Abstract

This study explores the impact of digitalization, literation, and innovation on the financial performance of Micro, Small, and Medium-Sized Enterprises (MSMEs) in Bojonegoro, East Java, Indonesia. Using a sample of 35 business owners, the research employs partial least squares structural equations modelling. The findings reveal a positive and significant relationship between innovation and MSMEs’ financial performance, emphasizing the crucial role of innovative practices. Additionally, business owners’ literacy levels positively influence innovation. Although digitalization shows a positive impact on innovation and financial performance, the lack of statistical significance calls for nuanced exploration. The study contributes to understanding the complex dynamics within MSMEs post-pandemic, emphasizing the importance of literation and innovation. The research offers practical insights for MSME owners on enhancing financial literacy and fostering an innovative culture within their businesses. Policymakers were also encouraged to allocate resources to facilitate financial training for business owners. Urban areas might employ varying pandemic response strategies depending on their economic circumstances, resulting in differences in interaction variables. Future studies should extend these findings to diverse urban settings to broaden our understanding of literation, innovation, and digitalization’s impact on MSME performance.

Reviewing Editor:

1. Introduction

Micro, Small, and Medium-Sized Enterprises (MSMEs) form the backbone of many economies worldwide, contributing significantly to economic growth and employment (Corazza, Citation2018; Eggers, Citation2020; Rosyidiana et al., Citation2022). In the wake of the post-pandemic economic recovery era, understanding the factors that influence the financial performance of MSMEs has become increasingly vital. Exploring strategies for navigating pandemics is crucial for gaining knowledge on effectively managing similar crises in the future. The process of digitalization enhances the effectiveness of MSMEs by transforming their interactions, communications, and transactions (Guo et al., Citation2020; Rahman et al., Citation2020; Zhou et al., Citation2024). This, in turn, helps economies bounce back from unforeseen disruptions (Zhou et al., Citation2024). Moreover, the level of financial literacy among business owners significantly impacts financial performance (Rahim & Balan, Citation2021; Wahyono & Hutahayan, Citation2021). Financial literacy is essential for overcoming financial challenges and shaping effective financial decision-making (Gunawan et al., Citation2023). Both the process of digitalization and financial literacy contribute to the advancement of innovation. Nevertheless, no prior studies have investigated the combined impact of these characteristics on financial success, with innovation acting as a mediator. This study investigates the intricate dynamics of the MSME sector, focusing on the effect of digital transformation, financial literacy, and innovation on their financial performance.

We conducted our research in the unique location of Bojonegoro City in East Java Province, Indonesia, renowned for its rich natural resources (Ardhanariswari, Citation2018). It’s also home to a thriving MSMEs ecosystem. By focusing our research on this specific location, we hoped to provide useful insights that could be immediately utilized by business owners considering expanding their operations inside the unique environment of Bojonegoro. The economic performance of Bojonegoro in 2022, as indicated by the Gross Regional Domestic Product (GRDP), reflects a value of IDR 100,492.89 billion (BPS, Citation2023). Following a period of economic contraction during the pandemic, it was noteworthy that economic growth in the years 2021 and 2022 has exhibited a favourable upward trajectory. This condition demonstrates Bojonegoro’s capacity to effectively navigate the challenges posed by the pandemic. This study selected Bojonegoro as the research site to sample and examine the tactics employed to navigate the pandemic, with the aim of understanding how these strategies can contribute to the survival of the region throughout the Post-Pandemic Economic Recovery Period.

A questionnaire of 35 business owners was analyzed utilizing a non-probability sampling technique to fulfill our research aims. To validate the suggested model and draw relevant conclusions, the acquired data was subjected to rigorous analysis using partial least squares structural equations modelling.

This research’s conclusions provided several important advances to the theoretical understanding of MSME dynamics. Notably, it indicated a significant and positive association between MSMEs’ financial success and innovation, stressing the critical importance of innovative methods in improving their economic outcomes. These findings were consistent with the prior study that indicates innovation as an essential variable in determining the financial performance of firms (Farida et al., Citation2019; Olazo, Citation2023; Rita et al., Citation2023; Wahyono & Hutahayan, Citation2021). Furthermore, our findings show that MSMEs owner’s financial literacy levels have a significant impact on promoting innovation within their organizations, highlighting the crucial significance of financial literacy as a catalyst for innovative activity (Wahyono & Hutahayan, Citation2021). Although the study revealed a positive association between digitalization and innovation as well as financial performance, it was important to note that this correlation was not statistically significant. This highlighted the need for further investigation in this field. This underscores the significance of a more nuanced examination of the intricate interplay between digitalization initiatives and their tangible outcomes within the MSME sector.

This research examined the intricate dynamics of MSMEs during the post-pandemic economic recovery period, with a particular emphasis on the role of digitalization, financial literacy, and innovation in determining their financial performance. One of the most important novelty of this study was its contextual relevance, as it offers timely insights into the challenges and opportunities encountered by MSMEs in a post-pandemic environment. This study offers a thorough overview of the factors that influence MSMEs by integrating and examining the combined impact of digitalization, literation, and innovation. Notably, it highlighted financial literacy as a crucial, yet relatively unexplored aspect of MSME operations, illuminating its positive impact on innovation and financial performance. In addition, the study investigated whether innovation functions as a mediator between literation and financial performance, thereby enhancing our comprehension of these relationships. Ultimately, this study offered practical implications for MSME owners, policymakers, and stakeholders by emphasizing the need to improve financial literacy and cultivate an innovative culture within these businesses, thereby providing valuable guidance for their success in the post-pandemic economic recovery period.

In terms of practical implications, this study advises MSME owners on enhancing financial literacy, enabling them to make more informed and strategic financial decisions. Improvements in financial literacy will lead to more efficient financial management, optimal resource allocation, and the identification of investment opportunities. Additionally, fostering an innovative culture will promote adaptability to changes, increase competitiveness, and inspire new ideas for their businesses. The study’s practical implications also extend to the formulation of programs by policymakers to facilitate the expansion of MSME businesses. Local governments may allocate resources to facilitate financial training for business owners. Furthermore, they can encourage collaboration between universities and industries to facilitate the transfer of information and technologies. In addition to strengthening digital infrastructure, policymakers can facilitate the implementation of digital technologies by MSMEs.

However, it was essential to acknowledge that this research was firmly rooted in the context of Bojonegoro. Comparative analyses with other urban areas in Indonesia were not conducted, limiting our ability to draw broader distinctions. Future research endeavours should prioritize investigating a more extensive array of urban settings to provide fresh perspectives on the influence of literation, innovation, and digitalization on MSME performance. Such endeavours will be instrumental in assisting entrepreneurs not only within Bojonegoro City but also in diverse urban locales. During the post-pandemic period, specific regions encountered a decline in economic growth, although Bojonegoro City witnessed a favourable expansion. In diverse economic contexts, various urban areas may implement a variety of pandemic response strategies. This may lead to distinct relationships between particular variables. Further study is required to comprehend the ways in which these variables impact their enterprises in diverse economic landscapes.

2. Literature review

2.1. Digitalization and its effects on the financial performance of MSMEs

Digitalization, in the context of MSMEs, has emerged as a transformative force (Amaral & Peças, Citation2021; Horváth & Szabó, Citation2019; Oggero et al., Citation2020). Based on the previous research, the adoption and integration of digital technology into business operations could have a considerable impact on the financial performance of MSMEs (Guo et al., Citation2020; Isensee et al., Citation2020; Komala & Firdaus, Citation2023). Digitalization increased operational efficiency, improved market access, allowing MSMEs to reach a larger consumer base, increased market share, and enhanced revenue (Gunawan et al., Citation2023).

Furthermore, digitalization provided MSMEs with important insights based on information (Handayani et al., Citation2023). In turn, this data-driven strategy could improve financial planning and forecasting accuracy, resulting in better financial results (Barann, Citation2019; Gunawan et al., Citation2023). Furthermore, digitalization had the ability to stimulate MSMEs’ innovation (Bhatti et al., Citation2022). It promoted the creation of new products, services, and business models that could differentiate them in the market and drive revenue growth (Khin & Ho, Citation2020). Adaptability and innovation in response to changing market conditions became increasingly important for financial success (Soetjipto et al., Citation2023). Despite this, earlier studies revealed that digitalization had no statistically significant impact on MSME performance (Niemand, Citation2017; Sari et al., Citation2023). A factor hindering the profitability of organizations through digitization was the additional costs associated with developing and maintaining IT systems (Niemand, Citation2017).

However, the literature also acknowledges digitalization’s difficulties (Amaral & Peças, Citation2021; Barann, Citation2019). These included concerns regarding data security, organizational problems, skilled labour, and the costs associated with adopting new technologies (Amaral & Peças, Citation2021). For some MSMEs, the initial investments require for digitalization could be a hindrance, and they may lack the skills and resources necessary to leverage digital tools effectively (Barann, Citation2019).

H1: Digitalization has a significant effect on the financial performance of MSMEs.

2.2. Digitalization and its effects on MSMEs innovation

Digitalization, the integration of digital technologies into business processes, has emerged as a transformative force in the business ecosystem of the present day (Rosyidiana et al., Citation2023). A comprehensive literature evaluation revealed a consistent and persuasive narrative concerning the effects of digitalization on the innovation capabilities of MSMEs (Khurana et al., Citation2022; Lu et al., Citation2023; Tajudeen et al., Citation2022). Digitalization equipped MSMEs with a formidable collection of technological tools that serve as innovation catalysts (Yang et al., Citation2023). Such capabilities enabled small businesses to innovate by allowing them to rapidly adapt to market dynamics, respond to customer demands, and develop novel products and services (Yang et al., Citation2023). The adaptability afforded by digitalization was a crucial element in fostering innovation among MSMEs (Bhatti et al., Citation2022).

Nevertheless, it was essential to recognize that while digitalization offers numerous opportunities for innovation, it also presented obstacles (Gupta & Kumar Singh, Citation2023; Khan & Uddin, Citation2023; Kusumaningtyas et al., Citation2022; Vo Thai et al., Citation2023). Data security and privacy concerns, as well as the digital skills divide, could pose significant obstacles for MSMEs. In addition, the digital divide might exacerbate disparities among MSMEs, as those without access to or the ability to leverage digital technologies were at a significant disadvantage (Anatan, Citation2023; Chanchaichujit, Citation2024; Tiara et al., Citation2023).

H2: Digitalization has a significant effect on innovation within MSMEs.

2.3. Literation and its effects on the financial performance of MSMEs

This study primarily focuses on financial literacy. The financial performance of MSMEs was significantly influenced by financial literacy (Rahim & Balan, Citation2021; Wahyono & Hutahayan, Citation2021). It includes all of the information and abilities required for efficient money management (Bire et al., Citation2019). Several studies demonstrated a correlation between financial literacy and the financial performance of MSMEs (Abd Majid et al., Citation2022; Gunawan et al., Citation2023). Literacy enabled them to make knowledgeable decisions and optimized their businesses for financial success. Despite this, other studies found that literacy had no significant effect on MSME performance (Sari et al., Citation2023). Despite this, there were disparities in financial literacy among MSMEs due to factors, such as education and access to financial education resources (Abd Majid et al., Citation2022).

H3: The level of literation has a significant influence on the financial performance of MSMEs.

2.4. Literation and its effects on MSMEs innovation

Research has demonstrated that financial literacy equips entrepreneurs with the knowledge and confidence needed to investigate innovative solutions (Khurana et al., Citation2022). Financially literate MSME proprietors were more likely to engage in strategic financial planning, evaluate the viability of innovative projects, and secure funding for innovation initiatives (Soetjipto et al., Citation2023). This improved their ability to develop and implement innovative solutions, to adapt to market changes, and ultimately to drive innovation (Wahyono & Hutahayan, Citation2021).

Prior studies have suggested that effective financial literacy implementation could facilitate the completion of financial responsibilities by means of resource allocation, financial planning, and acquiring financial services to optimize profits (Babajide et al., Citation2023; Rahim & Balan, Citation2021). By enhancing the financial literacy of MSMEs owners, they could establish and manage their enterprises more efficiently and profitably using the innovations they develop (Ali et al., Citation2020).

H4: Literation significantly contributes to innovation within MSMEs.

2.5. Innovation and its effects on the financial performance of MSMEs

In the field of MSMEs, innovation was increasingly recognized as a key factor in determining financial performance (Soetjipto et al., Citation2023). Comprehensive research revealed a compelling narrative highlighting the revolutionary effects of innovation on the economic outcomes of these small enterprises (Bouwman et al., Citation2018).

Multiple studies demonstrated a positive and robust correlation between innovation and financial performance (Doran & Ryan, Citation2012; Wedari et al., Citation2022). Innovations might take the form of new products, processes, or business models (Ali et al., Citation2020; Bornhausen & Wulf, Citation2023). These innovations enabled MSMEs to capture larger market shares, generate higher revenues, and achieve cost efficiencies, which all significantly contribute to enhanced financial performance (Akinwale, Citation2020; Ali et al., Citation2020).

H5: Innovation has a significant effect on the financial performance of MSMEs.

2.6. Innovation as a mediator on the financial performance of MSMEs

A comprehensive examination of the relevant literature reveals that the concept of innovation as a link between literacy, digitalization, and the financial performance of MSMEs was both complex and crucial. Literacy, which refers to the ability to read, write, and comprehend material well, was the first factor that, according to the majority of people, helps MSMEs innovate (Bire et al., Citation2019). Entrepreneurs who can read and write frequently have superior problem-solving abilities and are better able to absorb and utilize information (Babajide et al., Citation2023). These cognitive abilities enable individuals to think creatively and generate new ideas. However, it is crucial to keep in mind that even though literacy encourages innovation, it may not necessarily result in better financial outcomes. The literature demonstrates that the link between literacy and financial success could be mediated by entrepreneurs’ innovative activities (Khin & Ho, Citation2020; Soetjipto et al., Citation2023).

Digitalization, on the other hand, introduced the transformative force of digital tools to the world of MSME. Small businesses could become more innovative by utilizing digital tools and processes to gain access to vast quantities of data, enhancing communication, and streamlining operations (Maulana & Iskandar, Citation2023). However, automation may not have a direct impact on the success of a business. Instead, the effects of digitalization on financial results may be mediated by the way it impacts innovation. In essence, digitalization provides the technological infrastructure and resources that enable innovative activities, thereby enhancing financial performance (Soetjipto et al., Citation2023).

H6: Innovation has a significant moderating effect on the relationship between digitalization and financial performance of MSMEs.

H7: Innovation has a significant moderating effect on the relationship between literation and financial performance of MSMEs.

3. Methodology

3.1. Method

This study utilized a quantitative methodology, which involved a systematic examination of constituent elements and phenomena. Through the implementation of statistical analysis techniques, it also aimed to establish causal relationships between measurable variables. For the accumulation of numerical data in research investigations, quantitative research relies primarily on statistical methods. Within this research strategy, researchers employ a conceptual framework derived from theories related to the variables under consideration. This is a causal explanatory investigation in which hypotheses have been formulated based on both theoretical constructs and empirical research. These hypotheses specify the relationships between variables and are supported by both theoretical and empirical research. Subsequently, these relationships are empirically validated through the analysis of questionnaire survey data collected from MSMEs, utilizing statistical tools to determine whether the findings support or contradict the conclusions derived from prior research sources. Surveys offer researchers a reliable means to collect valuable first hand data that can assist in informed decision-making (Rahmawati et al., Citation2023).

Two sections were included in the questionnaire. The first section comprised inquiries relating to the gender, age, level of education, and the number of employees. The second section comprised inquiries that related to the participants’ perspectives on the following concepts: digitalization, literation, innovation, and financial performance. For this investigation, a five point Likert scale was selected, ranging an interval from ‘strongly disagree’ to ‘strongly agree’ (Tajudeen et al., Citation2022). The adoption of digitalization was measured based on Technological, Organisational, and Environmental (TOE) Framework (Ghobakhloo et al., Citation2011; Rahman et al., Citation2020). Technological was measured using a 3-scale item, organizational was measured using a 2-scale item, and environmental was measured using a 3-scale item. Financial literacy was measured using 5-scale items (Gunawan et al., Citation2023; Rahmawati et al., Citation2023; Soetjipto et al., Citation2023). Innovation was measured using 6-scale items (Soetjipto et al., Citation2023; Tajudeen et al., Citation2022).

3.2. Data

Micro, small, and medium-sized enterprises (MSMEs) in Bojonegoro, East Java Province, were the focus of the investigation. Random sampling, a form of probability sampling that ensures that every member of the target population has an equal chance of being selected, was used to select the sample. The purpose of this random sampling was to create a representative sample of the complete population. The initial population of MSMEs in this study totalled 86,820, a size that poses difficulties in constructing a suitable model (Hair et al., Citation2012). This population was mostly engaged in the sectors of food and beverage, fashion, crafts, and others (Rosyidiana et al., Citation2023). A total of 89% of the entities were classified as micro-businesses, 10% as minor businesses, and 1% as medium-sized enterprises.

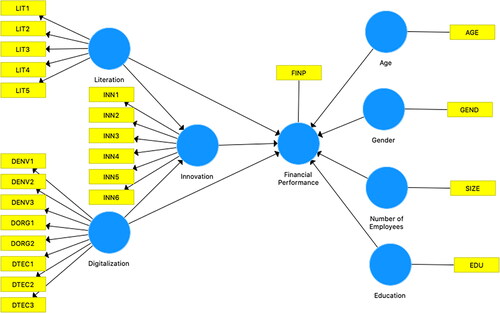

A questionnaire survey was distributed to a total of 60 owners of MSMEs. There were a total of 35 surveys that were completed and collected. The overall response rate was 58%. Among the 35 questionnaires collected, they have covered the type of industries and reflected the categorization of MSMEs, spanning from micro to small and medium-sized enterprises, with respective proportions of 89, 8, and 3% as shown in . This indicates that the sample accurately reflects the criteria of the population. The collected data were then analysed using partial least squares structural equation modelling, a technique employed to evaluate both the collected data and the validity of the proposed model, as shown in .

Table 1. Respondent statistics.

This study’s sample size was relatively small as only 35 business owners participated. This small sample size might decrease the study’s statistical power and generalizability. It is important to recognize these limitations when interpreting the research findings and to take them into account when applying the findings to the larger population of MSMEs. To resolve these limitations and improve the robustness and generalizability of future research, a more comprehensive and representative sampling approach could be explored.

4. Analysis and findings

In this study, the assessment of variables was conducted through a meticulous examination encompassing both validity and reliability assessments. In this study, the analytical procedure was divided into multiple phases. Initially, a thorough assessment of the research instrument’s reliability and validity was conducted. A subsequent stage involved hypothesis testing, which included an examination of the conformity of classical assumptions and the adequacy of the model. The final phase consisted of hypothesis validation utilizing Smart PLS as the primary analytical instrument. Specifically, the validity assessment of the research instrument was conducted to confirm the questionnaire’s accuracy and suitability, thereby enhancing the robustness of the research methodology.

4.1. Statistic descriptive

illustrates that the majority of participants in the study are women entrepreneurs, comprising 86% of the sample. The age distribution of the sample is primarily concentrated within the 30 to 50-year range, which comprises 86% of the participants. A smaller proportion of individuals, ∼3%, are younger than 30 years, while 11% are older than 50 years. There is a range of educational backgrounds among individuals, with the most prevalent group being high school graduates, which represent 40% of the sample, followed by individuals who have obtained a bachelor’s degree, comprising 34% of the population. The majority of firms, over 89%, have several employees <5 people. A smaller percentage, around 9%, employ between 5 and 10 individuals, while a paltry 3% have a workforce beyond 10 employees. These demographic variables serve as a comprehensive representation of the participant characteristics in the study, hence establishing the foundation for subsequent analytical procedures.

The descriptive statistics shown in provide an overview of the main pattern and variability within the dataset. For the variable Literation (LIT1 to LIT5), the mean scores range from ∼1.657 to 2.400, with medians mostly around 2.000. These scores reflect moderate levels of literation among the participants. The standard deviations, ranging from ∼0.5236 to 0.6590, indicate relatively consistent responses within this construct. Similarly, for the variable Innovation (INN1 to INN6), mean scores range from ∼1.829 to 2.343, with medians primarily at 2.000. These scores suggest that participants generally exhibit moderate levels of innovation. The standard deviations, ranging from around 0.2847 to 0.6417, indicate varying degrees of variability in responses within this construct. Regarding Digitalization (DTEC1 to DTEC3, DORG1 to DORG2, DENV1 to DENV3), the mean scores show a range from ∼2.057 to 2.829, with medians often at 3.000. These results suggest a moderate level of digitalization among the participants. The standard deviations, which vary from around 0.5493 to 1.4440, indicate varying degrees of dispersion in responses within this construct. Lastly, for Financial Performance (FINP), the mean is ∼17.229, with a median of 17.000, indicating relatively stable financial performance among the sample. The standard deviation of ∼1.1970 highlights some variability in financial performance scores.

Table 2. Descriptive statistics.

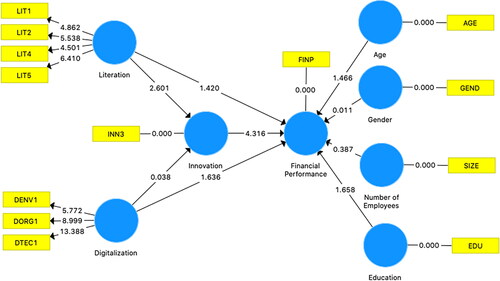

4.2. Validity and reliability test

The assessment of outer loadings for each indicator is essential in determining the reliability and validity of the measurement model. Among the indicators those with valid outer loadings that exceed the recommended threshold (usually 0.7) are considered robust measures of their respective constructs. In this analysis, as mentioned in , indicators, such as DTEC1 (0.769), DORG1 (0.818), DENV1 (0.781), LIT1 (0.802), LIT2 (0.929), LIT4 (0.816), LIT5 (0.706), and INN3 (0.857) demonstrate valid outer loadings, indicating their reliability in measuring their intended constructs. Conversely, indicators with outer loadings below the threshold are considered less reliable or invalid measures. These include DENV2 (0.665), DENV3 (0.644), DORG2 (0.495), DTEC2 (0.683), DTEC3 (0.570), INN1 (0.214), INN2 (0.688), INN4 (0.694), INN5 (0.603), and INN6 (0.500), which did not meet the criteria for robust indicators.

Table 3. Validity test.

Using the Average Variance Extracted (AVE) method to examine construct validity is a crucial aspect of this study. AVE evaluates the extent to which items within a construct quantify that construct relative to measurement error. According to the result, the AVE values for Digitalization and Literacy were 0.794 and 0.677, respectively. Both of these values exceed the recommended threshold of 0.5, indicating that the underlying constructs explain a substantial proportion of the variance in the observed variables. This indicates that the Digitalization and Literacy constructs in our research model are valid. Moreover, the AVE values for Innovation and Financial Performance were both 1.000, signifying that these constructs have outstanding convergent validity. In other words, all of the observed variance in the Innovation and Financial Performance variables can be attributed to the constructs themselves, with no influence from measurement error. This demonstrates the robustness of our measurement model even further.

compares and contrasts the assessment of discriminant validity, a pivotal aspect of construct validity, which was conducted in this study through the examination of Cross Loadings and the Fornell-Larcker Criterion for the variables Digitalization, Literation, Innovation, and Financial Performance. Upon scrutiny, it is evident that the Cross Loadings values consistently exceed the corresponding values in the same rows, affirming the distinctiveness of each construct from the others. For example, in the case of Digitalization, its Cross Loadings with itself (DENV1: 0.834; DORG1: 0.906; DTEC1: 0.930) surpass the Cross Loadings with other constructs (LIT1: 0.454; LIT2: 0.530; LIT4: 0.483; LIT5: 0.592; INN3: 0.286; FINP: −0.085). This pattern holds true for Literation, Innovation, and Financial Performance as well.

Table 4. Discriminant validity.

In addition, the Fornell-Larcker Criterion, which evaluates whether the square root of the AVE for each construct is higher than its correlations with other constructs, underscores the discriminant validity. Here, the square roots of the AVE values for each construct (Digitalization: 0. 891, Literation: 0.823, Innovation: 1.000, Financial Performance: 1.000) consistently exceed the correlation values between constructs. For instance, the correlation values between Digitalization and Literation (0.623), Digitalization and Innovation (0.286), and Digitalization and Financial Performance (−0.085) are notably lower than the square root of the AVE for Digitalization (0.891). The results of the discriminant validity assessment ensure the validity of our measurement model.

The assessment of reliability in this study, a critical element in ensuring the consistency and accuracy of our measurement instruments, was conducted using both Cronbach’s Alpha and Composite Reliability. Cronbach’s Alpha, a widely employed measure of internal consistency, yielded robust results in this study. Specifically, for Digitalization, the obtained Cronbach’s Alpha value was 0.873, while for Literation, it was 0.841. These values surpass the commonly accepted threshold of 0.7, signifying strong internal consistency for both constructs. Furthermore, for Innovation and Financial Performance, where all items within the constructs were identical, Cronbach’s Alpha yielded perfect values of 1.000, affirming their exceptional internal consistency.

Moreover, Composite Reliability, another measure of internal consistency, provided additional confirmation of the reliability of our constructs. Digitalization demonstrated a Composite Reliability value of 0.920, indicating a high degree of consistency, while Literation exhibited a value of 0.893, further substantiating its reliability. Similarly, Innovation and Financial Performance exhibited perfect Composite Reliability values of 1.000, underscoring their impeccable internal consistency. The results of both Cronbach’s Alpha and Composite Reliability analyses reinforce the high degree of reliability exhibited by our constructs—Digitalization, Literation, Innovation, and Financial Performance. These findings provide confidence in the accuracy and consistency of our measurement instruments, enhancing the overall robustness of our research methodology.

The R-squared value of 0.496 for Financial Performance indicates that ∼49.6% of the variance in Financial Performance is explained by the exogenous and endogenous variables included in the model. This indicates that the proposed model, which includes variables, such as Literacy, Digitalization, and Innovation, accounts for a significant portion of the variance in Financial Performance among the studied Micro, Small, and Medium-Sized Enterprises (MSMEs). Similarly, the R-squared value of 0.211 for the Innovation construct indicates that ∼21.1% of the variance in Innovation is explained by the factors included in the model. This highlights the significance of unmeasured variables, such as Literacy and Digitalization in determining the level of innovation among MSMEs.

In the context of MSMEs, the path coefficients of the inner model test cast light on the intricate relationships between Digitalization, Literacy, Innovation, and Financial Performance. Approximately 0.287% is the relationship correlation between Digitalization and Financial Performance. This positive coefficient indicates a positive relationship between Digitalization and Financial Performance among the investigated MSMEs. It is important to note, however, that this relationship is relatively feeble, as indicated by the small size of the coefficient. The Innovation to Financial Performance path coefficient is approximately −0.563, indicating a negative relationship between the two variables. In this context, it suggests that higher levels of Innovation are associated with lower Financial Performance among the MSMEs studied. While the correlation between Literacy and Financial Performance is approximately −0.345, indicating a negative relationship. This suggests that higher levels of Literacy among business proprietors correlate with poorer Financial Performance. In addition, positive path coefficients exist between Literacy and Innovation (0.464) and Innovation and Financial Performance (approximately −0.563). These coefficients shed light on the role of Innovation as a mediator in the relationship between Literacy and Financial Performance. The Normed Fit Index (NFI) has been obtained and found to be 0.720. In this instance, an NFI value of 0.720 indicates that the model fits the data adequately.

demonstrates that path coefficient analysis using bootstrapping yields insights into the investigated relationships. H1, which examined the relationship between digitalization and financial performance, yielded a T statistic of 1.636 and a p-value of 0.108, indicating that the relationship is not statistically significant. Similarly, H2, which examined the effect of digitalization on innovation, had a T statistic of 0.038 and a high p-value of 0.970, indicating that there was no significant effect. H3, which focused on the relationship between literacy and financial performance, yielded a T statistic of 1.420 and a p-value of 0.162, indicating that the relationship is not statistically significant. H4, which examined the relationship between literacy and innovation, demonstrated a significant T statistic of 2,601 and a low p-value of 0.012, indicating a strong positive relationship. H5, which investigated the relationship between innovation and financial performance, yielded a highly significant T statistic of 4.316 with a p-value of 0.000, indicating the existence of a strong positive relationship. H6 and H7, which investigated the mediating roles of innovation between digitalization/literacy and financial performance, exhibited insignificant relationships with p-values of 0.97 and 0.034, respectively. These findings provide nuanced insights into the complex relationships between these variables, highlighting the importance of innovation in enhancing the financial performance of MSMEs and the need for a more comprehensive understanding of the contextual influences of digitalization and literacy. The findings of the analysis conducted on the relationships under investigation are presented in .

Table 5. Hypotheses assessment.

5. Discussion

The results of this study shed light on several critical findings and offer significant implications for the business landscape in Bojonegoro, especially within the context of MSMEs. Bojonegoro, with a population of 1,301,635 people, offers a promising prospect for businesses operating within the area. This substantial population base could serve as a valuable customer pool and market opportunity for local MSMEs. In recent years, there has been a noticeable increase in the number of MSMEs in this city. This was what ultimately prompted the decision to conduct this study in this particular location. Although there might not have been a large sample size, the characteristics of the respondents were representative of the population as a whole.

Additionally, this study also highlights some challenges that the region faces, particularly in the wake of the COVID-19 pandemic. The Gross Domestic Product (GDP) in 2020 experienced a decline, falling from IDR 78,046.33 billion in 2019 to IDR 70,258.51 billion (BPS, Citation2022). This indicates a substantial economic setback, with a negative growth rate of −0.40% in 2020. These economic challenges have undoubtedly had an impact on the business landscape, including the performance of MSMEs. This city was experiencing positive economic growth in the post-pandemic era. This was not far from the active participation of the working-age population in economic performance, as well as the elderly’s dependency on the active and youthful populations for survival (Ntom Udemba et al., Citation2024). This is related to the case of Bojonegoro city, which has a 69% productive population. This was one of the factors contributing to the city’s economic comeback.

In light of these circumstances, this study aimed to explore the factors that influence the financial performance of MSMEs in the post-pandemic economic recovery era. We investigated the roles of literation, innovation, and digitalization in this context. While our findings indicate that literation, innovation, and digitalization did have positive effects on MSMEs’ financial performance, it was noteworthy that the statistical significance of these relationships varied.

Specifically, we observed a significant positive relationship between literation and innovation. The results were consistent with those of prior studies (Ali et al., Citation2020; Khurana et al., Citation2022; Soetjipto et al., Citation2023). Business owners with higher levels of literation were more likely to engage in innovative practices, suggesting the importance of literacy as a catalyst for innovation within MSMEs. This highlighted the crucial role of financial literacy in fostering innovative practices among MSMEs. Initiatives to improve financial literacy within the business community should be prioritized by business proprietors and policymakers. These initiatives could enable entrepreneurs to make educated financial decisions, pursue innovative strategies, and ultimately improve their financial performance.

This also contributes to the existing literature on developing countries by providing both theoretical and empirical evidence to support the effectiveness of financial literacy as a strategy. This was especially relevant when MSMEs face challenges in achieving innovation and financial performance. Policy makers can play a role in enhancing business owners’ literacy by fostering collaboration between the local government and universities through the Department of Trade, Cooperatives, and Micro Enterprises. This involves building a strong relationship with clients by offering them technical assistance and training in online marketing, including guidance on setting up and managing an e-commerce platform. It also encompasses the process of organizational learning at the managerial level. Additionally, assistance from additional stakeholders, such as financial institutions, non-profit organizations, and research institutions is required. They might help MSME owners by providing resources and financial assistance, while also arranging training programs and workshops that improve financial literacy and innovation capabilities in business.

On the other hand, while digitalization and innovation exhibited positive effects on financial performance, their relationship lacked statistical significance. This suggests that while these factors might contribute to improve financial outcomes, their impact might be influenced by various contextual factors. The absence of statistical significance suggests that the relationship between digitalization and innovation and financial performance might be complicated. MSMEs should approach digitalization initiatives with caution, recognizing that their effects may vary based on context. Policymakers and industry stakeholders can play a role in facilitating the adoption of digital technologies and providing support for MSMEs to maximize the benefits of digitalization.

Innovation remains a key driver of financial performance for MSMEs, particularly in difficult economic times (Akinwale, Citation2020; Olazo, Citation2023; Rita et al., Citation2023; Soetjipto et al., Citation2023). Despite the lack of statistical significance between digitalization and financial performance, emphasizing innovation was crucial. To improve their adaptability and resiliency, MSMEs should prioritize innovative practices.

This research also revealed that the number of employees had a positive path coefficient, indicating that having a larger workforce is associated with better financial performance. However, this relationship was not statistically significant. This suggests that while expanding the workforce may offer certain advantages, such as increased production capacity or service delivery, its impact on financial performance is not consistently significant. MSMEs should carefully assess their staffing needs and consider factors beyond just the headcount when aiming to improve financial outcomes.

Similarly, the age of business owners displayed a positive path coefficient, suggesting that more experienced entrepreneurs might have an advantage in terms of financial performance. However, like the number of employees, this relationship was not statistically significant. Age alone may not be the sole determinant of financial success for MSMEs, and other factors may play a more critical role.

The findings revealed that the gender of business owners had a positive path coefficient, implying that firms owned by women exhibited better financial performance. However, this result was not statistically significant. The gender of business owners continues to be an essential consideration in discussions of business dynamics and performance, and further research is needed to explore the nuanced factors that contribute to this relationship.

One unexpected finding was the negative path coefficient (−0.339) associated with the educational background of business owners. This result implies that contrary to conventional wisdom, lower formal educational qualifications among business owners were linked to higher financial performance in our study. Diverse research findings exist concerning the correlation between the two variables. While some research suggests a positive correlation (Altuwaijri & Kalyanaraman, Citation2020; Harymawan et al., Citation2023), others find no statistically significant association between the two variables (Gottesman & Morey, Citation2010; Jalbert et al., Citation2011). The potential cause for the outcomes of this study was that the educational background measurement was predicated on the business owners’ formal education. Numerous initiatives have been undertaken by the government to enhance the literacy of MSME proprietors through mentoring and training. Its potential inclusion as an educational measurement could result in an altered relationship. It also prompts an exploration of specific contexts in which educational backgrounds may have varying effects on financial performance. This unexpected result requires additional investigation to understand the underlying factors.

According to this study, internal factors had a substantial effect on the financial performance of MSMEs in Bojonegoro. Although they were not the sole determinants of financial performance, external variables also exerted an influence. External variables, such as uncertainty, time constraints, and complex developments hold significant importance (Utaminingsih et al., Citation2024), particularly in the aftermath of the pandemic. MSMEs were encouraged to embrace online sales as a means of adapting to these challenges. Online marketplaces have not only facilitated business survival but also fostered growth during the pandemic. While the region offers significant market potential, economic challenges, as highlighted by the decline in GDP and negative growth rate, underscore the need for businesses to adapt and innovate in the post-pandemic recovery period. Further research and policy initiatives can help businesses in the region navigate these challenges and capitalize on opportunities for growth and resilience.

6. Implications and conclusion

This research has uncovered a complex interplay of factors that influence the financial performance of MSMEs in Bojonegoro during the post-pandemic economic recovery period. Examining Bojonegoro City’s economic recovery strategy was a valuable endeavour. The participation of its 69% productive population has been identified as one of the factors contributing to the city’s economic resurgence, which underscores the importance of this study. Enhancing financial literacy emerges as a critical strategy for business owners to foster innovation. Innovation was also benefited by digitalization, albeit to a lesser extent than literacy. Nevertheless, MSMEs are still encouraged to implement digital technologies in the current era of digitalization to innovate and maximize their profits. The innovation enabled by MSMEs has the potential to enhance business productivity and navigate the post-pandemic era.

These findings emphasize the need for a holistic approach when assessing and supporting MSMEs. Bojonegoro hosts multiple MSME forums covering various industries including food and beverage, fashion, crafts, and more. The local government might partner with these forums to achieve extensive literacy, reaching beyond urban businesses to encompass those in neighboring rural areas. Collaboration with local businesses and universities can also contribute to resource allocation for improving literacy. Policymakers, business owners, and stakeholders should consider a multifaceted perspective that encompasses not only financial literacy, innovation, and digitalization but also the unique context of each business when allocating resources and providing support. Further research is encouraged to delve deeper into the unexpected results, such as the negative path coefficient associated with educational background, and to explore the potential moderating factors at play.

Our analysis provides valuable insights into the dynamics of MSMEs in Bojonegoro during the post-pandemic era of economic recovery. It has been demonstrated that literation, innovation, and digitalization are crucial determinants of financial performance, albeit to varying degrees of statistical significance. The importance of financial literacy in fostering innovation should be recognized by business owners and policymakers, who should consider targeted initiatives to improve financial literacy levels.

In an ever-evolving economic environment, fostering innovation and financial literacy remains pivotal for MSMEs. However, acknowledging the nuanced relationships uncovered in this study, such as those related to the number of employees and the educational background of business owners, is essential for designing tailored strategies to support the growth and sustainability of MSMEs in Bojonegoro and similar regions.

Author contributions

Riska Nur Rosyidiana: concept development, literature review, methodology, interpretation of data, and discussion. I. Made Narsa: Conceptualization, methodology, discussion, analysis, and conclusion.

Disclosure statement

No potential conflict of interest was reported by the author(s).

Data availability statement

The data supporting the findings of this study are available within the article.

Additional information

Funding

Notes on contributors

Riska Nur Rosyidiana

Riska Nur Rosyidiana is a Doctoral candidate in Accounting at Universitas Airlangga Surabaya Indonesia and a Lecturer in the Business Department, Faculty of Vocational Studies, Universitas Airlangga. Her research interests are MSMEs Management Accounting, Financial Accounting and Sustainability.

I. Made Narsa

I. Made Narsa is a Professor at the Faculty of Economics and Business, Universitas Airlangga, Surabaya Indonesia. His research interests are in Management Accounting, Behavioural Accounting, Corporate Governance, Sustainability, and Financial Accounting.

References

- Abd Majid, M. S., Faisal, F., Fahlevi, H., Azhari, A., & Juliansyah, H. (2022). What contributes to micro, small, and medium enterprises’ productivity in fisheries sector in Aceh, Indonesia? E3S Web of Conferences, 339, 1–17.

- Akinwale, Y. O. (2020). Technology innovation and financial performance of MSMEs during COVID-19 lockdown in Dammam area of Saudi Arabia: A case of food and beverage sector. International Journal of Technological Learning, Innovation and Development, 12(2), 136–152. https://doi.org/10.1504/IJTLID.2020.110622

- Ali, H., Hao, Y., & Aijuan, C. (2020). Innovation capabilities and small and medium enterprises’ performance: An exploratory study. The Journal of Asian Finance, Economics and Business, 7(10), 959–968. https://doi.org/10.13106/jafeb.2020.vol7.no10.959

- Altuwaijri, B. M., & Kalyanaraman, L. (2020). CEO education-performance relationship: Evidence from Saudi Arabia. The Journal of Asian Finance, Economics and Business, 7(8), 259–268. https://doi.org/10.13106/jafeb.2020.vol7.no8.259

- Amaral, A., & Peças, P. (2021). SMEs and Industry 4.0: Two case studies of digitalization for a smoother integration. Computers in Industry, 125, 103333. https://doi.org/10.1016/j.compind.2020.103333

- Anatan, L. 2023. Micro, small, and medium enterprises’ readiness for digital transformation in Indonesia. Economies, 11(6), 156. https://doi.org/10.3390/economies11060156

- Ardhanariswari, K. A. (2018). From nothing to something: Study on how local government transformed oil and gas area into ecotourism village in Indonesia through branding strategy. Journal of Environmental Management and Tourism, 9(8), 1760–1767. https://www.scopus.com/inward/record.uri?eid=2-s2.0-85064984860&doi=10 .14505/jemt.v9.8%2832%29.15&partnerID=40&md5=292207356a7d9a7c560faf5dc1f74bce

- Babajide, A., Osabuohien, E., Tunji-Olayeni, P., Falola, H., Amodu, L., Olokoyo, F., Adegboye, F., & Ehikioya, B. (2023). Financial literacy, financial capabilities, and sustainable business model practice among small business owners in Nigeria. Journal of Sustainable Finance & Investment, 13(4), 1670–1692. https://doi.org/10.1080/20430795.2021.1962663

- Barann, B. (2019). Supporting digital transformation in small and medium-sized enterprises: A procedure model involving publicly funded support units. In Proceedings of the 52nd Hawaii International Conference on System Sciences (Vol. 6, pp. 4977–4986). https://doi.org/10.24251/HICSS.2019.598.

- Bhatti, S. H., Ahmed, A., Ferraris, A., Hirwani Wan Hussain, W. M., & Wamba, S. F. (2022). Big Data analytics capabilities and MSME innovation and performance: A double mediation model of digital platform and network capabilities. Annals of Operations Research. https://doi.org/10.1007/s10479-022-05002-w

- Bire, A. R., Sauw, H. M., & Maria. (2019). The effect of financial literacy towards financial inclusion through financial training. International Journal of Social Sciences and Humanities, 3(1), 186–192. https://doi.org/10.29332/ijssh.v3n1.280

- Bornhausen, A. M., & Wulf, T. (2023). Digital innovation in family firms: The roles of non-family managers and transgenerational control intentions. Small Business Economics, 62(4), 1429–1448. https://doi.org/10.1007/s11187-023-00823-w

- Bouwman, H., Nikou, S., Molina-Castillo, F. J., & de Reuver, M. (2018). The impact of digitalization on business models. Digital Policy, Regulation and Governance, 20(2), 105–124. https://doi.org/10.1108/DPRG-07-2017-0039

- BPS (2022). Badan Pusat Statistik. Retrieved March 28, 2022, from https://www.bps.go.id/pressrelease/2022/02/07/1911/ekonomi-indonesia-triwulan-iv-2021-tumbuh-5-02-persen–y-on-y-.html

- BPS (2023). Pertumbuhan Ekonomi Kabupaten Bojonegoro Tahun 2022. Retrieved September 1, 2023, from https://bojonegorokab.bps.go.id/pressrelease/2023/02/28/25/pertumbuhan-ekonomi-kabupaten-bojonegoro-tahun-2022.html

- Chanchaichujit, J. (2024). Enablers and benefits of supply chain digitalization: An empirical study of Thai MSMEs. In Environmental footprints and eco-design of products and processes, faculty of environmental management (pp. 113–131). Prince of Songkla University. https://www.scopus.com/inward/record.uri?eid=2-s2.0-85172476794&doi=10 .1007/978-981-99-4894-9_8&partnerID=40&md5=dce379796db7eda175c480f6ad025ab8

- Corazza, L. (2018). Small business social responsibility: The CSR4UTOOL web application. Journal of Applied Accounting Research, 19(3), 383–400. https://doi.org/10.1108/JAAR-11-2014-0122

- Doran, J., & Ryan, G. (2012). Regulation and firm perception, eco-innovation and firm performance. European Journal of Innovation Management, 15(4), 421–441. https://doi.org/10.1108/14601061211272367

- Eggers, F. (2020). Masters of disasters? Challenges and opportunities for SMEs in times of crisis. Journal of Business Research, 116, 199–208. https://doi.org/10.1016/j.jbusres.2020.05.025

- Farida, L., Afandi, M. F., Sularso, R. A., Suroso, I., & Putri, N. A. (2019). How financial literacy, innovation capability, and human capital affect competitive advantage and performance: Evidence from creative MSMEs. International Journal of Scientific and Technology Research, 8(11), 2300–2310. https://www.scopus.com/inward/record.uri?eid=2-s2.0-85075276404&partnerID=40&md5=5a93ebc252547b153cef656c1e68c7fe

- Ghobakhloo, M., Arias-Aranda, D., & Benitez-Amado, J. (2011). Adoption of e-commerce applications in SMEs. Industrial Management & Data Systems, 111(8), 1238–1269. https://doi.org/10.1108/02635571111170785

- Gottesman, A. A., & Morey, M. R. (2010). CEO educational background and firm financial performance. Journal of Applied Finance, 2, 70–82.

- Gunawan, A., Jufrizen, & Pulungan, D. R. 2023. Improving MSME performance through financial literacy, financial technology, and financial inclusion. International Journal of Applied Economics, Finance and Accounting, 15(1), 39–52. https://doi.org/10.33094/ijaefa.v15i1.761

- Guo, H., Yang, Z., Huang, R., & Guo, A. (2020). The digitalization and public crisis responses of small and medium enterprises: Implications from a COVID-19 survey. Frontiers of Business Research in China, 14(1), 1-25. https://doi.org/10.1186/s11782-020-00087-1

- Gupta, A., & Kumar Singh, R. (2023). Managing resilience of micro, small and medium enterprises (MSMEs) during COVID-19: Analysis of barriers. Benchmarking: An International Journal, 30(6), 2062–2084. https://doi.org/10.1108/BIJ-11-2021-0700

- Hair, J. F., Ringle, C. M., & Sarstedt, M. (2012). Partial least squares: The better approach to structural equation modeling? Long Range Planning, 45(5–6), 312–319. https://doi.org/10.1016/j.lrp.2012.09.011

- Handayani, B. D., Hajawiyah, A., Putra Harjanto, A., & Fathur, M. (2023). Analysis of the use of accounting information technology in MSMEs in Indonesia. Quality-Access to Success, 24(195), 115–124.

- Harymawan, I., Minanurohman, A., Nasih, M., Shafie, R., & Ismail, I. (2023). Chief financial officer’s educational background from reputable universities and financial reporting quality. Journal of Accounting & Organizational Change, 19(4), 566–587. https://doi.org/10.1108/JAOC-12-2021-0195

- Horváth, D., & Szabó, R. Z. (2019). Driving forces and barriers of Industry 4.0: Do multinational and small and medium-sized companies have equal opportunities? Technological Forecasting and Social Change, 146(March), 119–132. https://doi.org/10.1016/j.techfore.2019.05.021

- Isensee, C., Teuteberg, F., Griese, K. M., & Topi, C. (2020). The relationship between organizational culture, sustainability, and digitalization in SMEs: A systematic review. Journal of Cleaner Production, 275, 122944. https://doi.org/10.1016/j.jclepro.2020.122944

- Jalbert, T., Furumo, K., & Jalbert, M. (2011). Does educational background affect CEO compensation and firm performance? Journal of Applied Business Research, 27(1), 15–40.

- Khan, M. A. I., & Uddin, M. A. (2023). Does managerial propensity towards digitalization enhances firm performance? A case study of Indian MSMEs. International Journal of Applied Economics, Finance and Accounting, 17(1), 168–175. https://doi.org/10.33094/ijaefa.v17i1.1093

- Khin, S., & Ho, T. C. F. (2020). Digital technology, digital capability and organizational performance: A mediating role of digital innovation. International Journal of Innovation Science, 11(2), 177–195. https://doi.org/10.1108/IJIS-08-2018-0083

- Khurana, S., Luthra, S., Haleem, A., Kumar, A., & Mannan, B. (2022). Can sustainability be achieved through sustainable oriented innovation practices? Empirical evidence of micro, small and medium scale manufacturing enterprises. Sustainable Development, 30(6), 1591–1615. https://doi.org/10.1002/sd.2330

- Komala, A. R., & Firdaus, D. W. (2023). Improving the quality of financial statements and the survival of MSMEs through digital economy: The case of Indonesia and Malaysia. Journal of Eastern European and Central Asian Research, 10(5), 752–763. https://www.scopus.com/inward/record.uri?eid=2-s2.0-85172761968&doi=10 .15549/jeecar.v10i5.1435&partnerID=40&md5=4bde712e043fb0cde8e05c4d9031ddfc

- Kusumaningtyas, R. O., Subekti, R., Jaelani, A. K., Orsantinutsakul, A., & Mishra, U. K. (2022). Reduction of digitalization policy in Indonesian MSMEs and implications for Sharia economic development. JURIS (Jurnal Ilmiah Syariah), 21(2), 157–171. https://doi.org/10.31958/juris.v21i2.6855

- Lu, H. T., Li, X., & Yuen, K. F. (2023). Digital transformation as an enabler of sustainability innovation and performance – Information processing and innovation ambidexterity perspectives. Technological Forecasting and Social Change, 196, 122860. https://doi.org/10.1016/j.techfore.2023.122860

- Maulana, A., & Iskandar, Y. (2023). The effect of technology adaptation and government financial support on sustainable performance of MSMEs during the COVID-19 pandemic. Cogent Business and Management, 10(1), 2177400. https://www.scopus.com/inward/record.uri?eid=2-s2.0-85148437482&doi=10 .1080/23311975.2023.2177400&partnerID=40&md5=1fdc2cb6bf870e3be9e716d089b7c629

- Niemand, T. (2017). Entrepreneurial orientation and digitalization in the financial service industry: A contingency approach. In Proceedings of the 25th European Conference on Information Systems, ECIS 2017 (pp. 1081–1096).

- Ntom Udemba, E., Khan, N.-U., & Raza Shah, S. A. (2024). Demographic change effect on ecological footprint: A tripartite study of urbanization, aging population, and environmental mitigation technology. Journal of Cleaner Production, 437, 140406. https://doi.org/10.1016/j.jclepro.2023.140406

- Oggero, N., Rossi, M. C., & Ughetto, E. (2020). Entrepreneurial spirits in women and men. The role of financial literacy and digital skills. Small Business Economics, 55(2), 313–327. https://doi.org/10.1007/s11187-019-00299-7

- Olazo, D. B. (2023). Marketing competency, marketing innovation and sustainable competitive advantage of small and medium enterprises (SMEs): A mixed-method analysis. Asia Pacific Journal of Marketing and Logistics, 35(4), 890–907. https://doi.org/10.1108/APJML-01-2022-0050

- Rahim, S., & Balan, V. (2021). Financial literacy: The impact on the profitability of the SMEs in Kuching. International Journal of Business and Society, 21, 1172–1191.

- Rahman, R. U., Mohsin Ali Shah, S., El-Gohary, H., Haider Khalil, S., Al Altheeb, S., & Sultan F. (2020). Social media adoption and financial sustainability: Learned lessons from developing countries. Sustainability, 12(24), 1–26.

- Rahmawati, A., Wahyuningsih, S. H., & Garad, A. (2023). The effect of financial literacy, training and locus of control on creative economic business performance. Social Sciences and Humanities Open, 8(1), 100721. https://doi.org/10.1016/j.ssaho.2023.100721

- Rita, M. R., et al. (2023). Lessons learned in the recovery of business performance from the COVID-19 endemic: The importance of working capital management and financial management. In Entrepreneurship business debates: Multidimensional perspectives across geo-political frontiers (pp. 67–85). Faculty of Economics and Business, Satya Wacana Christian University. https://www.scopus.com/inward/record.uri?eid=2-s2.0-85171501529&doi=10 .1007/978-981-99-1071-7_5&partnerID=40&md5=4c64f5fde4ab5c63f8d463bb057785b0

- Rosyidiana, R. N., Ervianty, R. M., Firmandani, W., Linduwati, M., & Margaretha, C. C. (2023). Digitalization of MSMEs: Implementation of product detail pages and digital financial management on MSMEs in Bojonegoro. Jurnal Layanan Masyarakat (Journal of Public Services), 7(1), 1–12. https://doi.org/10.20473/jlm.v7i1.2023.1-12

- Rosyidiana, R. N., Ervianty, R. M., Nurul, M., Linduwati, P. M., Arda Rini, I. N., & Rahmawati, L. A. (2022). Digitalization in financial reporting and marketing on micro, small and medium enterprises as a strategy for economic recovery in the pandemic period. Darmabakti Cendekia: Journal of Community Service and Engagements, 4(1), 16–22. https://doi.org/10.20473/dc.V4.I1.2022.16-22

- Sari, Y. W., Nugroho, M., & Rahmiyati, N. (2023). The effect of financial knowledge, financial behavior and digital financial capabilities on financial inclusion, financial concern and performance in MSMEs in East Java. Uncertain Supply Chain Management, 11(4), 1745–1758. https://doi.org/10.5267/j.uscm.2023.6.016

- Soetjipto, B. E., Handayati, P., Hanurawan, F., Meldona, Rochayatun, S., & Bidin, R. (2023). Enhancing MSMEs performance through innovation: Evidence from East Java, Indonesia. Journal for ReAttach Therapy and Developmental Diversities, 6(3s), 124–145. https://www.scopus.com/inward/record.uri?eid=2-s2.0-85159906711&partnerID=40&md5=b0096d02e66a769c93d20f96c3813090

- Tajudeen, F. P., Nadarajah, D., Jaafar, N. I., & Sulaiman, A. (2022). The impact of digitalisation vision and information technology on organisations’ innovation. European Journal of Innovation Management, 25(2), 607–629. https://doi.org/10.1108/EJIM-10-2020-0423

- Tiara, T., Purnomo, A., & Salim, G. (2023). Blockchain utilization in actions to empower digitalization of accounting information systems for small and medium-sized entities in Indonesia. Journal of Theoretical and Applied Information Technology, 101(17), 7033–7044. https://www.scopus.com/inward/record.uri?eid=2-s2.0-85174919181&partnerID=40&md5=5b75e9eb211bd42918216f8395b89c02

- Utaminingsih, A., Yuni Widowati, S., & Witjaksono, E. H. (2024). Sustainable business model innovation: External and internal factors on SMEs. International Journal of Innovation Science, 16(1), 95–113. https://doi.org/10.1108/IJIS-04-2022-0061

- Vo Thai, H.-C., Hue, T. H. H., Tran, M.-L., & Vo, X. V. (2023). A strategy tripod perspective on digitalization for sustainable development: A case of micro, small, and medium-sized enterprises in Vietnam. Journal of Small Business & Entrepreneurship, 35, 1–30. https://doi.org/10.1080/08276331.2023.2253682

- Wahyono, & Hutahayan, B. 2021. The relationships between market orientation, learning orientation, financial literacy, on the knowledge competence, innovation, and performance of small and medium textile industries in Java and Bali. Asia Pacific Management Review, 26(1), 39–46. https://doi.org/10.1016/j.apmrv.2020.07.001

- Wedari, L. K., Moradi-Motlagh, A., & Jubb, C. (2022). The moderating effect of innovation on the relationship between environmental and financial performance: Evidence from high emitters in Australia. Business Strategy and the Environment. https://www.scopus.com/inward/record.uri?eid=2-s2.0-85131842264&doi=10 .1002/bse.3167&partnerID=40&md5=44c50597cf2758500ee2326332916b97

- Yang, M., Gabrielsson, P., & Andersson, S. (2023). Entrepreneurs’ social ties and international digital entrepreneurial marketing in small and medium-sized enterprise internationalization. Journal of International Marketing, 31(4), 1–22. https://doi.org/10.1177/1069031X231178220

- Zhou, X., Sawada, Y., Shum, M., & Tan, E. S. (2024). COVID-19 containment policies, digitalization and sustainable development goals: Evidence from Alibaba’s administrative data. Humanities and Social Sciences Communications, 11(1), 1-16. https://doi.org/10.1057/s41599-023-02547-4