?Mathematical formulae have been encoded as MathML and are displayed in this HTML version using MathJax in order to improve their display. Uncheck the box to turn MathJax off. This feature requires Javascript. Click on a formula to zoom.

?Mathematical formulae have been encoded as MathML and are displayed in this HTML version using MathJax in order to improve their display. Uncheck the box to turn MathJax off. This feature requires Javascript. Click on a formula to zoom.Abstract

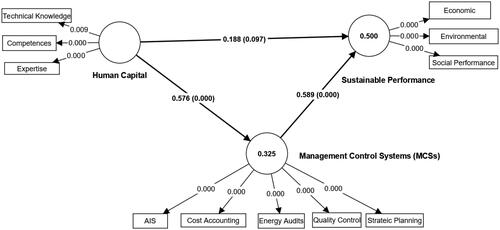

This study examines the relationship between human capital and Sustainable Performance (SP) with the mediating role of management control systems in power companies in Uganda. The study is based on a cross-sectional research design in which pre-specified hypotheses are tested on a sample of 105 power companies in Uganda. The primary data was collected using a questionnaire from the managers of power companies. The data were analyzed using SPSS and Smart PLS. The study finds that the relationship between human capital and sustainable performance is fully mediated by MCS. The findings highlight that MCSs serve as a bridge that connects human capital to sustainable performance, thus unifying the RBV (resource-centered) perspective with the stakeholder theory (stakeholder-centered). This study complements perception-based research that provides insights into all dimensions of SP based on the triple-bottom-line approach. This study provides undiscovered empirical evidence of the mediating role of MCS on the relationship between human capital and SP and provides actionable insights for power company managers to heighten their control mechanisms and align human capital strategies to effectively drive sustainable performance outcomes. This study provides evidence-based policy recommendations for power companies to create a supportive environment where employees effectively use MCS to utilize their competencies, knowledge, and experience to meet sustainable performance goals.

1. Introduction

The main aim of this study is to examine the mediating role of management control systems on the relationship between human capital and Sustainable Performance (SP) in power companies in Uganda. Equally, this addresses the following crucial policy concerns. First, is human capital directly related to sustainable performance? Second and final, given the need for an organizational system that collects and utilizes information on the several organizational resources for sustainability, do the management control systems relate directly to sustainable performance in power companies?

Globally, Economies hugely thrive on the effectiveness of power companies. Most importantly, power companies in most jurisdictions have a statutory mandate to generate, transmit, and distribute electricity (e.g., hydro, thermal, cogeneration, wind, geothermal, and solar) to the end-users for production and service functions. In this arrangement, power companies ought to ensure that as they achieve the economic targets they need to protect the environment and meet the expectations of society. This threefold mandate is construed as the sustainable performance of power companies in the context of this study. More so, the sustainability of power companies is expected to ensure that by 2030 all persons have access to inexpensive, reliable, sustainable, and clean electricity sources (Sustainable Development Goal 7). To achieve these targets, several reforms and developments have been instituted across the world. For example, amendment of legislation, independent regulations of the electricity industry, creation of viable electricity market structure, private sector participation, and efficient pricing (Gencer et al., Citation2020; Kumar et al., Citation2021).

In Uganda, the major reforms that liberalized the electricity sub-sector include the Uganda Electricity Act of 1999 (amended 2022) which detached the generation, transmission, and distribution of electricity. Together with the national energy policy for Uganda 2023, the Renewable energy policy of 2007, the Gender policy of 2007, and the Environmental and Social Safeguards Policy of 2018, the Act also provides for private-sector participation and integrated resource planning. Other related laws like the National Environment Act of 2019 provide guidelines for the sustainable environmental performance of power companies in Uganda. Through these reforms, the Government of Uganda is at the forefront of enforcing sustainability in the electricity sub-sector (Twesigye, Citation2022) though several challenges are also evident. For instance, human capital gaps in terms of knowledge, competencies, and experiences of the power sector dynamics have been linked to persistent power outages, deemed energy, and high electricity costs (Adepoju et al., Citation2022). Nonetheless, the constant reforms in the electricity sector have further heightened the need for management control systems within power companies to ensure compliance (Akankunda et al., Citation2023; Rehman et al., Citation2021) with regulations toward sustainable performance.

Theoretically, the corporation’s fundamental obligation is to ensure it survives and thrives while considering and balancing the needs of multiple stakeholders, instead of solely maximizing its financial success (Hasnas, Citation2013). First, a firm that takes care of all its stakeholders potentially performs better on all dimensions of sustainable performance. This is because stakeholders can affect or be affected by a firm by providing access to resources to that firm (Freeman & Reed, Citation1983). As such, building sustainable stakeholder relationships is therefore crucial because stakeholders make a firm possible to exist (Matos & Silvestre, Citation2013), they are essential to the firm’s survival and success (Freeman & Reed, Citation1983), and it is just morally correct to do so from an ethical perspective (Donaldson & Preston, Citation1995). Second, a company that focuses on developing valuable human capital resources achieves a sustainable competitive advantage (Deegan, Citation2014; Ployhart, Citation2021). Human resources are intangible and soft elements of organizational resources that are crucial in ensuring organizational sustainability (Amjad et al., Citation2021). Third, and final unique management control systems as organizational procedures and processes foster the achievement of organizational capabilities by focusing organizational attention on strategic priorities and stimulating dialogues (Henri, Citation2006). MCS enables organizations to specify and communicate their objectives among stakeholders, monitor performance by providing feedback and imposing control mechanisms, and motivate employees to achieve organizational goals by appraising and rewarding their accomplishments (Bezuidenhout et al., Citation2023; Janka, Citation2021). Therefore, the recent reforms, developments, and pressures highlighted by the scholars show the need for strong organizational capabilities and resource base in power companies to comply with the apparent stringent requirements towards sustainability. In sum, combining the stakeholder and resource-based view theoretical perspective posits that the strategic exploitation of company resources, facilitated by stakeholder engagement, human capital development, and effective management control systems, is foundational to achieving sustainable performance within power companies.

The extant literature has explored human capital, management control systems and sustainable performance among companies (Antwi-Boateng et al., Citation2023; Esho & Verhoef, Citation2020; Gerasimov et al., Citation2019; Gond et al., Citation2012; Rehman et al., Citation2021; Waqas Zaki, Citation2023; Wijethilake, Citation2017; Xu & Liu, Citation2019). Nevertheless, we contend that there are still several study gaps. First, whilst the direct associations of human capital on sustainable performance (AlQershi et al., Citation2022; Dwikat et al., Citation2023; Waqas Zaki, Citation2023; Yusliza et al., Citation2020), and management control systems on sustainable performance (Gond et al., Citation2012; Rehman et al., Citation2021) have been explored, especially from a Western perspective (Kanan et al., Citation2023), our understanding of the mediating role of MCS on the relationship between human capital and firms’ sustainable performance remains scarce (Hutahayan, Citation2020; Pandiyan et al., Citation2023; Wijethilake, Citation2017). Second, existing research on sustainable performance has predominantly concentrated on the construction (Khan et al., Citation2024; Salih et al., Citation2023), healthcare organizations (AlQershi et al., Citation2022; Mousa & Othman, Citation2020), and manufacturing sectors (Dwikat et al., Citation2023; Kanan et al., Citation2023; Xu & Wang, Citation2018; Wijethilake, Citation2017). Although the construction, manufacturing, and health sectors are vital to economic growth, a thorough investigation of the electricity sector in emerging nations is necessary due to its strategic significance in supplying energy to a range of industries and promoting socio-economic advancement in general. Third, there has also been scant attention to Uganda, and other studies have either been largely macro-level in nature using secondary data or based on content analysis (Amini et al., Citation2018; Crisóstomo et al., Citation2020; Lin et al., Citation2021; Ritala et al., Citation2018; Shuaibu & Oladayo, Citation2016; Slavković et al., Citation2023). Studies that rely on secondary data and content analysis, fail to fully capture all the dimensions of sustainable performance. Arguably, this impairs the current understanding of how management control systems and human capital enhance or limit the dimensions of sustainable performance, particularly in the Ugandan power companies’ context, where there have been significant reforms to improve the sustainability of the electricity sector (Twesigye, Citation2023).

Consequently, the current study seeks to address the above gaps, as well as make several further contributions to the existing power companies’ sustainability and resource exploitation literature. First, using the Triple Bottom Line (TBL) of Elkington’s (Citation1997) sustainability performance index we contribute to the literature by providing contemporary evidence on all the dimensions of sustainable performance in Ugandan Power companies. This extends the findings of prior studies that view sustainability on either a single or two dimensions, particularly in developing countries like Uganda with limited well-structured databases (Morioka & de Carvalho, Citation2016; Tondolo et al., Citation2021). As such, this study uses perception-based approaches to evaluate all the dimensions of sustainable performance (economic, social, and environmental performance), while incorporating the perspectives of managers through self-administered questionnaires. This study offers a reasonably solid benchmark to compare with future research relying on the TBL index from other countries, given it appears that few studies have investigated sustainable performance based on the TBL in the context of Ugandan power firms. Second, this study contributes to the literature by examining the extent to which management control systems mediate the relationship between human capital and sustainable performance in Ugandan Power companies which operate in a setting where resources are scarce with human capital gaps (Powering Jobs Census, Citation2022). Possibly, this contributes significantly to existing studies, including Twesigye (Citation2022) on governance, Kaawaase et al. (Citation2021) on energy and firm characteristics, and Bananuka et al. (Citation2023) on intellectual capital and sustainability reporting in Uganda. There are observable gaps in human capital and inadequate management control systems by most power companies in Uganda reflected in the Sustainable Performance (SP) score of 22% against the target of 60% (Sachs et al., Citation2023). Economically, there are persistent energy losses due to high deemed energy costs (GC 1,378.1 MW vs. 850 MW peak ED); high default rates (30%), and credit losses. Socially, PCs also have substantial gender gaps with less than 30% of the share of women in the PCs compared to Kenya (41%), Ethiopia, and Nigeria (37%) (Powering Jobs Census, Citation2022) and forceful evictions of the Project Affected Persons (PAPs). Environmentally, CO2 emissions rose to 8% in 2022 from 3% in 2018 with numerous water contaminations (Electricity Regulatory Authority (ERA), Citation2022). In a recent report, the International Energy Agency (IEA) recommended, in the Uganda Energy Policy Review (2023), that the Ugandan government create, implement, and track an Energy Transition Plan. This plan would outline a course for achieving Uganda’s energy-related objectives while striving for a low-carbon, climate-resilient economy, considering innovative ideas and new technologies, under Uganda’s Nationally Determined Contribution and the Paris Agreement. However, the question remains as to whether effective utilization of internal resources such as human capital and management control systems can contribute sustainably towards economic, social, and environmental performance to address the challenges (Malik et al., Citation2021; Mousa & Othman, Citation2020). Relatedly, the coexistence of human capital and management control systems in power companies creates a mutually reinforcing relationship, driving economic viability, environmental responsibility, and social benefits for both employees and broader societies (Chams & García-Blandón, Citation2019; Pyka, Citation2017). Based on the empirical results, we contend that the impact of human capital on sustainable performance may be enhanced with the effective utilization of management control systems by power companies.

We gathered data on 105 power companies in Uganda from the managers of power companies that responded to a survey, hence our research is perception-based. Given the survey’s ability to collect extensive data on the phenomena, we gathered data on all three SP dimensions: economic, social, and environmental performance. Our research indicates that 39.8% of the variation in the SP of Ugandan power firms might be explained by management control systems and human capital. The findings showed a nonsignificant direct effect of human capital on sustainable performance (β = 0.113) and a significant direct effect of MCSs on sustainable performance (β = 0.089), but there is a positive and significant indirect effect of MCSs on the relationship between human capital and sustainable performance (β = 0.105). Suggesting that the relationship between human capital and sustainable performance is fully mediated by management control systems.

The rest of the paper is organized as follows. Section 2 deals with background, Section 3 focuses on the theoretical literature review, Section 4 is Empirical literature review and hypotheses development, Section 5 is Research design, Section 6 presents Empirical results and discussion, and the paper ends with a summary and conclusions in Section 7.

2. Background

2.1. Uganda electricity sector institutional and regulatory framework

According to Twesigye (Citation2022), the regulatory environment in which Uganda’s electrical industry functions is marked by ongoing modifications, reforms, and policy updates. For instance, Uganda is one of the nations in Sub-Saharan Africa that has gone the furthest in putting the 1990s power sector reform model into practice. Since 2012, Uganda has maintained nearly cost-reflective tariffs, completed the vertical unbundling of the national utility, and allowed the private sector to participate in both the generation and distribution of electricity. Uganda implemented a comprehensive ‘Power Sector Restructuring and Privatization Strategy’ in the late 1990s and early 2000s. As a result, the vertically integrated Uganda Electricity Board was divided into three state-owned businesses in 2001, each of which is responsible for distribution, transmission, and generation. Additionally, it opened the door for the private sector to participate, which has resulted in several concession contracts, IPPs, and public-private partnerships. The government also founded the independent ERA about the same time. It also brought in the possibility of private sector involvement, which has actually resulted in a number of concession contracts, IPPs, and public-private partnerships. The government established the autonomous ERA about the same period. At the time, the reforms were motivated by a number of issues, such as insufficient institutional capacity, very low energy access rates, inadequate sector funds, and inadequate generating and transmission capacity. The three state-owned enterprises would be remerged under the ‘second generation’ of power sector changes that the government is preparing (Uganda Energy Policy Review by International Energy Agency [IAE], 2023a). Finding measures to reduce power costs and boost access to and demand for electricity, together with emphasizing economically viable energy usage, notably in the agricultural sector, are among the government’s top priorities in this area.

The National Energy Policy for Uganda (2023) focuses on expanding the electricity transmission and distribution grid networks increasing energy efficiency promoting the use of alternative sources of energy; and strengthening the policy, legal, and institutional framework. Additionally, the Policy is in line with the National Development Plan (NDP) III through the Sustainable Energy Program, which reiterates that ‘economic growth, poverty reduction, and the social and cultural transformation of society are all dependent on the availability of sustainable (reliable, affordable, and clean) energy services’. The legislative framework of the power sector is comprised of the 1995 Constitution of the Republic of Uganda (as amended) and the following laws and statutory instruments: The Electricity (Amendment) Act (2022) provides the regulatory framework for the electricity sub-sector; the Electricity Connections Policy (2018). The sector’s mandate is also supported by other sector policies, including the Gender Policy (2007), the Climate Change Policy (2015), and the Environment and Social Safeguards Policy (2018); National Electrification Strategy (2021–2030), Grid Development Plan. These reforms have significantly impacted the sustainability of power companies, presenting opportunities and challenges related to energy access, infrastructure, and environmental concerns.

The main government organisation involved in Uganda’s energy sector is the Ministry of Energy and Mineral Development (MEMD). Its responsibilities include developing national energy and mineral resource policies, encouraging investment, obtaining and analyzing data, monitoring the activities of private companies, and overseeing regulatory agencies (International Energy Agency [IAE], 2023b). As a result, MEMD proposes to develop an Integrated Energy Resource Master Plan (IERMP) in order to coordinate its various energy-related projects and strategies. A long-term energy master plan, inadequate technical capability and understaffing, as well as a lack of data and instruments for proper planning and administration of the sector, are among the significant challenges facing the Ministry’s current planning function, according to the Concept Note for the IERMP. The Ministry’s intended IERMP project will include a low-carbon Energy Transition Plan, an Energy Data Platform, institutional support from development partners, and capacity building.

Furthermore, the National Environmental Management Authority (NEMA), the primary body in charge of directing, monitoring, and supervising environmental management, was also established by the National Environment Act of 1995. It oversees granting environmental clearance certifications to the energy sector following the examination and approval of environmental audits, impact studies, and relocation plans. Other institutions include: Electricity Regulatory Authority (ERA) which regulates the generation, transmission, distribution, sale, export and import of electricity and issues and monitors licences in these areas. It also approves tariff structures, performance standards, and service terms and conditions; Rural Electrification Department of the MEMD; The Electricity Disputes Tribunal was established by the Electricity Act 1999 to arbitrate cases when stakeholders appeal a decision by the ERA. The tribunal has the powers of the High Court of Uganda. Uganda Energy Credit Capitalization Company (UECCC); Uganda Electricity Generation Company Limited (UEGCL); Uganda Electricity Transmission Company Limited (UETCL); Uganda Electricity Distribution Company Limited (UEDCL); and Electricity Disputes Tribunal.

Vision 2040 is one of the primary policy documents, with the goal of ‘transforming the nation from a predominantly low-income to a competitive upper-middle income country within 30 years’ (NPA, Citation2017). Targets the nation wants to hit in the energy sector by 2040. A number of national development programmes spanning five years are being used to operationalize Vision 2040. The Third National Development Plan (NDP III), which spans the years 2020–2021–2024–2025, is presently being implemented by the government. In order to create the greatest potential for job creation for our people and beneficial spillover effects on other sectors, the NDP III prioritizes ‘enhancing value addition in key growth opportunities (agriculture, tourism, minerals, oil and gas, and knowledge)’ (National Planning Authority (NPA), Citation2020).

Since before the early 2000s reforms, the World Bank has had a significant impact on Uganda’s power industry and has continued to play a vital advising, technical, and finance role over the years. The Power Sector Development Project and the Energy for Rural Transformation Project Phase III (ERT III) are two examples of this. According to the World Bank (Citation2022), the latter ‘aims to facilitate orderly longer-term expansion of electricity service and reduce short-term power shortages and financial imbalances’. The Uganda Energy Access Scale-up Project (UEASP) and the Electricity industry Development Project (2011–2019) are two more significant World Bank initiatives in the power industry (World Bank, Citation2022).

Germany (KfW and GIZ), Norway, Japan (Jica), the European Union, the African Development Bank, the Islamic Development Bank, the OPEC Fund for International Development, the Arab Bank for Economic Development in Africa, and the Saudi Development Fund are among Uganda’s additional development partners in the electricity sector. Numerous of these have aided in access expansion initiatives (World Bank, Citation2022). Uganda also adheres to regional and international legal and policy frameworks, including the East African Community’s laws and policies, the UN Sustainable Development Goals, African Agenda 2030, and Sustainable Energy for All (SEforAll). Uganda’s commitment to lowering carbon emissions and adjusting to climate change is further demonstrated by its ratification of the Paris Agreement.

However, despite the policies, regulations, institutional laws and commitments, power companies in Uganda face multidimensional challenges, including high capital costs, affordability concerns, weak grids, uncertain regulatory environments, and limited human capital (Falchetta et al., Citation2021; Yaguma et al., Citation2022). These challenges have significant implications for the economic, social, and environmental dimensions of sustainability. From a social perspective, issues such as forceful evictions of the Project Affected Persons (PAPs) from renewable energy projects and gender disparities in the Distributed Renewable Energy (DRE) workforce highlight the need for inclusive and transparent solutions (Powering Jobs Census, Citation2022). According to the Powering Jobs Census (Citation2022), for example, Kenya (41%), Ethiopia (37%), and Nigeria (37%) did significantly better than Uganda (28%) and India (21%), about women’s participation of the DRE workforce. There is growing evidence that building a gender-balanced workforce results in positive company performance by employing innovation, resilience, quality of service, reduced financial and reputational risk, and improved environmental standards (International Finance Corporation [IFC], Citation2022)). Moreover, underinvestment in renewables and high transmission losses contribute to environmental degradation.

Economically, Capital-intensive energy projects strain the economic viability of power companies, impacting their ability to invest in sustainable technologies. Limited affordability among users also affects revenue streams and financial sustainability, potentially hindering investment in cleaner and more efficient technologies.

The institutional framework in the Constitution of the Republic of Uganda supported by legislative acts and policies, provides a foundation for understanding the importance of electricity as a public good and the need for sustainable performance within the sector. The Constitution of the Republic of Uganda, notably Article 45, establishes electricity as a public good and underscores the right of Ugandans to access and utilize it, emphasizing recognition and protection at any cost. This constitutional provision highlights key aspects of sustainable performance within the power sector. It highlights the significance of ensuring widespread access to electricity, aligning with principles of inclusivity and social development. By enabling electricity access as a constitutional right, Uganda places a foundational emphasis on sustainability, reflecting a commitment to addressing the energy needs of its citizens while acknowledging the importance of environmental, social, and economic dimensions within the power sector.

Electricity companies are crucial in generating, transmitting, and distributing electricity – crucial because they affect economic development and growth positively and as drivers of any economy through their contribution to gross domestic product (GDP), provision of key inputs for most industries, and the supply of residential electricity (Gyamerah & Gil-Alana, Citation2023). Research suggests that for these companies to survive, thrive, and be economically viable, their companies’ operations need to be profitable, with positive environmental and social contributions in line with the Sustainable Developmental Goals (SDGs) (Mukisa, Zamora & Lie, Citation2022). Since the 1990s, there has been increased recognition amongst governments, scholars, businesses, consumers, investors, and other stakeholders of the importance of sustainable impacts of businesses on society and the environment (International Energy Agency [IAE], 2023b). The performance of power sector companies is considered sustainable if they can provide enough electricity and make investments to reliably meet the changing and/or increasing demands while generating adequate revenues to cover costs and complying with environmental and social norms (Sachs et al., Citation2023).

However, research on the sustainable performance of Ugandan power firms is noticeably lacking, especially when it comes to management control systems and human capital. Studies on the relationship between these parameters and sustainable performance in Uganda’s energy industry are scarce. With the specific context of Uganda’s power sector, the study seeks to provide important insights to academics and businesses, promoting a better knowledge of how management control systems could operate as a bridge to align human capital practices with organizational sustainability goals.

3. Theoretical literature review

This study draws on the Resource-based View of the firm. The resource-based view of the firm proposes that a firm is defined by the resources it controls (Litz, Citation1996), with the premise that differences in firm performance occur directly because of the collection of valuable, rare, inimitable, and non-substitutable resources or capabilities firms acquired (Barney, Citation1991; Ruf et al., Citation2001). In the context of this study, the Resource-based View theory suggests a focus on developing unique resources that affect positively all stakeholders (i.e. contributing to the economic, social and environmental dimensions). According to the resource-based view (RBV) theory, for a power company to achieve sustainable performance, the internal facilitating capital such as human capital and management control systems must be appropriate (Barney, Citation1991; Imasiku et al., Citation2020). Based on Barney’s (Citation1991) view of firm resources, they include all assets, capabilities, organizational processes, firm attributes, information, and knowledge controlled by the firm. It is reasonable to expect that a power company conceives and implements strategies that improve its sustainable performance through these resources. In this study, the firms’ resources include human capital (knowledge, competences and expertise/abilities) and management control systems (intangible) which are expected to enable the companies to perform sustainably.

RBV posits that for a power company to achieve sustainable performance, it must possess and leverage internal resources that are valuable, rare, inimitable, and non-substitutable (Barney, Citation1991). Sustainable performance, in this context, refers to a firm’s ability to consistently generate positive economic, social, and environmental outcomes over the long term. Human capital and management control systems are identified as critical internal resources that can contribute to sustained competitive advantage and, consequently, sustainable performance. Within the RBV framework, human capital is considered a valuable and intangible resource (Barney, Citation1991). The knowledge, competencies, and expertise of employees constitute unique attributes that contribute to a power company’s competitive advantage. In the context of the Ugandan power sector, where challenges related to energy access and infrastructure exist, the human capital’s ability to innovate, problem-solve, and adapt to changing circumstances becomes a source of sustainable performance.

RBV also emphasizes the importance of intangible resources, and management control systems fall into this category (Barney, Citation1991). These systems, encompassing organizational processes, information, and knowledge, are crucial for effective strategy formulation and implementation. In the case of power companies in Uganda, where dynamic regulatory changes and operational challenges are prevalent, having effective management control systems can be a source of competitive advantage, facilitating the implementation, tracking, collaborations, monitoring and strategic decision-making for sustained performance.

RBV theory has been successfully employed in predicting the competitive advantage, and performance in companies (Bhandari et al., Citation2020). However, RBV theory has rarely been applied at the organizational level of analysis relating to MCS, HC, and sustainable performance, and this is particularly relevant concerning the rapid global attention to sustainability practices over the past decades. Arguably, this current study therefore seeks to extend and apply both the stakeholder theory (the ethical branch) and the RBV theory to explain variations in sustainable performances among power companies with emphasis on management controls and human capital implications. Based on the theoretical frameworks, this study posits that human capital and management control systems are central resources that power companies in Uganda can leverage to enhance their sustainable performance. The firms’ resources, as per RBV, are not only valuable but also unique to each organization, forming the basis for sustained competitive advantage. The study hypothesizes that by examining the mediating role of management control systems, it can be revealed how human capital and these control systems collectively contribute to the sustainable performance of power companies in Uganda.

The development of intangible resources in Uganda is explained by the resource-based view theory specifically the human capital development. Consistent with RBV, a power firm is viewed as a collection of intangible resources that enable it to perform sustainably better relative to other firms. Extant studies fall short of explaining all the dimensions of SP due to the use of a single theory to provide a framework for understanding SP in PCs (Elmagrhi et al., Citation2019; Rehman et al., Citation2021). According to Ntim et al. (Citation2017), the ability of any single theoretical framework to explain numerous motivations for SP is limited. Thus, Combining Stakeholder Theory’s ethical branch with RBV provides a more holistic explanation indicating that the stakeholder theory helps organizations recognize and address the ethical dimensions of having environmentally friendly operations, social responsibility, and achieving economic viability to foster relationships based on trust and responsibility (Ntim et al., Citation2017). RBV complements this by providing a strategic perspective on how to leverage internal resources effectively to achieve economic success, environmental sustainability, and societal equity.

4. Prior empirical studies and hypotheses development

4.1. Human capital, management control systems, and sustainable performance in power companies

Drawing from prior empirical research on sustainable performance, the concept has evolved as organizations and researchers recognize the importance of integrating economic, environmental, and social considerations to achieve long-term success (Crossley et al., Citation2021; Indriastuti & Chariri, Citation2021; Latifah & Soewarno, Citation2023; Spreitzer & Porath, Citation2012; Thoradeniya et al., Citation2021; Tran et al., Citation2021). The history of sustainable performance can be traced back to the early 1990s when the concept of sustainability gained prominence. Initially, the focus was primarily on environmental sustainability and the impact of businesses on the natural environment. The Brundtland Report, by the United Nations in 1987, introduced sustainable development as development that meets the needs of the present without compromising the ability of future generations to meet their own needs (Zambran, Citation2023). Over the years, the definition of sustainable performance expanded to include broader aspects of corporate social responsibility (CSR), considering the social and ethical impacts of business activities (Pezzey, Citation1992). According to Rehman et al. (Citation2021); Thoradeniya et al. (Citation2021); and Elkington (Citation1994), sustainable performance is the ability of a firm to operate in an environmentally, socially responsible, and economically viable way in line with the triple-bottom line concept. Social performance covers the well-being of all the stakeholders such as shareholders, employees, customers, shareholders, and society. The economic performance considers the financial performance, while the environmental performance considers the minimization of environmental damage and protection of resource exploitation. Companies face economic problems (Zhu et al., Citation2013), social issues (Paulraj et al., Citation2014), and environmental issues (Muñoz et al., Citation2013) that are detrimental to the environment, the society, and also to companies. Economically, Capital-intensive energy projects strain the economic viability of power companies, impacting their ability to invest in sustainable technologies. Limited affordability among users also affects revenue streams and financial sustainability, potentially hindering investment in cleaner and more efficient technologies. Socially, emerging issues on forceful evictions for the Project Affected Persons (PAPs) land use for renewable energy deployment lead to human rights violations and impact indigenous communities, as well as inadequate labor practices and gender disparities in the DRE workforce necessitate inclusive and transparent solutions for sustainable energy development (Powering Jobs Census, Citation2022; World Bank, Citation2022). Furthermore, the underinvestment in renewables and resulting high transmission losses contribute to environmental degradation, hindering progress toward a cleaner and more sustainable energy mix. Balancing access, development, and the transition to cleaner energy sources presents environmental risks, requiring strategic solutions to minimize negative impacts on the environment. For instance, Power generation companies, are reliant on fossil fuels, and contribute to air pollution through the release of pollutants such as carbon dioxide (CO2), sulfur dioxide (SO2), and nitrogen oxides (NOx). Hydroelectric power generation, common in Uganda, also has impacts on local water ecosystems and aquatic life. High-voltage transmission lines produce electromagnetic fields, raising concerns about potential health impacts on both humans and wildlife. The electricity distribution has persistent disposal of old or damaged equipment, such as transformers and cables, which poses waste management challenges. The Off-grid systems often rely on energy storage solutions, such as batteries. Improper disposal of old panels and batteries, as well as recycling of batteries possess environmental risks (Kinally et al., Citation2022).;

Specifically, we examine how several human capital elements, including competences, knowledge and expertise influence on a Power company’s level of sustainable performance, as well as how management control systems such as Management information system (MIS), Cost accounting implementation, Cost control, Strategic Planning, Internal audit, Quality control implementation impact on the level of PC’s sustainable performance.

4.2. Human capital and sustainable performance

From a resource-based view theoretical perspective, human capital is an aggregate expression of the intangible assets possessed by the organization (Barney, Citation1991; Edvinsson & Sullivan, Citation1996; Kogut & Zander, Citation1992; Erik Sveiby, Citation1997).

According to Barney (Citation1991), Organizational resources include ‘all assets, capabilities, organizational processes, firm attributes, information, knowledge, etc. controlled by a firm that enable the firm to conceive of and implement strategies that improve its efficiency and effectiveness’. These resources can be divided into three groups: organizational capital resources, human capital resources, and physical capital resources. Physical capital resources consist of such things as the firm’s plant and equipment, technology, and geographic location. Human capital resources include such things as the experience, judgment, and intelligence of the individual managers and workers in the firm. Organizational capital resources consist of the firm’s structure, planning, controlling, and coordinating systems, and the informal relations among groups within the firm and between the firm and other firms in its environment. We define human capital as a human resource under the firm’s control in a direct employment relationship. Human resource practices are the organizational activities directed at managing the pool of human capital and ensuring that the capital is employed toward the fulfillment of organizational goals.

In line with Unger et al. (Citation2011), Edvinsson and Sullivan (Citation1996), Alnoor (Citation2020), and Singh et al. (Citation2022), we focus on the knowledge, competences and expertise possed by the managers in a company. Flamholtz and Lacey (Citation1981) focused on the skills of human beings in organizations, while Pham (Citation2020), developed a human capital model based on competencies classified as knowledge, skills, and abilities (KSAs) of organizational members. Both approaches recognize the importance of the individual members of organizations as the important resource, rather than the practices and/or procedures used by the firm. In contrast to the firm’s processes and/or procedures, both approaches acknowledge the value of the individual members of organizations as the primary resource.

In line with the Resource-based view theory, Human Capital as Valuable Resources considers that for human resources to be a source of sustained competitive advantage, they must provide value to the firm. Steffy and Maurer (Citation1988) and Barney (Citation1991) provides an examination of the conditions under which human value creation is and is not possible. First, there is no variance in individual contribution to the firm; (i) when both the demand for labor is homogeneous (i.e., employees are perfectly substitutable) and (ii) the supply of labor is also homogeneous (all employees and potential employees are equal in their productive capacity), In this situation, it is not possible to create value through investment in human assets. Nevertheless, Steffy and Maurer (Citation1988) also noted that there is variance in individuals’ contribution value to the firm when both the demand for labor is heterogeneous (i.e., firms have different jobs that require different skills) and the supply of labor is heterogeneous (i.e. individuals differ in both the types and level of their skills). This suggests that human capital can provide value to the company.

Furthermore, from a stakeholder theoretical point of view, stakeholders can affect or be affected by a firm by providing access to resources to that firm (Freeman & Reed, Citation1983). As such, building sustainable stakeholder relationships is therefore crucial because stakeholders make a firm possible to exist, they are essential to the firm’s survival and success (Freeman & Reed, Citation1983), and it is just morally correct to do so from an ethical perspective (Donaldson & Preston, Citation1995). We therefore consider human capital as lever for enhancing the economic, social and environmental value creation. Despite increasing consensus among strategy and stakeholder scholars that more attention to value creation and especially to ‘shared’ value creation is warranted (e.g., Adner & Kapoor, Citation2016; Freeman et al., Citation2021), relatively little is known about how stakeholder theory can be used by top managers for improving their companies’ economic, social and environmental value-creation strategies. Indeed, although stakeholder theorists have made progress in describing the ‘managing for stakeholders’ process (Freeman et al., Citation2021), the specific actions necessary for creating shared value remain underspecified. In a clear indicator of this gap in the literature, recent reviews of stakeholder theory have identified key unanswered questions, such as ‘How can firms create different types of value for different stakeholders?’ (Parmar et al., Citation2022), and ‘How [can firms] create value simultaneously for multiple stakeholders?’ (Freeman et al., Citation2021, p. 53). These fundamental research questions motivates our study. We demonstrate that because stakeholder groups have multi-attribute utility functions, competent, knowledgeable, and expert-seeking managers do have opportunities too often ignored to create sustainability value for multiple stakeholder groups, simultaneously and without trade-offs. The collective knowledge, competences, and expertise of managers drive organizational success, contribute to positive societal impact, and position the company as a responsible and sustainable contributor to the broader community.

The ethical stakeholder theoretical perspective highlights the mutual stakeholder relationships in which stakeholders are both recipients and creators or co-creators of value in joint value-creation processes. As a first step towards closing the research gap, this paper examines sustainable performance as value creation from a stakeholder theory perspective. Stakeholder theory proposes that value creation is a collaborative effort in relationships, ideally benefitting the focal business and all its stakeholders. This corresponds to the idea of multi-directional value flows and supports an in-depth analysis of what types of value a stakeholder relationship creates, with whom, and for whom. The view that value creation is a process resulting in different outcomes for different stakeholders is particularly prevalent in the sustainability-oriented business model literature (Freudenreich et al., Citation2020; Schaltegger et al., Citation2023). One explanation is that solving sustainability-related issues necessitates multi-stakeholder collaboration to provide the needed expertise and other resources (Freudenreich et al., Citation2020). Hence, such a perspective on sustainable value creation may be particularly helpful when analyzing the sustainable performance of business models. In addition to developing a stakeholder value creation framework, this study therefore discusses how human capital is key for achieving the economic, social, and environmental. Relatedly, recent scholars have recognized sustainable performance as a value-creation framework that involves the generation of value within an adequate balance between economic, social, and environmental interests (Acosta-Prado et al., Citation2023). Sustainable value creation is the real possibility of integrating the business into sustainable development through organizational performance. Thus, the exploitation of company resources is associated with sustainable performance. Human capital, encompassing the knowledge, competencies, and expertise of the company’s workforce, is a critical factor in influencing sustainable performance by providing significant value to the company. Arguably, in the context of increased competition, climate change, and socio-transformation agendas, recruiting and retaining competent, knowledgeable, and expert employees is crucial for a power company’s ability to achieve superior economic, social, and environmental performance.

The integrative theoretical framework we present makes several important theoretical and practical contributions. First, for the resources and sustainable performance literature, we show how a company that focuses on developing valuable human capital resources achieves a sustainable performance. Second, is that economic, social and environmental value creation is a collaborative and mutual effort within stakeholder relationships.

Within the mainstream empirical intellectual capital and sustainability literature, human capital has been found to have a significant effect on sustainable performance (Abdullah et al., Citation2015; Malik et al., Citation2020; Mousa & Othman, Citation2020; Obeidat et al., Citation2023; Xu & Liu, Citation2019; Yusliza et al., Citation2020). For example, Obeidat et al. (Citation2023) found a positive and significant al link between green HRM and sustainable performance for the service sector in Qatar. Bhattacharya et al. (Citation2014) also found that organizations investing in human capital also gain better performance. Similarly, it is believed that the greater human capital tends to contribute more to the development of economic, social and green organization because of the social and environmental knowledge and skills are rooted in the employees. On the other hand, human capital does not necessarily have a positive on sustainable performance. For example, researchers such as (Maditinos et al., Citation2011; Mehralian et al., Citation2012) found a negative relationship or no relationship between IC and a firm’s performance. Omar et al. (Citation2017) finds no evidence of a positive effect of human capital on business sustainability in Malaysian manufacturing SMEs. Similarly, Mukherjee and Sen (Citation2019) by studying non-financial firms in India, did not notice any evidence of a significant relationship between human capital and sustainable organizational growth. The contradictory results may stem from the fact that most of the studies have concentrated on manufacturing firms (Agyabeng-Mensah & Tang, Citation2021). Observably, there is severe lack of evidence on the relationship between human capital and sustainable performance in power companies and thus, this provides good opportunities to contribute to the extant literature. There are few exception studies such Zhu (Citation2023) which indicate that investments in human capital are perceived as important in achieving sustainable develpment goals in the leading carbon emitter countries. Ogunjobi et al. (Citation2021) also found that human capital is significantly and positively related to energy infrastructure and economic growth in Nigeria. Equally, Edziah et al. (Citation2021) also noted that human capital development promotes a greener future through energy conservation. Due to the mixed theoretical and empirical evidence on the relation between human capital and sustainable performance in power companies (Ferreira et al., Citation2021; Xu & Liu, Citation2019), we specify a non-directional hypothesis that human capital is related to sustainable performance, as follows:

H1: There is a significant association between human capital and extent of sustainable performance.

4.3. Management control systems (MCS) and sustainable performance

From a resource-based view perspective, performance is a function of distinctive and valuable resources and, especially, capabilities controlled by a firm (Barney, Citation1991; Deegan, Citation2014; Henri, Citation2006). As a result, properly designed management control Systems (MCS) enable firms to achieve their economic, social, and environmental performance (Antonini et al., Citation2023; Cavicchi et al., Citation2023). Power companies with unique and customized management control systems can track and monitor their sustainable performance. Unique management control systems as organizational procedures and processes foster the achievement of organizational capabilities by focusing organizational attention on strategic priorities and stimulating dialogues (Henri, Citation2006).

From the stakeholder perspective, MCS enables organizations to specify and communicate their objectives among stakeholders, monitor performance by providing feedback and imposing control mechanisms, and motivate employees to achieve organizational goals by appraising and rewarding their accomplishments (Janka, Citation2021). Therefore, the recent reforms, developments, and pressures highlighted by the scholars show the need for strong organizational capabilities and resource base in power companies to comply with the apparent stringent requirements towards sustainability. In sum, combining the stakeholder and resource-based view theoretical perspective posits that the strategic exploitation of company resources, facilitated by human capital development, and effective management control systems, is foundational to achieving sustainable performance within power companies.

With regards to the empirical literature on sustainable performance in companies, Positive evidence supports the specific role of management control systems being researched in various contexts (Akankunda et al., Citation2023; Bouten & Hoozée Citation2013; Cheffi et al., Citation2021; Conaty & Robbins, Citation2021; Crutzen et al., Citation2017; Felício et al., Citation2021; Heggen & Sridharan, Citation2021; Pondeville et al., Citation2013; Riccaboni & Luisa Leone, Citation2010). For instance, Durden (Citation2007) found that the existence of an MCS enabled managers to monitor whether the business is operating in accordance with social responsibility. Epstein and Roy (Citation2001, p. 600) also established that appropriate management control systems enable companies to obtain feedback information on potential environmental and social impacts, sustainability performance (at all organizational levels), sustainability initiatives, stakeholder reactions and corporate financial performance. Arjaliès and Mundy (Citation2013) show that companies manage sustainability strategy through a variety of MCS, including internal and external communication processes. Crutzen et al. (Citation2017) and Bouten & Hoozée (Citation2013) also note that the use of formal and informal management controls enable companies to achieve for sustainable performance. Rehman et al. (Citation2021) also revealed that recourse to environmental MCS packages significantly influences ecological sustainability, sustainable performance and environmental strategies using quantitative questionnaire data from construction firm representatives (from project, sales and construction managers and contract managers, executive directors and engineers). With a specific focus on the power sector, to the best of our knowledge, few studies have empirically tested the association between management control systems and the extent of sustainable performance and thus, offer an important opportunity to contribute to the extant power company sustainability literature (Slacik & Greiling, Citation2021).

In line with Duréndez et al. (Citation2016) and Davila and Foster (Citation2007), management control systems are systems, rules, practices, values and other activities management put in place to direct employee behavior. This study corresponds with Coller et al. (Citation2018) involves Management control systems include management information systems (MIS); degree of implementation of cost accounting; budget control; strategic planning; internal audit; and implementation of quality controls. Specifically, management information system (MIS) is an information system used for decision-making, and the coordination, control, analysis, and visualization of information in an organization. Budget control is a control technique that enables the comparisons of the actual results with budgets. Strategic planning is a process in which an organization’s leaders define the vision for the future and identify the organization’s goals and objectives. Internal audit refers to an independent, objective assurance and consulting activity designed to add value and improve an organization’s operations. Quality control implementation refers to the implementation of activities to ensure that produced items are fulfilling the highest possible quality. The synergy between MIS, budget control, strategic planning, internal audit, and quality control implementation empowers the power company to operate in a responsible, sustainable, and socially conscious manner. Equally, MCS enable power companies to respond to stakeholder expectations, and contribute positively to the economic, social, and environmental landscapes (Adib et al., Citation2021; Anzilago et al., Citation2022). Thus, the ability of power companies to utilize customized and unique management control systems, not only achieves its financial objectives but also becomes a responsible corporate entity that actively enhances societal well-being and environmental sustainability. Subsequently, the following hypothesis is proposed:

H2: Management control systems significantly relate to sustainable performance.

4.4. Human capita and sustainable performance: the mediating role of management control systems

As previously noted, there is recognition of the association between human capital and sustainable performance (Bounfour & Edvinsson, Citation2012; Ionita & Dinu, Citation2021; Xu & Liu, Citation2019), human capital and MCS (Cleary, Citation2015; Coyte, Citation2019; Dana et al., Citation2021; Herremans et al., Citation2011); MCSs and sustainable performance (Akankunda et al., Citation2023; Cheffi et al., Citation2021; Conaty & Robbins, Citation2021; Crutzen et al., Citation2017; Felício et al., Citation2021; Heggen & Sridharan, Citation2021). In literature however, a few studies have established the indirect effect of MCSs on the relationship between Human capital and sustainable performance (Dev et al., Citation2023). For instance, Hutahayan (Citation2020) finds that corporate human capital and internal process performance do not mediate the relationship between innovation strategy and financial performance. Hsu & Wang (Citation2012) finds that dynamic capability does not completely mediate the respective effects of human capital and relational capital on performance but does so only partially. While, Butt (Citation2020) postulated that most companies encounter difficulties implementing a good control system strategy because of the absence of synergy between performance and the control strategy. Therefore, it is of interest to examine the mediation effect of management control systems on the relationship human capital and sustainable performance. This could help power companies to improve the utilization of their existing management control systems as technological advancements for sustainable performance. In a developing country like Uganda, the management control system is one of the most vital organizational resources for improving access to electricity (Crespo et al., Citation2019; Johnstone, Citation2019). Management control systems serve as a critical bridge between human capital and the sustainable performance of power companies by facilitating alignment, accountability, and strategic integration. The Uganda Energy Policy (2023) emphasizes the need for Integrated Resource Plan for better planning and coordination amongst all stakeholders to create an appropriate balance between energy demand and supply for the short, medium, and long-term priorities. Likewise, the Electricity Regulatory Authority (ERA) Strategic Plan 2020–21 to 2024–25) has highlights the need for integrated management control system as mechanisms and structures in terms of setting clear budgets, reporting; quality management systems (ISO Certification and maintenance, and SOP’s for all key processes); Integrated MIS (ERP, CRM); (Geographical Information System (GIS) and Environmental Management System); Electronic Records Management System. As a result, our final hypothesis is that:

H3: The relationship between human capital and sustainable performance is significantly mediated by management control systems

5. Research design

5.1. Data considerations

Our sample is based on the study population of 124 power companies in Uganda’s Electricity Sector (Electricity Regulatory Authority (ERA), Citation2022; Rural Electrification Agency [REA], 2022). We limited our sample to the electricity generation, distribution, transmission, and standalone (off-grid) companies with operation licenses with ERA and off-grid solar companies that are members of Uganda Solar Energy Association (USEA). In total, 112 power companies met this criterion, and thus represented our final sample used in conducting our quantitative analysis. Our sampling also considered geographic/regional distribution (e.g. Central, North, East and West). In general, the Power companies that were sampled comprised almost 90% of the total population. We collected primary data on human capital, management control systems and sustainable performance.

shows that companies are composed of 54 generation companies, 9 distribution companies, 1 transmission company (UETCL) and 60 standalone companies (off-grid and mini-grid companies). A sample size of 112 firms from the population of 156 power companies was selected using Yamane’s formula (Almeda et al., Citation2010; Yamane, Citation1967). The Yamane formula ensures that the selected sample represents the population from which it is drawn. By using a random sampling technique, the formula provides a reasonable estimate of the population parameters. The formula also considers the desired level of precision (e) or margin of error. This study employed stratified simple random sampling based on proportionate sampling to enable the firms to have equal chances of being sampled.

Table 1. Sample size determination.

5.2. Operationalization and measurement of variables

We classify our variables used in testing H1-H3 into three main types with the presenting how we measured each of them. First, our main dependent variable is the sustainable performance. Human capital is the independent variable while management control system is the mediator variable.

Table 2. Summary of measures and variables.

The environmental performance dimension has 9 questionnaire items loading on to it, while the economic performance dimension retained 3 items; 4 questionnaire items loaded on to the social performance dimension. The confirmed factor loadings for human capital included only 2 factors were well loaded for knowledge, three each for competences and expertise. MCSs has 13 factor loadings. A structured survey questionnaire with close-ended questions was administered to the respondents in the selected Power companies. Based on the conceptual and theoretical framework that has been adopted to guide this study human capital, management control systems and sustainable performance were operationalized and measured based on previous research. A structured survey questionnaire with closed-ended questions was administered to the respondents, to capture their perceptions of the study phenomena.

Given the cross-sectional nature of our data, we begin our analyses by running cross-sectional structural model to evaluate the direct and indirect relationships between the latent variables. Our structural model was specified as follows:

(1)

(1)

Direct Path: Independent variables → Dependent Variables; SPi = β0 + β1HCi + ei (2)

Mediator → Dependent variable ; SPi = β0 + β3MCSi + ei (3)

Mediation Path: Independent variables → Mediator;

(4)

Total Effect: IV + mediator → Dependent Variable; SPi = β0 + β2HCi+ β3MCSi+ εi(5)

where: SP is Sustainable Performance: representing the dependent variable

HC is Human Capital, representing the independent variables

MCS is Management Control Systems: representing the mediator variable

β0–β3: the regression coefficients that represent the magnitude and direction of the relationships

εi: the error term representing the unexplained variation in the dependent variable

i: Individual data points (Individual Power firms)

We report the empirical analyses, including the descriptive statistics, bivariate and multivariate regression analyses and robustness analyses in the following sections. Smart Partial Least Squares (PLS) version 4.0 and the Statistical Package for the Social Sciences (SPSS) version 23 were used for the analysis.

6. Empirical findings and discussion

6.1. Structural equation analyses

reports the results of the structural equation model on the relationship between human capital and Sustainable Performance (SP) with the mediating role of management control systems in power companies in Uganda. Our findings indicate that management control systems and human capital have a cross-sectional effect on power companies’ sustainable performance. also shows the path diagram for the mediating role of management control, systems on the relationship between Human capital, and SP First; the statistical coefficient of MCSs is statistically significant and positively associated with the level of sustainable performance, an indication that H2, has an empirical support. The findings indicate a significant and positive relationship between management control systems and sustainable performance (β = 0.124; t = 4.736; p value = 0000). The results imply that MCSs provide the necessary mechanisms, structures, and processes to support and drive sustainable practices within the organization. By contrast, the relationship between human capital and sustainable performance is statistically insignificant (β = 0.113; t = 1.662; p value = 0.10), implying that H1 is not empirically supported. Third, the results further indicated an indirect positive and significant effect of MCSs on the relationship between human capital and sustainable performance is (β = 0.105, t = 3.215; p = 0.001), implying that H3 is empirically supported. As such, the findings indicate a full mediation effect. The results indicate that MCSs fully mediate the relationship between human capital and sustainable performance in line with (Zhao et al., Citation2010) criteria, which suggest that a full mediation is indicated in the case where the direct effect is not significant whereas the indirect effect is significant, which means only the indirect effect via the mediator exists. Based on the results, human capital has a non-significant impact on sustainable performance, but a significant indirect effect exists between human capital and sustainable performance through MCS. In this study, a full mediation of MCS on the relation between human capital and sustainable performance of power companies in Uganda. This finding implies that the impact of human capital, encompassing knowledge, competences, and expertise, on sustainable performance is not direct but is channeled through the effective implementation and utilization of MCS components. The contribution lies in recognizing the specific pathways through which human capital exerts its influence. In particular, the study highlights the vital role played by MCS, including Management Information Systems (MIS), cost accounting, internal auditing, quality control, and strategic planning. These components serve as conduits through which the pool of human capital resources within power companies creates the economic, social and environmental values.

Table 3. Mediating role of MCS on the relationship between human capital and sustainable performance.

The positive link between MCS and sustainable performance provides empirical support for the findings of past studies that focused on control systems and sustainability (Akisik & Gal, Citation2017; Maas et al., Citation2016)), which suggest that corporate boards of diverse ethnic and gender origins are likely to show greater commitment to increased voluntary disclosures., Li et al. also argue that effective internal control significantly promotes enterprises to assume social responsibilities and generate fair and sustainable benefits for stakeholders. The results also collaborate well with Akisik and Gal (Citation2017) who assert that the impacts of customers and employees on financial performance are influenced by effective internal control.

Maas et al. (Citation2016) contend that responding to stakeholders’ feedback is, thus, considered to be an outside-in perspective, where internal actors and external stakeholders work in a way that contributes to performance improvements in a sustainability direction through an iterative process. Gond et al. (Citation2012) based on different diagnostic and interactive uses of sustainability control systems and traditional management control systems to derive different patterns of integration of sustainability issues into organisational strategy and operations. Similarly, our results indicating that the relationship between human capital and sustainable performance is fully mediated by MCSs collaborate well with the extant studies, such as Hutahayan (Citation2020) who finds that Corporate human capital alone without internal process performance does not influence financial performance. The finding links well with the fact that the impact of human capital on sustainable performance is contingent on the presence and efficacy of management control systems. These systems likely play a critical role in aligning the efforts of employees and directing their competencies towards achieving sustainable outcomes. Without effective management control systems, the positive impact of human capital on sustainable performance might not be fully realized, and the company could struggle to meet its sustainability goals. Our findings appear to offer strong empirical support for the theoretical perspectives of the resource-based and stakeholder views. Specifically, they suggest that human capital alone may not improve sustainable performance, but only through the effective utilization of management control systems by providing collaborations with internal and external stakeholders (i.e. stakeholder theory), but also as a valuable resources to create the sustainable economic, social and ecological values (i.e. resource based view theory).

The positive association between management control systems (MCS) and sustainable performance provides empirical support for the stakeholder and resource-based view perspective. Specifically, MCS enables power companies to develop strategies, collaborate, communicate their objectives among stakeholders, monitor and track performance by providing feedback and imposing control mechanisms. Therefore, Strategic planning enables companies to plan, set clear goals for operations and develop strategies to achieve satisfactory financial performance, ensure compliance with environmental requirements, and foster coexistence with local communities. Power companies that implement cost accounting practices, including the establishment of a designated cost accounting unit, demonstrate a strategic approach to controlling costs and conducting performance evaluations, which improves operational efficiency, maximizes resource allocation, and harmonizes their financial plans with sustainability goals. Likewise, Power companies that leverage Management Information Systems (MIS) for automating their operations effectively report on social and environmental impacts across all processes, while simultaneously achieving adequate returns on their investments. Adhering to strict quality control standards enables power companies to ensure safety assurance, which yields enhanced customer satisfaction, improved service delivery, and minimized negative environmental impacts. Similarly, an internal audit professional team is a valuable resource for power companies to ensure compliance with economic, social, and environmental requirements, internal auditors contribute to the overall integrity and sustainability of the organization’s operations. Their role extends beyond financial considerations to encompass the broader spectrum of responsible business practices. Our results indicating that Management Control Systems (MCSs) fully mediate the relationship between human capital and sustainable performance align with both the stakeholder and resource-based view theoretical perspectives. This alignment signifies that MCS serves as a crucial bridge through which human capital influences power companies to achieve sustainable economic, social, and environmental outcomes.

Discernibly, the statistically insignificant association between human capital and sustainable performance fail to offer empirical support for our dual-theoretical framework in the context of the power sector

The management information systems could enable energy companies to track their progress toward sustainability goals, identify areas for improvement, and make informed decisions to improve SP.

7. Summary of findings, contributions, implications, limitations and avenues for future research

The results indicated that Sustainable performance in PCs cannot be achieved by effective human capital alone, it requires effective MCS. With this evidence, Power companies that institute conducive internal control systems create an enabling environment through which staff exhibit competencies that inherently improve sustainable economic returns, employee well-being, and environmental protection. This finding, therefore confirms the prediction of the resource-based view theory which focuses on developing unique resources to achieve a competitive performance. Essentially, the theory maintains that a firm is viewed as a collection of physical and intangible resources that enable it to perform sustainably better relative to other firms. In this study, the firms’ resources include human capital and management control systems, which are expected to enable the companies to perform sustainably. The results are also in line with previous empirical evidence for instance, Hutahayan (Citation2020) who finds that Corporate human capital alone without internal process performance does not influence financial performance. The characteristics of the MCSs in the company’s management are said to be effective and efficient if they can support information users to make correct, accurate, and timely decisions. The study results also resonate well with Hutahayan (Citation2020) who find that Management accounting information system plays an important role in improving internal process performance. Duréndez et al. (Citation2016) asserts that the existence of MCS enables managers to monitor whether the business is operating in accordance with social responsibility. Epstein and Roy (Citation2001) also establish that appropriate management control systems enable companies to obtain feedback information on potential environmental and social impacts, sustainability performance (at all organizational levels), sustainability initiatives, stakeholder reactions, and corporate financial performance. The results also contribute to the resource-based view theory by Barney’s (Citation1991), the firm resources include all assets, capabilities, organizational processes, firm attributes, information, and knowledge controlled by the firm. According to this study, through MCSs, a company’s human capital is among its most important assets. As a result, the organization’s essential resource for achieving economic prosperity, social equality, and environmental performance is human capital in terms of competencies and expertise. Contrary, the results are inconsistent with the findings of Bramasto and Adiwiguna (Citation2020) who indicate that HC does not rely on MCSs to drive economic performance but are both necessary for operational requirements. Bananuka et al. (Citation2022) also find that human capital as an intellectual capital element has a significant effect on the GRI-based sustainability performance disclosures in Manufacturing firms in Uganda. Based on the findings and arguments of preceding studies, this current study provided new information about the paramount role of management control systems on the association between human capital and sustainable performance based on the triple-bottom-line approach. Adds value to the existing literature by highlighting MCSs as a mediating factor between HC and SP in African countries such as Uganda, notably in the power sector.

The study results thus speak in favor of the stakeholder perspective of Barney’s (Citation2018) resource-based view theory, which suggests that stakeholders provide the company with access to resources such as MCs to achieve its goals. The results also agree well with those of Freeman et al. (Citation2021), who claim that stakeholder theory complements and unifies the RBV perspective. MCSs serve as a bridge that connects human capital (a critical resource) to sustainable performance, thus unifying the RBV (resource-centered) perspective with the stakeholder theory (stakeholder-centered). In this context, MCS enables energy companies to effectively use their human capital to meet the interests and needs of various stakeholders, including customers, investors, regulators and society at large. The Resource-Based View (RBV) theory, as expounded by scholars like Grant (Citation1991), Peteraf (Citation1993), and Teece et al. (Citation1997) provides a framework for understanding how management control systems optimize the utilization of human capital to achieve sustainable performance. Effective MCS helps firms identify, allocate, and manage their human capital in a way that aligns with their unique resources and capabilities, ultimately contributing to competitive advantage and long-term success.

The findings of this investigation have significant ramifications. First, the study’s theoretical stance was that because earlier studies only utilized one theory to describe one aspect of sustainable performance, they were unable to effectively explain the sustainable performance of businesses, particularly power companies. The current study, which used stakeholder, and resource-based theories, provides a better explanation for sustainable performance. Therefore, more than one theory offers a pertinent framework for understanding multidimensional notions like sustainable performance to capture more of the variance in sustainable performance. As such, this study has identified that the stakeholder theory and the resource-based view (RBV) theory complement one other to fully explain SP in PCs by prioritizing the needs of the stakeholders enhances SEE; SP is driven by the unique and valuable resources possessed by PCs (HC, MCS). A mediation model has been derived using a uni-theoretical framework with a focus on the ethical branch of the stakeholder theory, and the resource-based view theory in explaining |SP.

Second, according to this study’s approach, existing research’s usage of secondary data was not enough to fully capture all the aspects of sustainable performance in electricity corporations. Furthermore, secondary data falls short of offering management the direct incentives needed to pursue all aspects of sustainable performance. As a result, this study adds to the body of perception-based research that offers direct management incentives for long-term success. The perspectives of these managers have been gathered using self-administered questionnaires to gather impressions of managers of businesses, which has helped to tap into all aspects of sustainable performance. Perception-based approach offers an assessment of all the dimensions of SP based on the Triple Bottom Line (TBL) approach.