?Mathematical formulae have been encoded as MathML and are displayed in this HTML version using MathJax in order to improve their display. Uncheck the box to turn MathJax off. This feature requires Javascript. Click on a formula to zoom.

?Mathematical formulae have been encoded as MathML and are displayed in this HTML version using MathJax in order to improve their display. Uncheck the box to turn MathJax off. This feature requires Javascript. Click on a formula to zoom.Abstract

The purpose of this study is to examine the impact of need for achievement (NFA) and board creativity on financial performance. Furthermore, it attempts to investigate the mediating role of board diversity between need for achievement and financial performance. The assessment and estimation of how need for achievement and board creativity is associated with financial performance has not been previously provided. Using a self-administered survey to sample the Tanzanian microfinance institutions (MFI), the research measurement scale was adopted from previous studies, and data were collected from 189 MFIs. Drawing from McClelland, Institutional, Upper Echelons and agency theories’ insights, the proposed conceptual model and associated hypotheses were formulated and tested using structural equation modeling. The empirical findings indicate that the need for achievement has a positive significant direct impact on financial performance. Also, the need for achievement has a positive significant impact on board creativity. Furthermore, board creativity has a positive significant impact on financial performance. Moreover, the study finds that board creativity positively mediates the relationship between need for achievement and financial performance. Therefore, this study has several empirical, theoretical, and practical implications and recommendations regarding the corporate governance literature, finance, and entrepreneurship practices.

1. Introduction

Entrepreneurship has gained significant importance in the business landscape. As such, a critical element of the entrepreneurial disposition, defining one’s motivation in entrepreneurship is referred to as the need for Achievement (NFA) (Karimi et al., Citation2022). Consequently, several scholars have contended that a firm’s financial success is closely linked to the presence of managers possessing entrepreneurial traits, including need for achievement, innovation, autonomy, locus of control, and risk-taking (Hanifah et al., Citation2022; Makuya, Citation2023; Xie et al., Citation2021). Abadli et al., (Citation2020) and Ismail (Citation2022) have argued that various factors, such as the desire for achievement, perpetuating family traditions, financial rewards, social recognition, autonomy, self-employment, decision-making authority, wealth accumulation, and independence, all influence a firm’s financial performance. The governance of these firms relies on the decisions made by the board members. This article centres on the board members’ need for achievement, a crucial aspect of their entrepreneurial disposition. The concept of need for achievement has garnered increasing attention in financial performance (FIN) research, given its recognized significance in the development and success of entrepreneurial ventures (Cho & Lee, Citation2022; Ismail, Citation2022). Within the body of literature, researchers frequently ask why some entrepreneurs achieve more significant success than others in similar environments (Fatima & Bilal, Citation2019; Nikolić et al., Citation2019). However, it’s important to note that entrepreneurial need for achievement among board members, by itself, may not be the sole determinant of a firm’s financial performance (Ismail, Citation2022).

Thus, those with essential need for achievement traits must be creative for them to succeed in corporate business world (Gajda, Citation2016). In corporate business, there are boards which make decisions for the firms. These boards consist of individuals whose characteristics and behaviour determine the success or failure of the firm. Ntim (Citation2015) asserted board diversity to be one of determinants of organization valuation. However, different boards have different people with different entrepreneurial characteristics and each characteristic or combination of characteristics influences performance differently. Torchia et al. (Citation2011) argued board creativity (BCR) as one of entrepreneurial characteristic and attribute of deep level diversity is among the not easily observed factors, which is required during decision making processes, and board members’ interactions can lead to performance of a firm. Thus, ineffective board creativity can result into a loss of 80% businesses in Africa that is culminated from poor cash flow performance (JICA, Citation2017) and 99.9% of micro and small businesses worldwide (Department for business and innovation skills, 2011). Ineffective board creativity can weaken firm potential and open a way to financial difficulties. Therefore, board creativity enables organizations to increase their chances of performing well financially.

However, it is explained that for a person to work creatively, there must be a motive, something to drive the desire. So, for a person to be creative something must have triggered that habit. Every organization has goals and so do the individuals who are in the board of directors whose work represent the organization. Thus, their goals and actions or behaviours influence the activities and thus performance of the firm. That is to say, the desire to achieve something triggers the creativity tendency of a person. Thus, need for achievement can influence creativity. This study is motivated by an increase in social challenges which are evidenced by poverty, social inequalities, and corruption (Sanyaolu et al., Citation2022). These challenges are calling for firm’s attention to maintain sustainability in their operations by embarking on strategies and policies that will reduce these challenges. Mediating need for achievement with creativity in board room as individual characteristics and embracing financial performance are essential tools these challenges can be overcome. According to institutional theory, firms’ governance involves processes, schemes and operational practices established by authoritative guidelines which must consider the social behaviours of individuals for better performance. Board members are individuals with different characteristics that are placed to ensure the relevance of decision-making process and controls to balance the interests of stakeholders. If the board members are not determined enough for them to be creative, then the performance of the firm is at stake. Determined board members are an indicator of high need for achievement. From these arguments, we can deduce that it is important to study board creativity of individual board member as it can influence the relationship between need for achievement and firm’s financial performance. Moreover, Van Anh and Hoang Thi Ngoc, (Citation2023) encourage more studies on individual characteristics of board members. Firms believe that the combination of NFA and creativity guarantees innovation and competitiveness, critical for the success of businesses, particularly in sectors like microfinance institutions. Investigating the microfinance subsector is essential, given its significant contribution to employment (12% to 34%) and GDP (around 30%) in both rural and urban areas of Tanzania (UNCDF (Unlocking public & private finance for the poor), Citation2022). NFA and BCR serve as fundamental building blocks for corporate FIN in these highly competitive microfinance institutions, where the stakes are high. Since the literature on the relationship between NFA and FIN is limited, it is imperative to elucidate how NFA impacts BCR and, subsequently, a firm’s FIN (Ismail, Citation2022). Both NFA and BCR have the potential to enhance FIN independently and collectively.

There many studies conducted in the corporate governance and entrepreneurship fields. However, these studies have limitations as far as the current study is concerned. For instance, a recent study by Ismail (Citation2022) considered desire for achievement as one of the entrepreneurial motivational characteristics which might influence growth of a firm, however, the study focus on personality traits rather than governance issues. The existing studies on creativity focused on either employees or firm level single sex (Nguyen et al., Citation2020). The current study focused on the board of directors (both males and females) who are the decision makers of the firms, their governance potential has an impact on performance. The board diverse of the gender is important in bringing different insights in governing the MFIs. Moreover, studies that focus on NFA are scant. The studies on NFA as an independent variable are few, and do not explicitly focus on NFA (Ismail, Citation2022). Furthermore, some studies have focused on individual outcomes of corporate governance. For instance, Byron and Post (Citation2016) reviewed studies that have examined the relationship between corporate governance and Corporate social responsibility. Another gap from existing studies is paucity in mediation research specifically on BCR in microfinance institutions in developing countries. Existing literature lacks comprehensive investigations into the mediating role of BCR in translating individual traits into financial performance.

While studies recognize the importance of board characteristics and individual motivations, the specific processes through which these factors interact to influence financial outcomes remain unexplored. Drawing from McClelland’s achievement motivation theory in background perspective, prior studies have established a positive link between individual needs and leadership effectiveness (Van Anh & Hoang Thi Ngoc, Citation2023). However, a gap exists in understanding the intricate mechanisms through which the need for achievement influences financial performance as an organizational outcome, especially considering the potential mediating role of creativity within the board. McClellend’s theory provides the theoretical basis, positing that individuals with a high need for achievement are likely to exhibit goal-oriented behaviour and a drive for success. While past research has supported the general principles of the theory, there is a need for a more nuanced understanding of how these individual entrepreneurial traits manifest within the context of board dynamics. The upper Echelons theory asserts that the characteristics of top executives significantly influence organizational outcomes. The current study aligns with the theory by examining how the need for achievement among board members influences not only their creativity but also the financial performance of the firm.

Scholars have acknowledged that the direct relationship between need for achievement (NFA) and performance may not fully explain the intricate mechanisms through which these entrepreneurial traits interact (Anwar et al., Citation2018; Ismail, Citation2022). The mechanism through which the traits interact is important in speeding up the performance of the MFIs which ensure meet the objectives of serving the poor. While a limited number of studies have explored the direct link between NFA and financial performance (FIN), there remains a substantial gap in the literature regarding the pathways through which NFA influences FIN. Specifically, there has been scant attention to the potential mediating role of board creativity (BCR), which reflects the ability of board members to envision, craft ideas, and transform them into strategies that enhance a firm’s success (Karimi et al., Citation2022). The realm of FIN in developing countries like Tanzania, striving to secure their position in the global entrepreneurial economy, has received limited focus in the business literature. Competitive advantage is a primary goal in such contexts.

Thus, this study aims to provide further insights by addressing the following two research questions: RQ1. Does NFA significantly impact FIN? RQ2. Does BCR mediate the relationship between NFA and FIN? Thus, in addressing the research questions the following objectives are adopted by this article, 1: Examine the impact of the need for achievement on board creativity. 2: Investigate the mediating role of board creativity in the relationship between the need for achievement and financial performance. Consequently, the current study seeks to make the following contributions to the existing literature by addressing the theoretical gaps, enhancing empirical understanding, practical implications, methodological contributions, and contextual relevance. First, the study contributes by addressing the gap in theoretical understanding regarding the specific pathways through which the NFA influence FIN within the unique context of board dynamics. Second, by empirically investigating the mediating role of board creativity, the study provides a more detailed understanding of the processes linking individual traits to organizational outcomes, contributing to the broader literature on organizational behaviour and entrepreneurial traits. Third, the findings offer practical insights for organisations in selecting and developing board members. Understanding how individual motivations translate into creative processes and financial outcomes can guide leadership development programs and board recruitment strategies. Fourth, the study contributes methodologically by employing a mediating role analysis, providing a robust framework for examining the sequential relationships between the NFA, BCR and FIN. Fifth, the research recognizes the context-specific nature of board dynamics, particularly within MFIs, contributing to the literature on leadership in diverse organizational setting.

Specifically, the study contributes, first, by finding out the direct link between NFA of board of directors and FIN of especially MFIs. Second, by examining the relationship between NFA and board creativity (BCR) of board of directors and thus finding out the mechanisms through which these two entrepreneurial traits interact. Third, by determining the mediating role of board creativity on the influence of NFA on the financial performance of Microfinance institutions. Therefore, the study enhances the existing body of literature by exploring the role of board creativity as an intervening variable in the relationship between need for achievement and firm financial performance within Tanzanian firms. In doing so, it contributes to the ongoing debate regarding the influence of need for achievement on financial performance and broadens this discussion by examining the mediating effect of board creativity in the context of the financial sector.

The remaining parts of the work are structured as follows: Section 2 focuses on the background. Theoretical literature review forms the basis of Section 3, while empirical review and hypothesis development were done in Section 4. Section 5 addresses the issue of research design adopted. Section 6 focuses on empirical results and discussion of findings, while the Summary and conclusion form the basis of Section 7.

2. Background

Addressing the research question and objectives, this study is based on microfinance institutions (MFIs), which contribute significantly to the global economy in terms of job creation and income generation (Solomon & Makuya, Citation2022). There has been an increased interest in the performance of MFIs. One reason for this is that MFIs account for a significant portion of the global gross domestic product, estimated to be around 4% (Naz et al., Citation2016). Thus, MFIs are important in promoting economic development in developing countries. Moreover, the importance of MFIs extends beyond economic issues to promoting social development as well within the communities they serve. By participating in group loans, people can connect with others in the community and promote social cohesion and a sense of belonging. Therefore, it is important to recognize the role of MFIs within nations in ensuring economic and social development. Thus, the success of these businesses is the success of people and countries. Therefore, the performance of MFIs is worth studying, especially in developing countries. However, recent statistics show that more than half of the population in developing countries is excluded from financial services (Kipesha, Citation2013). One of the reasons could be that, despite their remarkable contribution to development, most MFIs find themselves failing due to, among other things, a high rate of loan defaulters, poor management of funds, and lack of awareness of better use of funds (Mlowosa et al., Citation2014; TAMFI (Tanzania Association of Microfinance Institutions), Citation2021), which are mostly corporate governance issues that need competent decision-makers.

One of the aims of these firms is to provide financial services in remote areas which have a high concentration of poor people who cannot access bank services, which is the essence of encouraging group loans for MFI beneficiaries. If the people who are managing these firms are not competent enough in reducing loan defaulters and managing funds, then the sustainability of financial services in the areas is at stake. Hastings and Mitchell (Citation2011) observed that individuals who have low levels of entrepreneurial tendencies are more likely to make suboptimal resource allocation decisions, thus making them struggle to pay bills on time, save, and diversify. This suggests the importance of entrepreneurial characteristics of individual managers on the performance of MFIs. It is in this sense that different countries and studies are encouraging people and business managers to learn entrepreneurial skills (Harrison et al., Citation2016; Xie et al., Citation2021). Entrepreneurship is seen as a development factor in societies that increases social welfare through its favorable impact on innovation, job creation, and economic growth (Al Mamun et al., Citation2018). However, the environment and rising rapid changes in cognitive complexities in societies brought by current dynamic trends have led to the shifting nature of interaction among individuals and groups (Xie et al., Citation2021). Thus, the individual entrepreneurial characteristics of board members play a significant role for MFI managers.

Microfinance institutions in developing countries depend on donor funds to run the businesses, and thus their performance relies on how much they receive from donors. However, as their numbers grew, MFIs experienced competitions for donor funds as well as changes in donor priorities. Thus, there was an increased need for efficient and sustainable institutions run by competent boards which do not depend on donations, and which can mobilize commercial funds and keep their social and economic mission of outreach to the poor (Kipesha, Citation2013). One way to manage commercial funds is by employing or engaging competent board members. Thuku (Citation2019) and Harrison et al. (Citation2016) reported that for a business to do well, the leaders (board members) should have entrepreneurial characteristics. Thus, the existence of entrepreneurial tendencies of the MFI board members seems important in influencing their performance. Further, what matters the most is the interaction of these entrepreneurial characteristics to bring the best of the MFI board members in ensuring their performance and thus sustainability. The sustainability of these businesses is important in ensuring they do what they are intended to do, that is, serving the poor people by increasing innovation, creating jobs, and growing the economy of the countries.

Thus, this study focuses on the interactions of the entrepreneurial characteristics of the MFI leaders since entrepreneurial characteristics lead to the preference of entrepreneurial activities (Xie et al., Citation2021). The main purpose of the study is to assess the influence and mediation role brought by BCR, which is one of the entrepreneurial characteristics in influencing particularly the financial performance of the MFI. Different studies have focused their attention on entrepreneurial characteristics such as locus of control (Al Mamun et al., Citation2018), risk-taking (Yusof et al., Citation2007), social networking (Yang et al., Citation2013), creativity (Gajda, Citation2016), self-efficacy (Piperopoulos & Dimov, Citation2015), and few have studied innovation (Rocha, Citation2014) and need for achievement (Ismail, Citation2022). Xie et al. (Citation2021) study focused on the mediating role of entrepreneurial intention in the influence of entrepreneurial characteristics generally on the performance of tourism vloggers. However, different entrepreneurial characteristics have different impacts (and different interactions with other characteristics) on the performance of a business. Thus, the current study focused on the mediating role of creativity on the influence of need for achievement specifically on the financial performance of MFI. Moreover, one entrepreneurial characteristic cannot be enough without being enhanced by another or others. Thus, it is learned from Nguyen et al. (Citation2020) that extensive insights from different agency, behavioral, economic, governance, psychological, and social-based theories (e.g. Adams & Flynn, Citation2015; Kirsch, Citation2018; Abdul Wahab et al., Citation2018; Ntim, Citation2016) suggest that boardroom homogeneity can lead to sub-optimal decision-making, which can impact negatively on corporate governance and thus performance. Diversity in entrepreneurial characteristics is then important in ensuring the financial performance of MFIs.

This article is enriched with the unique characteristics of MFIs and the business environment in Tanzania. The financial sector in Tanzania has experienced tremendous growth since the 1990s. These advances were reinforced by structural and microfinance policies such as structural adjustment programs (SADP1 and SADP2), the proliferation of international banks, successful financial market liberalization, and the adoption of international financial reporting standards. Various initiatives have been taken to assist and ensure that MFIs improve and continue to generate value, including but not limited to supervision and regulation, as well as the maintenance and development of standards and building capacity for board members (Matinde, Citation2013). Corporate governance is being insisted upon by the Capital Market and Securities Authority (CMSA, 2002) to be among the factors behind the good performance of the institutions. MFIs in Tanzania are registered by the Central Bank; however, among the requirements for MFI registration in the country is corporate governance. CMSA emphasizes on corporate governance on all financial institutions including MFIs to improve their performance. Corporate governance is insisted upon as it is believed to pave the way for the success of the MFIs. To reduce the rate of failures, MFIs are supposed to be guided by some sort of principles. Corporate governance is among them (Microfinance Regulations, 2019). The corporate governance guideline stipulates that each MFI should be composed of a board of directors. Each of these boards should have members with diverse characteristics and educational backgrounds. Countries across the globe are increasingly embracing corporate governance approaches due to their demonstrated potential to favorably improve organizational performance (Kenani, Citation2018).

Following the Enron scandal and subsequent corporate controversies in both the United States and Europe since October 2001, there has been a notable erosion of shareholder trust in the market (Ellili, Citation2023). As a result, stakeholders such as governance bodies, investors, and government regulators have called for heightened attention to corporate governance protocols across multiple domains, encompassing finance, accounting, economics, management, and legal frameworks (Gyapong et al., Citation2019; Harrison et al., Citation2016). It is critical to recognize that a successful corporate governance framework supports decision-making, accountability, and responsibility both within and beyond the organization. In 2019 the African Union (AU) initiated efforts to develop CG frameworks for its member countries (Bawuah, Citation2024). They noted that the codes will hinge on African values and realities and the need to address these issues. In Tanzania, the concept of corporate governance has been emphasized to MFIs. All MFIs, when preparing their annual report, are required to include the report on governance issues as prescribed in the CMSA guidelines. Despite these control environments, their sustainability is questionable as they are facing multiple governance challenges. For instance, during the COVID-19 era, some South African firms’ assets were depleted due to poor financial management and board decisions (Bawuah, Citation2024).

3. Theoretical literature review

The theoretical framework for understanding the interplay between financial performance, board member’s need for achievement, and board creativity draws on many theories. However, a multi-theoretical explanation is sometimes necessary and beneficial and allows us to better understand individual board member’s characteristics (Nguyen et al., Citation2020). Thus, this study is underpinned by these prominent theories: Institutional theory, Upper Echelons theory, McClelland’s achievement motivation theory, and agency theory to draw insights from both seminal and recently published studies.

3.1. Institutional theory

Institutional theory provides a broad explanation of how social forces, also termed entrepreneurial or enterprising characteristics in past studies, around the firm affect the behaviour of the firm, in this case, performance (Yousafzai et al., Citation2015). The theory sheds light on the various behavioural factors of board members, managers, and employees that contribute to the financial performance of a firm. Institutional theory emphasizes the fact that by increasing the need for achievement and creativity, firms can improve their financial performance. This theory offers a robust framework for understanding the actions of individuals and firms. It provides in-depth and intricate insights that can be applied to elucidate the practices and behaviours of board members (Torchia et al., Citation2011). Previous research has demonstrated that institutional theory effectively explains how individuals on firm boards make decisions that influence the firm’s performance (Nwekpa & Wabara, Citation2022).

The need for achievement leads to strong judgment and broad experience as it awakens and sparks imagination and problem-solving abilities. People will do things if they are inspired by the surrounding environment. A person can be inspired to become creative to achieve something. Thus, there must be a motive to spark the creativity inside a person. The same applies to board members. Board members can be inspired by something, for them to become strong problem solvers or decision-makers, which are indications of creativity. Thus, a board composed of people with both the need for achievement and creativity is likely to perform well. Thus, Gajda (Citation2016), Torchia et al. (Citation2011), and Karimi et al. (Citation2022) proved that the institutional behaviors of board members, which in this case is creativity, can be used as mediators in the performance of firms’ studies.

Institutional theory provides a lens to understand how organizations are influenced by external pressures and norms. In the context of the study, the NFA among board members can be examined through the institutional theory’s focus on the isomorphism of behaviours and practices within an industry. Institutional theory emphasizes the importance of organizations conforming to societal expectations for legitimacy. Boards, driven by the NFA, may adopt practices perceived as legitimate, including fostering creativity, to align with norms and maintain legitimacy. Boards may view creativity as an institutionalized practice, enhancing their image and reputation. This alignment with institutional expectations can positively influence how the organization is perceived by stakeholders. By incorporating institutional theory, the study can explore how the NFA influences board behaviour not only based on internal motivations but also as a response to external institutional pressures. This adds a layer of complexity to the understanding of how NFA translates into board actions and, subsequently, financial performance.

3.2. Upper Echelons theory

According to the Upper Echelons Theory, which was put forth by Hambrick and Mason (Citation1984), the traits of senior executives, especially board members, have a major impact on the outcomes of organizations. Expanding upon this notion, contemporary research highlights the significance of comprehending the characteristics and incentives of individual CEOs in forecasting the outcomes of their organizations. The Upper Echelons theory posits that the characteristics of top executives, including board members, significantly influence organizational outcomes. Cognitive and demographic attributes shape decision-making processes and ultimately impact firm performance. Recent studies by Finkelstein et al. (Citation2009) and Davis et al. (Citation2019) build on the Upper Echelons theory, emphasizing the importance of understanding individual executives’ traits and motivations in predicting organizational outcomes.

Building on the foundational insights from seminal studies, recent research extends the understanding of how the executive traits, especially the NFA, influence strategic decision-making and organizational outcomes. The Upper Echelons helps to contextualize how the individual characteristics of board members as explained by McClelland’s theory, influence the strategic choices made by the board. The synthesis of these theories positions board member’s NFA as a key factor influencing BCR, which, in turn, is expected to contribute to improved financial performance.

3.3. McClelland achievement motivational theory

McClelland’s Theory of Human Motivation, introduced in the 1960s, and comprises three core components: the need for power, the need for affiliation, and the need for achievement. These needs are not inherent but shaped by an individual’s life experiences. According to McClelland (Citation1965), achievement motivation revolves around competing against a standard of excellence. Employee motivation in the workplace is a significant managerial challenge, crucial for enhancing effort and performance to optimize organizational efficiency (Gajda, Citation2016). The Achievement Motivation Theory, also known as the Need for Achievement Theory, primarily applies to individuals who thrive on competition. It fosters strong critical thinking skills and emphasizes the importance of setting clear and attainable goals (Chazan et al., Citation2022). This theory delves into how an individual’s need for achievement guides their behavior and pursuit of success, significantly influencing their decision-making and overall performance in the firm.

According to McClelland’s Achievement Motivation Theory, people who have a strong desire to succeed are motivated to perform well, take prudent risks, and set challenging goals. The aforementioned theory sheds light on how board members’ personal goals could affect their leadership philosophies and methods of making decisions. Studies by Westphal et al. (Citation1997) and Hambrick and Mason (Citation1984) demonstrated the impact of executive traits on business performance. Current research has shed light on the influence of individual traits and board makeup on board dynamics (Torchia et al., Citation2011; Karimi et al., Citation2022). The research studies open up the possibility of examining the precise connections among financial performance, board creativity, and members’ need for achievement. Insights from seminal studies show that recent research expands our understanding of how executive qualities, particularly the drive for performance, affect organizational results and strategic decision-making, building on the fundamental ideas from key studies.

McClelland’s achievement motivation theory suggests that individuals with a high need for achievement are driven to excel, take calculated risks, and set challenging goals. This theory provides insights into how the personal motivations of board members may influence their decision-making and leadership styles. Contemporary studies such as those by Grant and Berry (Citation2011) and Rahman et al. (Citation2015) have revisited and extended McClelland’s theory, emphasizing its relevance in understanding the motivations of contemporary executives and their impact on organizational success. When linking NFA, BCR, and FIN, research by Hambrick and Mason (Citation1984) and Westphal et al. (Citation1997) laid a groundwork by highlighting the influence of executive characteristics on firm performance. While not explicitly focusing on NFA, these studies underscore the importance of individual traits in shaping leadership effectiveness. Study by Finkelstein et al. (Citation2009) and Ismail (Citation2022) provide contemporary insights into the impact of board composition and individual characteristics on board dynamics. These studies pave the way for investigating the specific linkages between board member NFA, BCR, and FIN of a firm.

3.4. Agency theory

Agency theory enhances the understanding of the monitoring role of the board of directors in supervising and controlling management actions (Khatib et al., Citation2020). Chen et al. (Citation2017) and Song et al. (Citation2017) considered agency theory in explaining CEO succession in family firms, which shows the impact of the compensation plan and industrial competition. In effect, firms are determined to ensure performance financially; however, due to agency conflict, firms are ineffective in performance. Consequently, studies recommend board member’s entrepreneurial characteristic to enhance performance in firms’ boards (Ismail, Citation2022; Van Anh & Hoang Thi Ngoc, Citation2023). Liu et al. (Citation2014) explained that agency costs can be improved by diversity in the board of directors. Many articles used agency theory to identify board of directors’ issues and are used to explain many kinds of board characteristics and corporate governance (Jensen, Citation1986; Jensen & Meckling, Citation1976). For example, Bawuah (Citation2024) used agency theory in the study of the role of corporate governance in the capital structure-performance nexus in sub-Saharan countries. Agency theory was also adopted in the study of board gender diversity and corporate social responsibility and dividend payment which show the importance of the theory in explaining the importance of diversity in boardrooms (Gyapong et al., Citation2019; Lu et al., Citation2022).

Agency theory focuses on the principal-agent relationship and the potential conflicts of interest that may arise between shareholders (principals) and executives or managers (agents) Rashid (Citation2015). In the context of the study, the NFA can be examined as a motivational factor influencing the behaviour of agents (board members) to align with or deviate from shareholders’ interests. A high NFA among board members may lead to aligned incentives with shareholders. Creativity, driven by the NFA, could be directed towards strategies that enhance shareholder value, ultimately impacting financial performance positively. Thus, a proactive and creative board, motivated by the NFA, may proactively address agency costs by taking actions that contribute to the financial success of the organization, aligning with the interests of shareholders. Therefore, integrating agency theory into the study allows for a nuanced understanding of how the NFA influences board decisions and actions in a way that addresses agency problems or conflicts of interests. It provides insight into the mechanisms through which the NFA can contribute to improved financial performance.

This theoretical framework synthesizes foundational concepts, integrates insights from seminal and recent studies, and provides a comprehensive basis for investigating the relationships between board member’s entrepreneurial characteristics, board dynamics, and organizational outcomes. The hypotheses, grounded in these theories, offer a roadmap for empirical research to further explore and validate the proposed linkages. By incorporating these theoretical perspectives, the study enriches its theoretical foundations, offering a more comprehensive framework to explore the intricate relationships between NFA, BCR, and FIN within the organizational and institutional context.

4. Empirical literature review and hypotheses development

4.1. Empirical literature review

Board members are under constant pressure to find new ways to reduce costs and increase the effectiveness of firms. Because there are various skilled people to choose from, firms’ expectations of the creativity of board members are getting higher. These aspects highlight the importance of pursuing incremental or radical creativity in boards’ operations. This study explores the association of the individual personality entrepreneurial characteristics of board members among Tanzania microfinance institutions which are need for achievement and board creativity. Need for achievement of board members is considered as independent variables, the financial performance of microfinance firms is considered as the dependent variable, and board creativity is considered as a mediator in current settings. The research established that need for achievement delivers a positive significant impact on the board creativity and the overall performance of the microfinance firms, which implies that the need for achievement of an individual board member has a positive impact on the overall financial performance of microfinance institution and the board creativity. Additionally, it delineates that board members, who have entrepreneurial characteristics like need for achievement, can improve their overall performance in decision making which eventually makes the firm perform well. The higher the need for achievement of board members will lead to an increase in the overall financial performance of a firm (Ismail, Citation2022). Likewise, board members who have need for achievement characteristics will have more improved and better creativity. Better creativity means better ideas, better problem-solving ability and thus better decisions to make the business processes run smoothly. Creativity of board members serves as the foundation for finding and capitalizing on new opportunities, developing new products and adapting to quickly changing market conditions (Lentju_senkova & Lapin, Citation2020). Thus, a board member who is determined to reach his/her goals is likely to be creative in finding a way to meet his/her desires.

This means that firms pay great attention to board members who have high need for achievement and creativity so as to achieve higher financial performance. There are many studies conducted on board of directors (Nguyen et al., Citation2020), however, these studies focused their attention on firm and board level ignoring the fact that individual directors or board members’ characteristics have an impact on their performance and thus the performance of the firm. Supporting this, Lu et al. (Citation2022) argued that most previous studies focus on firm and board level issues rather than individual level issues, and so the current study contributes to literature on individual board members’ entrepreneurial characteristics. In developing countries microfinance firms are composed of managers and directors. The position’s name depends on the financial ability of the firm to pay the board members. Most MFIs consist of managers as board members. Few MFI consist of both managers and directors.

4.2. Hypotheses development

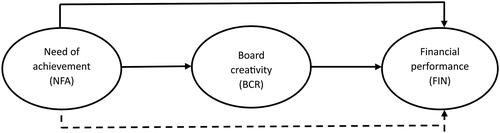

This study examines the relationship between the Need for Achievement (NFA) of board members and board creativity, as well as its impact on the financial performance of microfinance institutions (MFIs). Additionally, the study explores the mediating role of board creativity in the relationship between NFA and financial performance, as illustrated in . Conceptual framework: The present conceptual framework identifies two basic models. The first demonstrates a direct relationship between NFA and FIN. The second model demonstrates an indirect relationship between NFA and FIN, with BCR serving as a link between the two. Due to a lack of studies and inconsistencies presented in the literature review, the starting point is that, while NFA is critical for financial performance, BCR is thought to be in an excellent position to improve FIN when they act as a mediator between NFA and FIN. This implies that simply being motivated is insufficient to take a firm ahead.

4.2.1. Relationship between NFA and BCR of board members

A leader’s vision is an important key for turning individuals into creative minds. A leader with a need to achieve success will strategies work hard to get it and through that process, the firm also performs. There are many studies that have proved the relationship between entrepreneurial characteristics, and the need for achievement being one of them, with creativity. However, there are few studies that focus on board creativity. Operationally, creativity and board creativity are one and the same since all deal with individual behaviour. Payne and Whitworth (Citation2022) found that the increase in students’ creative ratings was closely linked to their motivation to succeed. Cai et al. (Citation2018) demonstrated that entrepreneurial leadership character has the potential to enhance creativity. An entrepreneurial leadership means a board member with enterprising characteristics such as need for achievement, which is also termed as achievement motivation by Torchia et al. (Citation2011). Gürol and Atsan (Citation2006), Arya and Maurya (Citation2016), and (Xie et al., Citation2021) asserted that need for achievement and creativity represent entrepreneurial characteristics and that research both support and refute the relationships between these characteristics. Thus, there is a need to do more research to take Tanzania’s stand.

The hypothesis suggests that a board member’s need for achievement has a positive impact on board creativity, which aligns with McClelland’s Achievement Motivation Theory. According to this theory, individuals with a high need for achievement have a strong drive to excel, continuously improve, and take on challenging goals. This implies that board members with a pronounced need for achievement may create an environment that encourages creative thinking, leading to innovative and solutions. While previous studies have emphasized the importance of individual characteristics in shaping board effectiveness (McClelland, Citation1961), there is a gap in exploring the direct relationship between board member need for achievement and board creativity. By conducting targeted empirical investigations, we can bridge this gap and strengthen the empirical foundation of the hypothesis. It’s crucial to consider the firm’s operational context when refining the hypothesis. For example, in industries where innovation is a key driver of success, a board member’s need for achievement may play a pivotal role in fostering a culture that values and encourages creative thinking. Also, examining firms undergoing strategic transformations or entering new markets provides an opportunity to understand how a board member’s need for achievement influences creative responses to dynamic business environments. Considering theoretical foundations, empirical support, and contextual insights, we can structure the enhanced hypothesis as follows:

H1: The need for achievement among board members has a positive influence on the board’s creativity in a firm.

4.2.2. Relationship between NFA and FIN

Entrepreneurship stands as a pivotal factor in achieving successful business performance, even in highly unpredictable circumstances (Cho & Lee, Citation2018). Among the entrepreneurial characteristics, the need for achievement is considered essential for board members to contribute to a firm’s success. Ismail (Citation2022) has provided evidence that a fervent desire for achievement, referred to as the need for achievement in this study, positively influences performance. Toste et al. (Citation2020) have similarly shown that achievement motivation impacts reading performance. Nonetheless, workplace diversity introduces significant challenges for board directors. The substantial differences among members within every organization imply that there is no one-size-fits-all solution to address such issues (Nduka, Citation2016). What motivates some board members to perform exceptionally well may demotivate others, presenting a significant challenge to a firm’s overall performance.

The study discusses a hypothesis that suggests a positive relationship between a board member’s need for achievement and a company’s financial performance. The hypothesis is based on McClelland’s Theory of Needs, which proposes that people have different motivational needs, and the need for achievement is essential for success in leadership roles. Empirical studies have also shown that individual traits and motivations influence leadership effectiveness and financial outcomes (Ismail, Citation2022). However, there is a need for a more direct examination of the need for achievement in executive roles to strengthen the hypothesis. The hypothesis can be refined by considering specific industry contexts and the nature of a company’s operations. For example, in rapidly changing and innovative industries, a high need for achievement may lead to a greater willingness to take calculated risks, pursue ambitious strategies, and be more proactive. Understanding such contextual nuances can refine the hypothesis to be more applicable across diverse business settings. Building on theory, empirical insights, and contextual considerations, the enhanced hypothesis can be structured as follows:

H2: A board member’s high need for achievement positively influences firm financial performance.

4.2.3. Relationship between BCR and FIN of a firm

Board members face constant pressure to find innovative ways to reduce costs and enhance firm effectiveness (Harrison et al., Citation2016). With a wide array of skilled individuals to choose from, firms are increasingly demanding higher levels of creativity from their board members. This underscores the importance of pursuing both incremental and radical creativity in board operations. Firms must ensure that their business processes are guided by conventional models and practices (Odebiyi et al., Citation2017). Leaders involved in decision-making must possess a creative mindset to navigate the competitive landscape effectively (Dunne et al., Citation2016). Effective leadership in entrepreneurship is a critical determinant of organizational success or failure. Therefore, board members who hold leadership positions in firms are expected to demonstrate creativity in their decision-making processes to enhance the firm’s financial performance.

Makuya (Citation2023) has demonstrated that creativity plays a predictive role in the economic well-being of retirees, which is linked to the financial performance of the businesses they operate. Conversely, research has shown that low board creativity may lead to negative performance outcomes and hinder the achievement of work-related goals (Du et al., Citation2020). Board members with low creativity often rely on existing solutions and are more likely to give up in the face of challenges (Richter et al., Citation2012). Thus, it is imperative to study the influence of board creativity on a firm’s financial performance.

Drawing on the Upper Echelons Theory, we can hypothesize that board member creativity can positively impact the financial performance of a firm. The theory suggests that the cognitive and demographic attributes of top executives and board members can significantly influence organizational outcomes (Hambrick & Mason, Citation1984). In terms of creativity, this theory proposes that the unique cognitive resources that creative board members bring may lead to innovative decision-making, strategic agility, and, ultimately, improved financial performance for the firm. Furthermore, empirical research supports the notion that incorporating cognitive diversity associated with creativity into board diversity can contribute positively to financial performance.

Studies by researchers such as Adams and Flynn (Citation2015) and Chen et al. (Citation2015) have found that diverse boards with creative perspectives lead to improved financial outcomes. This empirical evidence supports the hypothesis that the creative input of board members can be a valuable asset to a firm’s financial success. To gain additional insights, we can examine specific industry contexts. For instance, in technology-driven industries, having creatively inclined board members may prove especially advantageous as innovation is a key driver of success. Additionally, in dynamic and competitive environments where adaptability is crucial, the influence of creative board members on financial performance may be more pronounced. These contextual insights help refine the hypothesis by acknowledging potential variations in the relationship across different industries or environmental conditions. Building on the insights from the theory, empirical literature, and contextual considerations, the enhanced hypothesis can be structured as follows:

H3: The board members’ creativity has a positive effect on the financial performance of a firm.

4.2.4. Mediating role of board creativity (BCR)

In accordance with the research conducted by Falola et al. (Citation2018), entrepreneurial characteristics assume a pivotal role in the establishment of a prosperous business, as individuals amalgamate these traits with the creative capacities of the company to attain success. Mgeni (Citation2015) discovered a positive relationship between entrepreneurial leadership styles and SME performance. Additionally, Gürol and Atsan (Citation2006) argued that characteristics encompass a combination of individual, social, and environmental factors. Individual aspects include personal characteristics and values such as creativity, innovation, and risk-taking. Social factors consist of family, societal, and professional backgrounds, while environmental factors involve extrinsic characteristics (Hsieh et al., Citation2019). Creativity influences the objectives and strategic actions of people, subsequently impacting business performance (Karimi et al., Citation2022). Andriopoulos (Citation2001) posited that creativity alone is insufficient; it must align with individual and organizational goals driven by the need for achievement. Moreover, businesses were more likely to achieve positive performance outcomes when their managers considered themselves as "creators of change" (Nazir et al., Citation2023; Ringo et al., Citation2022).

The proposed hypothesis is supported by several theoretical frameworks. Firstly, it aligns with McClelland’s Achievement Motivation Theory, which suggests that individuals with a high need for achievement are intrinsically motivated to excel and continuously improve their performance. Secondly, the hypothesis is supported by Institutional Theory, which posits that organizations are influenced by the institutional environment in which they operate. Finally, it is consistent with Upper Echelons Theory, which emphasizes the influence of top executives’ characteristics, such as NFA, on organizational outcomes. Empirical studies provide additional support for the proposed hypothesis. Research by Grant and Berry (Citation2011) found a positive association between individual achievement motivation and creative problem-solving in organizational settings. Similarly, studies by Nielsen (Citation2010) and McClelland (Citation1961) demonstrated a positive correlation between achievement motivation and innovative behaviour among executives. Arya and Maurya (Citation2016) found a positive relationship between creativity, intelligence and academic achievement among secondary school girls. This shows the importance of creativity and need for achievement.

Moreover, research by Finkelstein et al. (Citation2009) and Davis et al. (Citation2019) highlighted the significance of individual board member characteristics, including NFA, in shaping organizational dynamics and performance. In the context of microfinance institutions (MFIs) in Tanzania, where the study is conducted, the hypothesis gains further relevance. MFIs operate in a dynamic and competitive environment, where the need for innovative solutions to financial inclusion challenges is paramount. Board members, as leaders of MFIs, play a crucial role in driving organizational performance and fostering a culture of innovation. Therefore, understanding how the need for achievement influences board creativity and, subsequently, financial performance is essential for enhancing the effectiveness of MFIs in achieving their goals. Based on the theoretical underpinnings and empirical evidence, the hypothesis can be formally stated as follows: In microfinance institutions, board creativity mediates the relationship between the need for achievement of board members and the financial performance of the institution. This hypothesis posits that individual board members’ need for achievement positively impacts the financial performance of the microfinance institution by fostering creative thinking and innovative problem-solving.

For board members, a significant challenge is to envision ambitious goals that drive the need for achievement, enabling the creation of innovative and profitable products and services. The influence of board members’ need for achievement on firm performance has been suggested to be positive in past studies (Forbes & Milliken, Citation1999). Nevertheless, this influence may be intricate and indirect (Torchia et al., Citation2011). Therefore, exploring intervening and mediating variables between board members’ need for achievement and firm performance is a valuable approach (Ismail, Citation2022). Karimi et al. (Citation2022) used creativity as a mediator to study the influence of leadership on innovation, and creativity was demonstrated to have a positive impact on firm performance (Torchia et al., Citation2011). Thus, since need for achievement influences performance and board creativity affects performance, it is fair to postulate that:

H4: Board creativity mediates the relationship between need for achievement and financial performance.

4.3. Conceptual framework

shows a conceptual framework of the relationship between the Need for Achievement (NFA) and financial performance (FIN), with Board Creativity (BCR) serving as a mediator. The present conceptual framework identifies two basic models. The first demonstrates a direct relationship between NFA and FIN. The second model illustrates an indirect relationship between NFA and FIN, with BCR serving as a link between the two. Due to a lack of studies and inconsistencies presented in the literature review, the starting point is that, while NFA is critical for financial performance, BCR is thought to be in an excellent position to improve FIN when acting as a mediator between NFA and FIN. This implies that simply being motivated is insufficient to propel a firm ahead.

5. Research design

5.1. Sample selection

The study targeted microfinance institutions (MFIs) in the Dodoma and Dar es Salaam regions of Tanzania. The study sample comprised 189 board members from 189 different MFIs, with the unit of analysis being directors and/or managers. In the selected regions, the total target population consisted of 374 MFIs (BOT (Bank of Tanzania), Citation2023). To determine the sample size from the target population, the Slovin formula was employed, using a confidence interval of 95%. This calculation resulted in a sample size of 193 MFIs. During the data collection process, 189 valid responses were collected, yielding an impressive response rate of 97.9%. The MFIs were selected using simple random sampling, ensuring that each MFI board member had an equal chance of being chosen, thereby minimizing bias (). The involvement of managers and/or directors as board members was important, as they possess the necessary knowledge of board operations and are actively engaged in the decision-making processes of the board. Some MFIs have directors, while others rely on managers during board of directors’ meetings. Self-administered questionnaires were employed to collect data on the main study variables, enabling the researchers to easily gather responses and draw meaningful conclusions. Bias in the instrument for data collection was addressed by ensuring confidentiality and anonymity of the respondents.

Table 1. Sampling procedure.

5.2. Variable measurement

In order to estimate the current research model, all measurement scales were adapted from the literature using reflective multi-measurements. The scale of NFA items was adapted from Gürol and Atsan (Citation2006); Ismail (Citation2022), and Conradi et al. (Citation2014). The measurement of BCR was adapted from Torchia et al. (Citation2011), and Nwekpa and Wabara (Citation2022). FIN was measured using Horváthová et al. (Citation2015) and Chi and Gursoy (Citation2009). Measuring FIN assumes three main dimensions: Profitability, Return on Investment, and net profit. All instrument statements used a five-point Likert scale (1 = strongly disagree to 5 = strongly agree). summarizes the variables used in the study.

Table 2. Operationalization of variables.

Need for Achievement (NFA): Refers to an individual’s intrinsic motivation to excel, set challenging goals, and continuously strive for success. In the context of board members, it signifies the extent to which individuals are driven to achieve personal and professional accomplishments. This variable is classified as an independent variable because it is presumed to have a direct influence on other variables within the model. In this case, the hypothesis posits that the need for achievement among board members directly influences both board creativity and, subsequently, financial performance.

Board Creativity (BCR): Refers to the ability to generate novel and valuable ideas or solutions (Ismail, Citation2022). In the context of the board, it signifies the board’s capacity to think innovatively, generate creative solutions, and foster a culture that encourages and values innovative thinking. BCR is positioned as a mediator in the proposed model. This means that it is hypothesized to explain the process through which the independent variable (NFA) influences the dependent variable (FIN). In other words, board member need for achievement is expected to influence financial performance indirectly by influencing the creativity of the board.

Financial Performance (FIN): Refers to the quantitative measure of a firm’s profitability, revenue growth, or other financial metrics. It provides an overall assessment of the firm’s effectiveness in utilizing resources to generate economic value. Financial performance is classified as the dependent variable in the model (). It is the outcome variable that is hypothesized to be influenced by both the independent variable (NFA) and the mediator (creativity). The financial success of the firm is expected to be positively impacted by the NFA of board members, both directly and indirectly through its influence on board creativity. Financial performance can be measured using different indicators such as profitability (Makona et al., Citation2023), capital adequacy ratio (Sanyaolu et al., Citation2022), spending or net profit (Sanyaolu et al., Citation2022), return on Asset (Solomon & Makuya, Citation2022), sales, income, net profit, market share, inventory cost (Ismail), and many more. Thus, this study used profitability, return on investment, and net profit. Return on investment was also used by Horváthová et al. (Citation2015).

The study acknowledges the fact that there are many factors or variables that could confound or control the relationships addressed such as board size (Sanyaolu et al., Citation2022), MFI age (Baccouche et al., Citation2010), Ownership (Schiehll & Bellavance, Citation2009), and board member demographic factors (Nguyen et al., Citation2020). However, since it is the first study to mediate board creativity to the relationship between NFA and FIN of MFIs, the study laid a foundation for future studies to expand into confounding and control variables. Moreover, the study considered the error term which accounts for unforeseen errors, and that, validity and reliability were tested and found to have values within the recommended ranges. Bias in the instrument for data collection was addressed by ensuring confidentiality and anonymity of the respondents. By employing a combination of robust measurement approaches, advanced estimation techniques, and addressing general endogeneities, research was able to enhance the validity and reliability of their empirical analyses when exploring the relationships between the need for achievement, board creativity, and financial performance.

5.3. Data analysis and model estimation

There were two major stages involved in the analysis. The confirmatory factor analysis (CFA) was the first step in which the items presented in and were associated with the NFA variable and FIN, verified in latent models to depict the overall pattern of observed variables. Following the CFA, the second stage involved hypothesis testing among variables, managed using path analysis techniques. There were also four models used in the path analysis: the first model was used to examine the relationship between all four variables. The following are the regression models that have been developed:

The first model was used to examine the relationship between NFA and FIN with the following regression model that has been developed:

(2)

(2)

where α is a constant, FIN is a dependent variable, β1 is a coefficient of X1 an independent variable which in this case is NFA, while ε is the error term. The second model is presented as follows:

(3)

(3)

where α is a constant, BCR is a dependent variable, β2 is a coefficient of X2 which in this case is NFA an independent variable, while ε is the error term. The third model is presented as follows:

(4)

(4)

where α is a constant, BCR is a dependent variable, β3 is a coefficient of X3 an independent variable which in this case is NFA, while ε is the error term. The fourth model is presented as follows:

(5)

(5)

where α is a constant, FIN is a dependent variable, β2 is a coefficient of X2 an independent variable which in this case is NFA, while ε is the error term. However, compared to the first three models, this model involves β3, representing the coefficient of X3 (BCR), which is considered as a mediator of the relationship between NFA and FIN.

The study acknowledges that there are other methods of estimating the models apart from structural equation model (SEM), as used by Changalima et al. (Citation2023), which could estimate the variables (independent and dependent). Methods such as lagged structure, and instrumental variables estimation, panel data analysis among others and general endogeneities are important in estimating time lags in the sequence of events, to address endogeneity by introducing a variable that is not directly linked with the dependent variable or applying data collected over multiple time-periods for the same entities are acknowledged. However, the study used SEM, which is a statistical technique that combines factor analysis and multiple regressions to examine complex relationships among variables. SEM can be used to model the relationships between latent constructs (such as NFA and BCR) and observed variables (such as FIN), offering a comprehensive understanding of the interdependencies. Robustness checks were done by employing different estimation methods and sample specifications to assess the consistency of findings across various specifications. Coupling with observing anonymity, confidentiality, and random selection of the respondents, the study was able to address bias issues.

This study employed CFA as part of SEM and PROCESS macro for data analysis. The results of the measurement model as presented in this study support the analysis as the measurements are reliable and valid. Thus, Confirmatory Factor Analysis (CFA) is employed to assess model fit indices, while Hayes’ PROCESS macro is utilized to analyze the mediating effect of board creativity on the relationship between the need for achievement and financial performance. CFA is crucial for establishing the validity of measured items concerning latent variables in multivariate analysis (Hayes, Citation2018). The use of the PROCESS macro is justified because it is recognized as a contemporary and robust tool for conducting regression analyses involving additional variables such as mediators, covariates, and moderators, with the added benefit of bootstrapping confidence intervals (Hayes, Citation2018).

5.4. Common method bias

As the data was gathered from a single individual for each MFI, the potential for common bias was a concern. Initially, the study applied procedural measures such as participant confidentiality for anonymity and having clear questions for each construct to reduce the risk of common method bias. Furthermore, following the recommended practice, the study utilized the Harman single-factor technique to assess the presence of significant common method bias (Podsakoff et al., Citation2003). The results revealed that approximately 39.26% of the variance in the model could be attributed to a single factor. Since this value falls below 50%, it can be concluded that common method bias is not a significant concern in this study.

6. Empirical results and discussion

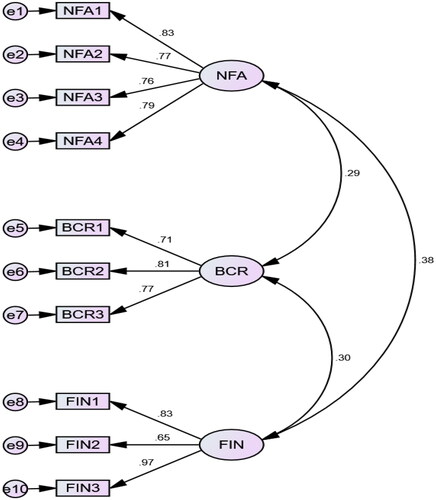

6.1 Evaluation of measurement model

The results for the evaluation of the measurement model (as presented in ) are used to assess reliability and validity in and . The evaluation of measurements is conducted by assessing internal consistency reliability through the use of parameters such as composite reliability, Cronbach’s alpha, and Average Variance Extracted (AVE) values. Additionally, discriminant validity is determined by applying the Fornell-Larcker criterion, which involves comparing the square root of AVE to the correlations between latent constructs. If the square roots of AVE, as presented in , are greater than the corresponding intercorrelations, this indicates that discriminant validity has been achieved (Fornell & Larcker, Citation1981). The results indicate that all AVE values are above 0.5, falling within the recommended range, signifying the attainment of convergent validity (Adil et al., Citation2019). Moreover, the values of Cronbach’s alpha and composite reliability should exceed 0.7, demonstrating the fulfillment of internal consistency reliability, as shown in Table1 (Hair et al., Citation2021). The results from the measurement model on the composite reliability and Cronbach’s alpha are presented in this sections.

Table 3. Measurements, reliability, and validity.

Table 4. Fornell-Larcker criterion of discriminant validity.

6.2. Structural model and hypotheses testing

The p-values and path coefficients used to assess the hypothesized relationships are displayed in . The results indicate that all the study’s hypotheses were accepted, as the findings align with the expected relationships. These findings indicate that NFA has a significant and positive impact on both BCR and FIN within MFI businesses. Specifically, the findings presented in support H1 (p = 0.001, β = 0.288). The implication of this is that a unit increase in NFA results in an increase in BCR by 28.8%. Thus, the need for achievement has a positive and significant influence on board creativity. Members of the board will have creative minds if they are motivated.

Table 5. Structural model analysis by using process macro.

The positive impact of NFA on both board creativity and financial performance aligns with McClelland’s achievement motivation and agency theories. McClelland’s theory posits that individuals with a high need for achievement are driven to excel and improve performance continuously. From an agency theory perspective, NFA can be examined as a motivational factor influencing the behavior of agents (board members) to align with shareholder interests. Empirical studies by Nielsen (Citation2010), Grant and Berry (Citation2011), and McClelland (Citation1961) have similarly found positive associations between achievement motivation and creative problem-solving. The finding is also consistent with studies that underscore the significance of board composition in influencing organizational outcomes (Finkelstein et al., Citation2009; Rao & Tilt, Citation2016). The finding that a unit increases in the need for achievement results in a 36.6% increase in financial performance provides a quantifiable measure of the impact. This strengthens the practical relevance and aligns with the increasing emphasis on quantifiable metrics in organizational research (Rahman et al., Citation2015).

The findings of the study also support the Upper Echelons theory, suggesting that individual board member entrepreneurial characteristics, in this case, the NFA, significantly influence organizational outcomes. This is consistent with recent studies by Davis et al. (Citation2019) and Finkelstein et al. (Citation2009), which highlight the relevance of Upper Echelons characteristics in shaping organizational dynamics.The implication that a unit increase in NFA leads to a substantial increase in BCR underscores the importance of motivation in MFIs. It suggests that fostering a culture of achievement and setting ambitious goals can contribute to a more creative and innovative board, aligning with practical insights from studies by de Stobbeleir et al. (Citation2011), Torchia et al. (Citation2011), and Xie et al. (Citation2021). The positive and significant influence of NFA on board creativity indicates that motivated individuals, driven by an NFA, are more likely to exhibit creative thinking. This aligns with studies in organizational psychology, such as those by Amabile et al. (Citation2005), emphasizing the connection between individual motivation and creative output. The quantifiable impact of a 28.8% increase in board creativity resulting from a unit increase in NFA provides a clear measure of the influence of motivational factors on creative processes within the board. This quantification aligns with the growing emphasis on measurable outcomes in organizational research (Rahman et al., Citation2015).

As for H2, results confirm the hypothesis, addressing research question number one (RQ1) (p = 0.000, β = 0.366) (). These findings imply that a unit increase in NFA results in an increase in FIN by 36.6%. Therefore, the need for achievement is a positive and significant predictor of financial performance, making it a necessary characteristic for a board member to possess in order to ensure the good performance of the board of directors and thus the firm. For a board member to perform well, there must be a reason or motivation, and the need for achievement serves as a drive that motivates a person to perform well.

The positive and significant relationship observed aligns with McClelland’s achievement motivation theory, which posits that individuals with high NFA are driven to excel and continuously improve their performance. This consistency supports empirical studies that have found a positive association between individual achievement motivation and organizational outcomes (Grant & Berry, Citation2011; McClelland, Citation1961). The results directly support the theoretical underpinnings of McClelland’s achievement motivation and institutional theories, which suggest that NFA is a critical motivator for individuals in leadership roles. These theories emphasize the positive impact of creating an environment of achievement-oriented behavior on individuals in leadership roles. The implication that the need for achievement is a positive and significant predictor of financial performance has practical implications for the selection and training of board members. Firms may consider assessing and prioritizing achievement-oriented traits when appointing or developing board members to enhance overall firm performance (Ismail, Citation2022).

H3 findings () indicate that BCR positively and significantly influences FIN (p = 0.001, β = 0.255). The findings imply that a unit increase in board creativity results in an increase in financial performance by 25.5%. Thus, board members with creativity are likely to enhance the performance of the firm. The positive and significant relationship between board creativity and financial performance aligns with previous research in the broader literature on firm performance and innovation. Studies by Zhou and Hoever (Citation2014) have consistently demonstrated that creativity, when fostered within organizational leadership and decision-making, can positively influence overall performance. The finding that a unit increase in board creativity corresponds to a 25.5% increase in financial performance provides a quantifiable measure of the impact. This aligns with studies by Anderson et al. (Citation2014), Torchia et al. (Citation2011), and Nwekpa and Wabara (Citation2022), emphasizing the significance of creative thinking in driving financial success.

The implication that board members with creativity are likely to enhance firm performance has practical implications for managerial decision-making. Firms may benefit from actively managed boards by fostering a creative culture at the board level to improve financial outcomes. This resonates with the managerial insights provided by studies such as Carmeli et al. (Citation2010) and Grant and Berry (Citation2011). The findings contribute to the literature on board effectiveness by highlighting the specific role of creativity in influencing financial performance. While numerous studies have explored the impact of various board characteristics, this finding adds to the understanding of the unique contribution of individual members’ creativity, as noted by Finkelstein et al. (Citation2009) and Davis et al. (Citation2019).

The positive relationship observed between board creativity and financial performance is consistent with the Upper Echelons theory. This theory posits that individual characteristics of top executives, in this case, creativity among board members, significantly influence organizational outcomes as suggested by Hambrick and Mason (Citation1984) and recent studies like Davis et al. (Citation2019). While the findings are insightful, future research could explore potential moderators or mediators, especially other entrepreneurial characteristics that might influence the strength or nature of the relationship between board creativity and financial performance. Additionally, considering contextual factors, such as industry characteristics, may offer a more nuanced understanding. In summary, the positive and significant relationship between NFA and FIN is consistent with existing literature on organizational behavior, innovation, and board effectiveness. The findings provide valuable insights for practitioners seeking to enhance firm performance by recognizing and cultivating creativity among board members.

In addition, the study investigated the mediating role of board creativity in the relationship between the need for achievement and the financial performance of MFI as part of addressing the second research question (RQ2) and supporting hypothesis H4 (). The results in indicate a significant indirect effect of the need for achievement on MFI financial performance as shown in the CB path model since bootstrapping confidence intervals have a nonzero value in between, which indicates mediation (β = 0.074). Since the direct effect is significant, the mediation is partial. These findings highlight the crucial role of board creativity as a significant mediator in this relationship between the need for achievement and MFI financial performance (p < 0.05). Thus, all the assumptions of mediation as stipulated by Baron and Kenny (Citation1986) hold. That is, if the direct effect is significant, then X does affect Y, and if the indirect effect is significant, then M does indeed mediate the relationship between X and Y.

The significant indirect effect of the need for achievement on MFI financial performance, as indicated by the nonzero value of the bootstrapping confidence intervals in the CB path model, suggests the presence of mediation, and the reported coefficient signifies the strength of this indirect effect. This finding aligns with research in the broader organizational and leadership literature that emphasizes the importance of individual entrepreneurial traits and motivations in influencing organizational outcomes. Studies by Grant and Berry (Citation2011) and Rahman et al. (Citation2015) have acknowledged the potential indirect impact of executive characteristics on financial performance through mediating factors.

The findings that the direct effect is also significant indicate partial mediation. This implies that while board creativity acts as a mediator in the relationship between the need for achievement and MFI financial performance, there are additional pathways or factors influencing financial performance beyond creativity. Partial mediation is not uncommon in organizational research. Studies by Amabile et al. (Citation2005) and de Stobbeleir et al. (Citation2011) have identified scenarios where the direct effect remains significant even when there is a mediating variable involved. This highlights the complexity of firm dynamics and the multiple pathways through which individual entrepreneurial characteristics can impact outcomes.