?Mathematical formulae have been encoded as MathML and are displayed in this HTML version using MathJax in order to improve their display. Uncheck the box to turn MathJax off. This feature requires Javascript. Click on a formula to zoom.

?Mathematical formulae have been encoded as MathML and are displayed in this HTML version using MathJax in order to improve their display. Uncheck the box to turn MathJax off. This feature requires Javascript. Click on a formula to zoom.Abstract

The International Accounting Standard Boards highlighted financial reporting timeliness (FRT), as one of the qualitative attributes taken into consideration when measuring financial reporting quality (FRQ). Considering that the board is the main internal corporate governance (CG) mechanism, the attributes of Chief Executive Officers (CEOs) are predicted to be associated with the FRT. The study aims to analyse the impact of CEO demographic characteristics on the FRT of non-financial listed companies in Nigeria. The sample consisted of 86 listed non-financial companies’ annual reports on the Nigeria Stock Exchange (NSE) for 2015–2021. Multiple linear regressions were used in analysing the collected data via STATA software. Results revealed that 6 out of 10 hypotheses were significantly related to FRT. Findings indicated that CEO characteristics may encourage managers to reduce reporting lag, increase the quality of financial reports, and signal good news to shareholders, which may significantly affect the company’s performance. It is recommended that stakeholders review CG and accounting standards reform to improve FRT and deter managers from late submission of financial statements to the NSE. The study contributes to stakeholders like managers, regulatory bodies, policymakers, and professional bodies to enhance current standards, and regulations in Nigeria. Finally, agency theory and upper echelons theory were used to delve into new findings based on the Nigerian setting and enhance the rigour, coherence, and impact of this study within its academic or practical domain.

Reviewing Editor:

1. Introduction

The timeliness of financial reports is one of the qualitative factors used to measure the quality of financial reporting (Aifuwa & Saidu, Citation2020; Givoly & Palmon, Citation1982). According to Pradipta and Zalukhu (Citation2020) and Muhammad (2020), timely reporting helps create an environment of trust in the financial markets. Azubike and Onukwube, (Citation2019) posit that timely reports convey a favourable indication to decision-makers and prospective shareholders regarding the performance of a company and financial reporting timeliness. However, the increased attention regarding the financial reporting timeliness has been motivated by the collapse of many large corporations in the early 1990s in Europe and the United States, such as in the case of Enron in 2002, when the performance of giant companies began to witness a decline in their productivity and have made investors lose confidence (Bala, et al., Citation2020; Omer et al, Citation2020). Corporate scandals have affected not only developed countries but also the developing economy (Bala, Citation2019; Ozili, Citation2020). Notably, recent corporate failures in developed economies have spread to developing nations like Nigeria, raising concerns about the effectiveness of corporate governance.

Meanwhile, the Nigerian government has set a limitation of 90 days for entities to issue and submit annual financial statements to the Stock Exchange. Nevertheless, several listed companies still failed to submit their financial reports on time. For instance, Cadbury Plc in 2006, and FTN Cocoa Processors Plc, Deap Capital Management, and Trust Plc. in 2019, among others (Itodo, Citation2019), failed to submit their audited financial statements for the fiscal year ended December 31, 2019. This demonstrates their incapacity to adhere to current corporate governance best practices and regulations, which require them to submit their financial statements within 90 days of the end of the financial year. Consequently, the Nigerian Stock Exchange (Citation2017) placed fines on some companies that fail to submit their audited reports for the period of their delay, leading to a loss in the value of shareholders’ investments (Gbalam & Uzochukwu, Citation2020). The companies comprised, but were not limited to, International Breweries N100,000 ($70.422), Meyer Plc N2.1 million ($1,478.852), Sovereign Trust Insurance N2.1 million ($ 1,478.852), Abbey Mortgage Bank N700,000 ($ 492.951), Fidelity Bank N2.7 million ($ 1,901.382), Sterling Bank N2.1 million ($ 1,478.852), Wema Bank N800,000 ($ 563.372), and FCMB N100,000 ($70.422). These issues have raised severe concerns regarding the efficacy and dependability of corporate governance mechanisms and financial reports in safeguarding the interests of investors (Al-Shaer, Citation2020; Habib et al., Citation2019).

In addition, it has been reported in the extant literature that most corpo nigeria rate financial report delay practices are perpetrated by the Chief Executive Officer (CEO) (The Nation Media Group, Citation2021; NSE, Citation2017). In Nigeria, 25 CEOs are reportedly involved in financial reporting delay practices in both non-financial and financial listed companies (Sani et al., Citation2020). The extant literature has perceived academic and professional experience to play a crucial function in influencing the timeliness of financial information (Laptes, 2020; Rashid, Citation2020; Ma et al., Citation2019). In Nigeria, it is obvious that professional accounting bodies offer education and training programmes that equip professionals with the necessary skills and knowledge to secure positions as top executives (Chijoke-Mgbame et al., Citation2020).

Based on the CEO’s gender diversity in Nigeria, Section 2.4 of the Nigeria Code of Corporate Governance (NCCG, Code 2018) states that, the board should promote diversity in its membership regarding a range of characteristics that are important for fostering improved governance and decision-making. Moreover, in the long term, highly educated CEOs and managers might concentrate more on the business strategies of their companies (Qi et al., Citation2018; Evert et al., Citation2018; Suman & Singh, Citation2021). As reported by Ma et al. (Citation2019), companies with board chairs who have completed more education provide more accurate and timely financial reports. This study examines the effects of corporate governance practices, like the CEO demographics (i.e., academic experience, financial expertise, gender diversity, educational level, and working experience) and firm characteristics (firm size, firm age, and firm growth), regarding the timely submission of financial reports of non-financial companies in Nigeria. Furthermore, previous studies have highlighted that research and development investment is an influential factor in investment decisions to obtain accurate information (Gounopoulos & Pham, Citation2018; Aldoser et al., 2021).

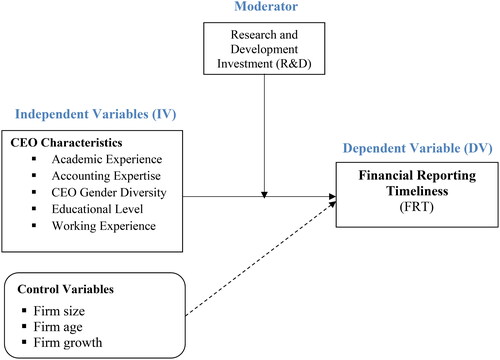

In addition, previous studies on the relationship between CEO characteristics and financial reporting timeliness provide mixed findings, such as Shen et al. (Citation2020), Rashid (Citation2020), Ma et al. (Citation2019), Abernathy et al. (Citation2018), Michel and Hambrick (Citation1992), Plöckinger et al. (Citation2016) and Al-Shaer (Citation2020), because the extant studies were carried out in different contexts and constructs. Therefore, this research investigates the effect of corporate governance (CG) mechanisms, that is, CEO characteristics and FRT. It also explores the moderating effect of research and development investment (R&D) on the correlation between CEO attributes and timely financial reporting. This study contributes to agency theory and upper echelon theory by presenting empirical findings on the correlation between corporate governance mechanisms and FRT in Nigeria. The results of the research will be valuable to investors and regulatory authorities responsible for monitoring managerial FRT. Regulatory authorities could also use these findings for better CG compliance and FRT.

Section One encompasses the introduction of the study, including a general summary of the research paper, the background of the research, the statement of problem, the main objective, and the contribution of the research. Section Two begins with a literature review, a discussion of conceptual reviews, and a theoretical literature review on FRT. This section followed by an overview of the empirical literature on CG mechanisms and FRT, research and development investment (R&D Investment), and the development of hypotheses based on pertinent theories. Section Three highlights the research methodology, method of data collection, sample size, and model specification. The instrumentation and measurement of the study variables are described in this section. Section Four focuses on the analysis results, discussion, descriptive statistics, correlation analysis, and discussion of the results. Section Five covers conclusions, recommendations, and limitations of the research.

2. Literature review

2.1. Financial reporting timeliness (timeliness)

Timeliness provides decision-makers with information before they lose their influence Zandi, and Abdullah (Citation2019). Stakeholders need quick and credible reports owing to increased information needs. The International Accounting Standard Board (IASB) defines timeliness as providing decision-makers with the information they need before it expires. According to IASB (Citation2008), financial reporting timeliness is a qualitative indicator of financial information quality (Aifuwa et al., Citation2020). As in previous study, timeliness refers to the number of days between a company’s financial year-end and the final release of its audited financial statements (Owusu-Ansah & Leventis, Citation2006). Baatwah (Citation2016) defines the number of days between the fiscal year end and the release of the annual report in official publications or on the capital market site. The detrimental effects of insider trading are lessened by prompt reporting, which builds trust in capital markets, and gives decision-makers and investors a good signal or indication of a firm’s performance and earnings (Oraka et al., Citation2019).

Many researchers have studied the association between timeliness of financial reporting (Beaver, Citation1968; Givoly & Palmon, Citation1982; DeLaney et al., Citation2013; Alsmady, Citation2018; Baatwah et al., Citation2018; Eze & Nkak, Citation2020; AlShaer, Citation2020). They claimed that companies delayed announcing their financial information when it was unfavourable news. However, when accounting figures show positive news, companies and managers rush to share it to benefit users of financial information. Several empirical investigations contradict the premise that ‘businesses deliver good news than bad news’. For example, Basu (Citation1995) hypothesises that businesses react better to negative news than to good news at present, since it affects the likelihood that potential customers will patronise the business. Moreover, every country has a different deadline set by the regulatory bodies. United State of America (USA) has reported a time of fifty-five (55) days, and the United Kingdom (UK) sixty-four (64) days, respectively (Aifuwa et al., Citation2018; Abernathy et al., Citation2018). For emerging countries, reporting lag for Malaysia was one hundred and three (103) days and Egypt seventy-two (72) days (Khlif & Samaha, Citation2016; Wahdan et al., Citation2023; Raweh et al., Citation2021).

In Nigeria, according to the regulatory filing calendar maintained by the NSE, the date by which corporations must submit their annual reports is 31st of March for each year and within a period of 90 days, as stipulated by the Exchange. Therefore, the NSE has seriously monitored 13 businesses in 2020 because they did not submit their reports by the deadline of March 31, 2020. Companies such as Aso Savings and Loans Plc, FTN Cocoa Processors Plc, DN Tyre and Rubber Plc, and Deap Capital Management and Trust Plc were among those involved in untimely financial reporting in Nigeria. As stated by Muhammad (2020), financial reporting timeliness is defined as promoting transparency and providing a comprehensive yearly report with a high standard. This study applies the delay in total reporting as an example of how the high value of accounting information can be evaluated if it can be reached by many people, not just by board of directors and management. This measurement requires waiting time before management and auditors can deliver certified annual reports to the public (Salleh et al., Citation2017).

2.2. CEO demographical characteristics and timeliness of financial report

According to a growing body of research (Ma et al., Citation2019; Shen et al., Citation2020), the attributes of executive managers may account for an important portion of the variation in company policy. Upper Echelons Theory (UET) by Hambrick and Mason (Citation1984) opined that a top executive’s perceptions, values, and cognitions significantly impact a firm’s choices and outcomes. Because executive values, perceptions, and cognitions are hard to quantify, the Upper Echelons Theory proposes that the executive qualities are suitable proxies to be applied in the study (Carpenter et al., Citation2004). According to Hambrick and Mason (Citation1984), empirical research reveals that CEO traits reliably influence organisational activity outcomes. Carpenter et al. (Citation2004) propose that the decision-making process of a CEO is most likely to represent the configuration of his various traits, which has been explored in past studies. The evidence presented above from the management literature points to a significant connection between CEO attributes and firms’ financial reporting timeliness. Research on top executives has shown that CEO characteristics are critical components of CG that influence both the timeliness of managers’ reports and the timeliness of financial reports. The CEO’s demographic characteristics include academic experience, financial expertise, gender diversity, educational level, and working experience, which are explained in the following paragraph.

2.2.1. Academic experience

Based on the CEO’s academic experience, Ma (2019) postulates that academics have comparatively higher moral and social standards. Ma et al. (Citation2019) defined top executive academic experience as having held a faculty position at a college or university or as a research associate at a research organisation. Shen et al. (Citation2020) identified executives with academic experience and documented that firms with former academic experience perform significantly better than businesses without these executives. However, this is in contrast to Ma et al. (Citation2019), who found that top academic management team members do not affect firms’ financial reporting timeliness. Ozili (Citation2020) is among the studies that examine the roles and impacts of academic experience on the timeliness of financial reporting. This creates gap for future research. Hence, this study fills the gap by analysing the effect of CEO academic experience on financial reporting timeliness in Nigeria. Based on Upper Echelons Theory, the research hypothesis is being formulated.

H1:

CEO academic experience has a significant impact on the timeliness of financial reports of non-financial listed firms in Nigeria.

2.2.2. Accounting expertise

Accounting expertise can considerably affect a firm’s FRT (Abernathy et al., Citation2017). Given its significance, is essential to determine the variables influencing FRT levels. Oradi et al. (Citation2020) opined that the accounting expert of the CEO has experience working as an auditor, holds a qualification in accounting, or the chief financial officer (CFO), holds other accounting-related positions. Thus, prior studies have identified top executive officers with accounting expertise as a good CG mechanism to mitigate delays of financial reports and enhance FRT (Rashid, Citation2020; Lapteș, Citation2020; Yu et al., 2019; Abernathy et al., Citation2014). The vast knowledge and skills that professional accountants acquire via their education and training programmes provided by esteemed accounting organisations such as the International Federation of Accountants (IFAC) can be utilised in executive positions (Ado et al., Citation2020; Berg, Citation2007). This is the result of the vital role of top executives and how their knowledge of finance may impact a company’s FRT (Ma et al., Citation2019). However, extant literature shows a dearth of literature to date in developing countries that studies the association between the financial expertise of a CEO and the FRT (Ismail et al., Citation2020). From the previous discussion, the subsequent hypothesis was formulated:

H2:

CEO accounting expertise has significant effect on the timeliness of financial reports of non-financial listed firms in Nigeria.

2.2.3. Gender diversity

Regulators and governments worldwide have mandated women to sit on committee boards and hold senior management positions (Ismail et al., Citation2020). Some governments have established voluntary requirements requiring all publicly listed companies to have a woman in management positions and on the board (Suman & Singh, Citation2021). This was done to help the women reach the top management level. Hunt (Citation2018) studied financial reporting timeliness in European organisations and their impact on gender diversity. Australian companies have the highest percentage of women in executive posts (21%) and Nigeria (14%) compared to the US (19%) and the UK (15%). The most robust connections were observed between executive team gender diversity and efficient financial reporting timeliness across geographical areas Quarato et al. (Citation2017) explored how senior management team diversity affects Italian fashion and upscale corporations’ performance. The findings indicate that greater gender diversity in CEOs is linked to improved company performance. Consequently, companies with greater board gender diversity are more effective in mitigating the financial reporting lag (Suman & Singh, Citation2021). Uyioghosa and Amede (Citation2019) carried out a study in Nigeria to examine whether CEO gender attributes are significantly related to financial reporting timeliness. The findings reveal that CEO gender is significantly related to financial reporting timeliness. Based on the findings, it was recommended that females be considered more for the position of CEO in Nigeria. Therefore, this study considers the gender diversity of CEOs and examines their likely influence on FRT in Nigeria. Based on Upper Echelons Theory and past studies, the hypothesis is formulated as follows:

H3:

CEO gender diversity has a significant impact on the timeliness of the financial reports of non-financial listed firms in Nigeria.

2.2.4 Educational level

Regarding CEO’s educational levels, highly educated top executives can acquire new ideas and implement better strategies because of their cognitive complexity (Ma et al., Citation2019; Omer, Citation2020; Fujianti, Citation2019). An educational degree indicates executive abilities and talents, based on research using Upper echelons Theory (Hambrick, Citation2007). Managers with greater levels of educational attainment possess enhanced cognitive capacity for processing and assessing information, which enables them to resolve organisational issues and make wiser decisions (Qi et al., Citation2018). Higher educated top executives are generally thought to be more cognitively complex, able to assimilate new information, and capable of executing more successful strategies (Omer et al., Citation2020). The Nigerian Code of Corporate Governance (NCCG, 2018) states that, in order for the board to attain the appropriate balance of expertise, abilities, background, diversity, and independence to effectively fulfil its governance role and obligations in an unbiased and effective manner, it must take responsibility for its composition by establishing its goals and approving the rules and regulations. This hypothesis was formulated as follows:

H4:

CEO education level has a significant impact on the timeliness of financial reports of non-financial listed firms in Nigeria.

2.2.5 Working experience

Decisions made by CEOs with work experience may deviate from the Expected Utility Theory. Expected Utility Theory points out that people do not have access to whole outcome distributions; instead, they are limited to accessing just samples of previous outcomes. (Hertwig, Citation2012). Psychology literature shows that experience influences decision-making (Dittmar & Duchin, Citation2015). The NCCG (2018) requires a combination of diversity, abilities, expertise, and background (including gender and prior experience) to guarantee that the committees within the board perform effectively without compromising competence, independence, and integrity. Interestingly, the rising finance literature studies how individual experiences affect investment behaviour (Ma et al., Citation2019; Shen et al., Citation2020). Nigerian Public Service Rules (Citation2008) stated that CEO job experience is important, but there is little empirical evidence substantiating the correlation between work experience and FRT. Dittmar and Duchin (Citation2015) examined how managers’ experiences affect companies’ financial policies. The results indicate that policies change according to managers’ experiences and careers. Managers with financial experience may comprehend that late financial reports annihilate their firm’s future success (Abernathy et al., Citation2015). In view of the above, this study investigates the effect of the work experience of the CEO on FRT in Nigeria. Consequently, the hypothesis is formulated as follows:

H5:

CEO work experience has a significant effect on the timeliness of financial reports of non-financial listed firms in Nigeria.

2.3 Moderating effect of research and development investment on the relationship between CEO characteristics and financial reporting timeliness

Studies related to CEOs have yielded varied and inconclusive results. Some researchers see that CEO traits are a major factor in financial reporting timeliness (Zheng et al., Citation2020). Other studies have found that CEOs are less likely to reduce financial reporting latency and are more likely to be involved in agency conflict (Ma et al., Citation2019). Thus, there is a gap in research and development investment. According to Percy (Citation2000), research and development investment occurs when one party has an informational advantage over the others. Financial reporting is important for internal and external stakeholders (Bala, Citation2019). This will help investors make efficient investment decisions (Adekoya et al., Citation2021).

According to Gerpott et al. (Citation2008), revealing R&D investments could be a strategy to close the information gap between managers and investors. As a result, many businesses provide information regarding the amount of money they spend on research and development (R&D) to enhance investors’ understanding of their businesses. It also influences investors’ interpretations of financial performance and evaluations of a company’s prospects. Accordingly, R&D Investments are seen as a proxy for knowledge asymmetry and can be associated with CEO and financial reporting timeliness. Aboody and Lev (Citation2000) and Cai et al. (Citation2015) found that the percentage of R&D-intensive companies that publish their financial information in a timely manner is much greater than that of organisations without R&D investments. They concluded that R&D was a major contributor to information asymmetry, and that investing in R&D, in general, would minimise the influence of the interaction between CEOs and the time gap in financial reporting in Nigeria. Based on past studies and agency theory, this study hypothesises the following:

H6-10:

Research and Development Investment (R&D) moderates the relationship between CEO demographic characteristics and financial reporting timeliness of non-financial listed firms in Nigeria.

2.4 Research framework

The study framework in this research applies Agency Theory and Upper Echelons Theory. The variables in this study are consistent with the main objectives of the study. The motivation of the study is based on past studies that have evidenced limited studies carried out in Nigeria related to CEO demographic characteristics and the timeliness of reporting in the non-financial sector in Nigeria. However, very few studies have incorporated CEO characteristics (e.g. academic experience, accounting expertise, gender diversity, education level, and working experience) in Nigerian non-financial firms. Therefore, this study is necessary in Nigeria. Therefore, this research is among the studies that examined the moderating effect of research and development investment between CEO demographical characteristics and FRT, as shown in below.

3.1 Research methodology

3.1. Sample size and data collection

As of December 31, 2021, the population consisted of 171 companies trading on the Nigerian Stock Exchange. Because of the different financial rules, and regulations, 55 financial institutions were excluded from the selection. The research excluded newly listed and delisted non-financial companies that occurred throughout the time frame of the study because the companies do not have complete data. In addition, companies that were unable to provide adequate yearly reports or supply the necessary amount of complete data were not included in the analysis. The total sample encompassed 86 different companies. resulting in a total of 602 observations covering 2015 to 2021. The steps for selecting the samples are outlined in . In addition, data on CEO demographic characteristics (academic experience, financial expertise, gender, education level, and working experience) were acquired manually from the audited annual reports of companies and through the companies’ websites and Nigerian Stock Exchange (NSE). These reports contain information on CEOs’ academic experience, financial expertise, gender, education level, and working experience. At the same time, information from the Thomson Reuters Database was used to gather data on financial reporting timeliness and other financial data pertinent to the control variables.

Table 1. Composition of non-financial industries in a Nigerian stock exchange sample.

3.2. Model specification

A panel data analysis was used in this study. Financial reporting timeliness (FRT) is the dependent variable as a function of explanatory variables, chief executive officer characteristics, research and development investment (R&D Investment), and control variables. In accordance with Borgi et al. (Citation2021) and Baatwah et al. (Citation2016), this study applied the delay of the total financial reports. This is because financial information and records may be highly informative when it reach a wider variety of decision-makers as opposed to board of directors and management. This metric calculates the length of time between the completion of audited annual reports and their release to the public. Therefore, it is determined by calculating the number of days between the fiscal year end and the day annual reports are made available to the public on the website.

Model 1 highlights the main regression analysis of the research using the proxies in . This explains the relationship Amidst dependent and independent variables.

Model 1: Direct effect

(1)

(1)

Where: FRT = financial reporting timeliness, CEO_AE = CEO academic experience, CEO_FE = CEO financial expertise, CEO_GD = CEO gender diversity, CEO_EL = CEO educational level, CEO_WE = CEO working experience, FSIZE = firm size, FAGE = firm age, and FGRWTH = firm growth.

The moderating effect of research and development investment is a proxy for R&D Investments cost, as indicated in Model 2:

Model 2: Indirect effect

(2)

(2)

Where: represent the coefficients of theregression model; FRT = Financial Reporting Timeliness; α0= Constant; RD = Research and development investment; CEO_AE*RD = CEO Academic Experience; CEO_FE*RD = CEO Financial Expertise; CEO_GD*RD = CEO Gender Diversity; CEO_EL*RD = CEO Educational Level; CEO_WE*RD = CEO Working Experience; FSIZE = firm size; FAGE = firms’ age; FGRWTH = firms’ growth. and

= Error term. The information regarding the measurements is highlighted in .

Table 2. Measurement and source of study variables.

3.3. Data analysis

The study employed multiple regression to test the hypotheses developed. According to Hair et al. (Citation2012), the multiple regression technique is a statistical approach used to examine correlation between a dependent variable and multiple independent factors. It does so by estimating the coefficients of the equation in a straight line.

4. Results

4.1. Descriptive statistics

This study analysed data using descriptive statistics, univariate t-tests, and multivariate tests. According to Tabachnick et al. (Citation2007), descriptive statistics are most frequently used to describe individual samples regarding combinations or variations. More so, Ott and Longnecker (Citation2010) write that ‘Effective descriptive statistics allow us to comprehend the data by condensing a vast array of measurements into a handful of summary measures that offer a reliable, approximate representation of the original measurements. ‘ illustrates the descriptive statistics of the mean, minimum, maximum, and standard deviation of continuous and dichotomous variables calculated using STATA 16 version.

Table 3. Descriptive Statistics between CEO Characteristics, RD, and Financial Reporting Timeliness.

presents a concise overview of statistical information for data on CEO characteristics, R&D, and financial reporting timeliness. The average duration for non-financial listed firms on the NSE to disclose their financial reports to the public following the conclusion of their fiscal year is 118 days. The financial reporting timeliness has a standard deviation of 103 days. Indicating significant fluctuation in the promptness of corporations’ reporting. The analysis also shows that the shortest financial reporting timeliness was as early as 31 days, and the longest was as late as 1335 days. This shows that most of the companies listed in Nigeria did not adhere to the required rules and regulations, which mandated them to publish their financial statements within 90 days.

Based on the academic experience of the CEO, the results revealed that the mean value was 48.2% and the standard deviation was 50%. This shows that a CEO with academic experience controls only 48% of board members. Comparatively, the total number of academic experiences exceeds the average mean of American companies (18%), as stated by Masulis et al. (Citation2012), and is 9% of Turkish companies, as indicated by Polovina and Peasnell (Citation2015). The mean value for CEO members with financial expertise in the Nigerian non-financial sector was 43.5%, and the standard deviation was 49.6%. This indicates that the top executive members’ financial expertise represents 44% of the board members, which conforms to the regulations of the NCCG 2011.

Considering the gender diversity of female executives, indicates a mean value of 10.2%, a minimum of 0.00, and a maximum of 1.00. This signifies that CEOs with gender diversity account for approximately 10% of the board members. This indicates that male CEOs dominate most firms in Nigeria, and some companies have all-male CEOs. Regarding the CEO’s educational level, the finding demonstrates that the mean value of the educational level of the CEO is 3.72, implying that, most of the CEOs have higher educational levels and can make viable decisions based on their educational experience.

Table 4. Matrix of Correlations Analysis.

Furthermore, a CEO with work experience indicates mean value of 5.412, a minimum value of 2.00, and a maximum value of 13. This signifies that CEOs with work experience account for approximately 15.3% of all board members. A 100% maximum indicates that certain organisations in Nigeria are mainly controlled by CEOs who have significant work experience. From , firm size (FSIZE) shows an average mean of 6.96, a minimum of 0.00, and a maximum of 9.70. This finding is in line with the findings of Sani & Musa Citation2016. The average age of companies listed on the NSE is 41.3 years, with a minimum of 0 years and maximum of 97 years. The average score for firm growth (FGROWTH) is 1.062, with a minimum value of 8.097 and a maximum value of 79.13. This outcome suggests that the average yearly sales increase was 35%. The average mean is closely linked to the average value of 85%, as per the report by Dakata (Citation2017).

4.2. Correlation analysis

The correlation coefficients amongst the research variables are shown in . There was no indication of multicollinearity (value less than 0.7) based on the results of the Pearson correlation analysis was conducted on explanatory variables, as shown in .

According to the data shown in , there was a positive and significant relationship amongst CFE and CAE. At a significance level of 5%, there were significant relationships between CGD, and CAE and FRT. At a significance level of 10%, there was a statistically significant and negative correlation between the FSIZE and FRT. At a 5% significance level, the variables FAGE and FRT, as well as FGRWTH and FRT, showed positive and significant relationships.

4.3. Multivariate analysis (testing of hypotheses for Direct effect)

displays the results on the relationship between CEO demographic characteristics (CEO academic experience, accounting expertise, gender diversity, educational level, and working experience), firm characteristics (firm size, firm age, and firm growth), and financial reporting timeliness.

Table 5. Direct relationship regression results.

The results of the association between demographic characteristics of the CEO, firm characteristics, and timeliness of financial reporting show a cumulative R-square of 0.227 and F-statistics are significantat1% (p < 0.01), showing that the overall model is fit showing the level of variability between endogenous and exogenous constructs. The regression model demonstrates that 23% of the aggregate variance in financial reporting timeliness is attributable to the combined influence of exogenous constructs (such as CEO academic experience, financial expertise, gender diversity, educational level, and working experience) and firm characteristics (including firm size, age, and growth). The R2 value in is greater than the R2 value of 0.136 found by Adamu et al. (Citation2017) when analysing listed companies in Nigeria.

5. Discussions

This study hypothesized that CEO’s academic experience has a positive and significant association with timeliness of financial reporting of non-financial listed firms on the NSE. However, this finding is in contrast with the research prediction, whereby the result shown in reveals that academic experience has positive and insignificant impact on financial reporting lag (β = 11.284; t = 1.26; p = 0.263). Hence, H1 is not supported. The findings indicate that companies headed by CEOs with academic experience are less capable of manipulating earnings and enhancing the financial reporting timeliness. Furthermore, financial expertise has a negative significant impact on the financial reporting lag (=14.21, t

-2.72, p

0.042). Therefore, H2is supported. The findings reveal that a CEO with accounting expertise has an advantage in selecting the best accounting policy that matches company objectives, thus enhancing the financial reporting timeliness. This result is consistent with those studies carried out in Nigeria (Ismail et al., Citation2020; Sani et al., Citation2020), and internationally (Rashid, Citation2020; Zhang et al., Citation2019).

Chief executive officer gender diversity has positive and insignificant impact on financial reporting lag (β = 14.69; t = 1.38; p = 0.226). Hence, H3 was not supported. This result contradicts those of previous studies examining CEO gender diversity and financial reporting timeliness (Ramalan et al., Citation2021; Quarato et al., Citation2017). CEO educational level has a significant and positive effect on the financial reporting lag (β = 1.641; t= -3.15; p = 0.007). Thus, H4 is supported. This finding is in line with Ma et al. (Citation2019), Omer et al. (Citation2020), and Qi et al. (Citation2018), who discovered that top CEOs with advanced educational backgrounds exhibit a higher level of cognitive complexity and possess a greater capacity to assimilate novel concepts and execute more efficient strategies. This indicates that the higher the CEO with higher education level, the lower the timeliness of financial reports. The CEO working experience has negative and insignificant effect on the financial reporting lag (-0.092; t= -0.29; p = 0.785). Hence, H5 was not supported. This study contradicts findings of previous research, which indicate that individuals’ experience may lead them to make better decisions different from agency theory due to their limit to only have access to samples of past outcomes and incomplete outcome distributions (Hertwig, Citation2012). Meanwhile, R&D has an insignificant and negative impact on financial reporting lag (

= 1.681; t= -0.48; p = 0.652). Hence, H6 is not supported. Finally, based on the relationship between firm size and the timeliness of financial report, the result shows a significant effect of firms size and financial reporting timeliness with (

= 3.824; t= -2.20; p = 0.079). Hence, the hypothesis H7 is supported.

5.1. Moderating effect of research and development investment

From the results for model 1 (direct relationship) between chief executive demographic characteristics and financial reporting timeliness is inconclusive. Thus, this study assumes that this relationship can be moderated by R&D Investments (Aboody & Lev, Citation2000; Cai et al., Citation2015). Cai et al. (Citation2015) documented that timely financial reporting is significantly higher in R&D-intensive firms than in non-R&D-intensive firms. Hence, the strength of the demographic characteristics of the CEO may be subject to research and development investments. examines the moderating effect R&D Investments on the relationship between demographic characteristics of the CEO (academic experience, financial expertise, gender diversity, educational level, and working experience) and financial reporting. Thus, presents the answer to whether R&D Investments moderate the association between CEO demographical characteristics and financial reporting timeliness of non-financial listed firms on the Nigerian Stock Exchange.

Table 6. Indirect relationship regression result (Moderating Effect of Research and Development Investment).

For Model 2 (indirect relationship), hierarchical regression was utilized, as opined by Baron and Kenny (Citation1986), as one of the techniques for testing whether variable interaction variables influence the prediction of the endogenous result from exogenous constructs. Meanwhile, a moderator is expected to strengthen, weaken, or change the direction of the association between CG and the timeliness of financial reporting of non-financial listed companies on the NSE. Table 6indicates that the overall R2 of financial reporting timeliness improved from 22.7% to 55.5% because of the moderating effect of R&D Investment on the relationship between characteristics of the CEO and financial reporting timeliness.

5.2. CEO characteristics, R&D investment and financial reporting timeliness (moderating effect)

For CEO academic experience, Model 1 (direct relationship) shows an insignificant and negative relationship with financial reporting timeliness (β = 11.284, t= −1.26, p = 0.263), as depicted in . However, it is interesting to find that in Model 2 (), research and development (R&D) Investment moderates the relationship between CEO academic experience and financial reporting timeliness (β = 0.921; t = 15.66; p = 0.000). Hence, H7 was moderated.

Based on the hierarchical regression, R&D Investments and CEO financial expertise are significantly and negatively related to financial reporting timeliness (β= −0.432; t= −8.54; p = 0.000). Therefore, R&D Investments improve the timeliness financial reporting. Hence, H8 is supported. This is consistent with Upper Echelons Theory that R&D Investments may increase the capacity of CEO’s financial expertise to improve reporting timeliness. In addition, the findings support those of previous study by Shen et al. (Citation2020) and Ma et al. (Citation2019), Who discovered that R&D Investments may be part of monitoring mechanisms and improving reporting timeliness.

Referring to on CEO gender diversity, the result (β= −0.032; t = 0.45; p = 0.504) is insignificant. R&D Investments do not moderate the relationship between CEOs gender diversity and financial reporting timeliness. Therefore, H9 is not supported. This indicates that R&D Investments are unlikely to empower female CEOs to exercise control and deter managers from manipulating earnings. This result suggests that information asymmetry and its relationship with gender diversity of the CEO may decrease the possibility of increasing the financial reporting timeliness. Hence, H9is not moderated. The results of this study contradict with some previous studies, like (Sani et al., Citation2020; Rashid, Citation2020; Zhang et al., Citation2019; Ismail et al., Citation2020) who suggest that is related to improving reporting timeliness.

Based on the hierarchical regression (see ), the resulting timeliness (β = 0.194; t = 6.08; p = 0.002) indicates that R&D Investment moderates CEO education level and financial reporting timeliness. Thus, H10 was supported. This finding substantiates the Upper Echelon Theory that R&D Investments may increase the capacity of CEO education level to improve reporting timeliness. This is also supported by previous research (Qi et al., Citation2018; Orazalin, Citation2020; Tanikawa et al., Citation2017) that information asymmetry is related to increased monitoring mechanisms and improved reporting timeliness.

Based on CEO working experience, the result (β = 0.495; t= −9.96; p = 0.000) explains that R&D Investments negatively moderate the relationship between CEO working experience and financial reporting timeliness. Therefore, H11 is supported, which indicates that the introduction of information asymmetry influences the relationship between CEO working experience and timeliness of financial reports. This result is consistent with previous study (Shen et al., Citation2020; Hertwig, Citation2012) which suggest that research and development investment is related to improved reporting timeliness.

5.3 Robustness test

The robustness tests, as indicated in , were performed to assess the stability of the results and verify that the conclusions are not excessively influenced by alterations in the model assumptions. Consequently, the robustness test conducted in this study demonstrated that the models are not dependent on particular modelling assumptions, thereby strengthening the reliability and validity of the findings, as the tests are an essential element of rigorous empirical research. The result shown in the below:

Table 7. Robustness test for regression results.

6. Conclusions and recommendations

In summary, this research examines the relationship between CEO demographic characteristics and the timeliness of financial reports of non-financial listed companies in Nigeria, with moderating effect of research and development investment (R&D Investment). Agency Theory and Upper Echelons Theory were applied in this research to delve into new findings based on the Nigerian setting. These findings indicate that CEO characteristics may encourage managers to reduce the reporting lag, increase the timeliness of financial reports, and signal good news to shareholders, which may significantly affect company performance. Therefore, Upper Echelon theory is among the theories applicable to this research.

With regards of the contribution, this research contributes to the relevant stakeholders in their decision-making process and policy formulation. Nigeria provides more relevant, reliable, and up-to-date information on CEO characteristics and financial reporting timeliness. Regulators are aware of the present state of corporate governance in Nigeria, especially in non-financial companies. Regulators may impose stringent penalties on companies that delay or submit late annual reports. Future research may consider and suggest that relevant stakeholders reconsider, review, and reform corporate governance and accounting standards to enhance the timeliness of financial reports. This research contributes to theory and practice as well as directions for further studies related to financial reporting standards and reporting timeliness.

Based on these findings, the study is limited to non-financial firms on the NSE, and further studies should go beyond non-financial listed firms. The research covered a period of seven years (2015-2021). The study was limited to Nigeria, where CG compliance to CG is weak. Further research is needed to examine how other CEO demographic variables not captured in this study will mitigate the financial reporting lag in Nigeria.

My sincere gratitude and respect to my current institution University Utara Malaysia (UUM), and Nigerian Securities and Exchange Commission (NSEC) for providing me with the available data and information for this research work. Thank you all, wishing you a long life and prosperity.

Authors’ contributions

Every author made contributions to the conceptualization and design of the study. Ahmad Muhammed Lawal performed material preparation and data collection, analysis, and discussion by Ahmad Muhammed Lawal, Prof. Dr Noor Afza Amran, and Dr. Nor Atikah Shafai. Ahmad Muhammed Lawal wrote the first draft of the manuscript, all contributors provided feedback on prior versions. The final manuscript was read and approved by every author. All authors unanimously accept responsibility for all parts of the work.

Acknowledgments

I express gratitude to the Almighty God for imparting me the courage and ability to successfully bring this work to its logical completion. I am very thankful to my competent and affable instructors and colleagues, whose guidance and contributions have made this research reality.

Disclosure statement

The authors’ research, "CEO Demographical Characteristics and Financial Reporting Timeliness in Nigeria: Moderated by Research and Development Investment," declares no conflicts of interest. We affirm adherence to ethical guidelines and regulatory standards. Data were sourced publicly and analysed transparently. While efforts were made for accuracy, inherent uncertainties exist. The opinions expressed are solely those of the authors and do not necessarily represent the institution. Feedback is welcomed for further discussion and research.

Data availability statement

The data substantiating the findings of this study are obtained in the Nigerian audited published financial statements from the Nigerian Stock Exchange official website of at (https://ngxgroup.com/exchange/trade/equities/listed-companies/?filter=Main%20Board), and from the University Utara Malaysia (UUM) library data Stream (Thomson Reuters Database) at (https://library.oum.edu.my/molec/db/Universiti%20Utara%20Malaysia%20).

Additional information

Notes on contributors

Ahmad Muhammed Lawal

Ahmad Muhammed Lawal is currently pursuing his PhD in Accounting at the Tunku Puteri Intan Safinaz School of Accountancy (TISSA-UUM), College of Business, Universiti Utara Malaysia. He completed his Master of Science (M. Sc) degree with honors in Accounting and Finance at Ahmadu Bello University (ABU) Nigeria, in 2018, and received his B.Sc. degree in Accounting from Kaduna State University (KASU) Nigeria, in 2012. Additionally, he obtained a Postgraduate Diploma in Education (PGDE) from the National Teachers’ Institute (NTI) in Kaduna, Nigeria, and a diploma certificate in computer applications. He has authored various publications in the areas of accounting, finance, and management, and is an esteemed member of several professional organizations including the Association of National Accountants of Nigeria (ANAN), the Institute of Certified Public Accountants of Nigeria (ICPAN), the Chartered Institute of Information and Strategy Management (CIISM), the Chartered Institute of Public Diplomacy and Management (CIPDM), the Nigerian Institute of Management (Chartered) (NIM), the Institute of Professional Managers and Administrators of Nigeria (IPMA), the Teachers Registration Council of Nigeria (TRCN), and the Institute of Chartered Accountants of Nigeria (ICAN) (In-view). He has participated in various local and international conferences and workshops. Furthermore, he has worked as a senior accounts officer in both the public and private sectors in Nigeria, amassing nearly 10 years of experience. Moreover, he possesses extensive knowledge of International Financial Reporting Standards (IFRS) and International Public Sector Accounting Standards (IPSAS), as well as considerable expertise in using accounting software and electronic payments and collections platforms.

Noor Afza Amran

Noor Afza Amran is a Professor of Tunku Puteri Intan Safinaz School of Accountancy (TISSA), College of Business, Universiti Utara Malaysia (UUM COB). Her Area of Expertise is Corporate Governance, Auditing, Fraud, Women Studies, Sustainability and Financial Reporting Quality.

Nor Atikah Shafai

Nor Atikah Shafai of Tunku Puteri Intan Safinaz School of Accountancy (TISSA-UUM), College of Business Universiti Utara Malaysia, 06010 Sintok, Kedah, Malaysia. Her Area of Expertise is Corporate Social Responsibility, Corporate Governance (Including Accountability, Ethics, Integrity), Financial Reporting, (Including Accounting Regulation, Accounting Standards, Accounting Theory, Standard Setting Process, Financial Reporting in Private and Public Sector Organisations).

References

- Abernathy, J. L., Barnes, M., Stefaniak, C., & Weisbarth, A. (2017). An international perspective on audit report lag: A synthesis of the literature and opportunities for future research. International Journal of Auditing, 21(1), 1–17. https://doi.org/10.1111/ijau.12083

- Abernathy, J. L., Beyer, B., Masli, A., & Stefaniak, C. (2014). The association between the characteristics of audit committee accounting experts, audit committee chairs, and financial reporting timeliness. Advances in Accounting, 30(2), 283–297. https://doi.org/10.1016/j.adiac.2014.09.001

- Abernathy, J. L., Beyer, B., Masli, A., & Stefaniak, C. M. (2015). How the source of audit committee accounting expertise influences financial reporting timeliness. Current Issues in Auditing, 9(1), 1–9. https://doi.org/10.2308/ciia-51030

- Abernathy, J. L., Kubick, T. R., & Masli, A. (2018). Evidence on the relation between managerial ability and financial reporting timeliness. International Journal of Auditing, 22(2), 185–196. https://doi.org/10.1111/ijau.12112

- Aboody, D., & Lev, B. (2000). Information asymmetry, R&D, and insider gains. The Journal of Finance, 55(6), 2747–2766. https://doi.org/10.1111/0022-1082.00305

- Adamu, A. I., Ishak, R., & Hassan, N. L. (2017). Is there relationship between board structures and dividend policy: Evidence from Nigeria. Journal of Advanced Research in Business and Management Studies, 9(1), 10–20. https://www.akademiabaru.com/submit/index.php/arbms/article/view/1274/436

- Ado, A. B., Rashid, N., Mustapha, U. A., & Ademola, L. S. (2020). The impact of audit quality on the financial performance of listed companies Nigeria. Journal of Critical Reviews, 7(9), 37–42. https://d1wqtxts1xzle7.cloudfront.net/72239149/LATEEF_SAHEED_AUDIT_QUALITY_2020-libre.pdf

- Al-Matari, E. M. (2020). Do characteristics of the board of directors and top executives have an effect on corporate performance among the financial sector? Evidence using stock. Corporate Governance: The International Journal of Business in Society, 20(1), 16–43. https://doi.org/10.1108/CG-11-2018-0358

- Al-Matari, E. M., Mgammal, M. H., Alruwaili, T. F., Kamardin, H., & Senan, N. A. M. (2023). Top management characteristics and performance of financial companies: The role of women in the top management. Corporate Governance and Organizational Behavior Review, 7(3), 8–18. https://doi.org/10.22495/cgobrv7i3p1

- Adekoya, A. C., Olugbodi, D. I., & Ogungbade, O. I. (2021). Audit quality and financial reporting quality of deposit money banks listed on the Nigerian Stock Exchange. Journal of Accounting Finance and Auditing Studies , 7(1), 77–98. https://doi.org/10.32602/jafas.2021.004

- Aifuwa, H. O., Embele, K., & Saidu, M. (2018). Ethical accounting practices and financial reporting quality. EPRA International Journal of Multidisciplinary Reseearch, 4(12), 31–44. https://ssrn.com/abstract=3423893

- Aifuwa, H. O., & Saidu, M. (2020). Audit committee attributes and timeliness of corporate financial reporting in Nigeria. Accounting and Finance, 88(2), 115–124. https://ssrn.com/abstract=3640107

- Aldoseri, M., Hassan, N., & Melegy, M. (2021). Audit committee timeliness and audit report lag: the role of mandatory adoption of IFRS in Saudi companies. Accounting, 7(1), 167–178. https://doi.org/10.5267/j.ac.2020.9.019

- Al-Shaer, H. (2020). Sustainability reporting quality and post-audit financial reporting timeliness: Empirical evidence from the UK. Business Strategy and the Environment, 29(6), 2355–2373. https://doi.org/10.1002/bse.2507

- Alsmady, A. A. (2018). The effect of board of directors’ characteristics and ownership type on the timeliness of financial reports. International Journal of Business and Management, 13(6), 276–287. https://doi.org/10.5539/ijbm.v13n6p276

- Azubike, J. U., & Onukwube, O. P. (2019). Effect of government revenue on the economic growth of Nigeria. International Journal of Social Sciences and Management Research, 5(1), 2545-5303. chromeextension://oemmndcbldboiebfnladdacbdfmadadm/https://iiardjournals.org/get/IJSSMR/VOL.%205%20NO.%201%202019/Effect%20of%20Government.pdf

- Baatwah, S. R. (2016). Audit tenure and financial reporting in Oman: Does rotation affect timeliness. Risk Governance and Control: Financial Markets and Institutions, 6(3), 16–27. https://doi.org/10.22495/rcgv6i3c1art2

- Baatwah, S. R., Ahmad, N., & Salleh, Z. (2018). Audit committee financial expertise and financial reporting timeliness in emerging market: Does audit committee Chair matter? Issues in Social and Environmental Accounting, 10(4), 63–85. https://doi.org/10.22164/isea.v10i4.164

- Bala, H. (2019). Audit committee characteristics and financial reporting quality in Nigeria: The mediatiting effect of audit quality. [Doctoral Dissertation]. (University Utara Malaysia). University Utara Malaysia Theses and Dissertation Archive. etd.uum.edu.my/7874/2/s901487_01.pdf

- Bala, H., Amran, N. A., & Shaari, H. (2020). Audit committee attributes and cosmetic accounting in Nigeria: The moderating effect of audit price. Managerial Auditing Journal, 35(2), 177–206. https://doi.org/10.1108/MAJ-06-2018-1897

- Baron, R. M., & Kenny, D. A. (1986). The moderator-mediator variable distinction in social psychological research: Conceptual, strategic, and statistical considerations. Journal of Personality and Social Psychology, 51(6), 1173–1182. https://doi.org/10.1037/0022-3514.51.6.1173

- Basu, S. (1995). Conservatism and the asymmetric timeliness of earnings. University of Rochester. https://www.proquest.com/docview/304234552?pqorigsite=gscholar&fromopenview=true&sourcetype=Dissertations%20&%20Theses

- Beaver, W. H. (1968). The information content of annual earnings announcements Author (s): William H. Beaver Source : journal of accounting research, Vol. 6, empirical research in accounting : selected published by : Wiley on behalf of Accounting Research Center, Booth. Journal of Accounting, 44(3), 533–545. https://doi.org/10.2307/3069368

- Berg, M. C. (2007). Continuing professional development–the IFAC position. Accounting Education, 16(4), 319–327. https://doi.org/10.1080/09639280701646430

- Borgi, H., Ghardallou, W., & AlZeer, M. (2021). The effect of CEO characteristics on financial reporting timeliness in Saudi Arabia. Accounting, 7(6), 1265–1274. https://doi.org/10.5267/j.ac.2021.4.013

- Cai, J., Liu, Y., Qian, Y., & Yu, M. (2015). Research and development investment and corporate governance. Quarterly Journal of Finance, 05(03), 1550014. https://doi.org/10.1142/S2010139215500147

- Carpenter, M. A., Geletkanycz, M. A., & Sanders, W. G. (2004). Upper echelons research revisited: Antecedents, elements, and consequences of top management team composition. Journal of Management, 30(6), 749–778. https://doi.org/10.1016/j.jm.2004.06.001

- Chijoke-Mgbame, A. M., Boateng, A., & Mgbame, C. O. (2020). Board gender diversity, audit committee and financial performance: evidence from Nigeria. Accounting Forum, 44(3), 262–286. https://doi.org/10.1080/01559982.2020.1766280

- Crossland, C., & Hambrick, D. C. (2007). How national systems differ in their constraints on corporate executives: A study of CEO effects in three countries. Strategic Management Journal, 28(8), 767–789. https://doi.org/10.1002/smj.610

- Dakata, M. N. (2017). The moderating effect of foreign ownership on audit committee characteristics and earnings management in Nigeria. chromeextension://oemmndcbldboiebfnladdacbdfmadadm/https://etd.uum.edu.my/7612/1/s96170_01.pdf

- Datta, D. K., & Rajagopalan, N. (1998). Industry structure and CEO characteristics: An empirical study of succession events. Strategic Management Journal, 19(9), 833–852. https://doi.org/10.1002/(SICI)1097-0266(199809)19:9<833::AID-SMJ971>3.0.CO;2-V

- DeLaney, M., Zimmerman, K. D., Strout, T. D., & Fix, M. L. (2013). The effect of medical students and residents on measures of efficiency and timeliness in an academic medical canter emergency department. Academic Medicine: journal of the Association of American Medical Colleges, 88(11), 1723–1731. https://doi.org/10.1097/ACM.0b013e3182a7f1f8

- Dittmar, A., & Duchin, R. (2015). Looking in the rearview mirror: The effect of managers’ professional experience on corporate financial policy. Review of Financial Studies, 29(3), hhv051. https://doi.org/10.1093/rfs/hhv051

- Evert, R. E., Payne, G. T., Moore, C. B., & McLeod, M. S. (2018). Top management team characteristics and organizational virtue orientation: An empirical examination of IPO firms. Business Ethics Quarterly, 28(4), 427–461. https://doi.org/10.1017/beq.2018.3

- Eze, P. G., & Nkak, P. (2020). Corporate governance and timeliness of audited reports of quoted companies in Nigeria. International Journal of Business and Management Invention, 9(1), 9. https://ssrn.com/abstract=3524383

- Fujianti, L. (2019). The role of legal compliance and good corporate governance on reducing audit delay on publicly listed companies in Indonesia. Research in World Economy, 10(3), 359–310.5430. /rwe.v10n3p359 https://doi.org/10.5430/rwe.v10n3p359

- Gbalam, E., & Uzochukwu, A. (2020). Moderating effect of dividend policy and share prices of quoted firms in Nigeria. International Journal of Research and Scientific Innovation, 7(2), 215–220. https://ideas.repec.org/a/bjc/journl/v7y2020i2p215-220.html

- Gerpott, T. J., Thomas, S. E., & Hoffmann, A. P. (2008). Intangible asset disclosure in the telecommunications industry. Journal of Intellectual Capital, 9(1), 37–61. https://doi.org/10.1108/14691930810845795

- Givoly, D., & Palmon, D. (1982). Timeliness of annual earnings announcements: Some empirical evidence. Accounting Review, 57(3), 486–508. https://www.jstor.org/stable/246875

- Gounopoulos, D., & Pham, H. (2018). Financial expert CEOs and earnings management around initial public offerings. The International Journal of Accounting, 53(2), 102–117. https://doi.org/10.1016/j.intacc.2018.04.002

- Habib, A., Bhuiyan, M. B. U., Huang, H. J., & Miah, M. S. (2019). Determinants of audit report lag: A meta-analysis. International Journal of Auditing, 23(1), 20–44. https://doi.org/10.1111/ijau.12136

- Hair, J. F., Sarstedt, M., Pieper, T. M., & Ringle, C. M. (2012). The use of partial least squares structural equation modeling in strategic management research: A review of past practices and recommendations for future applications. Long Range Planning, 45(5–6), 320–340. https://doi.org/10.1016/j.lrp.2012.09.008

- Hambrick, D. C. (2007). Upper echelons theory: An update. Academy of Management Review, 32(2), 334–343. https://doi.org/10.5465/amr.2007.24345254

- Hambrick, D. C., & Mason, P. A. (1984). Upper echelons: The organization as a reflection of its top managers. The Academy of Management Review, 9(2), 193–206. https://doi.org/10.5465/amr.1984.4277628

- Hertwig, M. (2012). Institutional effects in the adoption of e-business-technology. Information and Organization, 22(4), 252–272. https://doi.org/10.1016/j.infoandorg.2012.06.002

- Hunt, E. J. (2018). The influence of nonpublic audit concentration on public client audit outcomes. University of Arkansas. University of Arkansas ProQuest Dissertations Publishing. https://www.proquest.com/docview/2092109894?pq

- IASB, F. (2008). EXPOSURE DRAFT: Conceptual Framework for Financial Reporting: The Objective of Financial Re-porting and Qualitative Characteristics and Constraints of Decision Useful Financial Reporting Information. https://www.ifrs.org/content/dam/ifrs/project/conceptual-framework-2010/conceptual-framework-exposure-draft.pdf

- Ismail, I., Shafie, R., & Ismail, K. N. I. K. (2020). current trends and future directions on Women CEOs/CFOs and financial reporting quality. The Journal of Asian Finance, Economics and Business, 7(11), 679–687. https://doi.org/10.13106/jafeb.2020

- Itodo, S. J. (2019). [Corporate Attributes and Timeliness of Financial Reporting in Nigeria: A Study Of Selected Companies]. [Doctoral dissertation]. Department Of Management Sciences, College Of Management And Social Sciences, School Of Postgraduate Studies. https://scholar.google.com/scholar?hl=en&as_sdt=0%2C5&q=Itodo%2C+S.+J.+%282019%29.+&btnG=

- Khlif, H., & Samaha, K. (2016). Audit committee activity and internal control quality in Egypt: Does external auditor’s size matter? Managerial Auditing Journal, 31(3), 269–289. https://doi.org/10.1108/MAJ-08-2014-1084

- Lapteș, R. (2020). Ethics and integrity of the professional accountant. Bulletin of the Transilvania University of Brasov. Series V: Economic Sciences, 12(61), 87–92. https://doi.org/10.31926/but.es.2019.12.61.2.11

- Ma, Z., Novoselov, K. E., Zhou, K., & Zhou, Y. (2019). Managerial academic experience, external monitoring and financial reporting quality. Journal of Business Finance & Accounting, 46(7-8), 843–878. https://doi.org/10.1111/jbfa.12398

- Masulis, R. W., Wang, C., & Xie, F. (2012). Globalizing the boardroom—The effects of foreign directors on corporate governance and firm performance. Journal of Accounting and Economics, 53(3), 527–554. https://doi.org/10.1016/j.jacceco.2011.12.003

- Michel, J. G., & Hambrick, D. C. (1992). Diversification posture and top management team characteristics. Academy of Management Journal, 35(1), 9–37. https://doi.org/10.2307/256471

- Mohammed, H. S. (2021). Moderating effect of audit timeliness on the relationship between board characteristics and audit report lag of listed non-financial companies in Nigeria. Research Journal of Finance and Accounting, 12(8), 2222–2847. https://doi.org/10.7176/RJFA/12-8-06

- Na, K., & Hong, J. (2017). CEO gender and earnings management. Journal of Applied Business Research, 33(2), 297–308. https://doi.org/10.19030/jabr.v33i2.9902

- Nation Media Group. (2021). June 10. Annual Report and Financial Statements-2022. The Nation.https://www.nationmedia.com/financial_report/2021-annual-report-and-financial-statements/

- Nelson, J., Gallery, G., & Percy, M. (2010). Role of corporate governance in mitigating the selective disclosure of executive stock option information. Accounting & Finance, 50(3), 685–717. https://doi.org/10.1111/j.1467-629X.2009.00339.x

- Nigerian Public Service Rules. (2008). Public Service Rules (2008th ed.) https://elibrary.fmard.gov.ng/handle/123456789/475

- Nigerian Stock Exchange. (2017). Annual Report and Accounts. http://www.nse.com.ng/about ussite/Annual%20Reports/The%20Nigerian%20Stock%20Exchange%202013% 20Annual %20Repo rt.pdf

- Omer, T. C., Shelley, M. K., & Tice, F. M. (2020). Do director networks matter for financial reporting quality? Evidence from audit committee connectedness and restatements. Management Science, 66(8), 3361–3388. https://doi.org/10.1287/mnsc.2019.3331

- Oradi, J., Asiaei, K., & Rezaee, Z. (2020). CEO financial background and internal control weaknesses. Corporate Governance: An International Review, 28(2), 119–140. https://doi.org/10.1111/corg.12305

- Oraka, A. O., Okoye, J. A., & Ezejiofor, R. A. (2019). Determinants of financial reporting timeliness: an empirical study of Nigerian deposit money banks. 5(9), 18–35. chromeextension://oemmndcbldboiebfnladdacbdfmadadm/https://www.ijaar.org/articles/Volume5-Number9/Social-Management-Sciences/ijaar-sms-v5n9-sep19-p25.pdf

- Orazalin, N. (2020). Board gender diversity, corporate governance, and earnings management: Evidence from an emerging market. Gender in Management: An International Journal, 35(1), 37–60. https://doi.org/10.1108/GM-03-2018-0027

- Ott, R. L., & Longnecker, M. (2010). An introduction to statistical methods and data analysis: Brooks. Cole, Cengage Learning, 1273.https://scholar.google.com/scholar?hl=en&as_sdt=0%2C5&q=ott+and+longnecker+statistical+methods&oq=Ott+and+Longnecker+

- Owusu-Ansah, S., & Leventis, S. (2006). Timeliness of corporate annual financial reporting in Greece. European Accounting Review, 15(2), 273–287. https://doi.org/10.1080/09638180500252078

- Ozili, P. K. (2020). Corporate governance research in Nigeria: A review. SN Business & Economics, 1(1), 17. https://doi.org/10.1007/s43546-020-00015-8

- Plöckinger, M., Aschauer, E., Hiebl, M. R. W., & Rohatschek, R. (2016). The influence of individual executives on corporate financial reporting: A review and outlook from the perspective of upper echelons theory. Journal of Accounting Literature, 37(1), 55–75. https://doi.org/10.1016/j.acclit.2016.09.002

- Percy, M. (2000). Financial reporting discretion and voluntary disclosure: Corporate research and development expenditure in Australia. Asia-Pacific Journal of Accounting & Economics, 7(1), 1–31. https://doi.org/10.1080/16081625.2000.10510572

- Polovina, N., & Peasnell, K. (2015). The effect of foreign management and board membership on the performance of foreign acquired Turkish banks. International Journal of Managerial Finance, 11(3), 359–387. https://doi.org/10.1108/IJMF-06-2014-0086

- Pradipta, A., & Zalukhu, A. G. (2020). Audit report lag: Specialized auditor and corporate Governance. GATR Global Journal of Business Social Sciences Review, 8(1), 41–48. https://doi.org/10.35609/gjbssr.2020.8.1(5)

- Qi, B., Lin, J. W., Tian, G., & Lewis, H. C. X. (2018). The impact of top management team characteristics on the choice of earnings management strategies: Evidence from China. Accounting Horizons, 32(1), 143–164. https://doi.org/10.2308/acch-51938

- Quarato, F., Cambrea, D. R., Lussana, G., & Varacca Capello, P. (2017). Top management team diversity and firm performance: Empirical evidence from the fashion and luxury industry. Corporate Ownership and Control, 15(1–2), 325–340. p2 https://doi.org/10.22495/cocv15i1c2

- Ramalan, J., Kurfi, A. K., Bello, A. M., & Saifullahi, A. M. (2021). Firm-specific characteristics and voluntary disclosure of listed manufacturing firms in Nigeria. International Journal of Research and Innovation in Social Science, 5(07), 101–108. https://scholar.google.com/scholar?hl=en&as_sdt=0%2C5&q=Wawure+2018&btnG=

- Rashid, M. M. (2020). Presence of professional accountant in the top management team and financial reporting timeliness: Evidence from Bangladesh. Journal of Accounting & Organizational Change, 16(2), 237–257. https://doi.org/10.1108/JAOC-12-2018-0135

- Raweh, N. A. M., Abdullah, A. A. H., Kamardin, H., & Malek, M. (2021). Industry expertise on audit committee and audit report timeliness. Cogent Business & Management, 8(1), 1920113. https://doi.org/10.1080/23311975.2021.1920113

- Salleh, Z., Baatwah, S. R., & Ahmad, N. (2017). Audit committee financial expertise and audit report lag: Malaysia further insight. Asian Journal of Accounting and Governance, 8, 137–150. https://doi.org/10.17576/AJAG-2017-08-12

- Sani, A. A., Abdul Latif, R., & Al-Dhamari, R. A. (2020). CEO discretion, political connection and real earnings management in Nigeria. Management Research Review, 43(8) 909–929. https://doi.org/10.1108/MRR-12-2018-0460

- Sani, A. B., & Musa, U. M. (2016). Effect of Board Characteristics and Audit Committee Mechanisms on Value Relevance Of Accounting Information: Evidence From Listed Industrial Goods Firms In Nigeria. Ae-Funai Journal of Accounting, Business and Finance (FJABAF), 4(1), 2635-392. chromeextension://oemmndcbldboiebfnladdacbdfmadadm/https://www.fujabf.org/wpcontent/uploads/2019/08/Effect-of-Board-Characteristics-andAuditCommittee Mechanisms-on-Value-Relevance-of-Accounting-Information-Evidence-from-Listed-Industrial-Goods-Firms-in-Nigeria.pdf

- Shamil, M., M. Shaikh, J., Ho, P.-L., & Krishnan, A. (2014). The influence of board characteristics on sustainability reporting. Asian Review of Accounting, 22(2), 78–97. https://doi.org/10.1108/ARA-09-2013-0060

- Shen, H., Lan, F., Xiong, H., Lv, J., & Jian, J. (2020). Does top management Team’s academic experience promote corporate innovation? Evidence from China. Economic Modelling, 89, 464–475. https://doi.org/10.1016/j.econmod.2019.11.007

- Suman, S., & Singh, S. (2021). Corporate governance mechanisms and corporate investments: evidence from India. International Journal of Productivity and Performance Management, 70(3), 635–656. https://doi.org/10.1108/IJPPM-09-2019-0453

- Tabachnick, B. G., Fidell, L. S., & Ullman, J. B. (2007). Using Multivariate Statistics. (Vol. 5). https://scholar.google.com/scholar?hl=en&as_sdt=0%2C5&q=Fidell+%282007%29%2C+multivariate&oq=

- Tabachnick, B. G., & Fidell, L. S. (2007). Experimental designs using ANOVA (Vol. 724). Thomson/Brooks/Cole. https://www.researchgate.net/profile/BarbaraTabachnick/publication/259465542_Experimental_Designs_Using_ANOVA/links/5e6bb05f92851c6ba70085db/Experimental-Designs-Using-ANOVA.pdf

- Tanikawa, T., Kim, S., & Jung, Y. (2017). Top management team diversity and firm performance: exploring a function of age. Team Performance Management: An International Journal, 23(3/4), 156–170. https://doi.org/10.1108/TPM-06-2016-0027

- Ullah, I., Fang, H., & Jebran, K. (2019). Do gender diversity and CEO gender enhance firm’s value? Evidence from an emerging economy. Corporate Governance: The International Journal of Business in Society, 20(1), 44–66. https://doi.org/10.1108/CG-03-2019-0085

- Uyioghosa, O., & Amede, F. O. (2019). CEO attributes and timeliness of financial reporting. Accounting and Taxation Review, 3(3), 12–23. http://hdl.handle.net/11159/4434.

- Wahdan, D. M. A., Azzam, D. M. E. A., & El Demiry, A. N. (2023). The impact of audit committee independence and size on the audit report delay: An applied study. Journal Management System, 15(2), 1–32. https://doi.org/10.21608/masf.2023.299808

- Zandi, G., & Abdullah, N. A. (2019). Financial statements timeliness: The case of Malaysian listed industrial product companies. Asian Academy of Management Journal, 24(2), 127–141. https://ssrn.com/abstract=3573952

- Zhang, S., Yao, L., Sun, A., & Tay, Y. (2019). Deep learning-based recommender system: A survey and new perspectives. ACM Computing Surveys (CSUR), 52(1), 1–38.

- Zheng, W., Shen, R., Zhong, W., & Lu, J. (2020). CEO values, firm long-term orientation, a firm innovation: Evidence from Chinese manufacturing firms. Management and Organization Review, 16(1), 69–106. https://doi.org/10.1017/mor.2019.43