesit: Sales of firm i in year t less sales of firm i in year t-1; εit: disturbance term; α1, α2, α3 are regression parameters.

Finally, the two proxies are employed to quantify the level of real earnings management as follows:

Fundamental theories relating to earnings management

Positive accounting theory

This theory delves into how organizational management selects accounting policies from various alternatives to comply with standards. The positive approach, pioneered by Watts and Zimmerman (Citation1986), focuses on explaining accounting practices undertaken by management and accountants without prescribing a specific subsequent practice for the company. The Positive theory provide three assumptions to clarify earnings management: (i) Compensation plans drive opportunistic behavior by using accounting methods to boost earnings and manager rewards; (ii) Debt contracts encourage managers to adopt policies enhancing income, facilitating favorable financing terms; (iii) The political process: This assumption anticipates that companies are more inclined to employ accounting options that decrease reported earnings, particularly larger companies.

Agency theory

Agency theory insists that the inclination to distort firm performance through accruals-based earnings management arises from opportunistic behavior among insiders (Haw et al., Citation2004; Shleifer & Vishny, Citation1997). In pursuit of self-interest, agents may employ tactics like inflating earnings to hide true corporate performance from principles (Leuz et al., Citation2003). Notably, Kim et al. (Citation2016) suggest that managers are less likely to conceal unfavorable news when financial statements exhibit higher comparability, limiting their room for earnings management. Enhanced comparability enables stakeholders to assess a firm’s true performance more accurately, diminishing the appeal of earnings manipulation, as transparent and comparable information increase the likelihood of detection (Gong et al., Citation2013; Engelberg et al., Citation2018).

Signaling theory

This theory argues that the presence of information asymmetry could also be why ethical corporations use financial information to send market signals (Ross, Citation1977). Information disclosed to the market by regulators serves as a positive signal by reducing information asymmetry. Despite market efficiency assumptions, the information gap between owners and management prompts managers to strategically choose accounting methods, potentially obscuring the true company value. According to Chevis et al. (Citation2007), managers might manipulate earnings to convey favorable or unfavorable information about the company’s future prospects to capital markets. In more details, manipulating earnings can act as a signal to investors, suggesting the likelihood of improved future earnings and cash flows. In the context of market information asymmetry, companies use their financial reporting to communicate favorable information to investors. Managers, driven by incentives to attract both existing and potential investors and enhance the overall positive perception of the corporation, may choose to voluntarily disclose extra accounting information, especially when involved in earnings management (Sun et al., Citation2010).

Previous bibliometric research on earnings management

There has been a limited review paper that used bibliometric methods to discuss EM. Vagner et al. (Citation2021) reviewed of 1547 publications on EM collected through the Web of Science (WoS) database. The paper showed the dramatic development and changes in EM research in different sub-periods: 1988–1997, 1998–2007, 2008–2017, and 2018 to the present. Their results also revealed the global financial crisis as an interesting factor influencing the rapid increase in EM research. Then, further studies should focus on the changes of EM behavior in the context of the deep recession caused by the COVID-19 pandemic. In addition, Teixeira and Rodrigues (Citation2022) also employed 4343 journals available in the WoS database between 1900 and 2020 to understand the emerging trends, the most influential authors, the most productive countries and journals in this area. The results of their bibliometric study highlighted the strong relationship between EM and corporate governance and information quality. Furthermore, this study proposed future research focusing on EM, measured by real activities.

So far, the bibliometric method has been utilized in some publications with a specific focus on Kumar et al. (Citation2023) and Sofian et al. (Citation2022) analyzed trends and outcomes of EM and corporate social responsibility (CSR) disclosure research. The study of Kumar et al. (Citation2023) emphasized the relationship between EM and CSR in three major aspects: reducing information asymmetry, meeting stakeholders’ expectations, and the role of corporate governance and other institutional factors. Sofian et al. (Citation2022) visualized the past, present, and future research for EM and CSR reporting based on the Scopus database. They shed light on future research directions on different EM and CSR approaches. In addition, Potharla and Dissanayake (Citation2022) conducted a bibliometric review of corporate governance, institutional ownership and EM. The study used keyword analysis to highlight the topical trends in this area.

Apart from prior bibliometric studies, my paper uses the Scopus database and a unique time frame (1993–2021). Then, I provide a systematic review of the literature on EM, offering clearer insights into different schools of thought and highlighting research gaps that indicate directions for future studies.

Research methodology

Data selection

The Scopus database was chosen in this research for several reasons. First, it provides wide coverage of high-quality journals and publications (Sofian et al., Citation2022; Zakaria et al., Citation2021). Second, it has more advanced capabilities to export data which is helpful for bibliometric analysis (Hallinger & Nguyen, Citation2020). Last, Norris and Oppenheim (Citation2007) stated that the Scopus database is one of the most expansive and diverse academic journal databases available.

Based on the Scopus database, a systematic search with the keywords ‘earnings management’ was identified with the title, abstract and keywords of publications. My query string is presented as follows:

TITLE (EARNINGS MANAGEMENT) AND (LIMIT-TO (DOCTYPE, ‘ar’)) OR LIMIT-TO (DOCTYPE, ‘cp’) OR LIMIT-TO (DOCTYPE, ‘ch’) OR LIMIT-TO (DOCTYPE, ‘bk’) AND (LIMIT-TO (SUBJAREA, ‘SOCI’)) AND (LIMIT-TO (LANGUAGE, ‘English’))

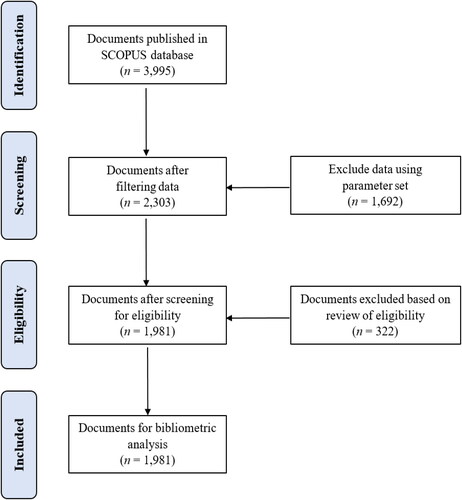

PRISMA screening

Based on the Preferred Reporting Items for Systematic Reviews and Meta- Analyses (PRISMA) guidelines (Liberati et al., Citation2009), the author implemented the search and screening process as shown in . Initially, a Scopus search produced 3995 documents. Among these, 1692 documents were excluded after the screening process because they did not meet the search criteria. In the next step, I reviewed the titles and abstracts to assess the topical relevance of each document. An additional 322 documents were removed from the Scopus list. As a result, 1981 Scopus-indexed publications of mixed types including articles, conference papers, books and book chapters were filtered and analyzed.

Bibliometric method and data analysis

The bibliometric method was defined by Pritchard (Citation1969, p. 349) as ‘the use of mathematical and statistical tools to articles and other forms of communication’. I utilize bibliometric analysis to capture the literature on EM. This method is very popular for scholars to discover the status and growth of scientific publications in the review areas (De Bakker et al., Citation2005; Lee & Hew, Citation2017; Kumar et al., Citation2020). In addition, it is widely used as a quantitative tool to provide descriptive results and a global picture of a specific topic in recent years (Merigo et al., Citation2015; Żarczyńska, Citation2012; Bui et al., Citation2023).

With the advent of VOSViewer developed by Van Eck and Waltman (Citation2010), I examine the similarities between different topics such as authors, countries, institutions, keywords and other bibliometric information. Van Eck and Waltman (Citation2014) confirmed ‘The number of co-occurrences of two keywords is the number of publications in which both keywords occur together in the title, abstract, or keyword list.’ Then, I expect to visualize the map and explain the EM topic more clearly.

Descriptive analysis and citation analysis are used in this review paper to provide the following bibliometric information: (1) The growth trajectory of publications; (2) Key authors; (3) Most cited papers, Leading countries and institutions; (4) Keywords co-occurrence network analysis. In addition, this research focuses on the fractional counting methodology instead of the ordinary full counting methodology as it is recommended by Van Eck and Waltman (Citation2014). In the case of the fractional counting methodology, highly cited publications play a less important role in constructing a bibliographic coupling network. In the same way, publications with a long reference list (e.g. review articles) play a less important role in the construction of a co-citation network.

Research results and discussions

RQ1. The total volume and growth trajectory of research on earnings management

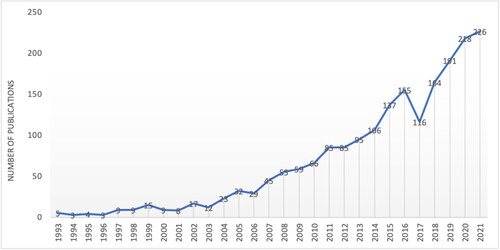

The 1981 Scopus-indexed publications spanning the past 28 years (1993–2021) show increasing knowledge of EM, particularly from 2017 to 2021. During 1993–2006, the EM study trend was relatively new, with a stagnant record of documents over the years, varying from 3 to 32 per year. Starting from 2006, the number of publications on EM grew quickly, with 45 documents in 2007, then the pace rose steadily, reaching 155 articles in 2016. Except for 2017, when there was a drop of published documents to 116 (compared to 155 in 2016), interest in the study of EM remained essentially steady from 2007 to 2021 (14 years, a total of 1083), averaging 120 documents each year. Between 1993 and 2006, there were 149 papers published. From 2007 to 2016, there were 327 articles published, while from 2016 to 2021, the number grew to 1,083. This rapidly developing period is evidenced by the fact that 54% of the literature in 28 years was produced in the 5 most recent years alone, between 2016 and 2021 (see ).

RQ2. The key authors in the earnings management literature

The list of most eminent authors is shown in after the threshold was set with the minimum number of documents of an author at 5 and the minimum number of citations of an author at 2. Based on the document number, the authors with the most articles are Kim Y. (10 documents, 365 citations), Alahadad M. (10, 180), Zhang H. (9, 529), Li L. (9, 166), Jarboui A. (9, 92). In terms of citations, the most cited author Kim J.-B. (1056) has published 8 documents. Meanwhile, Wang Y. and Jiraporn P., with the same number of documents published – have 412 and 316 citations each. Despite having the most documents (10 each) – Kim Y. and Alahadad M. only received 365 and 180 citations, respectively. Notably, for the same number of 5 publications, Cheng Q. and Lobo G.J. each received 874 and 554 citations, respectively.

Table 2. Key authors by citations and numbers of publications.

RQ3. Most influential papers, leading countries and institutions

Based on the top citations number, ‘Earnings management and investor protection: An international comparison’ (Leuz et al., Citation2003), ‘Audit committee, board of director characteristics, and earnings management’ (Klein, Citation2002) and ‘Earnings management through real activities manipulation’ (Roychowdhury, Citation2006) are the most influential papers in EM research. Leuz et al. (Citation2003) investigated systematic variations in earnings management among 31 nations, with conclusions confirming the relationship between corporate governance and reported earnings quality. Meanwhile, the second most influential paper of Klein (Citation2002) looked at the features of the audit committee and board about how the company manages its earnings. The study found negative relationships between abnormal accruals and the independence of the audit committee, and between abnormal accruals and board independence. The third most cited paper by Roychowdhury (Citation2006) proved that managers manipulate real activity to omit annual losses in financial reports. The author also found proof that real operations have been manipulated to fit yearly analyst projections. This is an important paper providing the measuring model for real EM that has been used in 1813 articles ().

Table 3. Most influential papers by citations.

The United States (582 publications), China (180), the United Kingdom (124), Australia (123), Taiwan (115), Malaysia (114), Indonesia (111), South Korea (104), Canada (88) and Spain (67) are among the top 10 leading nations as shown in . In terms of both documents and citations, papers from the United States have the leading number of citations at 41,123 articles with 582 publications. According to the number of publications, the other most significant writers are connected to China, the United Kingdom, Australia, Taiwan, Malaysia, Indonesia, South Korea, Canada, Spain, India, Hong Kong, Tunisia and Jordan, with at least 50 publications and 351 citations. Despite having the top number of publications, papers from Indonesia and India received a relatively small number of citations at 720 and 351, respectively. Meanwhile, at the 12th ranking, Hong Kong – with only 65 publications - has the second highest number of citations after the United States, at 7036.

Table 4. Leading countries by documents and citations.

Ranked by citation number, the top leading institutions publishing research on EM come from Hong Kong (5 institutions) and the United States (5 institutions), as shown in . The number of documents for each organization ranges from 3 to 5. Regarding publication number, the University of Houston, the University of California, Irvine, and the University of Iowa (United States) have a leading record with 5 documents each. Most notably, the Hong Kong University of Science and Technology has a leading number of citations at 1277 with 4 publications.

Table 5. The top 10 contributing institutions by citations.

RQ4. Four approaches to earnings management

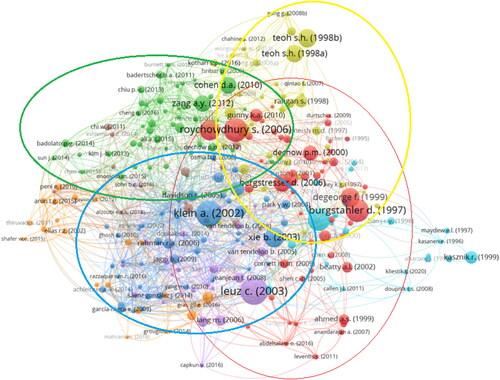

With a threshold of 50 minimum citations per document, the bibliographic coupling of documents results presented 264 documents grouped into 8 Clusters: Cluster 1 (50 documents), Cluster 2 (48), Cluster 3 (44), Cluster 4 (40), Cluster 5 (23), Cluster 6 (23), Cluster 7 (21), Cluster 8(15). Therefore, it can be recognized that earnings management literature focuses on four main conceptual themes ().

Figure 3. Science mapping of documents related to earnings management based on bibliographic coupling analysis between 1993 and 2021.Source: Extracted from VOSViewer with data from https://doi.org/10.7910/DVN/IA9LP1.

The first and largest cluster (red) showed the motives and characteristics of earnings management activities. Leading authors related to this school of thought include Roychowdhury (Citation2006) - 1813 citations, Burgstahler and Dichev (Citation1997) – 1680 citations, Cohen et al. (Citation2008) – 1277 citations, Degeorge et al. (Citation1999) – 1156 citations and Bergstresser and Philippon (Citation2006) – 976 citations. These scholars found evidence that managers use various earnings management tools: price discounts to boost sales in the current period, overproducing to decrease the cost of goods sold expense (Roychowdhury, Citation2006; Gunny, Citation2010), reducing research and development, selling, general, and administrative expenses to increase income (Gunny, Citation2010), bank loan loss provisions (Beatty et al., Citation2002; Kanagaretnam et al., Citation2010) or using derivatives and discretionary (or abnormal) accruals (Barton, Citation2001; Bergstresser & Philippon, Citation2006).

Numerous studies, including those by Schipper (Citation1989), Nia et al. (Citation2015) shed light on the two driving forces behind earnings management. The first stemmed from management’s opportunistic incentive to pursue a personal interest, while the second involved an efficiency incentive to enhance the company’s image and attract external stakeholders. These motivations could be explained by positive accounting theory and agency theory. Nevertheless, Healy and Wahlen (Citation1999) further classified managers’ motivations for engaging in earnings management into three distinct categories: Capital market motivation, Contracting motivations and Regulatory Motivations. Since then, Degeorge et al. (Citation1999), Das and Zhang (Citation2003) reported that firms manipulate earnings to meet analysts’ forecasts, disclose positive profits and maintain recent performance. Other authors focused on different issues and perspectives of EM. For example, the issuance of new regulations had a critical influence on firms’ level of earning management. Cohen et al. (Citation2008) documented that firms switched from an accrual-based approach to real earnings management methods after the passage of the Sarbanes-Oxley Act (SOX) in 2002. Using a sample of 91 EU-listed commercial banks over 10 years, Leventis et al. (Citation2011) also concluded that earnings management decreased after applying IFRS. In addition, EM is usually pronounced at firms where the CEO’s compensation is paid based on the market value of the shares and option holdings (Bergstresser & Philippon, Citation2006; Cornett et al., Citation2009).

The second largest (green) cluster focuses on real and accrual-based earnings management. Cohen and Zarowin (Citation2010) – 915 citations, the most frequently cited article, show firms’ choices of real versus accrual-based EM activities. They indicated that real EM is more difficult to detect than accrual EM. The next article, Zang (Citation2012) – 871 citations, found that trade-off EM methods based on their relative cost and the degree of accruals-based EM are driven by the actual level of real activities manipulation realized. Enomoto et al. (Citation2015) examined the two methods from the investor protection perspective. They revealed that managers tend to engage in real EM instead of accrual-based EM in countries with stronger investor protection. Other articles investigated the trade-off between real and accrual-based EM in different contexts, such as political connections (Braam et al., Citation2015), split share structure reform (Kuo et al., Citation2014), or firms with high audit quality (Burnett et al., Citation2012). However, many scholars used both measurements to detect earnings management (Veganzones et al., Citation2023). Nevertheless, the ongoing debate surrounding whether real earnings management is driven by efficiency or opportunism persists (Gunny, Citation2010; Habib et al., Citation2022). Hence, a more thorough exploration is needed to scrutinize the selection of alternative earnings management approaches.

The third largest (blue) cluster represents the relationship between corporate governance and earnings management. The most highly cited article is by Klein (Citation2002) – 2130 citations, who concluded that board or audit committee independence related negatively to abnormal accruals. Other scholars revealed that the role of backgrounds of board and audit committee members (Xie et al., Citation2003), the financial and governance expertise of audit committee members (Bédard et al., Citation2004), the size of the board of directors (Rahman & Mohamed Ali, Citation2006) affected the level of earnings management. In addition, ownership structure, especially institutional ownership significantly impacted on firms’ earnings manipulations (Chung et al., Citation2002; Koh, Citation2003; Cornett et al., Citation2008). Corporate governance is critical in addressing the agency problem and minimizing agency costs to enhance business performance and maximize shareholder wealth (Shleifer & Vishny, Citation1997; Duchin et al., Citation2010). Specially, Badolato et al. (Citation2014) and Nguyen et al. (Citation2024) proposed the advantages arising from better internal governance mechanism in lowering earnings management. Agency theory is useful to explain the association between corporate governance and earnings management.

The fourth cluster (yellow) focuses on earnings management and market performance. Teoh et al. (Citation1998a) – 1088 citations, the most highly cited article in this cluster, found that initial public offerings (IPOs) issuers with higher discretionary accruals had poorer stock return performance in the three years after that. Other highly cited articles are Teoh et al. (Citation1998b) – 977 citations, and Rangan (Citation1998) – 492 citations, which revealed this relationship before and after seasoned equity offerings (SEOs). In addition to analyzing the time of stock offers, scholars also demonstrate the impact of earnings management on stock prices in specific contexts such as financial distress (Beneish, Citation1997; Jaggi & Lee, Citation2002), stock swap announcements (Louis, Citation2004) and market repurchases (Gong et al., Citation2008). Managers engaging in earnings management to present better-than-expected financial results may use earnings manipulation as a signal to investors. This can create a positive perception in the short term, leading to an increase in stock prices as investors react favorably to apparent strong performance. On the other hand, consistent or severe earnings management may be interpreted as a negative signal. Investors may question the authenticity of reported financials, leading to a long-term erosion of trust. In this situation, stock prices may be adversely affected over time as investors become skeptical about the company’s financial health.

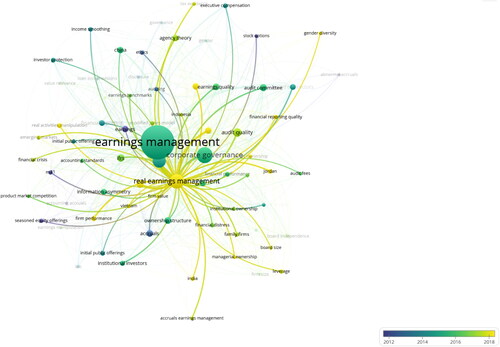

RQ5. Topical trends in earnings management literature

illustrates the network visualization map of the co-occurrence of keywords. The most recurring keywords are ‘earnings management’ (1270 occurrences), and ‘corporate governance’ (269 occurrences). These two ‘hot topics’ (big nodes) were mainly published from 2012 to 2016 and coincided with the first and third themes mentioned above. The lighter-shaded nodes present the latest topic trend and also address the research gaps by highlighting the frequency of occurrence of ‘real earnings management’, ‘gender diversity’, ‘family firms’, ‘leverage’, ‘Jordan’, ‘India’, ‘Indonesia’ and ‘Vietnam’.

Based on the co-occurrence network of keywords, this paper has successfully identified several gaps within the existing literature on earnings management. Firstly, the most frequent occurrence of the keyword ‘real earnings management’ reveals that we should consider different measurements of EM to mitigate earnings manipulation. The relationship between real and accrual-based EM is still a topic that draws much attention from scholars. While many studies such as Chang and Chen (Citation2018) documented a trade-off relationship, Li (Citation2019) indicated that firms may employ both EM strategies concurrently. Therefore, developing new models to detect EM techniques, for example, real EM to protect investors from financial risks due to distorted information is crucial. Secondly, due to the risk-averse nature of women, female managers are more cautious; therefore, gender diversity in supervisory boards and executives tends to curb real EM and improve earnings quality (Gull et al., Citation2018; Ghaleb et al., Citation2021; Li et al., Citation2021; Orazalin, Citation2020). However, further comprehensive research should be conducted on the impact of women’s involvement in management boards on real EM within various contexts, as these current studies have not yielded conclusive results (Li et al., Citation2021). Thirdly, family firms are playing an increasingly crucial role in the current global economy, and whether family firms are more or less likely to use real EM remains controversial. Eng et al. (Citation2019) highlighted that the levels of real EM differ between family and non-family firms, between the countries, and between crisis and non-crisis periods. While investigations into family firms have gained popularity in recent years, the role of EM, particularly real EM remains a mystery within the context of family firms (Al-Duais et al., Citation2019; Alhebri et al., Citation2021). Fourthly, although some studies have discussed the potential effects of EM on the leverage of the firms, there remains limited empirical evidence on this issue. Ajay and Madhumathi (Citation2015), An et al. (Citation2016), Dang et al. (Citation2021) observed a correlation between increased EM activities and higher firm leverage ratios. In addition, Anagnostopoulou and Tsekrekos (Citation2017) contributed to the literature by providing evidence that leverage and changes in leverage have a significantly positive impact on upward real EM as opposed to accrual-based EM. Nevertheless, Khalil and Ozkan (Citation2016) opposed that highly leveraged firms are unlikely to manipulate earnings to avoid high default risks. Consequently, the limited number of studies investigating this matter offer further research about EM and corporate debt levels. Last but not least, previous EM research has largely been focused on developed countries; however, recent studies have investigated more in ‘emerging markets’, such as Jordan, Vietnam, India, and Indonesia. It may improve understanding and guide most of the world deemed ‘developing’. Kliestik et al. (Citation2021) stated that each country’s cultural, social, and legal circumstances significantly impact the perception of EM. Furthermore, research on emerging markets has gained significant importance over the last two decades (Kumar et al., Citation2020), therefore, EM should be investigated and compared in emerging countries to help understand the different dimensions.

Conclusions and limitations

Concluding remarks

This research presents a structured review of the existing literature investigating the past, present and future of earnings management research. However, what set my paper apart from previous bibliometric research such as Vagner et al. (Citation2021), Teixeira and Rodrigues (Citation2022) is the 1981 Scopus–indexed publications and a unique time frame from 1993 to 2021. My database reveals quick growth in earning management research, indicating that 54% of the publications emerged during the last five years from 2016 to 2021, with a peak of 226 papers in 2021. Kim and Alahada were the two prominent contributors to EM research with 10 publications. The highest cited authors were Kim with 1056 times and 8 documents. Researchers from The United States, China, the United Kingdom and Australia frequently contribute to the journals. The most influential institution was Hong Kong University of Science and Technology measured by a leading number of citations at 1277 with 4 publications.

With a broader database from Scopus (1993–2021), my paper explores the four distinct themes of earnings management, each shedding light on more different facets of this complex phenomenon than the previous studies such as Vagner et al. (Citation2021), Teixeira and Rodrigues (Citation2022), Kumar et al. (Citation2023) and Sofian et al. (Citation2022). The largest cluster (red) focuses on the motives and characteristics of earnings management activities. Many scholars, including Burgstahler and Dichev (Citation1997), Degeorge et al. (Citation1999), Cohen et al. (Citation2008), Roychowdhury (Citation2006), and Bergstresser and Philippon (Citation2006), have contributed significantly to this school of thought. Their research highlights evidence of managers utilizing various earnings management tools, such as price discounts, overproduction, and expense adjustments, to manipulate reported financial results. The second cluster (green) delves into real and accrual-based earnings management, with Cohen and Zarowin (Citation2010) being the most cited. This cluster explores the challenges of detecting real earnings management compared to accrual-based methods and investigates the trade-offs between the two. The third cluster (blue) examines the relationship between corporate governance and earnings management, emphasizing the critical role governance plays in mitigating agency problems. Klein (Citation2002) leads this cluster, indicating a negative association between board or audit committee independence and abnormal accruals. The fourth cluster (yellow) centers on earnings management and market performance, revealing how discretionary accruals impact stock return performance, especially in IPOs and seasoned equity offerings. Understanding these clusters contributes to comprehending the multifaceted dynamics of earnings management. In addition, these findings could provide insights for regulators, policymakers, investors, and practitioners in their decisions. Regulators and policymakers may continue to contemplate, govern and legalize suitable guidelines to assist companies in providing high-quality financial reporting.

My findings contribute to a state-of-the-art overview of EM and address the research gaps for the coming years. The topics of ‘real earnings management,’ ‘gender diversity’, ‘family firms’, ‘leverage’ and different dimensions of EM in emerging markets could offer new insights. Firstly, the widespread use of ‘real earnings management’ emphasizes the need for different ways to measure EM and prevent manipulation. The complex relationship between real and accrual-based EM is a central theme, with some studies suggesting a trade-off and others indicating simultaneous use. Developing models to identify EM techniques, especially real EM, is crucial to protect investors from misleading information. Secondly, having more women in leadership roles seems to reduce real EM due to their cautious approach. However, we still need more conclusive research on the specific impact of women in curbing real EM. Thirdly, the role of family-owned businesses in EM, especially real EM, remains unclear. Further exploration of how EM affects a company’s borrowing levels, particularly in emerging markets, is needed for a comprehensive understanding. Therefore, this study might be useful for researchers to fill the existing knowledge gaps, and increase the quality of EM research shortly.

Limitations of the research

While this review provides valuable insights, it’s important to acknowledge its limitations. Firstly, the reliance on the Scopus database may mean that some relevant studies outside of this database were missed. The choice of using ‘earnings management’ as the sole keyword might overlook specific aspects covered by other keywords. Another limitation is the focus solely on ‘articles,’ potentially excluding insights from different types of publications. Lastly, bibliometric studies, like this one, may not capture the full qualitative context of the research. Researchers are encouraged to complement these findings with other research methods, like qualitative studies or meta-analyses, for a more thorough understanding of this interesting topic. Awareness of and addressing these limitations will contribute to a more comprehensive exploration of earnings management in the broader academic context.

Disclosure statement

No potential conflict of interest was reported by the author(s).

Data availability statement

The data that support the findings of this study are openly available at https://doi.org/10.7910/DVN/IA9LP1, Harvard Dataverse, V1, UNF:6:BDdjklqAgU6RPseEN + 6/DA== [fileUNF].

Additional information

Funding

Notes on contributors

Thu Hien Bui

Thu Hien Bui (PhD) is a senior lecturer and Vice Dean of the Faculty of Business Administration, Foreign Trade University, Hanoi, Vietnam. She has had many research papers published in local journals and reputable journals indexed in Scopus. Her main scientific activities are in the field of corporate finance, corporate governance and sustainability development. In addition, she is actively participating in many practical research projects to deliver knowledge to the public.

References

- Ajay, R., & Madhumathi, R. (2015). Do corporate diversification and earnings management practices affect capital structure? An empirical analysis. Journal of Indian Business Research, 7(4), 1–19. https://doi.org/10.1108/JIBR-01-2015-0008

- Al-Duais, S., Malek, M., & Abdul Hamid, M. A. (2019). Family ownership and earnings management in Malaysia. Journal of Advanced Research in Business and Management Studies, 15(1), 53–60. http://www. akademiabaru.com/doc/ARBMSV15_N1_P53_60.pdf

- Alhebri, A. A., Al-Duais, S. D., & Almasawa, A. M. (2021). The influence of independence and compensation of the directors on family firms and real earnings management. Cogent Economics & Finance, 9(1), 1934977. https://doi.org/10.1080/23322039.2021.1934977

- An, Z., Li, D., & Yu, J. (2016). Earnings management, capital structure, and the role of institutional environments. Journal of Banking & Finance, 68, 131–152. https://doi.org/10.1016/j.jbankfin.2016.02.007

- Anagnostopoulou, S. C., & Tsekrekos, A. E. (2017). The effect of financial leverage on real and accrual-based earnings management. Accounting and Business Research, 47(2), 191–236. https://doi.org/10.1080/00014788.2016.1204217

- Assenso-Okofo, O., Jahangir Ali, M., & Ahmed, K. (2021). The impact of corporate governance on the relationship between earnings management and CEO compensation. Journal of Applied Accounting Research, 22(3), 436–464. https://doi.org/10.1108/JAAR-11-2019-0158

- Athanasakou, V. E., Strong, N. C., & Walker, M. (2009). Earnings management or forecast guidance to meet analyst expectations? Accounting and Business Research, 39(1), 3–35. https://doi.org/10.1080/00014788.2009.9663347

- Barton, J. (2001). Does the use of financial derivatives affect earnings management decisions? The Accounting Review, 76(1), 1–26. https://doi.org/10.2308/accr.2001.76.1.1

- Beatty, A. L., Ke, B., & Petroni, K. R. (2002). Earnings management to avoid earnings declines across publicly and privately held banks. The Accounting Review, 77(3), 547–570. https://doi.org/10.2308/accr.2002.77.3.547

- Bédard, J., Chtourou, S. M., & Courteau, L. (2004). The effect of audit committee expertise, independence, and activity on aggressive earnings management. Auditing: A Journal of Practice & Theory, 23(2), 13–35. https://doi.org/10.2308/aud.2004.23.2.13

- Beneish, M. D. (1997). Detecting GAAP violation: Implications for assessing earnings management among firms with extreme financial performance. Journal of Accounting and Public Policy, 16(3), 271–309. https://doi.org/10.1016/S0278-4254(97)00023-9

- Bergstresser, D., & Philippon, T. (2006). CEO incentives and earnings management. Journal of Financial Economics, 80(3), 511–529. https://doi.org/10.1016/j.jfineco.2004.10.011

- Bhojraj, S., Hribar, P., Picconi, M., & McInnis, J. (2009). Making sense of cents: An examination of firms that marginally miss or beat analyst forecasts. The Journal of Finance, 64(5), 2361–2388. https://doi.org/10.1111/j.1540-6261.2009.01503.x

- Badolato, P. G., Donelson, D. C., & Ege, M. (2014). Audit committee financial expertise and earnings management: The role of status. Journal of Accounting and Economics, 58(2–3), 208–230. https://doi.org/10.1016/j.jacceco.2014.08.006

- Braam, G., Nandy, M., Weitzel, U., & Lodh, S. (2015). Accrual-based and real earnings management and political connections. International Journal of Accounting, 50(2), 111–141. https://doi.org/10.1016/j.intacc.2013.10.009

- Bruns, W., & Merchant, K. (1990). The dangerous morality of managing earnings. Management Accounting, 72(2), 22–25.

- Bui, T. H.,Tran, T. P. T.,Le, T. T. T.,Tran, T. K. A.,Bui, T. D., &Sinmanolack, S. (2023). Forty-five years of research on entrepreneurship education: A review and bibliometric analysis from the Scopus dataset. Journal of International Economics and Management, 23(2), 63–78. https://doi.org/10.38203/jiem.023.2.0070.

- Burgstahler, D., & Dichev, I. (1997). Earnings management to avoid earnings decreases and losses. Journal of Accounting and Economics, 24(1), 99–126. https://doi.org/10.1016/S0165-4101(97)00017-7

- Burnett, B. M., Cripe, B. M., Martin, G. W., & McAllister, B. P. (2012). Audit quality and the trade-off between accretive stock repurchases and accrual-based earnings management. The Accounting Review, 87(6), 1861–1884. https://doi.org/10.2308/accr-50230

- Chevis, G., Das, S., & Sivaramakrishnan, S. (2007). Does it pay to consistently meet analysts’ earnings expectations? Available at SSRN 982841

- Chang, C. C., & Chen, C. W. (2018). Directors’ and officers’ liability insurance and the trade-off between real and accrual-based earnings management. Asia-Pacific Journal of Accounting & Economics, 25(1–2), 199–217. https://doi.org/10.1080/16081625.2016.1253484

- Chung, R., Firth, M., & Kim, J. B. (2002). Institutional monitoring and opportunistic earnings management. Journal of Corporate Finance, 8(1), 29–48. https://doi.org/10.1016/S0929-1199(01)00039-6

- Cohen, D. A., Dey, A., & Lys, T. Z. (2008). Real and accrual-based earnings management in the pre- and post-sarbanes-oxley periods. The Accounting Review, 83(3), 757–787. https://doi.org/10.2308/accr.2008.83.3.757

- Cohen, D. A., & Zarowin, P. (2010). Accrual-based and real earnings management activities around seasoned equity offerings. Journal of Accounting and Economics, 50(1), 2–19. https://doi.org/10.1016/j.jacceco.2010.01.002

- Cornett, M. M., Marcus, A. J., & Tehranian, H. (2008). Corporate governance and pay-for-performance: The impact of earnings management. Journal of Financial Economics, 87(2), 357–373. https://doi.org/10.1016/j.jfineco.2007.03.003

- Cornett, M. M., McNutt, J. J., & Tehranian, H. (2009). Corporate governance and earnings management at large U.S. bank holding companies. Journal of Corporate Finance, 15(4), 412–430. https://doi.org/10.1016/j.jcorpfin.2009.04.003

- Dang, T. L., Dang, M., Le, P. D., Nguyen, H. N., Nguyen, Q. M. N., & Henry, D. (2021). Does earnings management matter for firm leverage? An international analysis. Asia-Pacific Journal of Accounting & Economics, 28(4), 482–506. https://doi.org/10.1080/16081625.2018.1540938

- Das, S., Kim, K., & Patro, S. (2011). An analysis of managerial use and market consequences of earnings management and expectation management. The Accounting Review, 86(6), 1935–1967. https://doi.org/10.2308/accr-10128

- Das, S., & Zhang, H. (2003). Rounding-up in reported EPS, behavioral thresholds, and earnings management. Journal of Accounting and Economics, 35(1), 31–50. https://doi.org/10.1016/S0165-4101(02)00096-4

- DeAngelo, L. (1986). Accounting numbers as market valuation substitutes: A study of management buyouts of public stockholders. The Accounting Review, 61, 400–420.

- De Bakker, F. G., Groenewegen, P., & Den Hond, F. (2005). A bibliometric analysis of 30 years of research and theory on corporate social responsibility and corporate social performance. Business & Society, 44(3), 283–317. https://doi.org/10.1177/0007650305278086

- Dechow, P. M., & Skinner, D. J. (2000). Earnings management: Reconciling the views of accounting academics, practitioners, and regulators. Accounting Horizons, 14(2), 235–250. https://doi.org/10.2308/acch.2000.14.2.235

- Dechow, P. M., & Sloan, R. G. (1991). Executive incentives and the horizon problem: an empirical investigation. Journal of Accounting and Economics, 14(1), 51–89.), https://doi.org/10.1016/0167-7187(91)90058-S

- Dechow, P. M., Sloan, R. G., & Sweeney, A. P. (1995). Detecting earnings management. Accounting Review, 70, 193–225.

- Degeorge, F., Patel, J., & Zeckhauser, R. (1999). Earnings management to exceed thresholds. The Journal of Business, 72(1), 1–33. https://doi.org/10.1086/209601

- Duchin, R., Matsusaka, J., & Ozbas, O. (2010). When are outside directors effective? Journal of Financial Economics, 96, 195–214.

- Dye, R. A. (1988). Earnings management in an overlapping generations model. Journal of Accounting Research, 26(2), 195–235. https://doi.org/10.2307/2491102

- Eng, L. L., Fang, H., Tian, X., Yu, T. R., & Zhang, H. (2019). Financial crisis and real earnings management in family firms: A comparison between China and the United States. Journal of International Financial Markets, Institutions and Money, 59, 184–201. https://doi.org/10.1016/j.intfin.2018.12.008

- Engelberg, J., Ozoguz, A., & Wang, S. (2018). Know thy neighbor: Industry clusters, information spillovers, and market efficiency. Journal of Financial and Quantitative Analysis, 53(5), 1937–1961. https://doi.org/10.1017/S0022109018000261

- Enomoto, M., Kimura, F., & Yamaguchi, T. (2015). Accrual-based and real earnings management: An international comparison for investor protection. Journal of Contemporary Accounting & Economics, 11(3), 183–198. https://doi.org/10.1016/j.jcae.2015.07.001

- Francis, J. R. (2011). A framework for understanding and researching audit quality. AUDITING: A Journal of Practice & Theory, 30(2), 125–152. https://doi.org/10.2308/ajpt-50006

- Friedlan, J. M. (1994). Accounting choices of issuers of initial public offerings. Contemporary Accounting Research, 11(1), 1–31. https://doi.org/10.1111/j.1911-3846.1994.tb00434.x

- Fudenberg, D., & Tirole, J. (1995). A theory of income and dividend smoothing based on incumbency rents. Journal of Political Economy, 103(1), 75–93. https://doi.org/10.1086/261976

- Ghaleb, B. A. A., Qaderi, S. A., Almashaqbeh, A., & Qasem, A. (2021). Corporate social responsibility, board gender diversity and real earnings management: The case of Jordan. Cogent Business & Management, 8(1), 1883222. https://doi.org/10.1080/23311975.2021.1883222

- Gong, G., Li, L., & Zhou, L. (2013). Earnings non-synchronicity and voluntary disclosure. Contemporary Accounting Research, 30(4), 1560–1589. https://doi.org/10.1111/1911-3846.12007

- Gong, G., Louis, H., & Sun, A. X. (2008). Earnings management and firm performance following open-market repurchases. The Journal of Finance, 63(2), 947–986. https://doi.org/10.1111/j.1540-6261.2008.01336.x

- Graham, J. R., Harvey, C. R., & Rajgopal, S. (2005). The economic implications of corporate financial reporting. Journal of Accounting and Economics, 40(1–3), 3–73. https://doi.org/10.1016/j.jacceco.2005.01.002

- Gull, A. A., Nekhili, M., Nagati, H., & Chtioui, T. (2018). Beyond gender diversity: How specific attributes of female directors affect earnings management. The British Accounting Review, 50(3), 255–274. https://doi.org/10.1016/j.bar.2017.09.001

- Gunny, K. A. (2010). The relation between earnings management using real activities manipulation and future performance: Evidence from meeting earnings benchmarks. Contemporary Accounting Research, 27(3), 855–888. https://doi.org/10.1111/j.1911-3846.2010.01029.x

- Habib, A., Ranasinghe, D., Wu, J. Y., Biswas, P. K., & Ahmad, F. (2022). Real earnings management: A review of the international literature. Accounting & Finance, 62(4), 4279–4344.

- Hallinger, P., & Nguyen, V. T. (2020). Mapping the landscape and structure of research on education for sustainable development: A bibliometric review. Sustainability, 12(5), 1947. https://doi.org/10.3390/su12051947

- Hamza, T., & Zaatir, E. (2021). Does corporate tax aggressiveness explain future stock price crash? Empirical evidence from France. Journal of Financial Reporting and Accounting, 19(1), 55–76. https://doi.org/10.1108/JFRA-01-2020-0018

- Haw, I., Hu, B., Hwang, L., & Wu, W. (2004). Ultimate ownership, income management, and legal and extra-legal institutions. Journal of Accounting Research, 42(2), 423–462. https://doi.org/10.1111/j.1475-679X.2004.00144.x

- Healy, P. M. (1985). The effect of bonus schemes on accounting decisions. Journal of Accounting and Economics, 7(1–3), 85–107. https://doi.org/10.1016/0165-4101(85)90029-1

- Healy, P. M., & Wahlen, J. M. (1999). A review of the earnings management literature and its implications for standard setting. Accounting Horizons, 13(4), 365–383. https://doi.org/10.2308/acch.1999.13.4.365

- Hepworth, S. (1953). Smoothing periodic income. The Accounting Review, 28(1), 32–39.

- Hong, N. T. P., & Linh, D. T. K. (2020). Effects of earnings management to investor decision–empirical evidence in Vietnam stock market. WSEAS Transactions on Environment and Development, 16, 84–97.

- Jaggi, B., & Lee, P. (2002). Earnings management response to debt covenant violations and debt restructuring. Journal of Accounting, Auditing & Finance, 17(4), 295–324. https://doi.org/10.1177/0148558X0201700402

- Jian, J., He, K., Liu, Y., & Sun, Y. (2023). Corporate social responsibility: opportunistic behavior under earnings management. Asia-Pacific Journal of Accounting & Economics, 1–22. https://doi.org/10.1080/16081625.2023.2170891

- Jones, J. J. (1991). Earnings management during import relief investigations. Journal of Accounting Research, 29(2), 193–228. https://doi.org/10.2307/2491047

- Kanagaretnam, K., Lim, C. Y., & Lobo, G. J. (2010). Auditor reputation and earnings management: International evidence from the banking industry. Journal of Banking & Finance, 34(10), 2318–2327. https://doi.org/10.1016/j.jbankfin.2010.02.020

- Khalil, M., & Ozkan, A. (2016). Board independence, audit quality and earnings management: Evidence from Egypt. Journal of Emerging Market Finance, 15(1), 84–118. https://doi.org/10.1177/0972652715623701

- Kim, J.-B., Li, L. Y., Lu, L. Y., & Yu, Y. X. (2016). Financial statement comparability and expected crash risk. Journal of Accounting and Economics, 61(2–3), 294–312. https://doi.org/10.1016/j.jacceco.2015.12.003

- Klein, A. (2002). Audit committee, board of director characteristics, and earnings management. Journal of Accounting and Economics, 33(3), 375–400. https://doi.org/10.1016/S0165-4101(02)00059-9

- Kliestik, T., Belas, J., Valaskova, K., Nica, E., & Durana, P. (2021). Earnings management in V4 countries: the evidence of earnings smoothing and inflating. Economic Research-Ekonomska Istraživanja, 34(1), 1452–1470. https://doi.org/10.1080/1331677X.2020.1831944

- Koh, P. S. (2003). On the association between institutional ownership and aggressive corporate earnings management in Australia. The British Accounting Review, 35(2), 105–128. https://doi.org/10.1016/S0890-8389(03)00014-3

- Kumar, S., Madhavan, V., & Sureka, R. (2020). The journal of emerging market finance: a bibliometric overview (2002–2019). Journal of Emerging Market Finance, 19(3), 326–352. https://doi.org/10.1177/0972652720944329

- Kumar, S., Sharma, A., Mishra, P., & Kaushik, N. (2023). Corporate social responsibility disclosures and earnings management: A bibliometric analysis. International Journal of Disclosure and Governance, 20(1), 27–51. https://doi.org/10.1057/s41310-022-00156-2

- Kuo, J. M., Ning, L., & Song, X. (2014). The real and accrual-based earnings management behaviors: Evidence from the split share structure reform in China. The International Journal of Accounting, 49(1), 101–136. https://doi.org/10.1016/j.intacc.2014.01.001

- Le, Q. L., Ha, H. H., Nguyen, T. M. P., & Doan, T. D. (2023). The association between upward and downward earnings management and equity liquidity: empirical evidence from non-financial firms listed in Vietnam. Cogent Business & Management, 10(2), 2211789. https://doi.org/10.1080/23311975.2023.2211789

- Lee, V. H., & Hew, J. J. (2017). Is TQM fading away? A bibliometric analysis of a decade (2006-2015). International Journal of Services, Economics and Management, 8(4), 227–249. https://doi.org/10.1504/IJSEM.2017.095450

- Leuz, C., Nanda, D., & Wysocki, P. D. (2003). Earnings management and investor protection: an international comparison. Journal of Financial Economics, 69(3), 505–527. https://doi.org/10.1016/S0304-405X(03)00121-1

- Leventis, S., Dimitropoulos, P. E., & Anandarajan, A. (2011). Loan loss provisions, earnings management and capital management under IFRS: The case of EU commercial banks. Journal of Financial Services Research, 40(1–2), 103–122. https://doi.org/10.1007/s10693-010-0096-1

- Li, L. (2019). Is there a trade-off between accrual-based and real earnings management? Evidence from equity compensation and market pricing. Finance Research Letters, 28, 191–197. https://doi.org/10.1016/j.frl.2018.04.021

- Li, X. J., Ahmed, R., Than, E. T., Ishaque, M., & Huynh, T. L. D. (2021). Gender diversity of boards and executives on real earnings management in the bull or bear period: Empirical evidence from China. International Journal of Finance & Economics, 28(3), 2753–2771. https://doi.org/10.1002/ijfe.2562

- Lisboa, I., & Kacharava, A. (2018). Does financial crisis impact earnings management evidence from Portuguese and UK. European Journal of Applied Business and Management, 4(1), 64–71.

- Louis, H. (2004). Earnings management and the market performance of acquiring firms. Journal of Financial Economics, 74(1), 121–148. https://doi.org/10.1016/j.jfineco.2003.08.004

- Merigo, J. M., Gil-Lafuente, A. M., & Yager, R. R. (2015). An overview of fuzzy research with bibliometric indicators. Applied Soft Computing, 27, 420–433. https://doi.org/10.1016/j.asoc.2014.10.035

- Mindak, M. P., Sen, P. K., & Stephan, J. (2016). Beating threshold targets with earnings management. Review of Accounting and Finance, 15(2), 198–221. https://doi.org/10.1108/RAF-04-2015-0057

- Liberati, A., Altman, D. G., Tetzlaff, J., Mulrow, C., Gøtzsche, P. C., Ioannidis, J. P. A., Clarke, M., Devereaux, P. J., Kleijnen, J., & Moher, D. (2009). Preferred reporting items for systematic reviews and meta-analyses: the PRISMA statement. Annals of Internal Medicine, 151(4), W65–W94. https://doi.org/10.7326/0003-4819-151-4-200908180-00135

- Nelson, M. W., Elliott, J. A., & Tarpley, R. L. (2002). Evidence from auditors about managers’ and auditors’ earnings management decisions. The Accounting Review, 77(s-1), 175–202. https://doi.org/10.2308/accr.2002.77.s-1.175

- Nia, M. S., Huang, C. C., & Abidin, Z. Z. (2015). A review of motives and techniques and their consequences in earnings management. Management and Accounting Review, 14(2), 1–28.

- Nguyen, H. A., Lien Le, Q., & Anh Vu, T. K. (2021). Ownership structure and earnings management: Empirical evidence from Vietnam. Cogent Business & Management, 8(1), 1908006. https://doi.org/10.1080/23311975.2021.1908006

- Nguyen, Q., Kim, M. H., & Ali, S. (2024). Corporate governance and earnings management: Evidence from Vietnamese listed firms. International Review of Economics & Finance, 89, 775–801. https://doi.org/10.1016/j.iref.2023.07.084

- Norris, M., & Oppenheim, C. (2007). Comparing alternatives to the web of science for coverage of the social sciences’ literature. Journal of Informetrics, 1(2), 161–169. https://doi.org/10.1016/j.joi.2006.12.001

- Orazalin, N. (2020). Board gender diversity, corporate governance, and earnings management: Evidence from an emerging market. Gender in Management, 35(1), 37–60. https://doi.org/10.1108/GM-03-2018-0027

- Palacios-Manzano, M., Gras-Gil, E., & Santos-Jaen, J. M. (2021). Corporate social responsibility and its effect on earnings management: an empirical research on Spanish firms. Total Quality Management & Business Excellence, 32(7–8), 921–937. https://doi.org/10.1080/14783363.2019.1652586

- Peek, E. (2004). The use of discretionary provisions in earnings management: Evidence from the Netherlands. Journal of International Accounting Research, 3(2), 27–43. https://doi.org/10.2308/jiar.2004.3.2.27

- Pipatnarapong, J. (2020). Essays on tax avoidance. Bangor University. research.bangor.ac.uk/portal/files/35135347/Essays_on_Tax_Avoidance_JP_500417753

- Porter, J. C., & Kraut, M. A. (2013). Do analysts remove earnings management when forecasting earnings? Academy of Accounting and Financial Studies Journal, 17(2), 95–108.

- Potharla, S., & Dissanayake, H. (2022). Institutional ownership, corporate governance and earnings management: A bibliometric analysis. IUP Journal of Corporate Governance, 21(3), 7–21.

- Prevost, A. K., Rao, R. P., & Skousen, C. J. (2008). Earnings management and the cost of debt. Available at SSRN 1083808.

- Prior, D., Surroca, J., & Tribó, J. A. (2008). Are socially responsible managers really ethical? Exploring the relationship between earnings management and corporate social responsibility. Corporate Governance: An International Review, 16(3), 160–177. https://doi.org/10.1111/j.1467-8683.2008.00678.x

- Pritchard, A. (1969). Statistical bibliography or bibliometrics. Journal of Documentation, 25, 348.

- Putman, R. L., Griffin, R. B., & Kilgore, R. W. (2009). The impact of earnings management on capital markets: Ethical consideration of the players. Journal of Legal, Ethical and Regulatory Issues, 12(1), 113–120.

- Rahman, R. A., & Mohamed Ali, F. H. (2006). Board, audit committee, culture and earnings management: Malaysian evidence. Managerial Auditing Journal, 21(7), 783–804. https://doi.org/10.1108/02686900610680549

- Rangan, S. (1998). Earnings management and the performance of seasoned equity offerings. Journal of Financial Economics, 50(1), 101–122. https://doi.org/10.1016/s0304-405x(98)00033-6

- Ronen, J., & Yaari, V. (2008). Definition of earnings management. Earnings Management, Book chapter 25–38.

- Roychowdhury, S. (2006). Earnings management through real activities manipulation. Journal of Accounting and Economics, 42(3), 335–370. https://doi.org/10.1016/j.jacceco.2006.01.002

- Ross, S. A. (1977). The determinants of voluntary financial structure: the incentives signalling theory approach. The Bell Journal of Economics, 8(1), 23–40. https://doi.org/10.2307/3003485

- Schipper, K. (1989). Earnings management. Accounting Horizons, 3(4), 91.

- Shleifer, A., & Vishny, R. W. (1997). A survey of corporate governance. The Journal of Finance, 52(2), 737–783. https://doi.org/10.1111/j.1540-6261.1997.tb04820.x

- Sofian, F. N. R. M., Mohd-Sabrun, I., & Muhamad, R. (2022). Past, present, and future of corporate social responsibility and earnings management research. Australasian Business, Accounting and Finance Journal, 16(2), 116–144. https://doi.org/10.14453/aabfj.v16i2.9

- Strakova, L. (2020). Earnings management in global background. In SHS Web of Conferences (Vol. 74, p. 01032). EDP Sciences.

- Sun, N., Salama, A., Hussainey, K., & Habbash, M. (2010). Corporate environmental disclosure, corporate governance and earnings management. Managerial Auditing Journal, 25(7), 679–700. https://doi.org/10.1108/02686901011061351

- Teixeira, J. F., & Rodrigues, L. L. (2022). Earnings management: a bibliometric analysis. International Journal of Accounting & Information Management, 30(5), 664–683. https://doi.org/10.1108/IJAIM-12-2021-0259

- Teoh, S. H., Welch, I., & Wong, T. J. (1998a). Earnings management and the long-run market performance of initial public offerings. The Journal of Finance, 53(6), 1935–1974. https://doi.org/10.1111/0022-1082.00079

- Teoh, S. H., Welch, I., & Wong, T. J. (1998b). Earnings management and the underperformance of seasoned equity offerings. Journal of Financial Economics, 50(1), 63–99. https://doi.org/10.1016/s0304-405x(98)00032-4

- Tran, K. H., & Duong, N. H. (2020). Earnings management to avoid earnings decreases and losses: Evidence from Vietnamese listed companies. Cogent Economics & Finance, 8(1), 1849980. https://doi.org/10.1080/23322039.2020.1849980

- Veganzones, D., Séverin, E., & Chlibi, S. (2023). Influence of earnings management on forecasting corporate failure. International Journal of Forecasting, 39(1), 123–143. https://doi.org/10.1016/j.ijforecast.2021.09.006

- Vagner, L., Valaskova, K., Durana, P., & Lazaroiu, G. (2021). Earnings management: A bibliometric analysis. Economics & Sociology, 14(1), 249–262. https://doi.org/10.14254/2071-789X.2021/14-1/16

- Van Eck, N., & Waltman, L. (2010). Software survey: VOSviewer, a computer program for bibliometric mapping. Scientometrics, 84(2), 523–538. https://doi.org/10.1007/s11192-009-0146-3

- Van Eck, N. J., & Waltman, L. (2014). Visualizing bibliometric networks. In Y. Ding, R. Rousseau, & D. Wolfram (Eds.), Measuring scholarly impact: Methods and practice (pp. 285–320). Springer International Publishing.

- Watts, R. L. & Zimmerman, J. L. (1986). Positive Accounting Theory. Prentice-Hall Inc. Available at SSRN: https://ssrn.com/abstract=928677

- Xie, B., Davidson, W. N., & Dadalt, P. J. (2003). Earnings management and corporate governance: The role of the board and the audit committee. Journal of Corporate Finance, 9(3), 295–316. https://doi.org/10.1016/S0929-1199(02)00006-8

- Zakaria, R., Ahmi, A., Ahmad, A. H., & Othman, Z. (2021). Worldwide melatonin research: a bibliometric analysis of the published literature between 2015 and 2019. Chronobiology International, 38(1), 27–37. https://doi.org/10.1080/07420528.2020.1838534

- Zang, A. Y. (2012). Evidence on the trade-off between real activities manipulation and accrual-based earnings management. The Accounting Review, 87(2), 675–703. https://doi.org/10.2308/accr-10196

- Żarczyńska, A. (2012). Nicola De Bellis: Bibliometrics and citation analysis, from the science citation index to Cybermetrics, Lanham, Toronto, Plymouth 2009. Toruńskie Studia Bibliologiczne, 5(8), 1–3. https://doi.org/10.12775/TSB.2012.009