Abstract

This study comprehensively evaluates 268 articles on forensic accounting using a meta-literature approach. By integrating quantitative and qualitative analysis, the research identifies prominent authors, publications, and themes. The analysis reveals four key areas of focus: the fraud triangle and financial statement fraud, corporate governance’s role in fraud prevention, fraud detection techniques, and the broader impacts of fraud. Furthermore, the review highlights 58 potential areas for future research, aiding scholars in identifying critical gaps in the field of forensic accounting.

1. Introduction

Forensic accounting is an important and diverse field that intersects with accounting, finance and law. It plays a critical role in detecting and preventing financial misconduct worldwide (Al-Htaybat et al., Citation2018). Forensic accountants have expertise in unravelling intricate financial concerns, detecting fraudulent acts and providing specialised evidence in judicial proceedings (Ramachandran Rackliffe & Ragland, Citation2016). The field has gained significant importance after corporate scandals and financial irregularities. Businesses and governments now acknowledge the need of specialist skills to maintain openness and integrity in financial reporting (Andiola et al., Citation2020). Forensic accountants use a wide range of abilities, including auditing, data analysis and investigative tactics, to thoroughly examine financial records and transactions in order to uncover any wrongdoing (Dzuranin et al., Citation2018). Forensic accounting is now in high demand globally due to the growing interconnectedness of the world. It has become an indispensable tool in combating white-collar crime and ensuring the financial accountability of stakeholders worldwide (Richardson & Shan, Citation2019).

Current academic research has mostly focused on the accounting curriculum, financial statement fraud, fraud investigation and the Fraud Triangle Theory. The studies mentioned include research conducted by Ramachandran Rackliffe and Ragland (Citation2016), Andiola et al. (Citation2020), Richardson and Shan (Citation2019), Zhou and Kapoor (Citation2011), Albrecht et al. (Citation2015a, Citation2015b), Craja et al. (Citation2020), Young (Citation2020), Brooks and Button (Citation2011), King (Citation2021), Mandal and Shanmugam (Citation2023), Sánchez-Aguayo et al. (Citation2021), Alshurafat et al. (Citation2024), Sharma et al. (Citation2023) and Kagias et al. (Citation2022). Despite being in its nascent phase, the field of forensic accounting is seeing rapid growth. This underscores the need for a comprehensive assessment of the existing knowledge in this domain, particularly with regards to business, economics, regulations and management.

The objective of this study is to explore the potential advantages that researchers may get from a more extensive use of forensic accounting. It offers a contemporary assessment of the latest research in the field of forensic accounting, therefore expanding the existing literature. Furthermore, the study aims to serve as a valuable reference for other scholars engaged in many areas of research pertaining to forensic accounting, ultimately aiming to enhance the overall knowledge base in this particular field. The objective of this study is to discover a substantial quantity of unexplored research inquiries that need investigation in the immediate future. This will be achieved by doing an in-depth analysis of the classification of literature in the field of forensic accounting.

Two recent studies have explored the role of forensic accounting, albeit with distinct focuses. Nasrallah et al. (Citation2022) delved into forensic accounting within the digital landscape, while Kamwani et al. (Citation2022) investigated the importance of forensic accounting methods for corporate governance. Despite not yielding significant direct impacts on the field itself, both studies employed a combination of qualitative and quantitative research approaches, offering valuable insights for future exploration.

The study differs from the previous literature in various respects. To begin, unlike Al Shbeil et al.’s (Citation2022) study, which focused only on business and management research, our analysis examines the influential and intellectual structure of literature in economics, finance, business, law and government. Second, we diligently collect and analyse a large dataset of 268 articles in order to provide readers with a more nuanced and thorough view of the overall influence of the forensic accounting discipline. Third, an important component of this study is the provision of extensive content analysis and a future research agenda, which provide significant insights to researchers while also contributing to the progress of academic work in forensic accounting and uncertainty within the larger corporate environment.

This study unfolds its investigation in a clear and structured manner. Following this introduction, Section 2 meticulously delves into the chosen methodology, laying the groundwork for the subsequent analysis. Section 3 then presents the captivating findings, illuminating the key players and drawing insightful conclusions from the network analysis. In Section 4, we embark on a content analysis of the field, paving the way for potential avenues of future research. Finally, Section 5 thoughtfully draws inferences from the accumulated results, bringing the investigation to a conclusive and illuminating end.

2. Methodological design

2.1. Strategy for data selection

Our initial data selection relied on the Web of Science Core Collection, a widely recognised behemoth in the world of social sciences, law, economics, finance and business studies. Experts like Alqudah et al. (Citation2023), Qudah et al. (Citation2023) and Momani et al. (Citation2023) commend its stringent vetting process, making it stand out from rivals like Scopus. Furthermore, WOS’s user-friendly interface and robust research validation tools make it a researcher’s dream for data extraction and refinement.

The accuracy of our findings hinged on the precision of our data-gathering queries. To capture every facet of our research topic, we compiled a comprehensive list of relevant search terms, including ‘accounting curriculum’, ‘financial statement fraud’, ‘forensic accounting’ and ‘fraud triangle theory’. Our initial search yielded 7315 papers published before December 2023. These results then underwent a two-stage refinement process. First, we employed an online vetting system to focus on English-language publications and reviews in relevant fields like economics, accounting, business management, law and ethics and company finance. This excluded papers from non-specialist journals in fields like computers, engineering, medicine and biology, resulting in a revised collection of 486 documents. In the second phase, we adopted a subjective review process, drawing on the methods of Paltrinieri et al. (Citation2019) and Khan et al. (Citation2020), to guarantee each article’s relevance to business. Every selected paper needed to demonstrate some connection to forensic accounting, so two independent researchers double-checked the entire collection. This subjective vetting eliminated 218 superfluous papers, bringing our final dataset down to 268 articles. provides a detailed overview of the search query and the resulting data for analysis.

Table 1. Description of the query.

2.2. Approach to the study

Our study delves deeply into the existing literature on forensic accounting using a meta-literature approach that seamlessly blends quantitative and qualitative methods. The bibliometric techniques used by Khan et al. (Citation2020), Paltrinieri et al. (Citation2019), Momani et al. (Citation2023), Aladayleh et al. (Citation2023), Alqudah et al. (Citation2023) and Al-Qudah et al. (Citation2022) serve as the foundation for our citation and network analysis. The investigation unfolds across five key avenues: content analysis, keyword analysis and bibliographic coupling analysis. Leveraging the ‘bibliometrix’ package in RStudio, we primarily rely on the powerful tool ‘biblioshiny’ for data analysis (Al-Qudah et al., Citation2022; Al-Qudah et al. Citation2023). Additionally, VOSviewer (Van Eck & Waltman, Citation2010, Citation2013, Citation2017; Waltman & Yan, Citation2014) provides visual mapping and network analysis, unveiling the intricate connections within the body of literature.

3. Outcomes

3.1. Overview and performance assessment

The study involves 268 different materials, and its growth rate is an astounding 12.93%, including journals and books, as shown in ’s complete overview, which covers the period from 2004 to 2023. Documents have an average age of 5.32 years and get 23.26 citations apiece. The document’s content is enriched with 159 Keywords Plus (ID) and 163 Author’s Keywords (DE) and the bibliography has 2851 references. The research represents a collaborative and internationally linked environment, with 126 authors, 10 single-authored publications and an average of 2.66 co-authors per document (36% including international cooperation). A total of 563 articles and 14 reviews makes up the document types.

Table 2. Overview Summary.

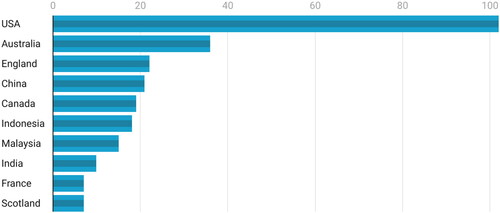

(most 10 significant countries) paints a vivid picture of the geographical distribution of research contributions in forensic accounting. The United States takes the lead with 102 publications, followed by Australia (36), England (22), China (21) and Canada (19). Notably, Malaysia (15), Indonesia (18), France (7) and Scotland (7) also make significant contributions, showcasing the truly global reach of forensic accounting research. This impressive spread across continents and countries underscores the growing importance and increasing international collaboration in this vital field (Tunger & Eulerich, Citation2018).

A tapestry of international institutions and organisations has woven breakthroughs in forensic accounting research. unveils the ten most prolific contributors, with the State University of New York (SUNY) System taking the top spot with seven insightful publications. Deakin University, the State University System of Florida and the University System of Georgia closely follow, each adding six publications to the growing body of knowledge. Further strengthening the field, the University System of Ohio, Macquarie University, SUNY Albany and the University of New South Wales Sydney each contributed an impressive seven publications apiece. Notably, seven of the top ten institutions hail from the United States, collectively accounting for 37 publications – a testament to their dedication to advancing this crucial field.

Table 3. Most significant institutions.

Further, our study aimed to identify key journals in forensic accounting to guide researchers in selecting impactful outlets for their work. Drawing on established criteria (Khan et al., Citation2020; Paltrinieri et al., Citation2019), we set a minimum threshold of four published papers and 100–200 citations. The Journal of Business Ethics emerges as the clear frontrunner, boasting 32 articles and an impressive 866 citations. Its shows that 6.1 impact factor and Q2 ranking in the 2022 JCR further solidify its stature as a top platform for influential research. It solidifies Springer’s position as one of the most prestigious publishing houses for significant work in the field. Notably, Issues in Accounting Education, Accounting Education and the Journal of Emerging Technologies in Accounting also deserve recognition as significant contributors to the forensic accounting landscape.

Table 4. Most significant sources.

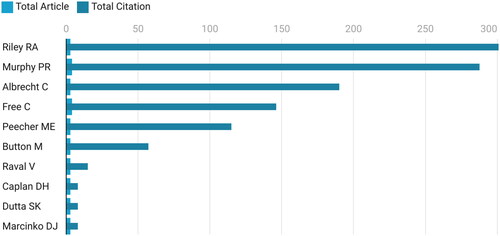

shines a spotlight on the leading figures in this field, showcasing the impact of their research. American scholar Riley RA takes the top spot, boasting three publications and a remarkable cumulative citation count of 301. Other key contributors hail from diverse corners of the globe, adding valuable voices to the academic discussion through their individual scholarship. Murphy PR from Canada, Albrecht C from the United States and Free C from Australia stand out amongst them, as evidenced by their substantial output and influential citations. This figure underscores the collaborative nature of research and the crucial role scholars play in shaping the forensic accounting landscape.

3.2. Analysis of citations

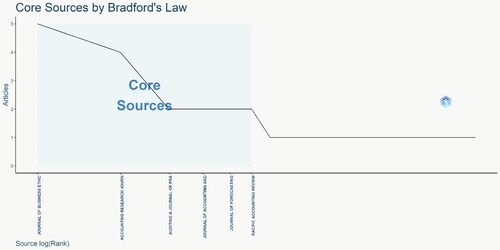

paints a revealing picture of publication trends in forensic accounting, echoing Bradford’s law. A select group of journals emerges as heavyweights, shouldering the majority of the field’s output. This concentration reinforces observations made by Tunger and Eulerich (Citation2018), who noted a similar pattern of ‘superstar’ journals. A handful of publications carry significant weight, acting as crucial platforms for shaping the discourse and direction of forensic accounting research.

highlights the most influential articles in forensic accounting research, serving as crucial benchmarks for the field’s global scientific quality and scholarly achievement (Clarivate Analytics, Citation2018). As Alqudah et al. (Citation2023) note, highly cited publications offer valuable insights into research trends and patterns, shaping the discipline’s distinct themes. Leading the pack is Hogan et al. (Citation2008) seminal work, ‘Financial Statement Fraud: Insights from the Academic Literature’, boasting a commanding 160 citations. Close behind, Perols (Citation2012) and Morales et al. (Citation2017) studies on fraud detection follow with 111 and 82 citations, respectively. delves deeper, showcasing the 20 most-cited papers, spanning diverse topics like judicial accounting, financial statement fraud, the fraud triangle theory, ethical concerns and fraud detection techniques. This comprehensive picture underscores the breadth and depth of research within forensic accounting, solidifying its vital role in ensuring financial integrity and transparency.

Table 5. Documents with the highest number of citations.

Table 6. Future directions of research.

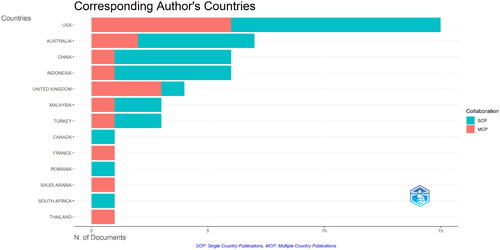

A closer look at Figure 4’s analysis of corresponding author countries reveals a clear power trio in the landscape of forensic accounting research: the United States, Australia and China. These nations stand out as the field’s primary contributors, wielding substantial influence through both the sheer volume of their research publications and the high rate of citations they attract. Their efforts have demonstrably shaped research outputs and set the direction for the subject.

3.3. Network analysis

3.3.1. Keywords/cartography analysis

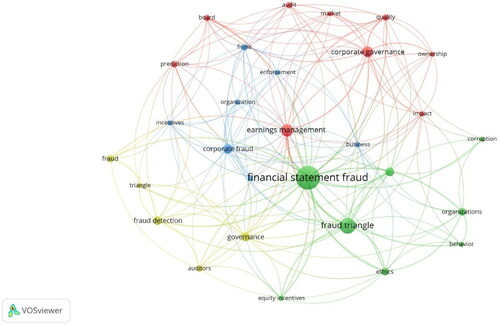

We looked at the most common keywords in forensic accounting literature using VOSViewer and the well-known methods of Khan et al. (Citation2020) and Paltrinieri et al. (Citation2019). This showed us the main ideas that are influencing the field. As shows, terms like ‘fraud triangle’, ‘corporate governance’, ‘earnings management’ and ‘fraud detection’ unsurprisingly take centre stage, reflecting the core concerns of the discipline. However, the analysis also showcases an exciting expansion of the field, with discussions now encompassing broader topics like initial government reactions to fraud, the global impact of financial statement manipulation and the ramifications of corporate misconduct. These emerging conversations are firmly anchored within the framework of corporate governance and fraud prevention, highlighting the crucial role forensic accounting plays in safeguarding financial integrity.

3.3.2. Keywords/growth analysis

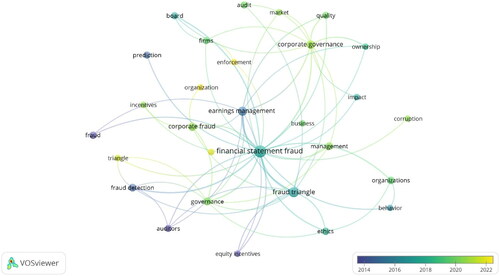

Our analysis of the contemporary landscape in forensic accounting research draws upon VOSViewer and methodologies established by Alqudah et al. (Citation2023) and Qudah et al. (Citation2023). This comprehensive approach reveals key themes shaping the field, with terms like ‘executive compensation’, ‘enforcement’, ‘triangle’ and ‘organisation’ rising to prominence, highlighting the discipline’s contemporary areas of focus. By examining these prevailing concepts and trends, we gain valuable insights into what defines and influences forensic accounting. further illuminates this evolving landscape, offering a concise and visually informative representation of the fundamental ideas and deepening our understanding of the field’s dynamic trajectory.

4. Directions for future research in content analysis

4.1. Analysis of content

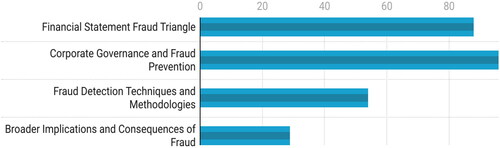

Complementing our qualitative analysis, we undertook a content analysis of the 268 forensic accounting documents in our dataset. This involved grouping similar articles into distinct thematic streams, creating a comprehensive roadmap for researchers (illustrated in ). This content analysis illuminates the diverse themes and areas of focus within the forensic accounting literature, providing valuable insights into the field’s breadth and depth.

4.1.1. Cluster 1: Financial statement fraud triangle

In this major cluster focused on financial statement fraud has shed light on the factors contributing to fraudulent operations in businesses. Hogan et al. (Citation2008) emphasise the importance of a holistic understanding of the issue. Free (Citation2008) calls for fresh approaches, highlighting emerging aspects of the fraud triangle. Nasir and Nabm (Citation2018) further bolster the discussion with insightful observations. A comprehensive review of the literature equips one with a firm grasp of the complexities involved.

Moreover, the sub-cluster additionally explores the role of corporate factors, exemplified by the connection between CEO demographics and the tendency to rationalise unlawful activities (Troy et al., Citation2015). Morales et al. (Citation2017) contribute a framework that analyses the relationship between vigilant organisations and risky individuals within corporations, tracing its roots back to the fraud triangle. Their findings emphasise the crucial role of innovative techniques and sophisticated analytics in fraud prevention. Studies like Wang (Citation2022) and Gepp (Citation2021) underscore the significance of CEO demographics and government sanctions. Furthermore, Howieson (Citation2018) and Dzuranin et al. (Citation2018) examine how data analytics can be incorporated into the accounting curriculum, offering practical insights for educating professionals in the field.

4.1.2. Cluster 2: Corporate governance and fraud prevention

This stream of financial statement fraud has captivated scholars in fields like corporate governance and fraud prevention. Hogan et al. (Citation2008) and Perols (Citation2012) delved deep into machine learning and statistical tools for fraud detection, emphasising the dynamic nature of risk assessment. Morales et al. (Citation2017) dissected the risky individual and vigilant organisation through the ‘fraud triangle’ lineage, adding valuable insights. By critically analysing the triangle and advocating new research avenues, Free (Citation2008) expanded the discussion. These studies, drawing from accounting, law and organisational behaviour, highlight the interdisciplinary nature of fraud prevention.

The sub-cluster, Perols (Citation2012) and Perols et al. (Citation2017), made significant contributions by analysing the intricate link between financial statement fraud and earnings management. Their research emphasises data analytics as a crucial tool for predicting fraud, marking a fundamental shift in fraud detection methodology. Lisic et al. (Citation2011) further enrich the discourse by examining the impact of government sanctions on Chinese accounting fraud. The sub-cluster, legal perspectives, is well represented in the literature. Troy et al. (Citation2015) shed light on the intersection of corporate governance and legal liability by examining the link between CEO demographics and justifying unlawful activities. Smaili and Arroyo (Citation2019) and Ghafoor (Citation2019) built on this by exploring the legal aspects of detecting financial statement deceit. Gepp’s (Citation2021) investigation of government sanctions as a deterrent reveals valuable insights into legal mechanisms against fraud. The sub-cluster, corporate governance, holds a prominent place in scholarly inquiry. Nasir and Nabm (Citation2018) offer valuable insights into its complexities through their examination of financial statement fraud in the broader corporate context. Hoogs et al. (Citation2017) address the need for proactive corporate measures by using a genetic algorithm to identify patterns indicative of fraud. Wang (Citation2022) investigates CEO demographics and their tendency to rationalise unlawful acts, providing corporate governance implications for fraud prevention. The literature review highlights the intricacy and variety of fraud prevention. A recurring theme is the shift towards proactive, data-driven methodologies through statistical and machine learning algorithms. However, Howieson (Citation2018) and Suh et al. (Citation2020) investigation of the fraud triangle demonstrates its continued relevance as a crucial framework.

4.1.3. Cluster 3: Fraud detection techniques and methodologies

In this major cluster, financial statement fraud has been extensively studied in the literature on fraud detection methods. Hogan et al. (Citation2008) provided a thorough analysis, drawing on academic resources to illuminate its complexities. Perols (Citation2012) recognising the ever-evolving landscape of detection, explored machine learning and statistical algorithms for fraud identification. Morales et al. (Citation2017) traced the origins of the ‘fraud triangle’ to examine how risky organisations and vigilant individuals develop. Free (Citation2008) further critiqued the triangle and championed further research in this area.

The sub-cluster explores the complexities of fraud detection using statistical and machine learning tools, as described in Peols (2012) and Perols et al. (Citation2017). Perols and Lougee (Citation2012) investigation into the link between earnings management and fraud offers valuable insights. Song et al. (Citation2011) and Hoogs et al. (Citation2017) enrich the accounting literature by advocating for machine learning methods in risk assessment, thereby introducing novel fraud prevention approaches. Ghafoor (Citation2019) and Suh et al. (Citation2020) further contribute by investigating the correlation between CEO demographics and accounting fraud, shedding light on the legal aspects of financial malfeasance.

The sub-cluster focuses on specific detection strategies. Perols and Lougee (Citation2012) established a connection between earnings management and fraud. Lisic et al. (Citation2011) delved into auditing, accounting fraud and the impact of government sanctions in China. Hoogs et al. (Citation2017) used a genetic algorithm to identify temporal patterns indicative of fraud. Nasir and Nabm (Citation2018) offered a literature-based analysis of financial statement fraud, while Albrecht (Citation2015a, Citation2015b) advanced the use of statistical and machine learning algorithms for detection. Other sub-cluster explores risk factors. Troy et al. (Citation2015) analysed the relationship between CEO demographics and fraud propensity. Smaili and Arroyo (Citation2019) built on the fraud triangle, tracing its legal lineage and examining the link between vigilant organisations and risky individuals. Ghafoor (Citation2019) further analysed statistical and machine learning algorithms for fraud detection. In the legal realm, Suh et al. (Citation2020) investigated the link between fraud and earnings management, while Wang (Citation2022) examined the role of CEO demographics in approving illegal activities.

Besides, the sub-cluster emphasises technology and prevention. Song et al. (Citation2011) used machine learning to assess fraud risk in China. Perols et al. (Citation2017) highlighted the power of data analytics in enhancing fraud prediction. Gepp (Citation2021) investigated the effectiveness of government sanctions in deterring fraud in Chinese corporations. Mui (Citation2015) proposed improved data analytics methods for predicting fraud. Several additional studies made notable contributions. Howieson (Citation2018) used a genetic algorithm to identify suspicious patterns; Alden (Citation2012) explored machine learning for fraud risk assessment; and Brooks and Button (Citation2011) proposed involving police in fraud investigations in the UK. Richardson and Shan (Citation2019) emphasised the importance of equipping future professionals with fraud detection skills by incorporating data analytics into the accounting curriculum.

4.1.4. Cluster 4: Broader application and consequences of fraud

Scholars within this major cluster have diligently explored various facets of financial statement deception. Hogan et al. (Citation2008) delved into academic literature, illuminating the complexities of falsifying financial statements. Perols (Citation2012) focused on employing machine learning and statistical algorithms for fraud detection, emphasising the dynamic nature of such methods. Morales et al. (Citation2017) traced the lineage of the ‘vigilant organisation’ and ‘risky individual’ to dissect how the fraud triangle forms. Additionally, Free (Citation2008) offered a critical analysis of the fraud triangle, advocating for exploring novel research avenues.

The sub-cluster delves into specific detection strategies. Perols and Lougee (Citation2012) established a link between earnings management and fraud. Lisic et al. (Citation2011) examined the interplay between government sanctions, auditing and accounting misconduct in China. Hoogs et al. (Citation2017) used a genetic algorithm to identify suspicious temporal patterns suggestive of fraud. Nasir and Nabm (Citation2018) provided literature-based insights into financial statement falsification. Other sub-cluster explores risk factors. Troy et al. (Citation2015) analysed the relationship between CEO demographics and fraud propensity to determine who is more likely to justify unlawful behaviour. Smaili and Arroyo (Citation2019) built on the legal aspects of the fraud triangle, tracing its lineage and examining the link between vigilant organisations and risky individuals, while Wang (Citation2022) examined the role of CEO demographics in approving illegal activities.

Furthermore, the sub-cluster emphasises technology and prevention. Song et al. (Citation2011) used machine learning to assess fraud risk in China. Perols et al. (Citation2017) highlighted the power of data analytics in enhancing fraud prediction. Gepp (Citation2021) investigated the effectiveness of government sanctions in deterring fraud in Chinese corporations. Mui (Citation2015) proposed improved data analytics methods for predicting fraud. Several additional studies made notable contributions. Howieson (Citation2018) used a genetic algorithm to identify suspicious patterns; Alden (Citation2012) explored machine learning for fraud risk assessment; and Brooks and Button (Citation2011) proposed involving police in fraud investigations in the UK. Richardson and Shan (Citation2019) emphasised the importance of equipping future professionals with fraud detection skills by incorporating data analytics into the accounting curriculum.

4.2. Future directions of research

According to Khan et al. (Citation2020) and Paltrinieri et al. (Citation2019), both bibliometric and content analyses are crucial tools for identifying the major trends in emerging research. The potential research questions in offer lasting value to researchers, extending beyond the current era of fraud and criminal activity. These questions benefit not only related research efforts but also serve as valuable assets for crisis accounting strategies and global fraud detection initiatives. While fraud remains an undesirable occurrence, acknowledging its historical prevalence and anticipating its ongoing nature can inspire collective efforts to mitigate its societal impact.

This study contributes to the field of forensic accounting by provoking thought-provoking inquiries into future research directions, promoting responsible measurement and investigation and addressing key issues. As a result, subsequent research can produce more reliable findings, reducing the ambiguity surrounding the current impact of forensic accounting and better equipping society for future challenges.

5. Conclusion

On an international level, forensic accounting is recognised by governments and businesses as a crucial and complex discipline that serves to prevent and address financial misconduct. In order to uphold the integrity and transparency of financial reporting, forensic accounting is an absolute necessity. The objective of this bibliometric study was to ascertain worldwide research patterns in the field of forensic accounting, encompassing a range of industries. By utilising bibliometric examination to drive content analysis, this study not only examined extant literature in the field of forensic accounting but also delineated a strategic plan to propel and stimulate future research endeavours. (1) Financial statement fraud triangle; (2) Corporate governance and fraud prevention; (3) Fraud detection techniques and methodologies; and (4) Broader implications and consequences of fraud were identified as the four principal clusters by the study’s findings.

The initial cluster of investigations aimed to gain a comprehensive comprehension of the factors that contribute to fraudulent activities through the examination of the Financial Statement Fraud Triangle. The analysis encompassed an exploration of financial statement fraud legal ramifications, an examination of fraud detection methods employing statistical and machine learning tools, an investigation into corporate factors, including the correlation between accounting fraud and CEO demographics, and the formulation of educational strategies to prevent fraud. The subsequent cluster put forth topics such as the ever-changing nature of risk assessment, the complex correlation between earnings management and fraudulent activities, proactive measures taken by corporations, and the significance of corporate governance in mitigating fraudulent activities. The third cluster explored methodologies and techniques for detecting fraud, including risk factors, monitoring strategies, technological advancements, preventive measures and further contributions to the discipline. The fourth and final cluster delved into the broader implications and repercussions of fraud, including risk factors, technology, prevention methods, detection strategies and additional scholarly contributions.

The importance of forensic accounting in maintaining the integrity and transparency of financial reporting is underscored in this study as the global landscape of financial misconduct continues to evolve. To add to what is already known in this area, possible future research directions could look into how to include ethical concerns in forensic accounting, new technologies, the effects of fraud around the world, or working together across different fields. The ongoing development of forensic accounting is dependent on such efforts to resolve financial irregularities across a variety of industries.

Authors’ contributions

Rana Airout, Sadam Abu Azam and Mohammad Airout all contributed significantly to different phases of this research. Rana Airout played a key role in the conception and design of the study, as well as in the analysis and interpretation of the data. Sadam Abu Azam contributed substantially to the drafting of the paper, ensuring its intellectual content, and Mohammad Airout actively participated in revising the manuscript critically. All authors collectively provided final approval for the version to be published and agreed to be accountable for all aspects of the work.

About the authors

Rana Mustafa Airout (Corresponding Author), Accounting Department, Faculty of Business, Philadelphia University, Amman, Jordan, Email: [email protected],

Sadam Abu Azam, Law Department, Faculty of Law, Jerash University, Jerash, Jordan, Email: [email protected]

Mohammad Airout, Law Department, Faculty of Law, Middle East University, Amman, Jordan, Email: [email protected]

Disclosure statement

The authors declare no competing interests in the study

Data availability statement

No data were generated or used in this work. The study did not involve the collection or analysis of original data. Therefore, there is no data available for sharing.

Additional information

Funding

References

- Al Shbeil, S., Alshurafat, H., Taha, N., & Al Shbail, M. O. (2022). What do we know about forensic accounting? A literature review. European, Asian, Middle Eastern, North African conference on management & information systems (pp. 1–17). Springer International Publishing. https://doi.org/10.1007/978-3-031-17746-0_49

- Aladayleh, K. J., Al Qudah, S. M. A., Bargues, J. L. F., & Gisbert, P. F. (2023). Global trends of the research on COVID-19 risks effect in sustainable facility management fields: A bibliometric analysis. Engineering Management in Production and Services, 15(1), 12–28. https://doi.org/10.2478/emj-2023-0002

- Albrecht, C., Holland, D., Malagueño, R., Dolan, S., & Tzafrir, S. (2015a). Financial statement fraud detection: An analysis of statistical and machine learning algorithms. Journal of Business Ethics, 131(4), 803–813. https://doi.org/10.1007/s10551-013-2019-1

- Albrecht, C., Holland, D., Malagueño, R., Dolan, S., & Tzafrir, S. (2015b). The role of power in financial statement fraud schemes. Journal of Business Ethics, 131(4), 803–813. https://doi.org/10.1007/s10551-013-2019-1

- Alden, M. E. (2012). Application of machine learning methods to risk assessment of financial statement fraud: Evidence from China. Journal of Emerging Technologies in Accounting, 12(1), 1.00–1.00. https://doi.org/10.2308/jeta-50390

- Al-Htaybat, K., von Alberti-Alhtaybat, L., & Alhatabat, Z. (2018). Educating digital natives for the future: Accounting educators’ evaluation of the accounting curriculum. Accounting Education, 27(4), 333–357. https://doi.org/10.1080/09639284.2018.1437758

- Al-Qudah, L. A., Ahmad Qudah, H., Abu Hamour, A. M., Abu Huson, Y., & Al Qudah, M. Z. (2022). The effects of COVID-19 on conditional accounting conservatism in developing countries: Evidence from Jordan. Cogent Business & Management, 9(1), 2152156. https://doi.org/10.1080/23311975.2022.2152156

- Alqudah, M., Ferruz, L., Martín, E., Qudah, H., & Hamdan, F. (2023). The sustainability of investing in cryptocurrencies: A bibliometric analysis of research trends. International Journal of Financial Studies, 11(3), 93. https://doi.org/10.3390/ijfs11030093

- Alshurafat, H., Al Shbail, M. O., Hamdan, A., Al-Dmour, A., & Ensour, W. (2024). Factors affecting accounting students’ misuse of chatgpt: An application of the fraud triangle theory. Journal of Financial Reporting and Accounting, 22(2), 274–288. https://doi.org/10.1108/JFRA-04-2023-

- Andiola, L. M., Masters, E., & Norman, C. (2020). Integrating technology and data analytic skills into the accounting curriculum: Accounting department leaders’ experiences and insights. Journal of Accounting Education, 50, 100655. https://doi.org/10.1016/j.jaccedu.2020.100655

- Brooks, G., & Button, M. (2011). The police and fraud investigation and the case for a nationalised solution in the United Kingdom. The Police Journal, 84(4), 305–319. https://doi.org/10.1350/pojo.2011.84.4.559

- Clarivate Analytics. (2018). InCites indicators handbook. ClarivateAnalytics

- Craja, P., Kim, A., & Lessmann, S. (2020). Deep learning for detecting financial statement fraud. Decision Support Systems, 139, 113421. https://doi.org/10.1016/j.dss.2020.113421

- Dzuranin, A. C., Jones, J. R., & Olvera, R. M. (2018). Infusing data analytics into the accounting curriculum: A framework and insights from faculty. Journal of Accounting Education, 43, 24–39. https://doi.org/10.1016/j.jaccedu.2018.03.004

- Free, C. (2015). Looking through the fraud triangle: A review and call for new directions. Meditari Accountancy Research, 23(2), 175–196. https://doi.org/10.1108/MEDAR-02-2015-0009

- Gepp, A. (2021). Accounting fraud, auditing, and the role of government sanctions in China. Accounting & Finance, 13(1), 4.33–2.25. https://doi.org/10.1111/acfi.12742

- Ghafoor, A. (2019). Financial statement fraud detection: An analysis of statistical and machine learning algorithms. Journal of Business Ethics, 19(1), 3.80–1.61. https://doi.org/10.1007/s10551-018-3877-3

- Hogan, C. E., Rezaee, Z., Riley, R. A., Jr. & Velury, U. K. (2008). Financial statement fraud: Insights from the academic literature. AUDITING: A Journal of Practice & Theory, 27(2), 231–252. https://doi.org/10.2308/aud.2008.27.2.205

- Hoogs, B., Kiehl, T., Lacomb, C., & Senturk, D. (2017). A genetic algorithm approach to detecting temporal patterns indicative of financial statement fraud. Intelligent systems in accounting. Finance & Management: International Journal, 24(1–2), 23–47. https://doi.org/10.1002/isaf.1426

- Howieson, B. (2018). A genetic algorithm approach to detecting temporal patterns indicative of financial statement fraud. Pacific Accounting Review, 13(1), 2.17–1.34. https://doi.org/10.1108/PAR-01-2017-0005

- Kagias, P., Cheliatsidou, A., Garefalakis, A., Azibi, J., & Sariannidis, N. (2022). The fraud triangle – an alternative approach. Journal of Financial Crime, 29(3), 908–924. https://doi.org/10.1108/JFC-07-2021-0159

- Kamwani, S. S., Vieira, E., Madaleno, M., & do Carmo Azevedo, G. M. (2022). Significance of forensic accounting techniques in corporate governance: Bibliometric analysis. Handbook of research on the significance of forensic accounting techniques in corporate governance (pp. 22–40). IGI Global. https://doi.org/10.4018/978-1-7998-8754-6.ch002

- Khan, A., Hassan, M. K., Paltrinieri, A., Dreassi, A., & Bahoo, S. (2020). A bibliometric review of takaful literature. International Review of Economics & Finance, 69, 389–405. https://doi.org/10.1016/j.iref.2020.05.013

- King, M. (2021). Financial fraud investigative interviewing – corporate investigators’ beliefs and practices: A qualitative inquiry. Journal of Financial Crime, 28(2), 345–358. https://doi.org/10.1108/JFC-08-2020-0158

- Lisic, L. L., Silveri, S. D., Song, Y., & Wang, K. (2011). Accounting fraud, auditing, and the role of government sanctions in China. Journal of Business Research, 64(3), 322–331. https://doi.org/10.1016/j.jbusres.2010.01.016

- Mandal, A., & Shanmugam, A. (2023). Fathoming fraud: Unveiling theories, investigating pathways and combating fraud. Journal of Financial Crime. Ahead-of-print. https://doi.org/10.1108/JFC-06-2023-0153

- Momani, M. A. K. A., Alharahasheh, K. A., & Alqudah, M. (2023). Digital learning in Sciences education: A literature review. Cogent Education, 10(2), 2277007. https://doi.org/10.1080/2331186X.2023.2277007

- Morales, J., Gendron, Y., & Guénin-Paracini, H. (2017). The construction of the risky individual and vigilant organization: A genealogy of the fraud triangle. Accounting, Organizations and Society, 60, 62–81. https://doi.org/10.1016/j.aos.2017.07.003

- Mui, G. (2015). Finding needles in a haystack: Using data analytics to improve fraud prediction. Accounting Research Journal, 18(1), 2.00–0.50. https://doi.org/10.1108/ARJ-10-2014-0092

- Nasir, N., & Nabm. (2018). Financial statement fraud: Insights from the academic literature. International Journal of Accounting Information Management, 23(2), 3.83–2.38. https://doi.org/10.1108/IJAIM-03-2017-0039

- Nasrallah, N. H., El Khoury, R., & Harb, E. (2022). Forensic accounting in a digital environment: A New proposed model. Handbook of research on the significance of forensic accounting techniques in corporate governance (pp. 128–149). IGI Global. https://doi.org/10.4018/978-1-7998-8754-6.ch007

- Paltrinieri, A., Hassan, M. K., Bahoo, S., & Khan, A. (2019). A bibliometric review of sukuk literature. International Review of Economics & Finance, 86, 897–918. https://doi.org/10.1016/j.iref.2019.04.004

- Perols, J. (2012). Financial statement fraud detection: An analysis of statistical and machine learning algorithms. Auditing: A Journal of Practice & Theory, 31(1), 1–32. https://doi.org/10.2308/ajpt-10209

- Perols, J. L., & Lougee, B. A. (2012). The relation between earnings management and financial statement fraud. Advances in Accounting, 27(1), 39–53. https://doi.org/10.1016/j.adiac.2012.01.004

- Perols, J. L., Bowen, R. M., Zimmermann, C., & Samba, B. (2017). Finding needles in a haystack: Using data analytics to improve fraud prediction. The Accounting Review, 92(2), 221–245. https://doi.org/10.2308/accr-51727

- Qudah, H., Malahim, S., Airout, R., Alomari, M., Hamour, A. A., & Alqudah, M. (2023). Islamic finance in the era of financial technology: A bibliometric review of future trends. International Journal of Financial Studies, 11(2), 76. https://doi.org/10.3390/ijfs11020076

- Ramachandran Rackliffe, U., & Ragland, L. (2016). Excel in the accounting curriculum: Perceptions from accounting professors. Accounting Education, 25(2), 139–166. https://doi.org/10.1080/09639284.2015.1126791

- Richardson, V. J., & Shan, Y. (2019). Data analytics in the accounting curriculum. In T. G. Calderon (Ed.), Advances in accounting education: Teaching and curriculum innovations (Advances in accounting education (Vol. 23, pp. 67–79). Emerald Publishing Limited. https://doi.org/10.1108/S1085-462220190000023004

- Sánchez-Aguayo, M., Urquiza-Aguiar, L., & Estrada-Jiménez, J. (2021). Fraud detection using the fraud triangle theory and data mining techniques: A literature review. Computers, 10(10), 121. https://doi.org/10.3390/computers10100121

- Sharma, R., Mehta, K., & Vyas, V. (2023). Investigating academic dishonesty among business school students using fraud triangle theory and role of technology. Journal of Education for Business, 99(2), 69–78. https://doi.org/10.1080/08832323.2023.2260925

- Smaili, N., & Arroyo, P. (2019). The construction of the risky individual and vigilant organization: A genealogy of the fraud triangle. Journal of Business Ethics, 157(1), 95–117. https://doi.org/10.1007/s10551-017-3663-7

- Song, X. P., Hu, Z. H., Du, J. G., & Sheng, Z. H. (2011). Application of machine learning methods to risk assessment of financial statement fraud: Evidence from China. Journal of Forecasting, 30(3), 293–317. https://doi.org/10.1002/for.1203

- Suh, I., Sweeney, J. T., Linke, K., & Wall, J. M. (2020). The relation between earnings management and financial statement fraud. Journal of Business Ethics, 162(3), 645–673. https://doi.org/10.1007/s10551-018-3982-3

- Troy, C., Smith, K. G., & Domino, M. A. (2015). CEO demographics and accounting fraud: Who is more likely to rationalize illegal acts? Strategic Organization, 13(1), 1–29. https://doi.org/10.1177/1476127014549441

- Tunger, D., & Eulerich, M. (2018). Bibliometric analysis of corporate governance research in German- speaking countries: Applying bibliometrics to business research using a custom-made database. Scientometrics, 117(3), 2041–2059. https://doi.org/10.1007/s11192-018-2919-z

- Van Eck, N. J., & Waltman, L. (2013). VOSviewer manual (Vol. 1, pp. 1–53). Univeristeit Leiden. https://doi.org/10.13140/RG.2.1.1093.7121

- Van Eck, N. J., & Waltman, L. (2017). Citation-based clustering of articles using CitNetExplorer and VOSviewer. Scientometrics, 111(2), 1053–1070. https://doi.org/10.1007/s11192-017-2300-7

- Van Eck, N., & Waltman, L. (2010). Software survey: VOSviewer, a computer program for bibliometric mapping. Scientometrics, 84(2), 523–538. https://doi.org/10.1007/s11192-009-0146-3

- Waltman, L., & Yan, E. (2014). PageRank-related methods for analyzing citation networks. Measuring Scholarly Impact: Methods and Practice, 83–100. arXiv preprint arXiv:1109.2058. https://doi.org/10.1007/978-3-319-10377-8_4

- Wang, Y. (2022). CEO demographics and accounting fraud: Who is more likely to rationalize illegal acts? Journal of Accounting and Public Policy, 16(1), 8.00–2.86. https://doi.org/10.1016/j.jaccpubpol.2021.106903

- Young, S. D. (2020). Financial statement fraud: Motivation, methods, and detection. In H. K. Baker, L. Purda- Heeler, and S. Saadi (Eds.), Corporate fraud exposed (pp. 321–339). Emerald Publishing Limited. https://doi.org/10.1108/978-1-78973-417-120201021

- Zhou, W., & Kapoor, G. (2011). Detecting evolutionary financial statement fraud. Decision Support Systems, 50(3), 570–575. https://doi.org/10.1016/j.dss.2010.08.007