Abstract

The Indonesian government has now developed a QRIS EPayment for non-cash transaction between MSMEs and customers. MSMEs are the main channel for the success of the program through various transaction services provided to customers. This study aims to investigate the determine customers intention to adopt of QRIS e-Payment in Indonesia. Extended of UTAUT Theory will be used to investigate. Partial least squares structural equation modeling (PLS-SEM) was use to analyze the data. Using the purposive sampling technique, this study collected 195 respondents. We found that There are two main variables driving the customer in adopting of QRIS e-payment, namely social influence and facilitating conditions. Meanwhile, the variable performance expectancy and effort expectancy have a positive but insignificant effect. This result implies that In order to increase customer intention to use the QRIS e-payment system by consumers in Indonesia, QRIS service providers need to form a favorable opinion in society by increasing social influence through collaborating with community leaders or important people in their community and facilitating services that facilitate community adopts QRIS. This will encourage customer intention to adopt of QRIS e-payment and accelerate the migration of cash transactions to non-cash transactions in Indonesia.

REVIEWING EDITOR:

1. Background

Technological developments have brought major changes to human life, including the financial industry. Today’s business people have developed their business by adopting digital technology to make it easier for customers to make transactions. Digital technology or financial technology in the financial business will support more effective and more transparent company operations (Andreeva & Epifanova, Citation2020). Japparova and Rupeika-Apoga (Citation2017) say that banking as one of the financial industries that adopt fintech faces various challenges not only from fintech companies but also building interactions with them. Hui et al. (Citation2019) added that fintech will offer consumers new products and services that they can take advantage of. Fintech also allows customers to make transactions without having to physically visit the company’s office; they can do it easily at home through technology (Dash and Bhusan (Citation2014).

Facing global challenges, banks in Indonesia have also adopted financial technology to accelerate financial transactions, both through internet banking and mobile banking. Yeşildağ (Citation2019) said that internet banking is very important for banks and customers. For banks, the use of internet banking will reduce costs, shorten processes, increase service speed and flexibility in business transactions (Nasri, Citation2011; Sankari et al., Citation2015). Kumar Sharma and Madhumohan Govindaluri (Citation2014) added that the integration of information and communication technology (ICT) with banking provides significant benefits between service providers and customers. The latest technology used by banks today is to combine ICT with the internet, namely mobile banking. Mobile banking is adopted by banks to provide easier and more flexible services to their customers. Ahmadi Danyali (Citation2018) states that there has been a shift in the use of internet banking to mobile banking, where the influencing factor is the perceived advantage to use mobile banking services. The influence of peer groups also affects the shift in the use of internet banking to mobile banking.

The latest development from the impact of technology today is the change in the business model carried out by banks in Indonesia. Banking in Indonesia has developed a digital payment business model that can be done online or offline. This approach is carried out to encourage business growth between banks and customers, both individual customers and corporate customers or MSMEs. The digital payment being developed at this time is the creation of a Quick Response (QR) Code for business transactions carried out by business people with their customers. Bank Indonesia initiated the creation of a one gate payment system with the name Quick Response Code Indonesian Standard (QRIS). QRIS was created to bridge the QR Code payment system created by each provider such as electronic money, electronic wallets and mobile banking (Bank Indonesia, Citation2019). The main target of QRIS is business actors or merchants who sell their wares. Until now, there have been recorded as many as 15.7 million merchants who have registered their products with QRIS (QRIS, Citation2022). This number is still relatively small when compared to the number of micro, small and medium enterprises (MSMEs) in Indonesia which reaches 64.2 million (Ascarya, Citation2020).

In addition to business actors who are the main priority for the implementation of QRIS, potential customers and customers are also important in the success of non-cash transactions using the QRIS application. They are also one of the main elements for the success of non-cash transactions using QRIS. The more people involved in using QRIS, the faster the migration process for cash transactions to non-cash transactions will be. But unfortunately there are still many Indonesian people who have not been able to access financial institutions. This can be reflected in the low level of financial inclusion in Indonesia, which only reached 67.8% (OJK, Citation2019). Access to banking services is the main door to being able to carry out non-cash payments using QRIS e-payment. For Indonesians who are already banking customers, it will make it easier for them to make non-cash transactions, but not necessarily they are willing to transact using e-payments.

There are many factors that influence a person’s willingness to adopt fintech services. Vaittinen et al. (Citation2018) said that there are many factors that affect a person’s readiness to adopt technology, both at the individual and organizational levels. At the individual level, factors that influence the readiness to adopt are perceived usefulness and social influence (Singh et al., Citation2020). Yen H Hoang et al (Citation2021) investigated the adoption of fintech in banking in Vietnam, the results showed that customers are willing to adopt financial services influenced by perceived usefulness, brand images, user innovativeness and trust. Akinwale and Kyari (Citation2020) found factors that influence Nigerian customers to be willing to adopt fintech provided by banks, namely perceived usefulness, perceived easy of use, service trust and social influence. Using the UTAUT2 theory, Negm (Citation2023) investigate the consumers’ acceptance intention of e-payment in Arab Region and found that performance expectance, facilitating condition, effort expectancy and social influence are significant impact on consumers’ intention to use of e-payment.

Trinugroho et al. (Citation2022) said that technology adoption in Indonesia for micro and small businesses faces obstacles, including firm and owner characteristics, so they have difficulty adopting technology. Nurhapsari and Sholihah (Citation2022) investigated the interest of MSMEs in traditional markets in Semarang, Indonesia in adopting QRIS e-payment using the theory of technology acceptance model (TAM). The results of this research show that the variables product knowledge, perceived usefulness and perceived easy to use positively and significantly influence interest in adopting QRIS. Kilay et al. (Citation2022) investigated the use of e-payment and e-commerce in Indonesia by MSMEs. By using multiple regression analysis, it was found that the use of e-payment and e-commerce in MSME business activities was able to improve business performance positively and significantly. Wardhani et al. (Citation2023) investigated the role of QRIS in improving MSME business performance in Indonesia. By using the theory of technology acceptance model (TAM), it was found that using QRIS can significantly improve business performance.

This study aims to investigate the customer intention to adopt a QRIS e-payment system provided by providers and merchants using the extended of UTAUT Theory approach. UTAUT theory is one of the appropriate theories used to see someone’s interest in adopting fintech services (Abushanab & Pearson, Citation2007). UTAUT has been shown to be up to 70% more successful in explaining the variance in intention to use technology than the other eight theories (Venkatesh et al., Citation2003).). UTAUT consists of four significant direct determinants for the benefit of the utilization and use of information systems, namely: Performance Expectancy (PE), Effort Expectancy (EE), Social Influence (SI), and Facilitating Condition (FC) (Venkatesh et al., Citation2003).

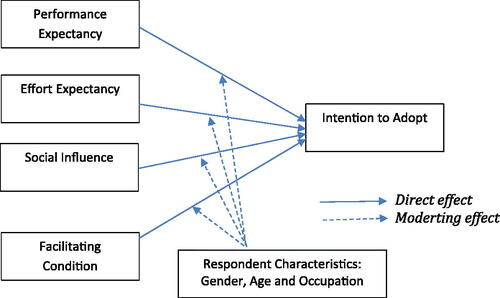

The elements in the model have been widely accepted as constructs to measure technology acceptance. UTAUT has been proven to be a valid research instrument and tool that is a predictor of adoption behaviour (Tarhini et al., Citation2016). This study will investigate the customer intention to adopt of QRIS e-payment by using the four components of the UTAUT theory, namely PE, EE, SI and FC and also added the respondent characteristics as a moderating variable. The uniqueness of this study is investigated from the customer perspective (demand side). Most of previous studies about QRIS e-payment focus on merchant side (supply side). Merchants are the main target for utilizing payment systems using QRIS (Bank Indonesia, Citation2019). Research on QRIS e-payment from the demand side is still limited so this research can be used as important information in developing QRIS e-payment in Indonesia. The addition of respondent characteristics as a moderating variable is a novel in this study.

The results of this study are expected to be used as a reference for policy and strategy development of non-cash payments using QRIS in Indonesia such as Bank Indonesia, bank manager and business owner. Therefore, the structure of the paper as follows. First, describes the phenomenon of research on new paid non-cash payment services in Indonesia. Second, to describe the literature review related to fintech adoption. Third, describes the methodology used to answer the research questions. Fourth, describe the results and discussion. Fifth, conclusions and recommendations.

2. Literature review

2.1. Financial technology

The importance of technological innovation in economic growth can be explained by the theory of Solow, Citation1956, which explains that technology is an important driver for economic growth. The digitalization of the economy has an impact on people’s lifestyle patterns. The involvement of disruptive innovations has changed human behavior massively. Technological innovation has shifted the way consumers obtain the needs of goods and services, from conventional ways to online platforms. This shift causes the elimination of business people who are not able to innovate in technology. The development of information technology has a domino effect that changes the nature of production to infinity and encourages the process of collaboration and sharing economy. This is allegedly eliminating the existing market, but it can have an impact on inclusion, especially in the financial industry. The effect of financial inclusion can provide a wider space for the community, thereby increasing access to financial services by changing the composition of the financial system such as transactions, services and available access points, so as to reduce economic inequality in society (Santoso et al., Citation2021).

Financial services have changed dramatically over the last few decades, mainly due to technological developments that have emerged from advances in telecommunications, information technology and financial practices. Technological advances encourage financial innovation to change several financial products, services, production processes and organizational structures (Frame et al., Citation2018). Over the past few years, the term fintech has become popular worldwide in relation to financial services. Although the rapid development of global fintech has received global attention, there is no standard definition of fintech (Chen et al., Citation2018; Cheng & Qu, Citation2020). The Financial Stability Board (FSB) defines fintech as technologically enabled financial innovation. Thakor (Citation2020) claims that fintech is the use of technology to provide new and better financial services. Wójcik (Citation2021) defines fintech as a set of innovations and economic sectors that focus on the application of newly developed digital technologies for financial services. The external definition comes from Leong and Sung (Citation2018), defining fintech as a cross-disciplinary subject that combines finance, technology management, and technologically enabled financial innovation management.

The emergence of financial technology or “fintech” has significantly changed the landscape of the global financial sector. Progressive technology systems that have created an efficient and practical impact on financial services businesses are one of the regular features of fintech (Lee & Shin, Citation2018). Currently there are more than 12,000 fintech startups worldwide, including from 93 Islamic fintechs (DinarStandard, Citation2018). The growth of global fintech investment is extraordinary. This achieved an increase of more than 50%, from $38.1 billion in 2017 to $57.9 billion in the first half of 2018 (KPMG, 2018). Fintech integrates finance and technology, provides a variety of innovative business services and leads the global economic revolution (Hsueh and Kuo, Citation2017). The application of fintech in financial inclusion practices will encourage social welfare and economic growth in various countries (Hussain et al., Citation2019). Technology-based financial innovation has developed significantly in developing countries and has been used to promote economic growth and financial inclusion (Junarsin et al., Citation2023).

With the significant development of fintech, it can change the way traditional financial services are. At the same time, fintech has an impact on improving the real economy. The impact of the emergence of fintech on the real economy is mainly reflected in the impact on companies, which can specifically be divided into the impact on the company’s financing ability, investment ability and technological innovation ability (Luo et al., Citation2022). On the financing side, financial technology innovations will trigger the emergence of regulatory arbitrage and shadow banking, where financial technology lenders serve more creditworthy borrowers and are more active in the refinancing market than other shadow banks. Basic modes of internet finance, such as equity-based crowd funding, P2P online lending, and online e-commerce can directly help solve the financing problems of small and medium-sized technology companies (Wonglimpiyarat, Citation2018). On the investment side of companies, research has proven that digital technology in fintech can provide strategic capabilities for companies to place a place in the financial sector, thereby increasing investment efficiency (Leong et al., 2017). From the perspective of the company’s technological innovation, fintech can increase the company’s independent innovation capability, thereby driving real economic growth (Hsu et al., Citation2014).

Based on previous literature, fintech can have a broad impact on people’s lives. Demertzis et al., (Citation2018) propose that fintech innovation can overcome most of the problems of information asymmetry and increase the efficiency of allocation of financial resources through data analysis and processing. It will also bring technological advancements and promote corporate innovation by providing innovative service education and training to investors (Haddad & Hornuf, Citation2019). So that finance can serve the real economy well, encourage economic output, and encourage productivity development (Broby et al., Citation2018). In addition, fintech innovation accelerates the substance of electronic money from traditional currencies, makes it easier for consumers to pay, and encourages household consumption in various dimensions by reducing payment costs, providing consumer credit and stimulating consumption impulses (Beck et al., Citation2018; Riley, 2018).). As one of the technological innovations, fintech has driven a lot of technological progress, corporate transformation, and increased corporate consumption. In addition, it was found that fintech can encourage household consumption, while online shopping, electronic payments, and online loans are intermediary variables for fintech to encourage consumption (Li et al., Citation2020). Luo et al. (Citation2022) examined fintech innovation in driving household consumption in China and found that fintech innovation can significantly boost household consumption at the national level.

Likewise, the recent development of fintech in Indonesia has also been phenomenal. In recent years, fintech has grown very rapidly globally, including Indonesia. The Indonesian fintech industry is ranked 47th globally. The value of this country’s digital economy reached US$40 billion or around Rp586 trillion, while e-commerce reached US$20.9 billion or around Rp308 trillion in 2019 (Kharisma, Citation2020). The company’s business pattern through digital service offerings is also changing. Indonesia is a country with a high fintech growth rate because it enters various business sectors, including payment systems, investments, and online loan funds (Santoso et al., Citation2021). Based on the Indonesia Fintech Association (AFTECH) until May 2022, the number of fintech companies in Indonesia has reached 352. Based on a report from AFTECH, the target market for Fintech companies is dominated by micro, small and medium enterprises (BRI, Citation2022). Fintech lending is the most growing company in Indonesia and in September 2022 managed to channel funding of Rp. 455 trillion (BI, Citation2022).

In addition, considering that Indonesia is home to 33% of the sharia fintech startup ecosystem worldwide, this situation makes this country the country with the highest number of sharia fintech companies (Hudaefi, Citation2020). For Indonesians, fintech provides convenience for financial activities, including mobile and internet payments, electronic money, crowdfunding, peer-to-peer lending, investment, financial aggregators, and financial consulting (Junarsin et al., Citation2023). Fintech in Indonesia has grown rapidly, as many companies have emerged and are offering their alternative funding services to the public. The fintech industry in Indonesia is dominated by two business categories, namely payments and loans (Utami & Ekaputra, Citation2021).

2.2. Digital payment adoption

Digital payments are currently becoming popular throughout almost the world with new technologies such as mobile payments, ATM debits, e-money and barcode-based digital payments. In several literatures, digital payments are mentioned differently, starting from electronic payments (Lok, Citation2015; Negm, Citation2023; Trianto et al., Citation2023), cashless payments (Rahman et al., Citation2022; Dieu et al., Citation2023), online payment (Kumar et al., Citation2023; Shankar et al., Citation2023), and Digital Payment (Bisma et al., Citation2020; Putrevu & Mertzanis, Citation2023). Companies that innovate in the financial sector to create convenience in carrying out business transactions and financial reporting. Digital payment is defined as a method of payment that is produced through digital methods. Both payer and payee use digital methods for sending and receiving cash in digital payments. So it’s called electronic payment as well (Bisma et al., Citation2020). The use of e-payments in business transactions has increased rapidly from previous years. The social distancing policy due to the Covid-19 pandemic, which prevents people from meeting face to face, has also accelerated the use of digital payments.

The existence of digital payments will help make payment transactions easier. However, there is resistance for some people in adopting. This resistance is caused by behavioral intention and innovation resistance (Sivathanu, Citation2019). Kaur et al. (Citation2020) revealed that resistance to adopting mobile payment is lack of consumer experience, lack of confidence, security risk and comprehensive functionality of mobile payment. Behera et al. (Citation2023) also revealed that consumers’ unwillingness to adopt mobile payments is caused by self-compassion (SC) characteristics such as anxiety, efficacy, fatigue, the tendency to wait and see and excessive technology choices. In a study conducted by Cham et al. (Citation2022), it was found that the habit of holding cash influences resistance and the formation of attitudes that enable the intention not to adopt digital payments. In their study, Trianto et al. (Citation2023) also found that the majority of merchants in Indonesia and Malaysia were more interested in carrying out cash transactions using cash rather than using digital payments.

The existence of digital payments also attracts many people to adopt them for various reasons. Several empirical studies show that the behavior of using digital financial technology is influenced by several factors. Flavián et al. (Citation2020) conducted an investigation of 414 mobile payment users in the United States and 380 mobile payment users in Spain. Data analyzed using SEM found that the determining factors for interest in using mobile payment were influenced by mindfulness, perceived ease of use, perceived usefulness, subjective norms and attitude. Trianto et al. (Citation2023) investigated 400 micro-entreprises in Indonesia and Malaysia in adopting e-payment. It was found that most micro-entreprises have adopted digital payment systems such as e-wallets and debit ATMs. Meanwhile, e-money and barcode systems have not been widely used by micro-entreprises in Indonesia and Malaysia. This research also found that the main factors determining interest in adopting digital payments in Indonesia are social influence and government support, while in Malaysia it is determined by facilitating conditions and government support.

Lok (Citation2015) investigated the adoption of Octopus e-payment by retailers in Hong Kong which was deemed unsuccessful. From the results of the investigation, cultural aspects must be the main concern in developing electronic payment systems. This research found that cultural aspects have a direct influence on perceived usefulness in the adoption of Octopus e-payment. Innovative characteristics and social influences are validated to be a significant as hypothesized. Negm (Citation2023) investigated the interest in adopting digital payments from the non-retail or non-merchant side among Arab consumers using the UTAUT theory approach. The results of this research indicate that performance expectation, facilitating conditions, effort expectations and social influence impact consumers’ e-payment acceptance intention. Yusfiarto (Citation2021) said that success in switching from cash to m-payment among Muslim consumers in Indonesia is influenced by religious commitment. The features of m-payment such as enjoyment, efficiency, security and convenience have the big contribution to the driving and attracting for Muslim individuals to switch from cah to m-payment. Al-Okaily et al. (Citation2022) added that trust, social influence and price value are also important factors in the adoption of m-payment. Alkhwaldi and Al Eshoush (Citation2022) claim that Trust and security are important factors in customer adoption of e-payment.

2.3. QRIS E-payment system

Technological developments force most people to make adjustments in their interactions, including in the payment system. The electronic payment system or e-payment is a form of response to technological developments. E-payment has begun to be developed in Indonesia with various payment gateways provided by various payment industries. Payment gateway is one of the efforts to bridge the interests of businesses and customers. Payment gateway is defined as an electronic service that allows merchants to process payment transactions using payment instruments using cards, electronic money and/or proprietary channels (Bank Indonesia, 2019). Bank Indonesia is also developing an electronic payment service based on the Quick Response Code (QR Code) under the name Quick Response Code Indonesian Standard (QRIS). QRIS was developed by the payment system industry together with Bank Indonesia so that the transaction process with the QR Code can be easier, faster and secure (Bank Indonesia, 2019).

The QRIS payment model provides benefits for both consumers and merchants. Consumers who use QRIS transactions will get benefits in the form of speed of service, security, cash-less and practicality. Meanwhile, merchants who have installed QRIS on their products will benefit from increasing business branding, potentially increasing sales, reducing cash management costs, no need to provide change, separate business and personal money and building a credit profile to make it easier to get financing in the future. (Bank Indonesia, 2019).

Currently, there are three types of QRIS developed in Indonesia that can be adopted by merchants, namely static Merchant Presented Mode (MPM), dynamic Merchant Presented Mode (MPM) and Customer Presented Mode (CPM). The static QRIS MPM is the easiest QRIS e-payment to use; merchants only need to install a sticker or QRIS print-out. Users only scan, enter nominal, enter PIN and click pay. Transaction notifications are immediately received by users or merchants. Meanwhile, QRIS MPM Dynamic is a payment system where QR is issued via a device such as an EDC machine or smartphone and it is free. Merchants must enter the nominal payment first, and then the customer scans the displayed or printed QRIS. Meanwhile, Customer Presented Mode (CPM) is a QRIS intended for merchants who require high transaction speeds such as transportation, parking and modern retail providers (Bank Indonesia, 2019).

2.4. Previous studies and hypotesis development

Abushanab and Pearson (Citation2007) in their research found that the UTAUT model has a good fit in the field of internet banking where UTAUT offers a strong basis for analysis of technology adoption. By using three main factors to analyze, namely performance expectations, business expectations and social influences, all of which have an impact on decisions to adopt technology to use internet banking. Farzin et al. (Citation2021) tested UTAUT2 in adopting M-banking on banking consumers in Iran and found that performance expectations are one of the predictors in influencing someone to adopt M-banking. Rahim et al. (Citation2023) also tested the adoption of Islamic fintech among Malaysian millennials using the UTAUT2 framework, finding that performance expectations affect a person’s adoption. Business expectation is the degree of ease in using innovation and technology (Rahim et al., Citation2023). Yu (Citation2012) also states that business expectations are a person’s level of comfort with certain technology users. Researchers have shown that when performance expectations are high, customers exhibit high levels of behavioral intentions (Chiao-Chen, Citation2013).

The extent to which a customer understands that his significant other such as friends and relatives believe that he or she should use a certain technology is known as social influence (SI) (Venkatesh et al., Citation2012; Yu, Citation2012). It is based on concepts such as social image and subjective norms (Farah et al., Citation2018), in which individuals typically choose behaviors that are supported by their social ties (Farzin & Fattahi, Citation2018). Social influence can influence the behavior of others in three ways, namely compliance, internalization and identification (Venkatesh et al., Citation2003). Compliance causes individuals to adjust their beliefs, while internalization and identification adjust individual beliefs based on social status or subjective norms. Researchers also argue that social influences are empirically related to and influence the intention to adopt Islamic fintch and fintch (Farzin et al., Citation2021; Soomro, Citation2019; Xie et al., Citation2021).

Facilitating conditions refer to the customer’s perception of available resources and support to perform the behavior (Venkatesh et al., Citation2012). This condition also refers to the availability and accessibility of resources that encourage the adoption of certain behaviors (Siddik et al., Citation2014). Chemingui and Ben Lallouna (Citation2013) stated that people are unlikely to adopt M-banking unless they have certain FC such as financial resources, skills needed to work with this application and mobile internet access. In line with that, Farzin et al. (Citation2021) tested UTAUT2 in adopting M-banking on banking consumers in Iran and found that FC is one of the predictors in influencing someone to adopt M-banking. Rahim et al. (Citation2023) also stated that FC influences Malaysian millennial fintch adoption. Thus, the following hypothesis is built:

H1: Performance expectations are positively related to behavioral intentions to adopt QRIS e-payment system

H2: Effort Expectation is positively related to behavioral intention to adopt QRIS e-payment system

H3: Social influence is positively related to behavioral intention to adopt QRIS e-payment system

H4: Facilitating Conditions are positively related to behavioral intentions to adopt QRIS e-payment system

In several studies, adoption interest is moderated by respondent characteristics such as gender, age, education level, income and experience. Al-Dmour et al. (Citation2020) said that demographic characteristics play an important role in determining internet banking behavior. Al-Dmour et al. (Citation2020) added that high income, young age and good education are determinants in internet banking adoption. Several studies also found that gender determines internet banking adoption (Alalwan et al., Citation2017; Hossain et al., Citation2018). Sobti (Citation2019) conducted an investigation in India on interest in adopting mobile payments and found that gender, age and education level had a positive but insignificant influence on mobile payment adoption. Several other researchers also found that age, gender, education, and merital status are not significantly related to e-payment (Dehbi Dehbini et al., Citation2015; Hossain, Citation2019). Gan et al. (Citation2006) found age, income and education level had a direct influence and gender had no direct impact on technology acceptance. Specifically, Alagheband (Citation2006) found that young individuals are more likely to adopt internet banking. However, the different effects of moderating variables such as respondent characteristics can be caused by the characteristics of each country so that the results cannot be generalized (Bommer et al., Citation2022). Therefore, we formulate the following hypothesis:

H5a: Respondent Characteristics (gender, age, and job) have a positive influence on the relationship between performance expectancy and intention to adopt QRIS e-payment system.

H5b: Respondent Characteristics (gender, age and job) have a positive influence on the relationship between effort expectancy and intention to adopt QRIS e-payment system

H5c: Respondent Characteristics (gender, age and job) have a positive influence on the relationship between social influence and intention to adopt QRIS e-payment system

H5d: Respondent Characteristics (gender, age and job) have a positive influence on the relationship between facilitating conditions and intention to adopt QRIS e-payment system

3. Research method

3.1. Research design

The purpose this study to determine the factors behavioral intentions using the QRIS e-payment model in Indonesia. The questionnaire items are measured by a five-point Likert scale from strongly disagree to strongly agree. The questions in the survey were developed according to the operationalization of the research variable using the UTAUT theory as follows ().

Table 1. Question statement.

3.2. Model development

This study adopted the research conducted by Farzin et al. (Citation2021) and Rahim et al. (Citation2023) using the UTAUT theory of adoption of fintech in the financial industry. In the UTAUT theory, there are four main variables to be investigated, namely performance expectancy, effort expectancy, social influence and facilitating conditions. We chose Extended of UTAUT theory as an approach because this study is preliminary to investigate customer interest (supply side) in adopting QRIS e-payment in Indonesia. The founder of UTAUT stated that using UTAUT as the main basis for research is better without adding other variables for two reasons. First, applying UTAUT to research allows researchers to understand the basis of technology diffusion (Thomas et al., Citation2011). Second, UTAUT is currently the center of academic and research attention in studying financial technology because the constructs used by researchers mostly refer to the UTAUT framework (Chhonker et al., Citation2017). In addition, UTAUT is chosen in financial and financial technology research because most studies prove that UTAUT contributes to more than 60% of the variance in consumer usage intentions and behavior (Rahim et al., Citation2023). So that the model developed in this study is as follows ().

3.3. Data collection

The population in this study is the Indonesian people and the sample selection was carried out using non-probability sampling. To follow the current physical distance policy by the Indonesian government, data collection was carried out using an online questionnaire. The online questionnaire in this study was designed using Google form and distributed through several social media platforms such as Facebook and WhatsApp. Distributed online questionnaires from July to December 2022 and we received feedback from 205 respondents. Some sample was rejected because they were not our criteria. Therefore the sample in this study was 195 respondents who met the criteria. The research was analyzed using Structural Equation Modeling (SEM). In SEM, there is no consensus on what the minimum and maximum sample sizes are (Masrizal et al., Citation2022). Hair et al. (Citation2006) said that in SEM analysis, the recommended minimum sample size is 100–200. Determination of sample size can vary depending on how complex the model is. In the simple model, a small sample size varying from 100 to 150 is sufficient. Complex models need more than that. The complexity of the model leads to a larger sample requirement (Aji et al., Citation2021).

3.4. Method of analysis

The analytical method used to test the research hypothesis is Partial Least Square-Structural Equation Modeling (PLS-SEM). PLS-SEM is a superior method in social science problems and is suitable for large and small samples (Hamdollah & Baghaei, Citation2016). PLS-SEM also suitable for a weak theoretical foundation model and does not require the normality of data assumptions (Darmansyah et al., Citation2019). There are two stages for SEM analysis namely confirmatory factor analysis (CFA) and Structural analysis. In the CFA analysis, several important components will be used as a benchmark, namely the loading factor value, average variance extracted (AVE) and discriminant validity or Cronbach alpha. The recommended loading factor and AVE values to support convergent validity must be higher than 0.5 (Ryu, Citation2018); Darmansyah et al., Citation2019). Meanwhile, the value of the Cronbach alpha recommended supporting convergent validity should be higher than 0.7 (Bagozzi & Yi, Citation1988; Jamshidi & Kazemi, Citation2019). In the structural model evaluation. At this stage, the result of the analysis of the relationship between each exogenous variable and the endogenous variable.

4. Result and discussion

4.1. Respondent Profile

Respondents in this study were dominated by 99 women or 50.77%, the rest were 96 men or 49.23%. Respondents in this study were also dominated by 172 university graduates or 88.21%, followed by 22 high school graduates or 11.28% and the rest 1 junior high school graduate or 0.5%. When viewed from the age level of the respondents, the respondents in this study were dominated by the age of 25–40 years as many as 90 people or 46.15%. This means that most of the respondents in this study came from Generation Y. Meanwhile, Generation X, which has an age range of 41–55 years, ranks second, with 59 people or 30.26%. The rest are Generation Z as many as 39 people or 20%. When viewed from the respondent’s occupation, the respondents in this study were dominated by workers or employees of private companies as many as 59 people or 30.26%. Meanwhile, most of the respondents have income below Rp. 5 million as many as 99 people or 50.77%. However, there are also respondents who have a monthly income above Rp. 20 million as many as 11 people or 5.64%. We also found the fact that as many as 136 people or 69.74% had made non-cash transactions using QRIS. However, we also found the fact that there are still many respondents who have never used QRIS in their daily transactions ().

Table 2. Respondent profile.

4.2. SEM-PLS evaluation

4.2.1. Measurement model evaluation

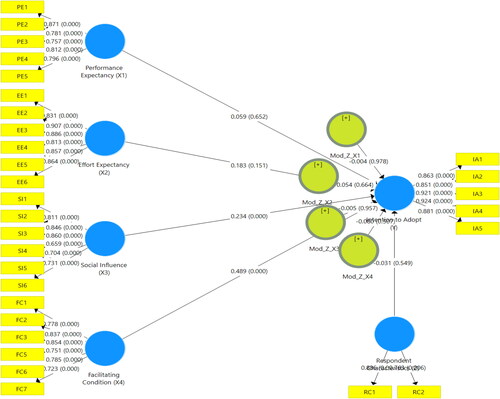

Smart PLS 3.0 software used as a data analysis tool. The measurement model allows us to determine whether the constructs are measured with satisfactory accuracy and the structural model assesses the explanatory strength of the model. Evaluation of the measurement model consists of loading factor, average variance extracted (AVE) and discriminant validity or Cronbach alpha. The recommended FL and AVE values to support convergent validity must be higher than 0.5 (Ryu, Citation2018); (Darmansyah et al., Citation2019). The recommended CR and Cronbach’s alpha values to support convergent validity should be higher than 0.7 (Bagozzi & Yi, Citation1988; Jamshidi & Kazemi, Citation2019). shows the results of loading factors and AVE (> 0.50) and Cronbach’s alpha (>0.70). This result is higher than the recommended level, meaning that all constructs support convergent validity.

Table 3. Measurement model evaluation.

4.2.2. Structural model evaluation

The results of this study show that performance expectancy has no effect on the intention to adopt QRIS of people living on the island of Sumatra with model acceptance β = 0.091 with p-value 0.661(>0.05). Therefore, the proposed hypothesis is rejected or H1 is rejected. Effort expectancy is also not a factor influencing the interest of the people on the island of Sumatra to adopt the QRIS payment system with model acceptance β = 0.167 with p-value 0.509 (>0.05). For this reason, the proposed hypothesis is also rejected (Rejected H2). Meanwhile, social influence is an important factor driving people on the island of Sumatra to adopt the QRIS payment system with a path coefficient value of 0.33 and p-value of 0.000 (<0.05) and therefore accept H3. Another determining factor is facilitating conditions. This variable is an important variable driving the interest to adopt QRIS as a non-cash payment instrument model acceptance β = 0.490 with p-value 0.000(<0.05). Therefore, we accept the proposed hypothesis (Accepted H4). Meanwhile, respondent characteristics as a moderating variable do not have a significant influence on the adoption of QRIS e-payment in Indonesia. Therefore reject the proposed hypothesis. Further details can be seen in . The relationship between variables can be seen in the .

Table 4. Structural model.

4.3. Discussion

The results of the study stated that Social Influence is a predictor variable for interest in the adoption of the QRIS e-payment system. When new technology is supported by key people, customers are more likely to accept it and adopt it. Mbrokoh (Citation2016) states that people have a tendency to pay attention to the suggestions offered by their social circles when using these services. Therefore, when community leaders or other public figures in their community use and campaign for QRIS, it will encourage their followers to adopt QRIS payment services.

The results also show that Facilitating Condition has become an influential factor in the interest in the adoption of QRIS. This finding is also in line with the results of other studies in the field of technology adoption platforms such as mobile wallets (Madan et al., Citation2016), mobile payments (Hossain, Citation2019), M-banking (Farzin et al., Citation2021. These findings indicate that people are very interested in this facility. In addition, the nature of the facilities required for QRIS is an important aspect for easy, convenient and secure access to these types of services such as internet access, smartphones, Wi-Fi and others.

These findings confirm that paying special attention to the availability of resources, skills, facilities and assistance is important to attract consumers to use QRIS. For unbanked customers (such as small entrepreneurs and workers) who are relatively poor, this facility is an important aspect in facilitating access to technology payment services. Joshua and Koshy (Citation2011) also stated that the adoption rate of mobile payments is faster among customers who have easier access to mobile phones and other technologies compared to those who do not have easy access to the same. In addition, mobile service providers must provide training and support programs that can lead to a good understanding and use of mobile applications by consumers. The mobile payment system designer may also provide an additional package of online training for the application to ensure that the consumer can see the necessary demonstrations to use the system. Adequate resources are available for consumers to use the mobile application to make using the system easier and increase their intention to use the application. In addition, mobile service providers can allocate more resources for training and user participation so that consumers are familiar with mobile payment systems (Patil et al., Citation2020).

The results of this study also found that social influence has a significant positive effect on behavior intentions. This finding is consistent with many previous researchers such as (Gupta et al., Citation2019; Tarhini et al., Citation2016; Zhou et al., Citation2010). This finding indicates that consumers value the support and view of their reference group in building trust in mobile payment services. Opinions and recommendations from influential and significant people can have a positive impact on the application of these technologies by forming a positive image about this service. In addition, mobile payment providers must also allocate resources and efforts towards leveraging more active societal influence to motivate consumer behavioral intentions. Mobile service providers or QRIS applications should advertise and encourage payments through the mobile system through celebrities, Instagrammers and role models who have a lot of fans so that consumers will believe their testimony and start using the system. Mobile service providers should also increase the use of social media such as Tiktok, Instagram, and Facebook, etc. to promote word-of-mouth interpersonal communication to increase the use of the QRIS mobile payment application.

4.3.1. Theoretical and practical implications

In many previous studies, it was stated that the main variables of UTAUT theory, namely performance expectancy, effort expectancy, facilitating conditions and social influence, are able to explain interest in adopting technology. This research also confirms that UTUAT theory and extended is the appropriate theory to use in investigating customer interest in adopting the QRIS payment system in Indonesia. Despite, respondent characteristic as an extended UTAUT theory in investigating the use of QRIS e-payment theoretically does not provide a significant impact but the main theory of UTAUT has besome a significant role in adopting QRIS e-payment. This means that for certain conditions, the main theory of UTAUT is more suitable for implementation. This indicates that the UTAUT theory framework used in this research to understand technology adoption has the potential to bring more and more people to transact using QRIS e-payment in Indonesia.

Practically, this research provides important insights for banking managers and merchants about consumer decision making in adopting the QRIS e-payment system. Service providers must focus on rational benefits in using QRIS e-payment services. Merchant managers and banking managers can create marketing messages to potential consumers by emphasizing the ease of non-cash transactions using the QRIS e-payment system. In influencing public opinion, QRIS providers should consider the opinions of influencers. In Indonesia, the public is easily influenced by the opinions brought by influencers so cooperating with them is something that must be done by QRIS providers to promote QRIS in non-cash transactions. This will increase the possibility of their followers to use the QRIS e-payment system in their daily transactions.

5. Conclusion and recommendations

5. 1. Conclusions

This study attempts to validate the measurement of interest in adopting QRIS payment services in Indonesia. The use of UTAUT2 as a theoretical framework to measure interest in technology adoption is considered appropriate because of its quality. This study has implications for existing knowledge in the fintech field by providing a better understanding of how the factors influence it. The findings of this study are strategically important for researchers in marketing seeking to advance knowledge about the impact of marketing practices on technology adoption interest. This study investigates technology adoption among consumers using the QRIS payment service. Thus, it is advantageous for MSMEs and business start-ups to understand consumer demand patterns in receiving QRIS payments. In addition, businesses can also infer consumer behavior in financial technology. Business people can explore the fintech market. This is because they can understand how consumers respond and react to technological changes by digital banking. Thus, businesses can frame their strategies to capture their market in the digital economy. However, this study has limitations in samples. Thus we suggest for future research to use a larger sample and enrich the research variables.

5.2. Limitation and future research

This research has provided us with insight regarding the adoption of QRIS e-payment in Indonesia from a customers’ perspective. However, there are several limitations, namely that the sample for this study was only taken on the two main islands in Indonesia, namely Sumatra and Java Island. The number of samples is also relatively small compared to the population on the two islands. We recommend increasing the sample size and expanding the sampling area for future research and consider to apply an another theoretical framework approach.

Disclosure statement

No potential conflict of interest was reported by the authors.

Additional information

Notes on contributors

Evan Hamzah Muchtar

Evan Hamzah Muchtar is an lecturer in Islamic Economics. Has experience writing scientific papers in the form of books, journal articles and draft regional regulations. Apart from academics, he is also a consultant in the field of Good Corporate Governance. He is expert in implementation of Good Corporate Governance.

Budi Trianto

Budi Trianto in Islamic economics. He received a doctoral scholarship from the Indonesian Ministry of Religion. His major research areas are Islamic finance, Islamic social finance, and Entrepreneurs, He has also received a research grant from Bank Indonesia. Some of his papers have been published in Scopus journals.

Irwan Maulana

Irwan Maulana is obtained a bachelor’s academic degree from Al-Azhar University in Cairo, Egypt, a master’s degree from the University of Indonesia and a doctorate from Trisakti University. Became chairman of the Syariah supervisory (DPS) of Islamic bank, founder & trainer at Attijarah Consulting and Islamadina Consulting.

Muhammad Nurul Alim

Muhammad Nurul Alim is a lecturer at STAI Asy-Syukriyyah Tangerang, Banten, Indonesia. He is completed his Bachelor of Accounting studies at Hasanuddin University Makassar. His Masters and Doctor of Economics from Trisakti University Jakarta, Indonesia. Beside a lecturer, he also works as a practicing accountant and auditor.

Ruslan Husen Marasabessy

Ruslan Husen Marasabessy is a bachelor’s degree graduate at Al-Azhar Cairo and Al-Aqidah Jakarta. His master and doctoral degree in Islamic economics at Universitas Trisakti, Jakarta. He is Chair of the Sharia Economic Law Study Program at STAI Asy-Syukriyyah. Apart from that, he is also a speaker on various T V programs.

Wahyu Hidayat

Wahyu Hidayat is Bachelor’s degree in Sharia Banking from STAI Asy-Syukriyyah and Master’s degree in Sharia Banking from Azzahra University. He is lecturer in Islamic Economics and Practitioner in Islamic financial institutions. Has experience writing scientific papers in the form of books, journal articles and regional government regulation.

Edy Junaedi

Edy Junaedi is lecturer in the field of Islamic Economics. Has experience writing scientific papers, journal articles and standard operating procedures for sharia bank financing and funding. He is also a banker. Experience working on project assessment financing and trainer financing and resolving bad credit at Islamic rural bank (BPD).

Masrizal

Masrizal is completed a doctoral program in Islamic economics at Airlangga University. He research area are economic modeling, Islamic banking and waqf. Several of his papers have been published in the Scopus journals.

References

- Abushanab, E., & Pearson, J. M. (2007). Internet banking in Jordan: The unified theory of acceptance and use of technology (UTAUT) perspective. Journal of Systems and Information Technology, 9(1), 1–18. https://doi.org/10.1108/13287260710817700

- Ahmadi Danyali, A. (2018). Factors influencing customers’ change of behaviors from online banking to mobile banking in Tejarat Bank, Iran. Journal of Organizational Change Management, 31(6), 1226–1233. https://doi.org/10.1108/JOCM-07-2017-0269

- Aji, H. M., Albari, A., Muthohar, M., Sumadi, S., Sigit, M., Muslichah, I., & Hidayat, A. (2021). Investigating the determinants of online Infaq intention during the COVID-19 pandemic: An insight from Indonesia. Journal of Islamic Accounting and Business Research, 12(1), 1–20. https://doi.org/10.1108/JIABR-05-2020-0136

- Akinwale, Y. O., & Kyari, A. K. (2020). Factors influencing attitudes and intention to adopt financial technology services among the end-users in Lagos State, Nigeria. African Journal of Science, Technology, Innovation and Development, 14(1), 272–279. https://doi.org/10.1080/20421338.2020.1835177

- Alagheband, P. (2006). Adoption of electronic banking services by Iranian customers [Master Thesis]. Lulea University of Technology.

- Alalwan, A. A., Dwivedi, Y. K., & Rana, N. P. (2017). Factors influencing adoption of mobile banking by Jordanian bank customers: Extending UTAUT2 with trust. International Journal of Information Management, 37(3), 99–110. https://doi.org/10.1016/j.ijinfomgt.2017.01.002

- Al-Dmour, A., Al-Dmour, H., Al-Barghuthi, R., Al-Dmour, R., & Alshurideh, M. T. (2020). Factors influencing the adoption of e-payment during pandemic outbreak (COVID-19): Empirical evidence. In M. Alshurideh, A. E. Hassanien, R. Masa’deh (Eds.), The effect of coronavirus disease (COVID-19) on business intelligence (Vol. 334). Studies in Systems, Decision and Control. https://doi.org/10.1007/978-3-030-67151-8_8

- Alkhwaldi, A. F., & Al Eshoush, A. S. (2022). Towards a model for citizens’ acceptance of e-payment systems for public sector services in Jordan: Evidence from crisis era. Information Sciences Letters, 11(3), 657–663.

- Al-Okaily, M., Alalwan, A. A., Al-Fraihat, D., Alkhwaldi, A. F., Rehman, S. U., & AL Okaily, A. (2022). “Investigating antecedents of mobile payment systems’ decision-making: a mediated model”, Global Knowledge, Memory and Communication, Vol. ahead-of-print No. ahead-of-print. https://doi.org/10.1108/GKMC-10-2021-0171

- Andreeva, O. V., & Epifanova, T. V. (2020). State support for small and medium-sized business in the social sphere and the development of social business in the economy of Russia. In Modernization of Business Systems of Russian Regions as a Factor of the Growth of Economy: Trends, Challenges, Models and Prospects (pp. 95–112).

- Ascarya. (2020). Islamic Economic Solution to Covid-19 Outbreak in Indonesia. Presented in UPI Bandung, April 2020.

- Bagozzi, R. P., & Yi, Y. (1988). On the evaluation of structural equation models. Journal of the Academy of Marketing Science, 16(1), 74–94. https://doi.org/10.1007/BF02723327

- Bank Indonesia. (2019). Bank Indonesia Terbitkan Ketentuan Pelaksanaan QRIS. Available at: Bank Indonesia Terbitkan Ketentuan Pelaksanaan QRIS, Access date: August 1st 2022.

- Bank Indonesia. (2019). QR code Indonesian Standard (QRIS). Available at: Kanal dan Layanan (bi.go.id). Access date: August 1st 2022.

- Bank Indonesia. (2022). Indonesia Fintech Summit dan Bulan Fintech Nasional 2022: Sinergi Pemenrintah, Asosiasi, dan Pelaku Industri Untuk Resiliensi Ekonomi dan Stabilitas Keuangan. Available at: Indonesia Fintech Summit dan Bulan Fintech Nasional 2022: Sinergi Pemerintah, Asosiasi, dan Pelaku Industri untuk Resiliensi Ekonomi dan Stabilitas Keuangan.

- Beck, R., Müller-Bloch, C., & King, J. L, IT University of Copenhagen. (2018). Governance in the blockchain economy: A framework and research agenda. Journal of the Association for Information Systems, 1020–1034. https://doi.org/10.17705/1jais.00518

- Behera, R. K., Bala, P. K., & Rana, N. P. (2023). Assessing factors influencing consumers’ non-adoption intention: Exploring the dark sides of mobile payment. Information Technology & People, 36(7), 2941–2976. https://doi.org/10.1108/ITP-03-2022-0223

- Bisma, R., Puspita, Y., & Sulistiyani, E. (2020 Technology Compatibility Factors in the Implementation of the Ovo Digital Payment Application [Paper presentation]. International Joint Conference on Science and Engineering (IJCSE 2020), In 146–151. Atlantis Press. https://doi.org/10.2991/aer.k.201124.027

- Bommer, W. H., Rana, S., & Milevoj, E. (2022). A meta-analysis of eWallet adoption using the UTAUT model. International Journal of Bank Marketing, 40(4), 791–819. https://doi.org/10.1108/IJBM-06-2021-0258

- BRI. (2022). Perkembangan Fintech di Indonesia dan Peran BRIAPI di Dalamnya. Availabe et: Perkembangan Fintech di Indonesia dan Peran BRIAPI di Dalamnya

- Broby, D., Hoepner, A. G., Johannes, Klausmann., & Adamsson, H. (2018). Fintech academic paper: The output and productivity benefits of Fintech collaboration: Scotland and Ireland.

- Cham, T.-H., Cheah, J.-H., Cheng, B.-L., & Lim, X.-J. (2022). I am too old for this! Barriers contributing to the non-adoption of mobile payment. International Journal of Bank Marketing, 40(5), 1017–1050. https://doi.org/10.1108/IJBM-06-2021-0283

- Chemingui, H., & Ben Lallouna, H. (2013). Resistance, motivations, trust and intention to use mobile financial services. International Journal of Bank Marketing, 31(7), 574–592. https://doi.org/10.1108/IJBM-12-2012-0124

- Chen, M. A., Wu, Q., & Yang, B. (2018). How valuable is FinTech innovation? The Review of Financial Studies, 32(5), 2062–2106. https://doi.org/10.1093/rfs/hhy130]

- Cheng, M., & Qu, Y. (2020). Does bank FinTech reduce credit risk? Evidence from China. Pacific-Basin Finance Journal, 63, 101398. https://doi.org/10.1016/j.pacfin.2020.101398

- Chhonker, M. S., Verma, D., & Kar, A. K. (2017). Review of technology adoption frameworks in mobile commerce. Procedia Computer Science, 122 Pages, 888–895. volume https://doi.org/10.1016/j.procs.2017.11.451

- Chiao-Chen, C. (2013). Library mobile applications in university libraries. Library Hi-Tech, 31(3), 478–492.

- Darmansyah, D., Fianto, B. A., Hendratmi, A., & Aziz, P. F. (2019). Factors determining behavioral intentions to use Islamic financial technology: Three competing models. Journal of Islamic Marketing, 12 (4), 794–812. https://doi.org/10.1108/JIMA-12-2019-0252

- Dash, M., & Bhusan, P. B. (2014). Determinants of customers’ adoption of mobile banking: An empirical study by integrating diffusion of innovation with attitude. Journal of Internet Banking and Commerce, 19(3), 1–21.

- Dehbi Dehbini, N., Birjandi, M., & Birjandi, H. (2015). Factors influencing the adoption of electronic payment cards in urban micro-payments. Res. J. Fin. Account, 6(1), 39–47.

- Demertzis, M., Merler, S., & Wolff, G. B. (2018). Capital markets union and the Fintech opportunity. Policy Contributions. 12. https://doi.org/10.1093/JFR/FJX012

- Dieu, H. T. M., Al Mamun, A., Nguyen, T. L. H., & Naznen, F. (2023). Cashless Vietnam: A study on intention and adoption of cashless payment. Journal of Science and Technology Policy Management, https://doi.org/10.1108/JSTPM-02-2022-0031

- DinarStandard. (2018). Islamic Fintech report 2018: A preview current landscape & path forward.preview current landscape and path forward. https://media.neliti.com/media/ publications/454557-an-overview-of-indonesian-regulatory-fra-2df72cf0.pdf.

- Farah, M. F., Hasni, M. J. S., & Abbas, A. K. (2018). Mobile-banking adoption: Empirical evidence from the banking sector in Pakistan. International Journal of Bank Marketing, 36(7), 1386–1413. https://doi.org/10.1108/IJBM-10-2017-0215

- Farzin, M., & Fattahi, M. (2018). eWOM Through social networking sites and impact on purchase intention and Brand image in Iran. Journal of Advances in Management Research, 15(2), 161–183. https://doi.org/10.1108/JAMR-05-2017-0062

- Farzin, M., Sadeghi, M., Yahyayi Kharkeshi, F., Ruholahpur, H., & Fattahi, M. (2021). Extending UTAUT2 in M-banking adoption and actual use behavior: Does WOM communication matter? Asian Journal of Economics and Banking, 5(2), 136–157. https://doi.org/10.1108/AJEB-10-2020-0085

- Flavián, C., Guinaliu, M., & Lu, Y. (2020). Mobile payments adoption—introducing mindfulness to better understand consumer behavior. International Journal of Bank Marketing, 38(7), 1575–1599. https://doi.org/10.1108/IJBM-01-2020-0039

- Frame, W. S., Wall, L. D., & White, L. (2018). Technological change and financial innovation in banking: Some implications for Fintech. Federal Reserve Bank of Atlanta (working paper series).

- Gan, C., Clemes, M., Limsombunchai, V., & Weng, A. (2006). A Logit analysis of electronic banking in New Zealand. International Journal of Bank Marketing, 24(6), 360–383. https://doi.org/10.1108/02652320610701717

- Gupta, K. P., Manrai, R., & Goel, U. (2019). Factors influencing adoption of payments banks by Indian customers: Extending UTAUT with perceived credibility. Journal of Asia Business Studies, 13(2), 173–195. https://doi.org/10.1108/JABS-07-2017-0111

- Haddad, C., & Hornuf, L. (2019). The emergence of the global Fintech market: Economic and technological determinants. Small Business Economics, 53(1), 81–105. https://doi.org/10.1007/s11187-018-9991-x

- Hair, J., Black, W., Babin, B., Anderson, R., & Tatham, R. (2006). Multivariate data analysis (6th ed.). Pearson Prentice Hall.

- Hamdollah, R., & Baghaei, P. (2016). Partial least squares structural equation modeling with R. Practical Assessment, Research and Evaluation, 21(1). https://doi.org/10.7275/d2fa-qv48 https://scholarworks.umass.edu/cgi/viewcontent.cgi?article=1349&context=pare.

- Hoang, Y. H., Nguyen, D. T. T., Tran, L. H. T., Nguyen, N. T. H., & Vu, N. B, School of Banking, University of Economics Ho Chi Minh City, Vietnam. (2021). Customers’ adoption of financial services offered by banks and fintechs partnerships: Evidence of a transitional economy[J]. Data Science in Finance and Economics, 1(1), 77–95. https://doi.org/10.3934/DSFE.2021005

- Hossain, M. A. (2019). Security perception in the adoption of mobile payment and the moderating effect of gender. PSU Research Review, 3(3), 179–190. https://doi.org/10.1108/PRR-03-2019-0006

- Hossain, M. A., Hossain, M. S., & Jahan, N. (2018). Predicting continuance usage intention of mobile payment: An experimental study of Bangladeshi customers. Asian Economic and Financial Review, 8(4), 487–498. https://doi.org/10.18488/journal.aefr.2018.84.487.498

- Hsu, M.-H., Chuang, L.-W., & Hsu, C.-S. (2014). Understanding online shopping intention: The roles of four types of trust and their antecedents. Internet Research, 24(3), 332–352. https://doi.org/10.1108/IntR-01-2013-0007

- Hsueh, S., & Kuo, C. (2017). Effective matching for P2P lending by mining strong association rules [Paper presentation]. Proceedings of the 3rd International Conference on Industrial and Business Engineering.

- Hudaefi, F. A. (2020). How does Islamic Fintech promote the SDGs? Qualitative evidence from Indonesia. Qualitative Research in Financial Markets, 12(4), 353–366. https://doi.org/10.1108/QRFM-05-2019-0058

- Hui, H. W., Manaf, A. W. A., & Shakri, A. K. (2019). Fintech and the transformation of the islamic finance regulatory framework in Malaysia. Emerging Issues in Islamic Finance Law and Practice in Malaysia., Emerald Publishing Limited. 211–222.

- Hussain, M., Mollik, A., Johns, R., & Rahman, M. (2019). M-payment adoption for bottom of pyramid segment: An empirical investigation. International Journal of Bank Marketing, 37(1), 362–381. https://doi.org/10.1108/IJBM-01-2018-0013

- Japparova, I., & Rupeika-Apoga, R. (2017). Banking business models of the digital future: The case of Latvia. European Research Studies Journal, XX(Issue 3A), 846–860. https://doi.org/10.35808/ersj/749

- Jamshidi, D., & Kazemi, F. (2019). Innovation diffusion theory and customers’ behavioral intention for Islamic credit card: Implications for awareness and satisfaction. Journal of Islamic Marketing, 11(6), 1245–1275. https://doi.org/10.1108/JIMA-02-2018-0039

- Junarsin, E., Hanafi, M. M., Iman, N., Arief, U., Naufa, A. M., Mahastanti, L., & Kristanto, J. (2023). Can technological innovation spur economic development? The case of Indonesia. Journal of Science and Technology Policy Management, 14(1), 25–52. https://doi.org/10.1108/JSTPM-12-2020-0169

- Joshua, A. J., & Koshy, M. P. (2011). Usage patterns of electronic banking services by urban educated customers: Glimpses from India. Journal of Internet Banking and Commerce, 16(1), 1–12.

- Kaur, P., Dhir, A., Singh, N., Sahu, G., & Almotairi, M. (2020). An innovation resistance theory perspective on mobile payment solutions. Journal of Retailing and Consumer Services, 55, 102059. https://doi.org/10.1016/j.jretconser.2020.102059

- Kilay, A. L., Simamora, B. H., & Putra, D. P. (2022). The influence of e-payment and e-commerce services on supply chain performance: Implications of open innovation and solutions for the digitalization of micro, small, and medium enterprises (MSMEs) in Indonesia. Journal of Open Innovation: Technology, Market, and Complexity, 8(3), 119. https://doi.org/10.3390/joitmc8030119

- Kharisma, D. B. (2020). Urgency of financial technology (Fintech) laws in Indonesia. International Journal of Law and Management, 63(3), 320–331. https://doi.org/10.1108/IJLMA-08-2020-0233

- Kumar Sharma, S., & Madhumohan Govindaluri, S. (2014). Internet banking adoption in India: Structural equation modeling approach. Journal of Indian Business Research, 6(2), 155–169. https://doi.org/10.1108/JIBR-02-2013-0013

- Kumar, R., Singh, T., Mohanty, S. N., Goel, R., Gupta, D., Alharbi, M., & Khanna, R. (2023). Study on online payments and e-commerce with SOR model. International Journal of Retail & Distribution Management. https://doi.org/10.1108/IJRDM-03-2023-0137

- Leong, K., & Sung, A. (2018). FinTech (financial technology): What is it and how Touse technologies to create business value in Fintech way? International Journal of Innovation, Management and Technology, 74–78. https://doi.org/10.18178/ijimt.2018.9.2.791

- Lee, I., & Shin, Y. J. (2018). Fintech: Ecosystem, business models, investment decisions, and challenges. Business Horizons, 61(1), 35–46. https://doi.org/10.1016/j.bushor.2017.09.003

- Li, J., Wu, Y., & Xiao, J. J. (2020). The impact of digital finance on household consumption: Evidence from China. Economic Modelling, 86, 317–326. https://doi.org/10.1016/j.econmod.2019.09.027

- Lok, C. K. (2015). Adoption of smart card-based e-payment system for retailing in Hong Kong using an extended technology acceptance model. E-services adoption: Processes by firms in developing nations (advances in business marketing and purchasing) (Vol. 23B, pp. 255–466). Emerald Group Publishing Limited. https://doi.org/10.1108/S1069-09642015000023B003

- Luo, S., Sun, Y., Yang, F., & Zhou, G. (2022). Does Fintech innovation promote enterprise transformation? Evidence from China. Technology in Society, 68, 101821. https://doi.org/10.1016/j.techsoc.2021.101821

- Madan, K., Madan, K., Yadav, R., & Yadav, R. (2016). Behavioural intention to adopt mobile wallet: A developing country perspective. Journal of Indian Business Research, 8(3), 227–244. https://doi.org/10.1108/JIBR-10-2015-0112

- Masrizal, M., Sukmana, R., Trianto, B., & Zaimsyah, A. M. (2022). Determinant factor crowdfunders’ behavior in using crowdfunding Waqf model in Indonesia: two competing models. Journal of Islamic Marketing, 14(7), 1793–1816. https://doi.org/10.1108/JIMA-08-2021-0246

- Mbrokoh, A. S. (2016). Exploring the factors that influence the adoption of internet banking in Ghana. Journal of Internet Banking and Commerce, 21(2), 1–20.

- Nasri, W. (2011). Factors influencing the adoption of internet banking in Tunisia. International Journal of Business and Management, 6(8), 143–160. https://doi.org/10.5539/ijbm.v6n8p143

- Negm, E. M. (2023). Consumers’ acceptance intentions regarding e-payments: A focus on the extended unified theory of acceptance and use of technology (UTAUT2). Management & Sustainability: An Arab Review. https://doi.org/10.1108/MSAR-04-2023-0022

- Nurhapsari, R., & Sholihah, E. (2022). Analysis of the factors of intention to use QRIS for MSMEs in Semarang City’s traditional market. Jurnal Ekonomi Modernisasi, 18(2), 199–211. https://doi.org/10.21067/jem.v18i2.7291

- OJK. (2019). Strategi Nasional Literasi Keuangan Indonesia. https://www.ojk.go.id/id/berita-dan-kegiatan/publikasi/Pages/Strategi-Nasional-Literasi-Keuangan-Indonesia-2021-2025.aspx.

- Patil, P., Tamilmani, K., Rana, P. N., & Raghavan, V. (2020). Understanding consumer adoption of mobile payment in India: Extending Meta-UTAUT model with person innovativeness, anxiety, trust, and grievance redressal. International Journal of Information Management, 54, 102144. https://doi.org/10.1016/j.ijinfomgt.2020.102144

- Putrevu, J., & Mertzanis, C. (2023). The adoption of digital payments in emerging economies: Challenges and policy responses. Digital Policy, Regulation and Governance. https://doi.org/10.1108/DPRG-06-2023-0077

- QRIS. (2022). Server Center QRIS. Available at: QRIS.id - Service Center QRIS, Access date: August 1st 2022.

- Rahim, N. @F., Bakri, M. H., Fianto, B. A., Zainal, N., & Hussein Al Shami, S. A. (2023). Measurement and structural modelling on factors of Islamic Fintech adoption among millennials in Malaysia. Journal of Islamic Marketing, 14(6), 1463–1487. https://doi.org/10.1108/JIMA-09-2020-0279

- Rahman, M., Ismail, I., Bahri, S., & Rahman, M. K. (2022). An empirical analysis of cashless payment systems for business transactions. Journal of Open Innovation: Technology, Market, and Complexity, 8(4), 213. https://doi.org/10.3390/joitmc8040213

- Ryu, H. S. (2018). What makes users willing or hesitant to use Fintech?: The moderating effect of usertype. Industrial Management & Data Systems, 118(3), 541–569. https://doi.org/10.1108/IMDS-07-2017-0325

- Sankari, A., Ghazzawi, K., El Danawi, S., El Nemar, S., & Arnaout, B. (2015). Factors affecting the adoption of internet banking in Lebanon. International Journal of Management, 6(3), 75–86.

- Santoso, W., Sitorus, P. M., Batunanggar, S., Krisanti, F. T., Anggadwita, G., & Alamsyah, A. (2021). Talent mapping: A strategic approach toward digitalization initiatives in the banking and financial technology (FinTech) industry in Indonesia. Journal of Science and Technology Policy Management, 12(3), 399–420. https://doi.org/10.1108/JSTPM-04-2020-0075

- Shankar, A., Yadav, R., Behl, A., & Gupta, M. (2023). How does dataveillance drive consumer online payment resistance? Journal of Consumer Marketing, 40(2), 224–234. https://doi.org/10.1108/JCM-03-2021-4555

- Siddik, M. N. A., Sun, G., Yanjuan, C., & Kabiraj, S. (2014). Financial inclusion through mobile banking: A case of Bangladesh. Journal of Applied Finance and Banking, 4(6), 109–136.

- Singh, S., Sahni, M. M., & Kovid, R. K. (2020). What drives FinTech adoption? A multi-method evaluation using an adapted technology acceptance model. Management Decision, 58(8), 1675–1697. https://doi.org/10.1108/MD-09-2019-1318

- Sivathanu, B. (2019). Adoption of digital payment systems in the era of demonetization in India: An empirical study. Journal of Science and Technology Policy Management, 10(1), 143–171. https://doi.org/10.1108/JSTPM-07-2017-0033

- Sobti, N. (2019). Impact of demonetization on diffusion of mobile payment service in India: Antecedents of behavioral intention and adoption using extended UTAUT model. Journal of Advances in Management Research, 16(4), 472–497. https://doi.org/10.1108/JAMR-09-2018-0086

- Solow, R. M. (1956). A contribution to the theory of economic growth. The Quarterly Journal of Economics, 70(1), 65–94. https://pages.nyu.edu/debraj/Courses/Readings/Solow.pdf. https://doi.org/10.2307/1884513

- Soomro, Y. A. (2019). Understanding the adoption of SADAD E-Payments: UTAUT combined with religiosity as moderator. International Journal of E-Business Research, 15(1), 55–74. https://doi.org/10.4018/IJEBR.2019010104

- Tarhini, A., El-Masri, M., Ali, M., & Serrano, A. (2016). Extending the UTAUT model to understand the customers’ acceptance and use of internet banking in Lebanon: A structural equation modeling approach. Information Technology & People, 29(4), 830–849. https://doi.org/10.1108/ITP-02-2014-0034

- Thakor, A. V. (2020). Fintech and banking: What do we know? Journal of Financial Intermediation, 41, 100833. https://ssrn.com/abstract=3429223 https://doi.org/10.1016/j.jfi.2019.100833

- Thomas, B., Miller, C., Packham, G., & William, J. (2011). Technology Diffusion. In Innovation and Small Business Volume 1 (pp. 44–58).

- Trianto, B., Nik Azman, N. H., & Masrizal, M. (2023). E-payment adoption and utilization among micro-entrepreneurs: A comparative analysis between Indonesia and Malaysia. Journal of Science and Technology Policy Management, Vol. ahead-of-print No. ahead-of-print. https://doi.org/10.1108/JSTPM-12-2022-0207

- Trinugroho, T., Pamungkas, P., Wiwoho, J., Damayanti, S. M., & Pramono, T. (2022). Adoption of digital technologies for micro and small business in Indonesia. Finance Research Letters, volume 45, 102156. https://doi.org/10.1016/j.frl.2021.102156

- Utami, A. F., & Ekaputra, I. A. (2021). A paradigm shift in financial landscape: Encouraging collaboration and innovation among Indonesian FinTech lending players. Journal of Science and Technology Policy Management, 12(2), 309–330. https://doi.org/10.1108/JSTPM-03-2020-0064

- Vaittinen, E., Martinsuo, M., & Ortt, R. (2018). Business customers’ readiness to adopt manufacturer’s new services. Journal of Service Theory and Practice, 28(1), 52–78. https://doi.org/10.1108/JSTP-03-2017-0053

- Venkatesh, V., Morris, M. G., Davis, G. B. and Davis, F. D. (2003), “User acceptance of information technology: Toward a unified view”, MIS Quarterly, 27(3), 425–478, https://doi.org/10.2307/30036540

- Venkatesh, V., Thong, J. Y. L. and Xu, X. (2012), “Consumer acceptance and use of information technology: Extending the unified theory of acceptance and use of technology”, MIS Quarterly, 36(1), 157–178. https://doi.org/10.2307/41410412

- Xie, J., Ye, L., Huang, W., & Ye, M. (2021). Understanding FinTech platform adoption: Impacts of perceived value and perceived risk. Journal of Theoretical and Applied Electronic Commerce Research, 16(5), 1893–1911. https://doi.org/10.3390/jtaer16050106

- Wardhani, R. A., Arkeman, Y., & Ermawati, W. J. (2023). The impact of quick response adoption of payment code on MSMEs’ financial performance in Indonesia. International Journal of Social Service and Research, 3(3), 869–878. https://doi.org/10.46799/ijssr.v3i3.294

- Wójcik, D. (2021). Financial geography II: The impacts of FinTech – financial sector and centres, regulation and stability, inclusion and governance. Progress in Human Geography, 45(4), 878–889. https://doi.org/10.1177/0309132520959825

- Wonglimpiyarat, J. (2018). Challenges and dynamics of FinTech crowd funding: An innovation system approach. The Journal of High Technology Management Research, 29(1), 98–108. https://doi.org/10.1016/j.hitech.2018.04.009

- Yeşildağ, E. (2019). Factors affecting internet banking preferences and their relation to demographic characteristics. In S. Grima, E. Özen, H. Boz, J. Spiteri, and E. Thalassinos (Eds.) Contemporary Issues in Behavioral Finance (Contemporary Studies in Economic and Financial Analysis) (Vol. 101, pp. 187–203). Emerald Publishing Limited. https://doi.org/10.1108/S1569-375920190000101013

- Yu, C. S. (2012). Factors affecting individuals to adopt mobile banking: empirical evidence from the UTAUT model. Journal of Electronic Commerce Research, 13(2), 104–121.

- Yusfiarto, R. (2021). The relationship between m-banking service quality and loyalty: Evidence in Indonesian Islamic banking. Asian Journal of Islamic Management, 3(1), 23–33. https://doi.org/10.20885/ajim.vol3.iss1.art3

- Zhou, T., Lu, Y., & Wang, B. (2010). Integrating TTF and UTAUT to explain mobile banking user adoption. Computers in Human Behavior, 26(4), 760–767. https://doi.org/10.1016/j.chb.2010.01.013