?Mathematical formulae have been encoded as MathML and are displayed in this HTML version using MathJax in order to improve their display. Uncheck the box to turn MathJax off. This feature requires Javascript. Click on a formula to zoom.

?Mathematical formulae have been encoded as MathML and are displayed in this HTML version using MathJax in order to improve their display. Uncheck the box to turn MathJax off. This feature requires Javascript. Click on a formula to zoom.Abstract

This study analyzed whether gender is an important factor in explaining the behaviour of taxpayers towards tax compliance. The study extended the theory of planned bahaviour to establish the factors influencing the behaviour of taxpayers towards tax compliance across gender. Primary data was collected from 390 taxpayers using a closed-ended questionnaire set. Descriptive and inferential statistical tools were used to analyze the data. Descriptive data were presented using the mean and standard deviation, while inferential data were analyzed using a multivariate regression analysis and a univariate and independent t-test. Findings from the survey showed that the predictor variables contribute 51% in explaining the taxpayers towards tax compliance of which 84.23% is for male taxpayers while 71.86% is for female taxpayers. The results further revealed that there is a statistical difference in the behaviour of taxpayers towards tax compliance. Female taxpayers are more influenced by tax knowledge, perception of government spending and roles of tax authority while male taxpayers are more influenced by tax penalties, economic factors and tax rates. Gender contributes 55.1% to taxpayers’ beheviour towards tax compliance. The study contributed to the current literature by establishing the predictor variables that influences the behaviour of taxpayers towards tax compliance which can be used as a basis when designing a tax compliance policy and program.

Keywords:

JEL CLASSIFICATION:

1. Introduction

The study analysed whether gender is an important factor in explaining the behaviour of taxpayers towards tax compliance. To achieve this objective, the study answered the following research questions; What are the determinants of taxpayer’s behaviour towards tax compliance between male and female -led taxpayers, does gender differences explain the behaviour of taxpayers towards tax compliance? The behavior of taxpayers towards tax compliance are manifested in two extreme theories which are the behavioral theory and the psychological theory. In 1985, Ajzen came up with a theory of planned behavior, which explains the intention of individuals to behave in certain ways. According to this theory, the individual’s action is controlled by their intention to perform or not to perform. The intention to perform different types of behavior can be predicted precisely from the attitude towards the behavior, and the control of the behavior. These theories, along with the understanding of behavioral control, also explain deviations from actual behavior. The study extended the current theory of planned behaviour to establish the difference in the determinants of taxpayers’ behavior across gender.

The tax has existed as long as humans have existed, and throughout history, people have always found ways to either evade or avoid paying taxes. This makes tax compliance remain a topical issue in the literature on taxation. The scope of tax compliance is broad, encompassing various aspects such as timely payment and declaration of taxes, timely tax registration, maintaining accurate accounting records, and cooperating during tax audits by providing the required information (Lotta & Bragger, Citation2021; Rotimi et al., Citation2019; Tarmidi, Citation2020).

Previous scholars have highlighted numerous factors influencing the behaviour of taxpayers towards tax compliance. Subadriyah and Harto (Citation2021), Resshe and Amir (Citation2019), and Olufemi et al. (Citation2022) observed that taxpayers’ behaviour towards tax compliance is influenced by several factors, including the roles of the tax authorities, understanding and knowledge of taxation, taxation sanctions, taxpayer awareness, and perception of tax effectiveness. Similarly, Ahamad et al. (Citation2020), Sing and Bidin (Citation2020), Rotimi et al. (Citation2019), Robert and Raphael (CitationCitation2020), and Susanto and Syah (Citation2017) highlighted tax audit, tax morale, tax fairness, peer influence, tax service quality, and tax knowledge corruption, perception of injustice, and lack of government incentives as the major determinants of taxpayers’ behaviour towards tax compliance.

The key question this article attempts to answer is whether gender influences the behaviour of taxpayers towards tax compliance. There is a vast and conflicting body of literature on gender and tax compliance. Some previous scholars have highlighted that female taxpayers are more compliant than men (Maharremi et al., Citation2022; D’Attoma et al., Citation2020). Barbara et al. (Citation2010) pointed out that women are risk-averse and thus are less likely to engage in unethical behaviour. Women are considered more cooperative than men and less likely to evade taxes. Yiman and Asmare (Citation2020) observed that there is a significant variation in behaviour between men and women regarding tax compliance, with women being found to be more compliant than men. On the other hand, other previous scholars Putri and Lintang (Citation2019), Syarbin et al. (Citation2023), Titisari and Damayanti (Citation2022), Rahmawati and Dwijayanto (Citation2021), and Garuba and Erichie (Citation2022) have pointed out that gender does not influence tax compliance.

Previous studies have attempted to address the question of whether gender influences tax compliance by examining the effect of gender on tax compliance. While some studies have indicated that women are more compliant than men, other studies have not found any significant effect of gender on tax compliance. However, these studies have not examined the factors influencing taxpayers’ behaviour towards tax compliance based on gender. The present study attempts to fill this gap by highlighting the determinants of taxpayers’ beheviour towards tax compliance across gender.

2. Literature review

2.1. Theoretical framework on the determinants of taxpayers’ behaviour towards tax compliance

There are two extreme paradigms regarding the factors that influence tax compliance. While some previous studies on tax compliance have highlighted that human behaviour plays a very important role in influencing tax compliance, other researchers have emphasized that tax compliance is influenced by economic factor.

The current study is built on the theory of planned behavior as put forward by Ajzen, (Citation1985). This theory was developed on three independent pillars of decision-making concepts. The first pillar explains the attitude towards the character, which expresses the good or bad aspects of the person evaluating the character in question. The second pillar explains an important social factor called subjective norms. This pillar is about social pressures to do or not do a behavior. The third pillar is about the level of awareness of behavioral control.

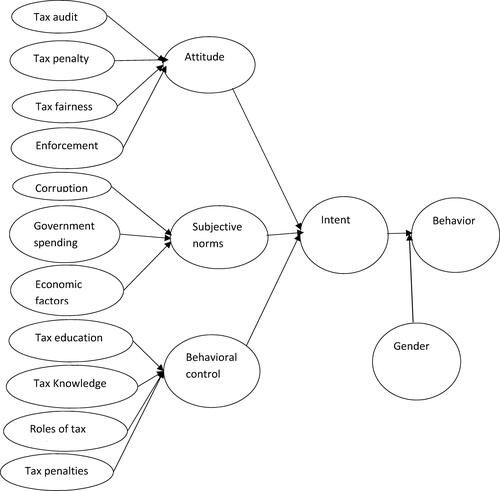

is depicted from Serkan et al. (Citation2011) and modified to show the relationship between the planned behaviour theory and the determinants of the taxpayer’s behaviour. Previous scholars Serkan et al. (Citation2011), Larissa-Margareta et al. (Citation2012) and Donna and Richard (Citation2003) adopted the theory of planned behavior to explain the behavior of taxpayers towards tax compliance. Taing and Chang (Citation2021) observed that tax fairness is an important predictor in explaining the attitude of taxpayers. Rosalita and Aulia (Citation2023) highlighted that trust in tax authority has a significant influence on tax compliance, tax literacy is an important factor explaining the attitude of taxpayers towards tax compliance. AL-Rashdan (Citation2020). Findings show that attitude, subjective norms and behavioral controls are important ingredients in explaining the behavior of taxpayers towards tax compliance.

Findings by Bobek et al. (Citation2013) show that behavioral beliefs, personal norms, subjective norms have a direct influence on the taxpayer’s behavior; however, descriptive norms have got an indirect influence on the taxpayer’s behavior. Thus, social norms have got an important role in explaining the behavior of taxpayers towards tax compliance. Hamdah et al. (Citation2020) Findings show that attitude, subjective norms and behavioral control have a positive significant effect on tax compliance. Although the theory of planned behavior provides the foundation for understanding the determinants of taxpayer’s behavior towards tax compliance, the theory falls short in explaining whether the behavior of taxpayers towards tax compliance is different across gender. The current study extends the theory of planned behavior by incorporating gender differences as an influencing on the behavior of taxpayers.

Subadriyah and Harto (Citation2021) employ a quantitative approach to analyse the factors that influence individual taxpayers’ compliance in paying taxes in Jepara, Indonesia. Multiple regression analysis was used to analyse the relationship between variables. Findings revealed various determinants of taxpayers’ behaviour, which include the quality of the tax authority, understanding and knowledge of taxation, tax sanctions, tax socialization, taxpayer awareness, and perception of tax effectiveness. The study by Ahamad et al. (Citation2020) on the determinants of tax compliance observed tax audit, tax morale, tax fairness, peer influence, tax service quality, and tax knowledge as the determinants of sales tax compliance. Sing and Bidin (Citation2020) investigated the determinants of sales tax compliance behaviour among small and medium enterprises in Malaysia. The study found that tax complexity, tax fairness, peer influence, and tax knowledge strongly influence tax compliance.

Robert and Raphael (Citation2020) analysed the determinants of tax policy compliance and the obstacles to its effective tax administration in Nigeria. The study observed a positive correlation between corruption and tax evasion. Susanto and Syah (Citation2017) analysed the effect of social norms on tax compliance. Findings show that the perception of justice influences tax compliance. Resshe and Amir (Citation2019) examined the effects of tax services, tax amnesty, taxation knowledge, and tax sanctions on tax compliance. Findings show that tax services and tax amnesty influence tax compliance, while tax knowledge and tax sanctions do not influence tax compliance. While conducting their study on the determinants of tax compliance in Vietnam, Nguyen et al. (Citation2019) highlighted that voluntary compliance is influenced by the probability of tax audits, corporate reputation, and business ownership.

In the study conducted by Olufemi et al. (Citation2022) on the impact of tax fairness and tax knowledge on the tax compliance behaviour of listed manufacturing companies in Nigeria, the results showed that tax fairness and knowledge significantly influence tax compliance. Rotimi et al. (Citation2019) conducted a survey of 150 officials using a questionnaire. The findings revealed that tax audits and tax penalties have a positive and significant influence on tax compliance. The results further revealed that tax amnesty does not influence tax compliance. Nyoman et al. (Citation2020) investigated tax knowledge, tax morality, tax volunteers, and tax compliance. The findings indicated that tax knowledge and tax morale influence tax compliance. Barineka and Umoren (Citation2017) analysed the influence of the perception of tax fairness on tax compliance. A survey was conducted with 380 taxpayers. The findings revealed that the perception of tax fairness has a positive and significant influence on tax compliance. Remali (Citation2021) investigated whether tax education influences tax compliance. The findings showed that tax education influences tax compliance.

2.2. Gender and tax compliance

Literature provides evidence of gender differences in behaviour across economic environments. Gender differences arise from risk-taking, honesty, and obedience, which are very important ingredients in tax compliance (Putri and Lintang, Citation2019; Syarbin et al., Citation2023; Rahmawati and Dwijayanto, Citation2021). While men have been considered risk-takers, women have been perceived as more risk-averse, obedient, and honest compared to men (Abung and Damayanti, Citation2023; Damayanti et al., Citation2020; Syarbin et al., Citation2023). D’Attoma et al. (Citation2020) have highlighted a difference in honesty between men and women. According to Rahmawati and Dwijayanto (Citation2021) and Maharremi et al. (Citation2022), women are generally considered to be more honest, obedient, and receptive to justice than men.

Women are very sensitive to the tax burden. An increase in the tax burden will significantly affect women, especially from a “pink tax” perspective. However, some studies suggest that women may be less sensitive to taxes compared to men, as they are accustomed to paying high taxes and, therefore, consider tax payments to be less burdensome (Jeyapalan and Hijattulah, Citation2006; Yiman and Asmare, Citation2020). Women are considered to be more cautious than men, and they tend to think holistically. Women consider paying taxes to avoid tax penalties (Abung and Damayanti, Citation2023; Damayanti et al., Citation2020; Syarbin et al., Citation2023).

Putri and Lintang (Citation2019) examined the characteristics of taxpayers and their tax compliance. A non-probability sampling method, specifically simple random sampling, was used to select 100 individual taxpayers as respondents. Multiple linear regression was used to analyse the relationship between the study variables. Findings from the survey show that gender and education do not have a partial influence on tax compliance, but nationalism does have an influence on tax compliance. However, when the three variables were combined, they indicated a tax influence on compliance.

Syarbin et al. (Citation2023) examined whether demographic factors, such as gender, age, happiness, and altruism partially or simultaneously affect tax compliance. The results from the survey show that gender does not affect tax compliance. However, happiness and altruism do have an effect on tax compliance. Abung and Damayanti (Citation2023) examined the influence of gender on tax compliance. Primary data were collected using a questionnaire from 96 taxpayers in Indonesia. Findings show that there is a relationship between gender and tax compliance, but this relationship can be weakened by the love for money. Damayanti et al. (Citation2020) analysed the effect of top manager gender on tax compliance, mediated by tax burden and corruption practices. The findings from the survey show that the gender tax burden and corruption influence tax compliance.

Titisari and Damayanti (Citation2022) examined the differences in tax compliance behaviour between individuals who receive positive and negative framing. They also explored the variations in individual tax compliance based on personal attributes, specifically gender (male and female). The results show that there is no influence of framing and gender on tax compliance. Yesaya and Imas (Citation2020) conducted a study aimed at exploring the impact of social factors on individuals’ intentions to comply with tax regulations. The results show that gender and trust in government have a significant impact on the perception of fairness and the compliance decision.

D’Attoma et al. (Citation2019) examined whether gender differences in tax compliance are due to higher prosociality among women. Findings show that women declare a significantly higher percentage of their incomes than men in all countries. Rahmawati and Dwijayanto (Citation2021) examined the effect of tax morale and tax compliance on decision-making from a gender perspective. The results of the survey indicated that tax morale and tax compliance have an impact on decision-making, while gender does not affect tax morale and tax compliance. The tax morale of women is based on ethics and compassion, while that of men is based on logic and principles. The study further pointed out that men dominate tax responsibility in the family, but women dominate the financial arrangement for taxes and tax calculations.

Jeyapalan and Hijattulah (Citation2006) investigated whether there are gender and ethnicity differences in relation to tax compliance attitudes and behaviour. The results show that males and females have similar attitudes towards tax compliance. The results further revealed that gender, academic qualification, and the person preparing taxes are significant determinants of noncompliance. Garuba and Erichie (Citation2022) examined the impact of employment status and gender on tax compliance in the informal sector. The findings show that gender does not influence tax compliance. Yiman and Asmare (Citation2020) examined the correlation between the gender of business owners and tax compliance in Ethiopian enterprises. The findings from the survey show that tax compliance is influenced by the behaviour of the owners.

Barbara et al. (Citation2010) investigated the tax compliance of men and women. The results indicated that both demographic sex and gender role orientation were significantly related to tax compliance. Tarmidi (Citation2020) examined the effect of personal factors on tax evasion. The findings indicated that women’s religious and ethical level have a negative statistical influence on tax compliance women understanding had a positive impact on tax evasion. The results further revealed that religious, ethical, and understanding that men have do not have a strong impact on tax evasion.

3. Material and methods

The current study analysed the paradox of whether gender influences the behaviour of taxpayers towards tax compliance. To achieve the stated objectives, the following materials and methods were used.

A quantitative research design which uses both descriptive and explanatory research strategies was used. This helped the researchers to triangulate different findings. The descriptive research aimed to provide a description of the extent to which explanatory variables influence taxpayers’ behaviour towards tax compliance. On the other hand, the explanatory research aimed at analysing the significance of the explanatory variables in explaining the behaviour of taxpayers towards tax compliance. The study population comprised 120,960 taxpayers registered with the Rwanda Revenue Authority (RRA) in Kigali, according to the RRA report (2021). According to the National Institute of Statistics Rwanda (Citation2020), 75% of the establishment are found in Kigali. This explains why the study was conducted in Kigali. These included micro, small, medium, and large taxpayers. The sample size of 401 taxpayers was calculated using Yemen’s formula . A stratified simple random sampling technique was used to select the sample. Two strata were formulated. One stratum is comprised of businesses owned or managed by females, while another stratum is comprised of businesses owned or managed by males. below show the sampling frame depicted from the study population.

Table 1. Sampling frame.

Primary data were collected from the selected taxpayers using a closed-ended questionnaire (). The questionnaire was designed using a Likert scale that ranged from a very low extent to a very large extent. The scale ranked a very low extent as 1 and a very large extent as 5. Research assistants were hired to collect the data from the selected sample. This helped the researchers minimize the non-response rate. The primary data, collected using a questionnaire, were captured using an SPSS template for analysis. Descriptive and inferential statistical tools were used to analyse and present the data. The descriptive statistics were presented using the mean and standard deviation. Descriptive statistics aim to explain the extent to which the explanatory variables influence behaviour to comply with the tax. A mean from 1–2.9 indicates a lower extent, 3.0 to 3.4 indicates an average extent, and a mean from 3.5 to 5 indicates a very high extent. The inferential statistics aimed to establish the significance of the explanatory variables in explaining taxpayers’ behaviour towards tax compliance, the significance of gender in taxpayers’ beheviour towards tax compliance, and the size of the effect of the explanatory variables and gender in explaining taxpayers’ behaviour towards tax compliance. To achieve these objectives, a multivariate analysis of variance (MANOV A) and independent t-test were used. The MANOVA test was used to examine the size effect of the variable in explaining taxpayers’ behaviour towards tax compliance, while the independent t-test was used to determine the significance of the mean difference between male and female taxpayers.

The explanatory variables are the determinants of taxpayers’ behaviour towards tax compliance. Literature provides several variables that influence the behaviour of taxpayers towards tax compliance. These include tax knowledge, perception of government spending, corruption, the role of the tax authority, tax audit, economic factors, tax penalties, tax education, tax rates, enforcement level, and fairness of the tax system. The variables were measured using a Likert Scale, which ranged from a ranking of 1 indicating a very low extent to a ranking of 5 indicating a very high extent. The fixed random variable considered in this study was gender, which was measured using two dimensions: male and female. The dependent variable, tax compliance, was measured using four dimensions: registering on time, declaring tax on time, paying tax on time, and keeping proper books of accounts. The researchers tested two hypotheses, which are formulated below:

Hypothesis 1

(Ho): There is no significant statistical difference in the determinants of taxpayers’ behaviour between male and female taxpayers.

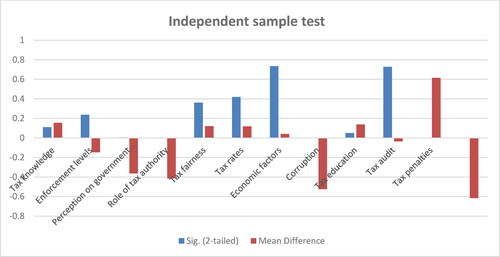

To test this hypothesis, an independent sample t-test was conducted to compare the mean scores of male and female taxpayers’ behaviours towards tax compliance. A t-test was used to compare the means of the two groups and test for equality. The mean difference was considered significant when the p-value is below the 5% level of significance.

Hypothesis 2

(Ho): Determinants of taxpayers’ behaviour and gender do not significantly explain tax compliance.

To test this hypothesis, a MANOVA test was used to determine the impact of the explanatory variables and the fixed random variable on tax compliance. Pillai’s trace measure was used to determine the overall contribution of the variables. This was done using the partial Eta square and the p-value. The variables were considered to significantly contribute to tax compliance when the p-value is below 5% and the partial Eta Square is above 50%. Levene’s test was also used to test the equality of error variance between the variables. The researchers also conducted a test to determine the significance and size of each explanatory variable in explaining tax compliance, as well as the subject effect. This was done using the partial eta square and the p-value. In addition, multivariate regression was used to determine the relationship between variables. Under this, gender was considered a dummy variable. below shows how the study variable were measured.

Table 2. Measurement of study of variables.

TB = F (Tax audit (TA), Tax penalties (Tp), Tax fairness (TF), Enforcement level (EF), Corruption (C), Government spending (GS), Economic factors (EF), Tax education (TE), Tax knowledge (TK), Roles of tax authority (RTA), Tax rate (TR), Gender (G)).

(2)

(2)

4. Results and discussion

This study aimed at analysing whether gender is an important factor in explaining the behaviour of taxpayers towards tax compliance. A questionnaire was sent to 401 taxpayers in the country from which 390 responded back to the questionnaire which represents 97.3%. The results from the survey are presented in the tables below:

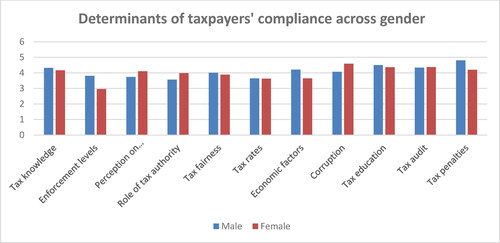

Determinants of taxpayers’ behaviour towards tax compliance across gender

The figure below shows the factors that influence the behaviour of taxpayers towards tax compliance across gender dimensions.

In (see in the appendix), the respondents were asked to rank the extent to which the above factors influence their behaviour towards tax compliance in Rwanda. The results from the survey show that there is a difference in tax knowledge between males and females, as evidenced by a mean of 4.3158 for males and 4.1602 for females. This shows that the behaviour of male taxpayers towards tax compliance is more influenced when they have more knowledge about tax compared to female taxpayers. The results further revealed a mean difference of 0.853 between male and female taxpayers in terms of the level of enforcement. The results showed that male taxpayers are more influenced to comply with taxes when the level of enforcement is high, as compared to female taxpayers.

Figure 1. Theoretical framework of analysis modified from Serkan et al. (Citation2011).

Figure 2. Group statistics on the determinants of taxpayers’ behaviour towards tax compliance between male and female taxpayers.

Regarding the perception of government spending, the findings show that female taxpayers are more influenced to comply with taxes when they have more knowledge about how the government spends the money collected from taxes, as compared to male taxpayers. This is evidenced by a mean difference of 0.363 between male and female taxpayers. Furthermore, with regard to the roles of the tax authority, the results show that female taxpayers are more likely to comply when they are aware of the responsibilities of the tax authority, as compared to male taxpayers. This is evidenced by the mean difference of 0.414 between male and female taxpayers.

Furthermore, the respondents were asked to rank how the fairness of the tax system influences their behaviour in complying with taxes. The results from the survey show mean difference of 0.12, which is skewed towards male taxpayers. However, although there is a difference between male and female taxpayers, the difference is small. This indicates that the behaviour of both male and female taxpayers is influenced by the fairness of the tax system. Regarding the tax rates, the results show that the behaviour of both male and female taxpayers is influenced by the tax rates, as evidenced by a mean of 3.6416 for male taxpayers and 3.6124 for female taxpayers.

The respondents were further asked whether economic factors influence their behaviour towards tax compliance. The findings from the survey show that the behaviour of male taxpayers is more influenced by economic factors compared to female taxpayers, as evidenced by a mean difference of 0.856 between male and female taxpayers. Corruption is another important factor in the literature that influences the behaviour of taxpayers towards tax compliance. The results from the survey show that the behaviour of female taxpayers towards tax compliance is more influenced by corruption compared to male taxpayers, as evidenced by the mean of 4.067 for males and 4.591 for females. The results revealed a mean difference in the behaviour of taxpayers regarding corruption between male and female taxpayers. The difference was 0.524, indicating a skew towards female taxpayers.

On the topic of whether and how tax education influences taxpayers’ behaviour towards tax compliance, the results indicate that both male and female taxpayers are influenced by tax education. This is evident from the mean scores of 4.502 for male taxpayers and 4.365 for female taxpayers. The results from the survey revealed a mean difference of 0.137, indicating a skew towards male taxpayers. Regarding whether and how tax audits influence the behaviour of taxpayers, the survey results indicate that both male and female taxpayers are influenced by tax audits. This is evidenced by a mean score of 4.335 for male taxpayers and 4.370 for female taxpayers. The results further revealed that there is a mean difference of 0.035 in the behaviour of taxpayers, with a skew towards female taxpayers. Regarding tax penalties, the results show that both female and male taxpayers are influenced by the tax penalties, as evidenced by a mean of 4.8066 for male taxpayers and 4.1914 for female taxpayers. The results further revealed that there is a statistical difference in the behaviour of male and female taxpayers regarding tax penalties. The skewness value of 0.6152 indicates that the distribution is skewed towards male taxpayers.

tests the relationship between the predictor variables in explaining the behavior of taxpayers towards tax compliance. Findings show that the predictor variables contribute 51% of the variation in tax compliance for both male and female firms combined, 84.23% of the variation in the behavior is contributed by male-led firms while female-led firms contribute 71.86% towards tax compliance. This implies that of the variation in the behavior of taxpayers towards tax compliance, 84.23% is contributed by being a male taxpayer, while 71.86% is contributed by being a female taxpayer, as evidenced by R-square. The findings revealed that there is a significant statistical difference in the behavior of taxpayers towards tax compliance. The findings revealed that the behavior of male-led firms is more influenced by the predictor variables as compared to that of female-led firms. Findings from previous studies suggest that females are honest, risk-averse, and honest (Putri and Lintang, Citation2019; Syarbin et al., Citation2023; Rahmawati and Dwijayanto, Citation2021). This partly explains why tax sanctions are not statistically significant for female taxpayers. Women consider paying taxes to avoid tax penalties (Abung and Damayanti, Citation2023; Damayanti et al., Citation2020; Syarbin et al., Citation2023). Abung and Damayanti (Citation2023) and Damayanti et al. (Citation2020) observed a significant relationship between gender and tax compliance.

Table 3. Regression models.

further tests the significance of the predictor variables in explaining the behavior of taxpayers in tax compliance. Model 1 tests the significance of the determinants of taxpayers’ behavior for both male and female-led firms; Model 2 tests the significance of the predictor variables in the female-led firms; and Module 3 tests the significance of the predictor variables in the female-led firms. Findings were further revealed.

Having relevant tax knowledge about the tax laws significantly influences female-led firms for income tax compliance. This implies that female-led firms comply more when they have knowledge about the relevant tax law. This is explained by the fact that females are obedient to laws as compared to males (Abung and Damayanti, Citation2023; Damayanti et al., Citation2020; Syarbin et al., Citation2023). However, findings indicate that there is no significant influence of tax knowledge on tax compliance among the male-led firm and for the combined model. The findings contradict the results observed in the study conducted by Subadriyah and Harto (Citation2021), who highlighted a significant influence at the general level and for male-led firms but concur with the findings for female-led firms. Regarding the enforcement level, findings show a negative and significant relationship between the level of enforcement and tax compliance within the male-led firms and a positive and significant relationship between the enforcement level and tax compliance among the female-led firms. This implies that increasing the level of enforcement within the male-led firm leads to a decrease in tax compliance but increases tax compliance among the female-led firms.

The perception of government spending defines how individuals perceive the efficacy of the management of their tax contributions. Findings of the study show that, at the general level, perceptions of government spending do not significantly contribute to the behavior of taxpayers towards tax compliance. However, after incorporating gender, findings show a significant positive influence of the perception of government spending on tax compliance among the male-led firms but a significant negative relationship among the female-led firms, as evidenced by a P-value less than 5%. This implies that a positive perception about government spending will lead to an increase in tax compliance among the male-led firms and a decrease in tax compliance among the female-led firms. This means that males are not much concerned about government spending as compared to female taxpayers.

Tax authorities play various roles, which include providing effective technology, trusting tax authorities, and ensuring simplicity in the tax system. Findings show that, at the general level, there is a significant positive relationship between the roles of tax authorities and tax compliance. This implies that the more trustworthy and powerful the tax authority, the higher the compliance. Tsikas (Citation2017) defined the roles of tax authority in terms of powerfulness and trustworthiness and observed a positive correlation between the role of tax authority and tax compliance. However, after incorporating gender, findings show that tax authority does not significantly influence the behavior of male-led firms towards tax compliance since the p-value is above 5%, but a significant positive influence was observed among the female-led firms, as evidenced by a p-value less than 1%. This is due to the fact that females are obedient, honest, and risk-averse, as observed in the study conducted by Damayanti et al. (Citation2020; Abung and Damayanti, Citation2023; Syarbin et al., Citation2023).

Having a fair tax system has a significant positive influence on the behavior of taxpayers towards tax compliance at the general level, as evidenced by a p-value of less than 1%. This implies that a fair tax system increases the behavior of taxpayers towards tax compliance. Findings further show that a fair tax system positively and significantly influences the behavior of taxpayers towards tax compliance among male-led firms but does not significantly influence the behavior of female taxpayers. Susanto and Syah (Citation2017) pointed out that the perception of justice has a significant influence on taxpayers’ behavior towards tax compliance.

Findings further revealed that tax rates have a significant negative influence on the behavior of taxpayers towards taxpayers at the general level and for male taxpayers with a p-value less than 1%. This implies that an increase in tax rates will reduce the behavior of taxpayers towards tax compliance. This is due to the fact that high tax rates reduce the disposable incomes of taxpayers, which may force them into unethical tax avoidance evasion. Studies by Chindengwike and Kira (Citation2022) and Abdulsalam et al. (Citation2014) observed a significant negative correlation between tax rate and tax compliance. However, Hassan and Sri (Citation2020) observed a significant positive relationship between tax rates and tax compliance, which contradicts the current results. The findings further show that there is no significant relationship between the tax rate and the behavior of female taxpayers towards tax compliance. This implies that an increase in the tax rate will have no influence on the behavior of female taxpayers but will positively influence the behavior of male taxpayers. Due to the fact that females are risk-averse, as observed in studies by Putri and Lintang (Citation2019), Syarbin et al. (Citation2023), and Rahmawati and Dwijayanto (Citation2021), female taxpayers may not engage in unethical behavior such as tax avoidance and evasion. Thus, not influenced by the tax rates.

On whether corruption influences the behavior of taxpayers towards tax compliance, findings show that there is a significant negative influence between corruption and the behavior of taxpayers towards tax compliance for both male and female-led firms and at the general level, as evidenced by a p-value less than 1%. An increase in the level of corruption within government institutions leads to a decrease in the behavior of taxpayers towards tax compliance. Previous scholars Yesaya and Imas (Citation2020) suggest that corruption weakens trust in government and government institutions, including the tax authority, thus leading to non-compliance. The findings concur with the results from the previous studies. The studies conducted by Robert and Raphael (Citation2020) observed a positive correlation between corruption and tax avoidance. Bertinelli et al. (Citation2020) also observed that corruption provides avenues for taxpayers to avoid tax.

The results further show that tax education has a positive and significant influence on the behavior of taxpayers towards tax compliance for both male and female-led taxpayers and at the general level, as evidenced by the p-value, which is less than 1%. This implies that an increase in tax education leads to an increase in the behavior of taxpayers towards tax compliance at all levels. Previous findings Remali (Citation2021) suggests that tax education helps in controlling the behavior of taxpayers towards tax compliance. However, the findings contradict the results of the study conducted by Putri and Lintang (Citation2019), who observed that tax education does not influence tax compliance. This could be due to the fact that gender was not considered a variable in the study.

Findings on whether tax audits influence the behavior of taxpayers towards tax compliance show that there is a negative and significant relationship between tax audits and the behavior of taxpayers towards tax compliance for both male and female-led firms and at the general level, as evidenced by a p-value that is less than 1%. This implies that an increase in the tax audit leads to a decrease in the behavior of taxpayers toward tax compliance. This contradicts the findings from the previous studies. Studies by Rotimi et al. (Citation2019), Ahamad et al. (Citation2020), and Nguyen et al. (Citation2019) highlight that tax audits lead to an increase in the behavior of taxpayers toward tax compliance.

Findings further show that tax penalties do not significantly influence the behavior of taxpayers towards tax compliance at the general level and for female taxpayers, but positively and significantly influence the behavior of male taxpayers, as indicated by a P-value less than 1%. The findings in the study conducted by Resshe and Amir (Citation2019) show that tax sanctions do not influence the behavior of taxpayers towards tax compliance but conform with the findings from the study conducted by Rotimi et al. (Citation2019). This implies that an increase in tax penalties increases the behavior of male taxpayers towards tax compliance but has no influence on female taxpayers. The results further show that gender is a significant factor in explaining the behavior of taxpayers towards tax compliance, as evidenced by a p-value less than 1%.

(see in the appendix) compare the mean samples from male and female taxpayers. It tests whether the mean samples of male and female taxpayers are statistically different from each other. The null hypothesis was that the mean difference between male and female taxpayers is not statistically significant. The results from the survey show that there is no statistically significant difference in tax knowledge, enforcement level, and fairness of the tax system, tax rates, and tax audit. This is indicated by a P-value greater than 5%. This means that the behaviour of taxpayers towards tax compliance, including their tax knowledge, enforcement level, fairness of the tax system, tax rates, and tax audit, is the same regardless of their gender. The results further revealed that there is a statistically significant mean difference between male and female taxpayers in their perception of government spending, the roles of the tax authority, economic factors, and corruption and tax penalties. This means that gender is an influencing factor in the behaviour of taxpayers towards tax compliance. Perception of government spending, corruption, and tax audits is skewed towards female taxpayers, while tax education and tax penalties are skewed towards male taxpayers.

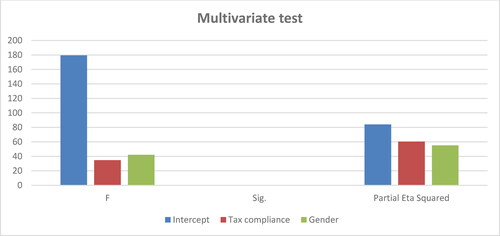

(see in the appendix) tests how explanatory variables contribute to tax compliance. Although the literature provides different methods for predicting the relationship between variables under MANOVA, in this study, the researchers preferred to use the Pillai Trace due to its robustness in minimizing errors in the results. On the determinants of tax compliance, the results show that the explanatory variables account for 60.3% of tax compliance, with a p-value of 0.000. This indicates a strong, positive, and significant relationship between the explanatory variables and tax compliance. The results further revealed that gender contributes 55.1% to the behaviour of taxpayers towards tax compliance. With a p-value of 0.000, it implies that there is a significant influence of gender on taxpayers’ behaviour towards tax compliance.

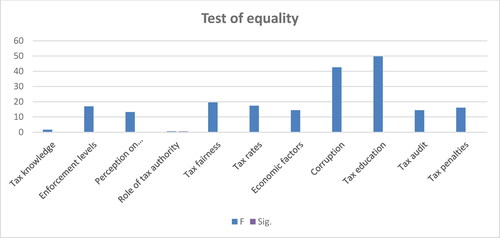

(see in the appendix) tests the null hypothesis of whether the samples have equal variance across groups. Apart from the tax knowledge and the roles of the tax authority, which have a p-value above .05, all other variables have a p-value less than 5%. This implies that the variance between tax knowledge and the roles of tax authorities is not equal across groups, and therefore, the null hypothesis is rejected. However, for other variables, their p-values are less than 5%, indicating that the null hypothesis is accepted.

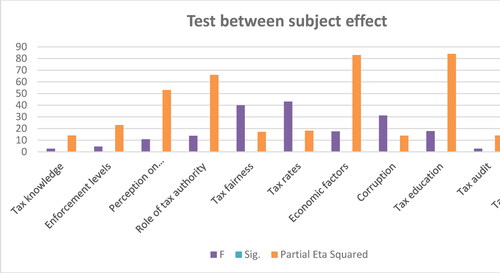

( in the appendix) tests the significance and magnitude of the effect between the study variables. The results from the survey show that tax knowledge is not statistically significant at the 5% level and only contributes 14% of the variation in taxpayers’ behaviour towards tax compliance, as indicated by the partial eta square. The results further revealed that the enforcement level is statistically significant, with a p-value of .012, and contributes 23% to the variance in taxpayers’ behaviour towards tax compliance. The perception of government spending is statistically significant, with a p-value of 0.000, and contributes 53% to taxpayers’ behaviour towards tax compliance. The role of the tax authority contributes 66% of the variance in taxpayers’ behaviour, which is statistically significant with a p-value of 0.000. The results further show that the fairness of the tax system contributes 17.1% to the variation in taxpayers’ behaviour towards tax compliance and is statistically significant with a p-value of 0.000. The study also shows that tax rates have a statistically significant influence on taxpayers’ behaviour towards tax compliance, with a p-value of 0.000.

Furthermore, findings from the survey show that economic factors contribute 83% to the variance of taxpayers’ behaviour towards tax compliance, and this relationship is statistically significant at a 5% level of significance. The results further show that corruption has a statistically significant influence on taxpayers’ behaviour, and it contributes to 13.9% of the variation in taxpayers’ behaviour towards tax compliance. Tax education contributes 84% to the variation in taxpayers’ behaviour towards tax compliance and is statistically significant with a p-value of 0.000. Tax audit was found not to be statistically significant at a 5% level, although it accounts for 14% of the variation in taxpayers’ behaviour towards tax compliance. The results further show that tax penalties are statistically significant, with a p-value of 0.000. Additionally, tax penalties contribute 28.4% to explaining taxpayers’ behaviour towards tax compliance

5 Conclusion

The study analysed the influence of gender on the determinants of taxpayers’ behaviour towards tax compliance. Based on the findings from the survey, the predictor variables contribute 51% of the variation in the taxpayer’s behaviour towards tax compliance. Findings further revealed that of the variation in the taxpayer, behaviour towards tax compliance 84.23% is contributed by the male taxpayers while 71.86% is contributed by the female taxpayers as evidenced by R-square, Thus, a indicating significant statistical difference between the behaviour of male and female taxpayers. several factors that influence the behaviour of taxpayers towards tax compliance.

Findings further revealed that the predictors variables influences both female and male taxpayers differently thus, the behaviour of taxpayers is different across gender for some predictors and similar for other predictors. The behaviour of Female taxpayers towards tax compliance is influenced more with tax knowledge, perception of government spending and roles of tax authority. Similarly, the behaviour of male taxpayers towards tax compliance is influenced by fairness of tax system, tax rates, economic factors and tax penalties as evidenced by P-value less than 5%. Tax education, tax audit and corruption have got a similar influence on the behaviour of taxpayers towards tax compliance. Based on the findings, gender is an important factor in explaining the behaviour taxpayers towards tax compliance.

Recommendation

Compliance costs is one of the biggest costs in tax administration, understanding the factors influencing the behaviour of taxpayers towards tax compliance is a key ingredient for developing compliance programs and policies. It is in this regard that researchers recommend to policy makers to design compliance programs that suits certain group of individuals since the behaviour of taxpayers is different across gender.

Strength and limitation of current study

The current study provided an extension to the planned behaviour theory by highlighting the factors that influences the behaviour of both male and female taxpayers towards tax compliance. The findings of this study can be used as an important input when designing compliance policies and programs. However, due to lack of administration data, the researchers used a Likert scale to from survey data to measure tax compliance. The results about tax compliance from survey data from may be subjective. Thus, future researcher can study the same topic but using panel data.

Authors’ contribution

The output of this research is as a result of contribution made by various members who came together to develop this manuscript.

Dr. Daniel Twesige made a literature survey which was used in this paper.

Dr. Eugene Rutungwa developed the methodology which used in the paper.

Dr Isaei Kadhafi Misago together with Dr Daniel Twesige captured the data collected and made the interpretation and discussion for the findings.

Ass. Prof. Faustin Gasheja made the proof reading and wrote the conclusion for the manuscript.

Dr Sammuel Mutarinda has come in later stages and has helped to develop the regression models which were requested by the reviewers.

Disclosure statement

No potential conflict of interest was reported by the author(s).

Availability of data

Raw data were generated from different business enterprises in Rwanda. Derived data supporting the findings of this study are available from the corresponding author (Dr Daniel Twesige) on request

Additional information

Funding

Notes on contributors

Daniel Twesige

Dr. Daniel Twesige is a senior Lecturer in Accounting and Finance at INES- Ruhengeri department of enterprise management with other 12 years’ experience in teaching, research and consultancy. He possesses a PhD in accounting and finance with research interest in taxation and economic development.

Eugene Rutungwa

Dr. Eugene Rutungwa, a PhD holder in Organizational Development and Transformation, is a Senior Lecturer at the University of Rwanda, College of Business & Economics. With 13 years of experience in teaching and research, he previously worked for both public and private institutions for nine years.

Gasheja Faustin

Prof Dr. Faustin Gasheja is an associate professor of accounting in the University of Rwanda, College of Business and Economics with 15 years of experience. He holds a PhD in Organizational development and Transformation (ODT), an MBA and he is a project management professional (PMP) certified by PMI. Prof Faustin’s research interest are critical management studies, entrepreneurship, auditing and tax.

Isaie Kadhafi Misago

Dr. Isaie Kadhafi Misago holds a PhD in Commerce with majors in Finance and a Master’s Degree in Finance and Accounting. He is a certified Project Management Professional offered by the Project Management Institute. He has over 12 Years’ experience in teaching, research, and conducting training in Business related courses.

Samuel Mutarinda

Dr. Samuel Mutarinda is a Senior Lecturer in accounting and finance in the College of Business & Economics, University of Rwanda with 15 years of experience in teaching, research, and consultancy. He possesses a PhD in Business Administration. Samuel’s research interests are in sustainable finance and growth.

References

- Abdulsalam, M., Almustapha, A. A., & El-Maude, J. G. (2014). Tax rate and tax compliance. European Journal of Accounting Auditing and Finance Research, 2(3), 22–30.

- Abung, Y. R., & Damayanti, T. W. (2023). The influence of gender on tax compliance with love of money as a moderating variable. Journal of Social Research, 2(4), 1–17. https://doi.org/10.55324/josr.v2i4.747

- Agusti, R. R., & Rahman, A. F. (2023). Determinants of tax attitude in small and medium enterprises: Evidence from Indonesia. Cogent Business & Management, 10(1), 2160585. https://doi.org/10.1080/23311975.2022.2160585

- Ahamad, F. A., Moh’d, A., Abdalwali, L., & Adi, A. (2020). A social-economic model of sales tax compliance in Jordan. Global Business Review, 8(4), 88.

- Ajzen, I. (1985). From intentions to actions: A theory of planned behavior. In J. Kuhl & J. Beckman (Eds.), Action-control: From cognition to behavior. (pp. 11–39), Springer.

- Al-Rashdan, M. (2020). The effect of attitude, subjective norms, perceived behavioral control on tax compliance in Jordan: The moderating effect of costums tax.

- Antwi, S. K., Inusah, A. M., & Hamza, K. (2015). The effect of demographic characteristics of small and medium entrepreneurs on tax compliance in Tamale Metropolis, Ghana. International Journal of Economics, Commerce and Management, 3(3), 1–20.

- Barbara, K., Stefan, G. D., Erich, K., Luigi, M., & Martin, V. (2010). Sex differences in tax compliance: Differentiating between demographic sex, gender-role orientation and prenatal masculinization (2D:4D). Journal of Economic Psychology Elsevier, 31(4), 542–552.

- Barineka, F. G., & Umoren, O. A. (2017). The perception of tax fairness and personal income tax compliance of SMEs in river State. Journal of Research in Business Management. Quest Journals, 5(2), 40–57.

- Bertinelli, L., Bourgain, A., & Léon, F. (2020). Corruption and tax compliance: evidence from small retailers in Bamako, Mali. Applied Economics Letters, 27(5), 366–370. https://doi.org/10.1080/13504851.2019.1616057

- Bobek, D. D., Hageman, A. M., & Kelliher, C. F. (2013). Analyzing the role of social norms in tax compliance behavior. Journal of Business Ethics, 115(3), 451–468. https://doi.org/10.1007/s10551-012-1390-7

- Chindengwike, J. D., & Kira, A. R. (2022). The effect of tax rate on taxpayers’ voluntary compliance in Tanzania. Universal Journal of Accounting and Finance, 10(5), 889–896. https://doi.org/10.13189/ujaf.2022.100501

- D’Attoma, J., Volintiru, C., & Malezieux, A. (2019). Gender, social value orientation and tax compliance. Journal CEsifo Economic Studies, 66(3), 265–284.

- D’Attoma, J. W., Volintiru, C., & Malézieux, A. (2020). Gender, social value orientation, and tax compliance. CESifo Economic Studies, 66(3), 265–284. https://doi.org/10.1093/cesifo/ifz016

- Damayanti, T. W., Prabowo, R., Sucahyo, U. S., & Supramono, S. (2020). The relationship between gender, tax burdens, corruption practices and tax compliance. Journal of Southwest Jiaotong University, 55(3).

- Donna, D. B., & Richard, C. H. (2003). An investigation of the theory of planned behavior and the role of moral obligation in tax compliance. Behavioral Research in Accounting.

- Garuba, A. O., & Erichie, D. (2022). Employment and status, gender and tax compliance behaviour of informal sector operators in Nigeria. Accounting and Taxation Review, 6(2)

- Hamdah, D. F. L., Rahmadya, R. R., & Nurlaela, L. (2020). The effect of attitude, subjective norm, and perceived behavior control of taxpayer compliance of private person in tax office Garut, Indonesia. Review of Integrative Business and Economics Research, 9, 298–306.

- Hassan, M. M., & Sri, S. (2020). The effect of tax ate perception, tax understanding and tax tax sanctions on tax compliance with small and medium enterprises in Sukoharjo. International Journal of Economics, Business and Accounting Research, 4(4).

- Jeyapalan, K., & Hijattulah, A. J. (2006). Gender and ethnicity differences in tax compliance. Asian Academy of Management Journal, 11(2), 73–88.

- Larissa-Margareta, B., Ramona-Anca, N., Ioan, B., & Bogdan-Andrei, M. (2012). Tax compliance models from economic to behavioral approaches. Transylvanian Review of Administrative Sciences, 8(36), 13–26.

- Lotta, B. L., & Bragger, B. (2021). Tax compliance dancing: The importance of time and space in taxing multinational corporations. Journal of Legal Anthropology, 5(1), 85-109.

- Maharremi, O., Salé, M. J., & Hoxhaj, M. (2022). A mixed methods study of the influence of demographic factors on Albanian individual taxpayers’ ethical beliefs surrounding tax compliance. Business Ethics and Leadership, 6(1), 47–66. https://doi.org/10.21272/bel.6(1).47-66.2022

- National Institute of Statistics Rwanda NISR (2020). Establishment census. Government of Rwanda Report Rwanda Revenue Authority RRA (2020). Statistical report. Government of Rwanda.

- Nguyen, T. T. D., Pham, T. M L., Thanh, T. L. E., Truong, T. H. L., & Tran, M. D. (2019). Determinants influencing tax compliance in Vietnam. Journal of Asian Finance, Economics and Business, 7(7), 209–2017.

- Nyoman, S. H., Ketut, A. B. W., & Nyoman, S. I. (2020). The impact of tax knowledge, tax morale, and tax volunteer on tax compliance. Advances in Social Science, Education and Humanities Research. Atlantis Press, 98–103.

- Olufemi, O., Tony, N., Damilola, E., Bitrus, G., & Adekunle, A. (2022). Impact of tax fairness and tax knowledge on tax compliance behaviour of listed manufacturing companies in Nigeria. Problems and Perspectives in Management, 20(1), 41–48. https://doi.org/10.21511/ppm.20(1).2022.04

- Putri, K. C., & Lintang, V. (2019). The effect of gender, education and nationalization level of individual taxpayers towards tax ojokerto compliance: A case stuy on KPP Pratama. International Conference on Economics, Education, Business and Accounting KnE Social Science, 170–187.

- Rahmawati, Y., & Dwijayanto, A. (2021). The effect of moral tax and tax compliance on decision making through gender perspective: A case study of Religious Communities in Megetan District, East Java, Indonesia. Academic Journal of Interdisciplinary Studies, 10(6), 237. https://doi.org/10.36941/ajis-2021-0168

- Remali, A. M. (2021). Does education influence tax compliance? Global Business Management Research: An International Journal, 13(4s), 963–972.

- Resshe, S. G., & Amir, H. (2019). Determinants of compliance with personal tax obligation. Do tax amnesty play. Accounting Research Journal of Sutaatmadja, 3(2), 259–267.

- Robert, D., & Raphael, D. (2020). Analysis of the determinants of tax policy compliance in Nigeria. Journal of Public Administration and Governance, 10(2)

- Rosalita, R. A., & Aulia, F. R. (2023). Determinants of tax attitude in small and medium enterprises: Evidence from Indonesia. Cogent Business & Management, 10(1), 2160585.

- Rotimi, O., Foluso, O. A., Ahmodu, A. L O., Sallu, A. Y., & Muyiwa, A. (2019). Tax enforcement tools and tax compliance in Ondo State Nigeria. Academic Journal of Interdisciplinary Studies, 8(2), 27.

- Serkan, B., Ahmet, F. C., & Tamer, B. (2011). An Investigation of tax compliance intention: A theory of planned behavior approach. European Journal of Economics, Finance and Administrative Science, 28(28), 180–188.

- Sing, T. L., & Bidin, Z. (2020). Sales tax compliance and its determinants in Malaysia. Advanced International Journal of Banking, Accounting and Finance, 2, 1–20.

- Subadriyah, S., & Harto, P. (2021). Determinants of personal tax compliance. Accounting, 7(7), 1675–1680. https://doi.org/10.5267/j.ac.2021.5.002

- Susanto, B. N., & Syah, T. Y. R. (2017). Analysis of social norm in personal taxpayer’s compliance in Indonesia. Russian Journal of Agricultural and Socio-Economic Sciences, 72(12), 58–71.

- Syarbin, I., Restiatiun, J., & Suratman, E. (2023). Demographic characteristics and tax compliance. Asian Journal of Social Science Studies, 8(1), 1. https://doi.org/10.20849/ajsss.v8i1.1322

- Taing, H. B., & Chang, Y. (2021). Determinants of tax compliance intention: Focus on the theory of planned behavior. International Journal of Public Administration, 44(1), 62–73. https://doi.org/10.1080/01900692.2020.1728313

- Tarmidi, D. (2020). Impact of personal factors on tax evasion: A comparatives analysis of gender. Saudi Journal of Economics and Finance, 04(01), 23–27. https://doi.org/10.36348/sjef.2020.v04i01.004

- Titisari, D. P., & Damayanti, T. W. (2022). An experimental study: Gender and framing in tax compliance. JATI.

- Tsikas, S. A. (2017). Enforce tax compliance, but cautiously: The role of trust in authorities and power of authorities (No. 589). Hannover Economic Papers (HEP).

- Yesaya, B. F., & Imas, N. I. (2020). Gender, trust and tax compliance: The mediating effect of fairness perception. Journal of Applied Accounting and Finance, 2, 131–145.

- Yiman, S., & Asmare, F. (2020). Gender and tax compliance: Firm-level and Evidence from Ethiopia: Working Paper 113 ICTD.

Appendix 1:

questionnaire

Questionnaire

Dear respondents, we are conducting a study on what influences the beheviour of taxpayers towards tax compliance. The responses given will be only used for academic purposes and no taxpayers’ name shall be disclosed in the study.

1. Size of the taxpayer

a. Micro business

b. Small businesses

c. Medium business

d. Large business

2. Type of business organisation

a. Individual business 5

b. Company 5

3. Gender of the owner/Manager

a. Male

b. Female

4. To what extent the following factors influence your behaviour towards tax compliance

5. Express your opinion on how comply to tax on whether you agree or disagree with the statement. (SD strongly disagree, D disagree, N neutral, A agree and SA strongly agree

Appendix 2:

Table showing results

Table A1. Group statistics on the determinants of taxpayers’ beheviour towards tax compliance between male and female taxpayers.

Table A2. Independent test.

Table A3. Multivariate testsa determinants of taxpayers’ compliance and gender.

Table A4. Levene’s test of equality of error variancesa.

Table A5. Tests of between-subject effects.