?Mathematical formulae have been encoded as MathML and are displayed in this HTML version using MathJax in order to improve their display. Uncheck the box to turn MathJax off. This feature requires Javascript. Click on a formula to zoom.

?Mathematical formulae have been encoded as MathML and are displayed in this HTML version using MathJax in order to improve their display. Uncheck the box to turn MathJax off. This feature requires Javascript. Click on a formula to zoom.Abstract

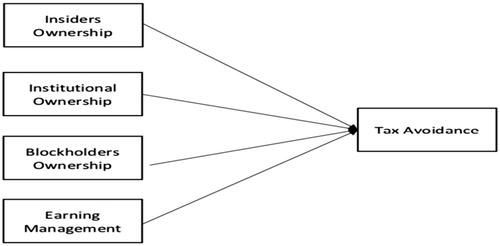

This study ventures into the underexplored realm of tax planning in Indonesia, a domain where extensive research is still in its nascent stage but critically vital. Amidst the Indonesian government’s reliance on taxation for fostering inclusivity, this research delves into the impact of ownership structures and earnings management on tax avoidance practices. By collecting and analyzing data from 90 companies listed on the Indonesia Stock Exchange from 2017 to 2020, encompassing 344 firm-years, this study employs multiple linear regression to dissect the complexities involved. The findings reveal that insider ownership and earnings management negatively influence tax avoidance, whereas institutional and blockholder ownership exhibit a positive impact. These insights offer a fresh perspective on how incentives for tax evasion vary across different ownership structures and management levels, highlighting how opportunistic behavior in earnings management can indicate a propensity toward tax avoidance.

IMPACT STATEMENT

Our research investigates the intriguing connection between different types of company ownership and tax avoidance strategies among manufacturing companies listed on the Indonesia Stock Exchange from 2017 to 2020. This study is particularly relevant to the general public as it sheds light on how companies manage their finances and taxes, impacting Indonesia’s economy and, consequently, its citizens. We explore how insider, institutional, and blockholder ownerships influence companies’ approaches to tax avoidance, providing insights that are crucial for understanding corporate financial behavior. These findings are significant for anyone interested in corporate governance, ethical business practices, and the economic health of the nation. By bringing these issues to the forefront, our research aims to foster greater transparency and accountability in the corporate sector, contributing to a more informed public discourse on financial and tax-related matters.

1. Introduction

In Indonesia, tax planning is crucial due to complex regulations and high corporate tax rates. The diverse ownership structures in Indonesian companies, alongside prevalent earnings management practices, significantly impact tax planning decisions. Government initiatives aimed at economic development through taxation add further complexity. Cultural and ethical factors also influence tax planning strategies. Understanding these dynamics provides insights for policymakers and practitioners to develop more effective tax policies and strategies to ensure compliance and foster economic growth.

Recent years have witnessed a burgeoning interest in the study of tax avoidance, both in academic circles and public discourse (Agusti & Rahman, Citation2023; Majeed & Yan, Citation2019). This study endeavors to provide a detailed exploration of the myriad factors and strategies employed by corporations in circumventing tax obligations. The criticality of this research stems from the fact that taxes represent the primary source of governmental revenue, a notion supported by Safuan et al. (Citation2022). These revenues are pivotal for a multitude of governmental functions, including but not limited to enhancing educational and welfare systems, constructing infrastructural projects to spur economic growth, bolstering national resilience and security, and promoting regional development (Ling & Abdul Wahab, Citation2019; Natpraypant et al., Citation2022). The loss of government revenue due to the tax gap is worrisome and burdensome for the government (Ling & Abdul Wahab, Citation2019). In Indonesia, the government heavily relies on income, a significant portion of which is derived from tax revenues (Agusti & Rahman, Citation2023).

In recent years, the study of tax avoidance has garnered increasing attention within academic circles and public discourse worldwide, driven by a growing awareness of its implications for governmental revenue streams. However, while existing literature has extensively examined the broad implications of tax avoidance, there remains a critical need to delve deeper into the intricacies of tax planning within specific national contexts, particularly in Indonesia.

Indonesia’s taxation landscape is undergoing significant regulatory reforms and policy developments, making it a pertinent context for this study. The Indonesian government has recognized the importance of optimizing tax revenues to sustain crucial governmental functions and spur economic development. In response, various regulatory initiatives and policy reforms have been implemented to enhance tax compliance and address tax avoidance practices.

One notable development is the ongoing refinement of Indonesia’s tax laws and regulations to align with international standards and best practices. These reforms aim to enhance transparency, strengthen tax administration, and combat illicit financial activities. Additionally, the government has introduced measures to streamline tax procedures, improve taxpayer services, and incentivize voluntary compliance.

Furthermore, Indonesia’s evolving economic landscape, characterized by rapid globalization and technological advancements, presents unique challenges and opportunities in the realm of tax planning. The digitalization of business operations and cross-border transactions has raised complexities in determining tax liabilities and enforcing compliance.

Against this backdrop, this study seeks to provide a comprehensive examination of tax planning dynamics within the Indonesian context. By exploring the interplay between regulatory frameworks, policy developments, and corporate tax strategies, this research aims to offer fresh insights into the complexities and nuances of tax planning practices in Indonesia. By contextualizing theoretical frameworks and empirical findings within the dynamic socio-economic and regulatory environment of Indonesia, this study contributes to both academic scholarship and practical policymaking.

Ultimately, by shedding light on the intricate relationship between tax planning practices and regulatory dynamics in Indonesia, this research aims to inform evidence-based policy interventions and strategic decision-making processes. Through its rigorous analysis and novel insights, this study endeavors to contribute to the enhancement of the integrity, fairness, and effectiveness of the tax system in Indonesia, thereby promoting sustainable economic development and societal well-being.

The profound significance of taxation to the state’s financial health is evident in the continual efforts to augment tax revenue (Agusti & Rahman, Citation2023; Kurniasih et al., Citation2023). However, the situation is different for business owners, as they are always trying to reduce business costs, including tax burdens (Safuan et al., Citation2022; Sebele-Mpofu et al., Citation2021).

This paper sets out to offer a comprehensive examination of tax planning dynamics within the Indonesian context, shedding light on a crucial aspect often overlooked in academic and public discourse. In recent years, there has been a notable surge in scholarly interest and societal dialogue surrounding tax avoidance strategies, reflecting the growing recognition of its impact on governmental revenue streams. However, while existing literature has extensively discussed the implications of tax avoidance, particularly on government budgets and public services, there remains a conspicuous gap in understanding the intricate mechanisms and unique challenges faced within specific national contexts.

In Indonesia, where tax revenues play a pivotal role in sustaining governmental functions and driving economic development, the dynamics of tax planning warrant nuanced investigation. By delving into the myriad factors influencing corporate tax strategies and the evolving regulatory landscape, this study aims to offer fresh insights into the complexities underlying tax planning practices. Such insights hold significant implications for policymakers, tax authorities, and business stakeholders alike, as they navigate the delicate balance between fiscal responsibility and corporate competitiveness.

Moreover, this research endeavors to enrich the existing body of knowledge by contextualizing theoretical frameworks and empirical findings within the Indonesian socio-economic milieu. By synthesizing insights from prior studies with empirical evidence drawn from interviews, case studies, and regulatory analysis, this paper seeks to provide a holistic understanding of the drivers, challenges, and implications of tax planning strategies in Indonesia. In doing so, it aims to contribute not only to academic scholarship but also to inform policy debates and strategic decision-making processes at both the organizational and governmental levels.

Ultimately, by illuminating the nuanced interplay between tax planning practices, regulatory dynamics, and socio-economic imperatives within the Indonesian context, this paper aspires to foster a more informed dialogue on the role of taxation in shaping economic development and societal well-being. Through its multifaceted analysis and novel insights, this study endeavors to pave the way for future research endeavors and policy interventions aimed at enhancing the integrity, fairness, and effectiveness of the tax system in Indonesia and beyond.

2. Background

Based on agency theory, differences in interest between the state and taxpayers (Jensen & Meckling, Citation1976) will cause taxpayers to not fully comply with tax regulations (Sri Utaminingsih et al., Citation2022). One way taxpayers avoid taxes (Agusti & Rahman, Citation2023; Kurniasih et al., Citation2023; Majeed & Yan, Citation2019; Sri Utaminingsih et al., Citation2022). In essence, tax avoidance is a legal tax strategy that companies can use to reduce their tax payments; examples include taking advantage of accumulated tax losses and transfer pricing (Sebele-Mpofu et al., Citation2021). Given that tax avoidance is a strategy, it may be beneficial.

Company shareholders and the management are parties that benefit from tax avoidance behavior (Flagmeier et al., Citation2023; Sebele-Mpofu et al., Citation2021). The profits obtained by a company’s shareholders can be in the form of an increase in dividends received from the company (Karjalainen et al., Citation2020; Sebele-Mpofu et al., Citation2021). For the management, the most common advantage of tax avoidance behavior is an increase in performance bonuses as a result of an increase in company profits (Liu & Zhao, Citation2022). Given that profits induce a performance bonus effect, the form of ownership becomes essential.

Management decisions related to engaging in tax avoidance are influenced by a company’s ownership structure (Li et al., Citation2021; Liu & Zhao, Citation2022; Richardson et al., Citation2016). Company ownership structures are divided into distributed and centralized ownership structures, or blockholders (Park & Yoon, Citation2022; Richardson et al., Citation2016). More agency conflicts occur between the management and shareholders in companies with dispersed ownership. Company owners play an important role in company decisions (Sri Utaminingsih et al., Citation2022), including engaging in tax avoidance practices. Several studies have been conducted to determine the effect of ownership structure on tax avoidance behavior (Karjalainen et al., Citation2020; Richardson et al., Citation2016). From the agency theory perspective, major shareholders can use tax avoidance behavior as a shield to divert resources from a company (Desai & Dharmapala, Citation2006; Sri Utaminingsih et al., Citation2022), such as through transactions between related parties (Sebele-Mpofu et al., Citation2021).

Share ownership by the board of directors is said to reduce the level of tax aggressiveness because the decisions taken will affect the entity they own (Karjalainen et al., Citation2020). Managerial ownership is seen as a uniting goal between shareholders and entities to reduce management behavior in terms of selfish interests (Karjalainen et al., Citation2020). Further, institutional ownership of entities is expected to monitor managers’ performance to make decisions more optimally (Khuong et al., Citation2020; Wang et al., Citation2021). This is expected to reduce aggressive tax actions taken by the management (Li et al., Citation2021).

The dichotomy between commercial and fiscal accounting standards often results in discrepancies that pave the way for strategic earnings management with an aim towards tax avoidance, a phenomenon well-documented by Alsmady (Citation2022). This study posits a significant correlation between various forms of ownership – insider, institutional, and blockholder – and earnings management in influencing tax avoidance behaviors. Particularly in Indonesia, a nation reliant on tax-derived income and employing a self-assessment system, both individual and corporate taxpayers possess the autonomy to compute and declare their tax dues. This autonomy, coupled with a nuanced understanding of the tax system, potentially leads to substantial tax avoidance opportunities, spurred by specific motivations stemming from ownership structures or earnings management practices. Diverging from previous research, this study innovatively connects the dots between earnings management and tax avoidance activities, offering a unique perspective. It contributes conceptually to the existing literature by highlighting the role of earnings management in the strategic reduction of tax liabilities, thereby addressing the critical issue of declining state tax revenues.

This research distinguishes itself by focusing specifically on the complexities of tax planning within the Indonesian context, a nuance often overlooked in broader studies. While existing literature provides insights into general tax avoidance strategies and their implications, our study delves deeply into the unique factors shaping tax planning decisions in Indonesia. By examining the interplay of regulatory frameworks, cultural influences, ownership structures, and economic dynamics, we offer fresh perspectives on the intricacies of tax planning practices. Through innovative methodologies such as empirical evidence from interviews, case studies, and regulatory analysis, we enrich our understanding of tax planning dynamics. Our findings not only contribute to academic scholarship but also provide actionable insights for policymakers, tax authorities, and businesses navigating Indonesia’s tax landscape. Ultimately, this research aims to inform evidence-based policy interventions and strategic decision-making processes, fostering a fairer, more effective tax system conducive to sustainable economic development in Indonesia and beyond.

3. Literature review

3.1. Agency theory as a motivation

This study delves into the intriguing realms of compliance and agency theories in the context of taxation and corporate governance. Compliance with taxation, as Étienne and Wendeln (Citation2010) note, is about adhering to rules and being disciplined in tax payments, shaped significantly by socialization processes.

Central to this discourse is the agency theory by Jensen and Meckling (Citation1976), which examines the alignment of agents’ (management) actions with principals’ (shareholders) expectations, particularly through compensation systems. This theory also highlights the inherent conflicts of interest in agency relationships, suggesting that accounting-based compensation contracts can help align managerial and shareholder interests, thereby reducing agency conflicts.

In the arena of tax avoidance, agency theory suggests that management, as agents, handle financial reporting as part of their stewardship role. This encompasses independent auditing to express financial statement accuracy, bonding expenditures ensuring agent adherence to owner wishes, and addressing residual loss in financial information usage (Fama & Jensen, Citation1983).

Furthermore, agency theory underscores the elimination of earnings management issues through self-monitoring and effective corporate governance (Istianingsih, Citation2021). It points out that the board of commissioners and ownership structure act as supervisory mechanisms in modern companies to mitigate agency problems between management and shareholders (Istianingsih et al., Citation2020). This theory provides a foundation for understanding the interplay between ownership structure, earnings management, and tax evasion behaviors, highlighting the conflict of interest between companies seeking to minimize taxes and shareholders concerned about the integrity of financial statements.

4. Hyphotheses deevelopment

Prior research indicates that a company’s ownership structure significantly impacts its earnings management practices. Dempsey et al. (Citation1993) and Yang et al. (Citation2022) highlight the substantial effect of ownership structure on reported earnings, though the role of insiders, institutional investors, and blockholders in influencing earnings manipulation remains a topic of debate. The literature differentiates between internal (owner-managed) and external (externally controlled) holders, with the former involving managerial ownership of significant company stock, and the latter where external blockholders own substantial shares.

Studies by Richardson et al. (Citation2016) and Warfield et al. (Citation1995) reveal a negative correlation between managerial ownership and earnings management, with the latter noting a weakened relationship in regulated firms due to fragmented institutional ownership impacting governance. Additionally, Shams et al. (Citation2022) found that family-controlled companies, unlike conglomerates, tend to limit opportunistic earnings management and promote efficient profit management. This approach, they suggest, is driven by a tendency to avoid tax evasion through careful decision-making, aligning the interests of management with those of the company. Karjalainen et al. (Citation2020) and Yang et al. (Citation2022) support this view, noting that managerial share ownership leads to more prudent decision-making, thus minimizing the likelihood of tax evasion. Based on these findings, the study proposes to further explore these dynamics.

H1: Insider ownership negatively affects tax avoidance.

Institutional investors, often deemed sophisticated, are typically more adept at using current information to forecast future earnings compared to non-institutional investors. (Balsam et al., Citation2003) find a negative relationship between unexpected discretionary accruals and stock returns around announcement dates, where the negative relationship varies depending on the level of investor sophistication, and market reactions from more sophisticated investors precede those from unsophisticated investors (Sastrodiharjo & Khasanah, Citation2023). Furthermore, (Istianingsih, Citation2021) finds that high institutional ownership limits managers in terms of managing earnings.

The ownership of entities by institutions is expected to improve the supervision of agents in conducting entity business processes (Hasan et al., Citation2022) and reduce tax avoidance by the management (Wang et al., Citation2021). However, earnings management can be efficient and only sometimes opportunistic. If earnings management is efficient, high institutional ownership increases earnings management (positive correlation). However, if a company’s profit management is opportunistic, high institutional ownership will reduce earnings management (negative correlation). Based on (Hasan et al., Citation2022; Istianingsih, Citation2021; Wang et al., Citation2021), we propose the following:

H2: Institutional ownership negatively affects tax.

H3: blockholder ownership negatively affects tax avoidance.

H4: Earnings management positively affects tax.

The necessity of articulating how Agency Theory serves as the overarching theoretical framework connecting the independent variables of insiders, institutional, and blockholders ownership, as well as earnings management, to the dependent variable of tax avoidance.

Agency Theory posits that there is an intrinsic conflict between the principals (shareholders) and the agents (managers) of a company. Principals seek to maximize shareholder value while agents are motivated to act in their own best interests, which may not always align with those of the principals. This discrepancy can lead to agents engaging in activities such as tax avoidance, which they may perceive as beneficial for their personal or immediate business objectives, albeit potentially at the cost of long-term shareholder value.

Each type of ownership embodies a different dynamic in the principal-agent relationship:

Insiders Ownership: When insiders hold significant equity, their interests are more likely to align with those of the external shareholders, potentially reducing the agency problem and influencing the propensity for tax avoidance. Institutional Ownership: Institutional investors often have the power and incentive to monitor management actions closely, which can either deter aggressive tax avoidance strategies or pressure management to engage in such strategies to enhance short-term returns. Blockholders Ownership: Blockholders, by virtue of their substantial holdings, can exert significant influence on corporate strategies, including tax planning. Depending on their objectives, they may advocate for more conservative or more aggressive tax avoidance.

Earnings Management: The relationship between earnings management and tax avoidance can be understood through the lens of Agency Theory as managers might manipulate earnings not only to meet certain benchmarks and personal bonuses but also as a means to reduce taxable income.

5. Research design

This study, categorized as explanatory research, employs hypothesis testing and causal descriptive approaches to analyze how ownership structure and earnings management affect tax avoidance. Data was collected from 90 companies over four years 2017-2020, totaling 360 firm-years, using the selection method outlined by Jensen and Meckling (Citation1976).

The observation period of 2017-2020 was chosen strategically for several reasons. Firstly, it aligns with significant regulatory reforms in Indonesia’s taxation landscape, providing relevant context. Secondly, focusing on a more recent timeframe allows us to capture up-to-date trends in tax planning practices. While a longer period could offer a historical perspective, it might overlook recent developments. Similarly, a more recent observation period might not fully capture longer-term trends. Therefore, the selected timeframe strikes a balance between relevance and robustness in understanding Indonesian tax planning dynamics.

This method highlights the impact of management-owner conflicts of interest on earnings management practices. The study also implemented a winsorization method for data processing, effectively handling outliers—data points with unique, extreme characteristics—without data loss.

presents the number of research samples and their criteria. The data were obtained from the official website of the Indonesia Stock Exchange (IDX). Univariate outlier detection involved converting data into z-scores (standardized scores with a mean of zero and a standard deviation of 1). As per Hair et al. (Citation2022), in small samples (<80), scores >2.5 are considered outliers. Of the 360 manufacturing company samples over four years, 16 are outliers.

Table 1. Research sample.

This study examines manufacturers listed on the IDX from 2017 to 2020, selected for their significance to Indonesia’s labor market and economy. The criteria included consistent publication of audited financial reports, no delisting, and stability in terms of mergers, acquisitions, or sector changes (Istianingsih, Citation2021; Istianingsih et al., Citation2020). It employed secondary data from the Indonesian Capital Market Directory (ICMD) and the Jakarta Stock Exchange, focusing on audited financial statements from the same period, collected via documentation methods.

5.1. Variable measurement

5.1.1. Tax avoidance

The tax avoidance measurement used in this study is based on the measurements by Desai and Dharmapala (Citation2006) as a robustness test to strengthen the research results. (Lim, 2011) undertakes measurements by modifying the measurements of Desai and Dharmapala (Citation2006). The procedure for calculating tax avoidance carried out by Lim (2011) involves two steps. The first step is to estimate discretionary accruals, using the formula from (Dechow et al., Citation1995). The total accruals for each company each year are regressed using the Dechow formula to obtain residuals that are discretionary accruals (DA_modi,t). The second step is to separate book tax into different components resulting from earnings management for tax purposes to identify these components as tax avoidance. Ordinary least squares regression was performed as follows:

Description:

BTD it = Book tax difference for company i in year t, lagged by asset t-1

BTD = Commercial profit – Fiscal profit

Fiscal profit = Tax expense/Effective tax rate

µi = Discretionary accruals for firm i in year t, scaled by asset t-1.

εit = Error

The residual of the BTD equation is the book’s tax-difference component resulting from earnings management for tax purposes (TA_Lim). Desai and Dharmapala (Citation2006) uses total accruals in a BTD regression to obtain earnings management for tax purposes (TA_Lim).

5.1.2. Earnings management

Earnings management is the degree of the correlation between a company’s (entity) accounting profits and economic profits. Earnings management is measured using a discretionary accrual proxy in the Modified Jones Model (Dechow et al., Citation1995). The following formula was used to calculate the model:

(1)

(1)

We then calculated the total accrual value (TAC) using the following regression equation:

(2)

(2)

Using the regression coefficient above, we can calculate the value of nondiscretionary accruals (NDTAC) using the following formula:

(3)

(3)

Discretionary accruals (DTAC) are the residuals obtained from the estimated total accruals, and are calculated as follows:

DTACjt = Discretionary accrual of company j in period t

NDTACjt = Non-discretionary accrual of company j in period t

TACjt = Total accrual of company j in period t

NI jt = Net profit of company j in period t

CFOjt = Company j’s operating cash flow in period t

TA jt-1 = Total assets of company j in period t-1

ΔSales jt = Change in company j’s sales in period t

PPE jt = Fixed assets of company j in period t

ΔRECjt = Change in receivables of company j in period t

5.1.3. Insider ownership

Insider ownership is measured by adding the percentage of shares owned by the management, including the percentage of shares owned by the management personally or by the subsidiaries of the company concerned and its affiliates. Insider ownership is the management’s share ownership, as measured by the percentage of total shares owned by the management (Warfield et al., Citation1995). The extent of insider ownership illustrates the similarity of goals between the principal and agent. The agent acts as the principal; therefore, managers will be more careful in making decisions. In this study, insider ownership is measured as the ratio of the number of shares owned by managers to the number of outstanding shares.

5.1.4. Institutional ownership

Institutional ownership is the percentage of company shares owned by other domestic and foreign companies as well as domestic and foreign government shares. Institutional ownership is measured by adding the percentage of company shares owned by other companies at home and abroad and domestic and pensionary government shares where the percentage of shares is more than 5%. Total institutional ownership is the sum of the proportion of the total number of outstanding shares held by all institutional investors at year-end (Lin & Fu, Citation2017).

5.1.5. Blockholder ownership

Based on the measurement of blockholder ownership as per a previous study (Handoko et al., Citation2022), the threshold of control rights for blockholders or controlling shareholders is more than 50% of all shares with fully paid voting rights. Following this rule, a company with over 50% share ownership is categorized as a blockholder company.

5.2. Data analysis

Multiple regression analysis was employed in this study, which included hypothesis testing for heteroscedasticity, autocorrelation of error terms, and multicollinearity among independent variables, along with a t-test, correlation test, and determination coefficient test.

6. Empirical results and discussion

6.1. Regression analysis

A regression analysis determines the relationship between the independent and dependent variables (Sekaran & Bougie, Citation2016). These independent variables consist of the effective tax rate (ETR), institutional ownership (INST), managerial ownership/insider ownership (INSDR), and blockholder ownership (BLOK), which were used to perform a regression analysis to determine the significance together and individually, as well as to test the coefficient of determination.

The summary model presented in was generated using multiple linear analysis tests. Based on the test results, the Adjusted R Square score is 0.099 or equal to 9.9%, which means that the effect of all the independent variables—INST, INSDR, BLOK, and DTAC—on the dependent variable, namely the ETR value of 0.099, or 9.9%. The remaining value of 0.901, or 90.1%, is explained by variables not included in this study.

Table 2. Model summary.

Based on the regression results, it can be seen that the independent effect of all the independent variables on the dependent variable, as shown in .

Table 3. F-test result.

The test results of the F-test of the independent variables affect the dependent variable if the F-count value is greater than the F-table or if the significance is less than 0.05. Based on , the F-test shows an F-count value of 6.452 and a significance value of 0.000 or less than 0.05; thus, it can be concluded that the four independent variables, on ETR.

Table 4. T-test results.

Based on the regression results, it can be seen that the effect of the partial independent variables is the effect of all the independent variables on ETR. The regression results are presented in .

Based on the regression results of the multiple linear regression analysis given in , the following can be inferred:

A constant of 593379.872 indicates that if the independent variable is considered constant, ETR is 593379.872.

According to the partial test calculations, INSDR is significant at 0.027, which is less than 0.05, confirming H1, in that, INSDR negatively affects tax avoidance.

According to the partial test calculations, INST positively affects tax avoidance, rejecting H2.

According to the partial test calculations, the value of 0.400 is greater than 0.05. The positive effect of BLOK on tax avoidance rejects H3.

Based on the partial test calculations, H4 is rejected because 0.547 is greater than 0.05

The coefficient is negative; therefore, every 1% reduction in DTAC decreases ETR by 450431.545. (If the other independent variables are constant).

6.2. Discussion

6.2.1. The effect of insider ownership on tax avoidance

Insider ownership has a negative effect on tax avoidance, where the value with a significance value of 0.027 is less than 0.05; thus, it can be concluded that H1 is accepted. The negative effect of insider ownership on tax avoidance indicates that insider ownership affect tax avoidance. This incentive, the alignment effect, is thought to have a greater impact than increasing managerial ownership, suggesting that increasing managerial ownership and earnings management as efficiently as possible increases the informativeness of earnings in communicating value-relevant information (Siregar & Utama, Citation2008). These results indicate that the greater the managerial ownership, the lesser the company’s tax avoidance practices. The results of this study support (Shams et al., Citation2022), who state that managerial ownership has a negative effect on tax avoidance. This research also supports Field (Badertscher et al., Citation2013; Shams et al., Citation2022) that companies with high managerial ownership tend to want less income tax (higher tax avoidance) than companies with low managerial ownership. To ensure that an investment provides a good future return (Yang et al., Citation2022), under managerial ownership, tax avoidance tends to be prevented. The results of this study support the findings of Karjalainen et al. (Citation2020), in that, managerial ownership helps align conflicts of interest between principals and agents.

6.2.2. The effect of institutional ownership on tax avoidance

Institutional ownership has a positive effect on tax avoidance, where the value with a significance value of 0.902 is greater than 0.05; thus, it can be concluded that H2 is rejected. Institutional ownership is the percentage of ownership of an entity by institutions. Ownership by institutions that are expected to increase the oversight of agents in conducting entity business processes to reduce opportunistic actions from managers.

The remaining results prove that the second hypothesis, which states that institutional ownership has a negative effect on tax evasion, is not supported. The results indicate that institutional ownership does not affect tax evasion. Based on the data sampled in this study, on average, they have a large institutional ownership of 65%. However, the supervision by institutional owners is not aimed at avoiding taxes. A possible justification is that institutional owners care about their reputation, so they expect the management to refrain from tax evasion. For a company that expects optimal returns from its investments, institutional ownership encourages the management to maintain its reputation, so it remains sustainable. This finding is in line with (Khuong et al., Citation2020), who explain that institutional ownership does not affect tax avoidance. Institutional investors are very wealthy; therefore, institutional ownership does not impact the occurrence of tax evasion. In this research sample, the management attempts to promote the corporate image or the management with other motivations and interests so that company performance continues to improve.

6.2.3. The effect of blockholder ownership on tax avoidance

Blockholder ownership has a positive effect on tax avoidance, where the value with a significance value of 0.400 is greater than 0.05, so it can be concluded that H3 is rejected. The positive effect of blockholder ownership on tax avoidance indicates that blockholder ownership does not affect tax avoidance. A high proportion of share ownership is more significant in encouraging the management to maximize firm value (Salhi et al., Citation2020). Blockholders are large owners who own at least 5% of a company’s shares. This study differs from previous research (Salhi et al., Citation2020), which found that large shareholders have strong power and incentives to maximize share value. The data support the statement of Menchaoui and Hssouna (Citation2022), in that, blockholder ownership tends to be risk averse because such owners are aware of the exposure with regard to considerable shareholdings, so they tend to choose not to engage in tax evasion. Under blockholder ownership, taxes are generally not evaded because such owners are aware of legal and reputational risks (Salhi et al., Citation2020).

6.2.4. The effect of earnings management on tax avoidance

Earnings management ownership proxied by the effective tax rate has a negative effect on tax avoidance, where the value with a significance value of 0.547 is greater than 0.05; thus, it can be concluded that H4 is rejected. These results of the current study indicate that earnings management does not affect tax evasion. This finding implies that the pattern of earnings management used by the companies in the sample tends to aim at something other than avoiding taxes. The descriptive statistical data show that the average earnings management is positive, indicating an increase in income. The earnings management pattern used by the sample increases profits, indicating that taxes are not avoided. These results of the current study indicate that earnings management does not affect tax evasion. This finding implies that the earnings management pattern used by the sample companies tends to aim for something other than avoiding taxes. The descriptive statistical data show that the average earnings management is positive, indicating an increase in income. The earnings management pattern used by the sample is to increase profits, which means that it does not aim to avoid taxes.

The findings of this study differ from those of Amidu et al. (Citation2019), in that, earnings management positively affects tax evasion. This study also differs from (Thalita et al., Citation2022), who found that earnings management significantly positively affects tax avoidance. The explanation for this study’s result is that managers manage earnings by reporting higher profits, and there are no incentives to avoid taxes but for other purposes.

7. Summary and conclusion

This study delves into the complex relationship between ownership structures and tax avoidance, unveiling compelling insights. It reveals that insider ownership surprisingly acts as a barrier to tax avoidance, challenging traditional beliefs and suggesting a negative correlation. Siregar and Utama (Citation2008) support this by showing how enhanced managerial ownership, when combined with effective earnings management, can enrich the communicative value of earnings.

Contrarily, institutional and blockholder ownership do not seem to have a significant impact on tax avoidance, indicating that diverse ownership forms may not strongly influence corporate tax tactics. Additionally, in an unexpected twist, earnings management, as measured via discretionary accruals, is observed to have no significant effect on tax avoidance. This finding suggests that effective tax rates might not play as significant a role in shaping tax strategies as previously assumed.

The study, while enlightening, acknowledges its limitations, notably the Jones model’s potential misclassification issues and data constraints on ownership structures, which may impact the depth of analysis in insider, institutional, and blockholder ownership. Additionally, the limited time for companies to appoint independent commissioners and form audit committees could have affected the results.

A significant future research avenue is the exploration of controlling shareholders, often overlooked in direct ownership analyses, yet crucial due to their link with tax avoidance and shareholder interests. Overall, this research not only enriches current understanding but also sets the stage for further investigations into the nuanced interplay of ownership and tax avoidance.

For future studies, considering panel regression analysis could provide a more comprehensive understanding of tax planning dynamics. Additionally, incorporating alternative tax avoidance measurements like CETR and ABTD would enrich the analysis, offering deeper insights into corporate tax strategies within the Indonesian context.

For future studies, incorporating control variables into the model would enhance the analysis. Control variables such as firm size, industry type, and financial performance metrics can offer valuable insights into tax planning dynamics in Indonesia. This inclusion allows researchers to isolate specific determinants and improve the accuracy of their findings. Therefore, integrating control variables is essential for refining our understanding of tax planning practices within the Indonesian context.

This study opens a gateway to several impactful implications, weaving a narrative that resonates beyond the academic sphere:

A Call for Enhanced Tax Compliance: It advocates for a heightened sense of responsibility among taxpayers, both corporate and individual. This call to action emphasizes the critical role of diligent tax compliance in bolstering state revenues, thereby contributing to the nation’s economic vitality.

Guidance for Corporate Tax Practices: The research specifically addresses corporate entities, urging them to stay abreast of and adhere to the latest tax legislation, particularly in relation to Income Tax, Article 21. By aligning employee tax allocations with current regulations, companies can ensure legal integrity and fiscal responsibility.

Expanding the Research Horizon: Looking forward, the study suggests an expansion of the research scope, both in terms of the sample size—by including a broader spectrum of companies listed on the IDX—and the duration of the study period. This expanded approach is envisaged to yield more robust, generalizable results. Moreover, it paves the way for future research streams to delve deeper into the nuances of evolving tax regulations, with a special focus on income tax.

In essence, this research not only sheds light on prevailing tax practices but also charts a course for future inquiries and practical applications, aiming to enrich understanding and enhance compliance in the ever-evolving landscape of taxation.

Nature of the data

The data used in this research are primarily quantitative in nature, derived from the financial statements of manufacturing companies. The data include financial figures such as revenue, expenses, profits, and other relevant financial metrics.

Source of the data

The data were sourced from two main sources: the Indonesian Stock Exchange (IDX) and the Indonesian Capital Market Directory (ICMD). These sources provide access to audited financial statements of publicly listed companies, which are required to disclose their financial information to the public.

Size of the data

The dataset comprises financial information from manufacturing companies listed on the IDX from the years 2017 to 2020. The exact size of the dataset in terms of the number of companies and the number of financial statements analyzed is detailed in the research article.

Accessibility of the data

Due to the proprietary nature of the data, it cannot be made openly accessible. However, researchers interested in accessing the data for academic or research purposes may submit a formal request to the corresponding author, Prof. Dr. Istianingsih Sastrodiharjo, at [email protected]. Requests will be considered in accordance with the data sharing policies of the Indonesian Stock Exchange and the Indonesian Capital Market Directory, and subject to necessary approvals and confidentiality agreements.

Details of rights and permissions required

Access to the data requires permission from the Indonesian Stock Exchange and the Indonesian Capital Market Directory, as the data are proprietary and subject to confidentiality agreements. Researchers interested in accessing the data must adhere to the data sharing policies of these organizations and obtain necessary approvals before accessing the data.

Acknowledgements

We express our heartfelt gratitude to those who contributed to our study on ownership structures and tax avoidance in Indonesian manufacturing firms (2017-2020). We appreciate the Indonesian Capital Market Directory (ICMD) and the Jakarta Stock Exchange for providing crucial financial data. Our team’s dedication and expertise were invaluable in conducting this comprehensive analysis. We also thank our academic mentors and peer reviewers for their insightful feedback and guidance. Finally, our families and friends deserve acknowledgment for their unwavering support and encouragement. This research reflects the collaborative efforts of many, and we are deeply thankful for their contributions.

Disclosure statement

No potential conflict of interest was reported by the author(s).

Data availability statement

The data supporting the findings of this research are available within the article. The data were sourced from the Indonesian Stock Exchange (IDX) and the Indonesian Capital Market Directory (ICMD), focusing on audited financial statements of manufacturing companies listed on the IDX from the years 2017 to 2020.

Additional information

Notes on contributors

Istianingsih Sastrodiharjo

Istianingsih Sastrodiharjoa (Lead Researcher): A distinguished Professor of Contemporary Accounting at Universitas Bhayangkara Jakarta Raya, Prof. Istianingsih is the principal investigator in this research. She brings an illustrious academic and professional background to the study, holding a Doctorate in Accounting Sciences with Cum Laude honors from Universitas Indonesia and having completed postdoctoral studies at the School of Governance, Murdoch University, Australia. Prof. Istianingsih’s expertise in contemporary accounting practices and her profound understanding of corporate finance and taxation are pivotal to the study’s focus on ownership structures and tax avoidance strategies in Indonesian manufacturing firms. Her role encompasses overseeing the research design, methodology, and analysis, ensuring the study’s academic rigor and relevance to both the academic community and industry practitioners.

Aloysius Harry Mukti

Aloysius Harry Mukti, Ph.D (Co-Researcher): As a co-researcher, Mr. Mukti contributed significantly to the data collection and analysis phases of the study. His analytical skills and knowledge in finance and economics were crucial in examining the ownership structures and tax avoidance strategies of Indonesian manufacturing firms. His role also included assisting in the preparation of the final research report and ensuring the accuracy of the data presented.

References

- Agusti, R. R., & Rahman, A. F. (2023). Determinants of tax attitude in small and medium enterprises: Evidence from Indonesia. Cogent Business & Management, 10(1), 1. https://doi.org/10.1080/23311975.2022.2160585

- Alsmady, A. A. (2022). Accounting information quality and tax avoidance effect on investment opportunities evidence from Gulf Cooperation Council GCC. Cogent Business & Management, 9(1), 2143020. https://doi.org/10.1080/23311975.2022.2143020

- Amidu, M., Coffie, W., & Acquah, P. (2019). Transfer pricing, earnings management and tax avoidance of firms in Ghana. Journal of Financial Crime, 26(1), 235–15. https://doi.org/10.1108/JFC-10-2017-0091

- Badertscher, B. A., Katz, S. P., & Rego, S. O. (2013). The separation of ownership and control and corporate tax avoidance. Journal of Accounting and Economics, 56(2–3), 228–250. https://doi.org/10.1016/j.jacceco.2013.08.005

- Balsam, S., Krishnan, J., & Yang, J. S. (2003). Auditor industry specialization and earning quality. Auditing: A Journal of Practice & Thoery, 22(2), 71–93.

- Dechow, P. M., Sloan, R. G., & Sweeny, A. P. (1995). Detecting earning management. Accounting Review, 70(2), 192–225.

- Dempsey, S. J., Hunt, H. G., & Schroeder, N. W. (1993). Earning management and corporate ownership structure: An examination of extraordinary item reporting. Journal of Business Finance & Accounting, 20(4), 479–500. https://doi.org/10.1111/j.1468-5957.1993.tb00270.x

- Desai, M. A., & Dharmapala, D. (2006). Corporate tax avoidance and high-powered incentives. Journal of Financial Economics, 79(1), 145–179. https://doi.org/10.1016/j.jfineco.2005.02.002

- Étienne, J., & Wendeln, M. (2010). Compliance theories: A literature review. Revue Française de Science Politique (English), 60(2), 139–162. https://doi.org/10.3917/rfspe.602.0139

- Fama, E. F., & Jensen, M. C. (1983). Separation of ownership and control. The Journal of Law and Economics, 26(2), 301–325. https://doi.org/10.1086/467037

- Flagmeier, V., Müller, J., & Sureth-Sloane, C. (2023). When do firms highlight their effective tax rate? Accounting and Business Research, 53(1), 1–37. https://doi.org/10.1080/00014788.2021.1958669

- Hair, J. F., Hult, G. T., Ringle, C., & Sarstedt, M. (2022). A primer on partial least squares structural equation modeling (PLS-SEM). SAGE Publications.

- Handoko, L. Y., Sari, M. M. R., Suaryana, I. G. N. A., & Putri, I. G. M. A. D. (2022). Political connections, blockholder ownership, and tax avoidance: Evidence from Indonesia. Budapest International Research and Critics Institute (BIRCI-Journal), 5(2), 173–180. https://doi.org/10.33258/birci.v5i2.4897

- Hasan, I., Kim, I., Teng, H., & Wu, Q. (2022). The effect of foreign institutional ownership on corporate tax avoidance: International evidence. Journal of International Accounting, Auditing and Taxation, 46, 100440. https://doi.org/10.1016/j.intaccaudtax.2021.100440

- Istianingsih, (2021). Earnings quality as a link between corporate governance implementation and firm performance. International Journal of Management Science and Engineering Management, 16(4), 290–301. https://doi.org/10.1080/17509653.2021.1974969

- Istianingsih, I., Trireksani, T., & Manurung, D. T. H. (2020). The impact of corporate social responsibility disclosure on the future earnings response coefficient (ASEAN Banking Analysis). Sustainability, 12(22), 9671. https://doi.org/10.3390/su12229671

- Jensen, M. C., & Meckling, W. H. (1976). Theory of the firm: Managerial behavior, agency costs and ownership structure. Journal of Financial Economics, 3(4), 305–360. https://doi.org/10.1016/0304-405X(76)90026-X

- Karjalainen, J., Kasanen, E., Kinnunen, J., & Niskanen, J. (2020). Dividends and tax avoidance as drivers of earnings management: Evidence from dividend-paying private SMEs in Finland. Journal of Small Business Management, 61(2), 906–937. https://doi.org/10.1080/00472778.2020.1824526

- Khuong, N. V., Liem, N. T., Thu, P. A., & Khanh, T. H. T. (2020). Does corporate tax avoidance explain firm performance? Evidence from an emerging economy. Cogent Business & Management, 7(1), 1780101. https://doi.org/10.1080/23311975.2020.1780101

- Kurniasih, L., Yusri, Y., Kamarudin, F., & Sheikh Hassan, A. F. (2023). The role of country by country reporting on corporate tax avoidance: Does it effective for the tax haven? Cogent Business & Management, 10(1), 2159747. https://doi.org/10.1080/23311975.2022.2159747

- Li, B., Liu, Z., & Wang, R. (2021). When dedicated investors are distracted: The effect of institutional monitoring on corporate tax avoidance. Journal of Accounting and Public Policy, 40(6), 106873. https://doi.org/10.1016/j.jaccpubpol.2021.106873

- Lin, Y. R., & Fu, X. M. (2017). Does institutional ownership influence firm performance? Evidence from China. International Review of Economics & Finance, 49, 17–57. https://doi.org/10.1016/j.iref.2017.01.021

- Ling, T. W., & Abdul Wahab, N. S. (2019). Components of book tax differences, corporate social responsibility and equity value. Cogent Business & Management, 6(1), 1617024. https://doi.org/10.1080/23311975.2019.1617024

- Liu, H., & Zhao, Y. (2022). Cannot investors really price the book-tax differences correctly? Evidence from accelerated depreciation policies. China Journal of Accounting Studies, 10(3), 301–322. https://doi.org/10.1080/21697213.2022.2143671

- Majeed, M. A., & Yan, C. (2019). Financial statement comparability and corporate tax avoidance: Evidence from China. Economic Research-Ekonomska Istraživanja, 32(1), 1813–1843. https://doi.org/10.1080/1331677X.2019.1640627

- Menchaoui, I., & Hssouna, C. (2022). Impact of internal governance mechanisms on tax aggressiveness: Evidence from French firms listed on the CAC 40. EuroMed Journal of Business, 1450–2194. https://doi.org/10.1108/EMJB-03-2022-0047

- Mocanu, M., Constantin, S.-B., & Răileanu, V. (2021). Determinants of tax avoidance – Evidence on profit tax-paying companies in Romania. Economic Research-Ekonomska Istraživanja, 34(1), 2013–2033. https://doi.org/10.1080/1331677X.2020.1860794

- Natpraypant, V., Arshed, N., & Power, D. (2022). The introduction of anti-tax evasion legislation in Thailand: An institutional theoretical perspective. Accounting Forum, 48(1), 121–147. https://doi.org/10.1080/01559982.2022.2092813

- Park, J., & Yoon, W. (2022). A foreign subsidiary’s largest shareholder, entry mode, and divestitures: The moderating role of foreign investment inducement policies. European Research on Management and Business Economics, 28(3), 100197. https://doi.org/10.1016/j.iedeen.2022.100197

- Richardson, G., Wang, B., & Zhang, X. (2016). Ownership structure and corporate tax avoidance: Evidence from publicly listed private firms in China. Journal of Contemporary Accounting & Economics, 12(2), 141–158. https://doi.org/10.1016/j.jcae.2016.06.003

- Ross, S. A. (1973). The economic theory of agency: The Principal’s problem. American Economic Review, 63(2), 39–134.

- Safuan, S., Habibullah, M. S., & Sugandi, E. A. (2022). Eradicating tax evasion in Indonesia through financial sector development. Cogent Economics & Finance, 10(1), 2114167. https://doi.org/10.1080/23322039.2022.2114167

- Salhi, B., Al Jabr, J., & Jarboui, A. (2020). A comparison of corporate governance and tax avoidance of UK and Japanese firms. Comparative Economic Research. Central and Eastern Europe, 23(3), 111–132. https://doi.org/10.18778/1508-2008.23.23

- Sastrodiharjo, I., & Khasanah, U. (2023). Is it the end of enterprise resource planning? Evidence from Indonesia state-owned enterprises (SOEs). Cogent Business & Management, 10(2) https://doi.org/10.1080/23311975.2023.2212499

- Sebele-Mpofu, F., Mashiri, E., & Schwartz, S. C. (2021). An exposition of transfer pricing motives, strategies and their implementation in tax avoidance by MNEs in developing countries. Cogent Business & Management, 8(1), 1944007. https://doi.org/10.1080/23311975.2021.1944007

- Sekaran, U., & Bougie, R. (2016). Research methods for business. (7th ed.). Wiley.

- Shams, S., Bose, S., & Gunasekarage, A. (2022). Does corporate tax avoidance promote managerial empire building? Journal of Contemporary Accounting & Economics, 18(1), 100293. https://doi.org/10.1016/j.jcae.2021.100293

- Siregar, S. V., & Utama, S. (2008). Type of earnings management and the effect of ownership structure, firm size, and corporate-governance practices: Evidence from Indonesia. The International Journal of Accounting, 43(1), 1–27. https://doi.org/10.1016/j.intacc.2008.01.001

- Sri Utaminingsih, N., Kurniasih, D., Pramono Sari, M., & Rahardian Ary Helmina, M. (2022). The role of internal control in the relationship of board gender diversity, audit committee, and independent commissioner on tax aggressiveness. Cogent Business & Management, 9(1), 2122333. https://doi.org/10.1080/23311975.2022.2122333

- Thalita, A. A., Hariadi, B., & Rusydi, M. K. (2022). The effect of earnings management on tax avoidance with political connections as a moderating variable. International Journal of Research in Business and Social Science (2147- 4478), 11(5), 344–353. https://doi.org/10.20525/ijrbs.v11i5.1864

- Wang, X., Bu, L., & Peng, X. (2021). Internet of things adoption, earnings management, and resource allocation efficiency. China Journal of Accounting Studies, 9(3), 333–359. https://doi.org/10.1080/21697213.2021.2009180

- Warfield, T. D., Wild, J. J., & Wild, K. L. (1995). Managerial ownership, accounting choices, and informativeness of earnings. Journal of Accounting and Economics, 20(1), 61–91. https://doi.org/10.1016/0165-4101(94)00393-J

- Yang, J., Hemmings, D., Jaafar, A., & Jackson, R. H. G. (2022). The real earnings management gap between private and public firms: Evidence from Europe. Journal of International Accounting, Auditing and Taxation, 49, 100506. https://doi.org/10.1016/j.intaccaudtax.2022.100506