Abstract

This study aims to investigate the effects of Strategic Management Accounting (SMA) on sustainable performance consisting of economic, environmental, and social performance. A questionnaire was utilized to collect primary data through a survey approach. This study includes as samples 187 green manufacturing companies in Thailand with green industry certifications from the Department of Industrial Works of Thailand. The statistical software was applied to implement the structural equation model. The results show that the causal relationship model fit to the empirical data was at an acceptable level. SMA has a significant positive direct effect on economic, environmental, and social performance. Moreover, environmental and social performance act in a partial mediating role in the relationship between SMA and economic performance. The findings also reveal that the three components of sustainable performance have causal relationships. In dealing with dynamic changes in the business environment, decision-making based on SMA information can be more proactive. The implementation and adoption of SMA techniques are known to be limited in emerging economies, with little information available on adoption and integration. The results of previous investigation are also inconclusive.

1. Introduction

Green manufacturing can promote global and local sustainable development (Toke & Kalpande, Citation2019). Since realizing its potential, numerous environmentally conscious businesses around the world have implemented an assortment of environmental management practices. According to Lee et al. (Citation2017) ISO 14001 and ISO 26001 are the most widely recognized environmental and social management standards. These standards guide the implementation of environmental and social management systems. Regulatory, consumer, ethical, and environmental and social consciousness are altering manufacturing strategies. Toke and Kalpande (Citation2019) noted the need for urgency in regard to industrial reform. Green manufacturing is increasingly viewed to increase corporate value and sustain competitive advantage over the long term. Sustainability and environmental concerns are gaining prominence in business, management, manufacturing, and new product development decisions (Afum et al., Citation2020, Afum et al., Citation2021; Çankaya & Sezen, Citation2019; Sezen & Çankaya, Citation2013; Yusliza et al., Citation2020).

Many businesses must overcome obstacles to maintain their competitive advantage (Ojra et al., Citation2021). To adapt to changing environmental conditions, a firm’s management accounting systems (MAS) may need to be reassessed. According to Ghasemi et al. (Citation2019), the literature implies that traditional management accounting may not be well-suited to modern manufacturing situations (Visedsun & Terdpaopong, Citation2021). Strategic management accounting (SMA) is an accounting approach that helps companies to better understand the market, competitors, and customers (Ojra et al., Citation2021). Senior executives use management accounting strategies to gather critical data to compete with other companies in a rapidly changing environment. Thus, management accounting may help manufacturing companies to succeed (Shahzadi et al., Citation2018). SMA evaluates corporate goals using external and internal non-financial data (Guilding et al., Citation2000). An organization must have strong cost measures as well as, robust planning, control, performance, and strategic decision-making procedures to compete. To stay competitive, the company must use customer and competitor accounting (Ojra et al., Citation2021).

The manufacturing industry will rely heavily on SMA to help it develop, improve, and apply ways to thrive in a volatile and changing environment (Oyewo, Citation2021). This will help the industry to stay competitive. However, in emerging economies, the reach of SMA practices is known to be rather limited, with little information available on the adoption and integration of SMA approaches. Given the positive impact of SMA strategies on business outcomes, it is critical to investigate the nature and scope of SMA practices in developing economies (Rashid et al., Citation2020). Prior studies have shown that SMA increases managerial and organizational performance (Al-Mawali, Citation2021; Cadez & Guilding, Citation2008; Kalkhouran et al., Citation2017; Lay & Jusoh, Citation2012; Pavlatos & Kostakis, Citation2018; Rashid et al., Citation2020; Zenita et al., Citation2015). Thailand’s SMA model evaluates organizational performance. This model has been studied in regard to industrial estates (Sumkaew & Intanon, Citation2021; Terdpaopong et al., Citation2017; Thapayom, Citation2019, Citation2022; Visedsun & Terdpaopong, Citation2021). Additionally, Nimtrakoon and Tayles (Citation2010) have examined this concept in companies that were publicly listed.

The empirical evidence on the extent to which SMA approaches have been adopted and/or thought to be beneficial in many nations. SMA tools enable businesses to comprehend their rivals, clientele, and industry sector’s profit growth, thereby enhancing overall performance. According to SMA, which is based on contingency theory, a company’s performance is contingent on its structure and environment (Kalkhouran et al., Citation2017; O’Higgins & Thevissen, Citation2017; Otley, Citation1980). In response to expanding sustainability concerns, manufacturing businesses must analyze sustainable performance and incorporate sustainable components into their operations (Amrina & Yusof, Citation2011). Green production is likely to stimulate the economy, particularly in Thailand. This research focuse on green manufacturing to boost competitiveness.

The importance of examining sustainable performance has grown in recent years. The concept of sustainable performance pertains to the comprehensive consideration and integration of economic, environmental, and social performance objectives inside organizations (Afum et al., Citation2020). This research sheds light on the scholarly body of knowledge pertaining to strategic management accounting, a field that has received limited attention, has been largely overlooked, and has not been extensively explored. Nevertheless, the accessibility of SMA data remains a challenge for researchers, impeding their ability to conduct comprehensive studies in many industrial sectors. SMA's influence on Thailand’s green manufacturing makes this a noteworthy contribution. Thailand’s manufacturing sector contributed 28% to GDP in December 2022. This sector contributes most to the Thai economy (The Office of Industrial Economics of Thailand, Citation2023). The BCG Model Policy stresses the value of generation and environmental sustainability. The idea can achieve sustainable goals in numerous sectors, especially Thailand’s manufacturing sector (Maimun et al., Citation2023).

The study, which is based on data collected from green manufacturers in Thailand, provides information about the use of a wide range of SMA and uses structural equation modelling to examine the effects of SMA on sustainable performance consisting of economic, environmental, and social performance. This study contribut to the knowledge base on the contingency factors of SMA use. It is anticipated that the outcomes of this study would offer SMA practice as a framework for organizational decisions for green manufacturing businesses that are coping with changes in the contemporary business environment. The paper proceeds as follows: Section 2 examines the background literature and develops the hypotheses; Section 3 outlines the research methodology; Section 4 presents the results and findings from the SEM analysis; and Section 5 concludes and discusses the findings of this study. The last two sections include implications and contributions, limitations, and suggestions for further research.

2. Literature review and hypothesis development

2.1. Theoretical perspectives

2.1.1. Strategic management accounting

The term ‘strategic management accounting’ (SMA) refers to management accounting (MAPs) sections that deal with providing strategically oriented data for decision-making and control (Guilding et al., Citation2000). When examining the stages of MAPs through four various stages of development (Pham et al., Citation2020; Terdpaopong et al., Citation2017), the International Federation of Accountants (IFAC) declarations on management accounting are utilized as a benchmark: Phase 1 (prior to 1950): Cost and budgetary control were the primary concerns. Phase 2 (1950–1965): Data for management decision - making, using a variety of strategies to aid decision-making; Phase 3 (1965–1985): Reduced resource waste through extensive use of mathematical models. Phase 4 (since 1985): Value creation through efficient resource utilization, as seen in emerging methodologies and MAPs in Thailand, which are at the same stage of development as those in Malaysia, Vietnam, and China (Pham et al., Citation2020).

Strategic management accounting (SMA) is optimal for organizational dynamics. In contrast, Thai businesses continue to use traditional management accounting methods in an environment that is dynamic and constantly changing. SMA techniques offer additional information for strategic decision-making (Sumkaew & Intanon, Citation2021). Due to increased competition, businesses must continually develop and employ effective management strategies to maintain stability and efficacy. Management accounting analyzes and consolidates data to meet the requirements of the organization. The synchronization of information between functions and goals increases efficiency and effectiveness (Bui et al., Citation2023). A strategic management accounting perspective aims to align accounting with strategy (Cescon et al., Citation2019). It is essential to note that the comprehensive use of SMA might result in advantages such as greater organizational competitiveness. Consequently, the long-term advantages of SMA may be of interest to forward-thinking corporations and result-oriented organizations looking to gain a competitive advantage (Cadez & Guilding, Citation2008; Kalkhouran et al., Citation2017; Lay & Jusoh, Citation2012; Oyewo, Citation2021; Rashid et al., Citation2020; Zenita et al., Citation2015).

SMA can be viewed as a set of strategically oriented accounting techniques. The following are the techniques in five categories (Cadez & Guilding, Citation2008; Cinquini & Tenucci, Citation2008; Oyewo, Citation2021): (1) Costing (attribute costing, target costing, and value-chain costing); (2) Planning, control and performance measurements (benchmarking, integrated performance measurement, and environmental management accounting); (3) Strategic decision making (strategic costing, strategic pricing, and brand valuation); and (4) Competitor accounting (competitor cost assessment, competitive position monitoring, and competitor performance appraisal) and (5) Customer accounting (Customer profitability, lifetime customer profitability analysis and the valuation of customers as assets)

2.1.2. Sustainable performance

The current state of growth and development is mostly centered around the concept of sustainable development. Sustainability can be achieved by prioritizing the interests and value addition of multiple stakeholders, while also ensuring the preservation of the environment and natural resources, rather than solely pursuing profit maximization without regard for these factors (Gunarathne et al., Citation2021).

Measuring organizational performance is problematic, especially when the conditions for measurement are constantly changing (Suttipun, & Saelee, Citation2015). Even though big companies are working on sustainable reporting, there is no agreement on a single standard, and the different frameworks are so complicated that they cannot be combined (Hubbard, Citation2009). Since the idea of Triple bottom line (TBL) was coined by Elkington, the trend of organizations addressing the interests of various stakeholder groups has been expanding in many nations (Hubbard, Citation2009 Suttipun et al., Citation2021). The phrase ‘corporate performance’ has been broadened to encompass not just financial but also social and environmental dimensions. As a result, extended corporate performance, also known as sustainable performance, includes economic, social, and environmental performance measures (Alsayegh et al., Citation2020; Alt et al., Citation2015; Braccini & Margherita, Citation2018; Çankaya & Sezen, Citation2019; Fauzi et al., Citation2010; Hourneaux Jr. et al., Citation2018; Khan, Irshad et al., Citation2021).

Manufacturing businesses use TBL to address stakeholders’ use of available environmental management and resolution (Khan, Irshad et al., Citation2021). The terms TBL and sustainable performance have been used interchangeably, and TBL and corporate performance are both used to refer to sustainable performance (Braccini & Margherita, Citation2018; Fauzi et al., Citation2010; Khan, Irshad et al., Citation2021). The content of each assessment factor, and thus the sustainable performance, can change over time and between situations (Fauzi et al., Citation2010).

Several research have categorized factors as sustainable performance variables (Cadez & Guilding, Citation2008; Kalkhouran et al., Citation2017; Lay & Jusoh, Citation2012; Thapayom, Citation2019, Citation2022; Zhu et al., Citation2019). Moreover, a number of scholarly investigations have classified performance indicators into three separate dimensions, namely economic, social, and environmental in the context of analyzing sustainable performance (Alsayegh et al., Citation2020; Çankaya & Sezen, Citation2019; Foo et al., Citation2018; Khan, Irshad et al., Citation2021; Le, Citation2020; Maletič et al., Citation2016; Sezen & Çankaya, Citation2013). This study examines the multifaceted dimensions of sustainable performance, encompassing economic, social, and environmental considerations.

In the social dimension, which mainly assesses employee well-being (Foo et al., Citation2018), the indicators of employee satisfaction, worker safety, and education and skills focus on the importance of employees as key stakeholder for industries (Amrina & Yusof, Citation2011; Fuzi et al., Citation2017; Hourneaux Jr. et al., Citation2018; Khan, Irshad et al., Citation2021; Khan, Wu et al., Citation2021; Maletič et al., Citation2016; Zhu et al., Citation2019).

The environmental dimension focuses on the consistency between the use and renewal of natural resources (Braccini & Margherita, Citation2018). Several indicators reflect environmental performance, including waste reduction and resource and energy utilization (Amrina & Yusof, Citation2011; Foo et al., Citation2018; Fuzi et al., Citation2017; Hourneaux Jr. et al., Citation2018; Khan, Irshad et al., Citation2021; Khan, Wu et al., Citation2021; Le, Citation2020; Maletič et al., Citation2016; Zhu et al., Citation2019).

The economic dimension of the organization’s performance is focused on its economic or financial aspects (Braccini & Margherita, Citation2018). Within the economic dimension, the indicators of profit growth rate (Foo et al., Citation2018; Hubbard, Citation2009; Khan, Irshad et al., Citation2021; Khan, Wu, Saufi et al., Citation2021; Maletič et al., Citation2016; Rabbani et al., Citation2014), reducing cost (Amrina & Yusof, Citation2011; Foo et al., Citation2018; Le, Citation2020; Maletič et al., Citation2016; Rabbani et al., Citation2014) and increasing market share (Hubbard, Citation2009; Khan, Irshad et al., Citation2021; Khan, Wu et al., Citation2021; Le, Citation2020; Maletič et al., Citation2016) are common indications of an organization’s value offer in the economic dimension.

2.2. Hypothesis development

The management accounting literature based on contingency theory is predominantly involved with manufacturing organizations (Nimtrakoon & Tayles, Citation2010). According to the contingency approach in SMA, there is no universal accounting system that can be used by all organizations in all situations (O’Higgins & Thevissen, Citation2017; Otley, Citation1980). As a criterion variable, the concept of a contingency fit necessitates some measure of effectiveness. So, we can say that a good contingent fit is more effective than a bad match (Nimtrakoon & Tayles, Citation2010; Otley, Citation2016).

Prior studies have shown that SMA increases managerial and organizational performance (Al-Mawali, Citation2021; Cadez & Guilding, Citation2008; Kalkhouran et al., Citation2017; Lay & Jusoh, Citation2012; Pavlatos & Kostakis, Citation2018; Rashid et al., Citation2020; Sumkaew & Intanon, Citation2021; Thapayom, Citation2019, Citation2022; Zenita et al., Citation2015). Therefore, strategic management accounting is critical to a company’s decisions (Alamri, Citation2019).

Management accounting scholars and managers have long focused on organizational performance. As the corporate environment has evolved rapidly, non-financial performance measures have also arisen (Al-Mawali, Citation2021; Suttipun, & Arwae, Citation2020). Manufacturing organizations are important to the growth of a country’s economy and must have a long-term growth and success strategy if they are to increase quality (Khan, Wu et al., Citation2021). Companies throughout the world must combine environmental, social, and economic factors into their plans (Hristov & Chirico, Citation2019). This study divided performance into three areas; economic, social, and environmental performance, with each factor having relationships with the others.

Previous research has significantly expanded the existing body of literature on green production and environmental management (Afum et al., Citation2020, Citation2021). The relationship between sustainable performance and operational effectiveness merits consideration. The results demonstrate a distinct and favorable correlation between environmental performance and social performance, thereby affecting economic performance. While there was no significant intermediate association observed, the development of a competitive advantage was found to be influenced by performance associations. Prior research has shown that there is a link between environmental performance, social performance, and economic or financial performance (Afum et al., Citation2020, Citation2021; Albertini, Citation2013; Al-Mawali, Citation2021; Asiaei et al., Citation2022; Hourneaux Jr. et al., Citation2018; Liu, Citation2020).

Inter-performance studies, such as that conducted by Liu (Citation2020), present a comprehensive multilevel framework for examining the intricate association between environmental performance and financial performance. The findings of this study reveal a generally positive correlation between environmental performance and financial performance. In addition, the study of Hourneaux Jr. et al. (Citation2018) conducted a comprehensive analysis of the interplay between economic, social, and environmental performance. Although environmental and social performance were found to affect economic performance, the study did not reveal a relationship between environmental performance and social performance.

There is also a link between environmental and social performance and economic sustainability performance, which means that the economic value of a company that also provides value for society, is also connected to social and environmental factors (Alsayegh et al., Citation2020; Alt et al., Citation2015). Moreover, social performance has a favorable influence on environmental performance, indicating that employees are crucial stakeholders who can influence the effectiveness of environmental management and that their influence is bolstered in companies with strong levels of common vision (Alt et al., Citation2015).

Afum et al.'s (Citation2020) research demonstrated that green manufacturing has a direct impact on economic, social, and environmental performance. Notably, social performance plays an important role as a mediator variable in this relationship. Furthermore, Al-Mawali’s research (Citation2021) found a positive correlation between environmental cost accounting and both financial and environmental performance. Additionally, the findings of the study also support the notion that environmental performance plays a mediating role in this relationship. The significance of sustainability in corporate management can be perceived as an alternative path. In addition, the concept of equilibrium across the dimensions of sustainable performance is never discussed, despite its obvious importance and implementation necessity. There is a lack of conclusive research on the mediating factors of the relationship between environmental performance, social performance, and economic efficiency, and the results are equivocal.

The contingency theory of management accounting (MA) has been empirically studied in a variety of contexts at industry, business, and unit levels (Haldma & Lääts, Citation2002). The current study was conducted at the level of the main business unit. It had two goals: to look into the relationship between the degree of use of strategic management accounting techniques (SMA Techniques) and sustainable performance, including economic, environmental, and social performance; and to test the indirect effects of social and environmental performance on the relationship between the degree of use of SMA techniques and the economic performance of green manufacturing. Structural equation modeling can also be employed to explain the hypothesised relationship between SMA techniques and sustainable performance by using contingency theory. Therefore, there are nine hypothese in this study which are:

H1: There is a positive relationship between the degree of use of SMA techniquesand economic performance.

H2: There is a positive relationship between the degree of use of SMA techniques and social performance.

H3: There is a positive relationship between the degree of use of SMA techniques and environmental performance.

H4: There is a positive relationship between social performance and economic performance.

H5: There is a positive relationship between environmental performance and economic performance.

H6: There is a positive relationship between social performance and environmental performance.

H7: Social performance mediates the relationship between the degree of use of SMA techniques and economic performance.

H8: Environmental performance mediates the relationship between the degree of use of SMA techniques and economic performance.

H9: Social performance and environmental performance mediate the relationship between the degree of use of SMA techniques and economic performance.

3. Research methodology

A questionnaire was utilized to collect primary data using the survey approach. The method of sampling used in the investigation was simple randomization. The study’s participants included green manufacturing firms that had earned Department of Industrial Works of Thailand green industry certificates at levels 3–5, which are comparable to ISO14001 and ISO26001. According to the Department of Industrial Works of Thailand website (Green Industry), there were 1,229 green manufacturing firms on the list as of August 2021, with the companies divided into seven categories. Only 195 of the 645 questionnaires were returned, which represents, a 30.23% response rate, and eight questionnaires were deemed unusable and the 187 valid responses was then examined. In this study, the primary unit of analysis is the organization itself. The questionnaire was completed by the manager or senior staff in the accounting and finance department, or individuals with similar roles, on behalf of the company.

In this study, questionnaires with a Likert scale were used to evaluate and measure the influence that the degree of usage of SMA techniques has on sustainable performance. All 15 items of measurement for the degree of use of SMA techniques were concept from Cadez and Guilding (Citation2008), Cinquini and Tenucci (Citation2008) and Oyewo (Citation2021), whereas all nine items of the measurement for sustainable performance were adopted from Amrina and Yusof, (Citation2011), Hourneaux Jr. et al. (Citation2018), Khan, Irshad et al. (Citation2021), Khan, Wu et al. (Citation2021), Le (Citation2020), Maletič et al. (Citation2016), Fuzi et al. (Citation2017) and Zhu et al. (Citation2019). For example, the questionnaire asked, ‘To what extent does your company use the following accounting techniques?’ All SMA techniques are assessed on a 5-point Likert scale from 1 (‘never’) to 5 (‘always’), and all sustainable performance factors are assessed on a 5-point Likert scale from 1 (‘Strongly Disagree’) to 5 (‘Strongly Agree’).

The results were subjected to quantitative data analysis, and the data were interpreted using structural equation modeling (SEM) with the use of statistical software. The SEM process has two distinct stages, namely the measurement model and the structural model. The discussion began by providing an overview of the company’s background information, followed by an examination of the adoption of SMA inside the organization and an assessment of the extent to which it is utilized.

4. Results and findings

4.1. Company background and characteristics

presents a summary of the research companies’ data characteristics. First, by dividing the companies into six categories (according to the Thailand Industries Sentiment Index) a total of 187 green manufacturing companies was revealed. This included supporting industries (Petrochemicals, Chemicals, Rubber products, Plastics, Pulp and Paper printing and Packaging, Aluminum, Digital, Biotechnology etc.) (31.02%), Automotive industries and machinery (29.41%), Food and pharmaceutical (13.37%), Electrical and electronics industries (12.83%), Construction industries and Electrical appliances (6.95%), and Energy industries (6.42%). Second, we categorized the companies by the firm’s size by revenue. This consisted of large-sized industry (Revenue > = 500 million baht) (74.86%), medium-sized industry (100 million baht = Revenue < = 500 million baht) (17.65%) and other (7.49%).

Table 1. Profiles of sample green manufacturing companies (n = 187).

4.2. SMA adoption and intensity of use

Incorporating frequency data can provide a more comprehensive analysis of the results. The first consideration is made in relation to the differentiation from ‘non-adopters’ to ‘adopters’ of SMA, which is the first factor to be considered. Those who answered 1 are classified as ‘non adopters’ (1 indicates ‘never’ used) as opposed to those who answered 2 or 3 (2 indicates ‘very seldom’ used and 3 indicates ‘sometimes’ used), implying a low degree of technique adoption and, according to Cinquini and Tenucci (Citation2008), those who rate themselves as 4 or 5 frequently use the strategy. This demonstrates how frequently the concept is utilized ().

Table 2. Frequency distribution in SMA applications.

In terms of usage, it is clear that the most popular SMA techniques are strategic cost management, strategic pricing, value-chain costing, and customer profitability analysis. Four of these methods had a mean score of at least 4.00. In contrast, customer asset value, brand valuation, and environmental management accounting had the lowest usage rates, each with a mean score below 3.50. The overall mean of 3.81 for the 15 SMA techniques shows that there is a high level of SMA adoption (frequent use) by green manufacturing in Thailand.

In this study, the adoption rate for strategic cost management and strategic pricing was over 75%. Indeed, the stated strategies heavily emphasize the availability of information for decision-making, hence influencing the strategic success of the company (Cinquini & Tenucci, Citation2008). Increased global competition has led to the development of organizational costing and strategic management practices that facilitate the achievement of competitive advantage (Thapayom, Citation2019).

It is noteworthy that planning, control and performance measurement techniques (environmental management accounting) have a high ‘low adoption’ rate (32.09%), which is consistent with the results of recent surveys of Nigerian listed manufacturing companies (Oyewo, Citation2021), and brand valuation has a high ‘non adoption’ rate (20.86%).

presents a statistical summary of the observed variables utilized in this study, including the minimum and maximum values, mean, standard deviation (SD), skewness, and kurtosis. Based on the established criteria, it is recommended that the skewness value falls within the range of -2 to +2, while the kurtosis value should be within a range of -7 to 7 (Byrne, Citation2010; Hair et al., Citation2010). shows the correlation matrix employed to evaluate the presence of multicollinearity between the latent variable and the variables utilized in this research.

Table 3. Descriptive statistics.

Table 4. Pearson’s parametric correlation coefficients.

To evaluate the presence of common method variance (CMV) with the Harman single factor technique, exploratory factor analysis (EFA) was employed. The results indicated that a single factor exhibited the highest amount of volatility, accounting for 38.423% of the total variance. Consequently, the probability of encountering CMV difficulties in our data set, which was obtained from a single source, was reduced (Eichhorn, Citation2014).

4.3. Evaluation of measurement models

SEM's measurement model is the CFA, which illustrates the pattern of observed variables for the hypothesized model’s latent components. The test of the observed variables’ reliability is an important part of CFA (Schreiber et al., Citation2006). First, the Fornell and Larcker (Citation1981) measurement model was utilized to conduct convergent and discriminant validity tests.

In order to determine the degree of agreement among many indicators of the same construct, the CV (convergent validity) method is employed (Ab Hamid et al., Citation2017). An appropriate convergence is demonstrated by a factor loading and an AVE value higher than 0.50 and a CR of 0.70 or higher, which are all essential conditions for the assumption of CV (Hair et al., Citation2019).

The scale items and evaluation of the variable are shown in . The factor loadings of the variables’ scale items ranged from 0.686 to 0.916, and the corresponding Z-test ranged from 12.312 to 51.169, exceeding the significance threshold of 1.96. In addition, the AVE ranged from 0.594 to 0.779, and the CR ranged from 0.812 to 0.913. The results for Cronbach’s alpha varied from 0.801 to 0.925 for external and internal consistency assessments and were greater than 0.70, (Cortina, Citation1993). The CV assumption was validated by the data, and the model’s measurement scales showed high reliability.

Table 5. Scale items and latent variable evaluation.

To assess the discriminant validity of the measurements, the AVE in the diagonal is compared with the correlation coefficients (off-diagonal) for each construct in the relevant rows and columns of . The correlation of latent constructs ranged from 0.121 to 0.637, whereas the AVE ranged from 0.594 to 0.779, indicating that the AVE was greater than the correlation of latent constructs (Fornell & Larcker, Citation1981). It is better for a latent construct to explain the variation in its own indicator than the variation in the indicators of other latent constructs (Ab Hamid et al., Citation2017). In general terms, the discriminant validity of this measurement model can be accepted ().

Table 6. Measurement model validity.

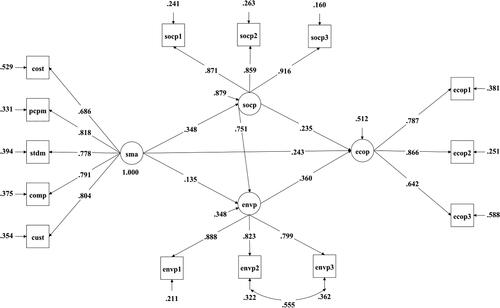

shows that all fit statistics have satisfied the acceptable levels after modification (MOD): χ 2 = 134.174, df = 70, and Chi-square divided by the degrees of freedom = 1.917. The comparative fit index (CFI) = 0.963, the Tucker-Lewis fit index (TLI) = 0.952, the root means square error of approximation (RMSEA) = 0.070 with 90% C.I 0.052–0.088 and the standard root means square residual (SRMR) = 0.056. These values show that the model and observed data are in good agreement and shows the standardized parameter estimations.

Table 7. Descriptive measures of overall model fit.

4.4. Structural model of SMA on sustainable performance

The results are presented in and . In terms of direct effects, path standard coefficient results revealed that H1: Sma has a positive effect on Ecop (β = 0.243, p < 0.001), H2: Sma has a positive effect on Socp (β = 0.348, p < 0.001) and H3: Sma has a positive effect on Envp. (β = 0.135, p < 0.05). The results also show that H4: Socp has a positive effect on ecop (β = 0.235, p < 0.05), H5: Envp has a positive effect on ecop (β = 0.360, p < 0.01) and H6: Socp has a positive effect on ecop (β = 0.751, p < 0.001).

Table 8. Hypothesis testing results from structural equation modeling.

The test for the indirect effect of Sma on Ecop via Socp and Envp. H7: Socp as a partial mediator of the relationship between Sma and Ecop (β = 0.082, p < 0.05), H8: Envp as a partial mediator of the relationship between Sma and Ecop (β = 0.048, p < 0.05) and H9: the boots of Socp and Envp as partial mediators of the relationship between Sma and Ecop (β = 0.094, p < 0.05). Thus, this study concludes that social performance and environmental performance mediate the relationship between the degree of use of SMA techniques and economic performance. Consequently, the SEM results confirmed that H1-H9 were also supported and the model explained (R2) 12.50%, 48.80%, and 65.20% of the variance in social performance, economic performance, and environmental performance, respectively. According to the given guidelines, the R2 values of 0.75, 0.50, and 0.25 might be regarded as substantial, moderate, and weak, respectively (Hair et al., Citation2019). This analysis revealed that the explanatory power of the R2 for economic performance was weak-moderate, whereas environmental performance was moderate-substantial. However, the R2 values must always be interpreted within the scope of the investigation (Hair et al., Citation2019).

5. Conclusion and discussion

The results indicated that SMA has a significant positive effect on economic performance, environmental performance, and social performance. This research into the contingency perspective of SMA for green manufacturing offers new insights into the effects on sustainable performance. The basic assumption of contingency theory, that organisational effectiveness is dependent on the fit between context and structure, is thus supported by previous research (Cadez & Guilding, Citation2008; Lay & Jusoh, Citation2012; Rashid et al., Citation2020; Thapayom, Citation2019; Zenita et al., Citation2015). Although uncertainty and performance have a significant impact on the usage of numerous performance measures, the degree of emphasis placed on performance is impacted by a variety of other factors, such as organizational and business strategy. Therefore, this approach to management accounting is consistent with the contingency perspective, and the organization’s management accounting instruments must be established and implemented strategically to suit the organization’s conditions. SMA is a combination of innovative accounting methodologies, and it mandates that businesses should always be on the lookout for creative prospects in the external business environment (Oyewo, Citation2021; Thapayom, Citation2019). Companies that employ SMA in their operations are always seeking new ways to gain an advantage over their competitors.

This study contributes to the literature on sustainable performance, which consists of economic, environmental, and social performance, and suggests that there are causal relationships between the three components of sustainable performance. According to the findings, environmental performance has a positive effect on economic performance. Generally, the results are supported by previous findings in the literature (Albertini, Citation2013; Al-Mawali, Citation2021; Liu, Citation2020). The positive impact on organisational costs results in the influence of environmental performance on organizational performance. It implies that reducing pollution allows businesses to save money on pollution control expenses, that these costs vary depending on the characteristics of the business and industry sector, and that businesses must have adequate financial resources to implement proactive environmental policies and initiatives (Hourneaux Jr. et al., Citation2018; Liu, Citation2020). The findings also revealed that social performance has a positive effect on economic performance. Improvements in health and safety conditions have a beneficial effect on the motivation and morale of workers, and also on their level of involvement with their employer and their commitment to the company, which can enhance organisational performance and reduce hiring and training expenses (Alsayegh et al., Citation2020). As a consequence of this, environmental and social performance have been found to be directly related to the performance of manufacturing organizations and also have a significant impact on the organization’s economic performance (Hourneaux Jr. et al., Citation2018).

The extent to which an organization has been effective in implementing its social goals, which may include improving working conditions, safety and health, health and wellbeing, and diversity, is reflected in its social performance (Alsayegh et al., Citation2020). Regardless of the context in which organizations operate, employees take central stage in the successful implementation of environmental goals (Alt et al., Citation2015). Rather than simply controlling emissions through end-of-pipe improvements, the purpose of an environmentally proactive strategy is to drastically reduce pollution through well-defined environmental objectives. This type of strategy is people-intensive and relies on employee involvement to create tacit skills (Albertini, Citation2013).

The results also show that the relationship between the degree of use of SMA techniques does have indirect effects on economic performance via social performance and environmental performance. This may be simply interpreted as meaning that higher SMA techniques will provide information to support decisions making and acquire competitive advantages, which in turn enhance environmental and social performance, which eventually enhances economic performance. As a result, it is expected that increased access to information enables more effective managerial decisions, which improves organizational performance (Cadez, & Guilding, Citation2008) and for the first time, the outcomes of this study were linked to social and environmental performance as mediating variables and provided valuable conclusions. As a result, this research contributes to the literature on SMA and performance.

The primary objective of the majority of organizations is to maximize profits. Therefore, economic performance indicates financial viability (Alsayegh et al., Citation2020). In a previous study (Alamri, Citation2019), the influence of SMA on economic performance was found to be greater than the influence it had on non-financial performance. However, the data indicate that SMA considerations must place equal emphasis on improving financial and non-financial performance, including social and environmental performance, in order to obtain a comprehensive view of the company (Alamri, Citation2019).

The findings provide more explanation and support for contingency theory assumptions for strategic management accounting academics. This is one of the first attempts in Thailand to use contingency theory and social and environmental performance as mediators. In dealing with rapid changes in the business environment, actions based on a strategic management accounting system will be more anticipative. Organizations’ ability to confront uncertainty will be increased as a result of better decision-making based on strategic management accounting (Zenita et al., Citation2015). As a result, this research enables green manufacturing to improve its competitiveness, efficiency, and profitability, thereby achieving its long-term goals (maximizing shareholder wealth) (Foo et al., Citation2018).

6. Contribution and implications

Sustainability is a management trend that is critical to modern organizational strategy and refer to the capacity of a business to integrate sustainability into its plans to make it more dynamic (Amui et al, Citation2017). The findings establish the first empirical relationship between the application of SMA techniques and sustainable performance in green manufacturing. There are only a few studies in Thailand that have examined the impact of SMA on sustainable performance in a variety of areas, including social, environmental, and economic performance. Additionally, the findings indicate causal relationships between the three components of sustainable performance, demonstrating that green manufacturing businesses can use SMA methodologies to help them make better decisions and to gain a competitive edge. Additionally, contemporary management accounting systems enable businesses to improve their overall innovative capacity and adaptability, enabling them to change and improve performance in both financial and non-financial areas (Thapayom, Citation2022).

However, the contingency approach to SMA is predicated on the premise that no universal accounting system fits all businesses in all circumstances (O’Higgins & Thevissen, Citation2017; Otley, Citation1980). Typically, executives use management accounting to make choices. Management accounting is employed to varying degrees in enterprises, depending on the level of requirements, management perceptions, and the readiness of the information. Each business, industry, and country will employ unique management accounting tools and methods, depending on the industry’s growth, the requirements of management, management assistance, and field knowledge (Cadez, & Guilding, Citation2008; Terdpaopong et al., Citation2017).

7. Limitations and suggestions for future study

This research is subject to a number of limitations. It is difficult to generalize these results to all organizations because the study was limited to green manufacturing companies that had acquired green industry certificates from the Department of Industrial Works of Thailand at levels 3 to 5. Second, since this study employed questionnaires, the research was based on perception measures (Pavlatos & Kostakis, Citation2018). Finally, the primary data acquired at random from managers (or senior accounting and finance workers, or related) limits the generalizability of conclusions to other managers representing their organizations.

This study investigated a list of fifteen SMA approaches gathered from prior studies. In future studies, researchers should study the utilization of SMA approaches not previously identified. In emerging economies, several SMA techniques, including comprehensive quality management, just-in-time (JIT), lean management, and the possibilities of value chain integration with suppliers and customers have not been investigated.

Author Biographies with Jum.docx

Download MS Word (13 KB)Disclosure statement

No potential conflict of interest was reported by the author(s).

Additional information

Notes on contributors

Worakorn Pumiviset

Worakorn Pumiviset is a Ph.D. candidate in Management from Faculty of Management Sciences, Prince of Songkla University, Thailand. She has also worked as an accounting lecturer at Faculty of Management Science, Songkhla Rajabhat University, Thailand.

Muttanachai Suttipun

Dr. Muttanachai Suttipun, Associate Professor teaches in the field of financial accounting as well as environmental, social and governance (ESG) disclosure including the other corporate voluntary disclosures. He has worked as an associate professor and researcher at the Accountancy Department, Faculty of Management Sciences, Prince of Songkla University (Hatyai Campus), Thailand since 2005. He completed his PhD (Accounting and Finance) in the area of corporate social and environmental disclosures utilizing legitimacy and stakeholder theories from the University of Newcastle, Australia in 2012.

References

- Ab Hamid, M. R., Sami, W., & Sidek, M. M. (2017). Discriminant validity assessment: Use of Fornell & Larcker criterion versus HTMT criterion. Journal of Physics: Conference Series, 890(1), 1. https://doi.org/10.1088/1742-6596/890/1/012163

- Afum, E., Agyabeng-Mensah, Y., Sun, Z., Frimpong, B., Kusi, L. Y., & Acquah, I. S. K. (2020). Exploring the link between green manufacturing, operational competitiveness, firm reputation and sustainable performance dimensions: A mediated approach. Journal of Manufacturing Technology Management, 31(7), 1417–16. https://doi.org/10.1108/JMTM-02-2020-0036

- Afum, E., Zhang, R., Agyabeng-Mensah, Y., & Sun, Z. (2021). Sustainability excellence: The interactions of lean production, internal green practices and green product innovation. International Journal of Lean Six Sigma, 12(6), 1089–1114. https://doi.org/10.1108/JMTM-02-2020-0036

- Alamri, A. M. (2019). Association between strategic management accounting facets and organizational performance. Baltic Journal of Management, 14(2), 212–234. https://doi.org/10.1108/BJM-12-2017-0411

- Albertini, E. (2013). Environmental management improve financial performance? A meta-analytical review. Organization & Environment, 26(4), 431–457. https://doi.org/10.1177/1086026613510301

- Al-Mawali, H. (2021). Environmental cost accounting and financial performance: The mediating role of environmental performance. Accounting, 7(3), 535–544. https://doi.org/10.5267/j.ac.2021.1.005

- Alsayegh, M. F., Abdul Rahman, R., & Homayoun, S. (2020). Corporate economic, environmental, and social sustainability performance transformation through ESG disclosure. Sustainability, 12(9), 3910. https://doi.org/10.3390/su12093910

- Alt, E., Díez-de-Castro, E. P., & Lloréns-Montes, F. J. (2015). Linking employee stakeholders to environmental performance: The role of proactive environmental strategies and shared vision. Journal of Business Ethics, 128(1), 167–181. https://doi.org/10.1007/s10551-014-2095-x

- Amrina, E., & Yusof, S. M. (2011). Key performance indicators for sustainable manufacturing evaluation in automotive companies. In Proceedings of the 2011 IEEE International Conference on Industrial Engineering and Engineering Management (IEEM), pp. 1093–1097. https://doi.org/10.1109/IEEM2011.6118084

- Amui, L. B. L., Jabbour, C. J. C., Jabbour, A. B. L., & Kannan, D. (2017). Sustainability as a dynamic organizational capability: A systematic review and a future agenda toward a sustainable transition. Journal of Cleaner Production, 142, 308–322. https://doi.org/10.1016/j.jclepro.2016.07.103

- Asiaei, K., Jusoh, R., Barani, O., & Asiaei, A. (2022). How does green intellectual capital boost performance? The mediating role of environmental performance measurement systems. Business Strategy and the Environment, 31(4), 1587–1606. https://doi.org/10.1002/bse.2971

- Braccini, A. M., & Margherita, E. G. (2018). Exploring organizational sustainability of industry 4.0 under the triple bottom line: The case of a manufacturing company. Sustainability, 11(1), 36. https://doi.org/10.3390/su11010036

- Bui, H. Q., Hoai, T. T., Tran, H. A., & Nguyen, N. P. (2023). Performance implications of the interaction between the accountants’ participation in strategic decision-making and accounting capacity. Journal of Asian Business and Economic Studies, 30(1), 67–81. https://doi.org/10.1108/JABES-04-2022-0087

- Byrne, B. M. (2010). Structural equation modeling with AMOS: Basic concepts, applications, and programming. Taylor and Francis Group Publication.

- Cadez, S., & Guilding, C. (2008). An exploratory investigation of an integrated contingency model of strategic management accounting. Accounting, Organizations and Society, 33(7–8), 836–863. https://doi.org/10.1016/j.aos.2008.01.003

- Çankaya, S. Y., & Sezen, B. (2019). Effects of green supply chain management practices on sustainability performance. Journal of Manufacturing Technology Management, 30(1), 98–121. https://doi.org/10.1108/JMTM-03-2018-0099

- Cescon, F., Costantini, A., & Grassetti, L. (2019). Strategic choices and strategic management accounting in large manufacturing firms. Journal of Management and Governance, 23(3), 605–636. https://doi.org/10.1007/s10997-018-9431-y

- Cinquini, L., & Tenucci, A. (2008). Is the adoption of strategic management accounting techniques really “strategy-driven”? Evidence from a survey. MPRA Paper, 11819. https://mpra.ub.uni-muenchen.de/11819/

- Cortina, J. M. (1993). What is coefficient alpha? An examination of theory and applications. Journal of Applied Psychology, 78(1), 98–104. https://doi.org/10.1037/0021-9010.78.1.98

- Eichhorn, B. R. (2014). Common method variance techniques (Vol. 1, pp. 1–11). Cleveland State University, Department of Operations & Supply Chain Management. SAS Institute Inc.

- Fauzi, H., Svensson, G., & Rahman, A. A. (2010). “Triple bottom line” as “Sustainable corporate performance”: A proposition for the future. Sustainability, 2(5), 1345–1360. https://doi.org/10.3390/su2051345

- Foo, P. Y., Lee, V. H., Tan, G. W. H., & Ooi, K. B. (2018). A gateway to realizing sustainability performance via green supply chain management practices: A PLS–ANN approach. Expert Systems with Applications, 107, 1–14. https://doi.org/10.1016/j.eswa.2018.04.013

- Fornell, C., & Larcker, D. F. (1981). Structural equation models with unobservable variables and measurement error: Algebra and statistics. Journal of Marketing Research, 18(1), 39–50. https://doi.org/10.1177/002224378101800313

- Fuzi, N. M., Habidin, N. F., Hibadullah, S. N., & Ong, S. Y. Y. (2017). CSR practices, ISO26000 and performance among Malaysian automotive suppliers. Social Responsibility Journal, 13(1), 203–220. https://doi.org/10.1108/SRJ-09-2015-0136

- Ghasemi, R., Habibi, H. R., Ghasemlo, M., & Karami, M. (2019). The effectiveness of management accounting systems: Evidence from financial organizations in Iran. Journal of Accounting in Emerging Economies, 9(2), 182–207. https://doi.org/10.1108/JAEE-02-2017-0013

- Guilding, C., Cravens, K. S., & Tayles, M. (2000). An international comparison of strategic management accounting practices. Management Accounting Research, 11(1), 113–135. https://doi.org/10.1006/mare.1999.0120

- Gunarathne, A. N., Lee, K. H., & Hitigala Kaluarachchilage, P. K. (2021). Institutional pressures, environmental management strategy, and organizational performance: The role of environmental management accounting. Business Strategy and the Environment, 30(2), 825–839. https://doi.org/10.1002/bse.2656

- Hair, J. F., Black, W. C., Babin, B. J., & Anderson, R. E. (2010). Multivariate data analysis (7th ed.). Cengage.

- Hair, J. F., Black, W. C., Babin, B. J., & Anderson, R. E. (2019). Multivariate data analysis (8th ed.). Cengage.

- Haldma, T., & Lääts, K. (2002). Contingencies influencing the management accounting practices of Estonian manufacturing companies. Management Accounting Research, 13(4), 379–400. https://doi.org/10.1006/mare.2002.0197

- HourneauxJr, F., Gabriel, M. L. D. S., & Gallardo-Vázquez, D. A. (2018). Triple bottom line and sustainable performance measurement in industrial companies. Revista de Gestão, 25(4), 413–429. https://doi.org/10.1108/REGE-04-2018-0065

- Hristov, I., & Chirico, A. (2019). The role of sustainability key performance indicators (KPIs) in implementing sustainable strategies. Sustainability, 11(20), 5742. https://doi.org/10.3390/su11205742

- Hubbard, G. (2009). Measuring organizational performance: Beyond the triple bottom line. Business Strategy and the Environment, 18(3), 177–191. https://doi.org/10.5897/AJBM11.2764.

- Kalkhouran, A. A. N., Nedaei, B. H. N., & Rasid, S. Z. A. (2017). The indirect effect of strategic management accounting in the relationship between CEO characteristics and their networking activities, and company performance. Journal of Accounting and Organizational Change, 13(4), 471–491. https://doi.org/10.1108/JAOC-05-2015-0042

- Khan, N. U., Irshad, A. R., Ahmed, A., & Khattak, A. (2021). Do organizational citizenship behavior for the environment predict triple bottom line performance in manufacturing firms? Business Process Management Journal, 27(4), 1033–1053. https://doi.org/10.1108/BPMJ-01-2021-0007

- Khan, N. U., Wu, W., Saufi, R. B. A., Sabri, N. A. A., & Shah, A. A. (2021). Antecedents of sustainable performance in manufacturing organizations: A structural equation modeling approach. Sustainability, 13(2), 897. https://doi.org/10.3390/su13020897

- Lay, T. A., & Jusoh, R. (2012). Business strategy, strategic role of accountant, strategic management accounting and their links to firm performance: An exploratory study of manufacturing companies in Malaysia. Asia-Pacific Management Accounting Journal, 7(1), 59–94. http://arionline.uitm.edu.my/ojs/index.php/APMAJ/article/view/57

- Le, T. T. (2020). The effect of green supply chain management practices on sustainability performance in Vietnamese construction materials manufacturing enterprises. Uncertain Supply Chain Management, 8(1), 43–54. https://doi.org/10.5267/j.uscm.2019.8.007

- Lee, S. M., Noh, Y., Choi, D., & Rha, J. S. (2017). Environmental policy performances for sustainable development: From the perspective of ISO 14001 certification. Corporate, 24(2), 108–120. https://doi.org/10.1002/csr.1395

- Liu, Z. (2020). Unraveling the complex relationship between environmental and financial performance: A multilevel longitudinal analysis. International Journal of Production Economics, 219, 328–340. https://doi.org/10.1016/j.ijpe.2019.07.005

- Maimun, T., Thongmark, C., Rattanatai, B., & Rojanadilok, T. (2023). BCG Economic model for balanced and sustainable development. EAU Heritage Journal Social Science and Humanities, 13(2), 14–27. https://so01.tci-thaijo.org/index.php/EAUHJSocSci/article/view/265111

- Maletič, M., Maletič, D., Dahlgaard, J. J., Dahlgaard-Park, S. M., & Gomišček, B. (2016). Effect of sustainability-oriented innovation practices on the overall organizational performance: An empirical examination. Total Quality Management & Business Excellence, 27(9–10), 1171–1190. https://doi.org/10.1080/14783363.2015.1064767

- Nimtrakoon, S., & Tayles, M. E. (2010). Contingency factors of management accounting practices in Thailand: A selection approach. Asian Journal of Accounting and Governance, 1(1), 51–78. https://doi.org/10.17576/ajag-2010-1-6546

- O’Higgins, E., & Thevissen, T. (2017). Revisiting the corporate social and financial performance link: A contingency approach. Business and Society Review, 122(3), 327–358. https://doi.org/10.1111/basr.12119

- Ojra, J., Opute, A. P., & Alsolmi, M. M. (2021). Strategic management accounting and performance implications: A literature review and research agenda. Future Business Journal, 7(1), 64. https://doi.org/10.1186/s43093-021-00109-1

- Otley, D. T. (1980). The contingency theory of management accounting: Achievement and prognosis. Accounting, Organizations and Society, 5(4), 413–428. https://doi.org/10.1007/978-1-4899-7138-8_5

- Otley, D. T. (2016). The contingency theory of management accounting and control: 1980–2014. Management Accounting Research, 31, 45–62. https://doi.org/10.1016/j.mar.2016.02.001

- Oyewo, B. (2021). Do innovation attributes really drive the diffusion of management accounting innovations? Examination of factors determining usage intensity of strategic management accounting. Journal of Applied Accounting Research, 22(3), 507–538. https://doi.org/10.1108/JAAR-07-2020-0142

- Pavlatos, O., & Kostakis, X. (2018). The impact of top management team characteristics and historical financial performance on strategic management accounting. Journal of Accounting & Organizational Change, 14(4), 455–472. https://doi.org/10.1108/JAOC-11-2017-0112

- Pham, D. H., Dao, T. H., & Bui, T. D. (2020). The impact of contingency factors on management accounting practices in Vietnam. The Journal of Asian Finance, Economics and Business, 7(8), 77–85. https://doi.org/10.13106/jafeb.2020.vol7.no8.077

- Rabbani, A., Zamani, M., Yazdani-Chamzini, A., & Zavadskas, E. K. (2014). Proposing a new integrated model based on sustainability balanced scorecard (SBSC) and MCDM approaches by using linguistic variables for the performance evaluation of oil producing companies. Expert Systems with Applications, 41(16), 7316–7327. https://doi.org/10.1016/j.eswa.2014.05.023

- Rashid, M. M., Ali, M. M., & Hossain, D. M. (2020). Revisiting the relevance of strategic management accounting research. PSU Research Review, 4(2), 129–148. https://doi.org/10.1108/PRR-11-2019-0034

- Schermelleh-Engel, K., Moosbrugger, H., & Muller, H. (2003). Evaluating the fit of structural equation models: Tests of significance and descriptive goodness-of-fit measures. Methods of Psychological Research Online, 8(2), 23–74.

- Schreiber, J. B., Nora, A., Stage, F. K., Barlow, E. A., & King, J. (2006). Reporting structural. equation modeling and confirmatory factor analysis results: A review. The Journal of Educational Research, 99(6), 323–338. https://doi.org/10.3200/JOER.99.6.323-338

- Sezen, B., & Çankaya, S. Y. (2013). Effects of green manufacturing and eco-innovation on sustainability performance. Procedia - Social and Behavioral Sciences, 99, 154–163. https://doi.org/10.1016/j.sbspro.2013.10.481

- Shahzadi, S., Khan, R., Toor, M., & Haq, A. (2018). Impact of external and internal factors on management accounting practices: A study of Pakistan. Asian Journal of Accounting Research, 3(2), 211–223. https://doi.org/10.1108/AJAR-08-2018-0023

- Sumkaew, N., & Intanon, R. (2021). The Study of factors influence organizational performance: Evidences from companies in the lower northern region of Thailand. Journal of Accounting, Business and Finance Research, 12(2), 48–52. https://doi.org/10.20448/2002.122.48.52

- Suttipun, M., & Arwae, A. (2020). The influence of sufficiency economy philosophy practice on SMEs’ performance in Thailand. Entrepreneurial Business and Economics Review, 8(2), 179–198. https://doi.org/10.15678/EBER.2020.080210

- Suttipun, M., & Saelee, S. (2015). Effects of corporate governance on sustainable development reporting in Thailand. Corporate Ownership and Control, 13(1), 692–700. https://doi.org/10.22495/cocv13i1c6p7

- Suttipun, M., Lakkanawanit, P., Swatdikun, T., & Dungtripop, W. (2021). The impact of corporate social responsibility on the financial performance of listed companies in Thailand. Sustainability, 13(16), 8920. https://doi.org/10.3390/su13168920

- Terdpaopong, K., Visedsun, N., & Nitirojntanad, K. (2017). The advancement of management accounting practices in Thailand and Malaysia. Suthiparithat (Journal of Business and Innovation: SJBI), 31(100), 190–207. https://so05.tci-thaijo.org/index.php/DPUSuthiparithatJournal/article/view/243568

- Thapayom, A. (2019). Strategic management accounting techniques and organizational sustainable performance: Evidence from industrial estates in Rayong Area, Thailand. Journal of Modern Management Science, 12(1), 51–74. https://doi.org/10.14456/jmms.2019.4

- Thapayom, A. (2022). The impact of contemporary management accounting practices on business success: Evidence from industrial estates in the eastern economic corridor, Thailand. Journal of Modern Management Science, 19(2), 90–109. https://so04.tci-thaijo.org/index.php/stou-sms-pr/article/view/253013

- The Office of Industrial Economics of Thailand. (2023). Gross domestic product (GDP) expansion forecast for the industrial sector. Industrial Economics Journal, 71, 3–5. https://www.oie.go.th/assets/portals/1/fileups/2/files/journal/JournalNo71.pdf.

- Toke, L. K., & Kalpande, S. D. (2019). Critical success factors of green manufacturing for achieving sustainability in Indian context. International Journal of Sustainable Engineering, 12(6), 415–422. https://doi.org/10.1080/19397038.2019.1660731

- Visedsun, N., & Terdpaopong, K. (2021). The effects of the strategy and goal on business performance as mediated by management accounting systems. Economies, 9(4), 149. https://doi.org/10.3390/economies9040149

- Yusliza, M. Y., Yong, J. Y., Tanveer, M. I., Ramayah, T., Faezah, J. N., & Muhammad, Z. (2020). A structural model of the impact of green intellectual capital on sustainable performance. Journal of Cleaner Production, 249, 119334. https://doi.org/10.1016/j.jclepro.2019.119334

- Zenita, R., Sari, R. N., Anugerah, R., & Said, J. (2015). The Effect of information literacy on managerial performance: The mediating role of strategic management accounting and the moderating role of self efficacy. Procedia Economics and Finance, 31, 199–205. https://doi.org/10.1016/S2212-5671(15)01221-6

- Zhu, Q., Zou, F., & Zhang, P. (2019). The role of innovation for performance improvement through corporate social responsibility practices among small and medium-sized suppliers in China. Corporate Social Responsibility and Environmental Management, 26(2), 341–350. https://doi.org/10.1002/csr1686