?Mathematical formulae have been encoded as MathML and are displayed in this HTML version using MathJax in order to improve their display. Uncheck the box to turn MathJax off. This feature requires Javascript. Click on a formula to zoom.

?Mathematical formulae have been encoded as MathML and are displayed in this HTML version using MathJax in order to improve their display. Uncheck the box to turn MathJax off. This feature requires Javascript. Click on a formula to zoom.Abstract

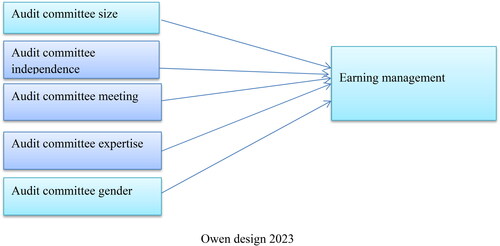

One of the key components of corporate governance frameworks, the audit committee is a potent instrument for controlling and supervising earning management. It might significantly affect how decisions about internal firm-board monitoring are made. The purpose of this study was to investigate the impact of audit committee features on the earning management of insurance businesses in Ethiopia from 2015 to 2022. The impact of audit committee features on earning management was studied using the generalized moment (GMM) model. According to the study, the size of the audit committee (ACS) has a significant and positive impact on the insurance companies’ earnings management in Ethiopia. Additionally, the study discovered that the audit committee’s independence (ACI), expertise (ACE), meeting (ACM), and gender (ACG) all have a significant and positive impact on the earning management of insurance companies in Ethiopia. Thus, the study came to the conclusion that all audit committee characteristic measures have a significant impact on the discretionary accrual (DA)-measured earning management of insurance businesses in Ethiopia. Therefore, the internal governance mechanisms should be strengthened and improved by insurance company policymakers in Ethiopia.

IMPACT STATEMENT

The topic of earnings management has been the subject of discussion by researchers around the world for many decades. The earnings management is the use of accounting techniques to produce financial statements that present an overly positive view of a company’s business activities and financial position. Based on previous literature, the factors that influence earnings management have been subjected to extensive investigations in developed countries; one of the most important factors was the audit committee characteristics. This paper aims to illustrate the effect of audit committee characteristics on the earning management of insurance companies in Ethiopia and provide additional insights into the literature of emerging markets. The results indicate strong evidence for the important role of audit committee characteristics in explaining the differences in earning management. Therefore, the internal governance mechanisms should be strengthened and improved by insurance company policymakers in Ethiopia.

1. Introduction

The audit committee is seen as an impartial entity within an organization that gives third parties assurance that the business is run ethically. The internal and external auditors are the first line of defense in ensuring that good governance practices are in place; hence, the audit committee communicates often with both of these groups (Abbott et al., Citation2010). The main goal of creating an audit committee is to complete the governance requirements for a public business and to serve as a vehicle for monitoring the protection of stakeholders’ interests, particularly those of minority owners. Audit committees now play a more significant part in society. The duties of the audit committee members have grown significantly over time (Rezaee et al., Citation2003). Today’s businesses operate in higher-risk environments and are under more intense public scrutiny. The public’s knowledge of corporate governance issues is growing, so members of the audit committee must exercise diligence in carrying out their responsibilities.

In addition to the general business environment, corporate governance has had a considerable impact on the accounting and auditing professions. Since several large local and international businesses have experienced financial failures, interest in the function of audit committees has grown (Hamdan & Mushtaha, Citation2011). Audit committees are a tool of corporate governance whose goal is to increase the questioning of the board of management and to increase the role of audit and its independence. Additionally, there has been an increase in organizational interest in the audit committee’s function in preparing financial reports during the past few years (Pucheta-Martínez & Fuentes, Citation2007). While Pucheta-Martínez and Fuentes (Citation2007) discovered that an audit committee would be more active in the process of monitoring financial statements and limiting the differences between the management and the external auditor. Wild (Citation1994) found that the existence of an audit committee emerging from the management councils of such companies depends on the credibility and fairness of financial reports issued by companies. By doing this, the likelihood that the company will receive qualified comments from the external auditor due to accounting errors or a lack of adherence to accounting rules is decreased.

The efficacy of internal control and management disclosure are closely watched by the audit committee (Bilal et al., Citation2018; Kao & Chen, Citation2019). The stated rationale is that the board of directors and senior management, who set what has come to be known as management’s tone of authority for every company, should serve as the foundation of the internal control environment. Additionally, according to a number of studies (Gleason et al., Citation2017; Nazir & Afza, Citation2018; Sam’ani, Citation2008), the audit committee is in charge of monitoring financial reports, overseeing external audits, and keeping an eye on how the internal control system (including internal audit) can lessen the opportunistic nature of management that performs earnings management.

Financial statements no longer accurately reflect a company’s core value as a result of attempts to manipulate information through earnings management practices (Chu et al., Citation2019; Jao & Pagalung, Citation2011; Zgarni et al., Citation2016). As a result, the misuse of information that is harmful to interested parties has made the analysis of financial statements a major problem. Because of this, occasionally obtained information does not correspond to the actual terms of the company. The techniques of income smoothing, taking a bath, and income maximization can all be used to control earnings (Scott, Citation2012). Earning management is frequently carried out by management (agents), according to Ibrani et al. (Citation2019), to raise firm value so that firm value looks good in the eyes of investors. It appears that investors are aware of the policy since earnings management is seen as a manager’s technique that tries to raise firm value.

According to Abbott and Parker (Citation2000), the audit committee’s sheer existence does not ensure that it will serve as a useful monitoring body; its qualities should be given additional thought. As a result, corporate governance standards establish specific qualities for the audit committee’s composition and structure in order to guarantee its performance. Therefore, improved audit quality has the ability to reduce reported profits uncertainty by limiting earnings management. Investors have a better ability to identify a firm’s genuine value because earnings management practices are limited. A management agency dilemma arises when managers employ earnings management to either maximize their own interests or the interests of the company’s shareholders (Jensen, Citation2005; Leuz et al., Citation2003).

The monitoring processes are intended to balance the interests of shareholders and management and to reduce any ensuing conflicts of interest and opportunistic behavior, in accordance with agency theory. The audit position lessens information asymmetry and conflicts of interest between management and shareholders, according to Arens et al. (Citation2010). The audit committee is viewed as a monitoring mechanism created to lessen information asymmetries between management and stakeholders because one of its main duties is to improve the quality and accuracy of financial information by continuously monitoring the management’s opportunistic behaviors (Li et al., Citation2012). The effectiveness of the audit committee is largely dependent on its characteristics Bédard and Gendron (Citation2010), Dhaliwal et al. (Citation2010), and Li et al. (Citation2012). To support the audit committee’s capacity to identify and avoid earnings management, the ideal audit committee size as well as a good combination of talents and expertise is important.

Prior research has shown that audit committees improve reported profit quality and lessen internal control weaknesses (Klein, Citation2002). Few studies, however, have looked at the audit committee’s contribution to improved performance in emerging economies. Among these Fan and Wong (Citation2005), revealed that the corporate governance tools like audit committees fall short of resolving agency issues in emerging markets, particularly those involving minority and controlling shareholders. Additionally, the monitoring systems that could lessen agency conflicts are constrained in emerging countries due to concentrated ownership (Jensen & Meckling, Citation1976). In order to lessen agency issues in emerging economies, it is therefore suggested that audit committees be employed as a governance monitoring method.

According to academic researchers, evaluating an audit committee’s quality solely based on its size, expertise, meetings, or independence is insufficient because these features work best when combined; focusing on one and ignoring the other will make the audit committee ineffective Al-Dhamari et al. (Citation2018) and Connelly et al. (Citation2012). Saleh et al. (Citation2007) also come to the conclusion that until the audit committee meets regularly, audit committee independence would not be sufficient to discourage accrual-based earnings management (AEM) in Malaysian enterprises. According to Bajra and Čadež (Citation2018), having audit committee is crucial, but it is insufficient on its own to guarantee high-level monitoring. Furthermore, Al-Sayani et al. (Citation2020) study on the impact of audit committee features on impression management ignored the effect of audit committee gender diversity instead focused on audit committee size, independence, expertise, and meetings. Therefore, this research is aimed at examining the association between audit committee characteristics and the earnings management of insurance companies in Ethiopia, including more audit committee characteristics.

The association between audit committee features and earning management in developing markets has also been studied in the past; however, emerging markets are not taken into consideration. Among them, Klein (Citation2002) and Zhang et al. (Citation2007) examine how the characteristics of audit committees affect the earnings management of businesses in industrialized nations. Additionally, Al-Jalahma (Citation2022) investigated the relationship between Bahraini enterprises’ performance and the attributes of their audit committees. The impact on earning management was not examined in the study. The impact of audit committee features on corporate governance disclosure data from listed businesses in Vietnam was investigated by Hong Hanh Ha (Citation2022). The impact on the management of earnings is not evaluated again in the study. Moreover, audit committee gender was not included in the study by Cheung and Chung (Citation2022), with the title of the impact of audit committee expertise on actual earnings-management evidence from Hong Kong despite the fact that audit committee gender has a significant impact on earning management and is included in this study as an independent variable that affects earning management.

The impact of corporate governance on the financial performance of insurance companies in the emerging economy: The case of Ethiopian insurance companies was explored by Abebe Zelalem et al., (Citation2022). The study shows the relationship between corporate governance mechanisms like board size, management soundness, dividend policy, debt, board remuneration, and financial disclosure on financial performance and the study even does not incorporate the audit committee as a corporate governance mechanism and not seen their effect on earning management. Therefore, there is still a research gap in emerging markets like Ethiopia because there has been no study conducted on the relationship between audit committee characteristics and earning management, and previous studies included one while ignoring the other proxies of audit committee characteristics that make the audit committee ineffective. Thus, this study investigates the effect of audit committee characteristics on the earning management of insurance companies in Ethiopia incorporating more audit committee characteristics with the following objectives and research questions:

RQ1: To investigate the effect of audit committee size on the earning management of insurance companies in Ethiopia.

RQ2: To assess the effect of audit committee independence on the earning management of insurance companies in Ethiopia.

RQ3: To examine the effect of audit committee meetings on the earning management of insurance companies in Ethiopia.

RQ4: To determine the effect of audit committee expertise on the earnings management of insurance companies in Ethiopia.

RQ5: To identify the effect of audit committee gender on the earning management of insurance companies in Ethiopia.

2. Background

Real earnings management and accrual earnings management are two types of earnings management. Accrual earnings management is the manipulation of earnings by managers through the flexibility of accounting techniques and estimates. Strong abilities in accounting and financial treatment of transactions are necessary for accruals and earnings management, which may be effectively curtailed by professional qualifications and knowledge. According to earlier research, the audit committee’s specialists in accounting, finance, industry, and law discouraged accrual earnings management (Bédard & Gendron, Citation2010; R. Cohen et al., Citation2014; Krishnan et al., Citation2011). Real earnings management has received less investigation than accrual earnings management (Zang, Citation2012). Real earnings management, however, decreases future operating performance (Gunny, Citation2010) and investment efficiency (Cohen et al., Citation2008), which lowers returns to shareholders. The boards, especially the audit committees, have the responsibility to supervise actual earnings management since they are in charge of the total returns and the calibre of financial reporting for shareholders.

One of the most powerful committees is the audit committee, which influences corporate governance, works with the board of directors to support the board in carrying out its supervisory duties over management, reduces information asymmetry between managers and shareholders, reduces agency costs, and produces transparent financial reports. The majority of the unrestricted board members who serve as intermediaries between internal and independent auditors make up the audit committee (Habib & Bhuiyan, Citation2016).

According to Bédard and Gendron (Citation2010), the audit committee can also stop financial restatement indirectly by overseeing independent auditing and internal controls and directly by keeping an eye on financial reporting. Generally speaking, we could increase investor confidence in the calibre of financial reporting and the effectiveness of the financial markets by strengthening the quality of the information and enforcing strict controls. In addition, the audit committee is essential in overseeing management disclosure and internal control efficacy (Bilal et al., Citation2018; Kao & Chen, Citation2019), (Bédard & Gendron, Citation2010; Zalata et al., Citation2018) because they are experts, that can exert influence over managers. Moreover, the financial specialists on the audit committee are more knowledgeable about the limits of earnings management and the suitability of managers’ accounting decisions (Li et al., Citation2012). The audit committee is in a stronger position to demand that managers carefully evaluate the propriety of their accounting treatment and the use of expenditures because of their authority derived from their financial competence.

The division of management and ownership emphasizes the necessity of a top-notch audit. The agency dilemma arises when managers deviate from their obligation to safeguard and advance the interests of shareholders (Jensen & Meckling, Citation1976). The purpose of the board of directors and audit committees is to keep an eye on management conduct and make sure that managers behave in the shareholders’ best interests. This illustrates the agency theory viewpoint (Fama & Jensen, Citation1983) that audit committees can lessen the conflict of interest between management and shareholders. The board of directors’ audit committee performs some of the duties of the board in its capacity as a committee. It is a statutory commission tasked with monitoring companies’ financial reporting procedures to guarantee the quality of financial reporting (Ormin et al., Citation2015).

The qualities of the audit committee have a significant impact on how effective it is. An optimal audit committee size and a well-rounded mix of skills and knowledge are critical to bolstering the committee’s ability to spot and steer clear of profit manipulation (Li et al., Citation2012). Thus, the purpose of this study is to evaluate how well audit committees work in Ethiopian insurance businesses to stop or restrict managers’ manipulation of earnings. As a result, the study helps legislators, regulators, and corporate boards evaluate how well audit committees ensure the quality of earnings.

3. Theoretical literature review

3.1. Agency theory

Conflicts of interest between owners and managers while using business authority were discussed by Jensen and Meckling, (Citation1976). The owner’s desire for a strong return on investment is the root of this conflict, and it has put pressure on managers to find ways to boost revenues and dividends to shareholders. When they produce strong business results, managers will receive executive bonuses and benefits. In order to assure the fulfillment of the aforementioned conditions, managers can apply earnings management (Nyberg et al., Citation2010). Enterprises must have a strong corporate governance framework or the involvement of foreign investors to strengthen control over business performance in order to minimize this behavior (Cornett et al., Citation2009; Krishnan, Citation2003; Shen & Chih, Citation2007).

Agency theory is used in studies to support the link between corporate governance and earnings management. Al-Haddad and Whittington (Citation2019), for instance, stress the importance of corporate governance as a means of reducing agency conflict and balancing the interests of owners and managers. In order to provide managers with adequate welfare policies and to impose limits on their self-interested behavior, corporate governance will fulfill the job of monitoring and evaluating management quality. This viewpoint is shared by Tjaraka et al. (Citation2022), who claim that as male CEOs exhibit more profitable managerial behaviors than female CEOs, an efficient corporate governance framework is required to keep an eye on the CEOs and prevent exaggeration of business success.

Since managers are driven to manipulate earnings to increase their bonuses, compensation, and commissions all of which are directly correlated with the profitability of the company and agency theory explains the motive for earnings management (Booth & Schulz, Citation2004; Shapiro, Citation2005). According to agency theory, audit committees are crucial mechanisms that ensure management is working to increase and extend the wealth of all shareholders (Al-Matari et al., Citation2016). The role of the audit committee lessens information asymmetry, which aids in reducing and resolving agency problems (Aldaoud, Citation2015). Turley and Zaman (Citation2004) go on to describe how, in light of the yearly financial reporting, the efficacy of external auditing, and internal control, the audit committee’s successful oversight protects the interests of shareholders.

In addition, the establishment of an audit committee serves as a governance instrument to successfully lessen conflicts that result from the division of ownership and control and impact earning management (Abbott & Parker, Citation2000). According to agency theory, an audit committee of independent directors is able to resolve conflicts among internal managers, thereby enhancing corporate governance and earning management (Fama & Jensen, Citation1983). Accordingly, agency theory proposes that the earning management of enterprises is significantly impacted by the audit committee’s qualities, including its size, independence, gender diversity, expertise, and meetings.

3.2. Institutional theory

According to Tallaki and Bracci (Citation2019), institutional theory is the predominant viewpoint in relation to organization and management in the enterprise. Old Institutional Theory and New Institutional Theory are the two main schools of thought within the theory. In order to influence people’s actions and beliefs, the first perspective of the theory focuses on defining the norms and values of the rules. According to Cohen et al. (Citation2008), who base their claim on institutional theory, the audit committee mostly performs ceremonial duties and is not always vigilantly monitored. Additionally, Beasley et al. (Citation2000) found that audit committee oversight varied from active, substantive monitoring to more ceremonial duties, and that it frequently was fairly inadequate.

In addition to this study, Bruynseels and Cardinaels (Citation2014) provide archival evidence to support their findings that friendship ties among audit committee management are related to better earnings management, lower audit fees, a lower likelihood of receiving a going concern opinion, and a lower likelihood of disclosing internal control deficiencies. Similar findings are made by Krishnan et al. (Citation2011) when they examine the relationship between audit and director-CEO and CFO social relationships. They offer proof that they are related to less accurate financial reporting and a higher likelihood of fraud, which is in line with managerial hegemony and institutional theory. According to a recent study by Wilbanks et al. (Citation2017), the audit committee appears to be less alert regarding the danger of fraud and the assessment of management integrity when the CEO has social relationships with the committee. Greater earnings management might be made possible by such decreased audit committee scrutiny. Consequently, Bruynseels and Cardinaels (Citation2014) suggested that there is a substantial correlation between audit committee attributes and earning management that is confirmed by institutional theory.

4. Empirical literature review and hypothesis development

4.1. Audit committee size

There are two points of contention about the relationship between the size of the audit committee and the management of earnings: is a smaller audit committee better or is a larger audit committee better? A smaller audit committee is preferable since it allows the board to act quickly and has less communication and free-rider issues (Bliss, Citation2011). On the other hand, a larger audit committee may be better than smaller audit committee because it has more competence (Bliss, Citation2011). According to an earlier study on the impact of audit committee size, smaller audit committees are preferable because they can reduce earnings management (Carcello et al., Citation2006). The number of audit committee members and earnings management, however, was not found to be significantly correlated Baxter and Cotter (Citation2009). This finding demonstrates that the size of the audit committee has no discernible impact on how earnings are managed. However, Sun et al. (Citation2014) found that a larger audit committee has no impact on the management of earnings.

The audit committee member does not significantly affect the management of earnings, according to Setiawan et al. (Citation2020). However, H. Galal et al., (Citation2022), found that the audit committee significantly impairs the management of earnings. Additionally, Jensen (Citation2010) discovered that smaller audit committees perform better because they can react more swiftly than bigger audit committees. As a result, it is anticipated that a smaller audit committee will be more effective in limiting earnings management. Furthermore, Ghosh et al. (Citation2010) discovered that earnings management, as determined by discretionary accruals, is significant in companies with small audit committees. This suggests that a small audit committee is more efficient in terms of financial reporting and monitoring and possesses the necessary skills and knowledge. Salihi and Jibril (Citation2015) found a strong correlation between the size of earning management and the composition of the audit committee. This is in line with the agency hypothesis, which contends that a sizable audit committee might have more independent members, improving management oversight and raising the standard of financial reporting. Sun et al. (Citation2014) haven’t, however, offered enough evidence to back up the idea that the audit committee’s size limits actual earning management. This study developed the following hypothesis based on the theoretical justifications and empirical studies mentioned above:

H1: Audit committee size has a significant negative effect on the earning management of insurance companies in Ethiopia.

4.2. Audit committee independence

Academicians and professionals have emphasized the significance of the audit committee’s independence in controlling the earning management. In a meta-analysis of 27 studies, Pomeroy and Thornton (Citation2008), found that audit committee independence is the most frequently used indicator of an audit committee’s effectiveness and that there is general agreement that it raises the caliber of financial reporting. As a result, a growing body of research has examined the connection between managerial financial reporting choices and audit committee independence as a key component. The existing research does, however, present conflicting views on the nature of this link. The independence of the audit committee is found to be negatively correlated with anomalous accruals. Businesses with a majority of independent audit committee members have much fewer abnormal accruals, according to Davidson et al. (Citation2005). However, this conclusion did not hold true for audit committees that were entirely independent.

Lydia Nelwan and Tansuria (Citation2019) found a strong but adverse association between audit committee independence and earnings management practices and no association was found between the audit committee’s independence and earnings management, according to Habbash (Citation2019). Additionally, Masmoudi and Makni (Citation2020) examined the impact of audit committee characteristics on real earnings management in the Dutch context, which included 80 non-financial companies listed on the Amsterdam Stock Exchange between 2010 and 2017. They discovered that audit committee independence has a significant and favorable impact on real earnings management.

Evidence was presented by Yunos (Citation2011) to support the claim that discretionary accruals and independent audit committee members are significantly correlated. The impact of audit committee independence on earnings management is examined by Salleh and Che Haat (Citation2014). Compared to the pre-revised Malaysian Code on Corporate Governance 2007 period, they discovered that audit committee independence in the post-revised Malaysian Code on Corporate Governance 2007 period was more successful in restricting earning management. Al-Rassas and Kamardin (Citation2016) discovered a strong and direct correlation between accruals earning management and the independent audit committee. Furthermore, Sharma and Kuang (Citation2014) discovered that income management is significantly impacted by the independence of the audit committee. Therefore, the study’s hypothesis is as follows, based on the aforementioned arguments:

H2: Audit committee independence has a significant and positive effect on the earning management of insurance companies in Ethiopia.

4.3. Audit committee meeting

According to numerous studies, effective monitoring requires that audit committees meet frequently throughout the fiscal year. They are better equipped to carry out their supervisory duties the more regularly they meet (Abbott et al., Citation2004; Xie et al., Citation2003). Studies have looked at the connection between earnings management and audit committee sessions. However, the studies were produced contradictory findings, which they attribute to variations in corporate governance practices across nations due to diverse legal systems, cultural norms, and political issues in each nation. Abbott et al. (Citation2000), Lin and Hwang (Citation2010), and Metawee (Citation2013) found a substantial inverse relationship between the practices of earnings management and audit committee meeting. Rajpal (Citation2012), Yang and Krishnan (Citation2005), and Bédard et al. (Citation2004) showed no correlation between the frequency of audit committee meetings and the level of earnings management. Additionally (Rakhmayani & Faisal, Citation2019), found the more the intense the audit committee meeting the more earning management. In Latin America, Sáenz González and García-Meca (Citation2014) found a correlation between fewer audit committee meetings and poorer earnings management. However, Katmon and Al Farooque (Citation2017) discovered a connection between high discretionary accrual and audit committee sessions. In light of the aforementioned arguments, this study’s hypothesis was formulated as:

H3: Audit committee meetings have a significant and positive impact on the earnings management of Ethiopian insurance companies.

4.4. Audit committee expertise

Audit committees are in charge of overseeing the process of financial reporting and making sure that financial statements are accurate. Members of the audit committee should have some knowledge of finance. Al Shbail et al. (Citation2022) studied on the moderating effect of job satisfaction on the relationship between human capital dimensions and internal audit effectiveness. The study found that expertise has significant and positive effect on internal audit effectiveness. According to Baxter and Cotter (Citation2009), the audit committee’s depth of knowledge might result in better financial reporting. According to Hamdan et al. (Citation2013), audit committee members having the necessary abilities, credentials, specialization, and accounting and financial knowledge enhance the efficacy of the audit process and guarantee the accuracy of financial reporting. Alodat et al. (Citation2023) studied on the relationship between audit committee effectiveness and firm performance: The moderating role of sustainability disclosure and found that accounting expert has significant and positive effect on the firms performance measured both by ROA and ROE. Market participants respond favorably to the formation of audit committees with financial experience in accounting, but no reaction has been found for audit committees with non-accounting skills DeFond and Francis (Citation2005). Thus, the committee’s oversight powers are strengthened and investors are persuaded that the corporations want to produce high-quality financial reports by including committee members with experience in accounting and finance.

According to Hamdan and Mushtaha (Citation2011) and Emmanuel et al. (Citation2014), there is a direct association between the accuracy of financial reports and the members of the audit committee’s financial experience. Studies by Xie et al. (Citation2003), Choi et al. (Citation2004), and Lin and Hwang (Citation2010) all found a negative correlation between the knowledge of audit committee members and earnings management. Nelson and Devi (Citation2013) investigated the relationship between audit committee specialists and financial reporting quality as evaluated by earnings management and found significant relationship.

Additionally, Dhaliwal et al. (Citation2010) assert that expert capacity raises the caliber of earnings. In fact, they discovered that the financial quality of organizations is positively impacted by the audit committee’s inclusion of accounting and finance professionals. In their study of the characteristics of audit committees and the management of earnings of publicly traded companies in Egypt, H. Galal et al. (Citation2022) found a considerable, impact of audit committee expertise on earning management. D. Setiawan, et al. (2022) investigated on the impact of audit committee features on earnings management in Indonesia and found that the experience of the audit committee has significant and positive impact on earnings management.

Krishnan et al. (Citation2011) investigate whether the presence of legal experts on an audit committee improves the calibre of financial reporting. The study discovered a major impact on the quality of financial reporting from audit committees that include members with legal expertise. According to Hassan and Ibrahim (Citation2014) research, the audit committee’s financial literacy effectively restrains real-earning management actions. Sun et al. (Citation2014) discovered, however, that the audit committee members’ financial expertise was unsuccessful in limiting real earnings management. García-Sánchez et al. (Citation2017) investigated whether having financial professionals on an audit committee raised the calibre of earnings and found that they had a useful role in raising earnings. It is proposed that audit committee members with financial and accounting backgrounds who are financially literate are more likely to lower their earnings, in line with agency theory and arguments discussed above this study formulate the hypothesis as;

H4: Audit committee expertise has a significant and positive effect on the earning management of insurance companies in Ethiopia.

4.5. Audit committee gender

The inclusion of female directors in subcommittees like the audit committee needs to be carefully considered in addition to being a question of governance. It is hardly unexpected that women are serving on significant committees like the audit committee, given the traits they are likely to bring to the business boardroom and their contributions to corporate governance because they are morally and conservatively more cautious than men, women’s audit committees can minimize earnings management (Lakhal et al., Citation2015). Women are allegedly more cautious and risk-averse than men, according to Saona et al. (Citation2019) and Gavious et al. (Citation2012).

Zalata et al. (Citation2018), claim that audit committees with a higher percentage of female members have a more notable impact on earnings management. Conyon and He (Citation2017) found that gender diversity on boards and audit committees enhances business performance because female directors have fundamentally different techniques of monitoring and swift responses to fraud, improves monitoring and the quality of financial reporting. The association between the gender of the audit committee and earnings management has been the subject of numerous studies. However, the thorough examination has only produced contradictory findings: From 2013 to 2017, Sudarman and Hidayat (Citation2019) looked at how the gender of the audit committee affected the management of the earnings of industrial companies listed on the Indonesian Stock Exchange. The study revealed that gender of the audit committee significantly affects how earnings are managed.

Gull et al. (Citation2018) looked into the connection between female directors and earnings management using a sample from French-listed companies between the years of 2001 and 2010. They discovered that female audit committee directors tend to minimize the level of corporate earnings management when combined with business experience in audit committee membership. The effect of gender diversity, earnings management techniques, and corporate performance of listed corporations in Nigeria from 2010 to 2014 was examined by Temile et al. (Citation2018). Regression analysis was used to examine the data, and it was discovered that female chief financial officers significantly increase earnings. Furthermore, agency theory explains that the principal raises monitoring expenses such as adding new members to the board and promoting gender diversity in order to keep an eye on the agent, as excessive spending lowers management income and company value (Zalata et al., Citation2018). To limit profit management, the audit committee’s gender diversity is crucial (Thiruvadi & Huang, Citation2011). This study developed the following hypothesis based on the agency theory and the aforementioned empirical arguments:

H5: Audit committee gender has a significant effect on the earning management of insurance companies in Ethiopia.

5. Research design

5.1. Sample selection

The population consists of all insurance companies that operated in Ethiopia from 2015 to 2022. The total number of insurance companies at the year’s end in 2022 was 18. From those insurance companies, 17 were chosen for this study. These are Africa Insurance Company, Awash Insurance Company, Global Insurance Company, Lion Insurance Company, Nib Insurance Company, Nile Insurance Company, Nyala Insurance Company, United Insurance Company, Abay Insurance Company, Berhan Insurance Company, National Insurane Company, Oromia Insurannce Company, Ethio- Life and General Insurance Company, Tsehay Innsurance company, Lucy Insurance Company, Bunna Insurance Company and Ethiopian Insurance Company, representing 94 percent of the total population. Zemen Insurance Company’s data is not included in the analysis because it was founded in 2020 and contains insufficient data. The insurance companies’ were the target population because data is readily available. The data were collected from seventeen (17) insurance companies annual audit reports. A summary of the selection process is provided in below.

Table 1. Study sample.

5.2. Model specification

This study utilized a generalized moment (GMM) model to investigate the intricate association between audit committee characteristics and the earning management of insurance companies in Ethiopia. A GMM model is a panel data estimator that employs the lags of the dependent variable as a tool to rectify the endogeneity bias associated with static estimating techniques. Arellano and Bond (Citation1991), in particular, established the GMM difference. This estimator uses the first differentiation strategy to address the inconsistent results and biases of the static estimating approaches. However, simulation studies have demonstrated that when a sequence is brief or continuous, the GMM difference appears to be less effective and results in subpar instruments (Bun & Windmeijer, Citation2010). As a result, the GMM system was created to handle the first difference estimator’s limitations. Lagged level conditions are currently employed as instruments for the differentiated equation, and lagged differences of a dependent variable are used as instruments for the level equation in the GMM approach (Blundell & Bond, Citation1998). The GMM system is comparatively more reliable and robust because the framework uses more procedures. Thus, accuracy is improved when used on a large panel for a brief period of time.

The two-step system estimator is more consistent and asymptotically effective at handling autocorrelation and heteroscedasticity (Arellano & Bover, Citation1995). Therefore, this study employed the two-step GMM framework to assess how the audit committee characteristics affected earing management. The diagnostic tests that can be used to confirm the outcomes of GMM estimation include The Arellano and Bond tests of no second-order serial correlation and the Hansen test of over-identifying restrictions are used with the null hypothesis that the conditions of the moments are true. The exogeneity of the subsets of GMM instruments is measured using a distinction in Hansen statistics. Thus, the inability to reject these null hypotheses indicates the reliability of the GMM estimates. As a result, this work modified Ozkan’s (Citation2001) partial adaptation model to reflect the main findings of the study. The model is given as:

1

1

2

2

where

EMi,t = earning management of insurance company i at time t; ACSi,t is audit committee size of insurance company i at time t; ACIi,t is audit committee independence of insurance company at time t, ACMi is the audit committee meeting of the insurance company; ACEi is the audit committee expertise of the insurance company; ACGi is the audit committee gender of the insurance company; and ε is the error term.

5.3. Variables construction

The study used earning management as the dependent variable and audit committee characteristics (audit committee size, audit committee independence, audit committee meeting, audit committee expertise, and audit committee gender) as the independent variables. The independent variables have no alternative measurements than the measurements used in this paper. However, the dependent variable earning management has been measured with other proxies like abnormal production costs, abnormal discretionary expenditures, and abnormal operating cash flow Roychowdhury (Citation2006). Moreover, scholars have also provided evidence that these measures capture real activity manipulation (Cohen & Zarowin, Citation2010; Owusu et al., Citation2022; Zang, Citation2012). The current study used discretionary accrual to measure the earnings management of insurance companies in Ethiopia. The study variables are summarized in .

Table 2. Variables and their measurement.

5.3.1. Dependent variable

Earning management: In order to conform to the global trend among these countries, governments have recently switched from cash-basis accounting to accrual-basis accounting, of them, Ethiopia is one. The rules that require economic transactions, including assets, liabilities, owners’ equity, revenue, and expenses, to be recorded at the time of the transaction, regardless of when the money is actually received or spent, are reflected in accrual basis accounting. This procedure gives stakeholders more accurate and pertinent financial information. However, Roychowdhury (Citation2006) asserts that managers might use the accrual basis as a tool to achieve earnings management by boosting income by establishing preferential payment terms, discounting practices, and transaction recording at the wrong time in order to increase sales; Reduce expenses, including those associated with selling, improper business management, and overproduction, in comparison to demand to represent the low cost of items supplied.

Researchers use total accrual earnings (TA) data to determine earnings management. Non-discretionary accruals (NDA), which reflect the unique business circumstances of each unit and cannot be changed by management, and accrual accounting variables, are the two components of TA. Adjustments are made to discretionary accruals (DA) using the accounting policies chosen by the manager to carry out earnings management behavior. The following steps are used by the study to calculate the values using the Jones (Citation1995) model:

Determine the total accrual value, which is the difference between net income and operating cash flow:

TACit = Total accruals of company i in time t

NIit = Net income company i in time t

CFOit = cash flow from operation activity of company i in period t

Calculate the estimated accruals value using regression equation.

TCAit = total company accrual i in year t;

TAit − 1 = total assets for company i for year t – 1;

ΔREVit = change in net revenues for sample company i in year t;

PPEit = fixed assets (gross property, plant, and equipment) of the company in period t.

Calculate non-discretionary accruals (NDA) as follows:

NDAit = nondiscretionary accrual in year t;

ΔRevit = change in net revenues for sample company i in year t;

ΔRecit = change in net receivables for sample company i in year t;

PPEit = fixed assets (gross property, plant, and equipment) of the company in period t;

TAit − 1 = total assets for sample company i in year t − 1;

β = the fitted coefficient obtained from the regression results in the calculation of total accruals.

Calculate discretionary accruals (DA) as a proxy for earnings management as follows:

5.3.2. Independent variables

Audit committee size: The number of individuals that should make up the audit committee is determined by the audit committee’s size. The size of a company’s board of directors and audit committee may be comparable. A larger board allows for a wider range of appointments for the audit committee members to carry out their individual monitoring responsibilities (Adelopo et al., Citation2012). According to Klein (Citation2002), a company’s ability to designate directors to the audit committee will be constrained if the size of the board is limited restrictions on selections can have a negative impact on the audit committee’s operation by limiting the skill set that the committee can bring to the table. According to Abbott et al. (Citation2000) and Dhaliwal et al. (Citation2010), the audit committee size is determined by adding together all of the committee members.

Audit committee independence: The percentage of non-executive directors on the audit committee is measured by its independence. Furthermore, it has been established that one of the primary elements enhancing the efficacy of audit committee independence (Ghafran & O’Sullivan, Citation2013; Klein, Citation2002). According to Abbott et al. (Citation2004), the audit committee’s status is being upheld and its organizational influence is being increased by requiring a minimum number of independent non-executive directors to be on the committee. The percentage of independent directors relative to the total number of directors in the audit committee serves as a proxy for the independence of the audit committee (Lubis & Adhariani, Citation2019; Meah et al., Citation2021; Rajeevan & Ajward, Citation2019).

Audit committee meeting: The number of meetings an audit committee holds over the course of a fiscal year is referred to as the audit committee meeting; more meetings are indicative of higher activity levels (Gendron et al., Citation2004). According to earlier research, the audit committee’s effectiveness and efficiency are significantly influenced by the number of meetings it holds. This is because a committee’s likelihood of accomplishing its goals and organizational objectives is higher when its members meet more frequently (Raghunandan et al., Citation2003). Although Li et al. (Citation2012) and Pearsons (Citation2009) found that committees tend to disclose more voluntarily when they meet more frequently.

Audit committee expertise: To protect the interests of the firm’s shareholders, an audit committee member must be able to ask pointed questions to make sure that management is accurately representing the company’s operations (Spira, Citation2003). Having a member with financial experience on the committee benefits the shareholders by providing technical accounting expertise. Members of the audit committee must also be able to read, analyses, and interpret financial statements in order to perform their duties effectively. The audit committee needs to be staffed with members who are financially sound because many of its responsibilities include financial matters, such as interacting with external auditors and examining regular financial reports. A financially literate audit committee team should gain greater trust from shareholders, who will view the financial reports particularly the earnings figures reported as more reliable and less likely to produce inaccurate financial reports. This will apply to both quarterly reports and year-end financial statements Raghunandan et al. (Citation2003). According to Meah et al. (Citation2021), the percentage of audit committee members with accounting knowledge serves as a proxy for the audit committee’s expertise.

Audit committee gender: The presence of women on the audit committee could improve the governance of the company. These qualities increase the board’s ability to carry out the crucial duty of supervising and monitoring management (Bear et al., Citation2010). Therefore, female audit committee members are more likely than their male colleagues to avoid the possible negative consequences of earnings deception if the board discovers earnings manipulation. Furthermore, women are more cautious than men while making decisions in a variety of situations, according to Byrnes et al. (Citation1999). Because they are more aware of the potential for lawsuits and reputational damage than men are, they are more inclined to take urgent action to improve the quality of their earnings. Women are therefore typically expected to approach earnings management cautiously (Gul et al., Citation2009). The proportion of female members of the audit committee serves as a proxy for the gender of the committee (Meah et al., Citation2021).

6. Empirical results and discussion

6.1. Descriptive statistics

As indicated in , the mean value of earnings management (EM) of insurance companies in Ethiopia is 16.657, with a minimum and maximum value of 1.256 and 56.321, respectively. The Ethiopian insurance companies’ earnings management deviates from its mean by 13.754. The mean value of audit committee size (ACS) for insurance companies is 4.7647, with a minimum and maximum value of 3 and 7, respectively. The audit committee size of insurance companies deviates from its mean by 1.521 in Ethiopia. The average value of audit committee independence (ACI) of insurance companies in Ethiopia is 0.4241, with a standard deviation of 0.2031. The minimum and maximum values of audit committee independence for insurance companies in Ethiopia are 0.026 and 0.965, respectively. The average value of audit committee expertise (ACE) of insurance companies in Ethiopia is 0.2101, with a standard deviation of 0.0803. The minimum and maximum value of audit committee expertise among insurance companies in Ethiopia is 0.012 and 0.3985, respectively. The mean value of audit committee gender (ACG) is 0.0814, with a standard deviation of 0.0933. The minimum and maximum values of the audit committee gender of insurance companies in Ethiopia are 0.012 and 0.3265, respectively. The average value of audit committee meetings (ACM) is 15.5, with a standard deviation of 6.2598. The minimum and maximum value of the audit committee meetings of insurance companies in Ethiopia were 2 and 36, respectively.

Table 3. Descriptive statistics.

6.2. Correlation matrix

As shown in below, there is a positive correlation between audit committee seize and earning management with a coefficient of 0.1679. Moreover, audit committee independence, audit committee expertise, audit committee gender, and audit committee meetings have all positively correlated with the earning management of insurance companies in Ethiopia, with values of 0.1713, 0.1127, 0.1604, and 0.0151, respectively.

Table 4. Correlation matrix.

6.3. Regression analysis

The model results are shown in below, which shows how audit committee features affect Ethiopian insurance company earnings management. The adjusted R2 value in below shows that the model’s variables explained 44.6% of the overall variability of insurance companies’ earnings management. Based on the results, the fundamental requirements of the GMM diagnostic tests are satisfied. The P-value of the Hansen statistics first indicates the validity of the GMM results. The P-value of the AR2 test also indicates the absence of a second-order serial correlation. The Wald statistics demonstrate the common relevance of the explanatory factors, while the Hansen test discrepancy verifies the homogeneity of the instrument subsets in the prediction of the dependent variable. At a 5% level of significance, the lagged EM (EMit-1) is significant in favor of the GMM estimations of the coefficients.

Table 5. The two–step system GMM estimation results.

With a coefficient of 0.9755 and a p-value of 0.062, the regression results show that audit committee size (ACS) has a significant and favorable impact on the earning management of insurance businesses in Ethiopia. The coefficient 0.9755 indicates the size of the audit committee of insurance companies. This indicates that a 1% increase in audit committee size results in a 0.9755 percent increase in the earing management of insurance businesses in Ethiopia, holding all other explanatory variables constant. A large audit committee is anticipated to be more effective since more committee members offer more resources to the monitoring process and a wider knowledge base from which to draw, according to the results of Karamanou and Vafeas (Citation2005). In accordance with research by Sharma et al. (Citation2009) and Raghunandan and Rama (Citation2007), larger audit committees are more likely to identify possible issues in financial reporting, enhancing the standard of internal control and earning management.

Furthermore, the study’s findings align with those of Ghosh et al. (Citation2010), who discovered that an audit committee with a broad membership possessed adequate knowledge and abilities and was more successful in monitoring financial reporting. Salihi and Jibril (Citation2015) also found a strong correlation between the size of the audit committee and the amount of earnings management, which is in line with agency theory. Sun et al. (Citation2014) haven’t, however, offered enough evidence to back up the idea that the audit committee’s size limits actual earning management. However, the result is in conflict with those of Lubis and Adhariani (Citation2019), Rajeevan and Ajward (Citation2019), Setiawan et al. (Citation2020), and Galal et al. (Citation2022), who found that the size of the audit committee has a negative and significant impact on the management of earnings. Consequently, the alternative hypothesis is rejected, and the null hypothesis is accepted in this study.

The regression analyses found that audit committee independence (ACI) is significantly connected with insurance companies’ earning management at a 1% level of significance with a coefficient of 12.270. This indicates insurance company audit committees are independent by 12.27% from the total audit committees. This suggests that insurance companies with high levels of audit committee independence may have effective earning management. The finding is in line with those of Fodio et al. (Citation2013) and Masmoudi and Makni (Citation2020), who claims that audit committee independence and earnings management have a favorable and significant relationship. Furthermore, because an audit committee independence is necessary to improve the quality of financial reporting, the study’s findings are in line with those of Yunos (Citation2011), Al-Rassas and Kamardin (Citation2016), and agency theory, which conclude that an independent audit committee has a significant and direct association with accruals earning management (AEM). Since independent members increase the audit committee’s efficacy in monitoring financial statements, Sharma and Kuang (Citation2014) also discovered that audit committee independence has a favorable impact on earnings management.

The outcome, however, conflicts with Klein’s (Citation2002) claim that an independent audit committee has a negative connection with earnings management. Additionally, Benkel et al. (Citation2006) and Inaam and Khamoussi (Citation2016) found that higher degrees of audit committee independence negatively influence the levels of earnings management. The study’s findings also ran counter to Suárez et al.’s (Citation2012) conclusion that there is insignificant correlation between earning management and the audit committee’s independence. Additionally, the study by Katmon and Al Farooque (Citation2017) discovered a negligible correlation between audit committee independence and earning management. Consequently, the study rejects the null hypothesis and accepts the alternative hypothesis.

At a 5% level of significance, audit committee expertise (ACE) has a positive and significant impact on the earning management of insurance companies’ with a coefficient of 14.779. This means 14.779% of audit committees are financial experts from the total audit committees of Ethiopian insurance companies. The conclusion implied that greater audit committee experience results in better earning management for insurance companies because greater audit committee expertise may improve financial reporting. This outcome is in line with the result of Dhaliwal et al., (Citation2010) that showed expert capacity boosts earnings quality and the inclusion of accounting and finance professionals in audit committees has a favorable effect on financial quality. Additionally, D. Setiawan, et al.’s (2022) investigation on the effects of audit committee features on earning management discovered that the experience of the audit committee has a significant impact on earnings management.

The study’s findings are in line with those of Badolato et al. (Citation2013), who discovered that the status of earning management is impacted by audit committee members possessing financial expertise. The manipulation of earnings by the firm’s managers may be restrained by a financial expert on the audit committee who has clear authority backed by adequate legislation. The results of this study also align with those of Hassan and Ibrahim (Citation2014), who discovered that an audit committee’s financial literacy effectively restricts actual earning management actions. This finding is compatible with both agency and institutional theory.

The findings is odds with those of H. Galal et al. (Citation2022), who discovered that the expertise of the audit committee has a significant and negative impact on the earning management of listed companies in Egypt. Furthermore, the study’s findings go counter to those of Sun et al. (Citation2014), who discovered that audit committee members’ financial expertise was unsuccessful in limiting real earnings management. As a result, the study rejects the null and adopts the alternative hypothesis.

At a 10% level of significance and a coefficient of 1.562, the audit committee gender (ACG) has a significant and positive impact on the earning management of insurance firms in Ethiopia. The coefficient of 1.562 indicates that there are 1.562% female members in the total audit committees of insurance companies in Ethiopia. The positive relationship between audit committee gender and earning management is because that the higher the audit committee gender, the more favorable the earning management of insurance businesses. The outcome is in line with the findings of Zalata et al. (Citation2018) and Conyon and He (Citation2017) that audit committees with a higher proportion of female financial specialists have a more significant impact on earnings management. Gender diversity on audit committees also improves monitoring and the quality of financial reporting because female directors have fundamentally different monitoring and fraud detection strategies. However, the finding is contradicted with those of Thiruvadi and Huang (Citation2011), Florencea and Susanto (Citation2018), Gull et al. (Citation2018), and Sudarman and Hidayat (Citation2019), who reached the conclusion that there is a negative and substantial correlation between the percentage of women on the audit committee and earnings management. As a result, this study rejects the null and adopts the alternative hypothesis.

Finally, it was discovered that audit committee meetings (ACM) had a positive and statistically significant impact on the earning management of Ethiopian insurance businesses at the 1% significance level and 0.048 coefficients. This means insurance companies’ conducted their annual meetings by 4.8% in a given fiscal year. This suggests that the audit committees are better able to carry out their oversight duties the more frequently they meet (Abbott et al., Citation2004; Xie et al., Citation2003). The results of this study are in line with those of Rakhmayani and Faisal (Citation2019), who claim that the audit committee members’ more intense meetings are an indication of the quality of the oversight provided.

Furthermore, the study’s findings support those of Katmon and Al Farooque (Citation2017), who discovered a link between audit committee meetings and high-earning managers. The study’s findings are in line with those of Xie et al. (Citation2003), Suárez et al. (Citation2012), and González and Garcia-Meca (Citation2014), who found a correlation between audit committee meeting frequency and earning management. This relationship is also in line with agency and institutional theory. However, the results of (Abbott et al., Citation2000; Lin & Hwang, Citation2010; Metawee, Citation2013) are in conflict with the conclusion of this study. Furthermore, the findings of this study are in conflict with the findings of Soliman and Ragab (Citation2014), who reported that there is no significant relationship between audit committee meetings and earning quality in Egypt. For these reasons, this study rejects the null and accepts the alternative hypothesis.

6.4. Test of statistical assumptions

6.4.1. Multicollinearity

displays the tolerance and variance inflation factor (VIF) for the independent variables utilized in the regression analysis. To ascertain whether there is severe multicollinearity between independent variables, the VIF statistics for each independent variable are computed. Multicollinearity is present if VIF is greater than 10. Tolerance (1/VIF) is also used to assess for multicollinearity. Multicollinearity is present if the tolerance is less than 0.1 and the VIF is more than 10 (Gujarati & Porter, Citation2009). According to , every VIF number is low; none of them is greater than 10, and there are no tolerance values that are lower than 0.1. Multicollinearity does not provide a challenge for our investigation, therefore.

Table 6. Multicollinearity test for explanatory variables.

6.4.2. Normality test

Tale 7 shows that the data are consistent with the standard distribution assumption, as shown by the probability values of 0.2132 in the Shapiro-Wilk W test statistics. It also suggests that conclusions regarding population parameters based on sample parameters seem to be accurate ().

Table 7. Normality test.

6.4.3. Heteroscedasticity and auto correlation

Treating heteroscedasticity and autocorrelation, the two-step GMM estimator approach is more consistent and asymptotically effective (Arellano & Bover, Citation1995).

7. Summary and conclusion

Due to recent high-profile corporate scandals, regulators from all over the world are paying more attention to the oversight role that audit committees play in the financial reporting process. In order to better understand how audit committee characteristics affect how insurance companies in Ethiopia manage their earnings this study investigates on the relationship between audit committee characteristics and earning management from 2015 to 2022. Earning management (EM) was used as the dependent variable in the analysis, along with independent factors such as audit committee size (ACS), audit committee independence (ACI), audit committee expertise (ACE), audit committee gender (ACG), and audit committee meeting (ACM). The study found that audit committee size (ACS) has a significant impact on the earning management of insurance businesses in Ethiopia. The positive correlation between audit committee size and earning management suggests that large audit committees are expected to be more effective because more committee members bring more resources and a broader knowledge base to the monitoring process, and larger audit committees are more likely to identify potential issues in financial reporting, improving the quality of internal control and earning management, which is supported by agency theory. Moreover, the study found that audit committee independence has significant and positive effect on the earning management of insurance companies in Ethiopia which is supported by the empirical research of Fodio et al. (Citation2013) and Masmoudi and Makni (Citation2020).

The results also showed that the management of insurance companies’ earnings in Ethiopia is significantly and positively impacted by the expertise of the audit committee (ACE) because expert ability increases earnings quality and that the presence of accounting and finance experts on audit committees has a positive impact on financial quality which is supported by the empirical study of D. Setiawan, et al. (2022). The gender of audit committees (ACG) and earnings management of insurance companies in Ethiopia also showed a positive and significant relationship. This is because insurance companies with a higher percentage of female audit committee members have a more significant impact on earnings management, and gender diversity on audit committees improves monitoring and the quality of financial reporting because female directors have fundamentally different monitoring and reporting techniques which is supported by the empirical study of Zalata et al. (Citation2018) and Conyon and He (Citation2017).

The study also found that audit committee meetings (ACM) has significant and positive effect on earning management of insurance companies in Ethiopia because the more the frequency of the audit committee meeting the more the effective the earning management of insurance companies which is supported by agency theory and empirical result of Rakhmayani and Faisal (Citation2019). Thus, the study concludes that the earning management of insurance businesses in Ethiopia is strongly monitored by the audit committee’s features, including size, independence, expertise, and meeting, gender, and audit committee expertise.

This study contributes to the earning management literature by providing an empirical examination of the effect of the various earning management strategies adopted by insurance companies and giving recommendations that can be utilized by policymakers in assessing the quality of financial reporting. The study also gives recommendations to managers and other stakeholders on how to control the earning management of insurance companies in Ethiopia.

The following policy implications were provided in light of the study’s findings: First, the size of the audit committees for insurance businesses in Ethiopia should be within a range that is both practical and efficient. Second, insurance companies’ audit committees should include independent members since they can effectively monitor and assess the effectiveness of their earning management. Thirdly, insurance companies should add more members to their audit committees who are skilled and knowledgeable in accounting and finance because these individuals can aid the companies in understanding the intricate accounting process and provide a solid base from which to examine and analyze financial data. Fourth, the audit committee meetings in insurance firms should be intense because issues in insurance businesses are discussed there more often, the more meetings there are. Fifth the study suggested that while developing audit committees in Ethiopian insurance businesses, consideration should be given to gender diversity and includes more females.

This study suffers from some limitations. First, the scope of the study is limited because it focuses only on insurance companies in Ethiopia from 2015 to 2022. Second, the sample data contains some missing values. Third, the study used only discretionary accrual to compute earnings management. Future research might be conducted by examining the effect of audit committee characteristics on the earning management of other institutions like banks, microfinance institutions, and manufacturing companies in Ethiopia. Moreover, future studies might be conducted using real earnings management as the dependent variable that this study missed.

Disclosure statement

The author has no competing interests.

Additional information

Funding

Notes on contributors

Ayalew Ali

Ayalew Ali Abebe is an assistant professor at the college of Business and Economics, Mizan-Tepi University. His research interests focus on the financial markets, corporate finance governance, business strategy, entrepreneurship, small business developments, accounting information system and earnings management.

References

- Abbott, L. J., & Parker, S. (2000). Auditor selection and audit committee characteristics. AUDITING: A Journal of Practice & Theory, 19(2), 1–23. https://doi.org/10.2308/aud.2000.19.2.47

- Abbott, L. J., Park, Y., & Parker, S. (2000). The effects of audit committee activity and independence on corporate fraud. Managerial Finance, 26(11), 55–68. https://doi.org/10.1108/03074350010766990

- Abbott, L. J., Parker, S., & Peters, G. F. (2004). Audit committee characteristics and restatements auditing. AUDITING: A Journal of Practice & Theory, 23(1), 69–87. https://doi.org/10.2308/aud.2004.23.1.69

- Abbott, L. J., Parker, S., & Peters, G. F. (2010). Serving two masters: The association between audit committee internal audit oversight and internal audit activities. Accounting Horizons, 24(1), 1–24. https://doi.org/10.2308/acch.2010.24.1.1

- Abebe Zelalem, B., Ali Abebe, A., & Wodajo Bezabih, S. (2022). Corporate governance and financial performance in the emerging economy: The case of Ethiopian insurance companies. Cogent Economics & Finance, 10(1), 2117117. https://doi.org/10.1080/23322039.2022.2117117

- Adelopo, I., Jallow, K., & Scott, P. (2012). Determinants of audit committees’ activity: Evidence from the UK. Social Responsibility Journal, 8(4), 471–483. https://doi.org/10.1108/17471111211272066

- Al Shbail, M. O., Alshurafat, H., Ananzeh, H., & Bani-Khalid, T. O. (2022). The moderating effect of job satisfaction on the relationship between human capital dimensions and internal audit effectiveness. Cogent Business & Management, 9(1), 2115731. https://doi.org/10.1080/23311975.2022.2115731

- Aldaoud, K. A. M. (2015). The influence of corporate governance and ownership concentration on the timeliness of financial reporting in Jordan University of Utara Malaysia. https://core.ac.uk ‘ download ‘ pdf

- Al-Dhamari, R., Almagdoub, A., & Al-Gamrh, B. (2018). Are audit committee characteristics important to the internal audit budget in Malaysian firms? Contaduria Y Administracion, 63(3), 1–23.

- Al-Haddad, L., & Whittington, M. (2019). The impact of corporate governance mechanisms on real and accrual earnings management practices: Evidence from Jordan. Corporate Governance: The International Journal of Business in Society, 19(6), 1167–1186. https://doi.org/10.1108/CG-05-2018-0183

- Al-Jalahma, A. (2022). Impact of audit committee characteristics on firm performance: Evidence from Bahrain. Problems and Perspectives in Management, 20(1), 247–261. https://doi.org/10.21511/ppm.20(1).2022.21

- Al-Matari, Y. A., Hassan, S., & Alaaraj, H. (2016). Application of BASEL committee’s new standards of internal audit function: A road map towards banks’ performance. International Journal of Economics and Financial Issues, 6(3), 1014–1018. http://www.econjournals.com

- Alodat, A. Y., Al Amosh, H., Khatib, S. F. A., & Mansour, M. (2023). Audit committee chair effectiveness and firm performance: The mediating role of sustainability disclosure. Cogent Business & Management, 10(1), 2181156. https://doi.org/10.1080/23311975.2023.2181156

- Al-Rassas, A. H., & Kamardin, H. (2016). Earnings quality and audit attributes in high concentrated ownership market. The International Journal of Business in Society. Corporate Governance, 16(2), 377–399. 0110 https://doi.org/10.1108/CG-08-2015-

- Al-Sayani, Y. M., Mohamad Nor, M. N., & Amran, N. A. (2020). The influence of audit committee characteristics on impression management in chairman statement: Evidence from Malaysia. Cogent Business & Management, 7(1), 1774250. https://doi.org/10.1080/23311975.2020.1774250

- Arellano, M., & Bond, S. (1991). Some tests of specification for panel data: Monte Carlo evidence and an application to employment equations. The Review of Economic Studies, 58(2), 277–297. https://doi.org/10.2307/2297968

- Arellano, M., & Bover, O. (1995). Another look at the instrumental variable estimation of error-component models. Journal of Econometrics, 68(1), 29–51. https://doi.org/10.1016/0304-4076(94)01642-D

- Arens, A., Elder, R. J., & Beasley, M. (2010). Auditing and assurance services: An Integrated Approach. Prentice-Hall.

- Badolato, P., Donelson, D., & Ege, M. (2013). Audit committee financial expertise and earnings management: The role of status. Journal of Accounting and Economics, 58(2–3), 208–230. https://doi.org/10.1016/j.jacceco.2014.08.006

- Bajra, U., & Čadež, S. (2018). Audit committees and financial reporting quality: The 8th EU company law directive perspective. Economic Systems, 42(1), 151–163. https://doi.org/10.1016/j.ecosys.2017.03.002

- Baxter, P., & Cotter, J. (2009). Audit committees and earnings quality. Accounting & Finance, 49(2), 267–290. https://doi.org/10.1111/j.1467-629X.2008.00290.x

- Bear, S., Rahman, N., & Post, C. (2010). The impact of board diversity and gender composition on corporate social responsibility and firm reputation. Journal of Business Ethics, 97(2), 207–221. https://doi.org/10.1007/s10551-010-0505-2

- Beasley, M. S., Carcello, J. V., Hermanson, D. R., & Lapides, P. D. (2000). Fraudulent financial reporting: Consideration of industry traits and corporate governance mechanisms. Accounting Horizons, 14(4), 441–454. https://doi.org/10.2308/acch.2000.14.4.441

- Bédard, J., & Gendron, Y. (2010). Strengthening the financial reporting system: Can audit committees deliver? International Journal of Auditing, 14(2), 174–210. https://doi.org/10.1111/j.1099-1123.2009.00413.x

- Bédard, J., Chtourou, S. M., & Courteau, L. (2004). The effect of audit committee expertise, independence, and activity on aggressive earnings management. AUDITING: A Journal of Practice & Theory, 23(2), 13–35. https://doi.org/10.2308/aud.2004.23.2.13

- Benkel, M., Mather, P., & Ramsay, A. (2006). The assassination between corporate governance and earnings management: The role of independent directors. Corporate Ownership and Control, 3(4), 65–75. https://doi.org/10.22495/cocv3i4p4

- Bilal, B., Chen, S., & Komal, B. (2018) Audit committee financial expertise and earnings quality: A meta-analysis Journal of Business Research, 84 (3), 253–270. https://doi.org/10.1016/j.jbusres.2017.11.048

- Bliss, M. A. (2011). Does CEO duality constrain board independence? Some evidence from audit pricing. Accounting & Finance, 51(2), 361–380. https://doi.org/10.1111/j.1467-629X.2010.00360.x

- Blundell, R., & Bond, S. (1998). Initial conditions and moment restrictions in dynamic panel data models. Journal of Econometrics, 87(1), 115–143. https://ideas.repec.org›eee›v87y1998i1p115-143

- Booth, P., & Schulz, A. K. D. (2004). The impact of an ethical environment on managers’ project evaluation judgments under agency problem conditions accounting. Organisations, and Society, 29(5-6), 473–488. https://doi.org/10.1016/S0361-3682(03)00012-6

- Bruynseels, L., & Cardinaels, E. (2014). The audit committee: Management watchdog or personal friend of the CEO? The Accounting Review, 89(1), 113–145. https://doi.org/10.2308/accr-50601

- Bun, M. J. G., & Windmeijer, F. (2010). The weak instrument problem of the system GMM estimator in dynamic panel data models. The Econometrics Journal, (13(1), 95–126. /j.1368-423X.2009.00299.x https://doi.org/10.1111/j.1368-423X.2009.00299.x

- Byrnes, J. P., Miller, D. C., & Schafer, W. D. (1999). Gender differences in risk taking: A meta-analysis. Psychological Bulletin, 125(3), 367–383. https://doi.org/10.1037/0033-2909.125.3.367

- Carcello, J. V., Hollingsworth, C. W., Klein, A., & Neal, T. L. (February (2006). Audit committee financial expertise, competing corporate governance mechanisms, and earnings management. Available at SSRN: https://ssrn.com/abstract=887512

- Cheung, K. Y., & Chung, C. V. (2022). The impacts of audit committee expertise on real earnings management: Evidence from Hong Kong. Cogent Business & Management, 9(1), 2126124. https://doi.org/10.1080/23311975.2022.2126124

- Choi, J., Jeon, K., & Park, J. (2004). The role of audit committees in decreasing earnings management: Korean evidence. International Journal of Accounting, Auditing and Performance Evaluation, 1(1), 37–60. https://doi.org/10.1504/IJAAPE.2004.004142

- Chu, J., Dechow, P. M., Hui, K. W., & Wang, A. Y. (2019). Maintaining a reputation for consistently beating earnings expectations and the slippery slope of earnings manipulation. Contemporary Accounting Research, 36(4), 1966–1998. https://doi.org/10.1111/1911-3846.12492

- Cohen, D. A., & Zarowin, P. (2010). Accrual-based and real earnings management activities around seasoned equity oferings. Journal of Accounting and Economics, 50(1), 2–19. https://doi.org/10.1016/j.jacceco.2010.01.002

- Cohen, D., Dey, A., & Lys, T. (2008). Real and accrual-based earnings management in the pre-and post-Sarbanes-Oxley period. The Accounting Review, 83(3), 757–787. https://doi.org/10.2308/accr.2008.83.3.757

- Cohen, J. R., Hoitash, U., Krishnamoorthy, G., & Wright, A. M. (2014). The effect of audit committee industry expertise on monitoring the financial reporting process. The Accounting Review, 89(1), 243–273. https://doi.org/10.2308/accr-50585

- Connelly, J. T., Limpaphayom, P., & Nagarajan, N. J. (2012). Form versus substance: The effect of ownership structure and corporate governance on firm value in Thailand. Journal of Banking & Finance, 36(6), 1722–1743. https://doi.org/10.1016/j.jbankfin.2012.01.017