Abstract

In the context developing country, the relationship between legal certainty and investment decision is still an underexplored yet important context. This study investigates the effect of independent judicial system, legal culture, and the existence of government authority as the determinant factors that influence legal certainty and the influence of legal certainty on investment decisions in the context of companies listed on the Indonesian stock exchange. The research employs partial least squares structural equation modeling to analyze primary survey data gathered from 270 investors who are clients of Investment Management Companies in Indonesia. The results indicate that an independent judicial system, legal culture, and the existence of government authority significant and positively affecting legal certainty and legal certainty has a significant and positive effect on investment decisions. This findings have various intriguing implications and provide valuable insights into how policymakers can improve their municipal bond regulation strategy to have better legal certainty; which will encourage more investors to invest.

1. Introduction

The concept of legal certainty stands as a foundational pillar in the architecture of financial markets, serving to fortify confidence among both domestic and international investors while simultaneously enhancing transparency and predictability in investment environments. This principle, as underscored by Daniswara and Purwanto (Citation2022), is crucial in fostering an ecosystem where investors can make informed decisions, underpinned by a robust understanding of legal frameworks and regulatory landscapes. The significance of legal certainty extends beyond mere regulatory compliance; it is instrumental in shaping an investment climate that is conducive to long-term planning and strategic investment, particularly in the realm of municipal bonds (Irtyshcheva et al., Citation2020).

Municipal bonds, as key financial instruments issued by local governments, are indispensable in mobilizing resources for public sector investments and regional infrastructure development (Sharma, Citation2023). These instruments are not only pivotal in bridging funding gaps for critical infrastructure projects but also play a critical role in advancing community welfare and economic development at the local level (Arnaud, Citation2023). According to the Organisation for Economic Co-operation and Development (OECD, Citation2015), investments facilitated through municipal bonds significantly contribute to the development of essential infrastructure, including but not limited to toll roads, bridges, tunnels, public schools, and water and sanitation systems, thereby catalyzing regional development and enhancing the quality of life for the society.

The deployment of municipal bonds in financing such diverse infrastructure projects underscores the necessity of having a clear, stable, and predictable legal framework governing these financial instruments. As Cebula (Citation2020) highlights, the positive impact of these investments on revenue generation and community welfare hinges significantly on the legal certainty surrounding municipal bond regulations. This is because investors’ willingness to commit capital to these bonds is directly influenced by their perceptions of risk and the assurance of returns, which in turn are shaped by the legal and regulatory frameworks in place (Schou-Zibell & Madhur, Citation2010). Thus, ensuring legal certainty in the context of municipal bonds is not merely a regulatory concern but a critical enabler for maintaining the stability and attractiveness of the investment climate, encouraging the flow of capital into vital public sector projects, and ultimately, fostering sustainable economic growth and development (Rohmat, Citation2022).

Indonesia as a country with the fourth largest population in the world, namely 276 million people, an economy of USD 1 trillion, a growing middle class, abundant natural resources and a stable economy are things that are attractive to domestic and foreign investors; however, investing in Indonesia is still a challenge according to business contacts (Central Bereau Statistics of Indonesia, Citation2021). In developing countries like Indonesia, the effect legal certainty and investment decisions holds particular significance due to the unique challenges and opportunities present in these environments. Legal certainty, defined as the degree of predictability and stability within the legal framework governing property rights, contracts, and regulations (Pistor, Citation2020; Tapia-Hoffmann & Tapia-Hoffmann, Citation2021), plays a crucial role in shaping investment decisions by both domestic and foreign investors (Parlindungan et al., Citation2023; Yu, Citation2023).

Firstly, developing countries often face higher levels of political and economic volatility compared to their developed counterparts. In such contexts, legal certainty serves as a beacon of stability, providing investors with the confidence that their rights will be protected and their investments will be safeguarded against arbitrary government actions or regulatory changes (Krever, Citation2011; Rodrik, Citation1991). From the agency theory perspective, the government, acting as an agent, is tasked with safeguarding the interests of bondholders who invest their funds in government bonds. Conversely, bondholders, serving as principals, anticipate receiving the agreed-upon interest payments and repayment of principal at bond maturity. This dynamic involves an information disparity wherein the government possesses greater access to financial data and expenditure plans compared to bondholders (Simonsen & Hill, Citation1998). Consequently, bondholders may face moral hazard, wherein the government is incentivized to undertake risky or irresponsible actions. However, the presence of robust legal frameworks plays a pivotal role in addressing this imbalance. Enhanced legal certainty renders bond contracts more enforceable, thereby diminishing the likelihood of default and bolstering investor trust. Such contracts typically outline the government’s obligations concerning interest payments, principal repayment, as well as requirements for budget transparency and fiscal responsibility (Simonsen & Hill, Citation1998).

Secondly, legal certainty directly impacts the cost of doing business in developing countries. A clear and well-defined legal framework reduces transaction costs associated with contract enforcement, dispute resolution, and regulatory compliance (Musole, Citation2009; Pongsiri, Citation2002). This, in turn, encourages investment by lowering the perceived risks and uncertainties inherent in business operations. Conversely, a lack of legal certainty can deter investors, as they may perceive the higher operational and legal risks as prohibitive barriers to entry (Schou-Zibell & Madhur, Citation2010). Moreover, legal certainty enhances investor protection and corporate governance standards, which are critical for attracting foreign direct investment (Moran et al., Citation2005) and fostering long-term sustainable growth (Hermes & Lensink, Citation2003). Foreign investors often prioritize jurisdictions with robust legal frameworks that offer strong investor protections, transparent regulatory regimes, and effective dispute resolution mechanisms (Chen, Citation2015). By strengthening legal certainty, developing countries can improve their competitiveness in the global marketplace and attract the investment needed to upgrade infrastructure, create jobs, and spur innovation (Dutz & Sharma, Citation2012).

In this regard, Indonesia’s ambition to strengthen infrastructure development through regional bonds has unfortunately regressed and become entangled in a web of legal issues. At the core of this problem is the conflict between two seemingly balanced but ultimately contradictory laws: the Law on Financial Relations between the Central Government and Regional Governments (UU HKPD) and the Regional Government Law. On one hand, Article 157 Paragraph (1) of UU HKPD acts as a strong gatekeeper, carefully outlining the intricacies of the steps in issuing regional bonds. Every detail, from authorization procedures to budget allocations, must closely follow its instructions. However, entering Article 300 Paragraph (2) of the Regional Government Law, another key holder with slightly different sets of keys emerges. This law also claims to regulate the process of issuing regional bonds, albeit with different provisions.

Some previous research discuss about legal certainty in the regulation of municipal bonds in various countries around the world is influenced by various factors, including an independent judicial system, legal culture, and government authority (Carrillo et al., Citation2021; Gao & Li, Citation2021; Guillaume, Citation2011; Olsen & Gøtze, Citation2011; Oomen et al., Citation2021). Firstly, an independent judicial system is crucial for impartial decision-making, free from external pressures or political interference. This independence safeguards the judicial process, ensuring cases are adjudicated based on law and evidence and strengthening legal certainty (Guillaume, Citation2011). Additionally, in Spain, Carrillo et al. (Citation2021) found that the consistency and clarity of laws serve as cornerstones, fostering public trust, minimizing disputes, and supporting economic and social stability. Meanwhile, Oomen et al. (Citation2021) state that government authority in the Netherlands, Turkey, Greece, and Italy plays a fundamental role in shaping legal certainty in the municipal bond market. A strong and effective government is crucial for upholding the rule of law and ensuring legal certainty in the municipal bond market (Davey, Citation1989).

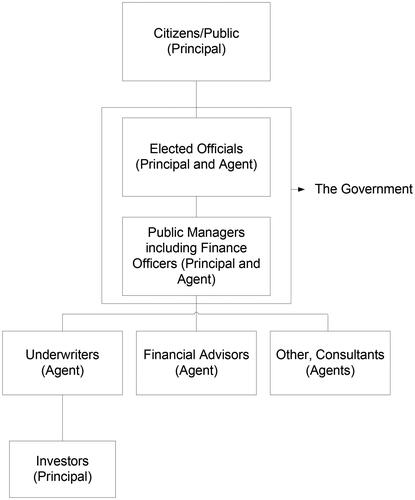

In the context of this research, the focus on investment in municipal bonds over stocks was driven by several key considerations specific to the objectives and scope of the study. Municipal bonds offer unique benefits, such as tax advantages and a relatively lower risk profile compared to stocks (Richelson & Richelson, Citation2011), making them an appealing subject for analysis within the realm of public finance and investment strategies. Given the research aim to explore aspects such as the impact of fiscal policies on local government financing, or the risk-return profile of municipal bonds, it was deemed more relevant to concentrate on bonds. Therefore, this research attempts to combine the independent judicial system, legal culture, and the existence of government authority as the determinant factors that influence legal certainty of municipal bonds regulation from several previous literatures, then connect the influence of legal certainty on investment decisions in the context of companies listed on the Indonesian stock exchange. In the domain of unexplored determinant factors influencing legal certainty and its consequential impact on investment decisions, we aim to shed light on a current research inquiry that has yet to be fully examined:

Do the independent judicial system, legal culture, and the existence of government authority has an effect on legal certainty?

Do legal certainty determine and interplay in explaining investment decisions?

2. Theoretical framework and hypotheses

2.1. The perspective of municipal bonds issuance in agency theory

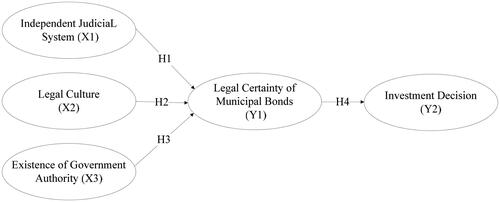

The explanation regarding municipal bonds within the framework of agency theory was previously presented by Simonsen and Hill (Citation1998). The process of selling municipal bonds involves various participants from both the private and public sectors, who assume different roles as principals, agents, or sometimes both, depending on the situation. Simonsen and Hill (Citation1998) illustrate the principal–agent relationships in municipal bonds generally in . They state that is a simplified representation, as in reality, there may be additional layers of management, involvement of more private sector entities such as bond insurance companies or rating agencies, and complexities such as bond funds buying bonds from underwriters and selling shares to investors.

Figure 1. Principal–agent relationship in municipal bonds issuance.

Source: Simonsen and Hill (Citation1998).

From , it is evident that there are only two actors who act as principals: the community/citizens issuing the bonds and the investors purchasing them. These actors often have conflicting interests. The community generally prefers lower interest rates to minimize taxes and fees, while investors seek higher interest rates for better investment returns. Elected officials typically serve as direct agents of the community, but in many cases, public managers, usually financial officials, handle bond sales, acting as agents for the elected officials. Thus, elected officials serve as public agents as well as principals to public managers. Financial advisors (FAs) function as agents for the issuers since they are paid by them. Therefore, although public managers act as agents for elected officials (and ultimately the community), they also serve as principals to various private sector consultants typically involved in bond sales (Simonsen & Hill, Citation1998).

Simonsen and Hill (Citation1998) argue that underwriters act as agents for both the issuer and the investor. Their profit depends on the difference between the purchase price and the selling price of the bonds. Underwriters are motivated to ensure the sale occurs, but within this context, their incentive leans towards higher interest rates. This is because, with higher interest rates, if other things are considered equal, underwriters stand to gain more profit.

2.2. Independent judicial system and legal certainty

Montesquieu’s theory of the separation of powers, particularly the independence of the judiciary, is a key element in modern constitutionalism (Vasilescu, Citation2014). This principle is crucial for maintaining the rule of law, preserving democracy, and protecting substantive rights (Akhtar, Citation2023). However, the practical application of this theory can be challenging, as seen in the Nigerian political system, where the judiciary often becomes the final arbiter in power struggles between the executive and legislative branches (Abdulrasheed, Citation2021). Despite these challenges, Montesquieu’s theory remains relevant in contemporary discussions on the balance of powers and the role of the judiciary in maintaining a just and stable society.

Furthermore, Zhao and Zhang (Citation2022) point out that an independent judicial is a crucial foundation in the legal system. This independence ensures a government that is fair and impartial, which in turn builds trust among investors and companies, thereby stimulating economic growth. Ippoliti et al. (Citation2015) add that the efficiency of the judiciary is vital for an effective legal system that supports economic activities and entrepreneurship. Ippoliti and Tria (Citation2020) indicate that reforms enhancing the performance of the judiciary, especially through the adoption of technology, are crucial for achieving justice.

Research consistently shows that an Independent judicial is crucial for legal certainty and public trust in the legal system (Bühlmann & Kunz, Citation2011). This independence is not only a matter of constitutional rules, but also of real-life experiences (Bühlmann & Kunz, Citation2011). Judicial independence is a key component of the rule of law, particularly in the context of market economies and democracies (Guarnieri & Piana, Citation2012). It serves as a check on the abuse of power by the state, ensuring that judges can make decisions based on the law. Therefore, the maintenance of an independent judicial is essential for legal certainty and the protection of individual rights. Consequently, we propose that:

Hypothesis 1.

Independent Judicial System exert a positive effect on Legal Certainty.

2.3. Legal culture and legal certainty

Lon L. Fuller’s “The Morality of Law” is a seminal work that emphasizes the importance of certain principles in the creation and application of laws. These principles, including generality, non-retroactivity, and clarity, are seen as essential for the functioning of a just legal system (Fuller, Citation1963). Rundle (Citation2016) further explores Fuller’s concept of the “internal morality of law,” which he argues is both internal to the legal system and has moral significance. Murphy (Citation2005) defends Fuller’s view that the rule of law has both instrumental and non-instrumental moral value, while Schauer (Citation2020) acknowledges Fuller’s significant contribution to the idea of the rule of law, despite some criticisms of his work. Bartholomew (Citation1964) provides a comprehensive overview of Fuller’s key principles and their philosophical underpinnings.

Legal culture, as a crucial aspect of human society, plays a significant role in shaping legal certainty. Berman (Citation2009) and Williams (Citation1990) both emphasize the inextricable link between law and culture, with the latter highlighting the role of culture in shaping certainty. Ibragimov and Makhmudova (Citation2020) and Batyrbaev et al. (Citation2021) further underscore the importance of legal culture in upholding the rule of law and the legitimacy of the social and legal order. These perspectives collectively suggest that legal culture, through its influence on legal consciousness and the values of society, is a key determinant of legal certainty. Consequently, we propose that:

Hypothesis 2.

Legal Culture exert a positive effect on Legal Certainty.

2.4. The existence of government authority and legal certainty

The existence of government authority and legal certainty is a crucial aspect of governance, particularly in the context of local government (Ostapenko, Citation2021). The need for institutions to control the broad authority of administration officials is emphasized, with the state administrative court playing a key role in this regard (Ruslin in Soehartono et al., Citation2021). Research consistently shows that the existence of government authority positively affects legal certainty. Lai et al. (Citation2010) found that public confidence in legal authorities is higher in China, where the government has a strong presence, compared to Taiwan. This is further supported by Ostapenko (Citation2021), who emphasizes the importance of legal certainty in local government, particularly in protecting citizens from unpredictable and unequal treatment. Corley and Wedeking (Citation2014) adds that the expression of certainty in legal language can enhance the persuasiveness of a message, suggesting that a strong government can effectively communicate legal certainty. Consequently, we propose our third hypothesis:

Hypothesis 3.

The Existence of Government Authority exert a positive effect on Legal Certainty.

2.5. Legal certainty and investment decision

In the context of the relationship between legal certainty and investment decision; the agency theory can be a foundation on this relationship. In the agency theory perspective as mentioned by Simonsen and Hill (Citation1998), the government, as an agent, has the responsibility to represent the interests of bondholders who entrust their funds to the government through bond purchases. On the other hand, bondholders are principals who expect to receive the promised interest payments and repayment of principal upon bond maturity. In this relationship, there is an information imbalance where the government has better access to information regarding its financial condition and expenditure plans than bondholders (Simonsen & Hill, Citation1998). This can expose bondholders to moral hazard, where the government may have incentives to engage in riskier or irresponsible actions. However, legal certainty plays a crucial role in remedying this dynamic. With high legal certainty, bond contracts become more enforceable, reducing the risk of default and increasing investor confidence (Lu et al., Citation2019).

Research consistently shows that legal certainty positively affects investment decisions. Lopez et al. (Citation2017) found that regulation-induced uncertainty, a type of legal uncertainty, is positively related to a firm’s decision to invest in measures to reduce environmental impact. Alao and Alao (Citation2012) further emphasized the importance of regulatory bodies in minimizing policy uncertainty, which can lead to risk and instability in the investment climate. Cukierman (Citation1980) also highlighted the impact of uncertainty on investment decisions, with both demand and price uncertainty influencing firms’ investment plans. These studies collectively underscore the crucial role of legal certainty in promoting investment. Thus, we propose that:

Hypothesis 4.

Legal Certainty exert a positive effect on Investment Decision.

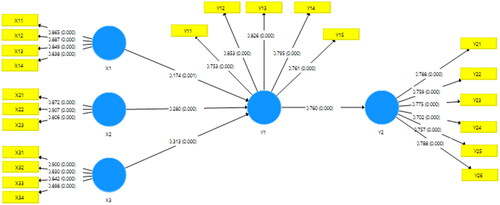

The conceptual model depicted in is constructed based on the proposed hypotheses.

3. Research methodology

3.1. Population and procedure

The data was collected from individuals holding shares or investing in companies listed on the Indonesia Stock Exchange. However, specifically, the targeted individuals to respond were investors acting as clients of Investment Management Companies and having knowledge about bonds investment. Until now, there are 94 Investment Management Companies in Indonesia. From each Investment Management Company, we target 2–3 of their clients who will be research respondents, so if calculated, the maximum target respondents in this study are 282 individuals/clients.

We employed a cross-sectional methodology utilizing a self-reported survey technique with a diverse pool of respondents to optimize data effectiveness. Initially, a roster of investors across the nine chosen sectors was gathered randomly, and their information was acquired from Investment Management Companies. Secondly, researchers then contacted each individual via email acquired and inquired about their willingness to fill out the questionnaire prepared by us. Each respondent was provided with a sealed package containing the survey questionnaire and a cover letter explaining the main purpose of the research and ensuring their anonymity. It is important to note that the original questionnaire was crafted in Bahasa Indonesia, with English included as an alternative, following the suggestion of Brislin (Citation1986). This was done to guarantee the clarity of the measurement tool’s content. Data collection was conducted twice, with the first collection taking place in November 2023 and the second collection taking place in February until first week of March 2024. The first collection gathered a total of 91 completed questionnaires from investors in Indonesia. Out of this number, only 80 (87.91%) questionnaires were fully completed. The second collection gathered a total of 196 questionnaires, with 179 questionnaires (91.3%) being fully completed.

To address the potential influence of Common Method Bias (CMB) on our findings, we conducted an examination of the data using variance inflation factor (VIF) as proposed by Kock (Citation2017) and Harman’s single factor test as proposed by Podsakoff and Organ (Citation1986). Initially, we employed the VIF test to assess multicollinearity among the constructs obtained through the cross-sectional design. Subsequently, we utilized Harman’s single factor test through SPSS software without rotation. This analysis revealed five components with eigenvalues exceeding one, collectively explaining 74.77% of the variance. Notably, the primary factor accounted for 38.52% of the variance, which fell below the 50% threshold. An indication of potential CMB is suggested if the VIF value surpasses 5 (Hair Jr et al., Citation2021). However, all construct VIF values were below this threshold, ranging from a maximum of 4.726 for X12 to a minimum of 1.539 for X23.

3.2. Measurements of research variables

The survey instruments employed in this study were derived from previously published journal articles and were subsequently compiled in for potential future reference. Reflective measures were employed to develop the principal constructs utilized in this investigation. Existing literature strongly recommends the utilization of the designated multi-item scales for construct formation, with assessment conducted on a 5-point Likert scale ranging from “Strongly Disagree” (1) to “Strongly Agree” (5). All scales exhibited satisfactory levels of reliability (α > 0.70) as indicated by Hair et al. (Citation2019). For example, the exogenous variable “Independent Judicial System” (X1) was evaluated using a 4-item scale adapted from… Van Dijk and Vos (Citation2018), with an example item stating, “Municipal bond regulations are firmly established in laws ensuring regulatory bodies’ independence from external influence”. The Cronbach’s alpha value (α) was 0.885. A 5-item scale by Yuriy and Vyacheslav (Citation2021) was employed to measure the endogenous variable, Legal Certainty of Municipal Bonds (Y1). An example item reads, “Internal factors play a key role in shaping investor confidence and risk assessment in municipal bond markets” The scale exhibited a Cronbach’s alpha value of 0.858. The full list of the questionnaire items can be seen in Appendix and the comprehensive testing details can be found in .

Table 1. Variable metrics and measurements.

4. Analysis and results

To analyze the gathered data, we utilized structural equation modeling (SEM), a statistical methodology employed to evaluate the vion in SmartPLS analysis does not require verification (Hair Jr et al., Citation2021).

The analysis using PLS-SEM comprises two distinct steps: the structural model and the measurement model (Anderson & Gerbing, Citation1988). The PLS algorithm examines the quality of the measurement model, while the bootstrapping technique, employing 5000 subsamples, scrutinizes the structural model (Hair et al., Citation2019). Within the measurement model, we assess the factor loadings, reliability, and convergent and discriminant validity of the variables. We begin by checking the factor loadings, expecting each item to have a minimum loading of 0.5 (Hair et al., Citation2019). The observed factor loadings range from a minimum of 0.702 (Y24) to a maximum of 0.907 (X22). Hence, all individual item loadings exceed the required threshold of 0.5 (Hair et al., Citation2019).

Composite reliability (CR) was employed to assess the scale reliabilities, following the guideline by Hair et al. (Citation2019) that suggests a CR value exceeding 0.70. Our data analysis indicated CR values ranging from 0.810 (Y1) to 0.891 (Y2). Additionally, convergent validity was appraised using the average variance extracted (AVE), with the recommended threshold set at 0.50 (Hair et al., Citation2019). All five constructs exhibited AVE values surpassing 0.5, thereby meeting the stipulated criterion. Given the positive results obtained regarding reliability and convergent validity, we advanced to assess discriminant validity utilizing the heterotrait–monotrait ratio (HTMT) (Henseler et al., Citation2015). An HTMT value below .90 is advised to ensure adequate discriminant validity (Henseler et al., Citation2015). Notably, all HTMT correlations in were below 0.90, indicating sound discriminant validity in our measurement model. The comprehensive findings of the measurement model are presented in .

Table 2. Convergent and discriminant validities.

In the structural model illustrated in , we analyze the hypotheses of our study by examining the connections between the constructs delineated in our suggested model. To determine the acceptance of each hypothesis, we applied a criterion: either a standard t-value exceeding 1.96 or a p-value below 0.05. We formulated four direct hypotheses, and the results obtained from the bootstrapping technique with 5000 resamples indicate that 4 hypotheses are accepted. Specifically, Independent judicial System (X1), Legal Culture (X2), and Existence of Government Authority (X3) is positively linked to Legal Certainty of Municipal Bonds (Y1) (t-value = 3.300 and β = 0.174; t-value = 3.840 and β = 0.280; t-value = 4.493 and β = 0.313). Legal Certainty of Municipal Bonds (Y1) also positively linked to Investment Decision (Y2) (t-value = 40.095 and β = 0.760). Consequently, our study lends support to four direct hypotheses as outlined in .

Table 3. Hypotheses testing results.

4.1. Coefficient of determination (R2), predictive relevance (Q2) and model fit

We employed various criteria to evaluate the significance and adequacy of our model. Initially, the coefficient of determination, represented as R2, was used to assess the explanatory power of the model, indicating variations in endogenous variables attributed to exogenous variables. The R2 values for the primary dependent variables were 0.390 for Legal Certainty of Municipal Bonds (Y1) and 0.577 for Investment Decision (Y2). Additionally, we investigated predictive relevance using the blindfolding procedure in SmartPLS to derive Q2 values (Geisser, Citation1974). According to Cohen et al. (Citation2000), Q2 values of 0.02 (minor), 0.15 (medium), and 0.35 (large) indicate predictive relevance, and they should always exceed 0 (Chin, Citation1998). Our results show that the Q2 value is 0.742, falling within the range of large predictive relevance (Cohen et al., Citation2000). Finally, we evaluated the model fit using the ‘Standard Root Mean Square Residual’ (SRMR), defined as ‘the root mean square discrepancy between the observed correlations and the model-implied correlations’ (Hu & Bentler, Citation1998). Hu and Bentler suggested that a model is considered a good fit if the SRMR score is less than .08. In our study model, the SRMR value was 0.012, meeting the criteria for a good fit.

5. Discussion and implications

In recent years, some research has focused on the legal certainty of investment decisions, with a particular emphasis on the need to understand the processes underlying these decisions (Mao & Helliwell, Citation1969; Slovic et al., Citation1972). This has led to a surge in scholarship in the field of international investment law, which is increasingly seen as a transnational legal order (Krajewski & Hoffmann, Citation2019). These studies have highlighted the importance of considering both national and international legal aspects in order to improve the legal certainty of investment decisions. As far as we know, this study represents one of the initial attempts to investigate the connection between legal certainty, emphasizing an independent judicial system, legal culture, and the presence of government authority, as a novel approach to bolster investment decision-making. According to Central Bereau Statistics of Indonesia report in 2021, the labor market in Indonesia is substantial, with 120.5 million individuals (115.2 million employed and 5.3 million unemployed) and the industry-wise distribution in the job market: agriculture/forestry/fishing (28.6%), community/social and personal services (20.3%), manufacturing (18.7%), wholesale and retail trade (15.1%), construction (9.9%), transport storage and communication (6.5%), and other categories (1.9%).

This study adds to the existing body of literature on investment law by investigating how legal certainty impacts investment decisions in Indonesian Stock Exchange. First, the results indicate that legal certainty is positively related to investment decisions. Legal certainty is a crucial factor for investors in decision-making (Krzykowski et al., Citation2021; Perry-Kessaris, Citation2008; Zegarlicki, Citation2018), providing stability and predictability, particularly in long-term investments such as the energy sector (Krzykowski et al., Citation2021). Principles of legitimate and reasonable expectations in international law can protect investors in the face of unexpected legal changes (Krzykowski et al., Citation2021). Legal certainty is also a fundamental pillar of the rule of law, safeguarding individuals from arbitrary state power (Zegarlicki, Citation2018). However, the disparity between investment theory and practice suggests that sophisticated techniques are not always fully implemented (Mao & Helliwell, Citation1969).

The findings of this research are consistent with several previous studies. Lopez et al. (Citation2017) discovered that uncertainty caused by regulations, a type of legal uncertainty, is positively related to corporate investment decisions. This is supported by Bloom et al. (Citation2007) demonstrating that higher uncertainty, including legal uncertainty, reduces the impact of demand shocks on investment. Both Cukierman (Citation1980) and Guiso and Parigi (Citation1999) found that increased uncertainty, including legal uncertainty, leads to delayed investment decisions and a decline in current investment levels. Therefore, legal certainty is a crucial factor in promoting investment.

Second, we investigated the effect of independent judicial system, legal culture, and the existence of government authority on legal certainty. The importance of an Independent judicial in ensuring legal certainty is underscored by several studies. Bühlmann and Kunz (Citation2011) emphasizes that judicial independence, particularly in terms of fairness and impartiality, is crucial for fostering public trust in the justice system. This is further supported by Islam (Citation2018), who highlights the role of an Independent judicial in guaranteeing individual rights and liberties, and in upholding the rule of law. However, Usman et al. (Citation2022) cautions that the exercise of judicial independence is a complex issue, requiring the judiciary to maintain its autonomy and professional responsibilities. This research consistently shows that an Independent judicial system is crucial for legal certainty and public trust in the legal system (Bühlmann & Kunz, Citation2011). This independence, which includes the judiciary’s ability to make decisions without interference from other branches of government, is a key factor in ensuring the rule of law. Despite these challenges, the positive impact of an Independent judicial on legal certainty and public trust remains a significant finding in legal research.

This research also support that legal culture positively significant affecting legal certainty of municipal bonds. Legal culture, as a set of values, attitudes, and behaviors towards the law, plays a crucial role in ensuring legal certainty (Ibragimov & Makhmudova, Citation2020). That is a key element in the legal system, influencing the observance of rules, moral convictions, and legal knowledge (Solovieva, Citation2023). The development of legal culture is essential for the effectiveness of legislative activity, as it shapes the perception and implementation of laws (Aldyan, Citation2022). Cultural aspects significantly influence legal certainty, as they shape legal languages, interpretation, and translation. Piszcz and Sierocka (Citation2020) highlight the impact of cultural factors on legal language and its interpretation, with Piszcz and Sierocka (Citation2020) specifically noting the influence of judicial discourse and legal interpretation. Orts (Citation2015) further emphasizes the role of cultural and epistemological differences in shaping legal traditions and texts, particularly in Spanish and English-speaking legal cultures. He also underscores the importance of understanding the cultural embeddedness of legal texts, particularly in the context of translation and communication between different legal systems. These studies collectively underscore the need for a nuanced understanding of cultural influences in legal contexts to enhance legal certainty.

Furthermore, this study explored that the existence of government authority has an positive and significant effect on legal certainty. This results are support the insights that provided by Ruslin in Soehartono et al. (Citation2021), Lai et al. (Citation2010), and Ostapenko (Citation2021), and The need for institutions to control the broad authority of administration officials is emphasized, with the state administrative court playing a key role in this regard (Ruslin in Soehartono et al., Citation2021). Research consistently shows that the existence of government authority positively affects legal certainty. Lai et al. (Citation2010) found that public confidence in legal authorities is higher in China, where the government has a strong presence, compared to Taiwan. This is further supported by Ostapenko (Citation2021), who emphasizes the importance of legal certainty in local government, particularly in protecting citizens from unpredictable and unequal treatment.

This results also particularly evident in the context of international investment law, where government control can lead to state interference and weak corporate governance, distorting investment decision-making (Xu et al., Citation2010). Legal certainty is a key factor in recognizing legitimate expectations in international investment law, with the prohibition on arbitrary conduct serving as a justification for their protection (Henckels, Citation2023). The role of government institutions, such as checks and balances, in reducing macroeconomic and political uncertainty and improving investment possibilities is also highlighted (Stasavage, Citation2002).

5.1. Theoretical implications

Theoretical contributions necessitate a specific type of research finding capable of providing a new perspective on a phenomenon that is essential for enhancing investment decision-making. Our research offers novel insights by adopting a comprehensive approach that underscores the diverse nature of legal certainty. It introduces the influence of an independent judicial system, legal culture, and government authority on investment decisions, expanding the conventional view of legal certainty. Specifically, we contribute to the investment law literature by underscores the crucial role of an Independent judicial system and legal culture in promoting legal certainty. It highlights the importance of judicial autonomy in upholding the rule of law and recognizes cultural influences on legal languages, interpretation, and implementation, shaping investors’ confidence and decisions. This study also offers a nuanced perspective on the relationship between government authority and legal certainty, finding that government authority has an insignificant effect. It challenges simplistic views, acknowledging the complexity of factors, such as financial motivations, citizen evaluations, and historical evolution, in understanding the impact of government authority on legal certainty.

Secondly, we discovered that legal certainty affects investment decision positively. This indicates that legal certainty as a protective mechanism for investors against unexpected legal changes. This theoretical contribution emphasizes that legal certainty serves as a shield for investors, providing a sense of security and minimizing risks associated with regulatory uncertainties. This protective function aligns with broader discussions on risk management within legal frameworks, extending the discourse on the symbiotic relationship between legal systems and investor confidence. Legal certainty is not merely a legal imperative but also a key driver for attracting and retaining investments. Legal certainty can be used as an active tool for economic development, suggesting that nations and regions can strategically leverage legal frameworks to create an attractive environment for investors.

5.2. Practical implications

Nowadays, investors are keenly focused on legal certainty before make a decision to invest. The increased attention to legal certainty underscores investors’ growing awareness of the risks associated with legal uncertainties. This research provides policymakers with innovative recommendations on integrating the determining factors of legal certainty and enhancing legal certainty itself to stimulate investment decisions. For example, our study can aid policymakers in incentivizing investors to prioritize pro-legal certainty measures prior to regulatory implementation.

In the context of municipal bonds regulation, our findings reveal that legal certainty is crucial in the regulation of municipal bonds, profoundly influencing investment decisions. Municipal bonds, as debt securities issued by local governments, rely on a stable and predictable legal framework to instill confidence among investors. This certainty serves as a bulwark against the perceived risks associated with sudden regulatory changes that could impact the financial returns on investments. Investors, seeking a lower-risk environment, are more likely to participate in the municipal bond market when assured of legal protections provided by the regulatory framework. Policymakers should recognize that fostering a stable and predictable legal environment is not only a regulatory necessity but also a strategic imperative to attract and retain investors. Clear and consistent regulations can enhance investor confidence, stimulate market activity, and contribute to economic development through the financing of public projects. Considering the effect of Independent judicial system and legal culture also can help policymakers to increase the legal certainty of municipal bonds regulation.

6. Conclusion and limitations

In conlusion, this study provides critical insights into the relationship between investment decision, legal certainty, and its determinant factors. An independent judicial system, legal culture, and the existence of government authority are significant and positively affecting legal certainty, while the existence of government authority gives a significant effect. Legal certainty has a significant and positive effect on investment decisions. Hence, it is essential to interpret the findings of this study considering their limitations. Firstly, akin to many empirical surveys, only a subset of determinants for a specific variable is examined and measured in this study, potentially overlooking other factors documented in scientific literature, and alternative factors may warrant consideration. Therefore, future empirical investigations could explore additional determinants not covered in this study to offer further validation for our findings. Secondly, this research is confined to a sample of investors in Indonesia, suggesting that future researchers may contemplate expanding our conceptual framework to encompass the non-manufacturing sector and advanced economies. Lastly, we rely on perception data or primary data, which may sometimes be inadequate in providing a comprehensive depiction of the prevailing scenario. We recommend supplementing primary data with secondary data from relevant organizations to enhance the robustness of research outcomes.

Authors’ Contribution

Benny Hutahayan: Conceptualization, Methodology, Software, Writing- Original draft preparation, Writing- Reviewing and Editing, Data curation. Mohammad Fadli: Data curation, Writing- Original draft preparation, Validation, Writing- Reviewing and Editing. Satria Amiputra Amimakmur,: Visualization, Investigation, Writing- Reviewing and Editing. Reka Dewantara: Supervision, Writing- Reviewing and Editing, Validation

Ethics statement

In accordance with pertinent institutional and national regulations, this research does not entail the participation of human or animal subjects, eliminating the necessity for ethical approval. Additionally, the information utilized in this investigation lacks personally identifiable details, obviating the need for specific privacy protection measures. Lastly, the authors assert the absence of potential conflicts of interest.

Disclosure statement

No conflict interest.

Data availability statement

Data available on request from the authors.

Additional information

Notes on contributors

Benny Hutahayan

Benny Hutahayan is a doctoral student in Law in Faculty of Law, Brawijaya University and permanent lecturer in the Doctoral Program of Administrative Sciences, Brawijaya University. He has Bachelor of Law Degree from Christian University of Indonesia and Master of Legal Studies degree from Christian University of Indonesia, and completed his Doctoral Program in Administrative Sciences from Brawijaya University in 2014. Prior to becoming an academician, he had 20 years of experience working for a multinational company British Petroleum. He is is a distinguished figure in the field of law, administrative sciences, and human resource management.

Mohamad Fadli

Mohamad Fadli is a distinguished figure in the field of law, specializing in several key areas including Administrative Law, Environmental Law, Islamic Law, Legislative Drafting, and Human Rights. His career has been marked by a deep commitment to these various branches of law, demonstrating a breadth of expertise that is both rare and valuable. In the realm of Administrative Law, Fadli has contributed significantly to the understanding and application of legal principles governing the administration and operations of government agencies. His work often involves navigating the complex interplay between government actions and the legal rights of citizens, ensuring that administrative processes are conducted fairly and in accordance with the law.

Satria Amiputra Amimakmur

Satria Amiputra Amimakmur is an esteemed academic in the field of legal studies, currently serving as a faculty member in the Doctoral Program of Legal Studies. His career in academia is marked by a profound commitment to the advancement of legal knowledge and a passion for nurturing the next generation of legal professionals. Amimakmur specializes in a range of legal disciplines, reflecting a deep understanding of both the theoretical and practical aspects of the law. His academic journey, characterized by rigorous scholarship and a dedication to continuous learning, has positioned him as a respected figure in the legal community.

Reka Dewantara

Reka Dewantara is a prominent figure in the field of law, with a specific focus on Business Law, Banking Law, and Corporate Law. Her extensive knowledge and expertise in these areas have established her as a key legal scholar and practitioner. In the realm of Business Law, Dewantara has likely contributed to understanding the legal intricacies of commercial transactions and business operations. This area of her work probably involves dealing with contracts, mergers and acquisitions, intellectual property, and perhaps international trade laws, reflecting her comprehensive grasp of the legal challenges faced by businesses in a globalized economy.

References

- Abdul Kareem, A. A., Fayed, Z. T., Rady, S., Amin El-Regaily, S., & Nema, B. M. (2023). Factors influencing investment decisions in financial investment companies. Systems, 11(3), 1. https://doi.org/10.3390/systems11030146

- Abdulrasheed, A. (2021). An appraisal of Charles De Montesquieu Theory of separation of power within the prisms of power relations among structures of government in Nigeria’s Presidential System: The dilemma and critical issues. FUDMA Journal of Management Sciences, 3(2), 1–18.

- Akhtar, Z. (2023). Montesquieu’s theory of the separation of powers, legislative flexibility and judicial restraint in an unwritten constitution. Amicus Curiae, 4(3), 552–577. https://doi.org/10.14296/ac.v4i3.5616

- Alao, D. O., & Alao, E. M. (2012). Islamic banking: The controversy over non-interest banking system in Nigeria. Nigerian Chapter of Arabian Journal of Business and Management Review, 1(1), 65–78. https://doi.org/10.12816/0003610

- Aldyan, A. (2022). The influence of legal culture in society to increase the effectiveness of the law to create legal benefits. International Journal of Multicultural and Multireligious Understanding, 9(11), 322–329.

- Anderson, J. C., & Gerbing, D. W. (1988). Structural equation modeling in practice: A review and recommended two-step approach. Psychological Bulletin, 103(3), 411–423. https://doi.org/10.1037/0033-2909.103.3.411

- Arnaud, N. N. (2023). Bond market development as a source of financing infrastructure projects: A comparison of India, Russia and other countries, 2010-2020. Applied Econometrics and International Development, 23(2), 37–50.

- Bárd, P. (2021). In courts we trust, or should we? Judicial independence as the precondition for the effectiveness of EU law. European Law Journal, 27(1–3), 185–210. https://doi.org/10.1111/eulj.12425

- Bartholomew, P. C. (1964). The Morality of Law. By Lon L. Fuller.(New Haven: Yale University Press, 1964. Pp. viii, 202, $5.00.). American Political Science Review, 58(4), 984–984. https://doi.org/10.1017/S0003055400291375

- Batyrbaev, B., Aidarbekova, G., Toktombaeva, A., Salybekova, T., Ganieva, T., Gulsara, K., & Abdullaeva, Z. (2021). Legal policy and legal culture in the system for public administration and judiciary in the Kyrgyz Republic. Open Journal of Social Sciences, 09(07), 53–61. https://doi.org/10.4236/jss.2021.97005

- Berman, P. S. (2009). The enduring connections between law and culture: Reviewing Lawrence Rosen, law as culture, and Oscar chase, law, culture, and ritual. American Journal of Comparative Law, 57(101), 101–111.

- Bloom, N., Bond, S., & Van Reenen, J. (2007). Uncertainty and investment dynamics. Review of Economic Studies, 74(2), 391–415. https://doi.org/10.1111/j.1467-937X.2007.00426.x

- Brislin, R. W. (1986). The wording and translation of research instruments. In W. L. Lonner & J. W. Berry, (Eds.), Field methods in cross-cultural research (Vol. 1, pp. 137–164) . California: SAGE Publications.

- Bühlmann, M., & Kunz, R. (2011). Confidence in the judiciary: Comparing the independence and legitimacy of judicial systems. West European Politics, 34(2), 317–345. https://doi.org/10.1080/01402382.2011.546576

- Carrillo, I., Mira, J. J., Guilabert, M., Lorenzo, S., & Group, S. (2021). Why an open disclosure procedure is and is not followed after an avoidable adverse event. Journal of Patient Safety, 17(6), e529–e533. https://doi.org/10.1097/PTS.0000000000000405

- Cebula, R. J. (2020). The community reinvestment act and real municipal bond interest rate yields in the United States: Evidence from the municipal bond market. Review of Regional Research, 40(1), 3–12. https://doi.org/10.1007/s10037-019-00130-6

- Central Bereau Statistics of Indonesia. (2021). Hasil Sensus Penduduk (SP2020) pada September 2020 mencatat jumlah penduduk sebesar 270,20 juta jiwa. https://www.bps.go.id/id/pressrelease/2021/01/21/1854/hasil-sensus-penduduk–sp2020–pada-september-2020-mencatat-jumlah-penduduk-sebesar-270-20-juta-jiwa-.html. Accessed on February 19, 2024 at 11.00 WIB.

- Chen, R. C. (2015). A contractual approach to investor-state regulatory disputes. Yale Journal of International Law, 40, 295.

- Chin, W. W. (1998). Commentary: Issues and opinion on structural equation modeling. In MIS quarterly (pp. vii–xvi). JSTOR.

- Cohen, D. A., Scribner, R. A., & Farley, T. A. (2000). A structural model of health behavior: A pragmatic approach to explain and influence health behaviors at the population level. Preventive Medicine, 30(2), 146–154. https://doi.org/10.1006/pmed.1999.0609

- Corley, P. C., & Wedeking, J. (2014). The (dis) advantage of certainty: The importance of certainty in language. Law & Society Review, 48(1), 35–62. https://doi.org/10.1111/lasr.12058

- Cukierman, A. (1980). The effects of uncertainty on investment under risk neutrality with endogenous information. Journal of Political Economy, 88(3), 462–475. https://doi.org/10.1086/260880

- Daniswara, A. A. D., & Purwanto, I. W. N. (2022). Juridical status of stock exchange and investor legal protection in forced delisting. Policy, Law, Notary and Regulatory Issues (Polri), 1(4), 39–48. https://doi.org/10.55047/polri.v1i4.464

- Davey, K. (1989). Strengthening municipal government. World Bank, Infrastructure and Urban Development Department.

- Dutz, M. A., & Sharma, S. (2012). Green growth, technology and innovation. World Bank Policy Research Working Paper No. 5932.

- Fuller, L. L. (1963). The morality of law. Yale Univesity Press.

- Gao, S., & Li, Y. (2021). An empirical study on the adoption of blockchain-based games from users’ perspectives. The Electronic Library, 39(4), 596–614. https://doi.org/10.1108/EL-01-2021-0009

- Geisser, S. (1974). A predictive approach to the random effect model. Biometrika, 61(1), 101–107. https://doi.org/10.1093/biomet/61.1.101

- Guarnieri, C., & Piana, D. (2012). Judicial independence and the rule of law: Exploring the European experience. In The culture of judicial independence (pp. 111–124). Brill Nijhoff.

- Guillaume, G. (2011). The use of precedent by international judges and arbitrators. Journal of International Dispute Settlement, 2(1), 5–23. https://doi.org/10.1093/jnlids/idq025

- Guiso, L., & Parigi, G. (1999). Investment and demand uncertainty. Quarterly Journal of Economics, 114(1), 185–227.

- HairJr, J. F., Hult, G. T. M., Ringle, C. M., Sarstedt, M., Danks, N. P., & Ray, S. (2021). Partial least squares structural equation modeling (PLS-SEM) using R: A workbook. Springer Nature.

- Hair, J. F., Risher, J. J., Sarstedt, M., & Ringle, C. M. (2019). When to use and how to report the results of PLS-SEM. European Business Review, 31(1), 2–24. https://doi.org/10.1108/EBR-11-2018-0203

- Henckels, C. (2023). Justifying the protection of legitimate expectations in international investment law: legal certainty and arbitrary conduct. ICSID Review. Forthcoming.

- Henseler, J., Ringle, C. M., & Sarstedt, M. (2015). A new criterion for assessing discriminant validity in variance-based structural equation modeling. Journal of the Academy of Marketing Science, 43(1), 115–135. https://doi.org/10.1007/s11747-014-0403-8

- Hermes, N., & Lensink, R. (2003). Foreign direct investment, financial development and economic growth. Journal of Development Studies, 40(1), 142–163. https://doi.org/10.1080/00220380412331293707

- Hu, L., & Bentler, P. M. (1998). Fit indices in covariance structure modeling: Sensitivity to underparameterized model misspecification. Psychological Methods, 3(4), 424–453. https://doi.org/10.1037/1082-989X.3.4.424

- Ibragimov, S., & Makhmudova, A. (2020). Legal culture-the basis for the rule of law. Збірник Наукових Праць ΛΌГOΣ, 1, 129–132.

- Ippoliti, R., Melcarne, A., & Ramello, G. B. (2015). The impact of judicial efficiency on entrepreneurial action: A European perspective. Economic Notes, 44(1), 57–74. https://doi.org/10.1111/ecno.12030

- Ippoliti, R., & Tria, G. (2020). Efficiency of judicial systems: model definition and output estimation. Journal of Applied Economics, 23(1), 385–408. https://doi.org/10.1080/15140326.2020.1776977

- Irtyshcheva, I., Kramarenko, I., Shults, S., Boiko, Y., Blishchuk, K., Hryshyna, N., Popadynets, N., Dubynska, І., Ishchenko, O., & Krapyvina, D. (2020). Building favorable investment climate for economic development. Accounting, 6(5), 773–780. https://doi.org/10.5267/j.ac.2020.6.006

- Islam, M. S. (2018). Independent Judiciary: Nature and facets from the international context. International Journal of Ethics in Social Sciences, 6(2), 15–32.

- Kaufmann, D., & Kraay, A. (2007). Governance indicators: Where are we, where should we be going? The World Bank Research Observer, 23(1), 1–30. https://doi.org/10.1093/wbro/lkm012

- Kock, N. (2017). Common method bias: a full collinearity assessment method for PLS-SEM. In Partial Least Squares Path Modeling: Basic Concepts, Methodological Issues and Applications (pp. 245–257).

- Krajewski, M., & Hoffmann, R. T. (2019). Research handbook on foreign direct investment. Edward Elgar Publishing.

- Krever, T. (2011). The legal turn in late development theory: The rule of law and the World Bank’s Development Model. Harvard International Law Journal, 52, 287.

- Krzykowski, M., Mariański, M., & Zięty, J. (2021). Principle of reasonable and legitimate expectations in international law as a premise for investments in the energy sector. International Environmental Agreements: Politics, Law and Economics, 21(1), 75–91. https://doi.org/10.1007/s10784-020-09471-x

- Lai, Y.-L., Cao, L., & Zhao, J. S. (2010). The impact of political entity on confidence in legal authorities: A comparison between China and Taiwan. Journal of Criminal Justice, 38(5), 934–941. https://doi.org/10.1016/j.jcrimjus.2010.06.010

- Lopez, J. M. R., Sakhel, A., & Busch, T. (2017). Corporate investments and environmental regulation: The role of regulatory uncertainty, regulation-induced uncertainty, and investment history. European Management Journal, 35(1), 91–101. https://doi.org/10.1016/j.emj.2016.06.004

- Lu, J. Z., Chao, J. J., & Sheppard, J. R. (2019). Guarantees for mobilizing private investment in infrastructure. The World Bank.

- Mao, J. C. T., & Helliwell, J. F. (1969). Investment decision under uncertainty: Theory and practice. The Journal of Finance, 24(2), 323. https://doi.org/10.2307/2325297

- MCC. (2023). Political Rights Indicator. https://www.mcc.gov/who-we-select/indicator/political-rights-indicator. Accessed on July 1, 2023, at 09.00 WIB.

- Moran, T. H., Graham, E. M., & Blomström, M. (2005). Does foreign direct investment promote development? Peterson Institute.

- Murphy, C. (2005). Lon Fuller and the moral value of the rule of law. Law and Philosophy, 24(3), 239–262. https://doi.org/10.1007/s10982-004-7990-3

- Musole, M. (2009). Property rights, transaction costs and institutional change: Conceptual framework and literature review. Progress in Planning, 71(2), 43–85. https://doi.org/10.1016/j.progress.2008.09.002

- OECD. (2015). Infrastructure Financing Instruments and Incentivesc https://www.oecd.org/finance/private-pensions/Infrastructure-Financing-Instruments-and-Incentives.pdf. Accessed on February 19, 2024, at 10.03 WIB.

- OECD. (2023). Policy Development and Co-Ordination. https://par-portal.sigmaweb.org/areas/2/indicators/17/. Accessed on July 1, 2023, at 12.30 WIB.

- Olsen, H. P., & Gøtze, M. (2011). Restrained integration of European Case Reports in Danish Legal Information Systems and Culture. Nordic Journal of International Law, 80(3), 279–294. https://doi.org/10.1163/157181011X581173

- Oomen, B., Baumgärtel, M., Miellet, S., Durmus, E., & Sabchev, T. (2021). Strategies of divergence: Local authorities, law, and discretionary spaces in migration governance. Journal of Refugee Studies, 34(4), 3608–3628. https://doi.org/10.1093/jrs/feab062

- Orts, M. A. (2015). Legal English and legal Spanish: The role of culture and knowledge in the creation and interpretation of legal texts. ESP Today, 3(1), 25–43.

- Ostapenko, H. (2021). Legal certainty in the aspect of local government. Bulletin of Taras Shevchenko National University of Kyiv. Legal Studies, 119(119), 59–63. https://doi.org/10.17721/1728-2195/2021/4.119-11

- Parlindungan, Januarita, R., & Sundary, R. I. (2023). Efforts to increase investment in Riau Province in terms of legal certainty and ease of licensing. European Journal of Law and Political Science, 2(4), 19–24. https://doi.org/10.24018/ejpolitics.2023.2.4.106

- Perry-Kessaris, A. (2008). Recycle, reduce, and reflect: Information overload and knowledge deficit in the field of foreign investment and the law. Journal of Law and Society, 35(s1), 67–75. https://doi.org/10.1111/j.1467-6478.2008.00425.x

- Pistor, K. (2020). The value of law. Theory and Society, 49(2), 165–186. https://doi.org/10.1007/s11186-020-09388-z

- Piszcz, A., & Sierocka, H. (2020). The role of culture in legal languages, legal interpretation and legal translation. International Journal for the Semiotics of Law = Revue Internationale de Semiotique Juridique, 33(3), 533–542. https://doi.org/10.1007/s11196-020-09760-3

- Podsakoff, P. M., & Organ, D. W. (1986). Self-reports in organizational research: Problems and prospects. Journal of Management, 12(4), 531–544. https://doi.org/10.1177/014920638601200408

- Pongsiri, N. (2002). Regulation and public‐private partnerships. International Journal of Public Sector Management, 15(6), 487–495. https://doi.org/10.1108/09513550210439634

- Richelson, H., & Richelson, S. (2011). Bonds: The Unbeaten Path to Secure Investment Growth (Vol. 145). John Wiley & Sons.

- Rodrik, D. (1991). Policy uncertainty and private investment in developing countries. Journal of Development Economics, 36(2), 229–242. https://doi.org/10.1016/0304-3878(91)90034-S

- Rohmat, R. (2022). Implication of investment legal political dynamics on the investment climate in Indonesia. Law Review, 22(1), 063. https://doi.org/10.19166/lr.v0i1.5328

- Rundle, K. (2016). Fuller’s internal morality of law. Philosophy Compass, 11(9), 499–506. https://doi.org/10.1111/phc3.12338

- Schauer, F. (2020). Lon Fuller and the rule of law. Routledge Handbook of the Rule of Law (London: Routledge, Forthcoming 2020). Virginia Public Law and Legal Theory Research Paper, 2020–2046.

- Schou-Zibell, L., & Madhur, S. (2010). Regulatory reforms for improving the business environment in selected Asian economies-How monitoring and comparative benchmarking can provide incentive for reform ADB Working Paper Series on Regional Economic Integration.

- Sharma, M. (2023). Mobilizing Resources through Municipal Bonds: Experiences from Developed and Developing Countries.

- Simonsen, B., & Hill, L. (1998). Municipal bond issuance: Is there evidence of a principal‐agent problem? Public Budgeting & Finance, 18(4), 71–100. https://doi.org/10.1046/j.0275-1100.1998.01150.x

- Slovic, P., Fleissner, D., & Bauman, W. S. (1972). Analyzing the use of information in investment decision making: A methodological proposal. The Journal of Business, 45(2), 283–301. https://doi.org/10.1086/295448

- Soehartono, S., Tejomurti, K., Aldyan, A., & Indriyani, R. (2021). The establishing paradigm of dominus litis principle in Indonesian administrative justice. Sriwijaya Law Review, 5(1), 42–55. https://doi.org/10.28946/slrev.Vol5.Iss1.877.pp42-55

- Solovieva, V. V. (2023). Legal culture as an important element legal system. Russian Studies in Law and Politics, 7(2), 72–85. https://doi.org/10.12731/2576-9634-2023-2-72-85

- Stasavage, D. (2002). Private investment and political institutions. Economics & Politics, 14(1), 41–63. https://doi.org/10.1111/1468-0343.00099

- Tapia-Hoffmann, A. L., & Tapia-Hoffmann, A. L. (2021). Legal certainty and central bank autonomy in Latin American emerging markets. Springer.

- Usman, A., Hassan, M., & Sial, A. (2022). Independence of judiciary leading justice system to injudicious outline. Journal of Law & Social Studies, 4(2), 233–246. https://doi.org/10.52279/ljss.04.02.233246

- Van Dijk, F., & Vos, G. (2018). A method for assessment of the independence and accountability of the judiciary. International Journal for Court Administration, 9(3), 1. https://doi.org/10.18352/ijca.276

- Vasilescu, G. (2014). Montesquieu “On the Spirit of Laws”. Jurnalul de Drept Si Stiinte Administrative, 1(1), 19–26.

- Williams, J. C. (1990). Culture and certainty: Legal history and the reconstructive project. Virginia Law Review, 76(4), 713. https://doi.org/10.2307/1073210

- Xu, L., Wang, J., & Xin, Y. (2010). Government control, uncertainty, and investment decisions in china’s listed companies. China Journal of Accounting Research, 3, 131–157. https://doi.org/10.1016/S1755-3091(13)60022-2

- Yu, C. (2023). Legalizing international investment law. In Dispute settlement and the reform of international investment law (pp. 131–178). Edward Elgar Publishing.

- Yuriy, T., & Vyacheslav, S. (2021). Smart contract: From definition to certainty. Legal Issues in the Digital Age, 1, 100–122.

- Zegarlicki, J. (2018). Legal certainty as an important value of the rule of law. Filozofia Publiczna i Edukacja Demokratyczna, 6(2), 143–166. https://doi.org/10.14746/fped.2017.6.2.19

- Zhao, R., & Zhang, J. (2022). Local judicial system reform and corporate investment: Evidence from unified management of local courts below the province. China Economic Quarterly International, 2(4), 290–303. https://doi.org/10.1016/j.ceqi.2022.11.005