Abstract

The study explores the implementation of risk management in Micro, Small, and Medium Enterprises (MSMEs) in Indonesia, with the objective of enhancing their adoption and fostering sustainable business practices. Despite the overarching goal, many MSMEs in Indonesia still lag in the implementation of risk management. The research specifically targets MSMEs without existing internal control and risk management systems. The questionnaire was distributed to 200 MSME representatives through an online Google Form. Out of these, we received 140 completed responses. After a thorough review for completeness and relevance to the study criteria, 111 responses were deemed suitable for analysis, resulting in a response rate of 70%. After the data is obtained, it is analyzed using partial least squares using smart-pls 4.0. Relative advantage (RA) is the most influential indicator on Adoption of Risk Identification (ARI). Other important factors are complexity (COMX), and security (SECU) for MSMEs. Conversely, organizational readiness (OR) and competitive pressure (CP) were found not to have a significant impact on ARI, suggesting these are not primary factors in enhancing risk identification adoption and business sustainability. These findings provide insightful implications for the strategic prioritization of risk management components in the Indonesian MSME sector.

REVIEWING EDITOR:

1. Introduction

Micro, small, and medium enterprises (MSMEs) have long been recognized as the backbone of many economies, and their role in Indonesia’s economic landscape is particularly pronounced (Sha et al., Citation2023). Historically positioned at the nexus of growth and development, MSMEs in Indonesia have not only thrived but also showcased commendable resilience against systemic shocks, one of the most poignant being the economic upheavals triggered by the COVID-19 pandemic (Kaya, Citation2022). This resilience can be attributed to the sector’s agility and adaptability.

Furthermore, the contribution of Indonesian MSMEs transcends mere numerical economic growth. Their multifaceted role encompasses job generation, enhancement of labor absorption rates, influencing the trajectories of the gross domestic product, and fortifying export regimes (Arshad et al., Citation2023). Their proficiency in maneuvering through complex regulatory processes and quickly adjusting to the unpredictable market requirements exemplifies the fundamental entrepreneurial expertise that characterizes this industry (Dambiski Gomes De Carvalho et al., Citation2021). Moreover, their adeptness at adjusting to environmental shifts underscores their pivotal function in ensuring the sustainable development of regional economies.

Within the larger framework of socio-economic discussion, MSMEs are widely recognized as crucial agents in facilitating both economic and societal change (Endris & Kassegn, Citation2022). Illuminating this assertion, data sourced from the Coordinating Ministry of Economic Affairs of the Republic of Indonesia for the year 2023 delineates a vivid picture: with 64.2 million active MSME units, these enterprises are projected to account for a remarkable 61.9% of the Gross Domestic Product (GDP), furthermore, in the employment spectrum, MSMEs stand as predominant employers, poised to engage a staggering 97% of the national workforce (Limanseto, Citation2023). Such data not only underscores the weight of the MSME sector in the national economic machinery but also underscores its irreplaceable role in sustaining the Indonesian economic fabric, notably in its capacity to galvanize labor markets and augment GDP trajectories.

The success and survival of the MSME sector in Indonesia is crucial for the country’s overall economic and social development. The government recognizes the importance of MSMEs and has implemented policies and programs to support their growth and development (Handrito et al., Citation2020). These government policies include providing training programs for new MSME actors, creating a favorable regulatory environment, and offering financial assistance and incentives to promote entrepreneurship (Ugwu-Oju et al., Citation2020). This can encourage economic growth in Indonesia. MSMEs not only contribute to a country’s economy, but also serve as a benchmark for the success of government policies in developing an entrepreneurial culture in the economy (Nasir et al., Citation2017). The government plays a direct role in advancing the economy by making policies that support MSME actors to increase their business, such as hosting training for MSME actors who are just entering the world.

Although the number of MSMEs in Indonesia continues to increase, judging by their performance, MSMEs in Indonesia can still be said to be low. MSMEs in Indonesia are currently unable to contribute to other businesses and develop (Sanistasya et al., Citation2019). This is because many MSMEs have not implemented an internal control system, risk management, and have not properly managed financial data. The development of MSMEs can be threatened due to financial constraints (Mina et al., Citation2021). MSMEs often experience problems in managing finances, which can threaten the development of MSMEs. The problem that often occurs in most MSME actors is the difficulty in implementing financial records for their business operations due to a lack of understanding of the basics of financial bookkeeping (Wardi et al., Citation2020). MSMEs need to improve their financial bookkeeping system to start improving the internal control system and risk management in other parts of their business.

To enhance the performance trajectory of MSMEs, the role of the internal control system is pivotal. An organization’s efficiency quotient is often anchored to a robust internal control system which ensures the delivery of premium-quality information, curbing discrepancies in operational endeavors (Cheng et al., Citation2018). When MSMEs operationalize efficacious internal controls, it acts as a bulwark against procedural mishaps. Conceptualized as a confluence of organizational architectures, methodologies, and coordinated measures, the internal control system is geared towards preserving organizational assets, validating the veracity of accounting intel, fostering operational efficiency, and buttressing alignment with managerial directives (Mulyadi, Citation2016). For every organization, this system stands as a beacon, outlining policies while stimulating policy-driven efficiency. Delving into empirical studies illuminates the positive correlation between internal control and organizational performance (Nursyamsi et al., Citation2015; Satria & Dewi, Citation2019). Collectively, these studies underscore the indispensable role of the internal control system in sculpting the risk identification and sustainability roadmap for MSMEs.

Diving into the financial literacy spectrum, Putri et al. (Citation2022) identify key indicators encompassing financial comprehension, credit and saving dynamics, investment strategies, and insurance acumen (Putri et al., Citation2022). Echoing these insights, Susan (Citation2020) affirm the instrumental role of financial literacy in influencing MSME performance metrics. Mastery in financial literacy underpins MSME performance enhancement. In tandem with this, an adept internal control system can invigorate organizational aims, especially in disseminating credible financial data, thereby safeguarding vital assets (Francis & Imiete, Citation2018). This enriched financial repository augments MSME operational efficiency, paving the way for goal realization.

Risk management’s imprint on performance metrics is incontestable, given its encompassing roles spanning design, consolidation, alignment, and critical appraisal, especially in formulating risk-centric strategies. This sentiment is further cemented by Kulathunga et al. (Citation2020), who attest to the positive ripple effect of Entrepreneurial Risk Management on MSME performance. Strategizing to preemptively address potential adversities is a critical attribute of risk management within the MSME ecosystem.

Current technological paradigms cast a profound influence on MSME performance contours. With innovation at the helm, digital intel acts as a catalyst in the global commercial arena (Omiunu, Citation2019). MSMEs are adept at assimilating technological advancements into their modus operandi to realize operational efficacies. The digital age’s technological marvels offer boundless opportunities for MSMEs, from marketing prowess and transactional ease to meticulous financial record-keeping (Pramono et al., Citation2020). Ensuring MSME sustainability amidst this technological maelstrom necessitates specialized acumen (Kulathunga et al., Citation2020). Armed with a nuanced grasp of IT, MSMEs can capitalize on the benefits ushered in by this technological renaissance.

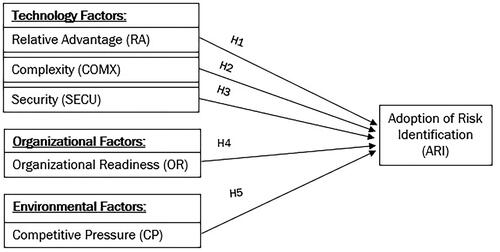

This research emphasizes the innovative dimensions of the study, highlighting its contribution to the existing scholarly landscape concerning Micro, Small, and Medium Enterprises (MSMEs). The study focuses on an integrated approach, encompassing technological, organizational, and environmental aspects, along with an in-depth exploration of internal control and risk management within the context of Indonesian MSMEs. This research uses empirical data with an exhaustive analysis of technological factors (relative advantage, complexity, and security), organizational factor (organizational readiness), and environmental factor (competitive pressure). This method diverges from the existing literature, which typically examines these elements in isolation, thus providing a more comprehensive understanding of the multifaceted challenges and opportunities confronting MSMEs.

The study contributes significantly to the research field through the development of a novel framework that integrates a variety of factors impacting MSME risk management adoption. This framework emanates from extensive fieldwork, detailed analysis, and the synthesis of diverse theoretical models, marking a notable advancement in the discourse surrounding MSME development in Indonesia.

The central objective of this scholarly research is to unravel the complex interactions among technological, organizational, and environmental dimensions, focusing particularly on internal control and risk management in MSMEs. There exists a notable gap in the existing body of research that specifically addresses the intersection of technology and financial literacy, despite their incontrovertible impact on the performance of MSMEs as highlighted by Mabula and Han (Citation2018). This study endeavors to critically assess various determinants, including technological, organizational, and environmental factors that potentially impact the adoption of risk identification processes within Micro, Small, and Medium Enterprises (MSMEs).

2. Literature review

The development of MSMEs today is rapidly increasing. This will certainly have a positive impact on the economy in Indonesia. Although MSMEs continue to grow rapidly, there are problems faced, namely, low productivity levels. The internal problems faced by MSMEs, namely, unqualified human resources, low knowledge of technology and marketing, MSME access to capital, are limited, lack of information, and other production factors (Nurpuspita et al., Citation2019). These problems can have an impact on decreasing the level of MSME performance. The ability to assess knowledge-based resources is essential to improve organ performance (Kubr, Citation2002). The basic knowledge possessed by MSMEs is very influential on the performance of MSMEs because the resources used have advantages for business continuity.

This is supported by the research conducted by Hadiyati (Citation2010), which states that a BPS-based survey analyses various problems and weaknesses faced by MSMEs based on their priorities, namely, the difficulty to market products, the number of competitors in the same industry, the difficulty of obtaining raw materials, lack of knowledge and experience in the field of production and expertise, and less qualified human resources. Many small businesses are unable to support risk management activities due to a lack of resources and capabilities (Hobijn & Jovanovic, Citation2001). This is very common, especially for businesses that are just starting up.

One of the reasons MSMEs do not apply risk management to their business is because the ability of their resources is still incompetent. Furthermore, lack of capital and knowledge about management in MSMEs, including accounting and finance, can affect their performance. Financial literacy significantly affects the performance of MSMEs, both in developed and developing countries (Wise, Citation2013). Good performance can be seen from the knowledge and understanding of finance. Most financial mistakes are due to lack of financial knowledge (Lusardi & Mitchell, Citation2014). The information in the MSME report will be considered for decision making. If the resulting financial statements are incompetent, it will affect the performance of MSMEs. Financial literacy is essential to invest efficiently (Davidson et al., Citation2004). In addition to providing benefits for decision making, good financial information will be useful for increasing investment and increasing business capital.

There are a multitude of primary concerns pertaining to the sustainability of MSME businesses. Initially, it is noteworthy that micro, small, and medium enterprises (MSMEs) encounter challenges in effectively managing and mitigating various types of risks, including those originating from within the organization as well as those originating from external sources. It has been acknowledged by actors in the MSME sector that the absence of risk analysis and the implementation of suitable risk management techniques might render their internal systems more susceptible (Virglerova et al., Citation2020). The absence of risk management implementation in MSMEs may give rise to significant challenges and concerns. The resolution of the issue can be achieved by the application of the Technology-Organization-Environment Framework (TOE Framework) approach, which involves the identification of the different hazards present.

Furthermore, a significant number of micro, small, and medium enterprises (MSMEs) fail to adopt internal control mechanisms and risk management systems. The primary objective of implementing risk management is to mitigate potential hazards to optimize outcomes (Buganová & Šimíčková, Citation2019). The efficient execution of operational tasks might yield advantages for Micro, Small, and Medium Enterprises (MSMEs). Thirdly, the generation of financial statements that deviate from the prescribed accounting standards owing to insufficient understanding of accounting and finance principles. The enhancement of financial literacy among micro, small, and medium enterprises (MSMEs) within the business environment might lead to improved performance by bolstering fundamental organizational knowledge (Jappelli & Padula, Citation2013). A comprehensive understanding of accounting and finance is important to effectively assemble financial statements with the aim of enhancing the operational efficacy of micro, small, and medium enterprises (MSMEs).

In the context of emerging markets, particularly focusing on Indonesia, the interplay between knowledge management and risk-taking displays a positive influence on the financial performance of Small and Medium Enterprises (SMEs). One of the factors most often used to detect MSME bankruptcy is financial performance (Cheraghali & Molnár, Citation2023). Intriguingly, there exists a mediating effect due to negative innovation outcomes in this correlation (Games & Rendi, Citation2019). Ascertains that the adoption of enterprise risk management (ERM) methodologies significantly drives competitive advantage, subsequently enhancing the performance metrics of SMEs (Yang et al., Citation2018). Beyond traditional financial ratios and payment behavior variables, our findings show that the incorporation of change in management, employee turnover, and mean employee tenure significantly improve the model’s predictive accuracy (Altman et al., Citation2023). The implementation of ERM needs to be continuously encouraged since the early MSMEs were established so that business actors are familiar with this concept.

In a parallel line of inquiry, Tan and Lee (Citation2022) directed their focus on SMEs situated in Malaysia, endeavoring to comprehend the extent of ERM practice integration. The crux of their study is two-fold: firstly, pinpointing the predominant risks challenging SMEs, and secondly, gauging the degree of ERM incorporation. Through their findings, a potent message is delivered SMEs must be agile and responsive in recognizing and adjusting to potential risks in a volatile business milieu, and efficacious management of ERM can be a catalyst for gaining a competitive edge.

Shifting the focus towards corporate sustainability practices, Das et al. (Citation2020) underscores the scenario within Asian emerging markets. A conspicuous observation from their study is the oversight in SMEs concerning social and environmental initiatives. They posit that a synergetic approach encompassing cooperative endeavors, shaping governmental policies, and nurturing a conducive organizational culture has the potential to enhance sustainability performance substantially. In another strand of SME research, Mainardes et al. (Citation2022) propound that adept marketing strategies can empower SMEs to deliver superior value propositions in their products and services, even under resource constraints.

In the context of a Latin American backdrop, Kolbe et al. (Citation2022) delve deep into how market orientation dovetailed with innovation capacity impacts the export metrics of SMEs. They elucidate the criticality of both proactive and reactive market stances and the potency of innovative prowess, especially pertinent for SMEs navigating through emerging market challenges.

Collectively, these scholarly pursuits weave a rich tapestry of understanding about risk management paradigms within SMEs in burgeoning markets. The panorama stretches from exploring the ramifications of knowledge management and risk-taking strategies on financial outcomes, the indispensable role of ERM, barriers to risk management effectiveness, to the quintessence of marketing adeptness and sustainability stratagems. However, it’s noteworthy, as highlighted by Chakabva et al. (Citation2021) that the depth of scholarship on risk management in SMEs of emerging markets remains somewhat nascent, beckoning further exploration and insights.

The concept of an internal control system extends beyond mere procedural formalities. It is an intricate amalgamation of organizational structures, systematic methodologies, and strategic measures meticulously orchestrated to preserve organizational assets, validate the veracity and trustworthiness of financial records, bolster operational efficiency, and ensure adherence to prescribed managerial policies (Mulyadi, Citation2016). Defined more succinctly, internal control manifests as a pivotal instrument geared towards actualizing organizational objectives (Odunko, Citation2022).

When management policies are astutely tailored and applied, they can substantially augment the operational prowess of Micro, Small, and Medium Enterprises (MSMEs), propelling them towards goal realization. The nexus between internal control and organizational performance has been the focal point of several scholarly investigations. For instance, empirical studies by Nursyamsi et al. (Citation2015) and Satria and Dewi (Citation2019) unequivocally establish that robust internal control mechanisms can significantly enhance overall performance.

Complementing these findings, research spearheaded by Bahar and Ginting (Citation2018) underscores the profound impact of the internal control system on the sustainability trajectory of MSMEs. A critical barometer for discerning the sustainability of MSMEs rests in their adeptness at assimilating and executing internal control systems within their daily operational frameworks. It becomes evident that an MSME’s performance and sustainability are inextricably linked to the rigor and efficacy of its internal controls. In essence, an MSME that prioritizes and refines its internal control infrastructure is better poised to excel in its business endeavors.

A deeper examination of corporate governance unveils its quintessential role in amplifying the efficacy of the internal control system. According to Musah et al. (Citation2022), stellar corporate governance practices have been identified as potent moderators in the nexus between the internal control system and financial metrics. The incorporation of robust corporate governance paradigms not only bolsters the proficiency of the internal control system but also acts as a linchpin in enhancing the financial performance trajectory of MSMEs.

Another paramount facet intertwined with the performance of MSMEs is risk identification. Risk management has its tentacles spread across a gamut of activities ranging from designing and consolidating to balancing and critically appraising, especially within the purview of risk management stratagems. Corroborating this stance, Kulathunga et al. (Citation2020) elucidate that Entrepreneurial Risk Management has a pronounced positive impact on the performance metrics of MSMEs. The reason of risk management assimilation, as highlighted by Ogutu et al. (Citation2018), is to seamlessly embed risk perspectives within an organization’s structural and decision-making matrix. Such integrative processes empower MSME stakeholders to augment performance and steer decision-making through a risk management lens. Building on the principles of the broaden-and-build theory, Mchiri (Citation2022) posits that entrepreneurs can cultivate their transient psychological resources to attain enhanced performance levels, thereby diminishing the effects of external shocks and navigating through significant crises, including the ongoing COVID-19 pandemic. The propositions offer valuable perspectives for practitioners, policymakers, and scholars.

Beyond the contours of risk and governance, sustainability emerges as a key determinant of business success. An MSME exhibiting commendable performance metrics showcases resilience, thriving even amidst economic tumult. (Putri et al., Citation2022) ventures into the realm of financial literacy, pinpointing indicators such as financial comprehension, credit and saving insights, investment acumen, and insurance knowledge as metrics for evaluation. An enriched understanding of these financial facets capacitates MSMEs to judiciously steward their finances. Consequently, as (Susan, Citation2020)affirm, such financial literacy prowess significantly influences the performance continuum of MSMEs. Mastery in financial literacy thus evolves as an instrumental determinant in managerial deliberations (Allgood & Walstad, Citation2016). This ensures that decisions sculpted by MSMEs are predicated upon financial intel meticulously crafted per prevailing norms.

In particular, the approach adopted in SMEs for Risk Management (RM) seems not to be specifically studied and understood (Ferreira de Araújo Lima et al., Citation2020). Diving into the realm of innovation and technology, the theoretical model, colloquially termed the TOE (Technology-Organization-Environment) framework, underscores the adoption of tech-driven novelties (Tornatzky et al., Citation1990). Maroufkhani et al. (Citation2020) proffer a detailed exposition, cataloging seven cardinal facets instrumental in risk identification and its ensuing influence on MSME adoption of risk management. These encompass top managerial involvement, institutional support, observability dynamics, experimental viability, the spectra of uncertainty and insecurity, and the intricacies of complexity, external backing, and organizational preparedness. Skafi et al. (Citation2020) further elaborate on this by signaling that the TOE framework, particularly its security and complexity constituents, can catalyze the adoption of risk identification modalities. Collectively, these elements, curated under the TOE framework’s aegis, become pivotal drivers, accentuating the significance of innovation and technology in the MSME landscape.

The Technology-Organization-Environment (TOE) framework plays a significant role in influencing the adoption of risk identification in organizations. Wallace et al. (Citation2020) and Ullah et al. (Citation2021) both propose extended TOE frameworks that include new dimensions and factors, such as cyber catalysts and practice standards, which are crucial in the context of cybersecurity and sustainable smart city governance. Mishra et al. (Citation2019) further emphasizes the importance of the TOE framework in enterprise risk management using the resource-based view to link risks to organizational resources. Khalilzadeh et al. (Citation2019) highlight the role of the TOE framework in identifying and prioritizing factors influencing risk tolerance.

In this study, the technology variables used are relative advantage, complexity, and security, which are the most common, relevant, and significant positive characteristics (Idris & Mohamad, Citation2017). Technology is an added value for MSMEs in terms of relative advantages, complexity, and security. For the organizational context used in this study is organizational readiness. The environmental context used in this study is the pressure of the competitors.

3. Research method

3.1. Data selection

This study used a quantitative approach. The target respondents of this study are MSMEs that have not implemented the internal control system correctly and appropriately. The researchers took samples using the sampling method using non-probability sampling with an accidental sampling approach. Researchers use the G*power method to determine the minimum number of samples to be taken. The sample size rate in the study was 0.95% or 5%, so the total of the minimum number of samples needed was 111 respondents (J. F. Hair et al., Citation2019).

The questionnaire was distributed to 200 MSME representatives through an online Google Form. Out of these, we received 140 completed responses. After a thorough review for completeness and relevance to the study criteria, 111 responses were deemed suitable for analysis, resulting in a response rate of 70%.

3.2. Data measurement

After the sample is determined, the researcher will distribute the questionnaire online to obtain the necessary data. Each questionnaire indicator is adopted from the TOE framework consisting of technological, organizational, and environmental points of view (Bany Mohammad et al., Citation2022). The questionnaire consists of 5 answers that correspond to the Likert scale with a value of 1 = strongly disagree up to a value of 5 = strongly agree.

After collecting all data, researchers used the SEM-PLS method to assess all data with the help of Smartpls 4.0. The stages in PLS consist of 3, namely, the measurement model, which is used to measure the validity and reliability of the data. The measurement of each variable can be seen in the Appendix. Second, by analyzing the structural model to see whether the model that has been built meets the criteria that have been set (Musyaffi et al., Citation2022). Finally, evaluate the hypothesis that has been proposed ().

3.3. Conceptual framework and hypothesis development

This research uses a hybrid model with technology-organizational-environmental (TOE) method as a theoretical basis. Using the TOE framework, the factors (internal and external) can be explained that influence the adoption of risk management in MSMEs. In addition, the framework can also help MSMEs improve performance by adopting risk management.

Based on previous research, a conceptual framework was created according to the TOE framework that adopts risk management. There are several TOE factors that are proven to affect technology adoption, but in this study, the research team focused only on technology factors (relative advantage, complexity, and security), organizational factors (organizational readiness), and environmental factors (competitive pressure).

3.3.1. Technology factor

According to the diffusion theory of innovation (DOI), relative advantage can be defined as a user considers the extent to which an innovation will be better than previous methods or competing technologies and positively affect users applying it periodically (Rogers et al., Citation2014). The relative level of excellence can be expressed as the degree to which the adoption of a new adoption can be felt. The use of IT provides positive value for management strategies related to aspects of communication, access to information, decision making, data management, and knowledge management in an organization (Adeosun et al., Citation2008). A business that applies relative advantages as the adoption of risk management will affect its performance. Business performance will be considered to have an advantage when the business actor applies risk management.

H1: The relative advantage has a positive effect on Adoption of Risk Identification.

It is important for MSME actors to be able to understand risk management to improve Adoption of Risk Identification. Compared to other indicators, complexity has been shown to positively affect the Adoption of Risk Identification. The challenge of implementing risk management arises when the MSME actors do not know and understand risk management thoroughly. Thus, if the MSME actors understand risk management well, the Adoption of Risk Identification will increase because the level of difficulty in implementing risk management is reduced.

H2: A high level of risk management complexity has a positive relationship with Adoption of Risk Identification.

Another indicator to consider in this study is safety. By implementing risk management, it is hoped that later MSME actors can maintain data security, both financial and operational activities that will affect the level of performance. Implementing risk management for data security is very necessary. Research conducted by Asiaei and Ab. Rahim (Citation2019) states that the adoption of data-related innovations requires security guarantees.

H3: Data security has a positive effect on the Adoption of Risk Identification.

3.3.2. Organizational factors

This research was conducted to test the readiness of organizations to face existing challenges and obstacles. The readiness of MSMEs to face existing obstacles can be seen in the application of risk management in these MSMEs. Organizational readiness in SMEs has been shown to have a significant relationship with MSME performance previous research (Asiaei & Ab. Rahim, Citation2019). With the implementation of good risk management, business actors can face existing obstacles. This will certainly affect the improvement of Adoption of Risk Identification.

H4: Organizational readiness to face obstacles has a positive effect on Adoption of Risk Identification.

3.3.3. Environmental factors

Based on the TOE framework, competitor pressure can affect the Adoption of Risk Identification. The pressure of competitors that is often experienced by MSME players in terms of the products produced is similar to that sold. Additionally, competitor pressure can also take the form of price competition. In related studies, several studies show that competition has a significant effect on Adoption of Risk Identification (Grandon & Pearson, Citation2004). Therefore, it is necessary to implement risk management that will help manage the risks experienced by competitors. If competitor pressure can be overcome properly, the Adoption of Risk Identification will increase.

H5: Competitive pressure has a positive effect on the Adoption of Risk Identification.

4. Data analysis

This study used SmartPLS to test the effect of each hypothesis. SmartPLS is a multivariate statistical approach that allows one to estimate significant variables simultaneously that can be solved by linear regression or a combination of regression analysis and factor analysis. Techniques with this model can work effectively and allow analysis of complex models, containing variables with moderate or mediation relationships, and with relatively smaller sample sizes (Alqudah et al., Citation2019). Therefore, we use SmartPLS testing techniques to test the relationship of each hypothesis to analyze the data. Techniques for path modelling are needed for this integration. This is in response to the researchers’ advice that PLS-SEM should be utilized if the study aims to make predictions or expand on an existing hypothesis (J. F. Hair et al., Citation2019). This technique can be used to assess the validity and dependability of existing variables after studying the structure model.

5. Results and interpretation

5.1. Assessment of the measurement model

The first step in performing an analysis with PLS is the measurement model to check the validity of the data with outer loading and AVE. The next step is CA and CR to check the reliability of the data.

The initial stages use SEM-PLS to check the data by performing a validity check (J. Hair & Alamer, Citation2022). This validity test was conducted to evaluate the AVE value and outer loading with value levels of 0.5 and 0.7, respectively. If the value is above the recommended one, then it means that every variable in the study meets the requirements of good validity. Based on the results of the validity test in above, the value of the smallest outer load is 0.707 in COMX2. As for the largest outer loading value, COMX3 is 0.949. When viewed from the point of view of the evaluation of outer loading, all indicators in this study have values greater than 0.7 (the smallest value is 0.707). This indicates that the indicators in this study are valid. However, an AVE evaluation needs to be done to reinforce this. As a comparison and reinforcement of the data validity test results, the highest value of the AVE results is found in the COMX indicator, which is 0.764. The lowest value is found in the OR indicator of 0.637. Thus, based on the results of the outer loading and AVE evaluation, all indicators meet the criteria of good validity.

Table 1. Results of the PLS algorithm in evaluating the adoption of risk identification.

The next stage is to evaluate the reliability of each indicator through CR and CA which have a minimum level value. 0.7 (J. Hair & Alamer, Citation2022). When viewed in above, the lowest CR value is in the CP indicator, which is 0.869. For the highest CR value, it is in the COMX indicator, which is 0.905. Based on the test results, CR meets the data reliability. Then, in CA, the highest value is in the SECU indicator, which is 0.855. The lowest value is in the CP indicator, which is 0.774. So, based on the CR and CA tests, it can be concluded that the indicators in this study meet the requirements of good data reliability.

The next stage in measuring the data model is to analyze the validity of the discriminant by evaluating it from Fornell-Lercker. Based on above, we can see the output of SEM-PLS regarding Fornell-Lercker. To meet the discriminant validity condition, the value of the square root AVE between the same indicator must exceed the value of the indicator with other different indicators. For example, the value of Fornell-Lercker RA – RA (0.819) must have a value greater than COMX – RA (0.122), SECU – RA (0.527), OR – RA (0.509), CP – RA (0.442), ARI – RA (0.668). RA results - When compared to other indicators, RA has a higher value. Based on the description in , the indicator values of COMX – COMX (0.874), SECU – SECU (0.836), OR – OR (0.798), CP – CP (0.831), and ARI – ARI (0.870) exceed the values of each indicator with other indicators. Thus, it can be concluded that the data in this study passed the Fornell-Lercker discriminant validity test.

Table 2. Fornell-Lercker adoption of risk identification.

The next step is to ensure the correlation between items that have size with other items by cross-loading evaluation. When the cross-loading value of each item against the indicator is greater than the cross-loading value, then the item meets the criteria of good discriminant validity through cross-loading evaluation. For example, based on , the values of the RA indicator for items RA1 (0.864), RA2 (0.826), RA3 (0.843), RA4 (0.738). While the value of the RA1, RA2, RA3 and RA4 items against several indicators such as COMX (0.102, 0.043, 0.106, 0.149), SECU (0.441, 0.385, 0.420, 0.480), OR (0.355, 0.474, 0.480, 0.369), CP (0.379, 0.315, 0.379, 0.374), and ARI (0.610, 0.519, 0.527, 0.524) is more significant than RA. Other indicators have better values compared to other indicators.

Table 3. Cross-loading adoption of risk identification.

HTMT performance evaluation is conducted to measure criteria from hetero-traits to mono-traits. For correlation to occur, HTMT must have a value below 0.9 (Henseler et al., Citation2015). Based on above, the range of HTMT values ranges from 0.147 (COMX – RA) to the largest value of 0.772 (ARI – RA). All HTMT values in are below 0.9. Thus, it can be implied that there are no correlated indicators.

Table 4. Heterotrait-Monotrait ratio (HTMT) adoption of risk identification.

Table 5. Evaluation of Q2 and R2.

5.2. Structural model

The next stage is the structural model. To evaluate the framework of the model that has been created, a structural model evaluation is carried out. This stage is done by predicting the model through predictive relevance (Q2) and R-square (R2).

The minimum level for R-squares is 0.19 low, 0.33 medium, and 0.67 high. In , the R2 on the ARI indicator is in the medium category because the value of the R2 is 0.543 or 54.3%. So, it can be concluded that the magnitude of the variance of the ARI variable that can be explained by RA, COMX, SECU, OR, and CP is 54.3% and is included in the category of moderate or moderate influence levels. Next, assess the value of Q2 to predict the framework model that has been prepared with a recommendation value greater than 0 (Henseler et al., Citation2015). When viewed in , the value of ARI3 has the smallest value (0.171). The largest value is in ARI1, which is 0.521. Furthermore, the value of the RMSE in the PLS is lower than the value of the RMSE in the LM. For example, in the ARI1 indicator, the RMSE PLS value is 0.491, while the RMSE LM value is 0.546. So, it can be concluded that all elements of endogenous variable measurement (ARI) of the proposed PLS model have a lower RMSE value compared to the LM (linear regression) model, then the proposed PLS model has medium predictive power.

5.3. Hypothesis test results

This section is carried out to test the hypothesis proposed by the researcher with details of the results of SEM-PLS according to the following .

Table 6. Hypothesis result.

Based on the table above, 5 hypotheses are proposed in this study. However, of the 5 hypotheses, there are 2 hypotheses that are rejected, namely H4 about the OR - ARI indicator (0.337) and H5 about the CP - ARI indicator (0.235). This is because both hypotheses do not meet the criteria that have been set in general to determine the hypothesis, namely the min. P-value of 0.05. Compared to P. H1, H2, and H3 there is a positive influence on ARI. This is because RA (0.000), COMX (0.059), and SECU (0.001) have a P-value below 0.05. Thus, it can be concluded that 3 hypotheses are accepted, while the other 2 hypotheses are rejected.

The highest value in the path is 0.439 contained in the 1st hypothesis (RA - ARI). This means that the RA indicator has a significant positive relationship of 43.9% with ARI. Meanwhile, the second largest relationship is found in the third hypothesis, namely SECU – ARI, with a significance value of 31.6% (path = 0.316). Thus, it can be implied that there are 2 hypotheses that have no significant effect (H4 and H5), and the rest have a significant positive impact.

6. Discussion

This study expands the TOE model by identifying other characteristics that affect the adoption of risk identification, especially RA, COMX, and SECU. RA proved to be the most positive variable on ARI, which was 43.9%. This shows that MSMEs are aware of the importance of implementing risk identification, so that it can be a relative advantage for their business sustainability. The main factor for someone wanting to use technology is their desire to use it (Venkatesh et al., Citation2012). The higher the intention of MSME actors, the more likely they are to use technology to implement risk identification, to facilitate their business operations. This is also supported by previous research, where the willingness to use can continue to increase its use (Damodharan & Ahmed, Citation2022); (Martinez & McAndrews, Citation2022).

Drawing parallels from the seminal work of Venkatesh et al. (Citation2012), the underlying motivation for individuals to adopt technology largely rests on their inherent desire to utilize it. Extending this logic, as the intentionality of MSME stakeholders heightens, there’s a commensurate increase in their proclivity to deploy technology for risk identification, thereby streamlining their business functionalities. This intention-behavior nexus finds resonance in preceding studies, which emphasize that an enhanced willingness invariably drives heightened usage.

Delving deeper, this study elucidates that the principal rationale behind championing risk identification is to smoothen operational intricacies. Given the primary goal of enhancing MSME efficiency, it becomes indisputably necessary for MSME stakeholders to acquire and effectively implement risk management solutions (Baral et al., Citation2022). It is evident from previous research that the purpose of implementing risk management is to minimize risk and get maximum results (Buganová & Šimíčková, Citation2019). The difficulties experienced by MSME actors can be properly overcome if they implement good risk management as well. Another study that supports these results is that MSME actors can minimize the occurrence of risks by implementing appropriate risk management (Virglerova et al., Citation2020). The performance of MSMEs can increase if the risk management applied to MSMEs is appropriate, so that the operational activities carried out can run effectively and efficiently.

In addition to relative advantages and complexity, another factor that improves the adoption of risk identification is security. MSME actors need to implement internal control systems and risk management. By implementing an internal control system, data security, be it financial statements or other reports, can be well maintained (Ríos-Manríquez, Citation2021). However, there are still many small businesses that do not support or even implement risk management due to lack of competent resources (Hobijn & Jovanovic, Citation2001). Competent resources are needed to maintain the confidentiality of business data and affect the performance of MSMEs (Talaulikar et al., Citation2022). This is supported by previous research, namely the adoption of data-related innovations that require security guarantees (Asiaei & Ab. Rahim, Citation2019). With competent resources, the adoption of risk identification can increase due to the guarantee of business data security.

Another factor that can improve the adoption of risk identification is the organization readiness to face the upcoming obstacles. Implementing good risk management will affect the performance of MSMEs because risk management is involved in designing, compiling, equalizing, and evaluating activities, especially in strategies to overcome future risks (Ríos-Manríquez, Citation2021). However, the use of risk identification did not result in a substantial impact on the performance of MSMEs in relation to organizational readiness (Kyal et al., Citation2021). MSMEs will be ready to face risks in the future with the implementation of good risk management. However, the results of this study produce different things with this hypothesis, where OR does not have a significant effect on ARI. This is because the OR does not see ARI improving MSME performance based on the adoption of risk identification. This is also supported by previous research, where OR is not a factor that causes an increase in MSME performance (Hanum & Sinarasri, Citation2018). The performance of MSMEs can be improved not only by organizational readiness but also by risk management and a good and orderly control system, which can be achieved if the resources owned are competent and superior.

This research also shows that competition pressure does not have a significant effect on the adoption of risk identification. There are many reasons why competition pressure does not affect MSMEs performance, one of which is the implementation of good risk management. Even if the products sold have similarities with competitors, if MSME players have good risk management, then it is not a problem. In fact, there will be an opportunity for MSME players to develop new product innovations. MSMEs can still thrive and develop new product innovations even in the presence of competition if they have good risk management practices (Singh et al., Citation2023). Efficiency in an organization can be influenced by effective internal control to improve the performance of MSMEs (Cheng et al., Citation2018). Operational activities can run smoothly if internal control is carried out effectively. This is supported by previous research that states that the internal control system affects the sustainability of MSMEs (Bahar & Ginting, Citation2018). The factors that increase MSME performance are internal control and good risk management. These findings suggest that internal control and risk management are crucial factors that can positively impact the performance of MSMEs, regardless of competition pressure (Latifah et al., Citation2021).

7. Conclusions and recommendations

In conclusion, this study significantly extends the current understanding of MSME risk management adoption by integrating variables such as RA, COMX, and SECU into the TOE model. This approach not only demonstrates the originality of the article but also provides a comprehensive framework for examining MSME risk management adoption behavior. Theoretically, this research contributes to the broader discourse on technology adoption and risk management in small and medium enterprises, offering fresh perspectives that challenge and expand upon traditional models.

Practically, the findings provide MSME stakeholders with critical insights into the importance of risk management and internal control systems, highlighting actionable strategies for improving operational efficiency and data security. Furthermore, the study underscores the societal impact of robust risk management practices in MSMEs. It highlights how effective risk management can contribute to the broader economic stability and growth, especially in developing economies where MSMEs play a crucial role.

Additionally, the findings have significant policy implications. They suggest the need for supportive regulatory frameworks and policies that encourage and facilitate the adoption of advanced risk management practices among MSMEs. This can lead to a more resilient and competitive MSME sector, which is vital for economic development.

Despite its contributions, this study acknowledges certain limitations, such as its regional focus, which may limit the generalizability of its findings. Future research could thus explore these variables in different geographical contexts or through longitudinal studies to understand the long-term impact of these factors on MSME risk management.

Based on the limitations and findings, future research should also consider examining the role of cultural factors in the adoption of risk management practices and how they influence MSME performance in various socio-economic settings.

Finally, this research underscores the vital role of comprehensive risk management in enhancing the performance and sustainability of MSMEs, offering a valuable reference point for both scholars and practitioners in the field. It contributes to the ongoing dialogue on sustainable business practices, highlighting how MSMEs can navigate challenges and seize opportunities in an increasingly complex business environment.

Authors’ contributions

This article represents a collaborative effort among all authors, who have each made significant contributions to the development and completion of this study. I Gusti Ketut Agung Ulupui: Conceived and designed the study, coordinated the research project, and contributed to the final approval of the version to be published. Also responsible for drafting the article and revising it critically for important intellectual content. Gentiga Muhammad Zairin: Played a key role in the analysis and interpretation of data, contributed to the drafting of the article, and provided critical revisions for intellectual content. Ayatulloh Michael Musyaffi: Assisted in the conception and design of the study, played a significant role in the analysis of data, and was involved in drafting and revising the manuscript. Febe Dwi Sutanti: Contributed to data collection, analysis, and interpretation, and assisted in drafting and revising the manuscript critically for important intellectual content. All authors have read and approved the final version of the manuscript to be published. Each author agrees to be accountable for all aspects of the work, ensuring that questions related to the accuracy or integrity of any part of the work are appropriately investigated and resolved.

Acknowledgements

The authors extend their deepest gratitude to the “Direktorat Riset, Teknologi, dan Pengabdian Kepada Masyarakat, Direktorat Jenderal Pendidikan Tinggi, Riset, dan Teknologi Kementerian Pendidikan, Kebudayaan, Riset, dan Teknologi” for their generous funding and unwavering support. This research was facilitated as per the agreement “Surat Perjanjian Pelaksanaan Penelitian Nomor 27/UN39.14/PG.02.00.PL/VI/2023” dated 27 Juni 2023.

Disclosure statement

The authors declare that they have no competing interests in relation to this research. There are no conflicts of interest, financial or otherwise, that could have influenced the work reported in this manuscript.

Data availability statement

The datasets generated and/or analyzed during the current study are not publicly available due to ethical and privacy concern. However, they are available from the corresponding author on reasonable request. The data supporting the findings of this study are contained within the manuscript. Further detailed data or materials related to this research may be requested from the corresponding author, I Gusti Ketut Agung Ulupui. Requests for access to these data will be considered by the author team, and data will be shared in a manner that adheres to ethical standards and respects confidentiality and privacy obligations. In cases where data cannot be shared openly due to ethical or privacy concerns, the authors commit to retaining the data and making them available upon reasonable request, subject to necessary approvals and conditions.

Additional information

Notes on contributors

I Gusti Ketut Agung Ulupui

I Gusti Ketut Agung Ulupui is a distinguished academician and lecturer with a profound dedication to the field of accounting and finance based at Accounting Department, Faculty of Economics, Universitas Negeri Jakarta. Her expertise and passion for teaching have seen her impart knowledge across various prestigious institutions in Indonesia from 1995 until now.

Gentiga Muhammad Zairin

Gentiga Muhammad Zairin is a dedicated lecturer and researcher based in Indonesia, specializing in the fields of sustainability, corporate governance, risk management, and accounting. Holding a position at Accounting Department, Faculty of Economics, Universitas Negeri Jakarta, he actively contributes to the academic community through both teaching and comprehensive research.

Ayatulloh Michael Musyaffi

Ayatulloh Michael Musyaffi is a lecturer at the Accounting Department, Faculty of Economics, Universitas Negeri Jakarta. He is a lecturer and researcher focusing on financial technology and accounting information system.

Febe Dwi Sutanti

Febe Dwi Sutanti is an accounting study program student at Faculty of Economics, Universitas Negeri Jakarta. Her research centers on taxation, accounting management, and SME’s research in accounting.

References

- Adeosun, O. O., Adeosun, T. H., Adetunde, I. A., & Adagunodo, E. R. (2008). Strategic application of information and communication technology for effective service delivery in banking industry. 2008 International Conference on Computer and Electrical Engineering, 1—18.

- Allgood, S., & Walstad, W. B. (2016). The effects of perceived and actual financial literacy on financial behaviors. Economic Inquiry, 54(1), 675–697. https://doi.org/10.1111/ecin.12255

- Alqudah, H. M., Amran, N. A., & Hassan, H. (2019). Factors affecting the internal auditors’ effectiveness in the Jordanian public sector: The moderating effect of task complexity. EuroMed Journal of Business, 14(3), 251–273. https://doi.org/10.1108/EMJB-03-2019-0049

- Altman, E. I., Balzano, M., Giannozzi, A., & Srhoj, S. (2023). Revisiting SME default predictors: The Omega Score. Journal of Small Business Management, 61(6), 2383–2417. https://doi.org/10.1080/00472778.2022.2135718

- Agrawal, K. P. (2015). Investigating the determinants of Big Data Analytics (BDA) adoption in emerging economies. Academy of Management Proceedings 2015, 11290. https://doi.org/10.5465/ambpp.2015.11290abstract

- Arshad, M. Z., Arshad, D., Lamsali, H., Alshuaibi, A. S. I., Alshuaibi, M. S. I., Albashar, G., Shakoor, A., & Chuah, L. F. (2023). Strategic resources alignment for sustainability: The impact of innovation capability and intellectual capital on SME’s performance. Moderating role of external environment. Journal of Cleaner Production, 417, 137884. https://doi.org/10.1016/j.jclepro.2023.137884

- Asiaei, A., & Ab. Rahim, N. Z. (2019). A multifaceted framework for adoption of cloud computing in Malaysian SMEs. Journal of Science and Technology Policy Management, 10(3), 708–750. https://doi.org/10.1108/JSTPM-05-2018-0053

- Bahar, H., & Ginting, D. (2018). Evaluasi Pengendalian Internal dalam Pengelolaan Sistem Penerimaan dan Pengeluaran Kas pada Pelaku UMKM di Kota Batam. Jurnal Benefita, 3(1), 34–43. https://doi.org/10.22216/jbe.v3i1.2454

- Bany Mohammad, A., Al-Okaily, M., Al-Majali, M., & Masa’deh, R. (2022). Business intelligence and analytics (BIA) usage in the banking industry sector: An application of the TOE framework. Journal of Open Innovation: Technology, Market, and Complexity, 8(4), 189. https://doi.org/10.3390/joitmc8040189

- Baral, M. M., Mukherjee, S., Nagariya, R., Singh Patel, B., Pathak, A., & Chittipaka, V. (2022). Analysis of factors impacting firm performance of MSMEs: Lessons learnt from COVID-19. Benchmarking: An International Journal, 30(6), 1942–1965. https://doi.org/10.1108/BIJ-11-2021-0660

- Buganová, K., & Šimíčková, J. (2019). Risk management in traditional and agile project management. Transportation Research Procedia, 40, 986–993. https://doi.org/10.1016/j.trpro.2019.07.138

- Chakabva, O., Tengeh, R., & Dubihlela, J. (2021). Factors inhibiting effective risk management in emerging market SMEs. Journal of Risk and Financial Management, 14(6), 231. https://doi.org/10.3390/jrfm14060231

- Chen, D. Q., Preston, D. S., Swink, M. (2015). How the Use of Big Data Analytics Affects Value Creation in Supply Chain Management. Journal of Management Information Systems, 32, 4–39. https://doi.org/10.1080/07421222.2015.1138364

- Cheng, Q., Goh, B. W., & Kim, J. B. (2018). Internal control and operational efficiency. Contemporary Accounting Research, 35(2), 1102–1139. https://doi.org/10.1111/1911-3846.12409

- Cheraghali, H., & Molnár, P. (2023). SME default prediction: A systematic methodology-focused review. Journal of Small Business Management, 0(0), 1–59. https://doi.org/10.1080/00472778.2023.2277426

- Dambiski Gomes De Carvalho, G., Resende, L. M. M. D., Pontes, J., Gomes, D., Carvalho, H., & Mendes Betim, L. (2021). Innovation and management in MSMEs: A literature review of highly cited papers. SAGE Open, 11(4), 215824402110525. https://doi.org/10.1177/21582440211052555

- Damodharan, V. S., & Ahmed, K. A. A. (2022). Antecedents of QR code acceptance during Covid-19: Towards sustainability. Transnational Marketing Journal, 10(1), 171–199. https://doi.org/10.33182/tmj.v10i1.2289

- Das, M., Rangarajan, K., & Dutta, G. (2020). Corporate sustainability in SMEs: An Asian perspective. Journal of Asia Business Studies, 14(1), 109–138. https://doi.org/10.1108/JABS-10-2017-0176

- Davidson, W. N., Xie, B., & Xu, W. (2004). Market reaction to voluntary announcements of audit committee appointments: The effect of financial expertise. Journal of Accounting and Public Policy, 23(4), 279–293. https://doi.org/10.1016/j.jaccpubpol.2004.06.001

- Endris, E., & Kassegn, A. (2022). The role of micro, small and medium enterprises (MSMEs) to the sustainable development of sub-Saharan Africa and its challenges: A systematic review of evidence from Ethiopia. Journal of Innovation and Entrepreneurship, 11(1), 20. https://doi.org/10.1186/s13731-022-00221-8

- Ferreira de Araújo Lima, P., Crema, M., & Verbano, C. (2020). Risk management in SMEs: A systematic literature review and future directions. European Management Journal, 38(1), 78–94. https://doi.org/10.1016/j.emj.2019.06.005

- Francis, S., & Imiete, B. U. (2018). Internal control system as a mechanism for effective fund management of universities in Bayelsa State, Nigeria. Global Journal of Social Sciences, 17(1), 77–91. https://doi.org/10.4314/gjss.v17i1.8

- Games, D., & Rendi, R. P. (2019). The effects of knowledge management and risk taking on SME financial performance in creative industries in an emerging market: The mediating effect of innovation outcomes. Journal of Global Entrepreneurship Research, 9(1), 44. https://doi.org/10.1186/s40497-019-0167-1

- Grandon, E. E., & Pearson, J. M. (2004). Electronic commerce adoption: An empirical study of small and medium US businesses. Information & Management, 42(1), 197–216. https://doi.org/10.1016/j.im.2003.12.010

- Hadiyati, E. (2010). Pemasaran untuk UMKM (Teori dan Aplikasi). Edisi Pertama, Cetakan Pertama., Bayumedia.

- Hair, J. F., Risher, J. J., Sarstedt, M., & Ringle, C. M. (2019). When to use and how to report the results of PLS-SEM. European Business Review, 31(1), 2–24. https://doi.org/10.1108/EBR-11-2018-0203

- Hair, J., & Alamer, A. (2022). Partial least squares structural equation modeling (PLS-SEM) in second language and education research: Guidelines using an applied example. Research Methods in Applied Linguistics, 1(3), 100027. https://doi.org/10.1016/j.rmal.2022.100027

- Handrito, R. P., Slabbinck, H., & Vanderstraeten, J. (2020). Enjoying or refraining from risk? The impact of implicit need for achievement and risk perception on SME internationalization. Cross Cultural & Strategic Management, 27(3), 317–342. https://doi.org/10.1108/CCSM-03-2019-0068

- Hanum, A. N., & Sinarasri, A. (2018). Analisis faktor-faktor yang mempengaruhi adopsi e commerce dan pengaruhnya terhadap kinerja umkm (studi kasus umkm di wilayah kota semarang). MAKSIMUM, 8(1), 1–15. https://doi.org/10.26714/mki.8.1.2018.1-15

- Henseler, J., Ringle, C. M., & Sarstedt, M. (2015). A new criterion for assessing discriminant validity in variance-based structural equation modeling. Journal of the Academy of Marketing Science, 43(1), 115–135. https://doi.org/10.1007/s11747-014-0403-8

- Hobijn, B., & Jovanovic, B. (2001). The information-technology revolution and the stock market: Evidence. American Economic Review, 91(5), 1203–1220. https://doi.org/10.1257/aer.91.5.1203

- Idris, K. M., & Mohamad, R. (2017). AIS usage factors and impact among Jordanian SMEs: The moderating effect of environmental uncertainty. Journal of Advanced Research in Business and Management Studies, 6(1), 24–38.

- Jappelli, T., & Padula, M. (2013). Investment in financial literacy and saving decisions. Journal of Banking & Finance, 37(8), 2779–2792. https://doi.org/10.1016/j.jbankfin.2013.03.019

- Kaya, O. (2022). Determinants and consequences of SME insolvency risk during the pandemic. Economic Modelling, 115, 105958. https://doi.org/10.1016/j.econmod.2022.105958

- Khalilzadeh, M., Masoumi, S., & Masoumi, I. (2019). Identification and prioritization of factors influencing organization risk tolerance level. Journal of Advances in Management Research, 16(4), 417–435. https://doi.org/10.1108/JAMR-07-2018-0061

- Kolbe, D., Frasquet, M., & Calderon, H. (2022). The role of market orientation and innovation capability in export performance of small-and medium-sized enterprises: A Latin American perspective. Multinational Business Review, 30(2), 289–312. https://doi.org/10.1108/MBR-10-2020-0202

- Kubr, M. (2002). Management consulting: A guide to the profession. International Labour Organization.

- Kulathunga, K., Ye, J., Sharma, S., & Weerathunga, P. R. (2020). How does technological and financial literacy influence SME performance: Mediating role of ERM practices. Information, 11(6), 297. https://doi.org/10.3390/info11060297

- Kyal, H., Mandal, A., Kujur, F., & Guha, S. (2021). Individual entrepreneurial orientation on MSME’s performance: The mediating effect of employee motivation and the moderating effect of government intervention. IIM Ranchi Journal of Management Studies, 1(1), 21–37. https://doi.org/10.1108/IRJMS-07-2021-0041

- Lai, Y., Sun, H. & Ren, J. (2018). “Understanding the determinants of big data analytics (BDA) adoption in logistics and supply chain management: An empirical investigation”. The International Journal of Logistics Management, 29 (2) pp. 676–703. https://doi.org/10.1108/IJLM-06-2017-0153

- Latifah, L., Setiawan, D., Aryani, Y. A., & Rahmawati, R. (2021). Business strategy–MSMEs’ performance relationship: Innovation and accounting information system as mediators. Journal of Small Business and Enterprise Development, 28(1), 1–21. https://doi.org/10.1108/JSBED-04-2019-0116

- Limanseto, H. (2023). Tingkatkan Inklusi Keuangan bagi UMKM melalui Pemanfaatan Teknologi Digital, Pemerintah Luncurkan Program PROMISE II Impact. Kementerian Koordinator Bidang Perekonomian Republik Indonesia. https://ekon.go.id/publikasi/detail/4980/tingkatkan-inklusi-keuangan-bagi-umkm-melalui-pemanfaatan-teknologi-digital-pemerintah-luncurkan-program-promise-ii-impact

- Lusardi, A., & Mitchell, O. S. (2014). The economic importance of financial literacy: Theory and evidence. Journal of Economic Literature, 52(1), 5–44. https://doi.org/10.1257/jel.52.1.5

- Mabula, J. B., & Han, D. P. (2018). Use of technology and financial literacy on SMEs practices and performance in developing economies. International Journal of Advanced Computer Science and Applications, 9(6). https://doi.org/10.14569/IJACSA.2018.090611

- Mainardes, E. W., Cisneiros, G. P. d O., Macedo, C. J. T., & Durans, A. d A. (2022). Marketing capabilities for small and medium enterprises that supply large companies. Journal of Business & Industrial Marketing, 37(1), 47–64. https://doi.org/10.1108/JBIM-07-2020-0360

- Maroufkhani, P., Tseng, M.-L., Iranmanesh, M., Ismail, W. K. W., & Khalid, H. (2020). Big data analytics adoption: Determinants and performances among small to medium-sized enterprises. International Journal of Information Management, 54, 102190. https://doi.org/10.1016/j.ijinfomgt.2020.102190

- Martinez, B. M., & McAndrews, L. E. (2022). Do you take…? The effect of mobile payment solutions on use intention: An application of UTAUT2. Journal of Marketing Analytics, 11(3), 458–469. https://doi.org/10.1057/s41270-022-00175-6

- Mchiri, A. (2022). Psychological capital and SMEs performance: The role of innovative behavior and risk propensity. Journal of the International Council for Small Business, 3(2), 176–183. https://doi.org/10.1080/26437015.2021.1976082

- Mina, A., Di Minin, A., Martelli, I., Testa, G., & Santoleri, P. (2021). Public funding of innovation: Exploring applications and allocations of the European SME Instrument. Research Policy, 50(1), 104131. https://doi.org/10.1016/j.respol.2020.104131

- Mishra, B. K., Rolland, E., Satpathy, A., & Moore, M. (2019). A framework for enterprise risk identification and management: The resource-based view. Managerial Auditing Journal, 34(2), 162–188. https://doi.org/10.1108/MAJ-12-2017-1751

- Mulyadi. (2016). Sistem Akuntansi (4th ed.). Salemba Empat.

- Musah, A., Padi, A., Okyere, B., E. Adenutsi, D., & Ayariga, C. (2022). Does corporate governance moderate the relationship between internal control system effectiveness and SMEs financial performance in Ghana? Cogent Business & Management, 9(1), 2152159. https://doi.org/10.1080/23311975.2022.2152159

- Musyaffi, A. M., Khairunnisa, H., & Respati, D. K. (2022). Konsep dasar structural equation model-partial least square (sem-pls) menggunakan smartpls. Pascal Books.

- Nasir, W. M. N. b W. M., Al Mamun, A., & Breen, J. (2017). Strategic orientation and performance of SMEs in Malaysia. SAGE Open, 7(2), 215824401771276. https://doi.org/10.1177/2158244017712768

- Nurpuspita, R., Sarfiah, S. N., & Ratnasari, E. D. (2019). Analysis of Village Fund Management As Realization of One Objective. Directory Journal of Economic Volume, 1(2), 136–150.

- Nursyamsi, N., Herawati, H., & Rifa, D. (2015). Pengaruh Sistem Pengendalian Internal, Pengalaman Pengurus Dan Pengetahuan Akuntansi Terhadap Keberhasilan Usaha Koperasi Di Kabupaten Agam. Abstract of Undergraduate Research, Faculty of Economics, Bung Hatta University, 7(1).

- Odunko, S. N. (2022). Internal control and firm performance: Evidence from selected firms in Nigeria (2015–2020). International Journal of Innovative Finance and Economics Research, 10(1), 68–80.

- Ogutu, J., Bennett, M. R., & Olawoyin, R. (2018). Closing the gap: Between traditional and enterprise risk management systems. Professional Safety, 63(04), 42–47.

- Omiunu, O. G. (2019). E-literacy-adoption model and performance of women-owned SMEs in Southwestern Nigeria. Journal of Global Entrepreneurship Research, 9(1), 26. https://doi.org/10.1186/s40497-019-0149-3

- Pramono, I. P., Suangga, A., Mardiani, R., & Ilhamsyah, M. J. (2020). Aplikasi Akuntansi Berbasis Android dan Gambaran Profil UMKM Pengguna Potensial Menggunakan IFLS Data. Kajian Akuntansi, 21(1), 46–63. https://doi.org/10.29313/ka.v21i1.5128

- Putri, N. L. D. M. E., Putra, I. N. N. A., & Suryani, E. (2022). Analisis Pengaruh Techno-Finance Literacy Dan Praktik Entrepreneur Risk Management Terhadap Kinerja Usaha Kecil Menengah (Ukm) Di Kabupaten Lombok Barat. Jmm Unram - Master of Management Journal, 11(1), 79–89. https://doi.org/10.29303/jmm.v11i1.705

- Ríos-Manríquez, M. (2021). Human capital and its influence on the e-readiness of the company: An empirical case. International Journal of Innovation, 9(1), 79–107. https://doi.org/10.5585/iji.v9i1.17950

- Rogers, E. M., Singhal, A., & Quinlan, M. M. (2014). Diffusion of innovations. In An integrated approach to communication theory and research (pp. 432–448). Routledge.

- Salleh, K. A., & Janczewski, L. (2016). “Adoption of Big Data Solutions: A study on its security determinants using Sec-TOE Framework”. CONF-IRM 2016 Proceedings, 66. https://aisel.aisnet.org/confirm2016/66

- Sanistasya, P. A., Raharjo, K., & Iqbal, M. (2019). The effect of financial literacy and financial inclusion on small enterprises performance in East Kalimantan. Jurnal Economia, 15(1), 48–59. https://doi.org/10.21831/economia.v15i1.23192

- Satria, P. A., & Dewi, P. P. (2019). Faktor-Faktor Yang Mempengaruhi Kinerja Sistem Informasi Akuntansi: Studi Kasus Pada Koperasi Simpan Pinjam Di Kabupaten Gianyar. Jurnal Ilmiah Akuntansi Dan Bisnis, 4(1), 81. https://doi.org/10.38043/jiab.v4i1.2148

- Sha, Y., Shah, S. G. M., & Sarfraz, M. (2023). Short selling and SME irregular CEO succession: Witnessing the moderating role of earnings management. International Review of Economics & Finance, 85, 163–173. https://doi.org/10.1016/j.iref.2023.01.017

- Singh, S., Chamola, P., Kumar, V., Verma, P., & Makkar, N. (2023). Explaining the revival strategies of Indian MSMEs to mitigate the effects of COVID-19 outbreak. Benchmarking: An International Journal, 30(1), 121–148. https://doi.org/10.1108/BIJ-08-2021-0497

- Skafi, M., Yunis, M. M., & Zekri, A. (2020). Factors influencing SMEs’ adoption of cloud computing services in Lebanon: An empirical analysis using TOE and contextual theory. IEEE Access. 8, 79169–79181. https://doi.org/10.1109/ACCESS.2020.2987331

- Susan, M. (2020). Financial Literacy and Growth of Micro, Small, and Medium Enterprises in West Java, Indonesia. In W. A. Barnett & B. S. Sergi (Eds.), Advanced Issues in the Economics of Emerging Markets (Vol. 27, pp. 39–48). Emerald Publishing Limited. https://doi.org/10.1108/S1571-038620200000027004

- Talaulikar, H., Hegde Desai, P., & Borde, N. (2022). Do risk attitude and trust moderate bank managers’ risk perceptions in lending to micro, small, medium enterprises? Managerial Finance, 48(3), 451–469. https://doi.org/10.1108/MF-06-2021-0294

- Tan, C., & Lee, S. Z. (2022). Adoption of enterprise risk management (ERM) in small and medium-sized enterprises: Evidence from Malaysia. Journal of Accounting & Organizational Change, 18(1), 100–131. https://doi.org/10.1108/JAOC-11-2020-0181

- Tornatzky, L. G., Fleischer, M., & Chakrabarti, A. K. (1990). The Processes of Technological Innovation. Lexington Books.

- Tu, M. (2018), “An exploratory study of Internet of Things (IoT) adoption intention in logistics and supply chain management: A mixed research approach”, The International Journal of Logistics Management, 29 (1), 131–151. https://doi.org/10.1108/IJLM-11-2016-0274

- Ugwu-Oju, O. M., Onodugo, A. V., & Mbah, C. P. (2020). Appraisal of government funding schemes on the development of small and medium enterprises in Nigeria: A study of Enugu state. World Journal of Entrepreneurship, Management and Sustainable Development, 16(3), 165–179. https://doi.org/10.1108/WJEMSD-08-2019-0067

- Ullah, F., Qayyum, S., Thaheem, M. J., Al-Turjman, F., & Sepasgozar, S. M. E. (2021). Risk management in sustainable smart cities governance: A TOE framework. Technological Forecasting and Social Change, 167, 120743. https://doi.org/10.1016/j.techfore.2021.120743

- Venkatesh, V., Thong, J. Y. L., & Xu, X. (2012). Consumer acceptance and use of information technology: Extending the unified theory of acceptance and use of technology. MIS Quarterly, 1, 36, 157–178. https://doi.org/10.2307/41410412

- Virglerova, Z., Khan, M. A., Martinkute-Kauliene, R., & Kovács, S. (2020). The internationalization of SMEs in Central Europe and its impact on their methods of risk management. Amfiteatru Economic.

- Wallace, S., Green, K. Y., Johnson, C. M., Cooper, J. T., & Gilstrap, C. M, University of Toledo. (2020). An extended TOE framework for cybersecurity adoption decisions. Communications of the Association for Information Systems, 47, 338–363. https://doi.org/10.17705/1CAIS.04716

- Wardi, J., Putri, G. e., & Liviawati, L. (2020). Pentingnya Penerapan Pengelolaan Keuangan Bagi Umkm. Jurnal Ilmiah Ekonomi Dan Bisnis, 17(1), 56–62. https://doi.org/10.31849/jieb.v17i1.3250

- Wise, S. (2013). The impact of financial literacy on new venture survival. International Journal of Business and Management, 8(23), 30. https://doi.org/10.5539/ijbm.v8n23p30

- Yang, S., Ishtiaq, M., & Anwar, M. (2018). Enterprise risk management practices and firm performance, the mediating role of competitive advantage and the moderating role of financial literacy. Journal of Risk and Financial Management, 11(3), 35. https://doi.org/10.3390/jrfm11030035