Abstract

Companies often favor debt financing over equity financing due to its tax benefits, allowing multinational companies to exploit internal debt to transfer profits to jurisdictions with lower tax rates. Although the BEPS Action Plan provides governments with guidelines to curb interest deductions and combat profit shifting linked to financing arrangements, its implementation varies across nations. Moreover, multinational corporations leverage internal debt for tax planning and profit-shifting purposes. This research conducts a Systematic Literature Review on the tax treatment of financial transactions, focusing on debt. Through an examination of papers available on the OECD website, particularly those analyzing thin capitalization rules and transfer pricing practices worldwide, we collected 43 empirical publications from three journal system publishers: ScienceDirect, SpringerLink, and Proquest. The study scrutinizes tax planning tactics adopted by multinational firms, particularly profit shifting, debt manipulation, and transfer pricing, to reduce tax liabilities and boost profits. It investigates the effects of thin capitalization regulations, highlighting discrepancies between countries. Although these practices comply with legal frameworks, tax authorities often perceive them as ethically questionable, prompting countermeasures. Tax regulations profoundly influence the strategic distribution of multinational corporations’ profits. Relaxed enforcement leads to heightened income shifting, particularly within privately owned multinational corporations (MNCs), necessitating legislative adjustments to promote fairer financing practices. Group ratios and anti-avoidance regulations are implemented to mitigate profit shifting, affecting tax revenue, investment dynamics, and economic stability.

1. Introduction

The company’s capital structure is derived from both equity and debt financing. The capital structure refers to the combination of long-term financing methods employed by the company. Companies exhibit a preference for debt financing over equity financing (Desai & Dharmapala, Citation2015). Multinational corporations can employ internal debt to divert profits from countries with high tax rates. Two approaches can be employed to accomplish this objective: tactically assessing the amount of domestic debt and establishing interest rates (Gresik et al., Citation2017). The decisions regarding a company’s capital structure are typically greatly influenced by tax considerations (Faccio & Xu, Citation2015). The interplay between capital structure and taxes can impact the cost of capital, cash flow, and the overall financial performance of a company. enterprises situated in nations with low effective tax rates exhibit less leverage compared to enterprises operating in nations with high effective tax rates (Faulkender & Smith, Citation2016).

The company’s desire to reduce tax liabilities, thereby increasing after-tax income for corporate taxpayers, influences companies to increase their debt financing because interest expenses reduce information asymmetry and reduce the level of tax burden (Sani et al., Citation2024). When a firm grants a loan, it will incur interest payments. Interest payments can be deducted as an expense based on corporate income tax. As the deductible interest expenditure increases, the taxable income or the company’s profit decreases. Concurrently, financing through shares will produce dividends that are liable to be taxed as income. Consequently, corporations have a preference for utilizing debt financing options over stocks.

Leverage, in financial terms, refers to the utilization of borrowed cash (debt) to finance a company’s operations or investments. A low leverage ratio signifies that the company possesses a comparatively small amount of debt in relation to its equity or assets (Hussan, Citation2016). The company exhibits less reliance on borrowed capital, resulting in a diminished debt burden and lower leverage. Consequently, the organization exhibits greater financial stability and adaptability. Reducing leverage can lead to decreased interest expenses and financial vulnerability as the company has a smaller amount of debt to repay. Companies have a preference for other funding methods rather than loans, such as raising share capital or selling fixed assets or inventories.

Multinational companies has the ability to secure funding through debt within the framework of the international tax system. The system also enables Multinational companies to transfer their profits to jurisdictions with lower tax rates in foreign countries. The OECD has established an all-encompassing system of guidelines and suggestions aimed at tackling the use of aggressive tax planning tactics employed by MNC (Ouelhadj & Bouchetara, Citation2021). The term used to refer to this framework is the BEPS Project. The objective of the BEPS Project is to mitigate tax evasion by multinational corporations by the rectification of existing loopholes in international tax legislation (Kobetsky, Citation2020). The OECD released the Action Plan on Base Erosion and Profit Shifting (BEPS) in 2013. It has exerted a substantial influence on global tax policies, shaping tax systems worldwide. Several nations have implemented or adjusted their national legislation to conform with OECD guidelines, enhancing openness and collaboration among tax authorities in order to address profit shifting and guarantee equitable taxes (Crivelli et al., Citation2016). The implementation and execution of these measures may differ across different countries. Continued endeavors are being made to tackle obstacles and evaluate the efficacy of the BEPS Action Plan in mitigating profit-shifting tactics.

The Action Plan on BEPS has 15 action items that tackle different facets of international tax planning and profit transfer. The key action points pertaining to profit transfer are Action 2, Action 3, Action 4, and Actions 7 to 10. According to BEPS Action 4, it is recommended to create regulations that would prevent the reduction of taxable income through interest payments and the avoidance of taxation from both foreign and domestic perspectives (Cencerrado et al., Citation2015). Effective execution of Action 4 necessitates the synchronization and collaboration among nations to guarantee uniform implementation and avoid transfers of the tax foundation across different jurisdictions.

The BEPS Action Plan provides guidelines for governments to establish legislation that effectively restrict interest deductions and reduce the chances of profit shifting related to financing arrangements. It is important to acknowledge that the implementation of Action 4 and other BEPS Actions might differ across nations, with specific rules and practices varying based on individual jurisdictions. Each nation is accountable for adopting and executing measures that align with the OECD BEPS principles, while considering the specific legislative and administrative structure of their own country.

The correlation between debt and taxes is a complex and multifaceted financial issue. Multiple studies have examined this correlation and offered valuable insights into the impact of taxes on corporate decisions about debt financing. Multinational company have the ability to utilize internal debt as a means to shift their profits away from jurisdictions with high tax rates (Gresik et al., Citation2017). By creating numerous operational and non-operational businesses, holdings, and sub-holdings in different jurisdictions, including tax havens, MNCs can also participate in tax optimization schemes. Due to the complexity of their structures, multinational company can capitalize on differences in national taxation policies and rates (Merle et al., Citation2019). They may choose to assign debt to jurisdictions with high tax rates due to the fact that loan interest can be deducted (Goldbach et al., Citation2021). This enables them to reduce their taxable revenue in regions with high tax rates while transferring profits to regions with lower tax rates. This possibility stimulated the emergence of a shift in earnings by leveraging lending programs. Internal debt is utilized by MNCs as a strategy for tax planning and profit shifting. This involves the provision of loans from firms situated in low-tax jurisdictions to subsidiaries in high-tax jurisdictions (Buettner et al., Citation2016). The allocation of income and expenses within multinational corporations, often aims to reduce taxable income, leading to base erosion and profit shifting (Sebele-Mpofu et al., Citation2021).

Research on how the tax code treats financial transactions like debt has surfaced recently. As technology advances, global corporations employ many ways to reroute their potential tax liabilities. Prior studies have looked at how multinational corporations manage their capital structure. Prior studies have only looked at aggressive tax planning techniques. Aside from that, no prior study has examined how the BEPS Action Plan is being implemented, mainly how interest is limited and what laws are in effect in each nation. SLR was not used in earlier studies either. The Systematic Literature Review (SLR) methodology is used in this study as part of a review research approach. This study tries to synthesize and evaluate the evolution of techniques used by multinational corporations using SLR. This study attempts to compile, using the BEPS Action Plan 4 recommendations from the OECD, the strategies or policies employed to reduce tax base erosion using debt schemes.

This research investigates multinational corporations’ (MNCs’) tax planning practices, focusing on profit shifting, debt manipulation, and transfer pricing to minimize tax liabilities and increase profits. This research also aims to analyze the impact of implementing regulations regarding thin capitalization, including safe harbor rules (SHR) and earnings stripping rules (ESR), as well as how these regulations vary in various countries.

2. Research methodology

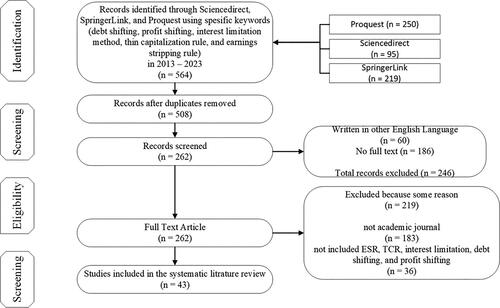

This study utilizes a qualitative research methodology. The research selection technique was described in compliance with the recommended reporting items in Systematic Reviews and Meta-Analyses (PRISMA) standards (Moher et al., Citation2010). The articles were carefully chosen and finalized. To extract the relevant data from the chosen publications, a number of technologies were used. The data needed for this research was collected using manual extraction methods, Microsoft Excel, and content analysis. shows each step carried out based on the PRISMA standard. is an exhaustive compilation of the journals employed in the conducted research.

Figure 1. Flow of Information through the different phases of systematic review.

Source: Researcher, 2023.

Table 1. The list of journal.

This research adopts research methodology (Lu et al., Citation2022). The SLR subject is defined as the tax treatment of financial transactions, particularly debt, by reading articles on the OECD website that discuss the most commonly referenced thin capitalization laws and transfer pricing profiles of nations worldwide. We obtained specific papers from three publishers of journal platforms – ScienceDirect, SpringerLink, and Proquest. Journal publisher platforms frequently offer direct access to journals and their published papers, ensuring superior content quality and greater relevance to a specific subject. Journal databases, on the other hand, compile information from several publications, which can be advantageous for conducting comprehensive searches but may require more precise criteria. (Koley et al., Citation2022; Laakso et al., Citation2011).

We gather data using a set of keyword strings. The initial search utilized the following keywords: ‘debt shifting’, ‘profit shifting’, ‘interest limitation method’, ‘thin capitalization rules’, and ‘earnings stripping rules’. These keywords were compared to the most commonly used ones in TCR-related articles and the three publishers’ platforms. In addition, these keyword strings were searched along with their synonyms and singular and plural versions to prevent prejudice.

Articles were included based on selection criteria. A total of 564 articles were published with the specified keywords on three platforms between 2013 and 2023, according to the initial search. After manually eliminating papers that were not available, duplicates, and articles with missing information, a total of 508 studies were left in the relevant fields. In addition, we employed many inclusion criteria based on the guidelines provided by Alhossini et al. (Citation2021) to evaluate the article’s quality. Every journal article is composed in English and contains the complete text—262 items completed this process.

Examine titles, abstracts, and keywords manually to generate more comprehensive word frequency lists that exclude articles that contain inaccurate keywords. Subsequently, the article undergoes a thorough evaluation, considering the title, keywords, and abstract, to determine its relevance to the study theme. The featured articles solely focus on debt shifting, profit shifting, and the limitations of interest deduction schemes. For example, we will remove the article about earnings management that does not directly address aggressive tax avoidance from the list. Furthermore, we excluded any research that did not meet the criteria of a scientific paper from the list. The ultimate compilation comprised 43 empirical publications.

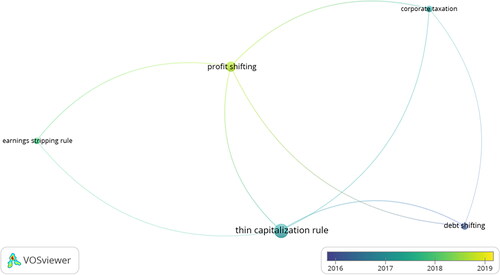

shows data visualization using VOSviewer with the analysis type "co-occurrence: and the unit of analysis ‘keyword’.

Figure 2. Network visualization keyword co-occurrence in thin capitalization.

Source: extraction from VOSviewer, 2024.

Research on debt shifting and thin capitalization rules has been conducted since 2013. As seen in the visualization results above, the color of the keyword’s thin capitalization rule and debt shifting is darker than the other keywords. Previous research linking thin capitalization rules with different topics, such as earnings stripping rules, profit shifting, and corporate taxation, emerged in 2017–2018. This topic still needs to be discussed in academic research in Indonesia, especially profit shifting, which began to be widely researched in 2018–2019. It can be caused by many multinational companies trying to shift profit due to various gaps in tax regulations in each country.

3. Analysis and discussion

The topics of debt and profit erosion have been the focus of both quantitative and qualitative research. Identifying effective strategies to halt this transition remains a tough task in research. The OECD has additionally presented recommendations for the BEPS Action Plan. This section provides a concise overview of several previous studies conducted between 2013 and 2023 that examined the strategies employed by multinational corporations to manipulate their debt and profits. Moreover, the presence of a BEPS action plan will unquestionably impact a country’s approach to mitigating debt and preventing the manipulation of profits in the realm of global taxation. We will endeavor to organize everything in accordance with the pertinent empirical methodology.

The aggressive tax planning strategies of multinational corporations

Debt and equity get disparate treatment in the context of corporate income tax. In most countries, interest is subject to taxation or can be deducted from taxes. Contrarily, dividends are disbursed from earnings that have already been subjected to taxation and do not reduce the taxable income of a company. Multinational corporations commonly utilize strategic tax planning strategies that take advantage of the tax implications of interest expenses. Companies endeavor to delay payments for various reasons. Multinational corporations have the ability to distribute their profits among the several countries where their subsidiaries are based through the utilization of transfer pricing, external and/or intra-company debt, and other strategic methods. Corporate tax avoidance encompasses several tactics employed by multinational corporations such as profit or debt manipulation to achieve a tax rate that is lower than the officially mandated tax rate (Kundelis et al., Citation2022).

In Indonesia, aggressive tax planning refers to the deliberate actions taken by corporations or individuals to minimize their tax obligations legally. However, tax authorities typically view this activity as unethical despite its legality. One of the primary tactics employed in this practice is known as transfer pricing, which involves firms manipulating the prices at which they sell goods or services amongst their subsidiary companies in order to shift profits to jurisdictions with lower tax rates. In addition, firms can exploit tax incentives or loopholes provided by Indonesian tax legislation, such as tax discounts for specific investments. Additional strategies include the utilization of intricate business formations, incorporating entities located abroad or in regions with reduced tax rates, and using debt to create interest that can be subtracted from taxable revenue.

Profit shifting refers to the act of moving profits to a different jurisdiction with the aim of minimizing tax liabilities (Dowd et al., Citation2017). To minimize their tax obligations and enhance their earnings, multinational corporations can exploit profit-shifting strategies (Buettner et al., Citation2016; Schindler & Schjelderup, Citation2016). Even with a consistent interest rate, multinational corporations have the opportunity to decrease their tax obligations by shifting debt to affiliates in countries with higher tax rates. Countries with high tax rates benefit from reduced interest rates, leading to tax savings that exceed the tax liabilities of the parent company. This incentive suggests that affiliates in countries with high tax rates are required to maintain higher levels of debt in relation to their assets and claim disproportionate deductions for interest expenses, as compared to affiliates in other countries (Schjelderup, Citation2016).

Multinational corporations employ debt shifting as a strategy for tax planning, whereby they transfer debt or financing arrangements across linked enterprises situated in different countries (Dallari et al., Citation2020). Shifting operations occur not solely from the main firm to the subsidiary. The tax-related corporate acts can be classified into four categories: income shifting, overseas relocations of headquarters, internalization of operational activities, and tax evasion (Eerola & Slangen, Citation2022). Shifts can also transpire in the opposite direction, whereby they move from subsidiaries to parent businesses. When the parent business is located in a country with a lower tax rate, the profits will be moved to the parent firm (Dischinger et al., Citation2014). Multinational corporations that operate in multiple jurisdictions have the ability to establish debt arrangements or intercompany loans among their subsidiaries. These loans can be structured to reduce taxable income in jurisdictions with low tax rates and increase interest deductions in areas with high tax rates (Goldbach et al., Citation2021).

Most countries commonly provide tax deductions for debt interest (Schjelderup, Citation2016). Businesses are inclined to choose debt financing over equity due to the tax advantages associated with debt interest. The term ‘debt bias’ is used to describe this organizational practice. This bias could potentially affect the financial framework of a company, leading to a rise in indebtedness (Dallari et al., Citation2020). Companies can minimize their taxable income and tax liabilities in jurisdictions with high tax rates by optimizing interest expense deductions through the expansion of intra-group debt or the reorganization of current debt. While both concepts relate to the utilization of debt in a company’s financial framework, debt bias and debt shifting are fundamentally different notions.

Multinational corporations may alter their organizational structure in response to tax-driven strategies aimed at shifting income. Multinational corporations have the autonomy to choose from many organizational frameworks for their overseas subsidiaries, including options like subsidiaries or flow-through organizations. These organizational forms have diverse tax implications. Subsidiaries are obligated to pay corporate income tax due to their separate legal status as different corporations. Multinational corporations can reduce their total tax liability by channeling their earnings to subsidiaries located in jurisdictions with lower tax rates. The organizational structure employed by the MNC can potentially affect the distribution of wealth. A multinational corporation may incur higher tax liabilities if it opts for subsidiaries located in countries with elevated tax rates. Alternatively, the multinational corporation can reduce its tax obligations by shifting income to flow-through entities situated in jurisdictions with lower tax rates. The selection of organizational structure by multinational corporations can lead to a redistribution of income, since it allows them to allocate profits to entities situated in many jurisdictions with lower tax rates, hence reducing their overall tax liability (Amberger & Kohlhase, Citation2023).

A parent firm domiciled in a jurisdiction with high tax rates establishes a subsidiary known as a controlled foreign company in a different country that offers a lower tax rate. The subsidiary firm is subject to the control of its shareholders. If dividends are allocated to shareholders, specifically the parent business in this instance, the subsidiary company’s revenue may be subject to taxation. If the parent company decides to delay the distribution of income (dividends), the dividends will not be taxed in the country where the subsidiary is located. CFCs can serve as a substitute for multinational corporations to transfer their profits or revenue. Multiple subsidiary firms possess the capability to exclude interest payments on internal debt from their taxable income. Multinational corporations possess the capacity to shift their earnings away from the host country by employing tax havens to create domestic debt. They have authority over the amount of debt they issue, and the interest rates they charge (Gresik et al., Citation2017).

Conduit entities or special purpose vehicles are alternative organizational forms employed by multinational corporations, in addition to CFCs. Conduit entities have a substantial impact on the practice of debt shifting. These are subordinate companies that function as middlemen, transferring debt from one affiliate to another inside a global corporation. This enables the transfer of profits from areas with high tax rates to areas with low tax rates, without increasing the overall debt of the group. Conduit entities have the ability to fulfill several functions, including the coordination of capital distribution, the consolidation of debt from various subsidiaries, and the obfuscation of the source of internal loans. Conduit businesses enable multinationals to enhance the opacity of their tax avoidance strategies and decrease the probability of thorough scrutiny by tax authorities. Conversely, the utilization of conduit entities might complicate the determination of how internal debt fluctuates in relation to tax rates, as it artificially inflates the levels of internal debt in these businesses (Reiter et al., Citation2021).

Multinational corporations engage in the practice of transfer pricing to manipulate their earnings. Transfer pricing entails the process of establishing the price at which items, services, or intellectual property are exchanged between two distinct organizations within a multinational corporation. Companies engage in pricing manipulation of goods and services traded between their subsidiaries in different countries or by utilizing tax havens and other tax planning strategies (Fossen et al., Citation2016). Under-invoicing is a method employed by firms to manipulate their international commodity trading transactions. Under-invoicing, also known as transfer mispricing, refers to the intentional act of undervaluing an export invoice in order to evade taxes or decrease reported earnings (Qureshi & Mahmood, Citation2016). By employing this strategy, firms can effectively conceal a portion of their global earnings from domestic tax authorities while retaining the money in jurisdictions with favorable tax rates (Thanasegaran & Shanmugam, Citation2007).

Companies can manipulate export invoices by deliberately undervaluing them, resulting in substantial disparities between the actual market prices and the stated values. This discrepancy can be leveraged to shift profits to countries with lower tax rates, hence reducing the tax liability in the country of origin. Under-invoicing, in this particular context, refers to a method employed to redirect earnings or money away from developing nations. The phenomenon might lead to the depletion of the tax revenue in the nation of origin and diminish the funds that the government should collect for the purpose of development and provision of public services (Ahene-Codjoe et al., Citation2022).

It is interesting to ponder whether alternative methods of reducing taxes are comparable, as changes in laws and regulations often focus on one part of tax avoidance while leaving other aspects unchanged. When evaluating the effects of policy modifications, it is imperative to consider a company’s growing adoption of different tax evasion tactics in response to such modifications. Companies should consider profit shifting through debt as a viable alternative to profit shifting through manipulation of transfer pricing. Further investigation utilizing more accurate data is necessary (Saunders-scott, Citation2015). Hence, multinational companies have the ability to modify their approach of transferring earnings from transfer pricing to internal debt or loans within the company. Modifications can be predicated upon tax enforcement. As taxation on multinational companies profits becomes more stringent, multinational companies are more inclined to employ various strategies to shift profits in order to maximize their profitability.

Although specific tax planning tactics may be legally acceptable, tax authorities frequently strengthen restrictions and intensify enforcement efforts to combat such practices. The government is increasingly emphasizing international collaboration to exchange tax information to combat tax avoidance schemes employed by multinational corporations. Although it is expected to engage in thorough and lawful tax planning, aggressive tax planning that takes advantage of loopholes in tax legislation can decrease state tax revenues and disrupt the financial equilibrium of the state. Hence, tax authorities must further enhance tax legislation and international collaboration to combat aggressive tax planning techniques.

Interest limitation methods

Enforcing tax legislation is crucial in shaping the behavior of MNCs when it comes to moving their income. When tax enforcement is not strict, MNCs are more likely to move their earnings from countries with high tax rates. The results of an extensive investigation carried out on over 8,000 subsidiaries, primarily owned by 959 European MNCs from 1998 to 2009, offer supporting evidence for this assertion. The study found that when local tax enforcement is ineffective, a considerable amount of cash is redirected from countries with high tax rates. In addition, private MNCs take advantage of lax tax compliance to a greater extent than public MNCs in order to redirect money away from their country of origin. Moreover, corporations originating from countries with less stringent tax laws are more inclined to exhibit higher levels of tax assertiveness and tax avoidance. This implies that MNC prioritize using tax advantages in jurisdictions with comparatively lax tax legislation. Tax enforcement has a substantial impact on the revenue shifting decisions made by MNCs. When MNCs are less influenced by expenses other than taxes, such as privately owned MNCs, they are more likely to engage in aggressive revenue shifting (Beuselinck et al., Citation2015).

The discrepancy in the treatment of debt and equity for determining the corporate income tax base is anticipated to lead to a tax advantage for debt, which is dependent on the statutory tax rate. The leverage ratio exhibits a positive correlation with the corporate income tax rate, as the latter directly impacts the extent of the tax benefit derived from borrowing funds. A higher statutory tax rate boosts the incentive to use debt financing, as the corporate income tax (CIT) can deduct interest payments from its taxable revenue. Therefore, policymakers should thoroughly assess the structure of the tax base and the handling of debt and equity to minimize any discrepancies in treatment while developing tax changes (Hemmelgarn et al., Citation2014).

The disparity in the handling of profits and interest could potentially act as a motivation to employ debt. In response to the problem of over reliance on debt financing, several governments have lately enacted new laws that impose limitations on the deductibility of interest expenses. Prior restrictions exclusively limited the allowance of interest deduction on debt between associated organizations. Nevertheless, there is a growing tendency to expand this restriction to include all payments of interest, including those made at market rates. This trend is seen in nations such as Australia, Belgium, Denmark, Germany, and Italy.

In addition, the recently imposed limitations apply to not just companies, but also partnerships and sole proprietorships, including those that are operating in Australia, France, and Germany. Various nations have distinct methodologies to assess excessive debt. Typically, two primary methods are employed: the majority of thin capitalization regulations restrict the allowance of interest costs when the debt exceeds a predetermined leverage ratio. The earnings-stripping rules necessitate the use of an interest coverage ratio in place of the leverage ratio. Under these circumstances, the deduction for interest expenditure is limited to a specific proportion of the earnings prior to accounting for interest, taxes, depreciation, and amortization (EBITDA). (Blaufus et al., Citation2015).

There is currently no research that specifically examines the relationship between conservative debt policies and the government’s ability to handle changes in debt levels. The main advantage of debt financing lies in the capacity to exclude the interest payments from taxes. However, the government possesses the capacity to influence alterations in debt by enacting fiscal policies and regulations. For example, the government can impose significant taxes on firm debt to encourage the use of its own capital or stock for financing purposes. Furthermore, the government have the power to impose limitations or standards regarding corporate debt with the purpose of controlling systemic risk and protecting the well-being of the overall population (Clemente-Almendros & Sogorb-Mira, Citation2018).

It is crucial for tax policy to take into account its influence on the level of debt incurred by firms. Studies have demonstrated that limitations on interest deductions affect the level of leverage (Blouin et al., Citation2014; Hebous & De Mooij, Citation2018). The current tax policies in many countries encourage corporations to take on more debt, which goes against other regulatory efforts aimed at strengthening company resilience by encouraging the improvement of balance sheets and lowering leverage. To address this inconsistency, previous studies have proposed investigating legislative options such as setting limitations on the deductibility of interest or introducing similar deductions for equity (Zwan et al., Citation2018). Several countries have enacted thin capitalization laws to restrict the deductibility of interest expenses; nonetheless, these limitations have only partially alleviated the inclination towards debt. They argue that achieving a state of neutrality between debt and equity financing could enhance economic efficiency, lead to less dependence on debt financing, and enhance the ability of firms to withstand shocks and cyclical downturns. Essentially, they suggest that imposing limitations on the deductibility of interest could be an effective policy strategy to address the problem of debt bias and encourage enterprises to decrease their reliance on debt financing. They propose that one method to reduce the amount of debt that businesses are encouraged to accrue as a result of current tax systems would be to enact tax regulations that limit the deductibility of interest expenses (Dallari et al., Citation2020).

According to the arm’s-length principle, the tax deductibility of internal debt may be denied if the internal financing could not have been accomplished using external debt in the same situation. The arm’s length principle has limited efficacy and presents difficulties in addressing the issue of debt shifting. Various evaluations consistently confirm the efficacy of CFC regulations in discouraging the movement of profits to regions with lower tax rates. Tightening rules on CFCs may curtail the practice of profit-shifting (Schenkelberg, Citation2020). The CFC laws violate the concept of tax exemption by requiring the instant inclusion of ‘passive income’ earned in low-tax subsidiaries (such as interest income from loans to related firms) in the taxable income of the main offices of domestic multinational corporations. The latter correspond to tax competition. However, current restrictions on the use of Controlled Foreign Companies do not successfully prevent the occurrence of high debt-to-equity ratios in local branches of multinational companies. As a result, this condition negatively impacts the competitive advantage of domestic multinational corporations in comparison to their competitors (Ruf & Schindler, Citation2015).

Thin capitalization regulations, sometimes known as such, already place restrictions on the tax planning efforts of multinational corporations in several nations. The regulations explicitly forbid the deduction of interest on internal debt, specifically referring to loans acquired from affiliated corporate entities. Once the debt-to-equity ratio above a particular limit, domestic debt becomes the predominant method of shifting profits to jurisdictions with lower tax rates. The implementation of thin-capitalization requirements effectively eradicates the incentive for tax planning by means of internal debt utilization. The data suggest that the use of internal loan finance for tax planning purposes is not widespread. However, there might be more substantial opportunities for leveraging internal debt. Moreover, this raises questions about Thin Capitalization Rule (such as investment and output), which have yet to be investigated in future research (Buettner et al., Citation2016).

Thin capitalization rules are regulated by Article 18 of the Indonesian Income Tax Law (UU Pajak Penghasilan). The purpose of these rules is to mitigate the occurrence of excessive interest deductions on debts owing to foreign-linked parties and to tackle the potential practice of profit shifting and tax avoidance. The debt-to-equity ratio (DER), often called the Thin Capitalization Rule, was initially established in 1984 by Indonesia. This regulation set a strict limit on the maximum debt-to-equity ratio at 3:1. The regulation was suspended shortly after its passage (Mukarromah, Citation2019). In 2015, Indonesia’s Minister of Finance released Minister of Finance Regulation No 169/PMK.010/2015 to provide guidelines for assessing corporate debt to capital ratio for income tax purposes.

The application of the interest deduction limiting method can impact the organizational structure of the company. One approach to restrict the deductibility of interest is to pass a law that takes effect when a company’s debt exceeds a predetermined maximum. Furthermore, there are special restrictions on the deductibility of interest expenses when they exceed a specified fraction of the company’s income (Blaufus et al., Citation2015). The loan, granted by an affiliated overseas entity located in a jurisdiction with favorable tax regulations, involves the payment of interest. Several nations have enforced thin-capitalization regulations to limit the deduction of interest expenses from the corporate tax base. The host country possesses the capacity to modify the effective tax rate for multinational corporations without altering its official tax rate by varying the stringency of its regulations. Thin capitalization requirements allow governments to counterbalance the advantages of foreign direct investment (FDI) by taking into account the costs arising from profit manipulation (Haufler et al., Citation2018).

Nevertheless, the host country’s government must thoroughly evaluate the benefits of increased investment from financially constrained corporations in contrast to the potential rise in profit manipulation from financially unconstrained companies. The government used a two-stage approach to ascertain the most optimal thin capitalization regulation. At the outset, the government chooses a particular type of thin capitalization law, such as a fixed debt-to-equity rule, a safe harbor provision, or an earnings-stripping rule. Next, they evaluate the strictness of the thin capitalization regulation. Implementing an earnings-stripping rule regularly results in a higher level of welfare compared to using a SHR or a mix of both. The reduced welfare is a consequence of the implementation of a more stringent TCR (Haufler & Runkel, Citation2012).

Most countries have implemented the TCR to limit the amount of interest deductions that surpass a certain level of debt. The TCR assesses the suitable measure of debt in respect to several factors such as total assets, total equity, internal equity from a single connected party, total internal equity, total internal foreign equity, or total foreign equity (Blouin et al., Citation2014). Several countries adopt the safe harbor concept to limit the deduction of interest charges. Several countries, including Japan, Iceland, Germany, Malaysia, Norway, and the Netherlands, have implemented earnings-stripping rules. However, specific countries such as Denmark and the United States combine both requirements (Gresik et al., Citation2017).

The deduction of interest costs in Norway was first capped at 30% of EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortisation) but revised to a lower maximum of 25%. The limitations imposed by Norway pertain exclusively to interest derived from domestic debt, as opposed to foreign debt. The implementation of Finland’s new rule occurred in 2014, following its initial proposal in 2012, without the prior TCR. The limits imposed in Finland mirrored that of Norway, which restricted the Earnings Before Interest, Taxes, Depreciation, and Amortisation (EBITDA) to 25%. Similar to the case of Norway, any amount over the specified maximum will not be eligible for deduction when determining the expenses for corporation taxation. The German government introduced a new set of thin capitalization standards. In 2008, Germany transitioned from the previous safe harbor law to the European Social Report (ESR).

Germany is widely recognized for effectively implementing the earning stripping regulation, making it an exemplary model for this policy. Germany’s income tax law allows for deducting net interest expenses of up to 30% of a company’s EBITDA. The computation commences by determining the interest expense and interest revenue. Interest expenses equal to or less than interest income are fully deductible, while any excess amount must undergo further evaluation. Interest expense consists of payments for loan interest, accumulated interest, discounts on receivables, and carried forward interest charges. Interest revenue consists of interest earned from loans, discounts on debts, and accruing interest on capital assets. Suppose the interest payments are below 3 million Euros. In that case, the firm is not affiliated with any other companies, or the firm is affiliated with a controlled group. However, the interest payments can be fully deducted if its equity ratio is up to two percentage points lower than the group’s equity ratio. Germany’s earnings-stripping legislation includes a provision that allows non-deductible interest to be carried over for a maximum of five fiscal years.

Before the implementation of the 2019 tax reform, the earnings stripping rules (ESR) imposed restrictions on the ability to deduct net interest expenses that were more than 50% of the adjusted taxable income (TAX-EBITDA) of Japanese companies. By the 2019 tax revision, the previously established threshold of 50% has been decreased to 20%. The ESR prohibits the deduction of net interest expenses. These expenses, however, can be carried over and subtracted from taxable income for the next seven years, with a maximum deduction of 20% of TAX-EBITDA. It is essential to highlight that after 60 months, the deduction ceiling may rise as the goodwill has been completely amortized.

Malaysia embraced ESR early, following the lead of the United Nations, the United Kingdom, Japan, and member nations of the European Union. On January 1, 2019, a new provision called section 140C, ‘Restriction on deductibility of interest’, was incorporated into the Income Tax Act 1967. If a company’s interest expense surpasses 20% of its Tax-EBITDA, the surplus can be carried forward and subtracted from its adjusted income in future assessment years. The maximum amount of interest that can be deducted in a specific tax year is limited to 20% of taxable earnings before interest, taxes, depreciation, and amortization (EBITDA). Although there may not be any interest expenses in the upcoming year, a company can utilize the remaining interest expenses from previous years until the total surplus amount is exhausted.

As of January 2022, the Indonesian government has not included any particular provisions regarding earnings-stripping procedures or safe harbors in its tax legislation. Nevertheless, it is plausible that the government has contemplated or strategized implementing such regulations to tackle aggressive tax planning strategies. The GR 55/2022 implements earnings stripping rules (ESR) to restrict interest deductions. The objective is to curb tax evasion by restricting the extent to which interest deduction can be claimed based on a specific proportion of borrowing expenses relative to EBITDA. The ESR enhances the previously utilized technique, which relied on the debt-to-equity ratio (DER) as specified in MoF Regulation No. 169/PMK.010/2015. Currently, the DER ratio is established at 4:1. If the debt-to-equity ratio exceeds this threshold, the interest accrued on the debt or loan cannot be accounted for as an expenditure.

Further specifications on the utilization of the ESR will be outlined in the MoF regulation. Indonesia’s adoption of ESR can be interpreted as implementing the recommendation made under BEPS Action 4. According to the OECD, the ESR value limit can be established within the 10 to 30% range. They promote the establishment of a specific percentage, ranging from 10% to 30%, as a baseline for individual countries. Each country is given the autonomy to establish the benchmark fixed ratio at a level they consider beneficial in reducing base erosion and profit shifting. This approach utilizes a ratio-based mechanism to ascertain the allowable deduction of interest expenses from the total income. It is worth mentioning that industrialized nations unanimously support the implementation of earning-stripping legislation.

Earnings stripping regulations are commonly implemented to restrict tax deductions related to interest payments in transactions between linked corporations. Safe harbor laws offer legal assurance to corporations in managing their capital structure by offering explicit guidance on acceptable limitations in their financial arrangements. Many countries have incorporated these regulations into their tax systems to enhance the system’s integrity and deter aggressive tax planning strategies. Thus, while Indonesia has no specific implementation, the government may contemplate adopting or creating legislation to enhance tax compliance and mitigate aggressive tax avoidance strategies.

Those that have well-developed financial systems usually implement strict TCR, while those with less established financial systems tend to have more lenient laws (Mardan, Citation2017). TCR are effective measures used to prevent tax base erosion and profit shifting by limiting the ability of multinational corporations to use debt financing to reduce their tax liabilities (Gresik et al., Citation2015; Mardan, Citation2017). Previous research has demonstrated that tax havens have a negative effect on the well-being of the countries that host them. The study specifically examined the impact of thin capitalization regulations on foreign direct investment (FDI) and the well-being of the host country. The study showed that interest constraints, commonly referred to as thin capitalization, adversely impact the foreign direct investment undertaken by multinational businesses (Buettner et al., Citation2018).

However, laws on thin capitalization might unintentionally result in negative consequences, such as restricting local enterprises’ ability to obtain external funding and discouraging countries that pursue foreign direct investment (FDI). This phenomenon can have a detrimental effect on the welfare of the host country, as it allows multinational businesses to shift their earnings to regions with lower tax rates and avoid fulfilling their tax responsibilities in the host nation (Gresik et al., Citation2015). The Debt-to-Equity Ratio (DER) is largely acknowledged as the prevailing thin capit alization regulation used worldwide. DER was the primary factor used by the majority of countries (49 out of 60) in 2016 to determine whether interest expenditures may be written off (Hebous & De Mooij, Citation2018). An example of such an area is the substantial degree of autonomy in choosing the interest rate that a company is obligated to pay on its loan.

Thin capitalization regulations exhibit diversity across countries, with rules falling into two primary categories: SHR and ESR. The SHR, an integral part of thin capitalization regulations, delineates an upper limit for a company’s debt financing concerning its equity. Maintaining a debt-to-equity ratio within the permissible threshold renders a company’s interest expense eligible for tax deduction. The primary objective of the SHR is to provide taxpayers with confidence and foresight, enabling them to structure their financial arrangements in a manner that complies with regulations and precludes potential disputes with tax authorities (OECD, 2012). Notably, some nations, like Belgium, lack explicit safe harbor laws but commonly adhere to an informal debt-to-equity ratio of 4:1 (Locher, Citation2021).

The safe harbor rule assumes a critical role in thin capitalization rules by establishing a transparent framework. This framework allows enterprises to organize their financing efficiently for tax purposes while simultaneously acting as a safeguard against excessive debt financing. Such excesses could lead to the erosion of the tax base and the shifting of profits (Asen, Citation2019). In essence, the safe harbor rule offers a balance between facilitating tax-efficient financial arrangements for businesses and preventing potential adverse effects on tax revenue and profit distribution.

The safe harbor regulations set limitations on the tax-deductible portion of internal debt in comparison to equity, while the profits stripping regulations govern the ratio of debt interest to pre-tax earnings. Notably, some countries exclusively adhere to one regulatory framework, while others have implemented measures that concurrently encompass both types of requirements, exemplified by Denmark, Czech Republic, Lithuania, Latvia, and Japan. Regardless of their categorization, thin capitalization laws unequivocally aim to curtail the illicit utilization of internal loans (Buettner et al., Citation2012; Goerdt & Eggert, Citation2022).

Earnings stripping regulations, often termed as interest deduction limitations, represent a legal avenue for tax minimization that exploits a loophole in tax legislation to reduce the tax liability owed to the government (Hussain, Citation2022). These regulations are designed to thwart profit-shifting and tax avoidance strategies commonly associated with excessive interest deductions. The primary goal of earnings stripping rules is to prevent companies from manipulating their financial structures by burdening their operations with excessive debt, thereby shifting profits to jurisdictions with lower tax rates or leveraging favorable tax deductions. By constraining the extent of interest deductions, these rules seek to promote fairness in taxation and mitigate tax base erosion.

Typically, ESR concentrate on interest payments made by a company to affiliated entities, particularly when those entities are located in jurisdictions with lower tax rates. The regulations are formulated to counter situations where a company artificially inflates its interest payments, intending to diminish taxable income in a higher-tax jurisdiction while transferring profits to a lower-tax jurisdiction. In essence, these rules aim to uphold the integrity of the tax system, ensuring that companies contribute equitably based on their actual economic activities rather than engaging in artificial financial maneuvers for tax advantage.

In the conclusive findings of BEPS Action 4, the OECD refrains from endorsing the utilization of the Debt-to-Equity Ratio (DER) as a TCR. Instead, the OECD puts forth an alternative recommendation, emphasizing the restriction of interest costs or the introduction of earning stripping/earnings threshold measures. The organization advocates for individual countries to establish a fixed ratio falling within the 10% to 30% range, serving as a benchmark. Each nation is granted the flexibility to set this benchmark fixed ratio at a level they deem effective in mitigating base erosion and profit shifting. This approach employs a ratio-based mechanism to determine the permissible deduction of interest expenses from the overall income. Interestingly, it is noteworthy that developed nations universally endorse the implementation of earning-stripping regulations.

How these regulations vary in various countries

Differences in tax rules, economic situations, and policy objectives lead to variances in interest-limiting approaches among countries. A practical method often used is the implementation of fixed ratio regulations, which establish a maximum percentage of interest in earnings (such as EBITDA). The purpose of this is to avoid excessive deductions of interest. Some countries employ group ratios to limit interest deductions, determined by the multinational company’s overall profitability. This approach promotes fairness and discourages the practice of shifting profits. Hybrid techniques integrate aspects of both fixed and group ratios to tackle unique tax difficulties effectively. Safe harbor laws provide clarity by establishing specific limits for permissible interest deductions, minimizing uncertainty for taxpayers. In addition, anti-avoidance laws are designed to address specific transactions that are susceptible to abuse, thus strengthening the tax system’s integrity. These approaches demonstrate how each country’s tax system and measures aim to protect against the loss of tax revenues and the shifting of profits.

Notably, stringent thin capitalization requirements exhibit a higher degree of efficacy compared to the OECD BEPS recommendations in preserving the tax revenue base of a jurisdiction. Transnational corporations exhibit limited concern about the adoption of either TCR or ESR, as both strategies impose similar constraints. This observation holds particularly true for multinational companies adopting a more proactive stance in fulfilling their tax obligations (Kayis-kumar, Citation2016).

Kalamov’s classification of TCR into SHR and ESR sheds light on a noteworthy dynamic. The unilateral substitution of SHR with ESR results in an undesirable externality characterized by profit shifting to another country, offering insights into the recent global trend transitioning from SHR to ESR. Interestingly, even in cases where SHR is considered socially optimal, ESR may emerge as a more advantageous strategy. This situation reflects a nuanced scenario akin to the classical prisoner’s dilemma, as observed in the policies governing ESR implementation (Kalamov, Citation2020).

ESR serve the purpose of curbing companies from leveraging debt to reduce their tax liabilities. The impact of these restrictions on company investments is discernible across seven European countries, displaying variability and inconsistency. The adverse effects on investment materialize when ESRs impose limitations on both overall debt and related-party debt. Importantly, the extent of this impact diverges among nations and across different categories of investment, encompassing both physical and non-physical assets (Leszczyłowska & Meier, Citation2021).

The diversity in the strictness of thin capitalization laws among different countries can perhaps be explained by disparities in financial development (Mardan, Citation2017). Particularly, nations with more sophisticated financial systems are prone to implementing stricter regulations in this matter. The tax deductibility restrictions on interest expenses effectively limit the use of internal loans. Studies have shown that when a more stringent thin capitalization condition is applied to U.S. foreign data affiliates, their debt-to-asset ratios decline (Blouin et al., Citation2014; Buettner et al., Citation2012). Implementing stricter regulations on debt shifting can incentivize the engagement in profit-shifting practices. The profits stripping rule fails to completely replicate the results of the SHR. Thus, employing both regulations could lead to an improvement in well-being (Schindler & Schjelderup, Citation2016).

Multi-national corporations possess the capacity to partake in debt shifting and transfer pricing, as demonstrated by a general equilibrium study. The SHR is seen less efficacious compared to the earnings stripping rule. The ESR is advantageous as it efficiently restricts the exploitation of debt financing and transfer pricing methods. The SHR specifically affects the debt-shifting strategy utilized by multinational companies. The ESR outperforms the SHR, indicating that nations shouldn’t favor hybrid laws as their preferred course of action (Gresik et al., Citation2017). The comparative efficacy of one legislation in relation to another depends on the extent to which multinational companies can employ different strategies for profit shifting, in addition to practices involving debt shifting (Mardan, Citation2017).

Given the presence of other profit-shifting tactics, multinational companies have two options when faced with hybrid legislation. Hybrid regulations can increase the overall cost of capital, leading multinational businesses to reduce their capital holdings. The second option is implementing stricter hybrid rules, which would require multinational companies to increase their capital in order to address the emerging limitations. Countries with a net inflow of foreign direct investment have a vested interest in safeguarding tax payments from multinational companies through the implementation of supplementary safe harbor legislation. In contrast, countries with a low ratio of incoming foreign direct investment relative to outgoing investment prioritize their domestic tax and wage income.

Extra-safe harbor restrictions are exclusively implemented when multinational companies increase their capital holdings. Many countries observe a disparity between the conduct of MNCs and their claimed beneficial characteristics. Therefore, it is imperative for these countries to adopt policies that prevent the erosion of revenue as a direct and effective response. Welfare research indicates that hybrid instruments possess the capacity to enhance the overall welfare of a nation. However, it is not obligatory for all countries to implement hybrid regulations. It is important to customize these policies to address important concerns related to a country’s desired welfare objectives, such as investment (Goerdt & Eggert, Citation2022).

The interest limitation approach can affect a country, affecting state tax revenues, investment levels, economic growth, corporate capital structure, global competitiveness, and financial market stability. Stringent interest limitation regulations can enhance state tax revenues by curbing corporations’ capacity to minimize tax obligations through interest expenses. However, these policies can impede economic expansion by restricting enterprises’ ability to secure funding through debt. Companies will modify their capital structures in response to interest rate cap regulations, explore more affordable financing options, and adjust their debt-to-equity ratios to optimize tax advantages. However, they will also consider the stability of financial markets and the country’s global competitiveness.

Conclusion

This research investigates multinational corporations’ (MNCs’) tax planning practices, focusing on profit shifting, debt manipulation, and transfer pricing to minimize tax liabilities and increase profits. This research also aims to analyze the impact of implementing regulations regarding thin capitalization, including safe harbor rules and earnings stripping rules, as well as how these regulations vary in various countries. In conclusion, Multinational firms utilize many tax planning techniques, including debt shifting, profit shifting, transfer pricing, and the implementation of organizational structures, to minimize their tax liabilities and optimize their earnings. These techniques entail capitalizing on the variances in tax rates and regulations among countries. Nevertheless, although these tactics are legal, tax authorities perceive them as morally wrong and are implementing strategies to counteract aggressive tax planning.

The implementation of tax regulations has a pivotal role in shaping the actions of multinational corporations (MNCs) as they strategically relocate their earnings to nations with more favorable tax rates. The study emphasizes that lenient tax enforcement results in heightened income shifting by multinational corporations (MNCs), mainly privately owned ones. It underscores the necessity for policymakers to rectify disparities in the taxation of debt and equity to reduce tax benefits and promote a more equitable approach to financing.

Ultimately, discrepancies in interest-limiting measures among countries are shaped by disparities in tax regulations, economic circumstances, and policy goals. Strategies to prevent profit shifting and loss of tax revenue include the implementation of group ratios, safe harbor rules, hybrid tactics, fixed ratio regulations, and anti-avoidance laws. The impact of thin capitalization laws, earnings stripping restrictions, and hybrid regulations on multinational firms’ profit shifting and debt financing strategies vary, affecting tax collections, investment levels, economic growth, and financial market stability.

There are several implications from this research. This study is extremely pertinent to international economic policy that demonstrates the necessity for nations to have comprehensive and well-coordinated policies to deal with profit-shifting and debt issues. The study result emphasizes how crucial it is for nations to work together and develop equitable policies to stop profit-shifting behaviors and reduce the danger of taking on too much debt. In order to prevent tax manipulation and successfully restructure debt, the government must take into account measures requiring stringent rules, financial openness, and cross-border collaboration. This research offers crucial information that policymakers may use to develop sensible debt management plans and stop profit-shifting tactics that harm the nation’s economy.

It is important to acknowledge the limitations of the study. First, this study focusing on profit shifting, debt manipulation, and transfer pricing to minimize tax liabilities and increase profits. Second, this research only explains strategic choices that limit the importance of having a direct impact on the level of welfare of a nation. Further investigation is recommended to examine the efficacy of different policy tools that nations employ to deal with fluctuations in debt and profit. Analyzing case studies from diverse nations with varying economic characteristics can help research reach a wider audience. The scope could also be expanded to consider the real-world effects of international tax laws and fiscal policy on debt and profit transfers and how they affect investment, economic expansion, and income inequality. Information technology’s function and current advancements in monitoring and enforcing tax laws could also be examined in future research. Therefore, greater research in this area can offer a more comprehensive and contextualized understanding of the best approaches to deal with issues about profit and debt shifts on a national and global scale.

Author statements

All authors of this manuscript have met all four criteria for authorship in the ICMJE Recommendations.

Author contributions

The author actively participates in the conceptualization and design, analysis and interpretation of data, the drafting of the paper, the critical revision of its intellectual content, and the final approval of the version to be published. The author accepts responsibility for all parts of the work.

Disclosure statement

The author declares that there is no financial, professional, or personal competition interest with other parties.

Data availability statement

All data underlying the results are available as part of the article and no additional source data required.

Additional information

Funding

Notes on contributors

Nurlita Sukma Alfandia

Nurlita Sukma Alfandia, Master of Accounting at Brawijaya University. Her research interests are accounting, international tax, education, and finance.

References

- Ahene-Codjoe, A. A., Alu, A. A., & Mehrotra, R. (2022). Abnormal pricing in international commodity trading: Evidence from Ghana. International Economics, 172, 1–18. https://doi.org/10.1016/j.inteco.2022.01.002

- Alhossini, M. A., Ntim, C. G., & Zalata, A. M. (2021). Corporate board committees and corporate outcomes: An international systematic literature review and agenda for future research. The International Journal of Accounting, 56(01), 2150001.

- Amberger, H. J., & Kohlhase, S. (2023). International taxation and the organizational form of foreign direct investment. Journal of International Business Studies, 54(8), 1529–1561. https://doi.org/10.1057/s41267-023-00614-1

- Asen, E. (2019). The economics behind thin-cap rules. International Debt Sharing. https://taxfoundation.org/thin-cap-rules-economics/

- Beuselinck, C., Deloof, M., & Vanstraelen, A. (2015). Cross-jurisdictional income shifting and tax enforcement: evidence from public versus private multinationals. Review of Accounting Studies, 20(2), 710–746. https://doi.org/10.1007/s11142-014-9310-y

- Blaufus, K., Kreinacke, M., & Mantei, B. (2015). Interest deductibility restrictions and organizational form. Business Research, 8(1), 3–37. https://doi.org/10.1007/s40685-014-0016-6

- Blouin, J., Huizinga, H., Laeven, L., & Nicodème, G. (2014). Thin capitalization rules and multinational firm capital structure IMF working paper thin capitalization rules and multinational firm capital structure. International Monetary Fund.

- Buettner, T., Overesch, M., Schreiber, U., & Wamser, G. (2012). The impact of thin-capitalization rules on the capital structure of multinational firms. Journal of Public Economics, 96(11-12), 930–938. https://doi.org/10.1016/j.jpubeco.2012.06.008

- Buettner, T., Overesch, M., & Wamser, G. (2016). Restricted interest deductibility and multinationals’ use of internal debt finance. International Tax and Public Finance, 23(5), 785–797. https://doi.org/10.1007/s10797-015-9386-8

- Buettner, T., Overesch, M., & Wamser, G. (2018). Anti profit-shifting rules and foreign direct investment. International Tax and Public Finance, 25(3), 553–580. https://doi.org/10.1007/s10797-017-9457-0

- Cencerrado, E., María, M., & Roch, T. S. (2015). Limit base erosion via interest deduction and others. Intertax, 43(1).

- Clemente-Almendros, J. A., & Sogorb-Mira, F. (2018). Costs of debt, tax benefits and a new measure of non-debt tax shields: Examining debt conservatism in Spanish listed firms. Revista de Contabilidad, 21(2), 162–175. https://doi.org/10.1016/j.rcsar.2018.05.001

- Crivelli, E., Mooij, R. d., & Keen, M. (2016). Base erosion, profit shifting and developing countries. FinanzArchiv, 72(3), 268. https://doi.org/10.1628/001522116X14646834385460

- Dallari, P., End, N., Miryugin, F., Tieman, A. F., & Yousefi, S. R. (2020). Pouring oil on fire: interest deductibility and corporate debt. International Tax and Public Finance, 27(6), 1520–1556. https://doi.org/10.1007/s10797-020-09604-7

- Desai, M. A., & Dharmapala, D. (2015). Interest deductions in a multijurisdictional world. National Tax Journal, 68(3), 653–680. www.RePEc.org https://doi.org/10.17310/ntj.2015.3.07

- Dischinger, M., Knoll, B., & Riedel, N. (2014). The role of headquarters in multinational profit shifting strategies. International Tax and Public Finance, 21(2), 248–271. https://doi.org/10.1007/s10797-012-9265-5

- Dowd, T., Landefeld, P., & Moore, A. (2017). Profit shifting of U.S. multinationals. Journal of Public Economics, 148(January), 1–13. https://doi.org/10.1016/j.jpubeco.2017.02.005

- Eerola, A., & Slangen, A. H. L. (2022). A review of international management research on corporate taxation. In Management International Review. (Vol. 62, Issue 5). Springer. https://doi.org/10.1007/s11575-022-00484-z

- Faccio, M., & Xu, J. (2015). Taxes and Capital Structure. Journal of Financial and Quantitative Analysis, 50(3), 277–300. https://doi.org/10.1017/S0022109015000174

- Faulkender, M., & Smith, J. M. (2016). Taxes and leverage at multinational corporations. Journal of Financial Economics, 122(1), 1–20. https://doi.org/10.1016/j.jfineco.2016.05.011

- Fossen, F. M., Simmler, M., Fossen, F. M., & Simmler, M. (2016). Personal taxation of capital income and the financial leverage of firms. International Tax and Public Finance, 23(1), 48–81. https://doi.org/10.1007/s10797-015-9349-0

- Goerdt, G., & Eggert, W. (2022). Substitution across profit shifting methods and the impact on thin capitalization rules. International Tax and Public Finance, 29(3), 581–599. https://doi.org/10.1007/s10797-021-09674-1

- Goldbach, S., Møen, J., Schindler, D., Schjelderup, G., & Wamser, G. (2021). 102119 Available online. Journal of Corporate Finance, 71, 102119. https://doi.org/10.1016/j.jcorpfin.2021.102119

- Gresik, T. A., Schindler, D., & Schjelderup, G. (2015). The effect of tax havens on host country welfare. https://ssrn.com/abstract=2603154Electroniccopyavailableat:https://ssrn.com/abstract=2603154https://ssrn.com/abstract=2603154Electroniccopyavailableat:https://ssrn.com/abstract=2603154

- Gresik, T. A., Schindler, D., & Schjelderup, G. (2017). Immobilizing corporate income shifting: Should it be safe to strip in the harbor? Journal of Public Economics, 152, 68–78. https://doi.org/10.1016/j.jpubeco.2017.06.001

- Haufler, A., Mardan, M., & Schindler, D. (2018). Double tax discrimination to attract FDI and fight profit shifting: The role of CFC rules. Journal of International Economics, 114, 25–43. https://doi.org/10.1016/j.jinteco.2018.04.007

- Haufler, A., & Runkel, M. (2012). Firms’ financial choices and thin capitalization rules under corporate tax competition. European Economic Review, 56(6), 1087–1103. https://doi.org/10.1016/j.euroecorev.2012.03.005

- Hebous, S., & De Mooij, R. (2018). Curbing corporate debt bias: Do limitations to interest deductibility work? Journal of Banking & Finance, 96, 368–378. https://doi.org/10.1016/j.jbankfin.2018.07.013

- Hemmelgarn, T., Teichmann, D., & Teichmann, D. (2014). Tax reforms and the capital structure of banks Tax Rate Increases Tax Rate Decreases. International Tax and Public Finance, 21(4), 645–693. https://doi.org/10.1007/s10797-014-9321-4

- Hussain, A. (2022). Earnings stripping. https://www.investopedia.com/terms/e/earnings-stripping.asp

- Hussan, J. (2016). Impact of leverage on risk of the companies. Journal of Civil & Legal Sciences, 05(04), 2169-0170. https://doi.org/10.4172/2169-0170.1000200

- Kalamov, Z. Y. (2020). Safe haven or earnings stripping rules: A prisoner’s dilemma? International Tax and Public Finance, 27(1), 38–76. https://doi.org/10.1007/S10797-019-09545-W/TABLES/1

- Kayis-Kumar, A. (2016). What’ s BEPS got to do with it ? Exploring the effectiveness of thin capitalisation rules. EJournal of Tax Research, 14(2), 359–386.

- Kobetsky, M. (2020). The status of the OECD transfer pricing guidelines in the post-beps dynamic. International Tax Studies, 3(2), 2. https://doi.org/10.59403/2rpcabz

- Koley, M., Namdeo, S. K., Suchiradipta, B., & Afifi, N. A. (2022). Digital platform for open and equitable sharing of scholarly knowledge in India. Journal of Librarianship and Information Science, 55(2), 403–413. https://doi.org/10.1177/09610006221083678

- Kundelis, E., Legenzova, R., & Kartanas, J. (2022). Debt or profit shifting? Assessment of corporate tax avoidance practices across Lithuanian companies. Central European Business Review, 11(2), 81–100. https://doi.org/10.18267/j.cebr.290

- Laakso, M., Welling, P., Bukvova, H., Nyman, L., Bjö Rk, B.-C., & Hedlund, T. (2011). The development of Open Access Journal Publishing from 1993-2009. PloS One, 6(6), e20961. https://doi.org/10.1371/journal.pone.0020961

- Leszczyłowska, A., & Meier, J. H. (2021). Do earnings stripping rules hamper investment? Evidence from CIT reforms in European countries. Economics Letters, 200, 109743. https://doi.org/10.1016/j.econlet.2021.109743

- Locher, T. (2021). Thin-cap rules in Europe, 2021. Thin-Capitalization Rules. https://taxfoundation.org/thin-cap-rules-in-europe-2021/

- Lu, Y., Ntim, C. G., Zhang, Q., & Li, P. (2022). Board of directors’ attributes and corporate outcomes: A systematic literature review and future research agenda. International Review of Financial Analysis, 84, 102424. https://doi.org/10.1016/j.irfa.2022.102424

- Mardan, M. (2017). Why countries differ in thin capitalization rules: The role of financial development. European Economic Review, 91, 1–14. https://doi.org/10.1016/j.euroecorev.2016.09.003

- Merle, R., Al-Gamrh, B., & Ahsan, T. (2019). Tax havens and transfer pricing intensity: Evidence from the French CAC-40 listed firms. Cogent Business & Management, 6(1), 1–12. https://doi.org/10.1080/23311975.2019.1647918

- Moher, D., Liberati, A., Tetzlaff, J., & Altman, D. G, PRISMA Group. (2010). Preferred reporting items for systematic reviews and meta-analyses: The PRISMA statement. International Journal of Surgery (London, England), 8(5), 336–341. https://doi.org/10.1016/j.ijsu.2010.02.007

- Mukarromah, A. (2019). Memahami Konsep thin capitalization rules. https://news.ddtc.co.id/memahami-konsep-thin-capitalization-rules-14945

- Ouelhadj, A., & Bouchetara, M. (2021). Contributions of the base erosion and profit shifting beps project on transfer pricing and tax avoidance. Financial Markets, Institutions and Risks, 5(3). https://doi.org/10.21272/fmir.5(3).59-70.2021

- Qureshi, T. A., & Mahmood, Z. (2016). The magnitude of trade misinvoicing and resulting revenue loss in pakistan. The Lahore Journal of Economics, 21(2), 1–30. https://doi.org/10.35536/lje.2016.v21.i2.a1

- Reiter, F., Langenmayr, D., & Holtmann, S. (2021). Avoiding taxes: Banks ‘ use of internal debt. International Tax and Public Finance, 28(3), 717–745. https://doi.org/10.1007/s10797-020-09625-2

- Ruf, M., & Schindler, D. (2015). Debt shifting and thin-capitalization rules – German experience and alternative approaches. Nordic Tax Journal, 2015(1), 17–33. https://doi.org/10.1515/ntaxj-2015-0002

- Sani, A. A., Kibiya, I. U., Al-Absy, M. S. M., Muhammad, M. L., Bala, H., Khatoon, G., Mohammed, S. D., & Garba, S. (2024). A dynamic panel data approach of corporate tax avoidance and debt financing in Nigeria. Cogent Business & Management, 11(1), 2316283. https://doi.org/10.1080/23311975.2024.2316283

- Saunders-Scott, M. J. (2015). Substitution across methods of profit shifting. National Tax Journal, 68(4), 1099–1119. (December), https://doi.org/10.17310/ntj.2015.4.09

- Schenkelberg, S. (2020). The Cadbury Schweppes judgment and its implications on profit shifting activities within Europe. In International Tax and Public Finance. (Vol. 27, Issue 1). Springer. https://doi.org/10.1007/s10797-019-09553-w

- Schindler, D., & Schjelderup, G. (2016). Multinationals and income shifting by debt. International Journal of the Economics of Business, 23(3), 263–286. https://doi.org/10.1080/13571516.2015.1129095

- Schjelderup, G. (2016). The tax sensitivity of debt in multinationals: A review. International Journal of the Economics of Business, 23(1), 109–121. https://doi.org/10.1080/13571516.2015.1115661

- Sebele-Mpofu, F., Mashiri, E., & Schwartz, S. C. (2021). An exposition of transfer pricing motives, strategies and their implementation in tax avoidance by MNEs in developing countries. Cogent Business & Management, 8(1), 1944007. https://doi.org/10.1080/23311975.2021.1944007

- Thanasegaran, H., & Shanmugam, B. (2007). International trade-based money laundering: the Malaysian perspective. Journal of Money Laundering Control, 10(4), 429–437. https://doi.org/10.1108/13685200710830916

- Zwan, P. V. D., Schutte, D. P., & Krugell, W. (2018). An evaluation of interest deduction limitations to counter base erosion in South Africa. South African Journal of Economic and Management Sciences, 21(1), 1–10. https://doi.org/10.4102/sajems.v21i1.1816