?Mathematical formulae have been encoded as MathML and are displayed in this HTML version using MathJax in order to improve their display. Uncheck the box to turn MathJax off. This feature requires Javascript. Click on a formula to zoom.

?Mathematical formulae have been encoded as MathML and are displayed in this HTML version using MathJax in order to improve their display. Uncheck the box to turn MathJax off. This feature requires Javascript. Click on a formula to zoom.Abstract

The unfavourable macroeconomic situation in Ghana has ignited innovations in the strategic direction of the banks especially in their loan portfolio allocation. In the wake of information sharing services provided by credit scoring agencies, this study examines the effect of banks’ asset and income diversifications on banking system stability in Ghana. We sourced the bank specific data from 14 banks. The credit scoring data were obtained from XDS Data Ghana. The period of the study is from 2010 to 2019. The paper used the system GMM approach to account for reverse causality/endogeneity. We found that income diversification reduces the systemic risk of the Ghanaian banking system. Also, the study found that asset diversification strategies of the banks have a meaningful effect on bank stability when financial institutions augment their diversification decisions with information from Credit Scoring Agencies. The implication of the study is that banks which employ the services of credit scoring agencies are more likely to alleviate information asymmetry in their intermediation process and therefore induce asset quality. The improvement in asset quality due to information sharing reduces the risk-taking behaviour of Ghanaian banks. The study recommends that the Bank of Ghana as a matter of urgency should make it compulsory for all banks to access and use the services of Credit scoring Agencies to induce the soundness of the banking system.

IMPACT statement

The study examines the role of information supplied by credit reference bureaus in Ghana in the banks’ diversification and banking system stability nexus. We collected data from 14 banks and XDS Data Ghana between the period 2010 and 2019 inclusively. We employed a data analytical method that accounts for reverse causality and produces efficient estimates of smaller observations. We found that information provided by credit scoring agencies can help the banks to do effective asset diversifications that can translate into the soundness of the Ghanaian banking system. The results of the study call on all stakeholders to strengthen the activities of the credit scoring agencies to induce the stability of the banking system.

REVIEWING EDITOR:

1. Introduction

Ghana’s financial market is dominated by the Banks and Specialised Depository Taking Institutions (BSDIs). Due to their size, the recent development in the BSDI sub-sector have caused shocks in the financial system and the economy of Ghana. By 2019, the Bank of Ghana revoked the licenses of seven banks. The GCB Bank, one of the nation’s largest banks absorbed the then UT Bank and Capital Bank. The five remaining banks were merged into the now Consolidated Bank. Furthermore, in 2017 the Bank of Ghana announced that it would increase the Capital requirement of the bank from GHS 120,000,000 to GHS 400,000,000. Subsequently, in December 2018, only 16 out of the over 30 banks were given clearance to operate after they met the capitalization requirement. As of 2020, there were 23 banks operating in Ghana. Within the period, 23 Savings and Loans Companies and 347 Microfinance Institutions also collapsed. These developments ignited discussions on the stability of the banking system with some concluding that the Ghanaian banking system was in crisis. The reorganization of the banking system was followed by macroeconomic instability which has also fueled the perception of instability in the banking system.

In the immediate fiscal period, headline inflation in Ghana increased from 23.4% in April 2022 to 41.20% in April 2023. In the same period, the share of private sector credit decreased from 26.51% to 19.77% even though broad money supply increased from 14.42% to 43.05%. The reduction in the credit to private sector shows that the banks are diversifying their loan portfolio to other sectors which can be counterproductive since the reciprocal of the credit to the private sector can be due to domestic loans to the government or to individuals for consumption or due to investment in the equity of other firms. Similarly, interest rates have increased astronomically which can restrict access to finance by the private sector.

During the review period, the BOG increased the reserve requirement from 12.5% to 15% since November 2022 which can reduce the credit creation ability of the banks and affect their diversification strategies. Similarly, the ability of the banks to continue their normal business has been complicated due to rising interest rates. The policy rate which is the base rate of the Bank of Ghana stands at 30% which portrays that the banks are susceptible to risk taking as they pursue high-yield investment through diversification. Even though deposit rates are still below 10% on average, the average lending rate is about 35% as of August 2023. The interest rate margin can discourage deposit mobilization which in turn can reduce the liquidity of the banks. These developments can increase asset and income diversification strategies of the banks.

Furthermore, in 2007 the government of Ghana passed the Credit Reporting Act, 2007 (ACT 726) to ensure that financial institutions make informed lending decisions through information sharing to reduce risk resulting from lending (Kusi & Opoku-Mensah, Citation2018). Following the spillover of credit risk resulting from the interconnectedness among banks (Yang et al., Citation2019), policymakers found it worthy to establish information sharing system in the Ghanaian banking sector to reduce the risk of lending. Kusi and Opoku-Mensah describe information sharing as the operation whereby Credit Referencing Bureaus (CRBs) make quality and adequate credit information about potential borrowers available to financial institutions to aid their credit decision-making. Since 2010, financial institutions in Ghana have made use of the services and products of CRBs, intending to reduce the poor performance of non-performing loans. Empirical studies have indicated that as banks in Ghana employ the services of CRBs, the degree of their risk-takings meaningfully reduces (Kusi, Agbloyor, Ansah‐Adu, & Gyeke‐Dako, Citation2017; Kusi & Opoku-Mensah, Citation2018).

The banks’ appetite for diversification can also increase due to the emergence of credit information sharing technology in 2010. Since 2010, Credit Bureaus have emerged to collect information about borrowers and sell same to the banks and other financiers in Ghana. This, at least in theory, should reduce the opaqueness in financial intermediation since the banks can now gather information about the creditworthiness of borrowers. Through the partnership of the banks and the Credit Scoring Agencies (CSAs), it is expected that borrowers with profitable projects can also obtain loans, earn enough profit, and honour their loan obligations. Under this situation, we expect the risk-taking behaviour of the banks to be value-enhancing to boost systemic stability due to improved liquidity from performing loans.

Bank diversification can influence the stability of banking sectors because it increases the risk-taking behaviour of the banks when they seek high yield portfolios through loan advancement which can be due to asset diversification (Abbas et al. Citation2021). In recent times, the banks have diversified their income and asset sources to enhance their resilience to shocks due to financial crises. However, the 2019 Annual Report of the Bank of Ghana reveals that some Ghanaian banks face the risk of distress due to their unproductive diversification activities. Banks are motivated to diversify because bank diversification strategies can boost the net income margin of the banks and channel resources into productive sectors, but it can also lead to the risk of financial distress. Yang et al. (Citation2019) adds that diversification increases the risk of banks and exposes the banking sector to a collapse because the banks especially when the banks are closely connected.

Diversification can help banks to increase their resilience to shock by investing in safer portfolios such extending credit innovative enterprises. Nevertheless, when all banks hold similar portfolios (diversify) simultaneously, it increases interbank overlaps, which can negatively affect bank stability, especially in times of economic shocks (Yang et al., Citation2019). Moreover, Abuzayed et al. (Citation2018) indicated that diversification can be an essential factor in reducing bank risk if the assets or sources of income are not perfectly correlated. Commercial banks face some common types of risk such as credit risk, liquidity risk, operational risk, and market risk (Musiega et al., Citation2017). However, their risk exposure increases when they pursue diversification strategies because they bear additional risks from trading in new markets and inherit risks associated with trading new products and services. It is evidenced in literature that diversification ventures can expose banks and the banking industry to systemic risk or financial instability (Abbas et al., Citation2021; Brunnermeier et al., Citation2020).

Considering these arguments, this article seeks to establish whether systemic risk will reduce if bank diversification is complemented with information sharing. The study dwells on the market failure theory to investigate bank diversification and systemic risk in Ghana: The role of information sharing. First, we examined the relationship between bank diversification and systemic risk and the impact of information sharing on systemic risk in Ghana. Unlike other studies conducted in Ghana, this study uses the Adjusted Herfindahl-Hirschman Index (AHHI) approach to measure two diversification strategies of banks: income and asset diversification. Also, the study employs time-varying z-score as a proxy for systemic risk and uses bank-level data to measure information sharing for fourteen cross-sectional units over ten years.

The world should be interested in the stability of the Ghana’s banking system. Ghana plays a significant in the economic development of the Sub-Saharan Africa. Ghana is the headquarter of African trade and investment, as it currently habours the African Free Trade Area. The development is positioning the country to attract commerce from all corners of the world into the African continent. The system also accommodates large Pan-African banks which are supporting trade and industrial developments in Africa. Hence, the financial institutions must position themselves in terms of generating adequate liquidity to support trade and investment on the continent.

Despite the above, we did not find any study that analyses the role of credit information sharing in bank diversification and systemic risk nexus. Regarding the mechanisms of reducing insolvency risk, this paper suggests that the introduction of information sharing is an effective regulatory system that can reduce the probability of market failure. Since loan processing remains a significant part of banking activities, it is expected that banks would not ignore the factor of asymmetric information when dealing with borrowers. Therefore, as banks diversify their portfolio to reduce risk and compression in profit, it is also required that proactive measures are taken to control the risk associated with lending by inquiring about their creditors.

Using the system GMM approach, which accounts for reverse causality and allows efficient estimate for a small cross-sectional sample and addresses issues of overriding identity, we found that income diversification can reduce the systemic risk of the Ghanaian banking system. Finally, the employment of the services of credit rating agencies can reduce the negative effect of diversification on systemic risk.

The organization of the subsequent sections is as follows. The second section presents the empirical literature review. The next section addresses the methods employed for the study. The fourth section analyzes and discusses the results. The final section presents the conclusion of the article.

2. Literature review

2.1. Justification for hypotheses development

Diversification, as an investment strategy, can introduce a greater level of interconnectedness among banks. Bank diversification allows for holding of similar portfolios and consequently lead to common exposure of network banks to systemic shocks. In line with the theoretical literature, the modern portfolio theory demonstrates that diversification will decrease the rate of risk-bearing when assets within a portfolio have high negative correlation (Harry Markowitz, Citation1952). Following competition in the banking sector, banks can end up with common diversification strategies due to the related business activities, they perform and weak intellectual property protection. Therefore, the entire banking industry is characterized by a common asset and a similar exposure paving the way for possible systemic risk. In regards, we test the hypothesis that bank diversification can induce the risk-taking behaviour of banks which in turn can lead to systemic risk in Ghana. The hypothesis is substantiated by the empirical studies that bank diversification has either a beneficial or detrimental impact on systemic risk (Abbas & Ali, Citation2022; Duho et al., Citation2019; Moudud-Ul-Huq et al., Citation2020).

Moreover, we test the hypothesis that credit information sharing can reduce credit risk which in turn can minimize systemic risk in Ghana. This is dependent on the argument in the literature that the amount of credit available in a financial system is partly influenced by information. In line with the information theory of credit, information is a determinant of credit in the sense that when credit providers have enough credit information about prospective borrowers, they can make informed lending decisions to reduce risk (Stiglitz & Weiss, Citation1981). The absence of reliable, adequate and complete information about a borrower can cause financial instability due to information asymmetry. The argument is that, when lenders lack the concrete means to track and/or verify credit information, some borrowers will provide false and incomplete information to obtain credit. Thus, the existence and quality of information sharing can bridge the information gap between credit providers and borrowers. In addition, empirical evidence supports the position that credit information sharing matters for the reduction of bank instability (Bamfo, Citation2019; Kiring’a et al., Citation2021; Rusmanto et al., 2020).

Another line of literature suggests that efficient regulation is required to address inefficiencies in the credit market (Peltzman, Citation1976). The literature of Peltzman (Citation1976) supports the argument that factors such as monopoly, asymmetric information and externalities are the major economic conditions that build up market failures. The suggestion for regulation to address asymmetric information is justifiable because gaps in information sharing can influence the banking industry’s failure. In the presence of incomplete information between borrowers and lenders, a market failure (systemic risk), resulting from adverse selection could occur in the banking sector.

We therefore state the following hypotheses:

: Bank diversification will increase the risk-taking behaviour of the banks in Ghana which can be detrimental to banking system stability.

: Information sharing systems can mitigate the problem of information sharing in lending and lead to banking system stability.

: Information providing by Credit Rating Agencies can reduce the risk of bank diversification and lead to banking system stability in Ghana.

2.2. Bank diversification and bank stability

Literature report that a moderate degree of bank diversification enhances the financial stability of banks (Kim et al., Citation2020). However, when diversification is at its peak, it can cause a detrimental effect on the stability of banks. Kim et al. investigated the relationship among financial crisis, bank diversification and financial stability of banks in the OECD countries. They found that bank diversification increases the risk of bank instability in periods of financial crises. Thus, in periods of financial crisis, banks are better off when they stick with traditional intermediation activities. Conversely, Abbas and Ali (Citation2022) report that asset diversification as well as funding diversification reduces the risks of banks. They also found that income diversification is positively related to the banks’ risk-taking. Thus, income diversification contributes to the instability of banks whereas asset and funding diversification induce bank stability.

Similarly, Brunnermeier et al. (Citation2020) investigated the impact of non-interest income on systemic risk of banks in the United States. The study found that trading and other non-interest income have a significant positive relationship with a bank’s interconnectedness risk. This implies that trading and other non-interest income causes systemic risk. Further, the findings revealed that non-interest income is more volatile than interest income in inducing systemic risk. Similarly, Duho, et al. (Citation2019) provide evidence that income diversification decreases the profit and profit efficiency of banks.

Furthermore, Nisar et al. (Citation2018) examined the effect of revenue diversification on the profitability and stability of banks in South Asia. The findings show that a positive relationship exists between revenue diversification and stability. An empirical study conducted by Chen et al. (Citation2018) on how asset diversification affects bank performance in Asia, shows that asset diversification has diminishing effect on banks’ performance. However, the effect is minimal for Islamic banks relative to that of conventional banks.

Moudud-Ul-Huq et al. (Citation2020) highlight the bank diversification conditions the relationship between banks’ risk-taking and performance. The study found that income and asset diversification reduce bank risk-taking. Again, bank diversification positively impacts banks’ performance in emerging economies while NPL contributes to the instability of banks. Moudud-Ul-Huq et al. added that the benefit of diversification varies according to bank-specific characteristics such as financial wellness, bank size or even location. In a similar study, Abuzayed et al. (Citation2018) suggests that asset diversification negatively affects the stability of banks.

Yang et al. (Citation2019) investigated the link between bank diversification and systemic risk with data from the United States. The authors measured diversification using the sources of revenue to the banks. They found that bank diversification significantly increases systemic risk. Further, the study showed that the effect is more substantial in larger and medium-sized banks than the smaller banks. Moreover, the results showed that in periods of crisis, bank diversification plays a crucial role in influencing systemic risk.

Liang et al. (Citation2020) investigated the relationship between bank diversification, performance, and corporate governance. They reported that the net benefit of diversification depends on bank specific factors and institutional factors such as regulations and market structures. The findings reveal that income diversification positively impacts accounting performance like return on asset while it causes a negative effect on market valuation. Furthermore, it was reported that corporate governance matters in diversification because it strengthens the positive impact of diversification on profitability.

Still, Abbas et al. (Citation2021) examined the impact of income and balance sheet diversification on the US commercial banks’ cost and profit efficiency. The study reveals that income diversification is positively related to the banks’ cost and profit efficiency whereas asset diversification has a negative effect on cost efficiency. Moreover, funding diversification was found to be detrimental to profit efficiency but positively related to the banks’ cost efficiency. Also, Adesina (Citation2021), shows that income and asset diversification turn to reduce the performance of banks. Nevertheless, the result reveals that the efficiency of banks’ human capital reduces the extent to which bank diversification affects the performance of banks in Africa.

The effect of bank diversification on the stability of the banking system can be due to other conditioning factors. However, none of the empirical studies have addressed the role of information sharing in the channels through which asset – and income diversifications affect banking system stability.

2.3. Information sharing and bank stability

In the study by Liem, Son, Tin and Canh (Citation2022) on the relationship among fintech credit, credit information sharing and bank stability, it was reported that credit information sharing increases bank stability. In addition, the positive impact of fintech credit on bank stability is being enhanced by the existence of credit information sharing institutions. Also, Tran, Nguyen, Nguyen and Nguyen (Citation2022) examined the moderating role of credit information sharing on the impact of credit booms on bank risk in Southeast Asian countries. The authors suggest that bank risk reduces through credit information sharing as they found a negative relationship between the variables. Moreover, credit information sharing moderates the relationship between credit booms and bank risk. Thus, credit information sharing reduces the unfavourable impact of credit booms on bank risk.

Still, Kusi and Opoku-Mensah (Citation2018) investigated the effect of credit information sharing affects the funding cost of banks in Africa. They found that the quality of information sharing matters when it comes to efficiency of banks as it reduces banks’ funding costs. Also, the authors found that the presence and coverage of credit information sharing reduces banks’ funding cost in Africa. Similarly, the study by Guérineau and Léon (Citation2019) shows that the financial fragility of banks in emerging and advanced countries can be reduced due to the presence of credit information sharing systems. Again, the authors found that credit information sharing reduces the negative effect of credit booms on financial fragility.

Rusmanto, et al. (Citation2020) investigated the impact of credit information sharing on bank charter value and systemic risk in Asian banking system. They reported that the degree to which charter value causes systemic risk is reduced for countries with higher depth of credit information index. The study reveals that countries with higher information asymmetry can substitute bank charter value with credit information sharing to mitigate risk. Moreover, their study highlighted that countries with higher coverage of private credit registries are more likely to reduce the negative impact of charter value on systemic risk.

Moreover, Pauline and Nadham (Citation2022) investigated the effect of credit information bureau and appraisal methods on the performance of commercial banks in the Mwanza Region of Tanzania. They found that credit information sharing significantly increases bank performance. Furthermore, they indicated that banking firms that employ the services of credit referencing bureaus can enhance their level of profitability through the reduction of credit risk. In a similar study, Boateng et al. (Citation2018) investigated the impact of information sharing institutions on market power in the African banking industry. They found that credit information from both public credit registries and private credit bureaus increases market power in the African banking industry. Their study suggest that information system can increase the inefficiencies in the African banking system since it increases bank market power.

In a study by Kiring’a et al. (Citation2021), it is reported that credit information sharing improves the positive impact of lending on access to financial services among small and medium-sized enterprises in Kenya. Bamfo (Citation2019) in his study on the effect of credit information sharing on bank profitability reveals that significantly, credit information sharing matters in enhancing the profitability of banks. In addition, the author suggests that government intervention through measures and policies will provide an enabling environment for credit referencing institutions to accelerate bank profitability. presents additional reviews of the empirical literature.

Table 1. Review of recent empirical literature.

The empirical literature provides substantial evidence that studies on the risk-taking behaviour of banks have soured in the aftermath of the global financial crisis. The studies reported conflicting impact of bank diversification on banks’ risk-taking behaviour. The conflicting results necessitate that more country-specific investigations should be conducted to unearth and appreciate the effect of bank diversification on banking system’s stability. Moreover, the issue of how information sharing system condition bank diversification to influence systemic risk has received little attention especially in emerging countries. Bank diversification can increase the risk-taking behaviour of banks. In the same token, banks patronize the services of credit rating agencies to minimize the risk of non-performing loans which will in turn boost the soundness of the banking system. The aim of the current study is to examine the role of credit information sharing in bank diversification and banks risk-taking nexus.

3. Methods

The study used secondary data from the audited financial statements of the financial institutions. We also collected data from XDS data Ghana Ltd., which is a credit referencing bureau in Ghana. Data from the banks’ audited financial statements were used to calculate the indicators of income diversification, asset diversification and systemic risk. Also, data from XDS Data Ghana Ltd. were employed to determine the information sharing measures. Based on the number of banks that access information from XDS Data Ghana Ltd., we included fourteen banks out of the existing twenty-three banks. The study period is from 2010 to 2019 which implies that we had a panel structure of 140 data observations.

3.1. Measurement of systemic risk

We found the accounting data-based method of measuring bank risk-taking suitable to estimate systemic risk. Particularly, the z-score method is employed to measure the state of stability in the banking sector of Ghana. The z-score method is preferred because of its ability to accurately capture bank risk (Li et al., Citation2017). Z-score helps to determine the extent with which a bank’s capital can absorb the variability in returns without the firm experiencing insolvency.

In recent times, studies have resorted to time-varying z-score measures because the traditional approach of computing z-score has failed to completely capture bank risk (Li et al., Citation2017). The different forms of time-varying z-score include the following: (1) the current period’s value of equity plus asset ratio with moving mean and standard deviation of Return on Asset (ROA) over a selected rolling length for example, a rolling length of previous 4 years; (2) the moving mean and standard deviation of ROA of the total sample period combined with current values of equity to asset ratio; (3) the combination of current values of equity to asset ratio and ROA with the standard deviation of ROA of the total sample period; ang (4) the volatility measure, which is the standard deviation, combined with the moving mean of ROA over the same period and the current values of the equity to asset ratio. Amid these measures, we used the combination of current values of equity to asset ratio with moving mean of ROA and standard deviation of ROA over the total sample period to measure z-score. The method is selected because it does not ignore previous observations, and thus, it gives a true picture of the firm’s risk profile. The z-score is calculated as:

(1)

(1)

where ROA is the return on assets, which is determined as net profit after tax divided by total assets.

is the standard deviation of ROA. It measures the variability in returns of the bank.

Z-score is employed as a measure of banking sector stability. Conversely, an inverse z-score measures financial instability. For ascertaining normality of the data, inverse z-score was computed to measure systemic risk. The inverse z-score is determined by the natural logarithm of z-score. Hence, we employ inverse z-score as a proxy for systemic risk.

3.2. Income diversification

Income diversification is used as a measure of bank diversification (Lee et al., Citation2020; Nguyen & Pham, Citation2020). It is calculated as the increase in non-interest income in addition to traditional interest income sources or the balance share among the different sources of income (Ebrahim & Hasan, Citation2008). Thus, a bank’s operating income consists of non-interest income and interest income. Non-interest income is the returns from activities other than banks’ primary businesses that yields net interest revenue. Income from these activities may include but are not limited to banks’ commissions and fees income, charges on service, trading income (Kim & Kim, Citation2020; Lee et al., Citation2020; Nguyen & Pham, Citation2020). We follow Abuzayed et al. (Citation2018) to determine income diversification with the Adjusted Herfindahl-Hirschman Index (AHHI). Income diversification is expressed in the equation below as.

(2)

(2)

where

NII = Net Interest Income

NOI = Net Operating Income

NON = Non-Interest Income

3.3. Asset diversification

The second measure of diversification considered for the analysis is asset diversification. It entails the distribution of a banks’ operating earning assets into non-lending and lending assets (Abuzayed et al., Citation2018). The lending assets are classified as net loans and non-lending assets are the other operating earning assets aside from net loans. Examples of non-lending assets include equity investments and government securities. Again, the study follows Abuzayed et al. (Citation2018) to measure asset diversification with the Adjusted Herfindahl-Hirschman Index. The asset diversification equation is expressed as follows.

(3)

(3)

where

LOAN = Net Loans

TOEA = Total Operating Earning Assets

OEA = Operating Earning Assets Aside Net Loans

3.4. Information sharing

Studies have shown that credit information sharing through CRBs has reduced the risk-bearing of financial institutions that employ the services of CRBs (Büyükkarabacak & Valev, Citation2012; Guérineau & Léon, Citation2019; Kusi et al., Citation2017). The study employs this variable because it is crucial to enhancing financial stability, the development of the credit market, and the economy. Information sharing is a mechanism to reduce asymmetries in information about prospective borrowers (Tchamyou & Asongu, Citation2017). Some traditional measures of information sharing include the existence of public credit registries, the existence of private credit registries, the coverage of information sharing by public credit registries, coverage by private credit registries, and the depth of information sharing. The traditional method is not applicable for this study because of unavailability of data at the bank level in Ghana.

This study follows Kusi et al. (Citation2017) to measure information sharing using two methods. The first method, which is the frequency at which banks use the services of a credit referencing bureau is determined as the natural logarithm of credit referencing enquiries made by a particular bank each year. Secondly, the study measures information sharing with the willingness of banks to use the services of CRBs. This is determined as the natural logarithm of the cost of enquiring divided by total loans and advances each year.

shows that the SG is the most stable bank in Ghana with an average rolling window Zscore of 48.34 whilst BOA is the least stable bank in Ghana. Interestingly, large banks such as the GCB are not necessarily the most stable banks. This shows that in Ghana the size of a bank does not guarantee the stability of that bank. In terms of cost of accessing the services of credit rating agencies, the fifth column shows that the cost of credit scoring information per loan ranges from 0.0000 (ECO Bank) to 0.0083 (ZBL). However, the most stable bank (SG) does not spend the highest expenditure on information even though the second most stable bank, ZBL, does. In general, shows that the instability of the banks, as measured by the log of the Zscore, has increased for most of the banks in recent years.

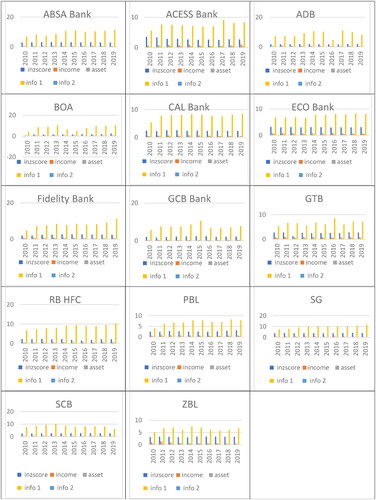

Figure 1. The distribution of the variables from 2010 to 2019. Note: inzscore is log of zscore; income is income diversification; asset is asset diversification; info 1 (information sharing) measured as natural log of Credit Reference Bureau enquiries made by banks; info 2 (information sharing) measured as cost of enquiries divided by total loans offered.

Table 2. Cross-sectional averaged distribution of the main variables.

Similarly, GTB tops income diversification with an AHHI of 0.8427 whilst the GCB is the most conservative bank concerning income diversification with an AHHI of 0.4073. shows that the banks maintain stable levels of income diversification from 2010 to 2019 with a marginal surge in the variable concerning the 2019 figures.

Furthermore, ABSA, a Pan-African Bank leads the league of asset diversification with a AHHI of 0.4932 whereas PBL is the most conservative when it comes to asset diversification. In general, we see that the banks mimic each other concerning asset diversification which substantiate a key feature of most banking system that banking products are not easily differentiable since intellectual property protection is very weak in the banking system. also shows that in general, asset diversification of the banking system has increased marginally in recent years after the global financial crisis.

3.5. Bank-specific variables

This study controls for firm-specific factors such as Loan to Asset Ratio (LAR), Cost to Income Ratio (CIR), Equity to Asset Ratio (EAR) and Bank Size (BS). The study follows Abuzayed et al. (Citation2018); Yang et al. (Citation2019) to adopt these control variables since they matter for a firm’s contribution to systemic risk. In the extant literature, the loan to asset ratio variable is reported as a reflection a bank’s principal business (Yang et al., Citation2019). The ratio provides a direction on how much of a bank’s asset is embedded in loans. LAR is measured as a total loan divided by total assets.

CIR is a bank-specific variable popularly used to measure efficiency in terms of cost (Abuzayed et al., Citation2018). A more efficient bank is positioned to inspire financial stability. CIR is measured as operating expenses divided by operating income.

In literature, studies explain that EAR partially analyses a firm’s capital adequacy (Abuzayed et al., Citation2018; Yang et al., Citation2019). Equity to asset ratio is a leverage ratio that determines the magnitude of capital owned by owners to fund assets. EAR helps to assess the core strength of a bank’s capital. It is determined as total shareholders’ equity divided by total assets.

Finally, bank size is an important variable that influences the stability of a bank. Bank size is measured as the natural logarithm of total assets.

3.6. Model specification

We employ the system generalised method of moment (GMM) under the dynamic panel estimators to estimate the models of the study. The dynamic panel estimators come in two forms: the difference panel GMM and the system panel GMM. Blundell and Bond (Citation1998) stated that the difference GMM is inappropriate and provides biased and inefficient results for a panel data that has a shorter period and more cross-sectional units. Hence, considering the period of 2010 to 2019 and the cross-sectional units of fourteen banks, we find the system GMM suitable over the difference GMM to estimate the hypotheses of the study. Moreover, the system GMM is chosen as the estimation technique because it addresses the weak instruments used by the difference GMM. Also, it caters for the problem of reverse causality, which is associated with endogenous variables (Blundell & Bond, Citation1998; Miletkov & Wintoki, Citation2012).

In addition, the system GMM comes in two forms, namely the one-step and two-step GMM. We employ the two-step GMM estimator for the empirical analysis because it enhances the efficiency and the power of the associated tests due to its minor asymptotic variance (Hwang & Sun, Citation2018). The two-step estimator provides statistical tests that are asymptotically more powerful (Hwang & Sun, Citation2018). Again, the paper used the first lag of the regressors as instruments. According to Roodman (Citation2009), too many instruments weaken the validity of the joint impact of the instruments especially, when the time series component is lesser than the cross-sectional units. The empirical model estimation for the hypotheses is expressed in Equationequations 4(4)

(4) and Equation5

(5)

(5) as follows.

(4)

(4)

Where i represents the cross-sectional unit (banks), t represents the period considered for the study, represents the coefficient, SRisk represents the Systemic Risk,

represents the Lag of Systemic Risk, BD represents Bank Diversification, INFS represents Information Sharing, Z represents the Control Variables, and

and

represent the intercept term and the error term, respectively.

For the interaction effect, the equation is expressed as:

(5)

(5)

where i represents the cross-sectional unit (banks), t represents the period considered for the study,

represents the coefficient, SRisk represents the Systemic Risk,

represents the Lag of Systemic Risk, BD represents Bank Diversification, INFS represents Information Sharing, BD*INFS represents interaction term of Bank Diversification and Information Sharing, Z represents the Control Variables, and

and

represent the intercept term and the error term, respectively.

3.7. Marginal effect

The study conducts a partial differential of the dependent variable (systemic risk) with respect to the independent variables (income diversification and asset diversification) to determine the marginal effect of the independent variables. Thus, the marginal effect is used to determine the additional effect of the independent variable when it is complemented with the moderating variable. The marginal or net effect is considered by estimating the derivative of a given function of the covariates and coefficients of the preceding estimation (Pepinsky, Citation2018). Dogarawa et al. (Citation2020) averred that the results from the regression are unadjusted margins while computing the net effect makes the results an adjusted predictive margin. Hence, by computing the net effect, the results are more tangible relative to the regression results. Therefore, the study estimates the marginal effect to make a reliable conclusion of whether there is a moderating effect. The marginal effect is computed to justifiably infer that information sharing conditions the effect of bank diversification on systemic risk in Ghana. The partial differential is derived from the equation:

(13)

(13)

Therefore, the net effect of the independent variable is expressed as:

(14)

(14)

where,

= coefficient of the independent variable

= coefficient of the interaction term

MN = the mean of the moderating variable

Moreover, since the regression equation for the moderating effect is a log-linear model, the study follows Benoit (Citation2011) to introduce the Euler’s number or the exponential constant (e = 2.71828) for the linear variable. Benoit explains that the natural logarithm conditions a base, which is equivalent to the exponential constant. Hence, a log-linear model becomes a uniform model (log–log) when the exponential constant is introduced for the linear variable in the model. Specific to the above equation, the dependent variable and the interaction term are logged variables. Hence, the study employs the exponential constant for the independent variables to achieve a uniform model and consequently, to obtain an unbiased result. presents a detailed description of the variables.

Table 3. Definition of the variables.

4. Empirical result

4.1. Descriptive statistics

presents the descriptive statistics for the variables used for the analysis. The descriptive statistics are presented on fourteen banks. The result reveals that z-score average16.648 with a dispersion of 11.127. The standard deviation shows that the mean of the z-score is not widely separated. Thus, banks in the Ghanaian banking sector are closely related in terms of their level of stability. Moreover, the result indicates that banks have diversified approximately 43.2% of their assets and about 66.2% of their income. Also, the number of credits referencing enquiries made by banks (FCRB) records a variation of 1.584 and averaged 7.972. The meaning of 7.972 indicates that each year, the average number of times a bank inquiry about a borrower’s credit information is approximately eight times. Logically, an enquiry of eight times within a year is not satisfactory because it is rare to notice that a bank would offer a loan facility to about eight borrowers within a given year. This implies that that in Ghana, the effort of banks to employ the services of CRBs is not motivating. Also, WCRB, which represents the willingness of banks to use the services and products of CRB, averaged 0.001 with a variability of 0.008. The moderately wide gap between the mean and the standard deviation predicts that firms in the Ghanaian banking industry are not closely related in terms of their willingness to employ the services of CRBs. Some banks spend more on credit referencing activities by inquiring about potential borrowers than others.

Table 4. Descriptive statistics.

The loan to asset ratio records a mean of 39.7% and variability of 12.5% implying that that about 40% of the bank’s assets are invested in loans. The result of the cost to income ratio predicts that the banking sector’s cost efficiency (CIR) has a maximum of 100% and a minimum of 30%. Moreover, the ability of firms to minimize cost and maximize revenue averaged 57.3%. The variability of 15.9% against a mean value of 57.3% suggests that the bank’s cost efficiency is not closely balanced. The equity to asset ratio records that on average, only about 15% of the banks’ assets are sourced from equity financing. The 15% of equity financing implies that firms in the Ghanaian banking sector resort more to debt financing, which increases banks’ risk and, consequently, instability. Bank size obtains a variability of 0.891 and an average of 21.492 within the ranges of 19.098 and 23.303. The result signifies that firms in the Ghanaian banking sector are not characterize by a uniform asset size. The wide range between the mean and the variability implies that some banks have a higher market share of assets while others have smaller sizes of assets.

4.2. Correlation analysis

The matrix below () serves as a diagnostic test for the variables in terms of the extent to which they correlate with each other. Adam (2015) states the correlation decision rule that a very weak correlation exists between variables with a correlation coefficient of (+/−) 0.10 to 0.29, and a weak correlation is when the correlation coefficient is (+/−) 0.30 to 0.49. Moreover, a correlation matrix with the coefficient of (+/−) 0.50 to 0.69 is described as moderate. A large correlation exists when the coefficient is (+/−) 0.70 to 0.99. From the result, the matrix shows no existence of large correlation coefficients. Therefore, the variables can be used for the regression analysis ().

Table 5. The correlation matrix of the variables.

4.3. Analysis and discussion of regression results

The result for the effect of income diversification and systemic risk in Ghana is presented in the second column of below. For all the results in , we found that the previous year’s systemic risk has a positive and significant impact on the present year’s systemic risk. The result shows that at a 5% alpha level, a percentage increase in the previous year’s systemic risk will increase systemic risk in the current year by 0.20%. Thus, the extent of the current year’s risk of insolvency is influenced by the risk of the previous year; hence, systemic risk can have a period spillover effect on the soundness of the banking system.

Table 6. The effect of income diversification, asset diversification and information sharing on systemic risk.

Also, the results in the second column reveal that at a 5% alpha level, income diversification harms systemic risk. This negative coefficient implies that a unit increase in income diversification decreases systemic risk by 23.9%. Thus, systemic risk is reduced when banks intensify the diversification of their income sources. On this note, it can be construed that banks can reduce the probability of failure due to illiquidity through income diversification since it reduces systemic risk. This finding is consistent with the study of Nisar et al., (Citation2018), where it was posited that revenue diversification enhances the stability of banks in South Asia. As well, Moudud-Ul-Huq et al. (Citation2020) found that income diversification is beneficial to the financial soundness of banks in emerging economies as it reduces bank risk. Contrary to our finding that income diversification reduces financial instability, Yang et al. (Citation2019) report that bank diversification increases systemic risk in the US. Again, our finding does not agree with those of Duho et al. (Citation2019) and Brunnermeier et al. (Citation2020), whose study report that income diversification has a positive effect on systemic risk since it worsens instability in the banking sector. Abbas and Ali (Citation2022) also add that income diversification is detrimental to the stability of banks. Moreso, our finding, which reveals an advantage of income diversification on banking system soundness in Ghana is inconsistent with the modern portfolio theory which presents that a diversified portfolio of correlated asset classes can provide the highest amount of volatility.

Moreover, the result in the third column indicates that asset diversification has a positive but insignificant effect on systemic risk in Ghana. Thus, diversification of asset sources has no meaningful impact on banking system stability in Ghana. The finding on asset diversification is not in line with the results of Abbas et al. (Citation2021) and Adesina (Citation2021). Abbas et al. reveal that asset diversification reduces the cost efficiency of banks in the US. Adesina (Citation2021) posits that asset diversification is detrimental to the banks’ performance in Africa. Again, our finding disagrees with that of Chen et al. (Citation2018) that asset diversification can be injurious to the soundness of the banking system. The study by Chen et al. shows that asset diversification diminishes banks’ performance in Asia. Earlier, Abuzayed et al. (Citation2018) reported that asset diversification does not enhance the stability of the banking sector.

Furthermore, with reference to the descriptive statistics, it is realized that asset diversification is moderately pursued by the banks relative to the degree of income diversification. On that note, our finding does not agree with the study of Kim et al. (Citation2020) where it is presented that a moderate degree of bank diversification enhances bank stability. Also, the result is inconsistent with the literature of (Abbas & Ali, Citation2022; Moudud-Ul-Huq et al., Citation2020). The authors indicate that asset diversification reduces the risk of banks. In our subsequent analyses we examine the conditional impact of credit information sharing in the relationship between asset diversification and bank stability.

The results in the last two columns show the relationship between information sharing and systemic risk in Ghana. In each case, it is found that information sharing is negatively related to systemic risk implying that credit information sharing reduces systemic risk in Ghana. However, the negative effect is statistically significant for the frequency at which the products and services of CRBs are patronized by banks (FCRB) but insignificant considering the banks’ willingness to patronize the products and services of CRBs (WCRB). The result suggests that by employing the services of CRBs more frequently, the banks can reduce their probability of failure.

The negative effect of frequency of usage of information from the CRBs on systemic risk is expected because CRBs can provide information on borrowers that can reduce adverse selection and moral hazards in the credit market. With the usage of the services of CRBs, customers with good credit credential are more likely to obtain loans which can enhance the asset qualities of the banks which in turns can promote the soundness of the banking system. However, from the descriptive statistics, it is clear the patronage level of the services of CRBs in Ghana is very low because the average number of times a bank could use the services of a CRB each year is approximately eight while their willingness to employ the services of a CRB averaged 0.001. The implication is that the central bank must encourage the use of the services of the CRBs to induce banking system stability. The bank can liaise the CRBs in its supervision and monitoring functions since the CRBs appear to have the state-of-the art technology to pinpoint borrowers with sound credit credentials. The bank can also issue directives to the banks to patronize the services of the CRBs in the intermediation process.

Our findings on the role of CRBs are consistent with that of Liem et al. (Citation2022), who reported that credit information sharing increases bank stability. Also, Guérineau and Léon (Citation2019) suggest that credit information sharing reduces financial fragility in emerging economies. Again, our findings are consistent with that Pauline and Nadham (Citation2022), who presented that credit information sharing has a positive impact on bank performance. The findings on the relationship between information sharing and systemic risk are however in line with the argument of the information theory of credit. Thus, credit information sharing has a beneficial outcome by reducing credit risk thereby increasing banks’ profitability and consequently, the stability of banks.

About the control variables, the result shows that leverage ratio (LAR) has a negative influence on bank stability since it has a positive effect on the inverse of bank stability. Since the debt structure of the banks is huge, it can be inferred that the banks face illiquidity due to mismatch in maturity of the assets and their liabilities.

We also found a positive and significant effect of EAR on systemic risk in Ghana. In literature, it is argued that when firms increase the percentage of equity holdings in their capital, they can reduce the risk associated with borrowing (Yang et al., Citation2019). That is, a higher value of EAR is required to reduce a firm’s possibility of being unstable. However, from the results, it is appreciated that increase in equity does not inspire stability in the Ghanaian banking industry. The implication is that the banks’ equity coverage may not induce the banking system stability. The negative effect of leverage on the soundness of the banking system can also imply that banks with greater equity buffer can invest in high yield but risky assets hence increasing their risk-taking behaviour. Therefore, the Bank of Ghana should focus on improving the asset quality of the banks rather than increasing the equity requirements of the banks when the bank wants to boost the soundness of the banking sector. The result is in line with the position of Abuzayed et al. (Citation2018). However, the positive effect of LAR on systemic risk implies that a higher proportion of loan to asset ratio motivates financial instability. The finding is consistent with Abuzayed et al. (Citation2018), who averred that LAR reduces the stability of a banking sector.

Also, we found that cost to income ratio (CIR) negatively affects systemic risk. The results imply that a higher CIR does not contribute to systemic risk in Ghana. This finding contradicts the position of Yang et al. (Citation2019), who positioned that higher CIR increases systemic risk. Moreover, the results show that bank size is positively related to systemic. The results on the bank size implies that a less competitive banking system is detrimental to the soundness of the system in Ghana.

In , we discuss the moderating role of information sharing in the impact of asset and income diversification on systemic risk. The second column presents the result for the moderating role of FCRB on the income diversification-systemic risk nexus. Column three also presents the results for the moderating role of WCRB on the relationship between income diversification and systemic risk. The fourth and fifth columns show the state of systemic risk in Ghana when FCRB and WCRB, respectively, are complemented with asset diversification. For all the result in , it is realized that the lag of systemic risk is positively related to systemic risk.

Table 7. Interaction effect of bank diversification and information sharing on systemic risk.

The interaction of FCRB and income diversification shows a negative but insignificant coefficient of 0.098 indicates that the joint impact of income diversification and FCRB does not have meaningful effect on systemic risk in Ghana. The result reveals that there is no moderating effect of FCRB on the relationship between income diversification and systemic risk. Similarly, the coefficient of the interaction between income diversification and WCRB is insignificant and negative coefficient (−0.014). This result confirms the earlier interaction results and invigorates the assertion that the banks are less willing to use the services of the CRBs to induce income diversification that can promote the soundness of the banking system. This implies that the banks rely more on their internal screening processes in their revenue diversification strategies. They do not use the services of CRBs when diversifying their revenue sources. This may imply that the banks do not perceive the CRBs as offering richer information about the gains in revenue diversification. The CRBs should be encouraged to research into beneficial revenue diversification outlets that can enhance the soundness of the banking system and sell the ensuing information to the banks.

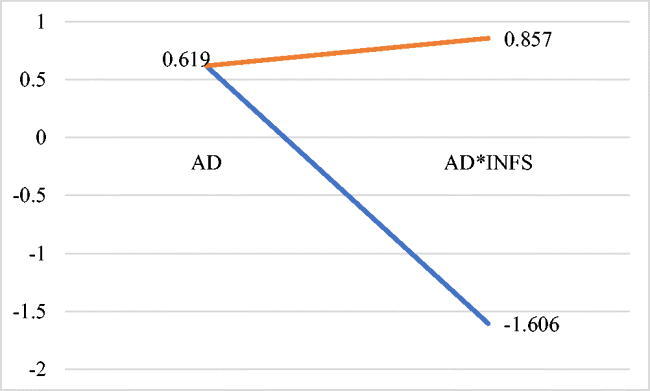

About the moderating role of information sharing on the relationship between asset diversification and systemic risk, the results provided in the fourth and fifth column of show that FCRB and WCRB moderate the relationship between asset diversification and systemic risk. The interaction of FCRB with asset diversification shows a significant effect on systemic risk with a negative coefficient of 0.309 at the! 0% level. However, the interaction of WCRB and asset diversification records a negative but insignificant coefficient of 0.070. The significant negative effect of the interaction terms in comparison with the positive coefficient of asset diversification, which is 0.619, indicate that information sharing moderates the relationship between asset diversification and systemic risk in Ghana. When the banks use information from the CRBs to do asset diversification, it has positive impact on the stability of the banking system. However, the impact of information sharing in the asset diversification and bank stability transmission is very weak which can be due to inadequate patronage of the services of the CRBs. Our findings are in line with the existing literature (Bamfo, Citation2019; Boateng et al., Citation2018; Kiring’a et al., Citation2021; Tran et al., Citation2022). These authors show in their study that credit information sharing is beneficial in reducing banking sector stability through improvement in asset quality of banks.

The net effect of asset diversification is calculated as the partial differentiation of systemic risk with respect to asset diversification. The marginal effect for the moderating role of FCRB is −1.606. The result for the interaction term is computed as e0.619– 1+ (−0.309*7.972) = −1.606. For the moderating role of FCRB, the net effect of −1.606 is an enhanced result compared with the regression result, −0.309, for the same interaction term. This result justifies the conclusion that FCRB conditions the effect of asset diversification on systemic risk in Ghana. The result is in line with the findings that information sharing yields a favourable effect on market power in the African banking industry (Boateng et al., Citation2018) and since market power is associated with monopoly rent, we can infer that information sharing can have dearer effect on banking system soundness. Kiring’a et al. (Citation2021) reveal that credit information sharing improves the positive impact of financial statement lending on access to financial services of firms in Kenya. However, ineffective information sharing can increase systemic risk. This result resembles the findings of Tran et al. (Citation2022), Kiring’a et al. (Citation2021), and Bamfo (Citation2019). These authors found that information sharing can reduce bank risk and enhance stability. The graphs for the moderation results are presented in Appendix A and B for easy visualization.

4.4. Diagnostics test

contains the results of the diagnostic tests. Two main diagnostics were conducted for the study. First, the autocorrelation test and secondly, the Sargan-Hansen test. Following Maliva, we make use of the Arellano and Bond serial correlation to evaluate autocorrelation. The test hypothesizes no autocorrelation. In the first difference of the test, the AR (1) process states the null hypothesis that autocorrelation exists in the model whereas the AR (2) process hypothesizes no autocorrelation. To make a justifiable conclusion of non-existence of autocorrelation, the null hypothesis for the AR (1) will be rejected and the AR (2), failed to be rejected. These conditions need to be held to conclude that the model is free from serial correlation. The serial correlation test is conducted for all the regression models that are estimated to analyze the study’s objectives. From the result, we found that at first difference, the probability value of the AR (1) and the AR (2) processes are both above the significance level of 5%. Hence, there exists no autocorrelation in the models.

Table 8. The diagnostic tests.

Also, the Sargan test is performed to assess whether the instruments introduced in the model are valid for a reliable estimation (Baum, Schaffer & Stillman, 2007). Thus, it is to evaluate the appropriateness of the instruments to be independent of the error term or not. The Sargan test holds the null hypothesis that the instruments are exogenous or uncorrelated with the error term, and the alternative hypothesis that the instrumental variables are not valid. On this note, a valid model will indicate that the alternative hypothesis is rejected. The probability value of the Sargan test is expected to be insignificant to conclude that the model is valid, or the instruments are exogenous. The p-value of the test must not be less than 5% and more than 10% level of significance. The results provided in the table below show that the Sargan tests for all the models are insignificant. Therefore, the models are statistically valid for regression analysis.

5. Conclusion

The literature on the risk-taking behaviour of banks stipulate that banks are susceptible to risk-taking as they seek high-yield investment opportunity especially when they have adequate capital base to support risk-taking in competitive banking environment. Moreover, the banks can portray a favourable performance indicator as they pursue diversification by reducing their equity base. Hence, regulators use capitalization requirements to ensure that the banks reduce their risk-taking behaviour. We contributed to the extant literature by examining the role of information sharing in the relationship between bank diversification and systemic risk in Ghana, a frontier economy that is facing economic instability.

Using the system GMM approach that accounts for endogeneity of the variables, provides efficient results for small cross-section in a panel data structure and addresses reverse causality issues, we found some interesting results. Our results stipulate that stakeholders in the financial sector should strengthen the activities of Credit Rating Agencies as they partner with financial institutions to reduce information asymmetry in financial intermediation. The study reveals that income diversification activities of the banks can reduce systemic risks. Conversely, we report that in the absence of credit reference bureaus, asset diversification activities of the banks can be injurious to the maintenance of the soundness of the banking system. However, we found that the use of the services of credit rating agencies can attenuate the negative impact of banks’ asset diversification on banking system stability.

Based on the results, we suggest that, to mitigate systemic risk, regulations must encourage the banks to continue to diversify their income sources to enhance banking system soundness. Also, banks that pursue asset diversification should frequently employ the services of CRBs. This is because the partnership between the banks and the credit rating agencies in inducing diversification and information sharing can significantly reduce systemic risk in Ghana. Further, policymakers should continually review the regulations regarding information sharing to enhance the quality of information sharing and to address the hindrances that prevent banks from patronizing the products and services of CRBs. Also, potential borrowers should be educated on the importance of providing adequate and complete information. For instance, borrowers should be educated to know how much benefit their accurate information brings to financial stability.

The CRBs must also engage the banks to understand their peculiar need in terms of the quality of information coverage. This will increase the appetite of the banks to patronize information from the CRBs.

Our study is limited to the Ghanaian banking system. We encountered difficulties accessing data on information sharing for all banks. We, therefore, resorted to limited data on only 14 banks out of the 23 banks. For further studies, researchers interested in the banking systems in Africa can replicate the study using listed banks so that they can use the covariance value-at-risk and expected shortfall measures to define systemic risk.

Disclosure statement

The authors declare there is no Complete of Interest at this study.

Additional information

Notes on contributors

Josephine Yarso Sarpong

Josephine Yarso Sarpong recently completed her MCOM studies at the University of Cape Coast. Her research interests include banking sector development and sustainable financial development.

Anthony Adu-Asare Idun

Anthony Adu-Asare Idun is Senior Lecturer at the University of Cape Coast. He teaches Research Methods, Finance and Economics. His research interests include Development Finance, Risk Management of Financial Institutions and Entrepreneurial Finance.

References

- Abbas, F., Ali, S., Moudud-Ul-Huq, S., & Naveed, M. (2021). Nexus between bank capital and risk-taking behaviour: Empirical evidence from US commercial banks. Cogent Business & Management, 8(1). Retrieved from https://doi.org/10.1080/23311975.2021.1947557

- Abbas, F., & Ali, S. (2022). Dynamics of diversification and banks’ risk-taking and stability: Empirical analysis of commercial banks. Managerial and Decision Economics, 43(4), 1–21. https://doi.org/10.1002/mde.3434

- Abbas, F., & Ali, S. (2022). Economic of loan growth, credit risk and bank capital in Islamic banks. Kybernetes, 51(12), 3591–3609. https://doi.org/10.1108/K-03-2021-0232

- Abbas, F., Rubbaniy, G., Ali, S., & Khan, W. (2021). Income and balance sheet diversification effects banks’ cost and profit efficiency: Evidence from the US. Available at http://dx.doi.org/10.2139/ssrn3808379.

- Abuzayed, B., Al-Fayoumi, N., & Molyneux, P. (2018). Diversification and bank stability in the GCC. Journal of International Financial Markets, Institutions and Money, 57(1), 17–43. https://doi.org/10.1016/j.intfin.2018.04.005

- Adesina, K. S. (2021). How diversification affects bank performance: The role of human capital. Economic Modelling, 94, 303–319. https://doi.org/10.1016/j.econmod.2020.10.016

- Bamfo, N. A. (2019). Do credit information sharing schemes matter to bank profitability? Evidence from Africa. IUP Journal of Bank, 18(4)

- Benoit, K. (2011). Linear regression models with logarithmic transformations. London School of Economics, 22(1), 23–36.

- Blundell, R., & Bond, S. (1998). Initial conditions and moment restrictions in dynamic panel data models. Journal of Econometrics, 87(1), 115–143. https://doi.org/10.1016/S0304-4076(98)00009-8

- Boateng, A., Asongu, S., Akamavi, R., & Tchamyou, V. (2018). Information asymmetry and market power in the African banking industry. Journal of Multinational Financial Management, 44, 69–83. https://doi.org/10.1016/j.mulfin.2017.11.002

- Brunnermeier, M. K., Dong, G. N., & Palia, D. (2020). Banks’ noninterest income and systemic risk. The Review of Corporate Finance Studies, 9(2), 229–255. https://doi.org/10.1093/rcfs/cfaa006

- Büyükkarabacak, B., & Valev, N. (2012). Credit information sharing and banking crises: An empirical investigation. Journal of Macroeconomics, 34(3), 788–800. https://doi.org/10.1016/j.jmacro.2012.03.002

- Caruana, J. (2010). Systemic Risk: How to Deal with It? Available at https://www.bis.org/publ/othp08.htm

- Chen, N., Liang, H. Y., & Yu, M. T. (2018). Asset diversification and bank performance: Evidence from three Asian countries with a dual banking system. Pacific-Basin Finance Journal, 52(1), 40–53. https://doi.org/10.1016/j.pacfin.2018.02.007

- Dogarawa . A. B., Maude, F. A., & Ringim, K. J. (2020). Estimating the marginal effect of interaction between industry concentration and CAMELS indicators on financial performance of deposit money banks in Nigeria. Sokoto Journal of the Social Sciences, 10(1), 67–87.

- Duho, K. C. T., Onumah, J. M., & Owodo, R. A. (2019). Bank diversification and performance in an emerging market. International Journal of Managerial Finance, 16(1), 120–138. https://doi.org/10.1108/IJMF-04-2019-0137

- Ebrahim, A., & Hasan, I. (2008). The value relevance of product diversification in commercial banks. Review of Accounting and Finance, 7(1), 24–37. https://doi.org/10.1108/14757700810853833

- Guérineau, S., & Léon, F. (2019). Information sharing, credit booms and financial stability: Do developing economies differ from advanced countries? Journal of Financial Stability, 40(1), 64–76. https://doi.org/10.1016/j.jfs.2018.08.004

- Hwang, J., & Sun, Y. (2018). Should we go one step further? An accurate comparison of one-step and two-step procedures in a generalized method of moments framework. Journal of Econometrics, 207(2), 381–405. https://doi.org/10.1016/j.jeconom.2018.07.006

- Kim, H., Batten, J. A., & Ryu, D. (2020). Financial crisis, bank diversification, and financial stability: OECD countries. International Review of Economics & Finance, 65, 94–104. https://doi.org/10.1016/j.iref.2019.08.009

- Kim, J., & Kim, Y. C. (2020). Heterogeneous patterns of income diversification effects in US bank holding companies. International Review of Economics & Finance, 69, 731–749. https://doi.org/10.1016/j.iref.2020.07.003

- Kiring’a, E. S., Ndede, F. W., & Wekesa, A. O. (2021). Financial statement lending, credit information sharing and access to financial services by small and medium enterprises in Kenya. Research Journal of Finance and Accounting, 243660835. https://doi.org/10.7176/rjfa/12-16-06

- Kusi, B. A., Agbloyor, E. K., Ansah-Adu, K., & Gyeke-Dako, A. (2017). Bank credit risk and credit information sharing in Africa: Does credit information sharing institutions and context matter? Research in International Business and Finance, 42, 1123–1136. https://doi.org/10.1016/j.ribaf.2017.07.047

- Kusi, B. A., & Opoku-Mensah, M. (2018). Does credit information sharing affect funding cost of banks? Evidence from African banks. International Journal of Finance & Economics, 23(1), 19–28. https://doi.org/10.1002/ijfe.1599

- Lee, C. C., Chen, P. F., & Zeng, J. H. (2020). Bank income diversification, asset correlation and systemic risk. South African Journal of Economics, 88(1), 71–89. https://doi.org/10.1111/saje.12235

- Li, X., Tripe, D. W., & Malone, C. B. (2017). Measuring bank risk: An exploration of z-score. The Journal of Economic Literature, 32(1), 1–38.

- Liang, H. Y., Kuo, L. W., Chan, K. C., & Chen, S. H. (2020). Bank diversification, performance, and corporate governance: Evidence from China. Asia-Pacific Journal of Accounting & Economics, 27(4), 389–405. https://doi.org/10.1080/16081625.2018.1452618

- Liem, N. T., Son, T. H., Tin, H. H., & Canh, N. T. (2022). Fintech credit, credit information sharing and bank stability: Some international evidence. Cogent Business & Management, 9(1), 2112527. https://doi.org/10.1080/23311975.2022.2112527

- Markowitz, H. (1952). Portfolio selection. The Journal of Finance, 7(1), 77–91. https://doi.org/10.2307/2975974

- Miletkov, M., & Wintoki, M. B. (2012). Financial development and the evolution of property rights and legal institutions. Emerging Markets Review, 13(4), 650–673. https://doi.org/10.1016/j.ememar.2012.09.005

- Moudud-Ul-Huq, S., Zheng, C., Gupta, A. D., Hossain, S. A., & Biswas, T. (2020). Risk and performance in emerging economies: Do bank diversification and financial crisis matter? Global Business Review, 24(4), 663–689. https://doi.org/10.1177/0972150920915301

- Musiega, M., Olweny, D. T., Mukanzi, D. C., & Mutua, D. M. (2017). Influence of liquidity risk on performance of commercial banks in Kenya. IOSR Journal of Economics and Finance, 08(03), 67–75. https://doi.org/10.9790/5933-0803046775

- Nguyen, D. T., Le, T. D., & Tran, S. H. (2023). The moderating role of income diversification on the relationship between intellectual capital and bank performance evidence from Viet Nam. Cogent Business & Management, 10(1), 2182621. https://doi.org/10.1080/23311975.2023.2182621

- Nguyen, P. H., & Pham, D. T. B. (2020). Income diversification and cost-efficiency of Vietnamese banks. International Journal of Managerial Finance, 16(5), 623–643. https://doi.org/10.1108/IJMF-06-2019-0230

- Nisar, S., Peng, K., Wang, S., & Ashraf, B. N. (2018). The impact of revenue diversification on bank profitability and stability: Empirical evidence from South Asian countries. International Journal of Financial Studies, 6(2), 40–64. https://doi.org/10.3390/ijfs6020040

- Pauline, E., & Nadham, V. (2022). Effect of credit information bureau and appraisal methods on performance of commercial banks in Mwanza region. International Journal of Engineering, Business and Management, 6(2), 24–38. https://doi.org/10.22161/ijebm.6.2.3

- Peltzman, S. (1976). Toward a more general theory of regulation. The Journal of Law and Economics, 19(2), 211–240. https://doi.org/10.1086/466865

- Pepinsky, T. B. (2018). Visual heuristics for marginal effects plots. Research & Politics, 5(1), 1–9. https://doi.org/10.1177/2053168018756668

- Roodman, D. (2009). A note on the theme of too many instruments. Oxford Bulletin of Economics and Statistics, 71(1), 135–158. https://doi.org/10.1111/j.1468-0084.2008.00542.x

- Rusmanto, T., Soedarmono, W., & Tarazi, A. (2020). Credit information sharing in the nexus between charter value and systemic risk in Asian banking. Research in International Business and Finance, 53(1), 101199. https://doi.org/10.1016/j.ribaf.2020.101199

- Stiglitz, J. E., & Weiss, A. (1981). Credit rationing in markets with imperfect information. The American Economic Review, 71(3), 393–410.

- Tchamyou, V. S., & Asongu, S. A. (2017). Information sharing and financial sector development in Africa. Journal of African Business, 18(1), 24–49. https://doi.org/10.1080/15228916.2016.1216233

- Tran, S., Nguyen, D., Nguyen, K., & Nguyen, L. (2022). Credit booms and bank risk in Southeast Asian countries: Does credit information sharing matter? Asia-Pacific Journal of Business Administration. https://doi.org/10.1108/APJBA-12-2021-0619

- Wu, X., Bai, X., Qi, H., Lu, L., Yang, M., & Taghizadeh-Hesary, F. (2023). The impact of climate change on banking systemic risk. Economic Analysis and Policy, 78, 419–437. https://doi.org/10.1016/jeap.2023.03.012

- Yan, Y., Jeon, B. N., & Wu, J. (2023). The impact of the COVID-19 pandemic on banking systemic risk: Some cross-country evidence. China Finance Review International, 13(3), 388–409. https://doi.org/10.1108/CFRI-08-2022-0158

- Yang, H. F., Liu, C. L., & Chou, R. Y. (2019). Bank diversification and systemic risk. The Quarterly Review of Economics and Finance, 77(1), 311–326. https://doi.org/10.1016/j.qref.2019.11.003

Appendices

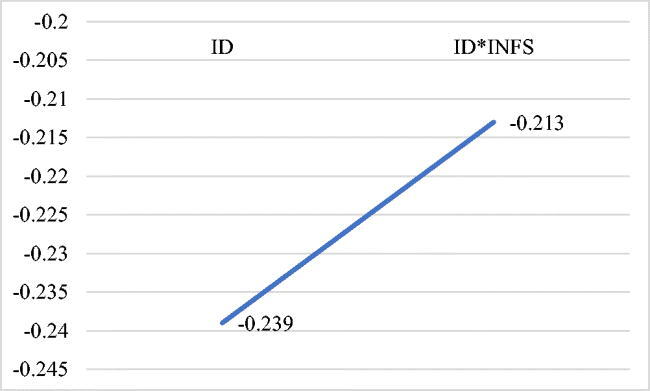

A: Interaction Effect of Income Diversification and Information Sharing.

.

.

Note: The moderating role of FCRB and WCRB have the same result, which is -0.213.

B: Interaction effect of Asset Diversification and Information Sharing.

.

.