?Mathematical formulae have been encoded as MathML and are displayed in this HTML version using MathJax in order to improve their display. Uncheck the box to turn MathJax off. This feature requires Javascript. Click on a formula to zoom.

?Mathematical formulae have been encoded as MathML and are displayed in this HTML version using MathJax in order to improve their display. Uncheck the box to turn MathJax off. This feature requires Javascript. Click on a formula to zoom.Abstract

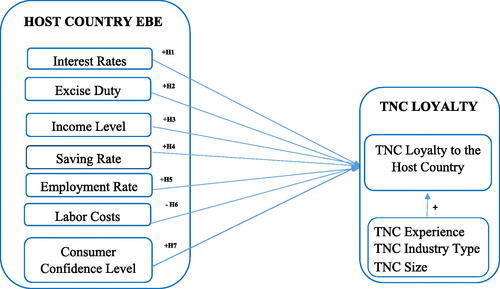

Foreign companies, including transnational corporations (TNCs), have shown disloyalty toward their hosts in sub-Saharan Africa by, among other things, scaling back strategic expansion plans, closing operations, and shifting income-generating activities to different countries. Therefore, the current study examines the influence of the economic business environment on TNCs’ loyalty in Tanzania. Using a cross-sectional survey design, data was collected from 131 executives of TNCs in Tanzania. The measurement model was verified by confirmatory factor analysis. Hypotheses were tested using hierarchical regression analysis. Results indicate that through income level, saving rate, consumer confidence level, and employment rate, the economic business environment of the host country has a positive and significant influence on TNC loyalty towards the host country. The labor costs have a negative and significant influence on TNC loyalty. TNC loyalty, however, is not significantly influenced by interest rates or excise duty. The current investigation’s findings contribute to the theoretical concept of loyalty, close a gap in the literature, and make an effort to advance knowledge of the host nation’s economic business environment’s effect on TNC loyalty. Policymakers should ensure policies that elevate key aspects of the economic business environment, specifically high income, savings rates, consumer confidence, employment rates, and policies that lower labor costs.

1. Introduction

Foreign investments globally excelled more than any other form of capital flow across national borders, reaching 1.5 trillion in 2019 before collapsing by 42% in 2020 due to the COVID-19 pandemic (Giroud & Azémar, Citation2023; UNCTAD, Citation2021). The developing economies have been strengthened by engaging in transnational corporations (TNCs) and foreign direct investment (FDI) attractions (Giroud & Azémar, Citation2023; Pandya, Citation2016). In the presence of these TNCs, the countries have experienced economic growth, employment creation, sectoral growth, competition, and proper utilization of resources (Magai, Citation2022). As of today, many countries are taking considerable initiatives and becoming more open to attract foreign firms, including TNCs, by reducing restrictions, offering generous investment incentives, and adopting agreements with global and international organizations such as the World Trade Organization (WTO), the International Monetary Fund (IMF), the World Bank (WB), bilateral investment agreements (BIAs), preferential trade agreements (PTAs), and regional integration agreements (RIAs) (Pandya, Citation2016). Therefore, the importance of TNCs cannot be overlooked, particularly in low-income countries, including sub-Saharan countries (Xiao & Tian, Citation2023).

Meanwhile, apart from the developing countries, studies have demonstrated that income-disadvantaged countries benefit even more from foreign investment overflows, including TNC income-generating activities conducted in the particular country where TNCs are hosted (Iršová & Havránek, Citation2013; Xiao & Tian, Citation2023). Therefore, in a low-income country like Tanzania, continued TNC operations, which are equivalent to TNC loyalty, are crucial for economic development. In this regard, TNC business operations continuity implies establishing new investments, reinvesting earnings, and spreading beneficial recommendations about the host country opportunities and potentials to foreign and international investors is critical for Tanzania’s economic prosperity. In order to attract, maintain, and sustain foreign companies as well as TNCs, these countries must provide favorable business environments, specifically economic business environments, through reciprocity duties.

Despite the fact that loyalty is well known and widely empirically examined, the concept of TNC loyalty to the host country is not documented in the literature (Jozef et al., Citation2019). Based on Jozef et al. (Citation2019), TNC loyalty to the host country is conceptualized as the willingness of TNC, as the host country’s customer, to continue proprietorship activities with the host country that provides raw materials, resources, a substantial market, and avenues that facilitate economies of scale (Usmed et al., Citation2021). Whereas, TNCs are explained by Finger and Svarin (Citation2018) as companies or corporations operating in more than one country rather than their home countries. In this view, host country means a foreign country where TNCs conduct business operations, while home country is referred to as the country where a TNC business was born (Duan et al., Citation2022). In this regard, TNCs are equipped with capital as well as goods and services, processes, trade names, marketing methods, knowledge, skills, technology, and most prominently, professional management. This implies that the TNCs have golden chances, and substantial resources to move operations or income-generating activities to countries where they think there is a more favorable economic business environment and where they can make more profits (Finger & Svarin, Citation2018; Medioli et al., Citation2023).

Frankly speaking, in recent years, some countries in the sub-Saharan economies, Tanzania included, have shown disloyal behaviors such as the exodus of foreign firms and reductions in strategic expansion and growth plans (Houreld et al., Citation2016; Kagochi & Durmaz, Citation2018; Ng’wanakilala, Citation2017). For example, TNCs reinvested earnings in Tanzania declined substantially between 2013 and 2022, by an average of almost 146.92% [Tanzania Investment Centre (TIC), Citation2018, Citation2023]. This behavior suggests limited levels of loyalty among TNCs in Tanzania. Meanwhile, studies (Kahyarara, Citation2021; Ngowi, Citation2018; Toloui, Citation2023) have connected TNCs disloyalty to the host country, Tanzania, with low performance in terms of sales, revenues, profitability, market shares, effectiveness, and efficiency, which are influenced by the economic business environment. According to Roche (Citation2015), Kahyarara (Citation2021), and Medioli et al. (Citation2023), to a large extent, interest rates, income, employment, labor costs, and consumer confidence level have been known as the main factors hindering TNCs performance. That is to say, economic business environments define the degree of successful performance of foreign firms, TNCs included (Farole et al., Citation2018). Despite the fact that the economic business environment influences TNC performance, there is no evidence that shows that TNC performance relates to TNC loyalty to the host country (Duan et al., Citation2022; Jozef et al., Citation2019).

However, TNC disloyalty can be associated with boredom, raising costs of production, reduced profitability, and failure to attain planned TNC strategic goals (Kahyarara, Citation2021; Ngowi, Citation2018), caused by huge interest rate amounts and the highest costs of trading across borders in the EAC region, among other things [World Bank (WB), 2019]. According to a study by Ngowi (Citation2018) and Kahyarara (Citation2021), the Tanzanian economic business environment is known for its high unemployment rate, low saving rates, very low income level, unstable consumer confidence level, and frequent changes in government economic policies that often affect the TNCs decisions and planning. On one side, Mehar (Citation2022), Khornen (Citation2005), and Farole et al. (Citation2018) established that a poor economic business environment negatively affects profitability, thus affecting reinvestment of earnings. According to Medioli et al. (Citation2023), uncompetitive economic business environments lead to TNCs income shifting to countries with competitive economic business environments. This implies that in an unfavorable host country’s economic and business environments, TNCs think of moving resources to another country with favorable economic and commercial climates. On the other side, the good economic business environment of the host country may be expected to significantly influence TNC loyalty towards the host country through reciprocal obligations. This underlines the utter importance of creating and maintaining an attractive and conducive economic business environment as an indispensable component for receiving the benefits of TNCs. With this reality, economic business environment conditions affect management decisions and planning and thus, the attainment of TNC performance goals (Egbunike & Okerekeoti, Citation2018). This means that economic business environment is a core determinant for TNC business continuity, which equates to TNC loyalty to the host country. But, very little is known about TNC loyalty to the host country in the economic business environment perspective.

Previous scholarly works have explored the effect of the host country’s economic business environment on the performance of TNCs. For instance, Egbunike and Okerekeoti (Citation2018) found a positive and significant relationship between macroeconomic business environment factors and the financial performance of TNCs. Similarly, Kahyarara (Citation2021) showed that a better macroeconomic business environment leads to better performance for TNC firms. Also, Strauss et al. (Citation2021) documented that improved economic business environments not only enhance better TNC performance in terms of revenues, return on investment, and profitability but also boost reinvestment of earnings in the host country. In addition, Roche (Citation2015) reported the adverse effect of higher taxes and unfair taxation on TNCs corporate performance in the host country. Moreover, Ta et al. (Citation2021) and Nazzal et al. (Citation2023) found a strong relationship between economic business environment factors and TNCs intentions toward investors. Meanwhile, Munyoro et al. (Citation2016) indicated that the poor economic business environment of a host country increases the costs of production and discourages intra-trade transfers and cross-border trade, thereby affecting many regional market-oriented TNCs (WB, 2020). Likewise, Medioli et al. (Citation2023) documented that unfavorable host country economic business environments offer an avenue for foreign firms to shift income generating activities to countries with competitive economic environments where they can immediately gain from their investments. Most of these studies have indicated that the host country’s economic business environment has a substantial influence on TNC performance (Mehar, Citation2022; Rani & Zergaw, Citation2017). However, these studies did not demonstrate how the economic business environment can influence TNC loyalty towards the host country. Nevertheless, the link between the economic business environment and TNC loyalty to the host country is not obvious, and it has not yet been empirically explored.

Notwithstanding, further studies such as Akpoviroro and Owotutu (Citation2018), Farole et al. (Citation2018), Khornen (Citation2005), and Bontempo (Citation2022) concentrated on examining the effect of the business environment on the performance of TNCs in the host country. Similarly, studies (Commander & Svejnar, Citation2011; Mwadime, Citation2020) reported a strong, positive, and significant relationship between the business environment and the performance of TNCs. All these scholars’ works above found a significant relationship between the business environment and the performance of TNCs. However, these studies were too wide in scope, as the concentration of the studies is all business environment components that include political, economic, socio-cultural, and technological business environments put together (Okechukwu & Okoronkwo, Citation2018). On the contrary, the current study focuses only on the economic business environment and TNC loyalty toward the host country. In summary, based on the argument above, the connection between the variables in the present study has not yet been empirically examined.

Besides, the loyalty of TNCs may be attributed to the dual embeddedness effect of host and home country, in the sense that TNCs integrate into host-country society and keep economic and cultural bonds with their home country (Duan et al., Citation2022). This implies that TNCs utilize their home country’s business environment while gaining access to valuable resources not available to their native-born country to enhance performance in the countries where they are hosted (Colic-Peisker & Deng, Citation2019). For example, TNCs obtain financial support from their home country’s banks when they fail to secure loans from their host country (Duan et al., Citation2021). Practically, considering dual embeddedness, TNCs benefit from their dual business environments, particularly host-and-home country economic business environment situations (Brzozowski et al., Citation2017; Duan et al., Citation2022). Thus, changes in the home country’s economic business environment may also affect their new investment decisions and reinvestment of earnings, and thus be likely to result in loyalty challenges in the host country (Duan et al., Citation2022). Evidence demonstrates that host-and home-country markets are very crucial in TNC trade since any alterations in export and import policies, trade agreements, or taxation policies between host and home countries impact TNCs business operations (Duan et al., Citation2022; Magai, Citation2022).

However, despite the fact that, loyalty of TNCs towards the host country may further be mediated by economic business factors of home countries, Farole et al. (Citation2018) and international production theory (IPT) emphasize that the host country economic business environment plays a key role in determining TNC business success and continuity, which equates to TNC loyalty (Dunning, Citation2001) through the reciprocity process. Moreover, based on social exchange theory (SET), if the host country makes available a conducive economic business environment for the TNC, the TNC is more likely to behave favorably by being loyal to the host country through the reciprocity principle, regardless of the situation of the home country’s economic business environment (Blau, Citation1964; Tegambwage & Kasoga, Citation2022b). Specifically, when the economic business environment in the host country is favorable, TNCs become successful (Kahyarara, Citation2021; Medioli et al., Citation2023; Oboreh & Arukaroha, Citation2021). Hence, TNCs demonstrate loyal behaviors to the host country based on reciprocity principle because positive reciprocity encourages loyalty (Tegambwage & Kasoga, Citation2022b, Citation2022c).

In summary, despite the fact that a number of previous studies have examined the relationship between economic business environment and performance, none of these studies examined TNC loyalty toward the host country from the perspective of the host country’s economic business environment. Also, considering the reciprocity benefits, TNC loyalty is crucial to the objectives of both TNC and the host country, as TNC must become more profitable and accumulate wealth, and the host country must nurture and sustain its economy. Therefore, the objective of the current investigation is to fill the gap by examining the influence of the host country’s economic business environment on TNC loyalty to the host country. This investigation is one of the first to explore TNC loyalty towards the host country from the viewpoint of the economic business environment of a country where TNCs operate. The present study aims to make a number of contributions to the TNC loyalty literature. First, it strengthens the theoretical concept of loyalty by proposing and testing a model of TNC loyalty towards the host country, mostly in the context of the host country economic business environment. Second, the study employs combinations of theories, including social exchange theory (SET) and international production theory (IPT) to a proposed and tested model of TNC loyalty to the host country. Third, this study fills the literature gap by linking the host country’s economic business environment and TNC loyalty towards the host country. Fourth, from a real-world perspective, the study will benefit host countries, mainly policymakers in low-income countries, by providing them with an understanding of the crucial differential contributions of the individual dimensions of the economic business environment on TNC loyalty. This will enable them to improve government policies and programs that capitalize on key economic business environment dimensions to attract TNCs, stimulate, elevate, and sustain TNC loyalty for economic growth and development. Finally, the findings on TNC industry sector type and experience help practitioners (TNCs and their investors) become familiar with the importance of the industry sector type to invest in and the duration of TNC years of operations in order to realize sufficient gain.

In order to accomplish the objective of the current study, this investigation attempts to answer the following questions:

Does the economic business environment in which TNCs operate affect TNC loyalty to the host country?

What are the differential effects of individual dimension(s) of the economic business environment on TNC loyalty to the host country?

What impact do the TNC internal specific advantageous factors exert on TNC loyalty through the host country economic business environment dimensions?

Do TNC internal-specific advantageous factors have a significant influence on TNC loyalty towards the host country?

This study is organized into five sections: first, the introduction; second, the theoretical and literature review; third, the methodology; fourth, the results and discussion of findings; and lastly, the conclusion, recommendations, research limitations, and future study direction.

2. Literature review

2.1. Theoretical review

2.1.1. The international production theory

The international production theory (IPT) of Dunning (Citation1977) is engaged to enlighten TNCs and their related facts regarding the location conditions of the host country, including the economic business environment, among others (Dunning & Rugman, Citation1985; Kimiagari et al., Citation2023). It explicitly explain three advantages, commonly known as ‘OLI’ for TNCs to operate successful in foreign country, namely ownership advantage (O), location advantage (L) and internalization (I) (Dunning, Citation2001). According to Dunning (Citation1977, Citation2001), these three advantages must be fulfilled for TNC to prosper in the host country. Thus, IPT explains the driving force behind TNCs involvement in cross-border business operations. It suggests that the foreign firm’s, TNCs included, operations in the host country will be successful given that the economic business environment of the country where the foreign firm operates is favorable. The theory also informs the advantages of economic business environment factors that enhance the TNC’s performance, and access to restricted markets and investment incentives such as tax relief, easy raw material and other resource acquisition, and low economic and financial risk. Moreover, the IPT reveals the effects of macroeconomic policies such as monetary policy in facilitating TNCs performance in terms of revenues, return on investments, return on assets, and profitability.

With regard to this, IPT additionally informs this study by providing the dimensions of the economic business environment such as interest rate, income, saving rates, consumer confidence level, employment rate, labor costs, and taxes that influence TNC profitability and eventually TNC business continuity in Tanzania (Dunning & Rugman, Citation1985), which equates to TNC loyalty in a host country. In this perspective, foreign firms, including TNCs, conduct business in countries where they feel they will achieve their set strategic financial and economic goals (Medioli et al., Citation2023) and hence business continuity (Kimiagari et al., Citation2023; Magai, Citation2022), leading to loyalty toward the host country. Moreover, the IPT provides an explanation of the foreign firm’s internal advantageous factors, such as size, industry type, and experience of TNCs in the host country. According to the IPT, these internal factors also play a significant role in influencing TNCs performance. Therefore, in this study, these factors are controlled in order to realize the effect of only the economic business environment on TNC loyalty. However, IPT does not demonstrate a clear link between economic business environment factors and TNC loyalty in a reciprocity duty. Thus, the social exchange theory was beneficial in order to explain the link between economic business environment and TNC loyalty through reciprocity obligations.

2.1.2. The social exchange theory

The social exchange theory (SET) by Blau (Citation1964) comprises economic and social relationships that happen when each party has something that the other party values. SET explains social existence in economic and social terms when partners perceive the ‘rules of exchange’, which integrate the dual components of reciprocity and repayment (Cropanzano & Mitchell, Citation2005). According to SET, social exchange relationships arise from a sequence of reciprocal transactions between parties that produce a pattern of obligations toward one another (Blau, Citation1964). Accordingly, the degree of commitment to the existing relationship is determined by the ongoing comparison of social and economic outcomes between a series of contacts between parties and alternatives (Blau, Citation1964). In other words, partners keep relationships because they expect benefits, which contain a sequence of exchanges that create commitments through reciprocal obligations. This suggests that any benefits gained create debts that can be comforted only by reciprocation. Thus, parties continue being loyal to each other through the principle of reciprocity as long as they obtain both adequate economic and social incentives (Tegambwage & Kasoga, Citation2023).

In agreement with SET, if the host country make available conducive economic business environment for the TNC, the TNC is more likely to behave favorably by being loyal to the host countries (Blau, Citation1964; Tegambwage & Kasoga, Citation2022b). specifically, when TNCs perceive that the host country has having their best interests at heart, by offering them a conducive economic business environment in all areas, including consistent and attractive economic policy that promote favorable bank interest rates, friendly excise duty, better income, and low labor costs, as well as, high saving rates, consumer confidence level, and sufficient employment opportunities. When economic business environment is favorable, TNCs become successful (Kahyarara, Citation2021; Oboreh & Arukaroha, Citation2021), and hence demonstrate loyal behaviors to the host country through reciprocity principle. This is because positive reciprocity encourages loyalty (Tegambwage & Kasoga, Citation2022b, Citation2022c). Therefore, the SET is used in illuminating the proposed positive effect of economic business environment on TNC loyalty.

2.2. Economic business environment

According to Khornen (Citation2005) and Mwadime (Citation2020), the economic business environment refers to external economic business environment operating factors that have an influence on the buying behaviors of consumers and businesses. These economic business factors were taxes, fees and charges, exchange rates, interest rates, income, saving rates, consumer confidence level, unemployment rate, labor costs, and excise duty. The economic business environment also comprises external business operating factors that describe economic variables and offer extensive opportunities for TNC businesses in the host country (Kim et al., Citation2018). These factors have an impact on the TNC’s operations outcomes since they have cost implications on production, prices of supply, exports, and imports of goods (Kahyarara, Citation2021). This implies that poor economic business environments result in higher costs of production, which lead to low profitability and eventually may lead to disloyal behaviors.

In the Tanzanian context, according to Ngowi (Citation2018) and Kahyarara (Citation2021), seven dimensions of the economic business environment affect the performance of TNCs, namely, bank interest rates, excise duty, income, saving rates, consumer confidence level, employment rate, and labor costs. Consequently, studies have described the Tanzanian economic business environment as characterized by the risk of high bank interest rates, labor costs, and a low employment rate, as well as difficulty in accessing financial assistance, including bank credits [World Bank (WB), 2019; Ngowi, Citation2018; Toloui, Citation2023]. These authors have also attributed Tanzania to having the highest costs of trading across borders in the region, unstable income, low savings rates, and a low consumer confidence level, among others. Nevertheless, different regimes have been implementing varying measures to address the aforesaid challenges that lead to difficult management decisions and unsatisfactory performance of TNCs in terms of sales, revenues, profitability, market share, and corporate image, among others (Ngowi, Citation2018). This, in turn, might be the reason for the limited loyalty challenges among TNCs in Tanzania. However, there is no empirical evidence that performance failure of TNCs in Tanzania lead to TNC disloyalty. Nevertheless, as said earlier, no prior research have attempted to examine the relationship between dimensions of economic business environment and TNC loyalty to the host country. Thus, the current study aims at exploring the link between economic business environment and TNC loyalty to the host country in reciprocity obligations.

2.3. Hypothesis development

Based on the literature arguments reviewed above, it is impetus to hypothesize that the host country’s economic business environment factors significantly affect TNC loyalty to the host country. However, as mentioned earlier, seven individual economic business environment factors influence TNCs performance in Tanzania, namely interest rate, excise duty, income level, saving rates, consumer confidence level, employment rate, and labor costs (Kahyarara, Citation2021; Ngowi, Citation2018). Accordingly, these dimensions of the economic business environment are expected to influence TNC loyalty in Tanzania. In addition, both coefficients and significance level of the hypotheses testing results for each dimension (p-value, p < 0.05) was used to confirm the hypotheses (Cohen et al., Citation2018). In this regard, the research questions are answered, and hence, the present study objectives are achieved. Thus, hypotheses of this study are stated as follow:

2.3.1. Interest rate

According to Mwadime (Citation2020), an interest rate is the entire amount an individual borrower is charged for borrowing money from a financial institution. It shows how much the cost of borrowing is (Mehar, Citation2022). According to Mehar (Citation2022), a low interest rate improves TNCs investments, significantly determines the performance of foreign firms, and boosts gross domestic product (GDP). Empirical studies (for example, Egbunike & Okerekeoti, Citation2018; Medioli et al., Citation2023), provide evidence that bank interest rates in a host country affect productive private sectors via the cost of debt and credit accessibility. Medioli et al. (Citation2023) indicated that through monetary policy, among other things, credit issues such as interest rates and charges affect productivity, and thus the interest rates could affect TNC loyalty to the host country. Furthermore, Mehar (Citation2018, Citation2022) and Githaiga (Citation2021) observed that commercial banks interests on the borrowed capital requirements of TNCs are included in the production costs. Based on SET, this implies that lower commercial banks interest rates improves the performance of TNCs in countries where they operate, which in turn boost TNC loyalty level through reciprocity obligations. Thus, the study hypothesizes that:

H1: The interest rate has a positive and significant influence on TNC loyalty to the host country.

2.3.2. Excise duty

According to the Tanzania Revenue Authority (TRA, Citation2023), excise duty is a tax charged on specific imports or locally manufactured goods and services. It is charged at varying rates based on the production within the country or sale of a good (Munyoro et al., Citation2016). In fact, excise duty seems to be a government mechanism for generating revenues from imports or exports of merchandise, and it significantly contributes to total revenues (Munyoro et al., Citation2016). However, sometimes, such excise duties can be higher, making the TNC-produced goods more costly (Mugano, Citation2015), causing low profitability. Weak excise duty practices in low-income host countries have a delicate and worsening domestic tax base that affects TNC performance (Brenton et al., Citation2011; Hamilton, Citation2009). However, Munyoro et al. (Citation2016) indicated that if excise duties are fair and simple, they play an important role in intra-trade transfers and cross-border trade since they discourage corruption and the smuggling of goods. Other studies (e.g. Mugano, Citation2015; Wilson et al., Citation2021) have demonstrated that fairness, clarity, and simple excise taxes save time and costs, enhance cross-border trade and intraregional transfers. In regard to reciprocity principle, friendly excise duty facilitate effectiveness in serving overseas and regional markets, and boost TNC profitability that is likely to elevate TNC loyalty level. Thus, based on SET, the current study assumes that:

H2: Excise duty has a positive and significant influence on TNC loyalty towards the host country

2.3.3. Income level

According to Githaiga (Citation2021), income is referred to as an amount of money received by an individual, an entity, or any other business, generated especially on a regular basis for work or through investment. It is a sum of money, property, or other transfers of value received over a certain period of time in exchange for goods or services (Egbunike & Okerekeoti, Citation2018). In income economies, Mehar (Citation2022) established that strong economic countries have higher income levels. Mehar indicated that income economies are associated with levels of income for people and corporate income that can be retained and reinvested. This may suggest that an income level determines the continued investment level of foreign firms, including TNCs, in the host country. With poor country economic situations, TNCs corporate income may be adversely affected, which can affect TNCs loyalty to the host country (Githaiga, Citation2021). Therefore, based on SET, countries with favorable economic business environment in terms of high income levels are expected to enhance the performance of TNCs (Kahyarara, Citation2021; Oboreh & Arukaroha, Citation2021), which in turn will lead to TNC loyalty through reciprocal obligations. Thus, this study proposes that:

H3: Income level has a positive and significant influence on TNC loyalty to the host country

2.3.4. Saving rate

The saving rate is described by Mehar (Citation2022) as a share of disposable income that is not consumed in the final consumption expenditure. It can also be defined as household savings divided by disposable income (Egbunike & Okerekeoti, Citation2018). Mehar (Citation2022) also argued that improved income in the host country plays an important role in saving. Nevertheless, Egbunike and Okerekeoti (Citation2018) reported a negative and significant effect of the saving rate on TNCs profitability. However, Medioli et al. (Citation2023) indicated that high-income economies boost saving rates, corporate retained earnings, investable funds in financial institutions, and inflows of foreign investment. This is to say, based on SET, countries with high saving rate are expected to lead to better performance of TNCs (Medioli et al., Citation2023), which in turn may lead to TNC loyalty through reciprocal obligations. Thus, it can be hypothesized that:

H4: Saving rate has a positive and significant influence on TNC loyalty to the host country

2.3.5. Consumer confidence levels

Consumer confidence level is a level of the host country’s economy shown by an economic indicator that assesses the degree of optimism that consumers feel about the overall state of the economy and the situation of personal finances in the host country (Nowzohour & Stracca, Citation2020). Sumarlinah et al. (Citation2022) reported that consumer confidence is one of the major indicators that generally determine the overall shape of the host country’s economy. It can serve as a means of depicting how confident consumers feel in regards to income stability when determining spending activities within the host country. In essence, Dimitris et al. (2009) established that if the host country’s economy expands, consumer confidence levels rise and consumers make more purchases. This means that TNCs are able to predict major changes in confidence and gauge the willingness of people to make new purchases (Nowzohour & Stracca, Citation2020; Dimitris et al., 2009). As a result, TNCs can adjust operations, increase investments, and reinvest their earnings. However, in cases where confidence is low and consumers are expected to reduce their spending, TNC manufacturers and service providers will tend to reduce production volumes, cut down inventories, and likely delay investing in new projects and facilities (Sumarlinah et al., Citation2022). Thus, drawing on SET, countries with favorable economic business environment in terms of consumer confidence level are likely to stimulate TNC loyalty through reciprocal obligations. Hence, the current study hypothesizes accordingly that:

H5: Consumer confidence level has a positive and significant influence on TNC loyalty to the host country

2.3.6. Employment rate

The employment rate has been explained as a measure that shows to what extent the host country’s available people to work have been used in productive activities [Organization for Economic Cooperation and Development (OECD), Citation2023]. In Tanzania, the employment rate is a ratio of the employed group to the working-age residents (Seleman, Citation2019). These rates are sensitive to the economic cycle and are significantly affected by the income support policies of the host country government (Thomas, Citation2023). According to Mei et al. (Citation2022), an improvement in employment rates leads to better public health, high economic growth, and a reduced crime rate, to mention but a few. This implies that a good employment rate results in economic prosperity for the host country, the attraction of new and potential TNCs, higher income, and assured job security within the country (Thomas, Citation2023). Consequently, Thomas (Citation2023; Zhu et al., Citation2022) suggests that host countries with high employment rates have a high rate of TNC attractiveness, retention, and satisfaction levels, which can result in TNCs’ loyal behaviors toward the host country. Thus, host countries with favorable economic business environment in terms of employment rate may encourage TNC loyalty level based on SET. Consequently, it can be hypothesized that:

H6: Employment rate has a positive and significant influence on TNC loyalty to the host country

2.3.7. Labor costs

According to Lai et al. (Citation2022), the cost of labor is described as the sum of all remunerations paid to employees, which include the cost of benefits an employee gets and the payroll taxes incurred by an employer. In fact, labor costs include expenses such as payroll taxes, overtime, health care, bonuses, sick days, vacation days, insurance, benefits, meals, supplies, and training costs (Oh & Park, Citation2022). Factors such as the kinds and types of TNC businesses, the industry type in which TNCs operate, the unit labor cost, geographical location, and the size of the TNCs contribute a significant percentage to the total costs of labor for the TNCs operations. It can sometimes be regarded as part of the overall TNC’s asset because higher wage rates and employee benefits make workers better off (Zhu et al., Citation2022), and also because, during uncertain situations, TNCs tend to increase investments in hiring more experts and professionals to maintain their level of profitability (Oh & Park, Citation2022).

Likewise, TNCs can maintain flexible operations in the host country through more competent employees who can make appropriate decisions over labor costs (Beladi et al., Citation2020). For example, Huang and Tarkom (Citation2022) document a positive relationship between cash flow unpredictability and labor investment efficiency. The findings also reported that dividend-paying TNCs are associated with higher labor investment efficiency. Moreover, insights from the neoclassical theory propose that inefficiencies in labor reduce TNC profitability and threaten TNC operations and growth in the host country (Cameron, Citation1999; Huang & Tarkom, Citation2022). Nevertheless, empirical evidence (e.g. Oh & Park, Citation2022; Taylor et al., Citation2019), suggests effective and efficient investment in labor enhances cash flows and helps the TNC’s business achieve the stated objectives. Therefore, in line with SET, host countries with favorable economic business environment in terms of lower labor costs can positively impact TNC loyalty through reciprocal obligations. Based on the empirical arguments, the current investigation hypothesizes that:

H7: Labor costs has a negative and significant influence on TNC loyalty to the host country

2.4. Conceptual framework

In accordance with the objective of the current study and the reviewed literature, the economic business environment forms the independent variables, while TNCs loyalty to the host country makes up the dependent variables. Based on the IPT theory and literature (Egbunike & Okerekeoti, Citation2018; Kim et al., Citation2018), that indicates that host country economic business environment (EBE) significantly influences TNCs performance; hence, the conceptual model () is grounded in the theoretical and literature review as well as primary data 2023 (Khornen, Citation2005; Sumarlinah et al., Citation2022).

3. Research methodology

The current study was attached to the positivism paradigm and adopted an explanatory cross-sectional research design to test the hypotheses (Githaiga, Citation2021). The positivist’s perspective was suitable for testing hypotheses and study the relationship between economic business environment and TNC loyalty, which can be measured at a specific point in time by focusing on study objectivity and evidences from empirical researches (Cohen et al., Citation2018; Saunders et al., Citation2019). It examines the relationship between the host country’s economic business environment and TNCs loyalty to the host country, as represented in .

3.1. Research design, sample size and data collection

This study employed an explanatory cross-sectional survey design because this design enabled the testing of hypotheses that clarified the relationship between the economic business environment and the TNCs loyalty (Hair et al., Citation2019). This is to say, it enabled the researcher to collect large amount of data using preset questions at a single point in time, and examine and explain the link between the study variables (Cohen et al., Citation2018). This design is suitable for answering study questions and objectives, which seek to obtain the influence of economic business environment on TNC loyalty to the host country. All TNCs in Tanzania were the target population, and the survey questionnaires were personally disseminated to all 161 TNCs in Tanzania. An investigator used the drop-and-pick technique as it involves personally submission and collection of survey questionnaires by the investigator (Matto, 2021). This strategy was suitable as it assisted the researcher to introduce the purpose and objective of the study, ensured quick submission and collection of completed questionnaire from the office of chief executive officers. The strategy also helped in cross checking the incomplete questionnaire as the approach offers an opportunity to request the executive to respond to the unattended question(s). Only one respondent from each TNC provided the information by filling out the questionnaire. Practically, the strategy ensured a higher response rate. With this regard, TNCs executives filled out the questionnaires and only top executive from each TNC provided the information. An 81.4% response rate was recorded from the 131 questionnaires. This response rate implies that the current study findings are suitable for generalization. Almost about 54.62% of the collected questionnaires were filled by chief executive officers on the same day of submission and the investigator collected them immediately. While 45.38% of the collected questionnaires were personally collected by the investigator on the regular follow-ups from chief executive officers at the head offices of TNCs. It is worth noting that the survey questionnaires were also personally collected from chief executive officers at the head offices of TNCs in Dar es salaam and Arusha commercial cities, where the majority of TNCs head offices in Tanzania are located (TIC, Citation2018). Free participation and anonymity were emphasized (Cooper et al., Citation1995).

3.2. Measurement of study variables

In order to maximize the construct validity and reliability, available items from the empirical literature were employed, and the variables were constructed with numerous items as suggested by Hair et al. (Citation2019). Specifically, economic business environment factors were derived from IPT theory and literature (Egbunike & Okerekeoti, Citation2018; Khornen, Citation2005). These include interest rate, excise duty, income level, saving rate, employment rate, consumer confidence level, and labor costs. While the items that operationalized loyalty in both behavioral and attitudinal terms for TNC loyalty were adapted from Swoboda and Hirschmann (Citation2016) and Tegambwage and Kasoga (Citation2022a, Citation2022b).

Based on Khornen (Citation2005) and Tegambwage and Kasoga (Citation2022a,Citationb), the five-point Likert scale was applied, ranging from (1) very poor to (5) very good for the economic business environment, while (1) strongly disagree to (5) strongly agree were used for TNC loyalty. The items for the questionnaire were adapted and modified to fit the TNCs context, and they were validated by TNCs business experts to enable face validity and item clarity (Hair et al., Citation2019). Some reviews and additional propositions were accommodated. A pilot test of the revised survey questionnaire was additionally conducted among the top executives of five dissimilar TNCs in Dar es Salaam before it was ratified as the final version for data collection.

3.3. Data analysis

Stata version 17 was used for confirmatory factor analysis (CFA) in the first stage in order to assess the validity of measurement variables. That is, CFA was performed to test whether data are suitable for hypothesized measurement model (Cohen et al., Citation2018). Also, the hierarchical multiple regression model (HMRM) was used to check the proposed hypotheses of this study because the model provides a chance to assess many variables and makes it easy to evaluate the causal-effect linkage at various levels between independent and dependent variables (Hair et al., Citation2019). Additionally, it provides an opportunity to analyze factors step by step and enable a researcher to observe changes in coefficient magnitudes, F-statistic, t-values and p-values, among other statistics, at different stages of analysis (Snijders & Bosker, Citation2012). Specifically, a HMRM was employed to create two models in order to achieve the current study objectives. The first model (1) checks the influence of economic business environment dimensions on TNC loyalty without the control factors as seen in equation (i), while the second model (2) checks the influence of the economic business environment dimensions on TNC loyalty in the presence of the control factors as seen in equation (ii), namely, TNC’s years of operations in Tanzania or experience (E), industry type (I), and TNC size (S). The study used control variables acquired by TNCs within the host country. This is because, these control variables have influence on TNC performance (Saridakis et al., Citation2019) and likely to result into a great probability of influencing TNC loyalty to the host country. Thus, they are controlled for protecting fake and false relationships. Moreover, both coefficients and significance level of the hypotheses testing results for each dimension at p-value less than 5% (p < 0.05) was applied (Cohen et al., Citation2018). These coefficients and p-value (p < 0.05) confirm whether the host country economic business environment influence TNC loyalty to the host country. Thus, the research questions are answered, and the study objectives of the study were achieved.

(i)

(i)

(ii)

(ii)

Whereas, LOY = TNC loyalty, α = constant coefficient, β = Regression coefficient; E = TNC experience; S = TNC size; I = Industry type; EBE = Economic business environment; EBE1 = Interest rate; EBE2 = Excise duty; EBE3 = Income level; EBE4 = Saving rate; EBE5 = Consumer confidence level; EBE6 = Employment rate; EBE7 = Labor costs.

4. Results and discussion

4.1. Measurement model assessment

An exploratory factor analysis (EFA) was conducted for economic business environment factors and TNC loyalty. The principal component analysis (PCA) was used to carry out the EFA. The output shows the variance at 61.79%. Moreover, the linkage of items to the extracted factors using a rotated component matrix sufficiently proved the relationship between variables and confirmed that seven itemized factors were used to measure the economic business environment and five itemized factors were used to measure TNC loyalty ().

Table 1. Assessment of measurement model.

The data’s appropriateness for factor analysis was tested by using Kaiser-Meyer Olkin’s (KMO), a measure for the adequacy of a sample, and Bartlett’s test of sphericity for each factor. The outcomes in show KMO values of 0.812 and 0.661 for the economic business environment and TNC loyalty, respectively. These values were significant (p˂0.001) and within the guideline above 0.5 (Hair et al., Citation2019), suggesting the sample size is adequate for factor analysis. Furthermore, all item factor loadings were significant and above 0.5, signifying an assured structure and confirming the measurements reliability (Hurley et al., Citation1997). Consequently, reliability was established by Cronbach alpha (CA) coefficients above the guided limit of 0.70 (Hair et al., Citation2019) (i.e. 0.822 and 0.739 for economic business environment and TNC loyalty, respectively) (). The convergent validity was confirmed by factor loadings, composite reliability (CR), and average variance extracted (AVE) (Fornell & Larcker, Citation1981), as presented in . Specifically, the values of factor loading, CR, and AVE that are greater than the minimum recommended guide of 0.50, 0.70, and 0.50, respectively, suggest convergent validity (Alarcon et al., Citation2015). Moreover, the bigger the square root of AVE in each column (and diagonally presented) than the correlations between the constructs in , the more discriminant validity evidence there is (Fornell & Larcker, Citation1981).

4.2. Descriptive statistics

indicates that Tanzania has a fair economic business environment in terms of labor costs, as demonstrated by a mean value of 3.008. However, the national economic business environment in terms of the interest rate, excise duty, income level, saving rate, consumer confidence level, and employment rate was not satisfactory, as evidenced by mean values ranging from 2.176 to 2.565 (). Accordingly, TNC loyalty to Tanzania was just fair, with an average mean of 3.803. These unsatisfactory findings are similar to the findings of Toloui (Citation2023), Ngowi (Citation2018), and Kahyarara (Citation2021), who reported an unconducive economic business environment in Tanzania despite the recent tremendous economic policy changes of different government regimes. The Shapiro-Wilk test indicates non-significant values (p > 0.001), implying a normal distribution of data within the sample (Snijders & Bosker, Citation2012). Generally, patterns of these descriptive statistics results indicate that economic business environment determine TNC loyalty. Besides, they provide insights for further statistical analyses for confirming hypotheses of this study.

Table 2. Descriptive statistics.

The loaded factors’ multicollinearity was tested by the variance inflation factor (VIF) for each of the measurements. demonstrates that VIF values are below 5, which is the most ideal (Hair et al., Citation2019). Hence, the components are not severely correlated with one another.

4.3. Correlation between constructs

The correlation between study variables is presented in . It is indicated that correlations power between constructs were not strong (r < 0.80), demonstrating that the current study was not exaggerated by the common method bias (Podsakoff et al., Citation2003). In addition, findings in discover that TNC loyalty has positive and significant (p < 0.05) correlations with all measurement variables. This means that the economic business environment is a determinant of TNC loyalty towards the host country. These results are coherent with the IPT theory (Saittakari et al., Citation2023; Kimiagari et al., Citation2023).

Table 3. Correlations between variables.

4.4. Hypotheses testing results

The hypotheses testing findings are represented in . The findings for the full model (Model 2) reveals that economic the dimensions of the economic business environment, such as income level (β = 0.163, p < 0.05), saving rate (β = 0.129, p < 0.001), consumer confidence level (β = 0.220, p < 0.05), and employment rate (β = 0.270, p < 0.05), have positive and significant influence on TNC loyalty, backing up H3, H4, H5, and H6. The labor costs have negative and significant influence on TNC loyalty, hence, supporting H5. The interest rates and excise duty, have positive and insignificant influence on TNC loyalty, thus, H1 and H2 are rejected.

Table 4. Direct effect on TNC loyalty.

The overall economic business environment in Model 2 clarifies 23.20% of the variance in the construct of TNC loyalty. This means that there are other dimensions of business environments, e.g. technological, socio-cultural and political factors which influence TNC loyalty in Tanzania. The results also disclose that the dimension of the economic business environment exert different intensity on TNC loyalty, with employment rate having the largest influence, next is consumer confidence level, followed by income level, and saving rate.

4.5. Robustness checks

The robustness test was carrying out to confirm the findings in . Specifically, in model 2, a regression analysis was run to find the determinant strength of economic business environment factors on TNC loyalty in the existence of the control variables (TNC experience in the host country, TNC industry type and TNC size). The outcome shows that TNC experience in Tanzania (β = 0.205, p < 0.001) and TNC industry type (β = 0.037, p < 0.05), have positive and significant influence on TNC loyalty. TNC size has positive and insignificant influence on TNC loyalty. The results in model 2 are similar to findings of Model 1 in terms of significance levels, but with changes in the sizes of the coefficients because of the effects of the control variables on TNC loyalty.

4.6. Discussion of findings

The objective of this study was to investigate the influence of the economic business environment on TNC loyalty to the host country. Results in show that five out of seven dimensions of the business environment have a significant influence on TNC loyalty. Specifically, the four dimensions of income level, saving rate, consumer confidence level, and employment rate exert a positive and significant influence on TNC loyalty based on SET. Meanwhile, the findings suggest that high income levels, savings rates, consumer confidence levels, and employment rates boost TNC loyalty towards the host country. Results indicated that labor costs have a negative and significant influence on TNC loyalty through reciprocal obligations. This implies that the higher the labor costs, the less loyalty TNCs have. This can be attributable to the increase in the cost of production, hence the reduced profit. Meanwhile, these findings are consistent with those of Ersin and Karakeçe (Citation2023), Issah and Antwi (Citation2017) and Mwangi and Wekesa (Citation2017), who found significant impacts of interest rates and employment rates on investment and firm performance in the host country.

Besides, the differential influence of different dimensions of the economic business environment on TNC loyalty can be credited to the complex interplay of number of business environment factors such as host country regulatory conditions, stability of host national or regional markets, prospects of economic growth, as well as, alignment or not alignment of TNC goals and strategies (Ersin & Karakeçe, Citation2023). This implies that some dimensions of economic business environment are less relevant while others offer opportunities or challenges. Moreover, decisions of TNCs about loyalty to the host country may further pivot on the capability to adapt to specific host country economic business environment conditions, which may lead to variations in the significance of these dimensions.

Likewise, these results suggest that the host country’s economic business environment significantly affects TNCs strategies and decisions, which power TNCs operations continuity in the host country (Ersin & Karakeçe, Citation2023; Issah & Antwi, Citation2017). Moreover, these findings are consistent with IPT theory, which argues that the host country’s economic business environment determines the prosperity of TNCs, which is crucial for continued investments, reinvesting of earnings, and helpful recommendations in favor of the host country.

Moreover, the results in disclose that employment rate is the super predictor of TNC loyalty in Tanzania, followed by consumer confidence level, income level, and savings rate. This suggests that a high level of employment rate, consumer confidence level, income level, and saving rate are crucial for improving, maintaining, and sustaining TNC loyalty in Tanzania under the reciprocity principle. In the same way, drawing on SET, the better the host country’s economic business environment, the more profitable TNCs are, and therefore, they continue operations, which equates to TNC loyalty to the host country through reciprocal obligations. Hence, the study underlines the prominence of a relatively better economic business environment as a necessary component to sustain TNC loyalty.

Furthermore, the results that TNC experience and industry type positively and significantly influence TNC loyalty (), mean that many years of operation in a given host country of TNC and continuous improvement in specific industry sector policies, regulations, and guidelines boost TNC loyalty to the host country through reciprocity duties. TNC size has a positive and insignificant impact on TNC loyalty. This means that the size of the TNCs influences TNC loyalty with minimal significance. However, Narula and Pineli’s (2019) study established that some foreign firms maintain businesses in the country where they have subsidiaries because of high switching costs linked to the nature of the assets invested, e.g., high-value or physically large industrial equipment and buildings, and the risk of losing business licenses, trademarks, and other intangible assets acquired over a period of time to local firms. This implies that foreign firms, including TNCs, may be loyal to the host country not because of favorable conditions in the host country’s economic business environment but because they lack other options other than continuing to operate in the already-destined country.

5. Conclusion and implications

The study empirically explored the influence of the economic business environment on TNC loyalty to the host country. The results indicate that the economic business environment exerts a positive and significant influence on TNC loyalty through income level, saving rate, consumer confidence level, and employment rate. The labor cost has a negative and significant impact on TNC loyalty. However, the interest rate and excise duty have an insignificant influence on TNC loyalty. Among all this study’s dimensions, the employment rate is the highest predictor of TNC loyalty, followed by the host country’s consumer confidence level, income level, and saving rate. This means that a high level of employment rate, consumer confidence level, income level, and saving rate are crucial for stimulating, building, and sustaining TNC loyalty to the host country, Tanzania. Hence, the achievement of sustainable economic growth.

The current study’s results have important implications for academics as well as practitioners. For academics, the study builds up the theoretical concept of loyalty by proposing and testing a model of TNC loyalty to the host country by integrating SET and IPT, specifically from the perspective of the economic business environment. No prior study has connected the host country’s economic business environment and TNC loyalty to the host country. Meanwhile, the findings of the current study have significant practical implications, as follows: First, Tanzanian income levels can affect the pricing of products and the market segmentation strategies used by TNCs. For example, luxury products may be more profitable for those with higher average incomes, while lower incomes may necessitate more cost-sensitive pricing. Second, investment decisions can be impacted by the saving rate; a higher rate could point to a developing domestic financial services sector, while a lower rate might call for different tactics like credit-based sales. Third, decisions about manufacturing and outsourcing can be influenced by labor costs, since lower labor costs could make Tanzania a desirable place to produce, while higher labor costs might force TNCs to automate processes or look into alternative markets. Fourth, product demand, marketing tactics, and the launch of new products can all be impacted by consumer confidence levels. While lower confidence may result in more cautious marketing and product development, higher confidence may stimulate spending and the launch of new items. Lastly, a high employment rate may result in a competitive labor market, necessitating greater compensation packages to attract top talent. Conversely, a low employment rate may offer a larger pool of possible employees. These factors might have an impact on recruitment and human resource tactics. In view of the practical implications, TNCs can influence the economic business environment as a vital source of information to sharpen their strategies and shape decisions by, among other things: One is having close monitoring of economic business factors such as consumer confidence level, income level, labor costs, and employment rate, among others. Two, fine-tune the pricing strategy and assess the feasibility of expanding into new market projects and ventures. Three, be aware of the conditions of the host country’s local market, such as consumer behaviors, regulatory frameworks, and labor, among others. This provides an opportunity for TNCs to modify goods, services, and distribution networks. Lastly, utilize economic data to make investment risk and opportunity assessments that enable TNCs make informed decisions on various business areas and optimize resource allocation. In actual fact, economic business environment serves as a compass that guides TNCs in steering the complex global setting and making decisions that align long term objectives

Overall, from a practical viewpoint, the study will benefit host countries, mainly policymakers in low-income countries, by providing them with knowledge of the differential contributions of individual dimensions of the economic business environment on TNC loyalty, enabling them to make policies that concentrate on the main economic business dimensions to attract, retain, and sustain TNCs for achieving economic development. More specifically, policymakers should ensure consistent policy addressing income-generating issues, strengthening savings habits, and a higher level of consumer confidence and employment in order to boost and sustain TNC loyalty. Moreover, based on the findings the government of Tanzania may consider to collaborate with financial institutions to offer savings programs or credit facilities for encouraging consumers to save and invest; invest in quality local workforce development programs to improve labor skills and productivity and make a more skilled and competitive workforce that reduce labor costs for TNCs in the long term; implement TNC satisfaction surveys and loyalty programs to gauge and improve TNC loyalty as well give incentives for new investments, reinvestments of earning, repeat business and positive recommendations in favor of a host country; encourage formation of strategic partnerships with local businesses and governments to gain support and insights into TNC operations and TNC preferences; maintain a close eye on TNCs and TNC loyalty programs as the government identify successful approaches from other host countries and adapt them in Tanzania.

5.1. Limitations and directions for future studies

This study concentrated on the influence of the economic business environment on TNC loyalty. Therefore, future research should examine the influence of other business environment dimensions (technological, social-cultural, and political) on TNC loyalty. This study was also restricted to seven economic business environment dimensions; future studies should focus on other dimensions such as taxes and fees, inflation rate, exchange rates, and unemployment rate, among others (Islam, Citation2023). Moreover, the economic business environment is contextual in nature (Farole et al., Citation2018); hence, future research should confirm the proposed model in other countries, specifically low-income ones. In addition, the present study focused on the single host country economic business environment, neglecting the dual embeddedness effect of the home country’s economic business environment (Duan et al., Citation2022). Future research may attempt to examine TNC loyalty from a host-and-home economic business environment perspective based on reciprocity obligations in terms of dual entrepreneurial ecosystems (Duan et al., Citation2022). Finally, the bibliographic review, which could broaden insights and possibly introduce other variables to the model that previous works have not considered, was not conducted due to financial and time constraints. Therefore, this study suggests future research consider a bibliographic review and the inclusion of other variables.

Authors’ contributions

MAR: conceptualization, writing, data analysis, and interpretation; PSM: editing and reviewing the manuscript.

Acknowledgements

Not Applicable.

Disclosure statement

No potential conflict of interest was reported by the author(s).

Additional information

Notes on contributors

Mshindi Andrew Rwamuhuru

Mshindi Andrew Rwamuhuru is PhD candidate at the University of Dodoma, Department of Business Administration and Management, Dodoma, Tanzania, His areas of expertise include international business, foreign direct investments (FDIs) and international trade.

Petro Sauti Magai

Petro Sauti Magai is a senior lecturer in International Trade and Economics, University of Dar es Salaam Business School, Department of General Management, Dar es Salaam – Tanzania. He is highly interested in the areas of trade and economics, business management, project management and foreign direct investments (FDIs).

References

- Akpoviroro, K. S., & Owotutu, S. O. (2018). Impact of external business environment on organizational performance. International Journal of Advance Research and Innovative Ideas in Education, 4(3), 1–20.

- Alarcon, D., Sanchez, J. A., & De Olavide, U. (2015). Assessing convergent and discriminant validity in the ADHD-R IV rating scale: User-written commands for Average Variance Extracted (AVE), Composite Reliability (CR), and Heterotrait-Monotrait ratio of correlations (HTMT) In. Spanish STATA Meeting, 39, 1–39.

- Beladi, H., Cheng, C., Hu, M., & Yuan, Y. (2020). Unemployment governance, labour cost and earnings management: Evidence from China. The World Economy, 43(10), 2526–2548. https://doi.org/10.1111/twec.12923

- Blau, P. M. (1964). Exchange and power in social life. John Wiley and Sons.

- Bontempo, P. C. (2022). Countries’ governance and competitiveness: Business environment mediating effect. RAUSP Management Journal, 57(1), 49–64. https://doi.org/10.1108/RAUSP-11-2020-0253

- Brenton, P., Saborowski, C., Staritz, C., & Uexkull, V. E. (2011). Assessing the adjustment implications of trade policy changes using Trist (tariff reform impact simulation Tool). World Bank. https://doi.org/10.1017/S1474745610000509

- Brzozowski, J., Cucculelli, M., & Surdej, A. (2017). The determinants of transnational entrepreneurship and transnational ties’ dynamics among immigrant entrepreneurs in ICT sector in Italy. International Migration, 55(3), 105–125. https://doi.org/10.1111/imig.12335

- Cameron, L. A. (1999). Raising the stakes in the ultimatum game: Experimental evidence from Indonesia. Economic Inquiry, 37(1), 47–59. https://doi.org/10.1111/j.1465-7295.1999.tb01415.x

- Cohen, L., Mannion, L., & Morrison, K. (2018). Research methods in education (8th ed.). Routledge.

- Colic-Peisker, V., & Deng, L. (2019). Chinese business migrants in Australia: Middle-class transnationalism and ‘dual embeddedness. Journal of Sociology, 55(2), 234–251. https://doi.org/10.1177/1440783319836281

- Commander, S., & Svejnar, J. (2011). Business environment, exports, ownership, and firm performance. Review of Economics and Statistics, 93(1), 309–337. https://doi.org/10.1162/REST_a_00135

- Cooper, D. R., Emory, C. W., & Irwin, R. D. (1995). Business research methods. Inc., Chicago.

- Cropanzano, R., & Mitchell, M. S. (2005). Social exchange theory: An interdisciplinary review. Journal of Management, 31(6), 874–900. https://doi.org/10.1177/0149206305279602

- Duan, C., Kotey, B., & Sandhu, K. (2021). The effects of cross-border E-commerce platforms on transnational digital entrepreneurship: Case studies in the Chinese immigrant community. Journal of Global Information Management,), 30(2), 1–19. https://doi.org/10.4018/JGIM.20220301.oa2

- Duan, C., Kotey, B., & Sandhu, K. (2022). Towards an analytical framework of dual entrepreneurial ecosystems and research agenda for transnational immigrant entrepreneurship. Int. Journal of International Migration and Integration, 23(2), 473–497. https://doi.org/10.1007/s12134-021-00847-9

- Dunning, J. H. (1977). Trade, location of economic activity and the MNE: A search for an eclectic approach. In The international allocation of economic activity: Proceedings of a Nobel symposium held at Stockholm. (pp. 395–418). Palgrave Macmillan UK.

- Dunning, J. H. (2001). The eclectic (OLI) paradigm of international production: Past, present and future. International Journal of the Economics of Business, 8(2), 173–190. https://doi.org/10.1080/13571510110051441

- Dunning, J. H., & Rugman, A. M. (1985). The influence of Hymer’s dissertation on the theory of foreign direct investment. The American Economic Review, 75(2), 228–232. https://www.jstor.org/stable/1805601

- Egbunike, C. F., & Okerekeoti, C. U. (2018). Macroeconomic factors, firm characteristics and financial performance: A study of selected quoted manufacturing firms in Nigeria. Asian Journal of Accounting Research, 3(2), 142–168. https://ssrn.com/abstract=3090767 https://doi.org/10.1108/AJAR-09-2018-0029

- Ersin, İ., & Karakeçe, E. (2023). Analysis of the effects of macroeconomic factors on entrepreneurship: An application on E7 countries. IGI Global, 643–659. https://doi.org/10.4018/978-1-6684-7460-0.ch035

- Farole, T., Hallak, I., Harasztosi, P., & Tan, S. W. (2018). Business Environment and Firm Performance in European Lagging Regions (December 18, 2017). World Bank Policy Research Working Paper No. 8281, Available at SSRN: https://ssrn.com/abstract=3090767

- Finger, M., & Svarin, D. (2018). Transnational corporations and the global environment. https://doi.org/10.1093/acrefore/9780190846626.013.489

- Fornell, C., & Larcker, D. F. (1981). Evaluating structural equation models with unobservable variables and measurement error. Journal of Marketing Research, 18(1), 39–50. https://doi.org/10.1177/002224378101800104

- Giroud, A., & Azémar, C. (2023). World investment report 2022: International tax reforms and sustainable investment: United Nations Conference on Trade and Development. Geneva and New York, 219. ISBN: 978-9211130492. https://doi.org/10.1057/s42214-023-00148-1

- Githaiga, P. N. (2021). Human capital, income diversification and bank performance: An empirical study of East African banks. Asian Journal of Accounting Research, 6(1), 95–108. https://doi.org/10.1108/AJAR-06-2020-0041

- Hair, J. F., Risher, J. J., Sarstedt, M., & Ringle, C. M. (2019). When to use and how to report the results of PLS-SEM. European Business Review, 31(1), 2–24. https://doi.org/10.1108/EBR-11-2018-0203

- Hamilton, A. (2009). Discussing Existing TRIST Tools for Twelve Developing Countries: Bolivia, Burundi, Ethiopia, Jordan, Kenya, Madagascar, Malawi, Mozambique, Nigeria, Seychelles. World Bank.

- Houreld, K., Blair, E., & Char, P. (2016). Exclusive: Foreign firms hit by tax demands rethink Tanzanian expansion, Routers. Available at: relocationafrica.com/foreign-firms-hit-tax-demands-rethink-tanzanian-expansion/

- Huang, X., & Tarkom, A. (2022). Labor investment efficiency and cash flow volatility. Finance Research Letters, 50, 103227. https://doi.org/10.1016/j.frl.2022.103227

- Hurley, A. E., Scandura, T. A., Schriesheim, C. A., Brannick, M. T., Seers, A., Vandenberg, R. J., & Williams, L. J. (1997). Exploratory and confirmatory factor analysis: Guidelines, issues, and alternatives. Journal of Organizational Behavior, 18(6), 667–683. https://www.jstor.org/stable/3100253 https://doi.org/10.1002/(SICI)1099-1379(199711)18:6<667::AID-JOB874>3.0.CO;2-T

- Iršová, Z., & Havránek, T. (2013). Determinants of horizontal spillovers from FDI: Evidence from a Large meta-analysis. Determinants of Horizontal Spillovers from FDI: Evidence from a Large Meta-Analysis’, 42, 1–15. https://doi.org/10.1016/j.worlddev.2012.07.001

- Islam, R. (2023). The impact of macroeconomic factors on profitability of commercial Bank in the UK Md Rakibul Islam. International Journal for Multidisciplinary Research, 5(1), 1–19.

- Issah, M., & Antwi, S. (2017). Role of macroeconomic variables on firms’ performance: Evidence from the UK. Cogent Economics & Finance, 5(1), 1–18. https://doi.org/10.1080/23322039.2017.1405581

- Jozef, E., Kumar, K. M., Iranmanesh, M., & Foroughi, B. (2019). The effect of green shipping practices on multinational companies’ loyalty in Malaysia. The International Journal of Logistics Management, 30(4), 974–993. https://doi.org/10.1108/IJLM-01-2019-0005

- Kagochi, J., & Durmaz, N. (2018). Assessing RTAs inter-regional trade enhancement in Sub-Saharan Africa. Cogent Economics & Finance, 6(1), 1482662. https://doi.org/10.1080/23322039.2018.1482662

- Kahyarara, G. (2021). Macroeconomic environment and firm level performance in Tanzania. African Journal of Economic Review, 9(2), 223–237.

- Khornen, K. (2005). Foreign direct investment in a changing political environment: Finnish investment decisions in South Korea, Doctoral thesis, ACTA University. http://urn.fi/URN:ISBN:951-791-973-5

- Kim, J., Zheng, T., & Schrier, T. (2018). Examining the relationship between the economic environment and restaurant merger and acquisition activities. International Journal of Contemporary Hospitality Management, 30(2), 1054–1071. https://doi.org/10.1108/IJCHM-07-2016-0346

- Kimiagari, S., Mahbobi, M., & Toolsee, T. (2023). Attracting and retaining FDI: Africa gas and oil sector. Resources Policy, 80, 103219. https://doi.org/10.1016/j.resourpol.2022.103219

- Lai, S., Wang, Q. S., Pi, S., & Anderson, H. (2022). Does directors’ and officers’ liability insurance induce empire building? Evidence from corporate labor investment. Pacific-Basin Finance Journal, 73(1), 101753. https://doi.org/10.1016/j.pacfin.2022.101753

- Magai, P. S. (2022). Trade and foreign direct investment in Tanzania: Do they matter for economic growth? Tanzanian Economic Review, 11(2), 22–40. https://doi.org/10.56279/ter.v11i2.82

- Medioli, A., Azzali, S., & Mazza, T. (2023). High ownership concentration and income shifting in multinational groups. Management Research Review, 46(1), 82–99. https://doi.org/10.1108/MRR-02-2021-0141

- Mehar, M. A. (2022). Role of monetary policy in economic growth and development: From theory to empirical evidences. Asian Journal of Economics and Banking, 7(1), 99–120. https://doi.org/10.1108/AJEB-12-2021-0148

- Mehar, M. R. (2018). Analysis of the capital structure and banks performance: Evidence from Pakistan. Journal of Business & Financial Affairs, 7(2), 1–5. https://doi.org/10.4172/2167-0234.1000343

- Mei, Y., Liu, W., Wang, J., & Bentley, Y. (2022). Shale gas development and regional economic growth: Evidence from Fuling China. Energy, 239, 122254. https://doi.org/10.1016/j.energy.2021.122254

- Mugano, G. (2015). The Impact of trade liberalisation on Zimbabwe Nelson Mandela. Metropolitan University, 27(2), 1–29. ISBN 978-0-620-66504-9.

- Munyoro, G., Chiinze, B., & Munyoro Dzapasi, Y. (2016). The Role of customs and excise duties on small enterprises: A case study of women cross border traders. Africa Development and Resources Research Institute Journal, 25(103), 25–48. https://doi.org/10.55058/adrrij.v25i10.299

- Mwadime, G. S. (2020). Macro Environmental Factors and Performance of Multinational Corporations in Kenya. University of Nairobi. Doctoral dissertation. http://erepository.uonbi.ac.ke/handle/11295/153322

- Mwangi, E. N., & Wekesa, S. (2017). Influence of economic factors on organizational performance of airlines: A case study of Kenya Airways Ltd. IOSR Journal of Humanities and Social Science, 22(05), 08–14. https://doi.org/10.9790/0837-2205050814

- Nazzal, A., Sánchez-Rebull, M. V., & Niñerola, A. (2023). Foreign direct investment by multinational corporations in emerging economies: A comprehensive bibliometric analysis. International Journal of Emerging Markets, 1746–8809. https://doi.org/10.1108/IJOEM-12-2021-1878

- Ng’wanakilala, F. (2017). Tanzania’s economic growth slowed by policy uncertainty, credit squeeze-World Bank, Reuters, available at: https://www.reuters.com/article/tanzania-economy-idUSL3N1HJ3PN

- Ngowi, P. (2018). Selected industrialization challenges in Tanzania. https://www.thecitizen.co.tz/tanzania/news/- selected-industrialisation-challenges-in-tanzania-2657734

- Nowzohour, L., & Stracca, L. (2020). More than a feeling: Confidence, uncertainty, and macroeconomic fluctuations. Journal of Economic Surveys, 34(4), 691–726. https://doi.org/10.1111/joes.12354

- Oboreh, L. E., & Arukaroha, J. (2021). Host country characteristics and performance of multinational companies. International Journal of Innovative Finance and Economics, 9(2), 117–128.

- OECD. (2023). Employment Rate (Indicator), https://doi.org/10.1787/1de68a9b-en(Accessed on 31 January 2023).

- Oh, H., & Park, S. (2022). Does corporate governance affect labor investment efficiency? Sustainability, 14(8), 4599. https://doi.org/10.3390/su14084599

- Okechukwu, E. U., & Okoronkwo, B. O. (2018). Evaluation of technological environment on organizational performance among selected medium scale enterprise in Enugu state. International Journal of Academic Research in Economics and Management Sciences, 7(3), 267–280. https://doi.org/10.6007/IJAREMS/v7-i3/4754

- Pandya, S. S. (2016). Political economy of foreign direct investment: Globalized production in the twenty-first century. Annual Review of Political Science, 19(1), 455–475. https://doi.org/10.1146/annurev-polisci-051214-101237

- Podsakoff, P. M., MacKenzie, S. B., Lee, J.-Y., & Podsakoff, N. P. (2003). Common method biases in behavioral research: A critical review of the literature and recommended remedies. The Journal of Applied Psychology, 88(5), 879–903. https://doi.org/10.1037/0021-9010.88.5.879

- Rani, D. M., & Zergaw, L. N. (2017). Bank specific, industry specific and macroeconomic determinants of bank profitability in Ethiopia. International Journal of Advanced Research in Management and Social Sciences, 6(3), 74–96.

- Roche, G. A. G. (2015). Taxation and its negative impact on business investment activities. Economic History Year Book, 8(1), 1–10.

- Saittakari, I., Ritval, T., & Beugelsdijk, S. (2023). A review of location, politics, and the multinational corporation: Bringing political geography into international business. Journal of International Business Studies, (2023), 1–27. https://doi.org/10.1057/s41267-023-00601-6

- Saridakis, G., Idris, B., Hansen, J. M., & Dana, L. P. (2019). SMEs’ internationalisation: When does innovation matter? Journal of Business Research, 96(1), 250–263. https://doi.org/10.1016/j.jbusres.2018.11.001

- Saunders, M., Lewis, P., & Thornhill, A. (2019). Research Methods for Business Students, 8th ed. Qualitative Market Research: An International Journal.

- Seleman, M. (2019). Policy Brief: How to reduce youth unemployment in Tanzania.