?Mathematical formulae have been encoded as MathML and are displayed in this HTML version using MathJax in order to improve their display. Uncheck the box to turn MathJax off. This feature requires Javascript. Click on a formula to zoom.

?Mathematical formulae have been encoded as MathML and are displayed in this HTML version using MathJax in order to improve their display. Uncheck the box to turn MathJax off. This feature requires Javascript. Click on a formula to zoom.Abstract

Effective capital decisions not only increase the operational efficiency of businesses but also is strategic to bring the enterprise’s competitive advantages to the market. Using an appropriate debt ratio helps businesses to strike a balance between internal and external resources to compete with other enterprises in the industry. This study aims to find out the effects of capital structure through debt ratio (DR) on the competitiveness of enterprises (HHI) in Vietnam. A sample of 574 companies listed on Vietnam’s stock exchange from 2010–2018 is studied with STATA software. The results show that capital structure affects the competitiveness of enterprises in reverse U-shape. At the same time, DR affects HHI in the form of the U-shaped function in industrial products, information and telecommunication, and consumer goods. Meanwhile, DR affects HHI in reverse U-shape in the sectors of consumer services, raw materials, and community utilities. With the results of this analysis, the research also provides discussion as well as policy implications for businesses to make optimal use of capital structure to provide competitive advantage in the market.

PUBLIC INTEREST STATEMENT

This study is one of the first to focus on the impact of capital structure on the market competitiveness of enterprises in Vietnam.

The results show that capital structure affects the competitiveness of inverted U-shaped enterprises

The increase in debt ratio makes the competitiveness of enterprises increase to the limit when increasing in debt ratio makes the competitiveness decrease.

Debt ratios in different industries have different effects on competitiveness

1. Introduction

During the period of international economic integration, enterprises are pressured to compete with not only other domestic businesses but also the foreign ones. Therefore, the implementation of business strategies should be carefully planned in advance. At the same time, in a fiercely competitive economic environment, this new investment expansion will help businesses ensure firm performance (Moeinaddin et al., Citation2013; Nguyen et al., Citation2014a). In order to implement these plans, investment attraction as well as capital policy is an important first step

Capital structure is one of the essential factors paid attention by economic researchers in studying the performance of enterprises. The capital structure is divided into three components: Short-term debt ratio; long-term debt ratio, and debt ratio. The value of a company can be increased by changing the capital structure based on the advantages of taxes and debt. Therefore, it is necessary to study the relationship between an enterprise’s competitiveness and capital structure in a context of competitive economy (Guney et al., Citation2011). Studying the relationship between capital structure and competitiveness among enterprises is a very significant topic that has been addressedby many scholars around the world in the past few decades (Kovenock & Phillips, Citation1995; Myers, Citation2001). In this study, the authors used the debt ratio variable to represent capital structure according to previous studies

The increase in debt use will affect the market power of that enterprise, if a new market entrant uses too much debt, it may face many failures in the competition to optimize production, price, and production against other competitors (Guney et al., Citation2011). Every enterprise will make greater efforts when it faces the option of paying down debt or closing the company. With large liabilities, enterprises will spend less cash flow to invest reducing their output. The payment of high profits, derived from large debts, reduces costs to shareholders from implicit commitments, and thereby increases competitiveness (Myers, Citation2001)

Information asymmetry exists and negatively affects businesses and investors in Vietnam (Huynh et al., Citation2020). Therefore, the policies on the use of capital are information emitted to the market so that investors can have information related to the operation of the enterprises (Brigham & Houston, Citation2012). In an emerging market like Vietnam, the study of the capital structure plays a vital role for companies and investors (Myers, Citation2001). Market information plays an essential role in investor decision-making in Vietnam (Dinh Nguyen et al., Citation2021). Meanwhile, these sources of information are disproportionate to investors. Therefore, wrong decisions can be encountered when making decisions. Standing on the position of the business, the use of capital can improve competitiveness, but it can also make the business stand on the verge of bankruptcy when it is under too much pressure from interest when using too much debt, but the return is not good (Guney et al., Citation2011). In particular, the studies in Vietnam mainly stop at assessing the influence of capital structure on firm performance to solve whether or not it is effective. Therefore, the problem of using capital structure to increase firm performance and increase competitiveness in the market is still limited.

A linear as well as nonlinear relationship exists between the competitive element and the capital structure of the enterprises (Fosu, Citation2013; Guney et al., Citation2011; Kovenock & Phillips, Citation1995; Moeinaddin et al., Citation2013; Myers, Citation2001). In Vietnam, according to the author’s study, there has not been any study to assess the impact of capital structure on the competitiveness of enterprises in the market. Therefore, this study is devoted to exploring the effect of capital structure on the market competitiveness of Vietnamese enterprises.

2. Literature review

2.1. Capital structure

There are different definitions of capital structure. According to Ross et al. (Citation2008), the capital structure of an enterprise, or financial leverage, is a combination of debt and equity use in a certain proportion to finance business activities (Ross et al., Citation2008; Vu et al., Citation2019). Some authors define capital structure as a combination of debt and corporate equity (Horn et al., 2005). Another author argues that the capital structure of an enterprise is a combination of debt and equity used to finance production and business activities (Damodaran, Citation2011). According to Ahmad et al. (2012), capital structure is the proportion relationship between debt and equity in the total capital of enterprises to finance production and business activities. By its nature, the authors’ concept of capital structure is slightly different. Therefore, to unify the concept, in this study, capital structure in an enterprise is understood as the ratio of debt to total assets to finance the business activities of the enterprise.

Modigliani and Miller (M&M) shows that the value of an enterprise is not affected by the capital structure, whether or not there are financing activities, the capital structure of the enterprise will not affect the value of the enterprise. However, the theory are still controversial because the assumptions are not realistic.

2.1.1. Trade of Theory

The theoretical arguments of M&M have led to the creation of a trade theory as a “trade theory of financial leverage” in which businesses will exchange tax benefits from debt financing. The theory of trade seems to counteract the theory of M&M when arguing that optimal financial leverage reflects a trade between the tax benefits of debt and bankruptcy costs. According to Myers (1984), an enterprise will set the target debt ratio by balancing the benefits from tax shields on debt and bankruptcy costs on corporate value and gradually adjusting to that goal.. The task of corporate finance managers is to know the opportunity cost when having to trade off the cost and benefit to achieve optimal financial leverage.

The trade-off theory has an important contribution to improving the theoretical system of modern capital structure. In fact, many large and successful businesses such as Intel and Microsoft use much lower levels of debt, and their corporate value is still high, which in turn leads to the development of another theory of capital structure.

2.1.2. Pecking order theory

One of the problems affecting capital structure of enterprises is asymmetric information between managers and investors. Managers often know more about the real value and risk of the business than outside investors, and therefore asymmetric will influence on the manager’s decision to financial capital. Myers (1984) began to study the classification order theory that explains the priority order among capital sources when businesses need to raise capital. Asymmetric information can make the stock price of the enterprise in the market underestimated to the real value, so it can also lower the prices of newly issued shares which are used to finance new investment projects (Myers & Majluf, Citation1984; Qu et al., Citation2018). When businesses lack capital, they need to mobilize more by issuing shares, and managers understand the real value of stocks is lower than the valuation market value. The issuance of additional shares has sent a not good signal about the prospects of the business, so the share price will reduce damage to businesses. Classification order theory suggests that businesses prefer to use their own equity rather than outside loans, prefer to use debt rather than issuing new shares. According to Myers (1984), enterprises do not have a predetermined goal of capital structure. If there is a need to mobilize capital from outside, it will issue the safest to the riskiest securities, namely borrowing, issuing convertible bonds, and then finally issuing shares. Businesses have enough reasons to avoid financing investments by issuing common stocks or other risky securities. The debt ratio of enterprises depends on the ability of enterprises to self-finance and the level of information asymmetry. Pecking order theory also has an important contribution in the system of modern theory of capital structure. Empirical studies show that businesses generally rely heavily on Loans, however, cannot explain the case when many businesses have issued shares while they can fully borrow. This aspect led to the creation of modern capital structure theories later.

2.1.3. Agency costs theory

Asymmetric information between managers and owners of businesses gives rise to costs called agency costs. For the sake of managers, they may not make decisions or make decisions that can cost businesses without trying to increase the value of the business. If equity is issued, managers’ benefits will be reduced, so managers have a tendency to benefit. The benefits that managers want to enjoy are the costs of damage that the owner incurs. In order to limit these risks, business owners need to monitor and manage so that managers’ activities are in line with their interests. These costs are referred to as agency costs including: Owner’s control costs (shareholders); Executive expenses of managers; The benefit section declined due to differences in managers “actual decisions and the decision to maximize owners” interests (Fama, Citation1980). The better-managed the enterprise, the lower the agency cost of equity. One way to reduce agency costs is to increase the use of debt. As the debt ratio increases, managers will have to be more cautious in making decisions to borrow new debt and use capital, making them more efficient in managing businesses (Ozkan, Citation2001). Outside investors can predict managers’ behavior when the market is operating effectively. The price of new shares will therefore be reduced by taking into account the agency costs. In this case the owner will prefer to use borrowed capital rather than equity. Fama (Citation1980) argued that the representative cost of equity is insignificant because in a well-functioning capital market, there will be pressure to force managers to represent the interests of outside shareholders. When borrowing, there may be a conflict of interest between the creditor and the manager, and thus, a representative cost arises. Borrowing is the motivation for managers to invest in projects that bring great benefits but at the same time high risks occurs, increasing the likelihood of failure. If it is successful, creditors are also not allowed to share profits, but if they fail, bankruptcy will incur additional risks. When increasing debt, interest rates will increase to compensate for the probability of bankruptcy. At this time, the agency cost of debt includes the opportunity cost due to the impact of debt on managerial investment decisions, control and compliance costs of creditors and managers; and costs related to bankruptcy and reorganization. Thus, debt and equity both give rise to agency costs, so it is considered to trade off between two types of costs when choosing the optimal capital structure. The representative cost theory states that the representative cost of equity is positively related to the debt ratio while the representative cost of debt capital is inversely related to financial leverage. of the business.

2.1.4. Signalling theory

M&M assumes that investors and managers have the same information about the business prospects and activities of the enterprise, called symmetric information. The situation, in which the investor has other better information about the prospects of the business than the manager, is called asymmetric information. And this has an impact on the optimal capital structure of enterprises (Brigham & Houston, Citation2012). Enterprises with a high level of information asymmetry will require higher returns from investors because of the higher costs of disproportionate information. Signals—the actions of the business management board—are designed to provide investors with a view of how the business outlook is. The sale of stocks outside is considered to signal the prospects of the business to the outside in the opinion of the manager is not good, often the share price of the business will decrease. Issuing stocks is a bad sign for mature enterprises rather than new fast-growing ones, where investors are expected to grow better and need more capital (Brigham & Houston, Citation2012). Thus, when making decisions on capital structure, in normal conditions despite good prospects, enterprises should maintain the ability to ensure external borrowing can be used in case of good investment opportunities.

2.1.5. Market-timing theory

Many studies have shown that prices play an important role in issuing shares, and many other studies also show that the issuance or redemption of shares when capital adjustment is strongly correlated with stock prices (Marsh, Citation1982; Opler & Titman, Citation1994). There are also researches suppose that between book value and market price to determine market timing is the first factor to identify the capital structure (Baker & Wurgler, Citation2002). Thus, businesses are not interested in the use of debt or equity and priority order of capital selection, and information asymmetry is not related to the selection of capital structure. Managers merely base on market conditions to decide to raise capital for businesses. Market positioning theory predicts an opposite trend with trade-off theory. Enterprises tend to issue shares instead of issuing debt when the market price of the stock is higher than the market price of that stock in the past and higher than the book value and vice versa.

2.2. Product market competition

Competitiveness is the ability to compete: only the economic strength or the strength of a country, an economic sector or a business when compared with its competitors in a global market economy in which goods, services, people, skills, and ideas can move freely without geographical limitation. Competitiveness of enterprises refers to its ability to maintain and expand the market share. National competitiveness is the ability of a country to achieve a high and sustainable per capita income ratio (Ajitabh & Momaya, Citation2003; Krugman, Citation1994; Porter, Citation1997). Moeinaddin et al. (Citation2013) explain the industry’s competitiveness as measured by the concentration index or market share of that industry. Accordingly, an industry is considered to be highly competitive when the market share is more scattered and vice versa. The authors commented on the HHI index which is often used in businesses or industry competitiveness measurement. Accordingly, the HHI is a very strong index to measure competitiveness by industry ranging from 0 to 1. Higher values signifiesmore market share of the industry focuses on a number of businesses, implying the decreading market competition (Moeinaddin et al., Citation2013).

2.3. Empirical studies

Research on the influence of capital structure on competition has been carried out by many researchers worldwide. In which, some typical studies are presented by the authors below:

Brander and Lewis (1986) were the first to study the interaction between capital structure decisions and theoretical product market competition. A research model showed that leverage leads to stricter competition due to the limited liability effect.

Chevalier (1995) studied the effect of capital structure on the competitive product market of the local supermarket industry in the US. Research results show that increased leverage will promote product market competition more gently. The market share ownership ratio measures the concentration coefficient, which contributes to the market structure. This study mainly provides an overview of enterprises to show the effects of capital structure on product market competition. A business tends to expand its market share to gain more profit, thereby paying off a bank loan. As market share grows, industry concentration tends to increase. Therefore, capital structure positively affects the concentration coefficient.

Mitani (2014) builds a model to evaluate the impact of capital structure (leverage) on the competitiveness (market share) of enterprises and uses the HHI index to measure the competitiveness of enterprises. The author provides evidence that the use of financial leverage has a positive effect on the firm’s market share. However, the study also shows a negative impact when using debt excessively when operational efficiency is stagnating.

Research results of the research group Gustavo Grullon et al. (2006) parallel comparison of businesses that raise capital with the responses of competitors in the same industry. According to the author, a company will respond more strongly than its peers in advertising competition if it uses less debt than its competitors. Thus, in the sample cases studied, a competitor’s leverage will reduce competitive strength; in other words, increased leverage seems to weaken a firm’s competitiveness.

It can be seen that the impact of capital structure on competition exists with different research results. Therefore, in the context of research in Vietnam, the authors will look at the effect of capital structure on the edge state to test this relationship in both linear and nonlinear trends.

3. Method

3.1. Model and hypotheses

With reference to Mitani’s research model (2013) assesses capital structure and competitive market in enterprises. The author proposed the following hypothetical model:

In which, the variables are described as

Table 1. Description of research variables

3.1.1. Hypotheses

Increasing debt ratio means the company is raising more capital to expand business or pay short-term debts. The increase in external loan structure may be due to the fact that the available capital in the enterprise has not been used or is insufficient for investment, leading to external borrowing. Increasing capital structure can increase business market share as long as the company expands its business, and debt utilization is effective (Fosu, Citation2013). However, the capital structure may also reduce the value of listed companies when announcing high debt ratios. This affects the business operation when the signal emitted about the debt ratio is high. Therefore, the author hypothesis is as follows.

H1: The capital structure has an impact on HHI in the form of a reverse U-shape

The expansion of scale will help increase market share, which tends to increase the competitiveness of enterprises in terms of market share. Not the same as for capital structure. The expanded scale helps increase the turnover of businesses in the market. These companies have higher-than-expected growth opportunities to improve their competitive position and increase their market share in the near future. The hypotheses are stated as follows:

H2: Firm size has a positive impact on the competitiveness of the enterprises.

H3: The growth rate of assets has a positive effect on the competitiveness of enterprises

Bolton and Scharfstein (Citation1990) show that firms with large cash are motivated to adopt a more aggressive output strategy. A cash-rich company can make larger investments in different projects and gain a place in the more competitive market. As such, higher liquidity is expected to correspond to a larger market share. The author presents the hypothesis as follows:

H4: The current ratio has a positive impact on the competitiveness of enterprises

3.3. Method

Authors will use panel data with companies listed on Vietnam stock exchange (HNX and HOSE). The form of data collection is the use of financial statements of listed companies from 2010–2018. The author collects data on Vietnam stock exchange. The collected data will be put into STATA software for analysis. Basic models such as Fixed effect (FEM) and Random effect (REM) will be used first by the author. The Hausman test is used to find a suitable model between FEM and REM for actual research data (Hausman, Citation1978)

In case of encountering defects in the model such as autocorrelation, variance change or endogenous phenomena, GMM estimation method will be conducted to overcome. The model to overcome endogenous phenomena by Arellano—Bond (1991) Difference Generalized method of moments (GMM). In addition, the Arellano—Bond method is also designed to overcome the fixed effect effect contained in the model’s errors (because the characteristics of the research companies do not change over time such as location. The reason and the type of company can be correlated with the explanatory variables in the model) and give table data with a short time (time = 9 years) and a large number of companies N, because it is capable of overcoming that causes the shock to the fixed effect of companies, reflected in the error, will decrease over time (Roodman, Citation2009).

To test the appropriateness of the estimated results according to the GMM, the Hansen and Arellano-Bond tests will be used. Hansen test determines the suitability of the intrument variables in the GMM model. This is the over-identifying restrictions of the model. Hansen test with hypothesis H0: Intrument variables are exogenous. The Arellano—Bond test was proposed by Arellano—Bond (1991) to check the autocorrelation of GMM model of first-order difference. In terms of the first order and AR (1), the testing results are ignored. AR (2) is tested on the difference of errors to detect the autocorrelation of errors at second order. The model is trusted when the p-value of two Hansen tests and AR (2) are both greater than 0.05.

4. Results

4.1. Descriptive

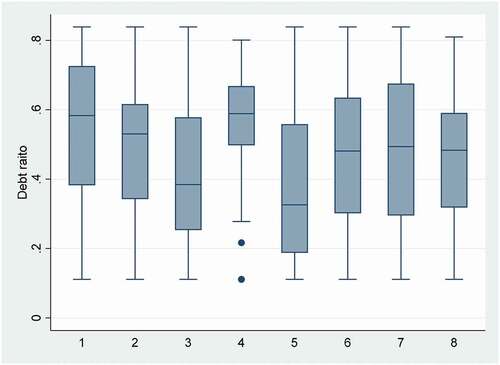

The descriptive statistics give the status of the variables in the model. The descriptive analysis shows that the mean of HHI competitiveness index is 0.022, equivalent to 2.2%. In particular, the largest value is 23.6% and the smallest is 0%. The standard deviation of HHI is 0.057 shows that the difference in HHI between enterprises in the industry as well as different industries is insignificant. Regarding the mean of debt ratio is 49.7%, in which the largest is 83.9% and the smallest is 11.%, the standard deviation of DR is 21.7%, showing that enterprises have other capital structure ratios. There are differences (there is a big difference in DR ratio). The indicators of control variables are detailed in .

Table 2. Summary statistics

For using capital structure through DR indicator, shows that all enterprises have debt ratio around 50%. Details of sectors are coded in .

Table 3. Describe the industry

The companies collected on the stock exchange are encoded and assign value labels to each industry code. The statistics on industries and number of companies in each industry are described in .

4.2. Regression

The regression analysis steps were conducted according to the research method in Section 3. Initially two FEM and REM models were implemented. The Hausman test indicates that the FEM model is more appropriate than the REM model. Autocorrelation tests, and Hetesoskedasticity test are performed on FEM models. The test results show that the FEM model both exists autocorrelation and Hetesoskedasticity. Therefore, endogenous problems can occur in the model. Therefore, GMM model is implemented to overcome endogenous problems. GMM model results are reliable with p-value of AR (2) and Hansen test are greater than 0.05. Detail in .

Table 4. Results of general regression analysis for all enterprises

Table 5. Analysis results by industry

The results show that capital structure affects HHI’s market share at the statistically significant 5% with βDR = 0.411. It is possible to identify the relationship between capital structure and HHI’s competitiveness, when the capital structure increases by 1 unit, HHI’s market share increase by 0.411 units. This result is also consistent with findings in the research of Xiao meng Xu (2013); Istaitieh & Fermandez (2006) and Nana & Roy (2011). Observed from the regression results, capital structure has a positive relationship with HHI’s market share but DR2 is negatively related to HHI’s market share and to better understand this relationship, through graphs we can see that That relationship is represented in reverse U-shape. The results show that DR has a positive impact on HHI, but up to a maximum value, the increase in DR will cause HHI to decrease in the form of reverse U-shaped.

Besides, SIZE and GRTA factors have no effect on HHI (p-value is greater than 0.05). It can be seen that an increase in the assets of an enterprise does not increase the competitiveness of the enterprises. Assets are not a signal to help companies increase their value and market share in the market. In addition, CR has a positive effect on HHI (βCR = 0.0154, p-value is less than 0.05). The better the current solvency of an enterprise, the stronger its competitiveness in the market. With good solvency, the cash flow of the enterprise is good. Indicators of revenue as well as profit of the enterprises are also good. Since then the market share of enterprises in the market has also increased.

The use of capital structure will be able to affect HHI differently between firms. Therefore, the study continues to compare the effect of DR on HHI by subsectors obtained from the collected data. The results of analysis by different groups indicate that there is a difference between groups in terms of the impact of DR on HHI. The analysis results for industries indicate that industrial products, information and telecommunication, and consumer goods tend to be the same when DR affects HHI in the U-shaped. The raw materials and community utilities has DR impacting on HHI in a reverse U-shape similar to the general results for all companies. Because the sample of oil and gas industry is only 6 enterprises, the assessment for the oil and gas industry is not significant

5. Discussion

The study shows that the influence of capital structure on competitiveness is measured by HHI in reverse U-shaped. As capital structure increases, HHI increases, the influence of capital structure is a positive impact on competitiveness, but up to 1 threshold value, increasing capital structure will reduce HHI. The expansion of market share to achieve the ultimate goal of the business is to optimize profits, create confidence and credibility for better repayment of debts. As capital structure increases, the market share expands (concentration coefficient tends to increase). Increasing capital structure, using higher leverage leads to stronger competition. However, to a certain extent, the increase in debt ratio pulled the market share down due to the use of debt overhang, which causes large capital costs and loss of debt control (Myers, 1977). The cause of this effect is the overinvestment and use too much from external loans in the long run, showing that the enterprises are operating inefficiently or due to abnormal problems in the business activities (Trong & Nguyen, Citation2020). This leads to low sales due to inefficient operation (not competing with other enterprises) or because the enterprise’s products are not well received by the market, leading to a decline in market share (Campello, Citation2006; Chevalier & Scharfstein, Citation1994; Kovenock & Phillips, Citation1997). When using the leverage policy, increasing the debt ratio seems to weaken the competitiveness of an enterprise and an enterprise will be better able to compete with competitors if it uses less debt (Gustavo Grullon et al., 2006). At the same time, the interviews with company managers also show that financial leverage can bring efficiency and good competitiveness when the business operates stably, and there is no unusual information.

I found that in the case of a company raising capital from issuing shares or borrowing outside capital to operate a centralized business, it will make investors more interested in the ticker […]. At the same time, the stable operation situation makes the market development more favorable. Investors or partners feel more secure when the operating situation is stable and the investment items are at a growth rate that is not too volatile.

Besides, managers also realize that over-investment will change the operating results and reduce the competitiveness of enterprises in the market.

When businesses show signs of over-investment, making investors more cautious in their investment decisions, they are willing to not hold long-term because they do not want to hold risks when the company is over-investment. With the release of information about over-investment, the market fluctuates and the business and sales activities of enterprises are also affected.

In the early stages, when the tendency of using debt as well as higher financial leverage led to a greater concentration of firms in the industry, higher concentration firms would use more debt in capital structure and then the competition is becoming more fierce (Istaitieh and Rodriguez, 2006). And the increase in sponsorship means that businesses significantly increase their costs compared to their competitors in the industry, and furthermore, the scale of this increase depends on the capital autonomy of enterprise. Establishing a reasonable capital structure depends heavily on equity. Whether or not to use leverage is common depends on the direction and the long-term strategy. Weakness and inefficiency stemming from business strategy mistakes when increasing debt utilization is an existing problem for businesses, and these discussions also suggest further study on effects of capital structure on firm market share. Whether or not to use debt, or how the increase is a strategic direction is extremely important to minimize the risk of withdrawing from the market when the market share has been lost. The finite impact of financial liabilities has also been proven through many studies.

6. Conclusion

From discussing the results of studying the impact of capital structure and competitiveness of listed companies, it is indicated thatcapital structure affects competitiveness of enterprises in the form of reverse U-shaped. This result also implies some recommendations for the existence, maintenance and development of listed enterprises. The enterpries have policies to raise more capital to invest, when HHI tends to increase, they should continue investing. However, enterprises need to observe the situation when HHI starts to decrease. It is necessary to consider whether the investment plan is still appropriate (Chevalier & Scharfstein, Citation1994). Considering the plan to stop using loans to invest, enterprises may turn to using internal capital (possibly due to problems with interest rates on bank loans or loans from outside banks) (Campello, Citation2006). It can be seen that the use of financial leverage is highly effective in the initial stage. When profits reach a stable level and operational costs as well as capital costs start to be ineffective, the problem of increasing capital sources makes businesses fall into a leverage trap.

Enterprises need to develop an effective debt ratio identification system and conduct regular reviews to provide a warning threshold for debt ratios in order. Enterprises will have a strategy to change loan capital to equity through issuing shares or using retained earnings to continue investing in production and business activities. Therefore, enterprises need to build internal capital to be ready for the conversion or reduction of loan rates in case the tax advantage is no longer used effectively. Or loan cost pressures threaten firm performance. When enterprises show signs of reducing competition when using capital structure, the capital structure reduction action should be taken immediately (Fosu, Citation2013). Firms that increase capital structure will be subject to the hunting effect of more competitive firms using less capital structure which put pressure on leaving the industry.

7. Litmitation and future research

Although the study has achieved the research objective when it shows the inverted U-shaped impact of capital structure on enterprises’ competition, at the same time, the study also indicates some control variables such as firm size, Growth of total assets, Current liquidity. However, there are also certain limitations in this study: the control variable does not have a broader coverage as when the study did not study the effect of other solvency ratios like interest coverage ratio and proprietary ratio on the competition. Therefore, in further studies, it is necessary to build more research variables that can be more representative. An analysis of the same would bring richness to the study.

Disclosure statement

No potential conflict of interest was reported by the author(s).

Additional information

Funding

Notes on contributors

Nga Thi Viet Nguyen

The research team implements topics related to finance and business management.

Nga Thi Viet Nguyen is a Doctor at the Academy of Finance, Hanoi, Vietnam. Her areas of specialization and research are financial management and securities investors.

Chi Thi Kim Nguyen

Chi Thi Kim Nguyen is a Doctor at Hanoi University of Bussiness and Technology, Hanoi, Vietnam. Her areas of specialization and research are financial management and accounting.

Phuong Thi Minh Ho

Phuong Thi Minh Ho is a Doctor at Quy Nhon University, Quy Nhon, Vietnam. Her areas of specialization and research are financial management and business.

Huong Thi Nguyen

Huong Thi Nguyen is a Doctor at the National academy of Education Management. Her areas are business management and financial management.

Duy Van Nguyen

Duy Van Nguyen is Lecturer at Applied School of Finance and Banking, Dai Nam University, Hanoi, Vietnam. His recent research has been published in Cogent of Economics and Finance, Safety Science, Journal of Sustainable Tourism, International journal of business and globalisation, Journal of Risk and Financial Management, etc.

References

- Ajitabh, A., & Momaya, K. (2003). Competitiveness of firms: Review of theory, frameworks and models (SSRN Scholarly Paper ID 2146487). Social Science Research Network. https://papers.ssrn.com/abstract=2146487

- Baker, M., & Wurgler, J. (2002). Market timing and capital structure. The Journal of Finance, 57(1), 1–14. https://doi.org/10.1111/1540-6261.00414

- Bolton, P., & Scharfstein, D. S. (1990). A theory of predation based on agency problems in financial contracting. The American Economic Review, 80(1), 93–106. https://www.jstor.org/stable/2006736

- Brigham, E. F., & Houston, J. F. (2012). Fundamentals of financial management (Concise Edition ed.). Cengage Learning.

- Campello, M. (2006). Capital structure and product markets interactions: Evidence from business cycles. Journal of Financial Economics, 68(3), 353–378. https://doi.org/10.1016/S0304-405X(03)00070-9

- Chevalier, J. A., & Scharfstein, D. S. (1994). Capital-market imperfections and countercyclical markups: Theory and evidence. https://www.nber.org/papers/w4614.

- Damodaran, A. (2011). The little book of valuation: How to value a company. John Wiley & Sons. Pick a Stock and Profit

- Dinh Nguyen, D., To, T. H., Nguyen, D. V., Phuong, D. H., & McMillan, D. (2021). Managerial overconfidence and dividend policy in Vietnamese enterprises. Cogent Economics & Finance, 9(1), 1885195. https://doi.org/10.1080/23322039.2021.1885195

- Fama, E. F. (1980). Agency problems and the theory of the firm. Journal of Political Economy, 88(2), 288–307. https://doi.org/10.1086/260866

- Fosu, S. (2013). Capital structure, product market competition and firm performance: Evidence from South Africa. The Quarterly Review of Economics and Finance, 53(2), 140–151. https://doi.org/10.1016/j.qref.2013.02.004

- Guney, Y., Li, L., & Fairchild, R. (2011). The relationship between product market competition and capital structure in Chinese listed firms. International Review of Financial Analysis, 20(1), 41–51. https://doi.org/10.1016/j.irfa.2010.10.003

- Hausman, J. A. Specification tests in econometrics. (1978). Econometrica, 46(6), 1251–1271. JSTOR. https://doi.org/10.2307/1913827

- Huynh, T. L. D., Wu, J., & Duong, A. T. (2020). Information asymmetry and firm value: Is Vietnam different? The Journal of Economic Asymmetries, 21, e00147. https://doi.org/10.1016/j.jeca.2019.e00147

- Kovenock, D., & Phillips, G. (1995). Capital structure and product-market rivalry: How do we reconcile theory and evidence? The American Economic Review, 85(2), 403–408. https://www.jstor.org/stable/2117956

- Kovenock, D., & Phillips, G. (1997). Capital structure and product market be- haviour: An examination of plant exit and investment decisions. The Review of Financial Studies, 10(3), 767–803. https://doi.org/10.1093/rfs/10.3.767

- Krugman, P. (1994). Competitiveness: A dangerous obsession. Foreign Affairs, 73(2), 28. https://doi.org/10.2307/20045917

- Marsh, P. (1982). The choice between equity and debt: An empirical study. The Journal of Finance, 37(1), 121–144. https://doi.org/10.1111/j.1540-6261.1982.tb01099.x

- Moeinaddin, M., Nayebzadeh, S., & Ghasemi, M. (2013). The relationship between product market competition and capital structure of the selected industries of the tehran stock exchange. International Journal of Academic Research in Accounting, 3(3), 221–233. https://hrmars.com/papers_submitted/132/Article_26_The_Relationship_between_Product_Market.pdf

- Myers, S. C. (2001). Capital Structure. Journal of Economic Perspectives, 15(2), 81–102. https://doi.org/10.1257/jep.15.2.81

- Myers, S. C., & Majluf, N. S. (1984). Corporate financing and investment decisions when firms have information that investors do not have. Journal of Financial Economics, 13(2), 187–221. https://doi.org/10.1016/0304-405X(84)90023-0

- Nguyen, V. D., Dao, T. K., Nguyen, T. H., & Huong, T. (2014a). Impact of capital strutures, firm size and revenue growth on the performance of fishery companies listed on the Vietnamese stock market. In International conference on emerging challenges innovation managerment for SMEs (pp. 623–628).

- Opler, T. C., & Titman, S. (1994). Financial distress and corporate performance. The Journal of Finance, 49(3), 1015–1040. https://doi.org/10.1111/j.1540-6261.1994.tb00086.x

- Ozkan, A. (2001). Determinants of capital structure and adjustment to long run target: Evidence from UK company panel data. Journal of Business Finance & Accounting, 28(1–2), 175–198. https://doi.org/10.1111/1468-5957.00370

- Porter, M. E. (1997). Competitive strategy. Measuring Business Excellence, 1(2), 12–17. https://doi.org/10.1108/eb025476

- Qu, W., Wongchoti, U., Wu, F., & Chen, Y. (2018). Does information asymmetry lead to higher debt financing? Evidence from China during the NTS reform period. Journal of Asian Business and Economic Studies, 25(1), 109–121. https://doi.org/10.1108/JABES-04-2018-0006

- Roodman, D. (2009). How to do Xtabond2: An introduction to difference and system GMM in Stata. The Stata Journal, 9(1), 86–136. https://doi.org/10.1177/1536867X0900900106

- Ross, S. A., Westerfield, R., & Jordan, B. D. (2008). Fundamentals of corporate finance. https://www.amazon.co.uk/Corporate-Finance-David-Hillier/dp/0077121155

- Trong, N. N., & Nguyen, C. T. (2020). Firm performance: The moderation impact of debt and dividend policies on overinvestment. Journal of Asian Business and Economic Studies, 8(1), 47–63. https://doi.org/10.1108/JABES-12-2019-0128

- Vu, T.-H., Nguyen, V.-D., Ho, M.-T., & Vuong, Q.-H. (2019). Determinants of Vietnamese listed firm performance: Competition, wage, CEO, firm size, age, and international trade. Journal of Risk and Financial Management, 12(2), 62. https://doi.org/10.3390/jrfm12020062