Abstract

The significance of ancillary services within the airline industry is progressively gaining prominence. As such, research on airlines’ ancillary services has continuously grown. The primary objective of this research article is to provide a review of ancillary services on passengers’ willingness to pay and the personalized pricing within the airline industry, achieved through the analysis of published scholarly works. The examination of published papers has been conducted with diverse criteria, including research methodologies, analytical perspectives, statistical methodologies, thematic coverage, technological dimensions, authorship, and geographical origins. The conclusions suggest a promising future regarding both airlines’ ancillary service applications and research in this area. The most crucial limitation stems from selecting works subject to examination as the analysis dealt with willingness to purchase and personalisation pricing field papers. Additionally, the selected region has not been widely covered. Nonetheless, this article can potentially be valuable for researchers and airline managers as it sheds light on emerging trends within both domains. These trends pertain not only to evolving technologies themselves but also to the novel applications thereof.

1. Introduction

The aviation sector stands as a pivotal global enterprise, facilitating essential linkages among individuals and societies across the globe. With its expansive reach spanning continents, it enhances the efficacy of travel processes, thereby fostering greater efficiency in global mobility. However, the aviation sector is unable to overcome its low profitability (Ozmec-Ban et al., Citation2022; Song & Lee, Citation2020) despite playing a significant role in the advancement of the world economy. This phenomenon is precipitated by several intertwined factors, such as diminished revenue yields from ticket sales, intensified competition regarding base fares, the ‘unbundling’ approach espoused by low-cost carriers (LCCs), and the prevalence of online fare comparison websites (O’Connell, Citation2011). Therefore, finding new sources of revenue growth for carriers is becoming increasingly important.

Despite these challenges, encouraging indications surfaced in the United States in 2015 (Song & Lee, Citation2020). Warnock-Smith et al. (Citation2017) ascribed the enhanced financial efficacy to supplementary revenues due to their observation of a positive correlation between the operating margins of carriers and the share of their overall revenue generated by ancillary sales. Ancillary revenues, denoted as “non-ticket revenues” (Wittmer et al., Citation2012), have progressively become the fastest growing revenue category (Centre for Asian Pacific Aviation (CAPA), Citation2014). On a global scale, airline ancillary revenues experienced a significant surge from $2.5 billion in 2007 to $38.1 billion in 2014. Implementing new service fees can potentially amplify revenues while simultaneously curbing costs. For instance, the imposition of checked baggage fees can reduce the volume of held luggage, thereby attenuating the associated handling fees that the airline must bear (de Wit & Zuidberg, Citation2012). Waguespack and Rhoades (Citation2014) highlighted the burgeoning importance of baggage fees for American airlines, noting the dramatic increase in baggage fee revenue from 2007 to 2012. To illustrate, during these five years, Delta Airlines and U.S. Airways saw a rise in revenue from baggage fees by 796 and 1760%, respectively. Ancillary revenues have become integral to airline accounts following the tremendous growth during the past few years (O’Connell & Warnock-Smith, Citation2013).

In the previous decade, airlines have substantially enhanced their ancillary revenues by adopting two key strategies: ‘unbundling’ and introducing innovative products (Ceregeiro, Citation2021; Materna & Tomová, Citation2016; Silva de Mattos et al., Citation2022). The term ‘unbundling’ denotes separately charging for products or services traditionally included in the base airfare, such as checked baggage (Avram, Citation2017; Waguespack, Citation2018). Notably, baggage-related fees increased fivefold between 2007 and 2010, as major American network carriers began imposing charges on domestic travellers for the first and second checked bags (DOT, 2016). These baggage fees currently contribute more than $1 billion annually to American Airlines alone, constituting approximately 2 to 4% of ticket revenue for major American network carriers. In aggregate, ancillary revenues have experienced a threefold increase over the past decade, surging from 3 to 8% of the total revenue (Stalnaker et al., Citation2016).

Airlines consistently strive to maximise the potential revenue from existing sources (Abdella et al., Citation2019; Bozogáň & Hurná, Citation2020; Klislinar & Wachidin Widjaja, Citation2020; Parise, Citation2018; Serrano & Kazda, Citation2020) and cultivate new revenue streams through further unbundling - resulting in the development of new products and services (Cui et al., Citation2018; Rouncivell et al., Citation2018; Shugan et al., Citation2017). The pricing of ancillary services necessitates a delicate balancing act, optimising the potential for revenue increase without causing a detrimental decline in base ticket sales (Silling, Citation2019; Zhao et al., Citation2021). A prevailing trend in the airline industry involves obfuscating ancillary revenue increases within increasingly complex products or offering these novel ancillary products free of charge to preferred or elite customers (Bachwich & Wittman, Citation2017; Garrow et al., Citation2012). Although ancillary revenue plays a pivotal role in modern airline operations, it is a novel revenue stream (Bockelie & Belobaba, Citation2017; Boin et al., Citation2017; Kosonen, Citation2020; Zhao et al., Citation2021). Hence, gaining deeper insights into the consumers’ willingness to pay on ancillary services and the formulation of pricing strategies by airline companies holds considerable significance for the sustained advancement of the broader aviation sector.

The primary aim of this article is to conduct a comprehensive literature review on integrating airline ancillary services, with a specific emphasis on publications about the willingness to pay (WTP) for such services and personalised pricing strategies for ancillary offerings. To achieve this objective, an extensive bibliographic analysis was undertaken to identify, categorize, discern, evaluate, and systematically present relevant scientific papers sourced from notable publications. Through this systematic literature review, the article sheds light on the contemporary trends, insights, and developments surrounding incorporating ancillary services in the airline industry’s pricing strategies.

The present article is organised as follows: Section 1 introduces the context and motivation behind the investigation of ancillary services within the framework. Subsequently, Section 2 offers a comprehensive framework for classifying ancillary services, accompanied by an analysis of the prevailing trends in their implementation, presenting a detailed exposition of ancillary services’ development status in the aviation industry. Section 3 introduces methodology applied in this article.

In pursuit of a comprehensive understanding, Section 4 thoroughly examines seminal studies concerning WTP assessments for ancillary services, the dynamic pricing strategies for these services, and the incorporation of personalized concepts. Each of these themes is scrutinized independently to discern their relevance and significance within the context of ancillary service management.

Finally, Section 5 culminates the review by succinctly summarising the key findings derived from the sections. Drawing upon these findings, this section also offers valuable recommendations for future research endeavours to fill gaps and extend the knowledge of ancillary services. Through this academic endeavour, the article aspires to contribute to the broader discourse surrounding ancillary service optimisation and enhancing ancillary service revenue practices in the aviation industry.

2. Theoretical framework

2.1 Ancillary service

The term "ancillary," as defined, denotes something that is "secondary or supplementary" (Grönroos, Citation2007). In the context of airline services, a service is an adjunct to the core business service, typically included in the base fare (Bozogáň & Hurná, Citation2020). The aviation industry’s core service revolves around transporting passengers from their departure point to their intended destination (Avram, Citation2017; Bozogáň & Hurná, Citation2020; Tsafarakis et al., Citation2018). Ancillary services encompass offerings beyond this fundamental transportation service, comprising preferred seating, booking enhancements, priority boarding, and food and beverage options (Morosan, Citation2014). These supplementary elements are often considered the foundational components of the overall service package, defining and rendering it competitive (Bozogáň & Hurná, Citation2020). Furthermore, these additional services constitute the principal sources of ancillary fees or revenue, a phenomenon underscored by Garrow et al. (Citation2012) through their analysis of product defunding trends. In summary, airline ancillary services enhance the customer experience by offering a personalised touch and concurrently contribute to airlines’ augmented revenue streams.

In economic terms, and as outlined in the literature, airline ancillary services are akin to add-on products (Bockelie & Belobaba, Citation2017). These optional services and products only add value when purchased with a primary product (Lal & Matutes, Citation1994). They are supplementary offerings tied to airlines’ core business services (Bozogáň & Hurná, Citation2020). For instance, an optional bag check service only adds value to a passenger if purchased along with a leading service, such as an air ticket.

Various definitions of airline ancillary service revenue have been proposed. According to Holloway (Citation2008), ancillary service fees can be seen as separating various components of the traditional airline product and imposing charges for features formerly bundled in the ticket price or limited to passengers in premium cabins. Vasigh et al. (Citation2012) posit that ancillary revenue refers to the income generated by an airline through non-ticket sources, which serve to enhance the airline’s services or product offerings, such as luggage fees or onboard services. According to the definition from IdeaWorks Company, ancillary revenues are the additional revenue generated beyond the primary ticket sales. These profits can be obtained from direct sales to passengers and indirectly from the overall travel experience or third-party engagement. The fees are only accrued when passengers choose to use the service.

2.2 Types of ancillary service

To understand ancillary services comprehensively, it is imperative to establish a clear definition and elucidate their operational mechanisms (Bozogáň & Hurná, Citation2020). Among the earliest forms of ancillary revenue generation is the sale of duty-free products during flights, which, for decades, represented the sole means through which airlines could augment their revenues from passengers while in-flight (O’Connell & Williams, Citation2011). Beyond duty-free product sales, another example of ancillary services includes what is commonly referred to as penalties, such as fees for excess baggage, flight cancellations, or flight changes (Ozmec-Ban et al., Citation2022).

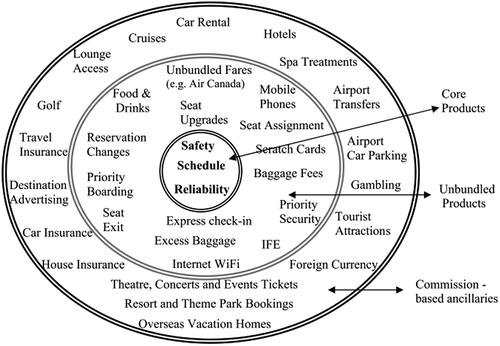

The classification of ancillary services has prompted differing opinions among various studies. The Amadeus Yearbook of Ancillary Revenues (2011), which is widely used by experts in the aviation sector, delineated four distinct classifications of ancillary services prevalent in the industry: (1) The term "a la carte" refers to additional services offered during a trip that requires a separate payment. These services may include onboard food and beverage options, checked-in bags, assigned seats, priority check-in, access to airport lounges, onboard entertainment, or Internet access. (2) The commission-based approach involves cross-selling endeavours, such as offering hotel accommodations, travel insurance, and car rental services. (3) The frequent flyers program allows companies to obtain airline miles that can be used for marketing initiatives, promotional campaigns, or loyalty-based marketing strategies. (4) Advertising generates revenue through various channels, including the inflight magazine and outdoor and indoor advertising spaces within aircraft, airline lounges, and airports. These classifications serve as valuable frameworks for understanding the multifaceted landscape of ancillary services in the aviation industry. However, some scholars propose that ancillary services generate revenues through two unique practices: the dismantling of the fare mechanism, which enables the carrier to charge for each flight product, and the cross-selling of third-party travel by-products through Bolton hyperlinks from an airline’s website (O’Connell, Citation2011). divides the flight products into three distinct categories; except for the core products, all the rest are ancillary service products, commonly regarded as the components of the service package that delineate and enhance its competitiveness (Zhou et al., Citation2020).

Figure 1. Map of core airline products (non-revenue) and revenue-producing products (Source: O’Connell).

A cadre of researchers has critically evaluated the shift towards the unbundling of aviation ancillary products in the American airline industry and has put forth a typology that segregates these services into three key categories, organised chronologically or historically. First, the "most established fees" category comprises charges that have existed since the era preceding deregulation and the rise of low-cost carriers, including fees for services such as ticket exchange, the accommodation of pets on board, and provisions for unaccompanied minors. The second category, "fees for services that used to be free," includes services that were initially offered free of cost but, in the wake of unbundling, are now chargeable. This category includes luggage check-in, in-flight meals, and seat selection. Lastly, the third category, "fees on newly introduced services," pertains to fees associated with introducing previously unavailable services and for which consumer demand might be somewhat restricted, such as premium dinners and onboard Wi-Fi (Garrow et al., Citation2012). Furthermore, some researchers have proposed a division of supplementary incomes into two separate categories: a la carte ancillaries, which include individual items that are not grouped, as well as punitive charges and third-party ancillary streams. The latter includes revenues sourced through commission-based incentives, frequent flyer programs, and advertising (Warnock-Smith et al., Citation2017).

IdeaWorks Company offered a more nuanced definition of ancillary revenue, categorised into a la carte features, commission-based products, frequent flier activities, advertising facilitated by the airline, and the a la carte components linked to a fare or product bundle. The details are shown in .

Table 1. Definition of ancillary revenue.

Moreover, it has been argued by certain scholars that these services could have a direct connection to the flight itself, encompassing aspects like baggage handling, seating upgrades, or meal options. Alternatively, these services may be integrated into the passenger’s broader travel arrangements, which could involve booking hotel accommodations, rental cars, or engaging in destination activities. Additionally, these services may be seen as a component of the passenger’s ongoing association with the airline, such as using a co-branded credit card (Bockelie & Belobaba, Citation2017), as shown in .

Table 2. Ancillary service categorization.

2.3 Global evolution of ancillary services

The inception of ancillary services within the aviation industry can be traced back to the 1940s and 50s when airlines initiated the provision of basic in-flight amenities such as meals, beverages, and blankets. These amenities were initially included in the ticket price to enrich the customer’s travel experience (Garrow et al., Citation2012). With the growth of the airline industry and intensifying competition, airlines began to offer more luxurious amenities, such as live T.V. and personal movie selections, as a method of differentiation (Garrow et al., Citation2012).

The deregulation of the American airline market in the late 1970s was a turning point in the evolution of ancillary services. This deregulation gave airlines more latitude in establishing fares and routes, fostering increased competition and price wars (Garrow et al., Citation2012). Consequently, airlines explored diversifying revenue streams, reducing reliance on ticket sales.

In contradistinction to the approach, low-cost airlines adopted an unbundling strategy, allowing passengers to select ancillary services based on their preferences and requirements (Ozmec-Ban et al., Citation2022). By unbundling services, these airlines allow customers to tailor their travel experience, opting for specific amenities or extras as desired and tailoring their overall travel costs accordingly. The rise of low-cost carriers (LCCs) like Southwest Airlines in America and Ryanair in Europe in the 1990s was instrumental in advancing the acceptance of ancillary services as additional revenue sources. These carriers adopted a business model focusing on operational cost minimisation and a la carte services at an additional fee (de Wit & Zuidberg, Citation2012). This service unbundling enabled LCCs to offer lower base fares, attracting price-sensitive travellers (Bozogáň & Hurná, Citation2020; de Wit & Zuidberg, Citation2012). Low-cost airlines employ various strategies, ranging from price mechanisms to extensive promotional efforts, to reduce ticket prices and attract customer interest. Consequently, LCCs are keen on offering ancillary products and services that directly engage passengers. These may include seat selection, baggage services, priority passes, food and beverage choices, and in-flight entertainment (Worasuwannarak, Citation2023).

The emergence of low-cost carriers (LCCs) has transformed the competitive landscape within liberalized markets (O’Connell & Williams, Citation2005). This development has revolutionized the conventional business model of airlines, significantly impacting the provision of ancillary services across the aviation industry. Traditional airlines have adopted the practice of charging for supplementary services, mirroring the strategies employed by low-cost carriers (Babić et al., 2019). The proliferation of charged in-flight services among traditional carriers exemplifies the ongoing process of hybridization, indicative of a gradual transition towards a hybrid business model (Tomová & Materna, Citation2017).

At the same time the traditional low-cost business model has progressively changed and LCC carriers have moved on both sides of the spectrum. On the one hand, this has led to the emergence of the ultra-low-cost business model (ULCC), in which carriers charge for all aspects of travel other than airfares, by adopting lower costs than low-cost carriers while generating ancillary revenues through aggressive fare splitting (Bachwich & Wittman, Citation2017). On the other hand, some carriers have begun a ‘hybridization’ process, offering services traditionally provided by full-service carriers (FSCs) therefore hybridizing their business models (Chiambaretto & Combe, Citation2023; Corbo, Citation2017; Morlotti et al., Citation2020). For instance, hybridized low-cost airlines compensate customers for higher ticket prices by offering additional airport or other ancillary services (Tomová & Materna, Citation2017). Presently, the rise of hybrid models diminishes the stark contrasts between LCCs and FSCs (Morlotti et al., Citation2020). This transformative shift also expands the potential for the evolution of airline ancillary services.

Digital technology and e-commerce facilitated the proliferation of airline ancillary services. Online booking platforms and mobile applications have empowered airlines to offer personalised ancillary services through targeted offers and dynamic pricing, acknowledging the Internet’s role as a revenue generator (O’Connell & Warnock-Smith, Citation2013). Additionally, digital channels have allowed airlines to gather valuable customer data, tailoring ancillary services according to individual preferences and travel habits.

The airline ancillary services market currently features various products and services catering to diverse customer segments and preferences. Furthermore, the ascension of ancillary services has stimulated the creation of novel business models and partnerships within the airline industry. For instance, airlines are increasingly partnering with hotels, car rental companies, and other travel service providers to offer comprehensive packages and one-stop travel solutions, improving the overall customer experience and generating additional revenue (Tiernan et al., 2021). As the industry progresses, the range and complexity of ancillary services are expected to expand further, driven by technological advances, shifting customer preferences, and the perpetual quest for competitive differentiation and revenue diversification.

3. Methodology

The search process involved the utilisation of pertinent keywords directly related to the addressed problem in the article, such as “airlines,” "airlines ancillaries," "airlines add-ons," "transport service," "transportation," and "pricing," among others. The chosen temporal scope for the study encompassed the preceding eight years. This decision was primarily based on the recognition that airlines commenced offering a diverse range of ancillary services only recently, rendering the past eight years a crucial period for understanding the evolution and impact of these services within the aviation industry. To ensure a comprehensive and rigorous analysis, databases such as Web of Science and Scopus were used, enabling the selection of relevant subject areas closely aligned with the research topic.

Initially, 120 research papers were accessed, and subsequent screening identified 64 papers deemed germane to the study’s parameters over a span of ten years. The selection criteria were applied to ensure congruence with the research topic and objectives.

The organization of the retrieved articles involved a multifaceted approach incorporating various criteria such as authorship, data collection method, type of ancillary services, region or airline, influencing factors and findings. This systematic organization facilitated a comprehensive examination of the literature, facilitating the identification of key themes, trends, and research lacunae within the domain of ancillary services in the airline industry.

4. Review of existing literature

The reviewed studies are systematically classified into two distinct research categories, each about a specific aspect of ancillary services in the airline industry: (1) WTP for ancillaries and (2) personalised ancillaries pricing. and present a summary of studies on the WTP for ancillary services and pricing strategies, respectively, encompassing key details such as the author(s), data collection methodology, types of ancillary services investigated, regions or airlines under study, antecedents or attributes considered, as well as the noteworthy findings derived from each respective research paper.

Table 3. Reviewing studies on the willingness to pay for ancillary services.

Table 4. Reviewing studies on pricing for ancillary services.

4.1 Willingness to pay (WTP)

In the ever-evolving world of aviation, airlines continually seek innovative ways to adapt to changing consumer preferences and optimise their revenue streams (Babić et al., 2019; Zhao et al., Citation2021). A prominent paradigm shift in this pursuit has been the growing emphasis on airline ancillary services, offering passengers various optional add-ons beyond the traditional ticket price (Rouncivell et al., Citation2018; Zhao et al., Citation2021). From in-flight amenities and seat upgrades to baggage fees and priority boarding, these supplementary offerings not only cater to the individualised needs of modern travellers but also present a strategic avenue for airlines to bolster profitability (Katsoni & Poulaki, Citation2021). Within this context, a pivotal aspect lies in discerning passengers’ WTP for these ancillary services, unearthing critical insights that illuminate the drivers behind this consumer behaviour while paving the way for informed decision-making and strategic positioning within the fiercely competitive airline industry.

Several academicians, including but not limited to Warnock-Smith et al. (Citation2017), Ren et al. (Citation2022), Chiambaretto (Citation2021), Wang et al. (Citation2022), Kassir and Ashaal (Citation2021) and Kuo and Jou (Citation2017), have engaged in research probing the influence of flight distance on passengers’ WTP for supplementary services, with a particular emphasis on seat selection, which is one of the most common ancillary services chosen by passengers (Wang et al., Citation2022). The consensus indicates that passengers embarking on long-haul journeys are more willing to pay for such services than their counterparts on short-haul flights. This tendency can be attributed to the increased duration of the in-flight experience during long-haul travel (Kuo & Jou, Citation2017). This extended duration might amplify the perceived value of supplementary offerings, such as seat preference, as passengers seek heightened comfort and a tailored experience. However, it warrants mentioning that Shaw et al. (Citation2021) found no substantial correlation between flight distance and passengers’ WTP for third-party supplementary services, suggesting that the relationship between these variables might be service-specific. Hence, the flight duration and the nature of the supplementary service play a pivotal role in shaping passengers’ preferences and WTP.

Moreover, travel purpose, also classified by some scholars as a traveller type, emerges as a critical factor in influencing passengers’ WTP for ancillary services, as substantiated by numerous scholarly investigations (Chiambaretto, Citation2021; Ren et al., Citation2022; Rouncivell et al., Citation2018; Warnock-Smith et al., Citation2017). It is essential to underscore that the effect of travel purposes on WTP could manifest differently across various aspects of ancillary services. For instance, Chiambaretto (Citation2021), through a choice-based conjoint analysis, uncovered that business passengers exhibit significantly less interest in features such as priority boarding or seat selection than leisure passengers. This differential could potentially stem from the fact that many business travellers enjoy privileged status within frequent flyer programs, receiving these benefits either free of charge or at a discounted rate, which could skew their perceptions and behaviours, consequently impacting their WTP for these ancillary services (Agostini et al., Citation2015; Terblanche, Citation2015). Conversely, research conducted in the United Kingdom (Rouncivell et al., Citation2018), Middle East (Kassir & Ashaal, Citation2021) and China (Ren et al., Citation2022) suggested that business passengers display a heightened WTP for seat selection due to their preference for extra legroom compared to leisure passengers. Interestingly, business and leisure passengers exhibit a uniform WTP for specific elements or tiers, such as the option for a gourmet meal, regardless of statistical significance. The attractiveness of a gourmet meal might be tied to a hedonic choice that affords passengers pleasure and satisfaction.

The frequency of flying has emerged as a crucial factor influencing passengers’ inclination towards purchasing ancillary services. Passengers who engage in regular air travel within a specific timeframe demonstrate heightened confidence in making ancillary service purchases (Leon & Uddin, Citation2017; Rouncivell et al., Citation2018; Shaw et al., Citation2021; Song & Lee, Citation2020). Researchers have frequently utilised flight frequency as a variable for cross-analysis with other influencing factors in the context of ancillary service consumption. For instance, Song and Lee (Citation2020) found that compared to short-distance travellers, high-frequency passengers on long-distance journeys display a greater propensity to purchase ancillary services. Moreover, Wang et al. (Citation2022) observed that frequent business travellers are more willing to pay for ancillary services.

4.2 Pricing strategies

The concept of dynamic pricing is not novel in the fields of economics and operational research. However, with the advent of new distribution systems like IATA NDC (New Distribution Capability), there arises a necessity for a more intricate and precise definition, particularly when it comes to its application within revenue management systems (Ozmec-Ban et al., Citation2022).

As unique and varied travelling demands swiftly emerge, the traditional passenger archetype is supplanted by passengers possessing distinctive needs and tastes (Zhao et al., Citation2021). From a research perspective, scholarly investigations now delve deeper and find broader applications.

Much of this research is centred on determining the pricing for a specific ancillary service (e.g., seat selection or baggage) using a discrete choice model. For example, Mumbower et al. (Citation2015) used JetBlue’s data to study selective pricing in the premium economy, uncovering that customers demonstrate decreased price sensitivity and a WTP higher seat fees as the departure date approaches. Similarly, Ren et al. (Citation2022) investigated passenger choice behaviour for paid seat selection by analysing, surveying, and modelling pricing strategies. Their calculation of optimal pricing based on domestic flight data in China indicated a substantial 74.4% revenue increase across passenger types.

Moreover, within the realm of airline revenue management, significant attention has been directed towards the pricing of paid seat selection, prompting numerous scholars to undertake diverse endeavours in this domain. Wang et al. (Citation2022) introduced a novel BCR-LightGBM model, which identifies passengers’ WTP for seat selection, laying the groundwork for personalised seat recommendations. Building upon this foundation, Yoon and Lee (Citation2021) devised a highly effective seat assignment approach, accommodating multiple fare classes while incorporating a payable upgrade option to optimise total revenue generation. These scholarly contributions collectively advance knowledge of airline pricing strategies and revenue optimisation techniques.

Scotti and Dresner (Citation2015) scrutinised pricing strategies related to checked baggage on a sample of American domestic routes using a simultaneous system of equations. The outcomes supported the theory that swapping higher fares with additional baggage fees could benefit airlines, thereby boosting revenue and preserving market share. Furthermore, Ambrosius (Citation2017) used empirical sales data from a low-cost airline to probe the impact of different pricing structures on passengers’ checked baggage purchasing behaviour. The findings illustrated that pricing alterations barely impacted consumers, with purchase likelihood primarily driven by days-before-departure (DBD) and group size. Kummara et al. (Citation2021) built the machine learning (ML) algorithm, which can suggest an optimal mix of products and price points with the highest propensity to purchase for a given customer and travel itinerary.

Finally, Ødegaard and Wilson (Citation2016) delved into the pricing of primary products and ancillary services, devising a revenue-maximising, multi-temporal, dynamic pricing model. Wilson (Citation2016) refined this approach further, proposing a dynamic product mix pricing model for fares and ancillary services based on the assumption of a linear passenger-passenger price demand curve.

Various studies have explored the intricacies of dynamic pricing of product combinations, proposing innovative models and algorithms to optimise revenue and personalise pricing. For instance, Zhao et al. (Citation2021) employed a binary logic model in simulating the determination of optimal prices for a product mix. Meanwhile, Bockelie and Belobaba (Citation2017) sought to shed light on the factors influencing consumer choice of airline itineraries and fare classes. Their integrated passenger choice model indicated the potential revenue and booking variations with different ancillary fee structures. They discovered that while bundling ancillary services could induce passenger buy-ups or buy-downs, sequential passengers generate more significant revenue for the airline.

Several other researchers, such as Kolbeinsson et al. (Citation2022) and Shukla et al. (Citation2020), expanded on personalised pricing, designing models and algorithms to enhance pricing for each shopping session. Concurrently, Wang et al. (Citation2021) used the Passenger Origin-Destination Simulator (PODS) to evaluate the impact of Dynamic Offer Generation (DOG) in a competitive network. Their findings suggested that the use of DOG by one or more airlines could potentially augment net revenue. Collectively, these studies shed light on the sophisticated strategies and models underpinning the dynamic pricing of product combinations, each contributing unique insights to this rapidly evolving field.

5. Conclusion

Airline ancillary business is becoming increasingly important in terms of increasing revenue and improving efficiency, and is becoming an important business for airlines to enhance their market competitiveness. Thus, making ancillary service operations an emerging and increasingly prominent subject of study, drawing heightened attention within the air transport industry. This is evidenced by the expanding literature in relevant academic journals and publications. The purpose of this article is to provide an extensive review of the literature on airline ancillary services over the past decade.

Innovation in creating and providing a spectrum of ancillary services is a rising trend among airlines, attributable to their potential to drive incremental revenues. However, which ancillary services should airlines sell and to whom should they sell?Consequently, it is important to carefully identify the passenger characteristics that influence ancillary purchases and the kinds of ancillary services that passengers are willing to purchase, given the noticeable variations in travelers’ preferences for these services based on factors like travel class, purpose of trip, length of flight, region, and so on. The introduction of these services necessitates the implementation of an appropriate pricing mechanism. For any kind of airline to succeed, it is essential to implement a suitable pricing strategy for the ancillary service that aligns with both the business model and the traits of the targeted customer segments. Personalized pricing for ancillary service calls for the capability to ascertain the characteristics of prospective passengers, coupled with their WTP, and to tailor real-time offers accordingly.

The studies that examine only one or a few ancillary services in WTP and pricing strategy (such as paid seat selection) are more numerous than others. This evidence can be attributed to multiple factors. Firstly, it is easier to gather just a few different types of opinions rather than overwhelming respondents with too many questions. Additionally, it is much easier to identify traveler attributes that correlate with the preferred service when concentrating on one or a small number of ancillary services. This is also more relevant when developing the appropriate pricing strategy.

From our literature review study, we can conclude that there is a large variety of pricing methods, and that it is difficult to understand if all the methods are suitable, or which are the best methods for pricing ancillary service. Therefore, it is important to investigate much more on the literature of the sector of air transportation ancillary service. Future research should strive to furnish practical solutions and delivering personalised offers to passengers while accounting for the influencing WTP factors and individual passenger behavior.

Looking ahead, an examination of ancillary fees reveals that all types carriers have implemented new fees over the past few years. How carriers have elected to implement these fees, though, varies. Therefore, it is advised that the carriers’ business models be divided in order to facilitate more thorough and accurate future research on WTP and pricing strategies. After all, the majority of research has only been done to classify carriers into two groups: traditional carriers and low-cost carriers. But the carrier’s model has gradually been addition of hybrid and ultra-low-cost models, which has an impact on the growth of ancillary services as well. Ancillary services present considerable opportunities for growth and innovation, particularly in light of the recent addition of a frequent flyer program by LCC to the hybrid model. Consequently, more research may strengthen the connection between ancillary services and traveler loyalty as well as satisfaction.

Authors’ Contributions

H.L. and N.H.A. provided concepts for the paper’s general conceptualization. H.L. and S.L. arranged and gathered the books. H.L. investigated into LCCs which was encouraged by N.H.A., who also oversaw the work’s results. H.L. drafted, checked, and revised the document. All authors discussed the results and contributed to the final manuscript. (H.L.: Honglin Liu; N.H.A.: Nawal Hanim Binti Abdullah; S.L.: Shin Yiing Lee)

Disclosure statement

No potential conflict of interest was reported by the author(s).

Data availability statement

The authors confirm that the data supporting the findings of this study are available within the article or its supplementary materials.

Additional information

Notes on contributors

Honglin Liu

Honglin Liu is a postgraduate research student of school of business and economic at Universiti Putra Malaysia. Her research interests include consumption value and services marketing.

Nawal Hanim Binti Abdullah

Nawal Hanim Binti Abdullah, PhD, is a Senior Lecturer of school of business and economic at Universiti Putra Malaysia. Her research focuses on services marketing and event tourism, specialises in qualitative research.

Shin Yiing Lee

Shin Yiing Lee, PhD, is a Senior Lecturer of school of business and economic at Universiti Putra Malaysia. Her research focuses on services marketing and consumer behaviour, specialises in quantitative research.

References

- Abdella, J. A., Zaki, N., Shuaib, K., & Khan, F. (2019). Airline ticket price and demand prediction: A survey. Journal of King Saud University - Computer and Information Sciences, 33(4), 1–14. https://doi.org/10.1016/j.jksuci.2019.02.001

- Agostini, C. A.,Inostroza, D., &Willington, M. (2015). Price effects of airlines frequent flyer programs: The case of the dominant firm in Chile. Transportation Research Part A: Policy and Practice, 78, 283–297. https://doi.org/10.1016/j.tra.2015.05.011

- Ambrosius, M. F. (2017). Effects of price discrimination on airline ancillary good sales: a multiple treatment propensity score weighting approach. Master’s thesis. University of Twente.

- Avram, B. (2017). Ancillaries in the aviation industry. Importance, trends, going digital. Expert Journal of Marketing, 5(2), 53–65.

- Bachwich, A. R., & Wittman, M. D. (2017). The emergence and effects of the ultra-low cost carrier (ULCC) business model in the U.S. airline industry. Journal of Air Transport Management, 62, 155–164. https://doi.org/10.1016/j.jairtraman.2017.03.012

- Bockelie, A., & Belobaba, P. (2017). Incorporating ancillary services in airline passenger choice models. Journal of Revenue and Pricing Management, 16(6), 553–568. https://doi.org/10.1057/s41272-017-0100-6

- Boin, R., Coleman, W., Delfassy, D., & Palombo, G. (2017). How airlines can gain a competitive edge through pricing. McKinsey. https://www.mckinsey.com/∼/media/McKinsey/Industries/Travel%20Transport%20and%20Logistics/Our% 20Insights/How% 20airlines% 20can% 20gain% 20a%20competitive% 20edge%20through%20pricing/How-airlines-can-gain-a-competitive-edge-through-pricing.ashx.

- Bozogáň, M., & Hurná, S. (2020). Use of modern technologies at baggage tracking and its impact on airline revenue. Mobility Internet of Things, 2018, 73–111. https://doi.org/10.1007/978-3-030-30911-4_6

- Centre for Asian Pacific Aviation (CAPA). (2014). Ancillaries Key for Airlines and Growing Rapidly. Retrieved from. www.centreforeaviation.com

- Ceregeiro, M. M. S. D. A. D. S. (2021). The future of the air travel industry: the concept of door-to-door luggage delivery service. Doctoral dissertation.

- Chiambaretto, P. (2021). Air passengers’ willingness to pay for ancillary services on long-haul flights. Transportation Research Part E: Logistics and Transportation Review, 147, 102234. https://doi.org/10.1016/j.tre.2021.102234

- Chiambaretto, P., & Combe, E. (2023). Business model hybridization but heterogeneous economic performance: Insights from low-cost and legacy carriers in Europe. Transport Policy, 136, 83–97. https://doi.org/10.1016/j.tranpol.2023.03.016

- Corbo, L. (2017). In search of business model configurations that work: Lessons from the hybridization of Air Berlin and JetBlue. Journal of Air Transport Management, 64, 139–150. https://doi.org/10.1016/j.jairtraman.2016.09.010

- Cui, Y., Duenyas, I., & Sahin, O. (2018). Unbundling of ancillary service: How does price discrimination of main service matter? Manufacturing & Service Operations Management, 20(3), 455–466. https://doi.org/10.1287/msom.2017.0646

- de Wit, J. G., & Zuidberg, J. (2012). The growth limits of the low cost carrier model. Journal of Air Transport Management, 21, 17–23. https://doi.org/10.1016/j.jairtraman.2011.12.013

- Garrow, L. A., Hotle, S., & Mumbower, S. (2012). Assessment of product debundling trends in the US airline industry: Customer service and public policy implications. Transportation Research Part A: Policy and Practice, 46(2), 255–268. https://doi.org/10.1016/j.tra.2011.09.009

- Grönroos, C. (2007). Service management and marketing: customer management in service competition. John Wiley & Sons.

- Holloway, S. (2008). Straight and level: Practical airline economics. 3rd ed. Ashgate Publishing Limited.

- Hugon-Duprat, C., & O’Connell, J. F. (2015). The rationale for implementing a premium economy class in the long haul markets – Evidence from the transatlantic market. Journal of Air Transport Management, 47, 11–19. https://doi.org/10.1016/j.jairtraman.2015.03.005

- Kassir, A., & Ashaal, A. (2021). Ancillary Revenue of full service airline an analysis of the passenger’s willingness to pay |WTP| (The Case of Middle East Airlines). Review of Politics and Public Policy in Emerging Economies, 3(2), 115–128. https://doi.org/10.26710/rope.v3i2.2234

- Katsoni, V., & Poulaki, I. (2021). Digital evolution and emerging revenue management practices: Evidence from Aegean airlines distribution channels. Journal of Hospitality and Tourism Technology, 12(2), 254–270. https://doi.org/10.1108/JHTT-12-2019-0145

- Klislinar, E., & Wachidin Widjaja, A. (2020). Analysis of willingness to pay for ancillary revenue of full service airline (The Case of Garuda Indonesia). KnE Social Sciences, 4(6), 1213–1230. https://doi.org/10.18502/kss.v4i6.6672

- Kolbeinsson, A., Shukla, N., Gupta, A., Marla, L., & Yellepeddi, K. (2022). Galactic air improves ancillary revenues with dynamic personalized pricing. INFORMS Journal on Applied Analytics, 52(3), 233–249. https://doi.org/10.1287/inte.2021.1105

- Kosonen, E. (2020). Dynamic pricing of airline ancillaries: co-creating a machine learning model to price ancillaries in the case company.

- Kummara, M. R., Guntreddy, B. R., Vega, I. G., & Tai, Y. H. (2021). Dynamic pricing of ancillaries using machine learning: one step closer to full offer optimization. Journal of Revenue and Pricing Management, 20(6), 646–653. https://doi.org/10.1057/s41272-021-00347-6

- Kuo, C.-W., & Jou, R.-C. (2017). Willingness to pay for airlines’ premium economy class: The perspective of passengers. Journal of Air Transport Management, 59, 134–142. https://doi.org/10.1016/j.jairtraman.2016.12.005

- Lal, R., & Matutes, C. (1994). Retail pricing and advertising strategies. The Journal of Business, 67(3), 345–370. https://doi.org/10.1086/296637

- Leon, S., & Uddin, N. (2017). Data-driven insights: Assessment of airline ancillary services. Journal of Transportation Management, 27(2), 59–74. https://doi.org/10.22237/jotm/1498867500

- Materna, M., & Tomová, A. (2016). Long-haul low-cost air services: revealing key competitive features of airline within airline strategy. Ekonomiczne Problemy Usług, 124, 151–162. https://doi.org/10.18276/epu.2016.124-12

- Morlotti, C., Birolini, S., Cattaneo, M., & Redondi, R. (2020). Introducing connecting flights in LCCs’ business model: Ryanair’s network strategy. Journal of Air Transport Management, 87, 101849. https://doi.org/10.1016/j.jairtraman.2020.101849

- Morosan, C. (2014). Toward an integrated model of adoption of mobile phones for purchasing ancillary services in air travel. International Journal of Contemporary Hospitality Management, 26(2), 246–271. https://doi.org/10.1108/IJCHM-11-2012-0221

- Mumbower, S., Garrow, L. A., & Newman, J. P. (2015). Investigating airline customers’ premium coach seat purchases and implications for optimal pricing strategies. Transportation Research Part A: Policy and Practice, 73, 53–69. https://doi.org/10.1016/j.tra.2014.12.008

- O’Connell, J. F. (2011). Ancillary revenues e the new trend in strategic airline marketing. In: J. F. O’Connell, & G. Williams (Eds.), Air Transport in the 21st Century. Ashgate.

- O’Connell, J. F., & Williams, G. (2005). Passengers’ perceptions of low cost airlines and full service carriers: A case study involving Ryanair, Aer Lingus, Air Asia and Malaysia Airlines. Journal of Air Transport Management, 11(4), 259–272. https://doi.org/10.1016/j.jairtraman.2005.01.007

- O’Connell, J. F., & Warnock-Smith, D. (2013). An investigation into traveler preferences and acceptance levels of airline ancillary revenues. Journal of Air Transport Management, 33, 12–21. https://doi.org/10.1016/j.jairtraman.2013.06.006

- O’Connell, J. F., & Williams, G. (2011). Air transport in the 21st century: Key strategic developments.

- Ødegaard, F., & Wilson, J. G. (2016). Dynamic pricing of primary products and ancillary services. European Journal of Operational Research, 251(2), 586–599. https://doi.org/10.1016/j.ejor.2015.11.026

- Ozmec-Ban, M., Škurla Babić, R., Vidović, A., & Bračić, M. (2022). A review of ancillary services implementation in the revenue management systems. Promet-Traffic & Transportation, 34(4), 581-594. https://doi.org/10.7307/ptt.v34i4.4065

- Parise, G. (2018). Threat of entry and debt maturity: Evidence from airlines. Journal of Financial Economics, 127(2), 226–247. https://doi.org/10.1016/j.jfineco.2017.11.009

- Ren, X., Pan, N., & Jiang, H. (2022). Differentiated pricing for airline ancillary services considering passenger choice behavior heterogeneity and willingness to pay. Transport Policy, 126, 292–305. https://doi.org/10.1016/j.tranpol.2022.08.001

- Rouncivell, A., Timmis, A. J., & Ison, S. G. (2018). Willingness to pay for preferred seat selection on UK domestic flights. Journal of Air Transport Management, 70, 57–61. https://doi.org/10.1016/j.jairtraman.2018.04.018

- Scotti, D., & Dresner, M. (2015). The impact of baggage fees on passenger demand on US air routes. Transport Policy, 43, 4–10. https://doi.org/10.1016/j.tranpol.2015.05.017

- Serrano, F., & Kazda, A. (2020). The future of airport post COVID-19. Journal of Air Transport Management, 89(101900), 101900. https://doi.org/10.1016/j.jairtraman.2020.101900

- Shaw, M., Tiernan, S., O’Connell, J. F., Warnock-Smith, D., & Efthymiou, M. (2021). Third party ancillary revenues in the airline sector: An exploratory study. Journal of Air Transport Management, 90, 101936. https://doi.org/10.1016/j.jairtraman.2020.101936

- Shugan, S. M., Moon, J., Shi, Q., & Kumar, N. S. (2017). Product line bundling: Why airlines bundle high-end while hotels bundle low-end. Marketing Science, 36(1), 124–139. https://doi.org/10.1287/mksc.2016.1004

- Shukla, N., Kolbeinsson, A., Marla, L., & Yellepeddi, K. (2020). From average customer to individual traveler: A field experiment in airline ancillary pricing. SSRN Electronic Journal. Available at SSRN 3518854. https://doi.org/10.2139/ssrn.3518854

- Silling, U. (2019). Aviation of the future: What needs to change to get aviation fit for the twenty-first century. In Aviation and its management-global challenges and opportunities. IntechOpen.

- Silva de Mattos, B., Tavares Guerreiro Fregnani, J. A., & Takachi Tomita, J. (2022). Effects of the 1978 airline deregulation act on aircraft industry measured by entropy statistics. TRANSPORTES, 30(2), 2594. https://doi.org/10.14295/transportes.v30i2.2594

- Song, W.-K., & Lee, H. C. (2020). An analysis of traveler need for and willingness to purchase airline dynamic packaging: A Korean case study. Journal of Air Transport Management, 82, 101735. https://doi.org/10.1016/j.jairtraman.2019.101735

- Stalnaker, T., Usman, K., & Taylor, A. (2016). Airline economic analysis. http://www.oliverwy man.com/content/dam/oliver-wyman/global/en/2016/jan/oliver-wyman-airline-economic-analysis-2015-2016.pdf

- Terblanche, N. S. (2015). Customers’ Perceived Benefits of a Frequent-Flyer Program. Journal of Travel & Tourism Marketing, 32(3), 199–210. https://doi.org/10.1080/10548408.2014.895694

- Tomová, A., & Materna, M. (2017). The directions of on-going air carriers’ hybridization: Towards peerless business models? Procedia Engineering, 192, 569–573. https://doi.org/10.1016/j.proeng.2017.06.098

- Tsafarakis, S., Kokotas, T., & Pantouvakis, A. (2018). A multiple criteria approach for airline passenger satisfaction measurement and service quality improvement. Journal of Air Transport Management, 68, 61–75. https://doi.org/10.1016/j.jairtraman.2017.09.010

- Vasigh, B., Taleghani, R., & Jenkins, D. (2012). Aircraft finance: Strategies for managing capital costs in a turbulent industry.

- Waguespack, B. P. (2018). Airline marketing. In The Routledge companion to air transport management (pp. 206–219). Routledge.

- Waguespack, B. P., & Rhoades, D. L. (2014). Twenty five years of measuring airline service quality or why is airline service quality only good when times are bad? Research in Transportation Business & Management, 10, 33–39. https://doi.org/10.1016/j.rtbm.2014.06.001

- Wang, Z., Han, X., Chen, Y., Ye, X., Hu, K., & Yu, D. (2022). Prediction of willingness to pay for airline seat selection based on improved ensemble learning. Aerospace, 9(2), 47. https://doi.org/10.3390/aerospace9020047

- Wang, K. K., Wittman, M. D., & Bockelie, A. (2021). Dynamic offer generation in airline revenue management. Journal of Revenue and Pricing Management, 20(6), 654–668. https://doi.org/10.1057/s41272-021-00349-4

- Warnock-Smith, D., O’Connell, J. F., & Maleki, M. (2017). An analysis of ongoing trends in airline ancillary revenues. Journal of Air Transport Management, 64, 42–54. https://doi.org/10.1016/j.jairtraman.2017.06.023

- Wilson, J. G. (2016). Jointly Optimising Prices for Primary and Multiple Ancillary Products. IFAC-PapersOnLine, 49(12), 267–270. https://doi.org/10.1016/j.ifacol.2016.07.615

- Wittmer, A., Boksberger, P., & Gerber, A. (2012). The future of ancillary service fees in air travel - An exploratory investigation of budget air travellers. International Journal of Aviation Management, 1(4), 231. https://doi.org/10.1504/IJAM.2012.050474

- Worasuwannarak, B. (2023). P-People”: The marketing mix approach of value-added in LCC ancillary service. In Strategic human resource management in the hospitality industry: A digitalized economic paradigm (pp. 1–14). IGI Global. https://doi.org/10.4018/978-1-6684-7494-5.ch001

- Yoon, M., & Lee, H. (2021). Seat assignment problem with the payable up-grade as an ancillary service of airlines. Annals of Operations Research, 307(1–2), 483–497. https://doi.org/10.1007/s10479-021-04329-0

- Zhao, G., Cui, Y., & Cheng, S. (2021). Dynamic pricing of ancillary services based on passenger choice behavior. Journal of Air Transport Management, 94, 102058. https://doi.org/10.1016/j.jairtraman.2021.102058

- Zhou, Y., Zhang, T., Mo, Y., & Huang, G. (2020). Willingness to pay for economy class seat selection: From a Chinese air consumer perspective. Research in Transportation Business & Management, 37, 100486. https://doi.org/10.1016/j.rtbm.2020.100486