Abstract

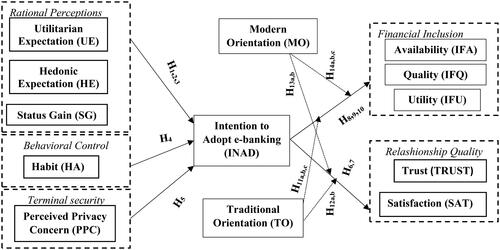

This study examines the antecedents of Mobile banking (M-banking) app adoption, explores post-adoption effects, and tests the moderating effect of consumer status orientation on the relationship between adoption intention and its consequences. The conceptual model hypothesized 20 relationships, including 10 moderations. Hypotheses are tested using the structural equation modeling method (PLS-SEM) on a sample of 509 individuals. The results reveal that the main variables of ‘users’ rational perception, namely behavioral control and terminal security, significantly influence the intention to adopt the application, which in turn impact relationship quality and financial inclusion. However, hedonic expectations do not have a significant impact on the intention to adopt the application; the impact of culture in these relationships is further established; indeed, traditional and modern values moderate the impact of the intention to adopt the application on key post-adoption factors, financial inclusion, and relationship quality. The main recommendations and limitations of the research are discussed.

Reviewing Editor:

Introduction

Over the past three decades, technological advancements have influenced how banks interact with their consumers. They have introduced alternative and more sophisticated distribution channels to support their customer relationship strategy, such as mobile banking (M-banking) (Hoehle et al., Citation2012). Mobile banking facilitates banking transactions via a mobile terminal such as a cell phone (Glavee-Geo et al., Citation2017; Singh & Srivastava, Citation2018). This technology includes basic services such as bank statements, money transfers, other electronic payment options, and information-based financial services. Thus, M-banking enables users to pay, save, borrow, and invest through digital means, which is crucial to increasing financial inclusion (World Bank Group, Citation2019). These customizable solutions enable financial institutions to offer their customers value-added services, reduce financial operating costs, and lower financial fees compared with conventional banking services (Baabdullah et al., Citation2019; Singh et al., Citation2020). Given the benefits of M-banking, many banks worldwide gain a competitive advantage by investing in increasing M-banking adoption (Baabdullah et al., Citation2019).

There is growing interest in mobile transactions in Cameroon as significant investments were made in technical infrastructures such as backbone networks and submarine optic fiber. Although the financial landscape is diverse and includes 18 banks and 412 MFIs, the Internet penetration rate stands at 45.6% for a total population of 28.28 million (We Are Social & Meltwater, Citation2023; World Bank Group, Citation2019). Despite an account ownership rate of nearly 34%, financial inclusion in Cameroon is poor (World Bank Group, Citation2019). Over the past five years, banks in Cameroon have launched various mobile apps to improve their customer experience. Despite the advantages of M-banking, its adoption remained lower than expected. According to the banks’ internal reports, the use of M-banking services by customers remains below 50%. Thus, the Cameroonian market is still at an early stage of its M-banking ecosystem.

Several types of research have been conducted to understand the adoption and use of electronic banking (Hoehle et al., Citation2012; Song et al., Citation2015). These studies intensively focused on the factors inducing M-banking adoption, with limited interest in the post-adoption effects (Tam & Oliveira, Citation2017). In an attempt to fill this gap, a few recent studies have examined post-adoption effects such as e-fidelity (López-Miguens & Vázquez, Citation2017), relationship quality (Arcand et al., Citation2017), financial inclusion (Kamdjoug et al., Citation2021). Considering that behavior is determined by values and social status aspirations (Eastman et al., Citation1999), adopting technological innovations may shape the individual’s social status. In Africa, consumers are influenced by both global and local consumer cultures (Diop & Merunka, Citation2013), with modern and traditional values and aspirations coexisting. Consumption of innovative products/services (Varman & Belk, Citation2011) is a way of seeking a ‘Western experience’, an opportunity to assert ‘one’s grounding in modernity but at the same time they do not entirely reject their traditional values (Diallo et al., Citation2015). So they attempt to reconcile modern influences with traditional values and struggle with the inherent conflicts that may occur between the two orientations (Nguyen et al., Citation2009). These new expectations of African consumers are not adequately addressed in the literature, especially the adoption of innovations (Diallo et al., Citation2015). Therefore, this study examines the moderating role of the status orientation of the consumer on the relationship between M-banking adoption and potential post-adoption outcomes.

More specifically, this study attempts to answer the following questions: what factors determine the adoption of the M-banking application among customers in Cameroon? Does M-banking adoption enhance trust, customer satisfaction and financial inclusion? Could the cultural orientation of consumers moderate the impact of M-banking adoption on these post-adoption factors? In other words, this study seeks to identify the factors determining the adoption of the M-banking application, particularly in the market where this technology is at an early stage. To answer these questions and fill gaps in the literature, we begin by presenting the theoretical background and research model, followed by the research methodology. We will then present our results and analyses, discussion, implications, limitations and future directions of the research.

Theoretical background and research model

Theoretical background

Several theoretical models have been used to explain technology adoption in mobile banking (Ha et al., Citation2012). Most of these models learn from cognitive and social theories (Liu et al., Citation2008; Pedersen, Citation2005), which include: the Theory of Reasoned Action (TRA), the Technology Acceptance Model (TAM), the Theory of Planned Behavior (TPB), the Diffusion of Innovation Theory (IDT), the Social Cognitive Theory (SCT), and the Unified Theory of Technology Acceptance and Use Model (UTAUT). Among these models, TAM has been one of the most widely used models (Dauda & Lee, Citation2015; Shaikh & Karjaluoto, Citation2015). However, the TAM model incorporates only two factors, namely perceived usefulness (PU) and perceived ease of use (PEOU), and does not include any other external factors, which limits its ability to explain behavior (Venkatesh et al., Citation2003). To address these limitations, Venkatesh et al. (Citation2003) integrated eight major theories into one model: the Unified Theory of Technology Acceptance and Use (UTAUT). Song et al. (Citation2015) grouped these eight (08) concepts into three (03) categories that influence ‘users’ intentions to adopt mobile device-based technology. These categories are rational perception, behavioral control, and social influence. On the other hand, cross-cultural studies show that the drivers of the adoption of mobile technology (e.g. M-banking) vary depending on the context of the study (Malaquias & Hwang, Citation2019). In South Africa, for example, adopting innovative technologies is conditioned by trust, security, and privacy (Matemba & Li, Citation2018). Thusi and Maduku (Citation2020) demonstrate that the intention to adopt M-banking applications depends mainly on habit, expected performance, perceived risk, enabling conditions, and institutional trust. In sub-Saharan African countries, such as Cameroon, speed, cost, mobility, perceived usefulness, security, social influence, interoperability, and network quality significantly impact on the acceptability of mobile payment (Tsanga, Citation2018). These findings concur that technological innovation is an important driver of the long-term relationship between customers and banks (Arcand et al., Citation2017) and the best way to promote financial inclusion in Africa (Hammerschlag et al., Citation2020, Kamdjoug et al., Citation2021).

Rational perceptions of the M-banking application

Our study draws on the existing literature on technological innovations (Kamdjoug et al., Citation2021; Song et al., Citation2015) to identify the most influential factors of rational perception in the intention to adopt online shopping. We selected the following variables: utilitarian expectation (UE), hedonic expectation (HE), and status gains (SG). These three constructs are assumed to positively influence the adoption intention of M-banking. Utilitarian value is one of the basic needs of consumers and one of the important antecedents of innovation consumption and adoption (Batra & Ahtola, Citation1991; Sullivan Mort & Drennan, Citation2007). Utilitarian Expectation (UE) pertains to the user perception of online purchases as a means of obtaining functional benefits. Hedonic expectation (HE) is similar to the concepts of hedonic value, pleasure, or emotional value (de Marez et al., Citation2007; Okazaki et al., Citation2008; Revels et al., Citation2010; Sullivan Mort & Drennan, Citation2007), all of which refer to the perceived pleasure derived from using an innovation. The search for pleasurable experiences and hedonic consideration are important factors influencing consumer choices (Dhar & Wertenbroch, Citation2000). Song et al. (Citation2015) argue that mobile technology provides entertainment capability in addition to utilitarian performance. Therefore, it can be anticipated that hedonic expectations may affect the intention to adopt M-banking. Status gain refers to the extent to which using M-banking is perceived as an opportunity to increase one’s social status. The diffusion of innovation theory emphasizes that the desire to gain status is an important reason for innovation adoption (Rogers, Citation2003). Zhu and He (Citation2002) add that status enhancement motivates Chinese consumers to adopt technological innovation. Since perceived status gain directly affects adoption intention, we formulate the following hypotheses:

H1. Utilitarian expectation has a positive influence on the adoption intention of M-banking.

H2. Hedonic expectation positively influences the intention to adopt M-banking.

H3. Status gains positively affect the intention to adopt M-banking.

Behavioral control and security

In this study, we chose Habit (HA) and Perception of privacy concern (PPC) as predictors because the diffusion of online shopping is still at an early stage in most African countries. Both factors play a key role in an individual’s intention to adopt technology (Song et al., Citation2015). Habit (HA) is the extent to which individuals tend to automatically adopt permanent and stable behaviors that become second nature due to learning (Baptista & Oliveira, Citation2015; Venkatesh et al., Citation2012). Habit is a power that facilitates effort in using technologies (Baabdullah et al., Citation2019; Ramírez-Correa et al., Citation2019). Perception of Privacy concern (PPC) refers to perceptions of opportunistic behaviors related to the release of personal data transmitted online (Mombeuil, Citation2020; Shareef et al., Citation2018). Consumers’ risk perceptions regarding the use of M-banking are mainly related to the uncertainty of product quality and aspects involving the privacy and security of personal information or the security of online transaction systems (Shaw & Sergueeva, Citation2019). Therefore, we formulate the following hypotheses:

H4. Habit has a positive influence on the intention to adopt M-banking.

H5. Perceived privacy concern is significantly related to the intention to adopt M-banking.

M-banking post-adoption effects

Relationship quality: Authors agree that relationship quality is a multi-dimensional concept reflecting the overall nature of the relationship between companies and consumers (Hennig-Thurau et al., Citation2002). Research conceptualizes relationship quality in at least two dimensions: satisfaction and trust (Crosby et al., Citation1990; Lagace et al., Citation1991). This study is based on the assumption that an increase in satisfaction and trust accompanies an increase in relationship quality. Customer satisfaction is defined as an evaluation based on the experience of purchasing and consuming a good or service over time (Garbarino & Johnson, Citation1999). Customers are satisfied when they have had good experiences with previous purchases. This motivates them to repurchase the same goods and services and determines the post-purchase or post-adoption satisfaction. Consistent with the ideas advocated by Vesel and Zabkar (Citation2010), this study uses a unidimensional trust construct with items reflecting both credibility and expertise, dimensions relevant to the banking industry. While the facets of trust may differ conceptually, they are empirically inseparable, supporting a unidimensional approach (Bhattacherjee, Citation2002). Satisfaction and trust in a technological innovation lead to better consumer experience and knowledge, enhancing their abilities to use the M-banking application more regularly and creatively (Koo et al., Citation2015; Sun et al., Citation2019). This exploitation/exploration of technology allows users to discover features that meet their personal and professional needs (Koo et al., Citation2015; Sun et al., Citation2019). In the long run, these uses promote increased post-adoption of consumer satisfaction and confidence (Delone & McLean, Citation2003; Venkatesh et al., Citation2003). Therefore, we hypothesize the following:

H6. The intention to adopt the M-banking application positively influences user satisfaction.

H7. The intention to adopt the M-banking application positively influences user trust.

H8-9-10. The intention to adopt the M-banking application has a positive influence on financial inclusion (Availability, Quality, Utility).

Moderating role of consumer status orientation

In transition economies, consumer culture develops as individuals gain access to products and material goods that were previously unavailable or inaccessible (Tambyah et al., Citation2009). Many African consumers, including those in Cameroon, aspire to own Western brands and use luxury goods as prestige symbols (Belk, Citation1999; Cui & Liu, Citation2001). Lascu et al. (Citation1994) explain that the fear of losing status or the desire to acquire status strongly influences individuals’ purchasing and consumption decisions in transition countries. According to Nguyen and Smith (Citation2012), status orientation refers to the degree to which an individual identifies with traditional values (the traditional self) and modern values (the modern self). The traditional self is often associated with norms, values, and beliefs, such as respect for traditional values and preference for traditional products. The modern self is characterized by norms, values, and beliefs mostly imported from more developed countries, such as the consumption of new products, greater self-care, and self-satisfaction (Nguyen & Smith, Citation2012).

Tambyah et al. (Citation2009) propose two dimensions of status orientation as distinct components that may coexist in each consumer at different levels. These are traditional status orientation (TSO) and modern status orientation (MSO). Individuals with high MSO believe that their social status will be enhanced by purchasing or consuming new products and brands (Steenkamp et al., Citation1999). Thus, high MSO consumers are expected to be more likely to engage in technological innovations such as M-banking. High TSO consumers are more traditional in their outlook and hold views such as patriotism and national pride. As a result, we expect high TSO individuals to be less engaged in adopting banking innovations such as M-banking and prefer products and services that are provided in the traditional way (Tambyah et al., Citation2009). Therefore, we hypothesize the following:

H11a,b,c. The relationship between consumer intention to adopt M-banking and financial inclusion (availability, quality, utility) decreases when consumers have a positive traditional orientation.

H12a,b. The relationship between consumer intention to adopt M-banking and relationship quality (trust, satisfaction) decreases when consumers have a positive traditional orientation.

H13a,b. The relationship between consumer intention to adopt M-banking and relational quality (trust, satisfaction) increases when consumers have a positive modern orientation.

H14a,b,c. The relationship between consumer intention to adopt M-banking and financial inclusion (availability, quality, utility) increases when consumers have a positive modern orientation.

Methodology

Measurements scales and sampling procedure

The study adopted a descriptive research design to explore the relationships among the variables of interest. This research design informed the choice of the quantitative method allowing the researchers to statistically assess the strength and direction of the relationships specified in the conceptual model.

Measurement scales from the existing literature were used to measure the model’s constructs ().

Table 2. Constructs and measurement items.

Measurement scales from the existing literature were used as a basis for measuring the constructs of the model (). The designed questionnaire contained thirteen (13) constructs and seventy-four (74) items. All items were measured using a seven (07) level Likert scale (1 = Strongly disagree, 2 = Disagree, 3 Somewhat disagree, 4 = Neither agree nor disagree, 5 = Somewhat agree, 6 = Agree, 7 = Strongly agree). This scale is commonly used to measure perceptions (Kavota et al., Citation2020; Wanko et al., Citation2019).

In the absence of a sampling frame for this population, and the lack of a database of M-banking users, a non-probability sampling method (snowball sampling) was the chosen (Khan et al., Citation2021; San Martín & Herrero, Citation2012). We worked closely with bank staff to reach as many users as possible. To ensure that the results of the structural equation modeling analysis are robust, it was essential to determine the minimum sample size. Although the 10 times rule was commonly applied to determine the sample size in previous studies, Hair et al. (Citation2021) argue that inverse square root is more accurate and easier to compute.

We used the GPower software (v.3.1.9.4) to calculate our minimum sample size (Faul et al., Citation2007; Kamdjoug et al., Citation2021). We entered the following data: Effect size f2 = 0.10, Power (1-β err prob) = 0.95, probability α err = 0.05, number of predictors = 13. Based on these parameters, the software suggested one hundred and thirty-three (133) as the minimum sample size to test our research hypotheses.

Data collection and analytical tools

We conducted data collection from M-banking application users, with a questionnaire consisting of sixteen (16) questions, including demographic questions. The questionnaire designed in Microsoft Word was edited in the Cspro designer application and then uploaded to Dropbox to allow access to the interviewer via a smartphone. The questionnaire was administered face-to-face to randomly selected respondents using the CAPI (Computer Assistant Personal Interview) collection technique. This approach allows uploading answers ready to be analyzed as an extension in an Excel or SPSS file. Experienced interviewers were briefed beforehand on the content of the tool and the techniques to be followed. Data was captured and cleaned with Microsoft Excel. Approximately 609 questionnaires were administered, a total of 509 were retained after removing those that were incomplete or contained errors. This sample size is deemed adequate as it is larger than the minimum suggested by Faul et al. (Citation2007), and the inverse square root method (Kock & Hadaya, Citation2018).

Descriptive statistics were performed with IBM SPSS statistics version 28 to profile the respondents, and structural equation modeling (SEM), the core analysis, was conducted with Smart PLS. SEM is appropriate for this study because the proposed conceptual model has more than one dependent variable and contains moderation analyses. The Smart PLS package has the advantage of generating moderation slopes to ease the interpretation. The SEM methodology includes two steps: (1) Confirmatory factor analysis (CFA) and (2) structural model analysis (Anderson & Gerbing, Citation1988).

Analysis and results

Demographic information

presents the profiles of the respondents. The figures obtained suggest a balanced sample and approximately represents the segments of the population that use banking services in Cameroon. Fourteen (14) mobile applications offered by local banks were evaluated.

Table 1. Characteristics of the sample (n = 509).

Descriptive results of the demographics indicate that most respondents are male (68.6%) and have at least a university degree (41.1%). The age group mode (47.2%) is 18–35, and 63.7% of respondents earn between 50 and 700$.

Confirmatory factor analysis (CFA)

The CFA establishes the reliability, convergent and discriminant validity of the fourteen (14) constructs used in the conceptual model. The statistical evidence of reliability and convergent validity is presented next.

Reliability and convergent validity

Reliability is the extent to which a set of items are internally consistent in measuring a concept (Pallant, Citation2010). Cronbach alphas and the composite reliability coefficients above 0.7 indicate reliable measurements. On the other hand, convergent validity assesses whether a set of items converge toward the same concept (Byrne, Citation2010). The evidence of convergent validity is an average variance extracted (AVE) above 0.5. Detailed results on reliability and convergent validity are presented (). According to the results, the reliability of all constructs is supported as all Cronbach and composite reliability coefficients are above the cut-off of 0.7. The convergent validity of all measurements is also established as all AVEs exceed 0.5. The following section presents evidence of discriminant validity.

Discriminant validity

Discriminant validity is the extent to which constructs differ from each other; this test is necessary to avoid including variables that overlap in the model. Two approaches are commonly used to assess discriminant validity in SEM: the heterotrait-monotrait (HTMT) ratio of correlations and the Fornell and Larcker (Citation1981) methods. The HTMT results () indicate a couple of high correlations such as the correlations between Financial Availability and Quality (HTMT ratio is above 0.9) and between Financial Quality and Utility. Since all three constructs make up the concept of financial inclusion, they are expected to be somewhat related. Traditional and modern orientations were also highly correlated, probably because most Cameroonians are attached to their traditions but remain open to modern technology. Consequently, they have a hybrid orientation that combines both orientations in different proportions. Lastly, like in other studies, a high correlation was found between Satisfaction and Trust. This result was expected because both concepts are interdependent, satisfied consumers tend to trust the brand.

Table 3. Assessment of homogeneity using Ratio Heterotrait-Monotrait (HTMT) Criterion.

The discriminant validity flags found above were further confirmed by the Fornell and Larcker (Citation1981) matrix (). Since all high correlations identified are theoretically justified, and the rest of the constructs are reasonably correlated, we can conclude that the discriminant validity of our measurements is supported.

Table 4. Assessment of the discriminant validity using the Fornell-Larcker Criterion.

Structural model analysis

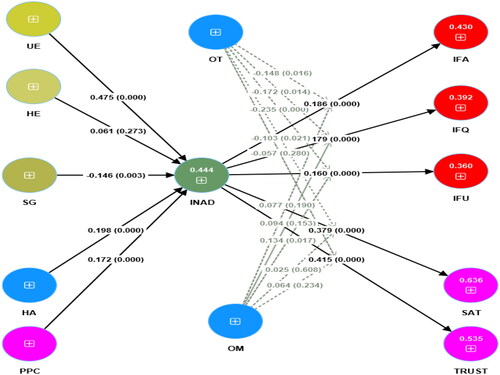

After establishing the convergent and discriminant validity of the constructs, we can confidently use these measurements to test the research hypotheses. The conceptual model hypothesized 20 relationships, including 10 moderations (). The test results are depicted in at 5000 sub-sample bootstraps.

The strengths of the predictions were assessed through the beta estimates with their respective p values in brackets (). The predictive power of the model was appraised through the coefficient of determination (R2) and the predictive relevance (Q2). The contribution of each exogenous factor to its dependent variable was measured using the f2, also known as the R2 change. Detailed results on the predictive power of the model are presented in and .

Table 5. R Squared and predictive relevance of the endogenous variables.

Table 6. Hypothesis testing.

The results of the research reveal that two variables (EU, SG) among the three rational perception factors have significant relationships with the intention to adopt the M-banking application (respectively O = 0.475 and O= - 0.146; p < 0.05). Therefore, hypotheses H1 and H3 are verified. Status gain had a small (f2>0.1) predictive effect, while Utilitarian expectation had a medium effect size (0.1<f2 <0.3) on intention to adopt M-banking. However, Hedonic expectation has a non-significant (O = 0.061; p > 0.05) effect on the intention to adopt e-banking, unlike the results of Baabdullah et al. (Citation2019) and Venkatesh et al. (Citation2012). Hypothesis H2 is therefore unsupported. In addition, the predictive effects of Habit (HA) was established as it was positively related to the intention to adopt M-banking (O = 0.198; p < 0.05). Hypothesis H4 is supported. This result corroborates those of Baabdullah et al. (Citation2019), Venkatesh et al. (Citation2012) and Kamdjoug et al. (Citation2021). Privacy concern influence individual’s intention to adopt the M-banking app. Perhaps the issues encountered with other forms of mobile money transfer solutions (mobile, payment, and transfer) may cause users to pay attention to security or privacy concerns. Hypothesis H5 is therefore supported.

Results indicated that the intention to adopt M-banking affects satisfaction (O = 0.379; p < 0.05) and Trust (O = 0.415; p < 0.05). After usage, customers find that the system’s functionalities perfectly meet their needs and that the application is reliable. Therefore, hypotheses H6 and H7 are confirmed.

Lastly, all three factors of financial inclusion (Availability, quality, and Utility) were predicted by intention to adopt e-banking (respectively O = 0.186, O = 0.179, and O = 0.160 at p < 0.05). Hypotheses H8, H9, and H10 are supported. Other authors have demonstrated that mobile technology-based transactions (wallet, transfer, payment) are beneficial for financial inclusion in Africa (Okello et al., Citation2018; Zaffar et al., Citation2019).

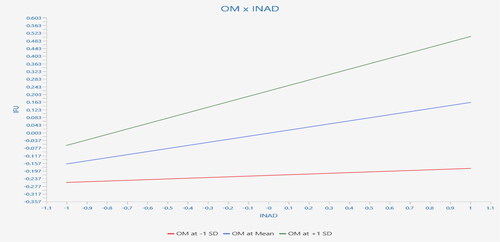

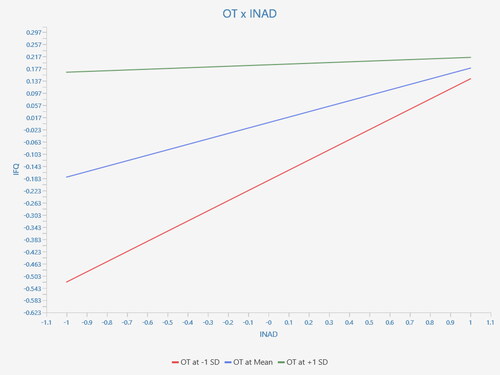

Furthermore, an analysis of the post-adoption relationships of M-banking shows the influence of moderating variables, including individuals’ modern and traditional status orientations. Results indicate that modern orientation only moderates the relationship between intention to adopt M-banking and financial utility (O = 0.124; p < 0.05). shows a positive green slope steeper than the red slope, almost horizontal. Meaning the influence of intention to adopt e-banking on financial utility is stronger among people with high modern orientation (green slope) compared to those less modern oriented (red slope). In other words, modern-oriented people with high intentions to adopt M-banking tend to report higher financial utility compared to individuals with a low modern orientation. Hence, hypothesis H14c is verified. On the other hand, modern self-perception does not affect the relationship between intention to adopt M-Banking, Accessibility (IFA: O = 0.071; p > 0.05), and financial quality (IFQ: O = 0.087; p > 0.05). Hypotheses H14a and H14b are not verified.

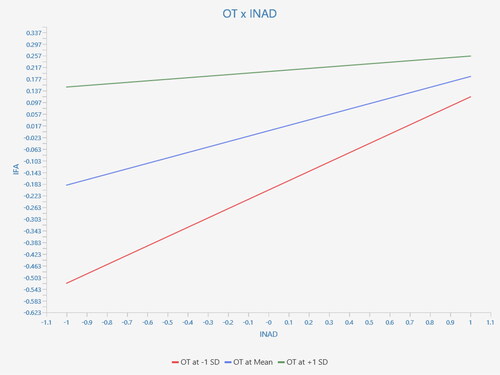

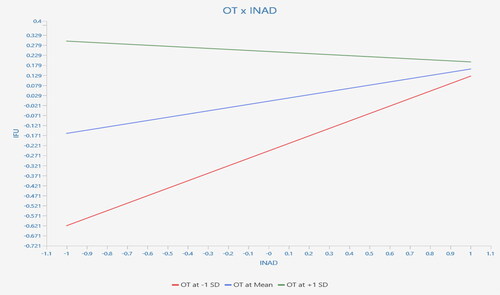

Traditional orientation moderates the relationship between the intention to adopt M-banking and the three factors of financial inclusion. First, shows a green slope that is almost flat and an oblique red slope, meaning that the relationship between the intention to adopt M-banking and financial availability is stronger among individuals less traditionally oriented. That relationship tends to be non-existent among people who are more traditionally oriented. In other words, high intention to adopt M-banking translates into high financial availability only among less traditionally oriented people.

A similar moderating effect was observed in the relationship between intention to adopt M-banking on financial quality (O = 0.087; p < 0.05). Therefore, interventions that enhance financial quality through the intention to adopt M-banking are more likely to succeed among less traditionally oriented individuals. Hypothesis 11b is supported ().

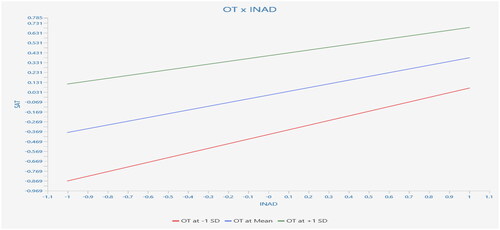

The moderating effect of traditional orientation on the relationship between the intention to adopt M-banking and financial utility is established (O= -0.212; p < 0.001). According to the results (), this relationship is positive among less traditionally oriented people (positive red slope) and negative among traditionally oriented people (negative green slope). Therefore an increase in intention to adopt e-banking will translate into an increase in financial utility among less traditionally oriented people. While an increase in intention to adopt M-banking will result in a decrease in financial utility among traditionally oriented individuals. So if we want to improve financial utility using this relationship, we should target less traditionally oriented segment. Hypothesis 11c is supported.

Traditional orientation positively moderates the effect of the intention to adopt M-banking on satisfaction (O= -0.092; p < 0.05). Therefore, (As shown in ), a high intention to adopt M-banking is associated with high satisfaction. However, this relationship is stronger among individuals that are less traditionally oriented compared to those that are attached to traditional values. Hypothesis 12b is supported.

On the other hand, there is no moderating effect of traditional self-perception in the relationship between the intention to adopt M-Banking and trust (O= -0.052; p > 0.05). Hypothesis H12a is not supported. We can assume that once they adopt the M-banking application, less traditional value-oriented individuals only use its basic functions for their daily activities, thereby impeding the establishment of a trust-based relationship.

Discussions

As banks strive to remain competitive, M-banking is emerging as one of the most effective tools for providing value-added services to customers and developing quality relationships (Baabdullah et al., Citation2019). In addition, M-banking is helping to improve financial inclusion among individuals with limited access to traditional banking services. (Kamdjoug et al., Citation2021; World Bank Group, Citation2019). However, very few studies have been conducted to understand the adoption and use of new technology such as M-banking in Cameroon. This study extends its investigation beyond the factors influencing M-banking adoption to explore post-adoption outcomes and moderating variables. It uses the PLS-SEM analytical technique to test the hypotheses and answer the research questions. The study extends beyond the mere adoption of technology (which is a short-term objective) and evaluates its effects on long-lasting relationships. The result is a better understanding of how financial institutions can use this channel to interact more effectively with their customers and build stronger relationships. The findings enable us to validate predictors of M-banking adoption, in line with previous literature (Baabdullah et al., Citation2019; Kamdjoug et al., Citation2021; Song et al., Citation2015; Zhang et al., Citation2018). Some variables of users’ rational perception and behavioral control have significant relationships with the intention to adopt the M-banking. In addition, the habit of using the M-banking positively reinforces the intention to adopt. On the other hand, the results show that the intention to adopt leads to customer satisfaction and improves their trust in the technology. The adoption of an M-banking application also contributes to financial inclusion. Other authors have demonstrated that mobile technology-based transactions (wallet, transfer, payment) facilitate financial inclusion in Africa (Kamdjoug et al., Citation2021; Okello et al., Citation2018; Zaffar et al., Citation2019).

Furthermore, an analysis of post-adoption M-banking relationships highlights the moderating role of modern and traditional customer status orientation. Overall, modern status orientation that reflects the norms, values, and beliefs characteristic of Western culture favorably influences perceptions of new banking technologies. In contrast, traditional self-perception characteristics of traditional values do not favor adopting M-banking as a financial inclusion tool in Africa (Bikanda & Mefoute, Citation2017; Diop & Merunka, Citation2013). The results have important implications for both theory and practice.

Implications

Theoretical implications

Our work contributes to the understanding of the intention to adopt an M-banking application by individuals, as well as the ability of this technology to improve the quality of the relationship with the bank and to promote financial inclusion in developing countries. We reviewed a few models and theories, including IS/IT. In addition to constructs related to rational perception and behavioral control, we added constructs related to perceived security and moderating variables related to ‘users’ status orientation. Thus, our research model can serve as a basis for future work on the consumption of innovative services/products and the impact of individual variables. At the end of our study, the results explain the intention to use M-banking at 45.50% (R2 = 0.455). Perceptual variables such as utilitarian expectation (UE), status gain (SG), PPC, and Habit (HA) significantly explain the intention to adopt M-banking. We then sought to identify the impact of M-banking adoption intention on both relationship quality and financial inclusion. Our study shows that M-banking applications catalyze relationship quality and financial inclusion. The study is a continuation of the work of Song et al. (Citation2015), which provides a psychosociological analysis of the process of influencing the rational perception of M-banking adoption. It further enriches the model by examining post-adoption variables and moderating variables likely to impact these relationships. Our study corroborates with the work of Kamdjoug et al. (Citation2021) and allows us to overcome some of the limitations identified. Specifically, the findings apply not only to a single M-Banking application but can also be extended to most mobile applications identified in the Cameroonian context. The study considerably broadens our target group and reinforces the generalization of the results. This research enriches our understanding of banking technology consumption behavior in Africa from a societal perspective. This new perspective shows that the orientation of users’ status towards traditional and modern values significantly influences the relationship between the intention to adopt and the post-adoption effects of M-banking in Cameroon. In this sense, this work sheds light on the marketing setup of financial services companies in Cameroon and describes the environment for future firms that would like to expand there. It confirms the results of the work of Diallo and Diop-Sall (Citation2022), according to which the management of commercial enterprises in Africa must take cultural aspects into account. For these researchers, the sociocultural equilibrium of African society is determined by the integration of traditional and modern values. The significance of modern and traditional orientations is underscored in our study, as Cameroonian consumers exhibit comparable levels of attachment to innovative technologies despite their deep-rooted adherence to traditional values. Our results also complement previous work in other contexts (e.g. Zhang & Jolibert, Citation2003), indicating how traditional values influence consumer behavior in countries that host innovative technology concepts.

Practical implications

In addition to contributing to the evolution of research on IS/IT models, our study makes contributions at the managerial level. This study could help managers of credit institutions and fintech organizations choose the right solutions tobuild strong relationships with users and improve financial inclusion. Furthermore, the critical elements that users generally put forward for adopting and using M-banking applications were unveiled. These elements are essential for policymakers and solution providers to develop better tools to improve their business strategies. This study provides bank managers with the essential tools for effectively implementing applications tailored to meet the specific needs of consumers. The main concerns of M-banking application users regarding security issues were also examined. These elements can help service/product providers implement effective policies to protect their private/financial data and that of their customers to reassure them and encourage them to adopt the technology. Concerning user status orientation, banking companies should focus on actions to encourage consumer trial of the technology, with an emphasis on the segment of users with less traditional status orientation. This segment could correspond to young people inclined towards new technologies. The post-adoption outcomes encourage banks to offer online banking services, as they offer more benefits to customers and banks. These services require fewer staff and physical branches, generate much lower operating costs, and offer customers convenience, speed, and 24-hour availability.

Limitations and future direction of the research

This research is not without limitations. First, it focuses only on consumers’ perceptions in one developing country: Cameroon. However, for many security and privacy issues, behaviors can vary from country to country. It would be interesting to replicate such studies and strengthen the generalizability of the findings. Second, integrating other cultural variables is recommended to monitor banking behavior accurately. Furthermore, demographic variables are not included in this model. Therefore, future research could incorporate the moderating effects of demographic variables to gain further insight into M-banking consumption behavior.

Informed consent

Informed consent was obtained from all individual participants included in the study.

Disclosure statement

The authors declare that they have no known competition for financial interests or personal relationships that could have appeared to influence the work reported in this article.

Data availability statement

Data will be made available on request.

Additional information

Notes on contributors

Alphonse Mefoute Badiang

Alphonse Mefoute Badiang hold PhD degrees in Management and work as lecturer at ESSEC Business School, University of Douala. He is currently head of the Marketing Department, co-editor of the Cameroon Management Review.

Emile Saker Nkwei

Emile Saker Nkwei is a researcher at the Central University of Technology, Bloemfontein, Free State, South Africa.

References

- Anderson, J. C., & Gerbing, D. W. (1988). Structural equation modelling in practice: A review and recommended two-step approach. Psychological Bulletin, 103(3), 1–18. https://doi.org/10.1037/0033-2909.103.3.411

- Arcand, M., PromTep, S., Brun, I., & Rajaobelina, L. (2017). Mobile banking service quality and customer relationships. International Journal of Bank Marketing, 35(7), 1068–1089. https://doi.org/10.1108/IJBM-10-2015-0150

- Asongu, S., & Nwachukwu, J. C. (2018). Comparative human development thresholds for absolute and relative pro-poor mobile banking in developing countries. Information Technology & People, 31(1), 63–83. https://doi.org/10.1108/ITP-12-2015-0295

- Baabdullah, A. M., Alalwan, A. A., Rana, N. P., Kizgin, H., & Patil, P. (2019). Consumer use of mobile banking (M-Banking) in Saudi Arabia: Towards an integrated model. International Journal of Information Management, 44, 38–52. https://doi.org/10.1016/j.ijinfomgt.2018.09.002

- Baptista, G., & Oliveira, T. (2015). Understanding mobile banking: The unified theory of acceptance and use of technology combined with cultural moderators. Computers in Human Behavior, 50, 418–430. https://doi.org/10.1016/j.chb.2015.04.024

- Batra, R., & Ahtola, O. T. (1991). Measuring the hedonic and utilitarian sources of consumer attitudes. Marketing Letters, 2(2), 159–170. https://doi.org/10.1007/BF00436035

- Belk, R. W. (1999). Leaping luxuries and transitional consumers. In R. Batra (Ed.), Marketing in transitional economies (pp. 39–54). Kluwer Academic.

- Bhattacherjee, A. (2002). Individual trust in online firms: Scale development and initial test. Journal of Management Information Systems, 19(1), 211–241. https://doi.org/10.1080/07421222.2002.11045715

- Bikanda, P. J., & Mefoute, B. A. (2017). Antropo-Marketing: les Logiques du Marketing En Afrique. Edition Cheikh Anta Diop, La Maison D’édition Panafricaine, Cameroun, 299.

- Byrne, B. M. (2010). Structural Equation Modeling with Amos: Basic Concepts, Applications, and Programming. (2nd ed.). Taylor and Francis Group.

- Crosby, L. A., Evans, K. R., & Cowles, D. (1990). Relationship quality in services selling: An interpersonal influence perspective. Journal of Marketing, 54(3), 68–81. https://doi.org/10.1177/002224299005400306

- Cui, G., & Liu, Q. (2001). Emerging market segments in a transitional economy: A study of urban consumers in China. Journal of International Marketing, 9(1), 84–106. https://doi.org/10.1509/jimk.9.1.84.19833

- Dauda, S. Y., & Lee, J. (2015). Technology adoption: A conjoint analysis of consumers’ preference on future online banking services. Information Systems, 53, 1–15. https://doi.org/10.1016/j.is.2015.04.006

- de Marez, L., Vyncke, P., Berte, K., Schuurman, D., & de Moor, K. (2007). Adopter segments, adoption determinants and mobile marketing. Journal of Targeting, Measurement and Analysis for Marketing, 16(1), 78–95. https://doi.org/10.1057/palgrave.jt.5750057

- Delone, W. H., & McLean, E. R. (2003). The DeLone and McLean model of information systems success: A ten-year update. Journal of Management Information Systems, 19(4), 9–30. https://doi.org/10.1080/07421222.2003.11045748

- Dhar, R., & Wertenbroch, K. (2000). Consumer choice between hedonic and utilitarian goods. Journal of Marketing Research, 37(1), 60–71. https://doi.org/10.1509/jmkr.37.1.60.18718

- Diallo, M. F., & Diop-Sall, F. (2022). Qualité de service, valeur perçue et intention d’achat dans un centre commercial innovant au Sénégal: Effets des valeurs traditionnelles. Management International, 26(3), 210–226. https://doi.org/10.7202/1090303ar

- Diallo, M. F., Seck, A. M., & Diop-Sall, F. (2015). L’innovation perçue et ses conséquences dans les centres commerciaux modernes d’Afrique: L’exemple du Sénégal. Management & Avenir, N° 81(7), 57–79. https://doi.org/10.3917/mav.081.0057

- Diop, F., & Merunka, D. (2013). African tradition and global consumer culture: Understanding attachment to traditional dress style in West Africa. International Business Research, 6(11), 1–14. https://doi.org/10.5539/ibr.v6n11p1

- Eastman, J. K., Goldsmith, R. E., & Leisa Flynn, R. (1999). Status consumption in consumer behavior: Scale development and validation. Journal of Marketing Theory and Practice, 7(3), 41–52. https://doi.org/10.1080/10696679.1999.11501839

- Faul, F., Erdfelder, E., Lang, A. G., & Buchner, A. (2007). G*Power 3: A flexible statistical power analysis program for the social, behavioral, and biomedical sciences. Behavior Research Methods, 39(2), 175–191. https://doi.org/10.3758/BF03193146

- Fornell, C., & Larcker, D. F. (1981). Evaluating structural equation models with unobservable variables and measurement error. Journal of Marketing Research, 18(1), 39–50. https://doi.org/10.2307/3151312

- Garbarino, E., & Johnson, M. S. (1999). The different roles of satisfaction, trust, and commitment in customer relationships. Journal of Marketing, 63(2), 70–87. https://doi.org/10.2307/1251946

- Glavee-Geo, R., Shaikh, A. A., & Karjaluoto, H. (2017). Mobile banking services adoption in Pakistan: Are there gender differences? International Journal of Bank Marketing, 35(7), 1090–1114. https://doi.org/10.1108/IJBM-09-2015-0142

- Ha, K.-H., Canedoli, A., Baur, A. W., & Bick, M. (2012). Mobile banking-insights on its increasing relevance and most common drivers of adoption. Electronic Markets, 22(4), 217–227. https://doi.org/10.1007/s12525-012-0107-1

- Hair, J. F., Jr, Hult, G. T. M., Ringle, C. M., & Sarstedt, M. (2021). A primer on partial least squares structural equation modeling (PLS-SEM). Sage publications.

- Hammerschlag, Z., Bick, G., & Luiz, J. M. (2020). The internationalization of African fntech frms: Marketing strategies for successful intra-Africa expansion. International Marketing Review, 37(2), 299–317. https://doi.org/10.1108/IMR-05-2019-0130

- Hennig-Thurau, T., Gwinner, P. K., & Gremler, D. D. (2002). Understanding relationship marketing outcomes: An integration of relational benefits and relationship quality. Journal of Service Research, 4(3), 230–247. https://doi.org/10.1177/1094670502004003006

- Hinson, R. E. (2011). Banking the poor: The role of mobiles. Journal of Financial Services Marketing, 15(4), 320–333. https://doi.org/10.1057/fsm.2010.29

- Hoehle, H., Scornavacca, E., & Huff, S. (2012). Three decades of research on consumer adoption and utilization of electronic banking channels: A literature analysis. Decision Support Systems, 54(1), 122–132. https://doi.org/10.1016/j.dss.2012.04.010

- Kamdjoug, K. J R., Wamba-Taguimdje, S.-L., Wamba, S. F., & Kake, I. B. (2021). Determining factors and impacts of the intention to adopt mobile banking app in Cameroon: Case of SARA by afriland First Bank. Journal of Retailing and Consumer Services, 61, 102509. https://doi.org/10.1016/j.jretconser.2021.102509

- Kavota, J. K., Kamdjoug, J. R. K., & Wamba, S. F. (2020). Social media and disaster management: Case of the north and south Kivu regions in the Democratic Republic of the Congo. International Journal of Information Management, 52, 102068. https://doi.org/10.1016/j.ijinfomgt.2020.102068

- Khan, R., Rana, S., & Imran Hosen, M. I. (2021). Impact of trustworthiness on the usage of M-banking apps: A study on Bangladeshi consumers. Business Perspectives and Research, 10(2), 234–250. https://doi.org/10.1177/22785337211001969

- Kock, N., & Hadaya, P. (2018). Minimum sample size estimation in PLS-SEM: The inverse square root and gamma-exponential methods. Information Systems Journal, 28(1), 227–261. https://doi.org/10.1111/isj.12131

- Koo, C., Chung, N., & Kim, H.-W. (2015). Examining explorative and exploitative uses of smartphones: A user competence perspective. Information Technology & People, 28(1), 133–162. https://doi.org/10.1108/ITP-04-2013-0063

- Lagace, R. R., Dahlstrom, R., & Grassenheimer, J. B. (1991). The relevance of ethical salesperson behavior on relationship quality: The pharmaceutical industry. Journal of Personal Selling and Sale Management, 11(4), 39–47. https://doi.org/10.1080/08853134.1991.10753888

- Lascu, D.-N., Manrai, L. A., & Manrai, A. K. (1994). Status concern and consumer purchase behavior in Romania. In Clifford J. Schultz, Russell W. Belk, and Güliz Ger, (Eds.), Research in consumer behavior: Consumption in marketing economics (vol. 7; pp. 80–122). JAI Press.

- Liu, X., He, M., Gao, F., & Xie, P. (2008). An empirical study of online shopping customer satisfaction in China: A holistic perspective. International Journal of Retail & Distribution Management, 36(11), 919–940. https://doi.org/10.1108/09590550810911683

- López-Miguens, M. J., & Vázquez, E. G. (2017). An integral model of e-loyalty from the consumer’s perspective. Computers in Human Behavior, 72, 397–411. https://doi.org/10.1016/j.chb.2017.02.003

- Malaquias, R. F., & Hwang, Y. (2019). Mobile banking use: A comparative study with Brazilian and U.S. participants. International Journal of Information Management, 44, 132–140. https://doi.org/10.1016/j.ijinfomgt.2018.10.004

- Matemba, E. D., & Li, G. (2018). Consumers’ willingness to adopt and use WeChat wallet: An empirical study in South Africa. Technology in Society, 53, 55–68. https://doi.org/10.1016/j.techsoc.2017.12.001

- Maurer, B. (2012). Mobile money: Communication, consumption and change in the payments space. Journal of Development Studies, 48(5), 589–604. https://doi.org/10.1080/00220388.2011.621944

- Mombeuil, C. (2020). An exploratory investigation of factors affecting and best predicting the renewed adoption of mobile wallets. Journal of Retailing and Consumer Services, 55, 102127. https://doi.org/10.1016/j.jretconser.2020.102127

- Nguyen, T., & Smith, K. (2012). The impact of status orientations on purchase preference for foreign products in Vietnam, and implications for policy and society. Journal of Macromarketing, 32(1), 52–60. https://doi.org/10.1177/0276146711421786

- Nguyen, T. T. M., Smith, K., & Johnson, R. (2009). Measurement of modern and traditional self-concepts in Asian transitional economies. Journal of Asia-Pacific Business, 10(3), 201–220. https://doi.org/10.1080/10599230903094745

- Okazaki, S., Skapa, R., & Grande, I. (2008). Capturing global youth: Mobile gaming in the US, Spain, and the Czech Republic. Journal of Computer-Mediated Communication, 13(4), 827–855. https://doi.org/10.1111/j.1083-6101.2008.00421.x

- Okello, C. B. G., Ntayi, J. M., Munene, J. C., & Malinga, C. A. (2018). Mobile money and financial inclusion in sub-Saharan Africa: The moderating role of social networks. Journal of African Business, 19(3), 361–384. https://doi.org/10.1080/15228916.2017.1416214

- Pallant, J. (2010). SPSS survival manual a step by step guide to data analysis using SPSS (4th ed). McGraw-Hill Education.

- Pedersen, P. E. (2005). Adoption of mobile internet devices: An exploratory study of mobile commerce early adopters. Journal of Organizational Computing and Electronic Commerce, 15(3), 203–222. https://doi.org/10.1207/s15327744joce1503_2

- Ramírez-Correa, P., Rondán-Cataluña, F. J., Arenas-Gaitán, J., & Martín-Velicia, F. (2019). Analysing the acceptation of online games in mobile devices: An application of UTAUT2. Journal of Retailing and Consumer Services, 50, 85–93. https://doi.org/10.1016/j.jretconser.2019.04.018

- Revels, J., Tojib, D., & Tsarenko, Y. (2010). Understanding consumer intention to use mobile services. Australasian Marketing Journal, 18(2), 74–80. https://doi.org/10.1016/j.ausmj.2010.02.002

- Rogers, E. M. (2003). Diffusion of innovations. Free Press.

- San Martín, H., & Herrero, Á. (2012). Influence of the user’s psychological factors on the online purchase intention in rural tourism: Integrating innovativeness to the UTAUT framework. Tourism Management, 33(2), 341–350. https://doi.org/10.1016/j.tourman.2011.04.003

- Shaikh, A. A., & Karjaluoto, H. (2015). Mobile banking adoption: A literature review. Telematics and Informatics, 32(1), 129–142. https://doi.org/10.1016/j.tele.2014.05.003

- Shareef, M. A., Baabdullah, A., Dutta, S., Kumar, V., & Dwivedi, Y. K. (2018). Consumer adoption of mobile banking services: An empirical examination of factors according to adoption stages. Journal of Retailing and Consumer Services, 43(July), 54–67. https://doi.org/10.1016/j.jretconser.2018.03.003

- Shaw, N., & Sergueeva, K. (2019). The non-monetary benefits of mobile commerce: Extending UTAUT2 with perceived value. International Journal of Information Management, 45, 44–55. https://doi.org/10.1016/j.ijinfomgt.2018.10.024

- Singh, N., Sinha, N., & Liébana-Cabanillas, F. J. (2020). Determining factors in the adoption and recommendation of mobile wallet services in India: Analysis of the effect of innovativeness, stress to use and social influence. International Journal of Information Management, 50, 191–205. https://doi.org/10.1016/j.ijinfomgt.2019.05.022

- Singh, S., & Srivastava, R. K. (2018). Predicting the intention to use mobile banking in India. International Journal of Bank Marketing, 36(2), 357–378. https://doi.org/10.1108/IJBM-12-2016-0186

- Song, J., Sawang, S., Drennan, J., & Andrews, L. (2015). Same but different? Mobile technology adoption in China. Information Technology & People, 28(1), 107–132. https://doi.org/10.1108/ITP-10-2013-0187

- Steenkamp, J.-B., Hofstede, F., & Wedel, M. (1999). A cross-national investigation into the individual and national cultural antecedents of consumer innovativeness. Journal of Marketing, 63(2), 55–69. https://doi.org/10.2307/1251945

- Sullivan Mort, G., & Drennan, J. (2007). Mobile communications: A study of factors influencing consumer use of m-services. Journal of Advertising Research, 47(3), 302–312. https://doi.org/10.2501/S0021849907070328

- Sun, J., Yoo, S., Park, J., & Hayati, B. (2019). Indulgence versus restraint: The moderating role of cultural diferences on the relationship between corporate social performance and corporate financial performance. Journal of Global Marketing, 32(2), 83–92. https://doi.org/10.1080/08911762.2018.1464236

- Tam, C., & Oliveira, T. (2017). Understanding mobile banking individual performance: The DeLone and McLean model and the moderating effects of individual culture. Internet Research, 27(3), 538–562. https://doi.org/10.1108/IntR-05-2016-0117

- Tambyah, S. K., Nguyen, T. T. M., & Jung, K. (2009). Measuring status orientations: Scale development and validation in the context of an Asian transitional economy. Journal of Marketing Theory and Practice, 17(2), 175–187. https://doi.org/10.2753/MTP1069-6679170206

- Thusi, P., & Maduku, D. K. (2020). South African millennials’ acceptance and use of retail mobile banking apps: An integrated perspective. Computers in Human Behavior, 111, 106405. https://doi.org/10.1016/j.chb.2020.106405

- Tsanga, R. C. N. N. (2018). What about acceptability of mobile money in sub-saharan Africa? The case of Cameroon. J. Bus, 6(1), 6–11. https://doi.org/10.12691/jbms-6-1-2

- Varman, R., & Belk, R. W. (2011). Consuming postcolonial shopping malls. Journal of Marketing Management, 28(1-2), 62–84. https://doi.org/10.1080/0267257X.2011.617706

- Venkatesh, V., Morris, M.G., Davis, G.B., & Davis F.D. (2003). User acceptance of information technology: Toward a unified view. MIS Quarterly, 3, 27, 425–478. https://doi.org/10.2307/30036540

- Venkatesh, V., Thong, J., & Xu X. (2012). Consumer acceptance and use of information technology: Extending the unified theory of acceptance and use of technology. MIS Quarterly, 36(1), 157–178. https://doi.org/10.2307/41410412

- Vesel, P., & Zabkar, V. (2010). Comprehension of relationship quality in the retail environment. Managing Service Quality: An International Journal, 20(3), 213–235. https://doi.org/10.1108/09604521011041952

- Wanko, C. E. T., Kamdjoug, J. R. K., & Wamba, S. F. (2019). Study of a successful ERP implementation using an extended information systems success model in Cameroon universities: Case of CUCA. Paper presented at the. World Conference on Information Systems and Technologies (pp. 727–737). Springer.

- We Are Social & Meltwater. (2023). ‘Digital 2023 Cameroon,’ retrieved from https://datareportal.com/reports/digital-2023-indonesia on 01 July 2023.

- World Bank Group. (2019). Digital economy for cameroon diagnostic report. World Bank. License: Creative Commons Attribution CC BY 3.0 IGO.

- Zaffar, M. A., Kumar, R. L., & Zhao, K. (2019). Using agent-based modelling to investigate diffusion of mobile-based branchless banking services in a developing country. Decision Support Systems, 117, 62–74. https://doi.org/10.1016/j.dss.2018.10.015

- Zhang, M. X., & Jolibert, A. (2003). Les valeurs traditionnelles des acheteurs chinois: Raffinement conceptuel, mesure et application. Recherche Et Applications En Marketing (French Edition), 18(1), 25–42. https://doi.org/10.1177/076737010301800102

- Zhang, T., Lu, C., & Kizildag, M. (2018). Banking ‘on-the-go’: Examining consumers’ adoption of mobile banking services. International Journal of Quality and Service Sciences, 10(3), 279–295. https://doi.org/10.1108/IJQSS-07-2017-0067

- Zhu, J., & He, Z. (2002). Perceived characteristics, perceived needs, and perceived popularity: Adoption and use of the internet in China. Communication Research, 29(4), 466–495. https://doi.org/10.1177/0093650202029004005